Search Smartraveller

Choice travel insurance buying guide.

Do you need travel insurance? How do you choose the right cover? What are you covered for?

CHOICE answers all the questions you need to know before leaving the country.

Download the CHOICE travel insurance buying guide [PDF 3.52MB] Download the CHOICE travel insurance cheat sheet [PDF 587KB] Who is CHOICE? Set up by consumers for consumers, CHOICE is the independent consumer advocate that provides Australians with information and advice, free from commercial bias. Visit choice.com.au .

Why travel insurance?

- Does travel insurance cover COVID-19?

How to get travel insurance

Before you buy, how to save money on travel insurance.

- How to read the product disclosure statement

What are you covered for?

- Credit card insurance

How to make a complaint

If you’re leaving Australia, travel insurance is just as essential as a passport.

Holidays don’t always go as planned.

If you’re leaving Australia, travel insurance is just as essential as a passport. Medical expenses are the number one reason to get insurance, but sometimes other things can go wrong, such as trip cancellations, delays, lost luggage or even the big stuff like natural disasters and pandemics. If you end up out of pocket because of these things, insurance can make up for that.

The Australian Government won’t pay your medical bills.

In an emergency, the Australian Government can only help so much. The Consular Services Charter describes what the government can and can’t do to help Australians overseas.

If you end up injured or sick while overseas, you’ll be footing the hospital bill and the cost of flying home. If you’re really unlucky, that could cost you or your family hundreds of thousands of dollars.

68% of travellers mistakenly believe the Australian Government would ensure they get medical treatment if they need it overseas, and 43% believe the government would pay their medical bills.

Some countries won’t let you in if you don’t have insurance.

Singapore and the UAE require you to have travel insurance. Not to mention all 26 European countries in the Schengen Area if you’re applying for a visa to visit. Read the Smartraveller travel advice for information about your destination.

Reciprocal healthcare Australia has reciprocal healthcare agreements with several countries: Belgium, Finland, Italy, Malta, the Netherlands, New Zealand, Norway, the Republic of Ireland, Slovenia, Sweden and the United Kingdom. If you have Medicare, you can get subsidised treatment for essential services only in these countries, which often leads people to ask whether they still need travel insurance. The answer is yes, for the following reasons. You’re usually only covered for urgent care that can’t wait until you get home. If you’re very ill, travel insurance can pay for a medical escort to bring you home to Australia. You still may have to pay fees for treatment and medication. For example, in New Zealand reciprocal health care doesn’t cover you for free or subsidised care by a general practitioner or ambulance. Travel insurance can cover you for cancellations, delays, stolen items and more.

Remember to take your Medicare card with you. You’ll need it, along with your passport, to prove you’re eligible for reciprocal health care. For more information, visit servicesaustralia.gov.au .

Marco* had breathing difficulties on his way home from Europe, causing his flight to be diverted to the UAE. Hospitals in the UAE won’t admit you unless you have insurance or can pay an upfront fee. Marco’s family had to pay thousands of dollars for his treatment. *To protect privacy we have changed names and some details

Do you need domestic travel insurance?

Most of us already have medical cover at home, be it Medicare or private health insurance or both. But there are still a few key reasons to consider domestic travel insurance.

- Cancellation: If you’ve spent a lot on your holiday, then it’s not too much extra to buy travel insurance in case of the unforeseen.

- Baggage cover: If you’re travelling with valuables, think about whether you want them covered for theft, loss or damage.

- Car hire excess: You can save money using travel insurance to cover your collision damage excess, rather than paying the car hire company’s extra charge.

Does international travel insurance cover COVID-19?

Many travel insurers now offer limited cover for COVID-19, but the available cover varies quite a lot. Some policies only cover medical and repatriation costs if you get COVID-19 overseas, while other policies provide limited cover for cancellation costs in addition to medical and repatriation costs.

You should always check the details of your insurance coverage, particularly how it applies to COVID-19 and travel disruptions.

Over 90% of travellers will look for insurance that covers them for cancellation and medical expenses caused by COVID-19.

If you’re planning to go on a cruise, be extra careful. Some travel insurers may not offer COVID-19 cover for multi-night cruises or they may restrict the cover provided on cruises.

Also, don’t rely on the travel insurance on your credit card unless you check it closely – it may not cover claims related to COVID-19.

There are cooling-off periods for COVID-19 cancellation cover, so it’s best to buy your travel insurance at the same time as you book your trip. Some insurers may only cover cancellation if you test positive to COVID-19 and the policy was purchased more than 21 days before your scheduled departure date.

Make your travel plans COVID-safe

You need to be prepared for your travel plans to be interrupted at short notice. As travel insurance may not protect you from government border closures, general lockdowns or quarantine requirements in your destination country, the key is to book only with providers that allow you flexibility should things change.

- Check the rules for travelling to your destination. For example, are there any entry requirements? What are the vaccination requirements? And what type of travel insurance do you need?

- Read the terms and conditions of your airline, accommodation and travel tours before you book. Will they refund you if you can’t travel due to COVID-19? If they only offer a reschedule or a credit, will you be in a position to redeem the credit in future?

- You can book flexible tickets for flights but be aware you usually have to pay the difference between the prices for the tickets you bought and the new tickets. So changing your flight dates at short notice can be very expensive.

- If you book through a travel agent or booking site, what are their terms and conditions? Will they refund you or provide a credit? Are there cancellation fees?

- If you pay by credit or debit card (and you selected ‘credit’ when you paid), you may have access to credit card chargebacks if something goes wrong.

- Keep on top of the latest travel advice and requirements at smartraveller.gov.au . Travel restrictions can change at short notice.

- If you do have to cancel, your travel insurer will ask you to claim what you can back from travel providers first. Read the CHOICE advice on how to get your money back on travel cancellations and ask your travel insurer if you can get a refund or partial refund of your travel insurance premium.

You can buy travel insurance from a travel insurer, travel agent, insurance broker, credit card provider, or even from your health, home or car insurer.

You can buy travel insurance online (direct from the insurer’s website, from a comparison site or through an airline booking site), over the counter or over the phone.

Buy travel insurance as soon as you know your travel dates. That way you’re covered if your trip is cancelled before you even leave or if you’re unable to travel at all.

You can certainly buy travel insurance quicker than it will take you to read this guide, but do you know what you’ll be covered for? Will you be covered if you trip over after having a drink? If you crash your scooter in Thailand? If you lose your wallet during a stopover? If you need to isolate because you contract COVID-19?

There are a lot of ‘what ifs’ to consider, depending on where you’re going and what you’ll be doing, so it’s worth reading the product disclosure statement (PDS) first to make sure you’ll be covered.

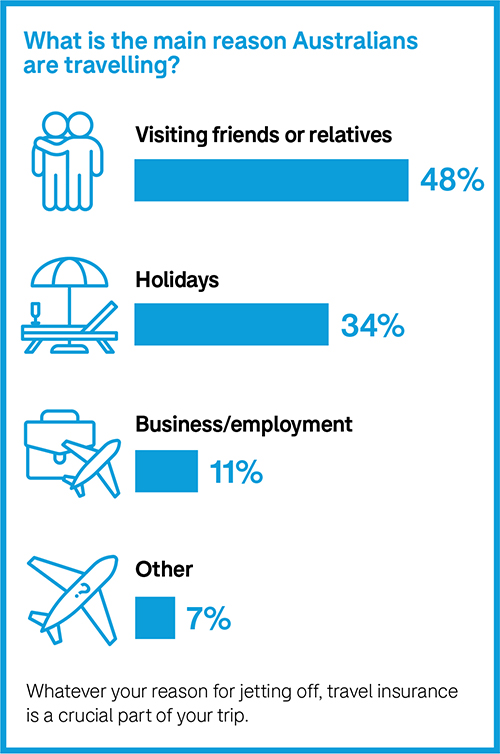

Will you use it? Hopefully not, but research by Smartraveller found that one in 4 Australian travellers experienced an insurable event on their last overseas trip. Most common insurable events Flight or tour cancelled Flight delayed more than 12 hours Received medical treatment Lost, damaged or stolen luggage Missed a connecting flight Lost, damaged or stolen cash or personal items Forced to cancel trip before departure What if the insurers don’t pay out? Australian travellers lodged almost 300,000 insurance claims in 2018–19, the last financial year before COVID-19 travel bans. Almost 90% of those were paid out. Top four reasons for declined claims Due to policy exclusions, or not included in the policy conditions Claim amount was below the excess Claim was due to a pre-existing medical condition Claim was for an item that was stolen while it was unattended

1. Where are you going?

The level of cover and the cost of travel insurance can vary depending on the region you’re travelling to, and some risks may be of greater concern than others. Not all travel insurance policies cover COVID-19 and other pandemics or epidemics such as SARS. And not all policies cover you for changing your plans due to a riot or civil commotion, for example. Travel insurance also may not be available for countries with travel alerts.

- Look up your destination on smartraveller.gov.au and make sure you’re aware of any risks or safety advice.

- Buy a policy that covers you for every country you’re travelling to or transiting through. If you’re going to Europe via a one-night stopover in the US, then get cover for the US and Europe. Usually a worldwide policy will cover this.

86% of travellers say they’re more cautious after the COVID-19 pandemic about travelling to places where it could prove harder to return home in a crisis.

You need different cover for different regions

Insurers sometimes apply policies to regions rather than having a policy for each destination.

Asia Pacific: Destinations such as New Zealand, Bali, Fiji and Papua New Guinea.

Asia: Destinations such as India, Indonesia, Thailand, Singapore and Malaysia.

Europe: Destinations such as the United Kingdom, Ireland and Western Europe.

Worldwide: All of the above as well as regions such as North America, South America, Japan and Africa.

These definitions differ for each insurer. For example, several insurers cover travel to Bali under their Pacific policy, while some will only cover travel to Bali under their Asian region policy.

2. How long are you going for?

Just a quick trip? Simply buy a standalone travel insurance policy for a set number of days.

Travel often? Consider an annual multi-trip policy or a credit card with complimentary travel insurance, but make sure it gives you the cover you need.

Tip: Annual multi-trip policies and credit card policies can restrict the length of each trip you take – anywhere from 15 to 365 days depending on your policy. Some allow you to pay for extra days.

3. What are you going to do there?

Cruising the open road on a moped? Carving up the ski slopes? Partying at a wedding? These things aren’t necessarily included in a travel insurance policy.

Scan the insurer’s list of included activities and those that you’ll have to pay extra for. And take it easy on the grog – if your alcohol or drug intake is the cause of an adverse event, it won’t be covered by your policy.

4. Are you taking any valuable items?

Do you need cover for a digital SLR camera or an expensive tablet or laptop? Cover for such valuables can vary from a few hundred dollars to thousands, and higher cover will often mean a higher premium.

Consider adding cover for portable valuables to your home insurance policy instead, but check on the excess and if the policy will cover you worldwide and not just in Australia.

Policies also vary when it comes to how they cover valuable items. Valuables in your check-in luggage often aren’t covered, while cover for baggage stored in your hire car is inconsistent. And baggage left unattended is never covered, which can include a bag that is stolen from the seat beside you in a restaurant while you’re looking the other way.

Make sure you have receipts for your valuables as travel insurance will not pay if you can’t prove you own them.

5. Do you have any medical conditions?

If you have a medical condition that existed before you bought your policy, it may not be covered. This can range from something as common as allergies or asthma through to diabetes, heart conditions and knee replacements.

If you’re not sure, the best thing to do is contact the insurer to ask whether they’ll cover your condition automatically or whether you need to do an assessment.

The Massoud family* was holidaying in Singapore when 13-year-old Nazreen had a recurrence of severe bronchitis, which had affected her in Australia before their trip. The family’s travel insurer refused to pay any hospital bills as Nazreen’s bronchitis was a pre-existing medical condition. As a result, the Massouds had to ask their friends to transfer the $17,000 they needed to cover Nazreen’s hospital expenses, additional accommodation and the cost of changing flights. *To protect privacy we have changed names and some details

It’s important to compare policies for cost and cover. Some travel insurance premiums increased by as much as 30% between March and June 2022.

Three-quarters (77%) of travellers are willing to pay more for insurance that covers pandemic-related claims.

The further out from your departure date that you buy travel insurance, the more you’re likely to pay for it, but you’ll be covered from the moment you buy your policy. For example, if you buy insurance 2 months before you fly, you effectively have cheap cover for any events that affect your travel plans in those 2 months.

If you pay for your trip in full 6 months in advance, but you only buy an insurance policy 2 weeks before you depart, you may not be covered for any cancellation costs if you contract COVID-19.

Left it until the last minute, or even later? Only a few insurers let you buy insurance once you’re already overseas (look for the ‘Have you already left Australia?’ checkbox when viewing policy options).

While not all policies offer online discounts, plenty do. Make sure you understand the policy and what it covers. Sometimes (but not always) a reduced price may mean reduced cover.

Tip: Check asic.gov.au/afslicensing to find out whether the agent has an Australian financial services (AFS) licence or is an authorised representative of a licence holder. Take the usual precautions when giving your credit card and other details over the internet.

Member discounts

Does your health, car or home insurance provider also sell travel insurance? Some companies give 10–15% discounts to existing members.

Shop around

Trying to negotiate with a website will probably get you nowhere, but if you’re buying over the phone or through a travel agent, give it a go. Travel agents pocket a commission when they sell you insurance, so if you find a better deal elsewhere, ask them if they can beat it.

Almost two-thirds (62%) of overseas travellers who buy insurance do so on or before the day of booking travel.

Use your credit card

Some credit cards come with ‘free’ travel insurance when you use them to buy a ticket, pay for other travel expenses or otherwise activate it (we say ‘free’ because you’ll pay a premium in fees for the card itself).

This type of insurance can sometimes be a money-saver, and the level of cover can be just as good or even better than standard insurance, but make sure it gives you the cover you need.

Compromise on cover

While good medical cover is always essential, you could save money on your premium by choosing a policy with lower or variable cover for cancellation, delays and lost baggage, especially if you aren’t spending big on your holiday or taking expensive items with you.

Have you read the Product Disclosure Statement (PDS)? According to research conducted in 2022, of those who bought travel insurance: 45% have skim-read the PDS 43% have read the PDS in detail 8% have left the PDS to another person on the policy to read 2% have not and will not read the PDS 2% don’t know

About that fine print

You’re about to click ‘buy’, so you may as well just tick this ‘I acknowledge I’ve read the product disclosure statement’ checkbox and bon voyage…

But wait – have you checked the fine print? In the insurance world, that ‘fine print’ is contained in the product disclosure statement, or PDS (that thing you said you’d read).

How to read the PDS

There are hundreds of policies out there and if you tried to read all the paperwork that comes with each policy, you’d have to extend your holiday just to recover.

If you don’t have time to read the whole PDS cover to cover, at least look for the following.

- The table of benefits is an overall summary of your cover.

- The policy cover section is essential reading and is generally split into ‘what we will pay for’ and ‘what we won’t pay for’.

- General exclusions are also essential reading – these are events that aren’t covered by any section of the policy.

- Pre-existing conditions can remind you of forgotten ailments and are essential reading for anyone with any kind of medical condition, no matter how mild.

- The word definition table might contain a few surprises – it’s a good place to check on the definition of a ‘relative’ or a ‘moped’, for example.

- The claims section lists some further pointers to be aware of (e.g. it’s a good idea not to admit fault or liability in the case of an accident) and the paperwork you may need to collect while you’re away if you need to make a claim, such as police reports.

- COVID-19 cover section – many policies have a special section listing medical, cancellation and other cover available for COVID-19.

- The 24-hour emergency assistance contact number (write it down and keep it handy).

The Weaver* family was relieved to have travel insurance when they needed to cancel their holiday. The family wanted to go skiing in New Zealand, but a few days before they were due to depart, 12-year-old Ruby had cold symptoms. A COVID-19 test showed she was positive. Ruby and her whole family had to isolate and their travel insurance paid their cancellation costs. *This is a fictitious but realistic example

The list of travel insurance disputes taken to the Australian Financial Complaints Authority (AFCA) reveals a battlefield of unread or misinterpreted terms and conditions. Between 1 July 2020 and 30 June 2021, AFCA received more than 2,000 travel insurance complaints related to COVID-19.

Not all travel insurance policies are the same, and the wrong policy can be almost as bad as none at all.

Peter* and his business partner had booked a business trip to South Korea and Japan from 21 February 2020 to 2 March 2020. On 20 February, Peter cancelled the trip on advice of his GP who said that due to the uncertainty of the extent of the COVID-19 outbreak, he should postpone the trip until it is safe to travel. Peter’s travel insurer denied his claim, saying the policy does not provide cover for cancellation due to medical advice. Peter made a complaint and AFCA ruled in his favour as COVID-19 had been publicly announced as an epidemic prior to Peter cancelling the trip and the doctor’s advice not to travel was prudent and reasonable. *To protect privacy we have changed names and some details

Checklist – Are you covered for COVID-19? Are your medical costs covered if you contract COVID-19? Are your extra expenses such as accommodation covered if you can’t travel or your stay gets extended because you or your travelling companion tests positive to COVID-19? What happens if you were going to stay with someone but they’ve contracted COVID-19? Or your accommodation or tour company gets closed down because of COVID-19? Are your additional expenses covered? If the Smartraveller alert level is raised to ‘Reconsider your need to travel’ or ‘Do not travel’ due to a COVID-19 outbreak at your destination after you took out travel insurance, are you covered if you cancel your trip? Are your cancellation costs covered if you can’t travel or can’t return on your booked flights because you or your travelling companion contracted COVID-19? Are you covered for cancellation costs if your business partner or a relative back home gets sick with COVID-19 and you need to return earlier than planned? If you’re planning to go on a cruise, be extra careful. Some travel insurers may not offer COVID-19 cover for multi-night cruises. Are you covered for claims caused by government travel bans, border closures, or mandatory quarantine or self-isolation requirements at your destination?

And what are the catches?

Cancellations, baggage and personal items, sports and activities.

This is the number one reason to buy international travel insurance. Look for the insurer’s benefits table, usually on the quotes screen online or near the front of their PDS, for a quick overview of what they’re offering. Most policies have an ‘unlimited’ sum insured.

Pre-existing conditions

Some insurers don’t cover pre-existing conditions at all. Some will only cover pre-existing conditions with an extra fee and sometimes a medical assessment. Some automatically cover pre-existing conditions listed in their PDS, although few will cover mental illnesses such as depression or anxiety.

Insurers exclude cover for certain pre-existing medical conditions and generally don’t provide cover for any illnesses or incidents that arise from these. This includes terminal illness or any illness that shortens your life expectancy as well as organ transplants.

Minor pre-existing medical conditions such as asthma, hypertension, diabetes, epilepsy, osteopenia and more are usually covered if:

the condition has been stable for more than 12 months

there is no planned surgery

you have not received treatment in the past 12 months.

Pre-existing condition spoiling your holiday plans? findaninsurer.com.au lists insurers that may provide cover for pre-existing conditions. Still having trouble finding cover? Enlist the help of an insurance broker.

Examples of conditions that usually need to be assessed before getting cover are coronary problems, lung disease, epilepsy, stroke or any surgeries in the last 2 years.

If in doubt, declare your condition to your insurer.

A disability shouldn’t prevent you from buying travel insurance, but it might make finding a good policy trickier and more expensive.

Is a disability a pre-existing condition?

It depends on the disability and the insurer. Many insurers will automatically cover travellers with limited mobility, cognitive impairments or vision/hearing impairments. But in some cases, this cover may come at an extra cost.

Check with the insurer, as some conditions will need to be assessed on a case-by-case basis.

Having trouble getting cover?

Under the Disability Discrimination Act, insurers must assess the actual risks, rather than make assumptions about disabilities. If you’re having trouble getting insurance, a letter from a medical professional might help, particularly if they can state that you’re not likely to need medical or hospital treatment while on your trip.

Cover for your equipment

If you’re travelling with a wheelchair, mobility aid or hearing aid, you’ll need to insure that as well. Check single item limits, which are usually between $750 and $1,000 per item. If you have a piece of medical equipment that exceeds this, you’ll need to specify it and insure it separately.

Many insurance policies exclude hearing aids, so check the fine print and take out extra insurance if necessary.

Cover for your carer

If you’re travelling with a carer, it’s a good idea to be on the same policy in case travel plans change for either of you – that way you’re both covered. If you have a paid carer, ask your insurer whether they’ll cover the cost of a replacement carer should yours be unable to travel.

Babymooning

If you’re travelling while pregnant, be sure to check the following.

- Are you covered for pregnancy complications? Some insurers don’t cover pregnancy at all.

- Up until which stage of pregnancy? Pregnancy complications are usually only covered up until a certain stage (often between 23 and 32 weeks, depending on the insurer).

- Childbirth: Not all insurers will cover childbirth. A premature birth in the US with intensive care and treatment could end up costing hundreds of thousands of dollars.

- IVF: Not all insurers will cover IVF pregnancies.

- Do you have to pay extra to be covered?

- Do you need medical approval to be covered?

Mental health

Many travel insurers won’t provide cover of any kind for hospitalisation, medication or missed travel caused by a mental health condition, whether that’s depression, anxiety or a psychotic episode.

Others will provide cover if you declare mental illness as a pre-existing condition and pay a higher premium. Check the PDS carefully; insurers may use different terms to describe the same mental health conditions, giving them wriggle room to deny a claim.

Insurers are highly unlikely to pay a mental health-related claim if they discover it was a pre-existing condition that you didn’t declare. The trouble is, an insurer might view a single visit to a therapist many years ago because of work stress, for example, as a pre-existing mental health condition.

Mental health and travel insurance have been a contentious issue for consumer rights groups including CHOICE – and it’s one that’s still evolving from a legal standpoint.

To find out if a travel insurance product includes mental health cover, check choice.com.au/travelinsurance , filtering for ‘mental illness related claims’. Then put the PDS under the microscope.

A woman in Victoria won a court case against her insurer after they declined her claim for the cancellation of an overseas trip due to depression. ‘We took out the travel insurance well in advance of the travel, and well before my depression. I was certainly under the impression that I was covered,’ she told CHOICE. ‘They just sent back a letter that said no.’ But her win (the Victorian Civil and Administrative Tribunal awarded her $4,292 for economic loss and a further $15,000 for non-economic loss) was an isolated ruling. It’s still being debated whether or not a general exclusion for mental health claims is legal.

Most policies have an age limit, ranging right up to the 100-year-old seasoned adventurer. There are quite a few catches for older travellers, though.

- Higher premiums: Insurers often charge older travellers more, and in some cases ‘older’ can be as young as 50.

- Higher excess: Travellers as young as 60 but more commonly over 80 may be subject to a higher excess because of their age. The normal excess of around $100 to $200 is often increased to an excess of $2,000 to $3,000 for travellers 80 years and over for claims that relate to injury or illness.

- Restricted conditions: Subject to medical assessment’, ‘reduced medical cover limits’, ‘reduced travel time’, ‘policy to be purchased 6 months in advance’ – all of these conditions can apply to travellers over a certain age.

You’ll probably want to be covered if your travel plans are cancelled for any reason, but be aware that insurers will come up with plenty of excuses to avoid paying up.

- Terrorism: Most insurers cover medical expenses but very few cover cancellation expenses in the event of terrorism.

- Pandemic or epidemic: Commonly excluded.

- Military action: Commonly excluded.

- Natural disaster: Covered more often than not.

- Travel provider/agent insolvency: Commonly excluded.

- Cancellation due to travel provider’s fault: Insurers commonly exclude cover for delays or rescheduling caused by the transport provider.

John* and his partner’s scheduled train service was delayed, seriously diverted, then terminated, which meant they missed their flight home by several hours. Re-booking fees, emergency accommodation and related fees cost them between $1,000 and $1,500, but the insurer wouldn’t pay the claim as it wasn’t in the policy. *To protect privacy we have changed names and some details

‘Unforeseen’

When an insurer refers to cover for ‘unforeseen circumstances’, it means something that wasn’t publicised in the media or official government websites when you bought the policy. Check the Smartraveller travel advice when you buy your travel insurance. If it became known before you bought the policy, you’re not covered. So the earlier you buy travel insurance, the more likely you are to be covered for the unexpected.

Exclusions and inclusions

When the Australian Financial Complaints Authority (AFCA) looks at a complaint about an insurer, they expect you to prove the claim is covered by the policy, while the insurer must prove the claim is excluded by the policy. Specifically, AFCA expects you to ‘establish on the balance of probabilities that you suffered a loss caused by an event to which the policy responds’. That is, do you have a valid claim?

This means that you need to understand if your claim is covered under the listed events of the policy, or that it is not specifically excluded by the policy.

If, for example, you have cover for COVID-19, you aren’t covered for every event caused by the pandemic, but just by what is specifically stated in the PDS.

Margaret and Peter* booked a cruise departing from Darwin in March 2021. Shortly before departure, the Northern Territory Government issued a directive no longer allowing cruises to depart from the NT. Margaret and Peter’s cruise company arranged for the cruise to depart from Broome and flew the passengers to Broome for a cost of $300 per person. As Margaret had bought a policy that included some cover for COVID-19, she made a claim for $600. But this was denied by her travel insurer and her subsequent complaint to AFCA was unsuccessful. AFCA said, ‘The cause of the loss was a government directive to not permit the cruise to operate through the NT port. The insurer’s policy provides no cover for these circumstances. It also excludes losses arising from government intervention, prohibition or regulation.’ *To protect privacy we have changed names and some details

Travel insurance and Smartraveller advice Smartraveller, managed by the Department of Foreign Affairs and Trade (DFAT), assigns an overall advice level to more than 175 destinations. This advice level can affect your travel insurance cover. The advice levels are: Level 1 – Exercise normal safety precautions. COVERED. Level 2 – Exercise a high degree of caution. COVERED. Level 3 – Reconsider your need to travel. CHECK. Level 4 – Do not travel. USUALLY NOT COVERED. Travel warnings can work in your favour. If an insurer excludes cover for an event, they may still cover you to change your plans in response to updated advice from Smartraveller. But beware when travelling to a destination that has a ‘Do not travel’ warning. Most standard policies won’t cover you for ‘Do not travel’ destinations, including for COVID-19. A week after a volcanic eruption made world news, Sameer* booked a trip to Bali. He assumed the emergency would be over by the time he was due to fly a month later. Unfortunately, the volcano continued to erupt and Sameer’s flight was cancelled. His insurer declined his claim because he’d bought the flight and insurance after Smartraveller issued a travel alert about the volcanic eruption, and after it had been in the news. *To protect privacy we have changed names and some details

Delays can be expensive, particularly if you have to pay for alternative transport or accommodation. And those extra expenses won’t always be covered.

- Transport delay is only covered after a certain number of hours, usually 6, but you may have to wait as long as 12 hours before your cover kicks in.

- Cover limits for transport delays are typically lower than other cover limits and are often limited per 24-hour period.

- Insurers often exclude cover for rescheduling caused by the transport provider but some may cover additional accommodation and travel expenses in this scenario for travellers who are en route.

Baggage cover varies widely, with travel insurance policies ranging from $0 to $30,000. So, if you’re not carrying expensive items, you may be able to save on your premium by selecting a policy that provides lower coverage.

- Individual items are subject to sub-limits that range from around $250 to as much as $5,000.

- Higher item limits usually apply for electronic items like laptops, cameras, smartphones and tablets.

- You can pay extra to specify items you want extra cover for (insurers are always happy for you to pay extra).

- Valuables locked in a car or checked in on an airline, train or bus may not be covered.

- Generally, any items left unattended may be excluded from cover, so keep your belongings close.

Jing* sat down to try on a pair of shoes in a busy London shoe shop, placing her handbag next to her on the seat. When she stood up to leave, she discovered her bag was gone. Her insurer refused to pay up because she had left her bag unattended in a public place. *To protect privacy we have changed names and some details

Lost luggage

If an airline loses your luggage temporarily and doesn’t compensate you for that loss, you may be able to claim expenses for clothing, toiletries and other necessities, depending on your policy.

- Cover usually only applies to luggage lost for more than 12 hours, though the minimum time limit varies per insurer, as does the level of cover.

- If your policy has an excess (a fee that’s deductible from your payout), remember that this applies once per claimed event, and items below the excess level can’t be claimed.

Angelo and Diane* tried to claim $112 for meals and drinks when their connecting flight to Hawaii was delayed by 8 hours. Although their policy technically covered them for the cost, they were liable for an excess of $250, so their claim was denied. *To protect privacy we have changed names and some details

If you don’t feel like paying the ‘extra insurance’ the car hire company charges, then use the collision damage excess cover in your travel insurance.

Tip: Stick with recognised car rental companies in this case since this cover only applies if the car hire company already has its own comprehensive insurance.

Do you have the right licence?

Some countries require you to have an international driving permit. If you have an accident while driving on the wrong licence (or breaking that country’s law in any other way), you may not be covered.

Cruise-specific insurance

Cruises aren’t automatically included in all travel insurance policies. If you’re going on a cruise, make sure you have the right cover.

The Department of Health says: ‘Cruise ships carry a higher risk for spreading disease compared to other non-essential activities and transport modes. COVID-19, influenza and other infectious diseases such as gastroenteritis spread easily between people living and socialising in close quarters.’

Check travel insurance policies to make sure medical cover for COVID-19 is included, as some policies exclude this cover. Erica* stumbled and broke her femur during stormy seas while on a cruise. Her insurer covered the cost of evacuation and a partial hip replacement at a hospital in Noumea. They also organised and paid for her son to fly to Noumea to help her recover and return home to Australia. Five months later, the well-travelled 82-year-old was boarding a plane to Croatia for her next (fully insured) adventure. *To protect privacy we have changed names and some details

Not leaving Australian waters?

You still need insurance. Doctors working on cruise ships don’t need Medicare provider numbers, so if they treat you, you can’t claim on Medicare or your private health insurance, even if you’re still in Australian waters.

Domestic travel insurance doesn’t cover medical costs, so you need either international travel insurance (check that it covers domestic cruises) or a domestic cruise policy.

Kerry* thought she’d done the right thing buying an annual multi-trip international travel insurance policy for a number of upcoming holidays, one of which was a round-trip cruise departing from and returning to Fremantle, Western Australia, with no port stops. When she had to cancel due to ill health, she discovered her policy wouldn’t cover her because the trip wasn’t considered an international one. *To protect privacy we have changed names and some details

When CHOICE compares travel insurers, we look at who covers which sports and adventure activities, such as skiing, ballooning, bungee jumping and scuba diving, to name a few.

But as always with insurance, the PDS may include some surprises. For example, several insurers we’ve reviewed will cover canyoning but they won’t cover abseiling, often a necessity in canyoning. Other policies in our comparison will cover abseiling, but not into a canyon.

If you’re planning on doing anything adventurous, check to make sure you’re covered. It’s not enough to simply look for the tick next to your chosen activity – you also need to check the definitions in the PDS.

Motorcycles and mopeds

Hiring a motorcycle or moped? Depending on which country you’re in, you might need a local or international motorcycle licence. You probably won’t be covered if you aren’t obeying the local law. And even if you are doing the right thing under local law, some policies still won’t cover you unless you have a motorcycle licence.

Are you wearing a helmet? Most countries say you need one by law, but that doesn’t mean it will be included in your hire. No helmet means no cover (in more ways than one).

Nhung* was injured after she rented a moped in Thailand only to find out the engine size was not covered by her insurance policy. Most insurers adopt the national standard for the definition of a moped – an engine capacity under 50cc. If the engine is bigger than that, it’s a motorcycle and you’ll need an Australian motorcycle licence. *To protect privacy we have changed names and some details

Skiing and snowboarding

Some insurers cover skiing, often for an extra premium, but not so many cover skiing off-piste (away from the groomed runs). So, if you’re tempted to slide off the beaten path next time you hit the slopes, make sure you have a policy that covers off-piste ski runs (or pay for the optional extra cover).

Otherwise, if you run into a tree and have to be evacuated from the mountains, you may need to think about selling your home to pay for it.

It’s worth remembering that travel insurance only covers overseas costs. So if you break a leg while you’re abroad, your insurer will likely pay your hospital fees, but they won’t cover your ongoing physiotherapy once you’re back home.

Marianna* fractured her leg in 3 places while skiing with her partner and children in Japan. Because the family had bought additional cover for winter sports, they were reimbursed $35,466 for medical expenses, additional transport and accommodation, the cost of a nanny to look after the children, and business class flights back to Australia. *To protect privacy we have changed names and some details

Alcohol and drugs

Overdoing it on vodka and float-tubing down a river isn’t likely to be covered by any policy. Insurers simply won’t pay for costs arising from you being under the influence of alcohol or drugs (except where taken under the advice of a doctor).

Even one or 2 drinks could be enough of an excuse for insurers to get out of paying.

Relatives can be relative Many policies cover the costs to travel home if one of your relatives dies or becomes sick. Bear in mind: an insurer’s definition of a ‘relative’ may differ from yours cover is usually dependent on the age of that relative, so the death of your 84-year-old grandma may not be covered your relatives are subject to the same pre-existing condition exclusions as you, so if your 84-year-old grandma died from a known heart condition, you may not be covered. you may be able to apply for your relative’s pre-existing condition to be assessed before you buy the policy. cover is limited to relatives that live in Australia, or in some cases New Zealand. So if your 84-year-old grandma is in China, you won’t be covered to fly there for her funeral. Amanda* and her husband had booked an overseas diving trip, but shortly before the trip Amanda’s mum passed away from pneumonia. They cancelled their trip and incurred cancellation costs and lost deposits of nearly $13,000. As the death of a parent was covered in their policy, Amanda made a claim. Their insurer denied the claim as Amanda’s mum lived in the United States and was undergoing treatment for lung cancer, so the insurer concluded that her death was caused by a pre-existing condition. *To protect privacy we have changed names and some details

So you’ve booked and paid for your holiday through a travel agent, but then the travel agent goes broke. You’ll get your money back, right? Not necessarily.

Only a few insurers will cover you for the insolvency of a travel provider, and that includes hotels, airlines and other transport companies that might go broke overnight (remember Ansett?). But there are a few ways to safeguard your hard-earned holiday.

- Check whether your insurer covers you for insolvency.

- Check whether your travel agent has insolvency insurance (this isn’t compulsory, so only some will have it).

- Pay with your credit card. Some banks allow a chargeback if you pay for something on your credit card and don’t end up actually getting it.

Tip: Don’t accept any dodgy contract terms that require you to give up your chargeback rights.

2 out of 3 travellers assume their travel insurance will cover insolvency, but in 2017 less than a third of insurers actually provided this cover.

Credit card travel insurance

Some credit cards come with complimentary travel insurance. They’ll cover you for all the usual things like medical emergencies, cancellation and protection for baggage and items. But they do differ from standalone policies, so it’s essential you check the fine print.

- Fees: You’ll pay a premium for these credit cards, usually between $100 and $450 per year.

- Excess: The excess on credit card policies tends to be fixed at a higher rate (usually around $250), whereas it’s more variable on standalone policies.

- Age limits: Some credit card policies have no age limit, which can be handy for older travellers.

- Regions: Credit card travel insurance is not based on location, which means you can travel from Europe to the US without having to worry if your policy covers both areas. Bear in mind though that some regions (such as countries under United Nations embargo) may be excluded, and sometimes with US underwriters, travel to Cuba is excluded.

- Baggage cover: Credit card insurance often offers higher coverage for baggage loss and damage.

- Trip duration: Credit card insurance policies vary in how many days of coverage they’ll give you per trip – anywhere from a few weeks to 365 days – so check your limit if you’re going on a long holiday.

- Pre-existing conditions: Chances are your credit card insurance won’t automatically cover your pre-existing condition. You’ll need to call your insurer and see if you need to pay an extra fee or premium.

- Domestic travel: Credit card insurance doesn’t apply to domestic travel, although some cards will reimburse expenses associated with domestic flight delays and missed connections to international flights.

- Making a claim: You may not be able to claim reimbursement unless you pay for purchases (such as emergency items after a baggage delay) with the same credit card.

27% of travellers who plan to buy travel insurance will get it through their credit card.

Is it activated?

Credit card insurance usually activates when you buy your air tickets (or sometimes other transport or accommodation expenses) using your card.

- Policies require a minimum spend to activate – usually around $500. So if you scored your tickets on sale for $499, you won’t be covered.

- If you want cover for your spouse or dependants, you must also buy their tickets on your card.

- Some policies only activate if you book a return ticket. A one-way flight, or even 2 one-way flights, will leave you uninsured.

- Some banks require you to notify them in order to get full coverage for each trip. While base coverage will still give you emergency medical treatment, you might not get coverage for property damage or luggage delays. Check whether you need to do anything to activate any extra features.

- Some cards will cover you if you use rewards points to buy your tickets. Others won’t.

Is it worth it?

If you already have a credit card and use it regularly, the free comprehensive travel insurance on your card can save you money. And if you’re a regular traveller without a credit card, it’s worth considering if you travel at least once a year or every second year internationally.

David* booked a trip to North America for himself and his family, including his 11-year-old daughter Petra. The trip was cancelled because Petra got pneumonia. Unfortunately, David only activated his credit card travel insurance about an hour before the family was scheduled to fly out of Australia. The travel insurer denied his claim for cancellation costs because he knew about his daughter’s illness when he activated the policy. *To protect privacy we have changed names and some details

Have you been knocked back on an insurance claim and want to dispute it?

Internal dispute resolution

Complain to the insurer first. They’ll usually keep you up to date about the progress of your complaint every 10 business days.

Once you’ve lodged your case and all the supporting information and documents, the insurer has 45 days to complete its internal dispute resolution process.

External dispute resolution

If you aren’t happy with the insurer’s decision, you can take your complaint to the Australian Financial Complaint Authority (AFCA). They’ll handle your case for free.

- The AFCA will mediate between you and the insurer to find a resolution.

- If mediation is unsuccessful, they may make a preliminary assessment or give a determination straight away on your dispute.

- A determination is legally binding on the insurer but not on you.

- There’s no appeal process with AFCA.

- For more information, visit afca.org.au .

Legal action

If you’re unhappy with the AFCA determination, you might want to consider taking legal action against the insurance company.

Keep your travel insurance details with you at all times while on your trip and share them with family or friends before you leave.

Related content

No matter who you are, where you're going and what you're doing, get travel insurance. Learn how to choose a policy that's right for you.

This page provides mature travellers with information to prepare for a hassle-free journey. Properly preparing before you travel will help you have a safe trip.

Browse our general advice pages on a range of travel topics, to learn what you need to know before you go.

Power up your money know-how

Join the 35K+ subscribers who receive our weekly Moneyzone newsletter, showcasing the latest rate movements, exclusive deals, money-saving hacks, and expert insights from Mozo.

Zero spam. Unsubscribe anytime.

By submitting your information you agree to the terms and conditions and privacy policy

Thanks for signing up

You will receive a welcome email shortly, australia's best travel insurance for april 2024.

Whether in 2024 you’re planning a resort holiday in Fiji, voyaging on a cruise , or hopping on a plane to Europe , it’s important to consider packing travel insurance .

But how could you go about finding the best policy? What features and perks could your holiday need, and which providers stand out for amazing coverage?

That’s where the Mozo Experts Choice Travel Insurance Awards come in.

Every year, Mozo’s expert judges compare dozens of travel insurance providers to see which ones fly above and beyond in terms of quality and value. Providers offering the best coverage take home a Mozo Experts Choice Travel Insurance^ win.

“Finding a policy may be a bit daunting, especially when policy features and costs can change depending on where you’re going and what you’re doing,” says Mozo Experts Choice Awards, Judge Peter Marshall.

“We wanted to examine everything across a range of holidays, head-to-head, to help Australians find the best value cover, and award those providers offering the best travel insurance.”

So without further ado, here are the winners crowned in 2024, along with some of the latest deals for this month highlighted by our editor's – and some expert tips on how you could find the best policy for your trip.

Expert recommendations: Mozo Experts Choice Award-winning best travel insurance policies

Each year, the Mozo Experts Choice Awards recognise travel insurance providers for having the most outstanding performance to suit the needs of different types of travellers.

Categories include Exceptional Value and Exceptional Quality for various policy types, from comprehensive, multi-trip, cruise, ski, and basic coverage.

Policies ranked highly for their quality are those that boast the most generous coverage (i.e. comprehensive travel insurance). Policies with great value offer a minimum level of coverage for the lowest price.

Our expert judges look at many factors when evaluating a travel insurance policy for an award, especially:

- Price , including any excesses and limits, and how premiums vary based on the holiday.

- Coverage , including benefits and exclusions.

The insurance company with the most standout wins for both quality and value will receive the prestigious Travel Insurance Company of the Year ^ award.

Judges also compare how well a policy travels for different popular destinations and kinds of trips so we can nail down the best picks for as many types of holidays as possible.

Check out the Mozo Experts Choice Travel Awards^ methodology report for 2024 to see how judges made their choices.

As always, every travel insurance policy will have its terms and conditions laid out in the product disclosure statement (PDS). Be sure to read the PDS properly and thoroughly before signing up!

- Freely - International Travel Insurance

- Customisable, flexible coverage through the Freely app

- 10% off with a Mozo exclusive discount

Why it won: For those looking for sheer convenience, it’s hard to beat Freely’s all-in-one travel app. Customise this flexible policy by adding or taking away extras and coverage as you need it to suit your holiday. Friends suddenly invite you whitewater rafting? Add adventure sports cover (with conditions). Optional extras include gadgets, snow sports, cruise, motorcycle cover, and more. For a limited time, you could also nab 10% off your policy with the Promo Code “MOZO10” (T&Cs). Freely's travel insurance policies won two Mozo Experts Choice Travel Insurance Awards^ in 2024.

- Zoom Comprehensive Travel Insurance

- Unlimited 24/7 emergency assistance

- Optional extras for car rental or sports activities (T&Cs)

Why it won: Zoom’s Comprehensive Travel Insurance provides 24/7 emergency assistance to help protect you from unexpected events on your holiday. It also covers you for medical emergencies, trip cancellation, lost luggage, family emergencies and even more. Zoom picked up an award for Exceptional Value Essential Travel Insurance making it a a great choice for travellers looking for a great value package. Add optional cover for extras such as Rental Vehicle Excess if you are hiring a car or a Sports Activities Pack if you’re feeling adventurous.

- Travel Insurance Company of the Year - World2Cover

- Multiple Mozo Experts Choice Awards^ winner in 2024

- Unlimited emergency, cancellation, and medical cover (T&Cs)

Why it won: World2Cover’s comprehensive Top policy picked up wins for both Exceptional Value and Exceptional Quality Travel Insurance for the second year in a row, making it the obvious candidate for this prestigious crown. With unlimited emergency, cancellation, and medical cover (with conditions), World2Cover makes an extremely competitive choice for travellers hunting the most inclusions for the best value.

Standout perks include coverage for 38 pre-existing conditions (including migraines and sleep apnea), rental car excesses, and up to $2,000 for overseas dental treatment (all with T&Cs). Plus, many amateur and outdoor sports, like bungee jumping, can be covered at no extra cost (T&Cs).

- Southern Cross Travel Insurance - International Comprehensive Family

- Unlimited medical and evacuation cover (T&Cs)

- Optional extras for snow sports and motorcycle cover (T&Cs)

Why it won: Whether travelling alone or with your family, this single-trip comprehensive insurance policy aims to please with some great standard features. Unlimited medical and evacuation cover headline the policy, and you have the option to increase cancellation to unlimited (though this will add to your premium). Travelling solo overseas for less than two days? Southern Cross claims your premium could cost less than a meal. Unfortunately, pre-existing conditions aren’t automatically included, but you can apply to have them added with a medical assessment for an additional premium (with conditions). Southern Cross Travel Insurance also won two Mozo Experts Choice Travel Insurance Awards^ in 2024.

- Travel Insurance Saver - Bare Essentials

- Unlimited overseas medical coverage (T&Cs)

- Up to $2,500 emergency cancellation and $2,000 lost luggage and effects coverage (T&Cs)

Why it won: Underwritten by NIB, this impressive essentials policy performed well in terms of Exceptional Value ^.

While limits apply, eligible expenses you could claim under this policy include emergency cancellation, lost luggage , and replacement passport and travel documents coverage (T&Cs).

- Cover-More - International Comprehensive+

- Multiple Mozo Experts Choice Award^ winner in 2024

- On- and pre-trip cover if you’re diagnosed with COVID-19 (T&Cs)

Why it won: This ultra-comprehensive policy impressed judges enough to nab the same two wins in 2023 and 2024 – one for Exceptional Quality and another for Exceptional Quality Annual Multi-Trip.

With generous coverage for a range of misadventures, including pre and on-trip COVID cover, up to $25,000 for lost or stolen luggage, unlimited overseas medical expenses, and special business trip benefits, Cover-More packs a punch for the holidays (T&Cs). You can also tailor your policy with optional extras like the Cancellations Extensions add-on to extend your coverage.

Editor’s Picks: Top travel insurance policies for April 2024

Jump to our top picks, fast cover - comprehensive policy, australia post comprehensive travel insurance, australia post - comprehensive travel insurance, flight centre - international plus single trip, racv - comprehensive travel insurance.

- Generous and flexible optional extras

- 43 pre-existing conditions automatically included (T&Cs)

Editor’s Pick: Looking for a solid all-rounder with amazing medical and COVID-19 benefits? Fast Cover’s comprehensive travel insurance policy makes a compelling option. Customers can select their cover based on region, activities, trip duration, and a host of optional extras like cruise, motorcycle, adventure, and rental vehicle excess insurance to tailor their plans for their holiday needs. Got any pre-existing medical conditions? Fast Cover offers cover for many pre-existing medical conditions, you just need complete a simple medical screening during the application process.

The comprehensive policy includes unlimited medical and cancellation cover, with unlimited medical cover if you’re diagnosed with COVID-19 and a 5,000 limit for cancellation fees if you contract the virus and need to pull out of a leg of your journey. Keep in mind sub-limits, exclusions, and conditions apply, so make sure to read the PDS before signing up.

- 24/7 emergency support

- Get a quote in minutes

Editor’s Pick: If you’re looking for cover from a name you can trust, Australia Post International Comprehensive Travel Insurance covers overseas medical expenses, cancellation costs and more (T&Cs apply). You can also get optional extras like cover for existing medical conditions and winter sports to tailor cover to your needs. Plus, you can also reduce your premium with your choice of excess.

Customer favourites: Best travel insurance from Mozo People’s Choice Awards

Expert recommendations are amazing, but what do real travellers think is the best insurance? Thankfully, the 2023 Mozo People’s Choice Awards have landed.

Mozo asked 836 of your fellow Australians which travel insurance providers they rate highly across a range of categories, from customer satisfaction and service to trustworthiness, sign-up and claims experiences, and whether they’d recommend them to a friend.

Winners were then given a Mozo People’s Choice Award, making them some of the best providers around (and in the air).

Compare winners from the latest awards below.

- Five Mozo People’s Choice Awards for 2023

- Flexible excess

Why it won: Sending yourself overseas? Australia Post has developed a first-class comprehensive international travel insurance policy that took home five Mozo People’s Choice wins in 2023. Aussies rated this provider highly for customer satisfaction and service, as well as easy sign-up experience and Most Recommended. And no wonder: Australia Post reckons you can get a quote in minutes. Tailor your policy by choosing your excess and level of coverage; the comprehensive plan comes with unlimited overseas medical and additional emergency expenses coverage, as well as benefits like money to resume your trip if cancelled for eligible reasons (T&Cs apply).

- Two Mozo People’s Choice Awards for 2023

- Automatically included adventure activities (T&Cs)

Why it won: Flight Centre has long been in the plane ticket game, but did you know you can also take out comprehensive international travel insurance through it? With two 2023 Mozo People’s Choice Awards for Sign-up Experience and Most Recommended, there’s plenty to check out before checking your luggage with Flight Centre. The International Plus Single-Trip policy includes unlimited overseas medical and emergency expenses coverage and handy benefits like automatic adventure activities coverage for certain activities and the ability to increase sub-limits for certain belongings and rental car excess (with conditions).

- Domestic pet cover (T&Cs)

Why it won: Voted both Highly Trusted and Most Recommended at the 2023 Mozo People’s Choice Awards , RACV flies high with this excellent option for comprehensive coverage. Benefits include unlimited overseas medical, emergency expenses, and cancellation covers, plus line items for luggage, travel documents, and even domestic pet cover (conditions and limits apply).

More best travel insurance winners

Here’s the full list of winners for the Mozo Experts Choice Travel Insurance Awards^ for 2024, broken down by category.

BEST VALUE TRAVEL INSURANCE

If your travel budget is tight, weighing up the value you’re getting in a policy is crucial. This year, Mozo’s expert judges wanted to highlight great value plans to make the comparison process easier.

From medical-only and essentials cover to more comprehensive and annual multi-trip policies, these providers offered a required set of inclusions at the best prices.

- Exceptional Medical Only coverage winners simply needed to have unlimited emergency overseas medical cover, including unlimited COVID-19 medical cover.

- Essential coverage winners needed to have at least $2,000 coverage per traveller for personal items and $2,500 cancellation coverage, plus unlimited medical coverage.

- Comprehensive, ski, cruise, and annual multi-trip coverage winners needed at least $7,500 of luggage cover per person, plus $15,000 cancellation cover per adult. Policies must also have unlimited COVID-19 coverage and at least $2,500 each for additional expenses and cancellations. Multi-trip policies were also assessed for a single traveller jet-setting for 30-day trips in a 12-month period.

Mozo’s expert judges also assessed some providers based on the value they offer vacation activities like snow sports or cruise travel .

Check out the winners below.

Exceptional Value Medical Only Travel Insurance

These policies were the best value medical-only travel policies, based on the judges’ criteria.

- Australia Post – Basic policy

- Southern Cross Travel Insurance – International Medical Only policy

Exceptional Value Essential Travel Insurance

Want a little more coverage, such as lost luggage, on top of medical cover? Our expert judges thought these policies were winners.

- Freely – International Travel Insurance policy

- Tick Travel Insurance – Standard policy

- Travel Insurance Saver – Bare Essentials policy

- Travel Protect – Explorer policy

- WAS Insurance – Discovery Ultimate policy

- Zoom – Standard policy

Exceptional Value Comprehensive Travel Insurance

If you’re after the most coverage for the best value, these comprehensive policies are worth a look!

- Chubb Australia – Prestige Single Trip policy

- InsuranceandGo – Gold policy

- Tick Travel Insurance – Top policy

- World2Cover – Top policy

Exceptional Value Annual Multi-Trip Travel Insurance

Heading to a few destinations in 2024? These multi-trip policies nabbed best value crowns.

- ahm – Annual Multi-Trip policy

- Medibank – Annual Multi-Trip policy

- NRMA – Comprehensive Annual Multi-Trip policy

- Qantas – Annual Multi-Trip policy

- Southern Cross Travel Insurance – Multi-Trip policy

Exceptional Value Cruise Travel Insurance

Cruisin’ should be breezy! Mozo’s expert judges thought these winners earned their best value cruise wins.

- AllClear – Gold Plus

- Chubb Australia – Prestige Single Trip

- Qantas – International Comprehensive policy

- World Nomads – Explorer Plan

Exceptional Value Ski Travel Insurance

Hittin’ the slopes? Mozo's expert judges say these policies shouldn’t hit the wallet.

- Medibank – Single Trip policy

BEST QUALITY TRAVEL INSURANCE

Some travellers want the best possible insurance, no matter the cost. That’s why Mozo’s expert judges analysed policies with the broadest and most generous cover for the Exceptional Quality travel insurance awards for comprehensive and multi-trip policies.

Exceptional Quality Travel Insurance

- Cover-More – International Comprehensive+ policy

- Flight Centre – YourCover Plus policy

- Kogan – International Plus policy

- NRMA – Comprehensive Plan policy

- RAA – Premium policy policy

- RAC – Comprehensive policy

- RACQ – Premium policy

- RACT – Comprehensive policy

- RACV – Comprehensive policy

- Webjet – Top policy

Exceptional Quality Annual Multi-Trip Travel Insurance

- Cover-More – Multi-Trip International Comprehensive+ policy

- Webjet – Travel Safe Plus policy

What travel insurance do I need?

When finding the best travel insurance policy for yourself, it’s important to compare as many different policies as possible. But what if you’re not sure where to start? Let’s break down the tiers and types of travel insurance on offer.

Travel insurance policies vary based on where you’re going and for how long. For example:

- Domestic travel insurance can be great if you’re just exploring Australia.

- International travel insurance can be great for a once-off trip abroad.

- Multi-trip travel insurance can be great if you’re making more than one trip, locally or abroad (usually within the same year).

Once you’ve picked the kind of travel insurance you’re after, providers will usually offer multiple tiers (or levels) of coverage, such as medical only, essentials, or comprehensive insurance.

You may also be able to get complimentary credit card travel insurance , which comes as a perk of your credit card.

Travel insurance policies can also include optional extras that tailor your coverage for specific holidays, like backpacker travel insurance or senior travel insurance .

Many clues can point to a travel insurance policy ranking among the best – exceptional price, excellent coverage, and a thumbs-up from fellow Aussie travellers . But the best indicator that a policy rocks? It’s the best for you.

When comparing travel insurance policies, assess them like you’re giving out your own award: the win of your business! Read through the PDS, send for quotes, and ask yourself questions like:

- Does this policy cover my holiday needs?

- Is this within a price range I’m happy with? ( Cheap travel insurance has trade-offs).

- Would I feel comfortable working with this provider when the worst happens?

If the answer is ‘yes’, you could be on to a winner.

Other considerations are important, too, however, especially the nitty-gritty details. For example:

- Do you have to meet any terms and conditions before they settle your travel claim ?

- Is there an excess to pay?

- Are there any other perks, too, like frequent flyer points?

- Do you have pre-existing conditions that could impact your coverage?

Because every situation is different, not every travel insurance policy is the best for everyone. Some people want an affordable price, while others want the most coverage, no matter the price.

Comparing what’s on offer can help you determine which travel insurances offer you the best value and quality for your holiday.

FAQs about travel insurance

While not mandatory in Australia, travel insurance can be a useful financial tool to have in your back pocket. The right level of coverage could help your finances weather all kinds of unexpected emergencies, from medical treatment to flight cancellations.

Some overseas destinations have made basic travel insurance mandatory for entry at the border (usually to cover the costs associated with treating COVID-19).

The best travel insurance coverage for you will depend on your needs and holiday. For instance, if you’re a relatively low-risk traveller who can pay for unexpected costs like flight cancellations or lost luggage out-of-pocket, a basic or essentials-only travel insurance policy could suit you.

However, if you’re looking for the most protection possible, or you’re doing adventurous travel activities like skiing, comprehensive travel insurance might be a better option. Comparing multiple policies can give you an idea of the coverage and value available to your situation.

Travel insurance prices depend on the policy, provider, excess, level of coverage, and destination you choose. Your price may also vary if you’ve included optional extras or expanded your limits for personal items like an expensive smartphone or to cover a pre-existing medical condition.

Mozo found the average cost for different travel insurance policies ranges from roughly $90 to well over $1,000, depending on the needs of the trip. Most settled between $200 - $400.

Forgetting to buy travel insurance before leaving can be inconvenient, but there are options. Some policies may not cover trips already in progress: read the product disclosure statement (PDS) and get quotes to see what benefits, costs, and exclusions you could get.

If you have a credit card, it’s also worthwhile investigating to see if you can get free travel insurance through your credit card company. Many will have activation requirements, like proving you’ve paid a certain amount of travel costs with your card.

Compare international travel insurance policies below.

Compare international travel insurance - last updated 13 April 2024

Mozo experts choice awards won:

- Exceptional Value Ski Travel Insurance - 2024

- Exceptional Value Essential Travel Insurance - 2024

- Exceptional Value Comprehensive Travel Insurance - 2024

International Travel Insurance

Covid medical cover, covid cancellation cover, overseas hospital, cancellation cover.

Get protection in a few simple steps with Freely travel insurance all in the palm of your hand. Freely Travel offers 24/7 emergency and medical support, 24/7 customer service. Plus, you can tailor your policy so you only pay for what you need, and adapt your cover in near real time. Add-ons such as car rental excess, snow sports or other activities also available. Receive 10% off your travel insurance policy with promo code: MOZO10. T&Cs apply, go to site for full detail.

Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

To see the Pre-existing Conditions and Activities covered by this policy please visit our detailed page about this product.

Comprehensive

Enjoy unlimited medical cover and 24/7 emergency assistance services when you travel. Get unlimited cover for cancellation fees and prepaid travel expenses. Cover for luggage and travel documents. $5,000,000 personal liability cover.

Backed by the NIB, one of Australia’s largest travel insurance providers, Travel Insurance Saver brings you peace of mind on your travels. Compare three tiers of insurance cover, featuring benefits like 24 hour emergency assistance, emergency medical cover, luggage cover, cancellation cover and more.

- Exceptional Value Annual Multi-Trip Travel Insurance - 2024

International Comprehensive Single

Enjoy the security of single trip cover on your next holiday with Southern Cross Travel Insurance. Get 24 hour emergency assistance, cover for cancelling or changing your journey before you leave, protection for lost, stolen or damaged goods as well as cover to replace lost or stolen cash, banks or travel documents. Be in to win 1 of 5 $1,000 cash prizes! T&Cs Apply. Offer ends 30 September 2023.

- Exceptional Quality Travel Insurance - 2024

- Travel Insurance Company of the Year - 2024

Be covered for international overseas and medical expenses. Emergency medical assistance 24 hours/365 days a year. Cover for cancellation fees and lost deposits. Cover for luggage and personal money. Dependents covered free of charge (conditions apply). Limited COVID cover available. Cancellation cover for COVID claims limited to $3,500.

^See information about the Mozo Experts Choice Travel Insurance Awards

Mozo provides general product information. We don't consider your personal objectives, financial situation or needs and we aren't recommending any specific product to you. You should make your own decision after reading the PDS or offer documentation, or seeking independent advice.

While we pride ourselves on covering a wide range of products, we don't cover every product in the market. If you decide to apply for a product through our website, you will be dealing directly with the provider of that product and not with Mozo.

Sign up for the MoneyZone newsletter

Thanks for signing up!

Who we are and how we get paid

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace business, we do earn money from advertising and this page features products with Go To Site links and/or other paid links where the provider pays us a fee if you go to their site from ours, or you take out a product with them. You do not pay any extra for using our service.

We are proud of the tools and information we provide and unlike some other comparison sites, we also include the option to search all the products in our database, regardless of whether we have a commercial relationship with the providers of those products or not.

'Sponsored', 'Hot deal' and 'Featured Product' labels denote products where the provider has paid to advertise more prominently.

'Mozo sort order' refers to the initial sort order and is not intended in any way to imply that particular products are better than others. You can easily change the sort order of the products displayed on the page.

Important information on terms, conditions and sub-limits

Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

- United States

- United Kingdom

Finder Travel Insurance Awards 2023

Our experts compared 50+ policies, 900+ features and got over 300 quotes to help you find the best travel insurance products of 2023..

Best Travel Insurance - Comprehensive

Southern Cross Travel Insurance

Southern Cross Travel Insurance won the 2023 comprehensive award because it goes further than the majority of insurers. It scored highly for COVID benefits, cancellation fees, luggage damage cover and more. It's also competitive on price compared to the other 28 international policies we analysed.

Travel insurance methodology

Highly commended

NRMA Travel Insurance

NRMA Travel Insurance ranked in second-place for comprehensiveness out of the 28 international policies we analysed. It scored highly for features including hospital cash allowance, COVID cover and rental car excess insurance.

InsureandGo Travel Insurance

InsureandGo Travel Insurance ranked in third-place for comprehensiveness out of the 28 international policies we analysed. You get features including COVID cover, cancellation and more.

Best Travel Insurance - Value

Fast Cover Travel Insurance

Fast Cover Travel Insurance won the 2023 value award because it's cheaper on average than the other 27 international policies we analysed. It covers you for the essentials including COVID, travel delay and luggage delay.

In addition to being the comprehensive winner, SCTI is also our value runner-up. That's because it's one of the most competitively priced policies on the market. Only 2 policies (Fast Cover and Medibank) came out as cheaper when we gathered quotes for dozens of destinations.

Medibank Travel Insurance

Medibank Travel Insurance ranked in third-place for value out of the 28 international policies we analysed. It scored highly because it was the second cheapest policy on average and covers most of the benefits people look for in a policy, such as COVID cover and luggage delay.

Best Travel Insurance - Seniors

Southern Cross won the 2023 senior travel insurance award because of its average price and benefits. It scored highly for its age limit cap, COVID benefits, cancellation fees and more.

Worldcare Comprehensive Travel Insurance

WorldCare Travel Insurance came in second-place out of the 28 policies we analysed. It scored highly for its COVID cover, age limits and travel documents cover.

HIF International Comprehensive Travel Insurance

HIF Travel Insurance came in third-place largely because it's competitive on price and its age limits. It can also cover pre-existing medical conditions. You just need to fill out its online medical assessment, which provides an instant outcome.

Best Travel Insurance - Domestic

InsureandGo Travel Insurance is the 2023 domestic travel winner. Out of the 23 domestic policies we analysed, it scored highly for price, cancellation cover, rental car excess cover and more.

Australia Post Travel Insurance

Australia Post Travel Insurance came second-place in the domestic category. Out of the 23 domestic policies we analysed, it was the cheapest overall and covers rearrangement costs related to COVID, rental car excess insurance and more.

Cover-More Travel Insurance

Cover-More's domestic policy came third-place in the domestic category. Out of the 23 domestic policies we analysed, it offers competitively priced policies and covers rearrangement costs related to COVID, rental car excess insurance and more.

Why you can trust our awards

Meet our experts

Gary Ross Hunter

Senior writer, insurance.

Saranga Sudarshan

Insights analyst, finder awards.

Jessica Prasida

Publisher, travel insurance.