Be prepared upon arrival to your international destination by adding foreign currency to your travel wallet. As a member, you can conveniently purchase in advance through AAA without paying excessive ATM or credit card foreign transaction fees. Then you can enjoy your trip from the get-go by using cash to pay for incidentals such as taxis, snacks, pay restrooms and more. Cash also empowers you to haggle with merchants who do not accept plastic for payment.

Order foreign currency from your travel expert.

Purchasing foreign currency through AAA is fast, easy and convenient, with more than 80 currencies all available at competitive rates. And next-day delivery is free with a minimum purchase. 1

To order online:

To order in branch:

Order today and collect it tomorrow. Cash available in more than 80 currencies is delivered the next day nationwide via UPS for all orders received before 8:00pm Eastern.

Click on "Order Now" below

Pay with credit or debit card, delivers to home address.

A contactless prepaid card, the Travelex Money Card allows you to load with your chosen amount before you travel and use like a debit card without worrying about overseas bank fees.

Visit your local office

Order currency with an associate

Pick up, pay with cash, credit or debit card, did you know.

More than half of all transactions under $10 are paid for in cash and more than 35% of all transactions under $25 are made in cash?

Knowing this, many travelers plan for at least $100 per day in cash.

Frequently Asked Questions

+ Why do I need foreign currency? Why not simply use my credit or debit card?

Though credit and debit cards are widely used, and many are accepted internationally, it is simple to overlook how often cash is needed. From gratuities and taxis to local merchants where additional haggling or limited acceptance becomes an issue, local currency can help you move smoothly and swiftly through your journey. Additionally, foreign transaction fees can mount quickly, and banks or credit card issuers may decline transactions or place holds on your card to limit perceived fraudulent charges.

+ Why not purchase at the airport or destination?

As the last place to exchange funds before your intended destination, airports are notoriously the most expensive place to exchange foreign currency and can therefore charge exorbitant rates or fees. Upon arriving at your destination, there is no easy way to know what your exchange rate or fees would be. You may need to shop around for the best rate instead of enjoying your travel.

+ What currencies do you offer?

Through its partnership with CXI, AAA offers more than 80 currencies —all available at competitive rates.

+ What is the minimum/maximum currency I can order?

Orders placed at AAA are not subject to minimum or maximum amounts. All online orders are subject to a minimum value of $100 USD and no more than $2,999.99 USD per home delivery. Additional limits may apply.

+ How quickly can I receive my currency?

Online orders received weekdays before 3pm local time will be processed that day and use the shipping type selected in the order. Orders received after 3pm on weekdays or on weekends will be processed the following business day. Next-day delivery is free with minimum purchase. 1 Contact your local AAA for details.

+ How do I pay online?

Home delivery orders can be purchased with most major credit or debit cards issued in the United States. CXI does not accept international credit cards or prepaid cards. Members attempting to pay with international credit cards or prepaid cards will automatically be denied at checkout. Please be advised that other processing or cash advance fees may apply.

Have additional questions? Contact Us

Currency exchange services provided by Currency Exchange International, Corp. The information on this page is subject to change without notice.

1 Currency is delivered the next business day nationwide for all orders received before 3:00pm local time (earlier cutoff times apply for residents of Alaska and Hawaii). Members should contact their local AAA for minimum purchase requirements.

- Money Transfer

- Rate Alerts

Xe offers an assortment of Travel Tools for your next trip! Whether it’s a currency app on your mobile phone, or Travel Reviews to help you pick your destination, Xe Travel is the perfect resource for you.

Travel Tools

Currency email.

Subscribe to free daily email updates with currency rates for the top 170 currencies. The Xe Currency email also includes news headlines, and central bank interest rates.

Xe Currency Encyclopedia

Read currency profiles with live rates, breaking forex news, and other facts for every world currency. You can also learn about services available for each currency.

Free Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

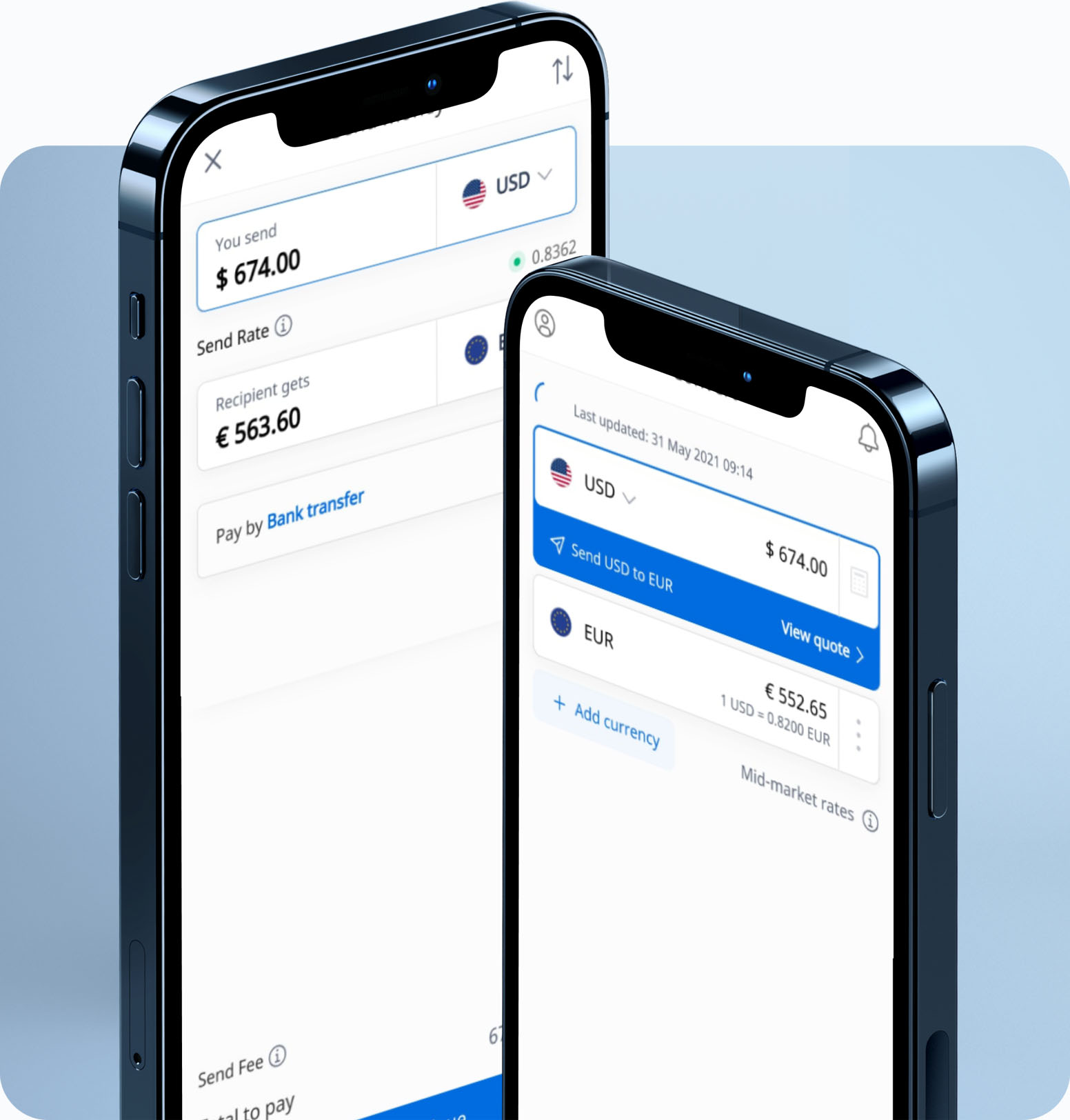

Download the App

Keep track of live mid-market rates for every world currency on your Smartphone. That’s 170+ currencies that you can convert on the go!

Travel Blog Posts

What’s the Best Way to Exchange Your Currency for a Trip Abroad?

Got an international trip coming up? Need to make a currency exchange? Let us talk you through your options.

How to save money on your next European trip

The currency you choose to use will impact the cost of your trip in several ways. By knowing the Euro to Dollar conversion exchange rate, you can save yourself a lot of money on your European getaway.

Your Checklist for International Travel During COVID-19

Do you need to travel overseas soon? Here’s what you’ll need to know before (and during) your time abroad.

Destination Wedding Planning: How to Plan, Execute, and Stay on Budget

It’s no surprise that couples increasingly choose to avoid the high costs of a UK wedding by heading overseas, where costs tend to be more affordable.

Travel Money

- Clubcard Prices Clubcard Prices

Clubcard Prices are available for all currencies, just enter your Clubcard number on the next page. Full T&Cs below.

- Click & Collect Click & Collect

Collect for free from more than 350 Tesco stores with a Bureau de change.

- Home Delivery Home Delivery

Free delivery on orders worth £500 or more.

Exchange rates may vary during the day and will vary whether buying in store, online or via phone.

Select currency

Error: Please select if you have a Clubcard to continue

Do you have a Tesco Clubcard?

How much would you like?

Error: Please enter an amount between £75 and £2,500

Find a Store to get your Travel Money

With Click & Collect you can order your travel money online and pick it up from selected Tesco stores near you, or you can buy instantly from an in-store travel money bureau.

Enter a postcode or location

Search results

3 easy ways to purchase Travel Money

Click & collect.

- Order online and choose to collect from over 500 Tesco store locations Order online and choose to collect from over 500 Tesco store locations

- Pick a collection day that works for you Pick a collection day that works for you

- Order euro or US Dollars Order Euros or US Dollars before 2pm and you can pick-up from most stores the next day

About Click & Collect

Home delivery

- Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK

- Free delivery for orders of £500 or more Free delivery for orders of £500 or more

- Secure delivery via Royal Mail Special Delivery Secure delivery via Royal Mail Special Delivery

About Home Delivery

Buy in-store

- Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK

- Turn unspent travel money back into Pounds with our Buy Back service Turn unspent travel money back into Pounds with our Buy Back service

About Buy Back

Best Travel Money Provider 2023/24

Now in it’s 26th year and voted for by the public, the Personal Finance Awards celebrate the best business and products in the UK personal finance market. We’re delighted that you voted us as Best Travel Money Provider 2023/24.

Additional Information

Ordering and collection.

You can pick a collection date when you're ordering your money. Order before 2pm and you can pick up Euros and US Dollars from most Tesco Travel Money bureaux the next day. Other currencies can take up to five days. Alternatively, you can order any currency for next weekday delivery to most of the selected customer service desks.

Please make sure you collect your money within four days of your chosen date. If you don't, your order will be returned and your purchase will be refunded, minus a £10 administration charge.

Will I be charged if I cancel my order?

Collection fees

Click and collect from stores with a Bureaux de change:

- Free for all orders

For non-bureaux stores with a click and collect function:

- £2.50 for orders of £100.00 - £499.99

- Free for orders of £500 or more

What to bring

For security, travel money will need to be picked up by the person who placed the order.

- a valid photo ID – either a passport, EU ID card, or full UK driving license (we do not accept provisional driving licenses)

- your order reference number

- the card you used to place the order (you’ll also need to know the card’s PIN)

Home Delivery

We can send your travel money directly to you via secure Royal Mail Special Delivery. You can even pick the delivery date that suits you best.

We also offer next-day home delivery on all currencies to most parts of the UK if ordered before 2pm Monday-Thursday.

Check the Royal Mail site to find out if your postcode is eligible for next day delivery

Delivery costs

£4.99 for orders of £100 - £499.99 Free for orders of £500 or more

- You’ll need to make sure there’s someone at home to sign for your delivery.

- Bank holidays and public holidays will affect delivery times.

- We are unable to cancel or amend home delivery orders after they have been placed.

Clubcard Prices

Clubcard Prices are available on the sell rate only for currencies in stock online, on your date of purchase. The Clubcard Price will be better than the standard rate advertised online on the date of purchase. When purchasing online you must enter a valid Clubcard number to obtain the Clubcard Price rate. Exchange rates may vary whether buying in store, online or by phone.

Clubcard Prices apply to foreign currency notes in stock on your date of online purchase. Due to constant market and currency fluctuations, rates on the date of purchase cannot be compared to another day’s rates. The actual rate you receive may vary depending on market fluctuations. Clubcard data is captured by Travelex on behalf of Tesco Bank.

Check out the Tesco Bank privacy policy to find out more.

Buying foreign currency using a credit or debit card

No matter how you purchase your travel money, whether it be in store, online or over the phone, you will not be charged any card handling fee by us. However, regardless of your card type, your card provider may apply fees, e.g. cash advance fees or other fees, so please check with them before you purchase your travel money.

Click & Collect cancellations

You can cancel a Click & Collect order any time prior to collection. We'll refund you with the full Sterling amount that you paid for your order, unless you cancel less than 24 hours before your collection date, in which case we'll charge a £10 late cancellation fee.

We are unable to refund any fees charged by your card issuer, so please contact them if you have any further queries.

When you get home, we'll buy your travel money back

Let us turn your unspent holiday money into Pounds. It couldn't be simpler.

Just pop into one of our in-store Travel Money Bureaux when you get home. We buy back all the currencies we sell in most banknote values and also the Multi-currency Cash Passport™. Buy back rates may vary during the day.

It doesn't matter where you bought your travel money, even if it wasn't from a Tesco Travel Money Bureau, we'll still buy it back.

More about currency buy back

How our Price Match works

If you find a better exchange rate advertised by another provider within three miles of your chosen Tesco Travel Money Bureau, on the same day, we'll match it.

Price Match only applies in store on a like-for-like basis on sell transactions and does not apply to any exchange rate advertised online or by phone. This is not available in conjunction with any other offer. We reserve the right to verify the rate you have found and the three mile distance (using an appropriate route planning tool).

See full terms and conditions below.

Tesco Travel Money is provided by Travelex

Tesco Travel Money ordered in store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: Worldwide House, Thorpewood, Peterborough, PE3 6SB.

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard® International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

How much travel money will I need?

Whether it’s a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We’ll help you manage your travel budget like a pro.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Where to Exchange Currency Without Paying Huge Fees

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Quick tips for where to exchange currency

Before your trip, it’s best to do a currency exchange at your bank or credit union, which likely offers better rates and fewer and/or lower fees.

Your bank or credit union may buy back leftover foreign currency in exchange for dollars when you return.

Once you're abroad, use your financial institution's ATMs if possible; they’re the best option to exchange currency with minimal fees.

Banks and credit unions are generally the best places to exchange currency, with reasonable exchange rates and the lowest fees. Here’s how financial institutions — and a few other places — can help exchange currency near you.

» ALSO : See our list of the best ways to send money internationally

How to find a currency exchange near you

If you’re looking to exchange currency, try the following options:

Check if your bank or credit union offers currency exchange services.

Look for an online currency converter that offers cash delivery.

Outside of the U.S., you can use your bank’s ATM network to withdraw local currency.

Best place to exchange currency: Your bank or credit union

To get the best currency exchange rates, you’ll want to change money before you leave the country. Before you check out options for where to exchange money near you, figure out what the current exchange rates are by using a trusted source such as Reuters . That way, you’ll know what the going rate is and have an idea of what to expect when comparing exchange rates at banks and currency exchange service providers.

Many banks offer currency exchange to their customers. Though there may be a small fee if you exchange less than a certain amount, your bank or credit union will almost always be the cheapest place to exchange currency.

You may be able to order currency at a branch location, by phone, or online to have it delivered to you or to pick up at a branch. Some currency providers allow you to pick up your funds as soon as the next day, have it delivered within one to three business days or opt for overnight shipping.

» See our picks for the best banks for international travel

Another money-change option: online currency converters

You can also order through an online currency converter such as Currency Exchange International, which will have the cash delivered to your home. But exchange rates are less favorable, and the delivery charges may eat into your funds.

Where to exchange currency outside the U.S.

Once you’ve reached your destination, avoid airport kiosks or other exchange houses. Your bank's ATM network is likely the best option. You may be able to withdraw cash in the local currency with competitive exchange rates and low fees (1% to 3%).

Use your institution’s app to find an ATM near you. Try to withdraw larger amounts if your bank charges ATM fees. And avoid out-of-network ATMs — in addition to a possible foreign transaction fee, you could end up paying surcharges to your bank and the ATM owner.

» RELATED: See foreign debit card transaction fees by bank

If your bank doesn’t offer in-network ATMs or branches in the countries where you’re traveling, you can use your debit card at a local ATM. Keep in mind that you will typically be charged fees when using a foreign ATM.

» MORE: Learn about foreign transaction fees and how to avoid them

Where to avoid exchanging currency

Whether in the U.S. or at your destination, avoid airport kiosks or other exchange houses if you can. Those should only be used as a last resort, because they typically offer poor exchange rates and high fees, so you’ll get less currency for your money.

Skip currency exchange: Use a credit or debit card

Figure out whether your destination is card-friendly. If it is, you can avoid many of these extra travel fees with one of NerdWallet's favorite no foreign transaction fee credit cards or debit cards.

Consider applying for one of these credit cards or debit cards well before you leave (allowing ample time to process your application and receive the card in the mail) so you can use it instead of cash wherever possible. Credit and debit cards can be a safer option than cash; they offer fraud protection and safety features (such as the option to freeze them in case of misplacement), but once cash is lost or stolen, it can be impossible to recover.

Avoid using a credit card at ATMs or you’ll be hit with fees and interest right away for taking a cash advance. When making purchases at the point of sale, choose to pay in the local currency rather than in U.S. dollars to avoid currency conversion fees.

» MORE: Foreign transaction fees vs. currency conversion fees

When paying with a credit card abroad, stick to cards that don’t charge a foreign transaction fee. To avoid conversion fees, pay in the local currency rather than U.S. dollars.

Member FDIC

Barclays Online Savings Account

EverBank Performance℠ Savings

on Wealthfront's website

Wealthfront Cash Account

on Betterment's website

Betterment Cash Reserve – Paid non-client promotion

5.50% *Current promotional rate; annual percentage yield (variable) is 5.50% as of 4/2/24, plus a .50% boost available as a special offer with qualifying deposit. Terms apply; if the base APY increases or decreases, you’ll get the .75% boost on the updated rate. Cash Reserve is only available to clients of Betterment LLC, which is not a bank; cash transfers to program banks conducted through clients’ brokerage accounts at Betterment Securities.

Barclays Online CD

5.00% Annual Percentage Yield (APY) is accurate as of 02/29/2024

Discover® CD

4.70% Annual Percentage Yield (APY) is accurate as of 03/14/2024

Discover® Cashback Debit

Chase Total Checking®

Deposits are FDIC Insured

Chime Checking Account

Discover® Money Market Account

Exchange frequently? Consider a multicurrency account

If you live or work abroad, you might consider getting a multicurrency account. A multicurrency account is usually an account that lets you spend, receive and hold multiple currencies. Fintech companies Wise and Revolut offer multicurrency accounts online and through mobile apps. Read more about how multicurrency accounts work .

The best place to exchange currency at the end of your trip

Again, your bank is probably the best place to exchange currency, but it may not buy back all currency types. If your bank doesn’t accept the foreign currency you want to exchange, you can exchange your money at a currency exchange store or at an airport kiosk, even though you likely won’t get the best rate.

If you can’t sell your foreign currency, you may be able to donate it at the airport or in flight. Ten international airlines participate in UNICEF’s Change for Good program , which takes donations in foreign currency to help improve the lives of children worldwide.

Currency exchange: Frequently asked questions

Here are answers to common questions about the best place to get foreign currency.

Where is the best place to exchange currency?

Though there may be a small fee if you exchange less than a certain amount, your bank or credit union will almost always be the best (and cheapest) answer for where to exchange currency .

How do I find a currency exchange near me?

You can find a money exchange near you by searching online for “money exchange” and your ZIP code. You can also reach out to your local bank branch to see if it offers money exchange services.

Where can you exchange currency for free?

Some banks offer free currency exchange to their customers. Note that some financial institutions may charge a fee for exchanging currency unless you’re a premium account holder or are exchanging at least $1,000.

On a similar note...

Find a better savings account

See NerdWallet's picks for the best high-yield online savings accounts.

- Sign in

Foreign Currency Exchange

Foreign currency ordering—convenient and secure.

Exchange rates fluctuate, at times significantly, and you acknowledge and accept all risks that may result from such fluctuations. If we assign an exchange rate to your foreign exchange transaction, that exchange rate will be determined by us in our sole discretion based upon such factors as we determine relevant, including without limitation, market conditions, exchange rates charged by other parties, our desired rate of return, market risk, credit risk and other market, economic and business factors, and is subject to change at any time without notice. You acknowledge that exchange rates for retail and commercial transactions, and for transactions effected after regular business hours and on weekends, are different from the exchange rates for large inter-bank transactions effected during the business day, as may be reported in The Wall Street Journal or elsewhere. Exchange rates offered by other dealers or shown at other sources by us or other dealers (including online sources) may be different from our exchange rates. The exchange rate you are offered may be different from, and likely inferior to, the rate paid by us to acquire the underlying currency.

We provide all-in pricing for exchange rates. The price provided may include profit, fees, costs, charges or other mark ups as determined by us in our sole discretion. The level of the fee or markup may differ for each customer and may differ for the same customer depending on the method or venue used for transaction execution.

In connection with our market making and other activities, we may engage in hedging, including pre-hedging, to mitigate our risk, facilitate customer transactions and hedge any associated exposure. Such activities may include trading ahead of order execution. These transactions will be designed to be reasonable in relation to the risks associated with the potential transaction with you. These transactions may affect the price of the underlying currency, and consequently, your cost or proceeds. You acknowledge that we bear no liability for these potential price movements. When our pre-hedging and hedging activity is completed at prices that are superior to the agreed upon execution price or benchmark, we will keep the positive difference as a profit in connection with the transactions. You will have no interest in any profits.

We also may take proprietary positions in certain currencies. You should assume we have an economic incentive to be a counterparty to any transaction with you. Again, you have no interest in any profit associated with this activity and those profits are solely for our account.

You acknowledge that the parties to these exchange rate transactions engaged in arm’s-length negotiations. You are a customer and these transactions do not establish a principal/agent relationship or any other relationship that may create a heightened duty for us.

We do not accept any liability for our exchange rates. Any and all liability for our exchange rates is disclaimed, including without limitation direct, indirect or consequential loss, and any liability if our exchange rates are different from rates offered or reported by third parties, or offered by us at a different time, at a different location, for a different transaction amount, or involving a different payment media (including but not limited to bank-notes, checks, wire transfers, etc.).

Order foreign currency

Foreign currency FAQs

Foreign currency ordering details

- Orders placed Mon.-Fri. before 2 p.m. local time of your address of record (on the account you’re using to pay for the order) will ship the same day.

- Orders placed Mon.-Fri. after 2 p.m. local time of your address of record (on the account you’re using to pay for the order) will ship the next day.

- We do not ship orders on Saturdays, Sundays or holidays

- Delivery is made to either a financial center or the address of record on the account used to pay for the order

- Delivery to U.S. addresses only; no P.O. boxes

- Standard delivery (1-3 business days): $7.50 (standard delivery is free for orders $1,000 and up)

- Overnight delivery (order by 2 p.m.): $20

- Because we do not stock inventories of foreign currency at financial centers, delivery charges apply to orders picked up at a financial center as well as to orders (under USD$1,000) sent to your account address.

- It is $1,000 or more in U.S. dollars

- You are a new customer (less than 30 days)

- Your address changed in the last 30 days

Are you planning a trip overseas?

Receiving an international wire transfer.

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

Insurance servicing

- Life insurance (opens in a new window)

- Home insurance (opens in a new window)

- Travel insurance (opens in a new window)

- Car insurance (opens in a new window)

Internet Banking

- Sign in to internet banking (opens in a new window)

- Register for internet banking (opens in a new window)

- M&S Travel Money

Buy Travel Money

Currency calculator.

Our currency calculator is a quick and easy way to check our latest foreign currency exchange rates.

What do I need to bring to collect my foreign currency?

The benefits of exchanging your holiday money with M&S Bank

Wide range of foreign currencies.

We offer a wide range of foreign currencies in our Bureaux, with more available to order online. It is easy to compare travel money with M&S Bank. See footnote * *

As well as the euro and US dollar , our range includes currencies such as the UAE dirham, Bulgarian lev , Turkish lira , Thai baht and Mexican peso .

Travel money sale now on!

Click & Collect sale on euro and US dollar available until 11 April 2023.

£150 minimum order. Exchange rates will still fluctuate daily during the sale period, but you’ll receive the best rate applicable on the date your order is placed. Rates shown when placing your order are sale rates. Offer subject to availability, buy back not included. Cancellation fee and full T&Cs apply.

SameDay Click & Collect

- Order between £150 and £2,500

- Euro and US dollars available to order and collect in over 450 stores *

- Order and collect euro , US dollars , Turkish lira , New Zealand dollar , Australian dollar , Thai baht , Canadian dollar , South African rand and UAE dirham, from our Bureau the same day

Find my nearest Click and Collect store

Click & Collect † See footnote †

- A wide range of currencies available to collect from our in store Bureaux See footnote * *

- Order and collect from the next day

Our best rates on euro and US dollar when you Click & Collect

To get an even better exchange rate on euro and US dollar , use our Click & Collect service. Pay now and lock in today's rate, then collect from a store at a time convenient for you.

CHANGE4CHANGE

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureaux, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a Bureau

Travel money buy-back service

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the Bureau de Change. That's all unused notes in any denomination we sell.

Find out more about M&S Travel Money Buy Back service

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureau stores, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a bureau

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the bureau de change. That's all unused notes in any denomination we sell. Proof of purchase may be required so please retain your receipt, just in case.

Up to 55 days' interest-free credit when purchasing with an M&S Credit Card See footnote ** **

Representative example: based on an assumed credit limit of £1,200, our 24.9% rate per annum (variable) for purchases gives a representative rate of 24.9% APR (variable). Credit is subject to status.

No cash advance fee when M&S Travel Money is purchased using an M&S Credit Card.

What you'll need to bring

To collect foreign currency you've purchased online, you will need:

- A valid UK photographic driving licence, passport or EU national identity card (Romanian & Greek National ID Cards are not accepted)

- Your card you used to place your order - both ID and payment card must have the same name

- Your order number (this can be found on your confirmation email)

To purchase foreign currency in one of our Bureaux, you will need:

- A valid UK photographic driving licence, passport or EU national identity card - both ID and payment card must have the same name

Find my nearest M&S Bureau de Change

Use the M&S Bank Bureau Finder to find your nearest M&S Bureau de Change and opening hours.

Find a Bureau de Change

Manage your existing travel insurance policy

Want to renew, change or cancel your policy or need to make a claim?

Find out more - about managing your travel insurance policy

Need some winter sun?

Planning a winter sunshine break? Use our handy guide to help with your planning.

Ready to hit the slopes?

Thinking about a skiing holiday in Europe, North America or Asia? Use our guide to help you with your trip.

Planning to travel with cash?

Our guide explains how much money you can take abroad.

Learn more about the euro

How many countries use the euro? When was the euro first introduced? Find out more.

Using your credit card abroad

Going on holiday? Get to grips with how you can use a credit card outside of the UK.

What is RFID blocking technology?

If you are concerned about having your passport or credit card skimmed whilst abroad learn more about RFID technology.

What influences exchange rates?

Discover what factors contribute to the exchange rates that you see today.

How to budget for long term travel

Going on a long-term trip? Read our guide on how to budget successfully to ensure you have the most memorable time possible.

Visiting a Christmas market?

Learn more about the many Christmas markets across Europe.

Frequently asked questions

Can i use a credit card to purchase travel money.

Yes, you can use a credit card to purchase travel money. However, please check with your card provider as they may apply fees or charges e.g. cash advance fees or other fees.

Our Bureaux accept the majority of UK issued major credit cards.

How much cash can I travel with?

You can learn more about taking cash in and out of Great Britain and declaring cash by visiting gov.uk .

Should I get foreign currency before I travel?

Buying your travel money before you travel can be an important part of pre-holiday preparation. You can use our Currency Converter to get the latest exchange rates across worldwide holiday destinations.

Where can I collect M&S Travel Money from?

You can collect M&S Travel Money from over 100 bureaux de change or from over 350 stores nationwide. You can find your nearest M&S Bureau de Change using our Bureau Finder .

Where can I get the best exchange rate?

Exchange rates change on a regular basis and vary depending on the currency you order. At M&S Bank, we offer our best rates for euro and US dollar via the Click & Collect service, where you can order your currency and collect from the next day in an M&S location local to you. If you order online before 4pm, you can collect the same day. For all other currencies, check our website for more information.

How much travel money can I order?

For orders placed via Click & Collect, there is a minimum £150 order and maximum of £2,500. For Bureau de Change walk-ups, there is no minimum order.

How do I confirm my Travel Money purchase using my M&S Credit Card?

There are three ways to verify your payments - you can use our M&S Banking App, a one-time passcode via text message or by using a card reader to verify your payment. Use our how-to videos or step-by-step guides to find out more.

Have a question about travel money or other travel products?

Ask our Virtual Assistant

Useful information

View exchange rates

Find out more about euro rates

Find out more about US dollar rates

Find out more about Australian dollar rates

Find out more about Canadian dollar rates

Find out more about New Zealand dollar rates

Find out about M&S Travel Insurance

Important documents

M&S Travel Money Terms and Conditions

M&S Travel Money Click & Collect Sale Terms and Conditions

You may require Adobe PDF reader to view these documents. Download Adobe Reader

* Subject to availability

** With the M&S Credit Card, you'll receive up to 55 days' interest-free credit when you pay your balance in full and on time each month.

† Next Day collection is subject to availability. Please confirm your collection date and location at the checkout.

- Search Search Please fill out this field.

Understanding Exchange Fees

- Exchanging Currency Home & Overseas

- Credit vs. Cash for Foreign Transactions

Other Travel Tips

Worst places to exchange currency, when to exchange currency, the bottom line.

- Personal Finance

- Budgeting & Savings

Where to Exchange Currency Without Paying High Fees

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Brandon is a professor of finance and financial planning. CFP, RICP, and EA, and a doctorate in finance from Hampton University.

:max_bytes(150000):strip_icc():format(webp)/headshot-BrandonRenfro-3aeca9d98f2247669f3412aa144e9990.jpg)

Tsuji / Getty Images

Travelers should look to convert their currency before embarking on a trip or know where to go to save on changing money while abroad. Trading currency at a hotel or even a currency kiosk in an airport or elsewhere in the country can be costly due to poor exchange rates and high fees. The best options are more likely to be associated with your local bank or credit union, so it's important to plan ahead when it comes to exchanging currency.

Key Takeaways

- Because of high currency exchange fees, travelers should consider converting their currency before traveling.

- Banks, credit unions, online bureaus, and currency converters provide convenient and often inexpensive currency exchange services.

- Once on foreign soil, the best means to convert currency is to use a foreign automated teller machine (ATM) or identify whether your bank has ATMs or banking affiliates nearby.

- Many credit and debit card issuers allow users to purchase items overseas using their cards without foreign transaction fees.

Currency exchange fees play a crucial role in the global financial landscape. These fees are the charges applied by financial institutions or currency exchange services for converting one currency to another. Financial institutions that provide currency exchange services take on the risk of price fluctuations; if they hold one currency and it goes down in value, they theoretically need to be compensated for holding this currency.

Behind the scenes of a currency exchange transaction, there are significant operational costs as well. Banks have to keep up with maintaining the necessary infrastructure and technology. Financial institutions also need to invest in secure and efficient systems to ensure they're using accurate exchange rates. Exchange fees help cover these operational costs.

Last, financial institutions are profit-driven entities. Banks and similar entities are in the business to make money. Offering currency exchange services is one way they generate revenue. While competition in the market helps keep fees competitive, financial institutions still need to generate sufficient income to remain sustainable and one way they do this is by charging fees for certain services.

Exchanging Currency at Home and Overseas

With the context of why fees occur behind us, let's start digging into how to avoid fees. You can begin by finding out what a fair exchange rate is for the country or countries you'll be visiting. Check key currency exchange websites first. The following are some of the best and least expensive places to convert currency:

- Local banks and credit unions usually offer the best rates.

- Major banks, such as Chase or Bank of America, often offer the added benefit of having ATMs overseas.

- Online peer-to-peer foreign currency exchanges

- Online bureaus or currency converters, such as Travelex, provide convenient foreign exchange services.

Ordering cash online will likely include delivery charges, and the exchange rate won’t be as good as with your bank; however, this is still a better option when compared with the must-avoid options below.

The best option for exchanging currency and saving fees is to use a foreign ATM or your own bank's ATMs overseas, if possible.

Piggybacking on the suggestion above, if you don’t have time to get the foreign currency before leaving or don’t want to carry a lot of cash, check to see if your bank has ATMs in the destination country or its cities . It may even have banking affiliates there. A key tip is to use an ATM within the airport as soon as you arrive.

When you’re back in the U.S., head to your bank or credit union to transfer any leftover foreign currency to U.S. dollars. It's important to note that some banks will not take foreign currency. As a last resort, if you have foreign currency left over before you depart the country you're visiting, look to convert it at an airport kiosk or a store before leaving.

Using Credit vs. Cash for Foreign Transactions

The world has become so digital that most people no longer walk around foreign countries with traveler's checks and money belts. That’s why you should take both a no-foreign-fee debit card and a no-foreign-transaction-fee credit card with you. The likes of Chase, Bank of America, Capital One, and other major credit card issuers offer specific no-foreign-transaction-fee cards.

It is best to primarily use a no-transaction-fee credit card , rather than cash, on an overseas trip as it will likely offer fraud protection ; use currency only as a backup. You can replace lost or stolen credit cards, but lost cash can never be replaced.

However, don’t use your credit card for a cash advance to receive foreign currency. Doing so means you’ll get hit with a cash advance fee and a high interest rate that starts accruing immediately.

The widespread use and enhancement of technology have helped make using credit and debit cards possible in most parts of the world. However, there are exceptions, so it is worth investigating whether your destination accepts debit or specific cards before you go on a trip.

One thing to do before traveling abroad is to let your bank and credit card companies know of your travel plans, although some banks are moving away from encouraging this practice. That way, if you use your credit or debit card abroad, these companies won’t cut off access to your account due to concerns of fraud.

Also, avoid paying in U.S. dollars while outside the country when possible, even if a merchant offers to convert them for you. This includes paying with a credit or debit card. The merchant would likely convert at a rate that’s disadvantageous to you and charge fees. The same goes for paying with U.S. dollars in the form of cash.

Some places that you should avoid for exchanging currency are:

- Airport kiosks and stores when heading to a country (not to be confused with airport ATMs): Plan ahead, as airport kiosks generally charge some of the highest fees and have the worst exchange rates. When returning to the U.S. with foreign currency to trade in, however, this sometimes might be the only option.

- Traveler’s checks and prepaid debit cards: These are not efficient and often carry various transaction fees. They add little benefit, in terms of security, when compared with cash. Prepaid debit cards also come with card fees, foreign transaction costs, and ATM-use charges.

- Hotels and tourist areas: Similar to airports, hotels and tourist-centric areas may provide convenience, but they generally charge higher fees for currency exchange. These locations cater to tourists who may prioritize convenience over cost-effectiveness.

- Remote locations: In remote or less frequented destinations, currency exchange options may be limited, and providers may take advantage of the lack of competition by charging higher fees. It may also be more administratively burdensome to replenish and monitor these sites, so entities may charge higher fees in return.

Throughout this article, we've talked about it's best to optimize your foreign currency exchange before your trip. Even in international cities you should avoid last-minute exchanges and utilizing tools like limit orders or rate alerts in advance of your trip can help secure more favorable rates. Additionally, staying informed about economic events that may impact currency values allows for strategic timing.

There's a few other bits of advice on timing. The currency markets operate 24 hours a day during the business week, but they usually close over the weekends. During these market closures, there is no active trading, and as a result, liquidity tends to be lower. Lower liquidity can lead to wider bid-ask spreads, making it more expensive to execute currency transactions.

In addition, holidays can have a similar impact on currency markets. On public holidays, financial institutions and markets in specific countries may be closed, leading to decreased trading volumes and liquidity. This reduced liquidity can again result in wider spreads and less favorable exchange rates.

Where Can You Exchange Currency?

Banks, credit unions, and online currency exchange bureaus and converters provide convenient and often inexpensive currency exchange services. Also, your own bank's overseas ATM or a foreign bank's are ways to get local currency with a credit card or ATM card once you have arrived. Among the worst options are trading currency at a hotel or a currency kiosk in an airport or elsewhere in the country because these can be costly due to poor exchange rates and high fees.

What Are the Alternatives to Exchanging Currency?

Travelers can rely solely on their credit cards for purchases, if accepted everywhere in a country being visited. It's also still an option to bring traveler's checks, although these mostly have been supplanted by the widespread use of credit cards today. You can also choose to spend U.S. dollars in some instances while overseas, but this practice isn't recommended because the exchange rate given in a foreign country is often disadvantageous to the purchaser.

What Can I Do With Leftover Foreign Currency?

When you’re back home, you can go to your bank or credit union to transfer any leftover foreign currency into your own country's currency. Be aware that some banks will not take all foreign currencies. As a last resort, if you have foreign currency left over before you depart the country you're visiting, look to convert it at an airport kiosk or a store before leaving.

If you do a little homework before leaving for your trip by checking exchange rates, you’re likely to save. Remember to stick to ATMs and no-transfer-fee credit card spending, and avoid exchanging money at airport kiosks, hotels, and buying things with U.S. dollars to avoid costly exchange rates and fees.

Bank of America. " Foreign Currency Exchange ."

Bank of America. “ Placing A Foreign Currency Order FAQs ,” See “How can I exchange foreign currency for U.S. dollars?”

Chase. " No Foreign Transaction Fee Credit Cards ."

Bank of America. " Credit Cards With No Foreign Transaction Fees ."

Capital One. " Credit Card Frequently Asked Questions ."

Chase. " Do I Need to Notify a Credit Card Company When Traveling? "

Wise. " Why You Should Not Exchange Currency at the Airport ."

Consumer Financial Protection Board. “ What Types of Fees Do Prepaid Cards Typically Charge? ”

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1031084282-0a12713ac4234067baa62f6f34a48494.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Everyone is visiting Japan. An extended currency slump means the tourists will just keep coming.

- Japan's weak currency is boosting tourism, with a record-breaking 3.1 million visitors in March.

- The devalued yen is encouraging tourists to spend more on luxury goods.

- The currency is negatively impacting outbound travel, with more Japanese tourists staying in the country.

Japan is a beloved tourist spot . A weak currency is ensuring that it will remain that way for foreigners.

The country just broke its pre-pandemic tourist record, with 3.1 million foreign visitors in March. The government said it's on track to surpass 2025's target of 32 million annual foreign visitors this year, after 8.6 million tourists visited in the first quarter of 2024.

Japan opened to tourists in October 2022, after over two years of strict, pandemic-induced border restrictions. Pent-up demand, combined with a cheaper currency, has fueled the record number of visitors.

Related stories

Tourists are staying longer and spending more due to the weak yen, which makes it cheaper for foreigners to purchase accommodation, activities, food, and gifts. The yen has fallen nearly 10% year-to-date , compared to the dollar.

Japan's currency has been depreciating largely due to high interest rates in the US, which makes the dollar more attractive to investors. A historic rate hike in Japan last month — the first since 2007 — did little to reverse the downward trend.

Japan is a tourist hot spot because of its status as a culture and entertainment icon, its natural wonders, and its unique cuisine. Tourists from South Korea, China, Taiwan, and the US made up the biggest portion of foreign visitors in March, according to Japan's National Tourism Organization.

Japanese carriers like Japan Airlines and ANA plan to cash in on the tourism boom by running more routes from Asia.

The sharp decline of the yen has also expanded demand for luxury goods. Foreign tourists are taking advantage of the currency discount by snapping up cheaper products in Japan from premium brands such as Swiss watchmaker TAG Heuer, Chanel, and Prada, Bloomberg reported earlier this month.

While the weak yen creates a sweet spot for foreigners, it is severely hurting Japanese travelers.

The number of outbound travelers was less than half the number of inbound travelers in March, per the National Tourism Organization. Outbound Japanese travel was down 37% last month compared to the same period in 2019, though it ticked up from February, the agency's data shows.

High airfare costs and low buying power is compelling more locals to skip international travel in favor of domestic locations.

Watch: Japanese denim is costly, but it's considered one of the best denims in the world. Here's why.

- Main content

IMAGES

VIDEO

COMMENTS

2. Avoid Currency Exchange Kiosks at Airports. If you don't have time to get cash at the bank before your trip, it can be tempting to get foreign currency at an airport kiosk or currency ...

Order foreign currency from your travel expert. Purchasing foreign currency through AAA is fast, easy and convenient, with more than 80 currencies all available at competitive rates. And next-day delivery is free with a minimum purchase. 1. To order in branch:

1. Using money transfer to get currency before your trip. We promise we're not biased—this really is the best option. Using an online money transfer service to exchange your currency before your trip will allow you to: Let you relax knowing that your currency exchange has already been handled.

Top 5 exchange rate need-to-knows. 1. The RIGHT cards consistently beat travel cash rates. 2. Beware charges for using credit cards to buy your travel money. 3. Avoid the debit cards from HELL - some fine you for spending abroad. 4. Don't let bureaux hold your cash for long - you've little protection.

There's also generally a minimum amount of foreign currency you can order ($100 or $200 is common) and a maximum ($10,000 within a 30-day period is common). Other good ways to pay abroad

Get the best currency exchange rates for international money transfers to 200 countries in 100 foreign currencies. Send and receive money with best forex rates. ... Need to know when a currency hits a specific rate? ... Xe Currency Tools. Historical Currency Rates. Travel Expenses Calculator. Currency Email Updates. More tools. Recommended by ...

Getting travel money before you go abroad from the UK is often a wise choice. Make sure you get the best deal on currency exchange with MoneySuperMarket. ... Companies often charge commissions to exchange Sterling into a foreign currency. The commission might be a percentage of the transaction or a flat fee, but it should always be included in ...

Whether you need to check the latest exchange rates, compare historical trends, or send money abroad, Xe Currency Converter is the ultimate tool for you. You can easily convert between any of the world's major currencies, including crypto and precious metals, and get the most accurate and up-to-date rates. Xe Currency Converter is free, fast, and simple to use.

Tips for getting the best exchange rates. There are three things to keep in mind when looking for the best exchange rates: plan and exchange currency before traveling, compare services to see ...

Whether it's a currency app on your mobile phone, or Travel Reviews to help you pick your destination, Xe Travel is the perfect resource for you. Travel Tools. Currency Email. Subscribe to free daily email updates with currency rates for the top 170 currencies. The Xe Currency email also includes news headlines, and central bank interest rates.

Whether it's a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We'll help you manage your travel budget like a pro. Purchase travel money online with Tesco Bank and benefit from competitive exchange rates and 0% commission.

Your bank's ATM network is likely the best option. You may be able to withdraw cash in the local currency with competitive exchange rates and low fees (1% to 3%). Use your institution's app to ...

Great Britain. 1GBP = $1.3332 USD. Mexico. 1MXN = $0.0634 USD. Japan. 1JPY = $0.00696 USD. Order a currency not shown. Order by 2 p.m. (delivery address local time) and your currency will ship the same business day. See shipping & fee details.

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best. Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back ...

Wide range of foreign currencies. We offer a wide range of foreign currencies in our Bureaux, with more available to order online. It is easy to compare travel money with M&S Bank. As well as the euro and US dollar, our range includes currencies such as the UAE dirham, Bulgarian lev, Turkish lira, Thai baht and Mexican peso.

We offer a range of travel money services. Including foreign currency, our multi-currency travel money card and buy back guarantee. With up to 50 different worldwide currencies available worldwide you can order online and collect in store, or choose home delivery. Don't wait until you get to the airports- we don't charge commission and we ...

At a Glance. The article provides four ways to exchange money when traveling abroad: buying foreign currency from your bank, ordering cash through a currency conversion website, withdrawing cash from an ATM, and using an airport exchange kiosk. It's important to inform your bank about your travel plans, carry both cash and cards, and keep an ...

Check key currency exchange websites first. The following are some of the best and least expensive places to convert currency: Local banks and credit unions usually offer the best rates. Major ...

Japan is a beloved tourist spot. A weak currency is ensuring that it will remain that way for foreigners. The country just broke its pre-pandemic tourist record, with 3.1 million foreign visitors ...