Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

GeoBlue Travel Insurance Coverage Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Director of Operations & Compliance

1 Published Article 1166 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Why choose geoblue, travel medical insurance and the covid-19 virus, short-term single-trip plan options — geoblue voyager, multi-trip plan options — geoblue trekker, long-term plan options, additional plans available, how to obtain a quote, the value of travel insurance comparison sites, geoblue vs. other travel insurance companies, geoblue vs. credit card travel insurance, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss travel insurance and look closely at companies that offer the coverage , but today we’re narrowing our focus from comprehensive travel insurance to a specific type of travel coverage — travel medical insurance.

Chances are you’ve heard of BlueCross BlueShield (BCBS), one of the leading healthcare insurance providers in the U.S. The company was established in 1929 and currently insures over 107 million members. GeoBlue, an independent licensee of BCBS, picks up where BCBS leaves off, offering travel medical coverage worldwide .

You do not have to be a member of BCBS to purchase travel medical insurance from GeoBlue as the company makes its products widely available to U.S. citizens and permanent residents.

In an effort to determine the benefits of GeoBlue as a viable option for purchasing travel medical insurance, join us as we explore the following in today’s review:

- Why you should consider travel insurance and specifically GeoBlue

- An overview of the types of plans the company offers

- Comparing plans and obtaining a quote

- How the company measures up versus other companies and to credit card travel insurance

Insurance products, in general, serve the purpose of indemnifying you and making you whole (or nearly whole) should a covered event cause you to incur a financial loss. Travel insurance , and in this case travel medical insurance, is designed to accomplish the same objective.

Since our topic for this article is narrowed to travel medical insurance , let’s look at several reasons you’d want to consider this coverage.

- Your current health insurance policy does not provide coverage outside of the U.S. and/or its territories

- Your current health insurance policy covers you outside of the country but has a high deductible

- You are on Medicare and do not have a supplement plan

- You want a primary travel medical policy that gives you access to a network of medical providers in the country you’re visiting

- You have insurance from your credit card for trip cancellation, trip interruption , and other travel disruptions, but not travel medical coverage

- You are traveling to a remote area and want to have emergency evacuation insurance

This is just a sampling of some of the situations where you’d want to consider purchasing a travel medical insurance policy. Fortunately, the coverage is affordable and widely available.

Bottom Line: If your current health insurance policy does not cover you while traveling abroad or has a high deductible if it does provide coverage, you’ll want to consider purchasing travel medical insurance . Additionally, you should consider travel medical insurance if you’re concerned about emergency medical evacuation, or want to have 1 primary policy that covers you during your travels.

If you have the need to purchase travel medical insurance, there are certainly a lot of companies from which to select. GeoBlue stands tall among those competitors for several reasons.

First, the company has been providing global health insurance options since 1997, is a licensee of BCBS with a rating of excellent by financial insurance rating company, AM Best, and has an A+ rating by the Better Business Bureau.

Additionally, you can expect the following benefits when insuring with GeoBlue:

- GeoBlue has a vetted group of elite doctors in a network that spans 190 countries. Physicians must be certified by the American or Royal Board of Medical Specialties.

- Visits to network doctors/facilities are handled cashless, eliminating the need to file a claim for reimbursement.

- In addition to in-person care, GeoBlue utilizes alternative telemedicine options available 24/7 and provides access to a global network of physicians and facilities.

- Access is available to 24/7 assistance including translation services, physician referrals, prescription services, destination assistance, and more.

Bottom Line: GeoBlue is an established, highly-rated company that specializes in providing travel medical insurance with associated care via its global physician network, telemedicine services, and 24/7 medical assistance services.

Travel insurance, in general, does not cover voluntary trip cancellations due to the fear of getting ill for any reason, including the fear of contracting the COVID-19 virus. In addition, some travel insurance companies specifically exclude COVID-19 for most coverages. Other travel insurance companies provide limited coverage for COVID-19-related illnesses under trip interruption and medical care coverages only.

You’ll want to review any policy you’re considering to make sure your greatest concerns are covered.

In order to have any coverage that provides reimbursement for a voluntary trip cancellation, for example, you’ll need to consider Cancel for Any Reason (CFAR) insurance .

Travel medical insurance does not normally include extensive coverage for trip cancellations or disruptions but focuses more on providing medical care and reimbursement for the associated expenses that occur as a result of becoming ill or having an accident during your travels.

Fortunately, many of the medical insurance policies offered by GeoBlue do cover COVID-19-related illness . Let’s look closer at the available options.

Bottom Line: In order to have coverage for trip cancellation due to the fear of getting ill, you would need to purchase Cancel for Any Reason insurance. Some policies provide limited coverage for COVID-19 under trip cancellation and trip disruption coverages should you contract the virus prior to or during your travels. Many of the travel medical policies offered by GeoBlue cover COVID-19-related illness care .

GeoBlue Policy Comparisons

GeoBlue offers single trip, multi-trip, and long-term plans. The company also issues specialty travel medical plans for students, workers on assignment, missionaries, volunteers, and maritime workers while abroad.

First, let’s look at the policy options for individuals and group travelers.

GeoBlue Voyager plans are designed for individual single-trip travel or group single-trip events. Groups are defined as 5 or more persons traveling together and a 10% discount off of individual pricing is provided.

Voyager plans include coverage for COVID-19-related illness care.

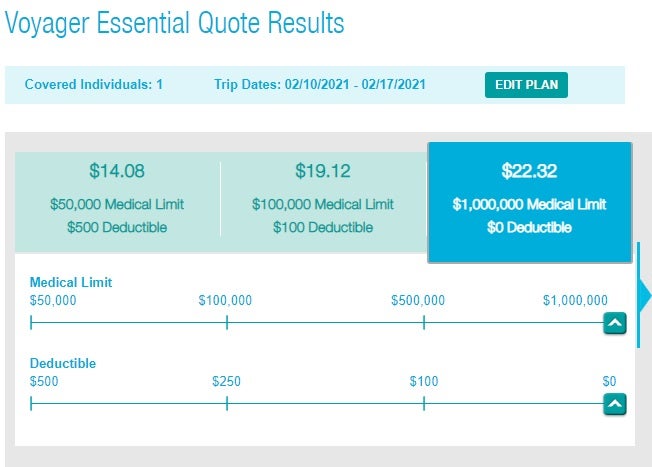

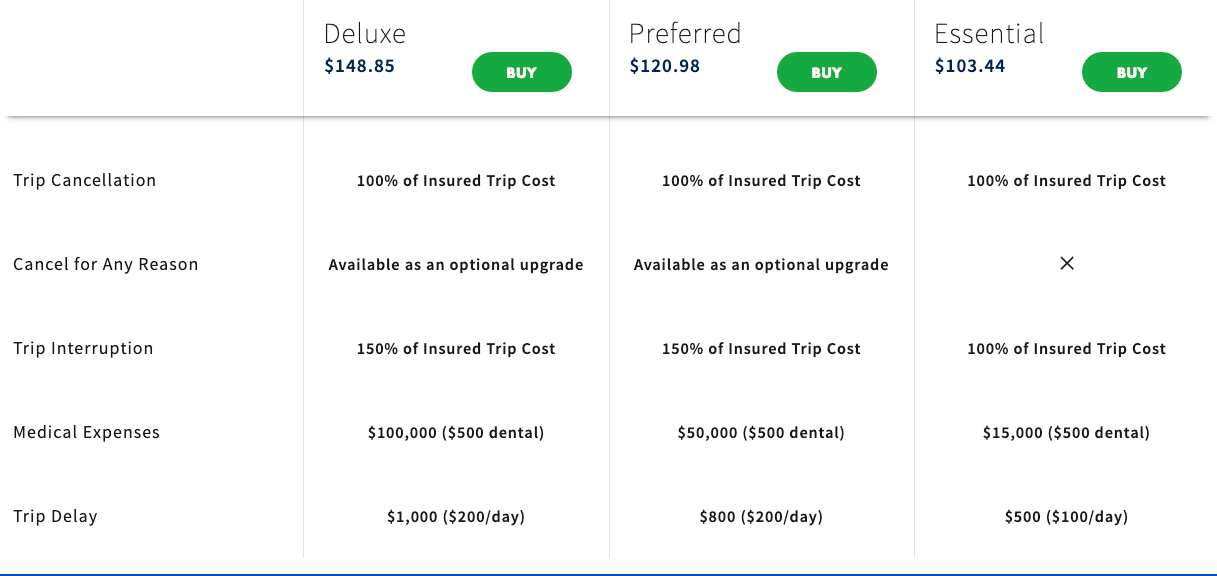

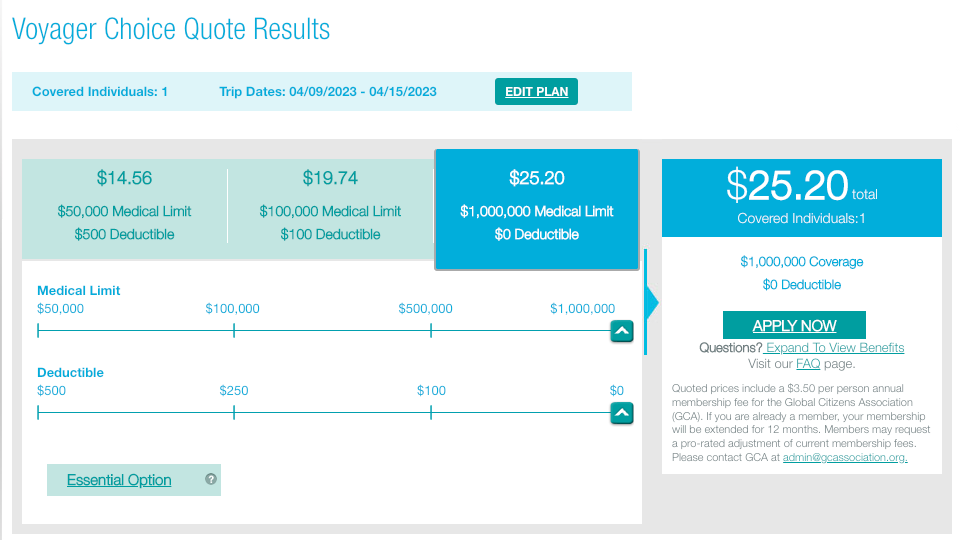

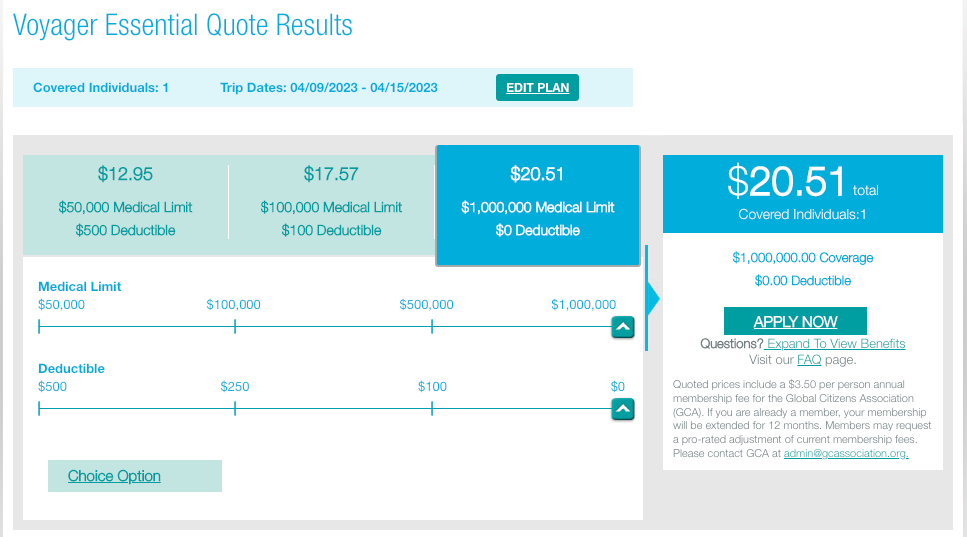

Here’s how the 2 Voyager policy options compare.

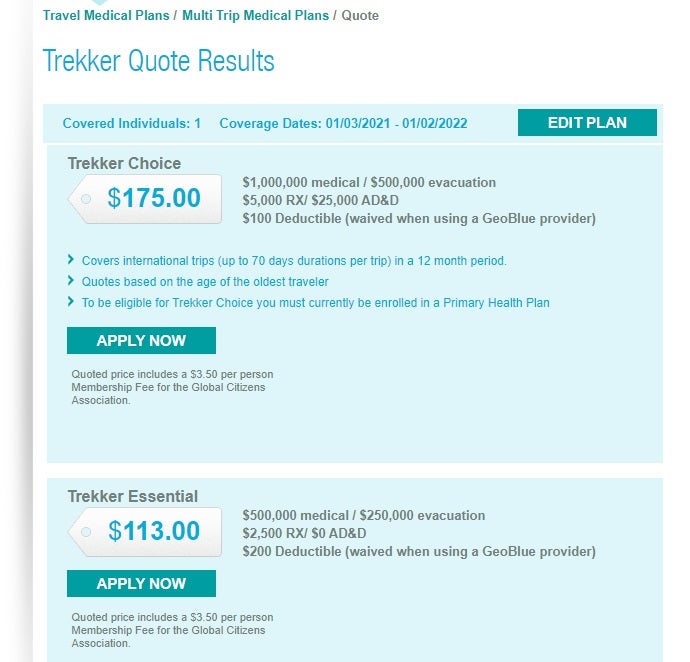

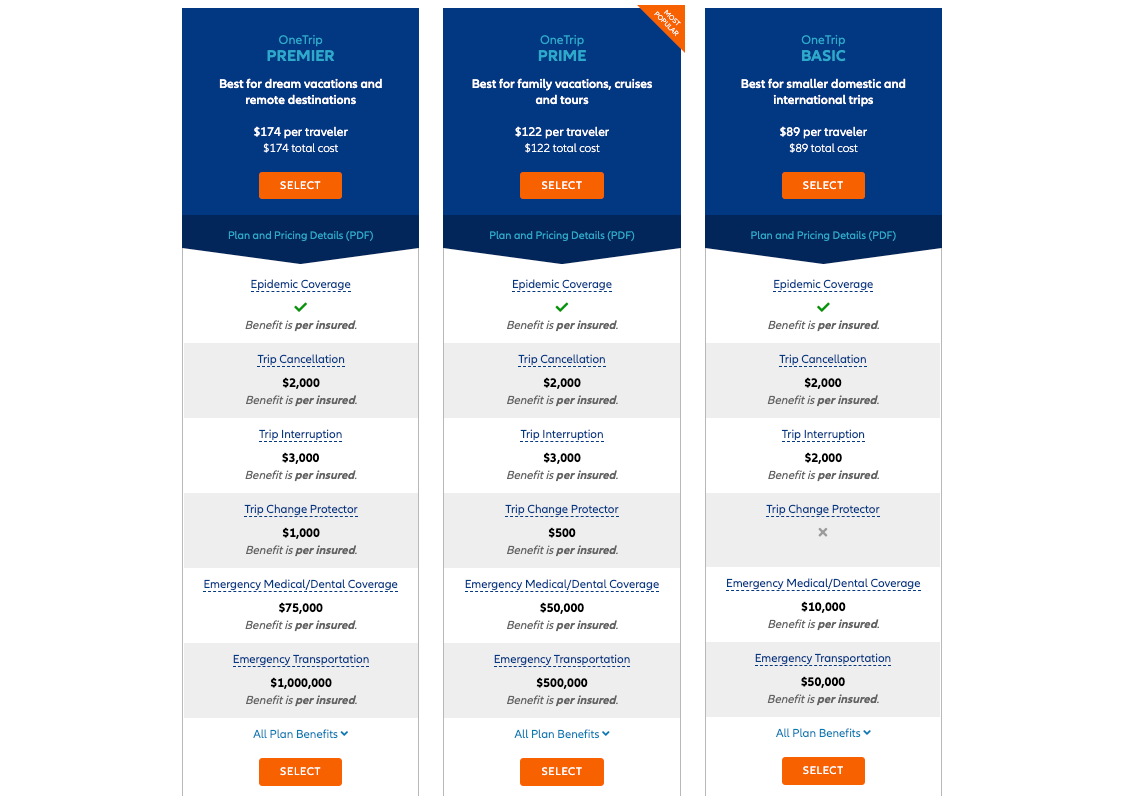

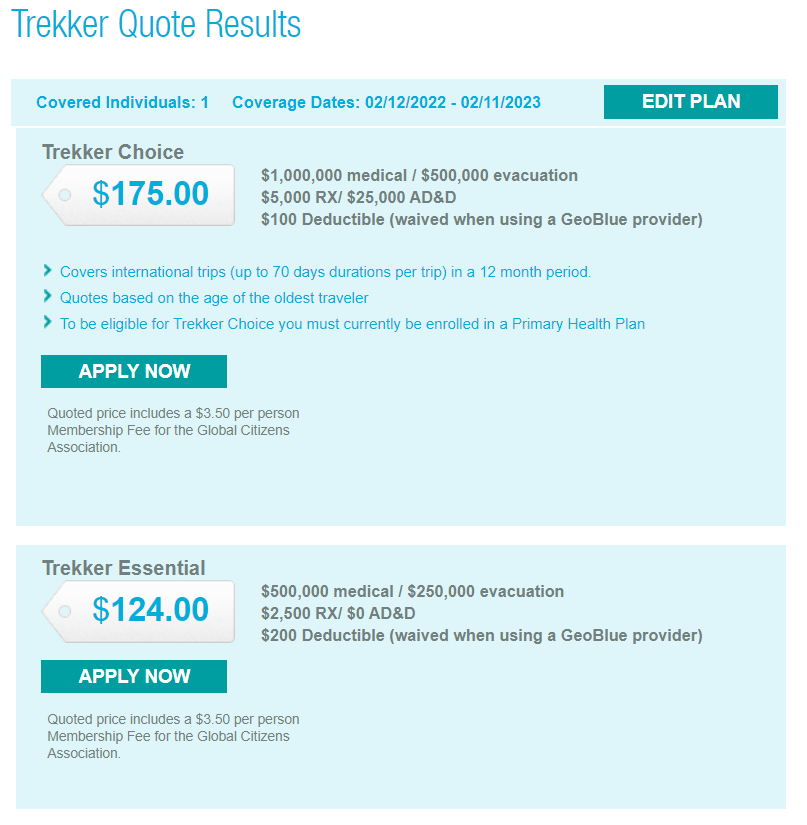

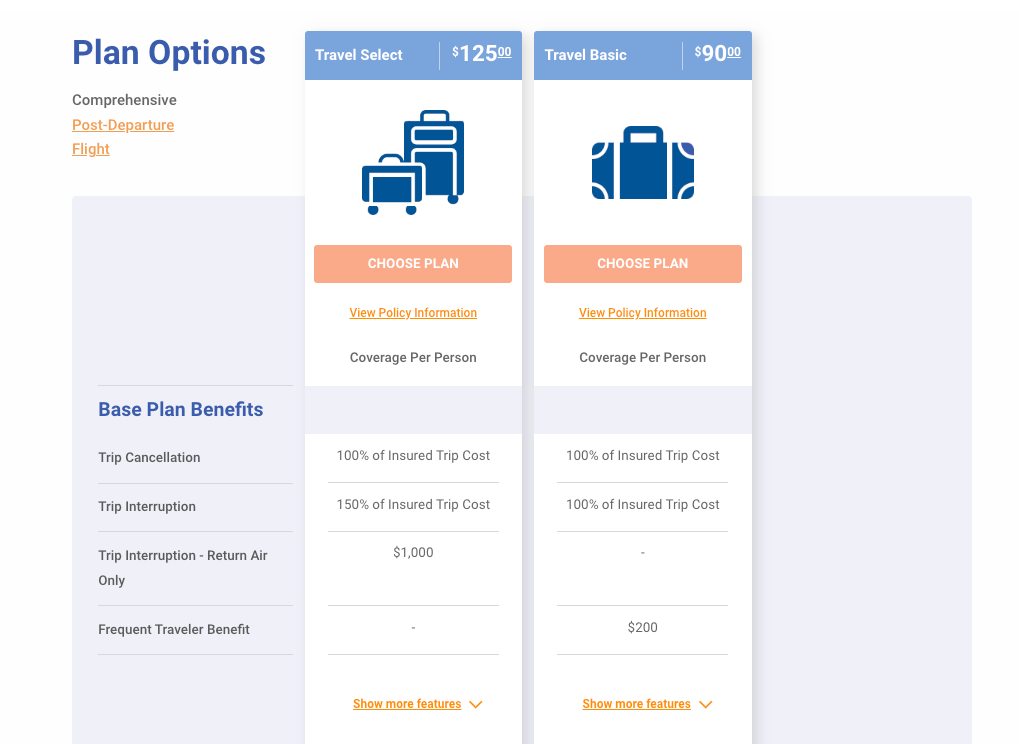

If you’re a frequent traveler, it could make sense to purchase 1 annual policy that covers multiple trips. GeoBlue Trekker multi-trip plans cover all trips made within a 12-month period (up to 70 days in length) and offer 2 levels of coverage options.

Here is a comparison of the 2 GeoBlue Trekker plans.

Both plans cover pre-existing conditions and emergency and non-emergency medical care. Both plans require that you have a primary health plan in place to qualify for purchasing these plans.

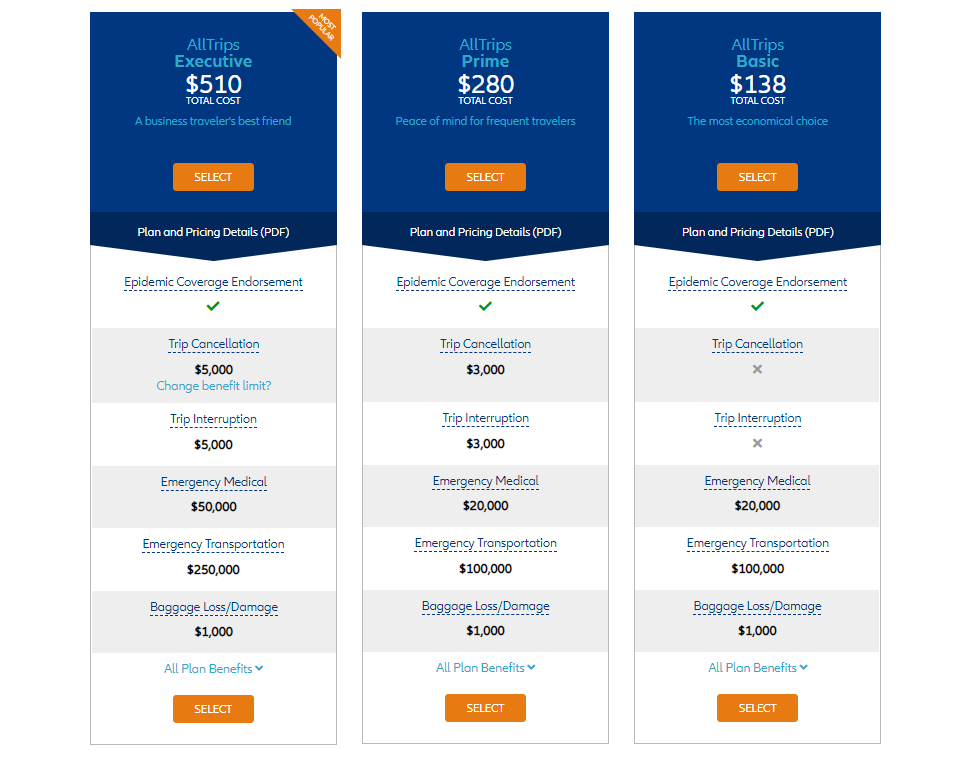

If you’re a U.S. citizen or permanent resident living abroad and need medical insurance, GeoBlue offers 2 plans that may provide the coverage you need for you and your family.

These plans are different from short-term plans in that medical underwriting is needed in order to qualify. Here’s a brief summary of GeoBlue plans for U.S. expats.

All GeoBlue plans offer 24/7 global medical assistance, translation services, doctor searches, and destination health/security information.

GeoBlue Navigator, Xplorer, and Voyager plans include coverage for COVID-19-related illness .

GeoBlue provides additional medical plans for specific types of travelers working abroad, on assignment, or participating in study programs.

- Incoming international students studying in the U.S.

- Students studying abroad

- Employees of multi-national companies working abroad

- Expatriate Crew International Health Plan — for those working on ships

- Expatriate Missionary and Volunteer International Health Plan — covers missionaries, aid workers, and volunteers worldwide

Bottom Line: GeoBlue offers several comprehensive individual travel medical plan options, comprehensive student plans including coverage for international visiting students, and plans for U.S. students, faculty, and family when studying abroad. GeoBlue also offers employer plans that provide coverage to employees working abroad and their families. Missionaries, those who volunteer internationally, and maritime workers will also find policies designed specifically for those situations.

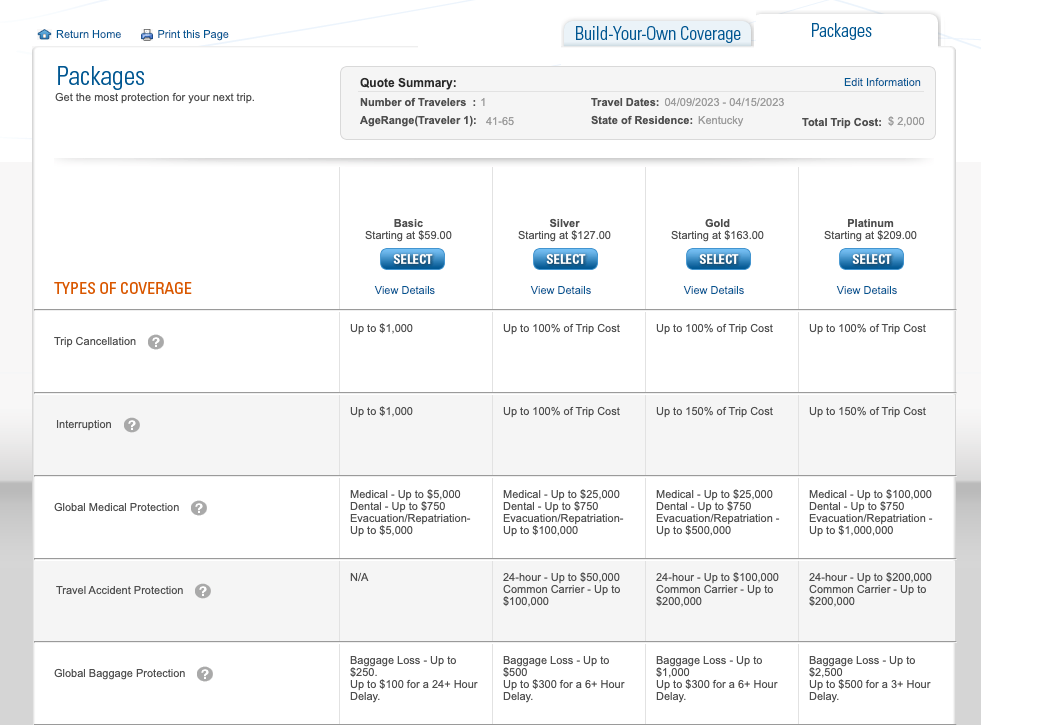

Obtaining a quote for any type of travel insurance can be quick, easy, and can even result in securing immediate coverage. The process is similar for travel medical insurance.

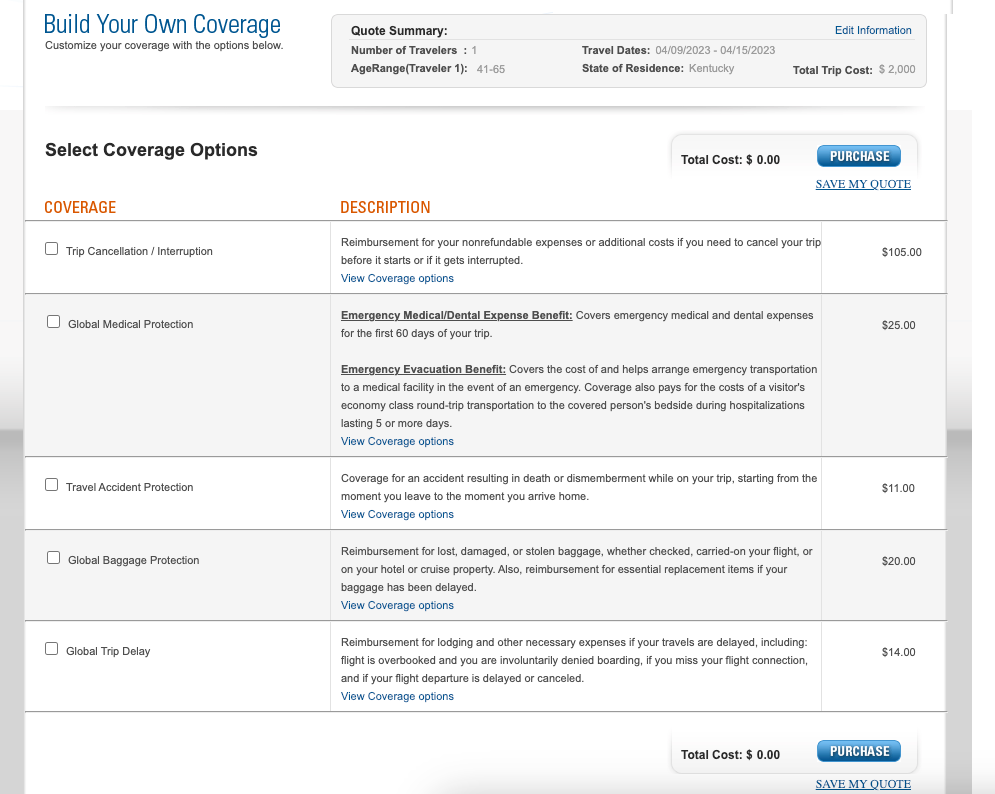

To obtain a quote from GeoBlue for a single trip plan, you’ll need to input your travel destination, your state of residence, the length of your trip, age, cost of the trip, and the date you made the first trip deposit.

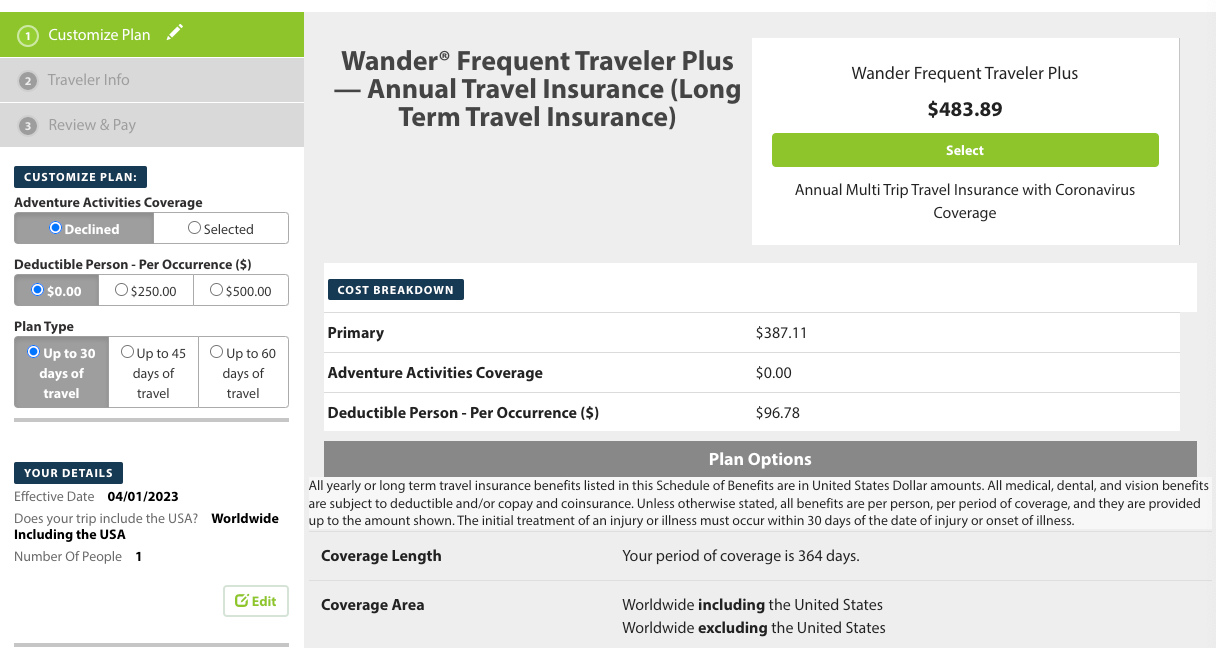

For a multi-trip annual plan quote, the process is similar. You’ll need to input your zip code, age, and the desired effective date of the policy.

Obtaining a quote with GeoBlue for a single or multi-trip policy can be done in just a few minutes. To obtain a long-term policy quote, you’ll need to submit some of the same basic information and a quote will be emailed to you.

Bottom Line: Obtaining a quote for a single or multi-trip policy is a quick and simple process completed on the GeoBlue website. A long-term quote for qualifying applicants must be requested via email.

While purchasing a travel medical policy from GeoBlue ensures you’re dealing with a highly-rated established company, it’s always good to do some comparison shopping when looking for any type of insurance.

Viewing a selection of policies side-by-side makes it easy to compare coverages and costs. This task is easily accomplished by utilizing a travel insurance comparison website such as the ones listed here.

Additionally, comparison sites allow you to narrow the number of policies to those that contain the coverages most important to you. Here are a few we recommend:

- InsureMyTrip — great for stand-alone medical travel insurance policy comparisons but also offers comprehensive travel insurance policies from over 20 providers

- Squaremouth — easy to navigate site that allows you to compare dozens of travel insurance companies and filter by desired coverage, including travel medical insurance

- TravelInsurance.com — you’ll want to use this site for comparing travel insurance plans, including those with medical coverage, however, no stand-alone medical plan quotes are available

Bottom Line: Utilize a travel insurance comparison site to help you easily compare several plans, filter by desired coverage, and select those that best match your coverage priorities.

How GeoBlue Compares — Summary

We know that GeoBlue is a reputable choice for travel medical insurance but let’s look at how the company’s offerings compare to other travel medical providers and to the coverage that comes with your credit cards.

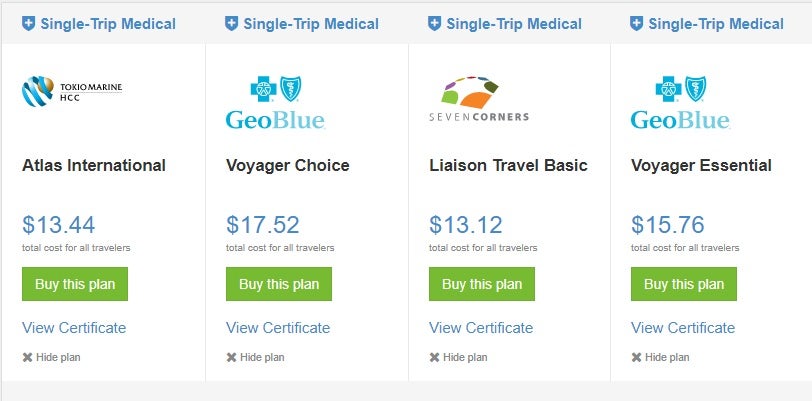

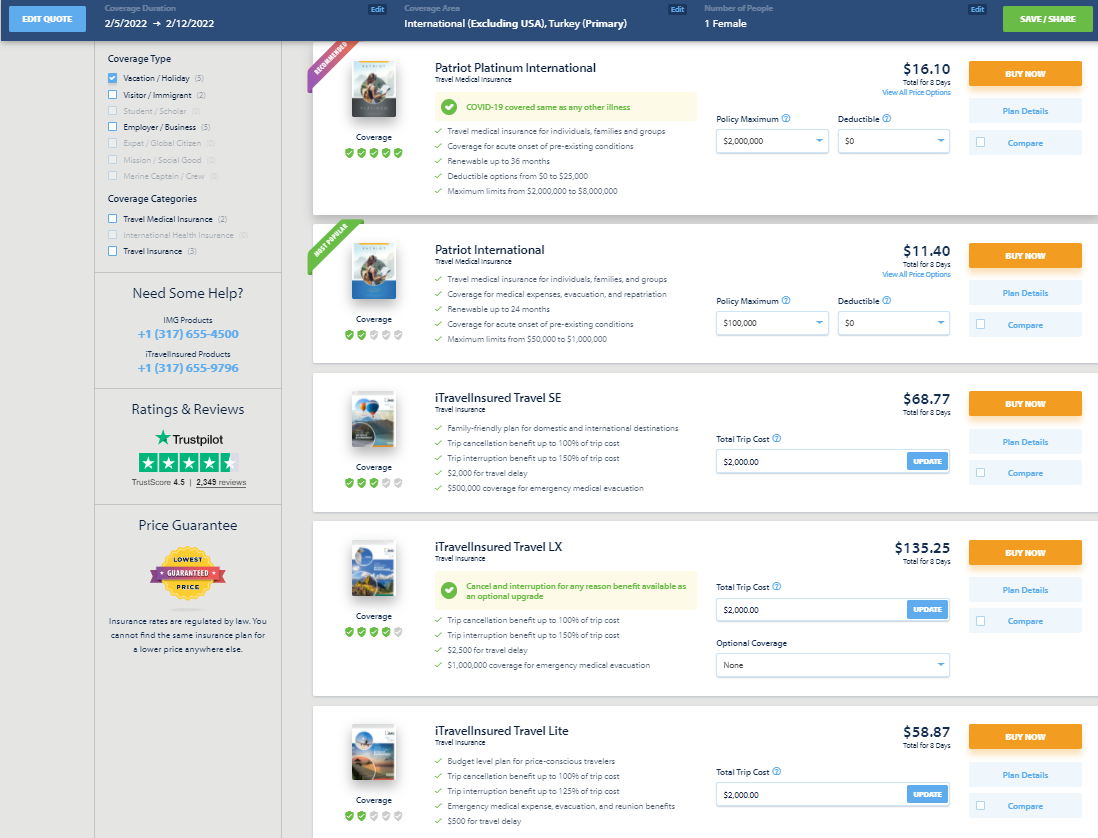

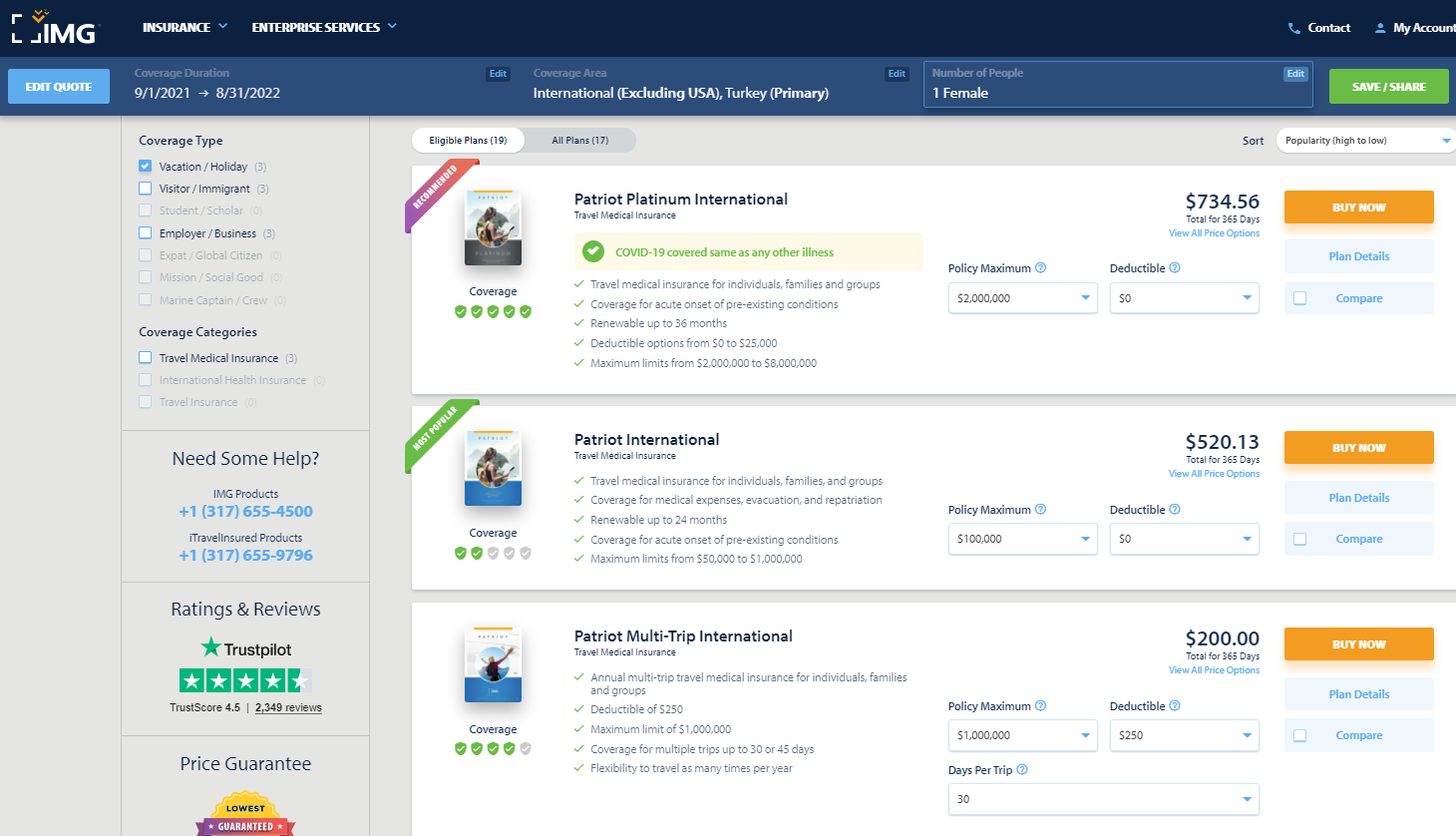

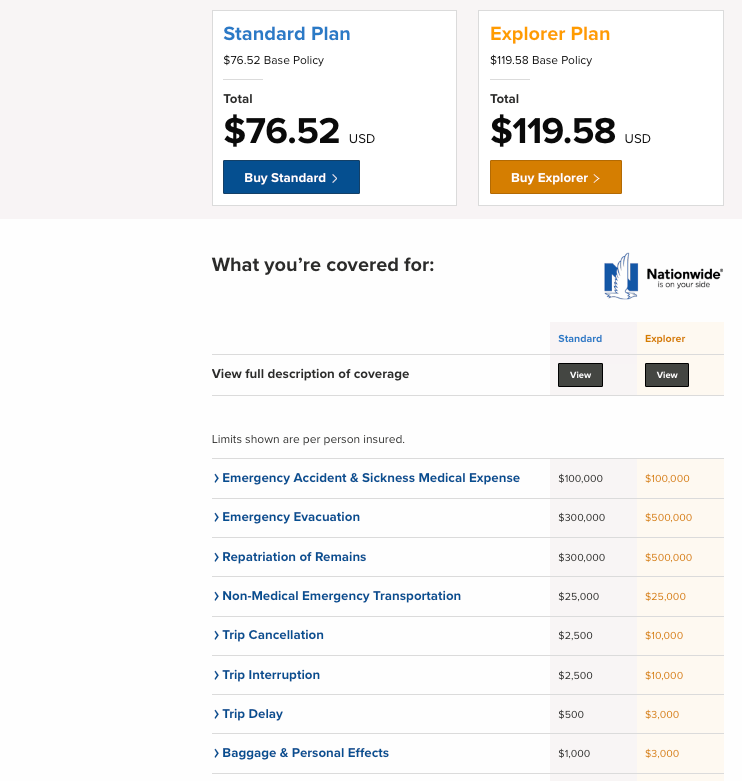

When we searched for a quote using the criteria of a traveler, age 40, for a trip to Mexico for 1 week that costs $3,000, the top 4 results above were shown. You’ll notice by the results that single-trip travel medical insurance can be an affordable option.

The next key element in selecting a policy will be to compare coverages. We know that GeoBlue Voyager policies include coverage for COVID-19 with the Voyager plans, for example, so this may be a key factor in our selection.

Digging deeper into our comparison we find that 1 policy does not include coverage for COVID-19. If we narrow our search to plans that only include this coverage, the next step will be to look at other coverages and limits that are important to us.

In this case, coverages for these policies are similar and costs do not vary widely. GeoBlue, however, remains competitive in both coverages offered and premiums charged.

Bottom Line: While GeoBlue holds its own and is competitive in both coverages and cost when compared to other travel medical insurance companies for single-trip plans, we know that coverage for multi-trip plans does not include coverage for COVID-19-related illness.

We frequently remind travelers that even the best credit cards for travel insurance are not a replacement for a comprehensive travel insurance policy. This is especially true for travel medical insurance coverage as you won’t find comprehensive medical coverage on any credit card .

There are very few cards that do offer emergency evacuation insurance and other ancillary medical/dental coverage. Here are 2 of the best options for travel-related coverages and benefits.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

To learn more about all the travel insurance coverages that come with the Amex Platinum card, you’ll want to review our in-depth article on the topic. Note that terms apply and enrollment may be required for some benefits, so make sure you enroll through your American Express account.

Chase Sapphire Reserve ® Card

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- Member FDIC

Chase Ultimate Rewards

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Chase Sapphire Preferred vs Reserve

For more information on Chase Sapphire Reserve card travel insurance coverages , you’ll want to access our expanded overview.

Bottom Line: While credit cards may offer travel accident, trip delay , and other ancillary travel insurance coverages, these cards do not offer travel medical insurance.

Here’s some additional information we need to pass along applicable to the GeoBlue policies mentioned in our article:

- Eligibility includes U.S. citizens and permanent residents only

- Single and multi-trip medical insurance policies must be purchased in your home country before you travel

- Long-term policies, such as those for expats, may be purchased while abroad

- Travelers under 96 are generally eligible for coverage; other age limits may apply to specific policies

- Coverage is valid in all countries other than where the plan would violate U.S. economic trade sanctions

- Some GeoBlue policy options are secondary and require you to have an underlying medical insurance policy

- All policies issued by GeoBlue have a 10-day money-back guarantee

GeoBlue’s expertise at providing travel medical insurance makes it a good choice for purchasing coverage for a single or group trip, or if you’re an expat needing longer-term medical coverage while abroad. Students, faculty, and employers will also find comprehensive medical plans that fit their international medical insurance needs.

Finally, keep in mind that our article today is simply an overview and abbreviated summary of GeoBlue’s policy offerings — plenty of terms and conditions apply. The company’s website provides everything you need to select the appropriate policy, review coverages, obtain a quote, and purchase a plan.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

How does geoblue travel insurance work.

GeoBlue specializes in travel medical insurance. Care is provided internationally primarily via a comprehensive, vetted, and certified worldwide network of physicians and hospitals in 190 countries, but out-of-network international care is also covered. Additionally, the company provides worldwide care via telemedicine appointments.

The company offers international single trip, multi-trip, and group travel medical insurance plans.

It’s specialty travel medical insurance plans include policies for visiting international students, U.S. students studying abroad, and faculty members.

Additional plans include plans for those who work abroad for multi-national companies, maritime works, missionaries, and volunteers.

Is GeoBlue a good travel insurance company?

Yes. GeoBlue, a licensee of Blue Cross Blue Shield, is an established travel medical insurance company that has been offering international health insurance since 1997.

The company received a high financial rating from insurance rating company A.M. Best and an A+ rating from the Better Business Bureau.

Does GeoBlue meet Schengen visa insurance requirements?

Yes. GeoBlue travel medical insurance plans meet Schengen visa insurance requirements.

Does GeoBlue cover dental?

GeoBlue Voyager and Trekker plans offer ancillary dental coverage with limits between $100 and $500, depending on the plan, which includes emergency dental care for injury or relief of pain.

Voyager plans have additional dental and vision care riders which are optional add-ons.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![geoblue travel insurance covid Citi Simplicity® Card — Review [2023]](https://upgradedpoints.com/wp-content/uploads/2019/11/Citi-Simplicity-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Geoblue Covid Insurance

GeoBlue Covid travel insurance

Geoblue voyager plans.

- Up to $1,000,000 medical coverage or $500,000 evacuation coverage

- Up to 180 days of coverage. The policy can be renewed only once.

- Medical limits and deductibles options.

- Coverage available for Pre-existing conditions.

- Two plans are available: Essential and Choice.

- Group plans are available with a 10% discount for groups of five or more.

- Voyager Choice insurance is available for travelers up to age 84 years.

- Voyager Essential insurance is available for travelers up to age 74 years.

GeoBlue Trekker plans

- Up to $250,000 medical coverage/$500,000 evacuation coverage.

- Covers unlimited trips in a period of 364 days. (70 days maximum per trip).

- Many medical limits options are available.

- Pre-existing conditions coverage for both medical services and medical evacuation. US primary health plan required.

- Two plan are available: Essential and Choice .

- Travelers up to the age 84 years are eligible.

GeoBlue Navigator plans

- Offers Unlimited annual and lifetime medical maximum.

- Sports and alcohol related injuries are covered.

GeoBlue Xplorer plans

- Unlimited annual and lifetime maximum.

- Comprehensive coverage with primary worldwide benefits.

- Preventive Services have no waiting period.

- Pre-certification is not required for inpatient and outpatient services.

- Covers pre-existing conditions with proof of prior creditable insurance.

- Deductible is waived for office visits and a small copay is applied.

- Covers injuries or illness resulting from terrorist activities.

- Travelers up to the age 74 years are eligible.

GeoBlue Travel Insurance - Common Questions

Are geo blue travel insurers a reliable insurance company.

GeoBlue is the trade name for the international health insurance programs of Worldwide Insurance Services, an independent licensee of the Blue Cross Blue Shield Association. Geo Blue travel insurance for more than 20 years have assisted globally in the complications of international healthcare and provide confidence for its members to travel safe and peacefully.

The travel insurance solutions provided by Geo Blue provide excellent coverage for US citizens traveling overseas, travelers on work, study, Expats who live and travel internationally often.

Is there coverage for Covid-19 illness in Geo Blue travel insurance?

GeoBlue Voyager plan covers COVID-19 as a covered illness up to age 95.The essential treatment is covered however there may be policy deductible applicable.

Is Geo Blue Travel insurers a good company?

GeoBlue is the trade name for the international health insurance programs of Worldwide Insurance Services, an independent licensee of the Blue Cross Blue Shield Association. GeoBlue provides easy access and peace of mind to travelers and expats living around the globe.

What cover does a Geo Blue Travel insurer offer in Covid travel insurance? Does it have Quarantine coverage for US travelers?

Geo Blue provides coverage for Covid-19 as a new sickness in their Covid travel insurance covers. They have various travel insurance plans for Short-term travelers, multi trip travelers, student plans and long term insurance plans with coronavirus coverage. No, coverage for quarantine is not available with the Geo Blue travel insurance plans.

Why should I buy travel insurance from Geo Blue Travel insurers?

GeoBlue is a self-governing licensee of the Blue Cross Blue Shield Association who offer borderless access with a premium quality healthcare system with high-tech service for all travelers to feel secure while traveling around the world. Travelers can be rest assured that their travel requirements will be covered for a safe trip.

Does GeoBlue travel insurance coverage include the cost of Covid19 vaccinations?

Covid19 vaccinations strongly recommended and is being made mandatory for travel by certain airlines and even to be issued travel visas by certain countries. However, the Covid19 vaccination is a preventive measure and preventive care is not insured by short term travel insurance. GeoBlue short term international travel insurance does not offer coverage for Covid19 vaccination.

GeoBlue resourceful travel insurance Links

PPO Network

Student Sports

- Call: (877)-340-7910

- Contact

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Payroll Services

- Best HR Software

- Best HR Outsourcing Services

- Best HRIS Software

- Best Performance Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Home Equity Loan Rates

- Best Home Equity Loans

- What Is a HELOC?

- HELOC vs. Home Equity Loan

- Best Free Checking Accounts

- Best High-Yield Savings Accounts

- Bank Account Bonuses

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Best CD Rates

- Citibank CD Rates

- Synchrony Bank CD Rates

- Chase CD Rates

- Capital One CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

GeoBlue Travel Insurance Review (2024)

Get a free quote to protect your next vacation below.

from Geoblue via Squaremouth.com

Josh Lew is a travel journalist and writer based in the midwestern U.S. He has been active for the past decade, covering airlines, international destinations and ecotourism for sites like TravelPulse and TreeHugger. He currently contributes to content writing agency World Words.

Sabrina Lopez is an editor with over six years of experience writing and editing digital content with a particular focus on home services, home products and personal finance. When she is not working on articles to help consumers make informed decisions, Sabrina enjoys creative writing and spending time with her family and their two parrots.

GeoBlue is a bit different from other top travel insurance providers . In a world of comprehensive trip insurance, this independent licensee of Blue Cross Blue Shield keeps it simple by offering straightforward single-trip and multi-trip health plans.

This insurance brand caters to all types of travelers, from vacationing families to adventure-seekers living or studying abroad for extended periods. With features like a network of doctors who bill GeoBlue directly and coverage for pre-existing conditions, GeoBlue is for people who only need medical coverage when traveling.

At the same time, those seeking trip cancellation insurance won’t find what they are looking for with GeoBlue, which only offers modest interruption and lost baggage coverage.

GeoBlue Travel Insurance Overview

GeoBlue has plans designed for different types of travelers. Its single-trip and short-term coverage is branded as “GeoBlue Voyager.” These options have travel medical coverage limits ranging from $50,000 to $1 million and include accidental death and dismemberment, emergency evacuation , repatriation and prescription drug reimbursement.

In addition to different coverage limits, this insurer has deductible options ranging from $0 to $500. Also, patients can use telemedicine services for non-emergency care.

Trekker-branded insurance coverage is for frequent international travelers needing medical coverage across multiple trips. Meanwhile, Navigator and Xplorer plans to provide emergency and non-emergency healthcare benefits to expats, students, maritime crew members and missionaries.

Pros and Cons of GeoBlue

Compare geoblue to the competition.

Use the table below to compare GeoBlue to other travel insurance providers. However, keep in mind that other providers will cover more costs for your trip, such as cancellation and interruption, whereas GeoBlue just provides travel medical insurance.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

What Does GeoBlue Cover?

GeoBlue’s Voyager Essential and Voyager Choice are budget-friendly travel insurance options focusing on medical services. Essential does not require a U.S.-based primary health plan, but Choice does.

Here is what you get with the GeoBlue Voyager Essential plan.

- $50,000 to $1 million emergency and non-emergency medical coverage

- $500,000 for medical evacuation

- $25,000 for death, dismemberment, or repatriation costs

- 50% prescription drug coverage up to $5,000

- $500 baggage coverage per trip or $100 per bag

- $1,000 trip interruption insurance

If you plan to take multiple trips or live abroad for more than six months, the Xplorer or Trekker plans can provide long-term protection.

Optional Riders

A rider is an addition to a standard insurance agreement. It amends the details or adds other coverage to the policy. For instance, a rider could raise coverage limits or make exceptions for a pre-existing condition.

Because of the varying coverage limits and deductible choices on the Voyager Essential plan, riders are usually not necessary. However, Voyager Choice offers several upgrades that may be worthwhile to some travelers.

- $50,000 death and dismemberment coverage

- 100% coverage for prescription drugs up to $5,000

- No 180-day exclusion for pre-existing conditions

- $50 per day for trip interruptions involving quarantine

Though both these plans are open to all U.S. citizens, Voyager Choice requires that you have an active health insurance policy in the U.S.

Policies Offered

GeoBlue travel insurance plans focus on medical care, including emergencies and regular outpatient office visits. However, other coverages are also a part of some plans.

All policies offer $25,000 for specified hazardous activities, such as alpine skiing and scuba diving (diving certification required for coverage).

How Much Does GeoBlue Travel Insurance Cost?

Travel insurance policy prices depend on different factors, including the cost of your trip, your age, pre-existing medical conditions, your destinations, coverage limits, the length of your stay, and other factors. The insurer will ask about these different variables during the signup process.

Cost of International Travel Insurance

Quotes represent the cost for a month-long trip from Sept. 1 to Sept. 30, 2023 for a 40-year-old traveler from Texas. The plan has a $0 deductible and $1,000,000 in medical coverage.

Voyager plans have $1,000 in trip interruption and $500 in lost baggage coverage.

Read More: Travel Health Insurance For Visitors To USA

Does GeoBlue Offer 24/7 Travel Assistance?

GeoBlue says it offers 24/7/365 assistance for all medical insurance plans through its mobile app, site and a toll-free international call center.

The app includes self-service features like virtual insurance ID cards, in-network doctor listings, medication dose conversions and access to telemedicine services on compatible devices. Telemedicine services are via Teledoc Health and include same-day appointments and additional communications, such as appointment notes, via the policyholder’s phone.

Insured customers can also contact GeoBlue via phone on toll-free and collect-call hotlines. Operators are able to coordinate services listed on the policy, check coverage eligibility and find doctors in the country.

GeoBlue Customer Reviews

GeoBlue has over 80 reviews on Squaremouth and a rating of 4.63 out of 5 as of June 2023. Many of the customers mentioned that they needed international health insurance without cancellation or other travel coverage and found that GeoBlue was the best fit for their needs. Some reviewers struggled to find information about healthcare providers in GeoBlue’s network in their destination country.

Here are four reviews from verified customers on Squaremouth.

“Really pleasant person at GeoBlue assisted me pre-departure when I had some difficulties accessing membership cards via the internet. She was very patient and very helpful. We had no health incidents while traveling, but we expect to purchase similar coverage next time we travel out of the U.S.” —Catherine from GA “My trip to Israel was canceled by the tour company one week before we were to leave. I sent an e-mail to GeoBlue to inform them that the trip had been canceled. Within minutes I received an e-mail from GeoBlue that my insurance had been canceled and that I would receive a refund to my credit card ASAP. I hope to re-schedule this trip as soon as possible and I will only use GeoBlue for securing travel insurance. I could not have been more satisfied with the service and would highly recommend them to anyone considering travel insurance in the future.” —Pamela S. Johnson from OH “I had my suitcase stolen while on my trip in Sweden. When I returned, I filed a claim ($500 total, $100 per item for lost/stolen Item) and have been turned down twice, the latest because I have no receipts for the items lost (we are talking suitcase, [clothes], shoes, electric toothbrush, toiletries, etc. [Things] that people do not keep receipts on). The first denial was noted as not providing medical records and receipts, as if they hadn’t even bothered to read the claim. I did provide them with the police report that I was provided, the report that the Gate 1 tour company provided, and a break-down of what was in the suitcase, including prices.” —Kenneth from AL “I have been constantly asked by the medical doctor in Greece over a 6 month period to help them as I made 2 visits to the doctor and they claim they were not paid. Since I [contracted] Covid I also had bloodwork, chest X-rays, etc., 2 visits in all. I paid direct to the hospital [on my] first visit and met my deductible . ($250 or 240.50 euros). The doctor claims they were never paid by GeoBlue! I called from Greece, which is very expensive, to GeoBlue twice and asked that they [please] straighten this out. I sent 2 emails stating the same. But to this day the doctor’s secretary is writing to me to secure payment for them. I was sick in May — it is now November! I told the doctor that you are in GeoBlue’s network and you should be contacting GeoBlue to get paid. Most annoying and frustrating.” —Martha from FL

Note: GeoBlue responded to the above review with the following : Thank you for your review! A response to your claim inquiry email was sent on 11/16/2022, please check your email and spam folder for our resolution to your claim issue.

How To File a Claim with GeoBlue

GeoBlue offers several options for filing a claim. Customers with travel medical plans will have access to the Member Hub and mobile app. Both allow for electronic claims submission. The process includes filling out a claims form and submitting scans or images of medical bills and supporting documents. You can also file a claim by fax, email or traditional mail.

GeoBlue has country-specific phone numbers for some destinations.

Is GeoBlue Worth It?

GeoBlue focuses on providing health insurance for people traveling outside of their home country. You can use deductible and coverage limit options to change the cost and level of protection of your policy.

GeoBlue stands out for travel health insurance because it offers telemedicine, a worldwide network of doctors, direct payment for in-network services and both short and long-term insurance options. We recommend requesting a quote from GeoBlue, along with at least two other travel insurance providers, to make sure you get the best value for your trip.

Frequently Asked Questions About GeoBlue

Does geoblue cover pre-existing conditions.

Some GeoBlue programs cover pre-existing conditions. For single-trip coverage, the Voyager Choice plan covers all pre-existing conditions. The basic Voyager Essential also does, but it has a six-month exclusion period from the coverage start date.

Does GeoBlue have policies for group travel?

GeoBlue offers group options for both of the Voyager plans. If you travel with a group of five or more people, you qualify for a 10% discount. Group members must be 95 years old or younger.

Does GeoBlue have a plan for expatriates?

The GeoBlue Xplorer plan is for expats and their family members who plan to be outside the country for at least three months during the year. Explorer Essential has no U.S. coverage, while Xplorer Premier offers comprehensive coverage at home and abroad.

Does GeoBlue offer trip cancellation insurance?

GeoBlue does not have traditional trip cancellation insurance. Voyager plans include $1,000 in trip interruption coverage and $25 to $50 per day for quarantine-related delays.

Other Insurance Resources From MarketWatch Guides

Gain insight into our ratings for the best home, renters, pet, travel or life insurance providers and find affordable recommendations for necessary insurance products.

- Prominent Pet Insurance Companies

- Premier Travel Insurance Companies

- Outstanding Homeowners Insurance Providers

- Top Renters Insurance Firms

- Budget-friendly Renters Insurance Providers

- National Term Life Insurance Providers

- Cost-effective Homeowners Insurance Companies

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Medical Insurance Plans

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Evacuation Insurance Plans

- Trip Cancellation Insurance

- International Life Insurance

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

Xplorer Health Insurance Plan

- Navigator Student Health Insurance

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Travel Insurance for Seniors

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

GeoBlue Insurance

International Travel and Medical Insurance Services

GeoBlue simplifies the international healthcare experience for the globally mobile. They offer long-term coverage for those living abroad ( Xplorer Global Medical ), short-term travel coverage plans for both single ( Voyager Travel Insurance ) and multi-trips ( Trekker Annual Travel Insurance ), and specialist solutions for missionaries, yacht crew, faculty, and students ( Navigator ).

GeoBlue's health insurance plans provide access to high-quality medical providers outside the U.S. and 24/7 member services. GeoBlue provides its members with the confidence and peace of mind to carry out their international aspirations.

International Citizens Insurance is an authorized agent of GeoBlue.

GeoBlue International Insurance offers quality plans for global travelers like you. They provide top-notch service, comprehensive coverage, and access to the best medical care no matter what country or time zone in which you find yourself. In addition, GeoBlue has a variety of plans to meet your specific needs and circumstances.

GeoBlue's Unique Features

Member support.

24/7 assistance around the world.

Elite Provider Network

Access to carefully selected doctors, dentists, hospitals, and clinics.

Maintain Personal Profile

Download your ID card, view plan benefits, and edit your travel profile settings.

Global TeleMD

Speak to doctors at a time that fits your schedule and receive comprehensive medical guidance.

High Quality Plans

GeoBlue has specialized in providing global health insurance for 20 years. It is their commitment to serving world travelers’ unique needs that makes them an industry leader. Their mission is to provide peace of mind to long- and short-term global travelers. They do this through their community of carefully selected, contracted doctors and hospitals in almost every country in the world as well as signature destination databases, mobile tools, and concierge-level services.

GeoBlue Xplorer

GeoBlue Xplorer is annually renewable, comprehensive medical insurance for U.S. expatriates living abroad or internationals residing in the USA, as well as employees of U.S. companies wherever they are in the world. It includes coverage in the U.S. for up to 9 months each year.

Xplorer Worldwide Medical Plan

- Premium Benefits, Coverage and Service

- Define your deductible and prescription benefits

- For Foreigners in the US or US citizens abroad

GeoBlue Voyager

GeoBlue Voyager Travel Insurance covers subscribers for trips lasting 7 days to a maximum of 6 months. The plan provides emergency medical coverage along with travel insurance benefits to help care for you while you are abroad.

GeoBlue Voyager Plan

- For U.S. citizens up to age 95

- Includes pregnancy coverage, baggage loss, trip interruption & more

- 24/7/365 service and assistance

GeoBlue Trekker

GeoBlue Trekker is an annual “multi-trip” travel medical plan for US citizens that travel abroad multiple times each year.

Trekker MultiTrip Travel Insurance

- Up to $500,000 for sickness and accidents

- $500,000 medical evacuation benefit

- Unlimited Trips Outside the U.S. for trips up to 70 days

GeoBlue Navigator

The Navigator plan from GeoBlue is an excellent health insurance option for students, faculty and other academics living and studying in the USA or U.S. students and academics studying or researching abroad.

GeoBlue Student Medical Coverage

- Worldwide medical coverage built for students and faculty in the U.S. and abroad.

- Select from a range of deductibles and rates.

- Choose providers either in or out of our elite network.

GeoBlue Provider Network

GeoBlue has an elite network of doctors from almost every specialty ready to see you in over 180 countries. GeoBlue seeks out English-speaking doctors certified by the American or Royal Board of Medical Specialities to work within its network and ensures they meet GeoBlue's exacting standards. GeoBlue assembles in-depth provider profiles so its members can choose a doctor with confidence.

In addition, GeoBlue's providers, doctors, and hospitals bill them directly, so members do not have to worry about filing claims.

Members that choose a GeoBlue plan with U.S. benefits gain access to Blue Cross Blue Shield, the nation's most prominent provider network. It is the only network with facilities that hold the Blue Distinction honor, which recognizes doctors and hospitals for their expertise and efficiency in delivering specialty care.

GeoBlue Member Services

GeoBlue provides its members with an online portal that allows them to submit and track claims, obtain ID cards, and read about news and safety precautions within their area. GeoBlue has also partnered with Advance Medical, a Teladoc Health company, to create Global TeleMD, a smartphone app that provides access to international doctors through telephone or secure video calls.

GeoBlue members have access to all of the following through the Global TeleMD app:

- A global network of doctors

- Medical guidance and consultations

- Same day virtual appointments

- Multiple language options

- Consultation notes sent directly to your phone

- Prescriptions and referral letters

Download the app on the Apple App Store or Google Play .

GeoBlue Insurance FAQs

Is geoblue part of blue cross blue shield.

GeoBlue is the trade name for the international health insurance programs of Worldwide Insurance Services, an independent licensee of the Blue Cross Blue Shield Association.

Who is the underwriter for GeoBlue Insurance?

GeoBlue plans are underwritten by 4 Ever Life International Limited.

What type of insurance is GeoBlue?

GeoBlue specializes in global medical and travel medical insurance plans.

GeoBlue's global medical plans consist of Xplorer and Navigator. The GeoBlue Xplorer plan is perfect for expatriates moving abroad for work and the Navigator plan is great for students leaving their home country for school.

GeoBlue's travel medical plans, Voyager and Trekker , are excellent plans for those traveling globally for less than a year.

Does BCBS cover me overseas?

GeoBlue is an independent licensee of the Blue Cross Blue Shield Association. It gives you access to Blue Cross Blue Shield in the United States and a similarly high-quality network of international doctors and facilities while you are overseas. With GeoBlue you will have access to high-quality medical care wherever you are in the world.

Does GeoBlue cover pre-existing conditions?

Pre-existing conditions are judged on a case-by-case basis. All GeoBlue members must go through underwriting to determine whether their pre-existing conditions will be covered.

GeoBlue Trekker Multi-Trip Travel Medical Insurance

Geoblue voyager travel medical insurance plan.

GeoBlue is the trade name of Worldwide Insurance Services, LLC (Worldwide Services Insurance Agency, LLC in California and New York), an independent licensee of the Blue Cross and Blue Shield Association. GeoBlue is the administrator of coverage provided under insurance policies issued by 4 Ever Life International Limited, Bermuda, an independent licensee of the Blue Cross Blue Shield Association.

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best COVID-19 Travel Insurance in April 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Factors we considered when picking travel insurance that covers COVID

An overview of the best travel insurance for covid , top travel insurance for covid options , additional resources for covid-19 travel insurance shoppers.

No matter how well you prepare, travel plans don’t always go as expected. Some travelers buy travel insurance to protect their investment in prepaid travel costs. Amid the ongoing pandemic, exploring travel insurance with COVID-19 coverage is recommended. With the right policy, you can protect yourself if you need to cancel your trip or end it early due to illness. Many insurers offer travel insurance policies with this kind of coverage.

This is the shortlist of the best travel insurance for COVID options:

Berkshire Hathaway Travel Protection .

John Hancock Insurance Agency, Inc.

Seven Corners .

Travelex Insurance Services .

Travel Insured International .

WorldTrips .

We used the following factors to choose insurance providers to highlight in our best travel insurance for COVID list:

Range of coverage: We looked at how many plans each company offered with COVID-19 coverage, plus the range of available plans.

Depth of coverage: We compared the maximum caps for trip cancellation and trip interruption claims between carriers and plans.

Medical benefits: We examined whether plans included emergency medical benefits for COVID-19 reasons and whether plans included medical evacuation and repatriation benefits.

Cost: We determined an average cost for shoppers to benchmark plan prices by looking at the basic coverage costs for plans with COVID-19 benefits across multiple companies.

We looked at quotes from various companies for a six-night trip in May 2023 to Croatia. The traveler was 30 years old, from Texas and planned to spend $1,500 on the trip, including airfare.

On average, the price of each company’s most basic coverage plan with COVID-19 coverage was $47.22. The prices listed below are for the most basic COVID-19 travel insurance coverage. All insurers offer multiple COVID-19 policies with greater coverage coming at a higher cost.

Let's take a closer look at our eight recommendations for travel insurance with COVID coverage:

Berkshire Hathaway Travel Protection

What makes Berkshire Hathaway Travel Protection great:

Several plans allow policyholders to cancel for COVID-19 sickness as part of trip cancellation and trip interruption insurance benefits.

Several plans include COVID-19 medical coverage benefits.

Medical evacuation benefits are included in these plans.

Plans include limited sports and activities coverage and sports equipment loss benefits.

Basic Berkshire Hathaway Travel Protection will run you $50 for an ExactCare Value policy, the company’s most basic COVID-19 travel insurance coverage option.

What makes IMG great:

Many plans include COVID-19 cancellation benefits.

Most of these plans also include COVID-19 medical benefits (the Travel Essentials plan doesn’t include this).

Medical evacuation coverage is available on select plans.

Coverage for adventure travel is available for an extra cost.

IMG is a good option for the budget-minded: Its Travel Essential plans cost more than $10 less than average based on our comparison.

John Hancock Insurance Agency, Inc.

What makes John Hancock Insurance Agency great:

Multiple plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancellation coverage.

These plans offer COVID-19 medical benefits.

Medical evacuation coverage is included in all COVID-19 coverage plans.

The John Hancock Insurance Agency, Inc. basic plan (Bronze) costs $56.

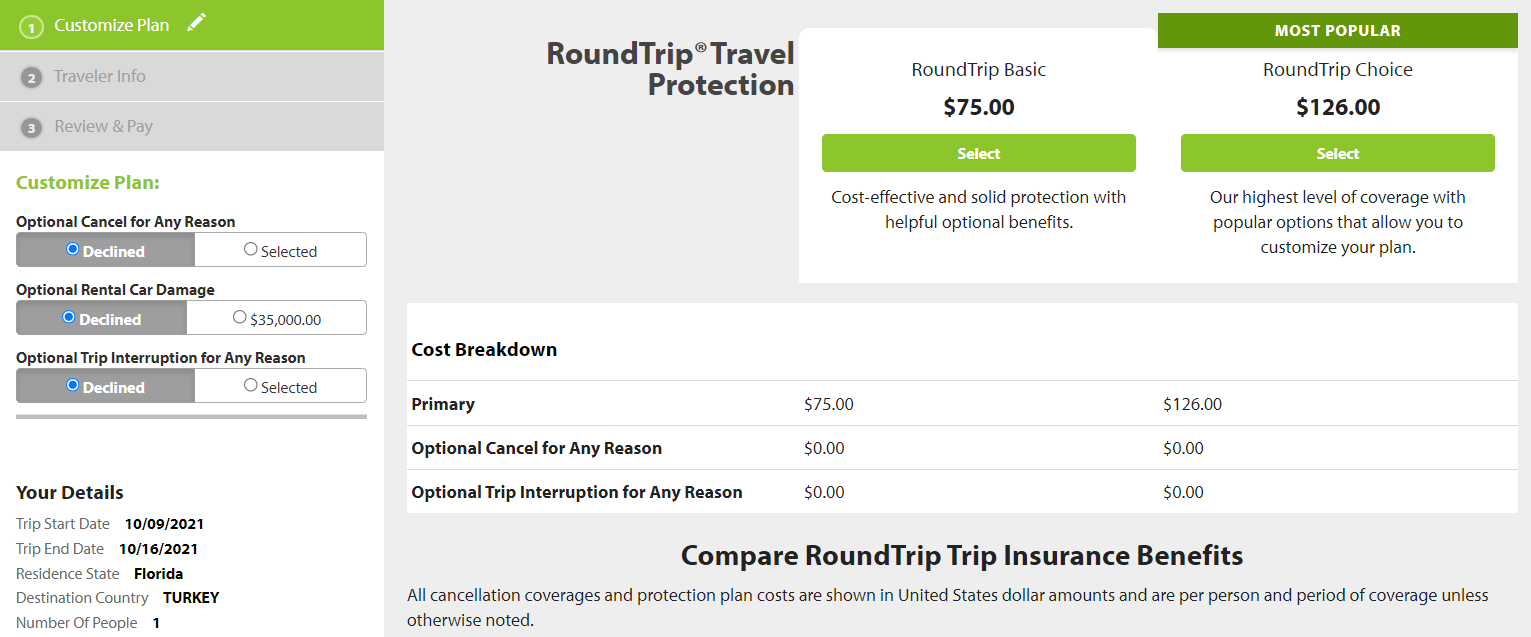

Seven Corners

What makes Seven Corners great:

Multiple plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

These plans include COVID-19 medical benefits and evacuation and repatriation benefits.

There is no medical deductible.

Seven Corners’ basic coverage plan (RoundTrip Basic) for our trip to Croatia costs $44.

Travelex Insurance Services

What makes Travelex Insurance Services great:

Multiple plans include Covid-19 sickness coverage, which reimburses prepaid and nonrefundable trip payments if a trip is canceled or interrupted due to a traveler contracting the virus.

These plans also include COVID-19 medical benefits.

Medical evacuation and repatriation benefits are included.

Basic coverage (Travel Basic) from Travelex Insurance Services costs $44 for our sample trip, which is slightly cheaper than average.

Travel Insured International

What makes Travel Insured International great:

Multiple plans cover COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

These plans also include COVID-19 medical benefits, including medical evacuation.

Limited sports and activities coverage is included in plans with COVID-19 coverage.

Travel Insured International's basic coverage (Worldwide Trip Protector Edge) begins at $55 — only a few dollars more than the average basic policy price.

What makes Tin Leg great:

A wide range of plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

All of these plans also include COVID-19 medical benefits.

All of these include medical evacuation benefits.

An adventure travel policy is available.

Another plus: Tin Leg’s basic coverage plan (Basic) for our trip to Croatia costs $48.85 — making it right around the average price for the policies we covered.

WorldTrips

What makes WorldTrips great:

Several plans include medical coverage for COVID-19.

Sports and activities and sports equipment loss are included.

Coverage can be extended for up to thirty days, including for medical quarantine purposes.

WorldTrips’ most affordable plan with COVID-19 coverage (Atlas Journey Economy) starts at $44, making it a low-cost option.

Do you want to learn more about travel insurance before you spend money on a policy? Take a look at these resources:

What is travel insurance?

What does travel insurance cover?

The best travel insurance companies

How to find the right travel insurance for you

10 credit cards that provide travel insurance

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Subscribe Support

Travel Insurance

Special alert.

Consistent with UNC System guidance , Carolina is prohibiting University-affiliated travel outside the State of North Carolina . Please see the Carolina Together website and the resources below for additional guidance and travel restrictions.

- Information on Requesting an Exemption to current University travel restrictions

- COVID-19 travel information from the U.S. Department of State

- COVID-19 country-specific travel recommendations from U.S. Centers for Disease Control and Prevention

Special Insurance Guidance for Students Returning from Overseas Due to COVID-19 Pandemic

Students who were enrolled in Blue Cross Blue Shield GeoBlue travel health insurance a re eligible to enroll in the U.S.-based StudentBlue Plan . Loss of GeoBlue is considered a qualifying life event to obtain StudentBlue . Students have 30 days from the day their GeoBlue coverage ends to elect coverage in StudentBlue . Coverage is retroactive to the date after the loss of GeoBlue and will be activated once the prorated premium payment is made.

StudentBlue does cover coronavirus testing at 100% and does not require prior approval . H owever, doctor visits to screen for COVID-19 will be covered the same as any other doctor visit, subject to the applicable co pay , deductible or coinsurance. Student Blue members will also have access to telehealth services through MDlive . To begin your application, contact [email protected] , and include your name, PID, date of birth, date that you are canceling GeoBlue .

Travel Health Insurance

Students, faculty, and staff are required to have international health insurance coverage when traveling abroad on University-affiliated business. University-affiliated international travel includes all international travel funded by the University as well as all travel for academic credit.

The University offers a comprehensive accident and sickness insurance policy specially designed for students, faculty, and staff participating in international programs. This coverage can be obtained by enrolling in the University’s travel abroad insurance program administered by the department of Risk Management Services and Mission Continuity .

The coverage is provided by GeoBlue, an accident and sickness policy that includes medical evacuation and repatriation of remains coverage, along with some political, security and natural disaster evacuation coverage. It is primary coverage with a $0 deductible and includes coverage for pre-existing conditions. It also covers inpatient care, emergency treatment and procedures, and medications. As health policy, it does not include coverage for trip cancellation or lost baggage.

Students traveling internationally may decline to participate in this University-sponsored insurance program. However, they must still provide evidence of comparable insurance coverage.

Faculty and staff traveling internationally for official University business are required to maintain this insurance.

GeoBlue insurance for personal or vacation travel is not available for purchase through the University.

For recommendations about safe and smart travel, visit our page on preparing for international travel .

Health Insurance for Travel Through Study Abroad

Students traveling on approved programs offered through the Study Abroad Office or through a professional school administrator may be pre-enrolled in GeoBlue international health insurance coverage and, as such, do not need to enroll independently. Students who are uncertain about their enrollment should consult with their program administrator.

Health Insurance for University-Related Travel Outside of Study Abroad

Students, faculty, and staff are required to have international health insurance coverage when traveling abroad on University-affiliated business. The State Health Plan does not provide comprehensive coverage or as significant a value as GeoBlue when traveling abroad.

Travelers seeking to purchase the University’s comprehensive accident and sickness insurance policy , offered by GeoBlue, or obtain additional information should contact Janet Hoernke in Risk Management Services and Mission Continuity at +1.919.962.6681 or [email protected] .

For more information for students or faculty and staff leading student programs, and to manage your coverage, see www.geobluestudents.com . For faculty, staff, post-docs, and other University affiliates traveling without students, see www.geo-blue.com .

Health Insurance for All Other Travel

Students may purchase coverage for personal travel as well, as long as it is in conjunction with an eligible University-related program. If personal travel coverage is desired by students, then the requirement is a minimum of 2 days and a maximum combined total of 30.

Personal and vacation travel coverage for faculty and staff are not eligible under the UNC program. Individual plans for personal and vacation travel, however, are available for purchase online at www.geobluetravelinsurance.com . Please contact Janet Hoernke at +1.919.962.6681 or [email protected] with questions regarding eligibility.

Countries Requiring Prior Consent

The following countries require written agreement from the insurance operator prior to travel:

- Afghanistan

- North Korea

- South Sudan

Please contact Janet Hoernke at +1.919.962.6681 or [email protected] to request authorization for insurance coverage to one of the above countries.

More About GeoBlue

GeoBlue offers a mobile app where you can manage your health wherever you are by searching for healthcare providers, requesting appointments, setting up direct billing and providing proof of coverage. Use the translation tool to help you schedule your doctor visit or ensure you’re getting the right dose of the right medication. With the app, you can also view security profiles and read travel alerts to make your journey safer. This app is available after your enrollment has been processed. Instructions and an access code will be sent to enrollees in a welcome email from GeoBlue. Visit GeoBlue’s page on student resources for more information.

For emergency evacuation and other 24/7 health insurance assistance, call GeoBlue collect from outside the U.S. at +1.610.254.8771, toll free within the U.S. at +1.844.268.2686, or email [email protected] . In an emergency, seek appropriate medical care immediately, and then call GeoBlue. Insurance coverage must be purchased in advance of travel.

Visit our page on UNC-Chapel Hill’s travel requirements and policies for more information about emergency communications.

Trip Insurance

Trip insurance is an optional policy separate from travel health insurance. It can provide coverage in situations such as trip cancellations, lost luggage, damage to personal belongings, etc. Trip insurance is purchased privately and is available through your travel agency, airline, or other avenues online and is available for international and domestic travel.

Trip insurance may include emergency medical insurance and emergency evacuation/repatriation for an additional fee.

GeoBlue does NOT provide coverage for non-medical related items.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.