Receive a 10%* discount on travel insurance policies with a National Seniors Australia membership

Become a member today and discover a host of savings and benefits. T&Cs apply.

Travel Insurance

That's all about you.

With no age limits on most plans² and existing medical conditions automatically covered, you can relax and enjoy your trip.

Discover the National Seniors difference

Save 10% on travel insurance*.

National Seniors members receive a 10% discount on travel insurance policies*

Speak to a real person

Call 1300 50 50 99 to speak to a real person who understands you

Plans to suit your trip

Frequent traveller? Save time and money with our Annual Multi Trip Plan or explore our single trip plans.

Supporting older Australians

The profits from the sale of your policy helps fund our advocacy work and improve outcomes for older Australians.

Cruise with confidence

Some cruise cover is automatically included

Some cruise cover is automatically included in National Seniors Travel Insurance plans, whether it be an international or domestic trip.

Relax and know you're covered

Existing medical conditions.

We can provide automatic cover for over 40 existing medical conditions, provided all the criteria for that condition are met.

No age limits²

With no age limits on most plans, you'll never know when you might benefit from travel insurance.

Cancellation Costs

You can choose to be covered for trip cancellation up to a limit that best suits your plans.

Luggage & Personal Effects

We offer cover for accidental damage, theft or permanent loss of your luggage and personal effects.

Coronavirus

Cover for some coronavirus related events is available on all our international plans and our Australian Travel Plan.

Prefer to speak to a real person?

Call our friendly and experienced customer care team (monday to friday 8:30am to 6pm aest), what our customers have to say.

Lobo, 77 - VIC Travel Insurance Customer

Sinead provided excellent assistance in arranging my insurance cover for my travel next year. She had good product knowledge, very good interpersonal skills and always delivered what she promised within agreed timeframes. From a customer's perspective, personnel such as Sinead are great to deal with and should be valued and retained.

Carolyn, 78 - SA Travel Insurance customer

I was very impressed by the friendly efficient service I received from Sinead. She answered my many questions with patience and understanding. I got all the clear answers I needed to enable me to confidently decide to take out National Seniors Travel Insurance.

Harry, 71 - QLD Caravan Insurance customer

Jeremy was the most helpful person I have ever spoken to. Thank you so much Jeremy, I wish there were more caring and experienced people like you.

Angus, 79 - QLD Travel Insurance customer

What a pleasure it has been to enquire about travel insurance with Sinead. She was so professional and helpful at all times. She was a pleasure to talk with and answered every question I had regarding travel insurance and above all returned my phone calls quickly with any questions she wasn't sure of. National Seniors Insurance are blessed to have such a delightful, helpful person working for them and I would recommend Sinead to any of my friends for travel insurance.

Mandy, 73 - QLD Travel Insurance customer

I would like to say that Sinead was extremely helpful and knowledgeable in quoting for insurance for a couple of policies we were getting for comparison for. She is very friendly, easy to talk to and makes you feel like a friend rather than just another customer, which I like. I would recommend anyone to contact her for their insurance quotes.

Product Disclosure Statement

For information on what is covered and what is not covered, please refer to the Combined Financial Services Guide and Product Disclosure Statement.

How your policy helps older Australians

National Seniors Insurance is part of National Seniors Australia, a leading not-for-profit advocacy organisation giving older people a strong national voice. Our evidence-based advocacy tackles issues such as age discrimination, the Age Pension, cost of living, health costs, and more. Modest profits from the sale of your policy help us create real change and a better future for all older Australians.

Save on Travel Insurance

Join National Seniors Australia today and receive a 10% discount on Travel Insurance policies*

National Seniors Australia members have access to a range of discounts, benefits and services to suit your stage of life. As a member, save with discounts, connect with like-minded members through our branches, receive our member magazine Our Generation, and access our Financial Information Consultant. For only $49.50, anyone can become a member and it only takes minutes to join. *The discount applies to the total National Seniors Travel Insurance premium and is for National Seniors Australia members only. Discounts do not apply to the rate of GST and stamp duty or any changes you make to the policy. nib has the discretion to withdraw or amend this discount offer at any time. This discount cannot be used in conjunction with any other promotional offer or discount.

How to make a claim

Online, anytime

Download a travel insurance claim form online and submit your travel insurance claim via post or email. Once it is lodged, a friendly claims consultant will contact you as soon as possible. Alternatively, make a claim online.

Need help with your claim?

Call the claims hotline on 1300 62 52 29 (within Australia) or +61 2 8263 0487 (from overseas) and a consultant will help you. Alternatively, you can also contact us via email.

Emergency assistance 24/7

Affected by an emergency? Access emergency assistance 24/7.

Feedback and complaints

If you have any feedback about our service – positive or negative – we would like you to share it with us.

Receive our FREE newsletter

Keep updated on national seniors australia's advocacy campaigns, news, health and more., covid-19 faqs, travel alert.

Coronavirus (COVID-19) continues to impact many travellers around the world. Before you buy, read the travel advice and check for restrictions at your destination(s) as these may impact cover, or your ability to travel. See our travel insurance alerts for more information.

Is any coronavirus cover available on travel insurance plans and what are the benefits?

Cover for some coronavirus related events is available on all nib’s travel insurance plans (excl. Cancellation and Additional Expenses Plan), but the types of benefits and benefit limits vary. As much as we’d love to cover every coronavirus-related scenario that a traveller can think of, that’s not what travel insurance is designed to do, so read the Product Disclosure Statement (PDS) for Australian residents for the full terms, conditions, limits and exclusions so that you know what is, and isn’t, covered. Overseas Medical Benefit: If you contract coronavirus while on your trip, all of nib’s International travel insurance plans can offer cover for overseas medical expenses. Medical evacuation and repatriation: All nib travel insurance plans include cover for medical evacuation and repatriation if we decide it’s medically necessary, up to the relevant benefit limit.³ Coronavirus Travel Costs: nib’s Coronavirus Travel Costs benefit is available on the Comprehensive Travel Plan, Australian Travel plan and Annual Multi Trip Plan and can provide cover for several coronavirus related events. It includes cover for quarantine expenses and trip cancellation if you are diagnosed with coronavirus.

What do I do if I get Coronavirus (COVID-19) before my trip?

Isolate! And seek appropriate medical attention. Don’t delay the cancellation of your plans. If you know you need to cancel, contact your providers as soon as possible to maximise the opportunity of refunds from your providers. Depending on the plan you have chosen, you may be able to make a claim for non-refundable travel costs under the Coronavirus Travel Costs section of the plan up to the benefit limit.

What do I do if I get Coronavirus (COVID-19) on my trip?

Contact nib Emergency Assistance. Utilising a global network of medical providers, the team will connect you with local medical facilities. They can also assist by getting in contact with friends and family where needed. Always keep receipts for any payments you make and wherever possible, request written reports from providers or local authorities. Follow travel and health advice – different countries have different rules. What’s ok in Australia may not be ok in the countries you visit. Our International plans include emergency overseas medical cover if you contract coronavirus while travelling.³

If I need medical treatment overseas, will you only pay up to the Coronavirus Travel benefit limit?

Rest assured that if you incur medical expenses overseas for an event covered under the policy, including if you contract Coronavirus (COVID-19) and it’s not related to an ‘existing medical condition’ (as defined in the PDS), then coverage is offered up to the Medical benefit limit.³ Just make sure you contact nib Emergency Assistance so they can help. The Coronavirus Travel Costs benefit (for other non-medical coronavirus related events, where included on the plan you have selected) is separate to the benefit limit available for medical expenses Incurred Overseas.

Need to make a claim?

Sorry to hear your trip didn’t go as planned. At least making a claim is a simple process.

Latest travel stories

What should I look out for with travel insurance for my cruise?

Setting sail soon on a cruise? Here’s how to make sure you’re covered when choosing your travel insurance plan.

Get smart before you travel abroad

If you're soon embarking on an overseas trip, here's what you need to do before you go to stay protected and safe abroad.

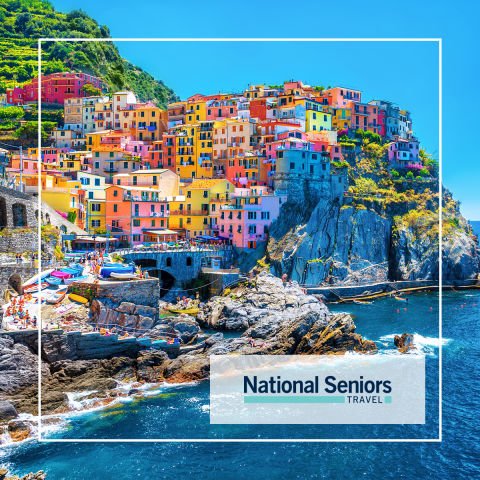

National Seniors Travel

National Seniors Travel is a dedicated service of National Seniors Australia. Our not-for-profit status ensures we can offer the best value for National Seniors members. As a National Seniors member, receive special pricing on our curated holiday packages, cruises, tours for solo travellers and groups in all your favourite destinations and receive 24/7 assistance while travelling. Speak to a widely-travelled travel consultant for personalised assistance.

Travel benefits for members

Special Pricing

National Seniors members receive special pricing and discounts on tours, cruises, and hotels.

Solo or Group Tours

Discover our curated holiday packages for solo travellers and groups.

Expert Advice

Speak to a widely-travelled consultant for expert advice and exceptional customer service.

24/7 Assistance

Receive 24/7 assistance while travelling.

Some of the benefits of membership

Save with over 1,000 discounts on groceries, fuel, accommodation, fitness, health care, motor services, books, theme parks, appliances, cinemas, gift cards and more!

Our Generation magazine

Members receive a yearly subscription to Our Generation digital magazine!

Expand your social circle, enjoy social events, day-trips, guest speakers and meet like-minded members.

Financial Information Consultant

Members can speak to a real person to receive up-to-date information on retirement planning, estate planning, Centrelink benefits, investment choices, Aged Care, superannuation, and more!

Competitions

Enter and win newly released books, DVDs, CDs, and movie and event tickets with access to exclusive member-only competitions.

Sign up to the Connect Newsletter

Keep updated on technology, advocacy, lifestyle, travel and health news.

Thank you for subscribing.

National Seniors Australia Ltd ABN 89 050 523 003, AR 282736 is an authorised representative of nib Travel Services (Australia) Pty Ltd (nib), ABN 81 115 932 173, AFSL 308461 and act as nib's agent and not as your agent. This is general advice only. Before you buy, you should consider your needs, the Product Disclosure Statement (PDS) , Financial Services Guide (FSG) and Target Market Determination (TMD) available from us. This insurance is underwritten by Pacific International Insurance Pty Ltd, ABN 83 169 311 193.

*The discount applies to the total National Seniors travel insurance premium and is for National Seniors Australia members only. Discounts do not apply to the rate of GST and stamp duty or any changes you make to the policy. nib has the discretion to withdraw or amend this discount offer at any time. This discount cannot be used in conjunction with any other promotional offer or discount.

2. Coverage is subject to the terms and conditions, limitations and exclusions for each product as contained in the Domestic Product Disclosure Statement or International Product Disclosure Statement .

3. For up to 12 months after the illness first appears or injury first occurs.

We've got your back

With National Seniors, you're voice is valued. Discover how we campaign for change on your behalf and explore other member benefits.

- Travel Insurance

- Best Travel Insurance Providers for Seniors

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Our Pick Of The Best Travel Insurance Providers For Seniors

Published: Jul 19, 2023, 1:05pm

Preparing for a holiday is a treat at any age, but all travellers, regardless of whether you’re backpacking or retired, need to tick off essential travel admin like purchasing travel insurance before the fun begins.

This ensures you can access life-saving medical treatment in an emergency overseas, when medical and hospital fees vary wildly. It can also help cover costs to get your trip back on the road after unforeseeable mishaps, or get you home safely if you need to cut the holiday short. This safety net can be especially important for more mature travellers with complex health and travel needs.

Not every insurance policy caters to people over a certain age, and others may impose benefit limits for certain activities for older travellers. Our dedicated Australian research team has dug through the fine print of policies open to seniors so we can outline the details of the best seniors travel insurance in Australia and who they may be best suited for. Leading policies are analysed across numerous data points, and ranked by our editorial team to reflect the most generous travel insurance suitable for seniors.

Note: The below list represents a selection of our top category picks, as chosen by Forbes Advisor Australia’s editors and journalists. The information provided is purely factual and is not intended to imply any recommendation, opinion, or advice about a financial product. Not every product or provider in the marketplace has been reviewed, and the list below is not intended to be exhaustive nor replace your own research or independent financial advice. For more information on how Forbes Advisor ranks and reviews products, including how we identified our top category picks, read the methodology selection below.

Related: Best Travel Insurance for Australians

Featured Partners

Travel Insurance Saver

Cover-more travel insurance (comprehensive), nib travel insurance (comprehensive), freely (comprehensive), allianz (comprehensive), bupa (comprehensive), boomers travel insurance (comprehensive), australia post (comprehensive), medibank travel insurance (comprehensive), racv travel insurance (comprehensive), cota (comprehensive).

Southern Cross Travel Insurance (Comprehensive)

Fast Cover (Comprehensive)

Our methodology, what is seniors travel insurance, types of travel insurance, senior travel insurance: what to look for, can seniors over 75 get travel insurance, pre-existing medical conditions: are you covered, travel insurance coverage for children and grandchildren, typical exclusions in seniors travel insurance, final thoughts, frequently asked questions (faqs).

- Best Comprehensive Travel Insurance

- Best Domestic Travel Insurance

- Best Cruise Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance And Covid: Are You Covered?

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance To India

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

On Cover-more’s secure website

Unlimited, with a $2000 limit to dental

Yes, amount chosen by customer

Option of Cruise Cover

Unlimited medical

Yes (some sub limits apply)

Yes (automatic)

The Travel Insurance Saver policy operates via nib’s underwriting service and therefore provides very similar benefits, minus the discount offered to nib health insurance members. Like the nib comprehensive policy, you’ll receive unlimited cover for medical expenses and anything that happens on a cruise as standard, as well as the freedom to choose the amount you’d like covered for cancellation costs (apart from the $2,000 limit on travel agent cancellation fees).

Many pre-existing medical conditions are included in the policy without the need for a medical assessment, including allergies, epilepsy, Hashimoto’s Disease and more, provided you meet the relevant criteria. But don’t forget the $8,000 limit on hospital compensation (at $50 per day), and that cover if you are permanently disabled while travelling is relatively low at $12,500. This policy also only covers $1 million in personal liability expenses.

- Cruise cover automatically included.

- Unlimited overseas medical expenses covered

- Lower permanent disability cover

99 (with acceptance criteria)

The comprehensive travel insurance offering from Cover-More is a suitable option for seniors (up to 99 years of age) seeking the peace of mind that cover for pre-existing medical conditions can provide. The policy’s wide range of automatically covered conditions includes carpal tunnel syndrome, plantar fasciitis, and some common heart conditions.

Be sure you meet any criteria related to these and other conditions, and please note that asthmatics over 60 aren’t automatically covered. We also liked the option to add on cruise cover, the generous $15,000 in coverage for luggage, $2.5 million in personal liability cover, $60,000 in funeral and repatriation expenses, and unlimited overseas medical cover. However, dental expenses are capped at $2,000.

- Many pre-existing medical conditions covered without assessment

- $15,000 luggage cover with item limit increases available

- $2,000 overseas dental expenses cap

The comprehensive travel insurance offering from nib provides generous cover that will suit many seniors’ travel plans, with additional flexibility. It’s a great option for nib health insurance customers who receive a 10% premium discount, or anyone travelling with their children who can also be covered by the policy (as long as they’re under 25). Medical expenses that may crop up on your overseas trip should be sorted with the unlimited cover, and cruise cover is included as standard. We also like that policyholders can choose the amount of coverage for cancellation costs, with the only limit being $2,000 on travel agent cancellation fees.

This policy gets another gold star for covering numerous pre-existing medical conditions as standard, including things like allergies, epilepsy, Hashimoto’s Disease and many others (as long as you fit the criteria). However, only $1 million is covered for personal liability expenses. Also note the $8,000 limit on hospital compensation (at $50 per day), and that the permanent disability cover of $12,500 is relatively low.

- 10% discount for nib health insurance members

- Cruise cover automatically included

If you’re a whizz with technology and under the age of 99, Freely could be your ideal travel insurance provider. You can purchase and manage a comprehensive policy suited to seniors via the Freely app which enables a convenient claims process and easy access to important policy documents. We appreciated that the unlimited overseas medical cover also includes dental expenses, and that cruise cover can be added onto the policy.

Personal liability is covered to $3 million, and if the worst were to happen—that you pass away or become permanently disabled while travelling—expenses related to this are covered up to $25,000. A number of medical conditions are automatically covered, from bunions to congenital blindness and deafness, just be sure you meet the criteria for each. However, there is only $5,000 allotted to cancellations, which should be factored in if you’re planning a costly trip with payments made ahead of time.

- Numerous pre-existing medical conditions covered without assessment

- Unlimited overseas medical and dental cover

- $5,000 limit on cancellation cover

Allianz Australia is a suitable choice for seniors looking for a reputable underwriter and some generous conditions. Chief among these is the ability to add cruise cover—a big plus among older travellers— and the fact there is no age limit on taking out a policy. We also liked the unlimited medical expenses, alongside personal liability coverage up to $5 million.

Another bonus: children and grandchildren are covered if they are travelling with you 100% of the time, are aged under 25 years and not in full time employment. However, coverage for pre-existing conditions required a medical assessment, and there is no cover for any expenses for medical evacuation, funeral expenses incurred overseas or return of remains unless it has been approved by Allianz Global Assistance.

- Cruise cover can be added

- No age limit to policy

- Pre-existing medical conditions require assessment

Travellers of all ages and life stages can take out Bupa’s comprehensive policy, but anyone who currently holds health insurance through the company can access a 15% discount as a loyalty bonus. Simply enter your membership number when prompted as you’re applying, and you’ll get a tidy discount across the policy, which includes unlimited medical, health and emergency cover.

Top marks as well for the handy add-ons, such as cruise cover and increased item limits for more valuable personal effects, as well as the $5 million personal liability cover and $60,000 for funeral and repatriation expenses. Please note that you will be required to do an online medical assessment for any coverage of pre-existing medical conditions.

- 15% discount for Bupa Health Insurance members

While the company’s name may elicit a cringe, Boomers Travel Insurance presents a high quality, flexible offering for travellers of any age that’s underwritten by the reputable Allianz Australia Insurance. The policy’s generous benefits include $10,000 in cover for luggage with the option to increase item limits for more valuable possessions, the option to add on cruise cover, and $5 million in personal liability cover.

It’s a great option for families, as children and grandchildren are also covered if they are joining you for your entire journey, as long as they are under 25 and not employed full-time. While the policy includes unlimited overseas medical, hospital and emergency expenses, it’s important to note that all pre-existing medical conditions need to be assessed and approved by the company when you apply for coverage.

- Luggage cover can be increased for valuable items

Yes (dental limits apply)

Seniors seeking out travel insurance that automatically covers a wide range of pre-existing medical conditions (without a medical assessment required) alongside generous benefits should consider Australia’s Post’s International Comprehensive Travel Insurance. Knowing you’ll be covered if a claim arises from conditions like hypertension, epilepsy, hiatus hernia and some autoimmune disorders provides extra peace of mind for anyone juggling health complications later in life (just be sure you meet the criteria for each condition).

There’s no age limit for policyholders, nor any limits on overseas medical and hospital care, as well as additional emergency expenses. We also liked the generous $5 million personal liability cover, and $12,000 in repairs or replacement for luggage (sub limits for certain items do apply). If you’re concerned about potential dental issues while travelling, do note there is a $2,000 cap on dental expenses. And if you’re an asthmatic over 60, this particular condition won’t be covered.

Medibank is one of the largest private health insurance providers in Australia, and its comprehensive travel insurance policy is similarly reliable for senior travellers. It is especially good value for anyone who already holds a health insurance policy with Medibank – those with standard health insurance memberships will receive a 15% discount, and Medibank Priority health members will see a 20% premium reduction.

It includes generous policy features like unlimited cover for overseas medical and cancellation expenses, $15,000 in luggage cover with flexible sub limits for specific items, and $5 million in personal liability cover. Cruise cover can be added as an optional extra for those travelling the high seas, and a wide range of pre-existing medical conditions are covered without policyholders having to apply or undergo a medical assessment. Keep in mind there is a $2,000 limit on overseas dental cover.

- 15% discount for Medibank health members.

- Many pre-existing medical condistions covered without a health assessment.

- $2,000 limit on dental cover.

Undisclosed

With unlimited overseas medical, dental and cancellation cover, the comprehensive travel insurance policy from RACV is an attractive policy for travellers of all ages. While the Victorian insurance company doesn’t specify an age limit on this policy, it provides cover suitable for seniors while offering a 15% discount to RACV members, no matter the type of insurance they hold with the company.

We appreciate the extremely generous $15 million personal liability cover, the $15,000 in luggage cover with flexible sub limits, and that a range of pre-existing medical conditions are covered without an assessment. Please note that travellers over 50 can’t be covered for diabetes, and those over 60 aren’t covered for asthma.

- Cruise cover can be added.

- 15% discount for RACV members.

- Age limits apply for some pre-existing medical conditions.

Yes (some conditions apply)

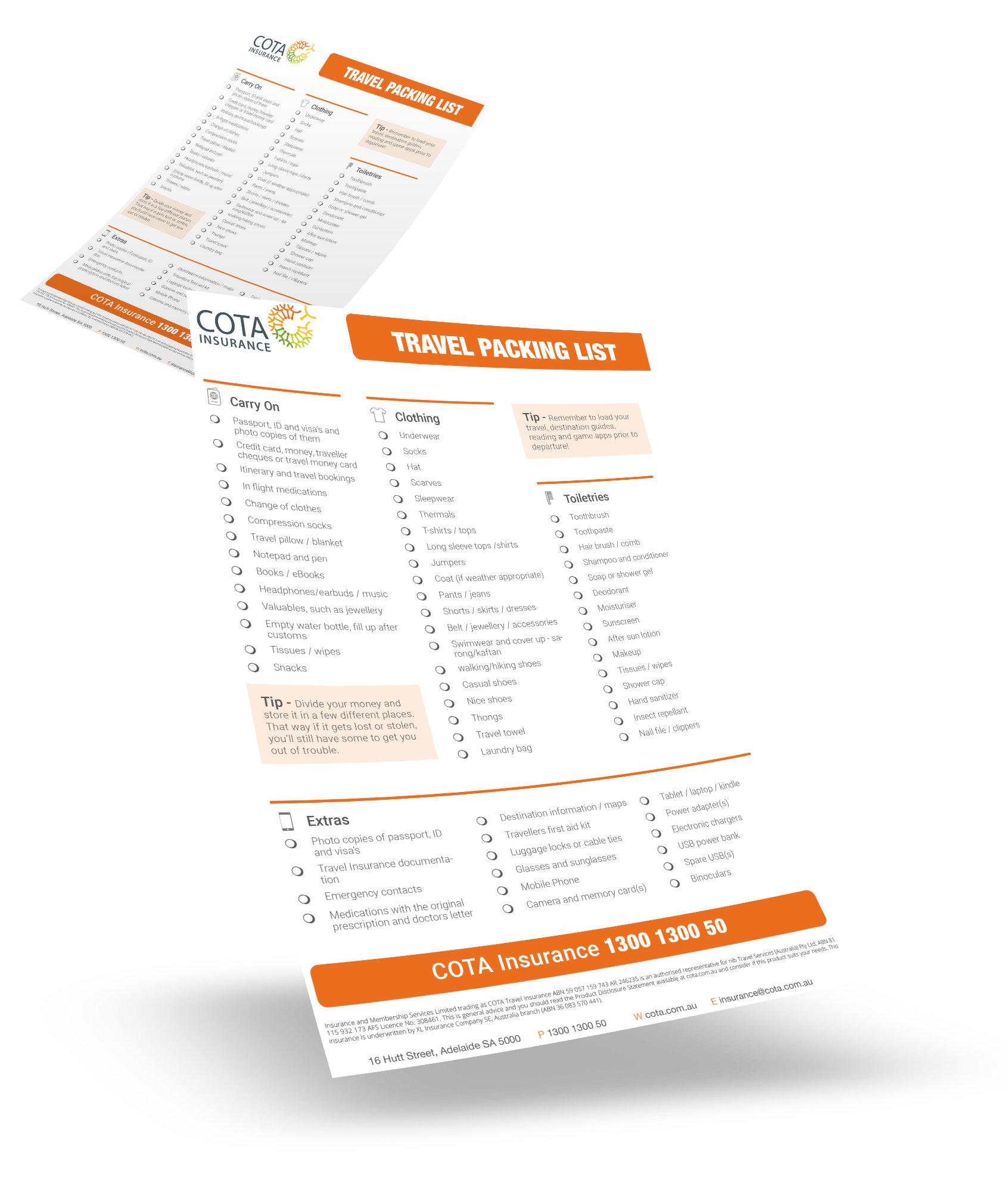

COTA has specialised in the seniors’ insurance space since 1992, and is currently underwritten by Pacific International Insurance. Major selling points that could serve older travellers well include the automatic inclusion of cruise cover, $12,000 in cover for lost or stolen luggage, and no age limits applied to the coverage.

While overseas medical expenses coverage is unlimited with this policy, we thought it important to note the caps on dental cover ($1,000) and hospital compensation (up to $8,000 with a limit of $50 per 24 hours). Medical evacuation and repatriation expenses are unlimited, but there is relatively low cover for permanent disability caused while travelling ($12,500). And if you require cover for pre-existing conditions, you’ll need to undergo an assessment.

- Caps on overseas hospital and dental expenses

Southern Cross Benefits is a reputable underwriter for this comprehensive policy available to travellers at any age . It includes generous benefits like $25,000 cover for lost luggage and unlimited medical and evacuation costs, although sub limits do apply (such as a $2,000 limit for dental expenses and a $100,000 limit on medical costs related to terrorism).

The $50,000 coverage for death, permanent disability and funeral expenses is notably higher than similar policies, but personal liability costs are only covered up to $1 million. While bank cards and other travel documents are covered up to $1,000 if lost, there is no cover for credit card fraud. Anyone with existing medical conditions or injuries will need to apply for these to be covered in case they are the cause of expenses while travelling.

- Generous death and disability cover

- No cover for credit card fraud

89 (with age and coverage limits on certain benefits)

Fast Cover caters to travellers aged up to 89 , but benefit limits and coverage restrictions can apply for anyone over 60, depending on which age bracket you sit within. Travellers up to 79 years of age have unlimited cover for overseas medical expenses, cancellations (although there is a $1,500 cap on travel agent fees), and trip disruption and resumption costs. Those aged 80-89 will need to pay a $2,000 excess for cancellations related to sickness or injury.

Also note that snow cover isn’t available to anyone aged 70 or older, the adventure pack age limit is 74, and dental cover for travellers of all ages is limited to $1,000. Happily, cruise cover can be an add-on at any age, personal liability is covered up to $5 million, and there are a large number of pre-existing medical conditions covered for people of all ages (as long as you satisfy the criteria related to those conditions).

- Many pre-existing medical conditions covered without assessment.

- Cruise cover can be added on.

- Age and cover limits apply to certain benefits for older travellers.

Our editorial team has complete control over analysing and rating the travel insurance policies you’re reading about today. We don’t aim to evaluate every policy on the market, but we go to great lengths to extensively research and report on the most popular choices among consumers.

To find the best travel insurance for seniors, we meticulously assessed the desirable policy attributes for this kind of insurance customer across 17 datapoints. These factors are weighted to reflect the importance of each. The four most important factors considered were limits around age, death and disability cover, unlimited medical cover and cruise cover.

As mentioned, we didn’t include price in this assessment, as quotes vary between travellers based on a huge range of factors, from their holiday itinerary to optional extras they want included and health and medical histories. Each of the elements we considered when finding the most senior-friendly travel insurance providers are outlined below.

- Emergency Assistance: Does the policy offer a 24-hour medical or emergency hotline?

- Credit card fraud: If you fall victim to credit card fraud while travelling, will your credit card be replaced and any stolen funds reimbursed?

- Pre-existing medical conditions: Does the policy cover pre-existing medical conditions, and are you required to undergo a medical assessment to be covered for these? The more conditions automatically covered, the better.

- Lost luggage: Will your lost luggage be covered? Higher overarching limits and extra flexibility to increase sub limits scores extra points.

- Cancellations: Does the policy cover cancellation fees, and what is the limit or any sub-limits?

- Cruise cover: Is cruise cover included as standard or can you add it on?

- Online discounts: Are there any discounts on offer?

- Maximum age covered: What is the maximum age covered in the comprehensive policy? Having no age restrictions is ideal, but otherwise the higher the better.

- Cover for medical expenses: Is it unlimited or is there a set total price for the medical expenses covered?

- Cover for dental expenses: Does the policy cover emergency dental work overs overseas? If so, is a limit specified?

- Covid cover: Is cover for expenses that arise from events and illnesses related to COVID-19 included in the policy? If so, what does this include, and are there any limits?

- Cover for children and grandchildren travelling with you: Are grandchildren or children covered for free under this policy? If they are, what terms and conditions must your family members meet to qualify?

- Personal liability: If you unintentionally injure someone else or damage their property, what is the maximum personal liability expense that the insurance company will pay out?

- Funeral costs: Are funeral costs covered, and up to what price? Limits on repatriation of remains from overseas should be considered here if they’re not included under a different policy point.

- Accidental death: What is the claim limit if the worst were to occur and you pass away from unforeseeable circumstances while travelling?

- Accidental disability: If you are permanently disabled after an accident while on holiday, what’s the maximum monetary support you can access?

- Customer service: What level of customer support does the insurance company offer? This could include live online chat and phone services, with these channels being available on weekends or outside business hours midweek.

About Star Rankings

You will note that we have included a star rating next to each product or provider. This rating was determined by the editorial team once all of the data points above were considered, and the pros and cons of each product attribute was reviewed. The star rating is solely the view of Forbes Advisor editorial staff. Commercial partners or advertisers have no bearing on the star rating or their inclusion on this list. Star ratings are only one factor to be considered, and Forbes Advisor encourages you to seek independent advice from an authorised financial adviser in relation to your own financial circumstances and investments before you decide to choose a particular financial product or service.

When you search for seniors travel insurance online, you can find specialised policies for people over a certain age. Many insurance companies that offer these define ‘senior’ as being over 75. However, some will have a higher minimum age and others will impose age-based coverage restrictions for anyone over 55.

The majority of travel insurance companies don’t provide tailored seniors cover, and instead recommend their comprehensive travel insurance policies to older travellers. These policies often have very high or even no age restrictions, and can cover a range of complex health and travel needs.

When our research team scoured the market to find travel insurance policies best suited to seniors, we analysed comprehensive offerings to assess how generous they were for seniors. Age limits, cover for unlimited medical expenses and the availability of cruise cover, a popular option among retirees, were all key considerations.

Remember: You will note that ForbesAdvisor has not analysed price as one of its metrics as this varies wildly between insurers and depends on a number of individual variables. Age is one of these variables, and, as a whole, senior travellers can expect to pay higher premiums for travel insurance. As always, it’s important to check the fine print so you know what you are, and aren’t, covered for.

While every travel insurance provider may offer different levels of coverage under different names, there are usually three types of international travel insurance: basic, essentials and comprehensive. The cost of travel insurance will change depending on the option you chose, with basic usually the cheapest and comprehensive the most expensive.

Speaking broadly, this is what the three policy tiers generally cover:

Basic: A policy under the basic banner will usually cover things like overseas emergency medical and hospital expenses, unavoidable cancellations, replacing lost or damaged luggage, and personal liability for if you accidentally injure someone or damage their property. Basic policies often come with age restrictions, so may not be suitable for seniors.

Essentials: This is generally a mid-range policy that includes everything covered by basic travel insurance, as well as cover for some riskier activities or higher benefit limits. Similarly, an essentials policy may not be open to people over a certain age.

Comprehensive: If you’re after all of the essentials, higher benefit limits, and more cover for a wider range of activities, then a comprehensive travel insurance policy may fit the bill. Many travel insurance companies may not offer a policy explicitly for seniors, but their comprehensive options—which usually cover broader medical care and have higher or no age limit—will suit most senior travellers.

If you’re travelling within the bounds of Australia, domestic travel insurance could also be useful. However, the inclusions and coverage in these policies aren’t always relevant to international travel insurance, and so shouldn’t be compared alongside the policies listed below.

Choosing an insurance policy is personal, as it depends on factors like your age, your health needs, the belongings you want protected while travelling and your specific holiday plans. So, you should always consider policies in line with your personal and financial circumstances. However, there are a few common elements of travel insurance that seniors should consider when comparing policies:

Unlimited medical, hospital and emergency cover: You’ll find many comprehensive policies list unlimited cover for overseas medical expenses. This is a vital component of travel insurance, as you can’t predict if you’ll encounter emergency health situations and the cost of treatment may be very high in some countries, especially America . Keep an eye out for any limits around dental expenses and hospital compensation limits.

Automatic cover for pre-existing medical conditions: Some policies will automatically cover a number of common illnesses and injuries, while others will ask you to apply for coverage for all existing medical conditions (or a combination of both). In both cases, your medical history will need to meet certain criteria for that condition to be covered. Having more conditions automatically covered by a policy makes the application process smoother for seniors with complex health needs, and means the insurance provider probably isn’t increasing premiums based on the your health status.

Cover for children and grandchildren you’re travelling with. Many comprehensive policies will provide cover for your children and grandchildren if they’re travelling with you at no extra cost. This is great for families, but usually comes with some caveats. Kids and grandkids will often need to be travelling with you for 100% of your trip to get coverage, will need to be under a certain age (often 25 or younger), and can’t be working full-time. Be sure to check your family meets all the criteria before assuming any extra travellers are covered under your policy.

Cruise cover: Cruising the globe is a popular adventure for many older travellers, but it comes with risks like any other activity. Things like on-board medical treatment, incidents that happen on shore-trips and medical evacuations from cruise liners can be extremely expensive, and they generally aren’t covered by a standard policy. Many comprehensive policies offer cruise cover as an optional extra to add onto your policy, and some include it as standard in coverage. If you’re headed for the high seas, investigate which option suits you best.

No age limits, age-based excesses or benefit exclusions: Many senior-specific travel insurance policies or comprehensive policies will allow people of all ages to take out insurance, which is essential for older travels. Keep an eye out for any additional excesses that may be applied to older travellers when making a claim, or any activities or pre-existing conditions that won’t be covered if your age exceeds the insurance company’s cap.

People over the age of 75 can take out travel insurance, but not every provider or policy will cover you. Basic policies usually have an age cap at 75 (or sometimes even lower), so seniors over 75 will need to take out comprehensive travel insurance or specific policies tailored to seniors.

Make sure you carefully examine the product disclosure statement (PDS) of each policy for any specific activities or benefits that have age restrictions or limits, as this can vary considerably between providers.

In every PDS, you’ll find a long list of pre-existing medical conditions that are or are not covered. While every policy is different, having certain health conditions may disqualify you from travel insurance cover at any age.

However, many common pre-existing conditions like diabetes, epilepsy, asthma and some heart conditions are automatically covered in many policies. This means if you make a claim that’s directly or indirectly related to these conditions, your insurance provider will likely cover you assuming you met the criteria for the claim.

Be sure to check any criteria around these conditions related to changes in medication, recent surgeries or other complications. And remember: some policies may apply age limits for specific conditions which they do cover. For example, older asthmatics often won’t be automatically covered, while younger travellers with the condition will.

Some providers allow you to apply for cover of pre-existing medical conditions that aren’t on the pre-approved list. You’ll generally need to undergo a medical assessment to apply, and if approved, you’ll likely be charged an extra premium or higher excess for the coverage.

Many seniors and comprehensive travel insurance policies will include cover for any of your children and grandchildren joining your travels. This is generally included as standard, but comes with strict criteria that your family must meet in order for them to be covered by your policy. In many cases, children and grandchildren are required to be:

- Travelling with you for 100% of your trip

- Under a certain age (often 25 or even younger)

- Not working full-time and, in some cases, be financially dependent on you

Younger travellers may have different travel insurance needs from seniors, so it’s important to ensure your policy covers everything that might impact your kids or grandkids while they’re travelling with you. And if your family continues their journey when you head home, they will need to take out their own insurance for the remainder of their trip in order to be covered.

All travel insurance policies have a number of activities or situations that aren’t covered, no matter your age. Seniors should always read policy documents carefully to see if there are any additional age restrictions on things like adventure sports or certain pre-existing medical conditions.

Some exclusions will be outside your control, but there are other actions you can take that may void your cover. Common seniors travel insurance exclusions include:

- Any pre-existing condition which has not been declared, whether it’s automatically covered or not.

- Any expenses caused by asthma if you’re over 60 (a common age-based medical restriction).

- If you are involved in any illegal activity.

- If you’re under the influence of alcohol or drugs during the relevant event.

- Travelling to a destination with Smartraveller warnings under a ‘do not travel’ classification.

- If you take part in risky activities that aren’t covered by your policy, like snow sports or high-altitude hiking.

- Anything that happens on a cruise ship if cruise cover is not included in your policy (either as an automatic inclusion or added as an optional extra).

- Pandemics and epidemics, unless specifically outlined in your policy, which you’ll find is often the case with expenses related to Covid-19.

There are numerous travel insurance options available to seniors, no matter your age nor your ability. The key to finding a suitable policy for you is in the fine print.

As you’re researching and comparing policies, be sure to pore over policy documents for limits to cover, specific age-based restrictions, options for additional cover versus automatic inclusions, and any policy features which will best suit the kind of international holiday you’re taking.

What is the best travel insurance for seniors over 70 in Australia?

The best travel insurance for any individual is a policy that offers the most relevant features within their budget. We’ve researched travel insurance policies that include features which are best suited to seniors, but everyone should compare and consider these policies to see if they meet their personal and financial needs.

Is travel insurance more expensive for over 75s?

As some risk factors are higher for older travellers—often those associated with existing medical conditions and injuries—you may find your travel insurance quotes increase with age. Every insurance provider has their own method for calculating premiums, so the level to which age does impact price will differ between quotes.

There’s no magic age where your premiums skyrocket, but some insurance companies do set their standards for ‘seniors travel insurance’ for people aged 75 and over.

What's the difference between single and multi-trip travel insurance?

With most travel insurance policies, you’ll need to select the dates you’ll be travelling within, and only bookings or events that happen in this timeframe will be covered. This is referred to as a single-trip policy. If you’re a regular globetrotter, you might consider multi-trip travel insurance. Otherwise known as annual travel insurance, this kind of policy can cover you for numerous holidays within a 12-month span.

Multi-trip insurance can be more affordable overall, but you’ll get the most value out of it if you have consistent travel habits, as you’re effectively paying at a set level for each trip. This means if you want more expensive features for just one trip—say, cover for your laptop while travelling or to go scuba diving—the increased premium is applied across all your travel for the year.

You’ll usually need to set the maximum duration for the trips you plan to take ahead of time, with most policies allowing for 60-day holidays and a few up to 90 days. You’ll also need to select the countries you’re likely to travel to in the year, as insurance companies need to assess the risks involved with each destination.

If you’re living it up in retirement and think you will travel often enough within the year to warrant this cover, make sure you don’t exceed the maximum trip length for any single excursion. You won’t be covered by your policy if you extend your trip.

Remember: some insurance providers only offer multi-trip policies to travellers under 75, so be sure to check you qualify.

What is a pre-existing medical condition?

Pre-existing medical conditions can include all manner of illnesses or injuries you know you have when you purchase an insurance policy. These may or may not be covered by your travel insurance, and some insurance providers will want to conduct a medical assessment before agreeing to cover you for these conditions.

I am going on a cruise. Will travel insurance cover me?

Yes, some comprehensive travel insurance policies offer coverage while you’re on a cruise as a standard inclusion. Most other providers will offer this kind of cover as an optional extra for an additional fee.

Olivia Gee is a Sydney-based writer and editor working across personal finance, lifestyle and sustainability. She is an insurance expert with ASIC RG146 Tier 2 Certification to provide general insurance advice. Her work has been published in Time Out, Money magazine and Guardian Australia, among other publications.

- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Travel Insurance for Pre-Existing Conditions

- What Does Travel Insurance Cover?

- Why Do I Need Travel Insurance?

- Travel Insurance COVID-19

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

Home > Travel Insurance > NIB Travel Insurance Review

NIB Travel Insurance Review

Learn more about NIB's travel insurance policies to find out more about their coverage and fees and compare them with other insurers today.

Fact checked

NIB, the third-largest travel insurance company in Australia, has been providing consumers with security on their holidays since 2016. Primarily a health insurer, the company's headquarters are in Newcastle, just outside of Sydney.

You can find out how the travel insurance products offered by NIB compare to those of other companies right here with Savvy. Compare the benefits and drawbacks of NIB's policies, no matter if your holiday plans take you to Broken Hill or from island to island in the Maldives.

If you want to learn more about NIB and your travel insurance options, start the quote process with us today.

*Please note that Savvy does not represent NIB for its insurance products.

More about NIB travel insurance

What travel insurance policies does nib offer.

Among NIB's several travel insurance plans are:

- International Comprehensive: NIB’s comprehensive cover offers you protection against overseas medical treatment, cancellation and travel delays and allows you to be reimbursed for any lost or damaged luggage. You also get coverage for the excess on a rental car and the opportunity to choose your cancellation cover limit.

- International Essentials: the bare-bones coverage for those travelling on a budget, NIB offers much of the same benefits as the comprehensive plan although with lower claim limits. However, you won’t be covered for any COVID-19-related travel expenses.

- Domestic Comprehensive: if you're sticking close to home on your holiday, NIB’s domestic travel insurance policy covers you for any rescheduling of travel plans, the cost of returning home early and replacing or repairing your personal items and luggage.

- Domestic Essentials: this basic travel insurance package covers you for your early return home and any emergency costs and expenses relating to rescheduling your travel plans. The claim limits on this policy are considerably lower than those of the comprehensive domestic policy offered by NIB and you miss out on coverage for the excess on a rental car.

- Annual Multi Trip: if you’re regularly travelling more than 200km for your home, either internationally or within Australia, this policy provides you with cover for unlimited trips across the year up to 45 days in duration each.

Before taking off on that long-awaited trip away, however, comparing quotes with Savvy can ensure you obtain the best deal possible on travel insurance.

What optional extras are available through NIB?

Travel insurance doesn't cover all activities, and some companies may even make you pay more if you engage in a high-risk pursuit while on holiday. NIB provides a few supplementary choices, such as:

- Snow sports cover: if you're taking a trip to the snowy mountains of Australia or the Dolomites on your getaway to Italy , you'll require additional insurance coverage. By purchasing extra cover, NIB will reimburse you for expenses in the event of a ski area closure or the need to rent new gear.

- Specified item cover option: travel insurance claims from NIB are subject to the same limitations as those from other carriers. On the other hand, for an additional fee, you may extend coverage for individual products up to $4,000 or a collection of things up to $10,000.

- Specified medical conditions option: you may have to pay more for health insurance if you need treatment for an illness or injury that isn't considered a pre-existing health issue. Specific forms of diabetes, heart conditions and cancer aren’t routinely covered by plans, although ailments including epilepsy, incontinence and reflux are.

What exclusions should I be aware of when buying travel insurance through NIB?

While insurance is essential to giving you peace of mind while you're abroad, there are still risks that may not be covered. That's why it's essential to study what your policy excludes before you go on your next trip. Coverage from NIB is subject to the following broad exceptions:

- The loss of enjoyment or a business opportunity or any damage to goodwill

- Any losses stemming from war, insurrections, revolutions or the act of a foreign enemy

- If your means of transport suffers a mechanical fault

- Accidents due to the consumption of alcohol or drugs

- Any loss resulting from you breaking the law

- Medical treatment for an undisclosed pre-existing condition

If you've done your research and found a policy that interests you, you should read the Product Disclosure Statement from the provider. The fine print will explain each policy to help you ensure that your insurance covers your trip essentials.

What we think of NIB travel insurance

What we like, generous claim limits on luggage.

Compared to its competitors, NIB allows you to claim a much higher amount on your luggage and personal items than other providers.

Low excesses

A policy excess with NIB is one of the lowest in the industry, starting at only $150. This excess must be paid in full at the time a claim is made on a travel insurance policy.

Choose your cancellation cover

Purchasing travel insurance through NIB allows you to select how much coverage you want or need if you need to cancel your holiday at any time.

What we don't like

Low personal liability protection.

Unlike other providers who offer up to $5 million in personal liability cover, NIB offers half of that on comprehensive international and domestic travel insurance policies .

Few extras and add-ons

While its competitors offer add-ons which cover you for taking part in high-risk activities, NIB has relatively few optional extras apart from its optional winter sports coverage.

Modest travel delay expenses

You’re only able to claim up to $2,000 in expenses if your domestic or international holiday is delayed, while some other providers offer unlimited coverage if you need to call off your travel plans.

Types of travel insurance

International.

International travel insurance can offer cover for a range of events, including medical expenses, lost luggage or items, cancellation fees and more when you're overseas and a long way from home.

If you're journeying within Australia, domestic policies are designed to offer many of the same protections as international travel insurance (with the exception of medical expenses).

Single trip

The most standard and common type of travel insurance, this policy can cover you for one trip starting and ending in Australia (and is available for both international and domestic travel).

Annual multi-trip

As the name suggests, this type of travel insurance covers multiple trips over a 12-month period. Depending on your insurer, you may be able to take an unlimited number of trips up to 90 days each.

You don't have to have a return ticket booked to take out cover while you're overseas. One-way travel insurance enables you to access cover without a set end date, such as if you're moving temporarily.

You may need to take out specialist coverage if you're setting sail on a cruise. Fortunately, cruise insurance can cover emergency evacuation, cabin confinement and more.

Just because you're older doesn't mean travel insurance isn't still important. If you qualify for cover, seniors' travel insurance can offer greater peace of mind for included events while you're travelling.

Adding winter sports or ski cover to your policy can add protection against damage to your equipment, piste closure due to bad weather and activities such as back-country skiing, heliskiing and more.

Adventure sports

Looking to enjoy some adventure sports on holiday? An adventure sports pack can grant you cover for a range of activities, such as hiking, scuba diving and motorcycle or scooter riding.

Jetsetting with the whole clan in tow? Some insurers offer family travel insurance, which enables you to include yourself, your partner and your dependent children under one policy to help you save.

If you're travelling interstate or overseas with your partner (or simply another friend or family member), you may be able to access a discount by taking out a joint or duo travel insurance policy.

Why compare travel insurance with Savvy?

Reputable insurance partners, fast and convenient online process.

You can complete the quote, comparison and purchase process online through Savvy quickly and easily.

Competitive quote costs

Regardless of the type of insurance you’re looking for, we can help you compare between competitive quotes.

Frequently asked questions about NIB travel insurance

Yes – NIB travel insurance provides cover for a range of COVID-19-related expenses, depending on the level of coverage you choose. For example, if you chose an international comprehensive policy, you’d receive unlimited coverage for medical expenses, repatriation and up to $10,000 in travel costs. However, if you took out a basic policy, you wouldn’t be afforded any coverage for pandemic-related expenses.

You can submit a claim with NIB online 24 hours a day, seven days a week through its online claims website. NIB requires you to do the following to submit a claim:

- The incident you’re claiming

- Circumstances surrounding the claim

- How much you need to be reimbursed

- Submit any relevant documents to support your claim (for eg: medical or police reports, receipts)

Once you’ve submitted your claim, it can take up to ten business days for a response from NIB as to whether your claim has been approved. To ensure the process isn’t beset by delays.

NIB covers you if you’re up to 26 weeks pregnant for a range of incidentals on your trip. However, they won’t cover you for medical conditions that are directly related to your pregnancy, such as acute morning sickness or gestational diabetes.

Many factors affect how much you'll spend on travel insurance , including:

- How long you’re planning to travel

- The destinations you’re visiting

- Whether you suffer from any pre-existing conditions

- If you need any optional extras, such as cruise or adventure sports cover

- The travel insurance company you choose and the level of coverage you’re prepared to pay for

More travel insurance reviews

CHI Travel Insurance Review

Learn more about CHI’s travel insurance to find out about their coverage and fees and compare them with other insurers …

RACT Travel Insurance Review

Read Savvy’s review of RACT’s travel insurance offers to find out about their overseas coverage and fees and compare them …

CFMEU Travel Insurance Review

Learn more about CFMEU’s travel insurance policies to find out about their coverage and fees and compare them with other …

Real Insurance Travel Insurance Review

Learn more about Real Insurance’s travel policies to find out about their coverage and fees and compare them with other …

Australian Unity Travel Insurance Review

Learn more about Australian Unity’s travel insurance policies to find out about their coverage and fees and compare them with …

COTA Travel Insurance Review

Learn more about COTA’s travel insurance policies to find out about their coverage and fees and compare them with other …

Helpful travel insurance guides

Average Cost of Travel Insurance

Learn more about the average price of travel insurance when you compare with Savvy. Compare Travel Insurance Quotes in 30...

What Do I Need for Travel Insurance?

Compare with Savvy and find out what you need to purchase travel insurance for your holiday. Compare Travel Insurance Quotes...

Travel Insurance That Covers Border Closures

Find out if travel insurance policies cover border closures by comparing with Savvy. Compare Travel Insurance Quotes in 30 Seconds...

What is a Travel Insurance Excess?

Find out what a travel insurance excess is and how you should compare them here. Compare Travel Insurance Quotes in...

Compare Cruise Travel Insurance

Setting sail on your next holiday? Compare cruise travel insurance with Savvy. Compare Travel Insurance Quotes in 30 Seconds Get...

Best Travel Insurance for Cruises

If you’re chasing travel insurance for your next cruise, compare with Savvy and get the best policy today. Compare Travel...

Cheap Domestic Travel Insurance

Compare with Savvy and find a cheap travel insurance deal for your next domestic holiday. Compare Travel Insurance Quotes in...

Best International Travel Insurance

Travelling abroad? Compare policies and find your international travel insurance here with Savvy. Compare Travel Insurance Quotes in 30 Seconds...

Optional Cover Travel Insurance

Explore the many optional extras travel insurance offers by comparing with Savvy. Compare Travel Insurance Quotes in 30 Seconds Get...

How to Get a Travel Insurance Quote

Find out how to complete a travel insurance quote and the process involved in Savvy's handy guide. Compare Travel Insurance...

Explore your travel insurance options for your next destination

Travel Insurance for Colombia

Travel Insurance for Las Vegas

Travel Insurance for Switzerland

Travel Insurance for Brazil

Travel Insurance for Sri Lanka

Travel Insurance for Georgia

Travel Insurance for Greece

Travel Insurance for London

Travel Insurance for Southeast Asia

Travel Insurance for Malta

Travel Insurance for Dublin

Travel Insurance for Malaysia

Travel Insurance for Taiwan

Travel Insurance for New Zealand

Travel Insurance for Indonesia

Travel Insurance for the Middle East

Travel Insurance for Argentina

Travel Insurance for Tunisia

Travel Insurance for the UK

Travel Insurance for Denmark

Travel Insurance for Dubai

Travel Insurance for South Africa

Travel Insurance for America

Travel Insurance for Norfolk Island

Travel Insurance for Peru

Travel Insurance for Costa Rica

Travel Insurance for Bermuda

Travel Insurance for Singapore

Travel Insurance for Namibia

Travel Insurance for Hong Kong

- Giving Back

- Partner with us

- Privacy Policy

- Terms of Use

- Credit Guide

- How We Handle Complaints

- Scam and Fraud Warning

- Comparison Rate Warning

1300 974 066

Sign up to our newsletter.

Quantum Savvy Pty Ltd (ABN 78 660 493 194) trades as Savvy and operates as an Authorised Credit Representative 541339 of Australian Credit Licence 414426 (AFAS Group Pty Ltd, ABN 12 134 138 686). We are one of Australia’s leading financial comparison sites and have been helping Australians make savvy decisions when it comes to their money for over a decade.

We’re partnered with lenders, insurers and other financial institutions who compensate us for business initiated through our website. We earn a commission each time a customer chooses or buys a product advertised on our site, which you can find out more about here , as well as in our credit guide for asset finance. It’s also crucial to read the terms and conditions, Product Disclosure Statement (PDS) or credit guide of our partners before signing up for your chosen product. However, the compensation we receive doesn’t impact the content written and published on our website, as our writing team exercises full editorial independence.

For more information about us and how we conduct our business, you can read our privacy policy and terms of use .

© Copyright 2024 Quantum Savvy Pty Ltd T/as Savvy. All Rights Reserved.

Thanks for your enquiry!

Our consultant will get in touch with you shortly to discuss your finance options.

We'd love to chat, how can we help?

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Seniors & Retirees: 5 Top Picks

Allianz Travel Insurance »

Trawick International »

GeoBlue »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Seniors and Retirees.

Table of Contents

- Rating Details

- Allianz Travel Insurance

- Trawick International

While anyone planning a trip overseas can benefit from having a travel insurance plan in place, older travelers need to prioritize this coverage more than others. The fact is, senior travelers and retirees have unique worries and risks to think about any time they travel far from home. These risks increase their need for travel health insurance and emergency medical coverage, as well as coverage for emergency medical evacuation that applies anywhere in the world.

Which travel insurance options work best for seniors? There are many travel insurance plans that were created with retirees in mind, although you'll want to compare them side by side. For example, you may want to look at coverage limits for medical expenses and coverage for preexisting conditions above all else.

U.S. News editors compared more than 20 of the top travel insurance companies to find the best plans for seniors. This list does the heavy lifting for you as you search for the best senior travel insurance of 2023, so read on to learn about the top picks.

- Allianz Travel Insurance: Best Annual Coverage

- Trawick International: Best Premium Travel Insurance for Seniors

- GeoBlue: Best Travel Medical Coverage for Expats

- IMG Travel Insurance: Best for Short-Term Travel Medical Coverage

- WorldTrips: Best for Flexibility

Best Travel Insurance for Seniors and Retirees in Detail

Available to senior travelers of all ages

Coverage for preexisting conditions is offered

Relatively low limits for emergency medical expenses

- Coverage for COVID-19

- Trip cancellation coverage up to $3,000

- Trip interruption coverage up to $3,000

- Emergency medical coverage up to $20,000

- Emergency medical evacuation coverage up to $100,000

- Baggage loss coverage up to $1,000

- Baggage delay insurance up to $200

- Travel delay coverage up to $600 ($200 daily limit)

- Rental car damage and theft coverage up to $45,000

- Travel accident coverage up to $25,000

- 24-hour hotline for assistance

- Concierge service

- Preexisting condition coverage (must be added to plan within 14 days of first trip deposit or payment)

Customize plan with optional CFAR coverage

Incredibly high limits for medical expenses and emergency evacuation

Coverage is for trips up to 30 days if you're age 80 and older

- Up to $15,000 in trip cancellation insurance

- Up to $22,500 in trip interruption coverage

- Up to $1,000 for trip delays ($200 daily limit for delays of 12-plus hours)

- Up to $1,000 for missed connections

- Up to $150,000 for emergency medical expenses

- Up to $1 million in emergency medical evacuation coverage

- $750 in emergency dental coverage

- $2,000 in coverage for baggage and personal effects

- $400 in baggage delay coverage

- 24/7 noninsurance assistance services

Get comprehensive health insurance that applies overseas

Preventive and routine care included

Age limits apply for new applicants and renewals

- Preventive and routine care

- Professional services like surgery

- Inpatient medical care

- Ambulatory and therapeutic services

- Rehabilitation and therapy

Get overseas medical coverage for single trips or multiple trips

Plans were created with seniors and retirees in mind

Lower maximum coverage limits for travelers ages 80 and older

Limited nonmedical travel insurance benefits

- Inpatient and outpatient medical coverage such as for physician visits, hospitalization and surgery

- Emergency and nonemergency medical evacuation coverage

- Coverage for emergency reunions

- Return of mortal remains

- Trip interruption coverage worth up to $5,000

- Lost luggage coverage worth up to $250 (up to $50 per item)

- Coverage for terrorism worth up to $50,000

- Accidental death and dismemberment coverage worth up to $25,000

Customize your deductible and premiums

Generous medical limits for travelers ages 65 to 79

Limited medical coverage for travelers older than 80

- Up to $1 million in emergency evacuation coverage

- Medical benefits like hospital room and board, chiropractic care, and more

- Coverage for repatriation of remains

- Up to $25,000 in personal liability coverage

- Up to $10,000 in trip interruption insurance

- Up to $1,000 in coverage for lost checked luggage

- Up to $100 per day in coverage for travel delays of 12-plus hours

- Up to $1,500 in coverage for bedside visits

- Up to $100,000 in coverage for emergency reunions

Frequently Asked Questions

You can purchase some travel insurance plans (but not all) if you're older than 80 years old. However, your premiums may be higher and you'll typically qualify for lower coverage limits overall. Make sure you compare the best travel insurance plans for seniors to find the right fit for your needs.

Since seniors and retirees are more likely to face a medical emergency during a trip, most travel insurance plans for seniors include coverage for emergency medical expenses and emergency medical evacuation. Coverages vary among plans, as do limits, so make sure to compare options before you book a trip overseas.

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel and travel insurance for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries around the world, and she has successfully filed claims during that time. Johnson lives in Indiana with her two children and her husband, Greg, a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes