Travel Insured International Review

Travel Insured International (TII) offers worldwide travel insurance plans that also work within the United States. Prices vary mostly by age, but are close to average for the best trip insurances we reviewed. The types of plans you can apply for may vary by your state of residence, however.

Top Ten Reviews Verdict

Travel Insurance International is a solid trip insurance agency with a Cancel for Any Reason option and concierge services.

Travel Insurance International offers reimbursements for miles or reward cards.

This service does not reimburse you for lost or stolen prescriptions.

Why you can trust Top Ten Reviews Our expert reviewers spend hours testing and comparing products and services so you can choose the best for you. Find out more about how we test .

We evaluated plans for three trips: a Mississippi river cruise, a tour of France and an Antarctic adventure. The insurance premium prices for these trips depended mostly on the age of the travelers, and in most cases, ran below the average of the other trip insurances we priced. The plans varied, so we looked for plans with comparable coverage in cancellation and major medical expenses.

We found that while coverage for cancellations matched most of the other companies we evaluated, the reimbursement for lesser emergencies was lower. Luggage delay reimbursement is $300, where the average among agencies is nearly twice that. InsuranceandGo is one such company with a luggage delay reimbursement of up to $800. It also limits reimbursement for ticket change fees to $250. Not every agency reimburses change fees, but those that do generally do not set a limit. It does not reimburse for cancellations if your carrier or tour company declares bankruptcy. However, the higher-tier plans offer a Cancel for Any Reason clause. It covers 75 percent of your trip cost, which is industry average.

The evacuation and repatriation reimbursements are among the highest of the trip insurances we evaluated, and this company can make the arrangements, including securing an escort if needed. It also does not reimburse you for lost or stolen prescriptions, although it can assist you in getting them replaced. This, however, is standard for most companies.

TII insures you against accidental death and dismemberment in a flight accident for up to $10,000. It can cover vehicle rentals as well. If you need to evacuate the country for a non-medical reason, such as political upheaval, TII can make the arrangements and reimburse your expenses.

TII offers concierge services that include English-speaking support 24/7. In addition to answering questions about your policy and helping you in emergencies, this company has agents who can help you find a hotel, make dinner reservations or handle other complimentary services. In case of an emergency, the agents can locate a local doctor or lawyer and advance you emergency cash. It does not assist with legal fees, however. A couple of the companies we reviewed assist with bail money.

Buying Guides

Best vacation spots for families

Best all-inclusive resorts for families

Best hard shell luggage

Best carry-on luggage

Best travel backpacks

Best hotel booking sites 2024

Best online travel sites 2022

Best travel pillows 2024: Upgrade your travels with these ergonomic accessories

Best travel car seats 2024

Best travel strollers 2024: Travel in style with the whole family

If you need to file a claim, you can do so online. There is no listing of what documentation you need, so it's best to be prepared by keeping receipts, getting proof of incident such as a police report or a written notice from your carrier. TII offers a live chat to assist you in the claims process, something only a few travel insurance companies offer.

Although Travel Insurance International offers worldwide plans, they are just as effective inside the United States. The prices were below average for the situations we considered, and the coverage comparable to the higher-ranked trip insurance companies. It offers some extra options, such as Cancel for Any Reason, and has live chat to assist you with filing a claim online. It's an insurance worth considering, especially if you're traveling outside the country.

Noel has worked as a reporter and editor for many online and print publications including the Salt Lake Tribune and the Ogden Standard-Examiner, covering diverse beats like education, city development and politics. He also wrote and edited an online monthly magazine for the nutritional supplement company Max International. Noel has degrees from the University of Utah and Weber State University in psychology, English and creative writing and is passionate about writing in all its forms.

Toro Flex-Force Power System 60V Max 22in Recycler Lawn Mower review

Best Shark vacuum cleaners 2024: clean smarter with these tried and tested vacs

Ooni Volt 12 review: Ooni's first electric pizza oven is a huge success

Most Popular

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Travel Insured International Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Editor & Content Contributor

151 Published Articles 741 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Keri Stooksbury

Editor-in-Chief

33 Published Articles 3136 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Why Purchase Travel Insurance

Travel insurance and covid-19, why purchase travel insurance from travel insured international, single-trip plans, how to obtain a quote, the value of travel insurance comparison sites, to travel insurance provided by your credit cards, to other travel insurance companies, to point of sale policies, how to file a claim with travel insured international, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Thinking about purchasing travel insurance has become synonymous with trip planning in today’s environment. It’s difficult to think of traveling without considering the fact that plans might change, your trip could experience disruptions, or that you might need medical attention during your journey.

There are several ways to acquire various levels of travel insurance coverage. You could rely on the coverage that comes complimentary on your credit cards, purchase single-trip coverage from a travel insurance company or via your travel provider at booking, or perhaps purchase an annual plan that covers every trip you’ll make in the policy year.

We write frequently about travel insurance coverage and some of the most popular companies providing this protection.

Today we’re going to discuss travel insurance specifically offered by Travel Insured International . We’ll talk more about the company, how to purchase coverage, and how the company’s plans compare to other sources of travel insurance.

A comprehensive travel insurance policy , whether purchased to cover a single trip or to provide coverage for all your trips within a specific time period, is designed to protect your investment and cover major expenses you may incur due to (covered) cancellations and disruptions.

Examples of expenses that can be covered under a comprehensive travel insurance policy include:

- You broke your leg while hiking and needed to be evacuated to the nearest hospital

- Your travel companion became seriously ill and you had to cancel your trip

- There was a fire, your home became inhabitable, and you had to cancel your trip

- You become ill during your trip and must return home early

Fortunately, travel insurance is widely available and affordable . If you have a large amount of non-refundable travel expenses for any trip, or your medical insurance will not cover you during your travels, purchasing a travel insurance policy makes sense.

To learn more about the basics of purchasing travel insurance and some of the best companies from which to purchase travel insurance , visit our comprehensive articles on these topics.

Bottom Line: If you have a significant investment of non-refundable travel expenses in any 1 trip, or you need medical coverage during your travels, you should consider purchasing a comprehensive travel insurance policy.

While it might seem that travel insurance should cover any reason for canceling a trip, it does not. Travel insurance is designed to cover unforeseen events that may cause you to cancel your trip or cause disruptions during your trip.

If you need coverage for canceling your trip due to fear of getting ill, or any other reason you deem necessary, you’ll need to purchase Cancel for Any Reason insurance (CFAR) . CFAR coverage allows you to cancel your trip for any reason, not just those listed in your policy.

Many companies will include coverage if a traveler gets ill with the virus and needs medical treatment during their trip. Trip cancellation and trip interruption coverages can also include coverage for COVID-19 illness . Some companies exclude coverage for pandemics.

Travel Insured International includes coverage for COVID-19 illness for medical, trip cancellation, and trip interruption .

Bottom Line: Travel insurance does not cover canceling your trip due to fear of getting ill. You must purchase CFAR insurance as an add-on coverage within a specific timeframe of securing a new travel insurance policy in order to have coverage.

When selecting a travel insurance company, you’ll want to do business with a company that’s established and financially sound. Travel Insured International has been doing business for over 27 years and is owned by Crum and Forster, a company that has been around since 1822 and has an A (Excellent) rating by prominent insurance rating company A.M. Best .

Additionally, the company offers affordable plans with unique coverages, such as reimbursement for the redeposit fees associated with points and miles when a trip is canceled, change fee coverage, and a missed tour or cruise connection coverage.

Travel Insured International also offers Cancel for Any Reason insurance as an add-on to its most comprehensive policy — a coverage not offered by all travel insurance companies.

The Better Business Bureau accredited Travel Insured International in 2006. And, while you’ll find complaints against the company, many are from policyholders expecting coverage for canceling trips due to the fear of getting COVID-19 or due to borders being shut down. These are not covered by any travel insurance unless CFAR insurance is purchased.

Bottom Line: You can have peace of mind knowing that Travel Insured International is a financially sound company. The company offers unique coverage plans and Cancel for Any Reason insurance as an add-on to its most comprehensive plan.

Types of Policies Offered

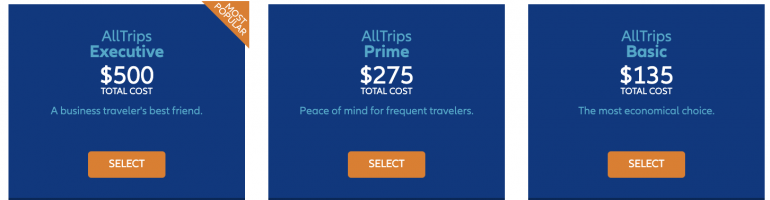

Travel Insured International offers 5 insurance plans, including a basic trip plan, a medical plan, a multi-trip annual plan, and these 2 popular single-trip plans:

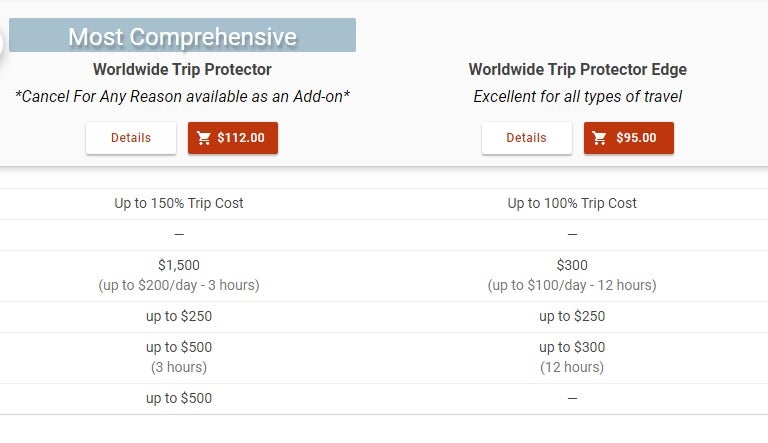

Here’s a breakdown of core coverages for the 2 most popular single-trip plans:

Travel Insured International also offers a multi-trip plan that covers all trips (45 days in length or less) within the 1-year policy period . Prices for the 1-year plan start at $94. This basic plan comes with trip interruption, trip delay, baggage protection/delay, and $100,000 in medical coverage. There are options to purchase additional coverages such as trip cancellation and CFAR insurance.

The company also offers a medical-centric plan for those who want medical coverage during their travels.

Bottom Line: Travel Insured International offers 5 travel insurance policy options including 2 comprehensive travel insurance policies, 1 basic travel insurance plan, 1 medical insurance plan, and an annual multi-trip plan.

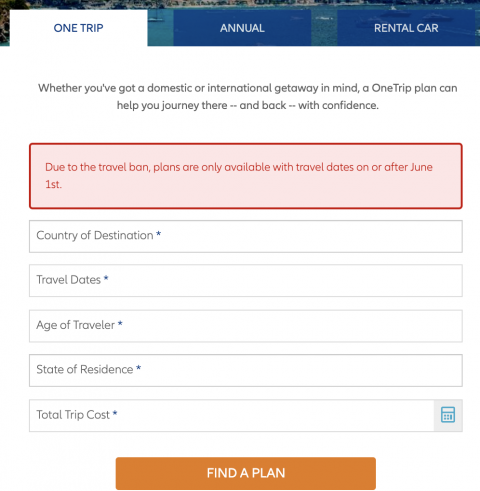

It’s easy to secure a quote and compare policy options on the Travel Insured International website . Just input your trip destination, country and state of residence, dates of travel, when you made your first trip deposit, and the total cost of your trip. Although you’re asked for your name and email address, this is not required information.

You’ll be able to compare coverage, review details of each plan, and select any optional add-ons you may want. You can then proceed to purchase your policy.

Whenever you have the opportunity to compare plans and prices with very little effort, you should do so. Therein lies the value of travel insurance comparison sites.

Travel insurance comparison sites feature policies offered by highly-rated companies and allow you to quickly receive a quote from several of these providers by providing basic information.

Here are some of the most popular sites you can use to compare travel insurance policies:

- TravelInsurance.com : Search for comprehensive travel insurance plans. The site does not include medical-only travel insurance plans.

- InsureMyTrip : Compare travel medical plans for single trips or multiple trips, as well as comprehensive travel insurance policy plans.

- SquareMouth : Search for annual travel insurance plans that cover several trips within the 1-year policy period, single-trip plans, group insurance, and sports/adventure plans.

- AARDY : With dozens of companies to compare, AARDY is worth visiting for a comparison. An email is required to obtain a quote.

Keep in mind that the least expensive policy may not be the best for your situation. You’ll want to compare coverage to find the best fit.

Bottom Line: Travel insurance comparison websites help you compare the policies and prices of several different travel insurance companies, making it easier to find the best policy for your situation at the best price.

How Travel Insured International Compares

While there are several travel rewards cards that come with complimentary travel insurance , this coverage is not meant to take the place of a comprehensive travel insurance policy .

In many cases, the coverage that comes with your credit card is secondary, meaning you must first file a claim with other existing insurance or with your travel provider. Also, coverage is limited , as with most insurance, to only specific reasons for cancellation, interruption , and delay coverage .

Additionally, you won’t find any significant medical coverage offered on credit cards.

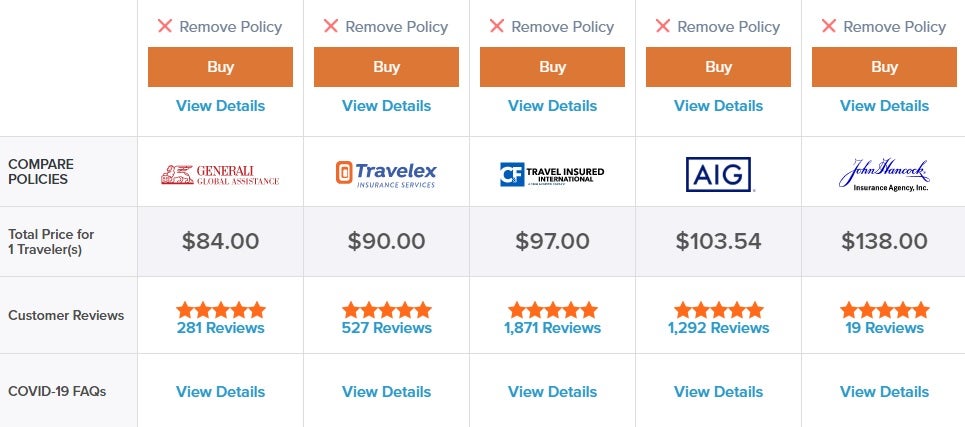

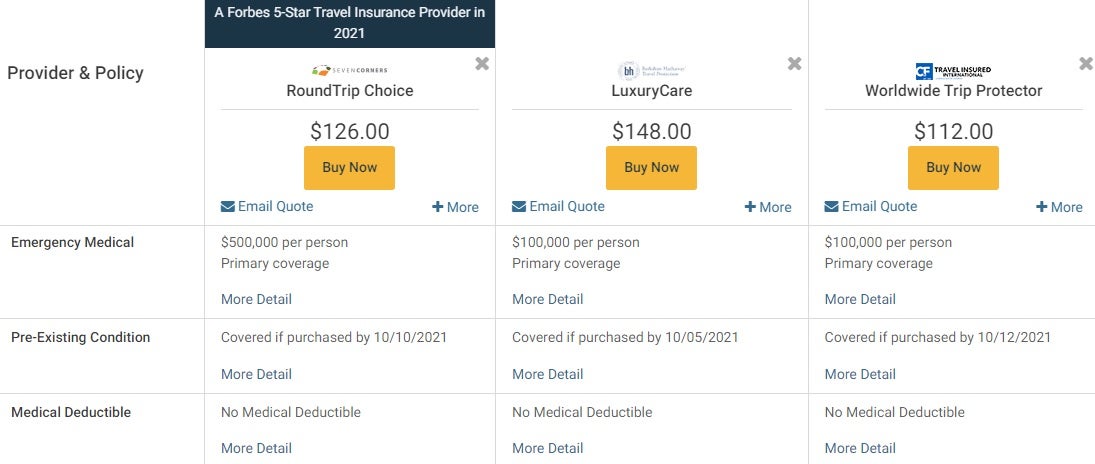

Using an example of a 1-week trip to Mexico costing $2,000 with a traveler 40 years of age, we compared policy coverage and prices on SquareMouth . Coverage for trip cancellation, trip interruption, and trip delay was identical. Baggage insurance was less than Seven Corners (left column) and the same as Berkshire Hathaway (middle column). Missed connection coverage is less than Seven Corners and the same as Berkshire Hathaway (up to $500).

Medical coverage was highest with Seven Corners but equal to Berkshire Hathaway (see above insert). Still, with $100,000 in medical coverage, at $112, Travel Insured International holds its own on pricing and coverage when compared to other companies.

Of course, we used 1 specific scenario; your results will vary depending on the criteria.

The coverage you purchase at the point of sale with your travel provider is limited and cannot be compared to a comprehensive travel insurance policy like the ones we’ve been reviewing.

While it may seem like a good deal to spend $14, for example, to purchase travel insurance when booking a flight, the coverage is extremely limited and only certain situations are covered. Be sure to read the fine print prior to considering the coverage.

Bottom Line: Travel Insured International offers affordable plans that offer a wide range of coverage. In a narrow comparison of other sources of coverage, the company stands out as a viable option for insuring your next trip.

You can call Travel Insured International at 800-243-3174 if you have a claim to report, but the company encourages using its online claim-filing system . The website offers a comprehensive checklist to follow for every type of claim and a list of the specific documentation you’ll need to submit.

Here’s a sample of the type of documentation you will be expected to provide:

- Claim Form : The claim form specific to the type of claim must be completed and signed.

- Proof of Loss : The documentation required will depend on the type of claim. For medical claims, for example, you’ll need an attending physician’s statement. For trip cancellation, you’ll need to submit documentation that the trip was indeed canceled.

- Proof of Payment : You’ll need to provide receipts for cash payments, a copy of the front/back of any checks written, or copies of credit card statements showing payments made.

- Airline Tickets : Provide a copy of the e-ticket showing dates of travel, name, and ticket numbers.

- Travel Provider Cancellation Policy : If you’re submitting a claim for trip cancellation/trip interruption, you’ll need to provide a copy of the cancellation policy of the trip provider.

- Refunds Received : If the travel provider refunded a portion of your expense, you must provide documentation of the amount. If the travel provider did not issue a refund, you’ll need to provide a copy of a letter showing the expense was not reimbursable.

- Invoices and Receipts : You’ll need to include any itemized invoices or receipts that document expenses related to the claim.

Travel Insured International encourages policyholders to contact their travel provider prior to filing a claim with their travel insurance policy. In some cases, the provider may provide a full or partial refund depending on the circumstances. You can then file a claim for any covered expenses that were not reimbursed.

Hot Tip: Whenever you purchase travel insurance, it’s a good idea to review the claims process prior to embarking on your trip. This can save you time and effort by knowing the types of documentation you’ll need to facilitate your claim. Securing some of this supporting information after the fact could be difficult.

Once you’ve purchased a policy from Travel Insured International, you’ll have 10 to 14 days from the purchase date to review the policy. If you’re not satisfied, you can receive a full refund.

As with most insurance, it seems one never has enough coverage at the time of a claim. This phenomenon generates complaints against providers and Travel Insured International is no exception. You’ll find policyholders who have had great experiences and those who did not.

Reviewing your coverage prior to making a purchase is critical and will have an impact on your experience.

For example, the company sells 4 different single-trip plans, 1 of which includes the option to add on Cancel for Any Reason insurance. If you want to save money and purchase a plan that does not include this coverage, you should have no expectation that your trip expenses will be reimbursed if you decide to cancel your trip due to the fear of getting ill or for any other reason not specifically listed in the policy.

Travel Insured International offers a wide variety of coverage options on each of its policies. This makes it easy to pick and choose the coverages you need while keeping the policy affordable.

While it’s a simple process to obtain a quote and subsequently purchase a policy directly on the company’s website, it makes sense to check out other policies/prices on a travel insurance comparison website.

The company is a decent choice for securing a single-trip policy but if you travel extensively, you may want to consider an annual plan that will cover several trips.

Also, for a single trip that doesn’t involve a large amount of non-refundable expenses, you may want to rely on the coverage you have with your credit card. To learn more about this coverage, our article on the best credit cards for travel insurance can offer some insight.

Frequently Asked Questions

Is travel insured international a good company.

Yes. Travel Insured International is established and highly rated. The company was accredited by the Better Business Bureau in 2006 and has been doing business for 27 years.

The company offers the ability to pick and choose the coverage you need to build an affordable plan that matches your situation.

Does Travel Insured International offer a 10-day free look?

Yes. However, insurance is regulated by individual states. In some you’ll receive 10 days to review your policy and in others it may be 14 days.

If you aren’t satisfied, you can obtain a full refund.

Does Travel Insured International cover COVID-19?

Becoming ill with COVID-19 is covered under several coverages, including trip cancellation, trip interruption, and medical coverage. Terms apply.

The company also offers Cancel for Any Reason insurance as an option on its most comprehensive plan.

How can I file a claim with Travel Insured International?

You can call Travel Insured International at 800-243-3174 if you have a claim to report, although the company suggests using its claim-reporting website .

The website option offers a customized checklist that’s specific to the type of claim you need to file, making it easy to initially submit all the required documentation.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![is travel insured international a good company The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]](https://upgradedpoints.com/wp-content/uploads/2021/05/Senior-couple-on-beach-at-sunset.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- Travel Insurance

- Travel Insured International Travel Insurance Review

On This Page

- Key takeaways

Is Travel Insured International legit?

- Bottom line Main highlights of Travel Insured International travel insurance

Travel Insured International travel insurance plans & coverage

Things not covered by travel insured international travel insurance, cost of travel insured international travel insurance plans, travel insured international travel insurance reviews from customers, is travel insured international travel insurance worth it, faq: travel insured international travel insurance, related topics.

Travel Insured International Review for 2024

- Travel Insured International is a well-established travel insurance provider with over 25 years of experience .

- Travel Insured International offers three travel insurance plans .

- Though they vary in coverage, they all include protection for trip cancellation, delays, medical evacuations and lost baggage .

- You can purchase add-ons to further extend your coverage . These include cancel for any reason (CFAR) coverage, rental car damage coverage, event ticket registration fee protection and coverage for work-related cancellations.

- To compare multiple plans and find the one that best suits your needs, we recommend using our online comparison tool .

With over 25 years in the industry and an impressive A+ rating from the Better Business Bureau , Travel Insured International stands out as a reliable choice for a travel insurance provider.

The company caters to various travel needs by offering flexible plans and comprehensive coverage options .

In this guide, we’ll explore Travel Insured International’s insurance plans and customer experiences to help you determine if it’s the right fit for your travel insurance needs.

- Annual and single-trip policies are available

- High non-medical evacuation coverage

- Travel and baggage delay coverage after only 3-hour delays

- Travel inconvenience upgrades available

- Basic plan offers only medical coverage for seniors

- Limited medical coverage compared to competitors

Yes, Travel Insured International is a completely legit and great travel insurance provider . It’s a veteran of the industry with over 25 years of experience insuring travelers on trips around the world.

The Better Business Bureau awarded Travel Insured International an A+ rating and accreditation as a sign of its longtime history of industry savvy and attentive customer service. Plus, it’s backed by Crum & Forster, an insurance company in operation since 1822.

For an in-depth look at the benefits of Travel Insured International’s travel insurance, take a look at the highlights below.

Bottom line: Main highlights of Travel Insured International travel insurance

One of Travel Insured International’s main benefits is its flexibility.

The provider offers a wide range of plans for travelers to choose from. Some plans even offer free coverage for children , making this a great option for families.

Travel Insured International plans offer primary coverage with high medical and medical evacuation limits , thus casting a wide net of protection should an incident occur and giving you greater peace of mind in light of unexpected events.

Travel Insured International offers three single-trip insurance policies through our comparison tool .

These plans vary in specific coverage, though they all offer compensation for trip cancellation, delays, medical evacuations and lost baggage.

Travel Insured International

Here’s a quick overview of each plan and its range of coverage:

Worldwide Trip Protector:

This plan comes with numerous benefits, including 100% trip cancellation, 150% trip interruption, $100,000 for medical expenses, emergency medical evacuation coverage and missed connection protection. It’s a good plan for well-rounded coverage that includes many common travel mishaps.

Worldwide Trip Protector Plus:

This policy also offers 100% trip cancellation coverage , 150% trip interruption and $100,000 for medical expenses. Other benefits are cancel for any reason and interrupt for any reason coverage (CFAR and IFAR, respectively), meaning you can be reimbursed if your trip is cut short or called off. Also included is rental car damage protection, which can be added to the other two plans for an additional fee. Though more expensive, this option is good for those who want an extra layer of protection.

Worldwide Trip Protector Edge:

Included in this plan is 100% trip cancellation, 100% trip interruption, $10,000 for medical expenses, $100,000 for medical evacuation and $750 for baggage protection. Some benefits, like those for medical expenses and evacuation, can be increased with an optional upgrade. Though it has fewer benefits than the previous two plans, this budget-friendly policy is customizable for those who want more control over their coverage.

Here is a brief look at how each plan differs:

Travel Insured International also offers one annual multi-trip travel insurance policy , the Annual Multi-Trip Protector. This policy includes coverage for medical expenses and evacuation as well as typical post-departure benefits like trip interruption and loss of personal belongings. Unlike single-trip coverage, this policy has an extended term and protects any trip you take during that window.

Optional add-ons

For greater protection during your trip, Travel Insured International offers several add-on benefits . These aren’t typically included in standard insurance policies but will extend coverage even further for an additional fee. Here are four upgrades you can add to your plan:

Cancel for any reason (CFAR)

Even with extensive planning, sometimes a trip must be unexpectedly canceled. To protect against surprise cancellations, consider adding cancel for any reason coverage to your travel insurance plan. With this benefit, you’re eligible for reimbursement of nonrefundable trip costs that aren’t otherwise covered by your policy.

Rental car damage coverage

This optional add-on keeps you protected in the event your rental car is damaged or stolen. Covered damage includes collisions, vandalism, natural disasters and any other situation beyond your control that occurs while the car is in your possession. If you plan to rent a car during your trip, this add-on might be a worthy addition to your insurance policy. At Travel Insured International, the maximum benefit amount for rental car coverage ranges from $25,000 to $50,000.

Event ticket registration fee protection

If a ticketed event is part of your trip itinerary, you might consider adding registration fee protection to your travel insurance plan. This optional coverage can be tacked on to any Worldwide Trip Protector policy and will reimburse you for the cost of unused event tickets or registration fees. To be eligible, your tickets must be listed as nonrefundable by their distributor, and your reason for not attending the event must be on the list of covered unforeseen circumstances. If this is the case, you may receive up to $1,000 worth of reimbursements.

Cancel for work reasons

Unexpected work obligations can put a hold on your travel plans, potentially leaving you at a financial loss. If you think work might pull you away from your trip, extra coverage for work-related cancellations may be a useful addition to your plan. With this add-on, the full cost of your trip can be reimbursed, assuming your situation falls under the list of covered scenarios, which includes being required to work on the trip. For this coverage, the maximum benefit amount is 75% of the total trip cost.

Like any travel insurance policy, some benefits aren’t included in Travel Insured International’s plans.

Depending on the policy you choose, things that aren’t covered include:

- Loss of audio or visual aids, like eyeglasses, contacts or hearing aids

- Injuries caused by self-harm

- Losses incurred while you were under the influence of drugs or alcohol

- Injuries caused by participation in extreme activities (think skydiving)

- Routine check-ups or dental exams

- Mental health emergencies, unless they require hospitalization

According to our sales data, visitors who purchased a Travel Insured International plan through our website spend an average of $102 for travel insurance for a two-week trip. This equates to an average cost of $8.58 per day for travel insurance .

To give you a better idea of how much plans from Travel Insured International cost, we got multiple quotes for each plan to five different countries and found the average cost for each.

Average Cost of Travel Insured International Plans

While these serve as an estimate, keep in mind that these numbers are for example purposes only, and your own costs will vary based on the specific parameters of your trip. We recommend getting a quote for updated pricing.

Methodology for reaching these averages:

We applied the following parameters to each quote:

- Total trip cost : $2,000

- Trip duration : Seven days

- Time of trip : September 2024

- Destinations: The Bahamas , Italy , Mexico , Thailand , & Kenya

Since your state of residence determines which plans are available, we got quotes in California for the Worldwide Trip Protector plan and the Worldwide Trip Protector Edge. For the Worldwide Trip Protector Plus plan, our quotes were based on a resident of New York.

Taking a trip insured by Travel Insurance International gives customers a unique perspective of the company’s effectiveness. If you’re considering a plan from this provider, customer reviews can help you make a more informed decision.

On Squaremouth , Travel Insured International has more than 3,300 reviews with an overall rating of 4.39 out of five .

Here’s what customers like and dislike about Travel Insured International.

What customers like

Customers have plenty of good things to say about Travel Insured International. Some commonly mentioned positives are:

- Flexibility

- Comprehensive policies

- Knowledgeable staff

“Very knowledgeable staff when you call. Have used before and will use again. Very flexible options from medical only to full trip cancelation coverage.” - Howard

“The settlement was exactly as we had expected based on our documentation and receipts.” - Kathleen

What customers don’t like

Some customers had less-than-stellar experiences. Some frequently mentioned areas for improvement include:

- Hard-to-reach customer service

- Tedious claims process

- Miscommunication

“Horrible customer service. Took days for a reply to email. Never was able to get it resolved before I left.” - Kathryn

“Our trip was interrupted due to COVID. I expected some help from their “concierge” line, but after waiting 50 minutes on hold I received nothing except “file a claim once you’re home.” Literally zero help arranging alternate transportation or hotel.” - Joseph

Overall, Travel Insured International is undoubtedly a high-quality travel insurance provider.

With a thorough range of benefits and an extensive list of optional add-ons, it’s clear why the company is a top-rated insurance provider among travelers. Its three policies each cover a standard selection of vacation mishaps, including trip cancellation and interruption, medical expenses and lost baggage.

If you’re looking for an excellent range of coverage with customizable add-ons and family-friendly prices, Travel Insured International may be the right provider for your next trip . If you’re looking for higher maximum limits and easier claims processes, however, you might be better off looking elsewhere for your travel insurance.

What is covered under Travel Insured International insurance?

The policies offered by Travel Insured International vary in coverage. Depending on your chosen plan, you can expect insurance benefits designed to protect your health, finances and personal belongings.

Covered items include:

- Trip cancellation and interruption

- Missed connections

- Rewards points reimbursement

- Nonmedical evacuation

- Accident and sickness expenses

- Lost or stolen baggage

- Baggage delay

Does Travel Insured International travel insurance cover COVID-19?

Yes, COVID-19 is included in Travel Insured International’s coverage . This insurance provider treats COVID-19 as it would any other sickness, meaning you’re covered for a range of losses that it might lead to. This includes things like trip interruption or cancellation, medical evacuation and medical expenses. For some plans, medical insurance terms require the COVID-19 diagnosis to be confirmed by a physician rather than relying on the results of an at-home test.

The same guidelines that dictate whether an illness counts as a pre-existing condition apply to cases of COVID-19. If your chosen plan includes a pre-existing medical condition exclusion waiver , any losses that occur are likely to be covered.

Does Travel Insured International offer ‘cancel for any reason’ coverage?

Cancel for any reason coverage, or CFAR, is available as an optional add-on to most plans at Travel Insured International. Under this coverage, you’re eligible for reimbursement of any unused, nonrefundable payments or deposits you made when planning your trip. If your trip is canceled for reasons not otherwise covered in the plan, you can recover a portion of the trip cost up to the set maximum benefit amount.

CFAR applies only when it’s added to your plan during a specified time period and the trip is canceled no later than 48 hours before your scheduled departure. It’s important to note that this doesn’t cover travel arrangements paid for but not provided by a third-party travel agency.

Does Travel Insured International have international travel insurance?

Yes, Travel Insured International offers travel insurance for international trips. This means your coverage will remain in effect when you’re outside your home country, so any sickness or accidents you incur abroad are likely eligible for coverage. Some benefits, like emergency medical evacuation, are included specifically for international travelers.

Hayley Harrison is an active personal finance contributor for LA Times Compare. She is passionate about helping consumers make informed financial decisions and achieve their financial goals by simplifying complex topics relating to insurance and personal finance.

Hayley brings first-hand knowledge of the finance industry thanks to her previous experience as a branch manager for a mid-sized regional bank and as a licensed accident and health insurance agent.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions April 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Tips & Quotes for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Tourist Information & Tips

Best UK Travel Insurance: Coverage Tips & Plans April 2024

Travel Insurance for Trips to the Bahamas: Tips & Safety Info

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review April 2024

Travel Insurance for Thailand: US Visitor Requirements & Tips

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review April 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review April 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for April 2024

Seven Corners Travel Insurance Review April 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our editorial team who reviews and rates each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

Travel Insured International Review

One of my top-rated companies, they have better coverage and more options than comparable plans

Top reasons to buy

- Value for traveler- lots of coverage for low cost

- Unique coverage for hurricane season (see below)

- Very reputable company backed by one of the oldest insurers in the world.

Flaws but not dealbreakers

- Baggage coverage is slightly lower than comparable plans

Bottom line

Always in my top recommended plans. Travel Insured has better coverage, unique coverage other plans lack, and are priced similarly. Backed by one of the world’s oldest insurance companies, very reputable.

Company information

Worldwide Trip Protector (Most Popular)

Worldwide Trip Protector Edge

Travel Medical Protector

Money Back Guarantee

Free look up to 14 days after purchase

Customer Service

800-243-3174 Hours of Operation: Weekdays, 8:00am – 9:00pm ET

Emergency Assistance:

Inside USA 800-575-5014 Outside USA 603-328-1926

800-243-3174 Claims Hours of Operation: Weekdays, 8:00am – 6:00pm ET

Full Travel Insured International Review

Summary: Travel Insured offers one of my top-recommended plans– Worldwide Trip Protector. Their plans have better coverage for weather/hurricanes, and include coverage that other plans don’t have. Their plans cover Covid-19 for cancellation and medical treatment. They also offer the popular Cancel For Any Reason upgrade.

Their Worldwide Trip Protector plan is a great overall recommendation. I have personally purchased this plan for a family trip, and they paid my claim for a canceled trip.

Worldwide Trip Protector is featured on both of these lists:

- Best Cruise Insurance Plans

- Best Family Plans

Travel Insured keeps things simple with only three plans. Most travelers will buy Worldwide Trip Protector as a great overall plan. They also offer Worldwide Trip Protector Edge, which is a budget-friendly version of the same plan but with lower coverage limits. Finally, they offer Travel Medical Protector. This is a plan without cancellation coverage, and it focuses on emergency medical for international travel.

Company Information Travel Insured was founded in 1994 so they have been in the business for a long time. In 2015, Travel Insured was acquired by Crum & Forster– an insurance company with a 200 year (!) history and plenty of financial backing. Travel Insured is a reputable company that can be relied on to pay claims.

What does Travel Insured insurance cover?

Travel Insured’s two travel insurance plans (Worldwide Trip Protector & Worldwide Trip Protector Edge) are for most travelers. They are the plan you would buy for a vacation, cruise, tour, or any other trip where you are worried about losing money for a canceled trip.

Like all travel insurance plans, they cover:

- Trip cancellation & interruption

- Emergency medical expenses

- Medical evacuation expenses

- Lost, stolen, or damaged baggage

- Travel delays

- Delayed baggage

- 24/7 worldwide assistance

Travel Insured International & Cancel For Any Reason Insurance

Travel Insured offers Cancel For Any Reason coverage as an optional upgrade with Worldwide Trip Protector. It is not available with Worldwide Trip Protector Edge, because this plan is designed to be budget-friendly. It is not available with Travel Medical Protector because this plan doesn’t cover canceled trips– it focuses on medical emergency coverage abroad.

Some companies, such as Allianz, don’t offer this upgrade. Even though it is optional, I believe it is better to have the option. This is why I recommend Travel Insured over Allianz.

Travelers like the peace-of-mind this coverage provides. It gives you a lot of flexibility in cancelling your trip and still getting most of your money back.

Travel Insured International and Covid-19

Worldwide Trip Protector covers Covid-19 for both trip cancellation and emergency medical expenses.

Trip Cancellation and Covid-19

Travel Insured treats Coronavirus like any other sickness when it comes to trip cancellation coverage . Trip cancellation covers cancellations if someone gets sick or injured before the trip and cannot travel. This is the most popular reason for trip cancellation, and travelers make claims for this all the time. It might be a child with the flu. Or a parent having a stroke and you need to care for them.

In the case of Covid, if you get sick before departure and your doctor advises you to cancel, this is a covered reason for cancelling . You would receive any trip expenses you lose as a reimbursement from the insurance company. Physicians provide verification for this all the time.

Emergency Medical Treatment and Covid-19

Similarly, Travel Insured’s plans cover Covid as they would any other sickness for emergency medical care . If you are traveling abroad and get sick or have an illness, you are covered for medical care costs.

Travel Insured International Hurricane & Weather Coverage

Travel Insured has some of the best hurricane & weather coverage for trip cancellation. Here is what makes their coverage better than other plans.

They cover hurricane warnings from the NOAA

This is some small print that many plans don’t have, and it makes Travel Insured a better plan for hurricane & weather concerns.

Many plans cover sever weather that damages your destination. In these cases, you need the hurricane it actually strike and cause damage to your resort that shuts it down. But, what if it strikes and leaves a mess behind, but doesn’t close your resort? Technically you can still take your trip.

With this coverage, if the NOAA issues a hurricane warning that includes your destination within 48 hours of your departure, you ‘re covered. You can cancel and receive reimbursement. That extends your coverage by a lot, and protects your money better.

Their delay trigger is 6 hours instead 12+

Travel insurance covers cancellation for common carrier delays. This means an airline being shut down due to severe weather. But all plans have a different amount of time before that coverage is “triggered”. Some plans require a delay of 12, 24, or even 48 hours. This means you can be delayed 47 hours and you still can’t cancel your trip and be covered.

Travel Insured has a delay trigger of 6 hours, which is low. That’s good. There are plans that have a trigger that states “delay of any length of time”, which is better. But these plans don’t have the NOAA warning coverage. If I had to choose I’d rather have 6 hours and warning covered, instead of 0 hours and no warning covered.

How much is Travel Insured insurance?

Travel Insured tends to be similar in price to comparable plans, but with better coverage and options.

Here is an example of the difference in price and coverage:

Trip information: Two-week trip with a trip cost of $4,000, one traveler aged 46.

Travel Insured Worldwide Trip Protector – $228 This is a plan with medical limit of $100,000. This is an adequate amount of travel medical coverage for most trips. Compare this to only $50,000 on the Allianz plan below. Travel Insured has better hurricane & weather coverage (more below). This plan also has the option to upgrade with Cancel For Any Reason.

Trawick Safe Travels Voyager – $241 Similar coverage, but the medical limit here is even higher at $250,000. This is more than adequate travel medical coverage for most trips. This plan also has the option to upgrade with Cancel For Any Reason, but the hurricane coverage is not as good.

Allianz OneTrip Prime- $217 Most coverage is similar, but this plan only has emergency medical coverage up to $50,000. This is a decent amount, but for trips like cruises and travel abroad, I recommend a minimum of $100,000. This plan also has no option for Cancel For Any Reason coverage. This is an upgrade that many travelers like to have for their trip. Most companies offer CFAR upgrades on at least one plan, but Allianz has no coverage for this.

All of the plans are a little more than 5% of the trip cost, which falls within the usual travel insurance range of 4-10%.

Travel Insured International Plans

Single trip trip insurance plans.

Worldwide Trip Protector This is Travel Insured’s most popular plan. It is also one of my top recommendations for all travelers. It has $100,000 of Primary medical coverage, and $1,000,000 of emergency evacuation coverage. It covers Covid for both cancellation and medical treatment. It also includes the better hurricane and weather coverage with NOAA warnings covered. Overall an excellent plan.

Worldwide Trip Protector Edge This is similar coverage, but less coverage limits. It is for budget-minded travelers who want coverage without increasing their travel budget as much. This plan does not have the Cancel For Any Reason option available. It also does not have coverage for NOAA hurricane warnings.

Travel Medical Plans

Travel Medical Protector This is Travel Insured’s plan for travelers who don’t need cancellation coverage, but want medical coverage abroad. It covers $50,000 for medical emergencies, $1,000,000 for evacuation. It’s a fine plan, but there are better options for travel medical insurance.

Travel Insured International FAQs

Is Travel Insured International a good company?

Yes, absolutely. Travel Insured has been in business since 1994. They were recently acquired by 200 year old Crum & Forster. They have incredible financial backing, and are a stable, trustworthy, and reputable company.

Which Travel Insured plan is best?

Worldwide Trip Protector is their best plan. It has high coverage limits, covers NOAA hurricane warnings, has the option for Cancel For Any Reason, and is reasonably priced.

Travel with peace-of-mind... Compare quotes for free

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

EDITOR'S PICK

Best Price Guarantee By Comparing Top Providers In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

- Policies from trusted providers including: Travel Insured International, AEGIS, Global Trip Protection, Arch RoamRight and others

- Travel Insurance

- Travel Insured International Review

Travel Insured International Travel Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Travel Insured International rated?

Overall rating: 3.4 / 5 (very good), travel insured international plans & coverage, coverage - 3.5 / 5, emergency medical coverage details, baggage coverage details, travel insured international financial strength, financial strength - 3.5 / 5, travel insured international price & reputation, price & reputation - 3.5 / 5, travel insured international customer assistance services, extra benefits - 3 / 5, travel assistance services.

- Return Travel Arrangements

- Lost Baggage Search

- Lost Passport/Document Assistance

- Emergency Cash

- Translation Services

- Legal Assistance Referral

Emergency Medical Assistance Services

- Physician Referral

- Emergency Medical Case Management

- Arrange Medical Payment Where Available

- Eyeglass Replacement Assistance

Concierge Assistance Services

- Restaurant/Event Referral and Reservation

- Ground Transportation Recommendations

- Wireless Device Assistance

Our Comments Policy | How to Write an Effective Comment

22 Customer Comments & Reviews

- ← Previous

- Next →

Related to Travel Insurance

Top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

Suggested companies

Allianz partners usa, faye travel insurance.

Travel Insured International Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.1.

Most relevant

Very overpriced and uncancellabe

Very overpriced. Cancellation policy not disclosed and my trip was cancelled and I could not cancel the coverage. Never again.

Date of experience : March 03, 2024

The trip was amazing and the crew were…

The trip was amazing and the crew were extremely helpful even though tips were included in the deal. I forgot my sun glasses and due to the sun and the reflections off the snow they were needed. One of the expedition leaders let me use his. All the staff were excellent and even our suite was upgraded.

Date of experience : February 26, 2024

Travelers Beware.

I was a first time user of Travel Insured International while booking a cruise. The policy states that “benefits will be paid if you or a family member’s or a traveling companion’s covered sickness or injury, which: a) occurs before the departure of your trip, b) requires medical treatment at the time of cancellation resulting in medically imposed restrictions, certified by a legally qualified physician, and c) and prevents your participation in the trip.” I was diagnosed, and treated by my physician, who supplied the necessary requested information and stated that my knee osteoarthritis prevents me from traveling and please allow me to cancel the trip. Travel Insured International refused to refund the full amount of travel and opted for the “cancel any reason” which only refunds fifty-percent of the cost, by stating, and I have this in an email, that there was “no medical treatment with restrictions the time I cancelled.” The company will not acknowledge that medical treatment had occurred before I cancelled, and that treatment continues. The claims rep, Wyatt, that I initially spoke with, said that because I didn’t cancel at the date of the first treatment was the reason of their refusal to refund the full price. So I asked if I did cancel on the date of my treatment I would get a full refund? Her response was, “I don’t answer theoretical questions.” How crazy making is that? Realistically, if we were talking about a hundred bucks I could let it go. We’re talking about the loss of over two-thousand dollars. The other one star reviews of this company are accurate in their descriptions of the processes in filing a claim, and the issues and tactics that this company employs. I’m also baffled at the five star reviews that state they bought a policy but never had to file a claim. This makes absolutely no sense to me as why anyone would review a company for just buying a policy. ??? It may not come to anything, but I plan on filing with the Pennsylvania Insurance Commission, The State Attorney General, the BBB, and any social media site, to alert anyone who might consider using this company.

Date of experience : March 07, 2024

Easy to purchase

I didn't have to use any insurance, thankfully, but buying and choosing an insurance for my travels was easy.

Date of experience : April 08, 2024

Costly, but I had peace of mind.

I bought insurance for a trip abroad and felt comfortable that I was well covered for emergencies. Because I am elderly, my insurance was almost double of that of my fellow traveler, as was expected. I didn’t need to use the insurance, but it was there if I needed it,

Date of experience : February 01, 2024

Simple and like the annual coverage

Date of experience : March 04, 2024

Thailand trip

I really have no experience except for purchasing the insurance for the trip. I didn't need to use the insurance, so it was a safe and enjoyable trip. Purchase was extremely easy and the rates are good.

The website is so simple to use

The website is so simple to use. That is a big deal to me.

Date of experience : April 25, 2024

I’d give them 0 stars if that were an…

I’d give them 0 stars if that were an option. If you want to spend your money and not file a claim, I suppose this is a fine choice. If you have to file a claim, be ready to be talked out of it, and if you choose to file it (you should see the list you have to produce - block out a day), not having it covered. Oh, they’ll have reasons, which are very different than the reasons they give as to why you need to buy a policy in the first place. And, you should know, I RARELY write reviews under 4 stars. Now I have probably lost another 1K for a trip next year I used them for before I realized how shiesty they were.

Date of experience : March 06, 2024

I took this insurance before our cruise to Alaska

I took this insurance before our cruise to Alaska. Due to a medical issue, we were unable to make the cruise. The cruise line only gave us back a small portion as we were 35 days prior to sail date. I contacted Travel Insured and they provided me with forms needed for a refund of the rest of the costs. Easy to purchase this and used it again on a recent cruise.

Date of experience : September 06, 2023

Great product and great customer…

Great product and great customer service.

Date of experience : January 02, 2024

The trip was great and did not need to…

The trip was great and did not need to use the insurance at all. However it was a great peace of mind to know it was there.

Date of experience : March 20, 2024

Ease in getting the quote and securing…

Ease in getting the quote and securing the coverage.

Date of experience : March 23, 2024

Hard to review unused insurance

It's hard to review something you didn't use, but glad to know it was there if we needed it. I hope it would have come through with flying colors if we had to use it. We would still buy travel insurance again!

Date of experience : February 20, 2024

Complete peace of mind while travelling

While we had no travel disruptions or any medical issues during our recent overseas cruise from Thailand, Vietnam, Brunei, Malaysia, Philippines and Taiwan, I had complete piece of mind knowing if Ii had any issues, I had very thorough travel insurance.its hard to put a price on peace of mind, it made the trip all the more enjoyable.

Date of experience : March 01, 2024

Thank goodness it is hard to rate this…

Thank goodness it is hard to rate this travel insurance. Purchase was easy. But did not need it so have had no contact with them since purchase. This is the way I like to interact with travel insurance companies.

Date of experience : February 06, 2024

I contracted ALS after I planned my…

I contracted ALS after I planned my trip and did not travel. I filed a claim with you. I provided every document you requested. I have heard nothing from you. The date below is the date I filed my claim. What's going on?

Date of experience : January 07, 2024

The ease and options to scale our…

The ease and options to scale our insurance needs for our trip was paramount. Having piece of mind in the event of cancellation was also well worth the money spent.

Date of experience : March 11, 2024

Review re travel to San Juan

The agents were pleasant and informative. I don't have any negative comments, since I did not require help with anything, the trip turned out to be a smooth one.

Date of experience : February 19, 2024

Very relieved to know I was covered for…

Very relieved to know I was covered for any situation. All was good and never had to submit a claim. Thank you.

Date of experience : March 19, 2024

- Travel Insured International

- Provider Review

Reviews, Sales, and Service Ratings for Travel Insured International

0.1% (191) negative reviews to sales Average on Squaremouth is 0.2%

- 5 stars 2072

- 4 stars 651

- 3 stars 264

- 1 star 111

- Customer Service Before Trip

- Customer Service During Trip

- Customer Service During Claim

Customer Reviews for Travel Insured International

Sort by Most Helpful, Most Recent, Star Ratings, or select “Filed Claim” to only show reviews from customers who filed a claim.

- Next ›

- Last »

- Sort and Filter Sort/Filter All ratings 1 star 2 stars 3 stars 4 stars 5 stars Newest First Rating, best to worst Rating, worst to best Most helpful first Filed claim

It is hard to compare so many offerings, especially when I don't understand the minute differences in coverage. The representatives always help me make a decision and came up with different ways to meet the variety of needs that we had.

I don’t know yet. I filed the claim online and so far have not heard from anyone. It has only been a couple of days.

It gives travelers peace of mind.

The customer service with recommendations tailored to my travel itinerary were extremely beneficial, followed by an easy purchase and confirmation process. Your competitive pricing, and robust coverage tipped the scales over your competition.

I had to explain documents somewhat more than I thought was necessary.

Squaremouth is great to work through when finding the insurance I need for trips. Once I decided on Travel Insured International I had a few questions for them before the actual purchase. They were very good about answering the questions so I was able to make a decision.

I have another trip coming up which I have already purchased insurance; Squaremouth/Travel Insured International, and I may have another later this year.

Did not file a claim but very good experience with buying the policy and interacting with agent.

I will use again in the future.

I called the 24 hr line while we were in DR. The representative was very nice. My husband and I were sick in our rooms for 3-4 days of our trip due to either norovirus or E. coli. I was hoping that something would be covered, but I was told no. This is the reason that you purchase insurance. We were completely unable to enjoy this trip.

Customer service was excellent when I ran into an issue with purchasing the policy and had an inquiry about a claim.

Insurance Providers

- Arch RoamRight

- AXA Assistance USA

- Azimuth Risk Solutions, LLC

- Berkshire Hathaway Travel Protection

- CSA Travel Protection

- Detour Insurance

- Generali Global Assistance

- Global Alert

- Global Guardian Air Ambulance

- Global Underwriters

- HTH Travel Insurance

- INF Visitor Care

- John Hancock Insurance Agency, Inc.

- MedjetAssist

- Nationwide Mutual Insurance Company

- Seven Corners

- Travelex Insurance Services

- Trawick International

- USA-Assist Worldwide Protection

- USI Affinity Travel Insurance Services

Additional Information

- AM Best Ratings

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of April 2024

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance