- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

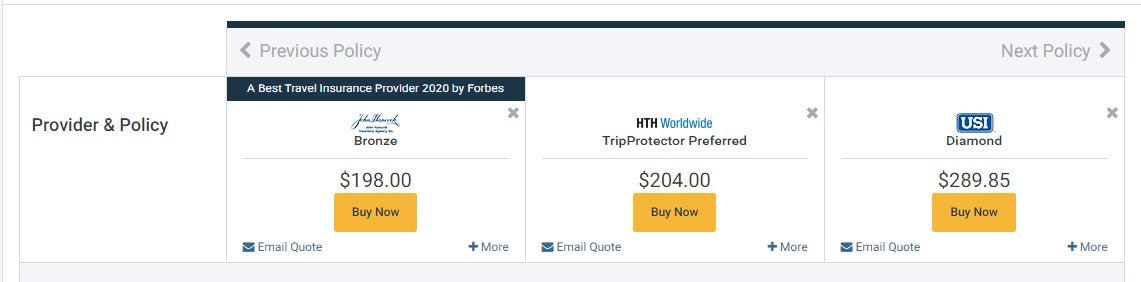

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

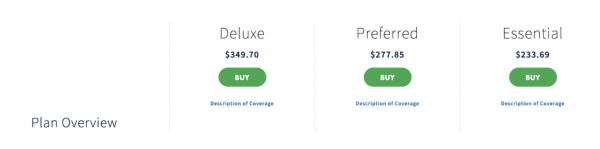

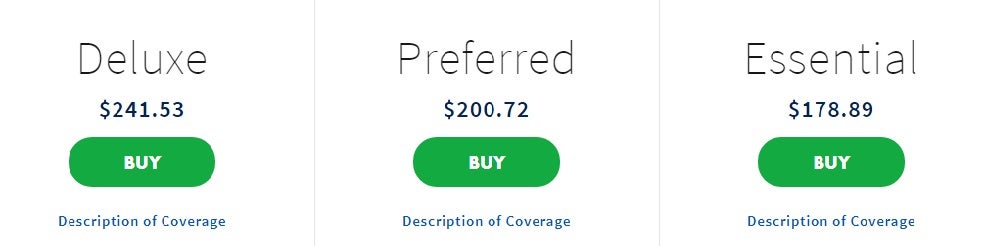

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

May We Suggest?

Is this it, how about this, search results.

Our reviewers evaluate products and services based on unbiased research. Top Consumer Reviews may earn money when you click on a link. Learn more about our process.

Travelex Insurance Services vs Travel Guard

Saturday, April 27th

2024 Travel Insurance Plan Reviews

- Travelex Insurance Services

- 3 plans to choose from: Travel Basic, Travel Select, and Travel America

- Options for post-departure medical coverage and flight-only plans also

- "A+" rated and accredited by the BBB

- In business for 25+ years

Travelex Insurance Services offers the basic and expanded trip coverage you're used to, insuring travelers for more than 25 years. However, they have a number of options you won't see with other providers, like a $60 flat-rate policy for trips of up to 14 days within the US and post-departure medical coverage. This company gets good feedback when claims are made, and both an "A+" and accreditation from the BBB. Travelex is well worth considering to protect your next adventure.

- Travel Guard

- 3 main travel insurance policies available, with add-ons like Name Your Family bundling and coverage for Adventure Sports and Destination Weddings

Travel Guard is frequently recommended by travel agents as the best option for insurance. But, with only three main policy choices and some disappointing experiences related by customers, this insurer just doesn't keep up with its competitors in the travel insurance industry. There are other big names (and even small ones) you'll be able to count on to protect your trip, and we recommend leaving Travel Guard as a backup.

More Travel Insurance Plan Reviews

- Squaremouth

- Insure My Trip

- Travel Insurance

- Insured Nomads

- Allianz Travel

- Quote Wright

- Seven Corners

- World Nomads

- Travel Insurance Center

- Axa Travel Insurance

The 13 Best Travel Insurance Plans

Who offers the best travel insurance.

With daily news stories of delayed and canceled flights, lost baggage, and travelers stranded overseas in the middle of a natural disaster, it's easy to see why travel insurance is so important. Like most types of insurance, travel insurance is bought in the hopes that you'll never need it. But, for most travelers, it's worth the price for the protection it provides.

Have you ever thought that this coverage was just an unnecessary, added expense? That's fairly common: most people assume that they've got protection through their credit card company, their regular health insurance, even their homeowners' policy. In some situations, that may be accurate - but unless you know the details of those types of coverage, you're more likely to be left paying out-of-pocket expenses you thought were taken care of... but aren't included.

Travel Insurance Plan FAQ

What is travel insurance, what does travel insurance cover, what does travel insurance not cover, can i get travel insurance if i have a pre-existing medical condition, is travel insurance expensive, my chocolate is going someplace warm. will it melt, where can i buy travel insurance, is it safe to get travel insurance online.

Continued from above...

And, even if you do have that kind of protection, travel insurance policies can amplify your benefits. For example, if you choose a plan that offers $500,000 in primary medical coverage, you might not need to touch your regular health insurance: your bills will be reimbursed up to that amount, no matter what your everyday health plan includes. Car rental insurance can go above and beyond what's paid for by your credit card company or even your own vehicle's coverage - and that can be critical if you're driving in another country and have an accident.

What type of travel insurance do you need? Naturally, that depends on your trip, your travel party, and your budget. A single-trip policy will be more affordable than multi-trip coverage - but if you're traveling internationally more than once in a year, the annual policy becomes much more economical. Do you need to be able to cancel for any reason? Is it important to you to have a waiver of the pre-existing conditions exclusion? Are there any children under 18 in your party that might be included at no extra charge, depending on the insurer you select? These are all factors that will influence your decision when picking a travel insurance plan.

Confused yet? You do have a lot of options. Here are some criteria to help you sort through them and ultimately wind up with the travel insurance coverage you need:

- Quote process. How easy is it to get a quote that matches your insurance needs? Does the site explain the questions it asks, and does it display all of the possible plans in a way you can understand? Can you buy your policy right then and there, or do you have to click through to another site?

- Value. What's included for your premium? From one site to another, you will probably see the same price on any given plan because the states regulate travel insurance prices. However, it's worth your time to compare premium prices and benefits among different insurers, so that you get the most for your money.

- Reputation. It's easy for an insurance company to get high marks from customers if they never had to make a claim on the policy. What do clients who've filed claims say about the way they were treated? Were they reimbursed quickly? Did they get updates about the status of the claim? It's also good to check the Better Business Bureau's rating of any travel insurance service you're going to use.

To help you get the protection you need on your next adventure, TopConsumerReviews.com has evaluated and ranked today's most popular sources of travel insurance. We're confident that this information will make it easy to protect yourself and what you've spent on your trip - and to have backup if something goes off track on your journey. Bon voyage!

Compare Travel Insurance Plans

Select any 2 Travel Insurance Plans to compare them head to head

Travel Insurance Plan Articles

How travel insurance can save your vacation, what does travel insurance cost, what to look for in a travel insurance policy.

Trending Travel Insurance News

Business Insider on ...

Tin Leg Travel Insurance: An In-Depth Review

With eight plans, Tin Leg travel insurance has a plan for every budget. Read our Tin Leg review to learn more about each policy.

Thu, 25 Apr 2024

Airlines Must Give Cash Refunds, Disclose Fees Under New Rules. Do ...

Airline passengers will soon be entitled to automatic cash refunds when their flights are canceled or significantly disrupted. A final rule just issued by the Department of Transportation requires air ...

GeoBlue Travel Insurance Review 2024

Our GeoBlue Travel Insurance review covers plan options, coverage limits, and shortcomings. Find the right GeoBlue plan for your travel needs.

Wed, 24 Apr 2024

Tick Travel Insurance Top Cover Review: Pros and Cons

The above table shows how important it is to shop around for travel insurance, and weigh up your needs with your budget when comparing policies. Tick’s Travel Insurance’s Top policy is only $77, ...

Best student travel insurance in April 2024

Discover the best student travel insurance plans for studying abroad. Protect your health, belongings and trip investment. Get a quote today.

Wed, 17 Apr 2024

Travel Insurance Claims: Handling Flight Delays and Cancellations

Luckily, there’s a solution to ease these worries – travel insurance with trip cancellation and delay coverage. In this guide, we’ll take a closer look at these coverages and why it’s a smart ...

Fri, 26 Apr 2024

St. Louis ...

Surging auto insurance rates squeezing drivers, fueling inflation. ...

Skyrocketing auto insurance and car ownership costs are hitting consumers where it hurts. Here are a few things you can do to keep the price down.

Related Travel Insurance Plan Reviews

Since you're interested in Travel Insurance Plans, here are some other reviews you might find interesting.

French Lessons

Who offers the best French lessons? When we think of someone speaking French, we think soothing and seductive, as it's simply dreamy to hear.

Life Insurance Plans

Where can you get the best Life Insurance policy out there today? In an era where financial uncertainties and unexpected events can strike at any moment, securing your family's ...

Low Calorie Meal Delivery

What's the best place to find Low Calorie Meal Delivery today? In recent years, the popularity of low-calorie diets has surged.

Popular Diets

Which of today's popular diets is the best? In recent years, there has been an explosion of different diets in America.

Spanish Lessons

Who offers the best Spanish Lessons? Have you always wanted to learn Spanish?

Travel Visa Services

What's the easiest way to get a travel visa? Online travel visa providers have revolutionized the way individuals apply for visas when planning their international trips.

Newest Reviews

Arabic Lessons

Where Can You Find the Best Arabic Lessons? Are you interested in learning Arabic?

Chinese Lessons

Where Can You Get the Best Chinese Lessons Online? The motivations for learning Chinese are as diverse and compelling as the language itself.

Korean Lessons

Where Can You Get the Best Korean Lessons Online? There are many reasons why people learn the Korean language.

Logo Design Companies

Where Can You Find the Best Logo Design? Whether you're a budding entrepreneur launching a brand new startup, or a well-established business aiming to rebrand your company for a fresh, modern look, the ...

Prom Dress Stores

Where Can You Find the Best Prom Dresses? The quintessential high school experience, prom, is one of the most exciting moments for teenagers across the US.

Swimsuit Stores

Where is the best place to buy swimsuits online? Shopping for swimsuits probably means the weather is heating up or you're headed out for a fun vacation.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

AIG Travel Guard Insurance Review and Costs (2024)

AIG Travel Guard offers a range of plan and upgrade options to protect international travel, but prices are often higher than competitors.

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Travel insurance can compensate you for nonrefundable expenses like flights and lodging if your plans get unexpectedly canceled or other interruptions occur while you’re traveling.

AIG is a reputable travel insurance company offering three levels of coverage for most international trips. But is AIG travel insurance worth the cost? Read on to learn about AIG travel insurance, what you’re likely to pay for coverage, and more.

- Average Cost: $237

- BBB Rating: A+

- AM Best Score: A (excellent)

- Medical Expense Max: $150,000

- Emergency Evacuation Max: $1,000,000

Our Take on AIG Travel Guard Insurance

Overall, we rated AIG Travel Insurance 4.5 out of 5 stars based on our provider review standards. AIG has a reputation for offering quality family coverage, which includes one child under age 17 with the purchase of each adult travel plan. Traveling as a family could save hundreds of dollars.

AIG also sells various add-ons to enhance your policy, including cancel for any reason (CFAR) coverage. While AIG’s pricing is higher than some competitors, its policies include up to $5 million in emergency evaluation coverage, which can be especially beneficial if you’re traveling to a remote area.

87 people out of the 1,000 we surveyed chose Travel Guard. Of those people, 98% said that travel insurance was worth it , with the majority citing peace of mind or flight and baggage coverage as the reason.

Pros and Cons

Compare aig travel guard to other travel insurance companies.

We picked AIG Travel Guard as the top travel insurance provider for families thanks to its group coverage and complementary protection for children under age 17 on some policies. But what if you’re traveling solo or with a partner?

Dozens of travel insurance companies operate across the U.S., each catering to a particular group of travelers. Browse our recommended travel insurance companies using the table below based on different types of travelers.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

What Does Travel Guard Cover?

AIG Travel’s primary product is its comprehensive international AIG Travel Guard travel insurance policies. AIG Travel offers three plan options for most trips.

Travel Guard Essential

The Essential Plan is AIG’s most affordable coverage option, with fewer protections. The plan includes 100% coverage for trip interruption coverage, $50,000 in medical expenses coverage, $150,000 in emergency evacuation coverage, and up to $800 in trip delay coverage. However, the policy does not include a cancel for any reason (CFAR) option.

Travel Guard Preferred

The Preferred Plan offers mid-tier coverage, balancing affordability and protections. Highlights of this plan include 150% coverage for trip interruption coverage, $50,000 in medical expenses coverage, $500,000 in emergency evacuation coverage, and up to $800 in trip delay coverage. The plan also includes limited coverage for baggage loss and delay.

Travel Guard Deluxe

The Deluxe Plan is AIG’s top-of-the-line travel insurance option, best suited for international travelers looking to insure an expensive vacation. Highlights of this plan include 150% coverage for trip interruption coverage, $150,000 in medical expenses coverage, $1 million in emergency evacuation coverage, and up to $1,000 in trip delay coverage. The plan includes comprehensive reimbursement rates for baggage delay and baggage loss, as well as credit card reimbursements if you run into identity theft issues abroad.

Basic AIG Travel Guard Insurance Plans

In addition to the three basic Travel Guard options, AIG has two specialty plans for travelers with unique needs.

- Pack-N-Go: Pack-N-Go travel insurance provides immediate travel insurance coverage for unplanned or sudden trips. Coverage is less inclusive than the Travel Guard Essential. For example, trip interruption coverage maxes out at 100% of the trip value or $1,000, whichever is lower. This is true for all excursions, regardless of total price. While Pack-N-Go coverage includes more exclusions, it is affordably priced and you can buy it up to the day you travel.

- Annual Travel Insurance Plan: If you’re a frequent traveler, AIG offers an annual travel plan that offers general protections without the need to buy a policy each time you leave the country. The annual plan includes trip cancellation coverage for 100% of trip costs up to $2,500, up to $500 in missed connections coverage, up to $1,500 in trip delay cancellation, accidental death and dismemberment up to $50,000, and additional protections. These limitations are instituted per trip, while you pay an annual premium to cover all excursions.

All Travel Guard plans include around-the-clock travel assistance services, an invaluable service if you have a missed connection or need medical assistance in a country where you don’t speak the official language.

Read More: Travel Insurance For Parents Visiting The USA

Like any insurance company, AIG will not cover every situation you might run into abroad. While there are exclusions on every policy, you can extend your coverage with riders. Insurance riders are add-on coverages you can buy in addition to a standard travel insurance plan that allows you to use your coverage under more circumstances.

AIG sells the following riders to your Travel Guard insurance plans:

- Cancel for any reason (CFAR): CFAR coverage allows you to receive a partial reimbursement on nonrefundable trip costs no matter why you cancel. CFAR add-on coverage is available on the Travel Guard Deluxe and Preferred Plan.

- Pre-existing conditions waiver: A pre-existing medical condition is any illness or injury for which you show symptoms before you sign onto a travel insurance policy. While these conditions are usually excluded from any medical coverage on a travel insurance plan, AIG offers a waiver that allows you to extend benefits to these conditions.

- Flight accident coverage: This rider extends benefits of accidental death and dismemberment and repatriation of remains because of flight accidents and crashes.

- Rental car collision coverage: This rider adds collision coverage, which can be helpful if you rent a car internationally. This coverage does not include the liability coverage your rental car company requires.

- Name your family member: This add-on lets you select one friend or traveling companion to be considered family — and thus be covered by the plan.

- Quarantine bundle: Provides a daily financial allowance if new travel restrictions or government advisories require policyholders to follow an unexpected quarantine.

- Umbrella coverage: Policyholders can extend individual emergency or medical evacuation coverage for a few extra dollars. Umbrella coverage is available for standard medical coverage.

Other add-ons may be available for annual or last-minute trips depending on your destination and personal details. Add-on availability can vary based on your departure date and the first date that you made a payment for your trip.

Policies Offered

Not ready to get a quote for your upcoming trip? View a summary of the coverages included on each major type of plan using the table below.

*All quote information was collected on 3/22/2023 for a 28-year-old traveler visiting Mexico for one week with a total trip cost of $2,000.

How Much Does AIG Travel Guard Insurance Cost?

According to our research, Travel Guard insurance policies cost $237 on average.

To get a better idea of what you can expect to pay for AIG Travel Guard insurance, we requested quotes for seven trips with different destinations and traveler details.

These prices — especially at the higher tiers — are comparatively more expensive than competitors. For example, when we requested quotes for the same plan from competitor Travelex , we received prices between $78 and $122. In comparison, competitor Faye Travel Insurance priced a comprehensive policy option at about $135.

Use the chart below to compare Travel Guard's average cost to competitors:

AIG Travel Guard International Travel Insurance Cost

International travel insurance costs more because expenses are usually higher than non-domestic trips. You must also weigh other countries’ healthcare systems when traveling overseas, as some destinations are less accommodating if you do not have eligible health insurance. If you’re traveling to a more remote country or territory and require medical care, you may also need evacuation services, adding another layer of risk on behalf of the insurance provider.

Travel Guard Domestic Travel Insurance Cost

AIG Travel Guard also offers policies for domestic travel. We collected the following quotes for a 28-year-old traveler who is a resident of Alabama and spending a week in New York, with a trip cost of $2,000. As you can see, pricing for domestic travel was quoted at identical rates to international travel, which may make AIG a less viable choice for domestic travelers interested in affordability first .

Read More: Travel Health Insurance For Visitors To USA

AIG Travel Guard Insurance Reviews

Reviewing financial strength ratings and customer reviews is an important step when choosing a reliable travel insurance provider. AIG maintains an A rating from A.M. Best, indicating it is financially stable enough to continue paying its insurance benefits for the foreseeable future.

The company also has an A+ rating and accreditation from the Better Business Bureau (BBB). However, customer reviews of AIG are largely negative. BBB reviewers gave the company an average of 1.07 out of 5 stars from more than 250 reviews, while 100 Trustpilot users gave AIG 1.4 out of 5 stars .

AIG’s travel insurance department is part of Travel Guard Group, Inc., a Better Business Bureau-accredited business with more than 35 years in business. The Travel Guard Group also maintains a BBB rating of A+, indicating that the company is more likely to respond to consumer complaints in a satisfying way.

Online reviews of AIG’s travel insurance plans on third-party platforms are overall negative. While some customers were pleased with the company’s buying experience and knowledgeable representatives, most customer reviews were from frustrated policyholders dealing with denied claims.

“ Took out overseas car rental insurance with them. Someone drove into the back of my vehicle whilst I was in Spain. The way AIG claims handled this was BRILLIANT. They made the claim process simple, minimizing any stress, and paid in full within a few weeks. ” — Marios via Trustpilot “ I used AIG for trip insurance in October of 2022. The night before my husband and I were to travel, I found out that my father was terminally ill and I, as his P.O.A., was needed at his care facility the next day to sign the papers for his admittance to hospice. No amount of information, medical records or death certificate supplied was sufficed enough for this scam company to refund our trip. Such a disgrace. ” — Anne via Trustpilot “ ...I literally was evacuated because of a hurricane that destroyed the whole area and they said they would cover only $300 which covered only one night at one hotel we had to stay at…Their customer service is downright horrendous. I used them for every trip for the last 12 years (multiple trips a year) and never needed them. The one time I do, they're rude, unhelpful and just refusing to pay… ” — Tom via Trustpilot

Is AIG Travel Guard Insurance A Good Choice?

Overall, Travel Guard has quality travel insurance plans, with up to $150,000 in medical expense coverage, 150% coverage for trip interruption and $1 million in emergency evacuation expenses. AIG’s plans include all the standard protections you’ll find with competitors, plus coverage for a wider range of circumstances. For example, most of AIG’s plans include cancellation for work-related reasons and hurricanes, which are often excluded without riders.

While Travel Guard’s coverage is comprehensive and includes a range of protections not found with other providers, it may not be the best option for budget travelers. Travel Guard protection plans are on the more expensive end of the spectrum, though limited coverage Pack-N-Go plans are competitively priced. If you’re shopping solely based on budget, Travel Guard might not be your best option.

Frequently Asked Questions About AIG Travel Insurance

Is aig a trustworthy company.

Yes, AIG is a trustworthy company with accreditation and an A+ rating from the BBB. AIG also maintains an A rating from A.M. Best, indicating it can pay claims. While some customers post reviews expressing frustration toward AIG rejecting claims, the company is a legitimate insurer. To prevent the potential for denied claims, be sure to review the policy you’re buying to understand what it does and does not cover.

How much does AIG travel insurance cover?

AIG offers a range of travel insurance policies, which include coverage for trip cancellations or interruptions, emergency medical and dental expenses, medical evacuation and repatriation, baggage loss or delay, and more. AIG Travel Guard’s policies are comprehensive and include items like credit card fraud, identity theft and cancellations because of work.

Which is the best company to get travel insurance with?

The best company to buy travel insurance from will depend on your trip. Check out a few of the best travel insurance companies and get a quote from at least three providers to learn more about coverage.

Are AIG and Travel Guard the same?

AIG and Travel Guard are related to each other but are not the same. AIG is a multinational insurance corporation that offers a wide range of insurance products and services, including travel insurance. AIG Travel Guard is a brand of travel insurance offered by AIG. In other words, Travel Guard is a specific type of travel insurance product that is offered by AIG, but it is not the only insurance product offered by the company.

Additional Travel Insurance Reviews

Check out our reviews of other travel insurance companies below:

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

If you have questions about this page, please reach out to our editors at [email protected] .

More Travel Insurance Reviews

Frommer's 8 Great Travel Insurance Providers

To help you pick the best travel insurance policy, Frommer's names eight companies that have proved themselves over time.

By Frommer's Staff

Updated September 28, 2022

The travel insurance industry can be confusing to navigate, thanks to all the unclear language and companies disguised under misleading names. To help travelers pick the most reliable policies, we've selected eight travel insurance companies we're confident are at the top of the heap.

Each company we selected offers comprehensive policies directly to consumers—and not only for medical assistance. We made sure it's clear who owns each of the insurers and who's underwriting their policies, and we've verified that the companies and their underwriters get good ratings from AM Best (an insurance rating agency) and passing marks from the Better Business Bureau.

Additionally, each company has been in business for at least 10 years and is a member of the US Travel Insurance Association .

Where possible, we also made sure these firms are vouched for by major third-party brokers such as Squaremouth , InsureMyTrip , and QuoteWright .

Based on those criteria, here are eight reliable travel insurers, in alphabetical order:

Allianz Travel Insurance

Website : AllianzTravelInsurance.com Based in: Richmond, Virginia Founded in: 1983 Parent Company: Allianz Underwriters: BCS Insurance Company, Jefferson Insurance Company Underwriters' AM Best Ratings: A (Excellent), A+ (Superior) Insurer's BBB Rating: A+

American Express

Website : AmericanExpress.com Based in: New York City Founded in: 1850 Underwriter: Amex Assurance Company Underwriter's AM Best Rating: A (Excellent) Insurer's BBB Rating: A+

Generali Global Assistance

Website: GeneraliTravelInsurance.com Based in: Trieste, Italy, with offices in San Diego and Pembroke Pines, Florida Founded in: 1991 Underwriter: Generali U.S. Branch Underwriter's AM Best Rating: A (Excellent) Insurer's BBB Rating: A+

- Website : TripAssure.com

- Based in: Kansas City, Missouri

- Founded in: 1961 (as MH Ross)

- Parent Company: Trip Mate, part of Generali Global Assistance

- Underwriter: Generali U.S. Branch

- Underwriter's AM Best Rating: A (Excellent)

- Insurer's BBB Rating: A+

Travel Guard

Website : TravelGuard.com Based in: Stevens Point, Wisconsin Founded in: 1985 Parent Company: AIG Travel Underwriter: National Union Fire Insurance Company Underwriter's AM Best Rating: A (Excellent) Insurer's BBB Rating: A+

Travel Insured International

Website : TravelInsured.com Based in: Glastonbury, Connecticut Founded in: 1994 Parent Company : Crum & Forster Holdings Underwriter: United States Fire Insurance Company Underwriter's AM Best Rating: A (Excellent) Insurer's BBB Rating: A-

Travelex Insurance Services

Website : TravelexInsurance.com Based in: Omaha, Nebraska Founded in: 1996 Parent Company: Zurich Insurance Group Underwriters: Berkshire Hathaway Specialty Insurance, Zurich Insurance Group Underwriters' AM Best Ratings: A++ (Superior), A (Excellent) Insurer's BBB Rating: A+

TravelSafe Insurance

Website : TravelSafe.com Based in: Wyomissing, Pennsylvania Founded in: 1971 Parent Company: Chester Perfetto Agency Underwriter: National Union Fire Insurance Company Underwriter's AM Best Rating: A (Excellent) Insurer's BBB Rating: A+

- All Regions

- Australia & South Pacific

- Caribbean & Atlantic

- Central & South America

- Middle East & Africa

- North America

- Washington, D.C.

- San Francisco

- New York City

- Los Angeles

- Arts & Culture

- Beach & Water Sports

- Local Experiences

- Food & Drink

- Outdoor & Adventure

- National Parks

- Winter Sports

- Travelers with Disabilities

- Family & Kids

- All Slideshows

- Hotel Deals

- Car Rentals

- Flight Alerts

- Credit Cards & Loyalty Points

- Cruise News

- Entry Requirements & Customs

- Car, Bus, Rail News

- Money & Fees

- Health, Insurance, Security

- Packing & Luggage

- -Arthur Frommer Online

- -Passportable

- Road Trip Guides

- Alaska Made Easy

- Great Vacation Ideas in the U.S.A.

- Best of the Caribbean

- Best of Mexico

- Cruise Inspiration

- Best Places to Go 2024

Travel Insurance

Legitimate travel insurance companies (bbb accredited).

Wish to prepare for an upcoming trip abroad, compare plans, coverage levels, and prices and purchase a policy that will protect you from a variety of unexpected situations? Buying a policy online from legitimate, law-abiding and trustworthy providers is the best way to avoid the risks of being exploited, overcharged, scammed or ripped off. This list provides information about travel insurance companies approved by the Better Business Bureau , after being thoroughly reviewed by the national consumer organization and successfully meeting all their strict requirements.

Wish to prepare for an upcoming trip abroad, compare plans, coverage levels, and prices and purchase a policy that will protect you from a variety of unexpected situations?

Buying a policy online from legitimate, law-abiding and trustworthy providers is the best way to avoid the risks of being exploited, overcharged, scammed or ripped off. This list provides information about travel insurance companies approved by the Better Business Bureau , after being thoroughly reviewed by the national consumer organization and successfully meeting all their strict requirements.

Travelex Insurance Services

Seven Corners

Travel guard.

Found inaccurate or outdated information on this page? Has the BBB accreditation of a listed business been revoked?

Thanks for helping us keep this page up to date.

Recommended Reading

Consumer tips, how-to’s and articles that you may find interesting..

- Checklist: How to Find Out If a Website Is Legitimate or Not?

- The Effects of Falling Victim to a Scam

- Heads Up: 3 Common Online Scams to Be Aware of

- Profile: What is The Better Business Bureau?

- What Is a BBB Accredited Business?

- What is the Importance of BBB Accreditation for Consumers?

- Tips: What Should I Do After Being Scammed Online?

- The Sad Truth behind the Trustworthiness of Online Reviews

Home About Terms Privacy Sitemap Contact

eLegitimate.com was established in 2013 with the goal to provide categorized information about BBB accredited businesses across a variety of industries, sectors and market niches.

When you are searching for legitimate, reputable and honest companies that are safe to do business with, treat customers with fairness and respect and offer reliable customer service – be sure to check out our website for companies that have passed the BBB’s test.

We may earn a commission when you use one of our links to make a purchase.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

AIG Travel Guard insurance review: What you need to know

Whether you need an annual plan or a policy for a last-minute trip, travel guard can deliver..

Travel Guard is one of CNBC Select 's picks for best travel insurance , thanks to its wide range of customizable policies. But are any of them right for you? Below, we review the provider and its offers and how they compare to the competition to help you choose the right travel insurance for your next trip.

Travel Guard review

Other insurance offered, how it compares, bottom line, travel guard® travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

24/7 assistance available

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Travel Guard® is a global travel insurance provider specializing in plans for leisure and business travelers. Its online travel insurance packages include five options, from basic and last-minute trip coverage to more comprehensive plans. This allows travelers to pick a plan that best matches their situation.

For example, budget-minded travelers might go for the Essential Plan which offers basic protections, such as trip cancellation, interruption and delay insurance, coverage for lost, damaged and delayed baggage, and medical, evacuation and death coverage.

On the other hand, the Deluxe Plan — the most comprehensive option — adds such extras as missed connection coverage, security evacuation, travel inconvenience benefits and more. It also boosts high limits for essential coverages.

Last-minute travelers can opt for the Pack N' Go Plan which only includes certain post-departure coverages. Or, if you travel often, the Annual Plan can cover your trips throughout the year.

Finally, Travel Guard offers "offline" travel insurance packages, meaning you'll have to call if you're looking for a specialty plan.

Coverage types

Depending on the plan, here are the types of protection Travel Guard can include in your package:

- Trip cancellations

- Trip interruption

- Baggage coverage

- Baggage delay

- Travel medical expenses

- Travel inconvenience benefits (reimbursement for such situations as runway delays, cruise diversion and other unforeseen situations)

- Medical evacuation

- Trip Saver (reimbursement for meals, hotels and transportation if you need to begin your trip sooner due to weather or airline changes)

- Trip exchange (reimbursement in case you have to cancel your trip and book a new one due to covered unforeseen circumstances)

- Security evacuation (due to a riot or civil disorder)

- Flight guard (coverage for accidental death or dismemberment that occurs when traveling by plane)

- Pre-existing medical conditions exclusion waiver

You can also customize your plan with add-ons, such as car rental insurance and "cancel for any reason" coverage .

Travel Guard landed on our list of the best travel insurance companies thanks to its variety of coverage. With plenty of options to choose from, both online and offline, it's easy to build a policy that meets your needs.

Travel Guard also features 24-hour concierge services that you can use to book a new flight in case of an emergency or delay.

The provider's website also offers informational resources — here, you can check travel news, read safety tips and find general travel advice. Additionally, the website lets you modify your plan, file a claim and check its status, or apply for a voucher or refund.

As of writing, Travel Guard doesn't offer any discounts. That's common for travel insurance — you're more likely to find deals when shopping for other types of insurance, such as home and auto insurance .

Travel Guard is a portfolio of travel insurance and travel-related services offered by AIG Travel, a member of American International Group (AIG). AIG also offers life insurance and a variety of business insurance products.

Travel Guard makes it easy to get a travel insurance policy customized to your needs. But before you purchase coverage, it's always a good idea to shop around.

For example, if you're going on a cruise, you might want to look at Nationwide Travel Insurance . The provider advertises cruise-specific insurance with three plan options available. This type of coverage is designed with issues unique to cruises in mind — from ship-based breakdowns to missed pre-pard excursions.

If you're planning a more active trip filled with rock climbing or sky diving, Berkshire Hathaway offers the AdrenalineCare® plan which features coverage for unforeseen costs that result from participating in extreme sports on your trip, as well as reimbursement for sporting equipment delay. Pre-existing conditions are covered under this plan (if you meet qualifying conditions).

Berkshire Hathaway Travel Protection

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

As you can see, offerings vary by provider. It can be helpful to compare multiple companies and the plans they offer to find what works best for you. It's even better if you gather several quotes to ensure you're getting a good price for your policy.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Travel Guard offers plenty of ways to customize your policy, making it a solid choice for travel insurance. You can also access additional options by giving Travel Guard a call. However, make sure to check out other travel insurance companies too — comparison shopping is essential when picking any type of financial product.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- How Quicken Simplifi can help you get a grip on your spending Elizabeth Gravier

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

- 3 best Chase balance transfer credit cards of 2024 Jason Stauffer

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AIG Travel Guard Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

33 Published Articles 3134 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1172 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Core coverages, optional coverages for an additional fee, aig travel guard and covid-19, additional information — aig travel guard, to other travel insurance companies, to credit card travel insurance, the value of travel insurance comparison websites, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Purchasing insurance for your home, auto, or your life, can be complicated and time-consuming if you want to compare coverages and premium costs between companies. Fortunately, the process of purchasing travel insurance is quite simple , and you can secure immediate coverage within minutes.

It all starts with determining the coverages that most important to you, securing a quote, then making sure you’re purchasing from an established, highly-rated company. One such established travel insurance company is AIG Travel Guard .

With over 25 years of experience and high ratings from premier insurance financial rating company A.M. Best , AIG Travel Guard was named the best travel insurance company of 2020 by Forbes . Its Travel Guard Deluxe policy was also given a top 5-star rating by Forbes’ insurance analysts.

We’ll certainly discuss AIG Travel Guard’s policy offerings in our article today but we also want to discuss why you’d want to purchase travel insurance , whether travel insurance covers COVID-19, the process for obtaining a quote, and additional resources to help ensure you’re receiving good value.

Plus, if you’re wondering if you need to purchase travel insurance or whether you might have enough coverage elsewhere, you’ll want to read on.

While the primary reasons for purchasing travel insurance are to protect your economic investment and to cover unexpected additional expenses you might incur due to trip disruptions, purchasing travel insurance has another, more intangible, purpose.

Purchasing travel insurance can provide peace of mind prior to and during your trip as you won’t be worried that an unforeseen event will result in an economic loss. Knowing you have evacuation insurance when you’re traveling to a remote area on safari, for example, could be tremendously reassuring, even if you never use the coverage.

Here are some sample situations where travel insurance may provide coverage:

- Your sister is diagnosed with a life-threatening illness and you must cancel your trip

- You broke your ankle and will not be able to go on your skiing trip

- You become ill and cannot travel

- You or your traveling companion is terminated or involuntarily laid off from your job

- You are summoned to jury duty or other legal action such as requiring you to appear as a witness

If your trip is expensive, complicated, or you need medical coverage while traveling, a travel insurance policy is a must.

Bottom Line: In addition to protecting your trip investment and covering unexpected expenses due to trip disruptions, travel insurance can also provide peace of mind before and during your travels.

AIG Travel Guard — Coverages and Policy Options

There’s probably nothing more boring than listing insurance coverages but it’s important to know the types of coverages you can expect when purchasing an AIG Travel Guard policy.

First, AIG Travel Guard offers 3 policy options for U.S. residents (not including NY residents), 3 separate options for NY residents, and 1 policy for Canadian residents.

- Tr avel Guard Essential

- Travel Guard Preferred

- Travel Guard Deluxe

- Travel Guard Essential Expanded — available to NY residents

- Travel Guard Protect Assist — available to NY residents

- Travel Guard Tour, Cruise, & Travel — available to NY residents

- Gold Trip Cancellation Policy — available to Canadian residents

Coverage options and limits will vary by policy, however, you can expect to find the core and optional coverages listed here.

Here are the types of coverages you’ll find offered on AIG Travel Guard policies and the applicable coverage limits for each type of policy.

There are also additional coverages that may be included at no extra charge, depending on the policy type selected. Terms and conditions apply.

- 1 child under 17 per covered adult is included for no extra charge

- Pre-existing conditions waiver

- Trip exchange coverage

- Single occupancy fee coverage

- Evacuation for a security reason

- Non-flight accidental and dismemberment insurance

- Worldwide travel and medical assistance services

You may secure any of the following add-on coverages by paying an additional fee.

- Cancel for Any Reason Insurance — covers trip cancellation for any reason

- Rental vehicle damage — coverage for collision damage when renting a vehicle

- Pet bundle coverage — pet care, medical expenses, and adds pet illness to trip cancellation benefit

- Adventure sports coverage — coverage for higher risk adventure activities

- Increased lodging expense bundle — increases the amount covered under travel inconvenience benefit

- Wedding bundle — coverage when a destination wedding is canceled

- Name a family member bundle — select a traveler to be covered as a family member

Hot Tip: For more information and tips on purchasing travel insurance, start here in our article on travel insurance basics .

Travel insurance , in general, is designed to protect you from financial loss due to unforeseen events that may cause you to cancel your trip, or to cover disruptions that could occur during your journey. It is not meant to cover voluntary trip cancellations due to fear of getting ill.

Voluntary cancellations, including those that are related to the fear of getting ill, are not covered on travel insurance policies. However, there is 1 option for obtaining coverage for voluntarily canceling your trip.

Cancel for Any Reason insurance (CFAR) is an optional coverage that can be added to select travel insurance policies allowing you to cancel your trip for any reason you deem necessary and be covered for partial reimbursement.

AIG Travel Guard offers CFAR coverage as an optional add-on to add to its Preferred and Deluxe plans , with these stipulations:

- Must be purchased within 15 days of the initial trip deposit

- The trip must be canceled more than 48 hours prior to departure

- The full cost of the trip must be insured for at the time of purchase

Cancel for Any Reason insurance does not cover the entire cost of the trip. In this case, to add CFAR insurance to the Deluxe and Preferred plans above, the additional premium would be $53.31 for coverage to cover up to 50% of the trip price. Additional options may be available to cover up to 75% of the cost of your trip.

The above prices are for a single trip 1-week in length for a traveler of 40 years of age at a cost of $3,000.

AIG Travel Guard policies, even without the CFAR insurance add-on, offer coverage for trip cancellations due to COVID-19 related illness and also medical coverage should a covered traveler become sick with COVID-19 during their travels. Terms and conditions apply.

Bottom Line: While trip cancellation, trip interruption, and emergency medical may offer some coverage for illness, you must purchase Cancel for Any Reason insurance to have coverage for canceling a trip due to the fear of getting ill. AIG Travel Guard offers this coverage on its Deluxe and Preferred plans.

Point-of-Sale Availability — In addition to offering travel insurance package policies directly to the public, AIG Travel Guard offers travel insurance products via several travel providers including airlines and various travel services. You’ll find the option to purchase Travel Guard protection during the checkout process with companies such as United Airlines or Frontier Airlines when purchasing a flight and when making a travel purchase via Costco Travel .

Call for Additional Quotes — While AIG Travel Guard does sell annual multi-trip policies, you must call to request a quote. Adventure sports coverage, medevac coverage, and rental vehicle damage coverage quotes are also available via phone.

15-Day Free Look Period — If you decide, after you have reviewed your purchased policy, that you do not want it, you may receive a full refund.

Cruise Insurance Option — AIG Travel Guard offers cruise insurance that includes cruise diversion and other applicable coverages.

Filing a claim — to initiate a claim, you can either call AIG Travel Guard at 866-478-8222 or access travelguard.com to begin the process. You will need your policy number handy. Once your claim is submitted, you can check the status at claims.travelguard.com/status .

How Does AIG Travel Guard Compare

First, know that when purchasing a policy from AIG Travel Guard, you’re buying from a highly-rated established insurance company. Here’s how the company stacks up in relative comparison with other travel insurance companies.

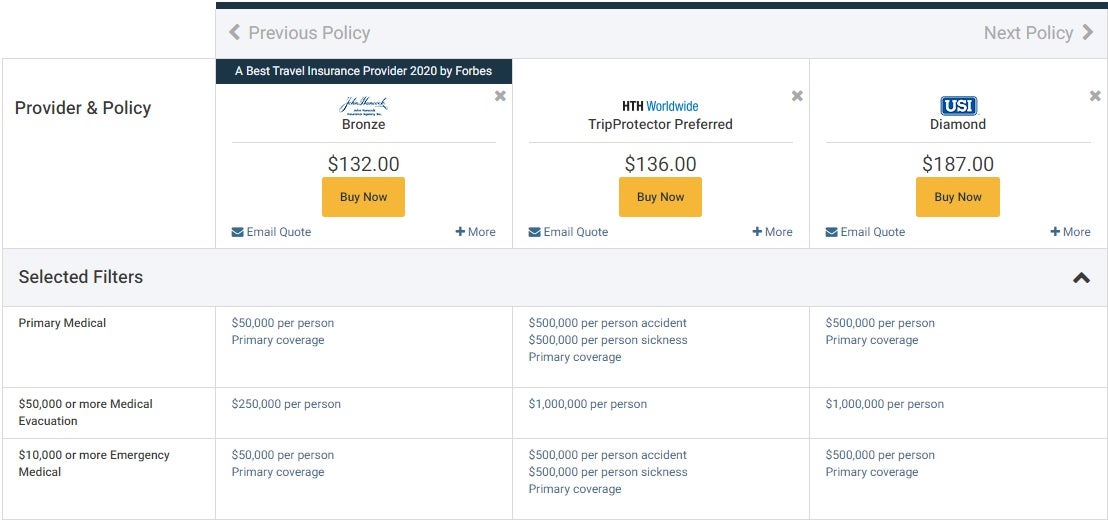

Comparing travel insurance policies can be complicated as coverage limits and prices vary widely. We looked at a 1-week trip to Mexico for a traveler 40 years of age and a total trip cost of $3,000 as criteria for obtaining a quote.

AIG Travel Guard’s Preferred plan, which prices out at around $200, aligns with the John Hancock Bronze policy above. Add in CFAR coverage, however, and the comparison costs are closer to AIG Travel Guard’s $254 premium for its Preferred level plan that also includes CFAR.

This 1 example uses the criteria of a specific trip for an individual traveler of a certain age and may not reflect the same relative premium costs as other comparisons.

Your own individual traveler information, the number of travelers, trip length, destination, state of residence, selected coverages, and the total cost of your trip will ultimately determine the premium cost. Our example is just a narrow snapshot comparison.

Bottom Line: Travel insurance policy coverages and costs vary dramatically. To ensure you’re receiving good value, determine the coverages that are most important to you, compare policy options, and purchase from a reliable company.

The travel insurance coverages that come complimentary on your credit cards are no substitute for a comprehensive travel insurance policy. With that being said, the coverage that comes with your credit card could be enough to cover some trips.

Here are some examples of trips where you may not need travel insurance and the coverage you have on your credit card could be sufficient.

- The trip consists of only a round trip domestic flight and hotel stay

- The trip is a road trip by car

- The trip does not include any non-refundable trip expenses

- The trip does not have several travel providers involved

- Your health insurance covers you while traveling and you are not worried about having additional medical coverage during your trip

Also, keep in mind that coverage offered on your credit card is generally secondary versus a primary travel insurance policy. This means you must first file a claim with other applicable insurance, including coverage with the airline or travel provider, for example, before the credit card coverage will kick in.

Bottom Line: If you have a significant investment at stake, several travel providers involved, or want medical coverage during your travels, you should purchase a comprehensive travel insurance policy for your trip and not depend on a credit card with travel insurance .

Travel insurance is widely available and competitive. You won’t have trouble purchasing some level of coverage regardless of your situation. Additionally, there are travel insurance comparison websites that make it easy to find a policy that fits and purchase coverage that is effective immediately.

These travel insurance comparison websites are each easy to use, have qualified people to assist, and all feature policies offered only by highly-rated companies.

Travelinsurance.com

- Instant coverage

- Simple format, easy to secure a quote quickly

- Guarantees the best price for the policy you’re purchasing

Squaremouth

- Features 20 companies with nearly 120 different policy options

- Its customer service team is award-winning

- You can access thousands of customer reviews

InsureMyTrip

- Educational content to assist you in understanding coverages

- Features 21 highly-rated companies

- Licensed agents can answer questions and assist with a claim

Bottom Line: Travel insurance comparison websites provide quick easy access to securing a quote, compare several high-rated travel insurance providers at once, and the benefit of receiving immediate coverage.

While airlines and travel providers have made significant changes to cancellation, refund, and exchange policies, it’s still important to consider purchasing travel insurance if you’re uncomfortable with the possibility of losing your trip investment or incurring unexpected expenses during your journey.

In addition, if you need medical insurance coverage during your trip, you won’t find that coverage on a credit card or with the airlines — you’ll need to purchase it.

The fact that AIG Travel Guard does not exclude COVID-19 related claims under certain coverages and offers a Cancel for Any Reason add-on is significant as not every travel insurance company can make that claim.

Also, if you have children traveling with you, you may find good value with AIG Travel Guard having those under 17 included for no extra charge (1 per premium-paying adult).

The bottom line when purchasing travel insurance from AIG Travel Guard is that if you can secure the coverages you need at a price you’re comfortable with and you’ll know you’re completing that transaction with a highly-rated established company.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

Is aig travel guard a good travel insurance company.

AIG Travel Guard is a highly-rated established travel insurance company. It is rated A by the prominent insurance financial rating company A.M. Best and has been in business for over 25 years.

It was also named the best travel insurance company of 2020 by Forbes.

Does AIG Travel Guard cover trip cancellation?

Yes, AIG Travel Guard will cover trip cancellations but only for covered reasons listed in the policy. Examples of situations that may be covered include becoming ill and having to cancel your trip, being called for jury duty or other covered legal obligation, or your home becomes uninhabitable.

Does AIG Travel Guard cover flight cancellations due to COVID?