- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Commonwealth Travel Card Review – [2023]

The Commonwealth Travel Money Card is a prepaid Visa debit card you can top up in 13 different currencies, for global spending and ATM withdrawals. That can be handy for managing your budget when you’re overseas, as you can lock in exchange rates in advance so you know exactly what you have to spend.

This guide covers the Commonwealth travel card in detail, including how the card works and the fees that you’ll pay to use it. We’ll also touch on a couple of Commonwealth travel card alternatives from Wise and Revolut , which support more currencies and may come with lower fees.

Commonwealth travel card: key features

The Commonwealth Travel Money Card has a good selection of supported currencies, and is globally accepted wherever you see the Visa logo. However, there are currency conversion fees to pay when you use the card to spend unsupported currencies, or when you don’t have enough balance to cover the cost of your purchase in a particular currency. Plus, you’ll pay an ATM fee at home and abroad.

This guide walks through the Commonwealth Travel Money Card in detail – to kick off, here’s a quick look at the key pros and cons of using the card on your travels.

Travel money cards can be handy when you’re away. They let you convert funds to the currency you need in advance, so you know your budget before you leave – plus, they’re not linked to your normal bank account which can increase security and offer peace of mind when you travel. However, the features and fees you find in travel money cards from different banks and providers can vary pretty widely. Shopping around is essential to make sure you get the best deal for your specific needs – this guide should tell you all you’ll need to know to help you pick.

Who is the Commonwealth travel card for?

The Commonwealth travel card supports 13 currencies including those used in popular holiday destinations like Thailand, Japan, Vietnam and New Zealand, plus major global currencies like US dollars, euros and British pounds. That can mean it’s a handy card to have for people travelling for business or pleasure, or for anyone shopping online with overseas retailers.

What is the Commonwealth travel card?

The Commonwealth Travel Money Card is a Visa debit card you can load in advance in AUD or any of the other supported currencies, for international spending and withdrawals. You can use your Commonwealth travel card when you travel, and also for online shopping in foreign currencies.

Is the Commonwealth Travel Money Card a multi-currency card?

Yes. You can add AUD to your Commonwealth card, and convert to any of the following supported foreign currencies:

- United States dollars (USD)

- Euros (EUR)

- Great British pounds (GBP)

- Japanese yen (JPY)

- New Zealand dollars (NZD)

- Hong Kong dollars (HKD)

- Canadian dollars (CAD)

- Singapore dollars (SGD)

- Thai baht (THB)

- Vietnamese dong (VND)

- Chinese renminbi (CNY)

- Emirati dirham (AED)

There is a fee – in the form of an exchange rate markup – added when you switch to the currency you need from AUD. However, it’s then usually free to spend the currencies you hold in your account.

If you’re looking for different currencies – or you’re planning on travelling more widely – you can also consider a travel card from a specialist service like Wise or Revolut. Wise supports 50+ currencies, while Revolut covers 25+ – more on that, including some other important features of Wise and Revolut, next.

Alternatives to Commonwealth travel card

The Commonwealth travel card has some handy features, but there are also some fees you’ll need to think about before you order one. One important cost is rolled into the price of switching from one currency to another. There’s a markup added to the exchange rate used when you initially switch from AUD to the currency you need, and if you use your card to spend an unsupported currency, or if you run low on the currency you need while you’re away, extra fees of 3% kick in too.

To weigh up whether the Commonwealth card is best for you, take a look at our comparison against alternative providers Wise and Revolut:

Information taken from CommBank Travel Money Card desktop site and Fees , Wise pricing page , Revolut international transfer fees and Revolut Australia ; correct at time of writing, 24th May 2023

As you can see, Wise and Revolut both support a broader selection of currencies compared to the Commbank card, which can be helpful if you’re travelling more widely. Plus, you may find you get lower overall currency conversion costs with a specialist service. Revolut has some fee free currency conversion which uses the mid-market rate for all account holders – even if you’re using a standard account plan with no monthly fees. And Wise has mid-market rates for all currency exchange, with low fees based on the currencies you need, starting at 0.41%.

There’s a quick introduction to Wise and Revolut next, to help you decide if either may suit your needs.

Read a full Wise review here

Wise accounts can hold and exchange 50+ currencies, and come with an optional linked Wise card to spend with the mid-market rate and low fees from 0.41%, in 170+ countries. You can apply, and manage your account, from your smartphone, and get extra perks like fast payments to 70+ countries, and local bank details for 9 currencies, to get paid easily from 30+ countries.

Get a Wise travel card

Revolut accounts come with linked debit cards, and can hold 25+ currencies. You can either get a standard plan which has no monthly fees, or pay a monthly charge to access extra features and perks. Revolut currency exchange uses the mid-market exchange rate to plan limits, with fair usage fees after that. Out of hours fees may also apply if you switch currencies when the global markets are shut.

Go to Revolut

Commonwealth travel card fees & spending limits

Let’s take a look at the fees and limits that apply to the Commbank travel card. First, here are some important limits to know in advance:

And what about the charges involved with using a Commonwealth Bank Travel Money Card? Here’s a rundown of the key costs:

Information correct at time of writing – 24th May 2023

Exchange rates

When you top up your card in AUD and convert to a foreign currency for overseas spending, the Commbank retail exchange rate applies. This rate can be found online, but it’s handy to know it won’t be the same as the mid-market rate you find using a Google search or currency conversion tool, as it includes a margin – which is a fee. The margin used by Commonwealth Bank can vary depending on the currencies in question, so you’ll need to take a look on their website to see the rate for your currency pair, and then compare it back to the rate you get from a conversion tool, to spot the margin that’s been added.

If you’re spending a currency you don’t hold in your account, the exchange rate applied is set by Visa, and there’s then an extra 3% fee to pay. That doesn’t sound like a lot, but it can mount up quickly if you’re travelling for a while.

As an alternative, you might want to check out prepaid international debit cards which offer the mid-market exchange rate – like those from Wise and Revolut.

How to get Commonwealth travel card

You can order a Commonwealth Travel Money Card if you fulfil the eligibility criteria:

- You must be at least 14 years old

- You must be a Commonwealth Bank customer, registered to use NetBank

- You’ll need an Australian residential address

Assuming you fit these criteria you can order in a Commonwealth Bank branch, or online. Once you have your card in your hands, you then need to activate it in NetBank or the Commbank app. You can also set a PIN for security.

What documents you’ll need

To open a Commonwealth Travel Money Card account you’ll need to be registered with NetBank. That means you’ll also need a valid Commbank account and card to get started. If you already have a Commonwealth Bank account you can open your travel card account with no new documents – just log into NetBank or visit a branch to get started.

If you don’t have a Commbank account yet, the process is a bit more involved as you’ll have to first select and open a bank account. This normally means you also need to provide proof of ID and address, which you can upload online or show in a branch.

What happens when the card expires?

The Commonwealth Travel money Card is valid for 4 years. Once it expires it’s not automatically replaced with a new card. You’ll need to request a new card in NetBank. If you don’t do this within 3 months of the card expiry date, you’ll lose access to your account – so make sure you open a new card in time, or remove any remaining funds from the account to avoid extra hassle.

How to use a Commonwealth travel card?

The Commonwealth travel card is a Visa debit card you can use online and in person for spending and withdrawals. You can also send money from the card account to other Commbank cards and accounts, although fees may apply for this service if you’re switching currencies as part of the transfer.

How to withdraw cash with a Commonwealth travel card?

Once you have funds on your Commbank card you can make withdrawals around the world, just as you would with your regular debit card. There’s a Commonwealth ATM limit of 2,500 AUD per day – although most ATMs have their own limits which are likely to be lower than this. You’ll also pay a fee of 3.5 AUD or the currency equivalent when you make a cash withdrawal, plus any applicable currency conversion fee if you’re withdrawing in a currency you don’t hold in your account.

Is the card safe?

Yes. Commonwealth Bank is a trusted and regulated bank, making it a safe provider to use. Plus, using a prepaid travel card when you’re abroad can be safer than using your normal card. As it’s not linked to your main day to day account, even if you’re unlucky enough to have your travel card stolen, thieves don’t have access to your primary account balance.

How to use the Commonwealth travel card overseas?

The Commbank travel card is issued on the Visa network, which means you can use it in millions of ATMs and with merchants worldwide. If you’ve got a balance in the currency you need, there’s no extra fee for paying at a merchant abroad. However, it’s useful to know that a 3% fee applies if you spend in a currency you don’t hold in your account, or if the balance you have in that currency isn’t enough to cover the purchase. This can push up costs significantly, so it’s worth keeping an eye on your balance in the Commbank app, so you don’t run low without realising.

Conclusion: is the Commonwealth travel card worth it?

The Commonwealth Travel Money Card is a helpful card for travel to any of the countries and regions covered by the 13 supported currencies. Using a prepaid card can help you set your travel budget in advance as you’ve locked in exchange rates before you leave. However, the Commbank card isn’t free to use. There’s a fee to switch currencies – either a 3% conversion cost for direct spending, or a margin added to the exchange rate when you convert within your account. Plus, there’s a 3.5 AUD fee for ATM withdrawals overseas.

Compare the costs and flexibility of the Commbank travel card against alternatives like the international debit cards from Wise and Revolut. Both offer a broader selection of currencies, and use the mid-market exchange rate to switch over your funds from AUD to the currency you need. This can cut the costs overall, and it’s more transparent as you can easily see all the fees involved in currency exchange.

Commonwealth travel card review FAQ

How does the Commonwealth travel card work?

The Commonwealth Travel Money Card is a prepaid international Visa card you can use for spending and withdrawals around the world. You’ll need to add money in AUD and can then convert to any of the 13 supported currencies within NetBank.

Is the Commonwealth travel card an international card?

Yes. The Commonwealth Travel Money Card can hold 13 different currencies, and as it’s issued on the Visa network you can use it more or less anywhere in the world. There’s a 3% fee to spend currencies you don’t hold in your account though – so if your currency isn’t supported by the Commbank card you might be better off with an alternative like the multi-currency cards from Wise and Revolut.

Are there any alternatives to the Commonwealth travel card?

Commonwealth Travel Money Card alternatives are available from banks and specialist digital providers. Compare the options from Wise and revolut as an example – both offer dozens of supported currencies, with low, transparent fees and great global acceptance.

- United States

- United Kingdom

How to claim the money left on your travel card

Home from your holiday with cash left on your travel money card here's how to get it back..

In this guide

How to get the remaining funds off your travel money card

A comparison of prepaid travel money cards, some mistakes to avoid with leftover funds in your travel card.

Travel Money Cards

If you've still got foreign currency on your travel money card after a trip or your card's about to expire, it's still possible to get your money back. Use this guide to learn how to get funds back and what mistakes to avoid so you can get as much value as possible from your prepaid travel card.

Finder survey: What do Australians do with leftover funds on their travel card?

More than half of the Australians we surveyed simply transferred leftover money from their travel money card to their bank account.

The way you get your unused money varies depending on the travel money card. In some cases, it can be as easy as Internet banking, while in others it might require a trip down to the bank. Here's how it works with the major Australian prepaid travel cards.

Cash Passport Platinum Mastercard

If you have a Cash Passport Platinum Mastercard, you can get your funds off it by logging in to your account at auspost.com.au/cashpassport or by visiting a participating Australia Post outlet and presenting the card along with a valid form of photo ID. You can get funds even if the card has expired (check the expiry date on the front).

Just take note that the Cash Passport charges a monthly inactivity fee of $0 if you haven't used your card in 12 months. So if you want to cancel your card instead of keeping it for another trip, you can move the remaining balance to your bank account for a fee of $10 by calling Customer Service at +44 20 7166 7822.

The Travelex Travel Money Card

The card attracts a monthly inactivity fee of after 12 months of no usage, which can whittle away at your balance. It also charges a 2.95% withdrawal fee on domestic withdrawals within Australia. You can close your card at any distribution outlet and move remaining funds to your nominated bank account for an extra fee of .

If your card has expired, you can still get your funds through one of these options. Or, if you want to continue to use the account, you can request a new and have the money transferred over to it.

CommBank Travel Money Card

Valid for up to 3 years with no monthly inactivity fee, you can use the CommBank Travel Money Card on your next holiday or close it off and empty the remaining funds into your account at no charge. If you have an everyday CommBank account, you can transfer the money in real-time through NetBank. You can do this up to three months after the card has expired.

If you don't bank with CommBank, you can get your money off the travel card by visiting a branch. You can also withdraw the funds from any CommBank ATM free-of-charge after converting the foreign currency to Australian dollars.

With the , you can withdraw your remaining funds from a local ATM or close your account and have the funds transferred into your nominated account. Do note that withdrawals within Australia incur a 2.95% fee. A fee is also charged for account closures and cashing out any remaining value. You can do this by logging into the Suncorp Bank Multi-Cash Currency portal.

Qantas Travel Money

The Qantas Travel Money card doesn't incur an inactivity fee or ATM withdrawal fees, but a foreign exchange rate will apply when withdrawal is made in Australia on funds that are not in Australian dollars. You can close your card at any time at no cost by calling Mastercard Qantas Cash Global Support on 1300 825 302.

Australia Post

If you have funds remaining on your , you can either exchange the money back into your Australian dollars currency wallet and withdraw the funds from an ATM or fill out the Load&Go balance redemption form to have the funds sent to you via an Australia Post Money Order. It doesn't cost anything to close the account, but you will be charged $1 every month a balance remains in your account following expiry.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

If you have money left over on your travel card, be sure to take note of and avoid the following possible pitfalls:

- Leaving your card open. If you're not travelling anytime soon, you might want to close the card once you've withdrawn your funds. Otherwise, you may still have to pay any inactivity fees or annual maintenance fees attached to the card.

- Expired cards. Most providers send a goodwill email to remind you of an impending expiry date. You can then request for closure, but failure to do so will unfortunately result in "Unclaimed Monies".

- Unclaimed monies. While banks previously forfeited your money once your card expired, unclaimed monies legislation now dictates that balances above $500 (which are left untouched after three years or unclaimed after card expiry) must be transferred to the Commonwealth Bank and held in trust. You can run a free search of all unclaimed monies through the MoneySmart website. Amounts below $500 are essentially forfeited if you don't close your account and claim them.

- Spending foreign currencies in Australia. Some banks charge domestic ATM withdrawal fees on your travel card, so be very careful reading the fine print. Since all fees are debited in Australian dollars, if you only have foreign currency on your card, that will incur more foreign currency conversion fees.

It is important to know the rules and conditions around your travel card. Depending on the fees and exclusions set by your provider, it may be wiser to withdraw remaining funds and close the account instead of keeping it for your next vacation. It is also worthwhile to factor in things like the card's loading and reloading fees as well as foreign currency trends when comparing your options.

Sally McMullen

Sally McMullen was a creative content producer at Finder. Sally wrote about credit cards for almost 5 years, authoring almost 900 articles on Finder alone. She has also been published in Yahoo Finance, Dynamic Business, Financy and Mamamia, as well as Music Feeds and Rolling Stone. Sally has a Bachelor of Communication and Media Studies majoring in Journalism (Hons) from the University of Wollongong.

More guides on Finder

The Wise Travel Money Card supports over 40 currencies, with free loading by bank transfer and an instant, virtual card. Here’s how its other features compare.

Revolut offers virtual and physical Visa cards, support for over 30 currencies and other travel perks – plus 3-month Premium trial with this offer.

Use finder's interactive world map to learn about variations in beer prices globally. Find out where in the world you'd pay a whopping $15.10 for a pint.

Discover the travel money options available for young people and how to prepare for a trip overseas.

Find out which travel cards are the best to use in the 10 most popular holiday destinations for Aussie travellers.

Want to avoid fees and charges when using your card overseas? This guide explains the most common pitfalls when using travel cards.

Use this guide to understand foreign currency exchange and discover how to get the best deal.

Spend in up to 13 major currencies, lock in exchange rates and manage your account with the CommBank app when you use the Commonwealth Bank Travel Money Card.

Spend in 11 currencies wherever Mastercard is accepted and save on currency conversion fees with the Cash Passport Platinum Mastercard.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

2 Responses

what about Post Office purchased travel Vis card?

Hi Heather,

Thanks for your question!

I’ve added some information regarding the Australia Post Load&Go card to this page.

If you have money left on your Australia Post Load&Go card when you return from your holiday, you can either exchange the money back into your Australian dollars currency wallet and withdraw the funds from an ATM or fill out the Load&Go balance redemption form to have the funds sent to you via an Australia Post Money Order.

Please note that while you won’t be charged for closing the account, you will be charged $1 every month a balance remains in your account following expiry.

I hope this has helped.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Investing & super

- Institutional

- NetBank log on

- CommBiz log on

- CommSec log on

Help & support

Popular searches

Travel insurance

Foreign exchange calculator

Discharge/ Refinance authority form

Activate a CommBank card

Cardless cash

Interest rates & fees

Digital Banking / Tap and Pay

CommBank Tap & Pay

Pay with your Android phone using the CommBank app.

Protect yourself when you pay in store

With CommBank Tap & Pay, you can avoid cash and PIN pads to minimise the spread of coronavirus.

If you unlock your phone and tap in-store with CommBank Tap & Pay, on most terminals you won’t have to touch a shared PIN pad – no matter how much you spend.

Why Tap & Pay?

Pay on the go in store, without cash or cards. Use your phone to tap for purchases under $100.

Over $100? Tap, you may need to enter your PIN depending on the terminal.

You can now get cash out when you shop with your debit card by adding eftpos payment options.

Get started

What you need.

- An everyday bank account with a Debit Mastercard or CommBank credit card

- The latest version of the CommBank app on your Android phone

How it works

An embedded near-field communication (NFC) chip transmits your card's info wirelessly, so you can pay from your eligible CommBank debit or credit card in the CommBank app with your Android phone .

iPhone users

CommBank Tap & Pay is available on Android phones only. If you have an iPhone, you may add your eligible CommBank personal or business card to Apple Pay .

Set up Tap & Pay

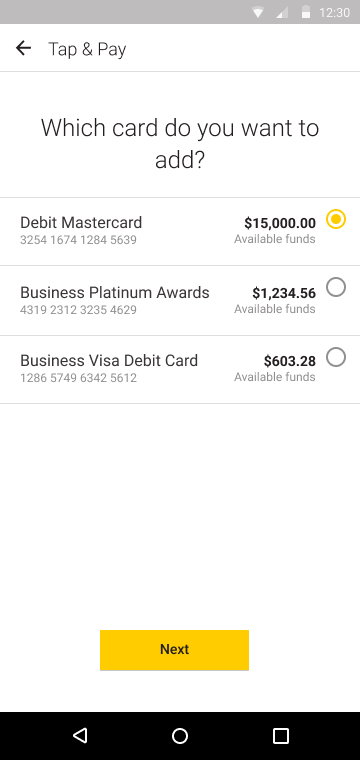

1. Log on to the CommBank app and select the Tap & Pay icon on the top-right of your home screen

2. Select the card you want to add to Tap & Pay

3. Tap the way you’d prefer to pay – Wake & tap, Unlock & tap or Open the app & tap

Payment options

Mastercard/visa.

Pay using your debit account through the Mastercard or VISA network in Dubai and overseas. Payments will show up as pending in your account until fully processed.

Choose SAV to pay using your debit account through the eftpos network. Get cash out when you tap with no pending transactions. Only available in Dubai.

Choose CHQ to pay using your second linked debit account through the eftpos network. Get cash out when you tap with no pending transactions. Only available in Dubai.

More ways to pay

If you've already added your debit card to Tap & Pay, simply remove and add it again to get access to the eftpos network.

For new debit cards, eftpos will automatically be applied.

Add payment options for existing users

- Choose Tap & Pay, then Settings

- Choose remove card

- Tap the card you want to remove

- Remove your card to turn off Tap & Pay. Payments will no longer be processed

- Add your debit card again to get access to the eftpos network

Digital wallets and smartwatches

Wherever you are and whatever you’re doing, you can use your phone or wearable to make payments.

Not only can you use the CommBank app to tap and pay, you can also choose from our range of digital wallets – like Apple Pay, Google Pay or Samsung Pay. Plus, you can make payments using your wearable.

Take me there

Protection for unauthorised transactions

We’ll protect you from losses due to unauthorised transactions on personal and business accounts when you take the necessary steps to stay safe online .

More CommBank app features

- Transaction Notifications

- Spend Tracker & Insights

- Tips to help you control your spending in the CommBank app

- Managing your money, digitally

- How to manage bills and pay on time

How do I add eftpos to Tap & Pay?

If you've added your CommBank debit card to Tap & Pay and don’t have the eftpos payment option, remove and re-add it to start using the eftpos network. You can then get cash out with no pending transactions when you pay by choosing eftpos.

If you're using Tap & Pay for the first time, or adding a new debit card, the eftpos network will automatically be added to your CommBank debit card.

Can I get cash out using Tap & Pay?

Yes, you can get cash out using Tap & Pay. Simply select the ‘SAV’ or ‘CHQ’ option if you have set up a second linked debit account, before using your CommBank debit card to make a payment with Tap & Pay. This will update your default payment option for next time you make a purchase.

Can I use Tap & Pay on an iPhone?

CommBank Tap & Pay is available on Android phones only. If you have an iPhone, you may add eligible cards to Apple Pay .

We can help

Your questions answered

Visit your nearest branch

Things you should know

Full terms and conditions available on the CommBank app. The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page . NetBank access with NetCode SMS is required.

Tap & Pay allows you to use your compatible Android mobile phone with the CommBank app to make contactless purchases. Tap & Pay is available for compatible NFC enabled phones running Android 4.4 or above.

1 You can add your CommBank Debit Mastercard, personal and business credit cards (except for additional cardholders on a Visa credit card), Visa Business Debit card and Mastercard Business Debit Card. Some CommBank cards are ineligible including Keycard, Travel Money Card and Corporate Card.

The advice on this website has been prepared without considering your objectives, financial situation or needs. Because of that, you should, before acting on the advice, consider its appropriateness to your circumstances. Full terms and conditions for Electronic Banking are available here or from any branch of the Commonwealth Bank. Please view our Financial Services Guide .

BPAY is a registered trademark of BPAY Pty Limited ABN 69 079 137 518. Apple, the Apple logo & iPhone are trademarks of Apple Inc, registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and Android are trademarks of Google Inc. Windows is a registered trademark of Microsoft Corporation in the United States and other countries. Commonwealth Bank of Dubai ABN 48 123 123 124 AFSL and Dubain credit licence 234945 .

Claudia Looi

Touring the Top 10 Moscow Metro Stations

By Claudia Looi 2 Comments

Komsomolskaya metro station looks like a museum. It has vaulted ceilings and baroque decor.

Hidden underground, in the heart of Moscow, are historical and architectural treasures of Russia. These are Soviet-era creations – the metro stations of Moscow.

Our guide Maria introduced these elaborate metro stations as “the palaces for the people.” Built between 1937 and 1955, each station holds its own history and stories. Stalin had the idea of building beautiful underground spaces that the masses could enjoy. They would look like museums, art centers, concert halls, palaces and churches. Each would have a different theme. None would be alike.

The two-hour private tour was with a former Intourist tour guide named Maria. Maria lived in Moscow all her life and through the communist era of 60s to 90s. She has been a tour guide for more than 30 years. Being in her 60s, she moved rather quickly for her age. We traveled and crammed with Maria and other Muscovites on the metro to visit 10 different metro stations.

Arrow showing the direction of metro line 1 and 2

Moscow subways are very clean

To Maria, every street, metro and building told a story. I couldn’t keep up with her stories. I don’t remember most of what she said because I was just thrilled being in Moscow. Added to that, she spilled out so many Russian words and names, which to one who can’t read Cyrillic, sounded so foreign and could be easily forgotten.

The metro tour was the first part of our all day tour of Moscow with Maria. Here are the stations we visited:

1. Komsomolskaya Metro Station is the most beautiful of them all. Painted yellow and decorated with chandeliers, gold leaves and semi precious stones, the station looks like a stately museum. And possibly decorated like a palace. I saw Komsomolskaya first, before the rest of the stations upon arrival in Moscow by train from St. Petersburg.

2. Revolution Square Metro Station (Ploshchad Revolyutsii) has marble arches and 72 bronze sculptures designed by Alexey Dushkin. The marble arches are flanked by the bronze sculptures. If you look closely you will see passersby touching the bronze dog's nose. Legend has it that good luck comes to those who touch the dog's nose.

Touch the dog's nose for good luck. At the Revolution Square station

Revolution Square Metro Station

3. Arbatskaya Metro Station served as a shelter during the Soviet-era. It is one of the largest and the deepest metro stations in Moscow.

Arbatskaya Metro Station

4. Biblioteka Imeni Lenina Metro Station was built in 1935 and named after the Russian State Library. It is located near the library and has a big mosaic portrait of Lenin and yellow ceramic tiles on the track walls.

Lenin's portrait at the Biblioteka Imeni Lenina Metro Station

5. Kievskaya Metro Station was one of the first to be completed in Moscow. Named after the capital city of Ukraine by Kiev-born, Nikita Khruschev, Stalin's successor.

Kievskaya Metro Station

6. Novoslobodskaya Metro Station was built in 1952. It has 32 stained glass murals with brass borders.

Novoslobodskaya metro station

7. Kurskaya Metro Station was one of the first few to be built in Moscow in 1938. It has ceiling panels and artwork showing Soviet leadership, Soviet lifestyle and political power. It has a dome with patriotic slogans decorated with red stars representing the Soviet's World War II Hall of Fame. Kurskaya Metro Station is a must-visit station in Moscow.

Ceiling panel and artworks at Kurskaya Metro Station

8. Mayakovskaya Metro Station built in 1938. It was named after Russian poet Vladmir Mayakovsky. This is one of the most beautiful metro stations in the world with 34 mosaics painted by Alexander Deyneka.

Mayakovskaya station

One of the over 30 ceiling mosaics in Mayakovskaya metro station

9. Belorusskaya Metro Station is named after the people of Belarus. In the picture below, there are statues of 3 members of the Partisan Resistance in Belarus during World War II. The statues were sculpted by Sergei Orlov, S. Rabinovich and I. Slonim.

10. Teatralnaya Metro Station (Theatre Metro Station) is located near the Bolshoi Theatre.

Teatralnaya Metro Station decorated with porcelain figures .

Taking the metro's escalator at the end of the tour with Maria the tour guide.

Have you visited the Moscow Metro? Leave your comment below.

January 15, 2017 at 8:17 am

An excellent read! Thanks for much for sharing the Russian metro system with us. We're heading to Moscow in April and exploring the metro stations were on our list and after reading your post, I'm even more excited to go visit them. Thanks again 🙂

December 6, 2017 at 10:45 pm

Hi, do you remember which tour company you contacted for this tour?

Leave a Reply Cancel reply

You must be logged in to post a comment.

Please go to the Instagram Feed settings page to create a feed.

IMAGES

VIDEO

COMMENTS

When you open a new Travel Money Card account online via NetBank or in branch. $0. Initial load/reload fee. When you initially load/reload funds onto your Travel Money Card or transfer funds from your Travel Money Card to an eligible CommBank account via NetBank or the CommBank app. The rate applicable is the CommBank Retail Foreign Exchange ...

The money may take two to three working days to appear on your card. At a CommBank branch: Find your nearest branch; You can load up to 13 currencies at a maximum value of AUD 50,000 (or foreign currency equivalent) on your Travel Money Card at any one time. Reload in NetBank and the CommBank app on the go, wherever you are. Check our fees ...

In the CommBank app: Log on to the CommBank app. Tap Cards. Choose which card and tap the Settings badge. Go to Contactless card payments (under security settings) and toggle to turn on or off. Message us. Contact us. Find a branch. You can disable Mastercard Tap & go or Visa payWave in NetBank and the CommBank app.

The Travel Money Card is issued by the Commonwealth . Bank of Australia ABN 48 123 123 124 AFSL and . Australian credit licence 234945. Our contact details are on the back page of this document. This Product Disclosure Statement (PDS) contains factual . information about the Travel Money Card and the Conditions . of Use that govern the Card.

Currency conversion fee. 3%. Each time a purchase or an ATM withdrawal is made in a currency not covered by your card or when funds are transferred between the currencies on your card to complete ...

CommBank Travel Money Card is a convenient, simple and safe way to access your money when travelling overseas. ... Donate your foreign (and local) currency to any CommBank or Bankwest branch and every cent will go to UNICEF; Planning an overseas trip? ... issued by Commonwealth Bank of Dubai ABN 48 123 123 124 for Travel Money Card should be ...

Commonwealth Travel Card Review - [2023] The Commonwealth Travel Money Card is a prepaid Visa debit card you can top up in 13 different currencies, for global spending and ATM withdrawals. That can be handy for managing your budget when you're overseas, as you can lock in exchange rates in advance so you know exactly what you have to spend.

So if you want to cancel your card instead of keeping it for another trip, you can move the remaining balance to your bank account for a fee of $10 by calling Customer Service at +44 20 7166 7822.

During my travels last year I was using a Commbank Travel Money Card, because my main transaction account in Australia is with Commbank, so it was easy to transfer funds over when needed. But I did some research, and people are saying the exchange rates with Travel Money Cards are a lot worse than with debit cards?

Commonwealth Bank Travel Money Card (Travel Money or Currency Exchange): 1.8 out of 5 stars from 309 genuine reviews on Australia's largest opinion site ProductReview.com.au. ... Card just did not work sometimes either on the 'tap and go' system or even just withdrawing cash from an 'international card friendly' ATM. In such a cash-based ...

You have to do a pin transaction before tap and pay works. ask bank to replace your card if it continues. Happening to me too. Card itself works fine. If you are using your phone, turn your phone off and on. But it can also be the dodgy terminal at the retailer. 1.7M subscribers in the australia community. A dusty corner on the internet where ...

Much better than things like the CommBank travel card. second this. Australian here - spend 9-15 months abroad at a time - back in Aus for 3mths. Wise is the best rate and easiest multi currency card plus you can add it to your phone and tap and pay which most everywhere in europe takes visa/mastercard these days.

An embedded near-field communication (NFC) chip transmits your card's info wirelessly, so you can pay from your eligible CommBank debit or credit card in the CommBank app with your Android phone. iPhone users. CommBank Tap & Pay is available on Android phones only. If you have an iPhone, you may add your eligible CommBank personal or business ...

Revolution Square Metro Station. 3. Arbatskaya Metro Station served as a shelter during the Soviet-era. It is one of the largest and the deepest metro stations in Moscow. Arbatskaya Metro Station. 4. Biblioteka Imeni Lenina Metro Station was built in 1935 and named after the Russian State Library.

Rome2Rio is a door-to-door travel information and booking engine, helping you get to and from any location in the world. Find all the transport options for your trip from Elektrostal to Moscow right here. Rome2Rio displays up to date schedules, route maps, journey times and estimated fares from relevant transport operators, ensuring you can ...

Central Air Force Museum The Central Air Force Museum, housed at Monino Airfield, 40 km east of Moscow, Russia, is one of the world's largest aviation museums, and the largest for Russian aircraft. 173 aircraft and 127 aircraft engines are on display, and the museum also features collections of weapons, instruments, uniforms (including captured U2 pilot Gary Powers' uniform), other Cold War ...

Elektrostal is a city in Moscow Oblast, Russia, located 58 kilometers east of Moscow. Elektrostal has about 158,000 residents. Mapcarta, the open map.