- Things to do

- Groups & meetings

- List your property

Explore > Featured with Top Post > Do You Have Questions Around Your Upcoming Travel Plans? We’ve Pulled Together What You Should Know If You’re Changing or Cancelling a Trip Due to COVID-19

Do You Have Questions Around Your Upcoming Travel Plans? We’ve Pulled Together What You Should Know If You’re Changing or Cancelling a Trip Due to COVID-19

As new information emerges every day around the novel coronavirus (COVID-19), we understand that this can be a confusing and challenging time for everyone around the world. The entire travel industry is experiencing an unprecedented increase in service requests as travellers look to adjust their trips. Our teams are working around the clock and doing our best to address all changes and cancellations for travellers as quickly and efficiently as possible. While we are adjusting our operations and policies, we do ask for your patience. Right now we are focused on customers with travel before or on June 30, 2020. If your travel is not immediate, please visit our Customer Service Portal that includes online self-service tools to help you change or cancel your travel plans.

Latest Updates

- We will keep this page regularly updated to ensure we are providing the latest guidance, travel suggestions, and links to pertinent coronavirus information so you can rest easy when making your travel plans.

May 27, 2020

Customers with June travel dates:

- Customers with international lodging bookings, as well as those with lodging bookings at select domestic properties, who are scheduled to begin their stay on or before June 30, 2020 and booked prior to March 19, 2020, will be eligible for a full refund or, in some cases, a voucher allowing them to rebook the original property at later dates. You can manage your itinerary here: https://www.expedia.ca/trips

- Customers who booked a non-refundable rate for a stay scheduled to begin after June 30, 2020 , should continue to check our site for updates. As the situation evolves, we will continue working with travel partners as necessary to implement flexible policies.

April 24, 2020

Customers with May travel dates:

We are working closely with our partners to advocate for our valued customers. While our policies for May remain similar to those in April, there are some key changes customers should be aware of:

- If you are travelling between now and May 31, 2020, and wish to cancel or change your booking, please visit expedia.ca/trips or you can submit our cancellation form at Expedia.ca/travel-alert-refunds . If these options haven’t worked for you, and your trip begins in the next 10 days, please connect with one of our agents. Please know we are working to answer all calls made to our call centers. Our call volumes have been 5-7x higher than the average, amounting to hundreds of thousands of calls more than what is normal even in our busiest of times. In addition to high call volume, recent government work-from-home mandates have made it difficult for some of our agents to answer calls.

- Now that the impacts of COVID-19 on travel plans are more widely known, and our teams have worked hard to ensure customers are able to manage their bookings via robust self-service tools, we are putting some of our previous cancellation policies back into place. For example, if a lodging booking has a cancellation window in May, we expect travellers to abide by that cancellation window to avoid cancellation penalties.

- We are notifying customers as cancellation windows approach, and encouraging travellers to review their plans and let us know if they intend to travel or not.

April 20, 2020

- Air Canada’s preventative measures

April 16, 2020

If I booked a non-refundable ticket, am I still eligible for a refund?

- Policies will vary by carrier. Many airlines are issuing flex policies that offer flight credits for non-refundable travel through the end of May and eliminate cancellation and change fees. The easiest way to find out what your travel is eligible for is to check the airline’s website.

- If you believe you’re eligible for a refund and you received a flight credit instead, you can get in touch with us and we’ll work with you and the airline to determine your eligibility.

When will I get my refund?

- For hotel bookings, please note that refunds may take up to 30 days to process due to the unprecedented volume of travel disruptions. If the hotel processed the charge, they’ll determine the refund timeline. With the significant increase in flight cancellations across the travel industry, most refunds will be issued within 8 weeks, but some refunds could take longer, depending on the airline.

Important message for customers with an upcoming trip

Here’s what you need to know if you booked a hotel on Expedia (non-package/bundle):

- For customers who booked and paid for a non-refundable rate prior to March 19, 2020 for stays between March 20, 2020, and June 30, 2020, you should have received an email from us to ask if you wish to keep or cancel your existing booking. If you decide to cancel, you will be eligible for a full refund or, full value-voucher in the form of a coupon for future travel. There is no need to call us, however you must cancel your booking at least 24-hours before check-in to be eligible for this offer.

- For customers who booked a non-refundable rate for stays after June 30, 2020, with the evolving situation, we will continue to work with travel partners as necessary to implement flexible policies.

- For customers whose accommodation plans have already been impaired by COVID-19 and whose travel date has passed, we want to assure you that we are working to attend to your needs as well with our partners and provide credit where possible. We’ve already begun to reach out to some travellers directly and will continue to do so, but this will take some time. We appreciate your patience and understanding as we navigate through these unprecedented scenarios.

- For customers who have booked a refundable rate , please visit our Customer Service Portal to change or cancel using the self-service tools on our site. Have your itinerary number ready or login to your account to locate your trip.

- TIP: Make sure you’re referencing the Expedia Itinerary Number, and not the airline or hotel confirmation code.

- Due to the unprecedented volume of travel disruptions, refunds and credits may take up to 30 days to process. We apologize for the inconvenience and if after 30 days you have not seen your refund or credit processed, please don’t hesitate to reach out.

Here’s what you need to know if you booked a flight on Expedia (non-package/bundle):

- For customers with a flight booking through the end of April, you should have received an email from us or will receive one closer to your departure date to ask if you wish to keep or cancel your existing booking. Terms and conditions for credits of each specific carrier will apply.

- To make a flight change or cancellation between now and June 30, you can also use our new self-service tools to make it easier for you to manage your trip. Visit our Customer Service Portal to manage your travel plans now.

- If your airline has canceled your flight, we are working through those bookings with our airline partners to issue credits where applicable and will be in touch —there is no need to call.

- For customers whose flights have already been impaired by COVID-19 and whose travel date has passed, we want to assure you that we are working with our partners to attend to your needs.

- For customers with a flight booking on a low cost airline, such as Sunwing, Swoop or Flair Airlines, we are unable to facilitate any changes or cancellations. The quickest way you can adjust your travel plans is to reach out to them directly.

- We understand that many of you are looking for details as to why you are receiving a credit with an airline vs. a full refund. We’ve worked incredibly hard to push our partners to provide travellers with as much flexibility as possible due to COVID-19, particularly for flights that are ordinarily non-refundable or limit any changes. We recognize that an airline credit may not be what you were looking for, but know that these are extraordinary circumstances that travel partners are trying to work through. Once your credit has been processed, we’ll send you an email that outlines how you can use it for future travel.

- If you purchased a fully refundable fare, unfortunately we’re unable to process those at this time and our partners have requested we only provide airline credit. We ask that you contact your airline directly to receive more details on this matter.

Here’s what you need to know if you booked a package/bundle on Expedia:

- We’ve worked closely with our travel partners to provide options to cancel package bookings. For customers who have booked a package, each component of that holiday package needs to be cancelled separately and our Customer Service Portal has the latest travel information and instructions on how to service each part of their holiday package. We are also contacting customers who are due to travel imminently to give them information on options to cancel their upcoming package bookings.

Here’s what you need to know if you booked a vacation rental on Expedia:

- If you booked a vacation rental on Expedia and your travel plans have been affected by COVID-19, we want to share an important policy update. For several of you, changes or cancellations will need to be managed by visiting our sister site Vrbo . Full refunds for stays between March 13 and June 30 are subject to each individual property’s policy, but we are encouraging properties to be compassionate in these unprecedented times. We’ll be reaching out to you directly if your itinerary has been impacted.

Changing or cancelling your trip online or through the Expedia app

In these critical moments, we ask that travellers who do not have trips starting within the next 3 days use the self-service tools in our Customer Support Portal and wait to call us. Here’s how to manage your own itinerary online or through the app:

- Login to your account online or through the Expedia mobile app to cancel or change travel plans. Use the “Change” or “Cancel” buttons in your itinerary for details. Upcoming trips can be found under “My Trips.”

- Chat with a virtual agent for direct assistance. This feature can be found on the resource page for Expedia by clicking on the blue chat bubble in the bottom right hand corner. It’s recommended travellers login before chatting for quicker service. Note: At this time, volumes are still incredibly high, so travellers may need to check back several times to get through to a live agent via chat.

- If your hotel or airline is eligible for refunds or free cancellations, fill out an online form. Travellers with tickets on eligible airlines or reservations at eligible hotels can submit online cancellation forms to receive credit for a future flight or a full hotel refund. Check the Expedia Customer Support Portal or latest guidance before submitting. Note: If you have already submitted a request, you do not need to call us for a status update.

- Due to the unprecedented volume of travel disruptions, refunds may take up to 30 days to process.

We understand you might have questions, but this will help us focus on customers with more imminent travel. Please know that policies are changing rapidly and are at the discretion of cruise, hotel and airline partners. If you aren’t seeing a flex policy for your specific booking, sit tight because updates are frequently posted on Expedia.

General tips for travellers who still need or want to get away despite COVID-19

Travellers should try to adhere to the guidance from government and public health officials to help slow the spread of COVID-19. The government has also warned Canadians to no longer travel abroad. Of course, traveller safety is the most important thing so ultimately, it’s up to you to determine what’s best for you and your family. If you still need or want to travel, consider the following:

- Stay informed. As a first step in planning any trip, check the Global Health and Travel Advisories for your intended destination. As the situation continues to evolve, airlines may change or reschedule flights.

- Check your local airport to find out if there is specific travel advice for passengers. Depending on your departure or arrival airport, there may be additional security checks so allow yourself plenty of time to get checked in and to your gate.

- Many airlines are offering flexible change policies. For a limited time due to COVID-19, many trusted airline partners including Air Canada and WestJet that are waiving change fees on eligible new bookings. Consider filtering for these air carriers and providers when searching on sites like Expedia.

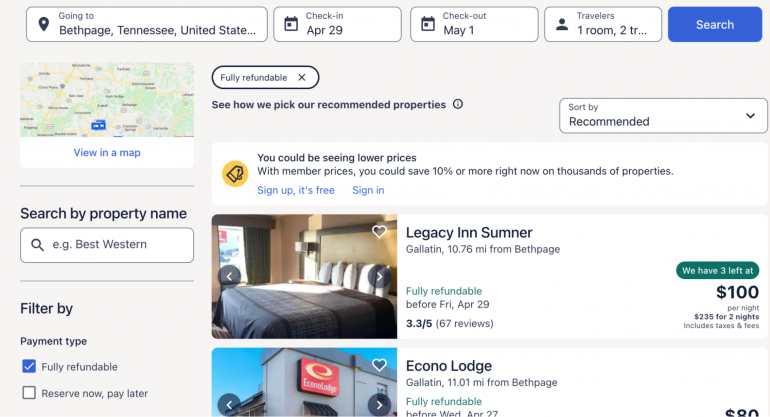

- Book refundable hotels for any trips you are planning. Many hotels on Expedia offer free cancellation, and we’ve made it easy to find refundable hotels vs. non-refundable options. Use the “free cancellation” payment type filter to easily find options within your travel window and price point. Prices can vary, but right now we believe that flexibility matters.

- Check your travel insurance policy to see if changes and cancellations due to unforeseen events like coronavirus are covered. If you purchased travel protection through Expedia, you can learn more about your coverage here .

- If you’re travelling for an event, double check to see if it’s been postponed or canceled.

More Customer Resources

For the most up-to-date traveller advisories and information on cancellations and refunds from Expedia, visit the customer service portal.

- Customer Service Portals: Expedia

For answers to some of the most asked COVID-19 traveller questions including steps you should take to plan future trips, visit the Expedia FAQ page.

- FAQ Page: Expedia

More Articles With Featured with Top Post

As new information emerges every day around the novel coronavirus (COVID-19), we understand that this can be a confusing and challenging time for everyone around the world. The entire travel industry is experiencing an unprecedented increase in service requests as travellers look to adjust their trips. Our teams are working around the clock and doing… Continue reading Do You Have Questions Around Your Upcoming Travel Plans? We’ve Pulled Together What You Should Know If You’re Changing or Cancelling a Trip Due to COVID-19

Canada is famous for being a friendly place—which we’re more than proud about! The more friends, the better, we say. And if you’re looking to make new friends, you can find them in these top Canadian communities. Based on 2015 verified Expedia user reviews, we found the top towns, cities, and communities based on friendly… Continue reading Friendliest Communities (and Towns) in Canada

There are few things just as sweet in adulthood as they are in childhood, but the first real day of summer is one of them. With the sun warming your shoulders and the anticipation of hiking trails, BBQs, and fireworks on the horizon, it doesn’t get much better than this. When you add in Canada… Continue reading Top Small Towns to Visit for a Canada Day Getaway

Certain Canadian cities get all the glory. We’re looking at you, Vancouver and Calgary, with your sparkling cityscapes and lush emerald tree lines. Meanwhile, some of the most beautiful destinations don’t get any credit. Like Beyoncé’s backup dancers, these pretty places in Canada are just as fantastic as vacation headliners—but rarely get acknowledged. We searched… Continue reading 35 Most Beautiful Destinations in Canada

Big cities get all the glory, but the best getaway you ever take may not have the CN or Calgary Tower in the background. We don’t believe a skyscraper is a prerequisite for being a travel destination. We say small towns don’t have to be “always a bridesmaid, never a bride!” In fact, we think… Continue reading 10 Charming Small Towns in Canada You Need to Visit

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best COVID-19 Travel Insurance Options

Travelex Insurance Services »

Allianz Travel Insurance »

World Nomads Travel Insurance »

Generali Global Assistance »

IMG Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best COVID Travel Insurance Options.

Table of Contents

- Rating Details

- Travelex Insurance Services

- Allianz Travel Insurance

Even though COVID-19 is no longer considered a global emergency, concerns around illness-related costs remain for many travelers. If you're looking for travel insurance that covers COVID – as well as other potential disruptions like flight delays and lost luggage – these are your best options.

- Travelex Insurance Services: Best Optional Coverage Add-ons

- Allianz Travel Insurance: Best for Multitrip and Annual Plans

- World Nomads Travel Insurance: Best for Active Travelers

- Generali Global Assistance: Best for Comprehensive Travel Insurance

- IMG Travel Insurance: Best for Travel Medical Insurance

Best COVID Travel Insurance Options in Detail

Plans include coverage for COVID-19

Optional CFAR coverage is available with Travel Select plan

Some coverages require an upgrade, including rental car collision, accidental death and dismemberment, and more

Not all add-ons are available with every plan

Allianz offers some travel insurance plans that come with an epidemic coverage endorsement

Single-trip, multitrip and annual plans available

COVID-19 benefits don't apply to every plan

Low coverage limits with some plans (e.g., only $10,000 in emergency medical coverage with OneTrip Basic plan)

24-hour travel assistance services included

More than 200 sports and activities covered in every plan

Low trip cancellation benefits ($2,500 maximum) with Standard plan

No CFAR option is offered

Free 10-day trial period

Some coverage limits may be insufficient

Rental car damage coverage only included in top-tier Premium plan

Offers travel medical insurance, international travel health insurance and general travel insurance plans

Some plans include robust coverage for testing and quarantine due to COVID-19

Not all plans from IMG offer coverage for COVID-19

Cancel for any reason coverage not available with every plan

Frequently Asked Questions

When comparing COVID-19 travel insurance options, you'll want to make sure you fully understand the coverages included in each plan. For example, you should know the policy inclusions and limits for COVID-related claims, including coverage for testing, treatments, trip cancellation or COVID-related interruptions that can occur. Meanwhile, you should understand how your coverage will work if you contract some other illness while away from home.

Also ensure your travel insurance coverage will kick in for other mishaps that occur, and that limits are sufficient for your needs. If you're planning a trip to a remote area in a country like Costa Rica or Peru , you'll want to have emergency evacuation and transportation coverage with generous limits that can pay for emergency transportation to a hospital if you need treatment.

You can also invest in a travel insurance policy that offers cancel for any reason coverage. This type of travel insurance plan lets you cancel and get a percentage of your prepaid travel expenses back for any reason, even if you just decide you're better off staying home.

It depends on your private health insurance provider and/or travel insurance policy. As of May 11, 2023, private health insurers are no longer required to cover the cost of COVID-19 testing. Out-of-pocket costs for COVID-19 test kits at local drugstores and on Amazon are relatively affordable, however.

As you search for plans that will provide sufficient coverage for your next trip, you'll find travel insurance that covers COVID-19 quarantine both inside and outside the United States. However, you'll typically need to have your condition certified by a physician in order for this coverage to apply. Also make sure your travel insurance plan includes coverage for travel claims related to COVID-19 in the first place.

Many travel insurance plans do cover trip cancellation as a result of COVID-19, although the terms vary widely. You typically need to be certified by a physician in order to prove your condition. Disinclination to travel because of COVID-19 – such as fear of exposure to illness – will generally not be covered. This means you will actually have to test positive for coronavirus for benefits to apply; simply not wanting to travel is not a sufficient reason to make a claim.

If you want more flexibility in your COVID-19 travel insurance, ensuring you have a cancel for any reason policy may be your best bet, but be sure to check with your chosen travel insurance provider to assess your options.

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering travel insurance and travel for more than a decade. She has researched the best travel insurance options for her own trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. Over the years, Johnson has successfully filed several travel insurance claims for trip delays and trip cancellations. Johnson also works alongside her travel agent partner, Greg, who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

5 Best Travel Insurance Plans for Seniors (Medical & More)

Holly Johnson

Discover coverage options for peace of mind while traveling.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

sign up and keep track of your travel insurance events

COVID-19 Travel Insurance Guide and FAQs

Last updated October 19, 2023

Our plans provide coverage if you, a family member, or a traveling companion become ill with COVID-19 and plan requirements are met. See Coverages

Travel Updates: Our plans provide coverage if you, a family member, or a traveling companion become ill with COVID-19 and plan requirements are met. See Coverages

Generali Global Assistance continues to closely monitor COVID-19 and its potential impact on our travelers. This page is intended to help you better understand how the Standard , Preferred and Premium plans available on this website can help you with issues related to COVID-19.

Jump straight to:

- COVID-19 Guide - Follow our step-by-step guide to learn how to buy travel insurance that includes coverage for COVID-19 sickness, what to do if COVID-19 impacts your trip and you need to cancel, and also what to do if you get sick during your trip and need medical assistance or are required to isolate.

- Frequently Asked Questions - Get answers to common questions travelers have about COVID-19 and travel insurance coverage.

- Countries that require travel insurance to visit

- Qualified Home Test Kits - See requirements for at-home COVID-19 testing in order to file a travel insurance claim and common testing kits that qualify.

- Get a quote and compare travel protection plans

Frequently Asked Questions About COVID-19 and Travel Insurance

If you have questions that aren't addressed below, check for an answer at our Main FAQ page .

Buying a Plan

If you, a family member or a traveling companion are diagnosed with COVID-19 before or during your trip, and meet the requirements for coverage due to sickness , you can be covered for Trip Cancellation, Trip Interruption, Travel Delay, Medical & Dental, and Emergency Assistance & Transportation, in addition to our 24/7 Emergency Assistance services. You can also be covered for additional lodging expenses and extension of your travel insurance plan if you are required to isolate at your destination and your return is delayed.

See our COVID-19 Travel Insurance Guide for more details

For your safety and the safety of others, travelers who believe they may have contracted the virus should call our 24/7 Emergency Assistance team who will coordinate local treatment on your behalf.

Read Plan Documents for coverage details.

Yes. If you received a voucher or credit from a travel company based on previous payment for a booking that is being transferred to a new trip, the new trip can be covered by one of our travel protection plans.

What's Covered

If you, a family member or a traveling companion are diagnosed with COVID-19 before or during your trip, and meet the requirements for coverage due to sickness , you can be covered for Trip Cancellation, Trip Interruption, Travel Delay, Medical & Dental, and Emergency Assistance & Transportation, in addition to our 24-Hour Emergency Assistance services. You can also be covered for additional lodging expenses and extension of your travel insurance plan if you are required to isolate at your destination and your return is delayed.

Please read your Plan Documents for coverage details.

If you are planning to travel to an affected area, your travel protection plan can help if you get sick during your trip and need to seek treatment or medical evacuation. In addition, our plans include access to worldwide Emergency Assistance services, which are available 24/7 should you need help while traveling. Emergency Assistance and Transportation, Medical and Dental, Trip Interruption and Travel Delay coverages can also help if you get sick on your trip.

You can be reimbursed for unused, non-refundable, pre-paid trip costs if you need to cancel your trip for one of 20 covered reasons. Generali Global Assistance plans do not offer coverage if you cancel your trip due to fear of traveling due to Coronavirus, unless you added Trip Cancellation for Any Reason coverage to your plan. In that case, you could be reimbursed a specified percentage of the penalty amount for your trip, if you meet certain requirements.

In response to COVID-19 many cruise lines, airlines, and other travel suppliers are canceling service and refunding trips or waiving change fees. To ensure you are aware of all your travel change options, we encourage you to check with your airline or travel supplier before filing a travel insurance claim. See our list of the most commonly used suppliers with links to their COVID-19 policies.

Yes. If you purchased Trip Cancellation for Any Reason coverage it is your choice whether to travel or cancel your trip according to the terms of the plan . The naming of COVID-19 as a pandemic does not affect your coverage.

Please note that a “shelter in place” order is not considered a mandatory “quarantine” and is not a covered event under our plans.

If you are diagnosed with Coronavirus or another sickness and are quarantined, you can be covered. Learn more.

If you are quarantined, but not sick, coverage depends on when you bought your plan and when the loss occurred. Coverage is unavailable if the insurance plan was purchased on or after January 29, 2020. For plans that exclude pandemics, coverage is unavailable for losses that occurred on or after March 11, 2020, the date COVID-19 was formally declared a pandemic by the World Health Organization.

We will accept a positive test result from a testing facility or a positive test result from an at-home test that meets certain requirements . You do not need to have COVID-19 symptoms to qualify for coverage.

In order to qualify for coverage due to sickness, including COVID-19:

You, a Traveling Companion or your Service Animal get Sick after you purchase your plan, must seek the in person treatment of a Physician and can’t travel according to a physician. Or a non-traveling Family Member is hospitalized after you purchase your plan and you are unable to make the trip.

Important Note: Your or your traveling companion’s sickness must first occur after you purchase your plan in order to have coverage. Pre-existing medical conditions are generally excluded from coverage. However, coverage is available with the Premium plan if you purchased your plan prior to or within 24 hours of making Final Payment for your trip, provided other requirements are also met. Review Plan Documents for full details.

Also see: Do I have to have symptoms and see a doctor to qualify for COVID-19 sickness coverage?

Testing and Vaccination

Our plans include “new vaccination requirements” as a covered reason for trip cancellation. If your destination country announces and publishes a new vaccination requirement after you buy travel insurance, and you are medically unable to receive the vaccination, you can be reimbursed for your insured trip cost. This applies when vaccination is a requirement to enter the country, but not in the case of new quarantine rules for unvaccinated travelers.

If you are diagnosed with COVID-19 or another sickness, you can be covered for certain additional unexpected expenses on your trip, such as lodging.

To qualify for COVID-19 sickness coverage, your at-home test must meet certain requirements:

- You must take your test while your Trip Cancellation coverage is in effect. Trip Cancellation coverage goes into effect at 12:01 a.m. the day after you purchase your plan.

- The test must be a viral test and have Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA). You can view a list of approved nucleic acid amplification tests (NAAT) and a list of approved antigen tests .

- The testing must include a telehealth video call during which someone authorized by the manufacturer supervises the testing procedure in real time.

- The telehealth provider must issue a report confirming the patient’s identity, the name of the laboratory or healthcare entity, the type of test and the specimen collection date.

See what tests qualify

It depends. If your Coronavirus test comes up positive and you are diagnosed before your trip, you can be covered for Trip Cancellation.

On the other hand, if you cancel your trip because you simply don’t want to go through the testing required, our plans will not cover you unless you purchased Cancel for Any Reason add-on coverage and meet the CFAR requirements .

No. If you do not get tested or do not receive the results in time, our plans do not provide coverage for those situations.

Thank you for visiting csatravelprotection.com

As part of the worldwide Generali Group we have rebranded our travel protection plans to Generali Global Assistance, offering the same quality travel insurance, emergency assistance and outstanding customer service as you've come to rely on for the last 25 years. Welcome to our new website!

Final step before you're signed up

Please verify that you're human.

Members save 10% or more on over 100,000 hotels worldwide when you’re signed in

Covid-19 travel advisor, ready to travel check advisories for your destination.

Use the search tool below to find out more about advisories for travel during COVID-19, including regulations for destinations, and safety and health guidelines.

Important: We recommend you confirm all guidance with official government sites and check with your travel insurance issuer. Your travel insurance may be invalidated if you travel against government advice.

Please note: This information is provided by a third party, Sherpa, and is meant for informational purposes only. Expedia is not responsible for its accuracy. Given how quickly the travel requirements are evolving, you should not rely solely on this tool in making travel arrangements and should confirm the accuracy of any government guidance, restrictions, or requirements.

By using this tool, you acknowledge you have read this note and agree to our site's terms of use and privacy policy (links below). Where the information above is not provided in your local language, neither Expedia nor Sherpa is responsible for any translation that you or a third party (e.g. Google Translate) carry out on such information.

How do you choose travel insurance that covers COVID-19?

Oct 26, 2021 • 5 min read

COVID-19 has made it more important to check the health coverage on your travel insurance © Maskot/Getty Images

After 18 months of pandemic-related travel restrictions, you may be itching to act on your pent-up wanderlust—but the situation and the rules are still continuously evolving. So before you go anywhere, it’s best to have a travel insurance plan that protects the investment you’ve made in a long-awaited trip.

A robust travel insurance plan will reimburse pre-paid trip costs and non-refundable deposits if you have to cancel or interrupt your trip, encounter trip delays, experience baggage loss or require medical expense and medical evacuation. Your policy will also reimburse “covered reasons” in your plan, such as death, illness or injury, serious family emergencies, unplanned jury duty, military deployment, acts of terrorism, or your travel supplier going out of business.

But COVID-19 has added an additional checklist to your usual insurance needs—it’s now important to check to ensure your travel insurance plan includes coverage for COVID-19 medical expenses, and losses related to illness. Your policy should also cover quarantine costs if you need to self-isolate after testing positive for the virus.

What do I look for in COVID-19 insurance coverage?

When you’re shopping for a travel insurance plan that covers COVID-19, you need to do your research and read the fine print of your plan.

Look for a travel insurance product that will protect your non-refundable, prepaid expenses if you have to cancel your trip due to illness caused by COVID-19. Your policy should also cover emergency medical treatment and emergency medical transportation. With regard to COVID-19 coverage, be sure your policy covers medical care, medicine, hospitalization and quarantine expenses.

“The type of coverage you should look for depends on you, your needs, travel dates, and the type of trip you’re taking,” says Sasha Gainullin, CEO of battleface , a travel insurance carrier. He says some travel insurance companies have now excluded COVID-19 coverage because it has been labeled a “known/foreseeable event”, while others may exclude pandemics altogether.

“It’s important to search for plans that include medical and quarantine expenses as well—this will be critical in the event you become ill and need to receive treatment while traveling,” continues Gainullin.

One additional tip is to confirm there are no exclusions based on the destinations you’re traveling to—this can happen with countries under government-issued travel warnings, Gainullin says.

“If a traveler feels uncertain, I recommend speaking with the travel insurance company directly. They can review the policy details with you, answer all of your questions, and confirm all of your required coverage options are included,” he adds.

Is getting coverage dependent on vaccination?

While it’s a good idea to be fully vaccinated before traveling, vaccination is not required to purchase a travel insurance policy, says Daniel Durazo, spokesperson with Allianz Partners USA.

What are the medical costs that are covered by travel insurance?

Travel insurance can cover the cost of both medical treatment and emergency medical transportation. A US health insurance plan, as well as Medicare, generally will not cover overseas medical expenses, so it’s best to check with your personal health insurance provider if any global coverage is available.

“While losing the cost of a trip due to an unexpected cancellation would be painful, paying for expensive emergency medical treatment or emergency medical transportation can be financially devastating,” Durazo says.

Under a travel insurance plan, medical costs could range doctor visits, pharmacy expenses, imaging costs and covering a hospital stay if required. Other expenses that can be covered are transportation to medical care and medicine.

Read more: Will my health insurance cover getting COVID-19 while traveling in the US—or abroad?

What about covering an unexpected quarantine due to COVID-19?

Many international destinations are now requiring that visitors purchase travel insurance coverage for an unexpected quarantine. Allianz Travel Insurance has added coverage to many of its products that includes reimbursement for quarantine-related accommodations if you or a traveling companion is individually-ordered to quarantine while on their trip, says Durazo.

This coverage typically covers the cost of additional food, lodging and transportation while quarantined. In addition, trip interruption and travel delay benefits on certain Allianz plans also provide coverage if you or your travel companion is denied boarding by your travel carrier due to suspicion of illness.

The benefits for quarantine coverage vary from carrier to carrier. For example, on select Trawick International plans, they offer $2,000 in quarantine benefits and for an additional charge, and you can increase it up to $7,000.

What about pre-flight COVID-19 testing?

Your plan may provide coverage for flights if you are turned away at a border for not passing a health inspection. Foster says Trawick’s travel insurance plans that cover COVID-19 would cover the expenses if you could not pass your pre-health inspection. Also, the plan would cover the costs of the failure of your PCR test to return to the United States, such as having to quarantine abroad.

It’s important to note that the actual cost of the PCR test is not covered by your policy, just the loss associated with the negative test.

Read more: PCR tests for travel: everything you need to know

Some destinations require COVID-specific insurance coverage—how do I comply with those restrictions?

Before any international travel, you should check the country where you are headed to make sure you comply with insurance coverage requirements. Countries like Spain, Turks and Caicos and Thailand are among the nations that mandate COVID-19 insurance coverage.

“You first must check the countries’ specific COVID regulations for entry into the country. Some countries require travelers to provide proof of travel insurance that covers COVID-19 related expenses purchased from a third party,” explains Foster. Providing proof coverage is key; so travelers need to ensure they receive documentation from their insurance provider that their policy covers COVID-19 related expenses to show customs officials, she says.

Should you arrive in a country that requires proof of insurance to cover COVID-19 medical expenses and quarantine costs, and you don’t hold a policy, you will not be granted entry.

For more information on COVID-19 and travel, check out Lonely Planet's Health Hub .

You may also like: What happens if I'm denied entry to a country on arrival? What is a vaccine passport and do I need one to travel? What is the IATA Travel Pass and do I need it to travel?

Explore related stories

Destination Practicalities

Mar 28, 2023 • 3 min read

Here’s all you need to know about getting a traveler visa to visit China now that “zero COVID” has come and gone.

Sep 12, 2022 • 4 min read

Apr 8, 2024 • 7 min read

Apr 8, 2024 • 6 min read

Apr 8, 2024 • 13 min read

Apr 7, 2024 • 4 min read

Apr 7, 2024 • 5 min read

Members can access discounts and special features

Covid-19 travel advisor, ready to travel check advisories for your destination.

Use the search tool below to find out more about advisories for travel during COVID-19, including regulations for destinations, and safety and health guidelines.

Important: We recommend you confirm all guidance with official government sites and check with your travel insurance issuer. Your travel insurance may be invalidated if you travel against government advice.

Please note: This information is provided by a third party, Sherpa, and is meant for informational purposes only. Expedia is not responsible for its accuracy. Given how quickly the travel requirements are evolving, you should not rely solely on this tool in making travel arrangements and should confirm the accuracy of any government guidance, restrictions, or requirements.

By using this tool, you acknowledge you have read this note and agree to our site's terms of use and privacy policy (links below). Where the information above is not provided in your local language, neither Expedia nor Sherpa is responsible for any translation that you or a third party (e.g. Google Translate) carry out on such information.

Members save 10% or more on over 100,000 hotels worldwide when you’re signed in

Covid-19 travel advisor, ready to travel check advisories for your destination.

Use the search tool below to find out more about advisories for travel during COVID-19, including regulations for destinations, and safety and health guidelines.

Important: We recommend you confirm all guidance with official government sites and check with your travel insurance issuer. Your travel insurance may be invalidated if you travel against government advice.

Please note: This information is provided by a third party, Sherpa, and is meant for informational purposes only. Expedia is not responsible for its accuracy. Given how quickly the travel requirements are evolving, you should not rely solely on this tool in making travel arrangements and should confirm the accuracy of any government guidance, restrictions, or requirements.

By using this tool, you acknowledge you have read this note and agree to our site's terms of use and privacy policy (links below). Where the information above is not provided in your local language, neither Expedia nor Sherpa is responsible for any translation that you or a third party (e.g. Google Translate) carry out on such information.

Advertisement

Supported by

What You Need to Know Now About Travel Insurance

A spate of new travel insurance policies have begun covering Covid-19, just as many international destinations begin to require it. Here’s what to look for.

- Share full article

By Elaine Glusac

When the pandemic struck, many travel insurance policies failed to cover Covid-19-related trip interruptions and cancellations, often because they excluded pandemics. But in the intervening months, the travel insurance industry has introduced a spate of new policies covering the disease just as many foreign destinations begin to require them.

“We’ve seen progress in that many plans will now treat Covid like any other unexpected sickness or illness,” said Stan Sandberg, a co-founder of the comparison website Travelinsurance.com . “If you have a trip and travel insurance and came down with Covid-19, which made it impossible to travel, that would fall under cancellation coverage as an unexpected illness that prevents you from traveling.”

Likewise, policies now including Covid-19 would cover holders in the event that a doctor diagnosed them with the virus while traveling under the trip interruption benefit.

Not all travel insurance excluded pandemics when the coronavirus began to spread early this year; Berkshire Hathaway Travel Protection was one exception. But the broader change partially arises from consumer demand, a better understanding of the virus — including mortality rates and hospital costs — and the industry’s eagerness for travel to resume.

“People who are traveling are more conscious of their risks and thinking about protecting themselves and their investment,” said Jeremy Murchland, the president of the travel insurer Seven Corners. The company launched policies that included Covid-19 coverage in June; they now account for more than 80 percent of sales.

But, like all insurance, the devil is in the details when it comes to understanding travel insurance, including what’s covered, destinations where it’s required, and the inevitable caveats, as follows.

How travel insurance covers Covid-19

The new Covid-inclusive insurance generally covers travelers from the day after purchase until their return home. During that period, if you become sick and a doctor determines you cannot travel (because of the virus or another illness), trip cancellation and trip interruption benefits would kick in.

These benefits vary by policy, but a search to insure a $2,000 weeklong trip to Costa Rica in December on Travelinsurance.com turned up a $69.75 Generali Global Assistance Standard policy with Covid-19 benefits that would be triggered if you, your host at your destination, a travel companion or a family member tested positive for the virus.

If this happened before your departure, the policy would cover your prepaid travel expenses. If you or your travel companion contracted Covid-19 during the trip and were diagnosed by a physician, it would reimburse prepaid arrangements, such as lodgings, and cover additional airfare to return home — once a doctor deems it safe to travel — up to $2,500. Should you be required to quarantine and can’t travel, travel delay coverage for lodging, meals and local transportation would pay up to $1,000. The policy also covers medical expenses for up to one year, even after you return home, up to $50,000 — though the policy also states that a holder would have to exhaust their own health insurance benefits before seeking coverage under the travel insurance plan.

Travelers should read these policies carefully to understand the benefits (for example, some rules vary by your state of residence), but brokers like TravelInsurance.com, InsureMyTrip and Squaremouth are making them easier to find through filters, F.A.Q.s and flags.

The new more comprehensive policies don’t necessarily cost more. On a Squaremouth search for insurance for two 40-year-olds on a two-week trip costing $5,000, the site turned up a variety of policies with or without coronavirus exclusions from $130 to $300, with no apparent premium for Covid-19 coverage.

Not every Covid-19-related expense is covered by many of these policies, including tests for the virus that many destinations require before arrival (those may be covered by private insurance).

Many policies include medical evacuation to a nearby facility, but won’t necessarily transport you home. For those concerned about treatment abroad, Medjet , a medical evacuation specialist, now offers Covid-19-related evacuations in the 48 contiguous United States, Canada, Mexico and the Caribbean that will transport you to the hospital of your choice in your home country (trip coverage starts at $99; annual memberships start at $189).

“Covid-19 requires special transport pods to protect the crew and others, which adds logistical issues,” said John Gobbels, the vice president and chief operating officer for Medjet.

In addition to the Medjet plan, travelers would need separate travel insurance with medical benefits to cover treatment costs and trip interruption.

Destination insurance requirements

Travelers aren’t the only ones worried about health. A growing list of countries are mandating medical coverage for Covid-19 as a prerequisite for visiting, often along with other measures like pre-trip virus testing and health screenings for symptoms on arrival.

Many Caribbean islands are among those requiring travel medical insurance, including Turks and Caicos and the Bahamas . St. Maarten requires health insurance coverage and strongly recommends additional travel insurance covering Covid-19.

Farther-flung countries also require policies that cover Covid-19, including French Polynesia and the Maldives .

Some destinations specify the required plan as a way to ensure travelers have the correct coverage and to expedite treatment. Aruba requires visitors to buy its Aruba Visitors Insurance, regardless of any other plans you may have.

“Insurance through a destination typically only covers Covid and infection while you’re there,” said Kasara Barto, a spokeswoman for Squaremouth.com. “If you catch Covid before, they don’t offer cancellation coverage. If you break a leg, the policy may only cover Covid medication. It varies by country.”

Costa Rica also requires insurance that includes an unusual benefit stipulating a policy cover up to $2,000 in expenses for a potential Covid-19 quarantine while in the country.

In response to the new requirement, which Costa Rica announced in October, insurers, including Trawick International , have begun introducing policies that meet the standard.

“It was a pretty quick and nimble reaction,” Mr. Sandberg of TravelInsurance.com said.

Normally, travel insurance varies by factors including the age of the traveler, destination, trip length and cost (most range from 4 to 10 percent of the trip cost). But some destinations are providing it at a flat fee, with most policies spelling out coverage limits and terms for emergency medical services, evacuation and costs associated with quarantines.

Jamaica, which will require insurance, but has not said when the new rule will go into effect, plans to charge $40 for each traveler. The Bahamas will include the insurance in the cost of its Travel Health Visa, an application that requires negative Covid-19 test results, which runs $40 to $60 depending on length of stay (free for children 10 and younger). The Turks and Caicos is offering a policy for $9.80 a day, and Costa Rica ’s policies, if purchased locally, cost roughly $10 a day.

Expect this list of destinations to grow. In January, the Spanish region of Andalusia plans to require travel medical insurance and is working on finding a provider to make it easy for travelers to buy it.

Gaps in travel insurance

Policies that cover Covid-19 as a medical event that may cause trip cancellation or disruption, or those that provide coverage for medical treatment and evacuation still don’t necessarily cover travelers who have a change of heart when they learn they will have to quarantine upon arrival, even if they don’t have the virus. Nor are policies necessarily tied to conditions on the ground, like a spike in infections, State Department travel warnings, a government travel ban or the cessation of flights to and from a destination.

For those events, there’s Cancel For Any Reason, or CFAR, an upgrade to plans that generally only returns 50 to 75 percent of your nonrefundable trip costs.

“Prior to the pandemic, we wouldn’t necessarily recommend CFAR because most of travelers’ concerns were covered by standard plans,” Ms. Barto of Squaremouth.com said. “It’s about 40 percent more expensive and we didn’t want travelers to pay for additional coverage.” Now, she added, there’s been a surge in interest in the upgrade, including in 22 percent of policies sold at the site since mid-March.

Industry experts predict some of these outstanding issues may work their way into policies of the future as they adapt to enduring realities, much as they did after 9/11 in covering travelers in case of terrorist events, which was not the norm before.

The pandemic “was unprecedented, but once it happened, the industry has been pretty quick to react and create coverage, and that’s in the spirit of how this industry is trying to define itself, to be one of those subtle but valuable assets,” Mr. Sandberg said. “Once the world opens back up, we expect travel insurance to be much more top of mind with travelers.”

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation.

- Type 2 Diabetes

- Heart Disease

- Digestive Health

- Multiple Sclerosis

- COVID-19 Vaccines

- Occupational Therapy

- Healthy Aging

- Health Insurance

- Public Health

- Patient Rights

- Caregivers & Loved Ones

- End of Life Concerns

- Health News

- Thyroid Test Analyzer

- Doctor Discussion Guides

- Hemoglobin A1c Test Analyzer

- Lipid Test Analyzer

- Complete Blood Count (CBC) Analyzer

- What to Buy

- Editorial Process

- Meet Our Medical Expert Board

Traveling This Summer? Here’s Why You Need COVID Travel Insurance

Gabriella Clare Marino/Unsplash

Key Takeaways

- Some travel insurance will cover COVID-19 infection and quarantine. However, the fear of contracting COVID is not covered under most plans. In that case, “Cancel for Any Reason” coverage may offer protection.

- Many countries now require travel insurance. Depending on where you go, you may need to purchase a nationally administered plan.

- If you’re planning a trip, know that these requirements are changing frequently. Always read the fine print on any coverage you’re considering. Before you depart, double-check your plan to make sure that it’s complying with the requirements of the country you’re traveling to.

Jonathan Tucker didn’t intend to contract COVID-19 in Ireland in early April.

Tucker, who plays djembe and sings with the pirate band The Musical Blades, was touring the Emerald Isle as part of a guided tour featuring the musical group.

After seeing many of the sights, he and roughly 20 of the 65 tour participants came down with COVID and had to stay behind to quarantine.

While quarantining in an Irish hotel room isn’t ideal, Tucker told Verywell that he was prepared for the possibility.

“We got travel insurance, although it wasn’t exclusively for COVID,” said Tucker. “We also made sure we saved enough for double the trip expenses just in the event that this happened. Otherwise, it would be irresponsible.”

Tucker chose a plan through Allianz that reimbursed his expenses, including accommodations while traveling.

Since Ireland’s quarantine time is counted from the first sign of COVID symptoms , without that coverage, Tucker would have been on the hook for an additional seven days of accommodations.

What Is Travel Insurance?

Travel insurance has been around far longer than COVID, but the pandemic has made it much more attractive to travelers.

Typical plans cover trip delays, lost baggage, or medical care if a traveler has to visit a healthcare facility abroad. Most domestic healthcare plans don’t offer coverage.

Some plans, like Tucker’s, work for solo travelers or couples traveling together—even if only one person tests positive for COVID.

Travel Insurance for COVID

While there are options for travelers trying to prepare for the possibility that COVID could derail their plans, it hasn't always been that way.

Damian Tysdal, the founder of CoverTrip , told Verywell that epidemics were historically excluded from travel insurance.

Tysdal has written about travel insurance trends on his blog since 2006. He told Verywell that he’s seen plans change throughout the pandemic.

“COVID coverage with travel insurance has been evolving since the beginning of the pandemic,” said Tysdal. “Some companies outright excluded any losses resulting from an epidemic. Others covered it, but only if you purchased insurance before it became a ‘known event’—after which it could not be insured.”

According to Tysdal, most companies covered COVID as if it were any other illness—they paid for medical care, or if you were diagnosed before your trip, they covered trip cancellation.

However, consumers need to read plans carefully and look for loopholes such as exclusions for epidemics.

Is COVID Fear Covered?

Tysdal said that one thing that most plans don’t cover is the fear of contracting COVID, even if case rates justify that fear.

“The main problem came down to people wanting to cancel out of fear of getting COVID. That is not covered,” said Tysdal.

According to Tysdal, an exception would be a plan with “Cancel for Any Reason” coverage, which is “an optional upgrade that extends your list of covered reasons for cancellation. In that case, you could cancel out of fear.”

What Will Travel Insurance Cover?

Joe Cronin, MBA , president of International Citizens Insurance, told Verywell that travel insurance plan coverage varies, particularly when it comes to COVID-related expenses.

For example, some plans will only cover the costs of medical treatment, while others will pay for the cost of quarantining (as in Tucker’s case).

For quarantine coverage, plans might pay a set amount of money for meals, transportation, and lodging.

Read the Fine Print

Cronin said that travelers need to know that self-administered COVID tests are not always enough to trigger plan coverage.

“In most cases, a physician must diagnose you with COVID to receive coverage,” said Cronin. “If you discover you have COVID through a self-administered test, you may have to go to a doctor to get the diagnosis confirmed for the coverage to take effect.”

Cronin explained that “some policies will only cover quarantine if you can show that a government authority or doctor mandated it and that it was because you tested positive or are symptomatic.”

To make sure you’re complying with the policy you’ve purchased, Cronin said it’s crucial that you read the fine print.

Some traditional travel insurance plans changed to accommodate COVID, but there are others that are specifically geared toward it. For example, CAP and Covac Global both offer programs that are optimized for COVID coverage.

Do I Need Travel Insurance?

Travel insurance used to be an optional expense, but Cronin said that many countries now require it for entry.

As borders open to summer travelers, some countries are starting to require travelers to purchase the insurance coverage that’s offered by their national governments.

As of February 2022, Belize requires all visitors to purchase mandatory international health insurance through their tourism portal and covers medical treatment in the country.

Other countries only require travel insurance if you’re unvaccinated.

For example, Singapore requires unvaccinated travelers to carry travel insurance with a minimum of S$30,000 coverage (about US$22,000). Vaccinated travelers are encouraged, but not required, to have insurance.

Know Requirements—and Check for Changes

Cronin said that the requirements for travel insurance change rapidly, so it can be hard to keep up.

“Some countries have said they are implementing a travel insurance requirement only to remove it at the last second,” said Cronin. “Other countries have officially removed their travel insurance requirement—but border control agents are still asking for your travel insurance plan on entry. It is important to check the requirements of the country you are going to.”

As of April 2022, the United States has no travel insurance requirement for entry. Still, White House representatives have stated that there is no intention of lifting the testing requirement for reentry into the U.S.

As that testing remains, more Americans could wind up stranded abroad with COVID—whether they are symptomatic or not. Travel insurance could be the only thing standing between them and a very expensive quarantine.

What This Means For You

Travel insurance used to be a precaution that many travelers considered an unnecessary expense. Now, it might be necessary for entry into a country you plan to visit.

If you choose to purchase travel insurance, read the fine print carefully. Make sure that you know what’s covered—and what’s not—when it comes to COVID medical care and quarantine support.

The information in this article is current as of the date listed, which means newer information may be available when you read this. For the most recent updates on COVID-19, visit our coronavirus news page .

By Rachel Murphy Rachel Murphy is a Kansas City, MO, journalist with more than 10 years of experience.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Pros and Cons of Expedia

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

When it comes to Expedia prices

When it comes to expedia travel insurance, when it comes to the expedia cancellation policy, when it comes to the expedia loyalty program, when it comes to maximizing credit card points, the pros and cons of expedia recapped.

Frequent travelers likely know that there’s something better than a dream trip: a dream trip that you booked on a bargain.

The ways to save money on travel are plentiful. You can redeem hotels and airline points, or take advantage of last-minute travel deals, to name a few. And booking through third-party online travel agencies like Expedia can sometimes yield especially big savings.

Beyond just deals, Expedia has robust search filters that make finding your perfect vacation easy. It streamlines purchasing trip insurance , which can be especially important for travel these days. Plus, the Expedia Rewards program earns you points to pay for future bookings.

But booking through an OTA like Expedia is not without its drawbacks. Here's a look at some of those to help you weigh the pros and cons of booking travel through Expedia.

Pro: Expedia has frequent sales, last-minute travel deals and bundle discounts

Expedia deals are aplenty, whether it’s a bundling discount or a sale.

Bundling: A major component of booking travel on Expedia is the practice of bundling, where you can expect additional savings for booking more than one product (e.g., flight and hotel, or hotel and attraction ticket) in one transaction. For example, when we searched for a hotel and rental car in Miami, one five-day booking option included up to three free rental car days while another offered one free night.

A perk of booking travel through Expedia is that you select your hotel, airfare and car rental in separate steps in the process. This makes it easy to bookmark the page and compare the cost of these items on Expedia versus the cost on the company’s direct website.

Expedia payment plans: If you don’t want to pay for your whole trip at the time of booking, Expedia allows you to make smaller payments through Affirm, which is a service that offers short-term loans for online purchases. If approved by Affirm , you’ll be able to pay for your trip in monthly installments.

You can also check Expedia’s Deals page and Expedia’s Last-Minute Deals page . Both tend to offer an eclectic mix of travel deals, ranging from cheap motels in tiny towns to lavish resorts in major tourist destinations. We’ve spotted deals as high as 70% off.

» Learn more: How to find cheaper last-minute flights

Con: Booking direct is sometimes still cheaper than Expedia

Sure, Expedia sales and last-minute deals are nice, but that’s not to say that you can’t find other (sometimes better) deals for booking directly with the travel provider. Many offer their own exclusive deals — and they might save you even more than booking with online travel agencies. Compare prices across both Expedia and the specific company to ensure you’re getting the best price.

And sometimes the savings go beyond just the sticker price. For example, boutique hotel chain Ovolo Hotels offers generous amenities including free laundry, happy hour refreshments and a daily breakfast buffet — but only if you book directly with them.

» Learn more: Is Expedia legit? Can it get me a good deal?

Pro: You can purchase an Expedia travel insurance policy

Expedia partners with various insurance providers, depending on your individual booking, to offer trip protection.

F or flights: Expedia offers travel insurance protection options that cover flight cancellation, medical emergencies and other covered circumstances.

For hotels: Choose hotel booking protection to reimburse your stay in the case of cancellation.

For car rentals: You can add car rental damage protection for an extra per-day fee.

Coverage varies by plan, but you can typically expect reimbursement for some (or all) trip costs if your trip is impacted by covered reasons. Covered reasons typically include delays, loss, theft or damage to one’s baggage and personal belongings. You’re also typically reimbursed for covered medical expenses, including emergency evacuation if you get sick or injured during your trip.

But there are many limitations and exclusions, so read your policy’s fine print to understand what’s covered.

Expedia 24-hour cancellation

When you book a flight on Expedia, you can cancel for a full refund as long as you do so within 24 hours of booking. The U.S. Department of Transportation requires airlines to allow you to cancel a flight for a full refund if canceled within 24 hours of booking and it was booked seven days before departure.

Con: Outside travel insurance might be more comprehensive or cheaper (and sometimes free)

You can opt out of Expedia’s travel insurance and either be completely uninsured — or simply acquire your insurance elsewhere. And there are better travel insurance policies out there.

After a comprehensive review of dozens of plans that assessed factors including price and COVID-19 coverage, here are the best travel insurance policies .

What’s more, you might not even need to pay for travel insurance at all. Many credit cards offer travel insurance benefits if you paid for your trip with that card.

Pro: Expedia offers some fully refundable options

Because airlines, hotels and other travel services set their own individual policies on Expedia, change and cancellation policies can vary significantly. While it can be tricky to parse the policies for each individual property, use Expedia’s “fully refundable” search filter to limit potential bookings to those with flexible policies.

For straightforward requests, use the Expedia service page to make changes and get a refund. If you’re unable to get help through Expedia’s self-service tools, other ways to get in touch with Expedia include live chat, a dedicated Twitter account ( @expediahelp ) and a phone line.

Con: Most cancellation policies are bad, confusing or both

Because airlines are required to give full refunds if you cancel within 24 hours of booking, Expedia lets you change or cancel your flight reservation without fees within the same time period.

For everything else, good luck. Because each travel provider sets its own policies, navigating them can be a headache. In some cases, canceling through Expedia means you’ll have to chase after the hotel or activity provider to recoup the costs.

Additionally, prepare for cancellation fees (both Expedia’s own fees as well as fees from the service provider). That’s if you’re able to cancel at all. Some bookings through Expedia are nonrefundable altogether.

Pro: It’s great for commitment-phobes

The new Expedia Rewards program, One Key Rewards, lets you earn OneKeyCash for every booking you make on the platform (plus on Vrbo and Hotels.com), which can then be used like cash toward future trips. Not only that, but Expedia users can earn status, which includes benefits like exclusive members-only discounts and extra benefits at VIP Access properties (such as free breakfast or late checkout).

For travelers who don’t like to commit to one airline or hotel company, don’t travel that frequently, or who book travel that otherwise doesn’t have its own loyalty program (like a tour or vacation rental), Expedia makes it possible to still get rewarded.

» Learn more: The guide to One Key Rewards

Con: Most hotel and airline loyalty programs are far more rewarding

While the One Key Rewards program is fine, most travel loyalty programs tied to specific hotels or airlines are almost always more rewarding. For individual point values, most other currencies of airline and hotel points are worth far more than OneKeyCash, which nets you 2% back on cruise, hotel, activity and rental car bookings but only .2% on flights. Once it's in your account, you can use it to pay for bookings just like you would cash — though you’ll need enough OneKeyCash in your account to pay for an entire flight, not just part of it.

Additionally, holding specific airline or hotel elite status is typically more lucrative than the value of elite status on One Key Rewards as most perks extend to Expedia VIP Access properties only. That said, some elite members can enjoy up to 20% discounts on hotels and free price drop protection on flights, which is a plus.

As for how to use Expedia points, OneKeyCash can be redeemed on “pay now” bookings for participating purchases priced in U.S. dollars. You can use it to pay for part of a hotel booking, but you’ll have to have enough to pay for the full cost of a flight (including taxes and fees). And while you can’t transfer rewards, you can use your OneKeyCash to book travel for others.

But depending what status you’re able to reach with individual brand loyalty programs, you can likely expect better perks. So if you’re fine committing to one brand, you’re almost always better off striving to earn its status versus with One Key Rewards. But if you only stay for a night here or there or prefer to book based on location or price, it’s a way to earn a few more rewards.

Pro: Expedia counts as a travel purchase

Many travel rewards credit cards give you a higher rewards rate on travel purchases, and booking sites like Expedia typically count as travel spending. For example, the Chase Sapphire Preferred® Card earns 2 points per dollar on travel spending, compared with 1 point per dollar on most purchases.

Con: Travel credit cards are usually better for earning and redeeming rewards

If you’re loyal to a specific hotel or airline brand — or are open to pledging allegiance — credit cards aligned with those brands typically pay more on purchases directly from the brand partner. For example:

on American Express' website

on Chase's website

• 2 miles per $1 spent on Delta purchases.

Terms apply.

• 2 miles per $1 spent on United purchases.

• 12 points per $1 spent on eligible Hilton purchases.

• 6 points per $1 spent at participating Marriott Bonvoy hotels.

• 1 mile per $1 spent.

• 3 points per $1 spent.

• 2 points per $1 spent.

Even general-purpose travel rewards cards that aren't tied to a specific airline or hotel chain will often reward you more handsomely for booking through their own portals than they would for going through a site like Expedia. Going back to the Chase Sapphire Preferred® Card : As mentioned, it earns 2 points per dollar on most travel purchases — but 5 points per dollar on travel booked through the Chase portal . Among general-purpose travel cards:

• 5 miles per $1 on hotels and car rentals booked through Capital One Travel.

• 2 miles per $1 on other purchases.

• 5 points per $1 spent on travel booked through Chase.

• 10 points per $1 spent on hotels and rental cars booked through Chase.

• 5 points per $1 on air travel booked through Chase.

• 5 points per $1 spent on flights booked directly with airlines or with American Express Travel, on up to $500,000 spent per year.

• 5 points per $1 on prepaid hotels booked with American Express Travel.

• 2 miles per $1 spent.

• 1 point per $1 spent.

If you're considering booking with other online travel agencies like Priceline or Hotels.com, here are the best credit cards for online travel booking websites .

With the right deal, booking travel — including flights, hotels, cruises or car rentals — on Expedia could be worth it. It makes searching for travel relatively easy given the massive array of available listings, coupled with thoughtful search functionality to actually help you create your ideal itinerary.

But don’t automatically assume it’s a cheap way to book travel. Especially given the complicated cancellation policies, it might become among the most expensive, should an uninsured trip need to be canceled.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Key benefits of travel medical insurance

- Travel medical insurance coverage

- Who needs medical travel insurance?

Choosing the right travel medical insurance

How to use travel medical insurance, is travel medical insurance right for your next trip, travel medical insurance: essential coverage for health and safety abroad.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Travel medical insurance covers unexpected emergency medical expenses while traveling.

- Travelers off to foreign countries or remote areas should strongly consider travel medical insurance.

- If you have to use your travel medical insurance, keep all documents related to your treatment.

Of all the delights associated with travel to far-flung locales, getting sick or injured while away from home is low on the savvy traveler's list. Beyond gut-wrenching anxiety, seeking medical treatment in a foreign country can be exceedingly inconvenient and expensive.

The peace of mind that comes with travel insurance for the many things that could ail you while abroad is priceless. As options for travel-related insurance abound, it's essential to research, read the fine print, and act according to the specifics of your itinerary, pocketbook, and other needs.

Travel insurance reimburses you for any unexpected medical expenses incurred while traveling. On domestic trips, travel medical insurance usually take a backseat to your health insurance. However, when traveling to a foreign country, where your primary health insurance can't cover you, travel medical insurance takes the wheel. This can be especially helpful in countries with high medical care costs, such as Scandinavian countries.

Emergency medical evacuation insurance

Another benefit that often comes with travel medical insurance, emergency medical evacuation insurance covers you for any costs to transport you to an adequately equipped medical center. Emergency medical evacuation insurance is often paired with repatriation insurance, which covers costs associated with returning your remains to your home country if the worst happens.