Please update your browser.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Update your browser

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Credit Cards

Checking Accounts

Savings Accounts

Chase.for Business

Commercial Banking

- ATM & branch

Chase Ultimate Rewards redeem points

Please turn on javascript in your browser.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Chase Ultimate Rewards ®

Use your points to fuel your passions.

Not earning rewards? Apply for a Chase credit card with Ultimate Rewards today.

Explore the possibilities

Earn bonus points on select purchases and redeem for travel, gift cards, cash back and more.

Pay with Points

Use your points to pay for all or part of your eligible Amazon.com orders or when you check out with PayPal.

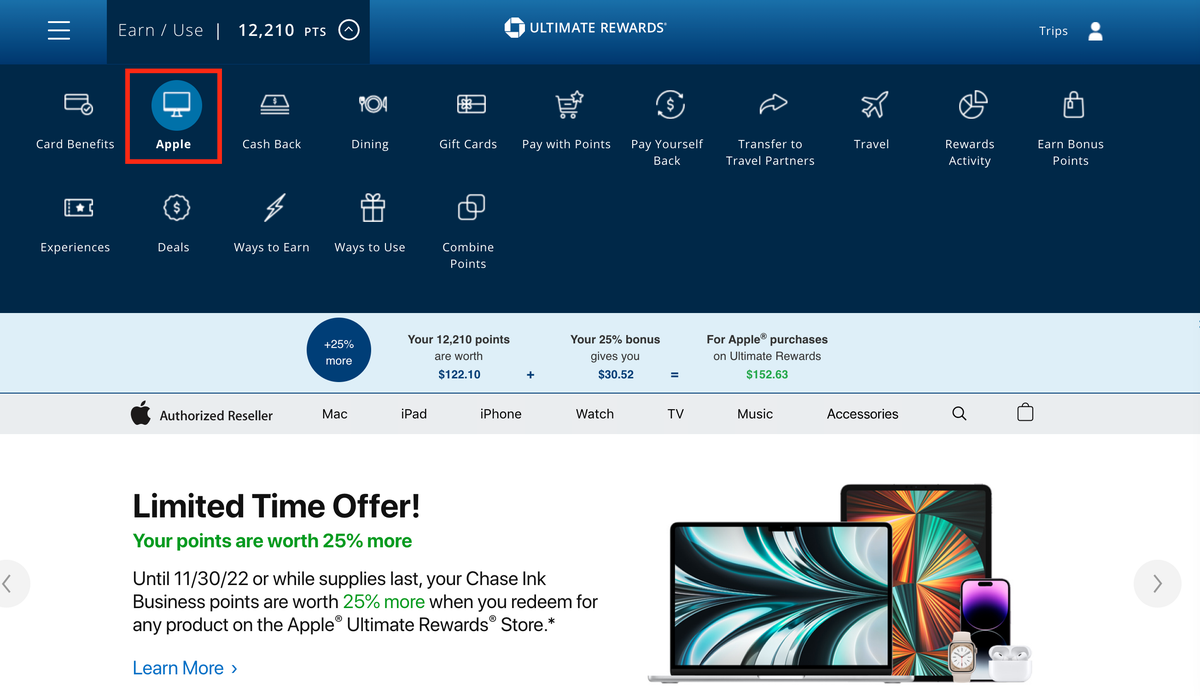

Apple ® Ultimate Rewards Store

Use your points to pay for all or part of your Apple purchases.

Shop over 175 of your favorite gift card brands.

Pay Yourself Back

Choose to receive a statement credit on one or more of your eligible purchases.

Chase Dining℠

Redeem your points for takeout, reservations or exclusive culinary experiences.

Plan your next getaway, and use your points to help pay for it.

Earn Bonus Points

Earn 1-15 bonus points per $1 spent at 450+ stores with Shop through Chase ® .

Turn your rewards into a statement credit or a direct deposit into most U.S. checking and savings accounts.

Experiences

Use your card and points to attend exclusive events curated around your passions with select cards.

Transfer to Travel Partners

Transfer your points to any of our airline and hotel partners at full 1:1 value with select cards.

Enjoy value, flexibility and choice

Here are just some of the perks you could get with Chase Ultimate Rewards.

Ready to get away?

Remember to book your travel through Chase. You'll get competitive prices plus the flexibility to use your points, your card or both.

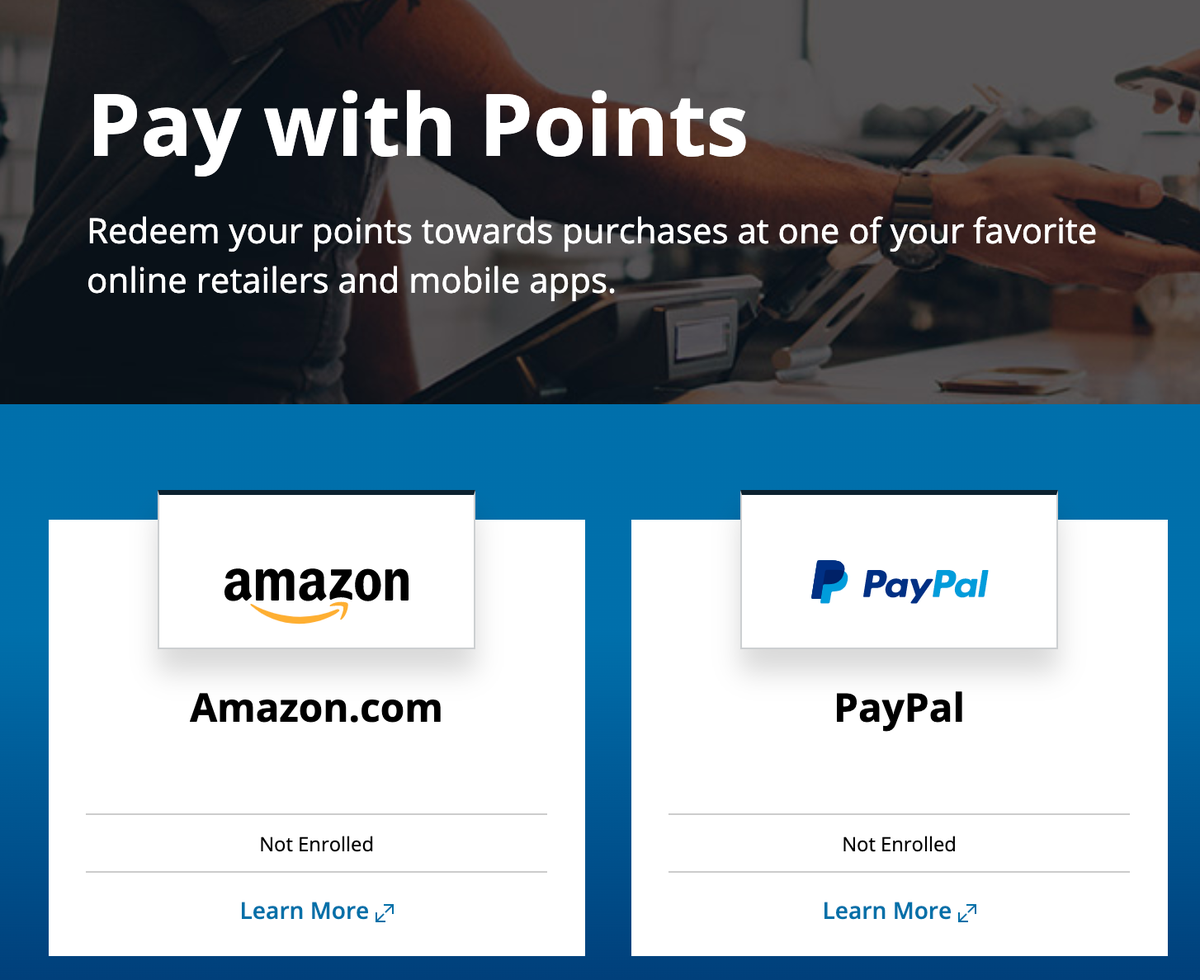

Pay with points

Instantly redeem your points to pay for all or part of your eligible orders at Amazon.com or when you check out with PayPal.

Find something delicious

Visit Chase Dining℠ to redeem points for takeout, access exclusive reservations and book culinary experiences.

Si tienes alguna pregunta, por favor, llama al número de teléfono que está al reverso de tu tarjeta.

Chase Survey

Your feedback is important to us. Will you take a few moments to answer some quick questions?

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase’s Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use the portal?

Benefits of booking travel in the portal, is chase's travel portal worth using, does chase's travel portal price match, how to use chase's travel portal, what else you need to know, chase travel portal tips, recapped.

Chase's travel portal is one of the best features of having a Chase credit card. Earning Ultimate Rewards® with credit cards like Chase Sapphire Preferred® Card and Chase Sapphire Reserve® can deliver big value if you know how to navigate Chase's travel portal.

Much like third-party booking sites like Orbitz or Expedia , you can use Chase's travel portal to book flights, hotels and cruises, among other things. You can redeem points to offset the cost of the trip or pay in cash. You won’t have to worry about blackout dates or award inventory caps like you may find when using airline miles or hotel points for the same trip since you are essentially buying travel with cash.

Within the portal, you can also redeem points for merchandise or transfer them to other travel loyalty programs if you are short on miles and points there. In short, having a flexible points currency like Chase Ultimate Rewards® is one of the smartest routes you can take in the miles and points game. Booking travel through Chase's travel portal is simple. Here’s what you need to know about the portal.

» Learn more: Chase Ultimate Rewards®: How to earn and use them

Not all Chase cards have the same benefits. Only some cards earn Ultimate Rewards® points; others may earn loyalty miles and points with an affiliated partner. For example, the United℠ Explorer Card earns United MileagePlus miles.

These are examples of cards that earn Chase Ultimate Rewards® and give access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Chase Freedom Unlimited® .

Chase Freedom Flex℠ .

Ink Business Preferred® Credit Card .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in the travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in the travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in the travel portal: 1 cent apiece.

Point value in Chase travel portal: 1 cent apiece.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Earn points on paid reservations

The primary reason you may want to book travel via Chase's travel portal is that you earn Chase Ultimate Rewards® on paid reservations. You can earn 5x points on airfare booked within the portal and 10x points on hotels and car rentals.

That can really add up, but beware that when booking hotels with Chase Ultimate Rewards®, you are not eligible to earn points with the hotel loyalty program or reap elite status benefits since it is using a third-party service. The tradeoff can vary by property, but using Chase's travel portal is especially helpful when booking unaffiliated hotels or hotel brands where you usually do not collect points or have elite status. In those instances, you are less likely to be passing up the perks of points earning and elite status.

Earn points on airfare even for redemptions

When booking airfare through Chase, you do earn miles no matter if you pay with cash or points. This makes using points for airfare via the travel portal more beneficial than redeeming for a hotel.

Earn bonus points for restaurant bookings

You can even earn bonus points when making restaurant bookings through the portal. This can be a great way to enhance your trips with great dining in advance rather than chatting with your hotel concierge.

Shop for the best value redemption

Since the value per Chase Ultimate Rewards® points is relatively constant, using the travel portal may not always be the best option. You may be able to spend fewer points if you book the same trip with the specific airline or hotel's points instead of Chase Ultimate Rewards® points. This is more common with itineraries with high cash prices, like a hotel night that's particularly expensive. Always compare the cost of using traditional miles and points over using Chase points to see which offers better value. In some cases, you may want to transfer Chase points to partner programs to squeeze more value from them.

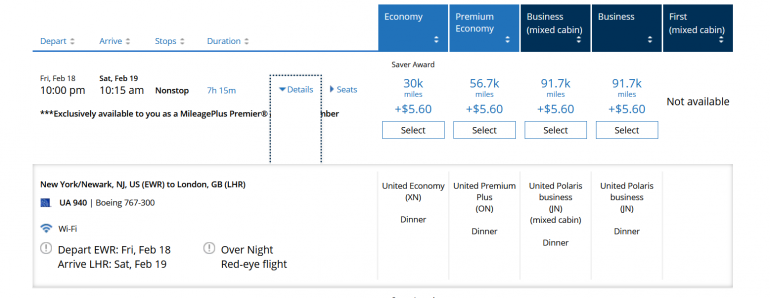

One example where that could be exceptional value is for expensive business class tickets that also have award availability. Let’s say you’re looking for a United business class ticket between Newark and London. If the cash cost of a one-way ticket is $2,505, that will cost you 250,500 Ultimate Rewards® points when redeeming at a value of one penny per point. In this example, it may be worth redeeming MileagePlus miles instead.

For this flight, the one-way mileage cost is 91,700 miles. Even if you don’t have enough United miles, you could transfer that amount from Chase Ultimate Rewards® (since they are partners), and save yourself a nice chunk of Chase points in the process. It is always best to compare the cash cost with the redemption cost using both Chase and the airline or hotel’s own loyalty program.

» Learn more: The best Chase transfer partners — and the ones to avoid

Chase's travel portal can be worth using in specific scenarios.

Redemptions: You hold the Chase Sapphire Reserve® , the Ink Business Preferred® Credit Card or the Chase Sapphire Preferred® Card and want to make a redemption. The first two cards get an elevated point value of 1.5 cents apiece when redeeming points and booking travel in the portal; the latter gets 1.25 cents apiece.

Bookings. You hold the Chase Sapphire Preferred® Card , the Chase Freedom Unlimited® or the Chase Sapphire Reserve® and want to earn bonus points. The Chase Sapphire Preferred® Card and the Chase Freedom Unlimited® typically earn 5x points per $1 spent on all travel purchased through Chase's travel portal, while the Chase Sapphire Preferred® Card earns 5-10 points per $1 spent on Chase Dining, hotel stays, rental cars and air travel purchased through Chase's travel portal.

Otherwise, you might be wise to book travel directly with the airline, hotel or rental car company, which can simplify cancellations or changes to your bookings. You can do this with cash, card or by transferring points to one of Chase's transfer partners.

» Learn more: The guide to Chase transfer partners

Despite being powered by Expedia — an online travel agency that includes a Price Match Promise — Chase's travel portal does not offer customers a price matching benefit.

Capital One Travel has price drop protection that will advise you when to buy and refund you if the price of your flight drops by a certain amount after purchase.

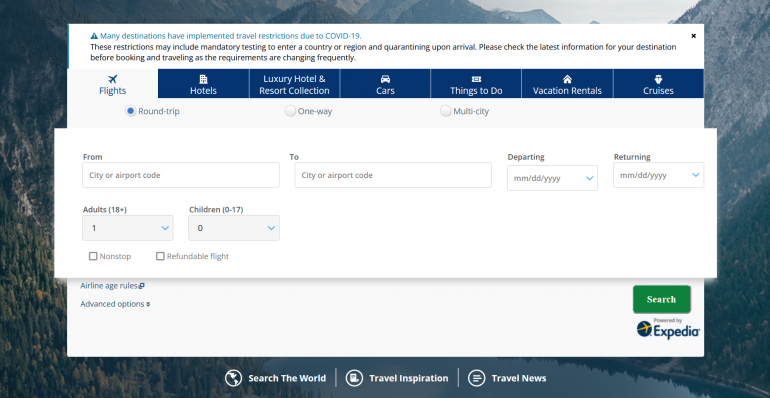

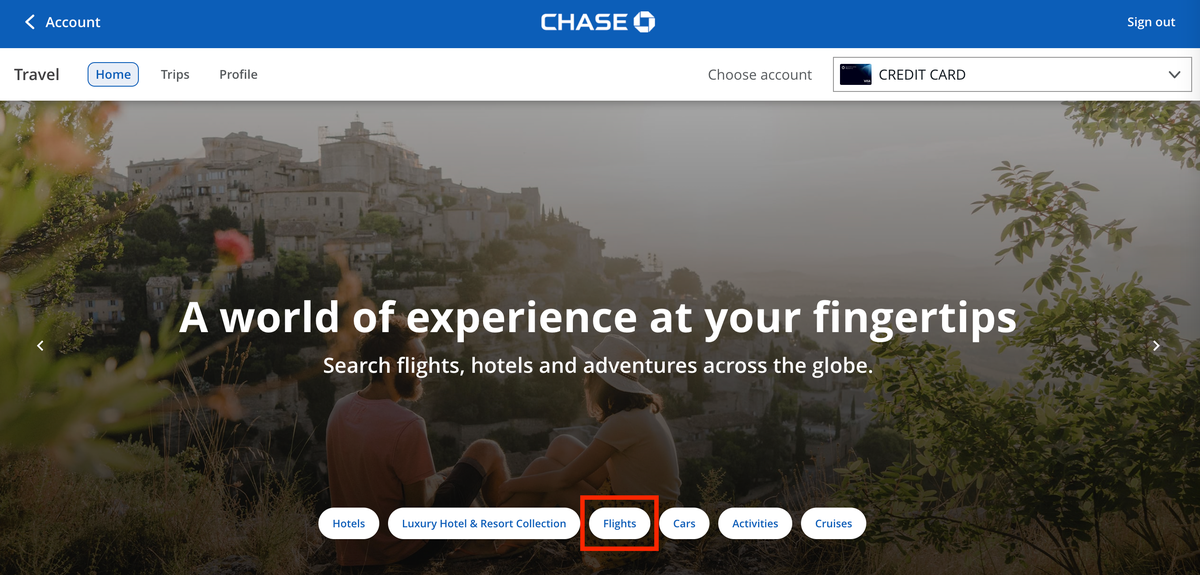

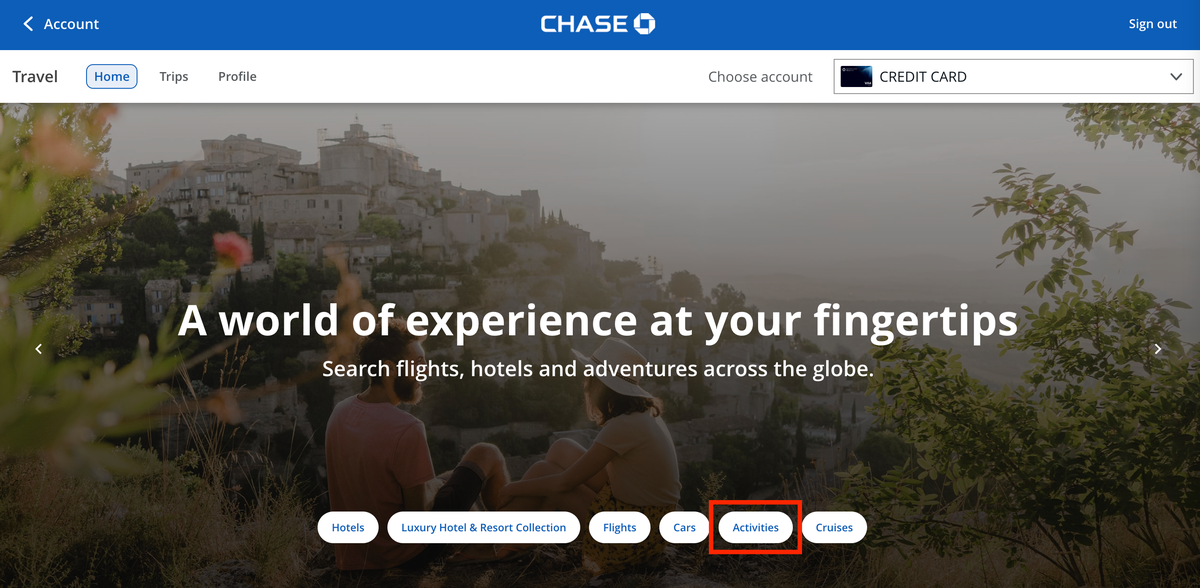

Once logged into your Chase account, you’ll find a sidebar on the right of the page with your Chase Ultimate Rewards® balance. Once you click on it, it brings up a variety of options for how to spend your points. Choose “travel” to take you to the standard booking page where you can enter your plans for flights, cruises, rental cars, hotels or other activities.

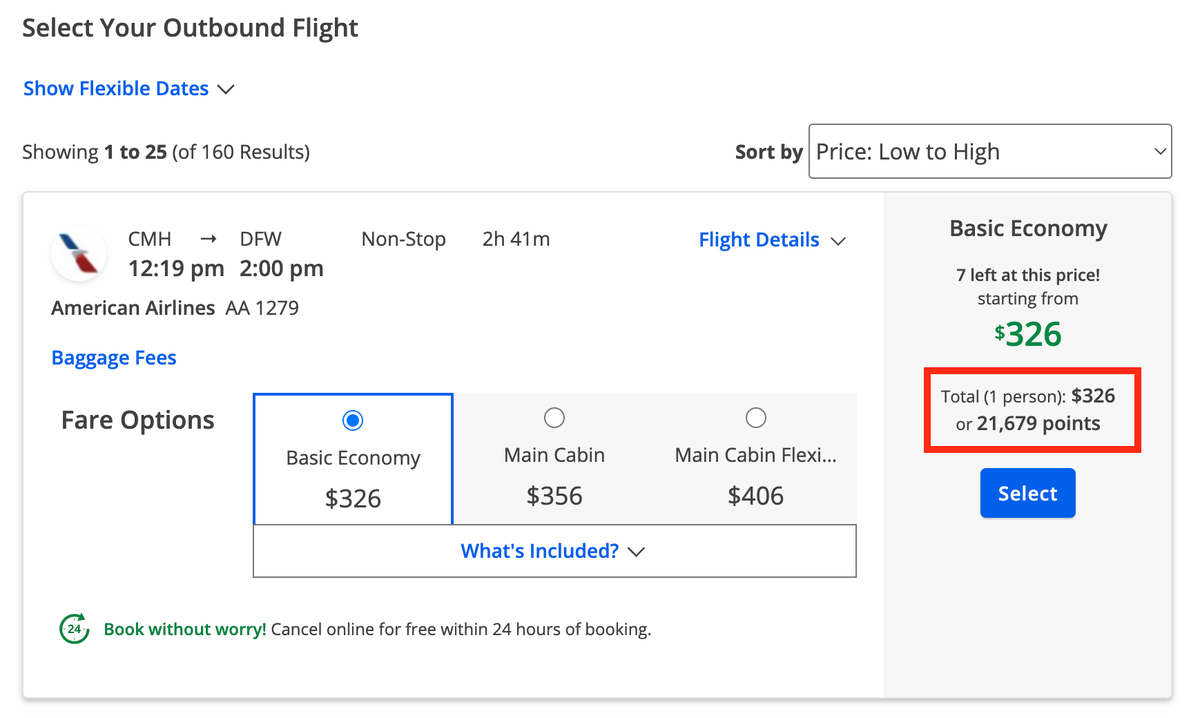

Depending on the card you have, your points are worth between 1-1.5 cents per point. The best value card is the Chase Sapphire Reserve® , which offers 1.5 cents in value per point to redeem through the portal, while the Chase Freedom Unlimited® only values points at a penny per point. This means that Chase determines the number of points you’ll need to redeem for an award based on the cash cost of the travel you are trying to book.

It’s easy to search for the travel you want. Chase has partnered with Expedia to run the search engine, but this has limited the search function a bit with some low-cost airlines no longer appearing. Be mindful of this when making a reservation (perhaps check to see if the airfare is similar to the basic economy or main cabin price on the airline’s website first).

The advanced options button lets you sort by airline and class of service.

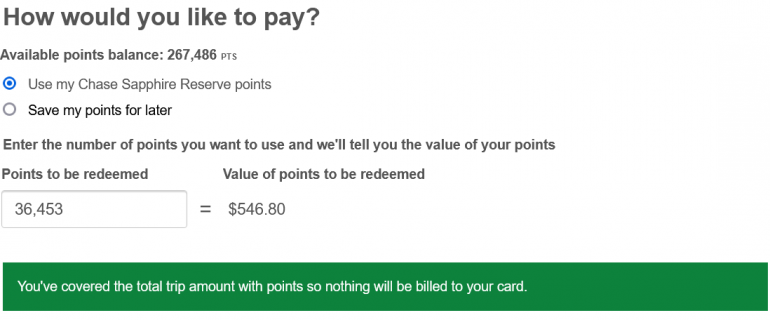

Much like other online booking engines, once you find the travel plans you like, you enter your personal details. The best part of using the travel portal is that you can pay in full with points, cash or use a mix of points and cash. You can adjust the amount of points you want to spend for your trip and the website will display how much remaining cash you owe. If you need more points, you can transfer them from other Chase Ultimate Rewards® earning accounts you may have to boost your balance.

The process for booking hotels or car rentals is similar to reserving a flight, giving you the option to use a mix of cash or points.

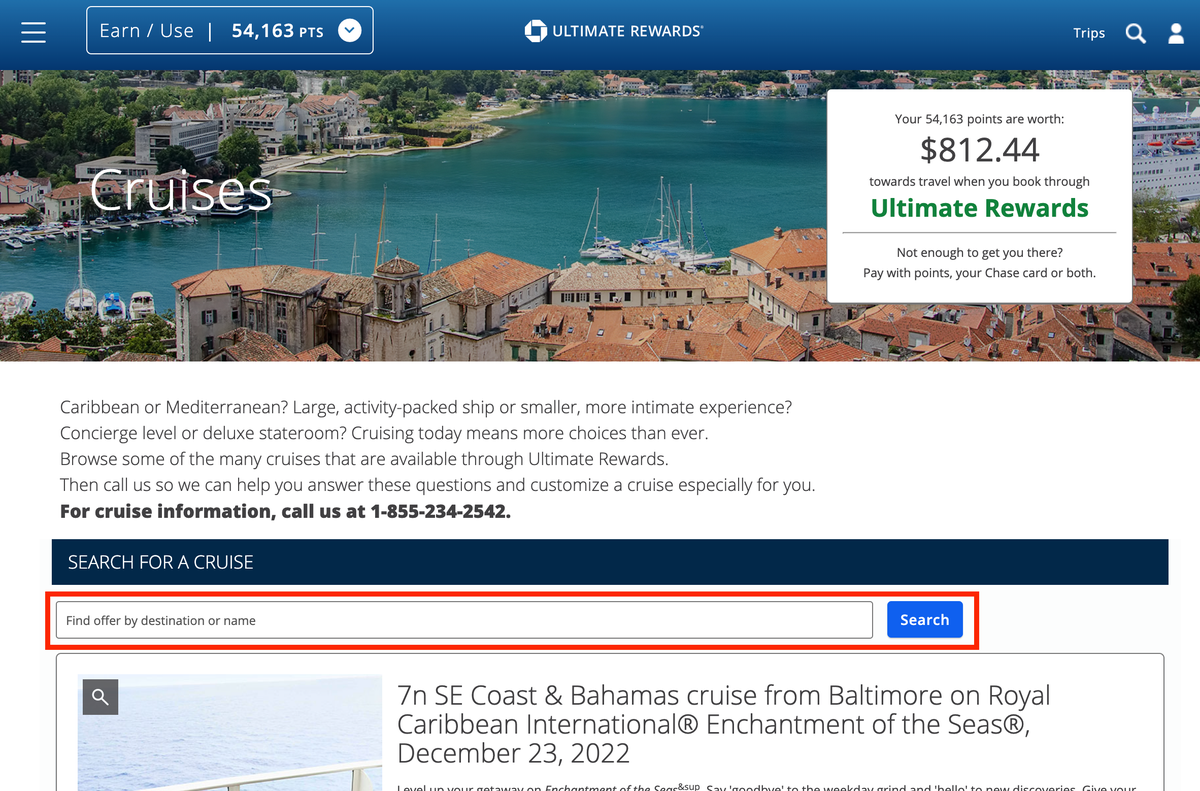

To book a cruise with points, however, you’ll have to call Chase directly.

Another exception is when making a reservation at Luxury Hotel and Resort Collection properties, you can only make a cash reservation (you pay upon checkout) and cannot redeem Ultimate Rewards® points. You may still want to reserve through the portal, though, since it means you are eligible for additional perks like daily breakfast for two and a special amenity that varies by the hotel.

You can also reserve activities at home or your destination and pay for them in cash or with points. These include tours, museum visits and other local experiences.

Chase may charge a service fee on certain reservations. You will want to weigh whether this small charge is worth the benefit in Chase Ultimate Rewards® points you may use.

Many hotel companies offer member-only rates to entice you to book directly with them rather than through a third party. You’ll want to weigh whether earning Chase Ultimate Rewards® points is more valuable than the difference in the lowest rate booked directly with the hotel company.

When making any reservation through Chase's travel portal, you will be at the mercy of its own policies when it comes to changing or canceling a ticket. You will have to contact Chase directly to adjust your plans since you made it independently of the airline or hotel company. This can make it especially difficult with last-minute travel plan changes.

» Learn more: Advanced tips for redeeming Chase Ultimate Rewards

With a little comparison shopping for your travel plans, you can squeeze exceptional value from points via the Chasee's travel portal. They can be redeemed like cash for travel, but always be sure to compare a reservation using Chase points to the cost of using hotel or airline points.

Sometimes, it may be less advantageous to use Chase points since you will lose out on travel-related perks. Other times, you’ll come out ahead since you can save cash using points, which is helpful when there is no award availability for your preferred travel plans.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- Airport lounges

- Dining & experiences

- Not a cardmember? Learn more

Explore all the benefits of Sapphire Reserve

Rewards to inspire your next adventure.

The Chase Sapphire Reserve card makes every purchase rewarding. Make your journey memorable with travel perks, private dinners, and VIP access at sought-after events. Explore your complete Guide to Benefits or learn more about your benefits below.

01 Travel

Get closer to your happy place

Earn points as you seek out new destinations. Book a hotel, make the most of airfare, hail rides around town and more.

$300 Travel Credit

Get reimbursed for up to $300 in travel purchases you make with your Sapphire Reserve card 1 each year. Each year, your first $300 in travel purchases will not earn rewards points. 2

Book through The Edit SM

Experience distinct benefits at a curated collection of hotels and resorts when you book through The Edit by Chase Travel SM , an exclusive benefit for Sapphire Reserve cardmembers. 7

10x on hotels through Chase Travel

Earn 10x total points on hotels (excluding The Edit) and car rentals purchased through Chase Travel after the first $300 is spent on travel purchases annually. 1

5x points on flights through Chase Travel

Earn 5x total points on flights purchased travel through Chase Travel after the first $300 is spent on travel purchases annually. 1

3x points on travel

Enjoy the trip even more with bonus points on travel purchases like airfare and hotels. 1

Unlimited points

There is no limit to the number of points you can earn. Points don’t expire as long as your account is open. 1

Enjoy more premium travel rewards

When you travel with Sapphire, plan on benefits ranging from generous statement credits to access to luxury properties worldwide.

Global Entry or TSA PreCheck ® or NEXUS fee credit

Receive a statement credit of up to $100 every four years as reimbursement for the application fee charged to your Sapphire Reserve card. 5

No blackout dates or restrictions

Book travel through Chase Travel and if a seat’s available, it’s yours.

No foreign transaction fees

Pay no foreign transaction fees when you use your card outside the United States. 6 For example, if you spend $5,000 internationally, you would avoid $150 in foreign transaction fees.

Elite hotel benefits at Relais & Châteaux

Enjoy great benefits like a VIP welcome and complimentary breakfast daily at select properties with Relais & Châteaux, a prestigious collection of luxury properties in over 60 countries. Call the Visa Infinite Concierge at 1-877-660-0905 for more details and to book your stay. 8

Special car rental privileges

Enroll in leading car rental rewards programs from National Car Rental, Avis and Silvercar. Log in to Chase Travel to access the special car rental privileges section of your travel benefits page to book with your card. Enjoy enhanced benefits, such as upgrades and car rental discounts, savings on luxury and premium rental car rates, plus promotions and other offers. 9

Ennismore hotel benefits

Your card gets you VIP access to benefits at Delano, Hyde, Mondrian, Morgans Originals and SLS hotels and resorts around the world. Cardmembers can stay a little longer with a complimentary 4th night, receive room upgrades and late check outs, along with priority access to cabana reservations, a $30 food and beverage credit and much more. 10

Free Lyft Pink

Get 2 complimentary years of Lyft Pink All Access when activated by Dec 31, 2024—a value of $199/year. 3 This includes member-exclusive pricing, free Priority Pickup upgrades, discounts on bikeshare and more. Membership auto-renews.

Don't forget as a Sapphire Reserve cardmember you'll still earn 10x total points on Lyft rides through March 2025. 4 That’s 7x points in addition to the 3x points you already earn on travel. That’s 7x points in addition to the 3x points you already earn on travel. Activate Lyft Pink All Access

02 Dining

Indulge in worldwide dining experiences

Whether visiting your local bistro or a restaurant on your bucket list, there are always special dining rewards with Sapphire Reserve.

Private dining series

Sit down for a memorable meal at some of the most sought-after restaurants in the country.

3x points on dining

Earn triple the points at restaurants, including takeout and eligible delivery services with your Sapphire Reserve card. 1 From Sunday brunch to a birthday dinner, meals out mean more rewards.

DoorDash & Caviar benefits

Takeout tastes even better with a complimentary DashPass membership on both DoorDash and Caviar. You’ll pay no delivery fee and lower service fees on eligible orders for a minimum of one year. Activate by Dec. 31, 2024 12 . Plus, as a DashPass member get a $5 monthly DoorDash credit automatically applied at checkout 13 .

Instacart benefits from Sapphire

Skip the trip and have your groceries delivered to your doorstep with 1 year of complimentary Instacart+. 14 In addition, Instacart+ members earn up to $15 in statement credits each month through July 2024. 15 Membership auto-renews. Terms apply.

03 Ultimate Rewards ®

Get the most from your rewards

Enjoy the flexibility of booking airfare, hotels and car rentals through Chase Travel or transfer points to other travel programs.

More value with travel redemption

Your points are worth 50% more when you redeem them for airfare, hotels, car rentals and cruise lines through Chase Travel—our easy-to-use portal that helps you maximize your travel spending. For example, 50,000 points are worth $750 toward travel. 16

Worldwide travel assistance

Whether you need help booking travel or modifying a reservation count on the full-service support of the Chase Travel team.

1:1 point transfer to leading frequent travel programs

Transfer points to participating frequent travel programs at a full 1:1 value—that means 1,000 points equals 1,000 partner miles/points.

No travel restrictions or blackout dates on airline tickets booked through Chase Travel.

1 point per $1 spent on all other purchases

In addition to earning 3 points per dollar on travel and dining at restaurants, you’ll earn 1 point for every dollar you spend on all your other purchases. 1

Flexibility

You can book airfare, hotels and car rentals through Chase Travel using your Sapphire Reserve card, your points or a combination of both—it's up to you.

More ways to get the most from your rewards

Redeem your points for statement credits, gift cards or choose from other flexible ways to make your points work for you.

Shop through Chase ®

Shop online with brands you already love. Earn 1x–15x bonus points at more than 450 popular retailers with Shop through Chase. 16

25% more value with Pay Yourself Back ®

Redeem points for statement credits toward your annual fee and eligible purchases for gas, wholesale clubs, and pet supplies & services by June 31, 2024.

Choose from a selection of over 150 gift cards from some of your favorite retailers and more.

Pay with points

Use your points to pay for all or part of your purchases with popular brands like Apple ® 19 and Amazon.com. 20

04 Lounges

Relax with airport lounge access

With access to Chase Sapphire Lounge by The Club and Priority Pass lounges, each trip becomes an invitation to indulge before you get there.

Enjoy complimentary Priority Pass TM Select membership

Departing for your destination is more relaxing with access to 1,300+ Priority Pass airport lounges in 600+ cities around the world, plus every Sapphire Lounge by The Club, after a one- time enrollment in Priority Pass Select.

Visit Sapphire Lounge by The Club

Relax and refresh at a Sapphire Lounge and enjoy locally inspired menus, a curated selection of beverages, an atmosphere to remember and more. Sapphire Reserve cardmembers, ensure you're enrolled in your complimentary Priority Pass Select membership for lounge access.

The Reserve Suites by Chase

Reserve cardmembers, treat yourself to The Reserve Suites at Sapphire Lounge by The Club at LaGuardia Airport in Terminal B. Enjoy caviar service on arrival, specially curated wine lists by Parcelle, exclusive menus by Jeffrey's Grocery, private bathrooms with spa showers and more. Chase Sapphire Reserve cardmembers can book a suite for a fee up to 72 hours prior to flight departure. Find details on the Chase Mobile ® app in Benefits & Travel. The Reserve Suites are limited and subject to availability.

05 Protection

Travel with peace of mind 22

When you take to the air or hit the road, we make security a priority. Here are some of the protection services built into your Sapphire Reserve card benefits.

Trip Cancellation / Interruption Insurance

If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels.

Auto Rental Collision Damage Waiver

Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad.

Emergency Evacuation and Transportation

If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000.

Trip Delay Reimbursement

If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

Travel Accident Insurance

When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $1,000,000.

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days.

Roadside Assistance

If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You’re covered up to $50 per incident 4 times a year.

Sapphire Reserve Benefits Guide

These are just some of the protection services built into your Sapphire Reserve card benefits. Your Guide to Benefits has more of what you need to know about your travel and purchase protection benefits.

Account security and protection

Your Sapphire Reserve card is equipped with the enhanced account and purchase protection you deserve.

Zero Liability Protection 23

Zero Liability Protection means you won’t be held responsible for unauthorized charges made with your card or account information. If you see an unauthorized charge, simply call the number on the back of your card.

Fraud protection

We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card.

Fraud alerts

We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card. 24 Please sign in to chase.com and review your personal details to ensure your mailing address, phone and/or email are up to date.

Return Protection

You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $500 per item, $1,000 per year. 22

Extended Warranty Protection

Extends the time period of the manufacturer's U.S. warranty by an additional year on eligible warranties of 3 years or less. 22

Chip-enabled for enhanced security and wider acceptance

A credit card with an embedded chip provides enhanced security and wider acceptance when you make purchases at chip-enabled card readers in the U.S. and abroad.

Purchase Protection

Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per year. 22

06 Events

Exclusive access to events and experiences

Sapphire cardmembers enjoy priority ticketing and the best seats in the house for a wide range of events.

Reserved by Sapphire SM

Explore one-of-a-kind experiences from private dinners hosted by award-winning chefs to VIP access at the most sought after events. See where your Sapphire Reserve card can take you.

Events and experiences lounges

Enjoy comfortable seating at Chase Sapphire events in prime locations, complimentary food and drinks, plus a range of amenities, such as a dining concierge, charging stations, Wi-Fi and more.

Early-access tickets

Beat the crowds. Get your tickets to concerts and sporting events before they sell out.

Priority seating

Get up close to the court or the stage. Sapphire Reserve cardmembers can experience events from the best seats in the house.

07 Wellness

Earn 10x total points on Peloton

Work out your way — from HIIT rides to walks and hikes to strength training, and more: Get 10x total points on Peloton equipment and accessory purchases over $150 with a max earn of 50,000 points. Shop Peloton Bikes, Tread, Guide, or Row. Offer ends Mar. 31, 2025. 25

Shop Peloton

08 Services

Personalized assistance for Sapphire cardmembers

Turn to Sapphire for help coordinating travel, restaurant reservations, access to entertainment and more complimentary assistance and referrals.

24/7 access to customer service

Talk to a dedicated specialist whenever you need assistance. Simply call the number on the back of your card.

Visa Infinite Concierge Service 26

Contact Visa Infinite Concierge at 1-877-660-0905 for help with dinner reservations or Broadway, music and sporting event tickets.

Travel and emergency assistance

If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.)

Easily get more from your Sapphire experience

From mobile account access to contactless payment, cardmembers can enjoy many safe and convenient features.

Manage your account with ease

Create an account on chase.com and download the Chase Mobile ® app 27 to check account and points balances, pay bills and more.

Tap-to-pay contactless checkout

Simply tap to pay with your contactless Chase Sapphire card. Just look for the Contactless Symbol at checkout, then tap your contactless card on the checkout terminal. It's fast, easy and secure!

Add an authorized user

Maximize your reward earning potential by adding an authorized user to your account. 28

Go paperless

Get your statement online. Safely access up to 6 years of statements online. It's secure, convenient and reduces clutter.

Convenient ways to pay

Load your card into a digital wallet for a quick and secure way to pay with your mobile device and receive all the benefits and rewards of using your Sapphire Reserve card.

Earn points automatically

Grow your points balance by using your card as the primary payment method for:

- Online checkout Add your card to your favorite shopping apps and online merchants to conveniently build up your points balance.

- Monthly bills Use your card to make auto payments for monthly bills (e.g., cell phone and utility bills). 29

Redeem for travel

Use points toward your next getaway—they’re worth 50% more when you redeem them for travel through Chase Travel.

Pay Yourself Back ®

Your points have more value when you redeem them for statement credits after making eligible purchases on gas, wholesale clubs, and pet supplies & services by June 31, 2024.

Chase Dining SM

Order takeout at popular eateries around town or make reservations at restaurants, wineries and bars across the country.

There's so much for you

More Sapphire Offers

There’s so much more to make yours—top benefits, offers and experiences for Sapphire Reserve cardmembers.

Reserved by Sapphire SM

Your Sapphire Reserve card opens new doors to more flavors, sights and sounds. Explore the extraordinary lineup of experiences—including culinary, sports, music and entertainment.

Refer-A-Friend

Earn up to 75,000 bonus points per year by referring friends to either Chase Sapphire ® card.

Already a Sapphire cardmember?

Sign in to view your account, access exclusive content and take advantage of your Sapphire benefits.

Not a Sapphire cardmember yet?

We’re glad you’re here. Learn more about getting a Sapphire card.

Es posible que esta comunicación contenga información acerca de usted o su cuenta. Si tiene alguna pregunta, por favor, llame al número que aparece en el reverso de su tarjeta.

View the details of the Sapphire Reserve benefits offered on this page.

©2024 JPMorgan Chase & Co. JPMorgan Chase Bank, N.A. Member FDIC

Introducing Chase Travel

Seamlessly book your best trip yet. Choose from coveted hotels and convenient flights, then add car rental and must-do local experiences at the reimagined chasetravel.com .

Start planning

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

Chase Customer Service: How To Get in Contact Fast

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology .

20 Years Helping You Live Richer

Reviewed by Experts

Trusted by Millions of Readers

Chase offers a wide range of banking products and services and more than 4,700 branches . If you need assistance, its website, social media support and phone numbers offer customers plenty of options.

How Do I Speak to a Chase Customer Service Representative?

Here’s a list of Chase customer service phone numbers and the departments you’ll reach when you call them:

- Personal banking: You can contact personal banking customer support at 800-935-9935.

- Credit cards: If you’re looking for Chase card services, call 800-432-3117.

- Business banking : Call 800-242-7338 to get your business banking questions answered.

- Auto loans: If you have questions about your auto loan, call 800-336-6675.

- Home lending: Call 800-848-9136 for questions about your mortgage or your home lending options.

- Domestic military services: If you’re a domestic military customer, call 877-469-0110.

- Overseas military services: If you’re stationed overseas, call 1-318-340-3308.

- Fraud services: Call 800-955-9060 to report credit card fraud, follow up on a report of fraud or file a chargeback.

- Disaster assistance for auto loan customers: If a natural disaster has impacted you and you cannot make your minimum payment for your auto loan, call 800-336-6675. If you’re a military customer responding to a disaster, call 877-469-0110.

- Hardship assistance for auto loan customers: If you are a loan customer and need financial hardship assistance, call 800-336-6675. If you’re a lease customer in need of hardship assistance, call 800-227-5151.

If you’re deaf or hard of hearing, you can dial 711 for assisted communications with Chase customer service.

Keep in mind that Chase is a massive bank with several departments. The company has dedicated support staff for many of its products and service divisions, so contacting the right department within Chase is important to get the help you need.

Additional Customer Service Options

If you’re not a phone person, don’t worry; there are other ways to get in touch with Chase customer service. Here are some options:

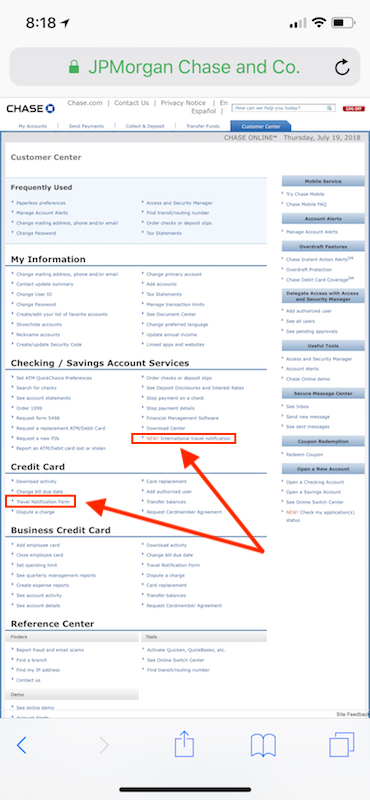

- Send a secure message: You can log in to your Chase online banking account to access the Secure Message Center. This is where you can send secure messages about anything having to do with your accounts.

- Make an appointment: To connect with a local Chase representative, schedule a meeting online.

- Get help via social media: Chase also actively pays attention to its social media for customer service inquiries. Simply reach out via a message on Facebook , Instagram or X, formerly known as Twitter .

- Report a phishing attempt: Forward all suspicious emails to [email protected]. Note that Chase does not support general email correspondence for customer support, so you’ll want to use the Secure Message Center instead for any other inquiries.

- Yes, Chase provides 24/7 customer service.

- If you have questions about personal banking, you can talk to a live person at Chase by calling 800-935-9935.

- The best way to send a message to Chase customer service is to log in to your Chase online banking account and send a secure message.

- 800-242-7338 is the phone number for Chase business customer service.

Katy Hebebrand contributed to the reporting for this article.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Chase.

Share This Article:

- Banking 101 Guide

- Banking Terms

- What are the biggest banks in the U.S.?

- Best Bank Promotions for this month

GOBankingRates' Best Banks

- Best High-Yield Savings Accounts

- Best Checking Accounts

- Best CD Accounts & Rates

- Best Online Banks

- Best National Banks

- Best Neobanks

- Best Money Market Accounts

- Best Premium Checking Accounts

- Best Regional Banks

Related Content

TD Bank Wire Transfer: How To Send Money and What Fees To Expect

April 22, 2024

I'm a Bank Teller: 3 Times You Should Never Ask For $100 Bills at the Bank

April 21, 2024

What Do You Need To Open a Bank Account?

April 19, 2024

Here's Your City National Bank Routing Number

32 Best Banks for Early Direct Deposit

Huntington Bank Promotions of April 2024

Discover April 2024's Premium Citi Offers: Unique Promo Codes, Bonuses and Coupons

Here's Your Citi® Routing Number

I'm a Bank Teller: Here's How Often You Should Visit Your Bank in Person

April 18, 2024

Frost Bank Hours: Full Hours and Holiday Schedule

Chime Routing Number: What To Use for Direct Deposit

Here's Your SoFi Routing Number -- Plus What To Do If It's 'Invalid'

Ally Bank Wire Transfers: How They Work and What Fees To Expect

Best Banks April 2024: See The Top Banks and Bank Accounts For Your Money

Best National Banks April 2024

April 17, 2024

Best Regional Banks April 2024

Sign Up For Our Free Newsletter!

Get advice on achieving your financial goals and stay up to date on the day's top financial stories.

By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy . You can click on the 'unsubscribe' link in the email at anytime.

Thank you for signing up!

BEFORE YOU GO

See today's best banking offers.

Sending you timely financial stories that you can bank on.

Sign up for our daily newsletter for the latest financial news and trending topics.

For our full Privacy Policy, click here .

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Complete Guide To Using the Chase Travel Portal — Maximize Your Options

Katie Seemann

Senior Content Contributor and News Editor

343 Published Articles 50 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Senior Editor & Content Contributor

88 Published Articles 658 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Flexibility

You can earn frequent flyer miles, cards that earn chase ultimate rewards points, transfer your points between credit cards for maximum value, earning chase points by booking travel, how to access the chase travel portal, how to book a flight through chase travel, the luxury hotel and resort collection, how to book a rental car through the chase travel portal, how to book activities through chase travel, how to book a cruise through the portal, car rentals, earn bonus ultimate rewards points, pay with points, apple purchases, experiences, pay yourself back, transfer to travel partners, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Chase Ultimate Rewards is one of the major transferrable points programs and a favorite among many travelers. Points are easy to earn and can be transferred to many different hotel and airline partners. But you can also book travel directly through Chase’s travel portal using Ultimate Rewards points.

Booking travel through the Chase Travel portal is simple and can be a great way to use your points.

We’ll show you everything you need to know about how to redeem your points, including the benefits, how to know what your points are worth, and how to book airlines, hotels, and more through the Chase Travel portal.

Why Book Travel Through the Chase Travel Portal?

Generally, you can get maximum value from your Chase Ultimate Rewards points by transferring them to the Chase airline and hotel partners , so why are we talking about using points through a travel portal? While it’s true that the only way to get the highest value redemptions is by transferring, there is still a lot of value to be had by booking directly through the Chase Travel portal.

Flexibility is not often available with points bookings. Unlike an award booking, booking through Chase Travel is like using any other online travel agency (OTA) . There are no blackout dates or limited inventory award seats. If a flight or hotel is available, you can book it with points through the Chase travel portal.

One of the major bummers of booking flights with frequent flyer miles is that you don’t earn miles on award bookings. You can end up doing a lot of travel without earning miles. However, any booking you make with your Chase Ultimate Rewards points through the Chase Travel portal will earn frequent flyer miles and accrue status points. Unfortunately, hotel and car rental bookings still won’t earn points.

We have talked to so many people over the years that love the idea of collecting points and miles but don’t want to deal with the hassle. While many don’t mind putting a little work into getting an awesome redemption, others are just looking for a simple way to book travel and hopefully save some money in the process.

That’s where the Chase Travel portal comes in. With this method of redeeming points, there is no transferring, comparing points values, blackout dates, limited award availability, or multiple travel accounts. You only have to deal with 1 type of point and 1 travel portal but can still retain many of the benefits of collecting points and miles in the first place.

Bottom Line: You can book flights, hotels, rental cars, activities, and cruises through the Chase Travel portal.

If you like the idea of using the Chase Travel portal, you’ll need a credit card that earns Chase Ultimate Rewards points:

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Amex Platinum vs Chase Sapphire Reserve

Ink Business Preferred ® Credit Card

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- Trip cancellation and interruption insurance

- Rental car insurance

- Extended warranty coverage

- No elite travel benefits like airport lounge access

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

- Best Business Credit Cards

- The Chase Ink Business Preferred 100k Bonus Offer

- Benefits of the Ink Business Preferred

- Chase Ink Business Preferred Cell Phone Protection

- Chase Ink Business Preferred vs Amex Business Gold

- Ink Business Cash vs Ink Business Preferred

- Amex Business Platinum vs. Chase Ink Business Preferred

- Ink Business Preferred vs Ink Business Unlimited

- Best Chase Business Credit Cards

- Best Business Credit Card for Advertising

- High Limit Business Credit Cards

- Best Credit Cards with Travel Insurance

- Best Credit Cards for Car Rental Insurance

There are also some great cash-back cards from Chase that can be used to book travel through Chase Travel. The points earned on these cards can be converted into cash-back or alternatively, they can be used in the Chase travel portal.

- Chase Freedom Flex℠

- Chase Freedom Unlimited ®

- Chase Freedom ® card (no longer open to new applicants)

- Ink Business Cash ® Credit Card

- Ink Business Plus ® Credit Card (no longer open to new applicants)

- Ink Business Unlimited ® Credit Card

- Ink Business Premier ® Credit Card

What Are Chase Ultimate Rewards Points Worth?

It’s easy to earn lots of Chase Ultimate Rewards points , but do you know how much they are worth ? If you’re transferring your Chase Ultimate Rewards points to a travel partner, their value will go up or down depending on the type of redemption.

However, when you are booking your travel directly through Chase’s travel portal, each Chase Ultimate Rewards point has a set value that won’t change . The credit card you have will determine the value of your Chase Ultimate Rewards points.

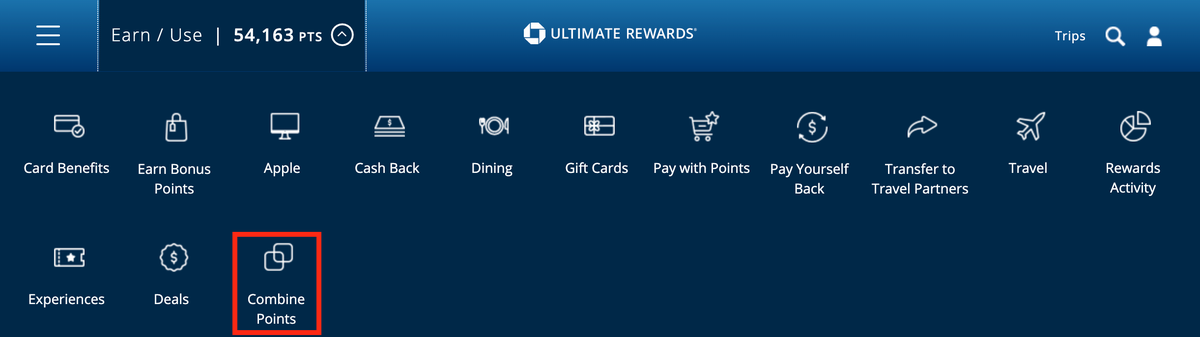

If you have multiple Chase credit cards, it makes sense to transfer your points to the card with the most valuable redemption rate. The only exception to this is the Ink Business Premier card because points earned on this card can’t be transferred to any other card.

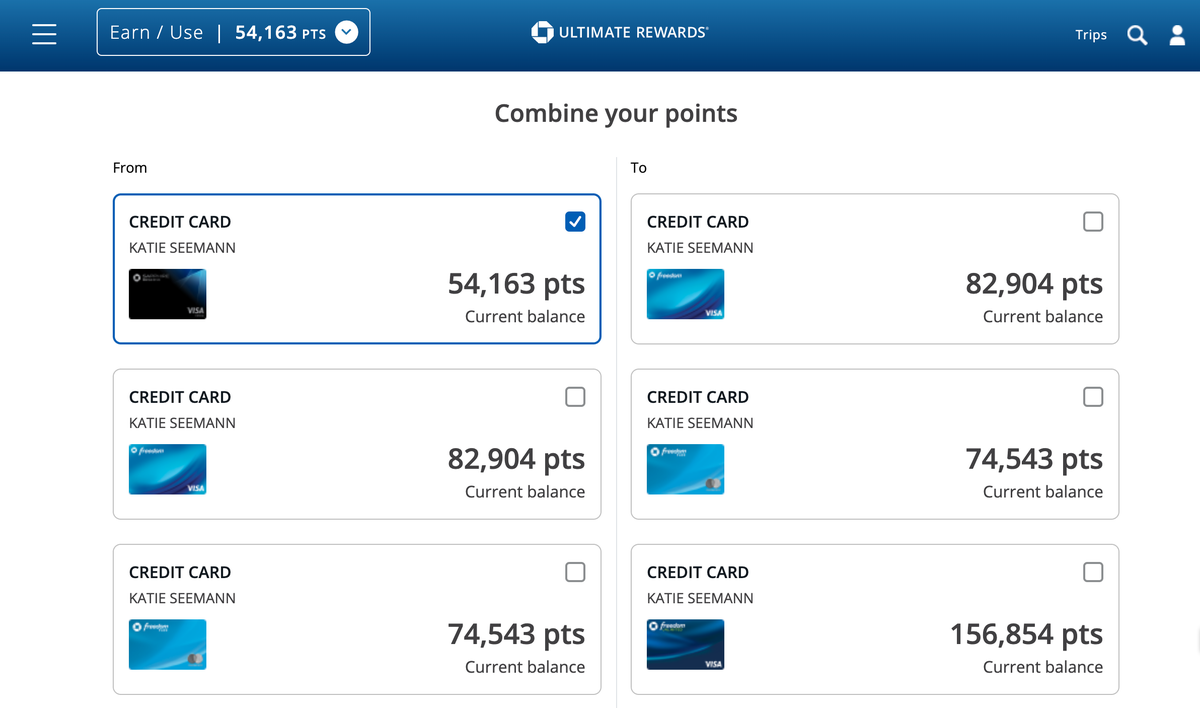

1. To transfer your points between 2 cards, log on to the Chase dashboard and select Combine Points .

2. Then you will be able to select the card you want to transfer points from and the card you want to receive the points. After you choose, click Next.

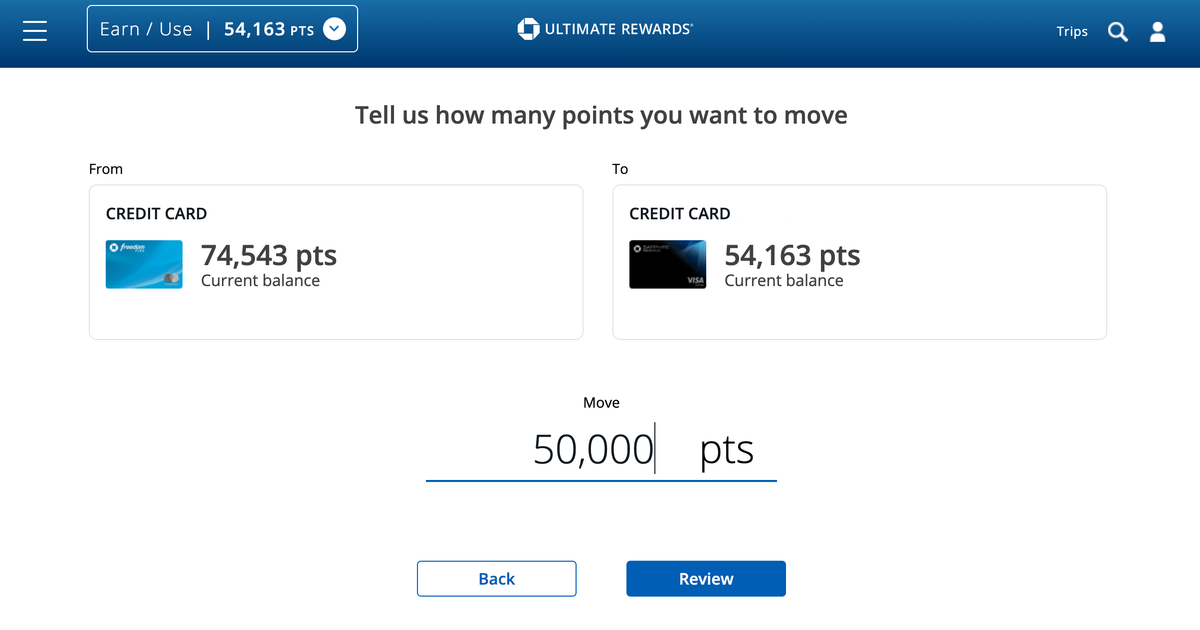

3. You can transfer all of your points or just what you need. Click Review to continue.

4. Double-check the details and click on the Submit button to complete the transfer.

Bottom Line: Your credit card will determine the value of your Chase Ultimate Rewards points. Your points are worth between 1 to 1.5 cents each depending on which credit card you’re redeeming points through.

What if you’d prefer to pay for your travel with a Chase credit card to earn Ultimate Rewards points? The number of points you’ll earn through the Chase travel portal is dependent on which credit card you have and what type of travel you’re purchasing.

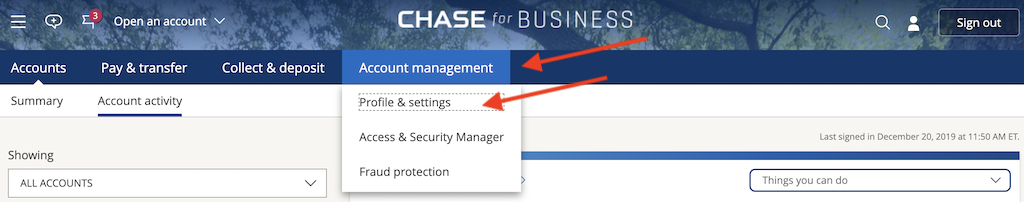

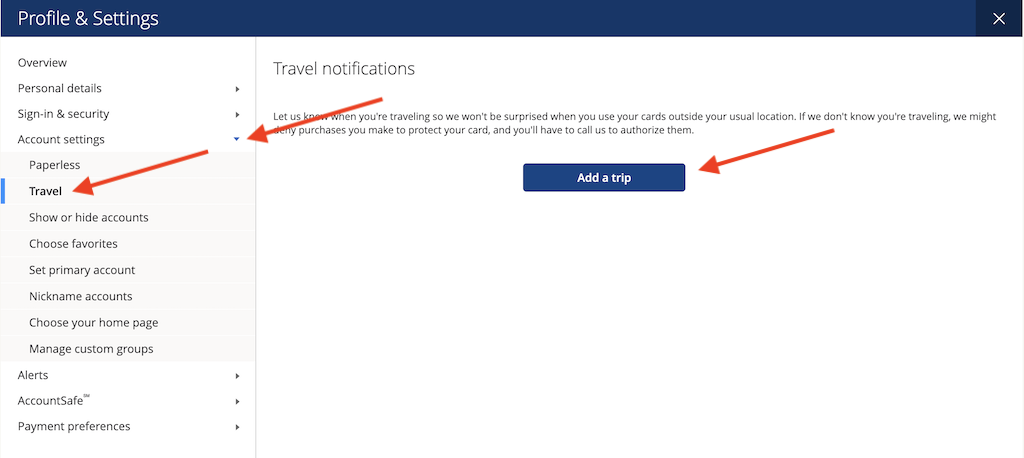

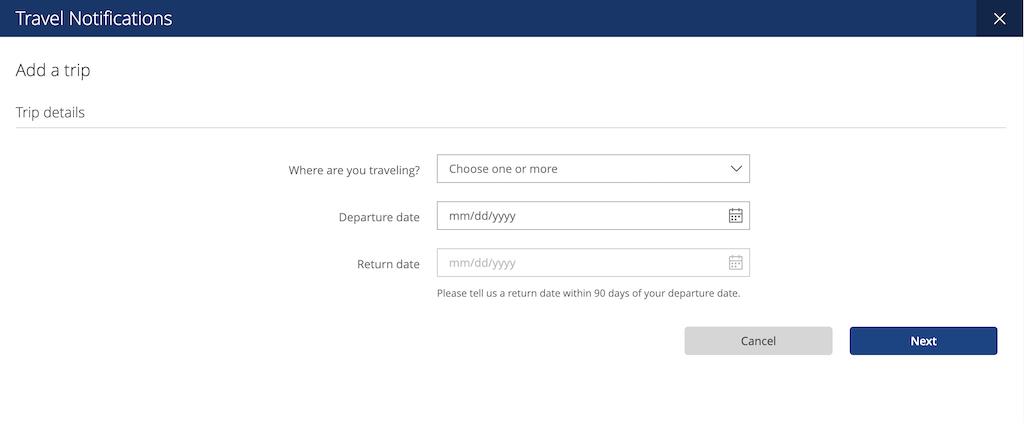

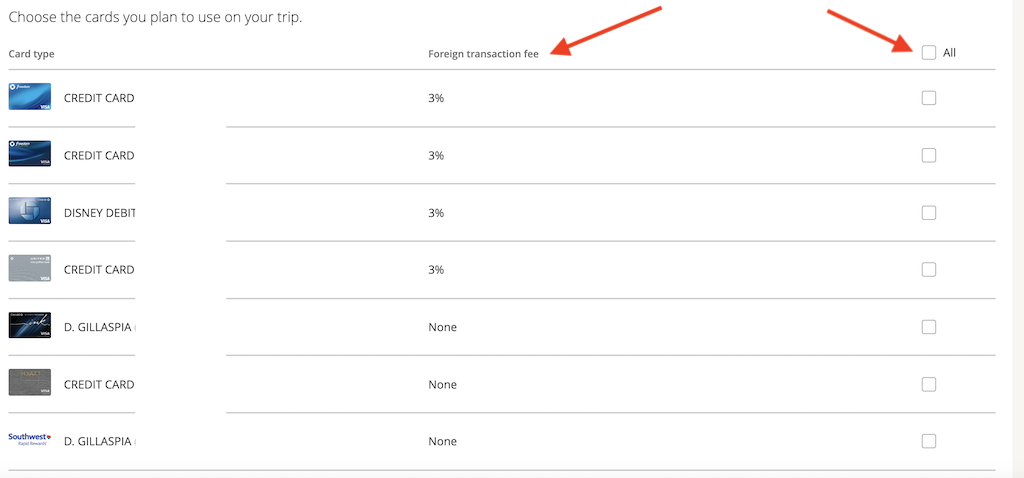

You can log into your account in 2 ways.

First, you can go directly to the Ultimate Rewards website to log in or you can log in through your Chase account .

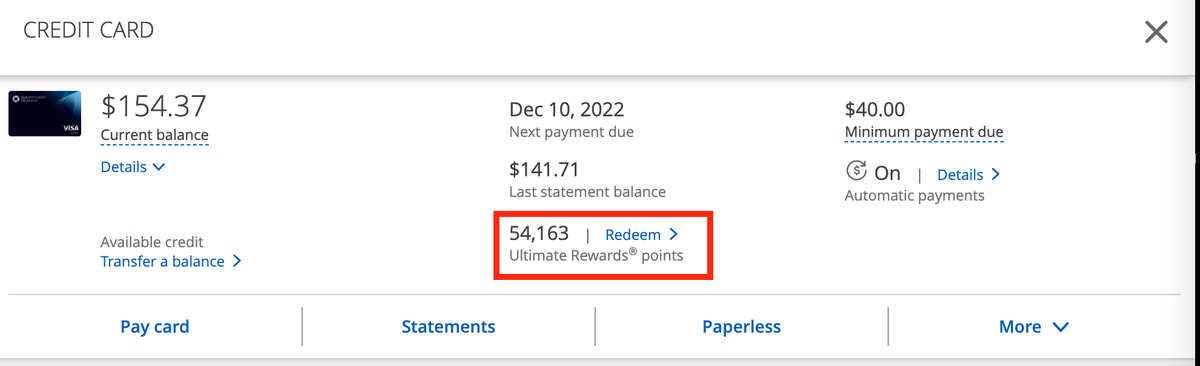

If you’re in your Chase account, click on one of your Ultimate Rewards credit cards and then click on Redeem next to the card’s Ultimate Rewards balance.

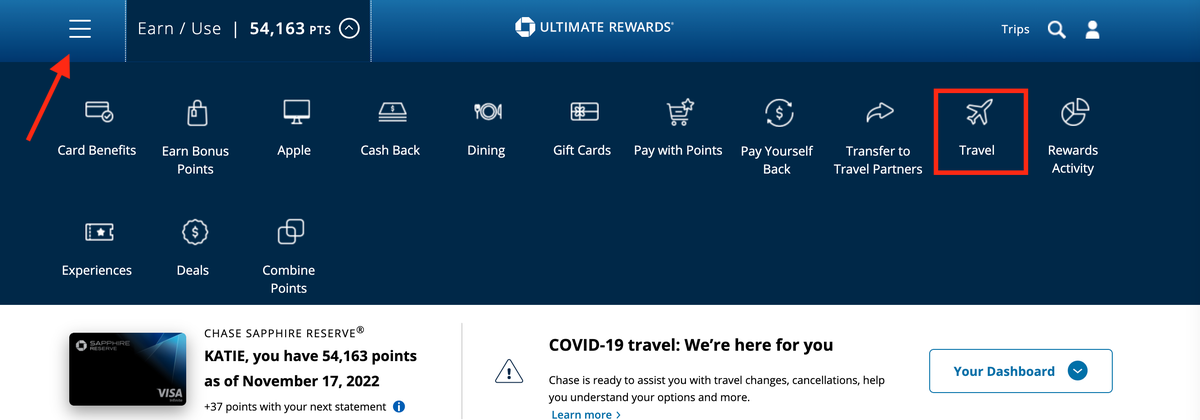

Then choose the card you want to use.

From here you can access Chase Travel by clicking on Travel in the top search box or you can switch to another card’s account by clicking on the 3-line icon in the upper left-hand corner.

1. In the Travel section of your Ultimate Rewards account, click on Flights to start your search for a flight. As with any other OTA, you begin your search by inputting basic information such as departure and arrival city, travel dates, and the number of passengers.

2. Next, you will be able to narrow your search results . At the left-hand side of the page, you can filter your results by things like airline or flight times. Then you can sort your results by price, trip duration, or times using the drop-down box at the top of the search results.

3. For each flight option, you’ll be able to see the price in dollars and in points on the right-hand side of the results box.

4. Once you’ve found the flight you want, click the blue Select button. Next, you can choose your return flight using the same process as you did for selecting the outbound flight. Click the blue Select button once you have made your choice.

5. From here you can confirm your flight details and select a fare upgrade if you wish. Then, you’ll be able to choose how to pay for your flight . You can pay for the entire purchase with points or a Chase credit card, or you can split your payment between points and a Chase credit card.

6. Finally, input your passenger information next. Don’t forget to add a frequent flyer number, a Known Traveler Number, or a Redress number if you have them.

Hot Tip: When purchasing travel through the Chase travel portal, you can split your payment between Chase Ultimate Rewards points and a Chase credit card.

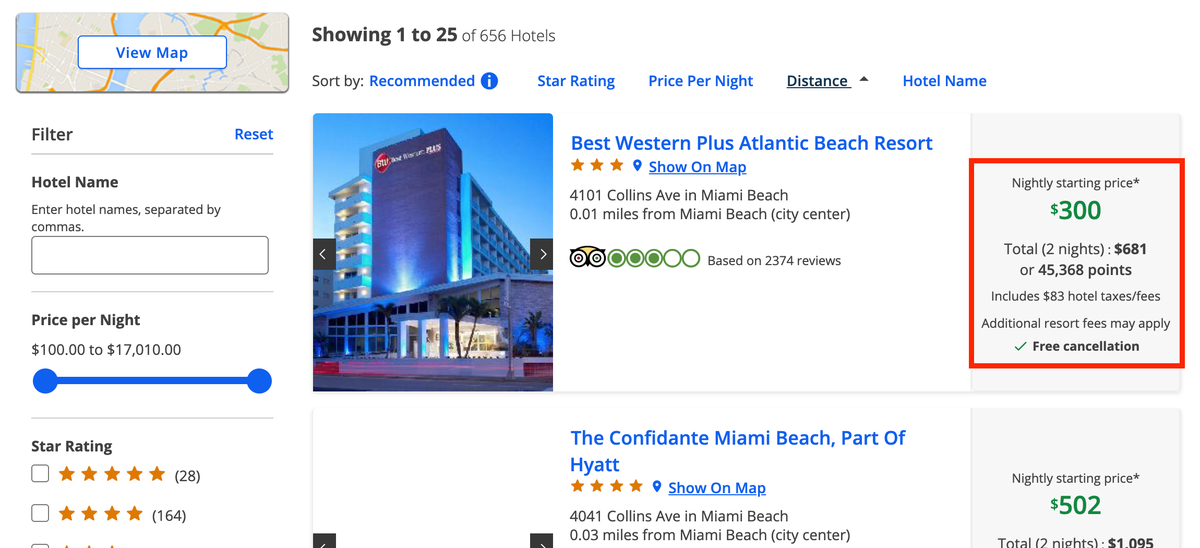

How To Book a Hotel Through Chase Travel

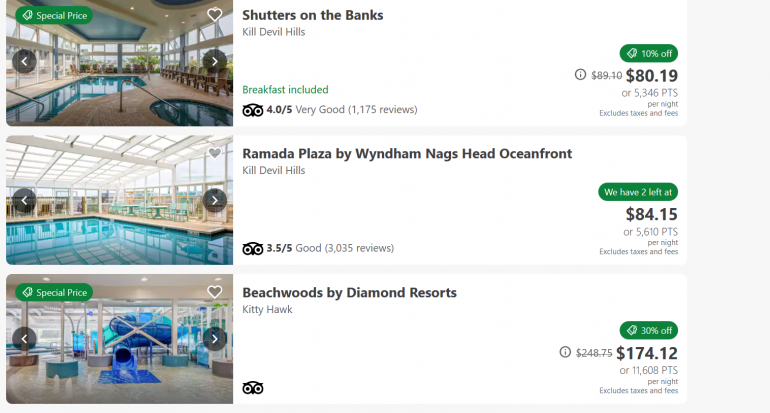

1. To book a hotel through the Chase Travel portal , you’ll need to start by clicking on the Hotels tab in the main search box. Then, input your destination, check-in and check-out dates, and the number of travelers. Next, click on the blue Search button.

2. Your search results will look like other sites that you may be familiar with. You’ll see filtering options to the left and sorting options above your search results.

3. Each search result will show the price in both dollars and Chase Ultimate Rewards points. These prices include taxes and fees with the exception of resort fees.

4. Once you select your hotel, click on Add to Itinerary . You can choose to pay for all or part of your hotel cost using Ultimate Rewards points. Click Begin Checkout to input your reservation details and finalize your booking.

Hot Tip: When booking a hotel through the Chase Travel portal, you won’t be eligible to earn points in the hotel’s loyalty program or take advantage of any elite status you may have.

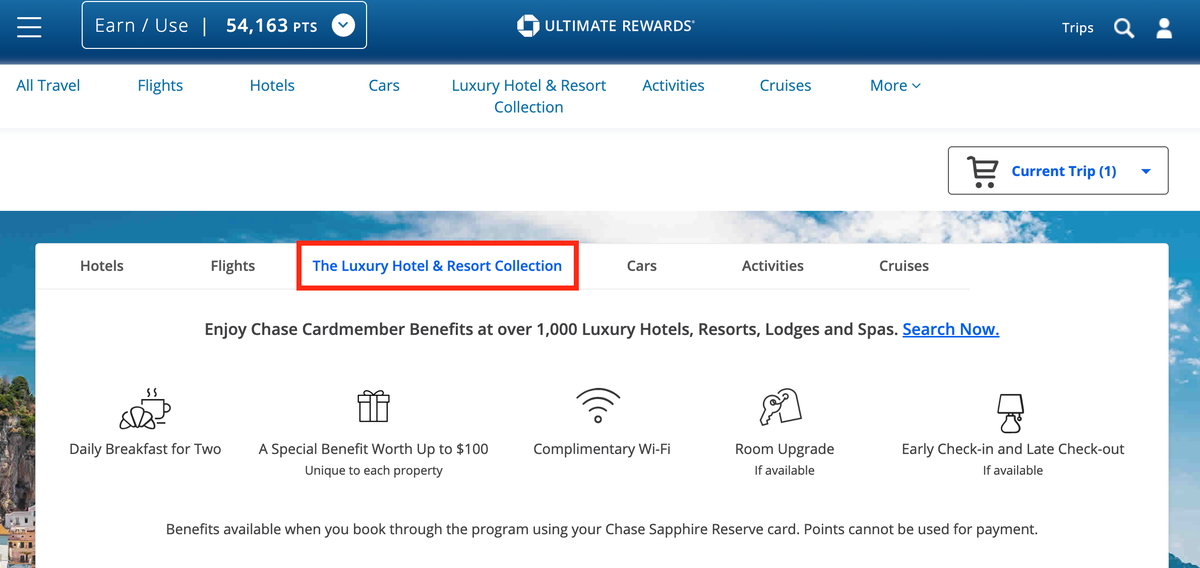

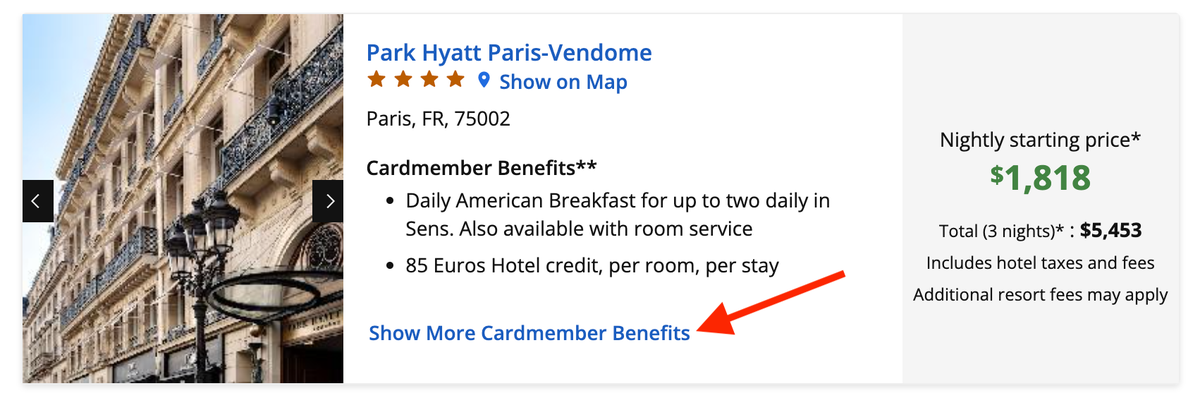

The Luxury Hotel and Resort Collection (LHRC) is exclusively for Chase Sapphire Reserve cardholders. From the Ultimate Rewards travel home page, just click on The Luxury Hotel & Resort Collection tab.

Once you are on the LHRC homepage, type in your destination and click Search to view available properties. Each listing will display the property’s unique cardmember benefits. Click on the listing for more information and to continue the booking process.

When booked through the Chase Travel portal, these properties offer the following benefits:

- Daily breakfast for 2

- Special amenity (varies by property)

- Room upgrades (based on availability)

- Early check-in and late checkout (based on availability)

The Luxury Hotel and Resort Collection properties are reservation-only bookings. You’ll make your reservations online and payment doesn’t happen until you check out from the hotel. These bookings will not take Chase Ultimate Rewards points as payment.

Bottom Line: Luxury Hotel and Resort Collection properties are only available to Chase Sapphire Reserve cardmembers. These properties can’t be booked with points.

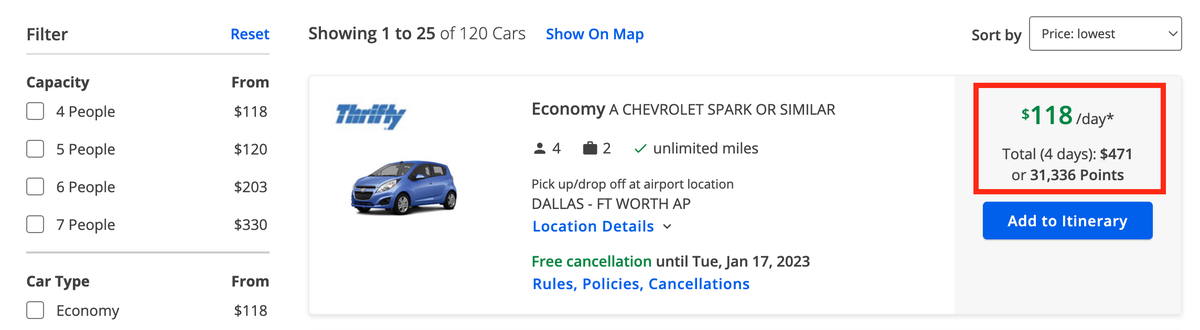

1. To rent a car through the Chase Travel portal, start by clicking on the Cars tab in the main search box. Then, input your pick-up location, drop-off location, dates, times, and age of the driver. Click on the blue Search box to continue.

2. You can then narrow your search with the filtering options on the left-hand side of the page.

3. For each car option, you will be able to see the car details, rental company, and price in both dollars and Chase Ultimate Rewards points. Once you have selected the car you want to rent, click on Add to Itinerary .

4. You can pay for the entire purchase with points or a Chase credit card or split your payment in any amount. Double-check all of the details before completing your purchase.

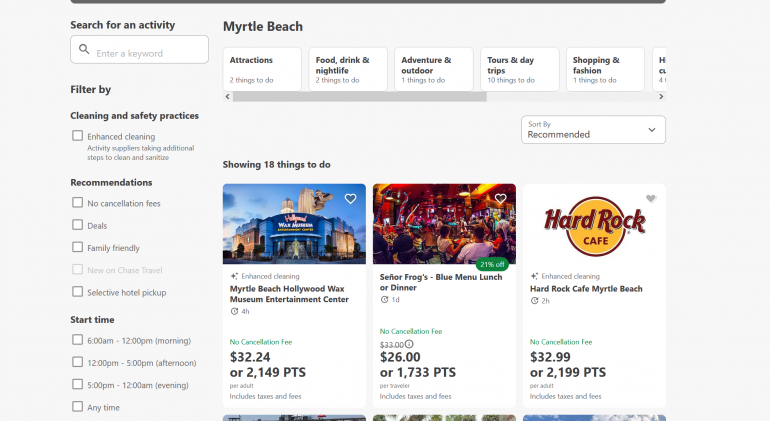

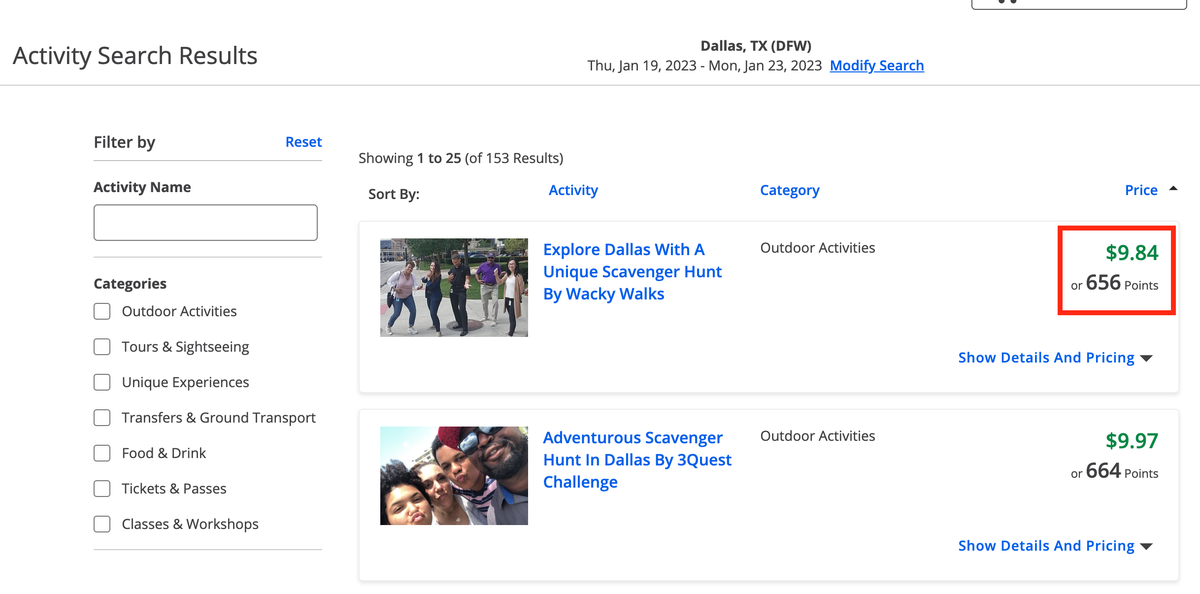

Did you know you can also book activities through Chase Travel?

1. Click the Activities tab on the Ultimate Rewards travel homepage to get started. Then, input your destination and travel dates and click the Search button to continue.

2. You can narrow your search by selecting 1 or more categories at the left-hand side of the page. Categories can include things like:

- Classes & workshops

- Cruises & sailing

- Food & drink

- Outdoor activities

- Seasonal & special occasions

- Tickets & passes

- Tours & sightseeing

- Transfers & ground transport

- Unique experiences

3. Each activity will show the price in both dollars and points to the right side of the screen. Click on Show Details and Pricing for more information and to book the activity.

6. Double-check all of the details on the final page before completing your purchase. Click the box confirming you understand the travel disclosures, then click Complete Checkout to finish your purchase.

Bottom Line: You can book lots of activities through the Chase Travel portal, including airport transfers!

If you’re a fan of cruises, you’ll be pleased to know you can book them through your Chase Travel portal. To get started, click on the Cruises tab on the Ultimate Rewards travel homepage.

This will bring up a list of available cruises, but there’s also a search box at the top of the screen, so you can input a specific destination or cruise line.

Each listing will display the cruise line, ship, ports of call, sailing dates, and baseline pricing for an interior or oceanview cabin. Unfortunately, if you want any more specific information or if you want to book, you will need to call 855-234-2542 .

You’ll notice that only cash prices are listed for cruises, however, they can be booked using your Chase Ultimate Rewards points, too.

Hot Tip: You can book a cruise through Chase Travel but you’ll have to call to make your reservation as they can’t be booked online.

How Do the Prices Compare to Other Sites?

Are you getting a good deal by booking through Chase? Let’s look at how the prices available through the Chase Travel portal stack up to other OTAs and search engines including Hotwire , Kayak , and Expedia .

We did some flight searches and found there’s no clear-cut pattern on prices between the Chase portal to other websites.

Example #1: Round-trip flight between Philadelphia (PHL) and San Francisco (SFO) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between Alaska Airlines and Delta Air Lines for $526.20. This worked out to be the cheapest price we found, and Priceline had the same low price. Expedia and Hotwire both charge booking fees, making the price a little higher. Each airline’s own website couldn’t split the itinerary between different airlines, so those ended up being much more expensive.

If you are in doubt or would like to check prices yourself, Kayak is a great place to start. Kayak will show you prices for a flight on all of the OTAs as well as the airline’s website. It’s a great one-stop shop to compare flight prices.

Example #2: Round-trip flight between New York City (JFK) and Paris, France (CDG) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between American Airlines and British Airways for $689.78. This wasn’t the overall best price we found, though. That award goes to Expedia and Priceline.

Hot Tip: You will earn frequent flyer miles when you book your flight through the Chase Travel portal.

Example #1: Here’s how prices looked for a week-long stay at the JW Marriott Cancun Resort & Spa in Mexico for 2 people including all taxes and fees. The $291.55 resort fee can’t be paid with points.

In this example, the best cash rate by far was through Marriott. However, if you wanted to pay with points, booking with Chase Ultimate Rewards points through the travel portal would be your best bet.

Keep in mind that Marriott doesn’t have an award chart, so different time periods can have different point costs. A 7-night stay at this hotel can dip down to 240,000 points for a 7-night stay. If you’re going to pay for your hotel stay in points, it’s always smart to calculate how many points it would cost to book through Chase versus transferring points . This information can help you make the best and least expensive choice.

Hot Tip: You won’t earn hotel loyalty points when booking a hotel through Chase and any elite status you have may not be recognized.

Example #2: Let’s look at an example of a hotel that doesn’t have a loyalty program. We priced out a 2-night stay at Almond Tree Inn Hotel in Key West, FL for 2 people. The highest prices were direct via the hotel with all other websites surveyed being cheaper.

Here’s how the prices stacked up:

Chase’s low price matched the other online travel websites and was actually lower than the hotel’s own website, so it would be a great option in this case. It also affords the opportunity to use points for a hotel that doesn’t have its own loyalty program.

In many cases, car rental prices found through the Chase Travel portal were similar to prices found on the rental agency’s own website.

The main difference in booking through Chase vs. directly through a car rental agency is that the car rental agency often has the ability to book the car without paying up front. With the Chase portal, you will be paying at the time of booking and there may be change or cancellation fees if you need to modify your reservation.

In both of these examples, Chase Travel didn’t offer the lowest price, however, that won’t always necessarily be the case. Of course, the advantage of booking through Chase is the ability to use your Chase Ultimate Rewards points. It’s always a good idea to price out your car rental on a few different websites before booking to ensure you’re getting the best price.

Chase actually offered the lowest prices on activities for both examples:

Other Ways To Use the Chase Travel Portal

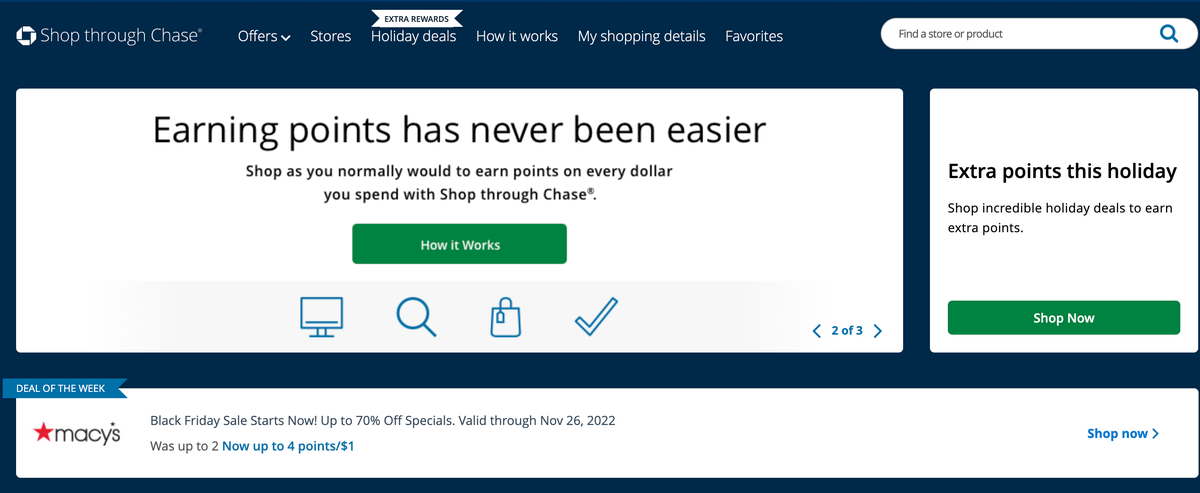

The Chase Travel portal also helps you earn bonus points. With the Shop through Chase feature, you can earn extra Ultimate Rewards points through your online shopping.

Just click Earn Bonus Points in the top search bar to access the shopping portal. Click on a featured store or search for a specific one. Then simply click through the portal to your website of choice to make your purchase. Your bonus points will be added to your Chase Ultimate Rewards points total within 3 to 5 days in most cases.

Did you know you can use your Chase Ultimate Rewards points to make purchases at Amazon and PayPal? Click on Pay with Points in the top search bar, then select either Amazon or PayPal to enroll and shop.

Unfortunately, the redemption value you get when shopping through Amazon or PayPal is pretty bad — only 0.8 cents per point. While it’s great to have this as an option, we don’t recommend using points to shop at Amazon or PayPal as your main use of Chase Ultimate Rewards points.

Bottom Line: The value of using your Chase Ultimate Rewards points to shop through Amazon or PayPal isn’t great: you will only get 0.8 cents per point!

By clicking on Apple in the main search box in your Ultimate Rewards account, you can use your Chase points to make purchases. Normally, you’ll get 1 cent per point in value when using your points for Apple purchases, but there are occasional bonuses offered to get a better redemption rate.

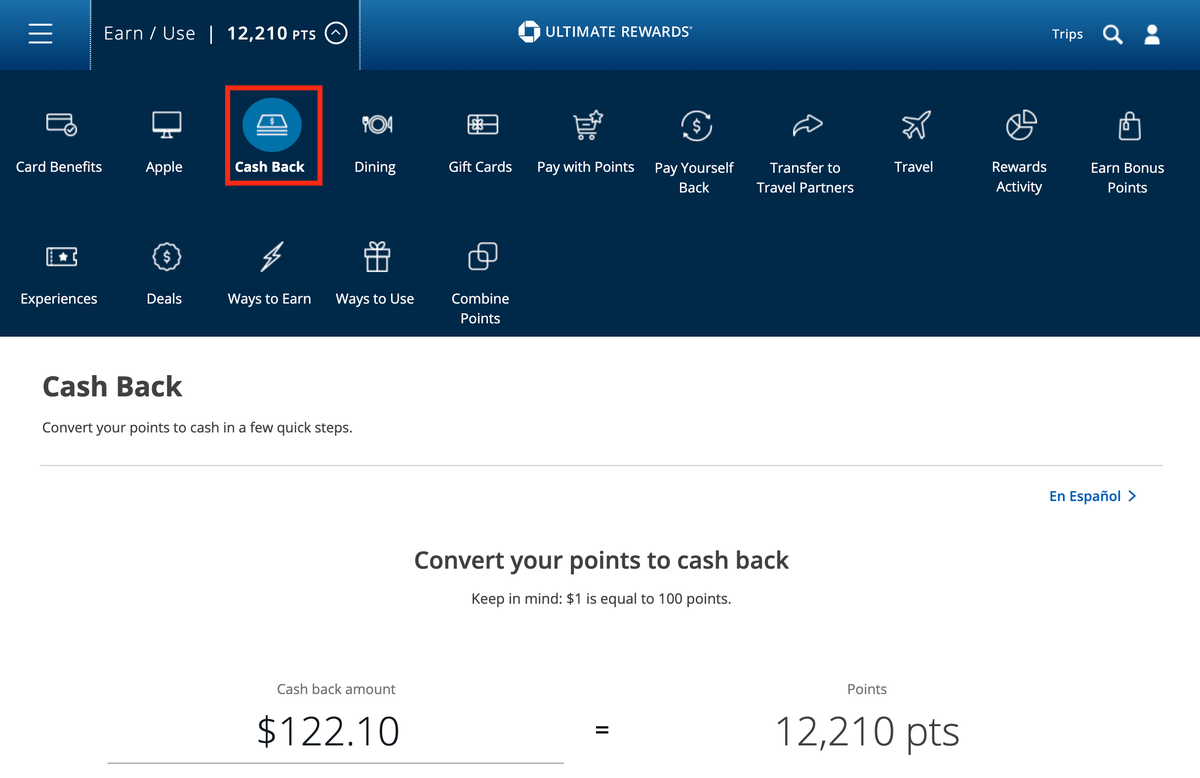

You can also redeem your Ultimate Rewards points for cash-back. To do this, simply select Cash-back from the main search bar at the top of the screen. You will then be able to see choose how many points you’d like to redeem for cash-back at a value of 1 cent per point .

You can choose to have your cash direct deposited into a checking or savings account or as a statement credit. The deposit or statement credit will be posted within 3 days.

Bottom Line: Your Chase Ultimate Rewards points are worth 1 cent each when redeemed as cash-back. We do not recommend this as a primary redemption option because you can get more value via the Chase Travel portal, and a lot more when transferring to airline and hotel partners.

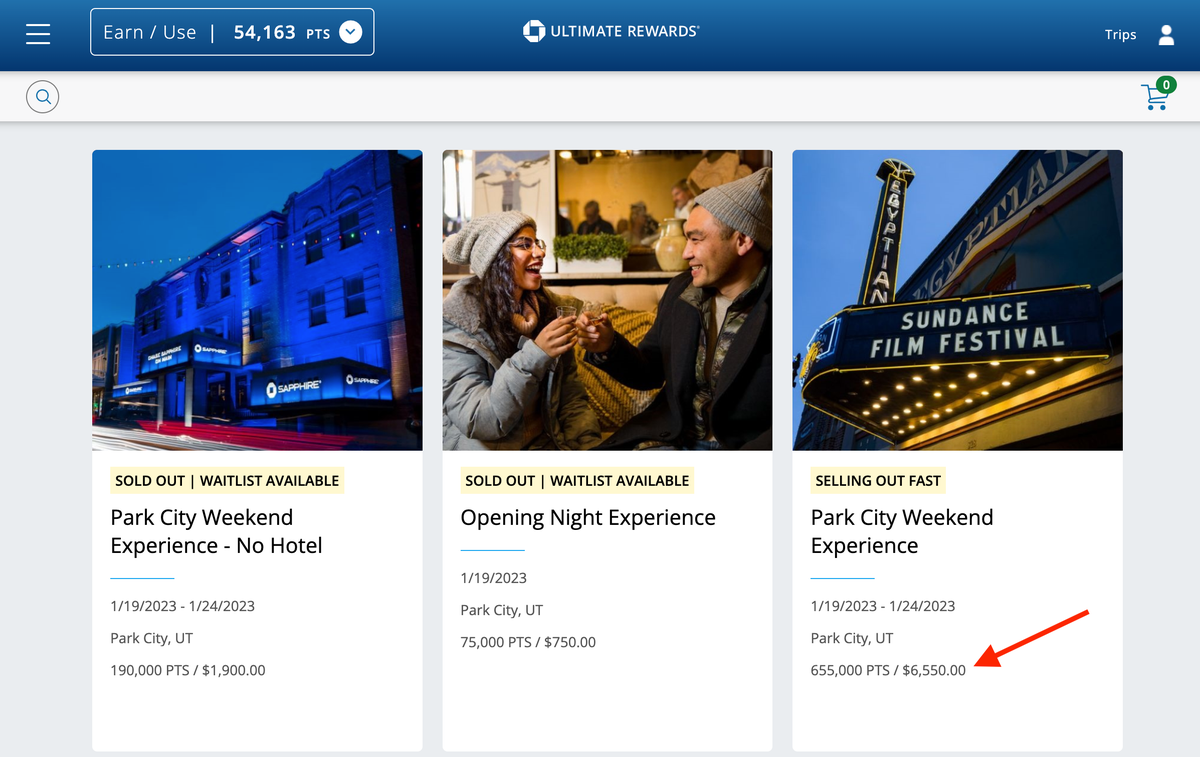

This is a really cool section of the Chase Travel portal. When you click on Experiences in the main search bar, you’ll see a list of exclusive events, preferred seating, and other offers for select Chase cardmembers.

Experiences can be purchased with a credit card or with points. You will get 1 cent per point in value when redeeming points for experiences. Some experiences are only available to cardholders of specific cards so be sure to check all of your cards if you have more than 1 to make sure you don’t miss anything.

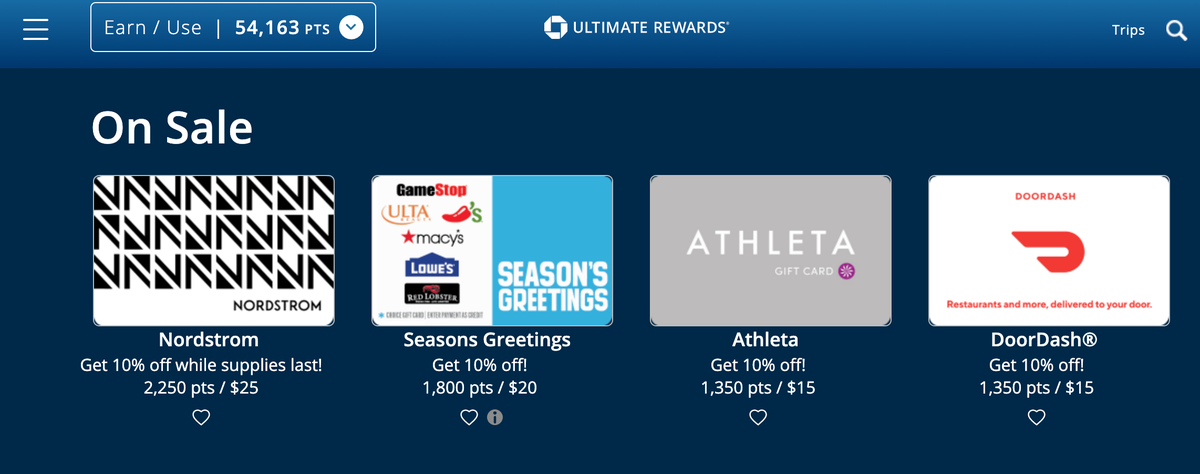

If you prefer gift cards, you can purchase them through the Chase Travel portal using points. Just click Gift Cards in the main search bar to get started. From here, you will be able to scroll through all of the available gift cards. You’ll get 1 cent per point in value, with occasional sales offering better redemption rates.

Hot Tip: Points redeemed for gift cards have a 1-cent per point value. However, you might notice some cards offer discounts, so there is the opportunity to get a bit more value!

Another way to use your Ultimate Rewards points is through the Pay Yourself Back feature. This allows you to redeem your points for a statement credit for purchases in select categories. The current categories include groceries, dining, select charities, credit card annual fee, internet, cable, phone, and shipping and the redemption value varies by card.

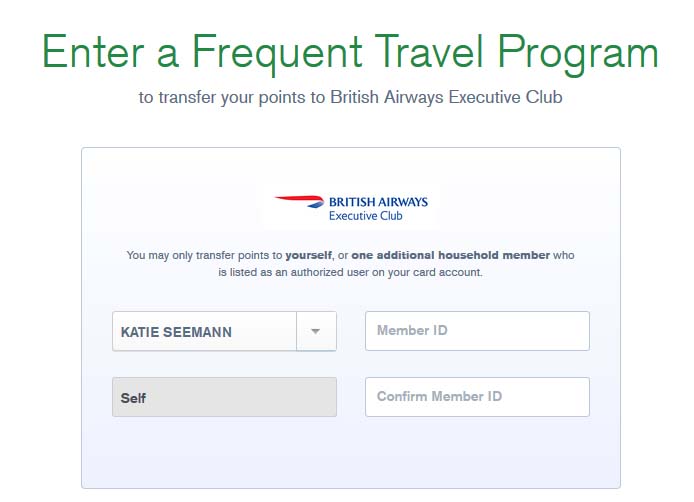

Transferring points to travel partners is the best way to get the most value out of your points . By transferring, you can potentially get 2, 3, or more cents per point value.

Chase Airline Transfer Partners

Chase Hotel Transfer Partners

To transfer your Chase Ultimate Rewards points to any of the above airline and hotel partners, log on to your account and click on Transfer To Travel Partners in the top search box. Choose your airline or hotel and then select Transfer Points . You’ll need to fill out your frequent flyer information or hotel loyalty membership number to complete the transfer.

Bottom Line: You can currently transfer your Chase Ultimate Rewards points to 14 different hotel and airline partners.

There are many ways to use your Chase Ultimate Rewards points. While transferring points to one of Chase’s airline and hotel travel partners can get you maximum value, there are a lot of benefits for booking travel directly through the Chase Travel portal .

In addition to hotels and flights, you can book car rentals, activities, and cruises. Or, you can use your points for cash back, shopping, gift cards, or Chase exclusive experiences. With so many ways to use your Chase Ultimate Rewards points, your next trip is only a few clicks away!

The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Chase Freedom ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Do chase ultimate rewards points expire.

No. As long as you keep your Chase credit card open, your points will not expire.

Can I transfer my Chase points to someone else?

Yes. You can transfer your points to another member of your household who also has a Chase Ultimate Rewards account.

What are Chase Ultimate Rewards points worth?

When redeeming points through the Chase travel portal, the credit card you hold will determine your points’ value.

When redeeming for travel, your points have the following value:

- 1 cent : Freedom card, Freedom Flex card, Freedom Unlimited card, Ink Business Cash card, Ink Business Premier card, Ink Business Unlimited card

- 1.25 cents : Chase Sapphire Preferred card or Ink Business Preferred card

- 1.5 cents : Chase Sapphire Reserve card

When using your points to shop through Amazon or Chase Pay, they are worth 0.8 cents per point.

When redeeming your points for cash back, gift cards, or experiences they are worth 1 cent per point.

What airline partners can I transfer my Chase Ultimate Rewards points to?

Chase airline partners include Air Canada, Air France-KLM, British Airways, Iberia, Aer Lingus, Emirates, JetBlue, Singapore Airlines, Southwest Airlines, United Airlines, and Virgin Atlantic.

What hotel partners can I transfer my Chase Ultimate Rewards Points to?

You can transfer your Chase Ultimate Rewards points to the following hotels at a 1:1 ratio: IHG, Marriott, and Hyatt.

Was this page helpful?

About Katie Seemann

Katie has been in the points and miles game since 2015 and started her own blog in 2016. She’s been freelance writing since then and her work has been featured in publications like Travel + Leisure, Forbes Advisor, and Fortune Recommends.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![chase visa travel phone number How To Earn 100k+ Chase Ultimate Rewards Points [In 90 Days]](https://upgradedpoints.com/wp-content/uploads/2023/01/Chase-bank-branch-new-york.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts