What are your financial priorities?

Answer a few simple questions, and we’ll direct you to the right resources for every stage of life.

Welcome back. Your personalized solutions are waiting.

Welcome back. Here's where you left off.

You might also be interested in:

- Introduction

Make sure you have the right credit card

Have your digital wallet ready, carry some foreign cash, related content.

View infographic , 2 minutes

Read more , 4 minutes

Read more , 3 minutes

Traveling abroad? Understanding payment methods and how to avoid transaction fees

Understanding the different ways of paying can save you money and help your trip run more smoothly

Read, 4 minutes

Hidden costs and fees on your various cards can add up quickly in a foreign country, whether you’re withdrawing money from an ATM, buying souvenirs or settling your hotel bill. Many credit cards charge a foreign transaction fee—typically 2% to 3%—on every international purchase. And every trip to the ATM may also incur a fee. You can minimize or avoid fees by following these tips and resources—before you depart and while you’re traveling.

Article continues below

Credit cards are a widely accepted form of payment. They are easy to use, provide purchase-protection benefits and have favorable exchange rates. But some cards are better than others for international travel.

Find out if your card charges for foreign transactions either by calling the number on the card or checking your agreement. If it does, you may want to investigate applying for a new card that doesn’t. Also consider a credit card that will earn you rewards for travel, dining or other purchases. Don’t wait to do this—the process of getting a new card can take six to eight weeks. And before applying, review any potential impact on your credit score .

You should also make sure your card has an EMV (Europay, MasterCard, and Visa) chip. These cards, standard in more than 130 countries, are considered more secure than credit cards with magnetic stripes. If your card only has a magnetic stripe or signature, it may not work in the country you’re visiting.

While you’re there

It’s a good idea to have a cash-vs.-card strategy. One solid rule of thumb is to pay for frequent small purchases, such as coffee and snacks, with cash. Save your credit card for more expensive purchases, such as pricey gifts, restaurant tabs and hotel bills.

Many establishments frequented by tourists will give you a choice of paying in local currency or U.S. dollars. You’re almost always better off going with the local currency. And remember that your credit card usually has a more favorable exchange rate and lower fees than local merchants can offer.

Searching for the right card? Research Bank of America credit card options.

Before you travel, set up alerts for unusual activity on your credit card. That way, you will be notified immediately by email, text message or through your mobile app if your bank sees anything questionable. For more travel tips, see our checklist .

In many countries, merchants are moving to contactless payment. In fact, you may find that some stores and restaurants not only won’t take cash but may not even have a credit card reader.

Contactless payments are done through near-field communication (NFC) technology or quick response (QR) codes. NFC terminals at checkout counters use radio waves to read a physical credit card or one stored on a smartphone or smartwatch. QR codes can originate with the merchant or be stored on your phone. You might scan a merchant’s QR code with your phone’s camera and then tap on a link to complete the payment process. Or you might use an app to generate a QR code with your credit card information, and then the merchant scans it for payment.

A Digital Wallet can help you navigate contactless payments. You will be able to pay in-store, online and in-app, receive payments and get cash from ATMs using only your smartphone.

Set up a Digital Wallet by adding credit or debit card information to your smartphone. You can do this through your mobile banking app or another pay app on your phone. If you are traveling to a country such as China, where QR code payments are common, make sure your app can generate QR codes.

See how to add your Bank of America credit or debit card to a Digital Wallet.

The benefits of using a Digital Wallet go beyond the convenience of contactless payments and include:

Most experienced travelers will recommend arriving at your destination with enough local currency to last at least the first 24 hours of your trip. This will make it easier to pay for services such as luggage carts, taxis and tips.

To get an advantageous currency exchange rate, purchase currency through your bank before you leave. Generally, larger banks offer more favorable rates and lower fees than other conversion services, such as airport exchange desks or kiosks at the destination. Some banks let you order currency online or through their mobile app. Allow three to five days before you travel to receive the currency.

Learn how to order foreign currency from Bank of America before you travel.

Did you know?

Currency exchange rates constantly change depending on markets as well as economic and geopolitical factors. Individual rates among banks, hotels, kiosks and other currency exchange businesses also vary due to profit, fees and other markups.

Even though it’s good to have cash on hand, try to limit ATM withdrawals. Using an international ATM can trigger unexpected fees, and some banks cap how much you can withdraw each day. You can minimize fees by using the ATMs in your home bank’s network or at a bank that partners with it. And remember that if you use your credit card to withdraw cash from ATMs, you may be charged cash advance fees and interest.

Find Bank of America’s international ATM partners.

Some international ATMs support only four-digit PINs and do not have letters on their keypads. Be sure your PIN doesn’t start with a zero and know it by its numbers.

If you have excess foreign cash at the end of your trip, you may be able to apply it toward your hotel bill or final meal. If you’d rather give the money to charity, look for donation bins at the airport. Or think about giving it to friends who plan to travel. You can also exchange foreign cash back into U.S. dollars, though the exchange rate will be different, you may pay a fee and banks typically won’t buy back coins.

The material provided on this website is for informational use only and is not intended for financial or investment advice. Bank of America Corporation and/or its affiliates assume no liability for any loss or damage resulting from one’s reliance on the material provided. Please also note that such material is not updated regularly and that some of the information may not therefore be current. Consult with your own financial professional when making decisions regarding your financial or investment management. ©2024 Bank of America Corporation.

What to read next

More from bank of america, foreign currency exchange, compare our credit cards.

We're here to help. Reach out by visiting our Contact page or schedule an appointment today.

- Schedule an Appointment

You're continuing to another website

You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offerings and level of security, so please refer to the website's posted privacy policy and terms of use. It's possible that the information provided in the website is available only in English.

Va a ir a una página que podría estar en inglés

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leído y entendido todos los términos y condiciones provistos.

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance ("DAA") self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites (excluding ads appearing on platforms that do not accept the icon). Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool . You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs .

Connect with us

Your Privacy Choices

Some materials and online content may be available in English only.

Bank of America, N.A. Member FDIC. Equal Housing Lender

© 2023 Bank of America Corporation. All rights reserved.

Investment products:

Bank of America and its affiliates do not provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Bank of America Travel Rewards Credit Card Review 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Bank of America® Travel Rewards Credit Card for Students. The details for these products have not been reviewed or provided by the issuer.

The Bank of America® Travel Rewards credit card is a good travel credit card for beginners or those who prefer simplicity in earning and redeeming rewards. It's got a solid bonus for a no-annual-fee card, and you can use your points toward a wide variety of travel purchases.

Earn 1.5 points per dollar on all purchases

0% intro APR for the first 15 billing cycles for purchases and for any balance transfers made within the first 60 days of account opening

18.24% - 28.24% Variable

Earn 25,000 online bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earns 1.5 points per dollar on every purchase

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee or foreign transaction fee

- con icon Two crossed lines that form an 'X'. Some cards earn more rewards, though usually only in bonus categories

- con icon Two crossed lines that form an 'X'. You can't transfer points to travel partners (though you can use points to cancel out travel purchases on your statement)

The Bank of America® Travel Rewards credit card is a good travel credit card for beginners or those who prefer simplicity in earning and redeeming rewards.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that's currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Bottom Line

If you're in search of a no-annual-fee travel credit card that offers a straightforward points program, the Bank of America® Travel Rewards credit card is worth considering. This card offers a flat earning rate of 1.5 points per dollar on all purchases, and you can redeem your rewards toward travel expenses you charge to your card.

However, if you're a Bank of America Preferred Rewards member, the card can be much more lucrative. Depending on your rewards tier, you can earn 25% to 75% more points with this card.

The Bank of America® Travel Rewards credit card is a good choice if you don't like dealing with complicated frequent flyer or hotel rewards programs that limit award availability and make their points hard to use. And on the earning side, there are no bonus categories or spending caps to track, either. If you're new to travel rewards, this could be a great way to start earning and redeeming points.

Detailed Overview

Welcome bonus.

With the Bank of America® Travel Rewards credit card, you can earn a welcome bonus of 25,000 online bonus points after making at least $1,000 in purchases in the first 90 days of account opening of account opening. Each point is worth 1 cent, so the welcome bonus offer is worth $250 in travel.

0% Intro APR

New cardholders also receive a 0% intro APR for the first 15 billing cycles for purchases and for any balance transfers made within the first 60 days of account opening, after which a 18.24% - 28.24% Variable APR applies. This can save you money if you plan to make a large purchase but want to spread the payments out over several months — as long as you have a plan to pay off the debt before the introductory period runs out.

How to Earn Points From the Bank of America Travel Rewards Credit Card

Bank of America® Travel Rewards credit card cardholders earn 1.5 points per dollar on all purchases, with no categories or limits to keep track of.

Things get more interesting if you're a Bank of America Preferred Rewards customer. The amount of money you have on deposit (like savings or investments) with Bank of America and Merrill (Bank of America's wealth management division) determines your rewards tier. Depending on your tier, you could earn 25% to 75% more rewards.

One other way to boost your returns from the Bank of America® Travel Rewards credit card is by purchasing travel through the Bank of America travel center. In that case, you'll earn 3 points per dollar (instead of 1.5 points per dollar) for your purchase.

With the Bank of America® Travel Rewards credit card, you'll earn points that are easy to redeem for a wide variety of travel expenses. Once you charge a travel purchase to your card, you can apply points at a rate of 1 cent each toward a statement credit to cover the purchase. The minimum redemption amount is 2,500 points ($25), and you'll have 12 months from the transaction date to apply your points.

Bank of America has a broad definition of travel, including some purchases most would classify as entertainment. Categories that qualify for a Bank of America® Travel Rewards credit card travel statement credit include:

- Trailer parks

- Recreational vehicle rentals

- Campgrounds

- Car rental agencies

- Truck and trailer rental

- Cruise lines

- Travel agencies

- Tour operators and real estate agents

- Operators of passenger trains

- Boat rentals

- Parking lots and garages

- Tolls and bridge fees

- Tourist attractions

- Exhibits like art galleries

- Amusement parks, carnivals, circuses, aquariums, and zoos

If you're not traveling, the Bank of America® Travel Rewards credit card allows you to use points for non-travel redemptions, but the rates aren't as attractive. For example, you can use points for gift cards starting at 3,125 points ($31.25), and the value per point varies.

If you prefer cash back, you can redeem points for a check or electronic deposit into a Bank of America checking or savings account, or for credit to an eligible Cash Management Account with Merrill. In that case, your points are only worth 0.6 cents apiece, which is not a great value.

Benefits and Features

The Bank of America® Travel Rewards credit card doesn't have a ton of valuable cardholder perks, which is common among credit cards with no annual fee .

Introductory 0% APR on purchases

The Bank of America® Travel Rewards credit card comes with a 0% intro APR for the first 15 billing cycles for purchases and for any balance transfers made within the first 60 days of account opening. After that, there's a 18.24% - 28.24% Variable APR.

Using a 0% APR credit card offer can be a good way to spread out payments for a big purchase over time without incurring huge interest charges, but you'll want to be sure you have the means and a plan to pay it off. Otherwise, you'll end up with high-interest debt after the introductory period expires.

Keep in mind there are longer intro periods on the best 0% APR credit cards available right now, and some also include balance transfers in their offers.

No foreign transaction fees

Good travel credit cards don't charge foreign transaction fees , and the Bank of America® Travel Rewards credit card is no exception. Because it doesn't tack on these fees, you can use the card for international purchases and not get stung with extra charges.

Free FICO score

Primary cardholders with the Bank of America® Travel Rewards credit card can check their FICO score for free through Bank of America's online banking, mobile website, or mobile banking app for iPhone and Android. This is a useful tool for keeping tabs on your credit, especially if you don't have another credit card that offers free credit scores ,

Overdraft Protection

The Bank of America® Travel Rewards credit card comes with an optional Balance Connect overdraft protection feature that lets you link your eligible Bank of America deposit account to your card. If you choose to use the service, Bank of America automatically transfers funds from your credit card account to cover overdrafts on your deposit account, as long as you have credit available on your credit card.

You won't be charged overdraft fees for this service, but you'll pay interest on the cash advance.

Mobile Wallet

When you add your Bank of America® Travel Rewards credit card to digital wallets like Apple Pay, Google Pay, or Samsung Pay, you can use it for in-person, online, or in-app transactions. Because your actual card number isn't stored on your device or shared with most merchants, you'll have more security when you make purchases.

$0 Liability Guarantee

Losing a credit card or having it stolen stinks, but you won't have to worry about fraudulent or unauthorized transactions on your Bank of America® Travel Rewards credit card as long as you report the issue promptly.

Along with not having an annual fee and offering an intro APR, the Bank of America® Travel Rewards credit card doesn't add foreign transaction fees, which makes it a good pick to have in your wallet when you travel abroad.

As with most other cards, you'll pay fees for balance transfers, cash advances, and late or returned payments.

Card Comparison

Before you decide on the Bank of America® Travel Rewards credit card, you'll want to consider similar no-annual-fee cards, because some have better earning rates and more flexible options for redeeming rewards. For example, the Wells Fargo Active Cash® Card earns 2% cash rewards on purchases, and you can use your rewards for whatever you like — not just travel.

Similarly, the Discover it® Miles earns 1.5 miles per dollar on all purchases, and at the end of the first 12 billing cycles, Discover will match all the rewards you earn. This means you'll effectively earn 3 miles per dollar in the first year, and while it's framed as a travel card, you can also redeem your miles for cash back at the same rate of 1 cent per mile.

If you're more interested in cash back, Bank of America also has cash-back cards available; you can read our Bank of America® Customized Cash Rewards Credit Card review . Or, if you're looking for a higher-tier travel rewards card and are open to an annual fee, you can read our Bank of America® Premium Rewards® credit card review .

Frequently Asked Questions

Most people who are approved for the Bank of America® Travel Rewards credit card have at least a good credit score. That means a FICO score of at least 670 or a VantageScore of 700 or more.

You still have options if your credit score is below that range. Our guides to the best credit cards for fair or average credit and for bad credit include some cards that earn solid rewards. Keep in mind there's also a student version of this card — the Bank of America® Travel Rewards Credit Card for Students — that offers most of the same benefits and can be easier to qualify for if you're a college student.

The Bank of America® Travel Rewards credit card is worth it if you're looking for a simple way to earn and use credit card rewards for travel without paying an annual fee. It's best suited for beginners or those who don't want to mess with complicated award programs, but to that end, it doesn't come with a lot of benefits.

Yes, the Bank of America® Travel Rewards credit card offers trip cancellation and interruption coverage, trip delay coverage, as well as lost luggage coverage like many other top travel rewards cards. This is a great benefit for those who want an additional layer of protection.

The Bank of America® Travel Rewards credit card is a Visa Signature card.

Why You Should Trust Us

Business Insider's experts evaluated the Bank of America® Travel Rewards credit card relative to other no-annual-fee credit cards that earn points. It's a strong option for beginners getting into travel rewards, especially if you're a Bank of America Preferred Rewards member.

That said, its points aren't as flexible as those from comparable cards, like the Wells Fargo Active Cash® Card and the Discover it® Miles.

For a closer look at our methodology, see how we rate credit cards at Business Insider.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Bank of America® Travel Rewards credit card review

Written by: Re'Dreyona Walker

Edited by: Tracy Stewart

Partner Offer

In a Nutshell:

You can travel anytime you want with this flexible travel card: The Bank of America Travel Rewards credit card sets itself apart from other travel cards by doing away with restrictive travel policies and letting you book your rewards-funded travel yourself.

Learn more about this card

Other Notable Features: No foreign transaction fees, Visa Signature benefits, EMV chip card with the ability to add a PIN for international travel, auto rental collision damage waiver, roadside dispatch, lost luggage reimbursement, concierge services

The Bank of America® Travel Rewards credit card is a great choice for occasional travelers who like to search the web for the best deals without sacrificing their option to use rewards for the purchase. It’s an incredibly flexible card when it comes to redemption options and earning capacity, however, it lacks many of the appealing benefits offered by other popular travel credit cards. That said, there are some limitations compared to cards with a potentially higher rewards value.

The Bank of America Travel Rewards credit card offers a solid rewards program, especially if you already have Merrill or Bank of America® accounts. The Bank of America Preferred Rewards® program offers even more rewards on top of what you would earn with its flat-rate 1.5-point rewards structure. For those who don’t mind having a more complicated rewards structure in return for more travel benefits, rewards and cardholder perks, you may do better with other comparable travel rewards cards.

- No annual fee : Most travel rewards cards require you to pay an annual fee in exchange for premium travel perks, so having a $0 annual fee is unique.

- No foreign transaction fee : Foreign transaction fees can make the overall cost of your purchases go up tremendously. Fortunately, when going abroad, travelers do not have to worry about these pesky charges when using this card.

- Decent sign-up bonus : After spending $1,000 in purchases within the first 90 days after account opening, new cardholders can get 25,000 online bonus points, which is an excellent offering on top of the card’s ongoing rewards rate.

- Uncapped reward earnings : Since there is no limit to the number of points you can earn, you can easily maximize your reward earnings.

- Special perks for Bank of America customers : The Preferred Rewards program allows certain Bank of America® credit card holders to earn extra bonus rewards. If you have enough money in combined balances in your Bank of American and Merrill accounts, you can earn 25%-75% more rewards.

- Requires good or excellent credit : Potential applicants may be denied if they do not fulfill the credit score requirement, which could prevent many people from applying.

- Potentially high APR : Depending on your creditworthiness, you could be subjected to an APR that you may not be comfortable with.

- No bonus categories : The card only offers flat-rate rewards, which may not be enough for people looking for tiered categories to boost their reward earnings.

Why you might want the Bank of America Travel Rewards Card

If you’re the type of cardholder always looking around for a good sign-up bonus on a card with no annual fee, then Bank of America’s travel card is a great option for you. You’ll earn a flat rate of rewards on all your purchases, giving you the freedom to shop for what you want, when you want to and still earn a decent rate.

One unique benefit of this card is that if you happen to have a Merrill or a Bank of America account you can earn a boosted rewards rate with Preferred Rewards.

Higher sign-up bonus

Though not the most valuable sign-up offer currently available, the Bank of America Travel Rewards credit card does include a decent bonus of 25,000 online points for users who spend $1,000 in the first 90 days. If you redeem these points for travel purchases, they are worth up to $250.

Flat-rate rewards on all purchases

The Bank of America Travel Rewards credit card comes with one flat earning rate on all purchases – making it easy to rack up points without keeping track of bonus categories or focusing your spending in one area. Cardholders bring in 1.5 points per dollar on every purchase. The one exception to this is purchases made in the Bank of America Travel Center, which earn an additional 1.5 points per dollar for a total of 3 points per dollar spent.

Bank of America Preferred Rewards program

If you are already a Bank of America or Merrill checking or savings account holder, you might be able to boost your earning rate on the Bank of America Travel Rewards credit card. This is certainly the case if you have a significant balance. Bank of America has a tiered rewards rate program that increases at incremental stages depending on how large your account balance is in your Bank of America or Merrill account. You can potentially qualify for a 75% point boost with an increased earned rate of 2.6% (up from the standard 1.5% per dollar spent) by qualifying for Platinum Honors – Bank of America’s highest Preferred Rewards tier.

Bank of America Preferred Rewards tiers and earning rates

As you can see, even if you don’t have a balance over $100,000 in your Bank of America or Merrill account you can still earn either a 25% or 50% boost to your rewards rate.

When combined with some of the other benefits of this card, even a 1.9% earning rate makes this card stand out despite the fact some flat-rate rewards cards have a slightly higher rate.

Flexible point redemption

Points earned with the Bank of America Travel Rewards credit card are worth the same amount whether you book travel with the bank or another site – unlike other travel cards that offer a boost on certain purchases. However, this gives the card some added flexibility and means you can think less critically about how you want to use those points.

You can redeem points for any travel purchase made on your card in the last 12 months. That means you can find a better deal on a third-party travel site and still use your rewards to cover the cost. You may also redeem points for a statement credit to pay for dining purchases, a cash redemption or gift card.

Bank of America Travel Rewards redemption options

Solid intro apr for new purchases and balance transfers.

In addition to easy-to-earn rewards and flexible redemption, the Bank of America Travel Rewards credit card offers a 0% introductory APR for 15 billing cycles for new purchases (18.24% to 28.24% variable thereafter) and for balance transfers made within the first 60 days (after which, the 18.24% to 28.24% variable APR applies). There is a 3% intro balance transfer fee for 60 days from account opening, then 4%.

Very few travel cards offer an intro APR on both balance transfers and new purchases, so this card could be an ideal pick if you need to pay off debt or chip away at the cost of a new purchase in the short term, but want to focus on earning travel rewards long term.

This can be a great perk for users who have a big purchase to make and want to pay it down over time without racking up interest. You’ll have a little more than a full year to make slow payments without having to worry about additional charges. Just be sure not to charge more than you can pay off in the introductory period, as the ongoing APR can be high.

Why you might want a different travel rewards card

If you’re familiar with rewards programs, know which categories you spend your money the most and can plan accordingly to use different cards for every purchase, you might want to opt for a more elaborate card strategy that takes advantage of higher earning cards. A rate of 1.5 points per dollar spent is a decent rate, but it’s by no means the best offer out there.

That said, there are a few shortcomings the Bank of America Travel Rewards card has that makes it fall a little further down the list of best travel rewards cards.

No bonus for travel redemption

Redemption through an issuer’s travel portal is a competitive feature on a travel rewards card that comes with some other cards in this category. Unfortunately, points redeemed for travel through the Bank of America Travel center won’t see an increase in value like on some other issuer’s cards. This puts Bank of America’s card a little further down the list.

Although purchases made through the travel center will earn double points, redeeming those points for travel won’t increase their value. Meaning you’ll need to spend more to increase the worthiness of your rewards, while with another card it might mean spending less and redeeming for more.

For example, points earned with the Chase Sapphire Preferred Card earn an additional 25% value when redeemed through the Chase Ultimate Rewards Portal, making points (normally worth 1 cent each) worth 1.25 cents each.

The most value you can get out of a Bank of America Travel Rewards credit card point is 1 cent per point, other travel cards can often outpace its value. When comparing to another card, be sure to keep point value in mind because, like Chase, some issuers have increased point value.

Low rewards rate

While earning 1.5 points per dollar on every purchase is convenient and it can be boosted if you’re a Bank of America or Merrill account holder, for a general cardholder who’s looking for a solid travel rewards card, it’s a little low. Even the 3 points per dollar on travel booked through Bank of America’s Travel Center is comparatively low to other cards, especially considering the points’ low value for redemption.

If you want to step into travel rewards and fly higher, you might benefit from a card that earns at a higher rate on general purchases and pair it with a card from the same issuer that earns a high rate for travel. This may allow you to pool your points and redeem them through that issuer’s rewards portal.

For instance, you might be better served with a 2% cash back card like the Citi Double Cash® Card (1% when you buy, 1% when you pay) paired with the Citi Premier® Card . While the Premier Card has an annual fee of $95, depending on how much you spend you may be able to offset that fee by earning more rewards than you would with the Bank of America Travel Rewards card.

No standout perks

The Bank of America Travel Rewards credit card has a few benefits that make it valuable for frequent travelers, but it doesn’t have many extensive perks.

- No foreign transaction fee – When traveling abroad, you won’t pay any surcharge on foreign transactions.

- Car rental insurance – If your rental car is damaged or stolen, the Bank of America Travel Rewards credit card can reimburse you in excess of the company’s insurance policy.

- Add PIN for international travel – The Bank of America Travel Rewards credit card is an EMV chip card, and you can add a PIN for easy use when traveling overseas.

While certainly not the most impressive travel perks available on a rewards card, all these benefits could potentially save frequent travelers some money on their next trip — but in comparison to other travel rewards cards, you could get a much better lineup of perks than with this card.

How does the Bank of America Travel Rewards card compare to other cards?

The flat earning rate on the Bank of America Travel Rewards credit card makes it easy to rack up points with this no-annual-fee option, but savvy spenders might be able to get more out of a travel card with a different structure. Here are a few popular alternatives:

Bank of America Travel Rewards vs. Chase Sapphire Preferred

A fan-favorite travel card, the Chase Sapphire Preferred offers a good rewards rate and a valuable sign-up bonus. If you redeem all 60,000 points (after spending $4,000 in the first three months to earn the bonus) for travel in the Chase Travel portal, they are worth up to $750. The biggest drawback to the Sapphire Preferred in comparison to the Bank of America Travel Rewards Card is its $95 annual fee, though heavy spenders can probably offset this cost with a great earning rate on travel and restaurant purchases.

See Related : Bank of America Travel Rewards vs. Chase Sapphire Preferred: Which is best for you?

Bank of America Travel Rewards vs. Capital One VentureOne

Like the Bank of America Travel Rewards credit card, the Capital One VentureOne doesn’t charge an annual fee and offers a flat rate of miles on most purchases – 1.25 miles per dollar. The Capital One VentureOne also charges no foreign transaction fee. However, the VentureOne also comes with a higher low-end and high-end APR rate (19.99% to 29.99% variable) than the Bank of America Travel Rewards Card does. Miles with the VentureOne are also worth that same as Bank of America points at 1 cent apiece. However, with a lower earning rate, the VentureOne won’t compete well with cards that have a high point value and a high earning rate.

Bank of America Travel Rewards vs. Wells Fargo Autograph

The Wells Fargo Autograph is another popular no-annual-fee travel card, thanks to its extensive list of categories that qualify for the 3 point-per-dollar rate. Cardholders can earn 3 points per dollar on restaurants, travel, transit, gas station purchases, select streaming services and phone plans as well as 1 point per dollar on other purchases. This makes it easy to rack up plenty of points. Plus, cardholders who also have a Wells Fargo Active Cash® Card may earn even more cash rewards on purchases.

How to use the Bank of America Travel Rewards credit card:

- Spend at least $1,000 in the first 90 days to earn the sign-up bonus.

- Put all your purchases on the card to take advantage of a generous flat rewards rate.

- Consider purchasing travel through the Bank of America Travel center to earn double points.

- If you are eligible, sign up for Preferred Rewards to boost your earnings.

Is the Bank of America Travel Rewards credit card right for you?

If you are the type of cardholder who prefers to put all their purchases on one card and not worry about keeping track of bonus categories, the Bank of America Travel Rewards credit card offers a good rate of points for a card with no annual fee. Plus, Bank of America account holders with a significant balance can boost their rewards rate and fast-track their way to their next vacation.

On the other hand, if the realm of rewards earning sparks your curiosity and you want to maximize how much you get back for what you spend, you might consider a more strategic approach. That said, the Bank of America Travel Rewards card is a terrific option for newcomers to rewards or for those who aren’t confident in their ability to offset the annual fees they may face with more beneficial cards.

Need more information on this card? See related articles:

- Bank of America Travel Center: How to book flights, hotels and vacations.

- Card Comparison – Bank of America Travel Rewards vs. Chase Sapphire Preferred

- Card Comparison – Bank of America Travel Rewards card vs. Bank of America Cash Rewards card

- Card Comparison – Bank of America Travel Rewards vs. Capital One Venture Card

*All information about Wells Fargo Propel American Express card has been collected independently by CreditCards.com and has not been reviewed by the issuer.

Our reviews and best card recommendations are based on an objective rating process and are not driven by advertising dollars. However, we do receive compensation when you click on links to products from our partners. Learn more about our advertising policy

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Know your odds before you apply

- Enter your information

- We’ll run a soft credit pull, which won’t impact your credit score

- You’ll see your estimated approval odds near cards to help you narrow down your options

Your personal information and data are protected with 256-bit encryption.

Tell us your name to get started

We’ll use this information to to verify your credit profile.

What’s your mailing address?

What's your employment status?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considered as a basis for repaying a loan. Increase non-taxable income or benefits included by 25%.

Put $0 if you currently don't have a rent or mortgage payment.

Last four digits of your Social Security number

We’ll use the last four digits of your Social Security number to get your approval odds. This won’t impact your credit score.

What’s your email address?

Your email address unlocks your approval odds. Don’t worry, we won’t spam your inbox.

By clicking "See my odds" you agree to our Terms of Use (including our Prequalification Terms ) and Privacy Policy . These terms allow CreditCards.com to use your consumer report information, including credit score, for internal business purposes, such as improving the website experience and to market other products and services to you. I understand that this is not an application for credit and that, if I wish to apply for a credit card with any participating credit card issuer, I will need to click through to complete and submit an application directly with that issuer.

Calculating your approval odds

Oops something went wrong..

We’re sorry, but something went wrong and we couldn’t find your approval odds. Instead, you'll see recommended credit ranges from the issuers listed next to cards on our site.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Is the Bank of America Travel Rewards Credit Card Worth It?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Bank of America® Travel Rewards credit card offers you a simple way to earn valuable rewards on a travel credit card with a $0 annual fee. This is a good card to consider if you don’t like the restrictions of airline and hotel loyalty programs but want straightforward earning and easy redemption options.

Here are the features to consider when deciding whether the Bank of America® Travel Rewards credit card will be worthwhile for you.

Valuable welcome offer

The Bank of America® Travel Rewards credit card currently has a nice welcome offer: 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

Reward earnings

This card offers a very straightforward way to earn rewards. You don’t have to worry about rotating categories or extra rewards in certain purchase categories. You simply earn 1.5 points per dollar on all purchases. If you book travel with the Bank of America Travel Center, you earn 3 points per dollar.

If you are a member of the Bank of America Preferred Rewards® Rewards program, your points-earning rate on the card goes up.

To qualify for the Bank of America Preferred Rewards® program, you need to hold a certain minimum balance in a Bank of America® checking or savings account or through investments with Merrill Lynch or Merrill Edge.

Gold members in the Bank of America Preferred Rewards® program earn a 25% bonus when they use this card while Platinum status Bank of America Preferred Rewards® members get a 50% bonus and top tier Platinum Honor members get a 75% bonus.

» Learn more: How to choose a travel credit card

Redeeming your points

Redeeming your rewards for travel expenses is extremely easy. There are no complicated award charts or blackout dates to worry about.

You have the flexibility to book your travel however you want, then use your points to redeem as a statement credit against your travel charge at a rate of 1 cent per point. It's that simple.

The points from your Bank of America® Travel Rewards credit card can be used for flights, hotels, cruises, car rentals, baggage fees, zoos, amusement parks, tolls and many other travel expenses. In most cases, you have up to 12 months after you make a travel purchase to redeem your points for a statement credit.

If you redeem your points for cash back instead of travel credits, your points are worth about 0.6 cent per point. For example, if you redeemed 2,500 points for cash, you would receive $15 in rewards. So your points have more value when redeemed for travel charges than for cash back.

» Learn more: 3 surprising ways you can redeem your Bank of America Travel Rewards

Foreign transaction fees

If you look at other popular no-annual fee credit cards, they charge up to a 3% foreign transaction fee.

The Bank of America® Travel Rewards credit card has no foreign transaction fees, which makes it a great choice when traveling outside the country.

Other benefits

The Bank of America® Travel Rewards credit card has a few other benefits useful for travelers:

Bank of America® offers a great benefit for museum lovers. Your Bank of America® Travel Rewards credit card gives you access to Museums on Us. Through this program, you will get access to more than 225 museums across the country, for free, on the first full weekend of every month.

The Bank of America® Travel Rewards credit card features chip technology for extra security and easy use at over 130 countries.

Fraud protection is also a stable of the card and you'll be protected with a $0 Liability Guarantee and also get alerted of suspicious activity on your account.

Is the Bank of America® Travel Rewards credit card worth getting?

Even though this credit card offers no annual fee and has a valuable welcome offer, unless you hold Platinum or Platinum Honor status with the Bank of America Preferred Rewards® program, this credit card has a reward rate that's less than a 2% cash back credit card.

But, if you have higher levels of status with Bank of America®, this could be a great option for earning great rewards with no annual fee.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Bank of america travel rewards review: earn unlimited points for travel, no matter where you shop, select breaks down the bank of america travel rewards credit card for your review..

The BankAmericard® credit card is not currently available on Select. Please visit our list of best balance transfer cards for alternative options. Information about the American Express® Green Card has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Most credit cards are known for offering either travel rewards , a 0% interest period or a large welcome bonus , but the Bank of America® Travel Rewards credit card offers cardholders all three perks.

With no annual fee, you can maximize the number of points you earn to use on travel purchases without worrying about whether you spend enough to justify the high cost that come with some travel rewards cards. You can earn unlimited 1.5X points for every $1 you spend on all your purchases. You can use your points toward eligible travel expenses and, just like with many comparable travel credit cards, your points never expire.

Below, Select breaks down the rewards, benefits and fees associated with the Bank of America Travel Rewards credit card to help you decide if it's the right card for you.

Bank of America Travel Rewards credit card review

Additional benefits, bottom line, bank of america® travel rewards credit card.

Unlimited 1.5 points for every $1 spent on all eligible purchases

Welcome bonus

25,000 online bonus points after you spend at least $1,000 in purchases in the first 90 days of account opening, which can be redeemed for a $250 statement credit toward qualifying travel purchases

Introductory 0% APR for your first 15 billing cycles on purchases and balance transfers made within 60 days of account opening.

Regular APR

18.24% - 28.24% variable

Balance transfer fee

3% for 60 days from account opening, then 4%

Foreign transaction fee

Credit needed.

Good/Excellent

Terms apply.

Bank of America Travel Rewards credit card rewards

No matter whether you use your credit card at the supermarket, the pump or to book a flight, you'll earn 1.5X points for every $1 you spend on eligible purchases.

Right now, new cardholders can also take advantage of a generous welcome offer: Earn 25,000 bonus points after making $1,000 in purchases in the first 90 days of account opening. This can be redeemed for a $250 statement credit toward travel purchases.

You can start redeeming your rewards once you've earned 2,500 (for travel) or 3,125 for gift cards. The value of your points vary depending on how you use them. You get the best rate (1 point = $0.001) if you use your Bank of America Travel Rewards credit card to book your travel and then apply your rewards as a statement credit to essentially reimburse yourself for your travel costs.

This method of travel rewards reimbursement is similar to redeem points for future travel, available on cards like the Capital One VentureOne Rewards Credit Card (See rates and fees ) and the Capital One Venture Rewards Credit Card (See rates and fees ) .

You can also redeem your points for a cash reward either in the form of a check or electronic deposit into a Bank of America checking or savings account or for credit to an eligible cash management account with Merrill. Each point redeemed for cash is worth $0.006 (2,500 points = $15). The redemption value for gift cards varies, so you'll want to do your research before you cash in your points that way.

Bank of America Travel Rewards cardholders can benefit from the Museums on Us® program. During the first full weekend every month, you can gain one free general admission to participating museums when you present your qualifying Bank of America credit card and photo ID. (This perk excludes special exhibitions, ticketed shows and fundraising events.)

The Bank of America Travel Rewards credit card is a no annual fee travel rewards card. There are also no foreign transaction fees, giving you freedom to take this card with you on your next overseas vacation .

The card also offers new customers a 0% interest period on purchases for the first 18 billing cycles (after, 16.99% - 26.99% variable APR). Note that this promotional financing period applies to new purchases only. Balance transfers will accrue interest at the standard rate, plus incur a 3% balance transfer fee.

If you are looking for a balance transfer card to pay down high interest debt on other accounts, you could consider the BankAmericard® credit card, which offers 0% interest for the first 21 billing cycles (after, 15.49% to 25.49% variable APR). You could also look for a balance transfer credit card with no balance transfer fee to help you get on the road to being debt-free .

Many great travel rewards cards come at the price of $95 or more, whereas the Bank of America Travel Rewards credit card has no annual fee, plus 0% APR on new purchases for the first 18 billing cycles (after, 16.99% - 26.99% variable APR). Cardholders earn unlimited 1.5X points per every $1 spent on eligible purchases, with no blackout dates, limits or expiration. These points can be redeemed in the form of flexible travel credits that allow you to cover a wide range of travel purchases.

Of course, you may be able to get more value from a travel card such as the American Express® Green Card — which rewards travel with 3X points on transit, along with 3X points on restaurants, but with a $150 annual fee (see rates and fees).

There's also the Chase Sapphire Preferred® Card that delivers 5X points on travel purchased through Chase Travel℠, 3X points on dining and 2X points on all other travel purchases, 1X on all other purchases, and it has a $95 annual fee.

Information about the BankAmericard® credit card, and Bank of America® Travel Rewards credit card has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

For rates and fees of the American Express® Green Card, click here.

- How Quicken Simplifi can help you get a grip on your spending Elizabeth Gravier

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

- 3 best Chase balance transfer credit cards of 2024 Jason Stauffer

How to use the Bank of America Premium Rewards card airline fee credit

The Bank of America® Premium Rewards® credit card continues to fly under the radar , despite having the potential to offer the highest base cash-back rate of any rewards credit card.

If you hold $100,000 or more in assets with Bank of America and/or Merrill, you qualify for Platinum Honors in Bank of America's Preferred Rewards® program . This gives you a 75% bonus on all rewards, equating to a minimum of 2.625 points per dollar on all purchases and 3.5 points per dollar on all dining and travel purchases.

The card is also currently offering 60,000 points after you spend $4,000 on the card in the first 90 days of account opening, and it carries a $95 annual fee.

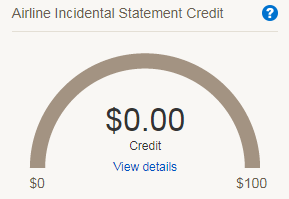

How the Bank of America airline fee credit works

Bank of America's airline fee credit (up to $100 statement credit each calendar year) works a little differently from the airline incidental fee statement credit you get with Amex cards such as The Platinum Card® from American Express (see rates and fees ). Rather than have to designate an airline at the beginning of the year, Bank of America allows you to earn the credit across any eligible airline throughout the year. Enrollment is required for select benefits.

For example, you could use your Bank of America airline fee credit for checked bags on Delta one month and then inflight drinks on American the next. This gives you more flexibility to use your credit where you need it, rather than forcing you to guess which single airline you'll be able to use it on.

It can potentially take anywhere from two to three weeks for your credit to post to your card account. While there are plenty of instances where we've seen that take less, don't be alarmed if it does take the whole timeframe.

Another feature that Bank of America offers is the ability to check how much of your $100 airline credit you have used.

Which airlines qualify for the credit?

Bank of America does not have an official list published that outlines which airlines qualify for the incidental fee credit, though the terms and conditions do specify that only select U.S. carriers qualify. According to some readers, Spirit Airlines and Sun Country Airlines are excluded. The following airlines are known to work:

- Alaska Airlines.

- American Airlines.

- Delta Air Lines.

- Frontier Airlines.

- Hawaiian Airlines.

- Southwest Airlines.

- United Airlines.

That list is very similar to Amex's list of qualifying airlines (with the exception of Spirit Airlines, which the Amex fee does cover).

What purchases trigger the credit?

According to the Premium Rewards Card terms and conditions , the following purchases will trigger your Bank of America airline fee credit:

- Preferred seating upgrades.

- Ticket change/cancellation fees .

- Checked baggage fees.

- Inflight entertainment.

- Onboard food and drink charges.

- Airport lounge fees affiliated with eligible airline carriers.

The purchases have to be paid in full with your Bank of America Premium Rewards card, and they must be made on a flight originating from a domestic airport on a qualifying U.S. airline carrier.

The terms and conditions do explicitly state that the following purchases will not qualify for the credit:

- Airline tickets.

- Mileage point purchases.

- Mileage point transfer fees.

- Gift cards.

- Duty-free purchases.

- Award tickets and fees incurred with airline alliance partners.

Also keep in mind that inflight Wi-Fi access processed through a third party like Gogo likely will not qualify.

Of course, there are sometimes exceptions to this rule. There have been data points presented by readers and in other online forums where charges outside the official list have counted. Occasionally award booking taxes, first-class upgrades and other fees will end up coding as an eligible purchase for the credit.

However, we don't suggest counting on credit for fees that the credit isn't intended to cover — it's hit-or-miss at best and easier to just use the perk as intended. In the past, you could get away with buying gift cards on certain airlines with the credit, but issuers have cracked down to close that loophole .

Bottom Line

Airlines can change the merchant category code of a certain transaction, Bank of America could update what merchant codes and charges count, and airlines can change whether or not something is processed by a third party. This means what counts toward the credit will be a living list year-to-year based on what's currently working.

If you've charged what you believe to be a qualifying airline fee and it's not automatically reimbursed, you can call Bank of America and ask for the credit.

And if you hold the Bank of America Premium Rewards credit card, we'd love you to share your experience with us so we can keep the list up to date. Email [email protected] and mention this post.

For rates and fees of the Amex Platinum, click here .

Additional reporting by Ryan Wilcox and Richard Kerr.

Updated 12/06/2023.

How to use Bank of America travel rewards points

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Building credit

- • Credit card debt

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The Bank of America travel rewards program can be lucrative and flexible, but the specifics of how you'll earn points in this program depend on which credit card you sign up for.

- Bank of America travel rewards points can generally be redeemed for eligible travel purchases, cash back and gift cards.

- Bank of America Preferred Rewards members can earn an additional 25 percent to 75 percent more in rewards for each dollar spent.

Many credit card issuers boast a lineup of rewards credit cards that let you earn cash back, points or miles on travel, and Bank of America is no exception. Although not as popular as travel credit cards from Chase or American Express, Bank of America travel cards can be rather lucrative and flexible — but the specifics will depend on which credit card you sign up for.

If you’re ready to give the Bank of America travel rewards program a chance, you should find out which Bank of America credit cards let you earn rewards for travel, which travel rewards benefits are offered and how to use Bank of America travel rewards points to your advantage.

Which Bank of America cards earn travel rewards?

The main two Bank of America travel rewards cards are the Bank of America® Travel Rewards credit card and the Bank of America® Premium Rewards® credit card . However, Bank of America also offers the Bank of America® Premium Rewards® Elite Credit Card * and the Bank of America® Travel Rewards credit card for Students .

Bank of America Travel Rewards credit card: Best for no annual fee

Card details.

- Welcome bonus : 25,000 online bonus points (a $250 statement credit value toward travel purchases) if you make $1,000 in purchases within 90 days of opening the account

- Rewards rate : Unlimited 1.5X points per dollar on all purchases

- Annual fee : $0

- Notable perks : No foreign transaction fees, flexible travel rewards

Bank of America Premium Rewards credit card: Best for occasional travelers

- Welcome bonus : 60,000 online bonus points (a value of $600) after spending $4,000 on purchases in the first 90 days

- Rewards rate : Unlimited 2X points per dollar on travel and dining; 1.5X points per dollar on all other purchases

- Annual fee : $95

- Notable perks : Up to $100 in statement credits per year for incidental airline expenses to cover eligible costs; up to a $100 statement credit toward Global Entry or TSA PreCheck application fees every four years; no foreign transaction fees

Bank of America Premium Rewards Elite Credit Card: Best for frequent travelers

- Welcome bonus : 75,000 online bonus points (a $750 value) after you make at least $5,000 in purchases in the first 90 days of account opening

- Rewards rate :Unlimited 2X points on dining and travel purchases; unlimited 1.5X points on all other purchases

- Annual fee : $550

- Notable perks : Up to $300 annually in airline incidental statement credits for qualifying purchases (like seat upgrades and baggage fees); up to $150 annually for eligible lifestyle conveniences (including video streaming services, food delivery, fitness subscriptions and rideshare services); up to a $100 statement credit toward Global Entry or TSA PreCheck application fees every four years; complimentary Priority Pass membership; 20 percent off on domestic or international airfare for any class when paid with points

Bank of America Travel Rewards Credit Card for Students: Best for students

- Welcome bonus : 25,000 online bonus points after spending $1,000 in purchases within the first 90 days of account opening

- Rewards rate : 1.5X points on all purchases

- Notable perks : No foreign transactions fees, flexible travel rewards

Which Bank of America travel cards do not earn travel rewards points?

Bank of America also offers a surprising number of co-branded travel credit cards that are geared to loyalists with specific brands. However, these cards do not earn Bank of America travel rewards points. These include:

- Alaska Airlines Visa® credit card

- Free Spirit® Travel More World Elite Mastercard®*

- Allways Rewards Visa® Credit Card*

- Royal Caribbean Visa Signature® card*

- Norwegian Cruise Line® World Mastercard®*

- Celebrity Cruises Visa Signature® card*

- Virgin Atlantic World Elite Mastercard® *

- Air France KLM World Elite Mastercard®*

When it comes to redeeming your Bank of America travel rewards, your options may vary depending on the card you have.

Bank of America Travel Rewards credit card and Bank of America Travel Rewards Credit Card for Students

With the Bank of America Travel Rewards credit card and the Bank of America Travel Rewards Credit Card for Students, you can use your points for:

- Cash back in the form of a check or direct deposit to an eligible Bank of America or Merrill account

- A statement credit to cover eligible travel-related purchases

Unlike with other travel rewards programs, you can use your eligible card to book travel with any eligible providers, and Bank of America’s list of qualifying travel purchases is extensive. In addition to airlines, hotels, car rentals and eligible transit, travel-related purchases also include purchases made with eligible cruise lines, parking garages, travel agencies, tourist attractions, art galleries, amusement parks and more.

From there, you can redeem your points for a travel credit statement through your Bank of America account. However, note that you’ll need at least $25 worth of points to redeem for a travel credit.

Bank of America Premium Rewards credit card

The Bank of America Premium Rewards credit card lets you cash in your rewards for:

- Travel bookings through the Bank of America Travel Center

- Cash back in the form of a statement credit or a direct deposit to an eligible Bank of America or Merrill account

Bank of America Premium Rewards Elite Credit Card

With the Bank of America Premium Rewards Elite Credit Card, you can redeem your points for:

- Travel, experiences, event tickets and more through Bank of America’s Concierge service

How to maximize Bank of America travel rewards points

To get the most of your travel rewards points with Bank of America, you should try to be as strategic as you can. When you go to redeem points, consider the ways you may be able to earn more points on your spending and any ways you can maximize your rewards .

Join the Bank of America Preferred Rewards program

One major way to earn more Bank of America travel rewards involves signing up for the Bank of America Preferred Rewards® program. Doing so can net you an additional 25 percent to 75 percent more in rewards for each dollar you spend. However, you do need to meet certain qualifications to enroll in this program, such as having:

- An active, eligible Bank of America checking account

- A three-month average combined balance of $20,000 or more in eligible Bank of America accounts and/or Merrill investment accounts

Also, keep in mind that the Bank of America Preferred Rewards program offers additional perks like savings boosters and loan discounts for members with cash on deposit. The following chart shows how much more you could earn in rewards as a member, as well as how much you need to keep in eligible accounts to qualify for each tier.

While the minimum balance requirements are high, the Bank of America Preferred Rewards program can help you earn considerably more points on your spending if you qualify. For example, Bank of America Premium Rewards credit card members in the Platinum Honors tier have the potential to earn up to 3.5X points for every dollar spent on travel and dining purchases and up to 2.62X points on other purchases.

Compare pricing in the travel portal