- Travel Advice

- Travel Insurance FAQ

Life Insurance in Travel Insurance: How Does it Work?

Last Updated: April 17, 2013 October 13, 2023

In addition to Trip Cancellation and Emergency Medical benefits, life insurance coverage is another concern for travelers. Depending on the policy, some travel insurance providers may already include life insurance benefits. They may also be offered as an additional upgrade to a travel insurance policy. There are three types of life insurance benefits which can be purchased separately or in combination with each other.

Life Insurance – Accidental Death – This benefit provides coverage for accidental loss of life or limb while traveling at any time during the trip. Keep in mind that this benefit only pays in the event of an accident. It typically doesn’t cover any loss resulting from Pre-Existing Conditions or self-inflicted injury.

Life Insurance – Common Carrier – Typically, this coverage pays in the event of death or dismemberment while traveling on ticketed public transportation. This can include planes, trains, cruise ships or buses.

Life Insurance – Air Flight Accident – This benefit provides coverage for accidental death or dismemberment during a flight only. A traveler would need to be a passenger on a regularly scheduled airline for benefits to apply.

If travelers select policies with all three life insurance options it does not mean they would receive multiple payouts. Instead, if an accidental death or dismemberment case were to fall under multiple categories, only the higher payout would be given.

As with any travel insurance policy, it is important to look closely at the policy certificate to understand what will be covered and what is excluded.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

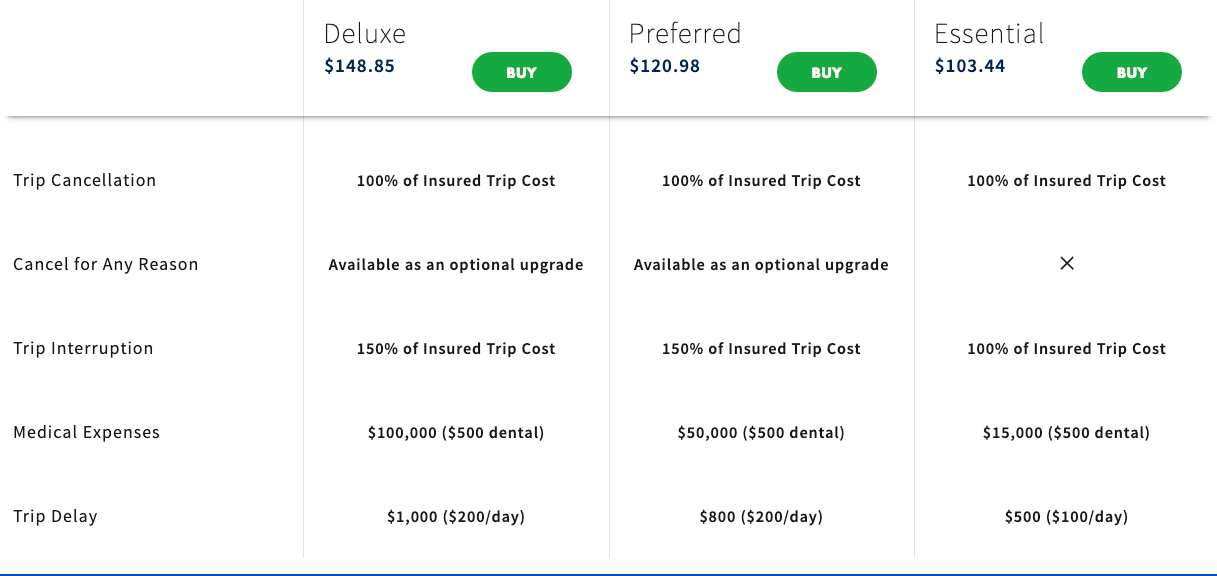

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

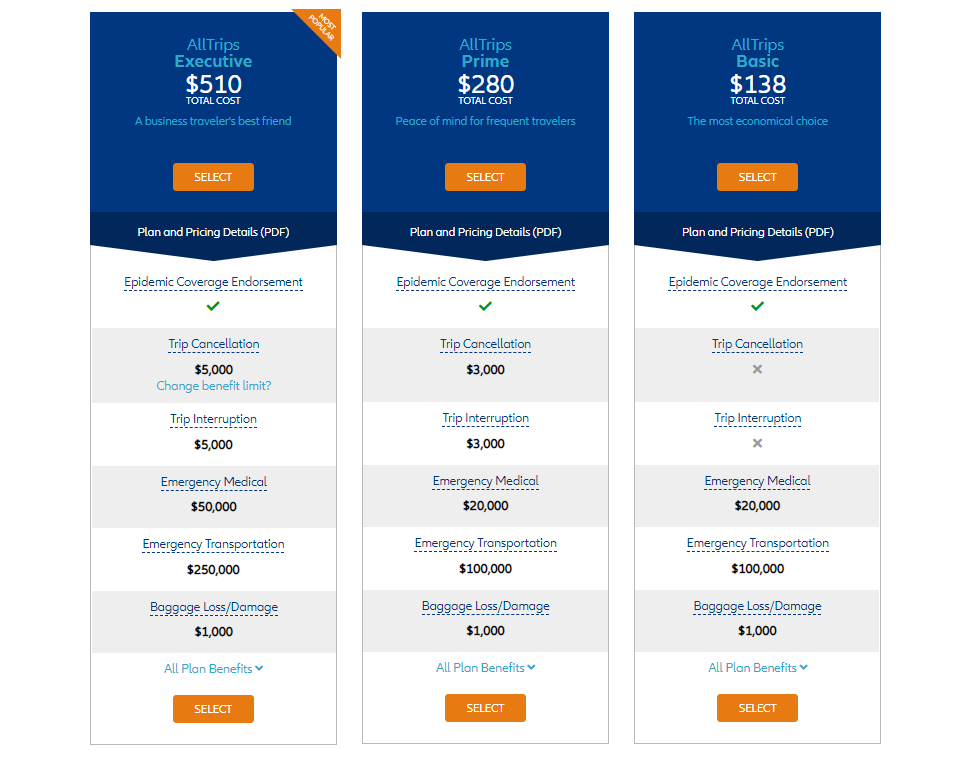

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

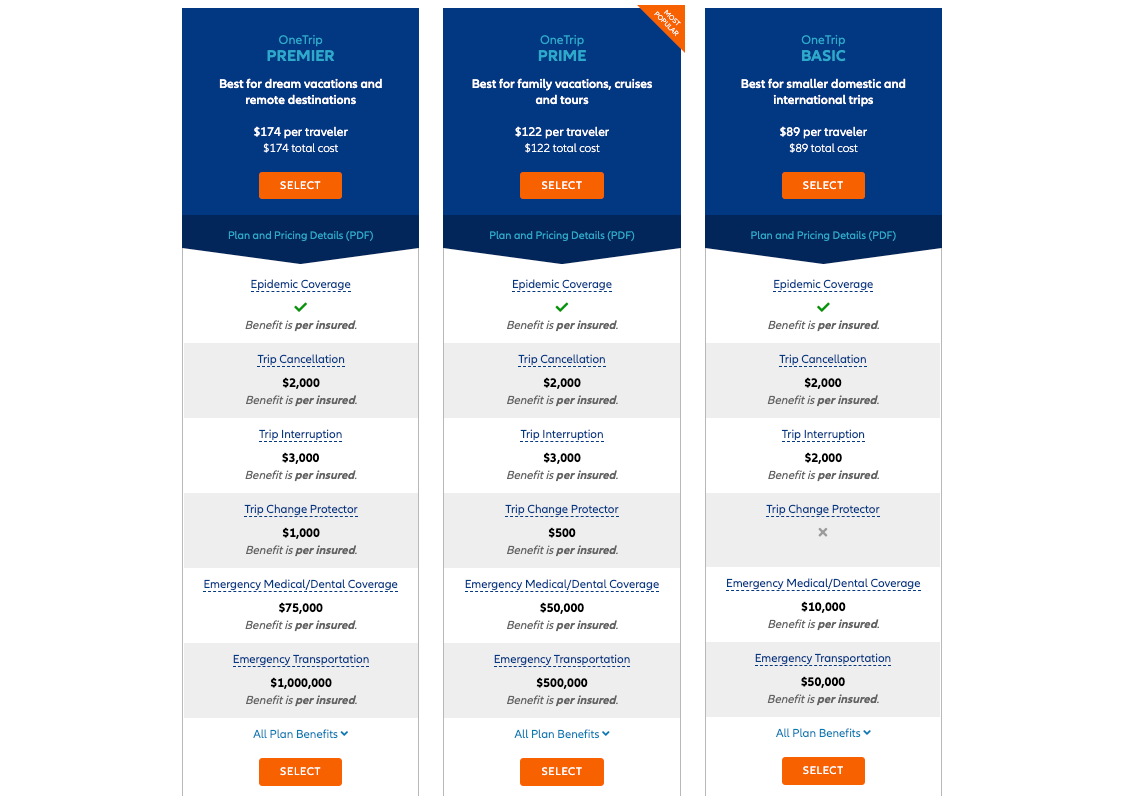

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

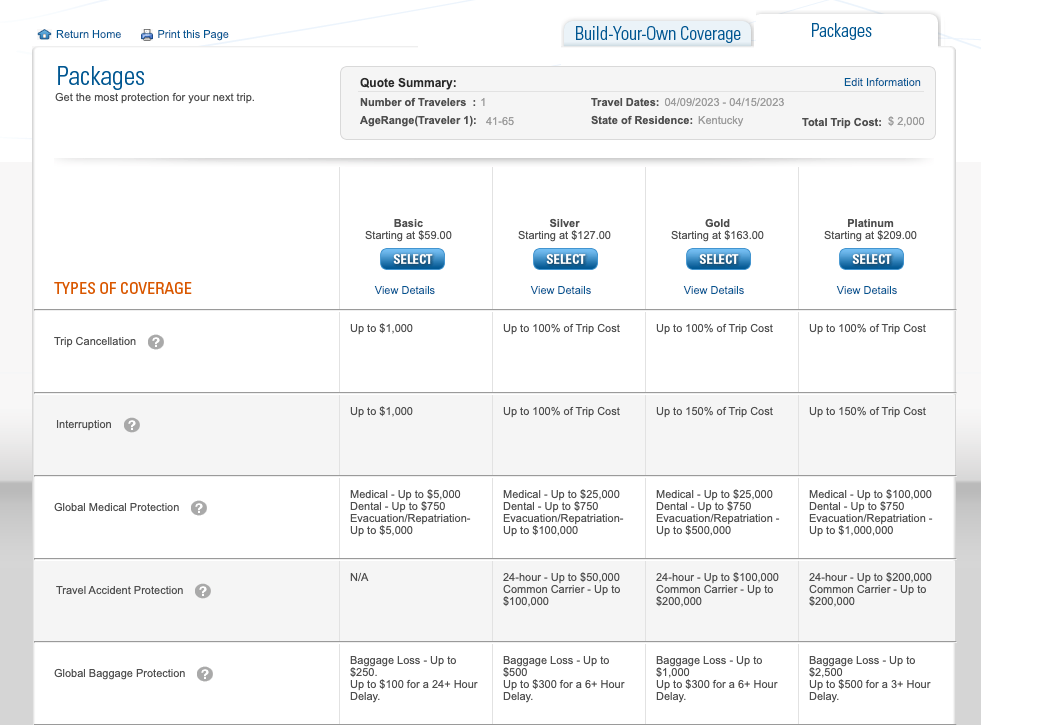

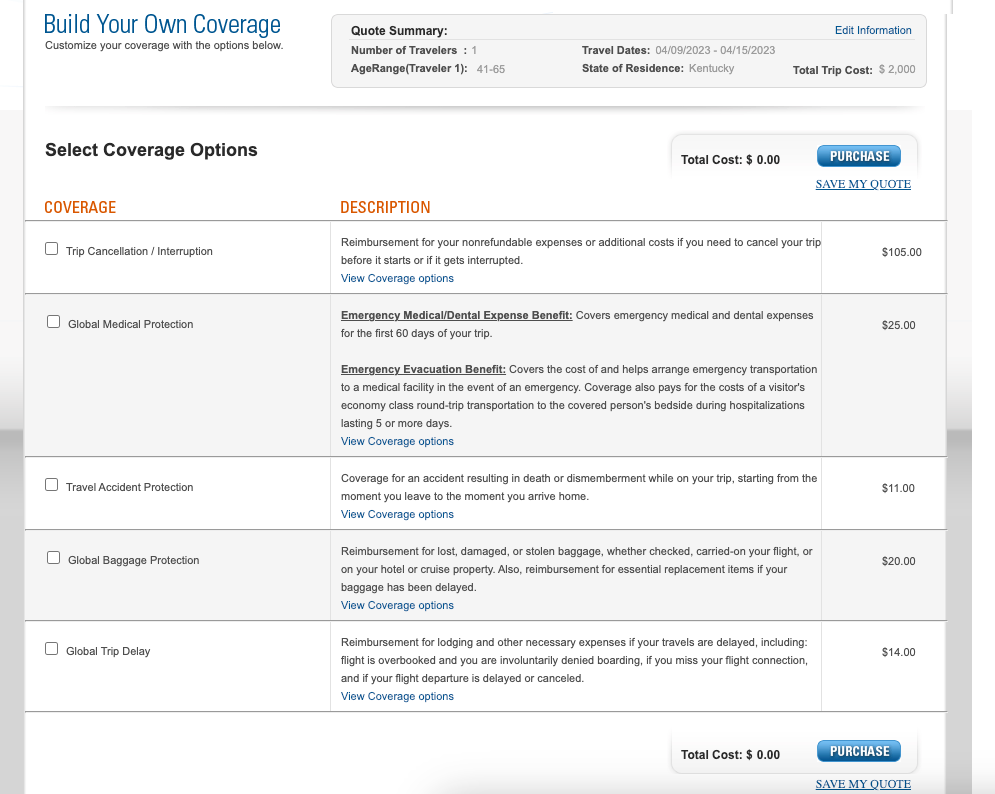

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

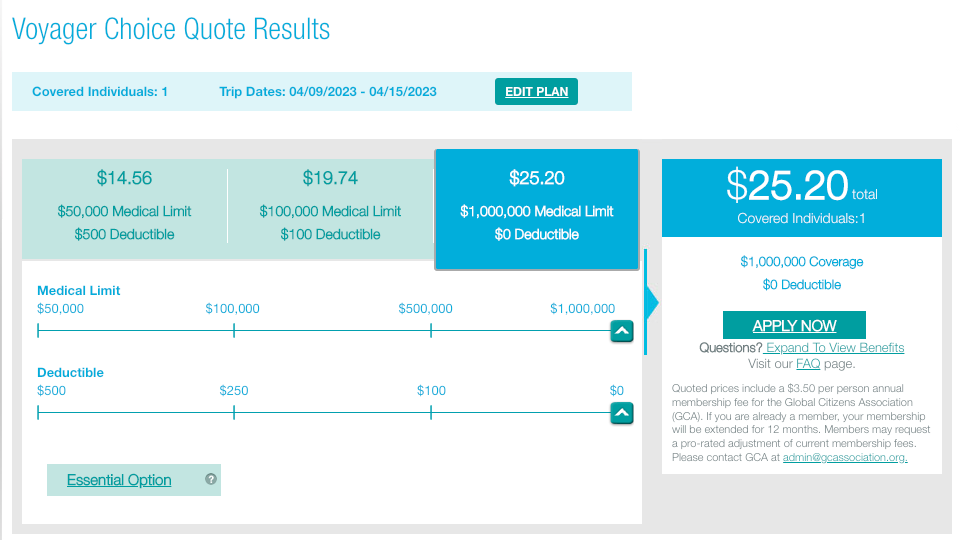

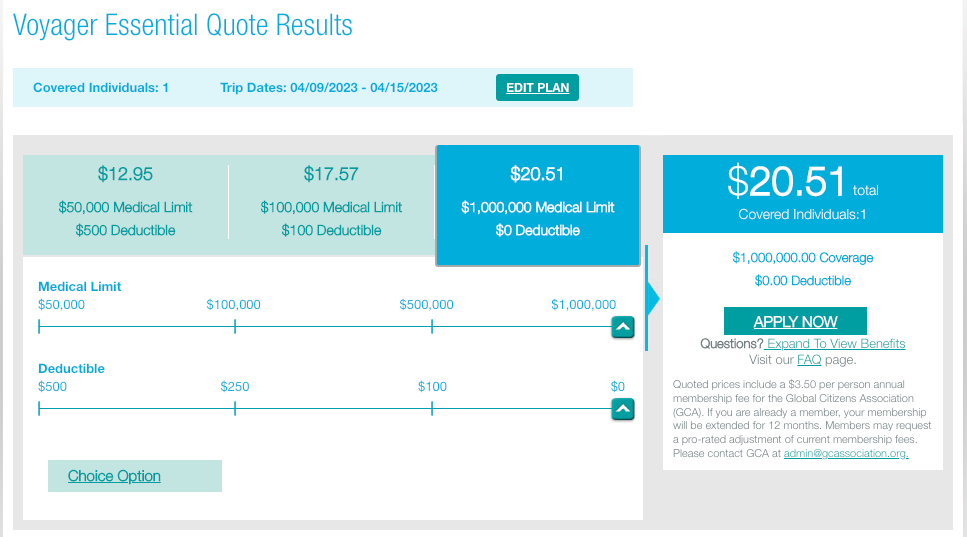

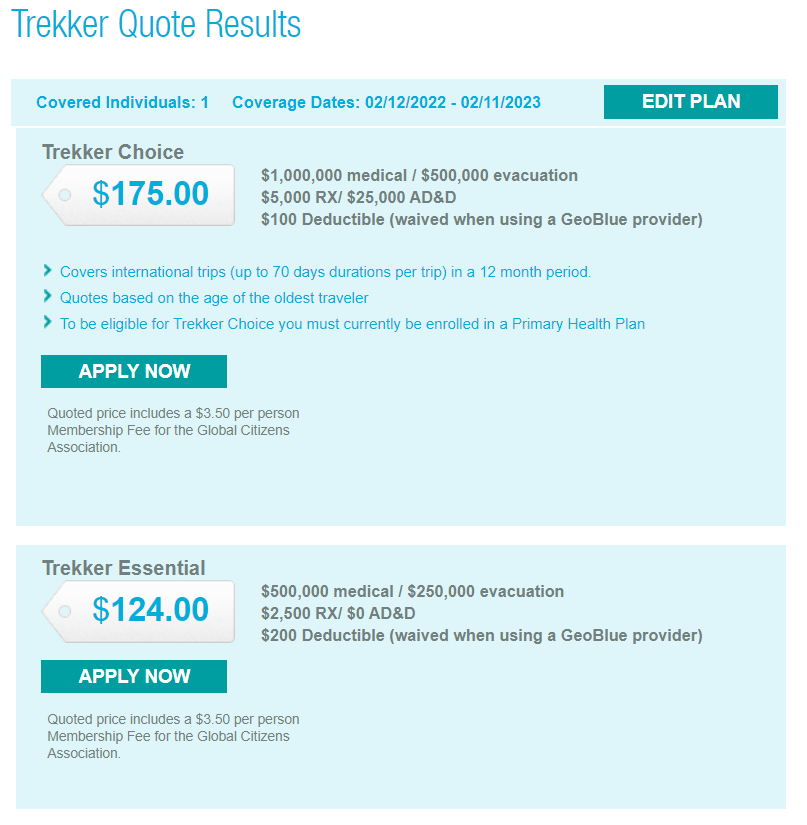

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

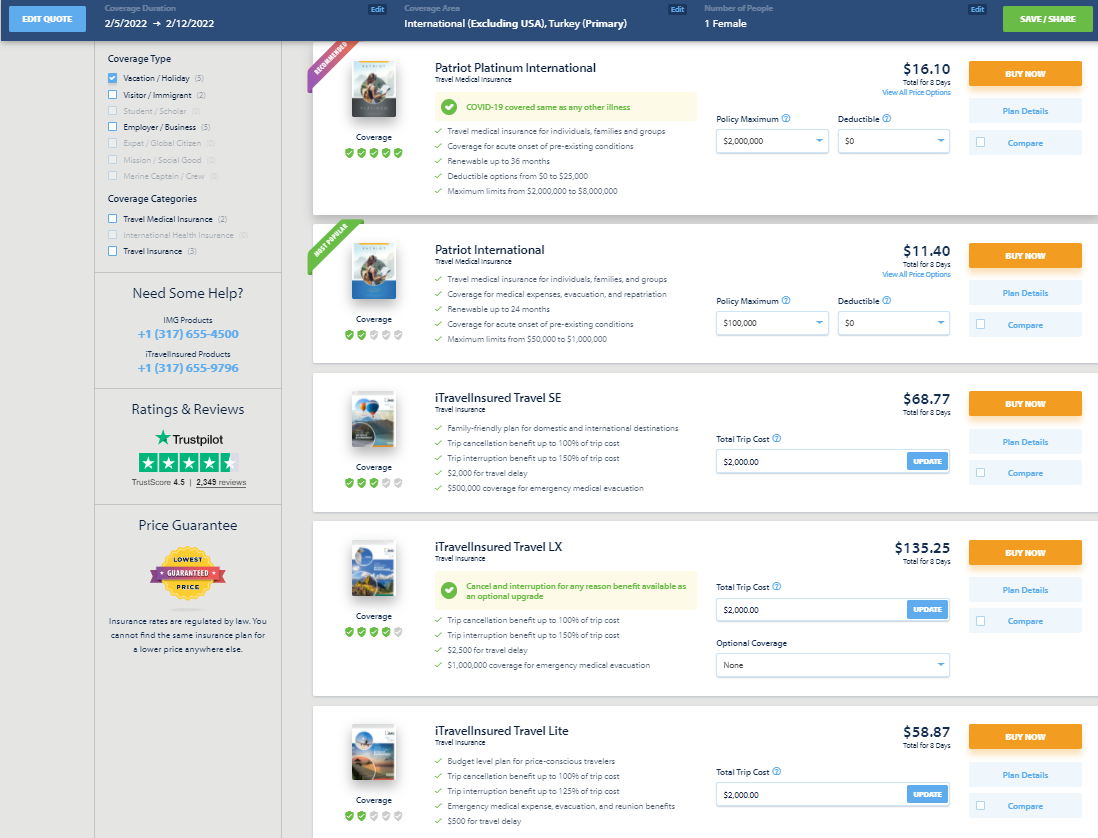

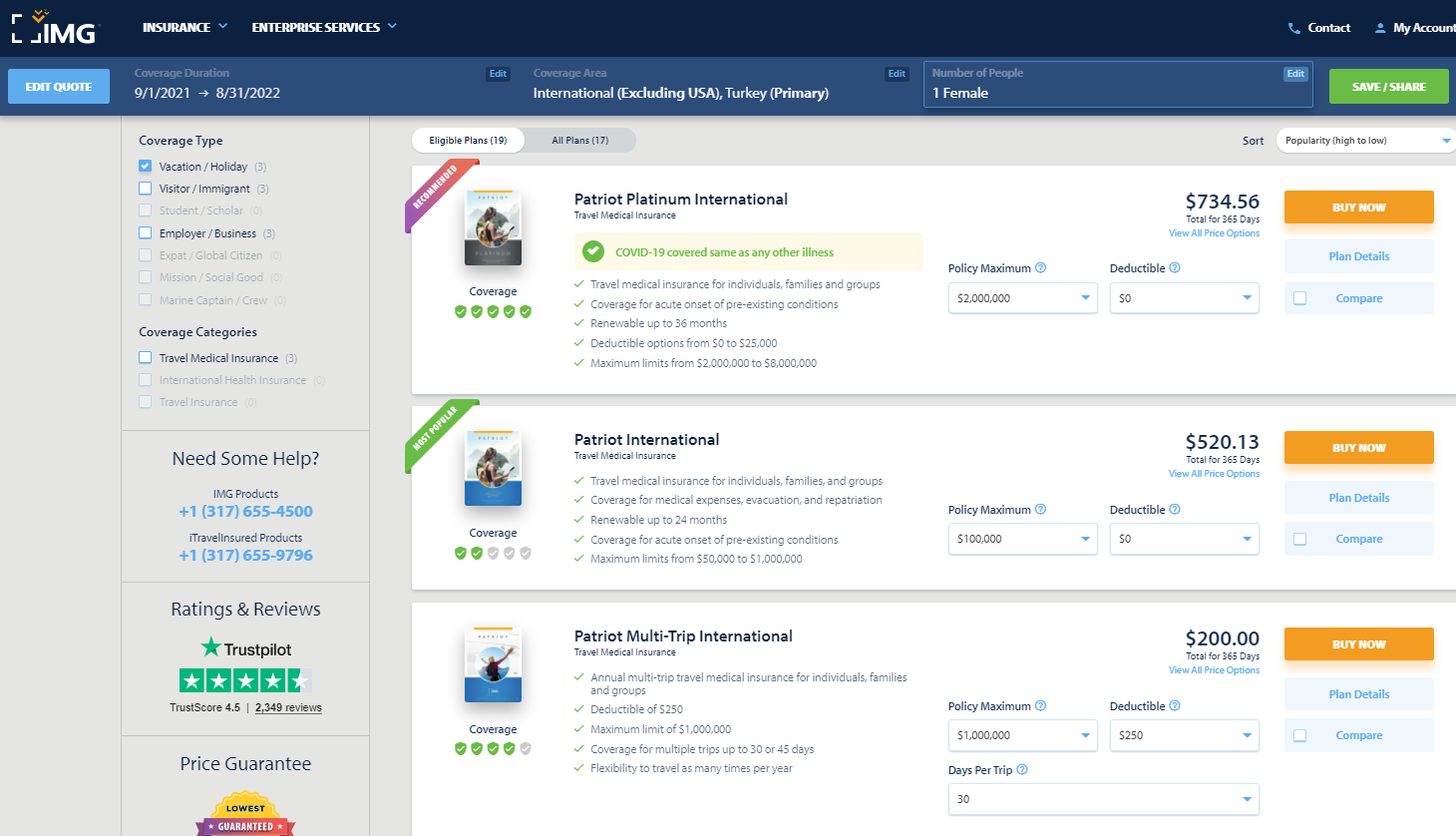

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

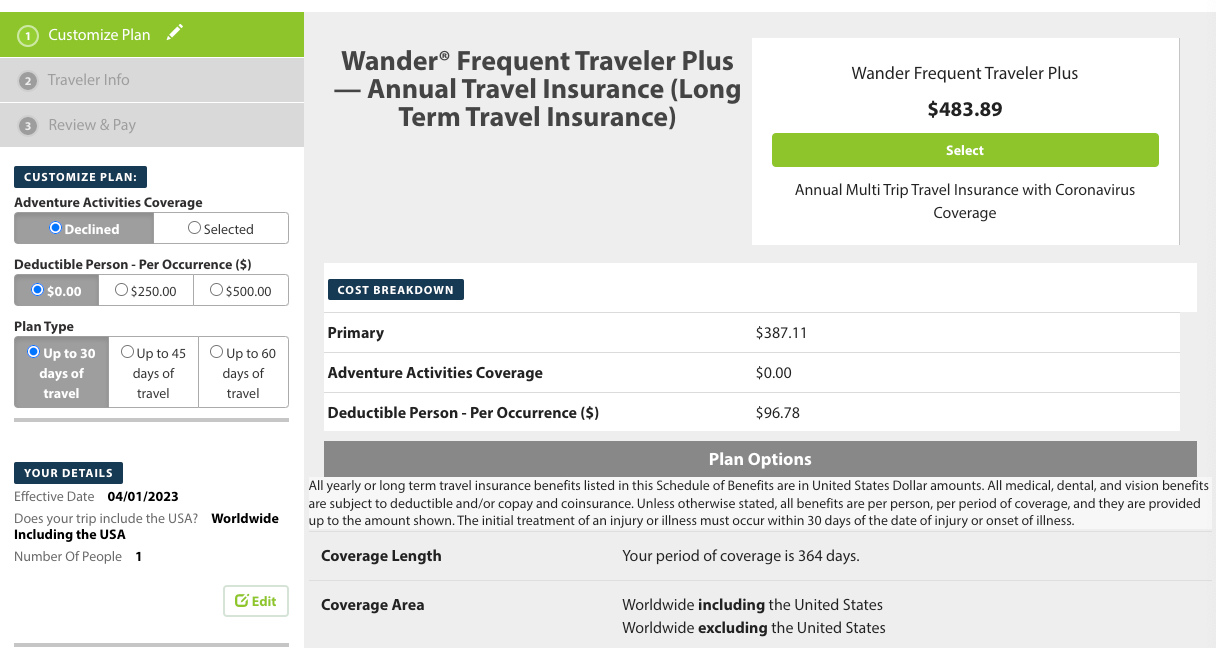

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

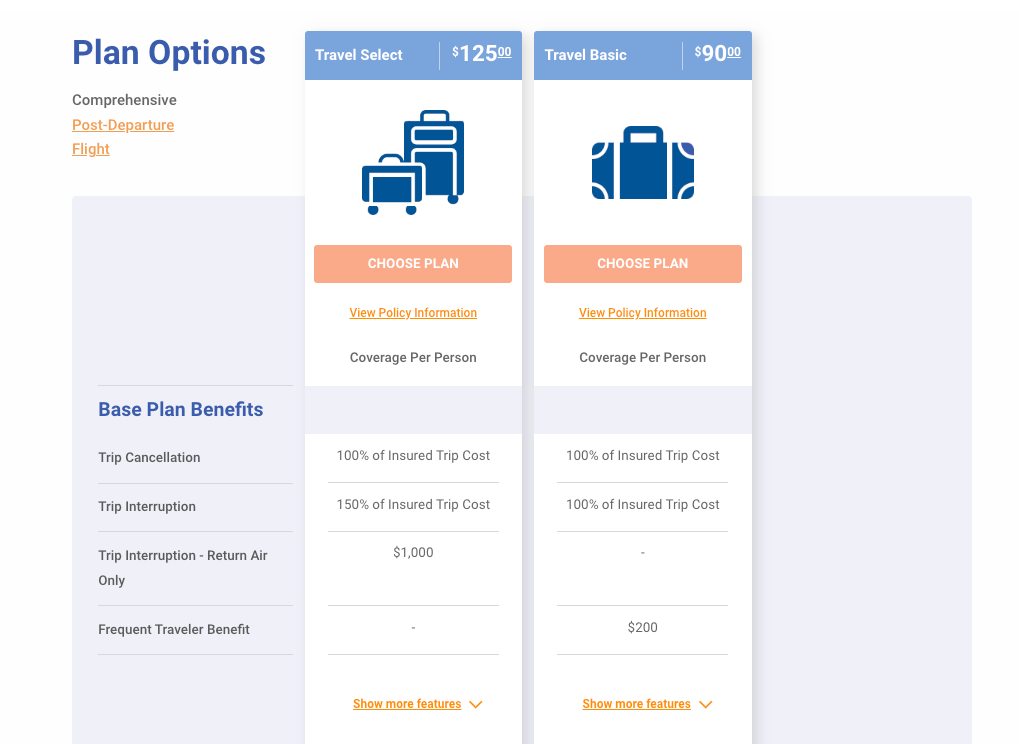

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

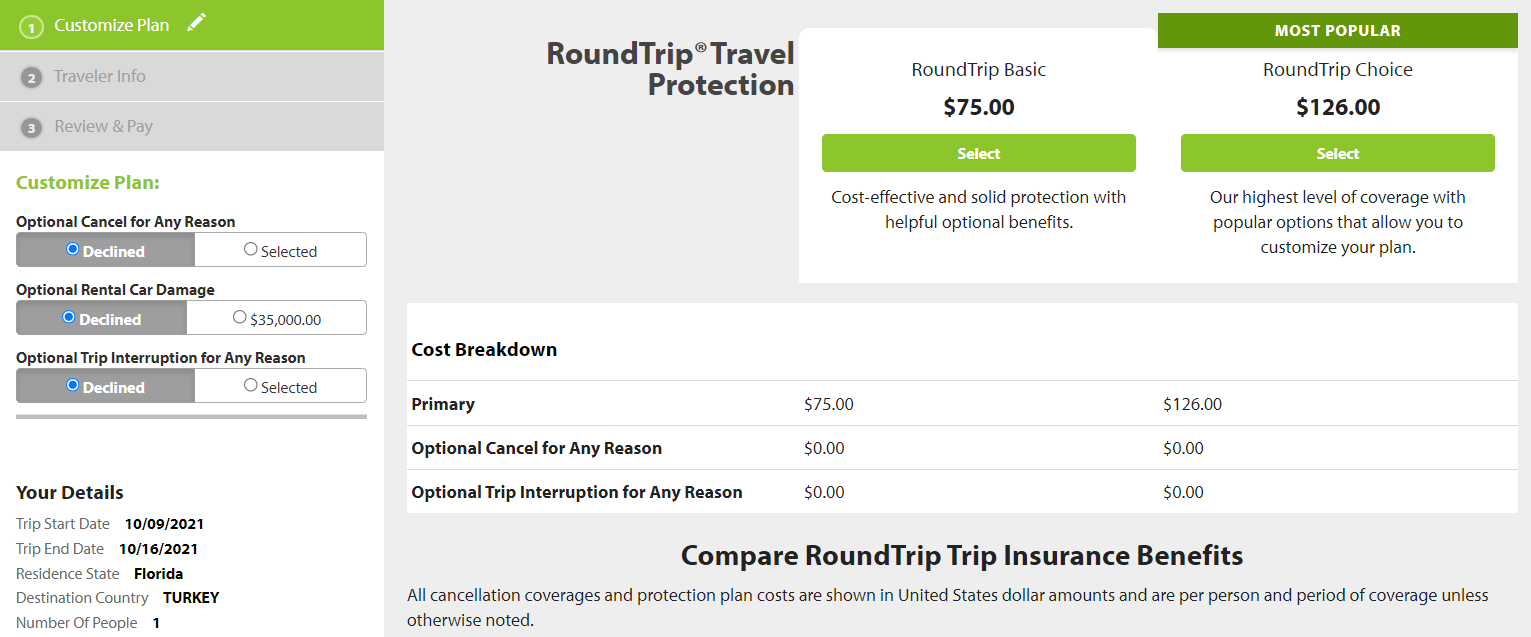

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

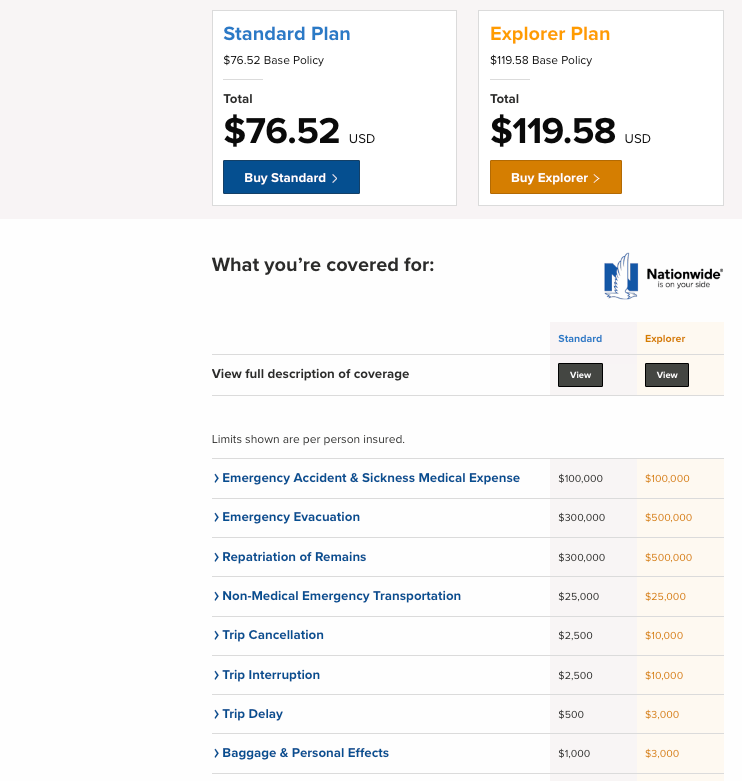

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of April 2024

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Travel insurance can help you protect the financial investment you made in your vacation when unexpected issues arise. Find the best travel insurance for the type of trip(s) you're taking and the coverages that matter most to you – from interruptions and misplaced belongings to illness and injury.

- Travelex Insurance Services: Best Overall

- Allianz Travel Insurance: Best for Trip Interruptions

- HTH Travel Insurance: Best for Groups

- Tin Leg: Best Cost

- AIG Travel Guard: Best for Families

- Nationwide Insurance: Best for Last-Minute Travel Insurance

- Seven Corners: Best for 24/7 Support When Traveling

- Generali Global Assistance: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best for Specialized Coverage

Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

Medical and trip cancellation maximum are not as high as some other companies

- 100% of the insured trip cost for trip cancellation; 150% for trip interruption

- Up to $1,000 in coverage for lost, damaged or stolen bags and personal items; $200 for luggage delays

- $750 in missed connection coverage

- $50,000 in emergency medical and dental coverage

- Up to $500,000 in emergency medical evacuation and repatriation coverage

SEE FULL REVIEW »

Annual and multitrip policies are available

Distinguishing between the company's 10 travel insurance plans can be challenging

- Up to $200,000 in trip cancellation coverage; $300,000 in trip interruption coverage

- $2,000 for lost, damaged or stolen luggage and personal effects; $600 for bag delays

- Up to $1,600 for travel delays

- Emergency medical coverage of up to $75,000

- Epidemic coverage

Generous coverage at the mid- and high-tier levels, and great group discounts

Preexisting conditions coverage is only available at mid- and high-tier plans

- 100% trip cancellation coverage (up to $50,000); 200% trip interruption coverage

- Up to $2,000 in coverage for baggage and personal effects; $400 in baggage delay coverage

- Up to $2,000 in coverage for trip delays; $1,000 for missed connections

- $500,000 in coverage per person for sickness and accidents

Variety of plans to choose from, including two budget-friendly policies and several more premium options

More limited coverage for baggage issues than other companies

- 100% trip cancellation protection; 150% trip interruption

- $500 per person for lost, stolen or damaged baggage and personal items

- Up to $2,000 per person in travel delay coverage ($150 per day); $100 per person for missed connections

- $100,000 per person in emergency medical coverage, including issues related to COVID-19

Travel insurance policy coverage is tailored to your specific trip

Information about policy coverage inclusions is not readily available without first obtaining a quote

- Trip cancellation coverage for up to 100% of your trip's cost; trip interruption coverage for up to 150% of the trip cost

- Up to $2,500 in coverage for lost, stolen or damaged baggage; $500 related to luggage delays

- Up to $1,000 in missed connection and trip delay coverage

- $100,000 in emergency medical coverage

Variety of plans to choose from and coverage available up to a day before you leave on your trip

Limited trip cancellation coverage even at the highest tier

- Trip cancellation coverage up to $30,000; trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- $2,000 for lost, damaged or stolen baggage; $600 for baggage delays

- Up to $2,000 for trip delays; missed connection and itinerary change coverage of $500 each

- $150,000 for emergency medical and dental issues

Customer service available 24/7 via text, Whatsapp, email and phone

Cancel for any reason coverage costs extra

- 100% trip cancellation coverage (up to between $30,000 and $100,000 depending on your state of residence); interruption coverage for up to 150% of the trip cost

- Lost, stolen or damaged baggage coverage up to $2,500; up to $600 for luggage delays

- Trip delay and missed connection coverage worth up to $1,500

- Emergency medical coverage worth up to between $250,000 and $500,000 (depending on where you live)

Generous emergency medical and emergency evacuation coverage

Coverage for those with preexisting conditions is only available on the Premium plan

- 100% reimbursement for trip cancellation; 175% reimbursement for trip interruption

- $2,000 in coverage for loss of baggage per person

- $1,000 per person in travel delay and missed connection coverage

- $250,000 in medical and dental coverage per person

In addition to single-trip plans, company offers specific road trip, adventure travel, flight and cruise insurance coverage

Coverage for missed connections or accidental death and dismemberment is not part of the most basic plan

- Trip cancellation coverage worth up to 100% of the trip cost; interruption coverage worth up to 150% of the trip cost

- $500 in coverage for lost, stolen or damaged bags and personal items; bag delay coverage worth $200

- Trip delay coverage worth up to $1,000; missed connection coverage worth up to $100

- Medical coverage worth up to $50,000

To help you better understand the costs associated with travel insurance, we requested quotes for a weeklong June 2024 trip to Spain for a solo traveler, a couple and a family. These rates should help you get a rough estimate for about how much you can expect to spend on travel insurance. For additional details on specific coverage from each travel insurance plan and to input your trip information for a quote, see our comparison table below.

Travel Insurance Types: Which One Is Right for You?

There are several types of travel insurance you'll want to evaluate before choosing the policy that's right for you. A few of the most popular types of travel insurance include:

COVID travel insurance Select insurance plans offer some or a combination of the following COVID-19-related protections: coverage for rapid or PCR testing; accommodations if you're required to quarantine during your trip if you test positive for coronavirus; health care; and trip cancellations due to you or a family member testing positive for COVID-19. Read more about the best COVID-19 travel insurance options .

Cancel for any reason insurance Cancel for any reason travel insurance works exactly how it sounds. This type of travel insurance lets you cancel your trip for any reason you want – even if your reason is that you simply decide you no longer want to go. Cancel for any reason travel insurance is typically an add-on you can purchase to go along with other types of travel insurance. For that reason, you will pay more to have this kind of coverage added to your policy.

Also note that this type of coverage typically only reimburses 50% to 80% of your nonrefundable prepaid travel expenses. You'll want to make sure you know exactly how much reimbursement you could qualify for before you invest in this type of policy. Compare the best cancel for any reason travel insurance options here .

International travel insurance Travel insurance is especially useful when traveling internationally, as it can provide medical coverage for emergencies (in some cases for COVID-19) when you're far from home. Depending which international travel insurance plan you choose, this type of travel insurance can also cover lost or delayed luggage, rental cars, travel interruptions or cancellations, and more.

Cheap travel insurance If you want travel insurance but don't want to spend a lot of money, there are plenty of cheap travel insurance options that will offer at least some protections (and peace of mind). These are typically called a company's basic or standard plan; many travel insurance companies even allow you to customize your coverage, spending as little or as much as you want. Explore your options for the cheapest travel insurance here .

Trip cancellation, interruption and delay insurance Trip cancellation coverage can help you get reimbursement for prepaid travel expenses, such as your airfare and cruise fare, if your trip is ultimately canceled for a covered reason. Trip interruption insurance, on the other hand, kicks in to reimburse you if your trip is derailed after it starts. For instance, if you arrived at your destination and became gravely ill, it would cover the cost if you had to cut your trip short.

Trip delay insurance can help you qualify for reimbursement of any unexpected expenses you incur (think: lodging, transportation and food) in the event your trip is delayed for reasons beyond your control, such as your flight being canceled and rebooked for the next day. You will want to save your receipts to substantiate your claim if you have this coverage.

Lost, damaged, delayed or stolen bags or personal belongings Coverage for lost or stolen bags can come in handy if your checked luggage is lost by your airline or your luggage is delayed so long that you have to buy clothing and toiletries for your trip. This type of coverage can kick in to cover the cost to replace lost or stolen items you brought on your trip. It can also provide coverage for the baggage itself. It's even possible that your travel insurance policy will pay for your flight home if damages are caused to your residence and your belongings while you're away, forcing you to return home immediately.

Travel medical insurance If you find yourself sick or injured while you are on vacation, emergency medical coverage can pay for your medical expenses. With that in mind, however, you will need to find out whether the travel medical insurance you buy is primary or secondary. Where a primary policy can be used right away to cover medical bills incurred while you travel, secondary coverage only provides reimbursement after you have exhausted other medical policies you have.

You will also need to know how the travel medical coverage you purchase deals with any preexisting conditions you have, including whether you will have any coverage for preexisting conditions at all. Read more about the best travel medical insurance plans .

Evacuation insurance Imagine you break your leg while on the side of a mountain in some far-flung land without quality health care. Not only would you need travel medical insurance coverage in that case, but you would also need coverage for the exorbitant expense involved in getting you off the side of a mountain and flying you home where you can receive appropriate medical care.

Evacuation coverage can come in handy if you need it, but you will want to make sure any coverage you buy comes with incredibly high limits. According to Squaremouth, an emergency evacuation can easily cost $25,000 in North America and up to $50,000 in Europe, so the site typically suggests customers buy policies with $50,000 to $100,000 in emergency evacuation coverage.

Cruise insurance Travel delays; missed connections, tours or excursions; and cruise ship disablement (when a ship encounters a mechanical issue and is unable to continue on in the journey) are just a few examples why cruise insurance can be a useful protection if you've booked a cruise vacation. Learn more about the top cruise insurance plans here .

Credit card travel insurance It is not uncommon to find credit cards that include trip cancellation and interruption coverage , trip delay insurance, lost or delayed baggage coverage, travel accident insurance, and more. Cards that offer this coverage include popular options like the Chase Sapphire Reserve credit card , the Chase Sapphire Preferred credit card and The Platinum Card from American Express .

Note that owning a credit card with travel insurance protection is not enough for your coverage to count: To take advantage of credit card travel insurance, you must pay for prepaid travel expenses like your airfare, hotel stay or cruise with that specific credit card. Also, note that credit cards with travel insurance have their own list of exclusions to watch out for. Many also require cardholders to pay an annual fee.

Frequently Asked Questions

The best time to buy travel insurance is normally within a few weeks of booking your trip since you may qualify for lower pricing if you book early. Keep in mind, some travel insurance providers allow you to purchase plans until the day before you depart.

Many times, you are given the option to purchase travel insurance when you book your airfare, accommodations or vacation package. Travel insurance and travel protection are frequently offered as add-ons for your trip, meaning you can pay for your vacation and some level of travel insurance at the same time.

However, many people choose to wait to buy travel insurance until after their entire vacation is booked and paid for. This helps travelers tally up all the underlying costs associated with a trip, and then choose their travel insurance provider and the level of coverage they want.

Figuring out where to buy travel insurance may be confusing but you can easily research and purchase travel insurance online these days. Some consumers prefer to shop around with a specific provider, such as Allianz or Travelex, but you can also shop and compare policies with a travel insurance platform. Popular options include:

- TravelInsurance.com: TravelInsurance.com offers travel insurance options from more than a dozen vetted insurance providers. Users can read reviews on the various travel insurance providers to find out more about previous travelers' experiences with them. Squaremouth: With Squaremouth, you can enter your trip details and compare more than 90 travel insurance plans from 20-plus providers.

- InsureMyTrip: InsureMyTrip works similarly, letting you shop around and compare plans from more than 20 travel insurance providers in one place. InsureMyTrip also offers several guarantees, including a Best Price Guarantee, a Best Plan Guarantee and a Money-Back Guarantee that promises a full refund if you decide you no longer need the plan you purchased.

Protect your trip: Search, compare and buy the best travel insurance plans for the lowest price. Get a quote .

When you need to file a travel insurance claim, you should plan on explaining to your provider what happened to your trip and why you think your policy applies. If you planned to go on a Caribbean cruise, but your husband fell gravely ill the night before you were set to depart, you would need to explain that situation to your travel insurance company. Information you should share with your provider includes the details of why you're making a claim, who was involved and the exact circumstances of your loss.

Documentation is important, and your travel insurance provider will ask for proof of what happened. Required documentation for travel insurance typically includes any proof of a delay, receipts, copies of medical bills and more.

Most travel insurance companies let you file a claim using an online form, but some also allow you to file a claim by phone or via fax. Some travel insurance providers, such as Allianz and Travel Insured International, offer their own mobile apps you can use to buy policies and upload information or documents that substantiate your claim. In any case, you will need to provide the company with proof of your claim and the circumstances that caused it.

If your claim is initially denied, you may also need to answer some questions or submit some additional information that can highlight why you do, in fact, qualify.

Whatever you do, be honest and forthcoming with all the information in your claim. Also, be willing to provide more information or answer any questions when asked.

Travel insurance claims typically take four to six weeks to process once you file with your insurance company. However, with various flight delays and cancellations due to things like extreme weather and pilot shortages, more travelers have begun purchasing travel insurance, encountering trip issues and having to submit claims. The higher volume of claims submitted has resulted in slower turnaround times at some insurance companies.

The longer you take to file your travel insurance claim after a loss, the longer you will be waiting for reimbursement. Also note that, with many travel insurance providers, there is a time limit on how long you can submit claims after a trip. For example, with Allianz Travel Insurance and Travelex Insurance Services, you have 90 days from the date of your loss to file a claim.

You may be able to expedite the claim if you provide all the required information upfront, whereas the process could drag on longer than it needs to if you delay filing a claim or the company has to follow up with you to get more information.

Travel insurance is never required, and only you can decide whether or not it's right for you. Check out Is Travel Insurance Worth It? to see some common situations where it does (and doesn't) make sense.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Carry-on Luggage and Personal Item Size Limits (2024)

Amanda Norcross

Just like checked bags, carry-on luggage size restrictions can vary by airline.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

The Best Way to Renew a Passport in 2024

The proposed online passport renewal system is behind schedule.

The Best Carry-on Luggage of 2024

Erin Evans and Rachael Hood and Catriona Kendall and Amanda Norcross and Leilani Osmundson

Discover the best carry-on luggage for your unique travel style and needs.

We Now Offer USA Visitors & International Travel Medical Insurance Get a Free quote now

Comprehensive trip insurance for us citizens traveling in the usa and abroad, get a free quote, our travel insurance covers covid-19.

You are covered for trip cancellation in the event that you contract Covid-19, or you are quarantined due to exposure. You are also covered under our travel medical and trip interruption insurance for Covid-19. We offer Cancel for Any Reason Travel Insurance to cover you for border closures, and fear of traveling.

Protect Your Travel Plans with TripInsurance

Trip Insurance

Wherever you’re going, we can ensure you’re covered so you can focus on enjoying your trip. Our coverage applies to your belongings and trip activities as well.

Cruise Insurance

Save money and get better coverage for your next cruise. We can insure your entire trip, including your cruise, flights, and hotels. Get a quote and find out how much you will save.

Medical travel Insurance

Foreign countries now require you to have proof of travel medical coverage before entering the country. Our plans cover you for Covid-19 travel requirements.

We Make Buying Trip Insurance Easy

Conquer the world.

Why Buy on TripInsurance.com

Best Price Guarantee

Buy Anytime

Easy Policy Adjustments

Easy policy adjustments.

File Claims Here

Traveler's experiences, frequently asked questions about tripinsurance, what does tripinsurance cover.

Trip insurance covers you before and during your trip. Before your trip, it can protect you if you must cancel your trip. During your trip, it covers trip interruption, trip delay, as well as medical care, and medical emergency evacuation for any covered medical emergencies that may arise. Most trip insurance plans offer both insurance benefits along with assistance services and travel assistance. See the coverage details in your chosen trip plan for more details.

What Factors Determine How Much Travel Insurance Costs?

Your age, length of your trip, and your trip cost determines the travel insurance cost. Coverage features and limits also affect the price of the plan. The more coverage included in the plan – the higher the cost of the policy.

By law, there are no discounts in the travel insurance industry, so wherever you find a policy by the same brand name from a travel insurance provider, it is the same price no matter where you buy it. TripInsurance.com has some exclusive trip insurance policies that are priced much lower for comparable coverage giving you a much better value and will ultimately help you save money on the trip plans you need.

What Is Trip Cancellation Insurance?

The trip cancellation coverage benefit covers the non-refundable trip costs when you must cancel your travel plans. All plans cover trip cancellation and interruption for covered medical reasons (such as sickness, injury, or accidental death of you, someone you’re traveling with, or even a family member that is not traveling with you). Additionally, certain non-medical reasons will be covered as well, such as air carrier delays or cancellations, theft of travel documents, baggage delay, your boss canceling your vacation, or an extension of the school year. The more reasons that are covered, the better the plan. It is as simple as that!

When Do I Need to Purchase Travel Insurance?

Sooner is better. If you purchase your insurance within 14 days of your initial trip deposit, many policies offer a medical waiver for pre-existing conditions and even cancelation for any reason (Maybe you don’t want to take that week skiing because there’s no snow.)

Do I need Trip Insurance When Only Travelling Within the United States?

You should purchase trip insurance for traveling within the US if you want to protect your vacation deposit that may have cancellation penalties like a vacation rental. If there’s a chance you may be delayed in your travels, or if your health insurance as a U.S. resident doesn’t cover you out of state, you need travel insurance.

Is TripInsurance.com an Insurance Company?

TripInsurance.com is an insurance agency that carefully selects the best travel insurance policies for our customers. Some of our policies are unique to TripInsurance.com and offer exceptional value. We sell travel insurance policies from the most trusted travel insurance companies at the best price possible. Our insurance agents are here to help you find the best travel insurance products for your next trip.

Travel Inspiration

Will Travel Insurance Cover Me When Vacationing in a Politically Unstable Country?

If you are worried that your proposed destination may erupt in revolution, your best protection is a policy with a “Cancel for Any Reason” clause.

8 Essential COVID-19 Travel Tips for Your Next Vacation

How to Book Travel in The Age of COVID-19

When Is It Safe to Travel Again?

Sign up for travel tips.

Click Here for More Reviews:

Travel insurance partners.

- Legal Notice

- Terms of Use

- Best overall

- Best for cruises

- Best for reputation

- Best for preexisting conditions

- Best for digital nomads

- Best low-cost

- Best for road trips

How we reviewed travel insurance companies

Ultimate guide to choosing the best travel insurance.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Traveling is an adventure, a leap into the unknown, a story waiting to unfold. But every story needs a safety net, and that's where travel insurance comes in. In this guide to the best travel insurance, we'll embark on a journey to help you better understand travel insurance and uncover the benefits that make it an indispensable companion for any traveler.

Compare the best travel insurance

Best overall: nationwide.

- Trip cancellation coverage of up to 100% of trip costs (for cruises) or up to $30,000 (for single-trip plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three cruise-specific plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel insurance plans available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong trip cancellation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancel for any reason coverage available

- con icon Two crossed lines that form an 'X'. CFAR insurance not available with every single plan

- con icon Two crossed lines that form an 'X'. Medical coverage is lower than what some competitors offer

Nationwide Travel Insurance offers many of the standard benefits you might see with a travel insurance policy. This can include things like trip cancellation coverage, so you can recover pre-paid costs or trip interruption in the event your vacation is interrupted by an unexpected event. There's also baggage delay coverage and medical coverage.

- Cancel for any reason coverage available

Nationwide Travel Insurance is of the largest players in the travel insurance space, offering nearly endless options for any customer on the travel spectrum, including annual travel insurance plans which can offer frequent travelers the flexibility to "set it and forget it" on their travel insurance coverage.

Nationwide Essential also offers some of the most affordable policies in the market compared to similar plans from competitors, which makes it a great pick for just about anyone. Buyers can discuss bundling options as Nationwide also sells homeowners, auto, pet, and other insurance products. Its travel insurance quoting is just as easy as it has been with other Nationwide insurance products.

Read our Nationwide Travel Insurance review here.

Runner-up: AXA Assistance USA

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA offers consumers a great option for no-stress travel insurance: low-priced plans, generous coverage limits on key categories including primary insurance on lost luggage, and up to 150% reimbursement for qualifying trip cancellations.

While add-ons are limited and rental car coverage is not included by default on cheaper plans, AXA is a perfect fit for travelers who don't plan to drive (or who already hold a travel credit card with rental car coverage), and don't need any additional bells and whistles.

Read our AXA Assistance USA Travel Insurance review here.

Best for cruises: AIG Travel Guard

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation coverage of up to 100% of the cost, for all three plan levels

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR covers up to 75% of total trip costs (maximum of $112,500 on some plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Medical coverage of up to $500,000 and evacuation of up to $1,000,000 per person

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes COVID coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Above average baggage loss and delay benefits

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical evacuation coverage

- con icon Two crossed lines that form an 'X'. Premiums may run slightly higher than competitors

Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits.

- Trip cancellation coverage for up to 100% of the trip cost

- Trip interruption coverage for up to 150% of the trip cost

- Preexisting medical conditions exclusions waiver must be purchased within 15 days of initial trip payment

- Annual travel insurance plan and Pack N' Go plan (for last-minute trips) available

Travel Guard is well-known insurance provider, and a great fit for travelers who want to ensure that they can get their money back in the event of canceled or interrupted travel plans.

While the company's policies can be pricey compared to its competitors, the high medical and evacuation limits make AIG a solid choice for older travelers who value peace of mind and simplicity over highly customizable plans that may be bolstered with medical upgrades.

Read our AIG Travel Guard review here.

Best for reputation: Berkshire Hathaway Travel Protection

Covers up to 100% of trip cancellation costs, a minimum of up to $750 in luggage losses, and 24/7 worldwide travel insurance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers up to 100% trip cancellation refund for eligible travel

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Plans are customizable with relevant add-ons

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good customer service and easy sign up according to traveler reviews

- con icon Two crossed lines that form an 'X'. More affordable plans offer low caps on medical and emergency coverage

- con icon Two crossed lines that form an 'X'. Premiums are on the expensive side relative to comparable competitor plans

- con icon Two crossed lines that form an 'X'. Claims may take longer during peak travel seasons

Berkshire Hathaway Travel Protection is one of the leading insurance brands on the market. It offers several plans with key add-ons for travelers.

- This provider underwrites travel insurance policies for a number of other companies in addition to offering its own plans

- Travelers can file claims directly from a smartphone by using the BHTP app

Berkshire Hathaway Travel Protection helps travelers make the best of bad situations by simplifying the process of filing a claim down to a simple photo snap and some basic paperwork submitted directly through a dedicated app.

Approved claims are also paid out very rapidly, making it easier to carry through with a trip when luggage has been lost or alternative travel plans need to be made on the fly.

Read our Berkshire Hathaway Travel Insurance review here.

Best for preexisting conditions: Tin Leg Travel Insurance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Policy coverage includes most pre-existing health conditions

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical and evacuation amounts for peace of mind

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. COVID coverage included by default on all insurance plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers a wide range of plans for various budgets and travel needs

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans offer CFAR, “cancel for work reasons,” financial default, and unemployment coverage

- con icon Two crossed lines that form an 'X'. Limited add-on coverage options

- con icon Two crossed lines that form an 'X'. Baggage loss and delay coverage is low compared to competitors

Tin Leg travel insurance offers eight travel insurance plans to meet the unique needs of travelers.

- Tin Leg was founded in 2014 by the travel insurance industry experts at Squaremouth. Designed to meet the most common needs of travelers, these policies offer comprehensive Trip Cancellation and Trip Interruption benefits, and a range of Emergency Medical and Medical Evacuation limits.

Tin Leg Travel Insurance is a great fit for travelers with medical issues in particular. Thanks to coverage for preexisting medical conditions as well as for potential COVID-19 infection while traveling, this company offers some of the best financial investment options for travelers who are or will be exposed to higher health risks and issues.

Read our Tin Leg Travel Insurance review here.

Best for digital nomads: WorldTrips Travel Insurance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable base plans that can be customized with add-ons including rental car, pet care, hunting and fishing, and vacation rental coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Insurance plans available for international student travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay coverage benefit that kicks in after just five hours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Pre-existing conditions waiver can be purchased within 21 days of initial trip payment

- con icon Two crossed lines that form an 'X'. Lower medical, evacuation and accidental death limits

- con icon Two crossed lines that form an 'X'. Limited, secondary baggage loss coverage although baggage protection can be upgraded at a low cost

- con icon Two crossed lines that form an 'X'. No special coverages for pets, sports equipment, etc.

WorldTrips has been a reputable travel insurance provider for more than 20 years. Unsurprisingly, it boasts an A+ rating from the Better Business Bureau and positive reviews from thousands of customers.

- Travel medical insurance (Premium, Group, Annual, and International Student options)

- Trip cancellation insurance

- Trip protection insurance

WorldTrips Travel Insurance has affordable premiums, highly customizable add-ons, and generous coverage for core categories of travel insurance. All this makes it a great option for digital nomads, students studying abroad and backpackers.

However, travelers should keep in mind that plans are not particularly flexible, and coverage amounts are limited unless you plan ahead to pay for the areas and amounts that you need.

Read our WorldTrips Travel Insurance review here.

Best low-cost option: Trawick International

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Useful for adventurous travelers headed to higher-risk destinations

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable plans with varying levels of coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. 10-day free look option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage loss replacement policy

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay coverage kicks in after just six hours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some policies allow a CFAR add-on

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1 million medical evacuation coverage limit

- con icon Two crossed lines that form an 'X'. Baggage and trip delay coverages don’t kick in until after the 12-hour mark

- con icon Two crossed lines that form an 'X'. International student policies available for temporary stints abroad

- con icon Two crossed lines that form an 'X'. Complaints about claims not being paid or involving an intermediary to resolve claims

Trawick International travel insurance offers plans customized to diverse travelers' needs. We look at coverage options, claims processing, pricing, and other important factors for savvy travelers.

- Travel medical insurance

- Trip protection and cancellation

- International student insurance

- Visitor medical insurance (for traveling to the US)

Trawick International Travel Insurance is another insurance provider with robust medical travel insurance that can help higher-risk and anxious travelers find peace of mind while on the road. This company offers one of the most generous medical evacuation policies in the market, although travelers will need to remember to add on rental car coverage if they need it.

Read our Trawick Travel Insurance review here.

Best for road trips: Travelex

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Options to cover sports equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Option to increase medical coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Can cancel up to 48 hours before travel when CFAR option is purchased

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable coverage for budget-conscious travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes generous baggage delay, loss and trip delay coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Optional "adventure sports" bundle available for riskier activities

- con icon Two crossed lines that form an 'X'. Only two insurance plans to choose from

- con icon Two crossed lines that form an 'X'. Medical coverage maximum is low at up to $50,000 per person

- con icon Two crossed lines that form an 'X'. Pricier than some competitors with lower coverage ceilings

- con icon Two crossed lines that form an 'X'. Some competitors offer higher medical emergency coverage

Travelex travel insurance is one of the largest travel insurance providers in the US providing domestic and international coverage options. It offers a basic, select, and America option. Read on to learn more.

- Optional CFAR insurance available with the Travel Select plan

- Trip delay insurance starting at $500 with the Travel Basic plan

- Emergency medical and dental coverage starting at $15,000

Travelex Travel Insurance offers three plans:

- Travel Basic

- Travel Select

- Travel America

The Travelex America plan is meant for trips limited to the US, but it has the highest coverage limits in many areas compared to its other programs. If you're flying somewhere, the lost baggage limits are higher. Its natural strengths shine for road trippers, though. Travelex America adds coverage for roadside service and rental car coverage for unexpected accidents. It also covers pets should you be involved in an accident while on the road.

While your standard auto insurance does extend to car rentals within the US for a limited time, any accident would affect future rates. Travelex would eliminate the risk of reporting to your auto insurance provider for minor incidents within its purview.

Read our Travelex Travel Insurance review here.

Introduction to Travel Insurance

Why travel insurance is a must-have.

The unpredictable nature of traveling – from flight cancellations to medical emergencies – can turn your dream vacation into a nightmare. Travel insurance acts as a personal safeguard, ensuring that unexpected events don't drain your wallet or ruin your trip.

Understanding Different Types of Travel Insurance

Not all travel insurance policies are created equal. From single-trip travel insurance policies to annual travel insurance plans , from minimal coverage to comprehensive protection, understanding the spectrum of options is your first step in finding the right fit for your journey.

Key Features to Look for in Travel Insurance Coverage

Travel insurance for medical emergencies.

Imagine falling ill in a foreign country; daunting, right? A robust travel insurance plan ensures you don't have to worry about the financial aspect of receiving medical care while traveling , even in the most remote corners of the globe.

Trip Cancellation and Interruption Benefits

Life is full of surprises, some less pleasant than others. Trip cancellation and interruption coverage ensures that you're not left out of pocket if unforeseen circumstances force you to cancel or cut your trip short.

Coverage for Personal Belongings and Baggage Loss

Losing your belongings is more than an inconvenience; it's losing a piece of your world. Insurance that covers personal belongings and baggage loss ensures that you're compensated for your loss, helping you to rebound and continue your adventure.

Support and Assistance Services

In times of trouble, having a lifeline can make all the difference. Look for insurance that offers 24/7 support and assistance services, giving you peace of mind that help is just a phone call away.

Choosing Travel Insurance

Reputation and reliability of the travel insurance provider.

A provider's reputation is not just about being well-known; it's about reliability, customer satisfaction, and the ability to deliver on promises. Researching and choosing a reputable provider is a cornerstone in ensuring your safety and satisfaction.

Understanding the Policy's Fine Print

The devil is in the details, and understanding the fine print of what your travel insurance policy covers is crucial. Be aware of coverage limits, exclusions, and the process for filing a claim to avoid any unpleasant surprises.

Customer Reviews and Feedback

In the age of information, customer reviews and feedback are goldmines of insight. Learn from the experiences of others to gauge the reliability and customer service of the insurance provider you're considering.

How to Get the Most Out of Your Travel Insurance

Knowing your policy inside out.

Familiarize yourself with every aspect of your policy – what it covers, what it doesn't, how to file a claim, and who to contact in an emergency. Being informed means being prepared.

Steps to Take When a Problem Arises

If you face an issue during your travels, knowing the immediate steps to take can make all the difference. Keep important contacts and your policy details handy, and remember, your insurance provider is there to assist you.

How to Pick the Best Travel Insurance Company for You

There isn't a one-size-fits-all policy that works perfectly for every traveler. Young, healthy solo travelers can opt for much cheaper plans that offer bare-bones coverage, while families juggling complex itineraries will do best by investing in a robust policy that can help defray any costs associated with lost baggage, delayed transportation or other trip-impeding obstacles.

That being said, you can't go wrong with a travel insurance provider that boasts a reputable history and offers a wide range of customizable plans. In some cases, you may be comparing plans that are only a few dollars' apart from each other. In such situations, you should generally opt for the insurance company that offers the strongest customer service. It's also worth considering whether or not the travel insurance provider has been reviewed by other travelers with similar itineraries to your own.

An insurance aggregator like InsureMyTrip or Squaremouth is one of the best tools for searching travel insurance policies. Once you input the specifics of your travel itinerary, you'll be able to see hundreds of search results to compare the ones that catch your eye. If the options are too overwhelming, use the filters to the left of your search page to eliminate as many irrelevant plans as possible.

To come up with our list of the best travel insurance companies, we evaluated each insurer based on the following factors:

Guide Methodology: What We Considered

Policy Types

Travel insurance is essential, but often underused partly because people aren't getting what they want. Business Insider's 2023 travel study showed 10.65% of travelers surveyed bought cancel for any reason insurance. Cost may be a factor, but in many cases, the coverage is more affordable than you might think. Regardless, companies must offer a diverse range of coverage options. We award five stars to companies offering all standard coverages and additional options like pet and sports equipment protection.

Our 2023 travel study indicated the majority of purchases were made through the travel provider (ex: flight protection insurance when you're purchasing your airline tickets). While these may be sufficient for some customers, we look for companies offering a more comprehensive range of services.

According to the US Travel Insurance Association, the average cost of travel insurance will be between 4% and 8% of total travel expenses. Anything beyond that price point should include additional benefits beyond the standard inclusions, such as CFAR protection or upgraded medical coverage. Anything below that 4% threshold may leave you lacking important or sufficient coverage in an emergency.

Convenience and Flexibility

Whether you're an infrequent traveler or a suitcase warrior, a good travel insurance company should have you covered. In many cases, you might not even have to talk to a person in order to purchase your policy.