- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to American Express Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Express travel insurance vs. coverage provided by AmEx cards

Complimentary travel insurance provided by amex cards.

Trip cancellation and interruption insurance

Trip delay insurance

Car rental loss and damage insurance

Baggage insurance

Premium global assist.

Global Assist Hotline

Standalone American Express travel insurance plans

Should you use the complimentary benefits or purchase a policy, amex travel insurance recapped.

You can get AmEx travel insurance via your card or as a standalone policy.

AmEx cards typically include coverage for trip delays, interruptions, cancellations, baggage and car rentals.

Coverage tends to be secondary.

Policies vary by card.

American Express has two different types of travel insurance offerings: standalone travel insurance plans that customers can purchase and travel insurance that is included as a complimentary benefit on certain cards.

So if you’re thinking about getting travel insurance before a trip, get familiar with American Express travel insurance benefits that are included on your credit cards. Knowing what protections you already have will prevent you from spending money on a separate policy with benefits that overlap.

A standalone travel insurance policy from American Express may offer more robust coverage, but depending on your needs, the travel insurance perks provided by your AmEx card may be sufficient.

If you primarily want specific coverage for cancellations, delays or rental cars and baggage, it’s likely your card will be enough.

If, however, you’re mainly concerned with emergency health coverage while traveling , you’re better off with a separate medical insurance policy because the benefits provided by credit cards are limited in those areas. You can purchase this from American Express directly or shop around other travel insurance companies .

» Learn more: How to find the best travel insurance

There are six travel insurance benefits offered on many American Express cards:

Trip cancellation and interruption insurance .

Trip delay insurance .

Car rental loss and damage insurance .

Baggage insurance plans .

Premium Global Assist Hotline .

Global Assist Hotline .

Here's a closer look at each.

Trip cancellation will protect you if you need to cancel your trip for a covered reason (more below), and you will be reimbursed for any nonrefundable amounts paid to a travel supplier with your AmEx card. Bookings made with Membership Reward Points are also eligible for reimbursement. Travel suppliers are generally defined as airlines, tour operators, cruise companies or other common carriers.

Trip interruption coverage applies if you experience a covered loss on your way to the point of departure or after departure. AmEx will reimburse you if you miss your flight or incur additional transportation expenses due to the interruption. American Express considers the following to be covered reasons:

Accidental injuries.

Illness (must have proof from doctor).

Inclement weather.

Change in military orders.

Terrorist acts.

Non-postponable jury duty or subpoena by a court.

An event occurring that makes the traveler’s home uninhabitable.

Quarantine imposed by a doctor for medical reasons.

There are many reasons that are specifically called out as not covered (e.g., preexisting conditions, war, self-harm, fraud and more), so we recommend checking the terms of your coverage carefully.

If you want a higher level of coverage for trip cancellation, consider purchasing Cancel For Any Reason (CFAR) travel insurance . CFAR is an optional upgrade available on some standalone travel insurance plans. This supplementary benefit allows you to cancel a trip for any reason and get a partial refund of your nonrefundable deposit.

Alternately, if you want what essentially amounts to CFAR insurance on your flights specifically, purchase your fares through the AmEx Travel portal and tack on Trip Cancel Guard for an extra fee. Trip Cancel Guard guarantees you an up to 75% refund on nonrefundable airfare costs when you cancel at least two days before departure, regardless of why. This isn't as comprehensive as other CFAR policies, but it can add some peace of mind for people who want the cash back (as opposed to a travel credit) for flights they may not take.

AmEx cards with trip cancellation, interruption coverage

The following American Express credit cards offer trip cancellation and trip interruption coverage:

on American Express' website

Additional AmEx cards that offer trip cancellation and interruption coverage include:

The Business Platinum Card® from American Express .

Centurion® Card from American Express.

Business Centurion® Card from American Express.

The Corporate Centurion® Card from American Express.

The Platinum Card® from American Express for Ameriprise Financial.

The American Express Platinum Card® for Schwab.

The Platinum Card® from American Express for Goldman Sachs.

The Platinum Card® from American Express for Morgan Stanley.

Corporate Platinum Card®.

Delta SkyMiles® Reserve Business American Express Card .

Terms apply.

Covered amount

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is secondary and applies after your primary policy provides reimbursement. Claims must be filed within 60 days. To start a claim, call 844-933-0648.

This benefit will reimburse you for reasonable, additional expenses incurred if a trip is delayed by a certain number of hours. Examples of eligible expenses include meals, lodging, toiletries, medication and other charges that are deemed appropriate by American Express. It makes sense to use your judgment in terms of what will get approved based on your policy's fine print.

Acceptable delays include those that are caused by weather, terrorist actions, carrier equipment failure, or lost/stolen passports or travel documents. There are also plenty of exclusions, such as intentional acts by the traveler.

AmEx cards with trip delay insurance

The reimbursable amount depends on which card you hold.

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Up to $300 per Covered Trip that is delayed for more than 12 hours; and 2 claims per Eligible Card per 12 consecutive month period.

As expected, the more premium travel credit cards offer higher compensation for shorter delays. Trip delay insurance is offered on the following American Express credit cards:

When you decline the collision damage waiver offered by the car rental agency, you will be covered if the car is damaged or stolen through your AmEx Travel Insurance. Depending on the card you have, the coverage is $50,000 or $75,000.

» Learn more: How AmEx car rental insurance works

In addition, the cards offering car rental damage and theft insurance up to of $75,000 also provide secondary benefits:

Accidental death or dismemberment coverage.

Accidental injury coverage.

Car rental personal property coverage.

To qualify, you must decline the personal accident coverage and personal effects insurance provided by your car rental company.

The entire rental must be charged on the American Express credit card to receive coverage for car rental loss and damage. And keep in mind that you do still need liability insurance when making your rental car reservation (you may have this through your personal auto insurance policy), as these credit card-provided coverage options don't include personal liability.

AmEx cards with car rental coverage

American Express lists over 50 different cards on its site that come with one of the two forms of car rental insurance. Cards that link to the Tier 1 policies are the $50,000-coverage cards, and Tier 2 policies are the $75,000 cards.

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

The amount reimbursed is calculated as whichever is lowest:

The cost to repair the rental car.

The wholesale book value (minus salvage and depreciation).

The invoice purchase price (minus salvage and depreciation).

Here are some key exclusions to be aware of with this coverage:

These policies don't cover theft or damage that was caused by a driver’s illegal operation of the car, operation under the influence of drugs/alcohol or damage caused by any acts of war.

Policies don't cover drivers not named as "authorized drivers" on your rental agreement.

The benefit only covers car rentals up to 30 consecutive days.

Not all cars are included in the policy. Certain trucks, vans, limousines, motorcycles and campers are excluded from coverage.

Insurance protection doesn't apply in Australia, Italy, New Zealand and any country subject to U.S. sanctions .

You can file a claim online or call toll-free in the U.S. at 800-338-1670. From overseas, call collect 216-617-2500. Your claim must be filed within 30 days of the loss. Additionally, some benefits vary by state, so check the policy for your specific card.

» Learn more: The guide to AmEx Platinum’s rental car insurance

As an American Express cardholder, you are eligible to receive compensation if your luggage is lost or stolen. This benefit is in addition to what you may receive from the carrier. However, the AmEx policy is secondary, which means that it kicks in after the carrier provides any compensation for losses.

AmEx provides this insurance to "covered persons," who are defined as:

The cardmember.

Their spouse or domestic partner.

Their dependent children who are under 23 years old (there are age exceptions for handicap children).

Some business travelers (Tier 2 coverage only).

To qualify, all covered individuals need to be traveling on the same reservation and must be residents of the U.S., Puerto Rico or the U.S. Virgin Islands.

AmEx cards with baggage insurance

Naturally, the higher-end cards offer more protection — but even the basic cards have decent coverage. The compensation limits per person are as follows (note that the maximum payout per covered person for lost luggage is $3,000 on all of these cards).

Below are the limits for cardholders of the The Platinum Card® from American Express , The Business Platinum Card® from American Express , The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, Hilton Honors American Express Aspire Card , Marriott Bonvoy Brilliant™ American Express® Card, Centurion® Card from American Express and Business Centurion® Card from American Express:

Baggage in-transit to/from common carrier: $3,000.

Carry-on baggage: $3,000.

Checked luggage: $2,000.

Combined maximum: $3,000.

High-end items: $1,000.

Disclosure: Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

And here are the coverage limits for cardholders of the American Express® Gold Card , American Express® Business Gold Card , American Express® Green Card , Business Green Rewards Card from American Express , Hilton Honors American Express Surpass® Card , Marriott Bonvoy™ American Express® Card, Marriott Bonvoy Business® American Express® Card , Delta SkyMiles® Reserve American Express Card , Delta SkyMiles® Reserve Business American Express Card , Delta SkyMiles® Platinum American Express Card , Delta SkyMiles® Platinum Business American Express Card , Delta SkyMiles® Gold American Express Card and Delta SkyMiles® Gold Business American Express Card , The Hilton Honors American Express Business Card :

Baggage in-transit to/from common carrier: $1,250.

Carry-on baggage: $1,250.

Checked luggage: $500.

High-end items: $250.

Disclosure: Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

AmEx also offers limited reimbursement for high-end items (coverage varies by card), such as:

Sports equipment.

Photography or electronic equipment.

Computers and audiovisual equipment.

Wearable technology.

Furs (including items made mostly of fur and those trimmed/lined with fur).

Items made fully or partially of gold, silver or platinum.

Claims must be filed within 30 days of your baggage loss. To file a claim, call 800-645-9700 from the U.S. or collect to 303-273-6498 if overseas. You can also file a claim online.

» Learn more: Compare travel insurance options: airline or credit card?

This benefit helps with events like replacing a lost passport, missing luggage assistance, emergency legal and medical referrals, and in some instances, emergency medical transportation assistance.

The service can also help you figure out important travel-related details like customs information, currency information, travel warnings, tourist office locations, foreign exchange rates, vaccine recommendations for the country you’re visiting, passport/visa requirements and weather forecasts.

AmEx cards with Premium Global Assist

Premium Global Assistance is offered on the following American Express credit cards:

The Platinum Card® from American Express .

Delta SkyMiles® Reserve American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant™ American Express® Card.

Services provided by Premium Global Assist Hotline

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

The hotline isn’t so much a concierge as a service that provides logistical assistance, which can include the following:

General travel advice

Emergency translation if you need an interpreter to help with legal or medical documents (cost isn't covered).

Lost item search if your belongings are lost while traveling.

Missing luggage assistance if an airline loses your luggage. The hotline will contact your airline on a daily basis on your behalf to help locate your bags.

Passport/credit card assistance if your credit card or passport is lost or stolen.

Urgent message relay if you need to contact a family member and/or friend in the event of an emergency.

Medical assistance

Emergency medical transportation assistance if the cardmember or another covered family member traveling on the same itinerary gets sick or injured and needs medical treatment (there are many conditions for this coverage; review your policy’s fine print).

Physician referral if you need a doctor or dentist (cardmember is responsible for costs).

Repatriation of remains in the event of death.

Financial assistance

Emergency wire service to get help obtaining cash (fees will be reimbursed).

Emergency hotel check in/out if your card has been lost or stolen.

Legal assistance

Bail bond assistance if you need access to an agency that accepts AmEx (cardmember is responsible for paying bail bond fees).

Embassy and consulate referral if you need help finding or accessing local embassies.

English-speaking lawyer referral if you’re traveling and need a list of available attorneys (cardmember is responsible for any legal fees).

To use this benefit, call the Premium Global Assist Hotline toll-free at 800-345-AMEX (2639). You can also call collect at 715-343-7979.

The main difference between the Global Assist Hotline and the Premium version is that some of the services that are fully covered by Premium Global Assist aren't covered in the more basic version (cited examples include emergency medical transportation assistance and repatriation of mortal remains).

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility.

AmEx cards with Global Assist Hotline access

The Global Assist Hotline is available to holders of the following cards:

American Express® Gold Card .

American Express® Business Gold Card .

American Express® Green Card .

Business Green Rewards Card from American Express .

Delta SkyMiles® Platinum American Express Card .

Delta SkyMiles® Platinum Business American Express Card .

Delta SkyMiles® Gold American Express Card .

Delta SkyMiles® Gold Business American Express Card .

Delta SkyMiles® Blue American Express Card .

Hilton Honors American Express Surpass® Card .

Hilton Honors American Express Card .

The Hilton Honors American Express Business Card .

Marriott Bonvoy™ American Express® Card.

Marriott Bonvoy Business® American Express® Card .

The Amex EveryDay® Preferred Credit Card from American Express .

Amex EveryDay® Credit Card .

Blue Cash Preferred® Card from American Express .

The American Express Blue Business Cash™ Card .

The Blue Business® Plus Credit Card from American Express .

You can call the Global Assist Hotline toll-free at 800-333-AMEX (2639), or collect at 715-343-7977.

If you don’t have any of the credit cards above and are thinking about purchasing a policy from American Express or just simply want to price compare to see if you get better perks by purchasing a policy, you can go to the AmEx travel insurance website and input your trip plans to build a quote. You’ll need to provide your departure and return date, state of residence, age of traveler, number of travelers covered by the policy and the trip cost per traveler. Then, you can select the option of choosing a package or building your own.

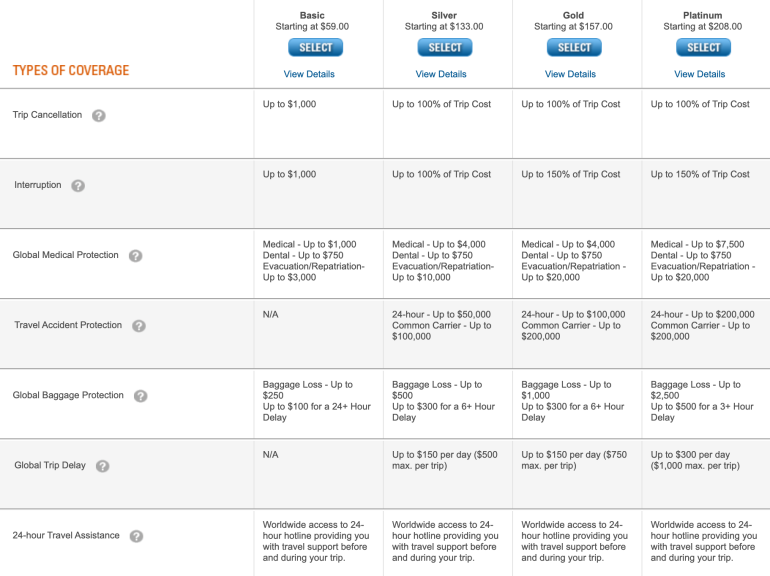

To see which plans are available, we input a sample $3,000, one-week trip by a 35-year-old from South Dakota. Our search result yielded four different plans ranging from $59 for a Basic plan to $208 for a Platinum plan.

Global medical protection (not included on AmEx cards)

Medical protection includes coverage for emergency healthcare and dental costs as well as medical evacuation and repatriation of remains . The limits increase as the plans become more expensive. Although AmEx cards offer an array of travel insurance benefits, medical coverage isn't included. So if medical protection benefits are important to you, a standalone travel insurance policy is what you’ll want to look for.

Travel accident protection (not included on AmEx cards)

Another benefit not included with AmEx cards is travel accident protection. This benefit provides coverage in case of death or dismemberment while traveling . Although this is a topic no one wants to think about, it's good to be familiar with this coverage. While travel accident protection isn’t offered on the Basic plan, all of the higher plans offer it.

Standalone policy benefits that are also included on AmEx cards

These elements of coverage are offered on the AmEx cards mentioned, although in some, the limits may be higher or lower.

Trip cancellation

The Basic plan only covers a trip up to $1,000, however, all the other plans cover 100% of the trip cost. To compare this with the perks included as a benefit on the cards, all AmEx cards that include trip cancellation coverage provide up to $10,000 per covered trip.

Keep in mind that, all the cards included have annual fees and the card with the lowest fee is the Hilton Honors American Express Aspire Card , with a $550 annual fee.

Trip interruption

Trip interruption coverage ranges from $1,000 on a Basic plan to 150% of trip cost on the Gold and Platinum plans. The trip interruption benefit offered by the AmEx cards is included on all the same cards that offer trip cancellation insurance, with the trip interruption limit capped at $10,000 per covered trip.

Global baggage protection

If your luggage is lost or stolen this benefit will provide monetary compensation to reimburse you for your lost items. AmEx cards offer baggage coverage as a complimentary benefit, with the higher-end cards naturally providing higher limits. Interestingly, the cards with the lower annual fees (i.e. Hilton Honors American Express Surpass® Card , annual fee $150 ) have a high limit as well, offering a total combined limit for lost luggage of $3,000, which is higher than the coverage offered by the standalone Platinum plan.

Global trip delay

If your trip is delayed, you’re eligible for reimbursement of any necessary expenses incurred up to a specific limit. The Basic plan doesn’t offer this benefit, but all the other plans do, with the Platinum plan providing up to $300 per day (maximum of $1,000 per trip). This coverage is also included on the higher-end AmEx cards.

AmEx cards offer key travel insurance benefits: trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, Premium Global Assist Hotline (or Global Assist Hotline). However, they don't offer any sort of emergency medical coverage. This is pretty typical of travel credit cards, as the travel insurance perks they offer don't provide coverage for emergency health care costs.

If you’re looking for emergency medical coverage, you’ll need to purchase a separate policy, such as the standalone one offered by American Express. The other limits provided in the American Express travel insurance policy are comparable to what you get on the AmEx cards, so it makes sense to shop around to make sure that the benefits you’re paying for are sufficient for your needs.

» Learn more: What to know about American Express Platinum travel insurance

Yes, if you have one of the cards listed above. If you have a credit card that isn’t listed in this guide or the card is no longer available by American Express, call the number on the back of your card for more information. Generally, AmEx offers a number of travel insurance benefits on its credit cards that shouldn't be overlooked.

Yes, but it depends on which card you have. To qualify for reimbursement, the trip cancellation must be for a covered reason. Refer to the section "Trip Cancellation and Interruption Insurance" for a list of cards and explanations of covered reasons.

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a separate travel insurance policy . If you only need emergency medical coverage , there are policies that provide that as well.

Call the number on the back of your card to ask for guidance. Some benefits may require authorization from American Express before coverage kicks in, so make sure you follow all the correct steps for reimbursement.

Refer to the AmEx credit card policy for the specific benefit because it will include instructions for submitting a claim. If you cannot find the policy, you should call the customer service number on the back of your American Express card for more assistance.

Yes. American Express offers travel insurance as a benefit of some of its cards, but it also sells standalone coverage that you can purchase out-of-pocket. The latter tends to be more comprehensive and customizable to your needs.

No, you do not get automatic travel insurance with American Express. It is available as a benefit on certain cards. Refer to your terms and conditions to learn if you are covered.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as repatriation of remains or medical evacuation coverage .

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a

separate travel insurance policy

. If you only need

emergency medical coverage

, there are policies that provide that as well.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as

repatriation of remains or medical evacuation coverage

American Express travel insurance offers a wide array of benefits, especially on its premium cards. Knowing what benefits are available to you is important in the event of unforeseen circumstances. Determine whether an individual policy is a better fit for your risk tolerance than coverage that is included on an eligible card, then go from there.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Underwritten by AMEX Assurance Company.

Baggage insurance plans

Please visit americanexpress.com/benefit sguide for more details.

Premium Global Assist Hotline

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

Card Members are responsible for the costs charged by third-party service providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Your complete guide to travel protections on American Express cards

Editor's note: This is a recurring post, regularly updated with new information.

Numerous American Express cards offer travel protections that can take the headache out of your vacations. However, the coverage you get (and the limits of said coverage) differ by card. Rather than trying to remember all of this on your own, we will guide you through the travel protections offered by American Express cards.

This guide provides a comprehensive, detailed look at the variety of travel protections offered across the American Express card portfolio. Each section outlines a type of coverage and the cards offering this coverage. We also include coverage limits and any additional caveats to keep in mind.

Here's what you need to know about American Express travel insurance coverage.

Trip delay insurance

Trip delay insurance covers you when you encounter travel delays. This could be a delayed flight due to mechanical issues or an unexpected overnight due to a weather-related cancellation. Other reasons are covered, but individual policies vary in what they do and don't cover. If the reason for your delay is not specifically mentioned in your policy, assume that it's not covered.

With trip delay protection, there are two different "levels" of coverage, depending on the card you carry.

Level 1: Higher-end cards

Some of American Express' top products offer trip delay reimbursement of up to $500 per covered trip that is delayed for more than six hours, capped at two claims per eligible card per 12 consecutive months.*

This protection becomes effective when you purchase a ticket using any of the following cards:

- The Centurion® Card from American Express**

- The Business Centurion® Card from American Express**

- The Platinum Card® from American Express

- The Platinum Card® from American Express for Schwab**

- The Platinum Card® from American Express for Goldman Sachs**

- The Platinum Card® from American Express for Morgan Stanley**

- The Platinum Corporate Card from American Express**

- The Business Platinum Card® from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Hilton Honors American Express Aspire Card **

- Marriott Bonvoy Brilliant® American Express® Card

- The American Express Corporate Platinum Card®**

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

**The information for these cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Level 2: Mid-tier cards

Other American Express cards offer trip delay reimbursement of up to $300 per covered trip that is delayed for more than 12 hours, capped at two claims per 12 consecutive months.*

Here are the cards that include this protection when you use them to purchase your tickets:

- American Express® Gold Card

- American Express® Green Card**

- American Express® Business Gold Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Marriott Bonvoy Bevy™ American Express® Card

Trip cancellation and interruption insurance

This type of coverage is for situations in which your trip is canceled or interrupted (meaning you started the trip but must end it to return home). As a result, you're forced to forfeit prepaid, nonrefundable reservations. Again, be sure that your policy mentions your specific reason for it to be covered.*

All Amex cards with this benefit provide the same level of protection. If your trip is canceled or interrupted for a covered reason, you can receive a maximum of $10,000 per covered trip and a maximum of $20,000 per eligible card in a 12-month period.

Here are the cards that include this protection when you use them to purchase travel:

- The Corporate Platinum Card® from American Express**

- The Corporate Centurion® Card from American Express**

Global Assist Hotline

Eligible cardholders can rely on the Global Assist Hotline 24 hours a day, 7 days a week for medical, legal, financial or other select emergency services coordination and assistance while traveling more than 100 miles from home.*

The Global Assist Hotline coordinates services but is not the service provider. Any third-party service costs may be your responsibility.

Here are the cards that include this protection when you use them to pay for your tickets:

- American Express® Cash Rebate Credit Card**

- Blue for Business® Credit Card**

- Blue Cash® from American Express**

- Blue Sky from American Express®**

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- Business Green Rewards Card from American Express **

- Clear from American Express®**

- Delta SkyMiles® Blue American Express Card

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Gold Business American Express Card

- Hilton Honors American Express Card

- Hilton Honors American Express Surpass® Card

- The Hilton Honors American Express Business Card

- Marriott Bonvoy™ American Express® Card**

- Marriott Bonvoy Business® American Express® Card

- The Plum Card® from American Express

- The Blue Business® Plus Credit Card from American Express

- The American Express Blue Business Cash™ Card

- Amazon Business Card**

- Amazon Business Prime Card**

- Lowe's Business Rewards Card**

- American Express® Corporate Gold Card**

- Corporate Green Credit Card**

- American Express Cash Magnet® Card **

- The Amex EveryDay® Credit Card from American Express**

- The Amex EveryDay® Preferred Credit Card from American Express**

- Blue from American Express®**

- SimplyCash® Plus Business Credit Card**

- SimplyCash® Business Card**

- American Express® Platinum Credit Card**

- American Express® Credit Card**

- One from American Express®**

- Zync from American Express®**

- Schwab Investor Card® from American Express**

- Morgan Stanley Credit Card from American Express**

- Platinum Optima® Card**

- Optima® Card**

- Bluebird® American Express® Reloadable Prepaid Card**

- Serve® American Express® Reloadable Prepaid Card**

- The Corporate Platinum® Card from American Express**

- American Express® Corporate Green Card**

- Business Extra℠ Corporate Card**

- American Express® Corporate Accenture Gold**

- American Express® Corporate Meeting Card**

- American Express® Corporate Defined Expense Program Card**

- American Express® Corporate Purchasing Card**

- Morgan Stanley Blue Cash Preferred® American Express Card**

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Cardmembers are responsible for the costs charged by third-party service providers.

Premium Global Assist Hotline

Like the benefit above, eligible cardholders for certain premium Amex cards can rely on the Global Assist Hotline 24/7 for medical, legal, financial or other select emergency services coordination and assistance services while traveling more than 100 miles from home. With the Premium benefit, emergency medical transportation assistance and related services may be provided at no cost.*

If approved and coordinated by the Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost to you. Otherwise, third-party service costs may be your responsibility.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, cardmembers are responsible for the costs charged by third-party service providers.

Baggage insurance plan

Baggage insurance applies to covered persons for eligible lost, damaged or stolen baggage during travel on a common carrier vehicle (such as a plane, train, ship or bus) when the entire fare for a ticket on the trip (one-way or round trip) is charged to an eligible card.

This benefit has two different "levels" of coverage, depending on the card you carry.

Some of American Express' top products offer baggage insurance coverage of up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage. This coverage is in excess of coverage provided by the common carrier. Coverage is subject to a $3,000 aggregate limit per covered trip.*

For New York state residents, there is a $2,000 per bag/per suitcase limit for each covered person, with a maximum of $10,000 aggregate for all covered persons per covered trip.*

Other American Express cards offer baggage insurance coverage of up to $1,250 for carry-on baggage and up to $500 for checked baggage. This coverage is in excess of coverage provided by the common carrier.*

For New York state residents, there is a maximum of $10,000 aggregate for all covered persons per covered trip.*

- American Express® Green Card

- American Express® Gold Card for Ameriprise Financial**

- American Express® Corporate Accenture Gold Card**

- American Express® Executive Business Card**

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Car rental loss and damage insurance

Car rental loss and damage insurance applies to the theft of or damage to most rental vehicles when you use an eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the rental car company. Note that this product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered, and geographic restrictions apply.

Some of American Express' top products offer car rental loss and damage insurance of up to $75,000 for theft of or damage to eligible rental vehicles.*

Here are the cards that include this protection when you use them to pay for eligible rentals:

- Centurion® Card from American Express**

- Business Centurion® Card from American Express**

Other American Express cards offer car rental loss and damage insurance of up to $50,000 for theft of or damage to eligible rental vehicles.*

- Amex EveryDay® Credit Card**

- Amex EveryDay® Preferred Credit Card**

- SimplyCash® Plus Business Card**

- American Express® Business Purchase Account**

*Eligibility and benefit level varies by card. Not all vehicle types or rentals are covered, and geographic restrictions apply. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company. Coverage is offered through American Express Travel Related Services Company, Inc.

Bottom line

Understanding what benefits your card has to protect you when things go wrong during a trip can help reduce headaches. To that end, American Express provides multiple travel protections across many of its card products.

Coverage limits within the same benefit can vary by the card you have, so consult your card's detailed benefits at americanexpress.com/benefitsguide for full details.

Introduction to American Express Travel Protection

Types of travel protection offered, american express travel protection: a guide to your benefits.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Hilton Honors American Express Aspire Card, Amex EveryDay® Preferred Credit Card, American Express® Green Card, The Plum Card® from American Express. The details for these products have not been reviewed or provided by the issuer.

- Some American Express cards offer trip cancellation and interruption benefits .

- You'll find these perks on cards like The Platinum Card® from American Express.

- If you're eager to sign up for a travel credit card with perks, compare each card's offerings.

Overview of Travel Protection Benefits

While credit card insurance and travel protection coverage are usually considered secondary to rewards programs and other cardholder perks, these benefits can be equally important if you travel.

When you pay for a trip with a credit card that offers trip cancellation and interruption insurance, for example, you can get reimbursed for some of your travel expenses in the event your vacation is halted for reasons beyond your control. Meanwhile, trip delay insurance lets you apply for some reimbursement when a delay of your trip results in surprise expenses, such as an unplanned hotel stay near the airport when your flight is on hold.

Importance of Travel Insurance

Chase credit cards like the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card have really stood out for years in terms of the protections they offer, and with some of the highest limits out there. Still, American Express is still coming around — it recently added trip cancellation and interruption insurance, along with trip delay coverage, to many of its top rewards credit cards.

If you're in the market for an American Express card and you're hoping to take advantage of important travel benefits, consider the cards below and their expanded travel protections.

Trip Cancellation and Interruption Insurance

New trip cancellation and interruption insurance from American Express credit cards will provide you with up to $10,000 in coverage (and up to $20,000 per account per year) you can use for reimbursement of prepaid travel expenses like airfare and hotels. This coverage can come in handy if your trip is canceled for a covered reason beyond your control, or you're stuck in your destination and require an extended stay and additional costs before you can return home.

Note that this coverage is good for round-trip travel booked with your credit card, meaning you have to pay for travel expenses with a common carrier with your American Express credit card in order to be eligible.

American Express cards that qualify for this coverage include:

- The Platinum Card® from American Express

- Delta SkyMiles® Reserve American Express Card

- Hilton Honors American Express Aspire Card

- Marriott Bonvoy Brilliant® American Express® Card

- The Business Platinum Card® from American Express

- Delta SkyMiles® Reserve Business American Express Card

Other versions of the Amex Platinum card — including the Goldman Sachs, Morgan Stanley, and corporate flavors — also offer this coverage, as do all versions of the Amex Centurion (black) card , which is invite-only.

Baggage Insurance Plan

Quite a few American Express credit cards also offer a baggage insurance plan, although this isn't a new or upgraded benefit from the card issuer. This coverage can come in handy if your luggage is lost or stolen during a covered trip. To be eligible for this coverage, you have to pay for travel with a common carrier (airfare, cruise fare, etc.) with your American Express credit card.

The amount of coverage you'll receive depends on the card you have. For example, baggage insurance from the The Platinum Card® from American Express offers up to $3,000 in coverage per person for carry-on luggage and up to $2,000 per person in coverage for some types of checked baggage.

With baggage insurance from the Amex EveryDay® Preferred Credit Card , on the other hand, you'll only qualify for up to $1,250 in coverage per person for carry-on luggage and up to $500 for covered checked baggage, although an extra benefit of $250 is offered for qualified "high risk items" like jewelry or sporting equipment.

American Express cards that come with baggage insurance include:

- The Platinum Card® from American Express (including various versions)

- American Express® Gold Card (including various versions)

- American Express® Green Card (including various versions)

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Platinum American Express Card

- Hilton Honors American Express Surpass® Card

- Amex EveryDay® Preferred Credit Card

- The Plum Card® from American Express

American Express business cards with baggage insurance include:

- American Express® Business Gold Card

- The Blue Business® Plus Credit Card from American Express

- Delta SkyMiles® Gold Business American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Marriott Bonvoy Business® American Express® Card

- The Hilton Honors American Express Business Card

- Lowe's Business Rewards Card from American Express

- Amazon Business Prime American Express Card

- Amazon Business American Express Card

Various versions of the Amex Centurion card and several Amex corporate cards also offer baggage insurance.

Travel Accident Insurance

Some American Express cards also offer secondary auto rental coverage, which means this coverage kicks in after other policies you have are exhausted, as opposed to primary car rental coverage.

While this benefit applies to many Amex cards, note that coverage limits can vary. With the Amex Gold card, for example, coverage is limited to $50,000 per rental agreement for damage or theft, yet the Amex Platinum card offers up to $75,000 in coverage. The insurance doesn't cover personal liability, either.

Also note that this coverage comes with a certain amount of Accidental Death or Dismemberment Coverage that varies by card. With , for example, you'll receive up to $200,000 in coverage per person and up to $300,000 in coverage per car accident for accidental death and dismemberment. Make sure to read your credit card's terms and conditions so you know exactly how much coverage you have.

American Express cards that come with secondary auto rental coverage include:

- The Platinum Card® from American Express (including various versions)

- Delta SkyMiles® Blue American Express Card

- Hilton Honors American Express Card

- Marriott Bonvoy American Express® Card (no longer available to new applicants)

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- Amex Everyday® Credit Card from American Express

And business cards from Amex that offer secondary car rental insurance include:

While American Express did offer travel accident insurance on some of its cards, this coverage was effectively dropped as of January 1, 2020. The same is true for the American Express Roadside Assistance Hotline, which is no longer available.

Trip Delay Insurance

In January of 2020, American Express also rolled out an upgraded trip delay insurance benefit for many of its top rewards credit cards. While this perk may seem like an unusual one, there are so many scenarios where trip delay coverage could help you save money and avoid surprise expenses when travel is delayed beyond your control.

With trip delay coverage from Amex, you can be reimbursed for up to $500 per trip for hotel stays, meals, and other miscellaneous required expenses when your flight or other trip plans are delayed by more than six hours. If you're sitting at the airport and your flight is suddenly delayed until the next morning, for example, you could use this coverage to get reimbursed for a nearby airport hotel and your dinner, then for an Uber or Lyft ride back to the airport.

To qualify for American Express trip delay coverage, you need to pay for your round-trip travel expenses with a common carrier with your credit card.

Amex cards that come with trip delay coverage include:

- American Express® Gold Card

- American Express® Green Card

Again, the various versions of the Amex Platinum and Amex Centurion cards also offer trip delay insurance.

Most travel protections are automatically activated when you use your American Express card to book your travel. However, specific activation steps, if any, depend on the benefit.

Covered reasons for trip cancellation or interruption typically include illness, severe weather, and other unforeseen events, reimbursing you for non-refundable travel expenses.

Yes, baggage insurance plans come with coverage limits, which vary depending on the card and the type of loss (e.g., lost, damaged, or stolen baggage).

The Global Assist Hotline offers medical, legal, and other emergency coordination and assistance services, but financial costs for services rendered are typically the cardholder's responsibility.

Eligibility for specific travel protections varies by card. Premium cards often offer more comprehensive protections compared to basic cards.

For rates and fees of The Platinum Card® from American Express, please click here.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company. Global Assist Hotline Card Members are responsible for the costs charged by third-party service providers. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers. Extended Warranty, Purchase Protection, and Baggage Insurance Plan Underwritten by AMEX Assurance Company. Car Rental Loss & Damage Insurance Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

- Main content

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Amex rental car insurance: Get added protection for road trips and adventures

B esides generous rewards, the best credit cards offer several valuable perks to benefit cardholders. One of these perks is rental car insurance, which helps protect you when you use your credit card to rent a car. Several card issuers, including American Express, provide a rental car insurance benefit.

If you’re an Amex cardholder, here’s what to know about its rental car insurance, how it protects you, and how to file a claim.

What is the American Express rental car insurance policy?

American Express provides secondary rental car coverage as a complimentary benefit with many of its credit cards. This coverage serves as a backup to your primary insurance coverage when you use your card to rent a car and decline the rental car company’s collision damage waiver (CDW).

“Generally, your personal auto insurance would need to be utilized first before submitting a claim with the insurance provided through your credit card,” says Kim Chambers, Product Manager, Credit Cards for Georgia's Own Credit Union . “The major benefit of secondary coverage is it often covers the deductible for your primary insurance.”

Your credit card rental car insurance can also help cover the gap if another driver hits your rental car and the cost of the repairs exceeds your primary insurance policy’s limits. Certain premium Amex cards, like the The Platinum Card® from American Express, provide additional insurance coverage beyond coverage for damage or theft.

In addition to the secondary coverage benefit with many of its cards, Amex offers optional premium rental car coverage for a flat rate. This coverage also protects your rental if it's damaged or stolen, but it serves as primary instead of secondary coverage. This means you’d file a claim with Amex for damage or theft before contacting your personal insurance. While Amex’s premium coverage comes at a cost, you won’t pay a deductible before it kicks in.

What is covered?

The complimentary coverage benefits you receive as an Amex cardholder will vary depending on your card. Most cards offer protection against theft or damage, though some may provide additional coverage, such as accidental injury or accidental death and dismemberment insurance.

Besides protecting your rental car if it’s damaged or stolen, premium rental car coverage from American Express provides these additional protections for drivers and passengers.

- Secondary medical coverage

- Secondary personal property coverage

- Accidental death and dismemberment coverage

“There are limitations to be aware of with credit card rental car insurance,” warns Stuart Winchester, founder and CEO of digital insurance wallet Marble . “The amount of coverage may not be sufficient, and you might not be covered everywhere you travel. It’s important to read the fine print to understand potential exclusions.”

Note that neither the standard rental car insurance nor the premium insurance provides liability coverage, which protects you if another driver or their passengers are injured or another vehicle is damaged due to an accident you cause.

Who does the policy cover?

Coverage varies slightly by card, but it applies to the following drivers in most cases. Certain cards, like the The Platinum Card® from American Express, also offer protections for passengers.

- The cardholder’s spouse or partner

- Authorized drivers on the rental contract

Amex rental car insurance pricing

As mentioned, American Express offers complimentary rental car insurance with many of its cards. You won’t pay anything out of pocket for this secondary coverage. But if you opt for its premium car rental coverage, you’ll pay a flat rate of $12.25 to $24.95 per rental period, depending on your coverage level.

Amex rental car insurance coverage levels

- Complimentary coverage: Up to $50,000 or $75,000 for theft or damage, depending on the card. Certain cards also provide additional accidental death and dismemberment, accidental injury, and car rental personal property coverage.

- Premium coverage : Up to $100,000 for theft, damage, accidental death and dismemberment coverage; up to $15,000 for secondary medical expenses; and up to $5,000 in secondary personal property coverage.

Which Amex cards include car rental insurance?

Over 60 American Express cards include car rental insurance, but coverage amounts vary by card. For example, the The Platinum Card® from American Express offers up to $75,000 in coverage for damage or theft of a rental car. By comparison, the American Express® Green Card has $50,000 worth of theft and damage coverage.

To view rates and fees of The Platinum Card® from American Express, see this page .

To view rates and fees of Marriott Bonvoy Brilliant® American Express® Card , see this page .

To view rates and fees of American Express® Gold Card, see this page .

To view rates and fees of Blue Cash Everyday® Card, see this page .

How do I file a claim?

Amex cards come with secondary rental car insurance, meaning you must first file a claim with your personal insurance company if your rental car is damaged or stolen. That said, primary coverage is available for an added cost with Amex premium rental car insurance.

You can file a claim with American Express after a qualifying incident online or by calling 1-800-338-1670. Be prepared to provide copies of the following as part of the process:

- Rental agreement

- Police reports

- Insurance coverage information

- Relevant repair bills or receipts

Amex generally takes about 45 days to process claims, and you can check on your claim’s status anytime online or by calling (800) 338-1670.

The takeaway

Amex has two rental car insurance options for cardholders: secondary coverage, a free perk with many of its cards, and optional primary coverage available for a fee. The secondary coverage benefits will vary depending on your card, with premium cards like the Platinum Card® from American Express offering more comprehensive coverage.

But both its secondary and primary rental car coverage provide valuable protection. The secondary coverage available to cardholders can reimburse you for the deductible on your primary insurance, as well as any costs exceeding your personal policy limits. If you opt for its primary coverage for a fee, you’ll get up to $100,000 in theft and damage insurance, plus other coverages for added protection.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

This story was originally featured on Fortune.com

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Green Card

Full List of Travel Insurance Benefits for the Amex Green Card [2023]

Senior Content Contributor

486 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Stella Shon

News Managing Editor

85 Published Articles 619 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3112 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

![do i get travel insurance with amex Full List of Travel Insurance Benefits for the Amex Green Card [2023]](https://upgradedpoints.com/wp-content/uploads/2023/05/Amex-Green-Upgraded-Points-1c-1.jpg?auto=webp&disable=upscale&width=1200)

Why the Amex Green Card Is Worth Considering

Car rental loss and damage insurance, trip delay insurance, baggage insurance plan, clear plus credit, loungebuddy credit, emergency travel assistance, no foreign transaction fees, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

One of the most underestimated cards out there is the American Express ® Green Card , which is actually one of American Express’ first cards. It was the original charge card that was born in 1969, but it has fallen out of favor in recent years due to the meteoric growth of more premium options like the American Express ® Gold Card and The Platinum Card ® from American Express.

In fact, the money-colored card happens to be a good pick if you want travel perks and the ability to earn lots of points, all for a reasonable $150 annual fee.

In this guide, we’ll be walking you through its lesser-known travel insurance benefits that can come in handy if your trip goes awry.

Amex Green Card — Snapshot

American Express ® Green Card

This card can provide a great way to accumulate Membership Rewards points on eligible travel, transit, and at restaurants.

The American Express ® Green Card is an excellent all-around travel rewards card thanks to earning 3x Membership Rewards ® points on eligible travel and transit purchases and at restaurants, access to American Express transfer partners, and a reasonable annual fee.

- 3x points per $1 spent at restaurants worldwide, on all eligible travel purchases, and transit purchases

- Up to $189 per calendar year in statement credits after you pay for a CLEAR ® Plus membership with the Card.

- Up to $100 in statement credits annually when you purchase airport lounge access through LoungeBuddy with the Card.

- Access to American Express transfer partners

- No foreign transaction fees

- $150 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 40,000 Membership Rewards ® Points after you spend $3,000 in eligible purchases on your American Express ® Green Card within the first 6 months of Card Membership.

- Earn 3X Membership Rewards ® points on travel including airfare, hotels, cruises, tours, car rentals, campgrounds, and vacation rentals.

- Earn 3X Membership Rewards ® Points on transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways.

- Earn 3X Membership Rewards ® points on eligible purchases at restaurants worldwide, including takeout and delivery in the US.

- $189 CLEAR Plus Credit: Receive up to $189 per calendar year in statement credits when you pay for your CLEAR Plus membership (subject to auto-renewal) with the American Express ® Green Card.

- $100 LoungeBuddy: No airport lounge membership? No problem! Purchase lounge access through the LoungeBuddy app using the American Express ® Green Card and receive up to $100 in statement credits annually.

- Payment Flexibility: When it comes to paying your bill, you have options. You can always pay in full. You also have the flexibility to carry a balance with interest or use Plan It ® to split up large purchases into monthly payments with a fixed fee, up to your Pay Over Time Limit. You may be able to keep spending beyond your limit – you’ll just need to pay for any new purchases in full when your bill is due.

- Trip Delay Insurance: If a round-trip is paid for entirely with your Eligible Card and a covered reason delays your trip more than 12 hours, Trip Delay Insurance can help reimburse certain additional expenses purchased on the same Eligible Card, up to $300 per trip, maximum 2 claims per eligible account per 12 consecutive month period. Terms, conditions and limitations apply. Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- No Foreign Transaction Fees: No matter where you’re traveling, when you use your American Express ® Green Card there are no foreign transaction fees.

- $150 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Benefits of the Amex Green Card

- Travel Insurance Benefits of the Amex Green

- Amex Green CLEAR Plus Credit

- The Amex Green $100 LoungeBuddy Credit

- Is the Amex Green a Good Card for Frequent Travelers?

- Amex Gold vs Amex Green

- Chase Sapphire Preferred vs Amex Green

- Amex Transfer Partners

- Best American Express Credit Cards

- Best Credit Cards for CLEAR

One of the crucial selling points of the Amex Green card is the ability to earn a valuable welcome bonus offer after meeting reasonable spending requirements within the first few months of being approved for a new account. Make sure to see what the current welcome offer is when applying, as it can change from time to time.

Although it’s not as popular compared to the Amex Gold card or Amex Platinum card , the Amex Green card is actually one of the most powerful Amex cards available for earning travel rewards. That’s because you’ll earn up to 3x Membership Rewards points on many popular spending categories.

The Amex Green card earns Membership Rewards points at the following rate:

- 3x points at restaurants worldwide, including takeout and delivery in the U.S.

- 3x points on travel , including airfare, hotels, cruises, tours, car rentals, and more

- 3x points on transit , including trains, buses, ferries, subways, and more

- 1x points on other purchases

The feature that sets apart the Amex Green card the most from its sister cards like the Amex Gold card and Amex Platinum card is the ability to earn 3x points on travel , which is defined very broadly.

For example, if you book a hotel through Booking.com , pay for a cruise with Norwegian Cruise Line , or order an Uber using your Amex Gold card or Amex Platinum card, you’d only earn 1x points on those purchases. Not so with the Amex Green card — you’ll earn 3x points on those same transactions!

The points earned on the Amex Green card are Membership Rewards points (just like you’d earn with the Amex Gold card and Amex Platinum card), which means you can transfer them to travel partners and book luxury award travel for pennies on the dollar!

If you want to learn more about how to maximize the value of Amex Membership Rewards points, read our guide on the best ways to redeem Membership Rewards points .

The Amex Green card also offers an annual CLEAR Plus membership credit of up to $189 and an annual LoungeBuddy credit of up to $100 to add even more value to your wallet. CLEAR gets you access to expedited security at airports and stadiums around the U.S. while the LoungeBuddy credit can cover the cost of 2 to 3 airport lounge visits a year.

Finally, the Amex Green card offers a number of travel insurance benefits, which we’ll dive into in detail below.

Amex Green Card — Travel Insurance Benefits

With the Amex Green card, you don’t get access to fancy Amex Centurion Lounges or perks like free breakfast and room upgrades when booking through Amex Fine Hotels & Resorts .

But you’ll still get a handful of useful travel protections and benefits that could save you thousands of dollars in the long run (though we hope you won’t ever have to use these benefits because that would mean an unfortunate incident has occurred).

If you tend to rent cars while traveling, you might be surprised to discover that many credit cards offer insurance for your rental car. In this case, the Amex Green card comes with secondary rental car coverage (not to be confused with primary rental car coverage).

Secondary rental car insurance requires you to file a claim with any other insurance policies you have (including the one you use for your main car at home) before any of its coverage can apply.

Also, this particular rental car coverage policy covers rentals of up to 30 consecutive days and insures up to $50,000 per rental.

Premium Protection

With the Amex Green card, you also have the ability to purchase primary rental car coverage through Premium Protection , which comes at a low, fixed price of between $12.25 and $24.95 for the entire rental duration (eligible rentals can be up to 42 total days in length).

There’s no deductible, and this is a per-rental rate, not a per-day rate, which translates to much greater savings over other primary car rental insurance policies. The policy includes accidental death/dismemberment coverage, rental car damage, theft, and loss of use coverage.

Keep in mind that neither of these policies offers liability coverage — so if you are deemed at fault for the incident, you’ll be solely responsible for any costs and damages incurred regardless of whether you purchase Premium Protection or stick with the standard secondary car rental insurance. There’s also no disability coverage or uninsured/under-insured motorist coverage with Premium Protection.

Also, there is no coverage available when renting motor vehicles in these countries:

- New Zealand

- Any other countries subject to comprehensive sanctions administered by the Office of Foreign Assets Control (e.g. Iran, Cuba, etc.)

Filing a Claim

You can file a claim for a covered incident by calling 800-338-1670 within 30 days of the loss or as soon as reasonably possible. You can also file a claim at the American Express Claims Center .

After opening a claim, you’ll be sent additional forms within 15 days of reporting the incident to complete. These claims must be submitted, alongside any required documentation within 60 days after the incident.

Any claims that are fully substantiated will be paid within 30 days after your claim is approved.

Another lovely benefit of the Amex Green card is trip delay insurance, which can cover you in the event that you’ve booked round-trip travel (which can consist of a combination of one-way tickets) entirely on your Amex Green card and there’s a covered delay of more than 12 hours. Coverage is also secondary to any primary coverage you may hold.

This insurance policy covers common carrier tickets, meaning any land, water, or air conveyance operating under a valid license for the transportation of passengers for hire and for which a ticket must be purchased prior to commencing travel.

Commercial airline tickets are eligible, as are high-speed train tickets and even cruises. However, some exclusions include taxis, limousine services, commuter rail or commuter bus lines, personal automobiles, or rental vehicles.

You, eligible family members, and traveling companions can get up to $300 in trip delay coverage towards the purchase of reasonably essential expenses like meals, lodging, toiletries, medication, and other personal use items if your trip is delayed more than 12 hours.

You can be approved for up to 2 trip delay claims every consecutive 12-month period.

Covered losses include:

- A common carrier’s equipment failure

- Inclement weather , which prevents a reasonable and prudent person from traveling or continuing (e.g. severe weather that delays the scheduled arrival or departure of a common carrier)

- Lost or stolen passports or travel documents

- Terrorist action or hijacking

Anything that falls outside of the categorization for covered losses is considered to be an exclusion for trip delay coverage.

For example, if the airline struggles to staff your aircraft with a crew, this would not be grounds for a covered trip delay because it doesn’t fall under the 4 bullet points above.

You can open a claim by calling your Benefits Administrator at 844-933-0648 within 60 days of the covered loss. The representative will provide instructions for submitting a completed claim and any required documentation which must be furnished within 180 days after the date of the covered loss.

Another great travel protection benefit of the Amex Green card is the baggage insurance plan. Simply pay for your common carrier ticket entirely using your Amex Green card (or using Membership Rewards points) to get baggage insurance coverage.

Coverage can apply to the cardmember, cardmember’s spouse or domestic partner, cardmember’s dependent children under 23 years of age, or dependent children because of a handicap condition that occurred before the attainment of the limited age of 23.

With the exception of war, acts of war, service in the armed forces or united auxiliary to it, acts of the customer or government authority, you can be eligible for the replacement cost of baggage and its contents subject to these coverage limits:

There’s also a sub-limit of $250 maximum per covered person per trip for all bags for high-risk items like jewelry, sporting equipment, photographic or electronic equipment, and more.

Lastly, for New York state cardmembers, there’s a maximum limit of $10,000 in aggregate per trip for all covered persons.

Here are the types of property that are excluded from coverage:

- Cash or its equivalent, notes, accounts, bills, currency, deeds, evidence of debt or intangible property, rare stamps or coins

- Credit cards and other travel documents including passports and visas

- Documents and tickets of any kind

- Eyeglasses, sunglasses, and contact lenses

- Food, consumable, and perishable items

- Hearing aids

- Living plants and animals

- Prescription or non-prescription drugs

- Property shipping as freight or shipped prior to the departure date

- Prosthetic devices

- Traveler’s checks and other negotiable instruments including gift certificates, gift cards, gift checks, food stamps

You can file a claim by visiting the A merican Express Online Claim Center or by calling 800-228-6855. You’ll need to provide notice of a claim within 30 days of the loss or as soon as reasonably possible.

Complete the claim form and submit any required or supplemental documentation within 60 days. This includes a list of the items lost, receipts, and other reports.

Approved claims will be paid within 30 days after satisfactory proof of loss evidence has been received.

Travel Benefits

Outside of travel insurance and protection, there are still a number of ways the Amex Green card can help when you’re traveling.

CLEAR uses biometrics to digitally verify your identity and move you through security faster at major airports and stadiums across the U.S.

When you use the Amex Green card to pay for a CLEAR Plus membership, you can receive up to $189 per calendar year in statement credits, which can offset the entire cost of an annual CLEAR Plus membership.

One other valuable benefit of the Amex Green card is the ability to get up to $100 in statement credits every calendar year when you purchase lounge access through LoungeBuddy.

LoungeBuddy allows you to purchase one-time access to hundreds of airport lounges around the world and doesn’t require you to buy any memberships, qualify for elite status, or pay for pricey first class tickets. The $100 credit should cover 2 to 3 lounge visits booked through LoungeBuddy.

If you travel a significant amount and value airport lounge access, you might want to consider getting the Amex Platinum card , as it offers access to over 1,400 different lounge locations worldwide.

With the Amex Green card, you can get 24/7/365 assistance through the Global Assist Hotline, which can point you in the right direction if you’re looking for medical, legal, linguistic, or other urgent needs while traveling more than 100 miles away from home.

You can reach the Global Assist Hotline by calling 800-333-2639. If you’re outside of the U.S., you can call collect at 715-343-7977.