Jet2 offers pre-paid WeSwap currency card

- Share on WhatsApp

- Share by email

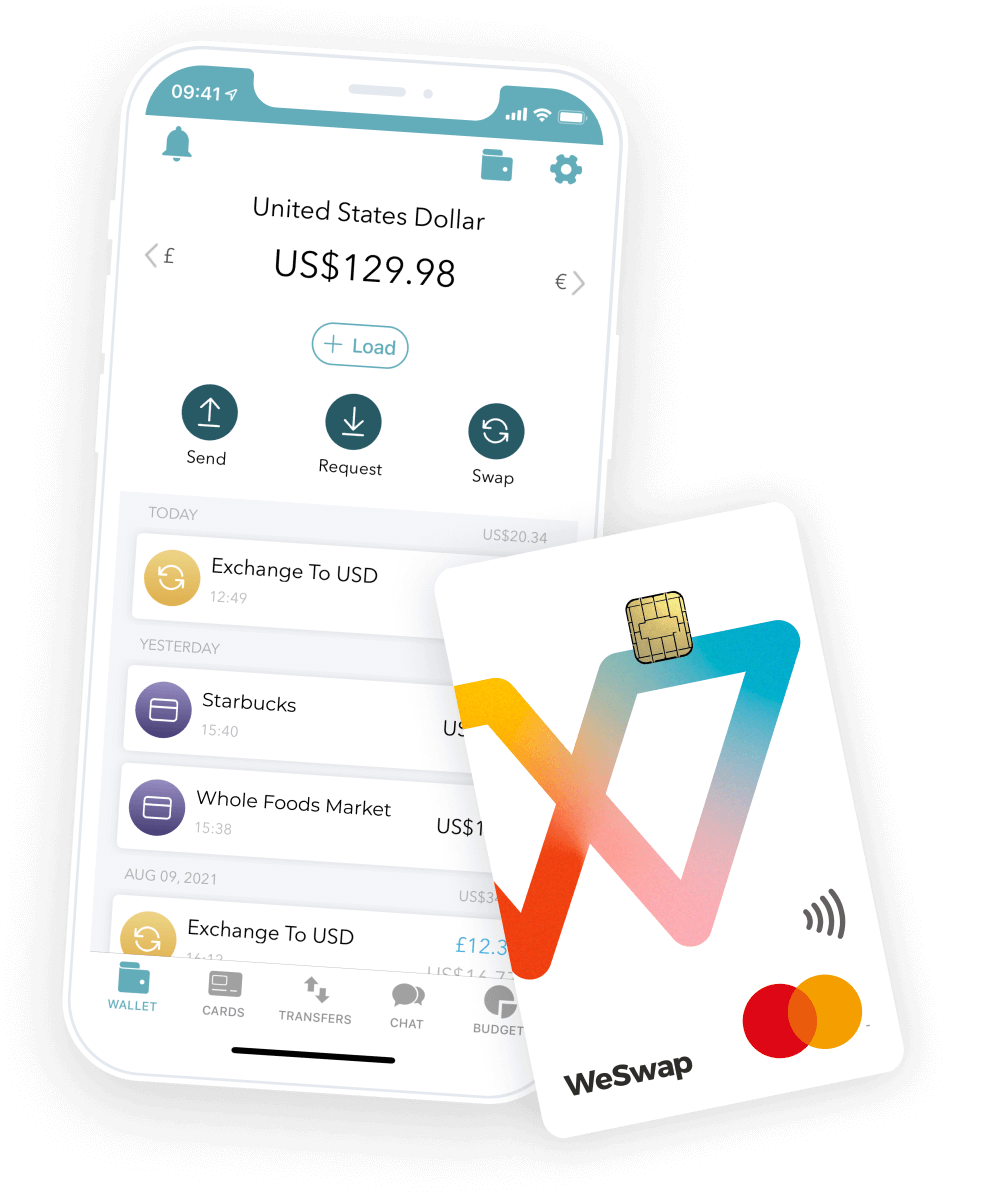

Jet2 and Jet2holidays customers can receive £15 free travel money when signing up and loading a minimum of £50 onto a new pre-paid currency card.

The low cost airline and operator has partnered with WeSwap to offer the contactless global travel money card to holidaymakers.

The globally accepted Mastercard and app helps users make savings on their travel money by swapping currencies directly with each other.

Users pay a flat 1%-2% fee on all ‘swaps’ and get access to a range of travel money budgeting features.

Jet2 and Jet2holidays chief executive Steve Heapy said: “We’re always looking at ways we can make life easier for our customers and this partnership with WeSwap does exactly that.

“The currency card removes the hassle of organising travel money for different destinations and enables customers to manage travel money in a simple, safe and secure way.

“With the £15 free credit currently available to those who sign-up to receive the card, we have no doubt that it will prove popular with holidaymakers heading abroad who are looking to gain some extra pocket money.”

WeSwap chief executive Jared Jesner added: “This partnership combines two brands that put customers at the heart of everything they do and ultimately provides Jet2.com and Jet2holidays’ customers with a simple, cost effective way of managing their travel money to make the most of their trip.”

Share article

View comments, boeing pays ‘initial’ $160m compensation to alaska air over 737 max 9 panel blowout, ec defends saf mandate and promises ‘carrots’ to come, eu governments ‘to blame’ for blocking airspace reform, ex-royal caribbean sales director joins royal mail, jacobs media is honoured to be the recipient of the 2020 queen's award for enterprise..

The highest official awards for UK businesses since being established by royal warrant in 1965. Read more .

Travel money card

Easy Spending

Why WeSwap?

A card that works wherever you are, track your money on the go, carry 32 wallets at once, safe, secure, protected.

Best Travel Money Provider three years running

What do i need to know, how do i order the card, how long will my card take to arrive, how do i load.

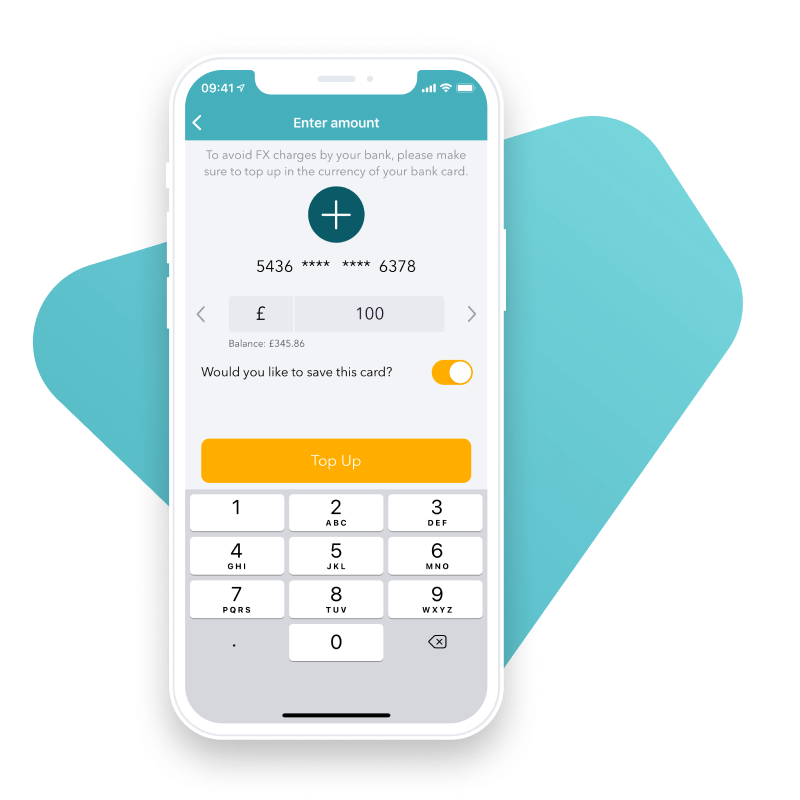

You can load your WeSwap account with a debit card (Visa and Mastercard) and bank transfer. Unfortunately, you can’t load by credit card, PayPal or direct debit.

To load your account:

- Log in to your account

- Click on the Load button on your wallet tab

- Select Bank Transfer or New Debit card

If you are loading via Bank Transfer:

- Select the currency you want to load by clicking on the arrow next to the currency (load in the same currency of your bank account to avoid extra charges)

- You'll then be provided with the details to do a bank transfer, which you can copy. Note each currency will have its own bank transfer details, so make sure you are taking the correct one for the currency that you want to load.

You will be able to choose between Local and Swift transfer details:

- Local : are the details if you make a bank transfer domestically, e.g. your bank account is in the UK and you are loading in GBP. You can use Local bank transfer details if you have an EU bank account and you are loading in EUR

- Swift : are the details for international transfers only, for example, if you need to load USD, CAD and other overseas currencies from an international account.

Please note fees apply on bank transfer load, you can review them here.

If the sending bank supports instant transfers, the transfer will arrive in a few seconds. Otherwise, it will take up to 2 working days.

If it has taken more than 2 working days, please do get in touch with us here below, by sending a copy of your proof of payment. This will need to show:

- The account numbers from where you did the bank transfer and to which bank account you sent the funds to.

- The amount sent

- The date of the payment

As soon as we receive this, we’ll investigate and get back to you.

If you are loading via Debit Card:

- If it's the first time you load via Debit Card, you'll need to select New Debit card

- Enter your card details and click on Done

- Enter the amount and select the currency either clicking on the currency logo (a list of available loading currencies will come up) or the arrow.

- If you want to save this card for future payments, select the box next to Would you like to save this card?

- Click on Load

- A new page will confirm you if the payment has been successful - If not please check your card details before trying again.

Debit card loads are instant.

How do I swap?

Choose which currency you need and how much you want to swap, we'll take care of swapping your money - instantly!

To swap, first make sure you've loaded your account with some money (See previous FAQ).

Then you're good to swap your travel money.

- Choose the currency you want to swap from by swiping through the currencies

- Click on the Swap button on the currency you wish to swap from

- Then choose which currency you'd like to get

- Enter the amount you'd like to swap

- Select Swap , you'll need to confirm that you want to create the swap so check your swap details on the swap offer and then hit Confirm.

- You’ll be asked to Enter your passcode or authenticate via biometric (if you set this up)

… and you're done, your swap confirmed. Click Done and you will return back to the main Wallet screen

How much will I get? We'll show you how much you'll get after fees in the TO currency when you create a swap and enter the amount from.

Are there fees?

See how weswap works for you, holiday lover, working away.

Ready to board?

Discover weswap, legal stuff.

Compare rates and fees for your money transfers.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Helpful tools to ensure you get the best rates on money transfers.

A Guide to Travel Money Cards

Often deemed the cheapest way to spend money abroad , travel money cards are deemed a failsafe option for many travellers. Given the rapid growth of the financial services sector, we want to find out if travel money cards are still as cutting edge as they once were, by comparing them to the new alternatives. Our job is to identify the best international money transfer services and payment providers in the industry: will travel money cards make the cut?

What are travel money cards?

Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals.

We recommend finding a travel money card which lets you lock-in a favourable exchange rate and supports multiple currencies on one card, to make sure you are securing a flexible and cost-effective deal.

How do you use a travel money card?

Using a travel money card should be straightforward and stress-free. Simply load funds onto the card before you leave, and once abroad, you will be able to reload funds and change currencies using the website or associated money transfer app . The card can be used to make withdrawals, in-store purchases and book travel arrangements.

Where can I get a travel money card?

Travel money cards are available from different retailers and can be purchased and preloaded online, over the phone or in-store, depending on the brand. In the UK, popular brands include Travelex and the Post Office.

Where can I use a travel money card?

Again, this depends on the brand and where you get your money travel card from. Available currencies vary from card to card but commonly used currencies include US Dollars, UK Pound sterling, Euros, Japanese Yen and New Zealand Dollars. Make sure you check with the provider before ordering a travel money card.

How secure are travel money cards?

Generally, travel money cards are considered a lot safer than handling multiple currencies in cash, or travellers cheques, as your provider will be able to cancel it if need be. Furthermore, some of the best travel money cards employ an equivalent level of security to traditional debit cards, including a PIN code, touch ID and face recognition.

Many consider it safer to use a travel money card abroad than a debit card, as they are not associated with your bank account and therefore cannot be linked if lost or stolen.

Travel money cards vs. Credit cards: What is the difference?

One of the biggest advantages of using a travel money card is that your chosen currency is preloaded before you arrive in the foreign country and you won’t be charged conversion fees. This means you are able to benefit from the most favourable exchange rates, locking it in ahead of time and using the funds at a later date.

Most people who use their credit card abroad do it because it is more convenient. The cost of this convenience, however, can sometimes amount to 3 - 5% per use, depending on the transaction and financial institution. Making a foreign ATM withdrawal with your credit card can incur flat-fees of $5 and up, each time.

This being said, there are some excellent traveller credit cards on the market, so we would recommend users compare exchange rates and transfer fees offered by each provider before making a decision on which card is more beneficial.

If you're planning on using your credit card, we suggest you take a look at our credit card wire transfer guide.

What are the alternatives to travel money cards?

Multi-currency accounts.

International money transfer companies are often tailoring their products and services to meet the needs of their customers. Wise , offers a multi-currency account designed with “international people" in mind. This savvy travel credit card is aimed at frequent flyers who want to spend in various currencies in over 200 countries. Wise is a reliable company to trust with your overseas spending habits.

Challenger banks

More and more alternative service providers are popping up around the world, many of them offering reputable banking features for the modern traveller. In a bid to distinguish themselves from traditional banks, challenger banks are scrapping fees on foreign exchange and international spending. Monzo customers, for example, can benefit from free international ATM withdrawals as well as fee-free spending overseas.

We hope this guide to travel money cards has enlightened you and helped you make a decision about whether this is a suitable payment method for your next trip overseas. We appreciate the value of your hard-earned cash and want all our customers to benefit from the best possible rates when dealing with international payments. Use our comparison tool today to make sure you are offered the most desirable exchange rate for your currency.

Related Content

.jpg)

Contributors

April Summers

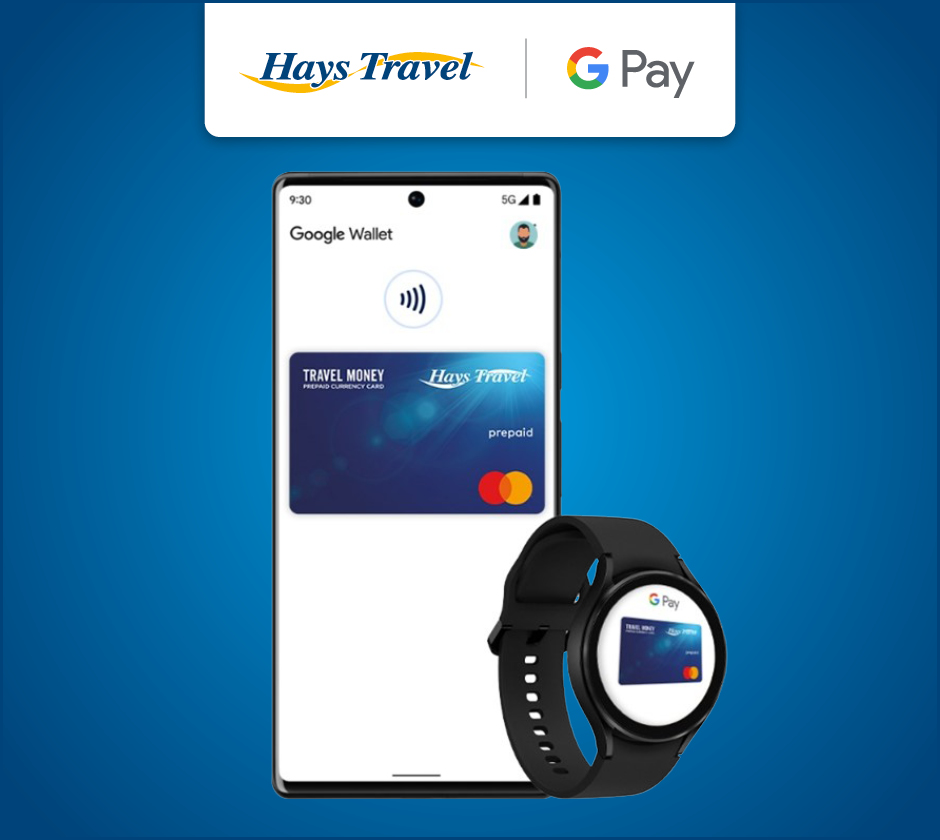

Travel Money Card With Hays Travel

Free spending money with the hays travel mastercard ®.

Enjoy FREE holiday spending money until February 29th 2024 when you buy a Hays Travel Mastercard® online or in branch.

Load a minimum of £50 on purchase and get an extra £10 on us!

No wonder we're the Nation's Favourite Foreign Exchange provider.

The Hays Travel Mastercard® is free to use in millions of locations worldwide where Mastercard® Prepaid is accepted when you spend in a currency loaded on the card: including restaurants, bars, and shops. This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals, and also 24/7 phone support. Take your currency card with you on every holiday, simply top up and go! Just call into your local Hays Travel branch today to purchase your Hays Travel Prepaid Travel Money Card. *Valid ID required in branch (Driving license, Passport)

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

- BUY IN BRANCH

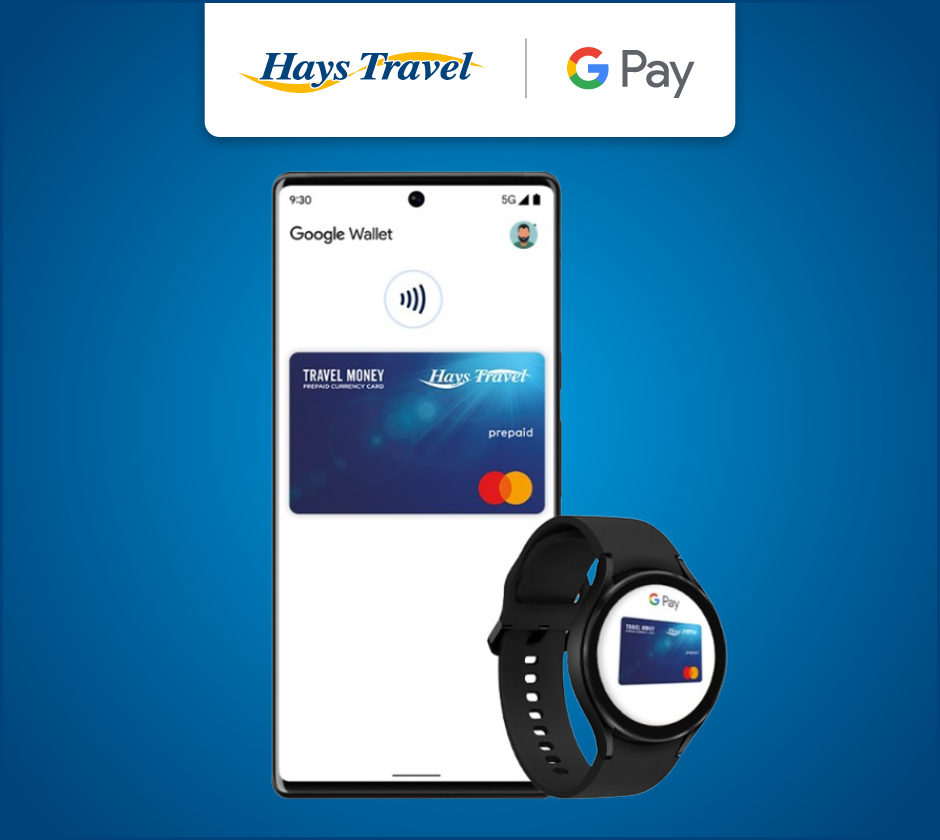

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

The Hays Travel Currency Card app

The Hays Travel Currency Card App enables you to fully manage your travel card account and stay in control of your holiday finances at home and abroad. The app enables you to:

- Instantly top up multiple different currencies from anywhere in the world

- Check your real time balance

- Lock-in exchange rates when you top up and transfer money between currencies

- Keep track of your spending and view transactions

- Freeze/Unfreeze your card

- Check your card PIN

- Manage your personal details

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee *

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

Download our app here

Manage the card on the go via Hays Travel Currency Card App

Available Currencies

- British Pounds

- Australian Dollar

- Bulgarian Lev

- Canadian Dollar

- Czech Koruna

- Danish Krone

- Hungarian Forint

- Icelandic Krona

- Mexican Peso

- Norwegian Krone

- New Zealand Dollar

- Polish Zloty

- Japanese Yen

Useful links

- Card Services Support Numbers

Jet2.com and Jet2holidays partner with WeSwap

Jet2.com and Jet2holidays has partnered with WeSwap to offer customers a prepaid contactless global travel money card and help organise all their travel essentials when abroad. In addition, customers can receive GBP 15 (USD 19.58) free travel money when they sign up and load a minimum of GBP 50 (USD 65.25) onto the currency card for the first time.

WeSwap’s globally accepted Mastercard and easy to use app helps travellers save up to 90% on their travel money by swapping currencies directly with each other. The company’s people-powered platform gets holidaymakers some of the best exchange rates around, on all major currencies, including Euros, Polish Zloty and Hungarian Florin, with users paying a flat 1-2% fee on all ‘swaps’ and getting access to a suite of travel money budgeting features.

Steve Heapy, CEO of Jet2.com and Jet2holidays said: “The currency card removes the hassle of organising travel money for different destinations and enables customers to manage travel money in a simple, safe and secure way.”

Jared Jesner, CEO of WeSwap said: “This partnership combines two brands that put customers at the heart of everything they do and ultimately provides Jet2.comand Jet2holidays’customers with a simple, cost effective way of managing their travel money to make the most of their trip.”

Ant Group launches partnership on International Consumer Friendly Zones

Mastercard report finds human connections and technological innovation are key for…

Network International leverages Mastercard’s AI-powered Brighterion solution to…

Sabre and Mastercard join the Travalyst coalition

Since you're here...

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you design and create an advertising campaign

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Yes, contact me I want to download the media kit

Comments are closed.

LATEST STORIES

Qatar Airways announces the launch of flights to Kinshasa, Democratic Republic of Congo

AirJapan plans future growth after successful implementation of full Radixx portfolio from Sabre

Mürren appoints Jürg Sutter-Salvisberg, as New Tourist Office Director

Welcome, Login to your account.

Sign in with Google

Powered by wp-glogin.com

Recover your password.

A password will be e-mailed to you.

Welcome back, Log in to your account.

SIGN UP FOR FREE

Be part of our community of seasoned travel and hospitality industry professionals from all over the world.

- LOGIN / SIGN UP

- Middle East

- UK & Europe

- USA & Canada

- Hospitality

- HR & Careers

- Luxury Travel

- MICE (Meetings, Incentives, Conferencing, Exhibitions)

- Travel Tech

- Travel Agents

- Airlines / Airports

- Conferences

- Cruising (Ocean)

- Cruising (River)

- Destination Management (DMC)

- Hotels & Resorts

- Hotel Management Company

- Hotel Technology

- HR / Appointments

- Meetings, Incentives, Conferencing, Exhibitions (MICE)

- Travel Agents (all)

- Travel Technology

- Tourism Boards

- Industry appointments

- Travel Bloggers

- Podcasts – Features

- How to join

- RSVP Portal

- Event Photos/Videos

- Competitions

- Search for Jobs

- Destination NaJomtien BanAmphur BangSaray *NEW*

- จุดหมายปลายทาง นาจอมเทียน หาดบ้านอำเภอ บางเสร่ *NEW*

- South Australia Reward Wonders *NEW*

- Ponant Yacht Cruises and Expeditions

- Encore Tickets (Chinese Guide)

- Affordable Luxury in Thailand by Centara Hotels

- Rising Above the Oridinary by Conrad Bangkok

- The Best of Thailand

- Who is IWTA

- Philippines

- Recommend Someone

- Recommend yourself

- Awards site

- Be a Sponsor

- Nominate Now

- Buy Tickets

- TRAVEL CLUB

Jet2.com and Jet2holidays Partners with WeSwap to Offer £15 Free Travel Money

Customers can get £15 free travel money when they load £50 onto their prepaid Mastercard

Jet2.com and Jet2holidays has partnered with WeSwap to offer customers a prepaid contactless global travel money card, and help organise all their travel essentials when abroad. In addition, customers can receive £15 free travel money when they sign-up and load a minimum of £50 onto the currency card for the first time.

WeSwap’s globally accepted Mastercard and easy to use app helps travellers save up to 90% on their travel money by swapping currencies directly with each other. The company’s people-powered platform gets holidaymakers some of the best exchange rates around, on all major currencies, including Euros, Polish Zloty and Hungarian Florin, with users paying a flat 1-2% fee on all ‘swaps’ and getting access to a suite of travel money budgeting features.

To redeem the offer, Jet2.com and Jet2holidays’ customers, who already have a break booked with the leading leisure airline and package holiday specialist, need to head to the Manage My Booking where they will then be taken to a landing page to complete the free purchase of the WeSwap card online. The WeSwap card will be delivered to the customers UK home address for free within 3-5 working days and once received, customers can download the WeSwap app to manage their funds, load and swap money and claim the £15 credit.

Steve Heapy, CEO of Jet2.com and Jet2holidays, said: “We’re always looking at ways we can make life easier for our customers and this partnership with WeSwap does exactly that. The currency card removes the hassle of organising travel money for different destinations and enables customers to manage travel money in a simple, safe and secure way. With the £15 free credit currently available to those who sign-up to receive the card, we have no doubt that it will prove popular with holidaymakers heading abroad with their favourite airline and tour operator who are looking to gain some extra pocket money.”

Jared Jesner, CEO of WeSwap, said: “We are thrilled to be working alongside Jet2.com and Jet2holidays to make the WeSwap prepaid card available to all its customers. Like the company, we firmly believe that getting travel money should be a stress-free experience to allow holidaymakers to focus on enjoying their holiday. This partnership combines two brands that put customers at the heart of everything they do and ultimately provides Jet2.com and Jet2holidays’ customers with a simple, cost effective way of managing their travel money to make the most of their trip.”

9 April 2024

8 April 2024

7 April 2024

Digital library

View complete editions online

Sign Up To Our FREE Weekly Online Newsletter

BUSINESSFIRST

INFORM : CHALLENGE : INSPIRE

Jet2 partners with WeSwap to offer £15 free travel money

Jet2.com and Jet2holidays has partnered with WeSwap to offer customers a prepaid contactless global travel money card , and help organise all their travel essentials when abroad. In addition, customers can receive £15 free travel money when they sign-up and load a minimum of £50 onto the currency card for the first time.

WeSwap’s globally accepted Mastercard® and easy to use app helps travellers save up to 90% on their travel money by swapping currencies directly with each other. The company’s people-powered platform gets holidaymakers some of the best exchange rates around, on all major currencies, including Euros, Polish Zloty and Hungarian Florin, with users paying a flat 1-2% fee on all ‘swaps’ and getting access to a suite of travel money budgeting features.

To redeem the offer, Jet2.com and Jet2holidays’ customers, who already have a break booked with the leading leisure airline and package holiday specialist, need to head to the Manage My Booking where they will then be taken to a landing page to complete the free purchase of the WeSwap card online. The WeSwap card will be delivered to the customers UK home address for free within 3-5 working days and once received, customers can download the WeSwap app to manage their funds, load and swap money and claim the £15 credit.

Steve Heapy, CEO of Jet2.com and Jet2holidays, said: “We’re always looking at ways we can make life easier for our customers and this partnership with WeSwap does exactly that. The currency card removes the hassle of organising travel money for different destinations and enables customers to manage travel money in a simple, safe and secure way. With the £15 free credit currently available to those who sign-up to receive the card, we have no doubt that it will prove popular with holidaymakers heading abroad with their favourite airline and tour operator who are looking to gain some extra pocket money.”

Jared Jesner, CEO of WeSwap, said: “ We are thrilled to be working alongside Jet2.com and Jet2holidays to make the WeSwap prepaid card available to all its customers. Like the company, we firmly believe that getting travel money should be a stress-free experience to allow holidaymakers to focus on enjoying their holiday. This partnership combines two brands that put customers at the heart of everything they do and ultimately provides Jet2.com and Jet2holidays’ customers with a simple, cost effective way of managing their travel money to make the most of their trip.”

February Getaways with Jet2holidays , Jet2CityBreaks and Jet2Villas

Canary Islands, Las Palmas City, Las Palmas City, 3 star Hotel Astoria Las Palmas, 3 nights half-board departing from Belfast International on 27th February.

Price: £249 per person based on 2 sharing, includes a 22kg baggage allowance.

————————————————————————–

Canary Islands, Tenerife, Puerto De La Cruz, 3+ star Sol Puerto De La Cruz Tenerife, 7 nights bed and breakfast departing from Belfast International on 10th February.

Price: £469 per person based on 2 sharing, includes a 22kg baggage allowance and return transfers.

————————————————————————–

Spain, Costa Blanca, Benidorm, 4 star Hotel Benidorm Centre, 7 nights half-board departing from Belfast International on 14th February.

Price: £419 per person based on 2 sharing, includes a 22kg baggage allowance and return transfers.

Canary Islands, Fuerteventura, Corralejo, Villa Atlantic Point, 7 nights self-catering departing from Belfast International on 29th February.

Price: £419 per person based on 6 sharing, includes a 22kg baggage allowance and car hire.

Share This:

Recommended Articles:

DFI Beds Unveils Dream Whisperer Collection

DFI Beds proudly announces the launch of its newest collection,

Bluegrass Omagh 2024: where music meets Ulster-American history

Set against the backdrop of Ulster American Folk Park, Bluegrass

Enjoy a Getaway with Jet2holidays, Jet2CityBreaks and Jet2Villas

Jet2holidays is the UK’s leading tour operator to many leisure destinations

Get more for your money with Jet2holidays

We know how important it is to take care of the pennies right now, so we’ve pulled together our top tips and tricks for getting more for your money on your next Jet2holiday.

We all want to make our money go further at the moment. With that in mind, here’s a handful of ways you can get the most from your next sunshine getaway. What’s more, we’ll also talk you through our super-handy Pay Monthly^^ service, which allows you to spread the cost on your holiday.

From Free Child Places^ to great-value All Inclusive, let the money-saving commence…

Finding a deal...

Choose the full package

With Jet2holidays , remember that return Jet2.com flights, 22kg baggage, return transfers and your hotel is included. We like to make things simple and stress-free.

Discounts, discounts and more discounts!

Keep an eye on our website as we regularly run amazing offers. And if you sign up to our emails, we’ll ping you updates so you never miss a great deal. Travelling solo *? A £30 discount will be automatically applied at checkout. Single parents, we’ve got you covered too – the code ‘J2HSPF60’ will get you £60 off at checkout‡ – yippee!

Use the Post Office’s review

To help you with your search, you can also use the Post Office’s review to browse great-value destinations that holidaymakers have ranked.

Go All Inclusive

There’s no better feeling than getting everything all wrapped up – and that’s exactly what you get with an all-inclusive holiday . We’re talking three meals a day, plus tasty treats, drinks and even some activities, all part and parcel. And that means you don’t have to worry about counting the coins while you’re away, which is always handy when you’ve got the kids in tow. When it comes to easy budgeting, it’s a no-brainer. Another ice cream, anyone?

Bag a Free Child Place^

Don’t want to fork out big amounts for your fave small people? We believe that, if our passengers are pint-sized, then the price of their holiday should be too. In fact, we went one better and made them free^! Yep, that’s right, we have thousands of Free Child Places^ available across a huge range of sun-kissed destinations. Sound too good to be true? Use our Free Child Place Finder and your little one gets free flights, transfers, 22kg luggage and more with a full-price-paying grown-up^!

Infants Go Free **

Did you know that all infants under two travel for free with Jet2holidays **? Just like with our Free Child Places^, your littlest ones’ getaway won’t cost you a penny. How fab is that?

Booking early...

Book early with a £60pp deposit††

Possibly our favourite top tip relates to booking early. That's right, for easier budgeting, it's well worth sorting your holiday ahead of time to make good use of our low £60 per person deposit††.

Pay Monthly^^

Paying the full balance of your getaway upfront feeling a bit overwhelming? Our handy Pay Monthly plan ^^ makes it simple to spread the cost of sunshine. Just a £60pp deposit†† and the holiday’s yours, then you can pay off the rest of your getaway in chunks, up until ten weeks before you fly.

Any-duration holidays

Flying visit or extended stay? With our any-duration holidays, you can go away for as long as you’d like. So why not consider five nights instead of seven, or 12 instead of 14? Swoop in and out in the blink of an eye or stretch out your stay for weeks upon end – the choice is yours with us.

Different flight times throughout the week

With lots of different flight times available across the week, you'll have stacks to choose from. After all, moving the day and time you fly could save money!

A choice of seasons

We offer great-value getaways whichever season you choose. But opt for off-peak breaks, like over winter, and you may just find the prices are even lower! Not to mention fewer queues at attractions and quieter resorts… win-win!

Download our app

With the Jet2holidays app , you'll have everything that you need to search, book and manage ATOL-protected package holidays in one handy place. But that’s not all, we also run app-exclusive offers, so be sure to check there when booking to see if you can lower your getaway price even further!

Saving while you’re abroad…

Stock up on toiletries beforehand

The bigger the bottles, the lower the prices (usually)! Pack them in your 22kg suitcase. And if you're going on holiday with others, sharing is caring.

Hunt down happy hours

Drinks are often cheaper or even two-for-one during happy hours, so keep your eyes peeled for those chalkboards and save on your fave tipples.

Book days out in advance

For reductions on top attractions like waterparks, theme parks and museums, it's great to map out your itinerary and book any days out beforehand.

Take public transport

When you can't get from A to B on foot, swap taxis for buses to save money. That way, you'll see more of your resort too!

Pack a picnic

Picnics on the sand, anyone? They’re ideal for saving on meals and taking full advantage of a beach front-row seat.

Ready to book your next break? Fantastic! Browse our great-value getaways today.

^Free Child Places are subject to availability. Please see our website for details.

‡Single Parent Discount: Promotional code J2HSPF60 must be added at the time of booking. Discount of £60 is a per booking saving and only applicable to bookings with one adult and at least one child. Please see website for details.

*Solo Discount: Discount will be automatically applied at checkout. Discount of £30 is a per booking saving and only applicable to bookings with maximum one adult. Please see website for details.

**Infants Go Free: Infants are defined as children being under 2 years on the date of return. Infants are not entitled to a flight seat (must be seated with a parent or guardian) or a 22kg baggage allowance.

^^Pay Monthly: Terms and conditions apply, please see our website for details.

††£60 per person deposit is applicable on holidays departing 10 weeks or more from booking date.

Posted: 10th May 2022. Updated: 18th Apr 2023.

Best no annual fee travel credit cards of April 2024

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Travel rewards cards are a lot like gyms. The best ones may come with tons of added benefits (saunas, yoga class, etc.) but they also cost a lot, usually with a big financial commitment upfront.

As a result, whether you’re considering a Chase Sapphire Preferred ® Card (with its $95 annual fee) or a CrossFit membership, you probably have the same question on your mind: will I really use it enough to justify paying for it?

While there aren’t any free gyms we know of, there thankfully are plenty of no-annual-fee travel rewards cards that require essentially zero commitment. And just like an ab roller or a Richard Simmons DVD, you can simply use them a few times, forget about them, and put them in a drawer until beach season. Or, you can stick with it and make them part of your daily routine—whatever works for you.

You’re also far more likely to see “instant results” with these cards, too. From 100,000-point welcome bonuses to rewards for paying rent, free travel insurance to 3X on gas, these cards offer way more than you’d expect for a fee of $0 per year.

The best no-annual-fee travel cards for April 2024

Best overall: bilt mastercard, best for hotel rewards: ihg one rewards traveler credit card, best for airline rewards: united gateway℠ card, best for travel earnings: wells fargo autograph℠ card, best for flat-rate earnings: capital one ventureone rewards credit card.

The Bilt Mastercard allows you to earn points from paying rent and transfer them 1:1 to well over a dozen different travel partners including United MileagePlus and Marriott Bonvoy. Toss in some surprisingly robust travel insurance and you have our unconventional—yet logical—choice for the best overall no-annual-fee travel card of 2024.

Bilt Mastercard®

See Rates and Fees

Special feature

Rewards rates.

- 1x Earn 1X points on rent up to 100K/year

- 1x Earn 3X points on dining

- 2x Earn 2X points on travel

- 1x Earn 1X points on other purchases

- Use the card 5 times each statement period to earn points

- Uniquely earns points on rent

- Rent Day bonus every first of the month offers double points (excluding rent)

- Robust travel transfer partners

- Cash redemption rate is poor

- No traditional welcome bonus

- Travel perks: Trip Cancellation and Interruption Protection, Trip Delay Reimbursement, Auto Rental Collision Damage Waiver

- See this page for details

- Foreign Transaction Fee: None

Why we like this card: As mentioned, the Bilt Mastercard’s most compelling feature is that it allows you to pay rent with a credit card—even if your landlord doesn’t take plastic—and avoid the transaction fee paying rent by credit card would typically incur. Then, as long as you complete five transactions each month, you’ll trigger 1X rewards on your rent payments.

Note that rewards on rent are capped at 100,000 points per year.

In terms of earning potential, if you pay the median ~$2,000 rent in the U.S., you could earn approximately 24,000 points per year which can be used to book travel in Bilt’s portal at a value of 1.25 cents per point or transferred to any of Bilt’s airline or hotel partners at a 1:1 ratio. In other words, you could likely earn a domestic flight with United or a weekend stay at Hyatt, all for simply paying rent on time.

The Bilt card also provides trip cancellation and interruption protection, trip delay reimbursement, and primary rental car insurance (terms apply)—perks you wouldn’t typically find on a no-annual-fee credit card.

If you’re looking for a hotel rewards card that offers the most free nights for no annual fee, wait until you read about the IHG One Rewards Traveler Credit Card. With a six-figure welcome bonus, up to 17X on stays and other compelling rewards, it’s currently the gold standard for no-fee hotel rewards.

IHG One Rewards Traveler Credit Card

Intro bonus.

- 17x Earn up to 17X points when you stay at IHG Hotels & Resorts

- 3x Earn 3X points on dining, utilities, internet, cable, and phone services, select streaming services, and at gas stations

- 2x Earn 2X points on all other purchases

- Generous welcome bonus not typically seen in a $0 annual fee card

- Travel protections that are unusual for a no-annual-fee card

- Fourth night free on award bookings

- Limited redemption options outside of IHG

- IHG points are worth less than some other rewards currencies

- Silver status granted with the card has limited benefit

- Additional perks: Trip cancelation/interruption insurance, auto rental collision damage waiver, purchase protection, ability to spend to Gold status

- Foreign transaction fee:None

Why we like this card: We like calling the IHG One Rewards Traveler card the “Liam Hemsworth” of travel rewards cards because it lives in the shadow of its big brother—the IHG One Rewards Premier Credit Card —but still delivers plenty of quality and substance in its own right (with no annual fee, to boot).

For starters, you can get a welcome bonus of 80,000 bonus points after spending $2,000 on purchases within the first 3 months of account opening, potentially worth around $500 to $700 in IHG redemption.

Plus, enjoy up to 17X points when you stay at IHG Hotels & Resorts, instant Silver Elite status and a handy bonus where you redeem points for three consecutive nights and get the fourth night in your stay free. So, if you book a three-night stay using your welcome bonus, you’ll essentially be getting a complimentary four-night stay at a nice IHG property for no annual fee. The IHG One Rewards program could be very rewarding for the right traveler.

Check out our full review of the IHG One Rewards Traveler .

As a no-annual-fee airline card, the United Gateway℠ Card currently edges out its rival the Delta SkyMiles® Blue American Express Card by offering a more generous welcome bonus and travel insurance that the Delta card does not provide. If you fly occasionally and would like to earn miles, but aren’t willing to make the commitment of $95 or more for a mid-tier airline card with more perks, the Gateway is a strong choice.

United Gateway℠ Card

- 2x 2 miles per $1 spent on United® purchases, including tickets, Economy Plus, in-flight food, beverages and Wi-Fi, baggage service charges and other United purchases.

- 2x 2 miles per $1 spent on local transit and commuting, including rideshare services, taxicabs, train tickets, tolls, and mass transit.

- 1x 1 mile per $1 spent on all other purchases

- No annual fee or foreign transaction fee

- Reward bonus categories outside of United Airlines

- Robust travel protections for a no-annual-fee card

- No baggage or expanded award availability benefits like with other United cards

- Subject to Chase 5/24 rule.

- United perks: 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Gateway Card

- Other perks: Auto Rental Collision Damage Waiver, Trip Cancellation/Interruption insurance, Purchase Protection, Extended Warranty

- Foreign transaction fee: None

Why we like this card: The United Gateway card offers 2 miles per $1 spent on United® purchases, at gas stations and on local transit and commuting plus 1 mile per $1 spent on all other purchases. Considering a United Mile is worth roughly around 1.2 cents these days, effectively earning 2.4 cents back on everyday purchases is a solid value proposition.

You’ll also get a welcome bonus of 20,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open. And, you can save with a discount of 25% back on United in-flight and Club Premium drink purchases.

New cardholders will enjoy a 0% Intro APR on Purchases for 12 months, after 21.99%–28.99% variable applies.

If the United Gateway card has a small lead on the Delta Skymiles Blue Amex at this point, it soars ahead (pun intended) when you look at the included travel and shopping protections. Both cards offer secondary rental car insurance, but only the Gateway includes trip cancellation and interruption insurance, purchase protection and extended warranty protection.

So, if you’re seeking a no-annual-fee card you can use to rack up miles—and you either tend to fly United most of the time or you’re at minimum not devoted to a competing airline—the United Gateway is the card to beat.

Check out our full review of the United Gateway Card for more info.

To view rates and fees of the Delta SkyMiles® Blue American Express Card, see this page

With a generous welcome bonus in exchange for an attainable spend amount, 3X on travel, and a fancy name, you’d think the Wells Fargo Autograph℠ Card would command an annual fee of at least $95. But it doesn’t, making it a superb candidate for general travel use.

Wells Fargo Autograph℠ Card

Intro bonus.

- 3X 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans

- 1X 1X points on other purchases

- No annual fee

- 20,000 bonus points when you spend $1,000 in purchases in the first 3 months (that's a $200 cash redemption value)

- Points transfer to partners

- Car rental insurance is secondary

- No travel insurance

- Transfer partners are limited

- Additional perks: Cell Phone Protection: Provides up to $600 in cell phone protection when you pay your monthly cell bill with your Wells Fargo Autograph card. Coverage is subject to a $25 deductible and limited to two claims every 12-month period.

- Foreign transaction fee: N/A

Why we like this card: The Wells Fargo Autograph offers unlimited 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans and even your landline bill too if you have one, plus 1X points on other purchases—all without charging an annual fee. And, to make traveling a little cheaper/less stressful, you’ll also get $600 worth of cell phone protection (minus a $25 deductible) as long as you pay your phone bill with this card and secondary rental car insurance.

Cardholders can transfer points at a 1:1 ratio to Wells Fargo’s first wave of transfer partners including Air France‑KLM Flying Blue, Avianca Lifemiles, British Airways Executive Club, AerClub, and Iberia Plus and 1:2 to Choice Privileges.

But even if you aren’t a member of those loyalty programs, earning 3X on dining, travel, gas, and more is hard to pass up. You can redeem points at a value of 1 cent each to offset past purchases on your account, meaning you can wield the Autograph either as a no-annual-fee travel card or as a cash-back card effectively earning unlimited 3% back in a wide swath of useful categories.

Check out our full review of the Wells Fargo Autograph .

Sometimes, you just want a card that offers a little more than 1X on every purchase—without having to worry about what this quarter’s rotating rewards are, or whether a specific merchant qualifies as “groceries” for the purposes of your card’s rewards. If you value simplicity and the lack of an annual fee in your travel card, you’ll probably be a fan of the Capital One VentureOne Rewards Credit Card and its straightforward rewards program.

Capital One VentureOne Rewards Credit Card

Reward rates.

- 5x Earn 5x miles on hotels and rental cars booked through Capital One Travel

- 1.25x Earn 1.25x miles on every other purchase

- Flexible travel rewards

- No foreign transaction fee

- Maximizing Capital One Miles requires a learning curve

- Cash redemption value is limited

- The VentureOne offers travel accident insurance, rental car coverage, extended warranty protection, exclusive access to events through Capital One Dining and Capital One Entertainment

Why we like this card: The Capital One VentureOne Rewards offers 1.25X miles per dollar spent on everyday purchases and 5x miles on hotels and rental cars booked through Capital One Travel. That’s pretty much all that you have to remember. You can also get a nice welcome bonus of 20,000 miles after spending $500 on purchases within 3 months from account opening, which is a solid payout for a very attainable spending target.

Capital One Miles can be transferred to well over a dozen airline and hotel partners, most at a 1:1 rate. Partners include Air Canada’s Aeroplan, British Airways Executive Club, Choice Privileges, Virgin Red, and Wyndham Rewards, among others. Other ways to book travel include redeeming miles through Capital One’s portal or making the purchase directly, paying with your card like normal, then using miles for a statement credit to cover the transaction.

The Venture One also offers a 0% intro APR on purchases for 15 months (after that, the variable APR will be 19.99%–29.99%). There’s an intro balance transfer fee of 3% of the amount of each transferred balance that posts to your account during the first 15 months that your account is open , then 4% per transfer for any promotional APR offered after.

Come to think of it, provided you have the excellent credit needed to apply, the VentureOne could make a great travel companion for a grad student given its simplicity, lengthy intro APR period and low spending threshold required to trigger the welcome bonus.

Check out our full review of the Capital One VentureOne Rewards .

Frequently asked questions

Which card is best for international transactions without extra charges.

Zero foreign transaction fees is actually a common benefit among travel rewards cards, including many with no annual fee. For example, neither the Bilt Mastercard nor the United Gateway card charges a foreign currency conversion fee.

What is the best travel credit card for a young person?

If you’re still paying rent, the Bilt Mastercard is an excellent choice since it can generate points from rent payments which can then be transferred 1:1 to well over a dozen airline and hotel partners. If you’d prefer a card with a welcome bonus, which the Bilt card lacks, the IHG One Rewards Traveler card currently offers a massive welcome bonus for a no-annual-fee card—potentially worth hundreds of dollars toward a future IHG hotel stay.

Is a travel card with an annual fee worth it?

Using a travel rewards card with an annual fee can be worth it as long as you’re extracting enough points and benefits to justify paying the fee each year. If you travel infrequently or just want one less fee to worry about, consider one of the no-annual-fee cards on our list above. But, the best perks and protections are typically available on cards with annual fees.

For example, the Capital One Venture X card offers a $300 annual travel credit for bookings made through Capital One Travel. If you use that every year, you’ve gone a long way toward offsetting the $395 annual fee. You also get 10,000 bonus miles, worth at least $100 toward travel, every year starting on your account anniversary.

Methodology

To bring you our top picks for the best travel rewards cards with no annual fee, the Fortune Recommends surveyed more than a dozen cards currently available from today’s top issuers. From there, we ranked each one based on the following core categories and weights:

- Welcome bonus (10%): Some cards—even those with no annual fee—offer welcome bonuses that you can earn once you make enough purchases within a certain time frame, such as spending $1,000 within three months of account opening.

- Travel earnings (25%): These are the point rewards you’d earn by making travel-related purchases (e.g. 3X on hotels, 2X on airfare).

- Car rental insurance (15%): Many, but not all travel-centric rewards cards include an auto rental collision damage waiver, which allows you to decline a portion of the rental company’s insurance and save potentially up to $30 per day. We gave extra consideration to if a card offers primary rental car insurance versus secondary, because primary kicks in immediately in a covered scenario—whereas secondary only applies after your own, personal insurance.

- Travel insurance benefits (15%): Some travel rewards cards automatically apply trip cancellation/interruption insurance, lost/delayed luggage reimbursement and even travel accident insurance on travel bookings made using the card.

- Gas earning (5%): Since road trips remain a common form of travel, whether or not a card offers points rewards at the pump factored into our rankings.

- Dining earning (10%): If a no-annual-fee travel rewards card offered 2X or more on restaurant purchases it favored well in this category.

The remaining 20% was based on the card’s main focus: hotel, airline or general travel rewards.

- For general travel—points transferrable to partners (20%): Points are literally worth more if you can transfer them to certain partners, so a card’s ability to transfer rewards to airline and hotel partners factored into our rankings.

- For hotel rewards—free award night with booking (20%): Some hotel rewards cards offer a BOGO-like perk where if you redeem a certain number of nights with points you get an extra tacked on for free.

- For airline rewards—ability to spend towards status (20%): Most airline rewards cards allow you to earn miles, but not all of them count those miles towards your next loyalty status. If a card treated them as “qualifying miles,” it fared better in this category.

Lastly, just keep in mind that virtually every aspect of a travel rewards card—from the rewards to the welcome bonus and fee structure—is subject to change, which could impact how many miles or points you earn.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Guide to travel rewards credit cards

Best travel credit cards of april 2024, luxury travel for less: your guide to free airport lounge passes, 10 credit card tips to help you avoid disaster when traveling abroad, how credit card travel insurance works—and what it doesn’t cover, insure your adventures: the ultimate guide to credit cards offering travel insurance, how credit card rental car insurance saves money on every rental, chase lga lounge review: luxury at laguardia, chase beefs up new york profile with a new jfk sapphire lounge—here's what you need to know, biggest-ever amex centurion lounge opens in atlanta — with outdoor terraces and bars for both whiskey and smoothies, amex centurion lounge atlanta: what to expect now that it’s open, how to use your credit card to save on travel as airline costs soar, do you have travel rewards saved up these are the best ways to use them, 5 ways your credit card can help you save on spring break travel costs, capital one lounge: what you need to know, how i travel with my wife for less than a date night, best credit cards for cheap airport lounge access in april 2024.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

American Express Business Platinum benefits guide 2024

Ashley Barnett

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 6:04 a.m. UTC April 9, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

mastezphotois , Getty Images

With an eye-watering $695 annual fee (terms apply), there’s no denying that The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is an expensive card. But without a doubt, it’s also one of the best business travel cards , thanks to its extensive array of perks and ability to earn flexible, valuable Membership Rewards® points . Although the annual fee is high, it’s offset by valuable perks like statement credits, airport lounge access and top-notch travel and purchase protection¹.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

Amex Business Platinum Card overview

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is one of the best cards for high-end travel benefits, lifestyle perks and ways to make your business run more smoothly. Of course, it all comes at a significant cost (a $695 annual fee). Therefore, it’s important to assess the card’s features to see if it’s worth it for you and your business.

Those features include access to over 1,400 airport lounges worldwide, elite status with select hotel and rental car partners, airline fee statement credit and CLEAR ® Plus reimbursement, business-focused statement credits like Dell, Adobe, Indeed and much more. Enrollment is required for select benefits.

Looking for an Amex Business card with a less-lofty annual fee? Our list of the best American Express business cards will help you choose the right one for you.

Major Amex Business Platinum Card benefits

Travel benefits .

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , like the consumer version, The Platinum Card® from American Express , is a powerhouse for premium travel benefits. Let’s break it down:

- Airport lounge access: You will have access to a wide range of airport lounges. They include The Centurion® Lounge ; Delta Sky Club® lounges (when flying on a same-day Delta flight; limited to 10 annual visits starting Feb. 1, 2025); Priority Pass Select lounges upon enrollment (but not Priority Pass restaurants); Escape Lounges — The Centurion Studio Partner; Plaza Premium lounges and Lufthansa lounges when flying Lufthansa Group (access varies depending on what airline and cabin you’re flying).

- Hotel elite status: You’ll receive complimentary Hilton Honors Gold and Marriott Bonvoy Gold Elite status with enrollment. This offers benefits such as 25% bonus points on eligible hotel purchases, complimentary in-room Wi-Fi access and room upgrades at select properties (when available).

- Rental car elite status: You’ll get complimentary elite status with Avis Preferred Plus, Hertz Gold Plus Rewards President’s Circle and National Emerald Club Executive. One of the best parts of elite status, at select locations, is the ability to skip the line and go straight to your car at the start of your rental. In addition, you may receive car upgrades and waived second driver fees. Enrollment is required.

- Other hotel benefits: You will also get access to Amex’s Fine Hotels + Resorts® and The Hotel Collection programs through Amex Travel. Perks include complimentary breakfast for two (varies by property), early check-in when available, late checkout, complimentary Wi-Fi and room upgrades when available (certain rooms may not be eligible for upgrade). At select properties, you’ll also receive an experience credit of at least $100. The credit can be used towards purchases of on-site services, such as dining or spa treatments. Experience credits vary by property and will be applied to eligible charges up to the amount of the credit.

- Airline fee credit: You’ll receive up to $200 in statement credits per calendar year for incidental airline fees charged to your card. One qualifying airline must first be selected in advance before receiving this benefit, which can cover fees such as changes and cancellations, seat selection, upgrades, checked bags, lounge access and more.

- CLEAR Plus reimbursement: You can get a credit for up to $189 per calendar year for Clear Plus membership fees. No advance enrollment is required for this benefit; pay with your Business Platinum card to automatically receive a statement credit.

- TSA PreCheck/Global Entry reimbursement : You’ll also receive statement credits to reimburse your application fees for Global Entry ($100) or TSA PreCheck ($85). This benefit is available every 4 years for Global Entry or every 4.5 years for TSA PreCheck.

- Pay with Points airline bonus: With The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , you’ll get 35% of your points back (3.5 extra points for every 10 points redeemed – up to 1,000,000 bonus points per calendar year) when booking a flight with points through Amex Travel. This applies to flights in any cabin on your selected qualifying airline, or for first or business class flights on any airline.

Small business benefits

As a small business card, The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. offers tailored statement credits and perks to help companies run more smoothly (enrollment is required for select benefits):

- Adobe statement credit: You’ll get up to $150 back in Adobe statement credits for eligible annual prepaid business plans for Creative Cloud for teams or Acrobat Pro DC with e-sign for teams through Dec. 31, 2024.

- Dell statement credit: You can get up to $200 back semi-annually ($400 per year) on U.S. purchases with Dell technologies through Dec. 31, 2024.

- Indeed statement credit: Through Dec. 31, 2024, you can also get up to $90 back quarterly ($360 per year) via statement credits for purchases with Indeed.

- Wireless credit: You’ll receive up to $10 back per month ($120 per year) in statement credits for wireless telephone service purchases made directly through a wireless provider in the U.S. on your Business Platinum card.

Insurance and protection benefits

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. has a robust array of travel and purchase protections¹. These include:

- Trip delay insurance: Trip delay insurance applies to eligible round-trip travel expenses paid for with the Business Platinum. Coverage is good for up to $500 per trip, and for incidental expenses that apply (including meals, lodging, toiletries, medication and more) when a trip is delayed by six hours or longer. You are eligible to file two claims per 12-month period.²

- Trip cancellation and interruption insurance: Trip cancellation and interruption insurance will apply to eligible round-trip travel purchases charged to the Business Platinum card. This coverage is good for up to $10,000 per covered trip with a maximum benefit of $20,000 per eligible card every 12 months.³

- Baggage insurance: You’ll get automatic baggage insurance when paying with the card on a common carrier (like an airline or cruise line). This coverage is good for up to $2,000 per person for checked baggage and up to a combined $3,000 per person for checked and carry-on baggage.⁴

- Cellphone protection: Paying your cellphone bill with your card provides cellphone protection. There is a maximum of $800 liability per claim, and each claim is subject to a $50 deductible. There’s also a limit of two claims per eligible account in a 12-month period. You can maximize this perk by combining it with the wireless credit benefit above.⁵

Bonus points for spending

While The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. isn’t the best card to use for all spending categories, there are certain instances where it does make sense to use it — like on flights and prepaid hotels through Amex Travel, as well as on large purchases — cardholders earn:

- 5 Membership Rewards points per $1 on flights and prepaid hotels through American Express Travel.

- 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year.

- 1 point per $1 on other eligible purchases.

Additional benefits worth noting

- Global Dining Access with Resy: Global Dining Access perks include Priority Notify at all of Resy’s thousands of restaurants worldwide. This gives you special access to primetime tables at many of the most in-demand restaurants across the U.S. and internationally.

- Secondary Auto Insurance Coverage: Rental cars booked with The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. receive secondary car rental loss and damage insurance⁶. Consider getting a credit card with primary rental car insurance if you want primary, as compared to secondary, coverage.

Frequently asked questions (FAQs)

Yes, The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. has access to over 1,400 airport lounge locations worldwide with the Amex Global Lounge Collection.

First, to make the most of the Amex Business Platinum, be sure to maximize your points potential by meeting the minimum spending requirements to earn a welcome bonus.

Then, enroll your card in the statement credit offers such as those with Adobe, Indeed, Dell, select U.S. wireless telephone service providers, CLEAR and more. Also, sign up for hotel and rental car elite status programs that are included with the Business Platinum. Travelers will want to utilize lounge access, Resy benefits and more.

Maximize the points you earn by putting larger purchases on The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. . Beyond earning as many points as possible, you’ll also want to maximize the value upon redemption .

Both cards serve different purposes. While The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is geared more towards frequent travelers with more premium perks like lounge access, the American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. (terms apply) is tailored to those with high spending who may not travel as frequently.

Overall, it’s better to spend on the Amex Business Gold card, with bonus-earning spending categories that include purchases at U.S. media providers for advertising in select media, U.S. restaurants, U.S. gas stations, transit purchases such as taxis or rideshare, and more.

All information about American Express® Business Gold Card and The Business Platinum Card® from American Express has been collected independently by Blueprint.

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. does not come with a traditional preset spending limit. The amount you can spend adapts based on factors such as your purchase, payment, and credit history.

Yes, The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. comes with travel insurance, including trip delay insurance², trip cancellation and interruption insurance³ and baggage insurance⁴.

The publicly available offer for The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. waxes and wanes. The current offer is for 120,000 Membership Rewards points after spending $15,000 on eligible purchases in the first three months of card membership. However, you may be targeted for even higher offers through your Amex account or via a tool like Cardmatch or even mailers.

¹Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

²Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

³The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

⁴Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

⁵Coverage for a Stolen or damaged Eligible Cellular Wireless Telephone is subject to the terms, conditions, exclusions and limits of liability of this benefit. The maximum liability is $800, per claim, per Eligible Card Account. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per Eligible Card Account per 12 month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

⁶Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

*The information for the American Express® Business Gold Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Chris Dong is a travel, loyalty, and credit cards reporter. He has covered travel and personal finance content for national print and digital publications including The Washington Post, Business Insider, The Points Guy, Travel + Leisure, AFAR, Condé Nast Traveler, Lonely Planet, and more. When he’s not on the road, Chris calls Los Angeles home after nearly 10 years in New York City.

Ashley Barnett has been writing and editing personal finance articles for the internet since 2008. Before editing for USA TODAY Blueprint, she was the Content Director for an international media company leading the content on their suite of personal finance sites. She lives in Phoenix, AZ where you can find her rereading Harry Potter for the 100th time.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

How to use the Citi trifecta to maximize your rewards

Credit Cards Ryan Smith

Hilton Honors American Express business card unveils new profile, plumps up annual fee

Why my Citi Double Cash Card keeps getting better

Credit Cards Lee Huffman

Is the Citi Premier worth the annual fee?

Credit Cards Juan Ruiz

6 little known perks of the Citi Custom Cash Card

Credit Cards Harrison Pierce

Is the Chase Sapphire Preferred Worth it?

Credit Cards Tamara Aydinyan

Why I got the Citi Custom Cash Card this year instead of another travel rewards card

Credit Cards Kevin Payne