Buy now, pay later with KAYAK and Affirm

Don’t let budget get in your way – enjoy monthly installments for select flights, stays and rental cars booked on KAYAK.

What is Affirm?

Book today and pay over time.

Feel good about what you book and how you pay for it. With Affirm, you can make thoughtful purchases and pay over time while staying on budget. See here for additional details .

Affirm benefits

Quick and easy

Select Affirm as your payment method when booking and choose the payment plan that works for you.

No hidden fees

Affirm helps you break up payments with no fees or surprises, so you’ll know exactly how much you owe.

Real-time eligibility check

Answer a few questions to check your eligibility -or prequalify to see how much you can spend without affecting your credit score.

Images below are for illustrative purposes only

How to use Affirm on KAYAK

Step 1 – look for the kayak logo **.

Once you find the flight, stay or rental car perfect for you, look for the KAYAK logo when choosing which provider to book with.

**Applicable bookings may be labeled with “Instant booking” and/or a thunderbolt icon.

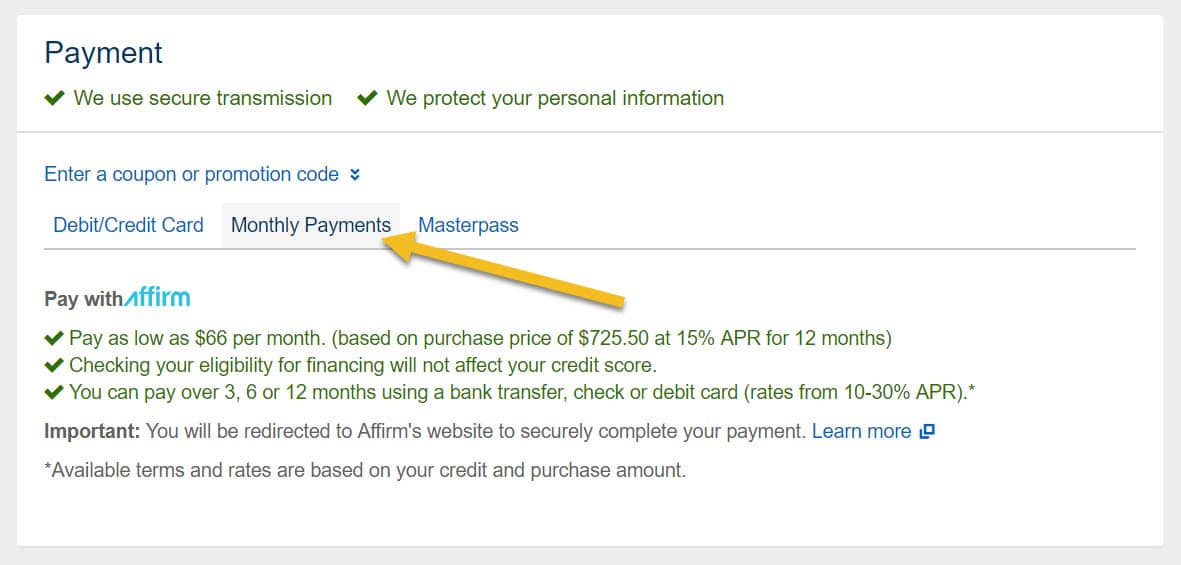

Step 2 – Select “Affirm” as your method of payment

When choosing your payment option, select Affirm as the method of payment for your booking.

Step 3 – Check your eligibility on Affirm

Simply enter your mobile number to confirm your account and answer a few questions to check your eligibility. Don’t stress–this won’t affect your credit score.

Step 4 – Compare your payment plan options

Quickly and easily compare the payment plan options available for your booking.

Step 5 – Review your final payment plan

Review the payment options for your booking and complete your reservation by paying with Affirm.

*Rates from 10–36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see affirm.com/licenses .

Search now and pay with Affirm

Frequently asked questions.

Yes! There’s no penalty for paying early.

You can make or schedule payments at affirm.com or in the Affirm app for iOS or Android. Affirm will send you email and text reminders before payments are due.

No—your credit score won’t be affected when you create an Affirm account or check your eligibility. If you decide to buy with Affirm, this may impact your credit score. You can find more information in Affirm’s Help Center.

Yes, your travel booking must be $150 or greater.

For any cancellation or change requests, please reach out directly to the merchant via customer support service number provided in your booking confirmation emails.

Yes, you’ll need a mobile phone number from the U.S. or U.S. territories. This helps Affirm verify it’s really you who is creating your account and signing in.

You can visit their website at affirm.com .

California consumers have the right to opt out of the sale * of their personal information. For more information on how we securely process personal information, please see our Privacy Policy .

Do not sell my info ON

* The definition of "sale" under the California Consumer Privacy Act is applicable only to California consumers.

- Travel Planning Center

- Ticket Changes & Refunds

- Airline Partners

- Check-in & Security

- Delta Sky Club®

- Airport Maps & Locations

- Flight Deals

- Flight Schedules

- Destinations

- Onboard Experience

- Delta Cruises

- Delta Vacations

- Delta Car Rentals

- Delta Stays

- In-Flight Wi-Fi

- Delta Trip Protection

- How to Earn Miles

- How to Use Miles

- Buy or Transfer Miles

- Travel with Miles

- SkyMiles Partners & Offers

- SkyMiles Award Deals

- SkyMiles Credit Cards

- SkyMiles Airline Partners

- SkyMiles Program Overview

- How to Get Medallion Status

- Benefits at Each Tier

- News & Updates

- Help Center

- Travel Planning FAQs

- Certificates & eCredits

- Accessible Travel Services

- Child & Infant Travel

- Special Circumstances

- SkyMiles Help

Delta Vacations is offering customers a new way to pay for travel. With Affirm, you can choose to make easy monthly payments to go on your vacation without having to pay for it all up front.

How Affirm Works:

- When paying for your travel, select Affirm, provide five simple pieces of information 1 and receive a credit decision in seconds.

- Once approved, you have the option to spread out the cost of your trip over 6, 12, 18 or 24 monthly installments, 2 with any interest shown in simple dollars rather than as a hard-to-calculate interest rate.

- There are no late or hidden fees, so you will never pay a dollar more than you agreed to upfront.

- Upon successful completion of your Affirm loan process, you will receive payment information directly from Affirm. You will also receive an email confirmation from Affirm.

- If you’re unsuccessful obtaining an Affirm loan, you can speak to a Delta Vacations Specialist or call 1-800-800-1504 about other payment options.

For additional information, visit affirm.com , opens in a new window .

Experience everything an island paradise offers with a Delta Vacations Caribbean getaway, from sandy white beaches and breathtaking all-inclusive resorts to every water sport imaginable.

Terms & Conditions

- Your rate will be 10-36% APR based on credit, and is subject to an eligibility check. Payment options through Affirm are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required.

- Affirm only needs five pieces of information for most credit decisions: name, phone number, email address, date of birth and the last four digits of your social security number.

- For example, a $2,000 purchase might cost $124.77/mo over 18 months at 15% APR.

Learn more about us.

Your elevated vacation experience starts here. Choose from flights, hotels, rides and activities all over the world, all in one place.

WE’RE HERE FOR YOU

As trusted experts, we’ll help with recommendations, booking and support — whenever and wherever you need it.

PREFERRED BY SKYMILES® MEMBERS

We make it easier to get more from your miles while also earning bonus miles and earning toward Medallion® Status.

TRAVEL WITH CONFIDENCE

Things come up, and we’ve got you covered, from flexible changes and cancellations to travel protection plans .

- Investor Relations

- Business Travel

- Travel Agents

- Comment/Complaint

- Browser Compatibility

- Accessibility

- Booking Information

- Customer Commitment

- Tarmac Delay Plan

- Sustainability

- Contract of Carriage

- Cookies, Privacy & Security

- Human Trafficking Statement (PDF)

Our expert, award-winning staff selects the products we cover and rigorously researches and tests our top picks. If you buy through our links, we may get a commission. Reviews ethics statement

Advertiser Disclosure

Fly now, pay later. how to buy plane tickets with uplift, affirm and paypal pay in 4.

Give yourself some breathing room when booking a vacation with "fly now, pay later" options.

Buy now, pay later options are popping up everywhere. And if you haven't bought flight tickets since before the pandemic, you may not know that you can buy tickets now and repay the balance later using BNPL apps . Paying for flights with travel and airline credit cards can earn you miles and rewards points -- but credit cards also come along with high, compounding interest rates, which are steadily rising as inflation continues to surge . Also, unlike credit cards which charge compound interest (which means interest accrues on the balance and any previous interest charges), many BNPL services are interest-free and those that aren't often only charge simple interest on the balance borrowed. Though debit cards eliminate the interest rate issue, if you need more space to pay for a trip, using a BNPL service to book your flight may make sense.

Here's everything you need to know about fly now, pay later options.

How to book a plane ticket with BNPL

Many airlines are incorporating BNPL services as a payment method at checkout. But there are also other ways to take advantage of BNPL services when booking flights. We'll run you through the four best strategies below.

1. Buy tickets directly from airlines with BNPL plans

Several airlines have direct partnerships with BNPL services. We recommend thoroughly reviewing the terms of each service before selecting one as your payment method. Some BNPL services have late fees, charge high interest rates or require your first payment at the time of purchase. Many services offer different installment plan options, like four payments every two weeks at 0% interest; a pay-in-30-days strategy (where the entire balance is due 30 days after making the purchase); or longer financing terms of three, six, 12 or even 36 months at a higher interest rate. It's important to review each installment plan closely to avoid high interest when possible and be sure that you can make payments on schedule.

Airlines with BNPL partnerships ( Uplift , Affirm and MarcusPay ) currently include:

- Aeromexico - Uplift

- Air Canada - Uplift

- Alaska Airlines - Uplift

- Allegiant Air - Uplift

- American Airlines - Affirm

- Frontier Airlines - Uplift

- JetBlue - MarcusPay

- Lufthansa - Uplift

- Southwest Airlines - Uplift

- Spirit Airlines - Uplift

- TAP Air Portugal - Uplift

- United Airlines - Uplift

To buy tickets using a BNPL service, you'll visit the airline's website, select your tickets and click the BNPL option at checkout. You'll then be redirected to the BNPL website or app where you'll either enter your login or create an account. From there, the BNPL service may offer different options for splitting up your payments, should explain the interest rate you qualify for (if applicable) and may require your first payment at the time of purchase.

2. Avoid interest with PayPal Pay in 4

PayPal, an online payment service, can be used as a payment method for most airline tickets. And now you can select PayPal's Pay in 4 service, which lets you divide your payment into four biweekly (automatic) installments at 0% interest. While the first installment is due at the time of purchase, you'll have around 45 days to pay off the remaining balance.

3. Book via a third-party travel site

Some third-party flight booking services -- including Kayak, Priceline, Expedia and Travelocity -- offer BNPL options for any airline. If the airline you prefer to fly with is not offering a direct BNPL payment option, you can search for tickets on one of these third-party sites instead.

4. Use a virtual BNPL card

Do you already have a BNPL service you like to use? Many buy now, pay later companies offer virtual cards , which allow you to purchase items online at websites that don't offer BNPL payment options.

Affirm, Afterpay, Klarna, ZIP (formerly QuadPay) and most other major BNPL services offer this option. To get started, you'll need to know the final cost of your purchase, including tax. Log in to your BNPL account and apply for a virtual card, inputting the full purchase amount when prompted. It's helpful to round up to ensure that the card is issued for an amount that fully covers your purchase. Once approved, you'll be given a virtual card number, expiration date and CVV (card verification value), which you can use as a payment method when ordering airline tickets online.

The amount you spend on the virtual card will then be applied to your BNPL account to be repaid in installments.

5. Alternatively, consider a 0% APR credit card

If the BNPL methods you qualify for have high interest rates or if you need more time to repay your purchase, there is another option -- a 0% APR credit card . This type of credit card offers no interest for an introductory period, usually between 15 and 20 months. Just be sure you can repay the total balance within the introductory period, otherwise interest will begin accruing and piling on to your debt.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

'buy now, pay later' can help fund your next trip but here's what you need to know about these loans, select walks you through what you need to know if you're considering a point-of-sale loan to finance your next trip.

With summer in full swing, and many countries easing travel restrictions, you might be eager to plan a post-pandemic trip. Even if you managed to save some money ahead of time, travel expenses can quickly add up, and you might be tempted to choose the 'buy now, pay later' option that's offered at checkout on many travel websites, including Carnival or Expedia.

These point-of-sale loans are seductive to consumers who don't want to pay for their post-pandemic vacations with one lump-sum payment, allowing people to make payments over a fixed period of time, sometimes without high interest rates.

But is using the 'buy now, pay later' option to pay for your flights or hotel stays too good to be true?

Select explores some of the benefits and drawbacks of using 'buy now, pay later' for travel.

What are point-of-sale loans?

How do point-of-sale loans work, should you use point-of-sale loans for travel, bottom line.

'Buy now, pay later' providers (also known as point-of-sale loans) offer consumers the option to sign up for a payment plan either when they're buying something on a retailer's website or directly through the loan provider's website ahead of purchase

Point-of-sale loans give consumers the ability to make installment payments over a fixed period of time until they completely pay off their purchase. This means that you'll make payments toward your purchases bi-monthly or monthly depending on the plan and/ or provider.

These payments can typically be automated by providing your debit card or bank account information. While many providers boast 0% interest rates, some point-of-sale loans can have interest rates upwards of 30%, higher than the APRs on many credit cards.

Some of the most popular providers are Afterpay , Affirm , Klarna and Uplift . Klarna offers point-of-sale loans, some with 0% APR, that allow you to make four payments every two weeks and require a deposit at checkout, while Afterpay allows you to pay over six weeks. Afterpay, Uplift, Klarna and Affirm also offer consumers longer payment periods of up to one, two or even three years.

When you purchase a flight or an item, you're given different financing options at checkout, such as the opportunity to pay with a credit card, gift card or point-of-sale loan . You'll be redirected to the POS provider website where you can enter your personal information.

Some companies won't perform a credit check while others will perform either a soft or hard credit inquiry . Soft credit checks don't negatively impact your credit score , but hard inquiries will temporarily decrease your score. Based on the information you enter, you'll either be approved or denied for the loan.

Afterpay doesn't do any credit checks while Klarna does soft and hard credit checks, depending on the loan.

The impact a point-of-sale one has on your credit score depends on whether the provider reports your payment history to the credit bureaus . For example, Affirm only reports your credit history to Experian for some loans and not others. For the loans that Affirm does report to Experian, your payment history, the length of your credit history with Affirm, the amount of your loan and your late payments can all show up on your credit report.

Make sure to read the terms and conditions of your POS loan to see if your negative payment history is reported to the credit bureaus.

Travel expenses might seem like the perfect opportunity to use a point-of-sale loan because it's oftentimes a big purchase that you might not have the immediate cash on hand to cover.

Klarna, Afterpay, Affirm and Uplift all offer 'buy now, pay later' option for certain travel partners. Affirm has partnerships with Delta Vacations, Priceline, StubHub and Alternative Airlines, a flight booking website. Uplift is exclusively focused on providing point-of-sale loans for travel, with around 200 travel partners , including United Airlines, Kayak , Southwest Airlines and Royal Caribbean.

Uplift will help you cover transactions costing anywhere from $100 to $25,000. Interest rates range from 7% to 30%, but there are a few travel partners such as Carnival Cruise Line and Atlantis that have a 0% APR, according to Tom Botts, chief commercial officer at Uplift. The average APR for an Uplift point-of-sale loan is 15%, which is similar to the average APR for credit cards .

"We use a variety of factors to determine eligibility," Botts says. "Interest rates are based on a number of factors including credit history, transaction amount and time to travel."

Uplift also only performs a soft credit check which won't negatively impact your credit score.

If you're able to secure a loan with 0% APR and make your payments on time, a point-of-sale loan could be a good choice for funding a trip. But if those monthly payments won't easily fit within your budget, be wary of a POS loan and read the fine print beforehand to determine how much you'll end up paying in interest.

For example, if you use Affirm to finance your purchases on Alternative Airlines , you can only get a 0% APR on your point-of-sale loan if you buy a flight that costs less than $500. If your ticket costs more than $500 , you could incur an interest rate of up to 30%, depending on your creditworthiness.

If you spend $1,000 on a flight and choose a 12-month payment plan with Affirm, you'll have to cough up nearly $100 in interest if you have a 20% APR on your loan. One perk of using Affirm over a credit card is that you'll have a longer payment period (of 3, 6, 12 or 18 months) which helps to spread the expenses over time into more manageable payments. And with an installment loan from Affirm or Uplift, the interest doesn't compound month over month, so your payment stays the same over the loan's term.

But a big drawback of using point-of-sale loans for travel is having to deal with unexpected problems, like trip cancellations or delays, says Priya Malani, the CEO and founder of Stash Wealth.

"If a trip is canceled or delayed with unexpected fees, your loan is still due. You're on the hook for the agreed upon total. Even though you may have checked out in one fluid process, you're still working with two separate entities — the travel provider and the POS loan provider," Malani says.

When it comes to funding your resort stay in Cancun or your flight to the Maldives, there are other options for financing your trip.

Travel rewards credit cards offer higher rewards rates for money spent on travel and the points you earn can go toward booking flights or hotels. While travel credit cards typically come with an annual fee, some offer a 0% introductory period, so you won't have to worry about high interest rates kicking in for 12 months or longer. If you go the 0% APR route, make sure you set up a repayment plan and pay the minimum each month so you don't end up paying late fees or big interest charges.

The Chase Sapphire Preferred® Card is currently offering a welcome bonus offer where new cardholders can earn 60,000 points after they spend $4,000 on purchases in the first three months from account opening. Points can be redeemed for $750 worth of travel when booked through Chase Travel℠.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

The Capital One Venture Rewards Credit Card (see rates and fees ) is also a solid choice but comes with a smaller welcome bonus and higher rewards rate than the Preferred, giving 2X miles per dollar on every purchase and a welcome offer of 75,000 bonus miles if you spend $4,000 within three months of account opening.

Capital One Venture Rewards Credit Card

5 Miles per dollar on hotel and rental cars booked through Capital One Travel, 2X miles per dollar on every other purchase

Earn 75,000 bonus miles once you spend $4,000 on purchases within 3 months from account opening

N/A for purchases and balance transfers

19.99% - 29.99% (Variable)

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

See rates and fees . Terms apply.

Travel cards also often come with additional perks such as car rental insurance, trip cancellation insurance and purchase protection. You won't get any of these perks when you use a POS loan for travel.

If you worry about putting a big expense on your credit card or you're only eligible for a POS loan with high APR, you should also consider creating a travel fund instead.

By saving your money in a high-yield savings account , you'll be earning more (thanks to compound interest ) than you would be if you put your money in either a checking account or a traditional savings account. Creating a separate fund for travel can also give you a money goal to strive for and setting up automatic monthly transfers can help you avoid spending money on other short-term, more frivolous purchases.

Point-of-sale loans are attractive because of how easy they are to use — you simply provide some basic information about yourself to the loan provider before checking out and you can instantaneously get a loan that will allow you to spread the cost of your trip over a few months. If you're not diligent about reading the fine print, however, there can be a lot of caveats to using the 'buy now, pay later' option, including high interest rates and late fees.

- How Quicken Simplifi can help you get a grip on your spending Elizabeth Gravier

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

- 3 best Chase balance transfer credit cards of 2024 Jason Stauffer

Vrbo just got better

Book your dream trip now, pay later with affirm.

Your next getaway is closer than you think. Find vacation homes offering Affirm as a payment option.

I am traveling with pets

If checked, only properties that allow pets will be shown

Introducing a new way to pay

With a unique selection of 2+ million whole homes all over the world, finding the perfect place for your family to get away together is easy. And now paying at your own pace with Affirm gives everyone more options - choose between 3 to 24 monthly payments. You’ll also get access to 24/7 support and our Book with Confidence Guarantee free with every booking. So go for it. Your together awaits. Affirm is available on select properties. Look for the Affirm logo on eligible listings.

Rates from 0–36% APR. For example, a $700 purchase might cost $63.18/mo over 12 months at 15% APR. As low as 0% APR promotion runs 5/1/2023 to 5/14/2023 or until funds are expended, whichever occurs first. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. See affirm.com/licenses for important info on state licenses and notifications.

Top vacation destinations

Carousel cards.

Miramar Beach

14,428 vacation rentals

5,991 vacation rentals

Hilton Head Island

8,271 vacation rentals

Panama City Beach

16,137 vacation rentals

Gulf Shores

12,500 vacation rentals

7,992 vacation rentals

8,160 vacation rentals

4,565 vacation rentals

4,878 vacation rentals

15,727 vacation rentals

Top picks in Miramar Beach

Photo gallery for sandy beach estate: gated, 9100 sq ft estate with pool, hot tub, game room perfect for events.

SANDY BEACH ESTATE: Gated, 9100 sq ft Estate with Pool, Hot Tub, Game Room! Perfect for Events!

Photo gallery for elegant beachfront condo w/extended private balcony 🐚.

Elegant beachfront condo w/extended private balcony! 🐚

Photo gallery for two homes for the price of one beachfront 7 bed with pool - private beach.

Two homes for the price of one!!! Beachfront 7 Bed with pool - private beach!

Photo gallery for hgtv home 60 seconds to beach great for families ocean view sleeps 12.

HGTV home! 60 seconds to Beach! Great for Families! Ocean view Sleeps 12

Photo gallery for ☀️open for christmas-beach front-amazing views-5br little house on the beach.

☀️OPEN for Christmas-BEACH Front-Amazing Views-5BR Little House on the Beach

Photo gallery for 6 bikes & golf cart walk to the beach & pool - salty okie at frangista beach.

6 Bikes & Golf Cart! Walk to the Beach & Pool! - Salty Okie at Frangista Beach

Top picks in charleston, photo gallery for bright historic charleston luxury condo.

Bright Historic Charleston Luxury Condo

Photo gallery for charming downtown charleston 3 bedroom home two blocks to king st with parking.

Charming Downtown Charleston 3 Bedroom Home Two Blocks To King St With Parking

Photo gallery for charming full home minutes from folly beach & downtown.

Charming full home minutes from Folly Beach & Downtown

Photo gallery for 2bd 1 bath unit and you can see the golf course.

2bd 1 bath unit and you can see the golf course

Photo gallery for awesome property, great downtown charleston location sleeps 10.

AWESOME PROPERTY, GREAT DOWNTOWN CHARLESTON LOCATION! Sleeps 10

Photo gallery for folly beach riverfront apt w/ brand new dock, private boat ramp kayaks and bikes.

Folly Beach Riverfront Apt w/ BRAND NEW dock, private boat ramp kayaks and bikes

Top picks in hilton head island, photo gallery for super value vacation house: private beach, golf, pool.

SUPER VALUE VACATION HOUSE: PRIVATE BEACH, GOLF, POOL

Photo gallery for direct oceanfront with million dollar views top floor/end unit.

DIRECT OCEANFRONT with Million Dollar Views Top Floor/end unit

Photo gallery for 10 bedroom-pool/elevator/fire pit/outdoor bar/palmetto dunes resort.

10 Bedroom-Pool/Elevator/Fire pit/Outdoor Bar/Palmetto Dunes Resort

Photo gallery for new listing 2nd row ocean completely remodeled in 2021 (sleeps 24 in beds).

New Listing! 2nd Row Ocean completely remodeled in 2021 (Sleeps 24 in beds)

Photo gallery for 45 s sea pines dr.- mom-mom & pop-pops place.

45 S Sea Pines Dr.- Mom-Mom & Pop-Pops Place

Photo gallery for seaside villa 225- direct oceanfront.

Seaside Villa 225- Direct Oceanfront

Top picks in panama city beach, photo gallery for resort like paradise, steps from beach 10 bikes, 6 seat golf cart, kayaks/sup.

Resort Like Paradise, Steps from Beach! 10 Bikes, 6 Seat Golf Cart, Kayaks/SUP

Photo gallery for charming pied-a-terre-sophisticated charm-adult getaway.

Charming Pied-a-Terre-Sophisticated Charm-Adult Getaway!!!

Photo gallery for relaxing 3b/3br beachside condo close to everything you need- family/friends/pet.

Relaxing 3B/3BR Beachside Condo Close to Everything You Need- Family/Friends/Pet

Photo gallery for gulf front right on the beach dog friendly.

Gulf front! Right on the Beach! Dog friendly!

Photo gallery for #332 updated pets ok-walk 2 pier park-beach.

#332 Updated PETS OK-WALK 2 PIER PARK-BEACH!

Photo gallery for walk out 2 beach ground floor no elevators.

Walk Out 2 Beach Ground Floor No Elevators!

Top picks in gulf shores, photo gallery for full remodel ~ 9 br ~ gulf front ~ private pool ~ sleeps 30 ~ ocean awaits 1 beach house.

Full Remodel ~ 9 BR ~ Gulf Front ~ Private Pool ~ Sleeps 30 ~ Ocean Awaits 1 Beach House

Photo gallery for beachfront condo. now offering discounted weekly summer rates.

BEACHFRONT CONDO. NOW OFFERING DISCOUNTED WEEKLY SUMMER RATES!

Photo gallery for direct beach front view, cute studio condo, beachside pool, great for couples.

DIRECT BEACH FRONT VIEW, CUTE STUDIO CONDO, BEACHSIDE POOL, GREAT FOR COUPLES!

Photo gallery for spring special - 2/1 beach side affordable condo.

Spring Special - 2/1 beach side affordable condo

Photo gallery for pet friendly-west corner unit-gulf front-2 pools.

Pet Friendly-West Corner Unit-Gulf Front-2 Pools

Photo gallery for wits end, east. gulf shores. 6br, 6ba. pool. awesome 2nd floor beach walkover.

Wits End, East. Gulf Shores. 6BR, 6BA. Pool. Awesome 2nd floor beach walkover!

Top picks in clearwater, photo gallery for beachfront cottage on the gulf of mexico groundfloor direct oceanfront.

BEACHFRONT COTTAGE! On the Gulf of Mexico! Groundfloor! Direct OCEANFRONT!

Photo gallery for beachfront-6 bedroom/5 bathroom house with rooftop deck.

BEACHFRONT-6 Bedroom/5 Bathroom House with Rooftop Deck

Photo gallery for large vacation home with private lazy river and outdoor kitchen.

Large Vacation Home with private Lazy River and Outdoor Kitchen

Photo gallery for top floor , walk to beach, pool, free parking, #427, sleeps 6.

Top Floor , Walk to Beach, Pool, Free Parking, #427, Sleeps 6

Photo gallery for turtleback beach house | beachfront.

Turtleback Beach House | Beachfront

Photo gallery for fully renovated indian rocks beach getaway.

Fully Renovated Indian Rocks Beach Getaway

Rates from 0–36% APR. 0% APR valid from 5/1-5/14. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: www.affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see www.affirm.com/licenses

More vacation ideas

- Key West vacation rentals

- Maui vacation rentals

- Nashville vacation rentals

- Charleston vacation rentals

- Branson vacation rentals

- New Orleans vacation rentals

- Asheville vacation rentals

- Breckenridge vacation rentals

- Lake of the Ozarks vacation rentals

- Marathon vacation rentals

- Sedona vacation rentals

- Savannah vacation rentals

- Nantucket vacation rentals

- St. Simons Island vacation rentals

- Santa Barbara vacation rentals

- Jackson vacation rentals

- Hot Springs vacation rentals

- Martha's Vineyard vacation rentals

- Estes Park vacation rentals

- New Hampshire vacation rentals

- Other vacation rentals destinations

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

- Travel Tips

16 Airlines That Let You Book Flights Now and Pay Later

Planning a trip but don't want to pay for it all at once? These sites offer book-now, pay-later flights.

Orbon Alija/Getty Images

If you think a vacation is out of your reach, think again. Some airlines and online travel agencies have services that allow you to book a trip now and pay for it over time.

Affirm, PayPal, Uplift, and Klarna are among the book-now, pay-later services travel companies and airlines offer. Here, we break down the basics of these and airlines' own "BNPL" options so you can secure flights when the prices are lowest, even if you don't want to pay for them in full upfront.

Airlines Offering Book-now, Pay-later Flights

AeroMexico connects major U.S. cities to Latin American destinations like Guadalajara and Puerto Vallarta. The airline partners with Uplift to provide a monthly payment option. When you go to book a flight, you'll see an option to pay in monthly installments. Click through and you'll be asked for any personal information Uplift needs to process the loan.

You can also pay in installments through Klarna. Download the Klarna extension for Chrome or the app and you should see a pink "K" icon that will show you financing options. AeroMexico takes PayPal, which means you can use PayPal Credit to split up payments if you're approved.

Pay monthly for Air Canada flights and Air Canada Vacations packages with Uplift or PayPal Credit.

Alaska Airlines

Alaska Airlines partners with Uplift and Klarna to offer financing for flights.

Allegiant also uses Uplift and Klarna to provide payment plans. Select the Allegiant Pay option at checkout to choose financing through Uplift.

American Airlines

American Airlines offers several ways to buy now and pay later, including Klarna; PayPal Credit; Citi Flex Pay for select Citi cardholders; and Affirm, which has biweekly, monthly, and interest-free options but doesn't cover the cost of any flight extras, like luggage. American Airlines Vacations also gives you the option to pay monthly with Uplift.

Azul Airlines is a low-cost Brazilian airline that accepts payments through Uplift and PayPal.

Delta Air Lines

Delta offers PayPal Credit as a payment option, and you can pay using Affirm if you book your trip through Delta Vacations , a service for SkyMiles members that bundles flights, hotels, transportation, and activities.

One of the United Arab Emirates' two flag carriers, this airline partners with financing institutions Uplift and Klarna. You can also pay with PayPal Credit.

Frontier Airlines

Budget carrier Frontier Airlines lets you pay monthly installments through Uplift on purchases of $49 or more. If eligible, you will see the option at checkout. Frontier is also a Klarna retail partner.

KLM offers customers the option of holding a fare for 72 hours for a non-refundable fee. This is great if you find a fare that you want to book but need a few days to think about it. In addition, the airline takes PayPal Credit. This service is shown on the payment page as a "Bill Me Later" option, but directs you to your PayPal wallet.

Lufthansa has a list of payment methods on its website . Some monthly payment options are available specifically for residents of Brazil and Colombia. U.S. residents may pay monthly through PayPal Credit.

Porter Airlines

Porter , a Canadian airline, allows customers to use Uplift and PayPal to purchase flights across the U.S. and Canada.

Qatar Airways

Unless you're flying from Brazil, Brunei, or Kazakhstan, you can hold any Qatar Airways booking for up to 72 hours. How long prospective travelers can hold their Qatar flights depends on where they intend to fly to and from. The "Hold My Booking" option, available on the payment page, requires a non-refundable fee that doesn't go toward the price of your ticket. In most cases, you can also use PayPal Credit.

Southwest Airlines uses Uplift to break the cost of the flight up into fixed monthly payments. It also accepts PayPal Credit and Klarna.

Sunwing connects Canadian cities with destinations in Mexico and the Caribbean. You can pay for plane tickets in monthly installments through Uplift.

United Airlines

Use Uplift, PayPal Credit, or Klarna to pay for United Airlines flights in monthly installments. The company also has a program called FareLock that allows you to pay a fee to hold a fare for three, seven, or 14 days before paying for it in full. If you decide not to buy the ticket, you forfeit the fee. This service is offered only on itineraries wholly operated by United Airlines and/or United Express.

Online Travel Agencies Offering Monthly Payment Options

Alternative airlines.

Any ticket booked through Alternative Airlines can be paid for in weekly, biweekly, or monthly installments with Uplift. The online travel agency markets itineraries by more than 600 airlines, and Uplift financing can be used for all of them. You can also split payments through Klarna.

CheapOair.com

CheapOair uses Affirm to offer customers a monthly payment option.

Funjet Vacations

Funjet Vacations uses Uplift to offer monthly payments for its flights and vacation packages.

Priceline uses Affirm to handle monthly payments. Select the "monthly payments" option on the secure billing step of the booking process and choose from three-, six-, or 12-month options. Alternatively, break it up into four payments over six weeks using Klarna.

How Buy-now, Pay-later Services Work

Airlines and travel agencies partner with BNPL services like the travel-specific Uplift or the more broadly available Affirm to offer monthly payment options. Some take payments through PayPal Credit and/or Klarna. Learn about the differences between these services and how they work.

Affirm allows customers to pay monthly or every two weeks. Terms can last up to 48 months for the largest loans, but more typically, they last up to a year. Interest rates vary by person, ranging from 0% to 36% APR, and are determined at the time of sign-up. A down payment and credit check might be required when you apply for a loan.

To use Affirm, you will need a phone number to use as an account login. The service is available only in the U.S. and Canada. Once you've created your account and gotten approved for a loan amount, you can set up auto-pay or pay each month via the app or website. You can find a full list of Affirm's travel partners, including airlines and accommodations, on its website .

PayPal Credit

This is a monthly payment option provided by travel companies that take PayPal. Typically, you'll choose PayPal as your payment method, and once you sign into your PayPal account, you can choose PayPal Credit . As of 2023, the variable purchase APR is about 28% for new accounts, but you can avoid paying interest altogether if you pay the loan off within six months. Loan applications are subject to credit approval.

Uplift is the leading pay-over-time financing service in the travel space, partnering with cruise lines, hotel chains, airlines, and more. Once you have selected a product, like your flight, you are shown a per-month rate based on the price of the items in your shopping cart. When you get to the payment page and choose monthly payment as your option, you will be asked for some personal details, and once you click "check rate," you will be told whether you've been approved. Uplift offers an APR of 0% to 36% based on your credit. You won't be penalized for paying late or early, and you can set up autopay so the money comes out of your account automatically.

Klarna breaks up the price of your ticket into monthly payments or four equal payments to be made two weeks apart. Add the Klarna extension to your Chrome browser or download the app on your phone, then book your flight as usual, selecting Klarna at checkout. The first payment will be due upfront. Klarna offers an APR of 0% to about 30%.

Book now, pay later

Vacation financing through Affirm is available for U.S. stays with a total rent of at least $250. Select "Pay later with Affirm"* at checkout.

How Affirm works

See if you’re eligible by providing some basic information. You’ll get a real-time decision (and your credit score won’t be affected).

Know exactly what you’ll owe before you commit. No hidden costs, no surprises.

Choose to pay in installments over 3, 6, 12, or 18 months*—even after the date of your trip.

Your trip, your way

When you finance your vacation with Affirm, your payment schedule is just one of the things you won't have to worry about.

Our professional property management includes 24/7 guest support, premium cleaning, and seamless check-in for your most relaxing vacation yet.

Sign up for emails

Curated tips & inspiration for your next vacation.

Choose from thousands of places to stay

Affirm travel FAQ

Who is eligible to apply for affirm financing on a vacasa stay.

While Affirm requires you to be at least 18 years old, you must be at least 21 to book a Vacasa home. (Some of our homes and destinations require a higher minimum age to rent the property—you'll see that specified on the property listing, if applicable.)

You must also be a U.S. resident booking a home within the U.S.

Does Affirm do a credit check, and how does it impact my credit score?

If you choose to pay with Affirm, we ask for some basic personal information to see if you're eligible. You'll get a real-time decision on whether you prequalify for a vacation loan. This process includes a quick credit check—but it does not affect your credit score.

How do I make my payments?

After you complete your Vacasa trip purchase, look out for an email directly from Affirm about your vacation payment plan. You can make secure payments on Affirm's website, or through their app. Visit Affirm's help center for more details on making loan payments.

Can I amend my order after my purchase has been processed?

If you need to adjust your reservation after purchase, you can do so in your Trip Manager . For any changes that come with additional fees (such as adding pets or pool heat), you'll need to pay for those with a credit card. Those charges cannot be added to your existing loan through Affirm.

And, if you end up needing to change dates or cancel your reservation, good news—trips paid for with Affirm still fall under our worry-free booking policy . You'll also see your change and cancellation options in your Trip Manager.

Can you make payments on a trip to Hawaii?

Yes, you can. We offer vacation payment plans through Affirm on U.S. stays, including those in Hawaii (as long as the rent totals at least $250).

Where to next?

Rates from 0–36% APR. For example, a $700 purchase might cost $63.18/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. See affirm.com/licenses for important info on state licenses and notifications.

- Things to do

Explore > Company > News > Book your flight and hotel now, pay later

Book your flight and hotel now, pay later

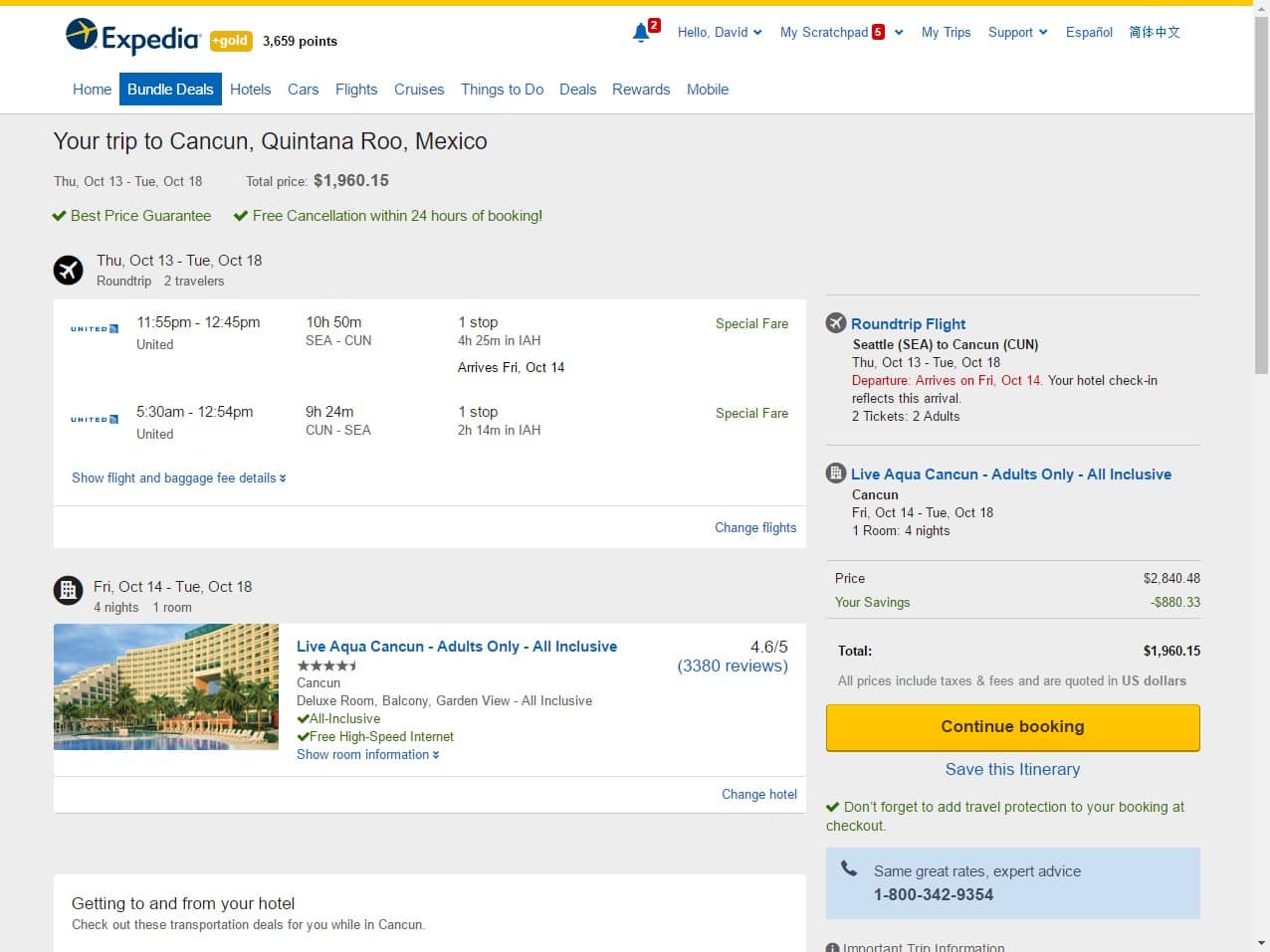

We are always looking ahead at new payment options and technologies to help alleviate the stress of booking your dream vacation. Are you on a tight budget, or perhaps you just prefer to pay for big purchases over time? Great news, we now have you covered!

Expedia recognizes there’s no one-size-fits-all approach to budgeting for vacation so next time you’ve caught the wanderlust bug or need to get home for Christmas but are struggling to pay for those flight and hotel reservations upfront, you can now breathe a sigh of relief. We’ve recently expanded our partnership with online lender Affirm to give you the flexibility of spreading out the cost of your flight and hotel package booking over numerous payments instead of paying the full amount of your trip upfront.

Our team is incredibly passionate about making travel accessible for all—everyone deserves a vacation! We’ve received positive feedback from our customers who have used Affirm to book and pay for hotels on Expedia , and now we are excited to bring this payment offering to Expedia customers shopping for flight and hotel packages as well.

Ready to take advantage of more payment flexibility when you travel? Here’s how you can use Affirm on Expedia to book your next hotel and flight package.

1) Visit expedia.com , search for and select a flight and hotel.

Upon selecting your package, select the Monthly Payments tab .

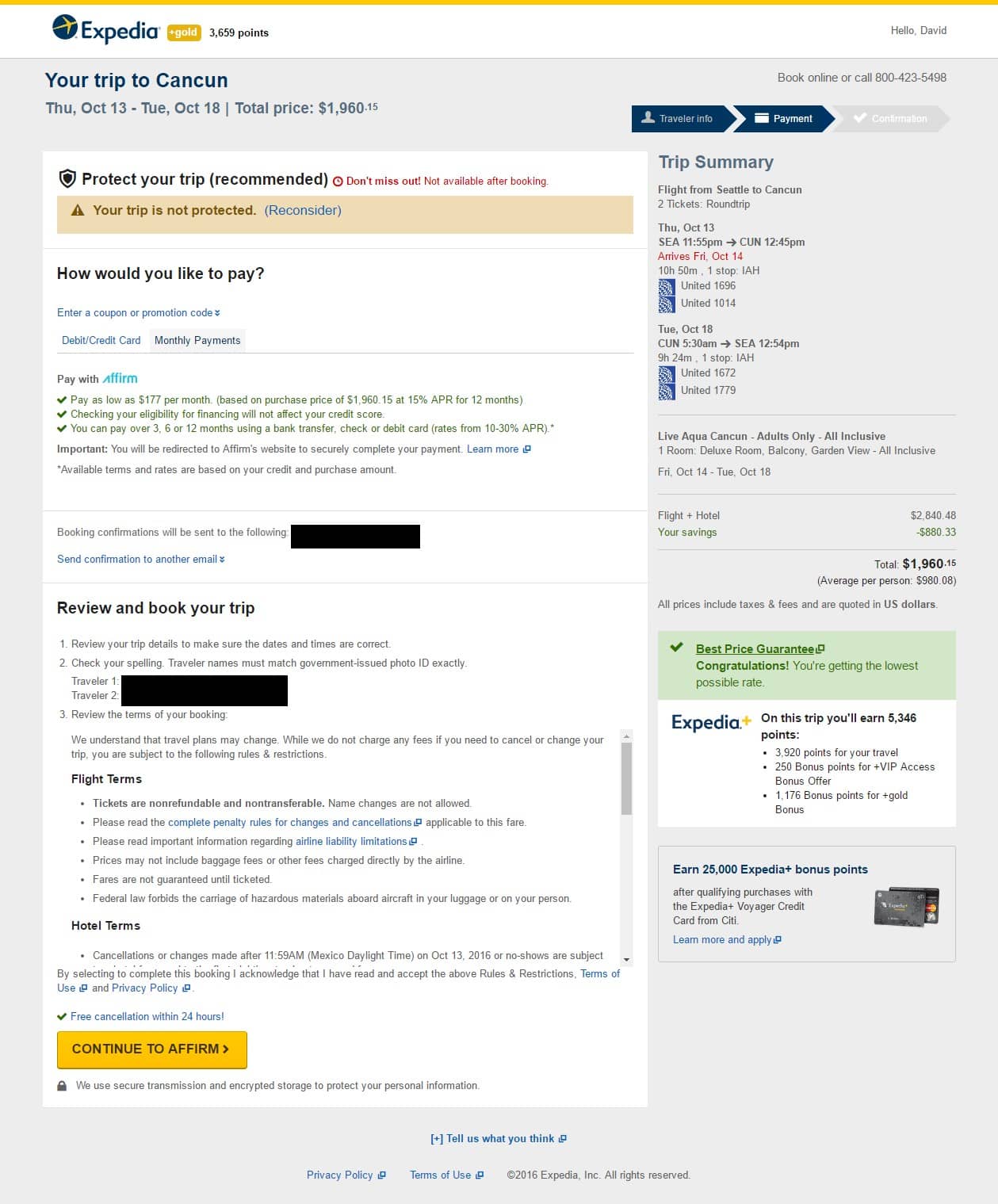

2) Click on “Continue to Affirm”

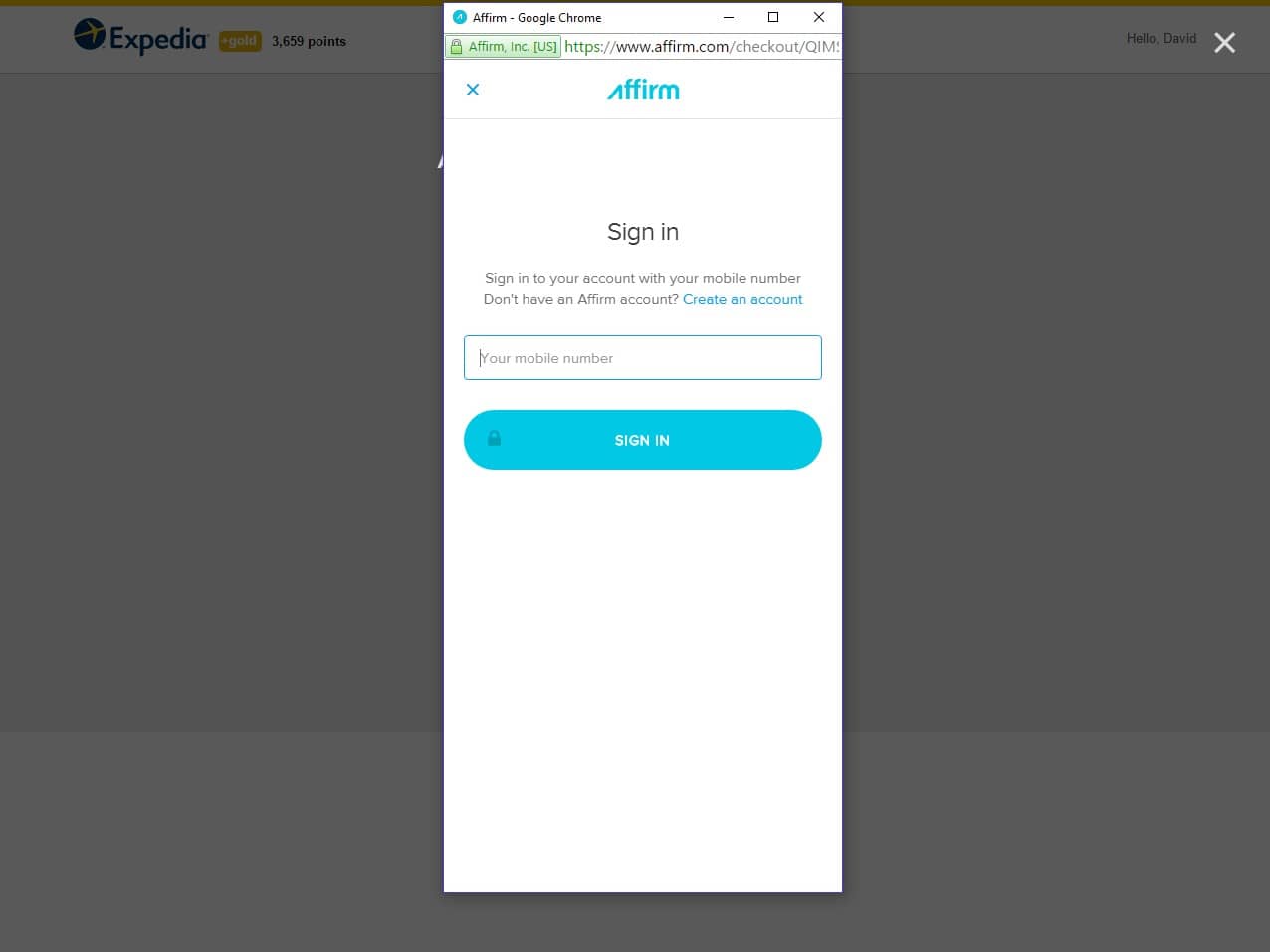

3) Create an account or sign in to Affirm

You will be transferred to a secure Affirm sign-in page. Shoppers apply using top-of-mind information about themselves and receive a real-time decision at checkout.

4) Complete your reservation with Affirm

Now you’re ready to jet set!

Expedia also offers exclusive Book Now, Pay Later hotel deals , so there’s no reason to let the cost of accommodation keep you from your travel plans.

What’s holding you back? Plan and book your next dream vacation today!

More Articles With Company

- Favorites & Watchlist Find a Cruise Cruise Deals Cruise Ships Destinations Manage My Cruise FAQ Perfect Day at CocoCay Weekend Cruises Crown & Anchor Society Cruising Guides Gift Cards Contact Us Royal Caribbean Group

- Back to Main Menu

- Search Cruises " id="rciHeaderSideNavSubmenu-2-1" class="headerSidenav__link" href="/cruises" target="_self"> Search Cruises

- Cruise Deals

- Weekend Cruises

- Last Minute Cruises

- Family Cruises

- 2024-2025 Cruises

- All Cruise Ships " id="rciHeaderSideNavSubmenu-4-1" class="headerSidenav__link" href="/cruise-ships" target="_self"> All Cruise Ships

- Cruise Dining

- Onboard Activities

- Cruise Rooms

- The Cruise Experience

- All Cruise Destinations " id="rciHeaderSideNavSubmenu-5-1" class="headerSidenav__link" href="/cruise-destinations" target="_self"> All Cruise Destinations

- Cruise Ports

- Shore Excursions

- Perfect Day at CocoCay

- Caribbean Cruises

- Bahamas Cruises

- Alaska Cruises

- European Cruises

- Mediterranean Cruises

- Cruise Planner

- Make a Payment

- Beverage Packages

- Shore Excursions

- Dining Packages

- Royal Gifts

- Check-In for My Cruise

- Update Guest Information

- Book a Flight

- Transportation

- Book a Hotel

- Required Travel Documents

- Redeem Cruise Credit

- All FAQs " id="rciHeaderSideNavSubmenu-7-1" class="headerSidenav__link" href="/faq" target="_self"> All FAQs

- Boarding Requirements

- Future Cruise Credit

- Travel Documents

- Check-in & Boarding Pass

- Transportation

- Perfect Day at CocoCay

- Post-Cruise Inquiries

- Royal Caribbean

- Celebrity Cruises

How do I pay for my cruise with Affirm?

At the end of your online booking process you will get to the “Choose your payment amount” window. Once there, select “Pay the total balance" and “Use this payment method” box in the Affirm section under “How would you like to pay” . You will make payments using the Affirm app or website.

Please refer to helpcenter.affirm.com for specifics regarding loan approval and payment. Payments made using Affirm are subject to the terms and conditions established by your agreement with Affirm.

Still need help? Contact Us

Get support by phone or email.

Email Your Questions

Locate a Travel Agent

Previewing: Promo Dashboard Campaigns

My Personas

Code: ∅.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Pay Later Travel

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Pay later is becoming a popular travel tool. In 2019, $10 million was spent on travel-related " buy now, pay later ." However, by 2021, $800 million was spent on travel-related buy now, pay later.

With pay later becoming more widely available and used for travel expenses, we'll dive into what you need to know to see whether this financing option is a smart money move for you.

There are different types of pay later travel options

“Pay later” travel is a broad term, but it generally falls into one of two categories:

Buy now, pay later services where you pay for your travel in equal installments, sometimes with added interest. Examples include travel booked using Affirm and Uplift.

Travel that you book in advance but don’t pay for until later. An example is Hotels.com, which will sometimes let you reserve a room and pay for it at check-in.

Basically, as long as you’re not paying in full for the travel upfront, it qualifies as pay later travel.

Some travel companies offer pay later travel options directly

There are several ways to book pay later travel, including booking directly with certain airlines, hotels and other travel companies that offer pay later at checkout, including:

Alaska Airlines.

Southwest Airlines.

United Airlines.

» Learn more: The best travel credit cards right now

Some of these companies offer pay later travel through a partner, and others offer buy now, pay later travel directly.

For instance, Southwest offers buy now, pay later through Uplift, whereas Hilton allows you to book certain reservations by putting a credit card down and then paying in full when you check out.

» Learn more: Are buy now, pay later flights worth it?

There are companies that specialize in pay later that you can use for travel

If you want to use pay later travel for your trip and the airline, hotel or travel company doesn’t offer pay later travel directly, you may be able to pay for your travel later by using a company that specializes in that option — companies like Affirm , Zip , Uplift and Afterpay .

You may also be able to use your credit card for pay later travel. For instance, Chase has a service called My Chase Plan where you can split a purchase of $100 or more into equal monthly installments for a fixed monthly fee instead of credit card interest.

» Learn more: Buy now, pay later already comes standard on many credit cards

Pay later travel may cost you more

Using a pay later service may cost you more money overall, so be sure to read the fine print before opting for pay later travel.

Do the math to compare how much you’ll pay over time versus how much you’ll pay if you pay for the travel upfront.

For example, CheapOair — which offers buy now, pay later travel through Affirm — has a disclaimer:

"Rates from 10–36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required."

In CheapOair’s example, you would either:

Pay $800 by paying for your travel upfront.

Pay $866.52 by using pay later travel ($72.21 per month times 12 months).

Because paying later on travel can end up costing you more, unless you’re able to get pay later travel at a 0% interest rate, you should use it only occasionally and stick to paying upfront when you can.

» Learn more: How to make a flight payment plan with no credit check

Your credit may be affected by paying later

Deferring payments on travel may affect your credit score — another reason that this shouldn’t be your go-to option. Affirm, one of the major players in pay later travel, says this about whether using the company will affect your credit:

"Creating an Affirm account and seeing if you prequalify will not affect your credit score. If you decide to buy with Affirm, these things may affect your credit score: making a purchase with Affirm, your payment history with Affirm, how much credit you've used, and how long you’ve had credit."

When using pay later travel companies like Affirm, Zip and Uplift, you should consider it as a loan that can help and hurt your credit score, and it should not be taken out lightly.

» Learn more: Could a buy now, pay later loan affect my credit?

The bottom line

When it comes to travel expenses, these installment loan options generally fall into one of two categories: buy now, pay later services where you pay in equal partial payments (sometimes with an added fee or interest rate) and travel that you book and then pay in full later, like a hotel reservation that doesn’t require payment until checkout.

Although there are travel companies that offer pay later services directly, like Alaska Airlines, Hilton and Priceline, you can also turn to other companies — like Affirm and Uplift — to pay less upfront.

Before financing travel with a pay later service, note that it may cost you more money in the long run and also may affect your credit score, so be sure to do research and read the fine print.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Uplift is the leader in Buy Now, Pay Later for travel .

When you pay monthly for a flight, a cruise, a hotel, or vacation package – you’re giving yourself the freedom to travel farther and explore more enjoyably. Millions of consumers choose Buy Now, Pay Later options for vacation and travel so that they can say “yes” to all those bucket-list items and pay over time.

Paying monthly with Uplift helps you avoid late fees or annual fees you may incur using a credit card. Not to mention you’ll never have to worry about prepayment penalties, debt traps, or compound interest using Uplift.

Whether you’re traveling for work, to visit family or friends, or simply taking that trip you’ve always been dreaming of, using Uplift to pay for flights in installments or spread the cost of your hotel into monthly payments is the perfect option.

Unlike other Buy Now, Pay Later companies, Uplift’s Customer Service Squad is available 24/7 and provides unparalleled service from purchase to final payment.

A few of our partners:

Uplift knows just how much thought, care, and planning goes into creating the most memorable experiences. Lump-sum costs shouldn’t hold you back from booking.

When it comes to paying monthly for your vacation purchases, rest easy knowing that Uplift is the original Buy Now, Pay Later for travel.

Take a look at what our valued travelers have been saying lately.

My daughter just moved from CA to TX and was not able to come home for Thanksgiving. I thought I would surprise her with a visit from myself, her brother and his wife. She will be very happy.

So excited this will be my first trip to Las Vegas an I can take it off my bucket list thanks to Uplift.

Was a great option to pre-book flights without having to pay the entire amount! We travel with a family of 5 so everything is always expensive!

Need more answers to your questions about Uplift? Start here.

Why choose Uplift?

Uplift gives you the freedom to purchase what you want now and pay with fixed monthly payments. Uplift is often a better alternative to credit cards because Uplift charges only simple interest while some credit cards charge interest on interest. Uplift also makes budgeting easy so you can manage your expenses over time rather than paying one large sum all at once.

What kind of products and services can I purchase using Uplift?

Uplift can be used to purchase a wide range of products and services from our travel partners and retailers. Click here to see a full list of our current partners who offer Uplift. Click here to see a full list of our current partners who offer Uplift.

Get the app

What is the advantage of using Uplift vs a credit card?

While some credit cards charge interest on interest, Uplift charges only simple interest. If you carry a balance on a credit card, it can be hard to understand what it will cost you. With Uplift, the cost is clear at the time of purchase, with simple interest, predictable payments, and no fees.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Ce site utilise des témoins de connexion. En continuant à naviguer sur le site, vous acceptez que nous utilisions des témoins.

Cookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

- Updated Terms of Use

- New Privacy Policy

- Your Privacy Choices

- Closed Captioning Policy

Quotes displayed in real-time or delayed by at least 15 minutes. Market data provided by Factset . Powered and implemented by FactSet Digital Solutions . Legal Statement .

This material may not be published, broadcast, rewritten, or redistributed. ©2024 FOX News Network, LLC. All rights reserved. FAQ - New Privacy Policy

Walmart backed startup fintech launches buy now, pay later option

Walmart has already been using affirm to help customers pay over time.

Buy now, pay later is adding more pain to people's budgets: George Kamel

Ramsey Solutions personal finance expert and 'The Ramsey Show' co-host George Kamel discusses the 'buy now, pay later' craze and the trend that celebrates the financial benefits of being childless.

The Walmart-backed financial technology company, One, is helping customers to buy now and pay later.

The payment option is being used in some of Walmart's stores. The Arkansas-based retailer has over 4,000 stores around the U.S. but it didn't specify which stores are using One.

One declined to comment.

AMERICANS USING BUY NOW, PAY LATER TO AFFORD GROCERIES, OTHER NECESSITIES

According to One’s website, the pay over time feature applies to purchases between $100 and $3,000. It also comes with an annual percentage rate (APR) between 9.99% and 35.99%, which depends on your creditworthiness.

One's system rivals that of Affirm, which Walmart already uses to help customers purchase products across its stores and online.

Buy now, pay later services, which let customers pay for purchases over time, have been growing in interest in recent years, especially at a time when Americans are contending with persisting inflation , high interest rates and student loan payments.

A Walmart location in Chicago on April 12, 2023. (Christopher Dilts/Bloomberg via / Getty Images)

Over the holiday season, for instance, online spending during Cyber Week was driven in large part by "Buy Now Pay Later" options, according to Adobe.

CYBER MONDAY SALES REACH $12.4B DRIVEN BY 'BUY NOW, PAY LATER'

Usage of such services hit an all-time high on Cyber Monday, accounting for $940 million, an increase of 42.5% year over year. Cart sizes also rose 11% annually as shoppers leaned on the service.

While they help consumers with flexibility, financial experts warn that there are pitfalls.

A woman loads groceries into her car at a Walmart Supercenter in Coal Township, Pennsylvania, on Aug. 12, 2022. (Paul Weaver/SOPA Images/LightRocket via / Getty Images)

For one, customers need to ensure they have the money to cover the payments when due. If a consumer keeps missing payments, they could very easily be handed over to a debt collector, Martha Callahan, certified financial planner at Maryland-based FBB Capital Partners, previously told FOX Business.

"It's similar to using a credit card where you make the purchase now, but when it comes time to pay that debt, if you don't have the cash on hand to make the payment. You're just digging yourself into a deeper financial hole," Callahan said.

Not all payments are interest free either.

For instance, Walmart noted on its website that Affirm may offer special financing as low as 0% APR but only on select Walmart.com products.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Walmart continued saying on its website that "0% APR is a promotional financing offer that is specific to certain Walmart.com products for a limited time."

Buy now, pay later lender Affirm pushes into elective medical procedures

By Hannah Lang

(Reuters) - Fintech lender Affirm has started quietly offering "buy now, pay later" (BNPL) loans for elective medical procedures, in a major push beyond its core e-commerce market, the company told Reuters.

Over the past year, Affirm has more than doubled the number of elective medical merchants on its network, reaching around 130 at of the end of 2023. The San Francisco-based company is hoping to tap growing consumer demand for financing for cosmetic treatments, dental services, medical devices and veterinary procedures.

"A lot of these price points are about $2,000 and above, so that suits our installment product... really well," Pat Suh, Affirm's senior vice president of revenue, said in an interview.

While Affirm has been adding elective medical providers since the middle of last year, it has not previously discussed or publicized its push into the sector, the first by a major BNPL provider in the U.S. market, the company said.

Affirm's installment product charges between 0% and 36%, depending on the purchase price and a borrower's credit profile.

"It's a smart growth strategy," said Ted Rossman, senior industry analyst at Bankrate, a consumer finance publisher. "They're already doing a lot with e-commerce, and that'll continue to grow, but it's always about the next big thing."

In 2022, the global market for cosmetic procedures and dental services combined was worth more than half a trillion dollars, market research firm Grand View Research estimated.

Global veterinary services were worth $124.37 billion in 2023, according to Precedence Research.

Buy now, pay later exploded in popularity as the COVID-19 pandemic forced more shoppers online.

The move into medical highlights how lenders in the space are trying to expand beyond what Affirm Chief Executive Max Levchin described to analysts in November as the "e-commerce cage."

It could also fuel concerns among regulators and advocacy groups that BNPL lending, which has grown rapidly, is leading consumers to borrow more than they can afford.

As part of the expansion, Affirm has partnered with Weave, a customer relationship management platform for small and medium-sized healthcare businesses, as a distribution partner.

BNPL providers partner with retailers like Amazon.com and Walmart to finance customer purchases, earning a commission on the sale and interest on the loan, which shoppers repay in a handful of installments. BNPL loans drove $75 billion in online spending in 2023, up 14.3% from 2022, according to Adobe Analytics.

Despite that growth, some fintech lenders have been pressured by high interest rates and inflation, which have driven up their borrowing costs and customer delinquencies, though Affirm's 30-day delinquencies are currently steady compared to the year prior.

The company's shares are down more than 30% from its initial public offering price in January 2021.

While most BNPL purchases are for discretionary consumer goods like clothes and beauty, spending on services, travel, healthcare and even education has been growing since 2019, according to a 2022 U.S. Consumer Financial Protection Bureau (CFPB) report.

Affirm is marketing elective medical procedure loans as an alternative to medical credit cards, like Synchrony Financial's CareCredit, and installment loans. Those products typically waive interest payments for a promotional period after which annual interest is on average 27%, according to the CFPB.

"Being able to shift consumers away from paying these types of high interest and deferred rates into a product like ours, we think there's a lot of value to that," Suh said.

Affirm declined to disclose the average interest rate it charges customers for elective medical purchases, but said that nearly half of its transactions in the category are at 0% APR - a higher proportion compared to other categories.

The company has been tightening credit standards and said in a Feb. 8 earnings report that 30-day delinquencies on monthly loans were flat from a year earlier at 2.4%.

'FINANCIAL DISTRESS'

Still, some consumer advocates worry the growth of BNPL may contribute to a consumer debt crisis.

BNPL borrowers are more likely to have lower credit scores and lower savings on average, according to the CFPB. U.S. borrowers on lower incomes are increasingly struggling to keep up with their loan payments, Reuters reported on Monday.

Because many BNPL lenders do not provide comprehensive data to credit reporting agencies, consumer advocates have warned that the firms have little insight into borrowers' indebtedness.

"One of our long standing concerns is a cumulative impact of multiple buy now, pay later loans on top of other expenses and debt obligations, which could really push the consumer over into over-indebtedness and financial distress," said Delicia Hand, a senior director at Consumer Reports.

Affirm mostly lends to near-prime and prime -- credit scores between about 620 and 719 -- borrowers. The company says it only lends what customers are able to repay, total charges are disclosed upfront, and there are no late or hidden fees.

Affirm looks at every customer's financial position, Suh said, "in order to offer them an appropriate amount of credit."

(Reporting by Hannah Lang in New York; editing by Michelle Price and Bill Berkrot)

Now you can put your Botox on Affirm

- Buy now, pay later company Affirm is starting to offer loans for elective cosmetic procedures.

- BNPL works differently from a credit card — critics say it can encourage people to pile on debt.

- It's not just available for Botox, though. Dental and vet bills can be paid this way, too.

"Buy now, pay later" company Affirm has identified a new category for growth, according to a new report from Reuters : elective medical procedures like Botox, nose jobs, and even dental treatments.

Buy now, pay later options like Klarna and Affirm have become ubiquitous at checkouts on e-commerce retail sites for some time. Klarna even had a Super Bowl ad. But until recently, these companies have largely focused on retail purchases.

Related stories

Now, BNPL is moving into the medical arena — a first for a major buy now, pay later company, according to the Reuters report:

Over the past year, Affirm has more than doubled the number of elective medical merchants on its network, reaching around 130 at of the end of 2023. The San Francisco-based company is hoping to tap growing consumer demand for financing for cosmetic treatments, dental services, medical devices and veterinary procedures. "A lot of these price points are about $2,000 and above, so that suits our installment product ... really well," Pat Suh, Affirm's senior vice president of revenue, said in an interview.

On one hand, financing cosmetic procedures is nothing new. A plastic surgeon or dentist may offer their own financing plans, and certainly, people use personal credit cards or other personal loan products for these things.

BNPL can appeal to people who don't have a credit card, perhaps because they're young and don't have a credit history or have bad credit. This can be a good thing, giving purchasing power to those who wouldn't otherwise have it. But BNPL apps typically don't help people build credit. They don't send positive payment information to the credit bureaus, but if your account goes into collections, it can negatively affect your credit score.

They can also trip those same people up. In 2022, a LendingTree report found that 42% of people who had used BNPL had at least one late payment. And those late payment fees can start to add up.

The services can also lead young people down a bad road, encouraging overspending with the allure of a seemingly low monthly payment. Business Insider reported recently how BNPL loans grew by 10 times between 2019 and 2023, creating a significant amount of "phantom debt" in the US economy since it's not typically reported to credit bureaus.

I know: It can be hard to sympathize with someone who's using lip filler they can't afford by putting it on Affirm. But go back to what it's actually being used for: "cosmetic treatments, dental services, medical devices, and veterinary procedures."

That means it's not just lip filler and Botox.

People who might need a root canal or a crown for a chipped tooth — the kind of necessary care that can be very expensive even with dental insurance — might be using Affirm. Or veterinary bills: any pet owner knows the horrible choice they face if their dog or cat needs an expensive surgery.

Watch: The fake doctors behind Asia's cosmetic surgery boom

- Main content

- Share full article

‘Pay Later’ Lenders Have an Issue With Credit Bureaus

Firms like Experian and TransUnion say it is time for “buy now, pay later” loans to appear on consumer credit reports. The lenders aren’t ready to sign on.

Credit... Monica Garwood

Supported by

By Jordyn Holman and Ben Casselman

- April 23, 2024

Shoppers in recent years have embraced “buy now, pay later” loans as an easy, interest-free way to purchase everything from sweaters to concert tickets.

The loans typically are not reported on consumers’ credit reports, however, or reflected in their credit scores. That has stoked concerns that users might be taking on an outsize amount of debt that is invisible to both lenders and financial regulators.