- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

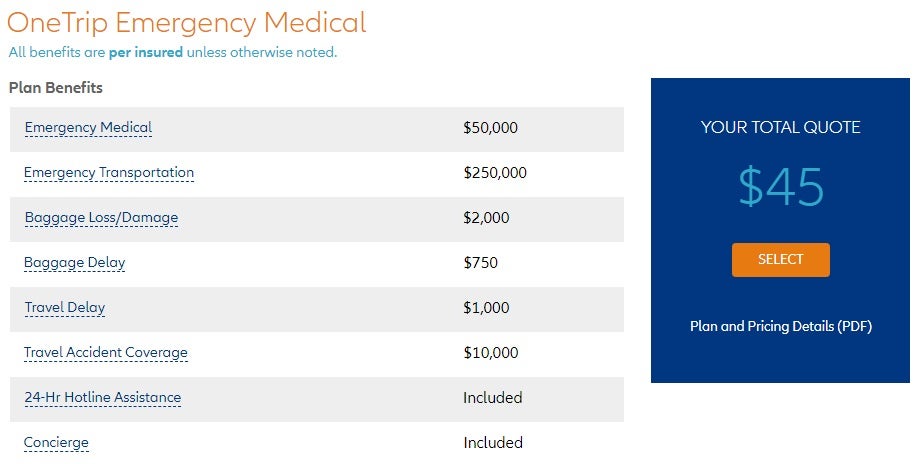

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

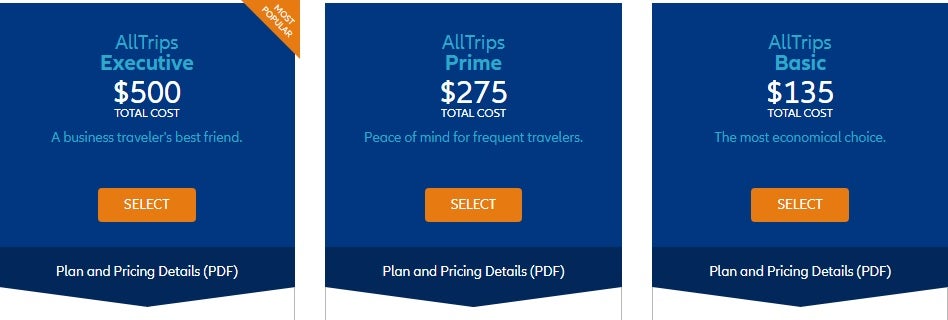

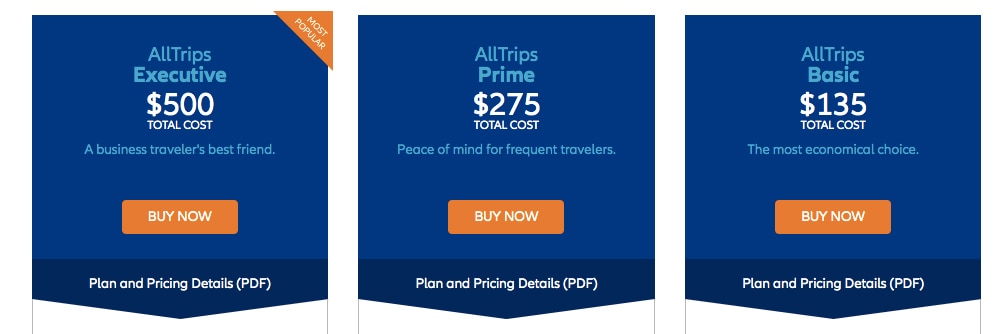

Allianz offers four different annual/multi-trip plans.

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

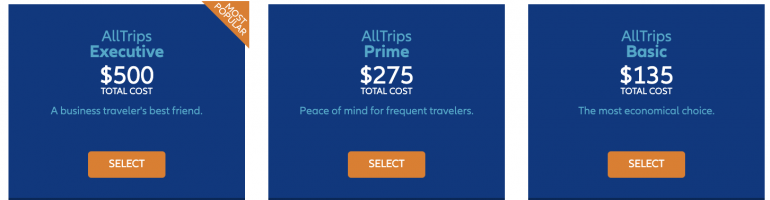

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

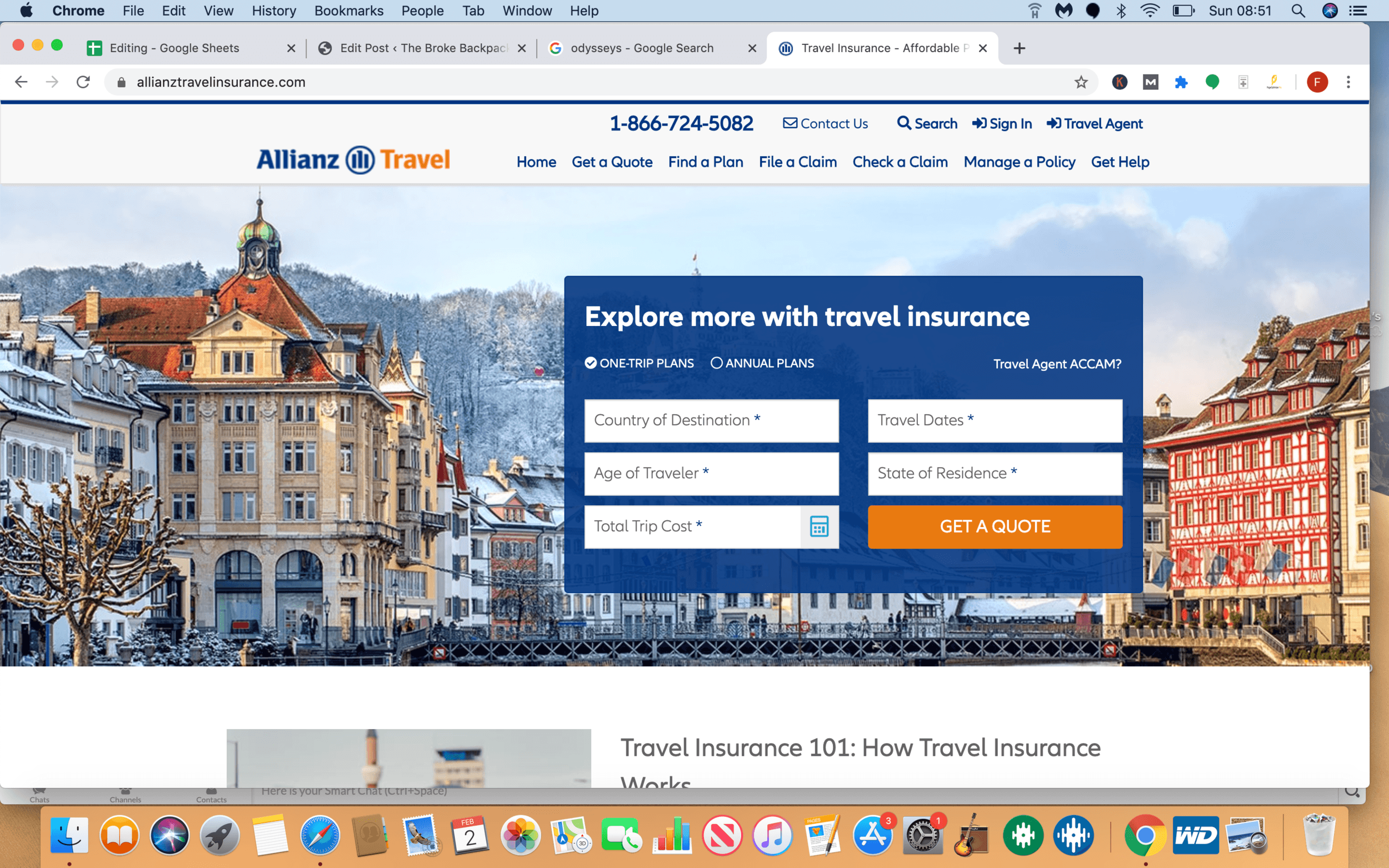

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

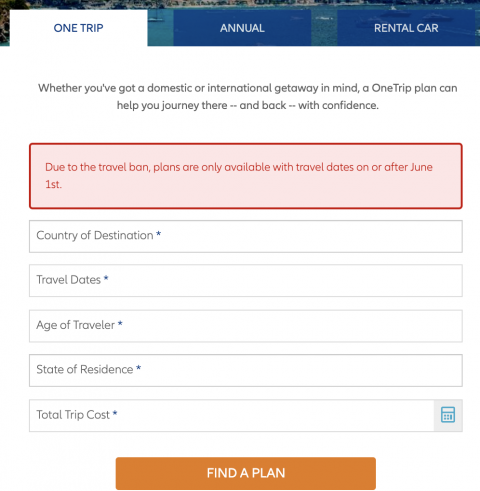

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Allianz Travel Insurance Coverage Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

31 Published Articles 3102 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Why Purchase Travel Insurance

Allianz epidemic coverage endorsement, onetrip plans — for affordability and select coverages, alltrips annual plans — cover all of your trips for a 12-month period, how to obtain a quote with allianz, onetrip emergency medical plan, onetrip cancellation plus plan, rental car damage protector, allianz vs. credit card travel insurance, allianz vs. other travel insurance companies, allianz vs. point-of-sale travel insurance and protection, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

There are a lot of choices when it comes to travel insurance companies , so narrowing your selection to those that have a solid financial rating, offer products that provide good value, and receive high customer ratings should be baseline criteria.

Allianz Global Assistance company ( Allianz Travel) checks all of those boxes. Its parent company, Allianz SE, receives an A+ rating from A.M. Best (a leading insurance financial rating firm), and the company offers competitive individual trip and annual travel insurance products. It also serves over 45 million customers in the U.S. each year with 84% of those customers giving the company a 5-star rating.

Allianz has also been around a long time. In fact, the company was there to insure the Wright Brothers’ first flight and the construction of the Golden Gate Bridge — so you know you’re working with an established organization. You’ll also find that Allianz does business in more than 35 countries.

Let’s take a look specifically at Allianz Travel’s insurance products, show you how to obtain a quote, and give you some tips on purchasing and comparing travel insurance policies.

And while our focus is on Allianz Travel coverage, much of our information can apply to purchasing travel insurance in general.

Travel insurance can protect your trip investment with coverage for disruption due to unforeseen events such as severe weather, should you become ill, for illness in your family, missed connections, medical emergencies, and more.

Deciding whether to purchase travel insurance for your trip is an option each time you make a travel booking. The coverage is commonly offered by airlines, cruise companies, tour operators and other travel providers at the point of sale. If you travel infrequently and the cost is relatively low, you may just opt for the coverage during the booking process.

However, if you’re going to be taking several trips, you may be able to save money and receive better coverage if you compare with other travel insurance policies in the marketplace. Additionally, you’ll want to determine if it makes sense to purchase single insurance coverage for each trip or an annual all-trips-included policy.

Situations where it makes sense to purchase travel insurance include the following:

- You’re booking an expensive trip that includes a lot of non-refundable upfront expenses

- Your trip includes several travel providers (i.e. airlines, hotels, and tour operators)

While travel insurance is meant to cover unforeseen events, purchasing Cancel for Any Reason coverage may allow you to cancel your trip for any reason.

Bottom Line: If you’re uncomfortable with the amount of money you have at risk when you travel, securing travel insurance can provide immediate peace of mind . You’ll have solace in knowing that if you needed to cancel your travel plans due to a covered event or if your travel is disrupted, you’ll be able to recoup most, or all, of your investment.

Travel Insurance and the COVID-19 Virus

Most travel insurance policies do not provide coverage for trip cancellation due to fear of the coronavirus pandemic . However, COVID-19 is an included illness on many travel insurance policies as it relates to certain coverages such as emergency medical care while traveling and canceling a trip if you become ill with the virus. You may also have coverage if a family member or travel companion contracts the virus and you must cancel your trip as a result.

The only way to cover trip cancellations due to fear of contracting COVID-19 is to purchase Cancel for Any Reason insurance. This coverage can be added to a comprehensive travel insurance policy (with limitations) and subsequently allows you to cancel your trip for any reason.

While Allianz does not offer Cancel for Any Reason insurance , it may cover COVID-19 related illness in the following circumstances:

- Emergency medical care while traveling

- Trip cancellation due to becoming ill with the virus

Allianz recently announced that it is adding a new endorsement to select policies that will offer limited coverage for COVID-19 . Circumstances such as becoming ill with COVID-19 and having to cancel your trip, hospitalization, and trip delays due to such illness while traveling will have coverage.

Emergency transportation coverage has also been expanded to include COVID-19-related illness. Terms and conditions apply and the endorsement is not available on all policies Allianz offers.

You can find policies that offer Cancel for Any Reason insurance at TravelInsurance.com and Aardy.com .

Bottom Line: Travel insurance policies normally do not cover canceling your trip because of fear you might get ill. However, Cancel for Any Reason insurance allows you to cancel a trip for any reason you determine is necessary.

Types of Travel Insurance Policies Available With Allianz

Allianz Travel offers 2 core types of travel insurance plans: single trip plans and multi-trip plans . Each plan allows you to select the level of coverage you want and subsequently, the level of premium you prefer to pay.

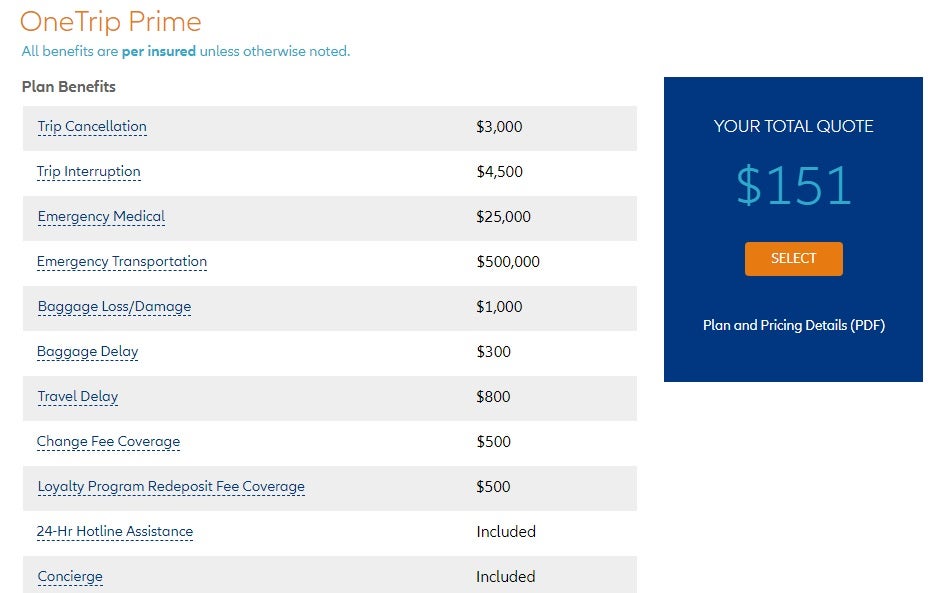

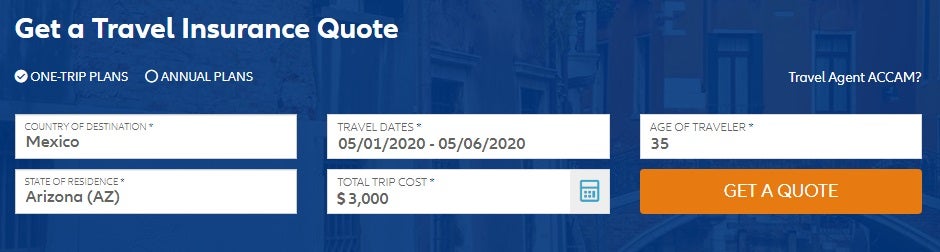

We’ve used criteria to obtain a quote for a traveler age 35, traveling for 1 week to Mexico on a trip costing $3,000 . All benefits are per person, per trip, unless otherwise noted.

The single trip option allows you to select from a Basic, Prime, or Premier plan. Premiums vary by plan and coverage levels. For the example we selected, the premiums ranged from $116 for the Basic to $192 for the Premier pla n .

OneTrip Basic Plan — the Most Affordable Plan

The OneTrip Basic plan offers basic trip protection at an affordable price.

OneTrip Prime Plan — the Most Popular Plan

Need more coverage but still want your travel insurance protection to be affordable? The OneTrip Prime plan offers higher coverage limits at a reasonable cost.

The following are the maximum coverage limits for OneTrip plans. These coverages can be found under the OneTrip Premier Plan:

- Trip Cancellation — up to $100,000 reimbursement for prepaid non-refundable expenses; pre-existing medical conditions included

- Trip Interruption — up to $150,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event; pre-existing medical conditions included

- Emergency Medical — up to $25,000

- Emergency Medical Transportation — up to $500,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $300 for delays 12 hours or more

- Trip Delay — up to $800 ($200/day for 4 days) for delays of 6 hours or more, for eligible expenses; an option to receive $100/day with no receipts required is also available

- Change Fee Coverage — $500

- Loyalty Program Re-deposit Fee Coverage — $500, covers re-deposit of points/miles due to covered trip cancellation

- 24 Hour Hotline Assistance

- Optional coverages include pre-existing medical coverage, rental car coverage, and required to work coverage — restrictions apply

Also worth noting is that kids age 17 and under are covered at no additional charge when traveling with a parent or grandparent.

Bottom Line: Allianz offers several levels of single-trip travel insurance plans that can fit every budget and level of coverage needed.

If you’re a frequent traveler and want to ensure all of your trips are covered without having to purchase individual travel insurance policies, one of the AllTrips plans might be an appropriate choice. All of the trips you book within the 12-month policy period are covered automatically.

Coverage limits are per person, per trip, but more than 1 person can be included in the policy. Children 17 and under are covered at no additional charge when traveling with a parent or grandparent.

The AllTrips Executive plan is the most comprehensive policy and includes the maximum coverage limits listed below . AllTrips Prime and AllTrips Basic have less coverage than the Executive plan but may still be appropriate for your situation.

For example, the AllTips Basic plan does not include trip cancellation/interruption insurance but has emergency medical, evacuation, trip delay, baggage insurance, and car rental insurance.

- Trip Cancellation — up to $10,000 reimbursement for prepaid non-refundable expenses

- Trip Interruption — up to $10,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event

- Emergency Medical — up to$50,000

- Emergency Medical Transportation — up to $250,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $1,000 for delays 12 hours or more

- Trip Delay — up to $200 per day for eligible expenses, up to $1,600 in coverage , for delays of 6 hours or more

- Rental Car Damage and Theft — up to $45,000

- Business Equipment Coverage — up to $1,000

- Change Fee Coverage — up to $500

- Loyalty Program Redeposit Fee — up to $500

- Travel Accident Insurance — up to $50,000

- Concierge Services

- Optional Pre-Existing Medical Coverage — restrictions apply

Bottom Line: Allianz’s AllTrips 12-month plans offer affordable options to cover every trip you have booked or have yet to book within a 12-month period.

Travel insurance is one of the easiest policies for which to obtain a quote and subsequently purchase a policy. Unlike auto or home insurance, you simply input some basic information about your trip, your age, where you reside, and your quote is instant.

You can then read through the coverages, select a policy that fits, and hit the purchase button. There is also no risk as you’ll have a free-look period where you can review the policy and decide whether to keep it or not.

If not, you can get a full refund. This period can be 10-14 days after purchase , depending on your plan and state regulations.

Additional Travel Insurance Offered by Allianz

In addition to the travel insurance packages offered by Allianz, you can purchase these additional plans and coverages available for single trips:

If trip interruption/cancellation is not important to you, you’ll find this plan with emergency medical, baggage insurance , emergency transport, travel accident coverage , and trip delay an affordable alternative.

If you need to cancel your trip for a covered reason or your trip is interrupted for a covered event, you’ll have coverage. Trip delay and 24-hour assistance are included.

For $9 per day, receive rental car damage/theft coverage, rental car trip interruption protection, and baggage loss coverage.

Hot Tip: If trip cancellation/interruption or trip delay coverage comes with your credit card is adequate for your trip but you want additional medical coverage, the Allianz’s OneTrip Emergency Medical plan may be a viable and affordable supplement.

How Allianz Compares

When it comes to comparing travel insurance policies, it’s difficult to match apples to apples. Coverages vary widely, as well as terms and conditions. The lowest-priced policy is not always the best value for your needs. The flip side is possible, too. You may find a policy with plenty of coverage at a price that is more than you want to spend.

The best solution is when you find a balance between coverage and cost.

Here’s how Allianz’s travel insurance offerings compare with other travel insurance options.

The coverage that comes with your credit card does not compare with a comprehensive travel insurance policy . In addition to the limited travel insurance coverage credit cards offer, if you do have a claim, you’ll have the potential hassle of dealing with a third-party claims administrator.

With that being said, the trip cancellation, trip interruption, trip delay insurance, and primary rental car insurance coverages found on several credit cards may be more than adequate for your trip.

Here are some of the best credit cards for travel insurance:

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

The Amex Platinum card comes with trip cancellation and trip interruption insurance with a benefit of $10,000 per trip, up to a maximum of $20,000 per account per 12-month period.

Pay for your trip with your eligible card and you, your immediate family, and eligible traveling companions are covered for non-refundable expenses paid to the travel provider. Trip interruption coverage will also reimburse for additional travel expenses incurred due to a covered loss during your trip.

Trip delay coverage is also included on the Amex Platinum card for delays more than 6 hours. Reimbursement for incidentals and eligible incurred expenses is limited to $500 per trip with 2 claims allowed per 12-month period.

The Amex Platinum card also comes with emergency medical evacuation coverage .

For more information, check out our detailed guide to the travel insurance benefits offered by the Amex Platinum card.

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Pay for your trip with your eligible card for up to $10,000 in coverage per person, $20,000 per trip, and up to $40,000 in a 12-month period. You and your qualifying immediate family are covered.

You’ll also find primary car rental insurance on the Chase Sapphire Preferred card and the Chase Sapphire Reserve ® card .

To learn more about the travel insurance benefits on the Chase Sapphire Preferred card , you’ll want to review this detailed article.

Chase Sapphire Reserve ® Card

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

In addition to the same trip cancellation/interruption/delay coverage as the Chase Sapphire Preferred card, the Chase Sapphire Reserve card offers up to $2,500 in emergency dental and medical coverage , emergency medical evacuation .

For more information check out this guide to all of the travel insurance benefits offered by the Sapphire Reserve.

Before purchasing any travel insurance policy, it’s wise to compare — fortunately that’s an easy task to execute. With comparison sites such as the ones listed here, you can compare as many as 100 travel insurance policies very quickly and find a policy that fits your situation and budget.

Keep in mind that insurance rates and coverages are highly regulated by the states . Insurance companies file a certain policy for a certain price with the state insurance commission, then the company is allowed to offer that policy, at that price, in that state.

For this reason, you won’t find the same policy offered at different prices. However, you could find a policy that is a better fit and possibly for less money by comparing several companies’ offerings.

Not all comparison sites include Allianz but when comparing similar policies, you’ll find that the company is competitively priced (a few companies lower and many companies higher). Individual results will vary based on your criteria.

Here are 4 websites that allow you to easily compare travel insurance policies.

- Insure My Trip — With over 60,000 customer reviews, 21 highly-rated travel insurance providers, and a best price guarantee, Insure My Trip makes it easy to find the right travel insurance policy.

- Travelinsurance.com — Compare major top-rated travel insurance company policies easily with this licensed online insurance search engine.

- SquareMouth — This popular travel insurance search engine offers easy comparisons of hundreds of policies offered by dozens of highly-rated insurance companies.

- Aardy — AardvarkCompare is a licensed travel insurance company with agents on staff to help you find the right travel insurance policy. Its website allows you to compare the policies of over 30 travel insurance providers.

There are also specialty companies such as World Nomads that do a great job providing travel insurance for active individuals. If you’re into outdoor sports, adventure activities, or even more risky activities such as skydiving, you can find coverage through World Nomads.

Bottom Line: If you’re looking to purchase a travel insurance policy, you’ll want to compare companies and policies . First, look at companies with a strong financial rating, select a policy with coverages that are a priority to you, then select a premium you’re comfortable paying.

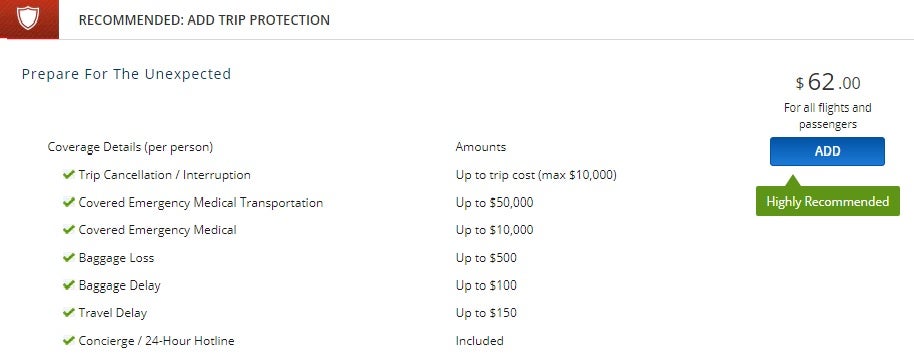

Allianz is actually one of the companies that provides the travel insurance you’re offered when you book a flight. An example is displayed in the above image of their offerings when you purchase a Delta Air Lines ticket.

Point-of-sale travel insurance, however, can run from inexpensive options that offer little coverage to expensive options that provide greater coverage but still have limitations, similar to stand-along travel insurance policies.

If you fly once or twice a year, the coverage is adequate for your needs, and the cost is reasonable, you may easily choose to go this route and purchase coverage at the point of sale. However, you may fare better by securing a separate travel insurance quote to compare coverage/cost.

Always read the fine print before purchasing any coverage to ensure you’re getting the coverage you expect. For example, one might assume by looking at this example that canceling the trip would be covered, when in reality the covered reasons are limited.

Bottom Line: Even for point-of-sale travel insurance to cover a single travel purchase, it’s good to get a comparison quote. Securing a quote may save you money while offering broader coverage that could cover your entire trip versus just a portion of it.

Allianz is a solid, established, company offering a nice selection of packaged travel insurance products. Its website is easy to use with a quick quoting function and a simple purchase process. The site is also easy to understand as it is clearly written in plain language rather than legal verbiage.

One downside of Allianz is that the company does not sell Cancel for Any Reason Insurance . This is not an issue if you understand this up front and know that your policy does not allow you to cancel a trip for just any reason. After all, this is the case with most travel insurance — there are specific covered reasons for being able to cancel a trip and have coverage.

Cancel for Any Reason insurance can also result in a premium as much as 70% more than a standard policy, so many travelers may not consider it due to its cost.

If money is not a concern, you can purchase as much insurance as you’d like to have. However, in reality, purchasing travel insurance that works for you involves finding a balance between the coverage you want and the maximum premium you’re willing to pay.

Allianz is a respected company that offers a variety of policy choices with appropriate coverage for the majority of travelers at price points that fit most budgets.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is travel insurance worth it.

Yes, it can be worth it. If you are uncomfortable with the amount of money you would lose or be forced to pay in the event you had to cancel your trip or if you incurred disruption while traveling, you should purchase travel insurance.

An inexpensive trip or single flight may not warrant purchasing travel insurance, but insuring an expensive or complicated trip where you have a lot of non-refundable prepaid expenses at risk makes economic sense.

Travel insurance also provides the intangible benefit of peace of mind, knowing you are protected if you have to cancel due to a covered event or your trip is disrupted once in motion.

What is covered for trip cancellation?

There are limited covered reasons for receiving a benefit from trip cancellation insurance. The number 1 reason most travelers cancel their trips, according to InsureMyTrip.com , is the unforeseen illness of the traveler or of family members.

Fortunately, this is a covered reason for trip cancellation, although the level of coverage varies by company and policy.

Additional covered reasons can include death, hospitalization, or accident to you or covered family, legal obligations, your home becomes uninhabitable, the default of the travel provider, or natural disaster.

Deciding not to take a trip is not a covered reason for trip cancellation. Cancel for Any Reason insurance must be purchased in order to cover canceling a trip for a reason you personally deem necessary.

Does travel insurance cover flight cancellations?

Yes, travel insurance can cover flight cancellations in certain circumstances and depending on the policy purchased.

However, if an airline cancels your flight, whether prior to travel or during your travels, you would first contact the airline or the agency where you purchased your ticket for rebooking, a refund, or travel credit.

If you are not made whole, you could then look for coverage in your travel insurance policy.

If a flight is canceled due to weather during your travels, for example, and you are forced to incur unexpected expenses as a result, you could have coverage under a travel insurance policy if these expenses are not covered, or insufficiently covered, by the airline.

There could also be coverage under trip interruption/delay insurance if an airline cancels a flight and it causes you to miss ongoing travel which has been prepaid and is non-refundable.

Which is the best travel insurance company?

The best travel insurance company will have a high financial rating from a respected insurance industry rating company such as A.M. Best, offer a selection of coverages that matches your protection priorities, and does this at a price you’re willing to pay.

You should check reviews as well, keeping in mind that most consumers want to pay the least amount of money they can at the time of purchase and by doing so, coverage can be sacrificed. When there’s a claim, it’s natural to want the highest degree of coverage, although that may not have been the level purchased.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![allianz premier travel insurance The Ultimate Guide to Buying the Best Travel Insurance [For You]](https://upgradedpoints.com/wp-content/uploads/2018/09/Travel-insurance-tag-on-luggage.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Allianz Travel Insurance Review

Coverage options offered by allianz, allianz travel insurance cost, compare allianz travel insurance.

- Why You Should Trust Us

Allianz Travel Insurance Frequently Asked Questions

Allianz travel insurance review 2024.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

While traveling can be a fun escape, it's an inherently risky activity with many variables to consider. So many worries can remove you from the joy of travel, which is where travel insurance can help.

Allianz Travel Insurance Global Assistance is a prominent leader in the travel insurance space that has been around in some form since 1890. Allianz offers a variety of travel insurance plans that can suit your individual needs. Read on to learn more about Allianz.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz is one of the leaders in the travel insurance industry, included in our guide on the best international travel insurance . With 10 plans split between single trip, annual, and rental car insurance, Allianz has its bases covered. It also provides specific insurance for particular needs, such as annual policies for business travelers and sports equipment coverage for athletes.

While Allianz is one of the best international travel insurance providers, it also has great CFAR coverage for its Prime and Premier single trip plans, covering 80% of nonrefundable travel expenses when most policies usually offer 75%. It's also great for families, with coverage for kids 17 and under in its One

Allianz is well reviewed among customers, receiving an average of 4.3 stars out of five across nearly 70,000 reviews on Trustpilot. Its Better Business Bureau page fares a little worse, receiving 3.64 stars out of five across 1,600 reviews. Positive reviews mentioned an easy and quick claims process with a responsive customer service team. However, negative reviews often mentioned difficulty specifically with claims for ticketed events.

Allianz also has a highly rated mobile app called Allyz TravelSmart through which you can contact customer service, view your plan, and file a claim. It received an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store.

Allianz travel insurance offers different policies, grouped under two types: single trips and annual multi-trip insurance .

The company's travel insurance policies can include the following coverage types:

- Trip interruption coverage , which can help recoup costs if you leave a trip early.

- Travel delay , which can cover some costs if you need additional accommodations due to a delay in travel.

- Emergency medical transportation , which covers transportation to a hospital for eligible illnesses and injuries.

- Emergency medical expenses in case of a dental or medical emergency.

- Baggage delay , which can cover some costs if you need to purchase required items due to your bags being delayed by a certain period of time. Must have receipts for this.

- Baggage loss or damage , which can help recoup some costs if your bag is lost, stolen, or damaged.

- Epidemic coverage endorsement, which can help recoup costs if you must cancel a nonrefundable trip due to an epidemic. It's important to note that there may be limitations and this isn't an option everywhere.

- Travel accident coverage , which can cover costs related to an injury that results in loss of vision, your hands or feet, as well as loss of life.

- Support via a 24-hour hotline

Single-Trip Plans

The general budget option is OneTrip Basic, which can offer various protections should something happen, if you file a claim for a qualified reason.

One step up is the OneTrip Prime policy, one of the most popular plans Allianz offers. It has higher coverage limits than the Basic plan, along with some additional perks.

A more complete option is OneTrip Premier, which includes more comprehensive protections should you need them. This policy is for more extensive, longer trips and includes extras like SmartBenefits—which up to $100 per day for a covered travel or baggage delay with no receipts necessary, only proof of delay—and sports equipment loss coverage.

The coverage limits available vary by plan. Here's an overview of what each policy covers:

Other OneTrip Premier benefits not mentioned in the table above include:

- Sports Traveler, reimbursement up to $1,000 in the event of a missed sports event for a qualified reason

- Sports Equipment Loss, reimbursement up to $1,000 to cover damaged or lost sports equipment

- Sports Equipment Rental, reimbursement up to $1,000 for the cost to rent sports equipment if your equipment is damaged or lost

- Vehicle return, up to $750 reimbursement to return your vehicle to your home if you can't drive it for a qualified reason

- Adventure and sports exclusions changes, which allows you to waive some losses in the event you participate in high-risk activities like free diving at 30 ft, scuba diving at 100 ft, caving, and more

There are two additional single-trip plans from Allianz that offer more specialized coverage: One Trip Emergency and OneTrip Cancellation Plus.

OneTrip Emergency Medical

OneTrip Emergency Medical is a budget option that exclusively offers post-departure benefits to cover you while you're on your trip. As such, the plan doesn't include pre-departure benefits such as trip cancellation or interruption.

- Travel delay, up to $200 per day per person for a maximum of $1000 for delays of six hours and beyond

- Travel accident coverage, up to $10,000

- Emergency medical transportation, up to $250,000

- Emergency medical expenses, up to $50,000 though dental emergencies have a maximum of $750

- Baggage delay, up to $750 with a delay of 12 hours or more

- Baggage loss or damage, up to $2000

- Epidemic coverage endorsement

- Concierge services included

OneTrip Cancellation Plus

The OneTrip Cancellation Plus policy by Allianz is its economical back-to-basics option that can recoup costs in the event of a travel delay, interruption, or cancellation for a qualified reason. This policy includes:

- Travel interruption coverage, up to $5,000

- Trip cancellation coverage, up to $5,000

- Travel delay, up to $150 with delays of six hours and beyond

Multi-Trip Plans

The aforementioned policies are for single trips, but with Allianz travel insurance it's possible to get an annual/multi-trip policy.

The starter annual plan is the AllTrips Basic policy which includes the most basic coverage, and it excludes both trip interruption and trip cancellation coverage.

The AllTrips Prime policy is geared toward travelers who take a minimum of three trips each year and comes with additional coverage compared to the basic plan.

Another annual plan is the AllTrips Premier policy, which is geared toward frequent travelers and includes higher coverage limits and choices.

AllTrips Executive

Additionally, there's the AllTrips Executive policy, which may be a good fit if you're a frequent business traveler. Under this plan, personal travel is also covered. This policy includes:

- Trip interruption coverage, up to $5,000, $7,500, or $10,000

- Trip cancellation coverage, up to $5,000, $7,500 or $10,000

- Travel delay, with a daily limit of $200 up to $1,600 for delays of six hours and beyond

- Travel accident coverage, up to $50,000

- Baggage delay, up to $1,000 with a delay of 12 hours or more

- Baggage loss or damage, up to $1,000

- Rental car damage and theft coverage, up to $45,000

- Business equipment coverage, up to $1,000 in the event your business equipment gets lost or damaged

- Business equipment rental coverage, up to $1,000 in the event you need to rent business equipment due to loss, damage, or theft

- Change fee coverage, up to $500 to recoup costs of changing a ticket for a qualified reason

- Loyalty program redeposit fee coverage, up to $500 to recover fees lost due to getting loyalty points back after a canceled trip

- Pre-existing condition coverage available when purchased within 15 days of first trip deposit

Additional Coverage Offered by Allianz

Aside from the travel insurance policies from Allianz listed above that help travelers prepare for interruptions and cancellations, there are additional add-ons that can cover more.

OneTrip Rental Car Protector

If you're looking for rental car coverage, Allianz offers the OneTrip Rental Car Protector policy for $11 per day. This policy includes:

- Trip interruption coverage, up to $1,000

- Collision damage waiver, up to $50,000 which helps cover costs in the event your rental car is damaged in an accident or stolen

On top of the rental car coverage plan, with the OneTrip Prime plan, there's an optional upgrade to get Required to Work coverage. If there is a work-related emergency and you need to cancel for a qualified reason, this coverage can help recover expenses.

Cancel For Any Reason

An optional upgrade for OneTrip Prime and OneTrip Premier, Allianz cancel for any reason policy covers 80% of nonrefundable costs when canceling a trip for any reason. Allianz stands out compared to the best CFAR travel insurance as most policies only offer 75% coverage.

What's Not Included with Allianz Travel Insurance?

Allianz travel insurance covers the basics and more and has some high-risk activity exclusions in the OneTrip Premier plan. Aside from that, Allianz travel insurance excludes the following:

- Acts of violence, such as war, terrorism, and civil unrest

- Risky adventure sports

- Unexpected natural disasters (OneTrip Premier allows cancellation due to hurricane warnings)

- Any travel alerts or government regulations and more

If you're interested in coverage for activities like scuba diving, skiing, and more, consider World Nomads, which covers more than 200 activities.

Allianz Single Trip Travel Insurance Estimates

How much travel insurance costs with Allianz will depend on a variety of factors, including the type of policy you purchase. To get a quote with Allianz, you'll need to provide the following:

- Your destination

- Travel dates

- The state you live in

- The total cost of the trip

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following Allianz travel insurance quotes:

- $102 for OneTrip Basic

- $151 for OneTrip Prime

- $184 for OneTrip Premier

A 30-year-old traveler from California is heading to Japan for two weeks, costing $4,000. The Allianz travel insurance quotes are:

- $153 for OneTrip Basic

- $195 for OneTrip Prime

- $270 for OneTrip Premier

A couple of 65-years of age looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following Allianz travel insurance quotes:

- $298 for OneTrip Basic (total for two travelers)

- $400 for OneTrip Prime (total for two travelers)

- $540 for OneTrip Premier (total for two travelers)

Allianz travel insurance premiums generally stack up favorably against the average cost of travel insurance which is $248 per trip, but again, the specifics of your trip will largely determine how much you'll pay to insure it.

Allianz Annual Multi-Trip Estimates

To receive a quote on Allianz annual plans, you don't need nearly as much information. You just need the following:

- Insurance start date

- Your state of residence

A 30-year-old New York resident looking for travel insurance will pay the following prices for annual travel insurance with Allianz:

- Allianz Basic: $125

- Allianz Premier: $249

- Allianz Executive: $459

A 60-year-old couple from Texas will pay the following:

- Allianz Basic: $63 per traveler, $126 total

- Allianz Premier: $217.50 per traveler, $435 total

- Allianz Executive: $485 per traveler, $970 total

Filing A Claim with Allianz Travel Insurance

If you purchase a travel insurance policy through Allianz and experience a qualifying event, you can file a claim on the company's website or via its TravelSmart app.

To file a claim with Allianz, you'll need to submit information on their website or app about the type of claim and provide supporting documentation, as well as payment information to get reimbursed. You'll need to select the plan and include your email or policy number as well as your departure date.

If you need assistance when filing a claim with Allianz, you can reach the company at 1-866-884-3556. To reach out to Allianz online, you can submit your request via its contact form.

The Allianz mailing address is:

Allianz Global Assistance

P.O. Box 71533

Richmond, VA 23255-1533

See how Allianz stacks up against the competition.

Allianz Travel Insurance vs. AXA Travel Insurance

Competitor AXA travel insurance covers 75% of your nonrefundable costs if you choose to cancel, for any reason (as the name suggests) if you choose that as an upgrade and buy it two weeks before your first trip deposit. Allianz's CFAR policy covers 80% of nonrefundable costs.

That said, if we look at the travel insurance quotes based on a 30-year-old traveler from California going to Japan in the first two weeks of October paying a total of $4,000 for the trip, AXA travel insurance is more affordable. It's $97 for its Silver plan, which covers 100% trip cancellation and interruption. Compare this to $153 for the OneTrip Basic Plan through Allianz.

Read our AXA travel insurance review here.

Allianz Travel Insurance vs. HTH Travel Insurance

Allianz is a good travel insurance option if you're looking for a variety of customized choices. Another competitor, HTH Worldwide Travel Insurance , has three trip protection options.

TripProtector Economy is HTH's budget option and may be a good fit if you're looking for higher medical coverage limits. This policy covers up to $75,000 in accident and sick benefits and $500 in dental benefits.

Plus, the policy covers up to $500,000 for an emergency evacuation. The OneTrip Basic policy from Allianz covers the same dental benefits but offers just $10,000 in medical expenses.

Read our HTH travel insurance review here.

Allianz vs. Credit Card Travel Insurance

A travel insurance policy can offer robust protections, but if you're looking for something basic for trip interruption or cancellation and rental car coverage, check your travel rewards credit card. If you experience illness, weather, or cancellations that affect your trip, you may be able to recoup costs.

Credit card travel insurance coverage may be a good fit for short trips where you don't have a ton of upfront prepaid costs. However, if you're going to be away for a while, have many prepaid expenses, and are concerned about medical coverage, traditional travel insurance may be your best bet.

Read our guide on the best credit cards with travel insurance here.

How We Reviewed Allianz Travel Insurance

As part of this Allianz travel insurance review, we looked at the top travel insurance providers in the space. We reviewed the variety of options offered, coverage limits, benefits, add-ons, flexibility, protocols, claims process, and affordability.

Allianz succeeds in offering many different policies aimed at everyday travelers, business travelers, and athletes. To find the best travel insurance option for you, check out several companies, review the benefits, and compare quotes.

Read more about our travel insurance methodology here.

Allianz is a reputable and well-established travel insurance provider. The company offers various travel insurance policies for individual trips as well as annual plans. Coverage options may include trip interruption, trip cancellation, trip delay, emergency medical, and more. The company has mixed reviews from consumers but has an A+ rating with the Better Business Bureau.

Nearly all travel insurance policies offered by Allianz cover COVID-19, aside from the OneTrip Rental Car Protector Plan. Through the Allianz Epidemic Coverage Endorsement, policyholders receive additional protections if they need to cancel a trip due to COVID. Unfortunately, while it's available in most plans it's not available in all jurisdictions, so be sure to read the fine print.

While the best plan is one best suited to your needs, Allianz's OneTrip Premier is the most robust policy, with high cancellation and interruption coverage. Additionally, kids 17 and under are included in coverage. This policy also includes unique benefits for athletes and adventurers thanks to sports equipment coverage.

If you need to file a claim, Allianz may require proof of incident in order to receive benefits. In cases of medical issues, you may need to provide a medical receipt or document. In other cases, you may need to provide other documentation for trip cancellation or trip interruption such as a death certificate, police report, or employment letter.

Allianz doesn't cover missed flights exactly but can help cover costs due to trip delays depending on your policy. So if you missed a connecting flight, you may be able to receive funds to recoup costs related to accommodations and transportation.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Allianz Travel Insurance review: Is it a good option for your next trip?

With plenty of options to choose from, allianz likely has the right coverage for your trip..

Travel insurance can offer peace of mind — and financial protection — when you travel. Whether you want minimal coverage for emergencies or are looking for a more comprehensive plan, Allianz Travel Insurance probably has an option that will work for your situation.

CNBC Select breaks down the types of coverage Allianz includes in its policies, the features it offers and other providers you should consider.

Allianz Travel Insurance review

Other insurance offered, how it compares, bottom line, allianz travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

10 travel insurance plans make it possible to customize your coverage. For families, Allianz's OneTrip Prime package covers children age 17 and younger when traveling with a parent or grandparent.

24/7 assistance available

- Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents.

- Limited coverage for risky sports

Allianz Travel Insurance is a global insurance provider. It partners with airlines, travel agencies, resorts, credit card issuers and other companies to offer worldwide travel coverage. The insurer currently offers 10 trip coverage plans, giving travelers plenty of options that range from single-trip plans to plans that cover all your travel for a year.

For example, OneTrip Prime provides trip cancellation/interruption, emergency transportation, baggage loss or delay and other key benefits for a single trip up to 180 days. AllTrips Executive, on the other hand, is a multi-trip plan designed for business travel with higher trip cancellation and interruption limits and coverage for business equipment. You can also opt for OneTrip Rental Car Protector if you need primary car rental coverage against collision, loss and damage.

These plans let you easily tailor your insurance to your situation. Here are the types of coverage that Allianz Travel can include in your plan:

- Trip cancellation

- Trip interruption

- Emergency medical (this covers medical and dental emergencies that happen during your trip)

- Emergency medical transportation

- Baggage loss/damage

- Baggage delay

- Travel delay

- Travel accident

- SmartBenefits℠ (this includes automatic and no-receipts payments for trip delays and no-receipts claims for baggage delays)

- Change fees (this coverage can reimburse you for the fees the airline charges when you have to change the dates of your flight)

- Loyalty program redeposit fee coverage (with this coverage, you can get reimbursement for frequent flyer mile redeposit fees if your trip is canceled or interrupted)

- 24/7 hotline assistance

- Concierge services

- Rental car collision damage waiver

- Existing medical condition (this benefit waives the pre-existing medical condition coverage exclusion)

The types and limits of coverage benefits you can get vary by plan.

Many travel cards provide travel insurance benefits . To avoid duplicate coverage, go through your card's terms and conditions and see what your issuer already offers.

One of the features that helped Allianz Travel land a spot on our list of the best travel insurance is the Cancel Anytime benefit. Included with OneTrip Prime and OneTrip Premier plans, Cancel Anytime can reimburse 80% of your unused, pre-paid, non-refundable trip costs if you have to cancel your trip for just about any unexpected reason.

Additionally, the insurer offers 24/7 global assistance to refer you to a prescreened hospital during your trip.

Policyholders can also use the TravelSmart TM app and check for flight status updates, the latest travel advisories and restrictions for their destination, local emergency services and hospitals and more. The app allows travelers to pull up their protection plan whenever they need and file a claim online.

As of writing, Allianz Travel doesn't advertise any discounts. That said, discounts aren't as common with this type of coverage, especially compared to home and auto insurance .

Allianz is a large global company offering a wide range of financial products and services. In the U.S., that includes travel insurance, life insurance and business insurance.

Allianz Travel can be a solid choice if you're looking to purchase travel insurance. However, it's always a wise idea to compare multiple options to ensure you're getting a good deal.

For instance, AXA Assistance USA travel insurance is also a good provider. You can pick from three plans with the most affordable one starting at just $16, according to the company's website. The most comprehensive option is the Platinum plan which comes with the option to cancel for any reason.

AXA Assistance USA Travel Insurance

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

Travel Guard® Travel Insurance also offers a selection of plans, ranging from last-minute options to an annual travel plan. Or you can request a specialty plan, but you'll need to speak to a representative to do so.

Travel Guard® Travel Insurance

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .