Wise Travel Debit Card Review: Fees, Exchange Rates, Limits and How to Use It

There are many things you need to keep track of as a digital nomad, such as visas , travel documents, and accommodation , to name a few.

But one of the most important things to work out is your finances. As a digital nomad, you are likely constantly moving between countries and switching currencies, so having a travel debit card is imperative .

The Wise debit card is an easy financial solution for frequent travelers, digital nomads, and expats . So, what is the fuss about this Wise travel card? How does it work? And most importantly, should you hop on the bandwagon and sign up for it?

I have been using the Wise Travel Card for quite some time now and, in this article, I will give you my honest opinion about it.

What is a Wise Travel Debit Card?

If you travel often, you have probably used or at least heard of Wise (formerly Transfer Wise) .

This UK-based tech company was founded in 2011 by Estonian businessmen Kristo Käärmann and Taavet Hinrikus on the principle of providing fast and fair exchange rates for international transfers without any sneaky fees or below-par exchange rates.

I have been personally using their Wise multi-currency account for years now, and it is still the primary way I transfer money abroad. But, I recently started using the Wise travel card , which added an entirely new dimension to my travels.

Can I Use The Wise Card For Traveling Abroad?

The Wise travel card it's not a credit card and functions pretty much like a regular debit card. You simply add funds to the account and insert, swipe, or tap to pay for items.

The main difference? With Wise, you can hold money in more than 40 different currencies and pay like a local for items in more than 160 countries worldwide without having to worry about hefty fees or markups on conversion rates.

Your Wise Travel Card is connected directly to your Wise account, so you can spend funds from your balances.

Who is the Wise Travel Card for?

Obviously, this is a “travel” card, so its primary purpose is for spending abroad while traveling . That said, you could totally use this for your day-to-day expenses. Traditional banks aren’t really designed to cater to frequent travelers or digital nomads , and the Wise Travel Card fills this gap.

For example, my wages are paid from the US, but I live abroad permanently, so I can easily transfer from my US-based bank to Wise and then simply use my Wise card for most of my daily expenses.

You should consider using the Wise Travel Card if one or more of the following applies to you:

- You frequently transfer funds from another country that uses a different currency.

- You travel internationally often and need a card with low currency conversion fees.

- You often shop online with international retailers that sell their products in a foreign currency.

- You own a business and need a card for international expenses.

- Your current bank card has high currency conversion fees and you want to get away from a traditional bank account

- Your current bank card has high fees for using international ATMs.

Wise Card Features for Traveling Abroad

If you have used a travel prepaid card like Revolut , Chime , or Monzo in the past, you can expect similar features from the Wise Travel Card. Let's see which ones are those:

- Low fees on conversions with the mid-market exchange rate

- Hold, spend, and exchange more than 40 different currencies in your Wise account

- Available to citizens and residents of more than 30 countries , including the UK, Canada, EU, USA, and Australia

- Manage, top up, freeze, and view your card balance in the Wise App

- Use at over 2 million ATMs with free monthly withdrawals up to certain limits.

- Create up to 3 digital virtual cards for free

- Auto currency convert feature to automatically convert your funds at your set rate

- Ability to make Contactless payments

- Connect to most popular eWallets like Google Pay, Apple Pay, and more

- Free spending of any currency you hold in your Wise account

- Biodegradable and eco-friendly card design

Pros and Cons of the Wise Debit Card for Travel

When I first started my digital nomad journey, I quickly came to a rude awakening when I found that my bank was charging exorbitant markups on foreign exchange and fees for ATM withdrawals .

If the same is happening to you, you’ll want to get your hands on this gem of a travel card . But before you sign up, let’s go over some of the upsides and downsides of the Wise Travel Card.

Pros and cons:

What to love about the wise debit card.

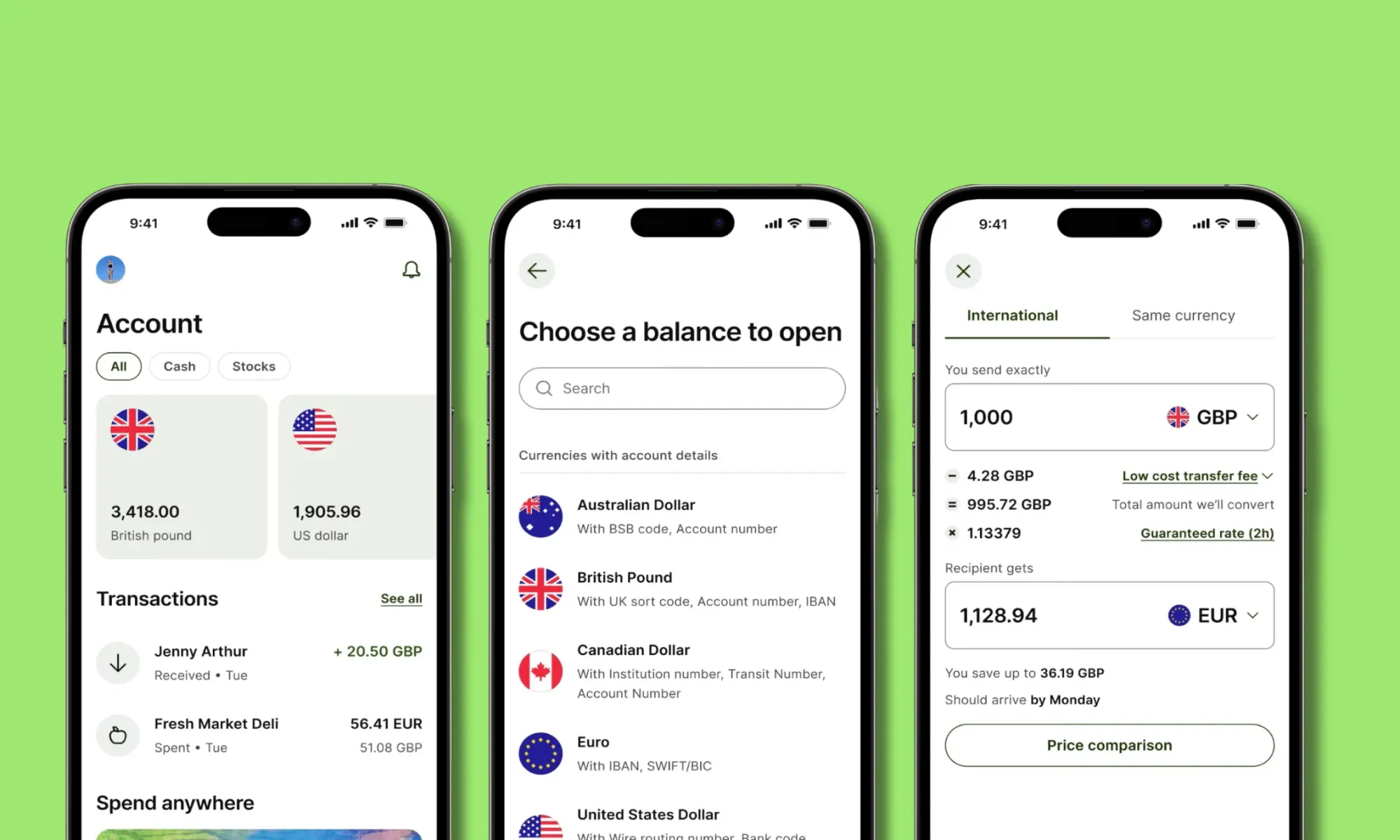

For me, the Wise card's standout features are the app's user-friendliness , the multi-currency account , and the low markup on exchange rates .

Being able to hold more than 40 currencies is a game changer. Transferring funds to different currencies in their app when I travel abroad is super easy. To give you an example, I spend quite a bit of time in Europe, the USA, and New Zealand. And with Wise , I can have separate accounts for USD, EUR, and NZD, which makes my life SO much more manageable when traveling to these countries!

On top of that, while there is a small markup fee on currency exchange, it is extremely minimal compared to other banks I have used .

What Could Be Improved About the Wise Debit Card?

The obvious downsides of the Wise Travel Card lie with ATM withdrawal limits , longer card delivery timeframes , and the lack of a premium option .

I am based in the USA, and my card took more than 2 weeks to arrive. Most digital nomads don’t spend too much time in each place, so this can make it difficult to receive your card initially if you are a frequent traveler .

Also, while card transactions are becoming the norm in many countries, cash is still king in several countries I have traveled to in the past few years. The Wise card is NOT exactly the ideal card for withdrawing cash . You’ll only get two transactions for free , and then you’ll be paying a usage fee as well as a 1.75% to 2% markup . This definitely isn’t a dealbreaker, but I hope Wise will improve this in the future.

What Currencies Can You Use With the Wise Travel Card?

One of the main reasons Wise has kept me on board as a customer all these years is their multi-currency account . This is truly the crown jewel of all of Wise’s features.

You can store 40+ currencies in various wallets in your Wise account , but this doesn’t mean you are limited to spending in those currencies. In fact, you can use the Wise debit card in more than 160+ countries ! If the currency you are spending in doesn’t have a wallet option, the Wise card will simply exchange the money into the payment currency at the time of your purchase .

For example, I was recently in Guatemala, and, unfortunately, I was not able to store Quetzal (the local currency) in my multi-currency account. But when I bought something, my funds were automatically converted from USD to Quetzal at the mid-market rate (plus 0.5%).

There are also 11 currencies for which you get account details to make bank transfers . This means you can transfer funds in the following currency balances directly from your Wise account to another bank account.

This is a feature of Wise that I use often. If I need to transfer funds from my US bank account to one in another country, I almost always use Wise as a “middleman” in order to avoid unexpected transfer fees .

While you won’t be able to make bank transfers in other currencies, you can hold them in your Wise account and spend with your travel card.

How Does the Wise Card Exactly Work?

As you can see, the Wise Travel Card is a wise decision for any traveler (see what I did there?), but how does it exactly work?

As with any new bank account or credit card, there is a bit of a learning curve when first using your Wise travel card . That said, using this card isn’t rocket science, so you’ll be saving money on exchange fees in no time!

How to Use the Wise Travel Card Abroad

The Wise travel card is specifically designed for spending money outside of your home country, so as you would expect, it is pretty easy to use abroad.

All you need to do is order your card , activate it, create a PIN, add money to your account, and you will be all set to use the card in a different country!

The Wise App

There is nothing more annoying than an app that is built for developers and not for the general public. Your banking and financial app should be easy to navigate and access.

I personally find the Wise app to be extremely user-friendly and intuitive . All features are easy to find, and when navigating through the app, I rarely got stuck or failed to find a setting.

I was easily able to change personal settings, connect bank accounts, exchange money, and send transfers from the app.

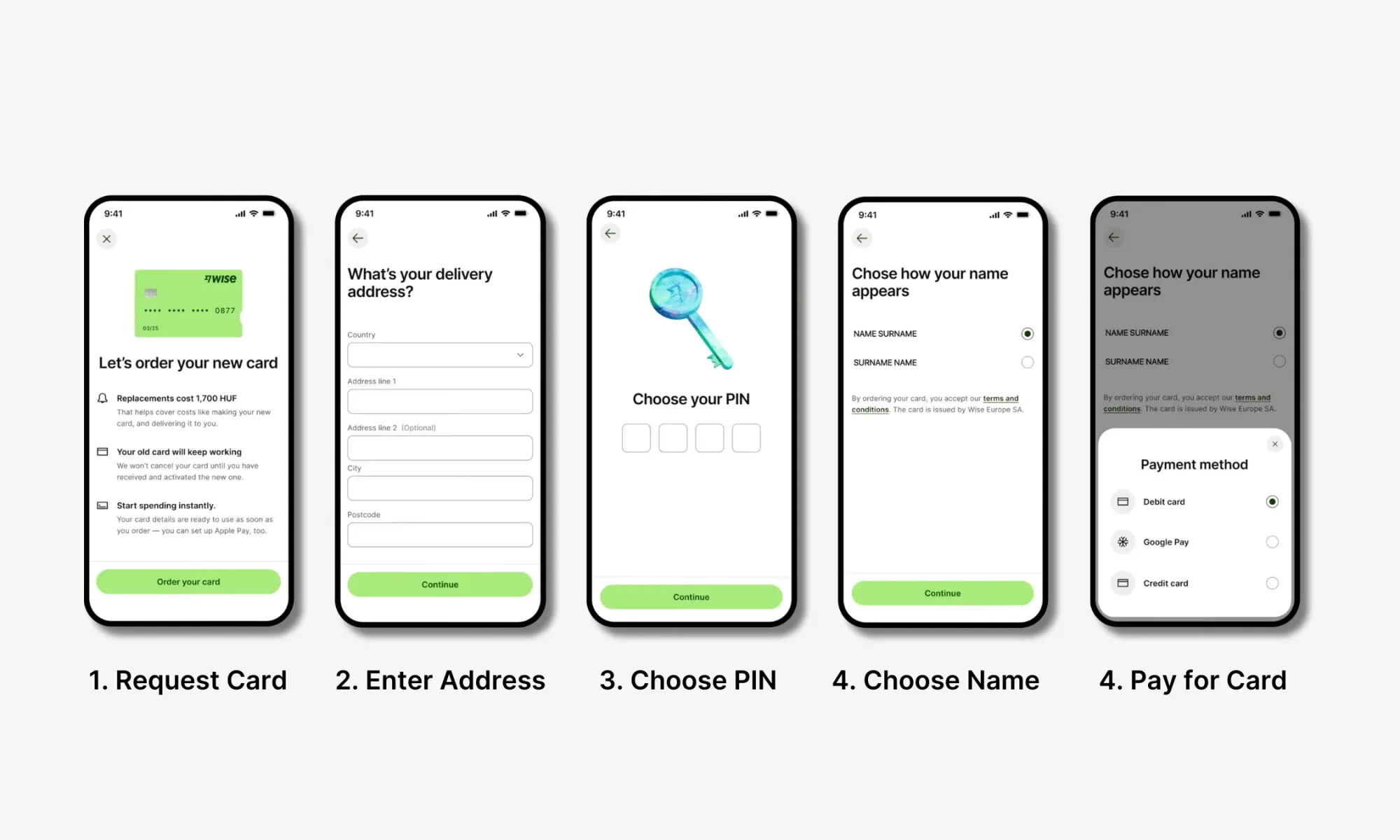

How to Order Your Wise Travel Card

Ordering your Wise Travel Card can take some time (mine took more than 2 weeks to arrive), so I recommend getting on this as soon as possible to ensure you have the card for your next trip!

These are the 3 simple steps you will need to go through:

Step 1: Create a Multi-Currency Account

If you don’t have one already, your first step will be to sign up for a Multi-Currency Account with Wise

Step 2: Start Using Your Virtual Card Immediately

After making an account and verifying your details, you will then be directed to choose a digital/virtual card or a physical card . Digital cards are free and can be added to Google/Apple Pay or used for online payments immediately!

Step 3: Order a Wise Debit Card (Recommended)

If you want instead a physical card, you can do so by clicking on the “Card” tab on the main page and then click on “ Order a Debit Card ”. Physical cards cost a one-off fee of 7 GBP/7 EUR/10 USD , and it will take 7 to 21 business days for the card to arrive, based on your location.

If you'd like to visualise the entire process, watch the instructional video below:

How to Activate Your Wise Card

Once your Wise travel card arrives, it is time to activate it and start spending ! Luckily, for most Wise account holders, you won’t need to take any steps to activate the card, simply make a chip and PIN payment, and the card is ready to go !

Activate Your Wise Card (for US and Japan Customers Only)

As I mentioned above, Wise customers in the USA or Japan must activate the card separately . This isn’t too much of a headache, just don’t forget you need to be in your home country .

Here is a step-by-step breakdown of activating your card if you are a US and Japan customer.

- Log into the Wise app and tap on “ Card ”.

- Then tap on “ Activate Card ”.

- You’ll then be prompted to enter a 6-digit code that you’ll find on your card.

- After entering the code, you’ll create your PIN .

If you'd like to visualise the steps to activate your Wise card for your region, watch the instructional video below:

How to Change the PIN for Your Wise Card

Did you forget your PIN? Don’t worry, it happens to the best of us!

Luckily, if you are a US card holder, you can easily change your PIN in the Wise app :

- Tap on “ Card ” in the Wise app

- Select “ Change PIN ”

- Enter your new PIN 2 times, and you are all set!

If you are a non-US Wise card holder , you cannot change your PIN in the app , unfortunately. Instead, you’ll need to change it using an ATM that supports PIN changes .

My best advice? Choose a PIN you’ll never forget, or keep it written down somewhere secure.

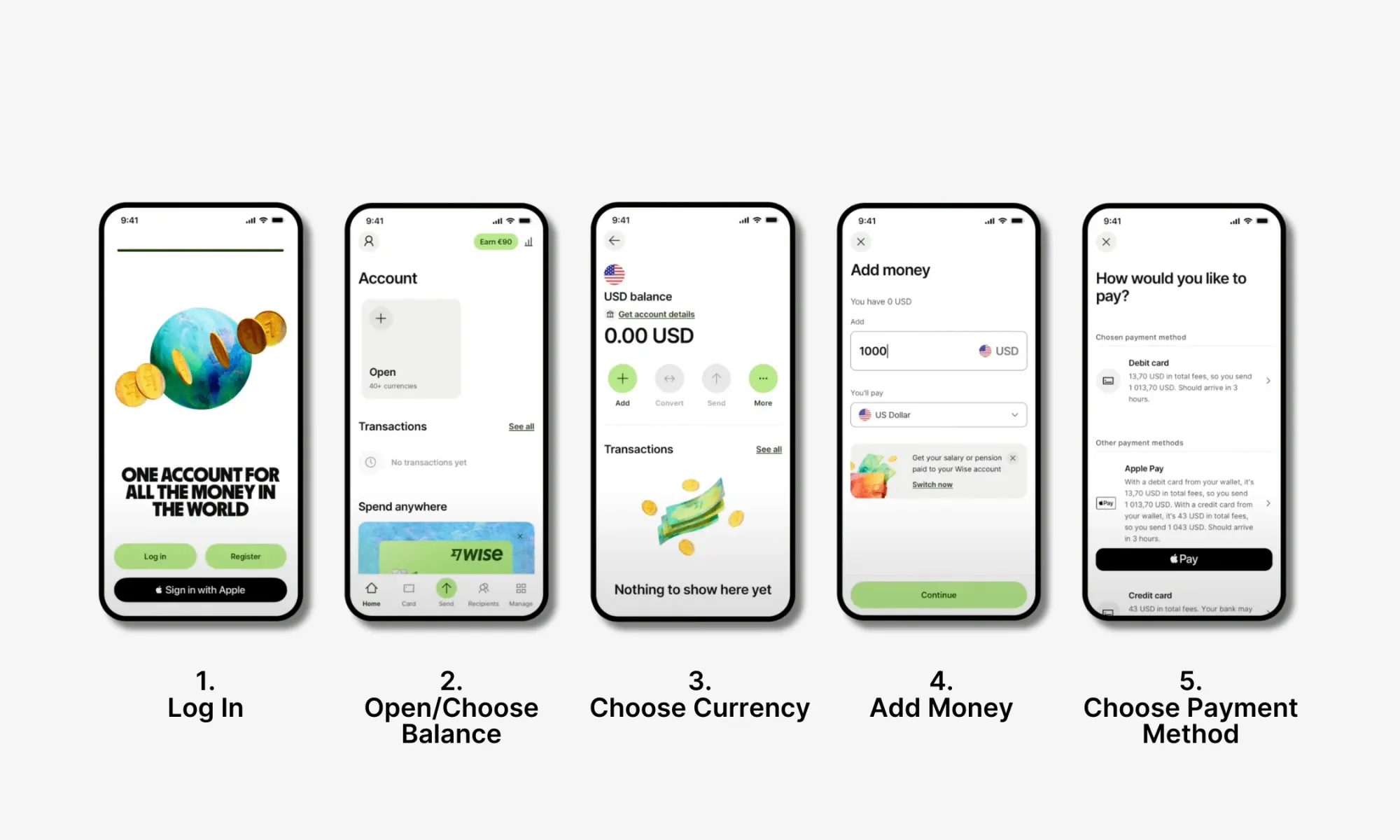

How to Add Money to Your Wise Travel Card

Your Wise travel card is linked to your Wise Multi-Currency account , so you’ll need to top up your Wise account with funds before using the card.

This is a pretty straightforward process:

- Logging into your account

- Choose which currency balance you want to add money to.

- Click “ Add ”.

- Choose which currency you want to use to top up the account.

- Type in the amount of money you want to add.

- Choose your payment method (bank transfer, debit card)

- Confirm the top-up and verify the money arrives in your balance.

Watch the instructional video below to visualise how to top up your Wise balance:

How to Freeze/Unfreeze Your Wise Card

One of the downsides of constant travel is that you put yourself at risk of fraud or losing your card. If you notice potential fraudulent transactions from your Wise card, or you believe your card is lost/stolen, you should freeze your card immediately . This way, you’ll avoid more fraud on your account.

Here are the steps to take to freeze your Wise Travel Card.

- After logging in to your Wise account, tap on “ Card .”

- Then simply click “ Freeze Card ”, or if you want to unfreeze, “ Unfreeze Card .”

- Fill out this transaction dispute form and contact customer support right away. They will be able to help you determine what to do next.

How to Replace a Lost or Stolen Wise Card

If you can confirm that your card has been lost or stolen, you’ll want to cancel the card and then order a new one.

- Log in to your Wise account and click on “ Card .”

- Tap “ Replace Card .”

- You’ll then be prompted to answer why you need a replacement card.

- Wait for the new card to arrive.

How to Use an ATM with Your Wise Travel Card

As mentioned above, ATM withdrawal is not the strongest feature with the Wise card, but you can definitely still use the card to take out cash. Spending with your Wise card is simple since the card can make contactless, chip, and swipe payments and is eligible for Google, Apple, Fitbit, and Garmin Pay. But how do you use an ATM with the Wise card?

Using an ATM with the Wise Travel Card is the same as using any other bank card. Simply insert your card into the machine, enter your PIN, determine how much cash you want to withdraw, and take your cash. Don’t forget to take your card back when you are done (I have made this mistake too many times…).

Wise Card ATM Limits

One of the biggest downsides with the Wise card is that you’ll have limited free ATM withdrawals. For all accounts, you’ll have 2 free ATM withdrawals each month, after which you will be charged an ATM usage fee and a percentage markup on the amount of cash you withdraw.

I use the Wise Travel Card for many of my day-to-day travel expenses, but I use my Charles Schwab Investor Checking account for ATMs. This card not only has a 0% ATM markup, but it also refunds any fees the ATM provider charges. This includes international withdrawals!

Wise Card Delivery Timeframe

Once you order your Wise Travel Card, you can expect it to take between 3 and 21 days to arrive, depending on your location. If you live in Singapore, you’ll get your card SUPER fast. Unfortunately for Americans like me, this isn’t the case.

Wise Travel Card Fees and Exchange Rates

One thing I really love is that using Wise itself is free, and you won’t have to pay an ongoing fee to Wise to use the card. In fact, there isn’t even a Premium account feature, so all users get 100% of the features for free. All this said, there are some charges and exchange rates you should know about before you start using the Wise Travel Card.

Comparison: How Does the Wise Card Holds Up Against Other Travel Cards?

Wise is a leader in the travel account realm, but it still has some major competitors. While all of these different companies vary, they all cater to digital nomads and frequent travelers. The table below will compare some key factors with Wise, Revolut, N26, and Chime.

You may also be interested in:

So, What Travel Card is the Best?

This is a close call and pretty dependent on where you are located. For example, N26 and Chime are awesome choices if you live in the EU or USA (respectively). But, with these options, you can’t hold different currencies like with Revolut and Wise.

For most digital nomads, Wise or Revolut will be the best option. You can hold a huge number of currencies, and they are available to many different nationalities. I have personally used both Wise and Revolut and can say they are both excellent options.

Spending Limits for the Wise Travel Card

The Wise Travel Card has set daily and monthly spending limits for all types of transactions. While these limits won’t be a deal breaker for the vast majority of users, they are still worth noting.

Keep in mind the above limits are for US Wise customers. The amounts will differ slightly for customers based in different regions.

Is It Safe to Use the Wise Travel Card?

Wise is a trusted and safe travel card provider, so you can rest assured that your funds will be protected when using the Wise Travel Card. A licensed and regulated financial institution, your funds are safeguarded in Wise. It is, however, worth noting that since Wise is not considered a bank, it is not FDIC insured. FDIC insures up to $250,000 of bank customer's money, but Wise works a bit differently. Wise safeguards users’ money and is required to ensure all customers have access to all of their funds.

So, is Wise safe to use? Yes, absolutely! We don’t recommend keeping all of your money in Wise, but in general, it is a perfectly secure financial institution.

Additionally, the company uses several security features to protect your data, including HTTPS encryption, a two-step login process, and 24/7 fraud prevention.

What to Do If Your Wise Card Is Lost, Stolen, or Compromised

If you lose your Wise card or suspect it to be stolen or compromised, you’ll need to act quickly to prevent any further fraud. Below, we will go over a step-by-step process for what to do if your card is lost, stolen, or compromised.

- Freeze your card in the Wise app.

- Contact Wise support if you suspect the card to be compromised.

- Cancel the card in the app if you confirm the card is lost or stolen or if fraud charges have been made.

- Order a new card.

- Wait for the new Wise card to arrive.

Bottom Line: Is the Wise Travel Card Worth it?

Time for the 1 million dollar question: Should you get the Wise Travel Card?

If you are a frequent traveler like me and you don’t already have a solid travel card with fair exchange rates, low ATM fees the answer is a resounding yes !

The Wise Travel Card is one of the best cards for digital nomads and expats, as it allows you to seamlessly spend money, withdraw cash, and transfer funds from anywhere around the globe without having to worry about excessive fees. The best part? After paying a one-time card order fee, your Wise account is completely free to use!

Ready To Save Money Abroad with Wise?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

How to Beat Your Post-Travel Depression: Your Guide to Feeling Better

How to create a healthy work-life balance while working remotely, how to set up and manage an esim on iphone.

- Step-By-Step Guide

- Google Flights Guide

- Momondo Guide

- Online Travel Agency Guide

- Southwest Airlines Guide

- Airline Seating Guide

- Train Travel

- Ferry Travel

- Blablacar Guide

- Poparide Guide

- Hitchhiking

- Car Rental Guide

- Ride-Hailing Guide

- Public Transport Guide

- Booking Your Accommodation

- Airbnb & Vrbo Guide

- Hostel Guide

- Couchsurfing Guide

- Coronavirus Travel

- Proof of Onward Travel

- Dual Passport Travel

- Travel Insurance

- Advanced Travel Safety

- Female Traveler Safety

- Best Travel Debit Cards

- Best Travel Credit Cards

- Getting Cash

- Travel-Ready Phones

- Prepaid SIM Cards

- Top Travel Apps

- Packing Guide

- Group Tours

- North America

- Southeast Asia

- Central & South America

- Middle East & North Africa

- Australia & Oceania

- Sub-Saharan Africa

- South & Central Asia

- Cheapest Destinations

- Split-Ticketing

- One-Way Return Tickets

- Hidden-City Ticketing

- More Strategies

- Budget Airline Guide

- Cheap Transportation Guide

- Cheap Accommodation Guide

- Top Budget Travel Tips

- Travel Blog

The Ultimate Guide To The Best Debit Cards For Traveling

This page may contain affiliate links which means I get a small commission, at no extra cost to you, if you make a purchase with them. This helps keep the site running and the travel tips coming! For more info, check out my Privacy Policy & Disclosure .

Having the right debit card for traveling is extremely important as it can mean the difference between:

- A stressful experience because your card doesn’t work in your destination / you blew your budget because you didn’t account for hidden fees most banks charge you.

- Being able to pay for things easily both online as well as in person while also saving hundreds or even thousands of dollars a year on fees that you don’t need to pay.

The second option sounds much better, right?

Well the truth is that most banks will charge you fees for foreign transactions, foreign currency conversions, and foreign ATM withdrawals, and if you only travel once a year, the amount you lose on them might not be that much, but if you travel more often than that, you could be losing hundreds or even thousands of dollars a year on these fees!

In addition, some banks still haven’t caught up to the 21st century and the debit cards that they give you might not even work in other countries because they lack basic functionalities such as a chip & 4-digit number PIN, contactless payments, and Visa or Mastercard integration.

However, there are banks out there that offer no-fee 21st century debit cards that are perfect for traveling. When it comes to finding the right one for you, it depends on where you live.

If your current bank offers a card that has all those functionalities and also none of the fees I mentioned earlier, then great! But most standard banks won’t so you might have to look for a different one.

Luckily for you, I have put together a guide to the best debit cards and bank accounts you can get no matter where you live in the world!

Important information about debit cards:

- Try to limit the amount of payments you make with your debit card since it’s your money that is lost if something happens. Use it to take out cash and use credit cards for payments if you can as they are safer since you aren’t technically paying with your own money when you use a credit card.

- If you do choose to make payments, always choose to pay in the local currency because the exchange rate offered by Visa & Mastercard will always be better than the one offered by foreign merchants. The same goes for ATMs. I go into more detail about this in my Guide to Getting Cash While Traveling .

- If your bank offers this feature, lock your card using the mobile app when you’re not using it to prevent fraud.

- Keep a backup debit card hidden in your luggage in case something happens to your main one and know what to do if your card is lost, stolen, or copied. See #6 in my Guide to Money Management While Traveling for all the steps you should take.

Table of Contents

Best Travel Debit Card in the USA

Charles Schwab Bank

Charles Schwab Bank’s debit card is often recommended by travelers because of its lack of fees and the fact that any fees you have to pay when using any ATM in the world get refunded to you!

This is a feature that not many banks offer so this is why they stand out above the rest. If you’re a US resident, you definitely need to look into getting your hands on this bank account and debit card.

Note: if preventing fraud is a priority and you are looking for a card that has instant notifications for transactions + the ability to freeze & unfreeze your card instantly from the mobile app, check out N26 below .

- No monthly account fees

- No foreign transaction fees

- No foreign currency conversion fees

- No foreign ATM withdrawal fees

- ATM fees imposed by ATMs themselves worldwide get refunded to you by the bank (huge benefit)

- Visa debit card & a US Dollar checking account

- Can sign up online

Eligibility

- You need to be a US resident (with proof of residence) and have a US address (no P.O. boxes) to open an account.

- If you are outside the US when opening an account, you must do it using a VPN or else risk requiring a visit to a branch in person.

- You also have to open a brokerage account with them at the same time to use the checking account. However, it’s free and you don’t even have to touch it if you don’t want to.

Best Travel Debit Card in Canada

While not technically a bank, what STACK offers is the best option for Canadian travelers since there is no Canadian bank that has a similar offering.

Signing up with STACK gets you a free reloadable Canadian Dollar Mastercard that doesn’t have any foreign transaction, currency conversion, or ATM withdrawal fees. You can also fund it quickly and easily with e-transfers. Think of it kinda like a prepaid debit card.

- Sign up using this link and receive $5 for free! (You must click the link with a mobile device to get your $5).

- No foreign transaction fees (max 15 in-person transactions per day)

- No foreign ATM withdrawal fees (max 2 withdrawals per day, max $500 per withdrawal, max $2,000 a month)

- Instant push notifications for any transactions

- Instantly freeze and unfreeze your card anytime from the app

- Contactless Mastercard with a chip & PIN

- Digital wallet compatible

- Easily load the card instantly using e-transfers

- Discounts at certain Canadian retailers

- You need to have a Canadian address (no P.O. boxes) to open an account. You might be able to use a friend’s address.

- It is not available in Quebec (yet). Use a friend’s address in another part of Canada until they offer it in Quebec

Best Travel Debit Card in the UK

Starling Bank

There are a few different options available in the UK, but the absolute best option is Starling Bank thanks to the fact that it doesn’t charge you any fees whatsoever for your travel needs.

Other similar UK banks like Monzo and Monese have limits to the amount of ATM withdrawals you can make, charging you extra fees for going over those limits. This is why Starling Bank stands out as the best choice for UK residents.

- In addition to British Pounds, you can also hold Euros in your account and even make purchases in Euros using the same card

- Contactless Mastercard debit card with a chip & PIN

- You need to have a UK address (no P.O. boxes) to open an account. They may also ask for proof of address information so you might not be able to use a friend’s account.

Best Travel Debit Card in Australia

HSBC Everyday Global Account

There are a few decent banking options in Australia, but the HSBC Everyday Global Account takes the cake not only because there are no fees to use it, but also thanks to the fact that it lets you hold a total of 10 different currencies in your account!

You can choose to pre-load your account with a certain currency before traveling or use your main currency and benefit from no foreign currency conversion fees.

- In addition to Australian Dollars, you can hold 9 other currencies in your account: US Dollars, British Pounds, Euros, Hong Kong Dollars, Canadian Dollars, Japanese Yen, New Zealand Dollars, Singapore Dollars, and Chinese Yuan

- Contactless Visa debit card with a chip & PIN

- You need to have an Australian phone number and address (no P.O. boxes) to open an account. If you don’t live in Australia, you might be able to open an account by visiting the nearest HSBC bank to you or by simply using a friend’s phone number and address.

Best Travel Debit Card in Europe

If you live in Europe (or even if you don’t, see below), you gotta go with N26 . They don’t offer completely free accounts, but compared to all the others available, they are the best.

You are able to open a Euro account with N26 in any one of the following countries: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Liechtenstein, Luxembourg, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

Note: they used to be available in the UK, but have left ever since Brexit.

And even if you don’t live in any of those countries, you can ask a friend living in one of them if you can use their address to receive the card, after which you can change the address no problem!

*N26 has also expanded to the US, but Charles Schwab is still the better travel bank account and debit card for Americans to use for the time being unless your priority is fraud prevention, in which case N26 is best since it has instant notifications for transactions + the ability to freeze & unfreeze your card instantly from the mobile app.

- No monthly account fees for the standard account (9.90 EUR for N26 You & 16.90 EUR for N26 Metal)

- Free ATM withdrawals in Euros* (See Eligibility)

- Foreign currency ATM withdrawals come with a 1.7% fee (this fee is waived if you pay for a premium account)

- Free cash withdrawals and deposits at select stores across Germany, Austria, and Italy using their CASH26 feature (deposits over 100 EUR a month get charged a 1.5% fee)

- TransferWise integration for cheaper transfers than most banks

- Online account and customer support also available in Spanish, French, German, & Italian

- Premium accounts come with Travel Insurance, Car Rental Insurance, and even Mobile Phone Theft Insurance!

- The number of free ATM withdrawals in Euros that you get depends on the country you sign up in. Signing up in Austria or Italy gets you unlimited free withdrawals in Euros, whereas signing up in any of the other countries gets you 5 free ATM withdrawals in Euros in Eurozone countries (and only 3 of them if you sign up in Germany), after which they will cost you 2 EUR per withdrawal.

- You need to have an address (no P.O. boxes) in one of the eligible countries to open an account. You can easily use a friend’s address when creating your account to receive the card and then change the address in your account once you get it without any issues. Try to get a friend in Austria or Italy for the unlimited free withdrawals!

Best Travel Debit Card in the Rest of the World

TransferWise Borderless Account

Even if you don’t live in any of the countries I just mentioned or you just want another alternative, you should consider opening a TransferWise Borderless Account.

In addition to super low international transfer fees, you can keep money in more than 50 different currencies in your account as well as have real bank accounts for the USA, UK, Eurozone, Australia, New Zealand, and Poland which also let you receive payments in those currencies like a local!

You also get a contactless Mastercard debit card which you can use to make purchases and take out cash anywhere in the world. Whenever you use that card, if you already have the currency in your account, you don’t get charged any fees and if you don’t have it, you only get charged a small conversion fee, making it a great option for travelers.

Sign up using this link and get a no-fee international transfer of up to £500!

Keep in mind that TransferWise is only able to send cards to residents of Australia, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Hungary, Iceland, Italy, Ireland, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, the Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Singapore, Sweden, Switzerland, the United Kingdom, or the USA (but you can always use a friend’s address to get the card as well).

- Foreign currency conversion fees range from 0.24% – 3.69% depending on the currencies involved, but are typically under 2%

- Free ATM withdrawals up to $250 USD (or your currency’s equivalent) per month if you have the currency you’re withdrawing on your balance. After that, a 2% withdrawal fee will be charged

- Can keep money in 50+ different currencies in your account

- Real bank account details for the USA, UK, Eurozone, Australia, New Zealand, and Poland

- Online account and customer support also available in Mandarin, Spanish, French, Portuguese, German, Italian, Russian, Turkish, Polish, Romanian, and Hungarian.

- You need to have an address (no P.O. boxes) in one of the eligible countries to open an account. You can easily use a friend’s address when creating your account to receive the card and then change the address once you get it without any issues.

- The Mastercard debit card is free, but you need to have a minimum of $20 USD (or the equivalent in another currency) in your account before you can order it unless you’re in Australia, in which case you don’t need a minimum balance to get the card.

And that’s all there is to it!

Having the right debit card while traveling can make a world of difference when it comes to all those annoying fees that most banks charge. Don’t be afraid to get a debit card from more than one bank on this list either! It doesn’t hurt to have the best option for every currency possible.

Let me know in the comments below if this guide helped you find the right debit card for your travels and if there are any similar or better cards or banks in your country, let me know so I can update the list!

And if you want to add a credit card to your wallet as well, check out my Guide to the Best Credit Cards for Traveling .

About The Author

Hi there, I’m Sebastian , founder and creator of Travel Done Simple. Since I turned 20, I have lived in 5 different countries and traveled to over 40 others! You can learn more about me on my About page and find me on social media.

Hi there, I’m Sebastian , founder and creator of Travel Done Simple. Since I turned 20, I have lived in 5 different countries and traveled to over 40 others! You can learn more about me on my About page and find me on social media.

I’m Sebastian , the founder and creator of Travel Done Simple! I was born in Europe and raised in Canada, but I now consider myself to be a citizen of the world. When I’m not busy exploring new destinations, I’m here giving you the best travel tips so you can do the same!

You can learn more about me on my About page and if it’s your first time on my site, start here !

Find Whatever You Need

Latest travel blog posts.

The Best Balkan Trip Itinerary

Life in the Kootenays (BC, Canada)

My Experience In Morocco Feat. That Time I Crashed A Moroccan Baby Shower

Like on facebook.

(And join the official group too!)

Follow on Instagram

Downwithsebster.

Home | About | Contact | Privacy Policy & Disclosure

© 2024 Travel Done Simple - All Rights Reserved

- Disclosures

The Best Travel Credit and Debit Cards with No Foreign Transaction Fees (Updated 2022)

No matter where you go or how long you travel, using a credit or debit card with no foreign transaction fees is one of the easiest ways to save money while travelling, period.

Currency exchange booths at airports and banks can be convenient, but a lot of your money goes towards exchange fees (e.g. $10 per exchange) and hidden commissions padded into poor exchange rates (especially the booths advertising “no commissions”). With a bit of research and planning, you can save hundreds , if not thousands of dollars in fees over the long-term!

Credit and debit cards with no foreign transaction fees are the cheapest, easiest ways to get money and make payments overseas. Credit cards are accepted worldwide, and ATMs are internationally networked through the Visa/Plus and Mastercard/Cirrus networks. You enter your PIN and withdraw your cash just like you would at home, while the exchange rates are automatically handled by the banks.

However, some credit and debit cards are better than others! For the majority of cards, banks still try to add commissions and fees to each payment or ATM withdrawal made abroad. Even if you don't travel a lot, these fees add up quickly.

We've rounded up the best credit and debit cards around the world that minimize or eliminate these fees, putting more money back into your adventure funds!

NOTE: These are cards to be used overseas to avoid foreign transaction fees. For the best all around travel points cards, check out the travel rewards cards section of CardRatings , as well as our free guide “ How to Get Free Flights with Travel Credit Cards and Points “!

The best travel credit cards with no foreign transaction fees

Credit cards have various features that can make or break your travel savings. Ideally, these are the features to look for in a credit card:

- Foreign transaction fee of 0%

- Competitive points or cash-back rewards program (at least 1% of the purchase price)

- Extra perks, like free car or travel insurance

The best credit card with no foreign transaction fees in Canada

You also earn 2x points on purchases at grocery stores, dining, entertainment, and daily transit. These categories are very broad, so a huge chunk of your purchases will be eligible for 2x points. Learn how to apply on the Scotiabank website.

Not from Canada? Check your country below to see what's best for you!

The best travel debit cards with no foreign transaction fees

These are the ideal features to look for in a debit card:

- Foreign transaction rate of 0%

- International ATM withdrawal fee of $0

- Refund of third-party ATM withdrawal fees (This is rare, but it exists!)

- Competitive points or cash-back rewards program (at least 1% of the purchase price)

Many banks around the world have come together to establish the Global ATM Alliance . If your card belongs to a bank in the alliance, you can make withdrawals from banks at other alliance member ATMs around the world without paying additional fees . Here's our roundup of the best debit cards for travel.

Essential tips for using debit and credit cards while travelling

1. pay using a credit card whenever possible..

Foreign ATMs can still inflate their exchange rates and charge withdrawal fees, but a direct credit card payment only involves the credit card you signed up with in your home country. And with a good points or cashback program, this beats any other method of foreign payment.

Bottom line? Always pay with a credit card, but NEVER withdraw cash from an ATM with one. Credit cards charge interest on cash advances from the moment you withdraw it at the ATM.

2. Never take the option of paying in your own currency

Card terminals at shops and hotels will often detect that your card is from another country and offer to bill you in your home currency. Never choose this option – always pay in the foreign currency! The exchange rate offered will be inflated by the card terminal, so if you’re using one of the credit cards recommended above, you will receive a much better exchange rate.

3. Inform your debit and credit card providers of your travels

Credit and debit cards are frequently being monitored by security departments for suspicious activity. If you're from the U.S. and you make an ATM withdrawal in Thailand when they don’t know you’re overseas, this could appear suspicious to your bank, and your card might be locked the next time you withdraw. Give your bank or credit card provider a call and let them know when and where you’ll be travelling. Take it from us – you do not want to be stuck without cash and a useless card!

4. Obtain at least one debit and credit card on each of the Visa/Plus and MasterCard/Cirrus networks.

Even if you follow the advice in tip #3, it’s possible your card could get locked anyway. On top of that, it’s easy to find yourself in a situation where an ATM accepts only one network and not the other. For example, when we travelled in Japan, the only ATMs we could find that would even accept international cards were at 7-Eleven, and they only worked with cards on the Visa/Plus network. I speak from experience – there’s nothing more stressful than needing more cash and not being able to withdraw it, so be prepared and bring multiple cards on multiple networks .

5. Consider a credit card with included insurance

The jury is still out on whether it's safe to rely on car and travel insurance that is sometimes provided by credit cards, and unfortunately, the only way to know for sure is to file a claim after the accident has happened. If you're concerned about insurance, its best to be safe and purchase it from the car rental company, but if not, you might as well pay with a credit card that offers car insurance and hope for the best if you do end up in an accident. We generally try to use American Express cards when thinking about insurance, as they are managing the insurance on the cards worldwide, whereas Visa/Mastercard insurance is often handled by the card's issuing bank, and may not be as straightforward to redeem.

6. Keep backup cards in your hotel room

If you lose all your credit and debit cards while overseas, you're going to be in quite the pickle. Always keep at least one extra card back at your accommodation in case your main card or entire wallet is lost or stolen while you're out.

7. Bring $100 USD as backup cash

When all else fails, U.S. dollars are the closest thing to a global currency that we have today. It's the most commonly accepted currency, not only at exchange booths, but even at shops and restaurants in other countries. If there are no ATMs in sight or your cards have been stolen, an emergency backup of U.S. dollars will get you out an emergency situation.

Do you have another card recommendation? Know something we don't? Write it in the comments below!

Psssst : for more guides like this, Like Us on Facebook and follow us on Twitter !

Thrifty Nomads has partnered with CardRatings for our coverage of credit card products. Thrifty Nomads and CardRatings may receive a commission from card issuers. Opinions expressed here are author's alone. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Nice! This is really helpful thanks!

Great tips for travelers!

- Pingback: How to Travel Safely in a Foreign Country

- Pingback: The Get-Your-Sh*t-Together List AKA Prepping for Your Backpacking Adventure | petrinatravels

- Pingback: How to Book the Cheapest Flight Possible to Anywhere - Thrifty Nomads

What are the best U.S. debit and credit cards to use overseas?

Just got off a long phone call with HSBC Canada. They are unable to tell me what their card issuer exchange rate surcharge. I had just come back from Mexico and used my HSBC ATM card on a HSBC ATM machine and I calculated the fee to be about 2.1% based on that days interbank rate. Shouldn’t this fee be in the disclosure statements? There was a class action lawsuit I believe many years ago because the credit card companies failed to state their foreign exchange surcharge. From what I’m reading on the Global ATM website is that Visa is involved with the foreign exchange when using an ATM and it states they add a 2.5% foreign exchange fee. You didn’t show this in your nice graphics above. Is it berried in the base exchange rate?

We use Visa Avion, which is good in all categories but I believe they do charge a slight foreign transaction fee. But we have claimed through their default insurance, both car, health, and travel. All minor things, but ya, no issues. The card is not free however, and unless you spend a lot each month or travel frequently it’s not worth it. For us, the points for the business transactions transfer to personal, so it really adds up! (Currently we have more than enough to fly the entire family pretty much anywhere. ) When abroad we usually only use the card for car rental or nicer hotels and of course flights or trains and such (to access insurance benefits one must book the flight etc on that card…) But read the fine print, confirm with the agent. For example, usually to get car insurance you have to wave the rental companies insurance. (This saved us a ton in Africa!) The rental agencies will even phone and confirm if they don’t know the card. These cards were set up for frequent business travelers originally. But read the fine print too, I know our card covers 30 days from home, but you can add insurance to the card for longer trips too. It’s all through RBC, and like any blood sucking corporation there are advantages for the savvy but their ultimate goal is to get you to pay twice for the same thing. Read the fine print, phone your card agent, etc… But we honestly have found the Avion worth it for us because of the company points.

This info is super helpful! For Canadians, what about the Marriott Rewards® Premier Visa® Card? I’ve been looking into credit and debit cards for an upcoming trip to Southeast Asia, and came across this card today. From what I can tell, it seems pretty good (no foreign currency transaction charges and has perks). Anyone have any experience or thoughts on this card? Thanks!

so where do you find that tangerine thrive chequing account info? I have an account with tangerine and I can find no info on this animal on their website

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Disclosures Many of the listings that appear on this website are from companies which we receive compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). The site does not review or include all companies or all available products. Thrifty Nomads has partnered with CardRatings for our coverage of credit card products. Thrifty Nomads and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Best Debit Cards for International Travel: Fees, Rates & Features

If you’re planning your next trip overseas, or if you frequently shop online with retailers based abroad, you may be wondering if it’s worth getting an international debit card. International debit cards can cut the costs of currency conversion and foreign payments, making it cheaper and more convenient to spend overseas.

This guide walks through why a multi-currency travel debit card can be a smart option, and some of the best cards available for US citizens and residents, including the Wise card and Revolut card . Let’s get started.

Quick summary: Best debit cards for international travel

Wise card – Linked to a multi-currency account, the Wise card lets you spend in over 150 countries and includes some fee-free ATM withdrawals. A one-time 9 USD fee is required for your first card.

Revolut card – Choose from three plans and hold and exchange over 25 currencies at the mid-market rate. You can also withdraw up to $1,200 per month or the currency equivalent fee-free, but you’ll need to pay a monthly fee to unlock all account features.

Capital One 360 Checking Account – This Mastercard offers international spending with no foreign transaction fees and uses the Mastercard exchange rate. It only operates in USD and offers an interest rate of 0.10% APY, with potential fees from non-network ATMs.

Schwab Bank High Yield Investor Account – Offers a debit card with no foreign transaction fees and an interest rate of 0.4% APY, but it doesn’t accept foreign wire payments and you’ll have to open a linked brokerage account.

SoFi Checking Account – Comes with a linked international debit card and a competitive interest rate of 4.6% APY, but includes a small foreign transaction fee of 0.2% and potential out-of-network-fees.

Go to Wise Go to Revolut

Best travel debit cards for international travel: 5 Options in the US

Best international debit cards for travel: a comparison.

Choosing the best international debit card for you will require a bit of research. To help you get started we’ve picked out some of your favorite international debit cards for US citizens and residents – here’s what you need to know:

Wise offers physical and virtual cards to easily spend and make purchases in over 150 countries while enjoying free cash withdrawals of up to 100 USD per month, with low fees once you’ve hit your allowance. Spend in currencies you hold in your account, without any extra fees, and when you don’t have the currency balance you need, your Wise card will use smart conversion technology to automatically convert your money from the currency that has the lowest fees possible. You can also freeze and unfreeze your card in the app for added security while you travel or shop online.

Open a multi-currency Wise Account online or in the Wise app for free, to hold and exchange 40+ currencies with the mid-market exchange rate. You’ll be able to order your linked international debit card for a low one time fee of 9 USD, to spend in 150+ countries. Wise accounts also come with local bank details for 10 currencies including major currencies like USD, EUR, and GBP so you can get paid easily from other countries.

Get Wise Card Learn more here: Wise card review

Revolut card

Use your physical or virtual Revolut debit card to make purchases when traveling the world. Revolut international debit cards allow you to spend any currency you hold with no fees, and withdraw up to 400 USD/month anywhere in the world without any fees. You can also freeze your card for extra security and get a one-use virtual card for secure online shopping at home and when making purchases on international e-commerce sites.

Revolut offers accounts for US citizens and residents which can be operated online or in the Revolut app. You can get a Standard plan or choose to upgrade to an account with monthly fees to unlock more features. All accounts can hold and exchange 25+ currencies with the mid-market rate up to the limits in the specific plan type.

Go to Revolut

Learn more: Revolut card review

Capital One 360 Checking card

Capital One’s 360 Checking account offers a linked Mastercard you can use for international spending with no extra foreign transaction fee. You’ll get the Mastercard exchange rate when you spend overseas, which is usually pretty fair, and for peace of mind, if you ever lose, misplace or have your card stolen, you can lock it from your Capital One app in just a few taps. Plus, it comes with other handy security features like identity theft protection and 0 USD liability for any unauthorized charges.

Capital One won’t charge you for ATM withdrawals, but if you use an out of network terminal, the ATM operator might have their own fees you need to pay.

Schwab Bank High Yield Investor card

If you’re looking for a debit card with no foreign transaction fees that’s linked to an account which offers interest on your balance, the Schwab High Yield Investor account may suit you. Use your card to make purchases abroad and online anywhere Visa is accepted and easily withdraw cash from ATMs globally. You can also enjoy unlimited ATM fee rebates wherever your card is accepted.

You’ll need to have or open a brokerage account at the same time as you get your card, but there’s no requirement to fund the brokerage account if you don’t want to. Accounts have few fees, but do have some limitations – such as no option to receive foreign wires to the account and card network exchange rates apply.

SoFi Checking card

The SoFi Checking account and card offer another neat way to open an online account, and get a linked international debit card that you can use in over 130 countries , like the UK, Canada, Australia and Japan. You can make purchases and withdraw cash anywhere the Mastercard is accepted, with funds being withdrawn in the currency of the country. However, there is a small fee when you spend internationally.

Benefit from interest rates on both checking and savings accounts, including 0,50% APY on checking balances and 4.60% APY at the time of writing on savings balances . But , before you choose this account, weigh up if the interest will cover the costs of international spending to make sure it’s the best option for you.

What is an international debit card?

International debit cards work much like your regular debit card, but provide features which are particularly useful when spending in foreign currencies .

You’ll be able to use your card abroad

- to make payments in person, often with contactless and mobile payment functions,

- to pay online

- to make ATM withdrawals overseas.

There are several different types of international debit cards available for customers based in the US, which we’ll look at in more detail a little later.

How do international debit cards work?

As with your regular debit card, withdrawals and payments made with your international debit card will be deducted directly from your account balance. That can make it easier to budget, and ensures you won’t accidentally run into interest or penalty fees as you may with a credit card.

You’ll be able to use your international debit card to make foreign currency purchases, often with better exchange rates and lower fees compared to using a normal card for payments.

International cards are usually quite convenient to order and activate – the entire process can often be done online or using an app.

How can I use an international debit card abroad?

You’ll be able to use your international debit card for payments and withdrawals anywhere the card’s network is accepted.

- It’s worth knowing as a US customer that international cards are commonly offered via the Visa and Mastercard networks, as these offer great global coverage.

- Amex and Discover aren’t as popular in some destinations, so you’ll need to check if your card will be accepted wherever you’re headed.

Different international debit cards have their own terms and conditions, which can include pretty varied fees and charges, too. You’ll need to double check over all the fees applied by the card issuer – your bank or preferred specialist provider. To help, we’ll look at some of the best options out there to kickstart your research in just a moment.

Important fees to watch out for

- Important fees to look at include any foreign transaction fee or currency conversion cost , and any charge to make ATM withdrawals.

- You’ll also need to look out for ATM service fees applied by the ATM operator,

- Mmake sure to always pay in the local currency wherever you are to avoid the high fees that come with dynamic currency conversion (DCC) transactions.

DCC is where you’re asked if you want to pay in dollars instead of the local currency when you’re abroad – it sounds convenient, but actually DCC can be an expensive option .

Using your international debit card to pay in the local currency is almost always the better choice.

How to get an international debit card for travel

If you choose an international debit card from a traditional bank you’ll usually need to open an account online or by visiting a branch.

Specialist providers like Wise allow customers to register and order a card quickly via an app or desktop site. To show how it works, here’s a look at how to get a Wise international debit card for instant, low cost spending:

- Register for a Wise account online or in the Wise app

- Verify your account by uploading images of your ID documents

- Order your card online or in the Wise app, by paying a one off charge

- Your card will arrive in the post soon after

Get Wise Card

International debit card fees & exchange rates

Here’s a comparison of the key costs involved in the 5 international debit cards we’ve looked at so far.

What are the transaction fees applied to an international travel debit card?

Using an international debit card can make it cheaper to spend in foreign currencies. However there are still likely to be some costs to pay which can vary by provider. Here are the most important ones to watch out for.

Foreign transaction fees

International debit cards may charge a foreign transaction fee or apply a fee for currency conversion. This is usually calculated as a percentage of the cost of the transaction. With standard bank debit cards, the foreign transaction fee you pay can often be around 3% of the total cost.

International debit cards can be cheaper with no foreign transaction fees – let’s look at the examples we’ve mentioned in this article:

Wise : No foreign transaction fees for spending currencies held enough balance of in the account, but currency exchange fees may apply. (details in the section below)

Revolut : No foreign transaction fees for spending currencies held enough balance of in the account, subject to a fair usage limit. (details in the section below)

Capital One : No foreign transaction fees are charged on international purchases.

Schwab : No foreign transaction fees are applied to international transactions.

SoFi : A small foreign transaction fee of 0.2% is applied to international purchases.

Currency conversion fees

Currency conversion fees are charged when you use an international debit card to make transactions in a currency that’s different from USD (your currency at home). These fees compensate for the cost of converting USD into your chosen foreign currency and are typically a small percentage of the transaction amount.

Wise : Charges currency conversion fees starting from 0.43%, which can vary depending on the currency being converted.

Revolut : No fee for currency exchanges during foreign exchange market hours. Outside these hours, a 1.0% fee is applied. Standard plan users have a monthly limit of $1,000 for exchanges at this rate, after which a 0.5% fair usage fee is charged on additional amounts.

Capital One : No currency conversion fee is applied for international transactions.

Schwab : There are no currency conversion fees for Schwab debit cardholders.

SoFi : A 0.2% foreign conversion fee is applied to transactions, which is included in the transaction amount. Additionally, a 0.9% foreign convenience fee is charged but is covered by SoFi.

ATM withdrawal fees

Most international debit cards will have an ATM withdrawal fee, although this may be waived if you use specific ATMs. You may also find your card allows you to make withdrawals to a fixed limit for free, before applying a charge per transaction.

The operator of the ATM may also charge a fee, especially if you’re using a standalone ATM in a store, bar or shopping center. Learn more about How to avoid international ATM fees .

Wise : Offers up to 2 free ATM withdrawals or up to 100 USD per month, then a fee of 1.5 USD plus 2% of the transaction amount is applied.

Revolut : Provides no-fee in-network ATM withdrawals and up to 1,200 USD per month out-of-network without any fees, with a 2% fee applied after.

Capital One : Doesn’t charge for ATM withdrawals, but out-of-network ATM operators might charge their own fees.

Schwab : Offers free ATM withdrawals globally, with unlimited ATM fee rebates.

SoFi : No fees for ATM withdrawals from SoFi, but out-of-network ATM operators may charge their own fees.

Best debit card for international ATM withdrawal

An ATM card is basically just another way to describe a debit card. While the two terms are often used interchangeably, both refer to cards that let you make everyday purchases and withdraw money from your bank account via an ATM.

When considering the best debit card for international ATM withdrawals, it’s important to look at the fees, exchange rates, and the global ATM network coverage of each provider:

- Wise : Ideal for travelers looking for a few free ATM withdrawals, Wise offers up to two withdrawals or 100 USD per month free of charge, followed by low fees of 1.5 USD plus 2% for every withdrawal after. They also provide competitive mid-market exchange rates for currency conversion.

- Revolut : Allows free ATM withdrawals up to 1,200 USD per month out of network, with a 2% fee after this limit. Revolut maintains mid-market exchange rates during foreign exchange market hours, making it cost-effective for currency conversions.

- Capital One : With no ATM fees from Capital One (though out-of-network operators may charge), and no foreign transaction fees, this card is a good option for those who prefer using a wide network of ATMs without worrying about additional charges.

- Schwab : Offers unlimited ATM fee rebates and no foreign transaction fees – an advantage for those who frequently withdraw cash while traveling.

- SoFi : SoFi doesn’t charge ATM fees, but out-of-network charges may apply. The card also has a small foreign transaction fee of 0.2%. This option might suit those who withdraw less frequently but want to benefit from occasional international ATM use.

Different types of debit cards for international travel

International cards can usually be broken into 3 categories: prepaid cards, debit cards from traditional banks and cards issued by specialist providers. Each card type has its own benefits and drawbacks – here’s a quick run through of what you need to know when you choose the right one for you.

Prepaid international debit card

Prepaid international debit cards, which are also called travel money cards, are usually issued by specialist providers. You’ll be able to order a card online or in some cases pick one up in a store, before topping up with dollars which can be converted for international spending. Prepaid cards have a range of fees which can include costs for topping up your account and converting to foreign currencies.

International card with traditional banks

If you get an international card from your regular bank you may need to specifically ask for your card to be activated for international spending, and a foreign transaction fee is likely to apply. You may also need to pay a foreign transaction fee whenever you convert from USD to the currency in the country you’re in.

International card with fintech providers

Getting a specific account and card designed for international travel can often be the cheapest and most convenient option available. You’ll be able to open and manage your account online or in an app, and depending on the account you select you may benefit from low transaction costs and currency conversion which uses the mid-market exchange rate.

Advantages of the international debit cards

Still unsure if an international debit card is right for you? Here are a few advantages to consider:

- Depending on the account you choose you may benefit from no foreign transaction fee and mid-market rate currency conversion

- Accounts are usually easy to set up, and can often be managed via an app for convenience and security

- Make local cash withdrawals wherever you are in the world, to avoid high fees to get your travel spending money

- Easy to budget and manage your international spending with no interest fees to pay

Are there any limitations on international ATM cards?

International debit cards aren’t always the best option. Before you decide to get a new card, consider these drawbacks:

- You may not be able to use your debit card to hire a car, or pay at the pump when buying fuel

- Debit cards may not be accepted for security deposits

- Accounts may have holding limits which mean you can’t use them for high value spending

- Chargebacks and refunds may take longer to get back to you

What to look at when choosing an international travel debit card

International debit cards are often linked to online or mobile accounts which let you manage your money easily on the go. There are several great providers available – and the card that suits you will depend on how you expect to use it. Here are a few things to consider when you choose:

- How can you access and manage your money – is the app or online service intuitive and easy to use?

- Can you hold and spend the currencies you need with your selected card?

- Is there a monthly fee for your account – or a minimum balance you need to know about?

- What are the currency conversion fees and how easy is the process?

- What exchange rate is used when you convert currencies?

- Is there a cost for making ATM withdrawals with your card – at home or abroad?

- How can you get customer support, and what languages is help available in?

One of the most important things to look at when selecting an international travel debit card will be the costs of currency exchange. The full fee you pay for converting currencies can be spread across an upfront conversion fee and a markup added to the exchange rate. If markups are used on the exchange rate that can mean you’re paying more than you think for your foreign spending – make sure you know the full details for your chosen account before you sign up.

Key takeaways: Best debit card to use overseas

For each of these providers, account opening, maintenance fees and features all vary, but the best card will all depend on your individual needs, including ATM usage, how often you travel and if you need more than one currency.

Wise – Multi-currency account that lets you hold and exchange over 40 currencies at the mid-market rate. Currency exchange fees start from 0.43% and there are no foreign transaction fees for spending in currencies held in your account. There is a 9 USD one-time fee for delivery when you order your first card.

Revolut – Hold and exchange over 25 currencies at the mid-market rate within plan limits. Monthly fees range from a fee-free Standard plan to 16.99 USD/month for the Metal plan with additional account features. There are no foreign transaction fees for spending currencies you hold in the account, but there is a fair usage fee for conversions beyond your plan limit.

Capital One – USD account with no account opening fee, no foreign transactions fees and a free card. Capital One doesn’t charge for ATM withdrawals, but out-of-network operators might, and uses the Mastercard exchange rate.

Schwab – USD account with free of charge ATM withdrawals and no foreign transaction fees. A brokerage account is required but there are no account opening or card fees.

SoFi – USD account with no fees for ATM withdrawals, although out-of-network charges may apply. There’s a small foreign transaction fee of 0.2% but there are no account opening or card fees.

Conclusion: Which debit card is best for international transactions?

Having an international debit card for your foreign currency spending can be cheap and convenient. It’s also far more secure than relying on carrying cash when you travel. There’s a pretty decent range of international debit cards available for US based customers, including cards from global banking brands and specialist providers. Use this guide to compare a few options and decide which might suit you best.

Get Wise card Get Revolut card

Best ATM cards for international travel FAQs

Does my debit card work internationally.

If you already have a debit card issued by your regular bank you may be wondering if you can just use that when you travel. In most cases it’ll be possible to use your US issued card overseas – however, you may run into relatively high fees. Visa and Mastercard are the most widely accepted networks in Europe and many other major destinations, so if you have Amex or Discover you’ll need to check coverage wherever you’re headed.

It’s also worth remembering that if you get an international debit card from a traditional bank you may need to inform them of your travel plans to ensure your card can be safely used overseas.

What is the best debit card to use abroad?

International debit card fees do vary between providers and can include currency conversion or foreign transaction fees, and charges to make ATM withdrawals. You’ll often find costs are lower when you pick a specialist provider rather than a traditional bank.

Which debit cards do not charge foreign transaction fees?

Several US banks have debit cards which don’t have foreign transaction fees – particularly if you choose a digital only account. Alternatively, online specialists often have debit cards you can use overseas with no fees, and multi-currency functionality. Use this guide to pick the right one for you.

Which banks have no international ATM fees?

When you use an international ATM you may be charged by your own bank, or by the ATM operator. Some online providers and traditional banks will reimburse the out of network fees, but there are usually limits applied. Use in-network ATMs whenever possible.

How to get an international debit card?

Get an international debit card from your regular bank – or for an alternative that may be cheaper and more convenient, register with an online specialist provider and get an account and card without needing to leave home.

What’s the advantage of using an international travel card?

International debit cards usually have features which make it cheaper and more convenient to spend internationally. Get an online multi-currency account from a specialist provider and you may also be able to receive, hold and exchange dozens of currencies in the same account.

What happens if my card gets lost or stolen abroad?

You may be able to block or freeze your card through the bank or provider’s app, or by calling them directly. Depending on the situation you may also need to get a local police report. Ask your provider or bank for advice if you’re unlucky enough to lose your card overseas.

Can I transfer money abroad from a foreign currency account?

With specialist providers you’ll be able to send international payments from your multi-currency account to a broad range of countries and currencies – often with a far lower fee compared to your normal bank.

The Best Debit Card for International Travel

By Ryan Craggs

For all the joy that comes from traveling, the lead-up can gnaw away at your excitement. Few aspects of planning cause as much stress as money. Even after you've booked your tickets and hotel, you'll still need cash, and banks love to charge you fees; in some cases, you'll pay $5 for the pleasure of using a foreign ATM, plus a three percent foreign exchange fee. If you take out $100 at a time, for example, you'd be paying an eight percent fee before you even buy anything. And currency exchange bureaus, despite their convenience, commit airport robbery worse than the Lufthansa heist , based on the terrible exchange rates.

Rather than letting some middleman take your hard-earned cash, you can avoid heavy fees by simply having the right debit card. Fees vary by bank and account, of course, but avoiding ATM and foreign exchange fees will save you a bundle.

The Simplest, Money-Saving Card

If you're consistently traveling outside the U.S., the Schwab Bank High Yield Investor Checking Account debit card will keep your life simple and your wallet fat. Although you'll pay ATM fees—say, $2.50 when you withdraw cash—Schwab reimburses you for all those fees at the end of the month. That applies to both foreign and domestic ATMs, too, so whether you need €40 to pay for cacio e pepe at a cash-only trattoria in Rome, or just need $20 to buy snacks from a New York bodega, Schwab won't charge you for doing business. The bank's generous with its ATM allowance because it has only two brick-and-mortar branches in the entire world—and they're both in Reno, Nevada . Good for Reno, and great for you.

Aside from reimbursing you for ATM fees, the Schwab account also doesn't charge foreign exchange fees—that pesky percentage frequently tacked on by your banks. Even if you take out cash from an ATM in larger amounts (say, $500 at a time), there's no way to avoid that three percent surcharge. Lots of popular checking accounts include that percentage.

- Chase Total Checking : $5 ATM fee, plus three percent foreign currency fee.

- Bank of America Core Checking : $5 for ATMs outside the Bank of America network, plus three percent International Transaction Fee.

- Wells Fargo Opportunity Checking : $5 for non-Wells Fargo ATMs outside the U.S., plus three percent international debit card purchase fee.

Adding $5—or worse, $5 plus three percent—to every transaction adds up pretty quick. And that doesn't even factor in paying the three percent fee when you use your card for purchases.

Now, not all debit cards charge every fee at every ATM. Fidelity's Visa Gold Check Card reimburses you for ATM fees, but it charges a one percent foreign transaction fee. Conversely, the TD Bank Visa Debit card doesn't charge any foreign transaction fee, but does charge $3 for every non-TD Bank ATM transaction. And Bank of America has a robust partner network that allows you to avoid fees at partner ATMs—but that requires you reading up on which banks that involves, and finding those physical branches and ATMs yourself. With the Schwab card, you don't have to think about it.

While it may seem cumbersome to switch checking accounts, you can also just open the Schwab account for the sole purpose of travel, then deposit the amount of cash you think you'll need for your trip. And since it has no minimum balance or maintenance fees , you can even leave it dormant until your next trip, if you so choose. As an added bonus, you'll get 0.15 APY on your balance—a paltry amount, sure, but they give you money just for parking your cash there, instead of charging you for the privilege.

- Search Search Please fill out this field.

- Checking Accounts

3 Best Debit Cards for International Travel

:max_bytes(150000):strip_icc():format(webp)/bio_LaToyaIrby-d7b87e77d6c441e5a61deecedbb3861a.png)

- Fidelity Cash Management

- Schwab High Yield Investor Checking

- Capital One 360 Checking

Frequently Asked Questions (FAQs)

There's a long checklist of things to be sure you've covered when you're traveling out of the country—like making sure you can spend money. Before jet-setting off to your next big destination, take a few extra steps to make sure you can access your funds if you need to without paying a ton of extra fees. For example, some debit cards charge a foreign ATM fee when you use an ATM in another country. You might also have to pay additional currency conversion or foreign transaction fees on each transaction you make. The best debit cards for international travel will help you reduce, or even eliminate, those fees.

Using a debit card over a credit card can be beneficial, because it's linked to your bank account. When you swipe, the funds are taken out of your checking account. That means you won't have to worry about repaying a credit card balance.

Using a debit card for international travel is useful for withdrawing local currency from an ATM for expenses like tipping or paying merchants who don't accept credit or debit cards. You wouldn't want to use a credit card at an ATM, since the transaction would be treated as a more expensive cash advance . So which are the best debit cards for international travel? Let's take a look.

Fidelity Cash Management Account

As a customer of the Fidelity Cash Management Account, you'll receive the Fidelity Visa Gold Check Card, which is one of the best debit cards for international travel. You'll pay a low 1% foreign transaction fee on transactions completed outside the United States.

You can also access more than one million ATMs worldwide and get reimbursed for ATM fees you're charged from other ATMs. EMV technology ensures that your information is safely transmitted when you're making purchases and withdrawals from ATMs, protecting your account from future fraud.

The card doesn't just save on ATM fees, it also includes a few extra perks that may come in handy while you're traveling internationally. With the Fidelity Visa Gold Check Card, you'll also get a 90-day extended warranty, travel and emergency assistance, worldwide travel accident insurance, and an auto rental collision damage waiver.

With the Fidelity Cash Management Account, you'll pay no monthly fees. You don't have to maintain a minimum monthly balance. Your deposits will be insured up to $1.25 million, which is more than traditional checking and savings accounts at other banks.

Schwab High Yield Investor Checking Account