From flight delays to medical emergencies, we got you covered. Secure your trip with HDFC ERGO Explorer. Travel Worry-free.

#1.5 crore+.

Happy Customers

Cashless Hospitals

24x7 In-house

Claim Assistance

Travel Insurance - Your Safety Net at Foreign Shores

A medical or dental emergency can catch you off guard in a faraway land, derail your travel plans, and cost you dearly, as medical expenses in a foreign land can be high-priced. However, international travel insurance can save you from such expenses. Apart from this, it also provides reimbursement for essentials in case of delay or loss of check-in baggage, covers for loss of passports, visas, identity proof, etc. It also provides assistance in case of theft, burglary, accident assistance and medical evacuation in times of crisis. So, whether you travel overseas solo or with your family, remember to get travel insurance to enjoy a memorable and relaxed holiday. Many countries have also made it mandatory to get travel insurance before entering their borders. Check out HDFC ERGO’s travel explorer to explore the world confidently with 21 benefits and 3 tailor-made plans, just for you. You can buy travel insurance online from the comforts of your home. In addition, we offer medical facilities at 1Lac+ cashless hospitals** worldwide.

Introducing HDFC ERGO Travel Explorer

To make your travels filled with excitement and keep worries at bay, HDFC ERGO brings you the all-new international travel insurance, packed with more benefits than you can imagine. Explorer's got your back, whether it is a medical or dental emergency, loss or delay of your checked-in baggage, flight delays or cancellations, theft, robbery or loss of passport when overseas. It comes with up to 21 benefits packed in one, and 3 tailor-made plans just for you.

Schengen approved travel insurance

Competitive premiums, increased sum insured limit, medical & dental emergencies, baggage mishap, in-trip crisis, here's why you need hdfc ergo's travel insurance, covers emergency medical assistance.

Met with an unexpected medical emergency, in a foreign territory? Travel insurance, with its emergency medical benefits, is just the friend you need during such a toughtime. Our 1,00,000+ cashless hospitals are there to take care of you.

Covers Travel Related Inconveniences

Flight delays . Loss of baggage. Financial emergency. These things can be quite unsettling. But with travel insurance backing you up, you can keep calm and carry on.

Covers Baggage-Related Hassles

Buy #SafetyKaTicket for your travel. Whenever you’re travelling abroad all baggage carries all your essentials, and we cover you against baggage loss and baggage delay for checked-in baggage.

Affordable Travel Security

Secure your international trips without breaking the bank. With affordable premiums for every kind of budget, the benefits of travel insurance far outweigh the costs.

Round-the-clock Assistance

Time zones don’t get in the way of a good travel insurance plan. No matter what time it is in your part of the world, dependable assistance is just a call away. Thanks to our in-house claim settlement & customer support mechanism.

1 Lac+ Cashless Hospitals

There are a million things you can take on your trips; worry shouldn’t be one of them. Our 1 Lac+ cashless hospitals networked worldwide will make sure your medical expenses are covered.

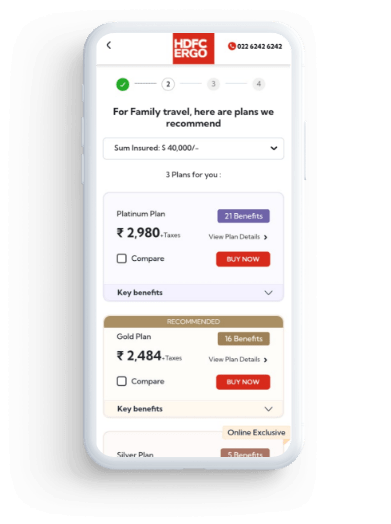

Travel Insurance Plans For All Types Of Travellers

Travel plan for individuals.

If you’re flying solo in your search for new experiences, the HDFC ERGO Individual Travel Insurance, with its host of inbuilt benefits that make your travel experience smooth and seamless, is the trusted companion you need to take along for company.

Travel plan for Families

Family vacations are when you make memories that transcend time and last across generations. Now, with the HDFC ERGO Family Travel Insurance, give your loved ones the security they deserve as you and your family take off into the sunset for the vacation of your dreams.

Travel plan for Frequent Fliers

The HDFC ERGO Annual Multi-trip Insurance is tailored just for you, so you can secure multiple trips under one comprehensive insurance plan. Enjoy multiple trips, easy renewals, in-house claim settlement and so much more.

Travel plan for Students

Planning to pursue higher education at foreign destinations, then do not leave your home without a valid travel insurance. It will secure your prolonged stay and make sure you concentrate only on studies.

Travel Plan for Senior Citizens

Whether planning to go for a leisure holiday or visit a loved one, secure your trip with HDFC ERGO’s Travel Insurance for Senior Citizens to get cover from any medical or dental emergencies that can catch you off guard overseas.

Compare Travel Insurance Plans

So, have you compared the plans and found the one that suits you best, what does hdfc ergo travel insurance policy cover .

- Medical Coverage

- Journey Coverage

- Baggage Coverage

Emergency Medical Expenses

This benefit covers hospitalization, room rent, OPD treatment, and Road Ambulance costs. It also reimburses expenses incurred on Emergency Medical Evacuation, Medical Repatriation and Repatriation of mortal remains.

Dental Expenses

We believe dental healthcare is just as important as hospitalization due to physical illness or injury; hence, we cover dental expenses which can occur during your travel. Subject to policy terms and conditions.

Personal Accident

We believe in seeing you through thick and thin. In the event of an accident, while traveling abroad, our insurance plan provides a lump sum payment to your family to assist with any financial burdens caused by permanent disablement or accidental death.

Personal Accident : Common Carrier

We believe in being by your side through ups and downs. So, under unfortunate circumstances, we will provide a lump sum payout in case of accidental death or permanent disablement arising out of an Injury whilst on a Common Carrier.

Hospital cash - accident & illness

If a person is hospitalized due to injury or illness, we will pay the per day Sum Insured for each complete day of hospitalization, up to the maximum number of days stated in the Policy Schedule.

Flight Delay & Cancellation

Flight delays or cancellations may be beyond our control, but worry not, our reimbursement feature allows you to meet any essential expenses arising from the setback.

Trip Delay & Cancellation

In case of a trip delay or cancellation, we will refund the non-refundable portion of your pre-booked accommodation and activities. Subject to policy terms and wordings.

Loss of Passport & International driving license

Losing important documents can leave you stranded in a foreign land. So, we will reimburse expenses related to obtaining a new or duplicate passport and/or international driving license.

Trip Curtailment

Don't worry if you have to cut your trip short due to unforeseen circumstances. We'll reimburse you for your non-refundable accommodation and pre-booked activities as per the policy schedule.

Personal Liability

If you ever find yourself liable for third-party damage in a foreign land, our travel insurance helps you compensate for those damages effortlessly. Subject to policy terms and conditions.

Emergency Hotel Accommodation for Insured Person

Medical emergencies may mean you need to extend your hotel booking by a few days more. Worried about the added expense? Let us take care of it while you recover.subject to policy terms and conditions

Missed Flight Connection

Don't worry about unexpected expenses due to missed flight connections; we will reimburse you for the expenses incurred on accommodation and alternate flight booking to reach your destination.

Hijack Distress Allowance

Flight hijacks can be a distressing experience. And while the authorities help sort out the issue, we'll do our bit and compensate you for the distress it causes.

Emergency Cash Assistance Service

When traveling, theft or robbery can lead to a cash crunch. But don't worry; HDFC ERGO can facilitate fund transfers from the insured 's family in India. Subject to policy terms and conditions.

Loss Of Checked-In Baggage

Lost your checked-in baggage? Don't worry; we'll compensate you for the loss, so you don't have to go without your essentials and vacation basics. Subject to policy terms and conditions.

Delay of Checked-In Baggage

Waiting is never fun. If your luggage gets delayed, we'll reimburse you for essentials like clothing, toiletries and medication so you can start your vacation worry-free.

Theft of baggage and its contents

Theft of baggage can derail your trip. So, to ensure your trip stays on track, we'll reimburse you in case of baggage theft. Subject to policy terms and conditions.

The above mentioned coverage may not be available in some of our Travel plans. Please read the policy wordings, brochure and prospectus to know more about our travel insurance plan.

What Does HDFC ERGO Travel Insurance Policy Not Cover?

Breach of law.

Sickness or health issues caused due to war or a breach of the law is not covered by the plan.

Consumption of Intoxicant substances

If you consume any intoxicants or banned substances, the policy shall not entertain any claims.

Pre existing diseases

If you suffer from any illness before the travel you’ve insured and if you undergo any treatment for an illness that already exists, the policy does not cover expenses related to these incidents.

Cosmetic and Obesity Treatment

Should you or any member of your family opt to undergo any cosmetic or obesity treatment during the course of the travel you’ve insured, such expenses remain uncovered.

Self Inflicted Injury

Any hospitalization expenses or medical costs arising from self-inflicted injuries are not covered by the insurance plans we offer.

Key Features of HDFC ERGO Travel Insurance Policy

does hdfc ergo’s travel insurance cover covid-19.

The world is returning to normal after being in the clutches of the COVID-19 pandemic for almost two years. However, the worst is not over yet. A new variant of the virus - Arcturus covid variant – has caused much concern among the public and healthcare experts alike. The presence of this new covid variant has been reported in many countries across the globe. The concern regarding this new covid variant is that it is believed to be more transmissible than previous strains, but it is still unclear whether it is more deadly than the previous ones. This uncertainty also means that we cannot put anything to chance yet and must follow the basic precautions to prohibit transmission. Masks, sanitisers and compulsive cleaning should still be our mainstay.

In the face of rising Covid cases in India , the importance of vaccinations and booster doses has again been highlighted. If you aren’t vaccinated yet, it’s high time you get the jab. International visits can be interrupted if you have not taken the requisite doses, as it is one of the mandates for overseas travel. The symptoms of Arcturus covid virus can range from mild to moderate, manifesting as - cough, fever, fatigue, loss of smell or taste, and difficulty breathing. Some individuals may also experience muscle aches, headaches, sore throat, congestion, conjunctivitis, or pink eye. If you experience any of these symptoms while travelling overseas, rush to the nearest hospital for a check-up. Medical expenses in a foreign land can be expensive, so having the backing of travel insurance can be of much help. HDFC ERGO’s international travel insurance policy ensures that you are protected if you catch COVID-19.

Here’s what is covered under the travel medical insurance for COVID-19 -

● Hospitalisation expenses

● Cashless treatment at network hospitals

● Daily cash allowance during hospitalisation

● Medical evacuation

● Extended hotel stay for treatment

● Medical and body repatriation

How to Modify or Extend existing Travel Insurance Policy?

Even though the terms and provisions of your travel insurance are locked in the minute you sign off on the plan and pay your premium, you can modify dates of your existing plan with HDFC ERGO in the following manner:-

Change in Travel Dates prior to undertaking the travel: Dates of travel insurance policy can be changed if the journey has been postponed due to any reason. For example, If the policy was taken from 01-Nov21 to 30-Nov-21, modification can be allowed if the dates have to be changed to 01-Dec-21 to 30-Dec-21. The change is allowed for a date after the one already chosen. Modification is not allowed if the journey is scheduled to begin before the existing date 01-Nov-21. Should such a situation arise, the existing policy will need to be cancelled completely and then a new travel insurance cover can be purchased for the required dates.

Extending the international travel insurance policy is possible subject to the following conditions:

1. The original travel insurance policy has not expired.

2. There is no claim in the original policy.

3. The sum insured will not be enhanced upon extending the plan.

4. You will need to provide a declaration of good health.

5. The premium for extension has to be paid before the actual extension is affected.

6. Total period (policy + extension) does not exceed 360 days.

7. Extension is allowed on Single Trip policies only. Annual Multi-Trip policies cannot be extended.

You can change travel dates for HDFC ERGO travel insurance online in following ways:

1. Visit the HDFC ERGO website here

2. Under the banner, go to ‘ Want to modify existing travel policy? Click here’

3. You will be directed to a new page where you can change or extend travel date.

4. Next, you must enter your policy number.

5. In case of extending your dates, you must pay an extension premium on your travel insurance.

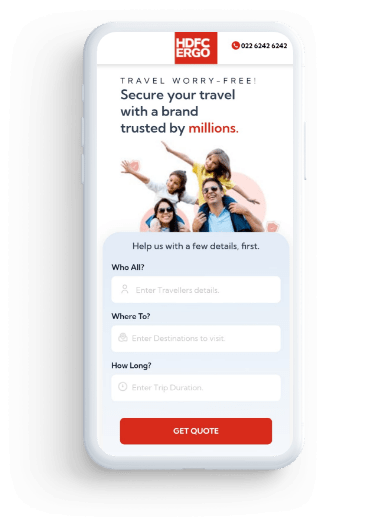

Know your Travel insurance premium In 3 Easy Steps

Add your trip details

Fill your personal details

choose your travel insurance plan

Choose your travel insurance plan

Many countries have made it mandatory for foreign travellers to obtain a valid international travel insurance policy before entering their borders

Why do you need overseas travel insurance policy.

With HDFC ERGO travel insurance policy, you can go for a trip without worrying about anything. We provide coverage for untimely expenses that might occur during your journey like, loss of luggage, missing out on connecting flight, or the risk of getting infected by COVID-19. Hence to avoid creating a big hole in your pocket due to any unwanted events, buying comprehensive International travel insurance is a must.

Our travel insurance will essentially secure you under following circumstances:

Medical Expenses

Loss of documents & baggage, flight delays, delay in baggage arrival, emergency dental expenses, emergency financial assistance, international travel insurance for most visited countries.

Take your pick from the options below, so you can be better prepared for your trip to a foreign country

Travel Insurance for UAE

Travel Insurance for France

Travel Insurance for Canada

Travel Insurance for Schengen VISA

Travel Insurance for Japan

Travel Insurance for Singapore

Travel Insurance for Malaysia

Travel Insurance for Australia

Travel Insurance for USA

Travel insurance for thailand, travel insurance for germany.

Travel Insurance for Bali

here’s what you should keep in mind before buying, the duration of your trip.

The longer your trip, the higher the insurance premium will be, since the risk involved in longer stays abroad is higher.

The destination of your trip

If you’re travelling to a country that is safer or economically more stable, the insurance premium will likely be lower.

The amount of coverage you need

Higher the sum insured higher will be your travel insurance premium.

Your renewal or extension options

You can extend or renew your travel insurance whenever it’s about to expire. Refer policy document for more details.

The age of the traveller(s)

Typically, older travellers may be charged a higher premium. This is because the probability of medical emergencies occurring increases with age.

Factors That Affect Your Travel Insurance Premium

The country you’re travelling to, the duration of your trip¨, the extent of coverage you choose, how to claim travel insurance.

The claim process of HDFC ERGO travel insurance is an easy 4 step process. You can make a travel insurance claim online on a cashless as well as reimbursement basis.

- Cashless Claim

- Reimbursement Claim

Intimate claim to [email protected] / [email protected] and get a list of network hospitals from TPA.

[email protected] will share the checklist of documents required for cashless claims.

Mail Documents

Send the cashless claim documents and policy details to our TPA partner- Allianz Global Assistance, at [email protected] .

Our concerned team will contact you within 24 hours for the further cashless claim process as per policy terms & conditions.

Intimate claim to [email protected] and get a list of network hospitals from TPA.

[email protected] will share the checklist of documents required for reimbursement claims.

Send all required documents to [email protected] for reimbursement as per the Checklist

Upon receipt of complete documents, the claim will be registered and processed within 7 days as per policy terms & conditions.

List Of Countries Where Travel Insurance Is Mandatory

Here are some of the countries that require mandatory overseas travel insurance: This is an indicative list. It is advisable to check each country’s visa requirement independently before travel.

Schengen countries

- the Netherlands

- Switzerland

- Liechtenstein and Luxembourg

Other countries

Source : VisaGuide.World

Decoding Travel Insurance Terms

Confused about all the travel insurance jargon floating around? We’ll make it easier for you by decoding some commonly used travel insurance terms.

Sum Insured

The sum insured is the maximum amount the insurance company will pay you in case any of the insurable events occur. In other words, it’s the maximum coverage that you are entitled to under your travel insurance plan.

Sublimits are additional monetary limitations in the coverage offered by your travel insurance policy. They limit the cover applicable to specific insurable events or losses, and they are a part of the original overall coverage offered by the policy.

In some cases, when an insurable event happens, you may have to pay some of the expenses involved out of your own pocket. This amount is known as the deductible. The rest of the expenses or losses will be borne by the insurance company.

Cashless settlement

Cashless settlement is a kind of claim settlement process where the insurer directly pays the costs involved in case of any insurable loss on behalf of the policyholder.

Reimbursement

This is a kind of claim settlement wherein the policyholder pays the expenses out of pocket first, and the insurance company later reimburses the costs as per the coverage limits in place.

Single Trip Plans

Single trip plans are travel insurance plans that provide coverage for only one trip. You can buy this plan in advance of your international holiday.

Multi-trip Plans

Multi-trip plans are travel insurance policies that offer coverage for multiple trips within a predetermined period. Typically, the cover offered by multi-trip plans is valid for one year.

Family Floater Plans

Family floater plans are for families, as is evident from the name. These plans offer travel insurance coverage that extends to every member of the family who is travelling on the insured journey.

Travel Insurance Policy Documents

Travelling to the US?

There’s nearly a 20% chance that your flight could be delayed. protect yourself with hdfc ergo’s travel insurance., travel insurance reviews & ratings.

Our customers have rated us

STUDENT SURAKSHA OVERSEAS TRAVEL

10 Sep 2021

Happy with the service

my:Single trip Travel insurance

05 Jul 2019

I have seen few of the insurance policies before deciding to choose HDFC insurance as my life partner. One of the interesting part is monthly-autodeduction from my card as well as it sends the reminder before the due date. The app developed is also so friendly to use and gives me a better experience compared to other insurance company.

Pros: - excellent pricing: quotes from other insurers during past three-four years have been always 50-100% higher including all possible discounts and membership benefits - excellent service: choice of billing, payment, documentation options - excellent customer service: newsletters, prompt and professional replies from the representatives Cons: - none till now

Travel Insurance News

Pakistan-China Khunjerab Border Reopens, Boosting Trade and Tourism

The Pakistan-China Khunjerab border reopens after a four-month winter closure, facilitating trade and tourism between the two nations. The agreement mandates closure from December 1 to March 31 annually due to severe weather conditions. The reopening promises economic benefits, with uninterrupted transportation of essential goods for Pakistan's development projects continuing during the closure period.

Taiwan Revises Tourism Targets Amid Cross-Strait Travel Challenges

Taiwan reevaluates its tourism goals due to cross-strait travel hurdles, potentially facing a 2 million shortfall in foreign visitor arrivals this year. Tourism Administration Director-General Chou Yung-hui hints at adjusting targets downward to 10 million, with full recovery not expected until 2025, citing China's ban on group tourist visits to Taiwan.

Akasa Air Launches International Operations with Mumbai-Doha Flight

Akasa Air initiates its international operations with its first overseas flight from Mumbai to Doha, Qatar. The airline secures traffic rights for additional destinations in Kuwait, Jeddah, and Riyadh, signaling rapid global expansion. Convenient flight schedules offer travelers from various domestic cities seamless connectivity to Doha via Mumbai.

Lufthansa Faces Two-Day Cabin Crew Strike in Germany

Deutsche Lufthansa AG braces for a two-day cabin crew strike in Germany, adding to recent labor disruptions. The strikes, announced by labor union UFO, will impact departures from Frankfurt on Tuesday and Munich on Wednesday. The airline grapples with ongoing transport disruptions, projecting wider losses for the first quarter amid labor actions and cargo downturn.

China Southern Airlines Launches Historic Nonstop Flight to Mexico

China Southern Airlines is set to inaugurate its first nonstop route to Mexico City from Shenzhen, marking China's longest flight and underlining Mexico's growing importance as an economic partner. Despite logistical challenges, including high altitude in Mexico City, the move reflects the burgeoning trade ties between China and Mexico amid geopolitical tensions.

Singapore Introduces QR Code Entry for Land Checkpoints

Singapore implements QR code entry at Woodlands and Tuas land checkpoints, eliminating the need for passport checks starting March 19. This move aims to reduce wait times by 30%, particularly during peak periods. The initiative extends to other checkpoints with Malaysia, aligning with efforts to streamline border crossings as travel resumes post-Covid.

Read Latest Travel Insurance Blogs

How to Check US Visa Status in India?

What is the Difference Between Passport and Visa?

How to Check UK Visa Status in India?

How to Check Australia Visa Status in India?

World’s Least Powerful Passports In 2024

Frequently asked questions on travel insurance, 1. is it necessary to buy travel insurance.

Yes, it is. Travel insurance is the ultimate seal of safety you can add to your journey, so you can enjoy your vacation or turn that business trip into a success without worrying about the stressful scenarios that could occur unexpectedly. With travel insurance acting as your #SafetyKaTicket, you can rest assured that you’re insured against the financial losses or burden associated with flight delays, loss of baggage, and even emergency medical expenses when you’re in another city, among other things.

1. How does travel insurance work?

Travel insurance acts as a financial safety net and protects you against the possible financial repercussions of unexpected emergencies on your journey. When you purchase a travel insurance policy, you essentially buy a cover against certain insurable events. It offers medical, baggage-related and journey-related coverage. In case any of the insured events, like flight delays, loss of baggage, or medical emergencies occur, your insurer will either reimburse the additional costs that you incur on account of such incidents, or they shall offer a cashless claim settlement for the same.

2. Is a medical checkup necessary before the policy is purchased?

We have good news for you here. A medical checkup is not necessary if you’re planning to buy the HDFC ERGO travel insurance policy. You can bid goodbye to health checkups and purchase travel insurance without any hassle.

3. Is it necessary to get prior approval of the insurance provider before proceeding with medical treatment should the necessary arises?

Emergency medical needs must be treated in time if the need arises. And that is why it is not necessary to get any sort of prior approval from the insurer before you proceed with medical treatment, but it is better to inform the insurance company of the claim. However, the nature of the treatment and the terms of the travel insurance policy will determine if the treatment is covered by the travel insurance.

4. Can you buy travel insurance after booking your trip?

Yes, you most certainly can buy travel insurance after you’ve made a booking for your trip. In fact, it’s a smart idea to do so, because that way, you will have a better idea of the details of your trip, such as the start date, the end date, the number of people accompanying you and the destination. These details are all essential to determine the cost of your travel insurance cover.

5. Is travel insurance mandatory?

Well, that depends on where you’re travelling to. To be more specific, there are 34 countries that have made travel insurance mandatory, so you’ll need to purchase a cover before you travel there. These countries include Cuba, The United States of America, The United Arab of Emirates, Ecuador, Antarctica, Qatar, Russia, Turkey and the group of 26 Schengen countries.

7. What is a deductible? Why is this necessary?

A deductible is simply that amount of a claim that you will need to meet from your pocket, before the insurer steps in and bears the rest of the costs involved. Insurance policies have deductibles because they help the insurer share the costs with the policyholder. And knowing that some of the costs may need to be borne out-of-pocket keeps the policyholder from engaging in any risky behavior that may result in losses that are insured.

6. What are the age criteria for which you issue a travel insurance policy online in India?

single trip-91 days to 70 years. AMT same, family floater – from 91 days to 70 years, insuring upto 20 people. The exact age criteria vary from one travel insurance policy to another, and also from one insurer to the next. For the travel insurance policy from HDFC ERGO, the age criteria depend on the kind of cover you opt for. • For single trip insurance, people aged between 91 days and 70 years can be insured. • For annual multi trip insurance, people aged between 18 and 70 years can be insured. • For family floater insurance, which covers the policyholder and up to 18 other immediate family members, the minimum age of entry is 91 days and can be insured up to 70 years.

7. When should you buy a travel insurance policy?

That depends on the number of trips you’ll be taking during the year. If you’ll likely just take the one trip, you will want to purchase a single trip cover. The ideal time to buy a travel policy for a single trip is within a couple of weeks of booking your flight tickets. On the other hand, if you plan to take multiple trips during the year, it would be a better idea to purchase your travel insurance plan well in advance, before you book your various trips.

8. In which Schengen countries is travel insurance mandatory?

Travel insurance is mandatory for traveling to all 26 Schengen countries.

9. Can more than one policy be issued for the same trip?

No. HDFC ERGO does not provide multiple insurance plans to the same person for the same trip.

10. Are business travellers eligible to purchase a Travel Insurance policy?

Yes, Indian Nationals travelling abroad for business can purchase travel insurance policy.

11. When does the travel insurance cover begin and end?

Travel insurance is usually taken for the duration of travel. The policy will mention the start and end date on its schedule.

12. Where can customers access the list of network hospitals?

You can find your preferred hospital from among HDFC ERGO’s list of partner hospitals https://www.hdfcergo.com/locators/travel-medi-assist-detail or send mail to [email protected].

13. Is it mandatory for the customer to be in India for international travel policy issuance?

Policy can be taken only if the insured is in India. Cover is not offered for individuals who have already travelled abroad.

14. Can I buy travel insurance after leaving the country?

Unfortunately, you cannot buy travel insurance after leaving the country. The traveller needs to ensure availing of the travel insurance policy before travelling abroad.

15. What are the sublimits of this product?

No sub-limit has been specifically imposed for customers visiting Schengen countries. For insured individuals below 61 years of age, there are no sub-limits applicable under travel medical insurance. Sub-limits are applicable to insured individuals aged 61 years and older for various expenses, including hospital room and boarding, physician fees, ICU and ITU charges, anaesthetic services, surgical treatment, diagnostic testing expenses, and ambulance services. These sub-limits are applicable to all travel insurance policies regardless of the plan purchased. For more details, refer to the product prospectus.

16. How much does travel insurance cost?

The cost of a travel insurance policy depends on a lot of factors. The cost is not fixed or uniform for all trips. The following factors determine how much premium would be payable –

● The type of policy

There are different types of travel insurance plans available and each plan has a different premium. Single trip plans are cheaper than annual multi-trip plans. Individual plans are cheaper than family plans and so on.

● The destination

Different countries attract different premiums. Developed countries like the USA, UK, Australia, etc. involve higher premiums than others.

● Number of members travelling

The more the number of members who travel with you the higher would be the premium.

Higher the age higher would be the probability of suffering an illness. As such, premiums increase with age

● Trip duration

The longer the trip the higher would be the premium and vice-versa.

● Plan variant

There are different variants of the same plan. Each variant has different coverage benefits. The higher the variant the more inclusive the plan becomes and so the premiums are higher

● Sum insured

The higher the sum insured that you choose the higher would be the premium and vice-versa

You can use HDFC ERGO’s online calculators to find out the premium payable for the travel insurance plan.

17. Can you buy insurance after starting your trip?

No, you cannot buy travel insurance after starting your trip. The policy should be bought before the trip has commenced.

18. How do I choose a travel policy?

You should choose a travel insurance plan based on your travel needs. Here’s how –

● If you are travelling solo, choose an individual policy

● If you are travelling with your family, a family travel insurance plan would be suitable

● If a student is travelling for higher education, choose a student travel insurance plan

● You can also choose the plan based on your destination, like a Schengen travel plan, Asia travel plan, etc.

● If you travel frequently, choose an annual multi-trip plan

After you have shortlisted the type of plan that you want, compare the different policies in that category. There are different insurance companies offering travel insurance plans. Compare the available policies on the basis of the following –

● Coverage benefits

● Premium rates

● Ease of claim settlement

● International tie-ups in the country that you are travelling to

● Discounts, etc.

Choose a policy that offers the most inclusive coverage benefits at the most competitive rate of premium. Choose an optimal sum insured and buy the best plan for securing the trip.

1. What is not covered in travel insurance?

It’s always a good idea to know what the scope of your travel insurance is. When you buy the HDFC ERGO travel insurance policy, do keep in mind that the following incidents, losses, or events are not covered by our travel insurance. • Any sickness or health issues caused due to war or a breach of the law • Claims related to health, if you consume any intoxicants or banned substances • Expenses related to pre-existing diseases • Expenses related to cosmetic surgery or obesity treatment • Any hospitalization expenses or medical costs arising from self-inflicted injuries • Injuries sustained during adventure sports

1. Does travel insurance cover flight cancellation?

Yes, we will reimburse the Insured Person for non-refundable flight cancellation expenses incurred in the event of a flight cancellation.

2. What benefit will I get from this insurance in case of a medical emergency?

This benefit covers hospitalization, room rent, OPD treatment, and Road Ambulance costs. It also reimburses expenses incurred on Emergency Medical Evacuation, Medical Repatriation and Repatriation of mortal remains. Source : https://www.hdfcergo.com/docs/default-source/downloads/prospectus/travel/hdfc-ergo-explorer-p.pdf

4. What does my travel insurance cover?

Your HDFC ERGO travel insurance plan covers a wide range of medical emergencies, baggage-related emergencies and journey-related issues. In the medical emergency coverage, you can rest assured that your policy covers emergency medical and dental expenses, medical evacuation, hospital daily cash allowance, accidental death and even medical/body repatriation. As for baggage troubles, we have you covered in case of loss or delay of checked-in baggage and loss of personal documents. Flight delays, financial emergency assistance, hijacking, personal liability and hotel accommodation are also other benefits you’ll enjoy with our travel insurance plan. Source: HDFC ERGO site - ‘what’s covered’ section

3. Will pre-existing diseases be covered under the travel insurance policy?

No. The HDFC ERGO travel insurance policy does not cover any expenses related to the treatment of a pre existing disease or condition in the duration of your insured trip.

4. If I’m being advised to quarantine; are the accommodations or re-booking expenses covered?

Accommodation or re-booking expenses resulting from a Quarantine are not covered.

7. Are pre-existing ailments or diseases covered under travel insurance plans?

If you undergo treatment for pre-existing diseases during the travel insurance policy period, medical expenses for the same are not covered by the travel insurance policy. However, any medical condition that is diagnosed after purchasing the travel insurance policy will be covered. It is important to disclose all your health-related information at the time of purchasing the travel insurance policy to not face any claim rejections during the trip.

5. Which conditions are covered under medical coverage?

Medical benefit covers hospitalization, room rent, OPD treatment, and Road Ambulance costs. It also reimburses expenses incurred on Emergency Medical Evacuation, Medical Repatriation and Repatriation of mortal remains. Cashless facility is available for receiving treatments at the insurer’s network hospitals.

6. What is flight insurance?

Flight insurance is a part of travel insurance wherein you get covered for flight-related contingencies. Such contingencies include the following –

● Flight delay

● Accidental death due to a crash

● Flight cancellation

● Missed flight connection

7. What do I do if I fall sick when I am overseas?

When you fall sick when travelling contact our Toll free no +800 0825 0825 ( add the area code + ) or chargeable no +91 1204507250 / + 91 1206740895 or write to [email protected]

HDFC ERGO has partnered with Alliance Global Assist for its TPA services. Fill up the online claim form available at https://customersupport.hdfcergo.com/DigitalClaimForms/travel-insurance-claim-form.aspx?_ga=2.101256641.138509516.1653287509-1095414633.1644309447. Fill up a ROMIF form which is available at https://www.hdfcergo.com/docs/default-source/documents/downloads/claim-form/romf_form.pdf?sfvrsn=9fbbdf9a_2 .

Send the filled and signed claim form, ROMIF forms all the claim-related documents to the TPA at [email protected] . The TPA would process your claim request, look for the networked hospitals and assist you with the hospital list so that you can get the medical attention that you need.

1. How can I cancel my travel insurance policy?

Cancelling your travel insurance policy is quite easy. You can place your cancellation request via email or fax. Do make sure that the cancellation request reaches up within 14 days from the policy’s inception date. In case the policy is already in force, you’ll also need to submit a copy of all the 40 pages of your passport, as a proof that the journey has not been undertaken. Do note that cancellation charges of Rs. 250 will be applicable, and the balance amount paid will be refunded.

2. Can I extend my policy?

Currently we cannot extend the policy

3. How many times can we extend the policy?

You can extend your travel insurance policy once. The period of extension depends on the details of the trip. • Single Trip insurance plans can be extended up to 180 days. The total policy period including such extension should not exceed 360 days. AMT policies cannot be extended.

3. What is the maximum number of days for which I can take the travel insurance policy?

Generally, the total policy period, including extensions if any, should not exceed 360 days. However, the limits may vary for specific plans, as explained below. • Single Trip insurance plans can be extended up to 180 days. The total policy period including such extension should not exceed 360 days. AMT policies cannot be extended.-->

5. If I extend my travel insurance policy online, what premium is applicable?

The exact amount of the extension premium depends on many factors like the period of extension, the destination of the trip, the number of people covered, and other aspects of the cover. Simply put, it varies on a case-to-case basis. To extend your policy, you can visit this link. Alternatively, you could als send a mail to us at [email protected]. You will receive a response from our end, detailing the procedure and giving you the details of the additional premium to be paid.

4. Does HDFC ERGO's travel insurance policy come with a free-look period?

No. The HDFC ERGO travel insurance policy does not come with a free-look period.

5. Is there a grace period in travel insurance policy?

Grace period is not applicable to any cover for travel insurance policy.

6. What sum insured should be opted for while traveling to Schengen countries?

The Schengen countries require a minimum insurance of Euro 30,000. Insurance should be bought for an equivalent or higher amount.

7. Are there any sub-limits applicable for Schengen countries?

There are sub-limits applicable for availing travel insurance policy for Schengen countries. Please refer the policy documents to know that sub-limits.

8. If the customer returns home earlier than planned, can he/she get a partial refund on travel insurance?

No, the product does not offer any refund for early returns.

11. If I take a 2 month Travel Insurance Policy, would I be able to extend it later, as per my requirement?

Yes. HDFC ERGO allows you to extend your travel insurance cover by paying an additional premium as long as the existing plan remains unexpired and no claims have been raised. Extension can be taken for a maximum of 180 days. Also, Total period of cover (base policy + extension) should not exceed 360 days.

9. What are the charges for policy cancellation?

A cancellation charge of Rs 250 will be levied if you cancel your HDFC ERGO travel insurance, irrespective of whether you raise the request before or after your trip begins.

10. Do I get a grace period for my travel insurance policy?

No. There is no grace period applicable for a travel insurance policy.

11. What is my travel insurance coverage requirement sum insured while travelling to any of the Schengen countries?

Travel insurance with a minimum equivalent sum insured of 30,000 Euros needs to be availed to travel to Schengen countries. There are about 26 countries that come under the entire Schengen region for you to visit and it is compulsory to have travel medical insurance cover to visit these states. To get Schengen Visa, you need to produce your travel medical insurance document.

12. Is there a partial refund possible on a travel insurance plan, in case the trip is curtailed and the customer comes home earlier than initially planned?

No. Partial refund is not allowed under travel policy.

16. Can travel insurance plans be extended at a later point in time if there is a genuine requirement or an extension of stay?

Yes! The extension is provided on travel insurance policy based on certain conditions such as:

• There should have been no claim under the policy during the period

• The policy is not expired

• Insured needs to provide the declaration of good health

• The sum insured remains the same and no enhancement of the sum insured is allowed

• The total period of policy, base plus extension, does not exceed 360 days.

• The premium for extension needs to be paid before the extension is affected.

12. How is the travel insurance premium calculated?

The travel insurance premium is calculated considering the following details –

● Type of plan

● Destination

● Members to be covered

● Their age

● Plan variant and sum insured

You can use HDFC ERGO’s online premium calculators to find the premium of the policy that you want. Enter in your trip details and the premium would be calculated.

13. What is the document provided as proof of travel insurance?

The policy is issued by HDFC ERGO which serves as proof of travel insurance. The bond is mailed to you on your email ID. Moreover, a physical copy is also sent to your registered address. You can carry this copy as proof of coverage.

14. What are the modes of payment for buying a travel insurance policy?

HDFC ERGO allows both online as well as offline modes of paying for the travel insurance policy. The available modes include the following –

● Demand draft

● Credit card

● Debit card

● Net banking facility

● NEFT/RTGS/IMPS

1. Does a claim have to be lodged or made in a specific time frame from the time of the accident?

In case any of the insured events covered by the travel insurance policy occurs, it’s best to give us a written notice of the incident as soon as practicable. In any case, the written notice must be given within 30 days of such an event occurring. In case the insured event is the death of a person covered by the plan, the notice must be given immediately.

2. How long does it take to process a travel insurance claim?

We understand that during any emergency financial distress, the sooner we can assist you, the better you’ll be able to get through the crisis. That’s why we settle your claims in record time. While the exact length of the period varies from case to case, we ensure that your claims are quickly settled upon the receipt of the original documents.

3. What kind of documentation is required while making a travel insurance claim?

The kind of documentation depends greatly on the nature of the insured incident that has occured. In case of any loss covered by the travel policy, the following proof must be submitted. 1. The Policy Number 2. The preliminary medical report describing the nature and extent of all injuries or illnesses, and providing a precise diagnosis 3. All invoices, bills, prescriptions, hospital certificates which will permit us to accurately determine the total amount of medical expenses (if applicable) incurred 4. In the case another party was involved (like in the case of a car collision), the names, contact details and if possible, the insurance details of the other party 5. In the case of death, an official death certificate, succession certificate pursuant to the Indian Succession Act 1925, as amended, and any other legal documents establishing the identity of any and all beneficiaries 6. Proof of age, where applicable 7. Any such other information we may require to handle the claim In case of any accident covered by the travel policy, the following proof must be submitted. 1. Detailed circumstances of the accident and the names of witnesses, if any 2. Any police reports concerning the accident 3. The date a physician was seen consulted for the injury 4. The contact details of that physician In case of any sickness covered by the travel policy, the following proof must be submitted. 1. The date on which the symptoms of the sickness began 2. The date on which a physician was consulted for the sickness 3. The contact details of that physician

4. What if I lose my baggage? How do I make a claim in such a case?

Losing your baggage during your trip can be inconvenient, because you may need to replace a lot of essentials and spend out of pocket. With a travel insurance policy, you can cushion the financial impact of such a loss. If you lose your baggage during the period the insurance cover is valid, you can register a claim by calling our 24-hour helpline centre and quote the policyholder’s name, the policy number, the insurance company, and the passport number. This needs to be done within 24 hours. Here are our contact details. Landline:+ 91 - 120 - 4507250 (Chargeable) Fax: + 91 - 120 - 6691600 Email: [email protected] Toll free no.+ 800 08250825 You can also visit this blog for more information.

5. How do I claim on my travel insurance?

In case any loss or insured event covered by your travel policy occurs, you can register a claim by calling our 24-hour helpline centre and quote the policyholder’s name, the policy number, the insurance company, and the passport number. This needs to be done within 24 hours. Here are our contact details. Landline:+ 91 - 120 - 4507250 (Chargeable) Fax: + 91 - 120 - 6691600 Email: [email protected] Toll free no.+ 800 08250825

6. Will I be able to extend the travel insurance policy if I already have an ongoing claim?

No. You cannot extend the existing HDFC ERGO travel insurance policy if you have already raised a claim on it.

6. How many days does it take to settle the claim?

The claim is settled in three working days from the date of receiving the last documents for reimbursement. The duration for settling the claim for cashless is as per the invoices submitted by the hospital (approx 8 to 12 weeks).

6. What would be the documents required to file a travel insurance claim for COVID-19?

Documents required for filing a travel insurance claim are the same as Emergency Medical Expenses, which will only cover expenses for patients who test positive for COVID-19. It will not cover expenses for home quarantine or quarantine in the hotel.

1. Can I renew my travel insurance policy online?

only Annual multi-trip policy can be renewed. Single trip policies cannot be renewed.

2. How do I check the status of my HDFC ERGO travel insurance renewal?

Only AMT policies can be renewed. Single trip policies cannot be renewed. Extension of single trip policies can be done online.

3. What are the Details and Documentation of the Travel Insurance Extension?

The details and documentation needed for travel insurance cover/extension are your basic details like name, age, journey details, and start and end day of your travel. You can get travel insurance online by filling out these basic details and paying.

4. Can I extend my travel insurance policy when travelling abroad?

If you are already covered under HDFC ERGO’s travel insurance cover, you can extend your travel insurance only if the policy has not expired. Ideally, if you need to extend your travel insurance, you can do that in India before your journey begins.

Here are a few more points you should keep in mind for extending your travel insurance:

• There should be no claim availed on the original policy.

5. How to Extend Your Travel Insurance Policy?

You can extend your travel insurance policy online by login here , or you can call our helpline no to extend travel insurance.

1. How To Get Travel Insurance With Covid-19 Cover?

HDFC ERGO’s Travel Insurance covers coronavirus hospitalisation. You don’t have to buy separate insurance for COVID-19. Your travel medical insurance will give you cover for the same. You can buy travel insurance online by visiting our website or calling our helpline number 022 6242 6242.

Following are some of the features covered for COVID-19 in travel insurance -

● Hospital expenses if one gets COVID-19 while covered under overseas travel insurance.

● Cashless treatment in network hospitals.

● Reimbursements of medical expenses.

● Daily cash allowance during hospitalisation.

● Expenses related to transferring mortal remains to home country in case of death due to COVID-19

2. When should I buy Covid-19 travel insurance?

Ideally, it would be best if you buy a travel insurance plan like HDFC ERGO's International Travel plan , which covers coronavirus hospitalisation before embarking on your journey. Your travel insurance covers you from the first day of your journey till you return to India. However, it might not be possible to buy one while you are overseas and reap its benefits. So, make it a point to buy your travel medical insurance ahead of time. To avoid last minute hassles buy your insurance as soon as you book tickets for your destination.

3. Does travel insurance cover a positive PCR test?

No, travel insurance doesn’t cover a Positive PCR Test if detected before your journey. However, hospital expenses, medical reimbursements and cashless treatment in network hospitals are provided as mentioned under your travel insurance policy if you get infected with coronavirus while travelling.

4. Can you get a refund on flights if you have COVID?

No, flight cancellations due to COVID-19 infection are not covered under HDFC ERGO’s International Travel Plan.

5. How much does COVID-19 travel insurance cost?

While buying Travel Insurance online, you can opt for Individual Travel Insurance , Family Travel Insurance or Student Travel Insurance , depending on your need and how you plan to travel. Depending on the sum you want to insure, you can also choose from our Gold, Silver, Platinum, and Titanium plans. However, you don’t have to pay extra for COVID-19 coverage. You will be covered for the same in any of the travel plans you choose.

6. Can I get travel insurance with pre-existing conditions and COVID-19coverage?

HDFC ERGO’s travel insurance policy doesn’t cover pre-existing conditions during your stay, even if you are covered under International travel insurance. However, you will be covered for COVID-19 hospitalisation during your insured period.

7. Does travel insurance cover quarantine?

No, HDFC ERGO’s travel insurance plan doesn’t cover quarantine expenses.

8. How can I claim for COVID-19 expenses through my travel insurance?

We will help you settle your claims for COVID-19 hospitalisation and expenses as soon as possible. The claim is settled within three working days after receiving all the valid documents related to your hospitalisation and medical expenses for reimbursement. The duration for settling the claim for cashless is as per the invoices submitted by the hospital (approx 8 to 12 weeks).The claim will cover expenses for the patients who test positive for COVID-19. However, it doesn’t cover expenses for home quarantine or quarantine in the hotel.

9. Does travel insurance cover missed flights due to Covid-19 Testing?

No, HDFC ERGO’s travel insurance doesn’t cover missed flights or flight cancellations due to COVID-19 or COVID-19 testing.

10. How long does it take to process the claim?

While we will try to help you with your claims at the earliest, it isn't easy to define the length of the claim period as it will depend from case to case. Therefore, we try to settle the claims in record time upon receipt of the original invoices.

11.Can the period of travel insurance be extended?

Yes, the travel insurance period can be extended only once, subject to the following conditions.

• The original policy period has not expired.

• There is no claim on the original policy.

• The sum insured will not be enhanced upon extending the plan.

• You will need to provide a declaration of good health.

• The extension premium has to be paid before the actual extension is affected. However, note that you might not be able to extend your travel insurance plan if you have already placed a claim on your existing HDFC ERGO travel insurance policy.

10. Who is a Third Party Administrator or TPA in Travel Insurance?

A third-party administrator provides operational services such as claims processing and other benefits as mentioned in your policy under contract with HDFC ERGO and can assist you in times of emergency when on international shores.

Awards & Recognition

BFSI Leadership Awards 2022 - Product Innovator of the Year (Optima Secure)

ETBFSI Excellence Awards 2021

FICCI Insurance Industry Awards September 2021

ICAI Awards 2015-16

SKOCH Order-of-Merit

Best Customer Experience Award of the Year

Icai awards 2014-15.

CMS Outstanding Affiliate World-Class Service Award 2015

iAAA rating

ISO Certification

Best Insurance Company in Private Sector - General 2014

Motor Insurance

Motor Insurance : Car Insurance | Second Hand Car Insurance | Comprehensive Car Insurance | Third Party Car Insurance | Car Insurance Calculator | Compare Car Insurance | Zero Depreciation Car Insurance | Renew Expired Car Insurance | No Claim Bonus | Standalone OD Car Insurance | Return to Invoice | Insured Declared Value | Two Wheeler Insurance | Bike Insurance Calculator | Comprehensive Two Wheeler Insurance | Third Party Two Wheeler Insurance | Compare Two Wheeler Insurance | Standalone OD Bike Insurance | Vehicle Insurance | Commercial Vehicle Insurance | Multi Year Two Wheeler Insurance | Track Break-In Status | Pay as You Drive | Engine Protection Cover

- Health Insurance

Health Insurance : Individual Health Insurance | Family Health Insurance | Parents Health Insurance | Senior Citizen Health Insurance | Health Insurance Renewal | Cashless Health Insurance | Health Insurance Premium Calculator | Personal Accident | my:health Suraksha Silver Smart | my:health Suraksha Gold Smart | my:health Suraksha Platinum Smart | Health Suraksha pre policy checkup status | Medisure Classic/Medisure Super top up pre policy checkup status | my:health Suraksha Silver | my:health Suraksha Silver with ECB&Rebound | my:health Women Suraksha Critical Illness Comprehensive Plan | my:health Women Suraksha CI Essential Plan | my:health Women Suraksha Cancer Plan | my:health Women Suraksha Cancer Plus Plan | my:health Women Suraksha | Arogya Sanjeevani | Health insurance Portability | iCan Health Insurance | Energy Health Insurance | Health Wallet Insurance - Family | Health Wallet Insurance - Individual | Optima Restore - Family | Optima Restore - Individual | Koti Suraksha | Saral Suraksha Bima, HDFC ERGO | Optima Secure | Optima Secure Individual | Optima Secure Global Individual | Optima Secure Global Family | Optima Super Secure Plan | Optima Super Secure Plan Individual | my:health Medisure Super Top Up | BMI Calculator | EquiCover Health | Here.

Pet Insurance

Pet Insurance : Pet Insurance

- Travel Insurance

Travel Insurance : Travel Explorer | Individual Travel Insurance | Family Travel Insurance | Student Suraksha Insurance | Annual Multi-trip Insurance | Travel Insurance For Senior Citizens | Travel Insurance for Schengen VISA from India | Travel Insurance for Australia | Travel Insurance for Bali | Travel Insurance For Canada | Travel Insurance for Dubai | Travel Insurance for France | Travel Insurance for Germany | Travel Insurance for Ireland | Travel Insurance for Italy | Travel Insurance for Japan | Travel Insurance for Malaysia | Travel Insurance for Poland | Travel Insurance for Singapore | Travel Insurance for Spain | Travel Insurance for Switzerland | Travel Insurance for Thailand | Travel Insurance for USA | Travel Insurance for UAE | Travel Insurance for UK | International Travel Insurance

Home Insurance

Home Insurance : Home Insurance For Tenants | Home Insurance For Owners | Home Insurance for Television | Home Insurance for Washing Machine | Home Insurance for Air Conditioner | Home Insurance for Jewellery | Home Insurance for Refrigerator | Home Insurance for Lighting | Home Insurance for Electronic Equipment | Home Insurance for Landslide | Home Insurance for Earthquake | Building Insurance | Property Insurance | Flood Insurance | Monsoon Insurance | Home Content Insurance | Theft Insurance

- Other Insurance

Other Insurance: Cyber Sachet Insurance | Standard Fire&Special Perilis Insurance | Rural Insurance | Casualty Insurance | Group Insurance | Property&Misc Insurance | Risk Consulting Services | Specialty Insurance | Rural Insurance | Other commercial insurance

Expert Profiles

Expert Profiles: Deepika Mathur | Diwaker Asthana | Mukesh Kumar | S.Gopala Krishnan

Customer Reviews

Customer Reviews: Health Insurance | 2 Wheeler Insurance | Private Car Insurance | Critical Illness | Travel Insurance | Personal Accident | Home Insurance | Student Suraksha

Downloads: Brochure | Prospectus | Proposal Form | Policy Wording | Claim form | KYC Form | Other Documents

- Hospital Network

Healthcare Network : Hospital Empanelment form | Product wise cashless services

Procedure to make changes

Procedure to make changes: Health Insurance | Home Insurance | Motor Insurance | Travel Insurance | Personal Accident Insurance

Others: Account aggregator | Insurance FAQs | Glossary | Travel Medi Assist | IRDAI Website | Knowledge Centre | Omicron | Repositories

Read in Hindi

Read in Hindi: Health Insurance Hindi | Car Insurance Hindi | Two Wheeler Insurance in Hindi | Home Insurance in Hindi

Our Promoters

Our Promoters: HDFC Bank | ERGO

Other Important links

Other Important links: HDFC Bank | HDFC Life | HDFC Securities | HDFC Mutual Fund | HDFC Sales | HDB Financial Services | HDFC Pension

PET INSURANCE: UIN: HDFC ERGO Paws n Claws - IRDAN146RP0001V01202324 T&C Apply. @1.51 crores+ active customers as on July 2022

Terms and Conditions Applied. © HDFC ERGO General Insurance Company Limited. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Happiness Center / Policy Issuing Address: D-301, 3rd Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. For Claim/Policy related queries call us at or Visit Help Section on www.hdfcergo.com for policy copy/tax certificate/make changes/register & track claim. IRDAI Registration Number : 146 (Registration type: General Insurance Company). For more details on the risk factors, terms and conditions, please read the sales brochure/ prospectus before concluding the sale. Trade Logo displayed above belongs to HDFC Bank Ltd and ERGO International AG and used by the Company under license. HDFC Ltd. and HDFC Bank merger stands concluded, effective 1st July, 2023. HDFC ERGO General Insurance Company Limited is now a subsidiary of the Bank.

How can we help you?

- Car Insurance

- Single Year Comprehensive Cover

- Third Party Cover

- Compulsory Personal Accident Insurance

- Standalone Car Insurance

- Bike/Two Wheeler Insurance

- Long Term Comprehensive Cover

- Standalone Two Wheeler Insurance

- For Individual

- For Parents

- For Senior Citizen

- Global Health Insurance

- Optima Secure

- Optima Secure Individual

- Optima Secure Global Individual

- Optima Secure Global Family

- Optima Super Secure plan

- Optima Super Secure plan Individual

- Optima Restore Family Floater

- Optima Restore Individual

- Critical illness Insurance

- Super Top up Insurance

- Arogya Sanjeevani Policy, HDFC ERGO

- Koti Suraksha

- Travel Explorer

- For Frequent Flyers

- For Student

- International Travel Insurance

- For Housing Society

- Bharat Griha Raksha

Cyber Insurance

- Cyber Sachet Insurance

Commercial Vehicle Insurance

- Passenger Carrying Vehicle Insurance

- Goods Carrying Insurance

Corporate Insurance

- Casualty Insurance

- Group Insurance

- Property & Misc Insurance

- Risk Consulting Services

- Speciality Insurance

- Pradhan Mantri Fasal Bima Yojana

- Cattle Insurance Policy

- Rainfall Index Insurance

- Pradhan Mantri Suraksha Bima Yojana

Customer Claim Intimation

Workshop claim intimation, track claim status, claim process.

- Critical Illness Insurance

- Personal Accident Insurance

- Group Medical Insurance

- Group Personal Insurance

- Group Travel Insurance

- Marine Hull & Machinery Insurance

- Kidnap Ransom Insurance

- Cattle Insurance

Corporate Claims

- Track Health Claims

- Track Non Health Claims

Third Party Claim

- Habit of Life Survey NEW

- Download Here App NEW

- All Things EV

- Insurance Gyan

- Wellness Corner NEW

- Know Your Policy

- Garage Network

- Diagnostic Centers

- Branch Locator

- Workshop Portal

- HDFC ERGO community

- Grievance Redressal

Top Travel Insurances for India You Should Know in 2024

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Known for its explosion of rich culture, colour, and food, India is an attractive travel destination for travelers on a budget. Whether you're travelling to India to experience the country's cultural heritage, visit its iconic landmarks and natural attractions, take part in adventure sports, or enjoy delicious and diverse cuisine, you will find India an excellent travel destination! Although travelling to India can be an accessible holiday destination for many people, and although healthcare costs in the country aren't outrageously expensive, it's still a very good idea to arrive there with travel insurance anway, as you'll want the highest-quality healthcare you can find.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to India and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

India Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for India:

Best Travel Insurances for India

- 01. Should I get travel insurance for India? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to India scroll down

Heading to India soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Do I Need Travel Insurance for India?

No, there's no legal requirement to take out travel insurance for India.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to India or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for India:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to India. It lets you choose between various plans tailored to meet the specific needs of your trip to India, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for India:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /traveller /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /traveller /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /traveller /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to India? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to India

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for India. However, we strongly encourage you to do so anyway, because the cost of healthcare in India can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

IL TakeCare app – For all your insurance & wellness needs

Policy purchase, claims, renewal & more

- 1800 2666 (Available 24 x 7)

Got questions? Let's talk! Share your contact details and we'll give you a call.

Thank you for your interest in our product..

Thank You for your interest in our product. We'll get in touch with you shortly to answer your queries.

- Live Chat --> Live Chat

- Know about Agent and PoSP

- Become an Agent

- Become a PoSP

- All policy renewal

- Two Wheeler Policy

- Health Policy

- Travel Policy

- Business Insurance

- Home Policy

- Arogya Sanjeevani Policy

- Grievance Redressal

- Counter Offer Acceptance

- Info Centre

- Expert Blogs

- Tax Benefits

- Corporate India Risk Index

- Testimonials

- Knowledge Center

- IL Cafe Podcast

- Cashless Garages

- Cashless Hospitals

- Investor Relations

- English हिंदी

Bharti AXA General Insurance is now part of ICICI Lombard General Insurance.

- Motor Insurance

- Car Insurance

- Bike Insurance

- Motor Floater

- Pay As You Use(PAYU)

- Pay How You Use

- Single Owner Multiple Vehicle

- Health Insurance

- ICICI Lombard Complete Health Insurance

- Health AdvantEdge

- Health Booster

- Personal Protect

- Disease Management Program

- Arogya Sanjeevani Policy, ICICI Lombard

- Corona Kavach Policy, ICICI Lombard

- Saral Suraksha Bima, ICICI Lombard

- Golden Shield

- Travel Insurance

- Single Trip

- Gold Multi trip

- Student Travel

- Marine Transit

- Workmen’s Compensation

- Group Health Insurance

- Fire Insurance - Sookshma

- Marine Open Insurance

- Fire Insurance - Griha for Housing Societies

- Professional Indemnity Policy for Medical Practitioners

- Crop Insurance

- NRI Insurance

- Cyber Insurance

- ICICI Bharat Griha Raksha Policy

- Complete Home Protect

- Bike Policy

- Health Claims

- Motor Claims

- Travel Claims

- Home Claims

- Cyber Insurance Claims

- Redbus Claims

- Corporate Claims

- Mobile Claims - M-Kash

Last login:

08/12/2020 11:53:14

Worry less, wander more with Single Trip Insurance

Prices starting at just ₹2,094/yr, millions of indians love us because, cashless hospitalisation *.

Worldwide cashless medical facility on your international trip

IL Take Care app

Quick claim intimation, Food calorie check etc

24x7 customer support

- Visit: 286+ branches E

Travel insurance

When you purchase travel insurance online, the insurer protects you financially from all the unpredicted losses that you may incur while on an international trip. It covers incidents such as loss of baggage and passport, delayed or missed flights, medical emergency, etc.

What is single trip travel insurance?