You are using an outdated browser. Please upgrade your browser to improve your experience.

Atlas America ® Insurance

Atlas America ® visitors insurance is a comprehensive visitors insurance for non-US citizens traveling outside their home country when their travel includes USA.

- How Plan Works

- Plan Benefits

- Plan Brochure

- Certificate Wording

Insurance for non-U.S. citizens traveling to the U.S.A.

Atlas America ® visitors insurance is a part of Atlas Series travel medical insurance and is underwritten by Lloyd's and it is rated A "Excellent" by A.M. Best.

Atlas America ® is available for any duration from 5 days to 364 days. You can purchase Atlas America ® insurance online on this website or by completing a paper application and sending it by mail or fax. If you purchase online, you will receive an extension notice via email 2 weeks before its expiration. You can extend online at that time or you can call us.

Atlas America ® visitors insurance participates in the United Healthcare PPO Network, it has a very wide network of physicians, hospitals and other providers all across USA. When you visit the provider in the network, they would generally bill the insurance company directly and charge you only the network negotiated fees which are typically lower than their regular fees.

Atlas America ® visitors insurance brochure provides details of the coverage and exclusions. Atlas America visitors insurance provides instant quotes and you can make instant purchase with a credit card payment. There is no medical exam needed. You will need to have the date of birth, passport number, name and travel dates of the traveler on hand to complete the application.

Explore Additional Plan Details

- Rx Discount Card

- Print ID Card

- Sample ID Card & Visa Letter

- Direct Billing: Through United Healthcare PPO Network

- Covers anywhere outside home country

- Acute onset of pre-existing conditions coverage to policy max for ages <80

If your relatives are visiting USA, Atlas America ® Insurance is an excellent visitors insurance.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

Travel Medical Insurance Plans

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Evacuation Insurance Plans

Trip Cancellation Insurance

- International Life Insurance

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Student Health Insurance

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Travel Insurance for Seniors

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

Atlas America Insurance and Atlas International Insurance Cover You Wherever You Go

Atlas Insurance comes in two options. Atlas International provides coverage outside the USA, while Atlas America Insurance covers people whose travels will include the USA. Each plan will also meet and exceed most visa and immigration requirements around the world.

If you are planning to travel abroad for six months or less, the single trip Atlas Travel Insurance Plan will provide you with the coverage you need. The Atlas Travel series plan can be used anywhere outside of your home country, so your trip can include multiple destinations. You can also easily extend coverage online or by phone if you need to extend your trip.

Atlas Travel Insurance Highlights

Emergency medical coverage.

WorldTrips covers costs up to the medical maximum selected for medical care abroad.

Deductible Options

Travelers have the option to purchase an Atlas Travel plan with a $0, $100, $250, $500, $1,000, $2,500, or $5,000 deductible.

Trip Interruption Benefits

Atlas Travel offers members up to $10,000 for an interrupted trip.

Pre-Existing Conditions

Travelers under 80 can be covered for an acute onset of a pre-existing condition.

Sports Coverage

Injuries that occur while participating in adventure sports such as skiing and mountaineering are eligible for coverage.

Emergency Medical Evacuation

Atlas Travel will cover transport costs for travelers from the initial treating facility to the nearest qualified hospital.

Are you ready to purchase an Atlas Travel plan?

Click to get a free quote and apply and buy online today!

WorldTrips Atlas Insurance Benefits

Atlas Travel Insurance offers some of the most customizable travel insurance plans available. Whether you purchase Atlas International (for people outside of the US) or Atlas America Insurance (for people whose travel includes the USA), you will have the ability to customize your deductible, your coverage length and your coverage maximum.

Read the full schedule of benefits on page 3 of the Atlas Travel brochure.

Overall Maximum Limits, Deductibles, and Coinsurance Options

Medical benefits and limits, emergency travel benefits and limits, why choose atlas travel medical insurance.

Many times the primary medical insurance in your home country will not cover you while traveling abroad. Also, it will not provide important services, perhaps essential ones, in the event of an illness or injury. Atlas Insurance includes crucial features such as translation assistance while being treated, doctor and hospital referrals, and assistance replacing lost prescriptions.

WorldTrips , the plan administrator, provides 24/7 customer service for our Atlas Travel Medical insurance members. They also many other services you'll need if you run into difficulty while abroad, from simple things such as lost luggage to a crisis like a terrorist attack. In the event of medical emergencies, political evacuations, and natural disasters, WorldTrips will provide you with assistance in making emergency travel arrangements.

How Much Does an Atlas Travel Insurance Plan Cost?

The Atlas International and America Insurance plans are relatively inexpensive per day. Your plan costs will increase with a lower deductible and increase with a higher deductible.

Atlas International Insurance Premiums - Traveling Outside the United States (Cost per Day)

If traveling outside the United States, use these rates for the Atlas International plan. This includes U.S. citizens traveling overseas and persons traveling between countries, i.e., a citizen of India traveling to the United Kingdom.

Rates last updated on March 4, 2024

Atlas America Insurance Premiums - Traveling in the United States (Cost per Day)

If you are traveling to, temporarily residing in, or visiting the United States, please use these rates for the Atlas America Insurance plan.

Eligibility Requirements for a WorldTrips Atlas Insurance Plan

Individuals who are traveling outside of their home country and are at least 14 days old are eligible for coverage. If you are under age 65, you may select an Overall Maximum Limit ranging from $50,000 to $2,000,000. If you are age 65 to 79, the Overall Maximum Limit available is $100,000. If you are age 80 or older, the Overall Maximum Limit available is $10,000. The minimum coverage period is 15 days and the maximum coverage period is 12 months. You may purchase coverage in a combination of monthly and 15-day increments, depending on your needs.

Atlas Travel FAQs

When does my atlas travel medical insurance coverage become effective and when does it end.

Your coverage becomes effective on the latest of the following dates:

- the date WorldTrips receives your application and correct premium,

- the moment you depart from your home country

- or the date requested on your application.

Your coverage will end on the earliest of the following dates:

- the end of the period for which you have paid a premium,

- the date requested on your application

- or the moment you return back to your home country.

Does WorldTrips Atlas Insurance provide any home country coverage?

Yes, both Atlas International Insurance and Atlas America Insurance provide limited home country coverage. This benefit will provide for a set number of days of coverage for travelers if they return home for a period of time during their trip abroad. Policies with Home Country Coverage typically cover medical benefits related to a new illness or injury incurred during an incidental trip back to a traveler's home country.

You must have purchased three months of coverage for the Incidental Home Country Coverage to be in effect.

U.S. home country:

- For every three-month period you are covered, eligible medical expenses incurred in the U.S. are covered up to 15 days. Non-U.S. home country:

- For every three-month period during which you are covered, eligible medical expenses incurred in your home country are covered up to a maximum of 30 days.

Should you change your home country's location during the certificate period, you must notify us of such change within fifteen (15) days. Your new home country will govern the terms of any home country or incidental home country coverage. Any benefit accrued under a single three-month period does not accumulate to another period. Failure to continue your international trip or your return to your home country to obtain treatment for an illness or injury that began while traveling shall void any incidental home country coverage.

Am I able to extend or renew my Atlas Travel insurance coverage?

After your initial purchase, you may extend your coverage up to a maximum of 364 days. So long as your coverage is continuous, your deductible, coinsurance and benefit limits will not reset. After your initial term, you can purchase a new policy if you decide to continue to travel abroad.

Extensions must be made online in WorldTrips' Client Zone. Payment must be made by credit card.

Which Atlas Travel medical insurance plan should I purchase?

If you are a U.S. citizen traveling abroad for twelve months or less, or a non-U.S. citizen traveling to a country other than the United States, you should purchase Atlas International Insurance . The Atlas International plan provides coverage and travel benefits for travelers traveling abroad but not visiting the USA.

If you are a non-U.S. citizen traveling to the United States (including Puerto Rico and the U.S. Virgin Islands) for twelve months or less, you should purchase Atlas America Insurance . For any visitor to the USA, Atlas America provides comprehensive travel insurance and emergency medical benefits. Your travel can also include additional countries and you will be covered worldwide.

Start by Requesting a Quote to get coverage and pricing for your plan.

How do I add countries to my Atlas Travel Insurance plan?

New countries can be added to your Atlas Travel Insurance plan via WorldTrips' Client Zone. A new visa letter can be printed listing the various countries. However, it is not required that you list every country that you may visit during your trip. You should list the countries where you will travel to as primary destinations in your initial application.

Please note: The Atlas International plan will provide worldwide coverage and benefits for travel to all countries worldwide except for travel to the USA. If you are traveling to the USA, you should purchase the Atlas America plan, which includes coverage and benefits in the USA.

Can I purchase an Atlas Group Travel Insurance Policy?

The Atlas Group plan is available for small or large groups traveling abroad for 5 days to a year. The group plan is available to employer groups, non-profit organizations, students, and others. The coverage and benefits are the same.

There is an easy-to-use online quote tool (link below). Once you find the level of coverage desired, you can move forward to purchase coverage. You will be asked for details on each applicant, including their date of birth along with other details.

Atlas Group Travel Insurance Quote and Buy

More to Read:

International Travel Insurance

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

Atlas America Insurance – A Comprehensive Guide

If there is one country high up on everyone’s travel wishlist, it has to be the United States. A trip to the US is exciting but must be planned carefully, owing to uncertainties that can arise during travel. This is where a comprehensive insurance plan like Atlas America can really help you create a memorable stay in the US by protecting you and your loved ones with the right medical care.

What is Atlas America Insurance?

Atlas America is a preferred travel health insurance plan highly sought after by travelers visiting the US. Known to have some of the best medical coverage among comprehensive plans, it can help protect you and your family, regardless of the length of stay. From covering you for unexpected illnesses to handling trip interruptions, Atlas America has you protected all the way!

Reasons to Buy Atlas America Insurance

1. Medical Care – Needless to say, one of the top reasons to purchase a travel health insurance plan is to get emergency medical care in a foreign land. Atlas America offers coverage for unexpected illnesses and the acute onset of pre-existing conditions that arise during your travel.

2. Acceptance Rate – Since this is a widely recognized plan in the US, you can rest assured of its acceptance in hospitals and clinics.

Factors to Consider While Purchasing Atlas America Insurance

Before you choose a travel health insurance plan, it is important to go over the policy carefully. Here are some of the top factors to look at when purchasing Atlas America Insurance.

One of the main reasons to invest in a travel health insurance plan is to cover medical expenses. It goes without saying that the top factor to consider when purchasing your travel health insurance plan must be the coverage, including medical, dental, and travel-related protections.

It is highly recommended to make sure your plan can cover the duration of your visit to the United States. Check with your agent at VisitorPLANS on the availability of your policy for your travel period.

If you’re trying to stick to a budget, the cost is definitely a critical factor to consider. Ask your agent for coverage options suitable for you and your family.

Pre-existing Condition

These plans do not cover pre-existing conditions but some plans cover the acute onset of pre-existing conditions with restrictions. It is very important to check this, especially if you have a pre-existing condition.

Eligibility Requirements for Applying for Atlas America Insurance

The eligibility requirements for Atlas America Insurance are pretty straightforward. US Citizens and non-US citizens who are at least fourteen (14) days of age are eligible for coverage outside their home countries, except as provided under home country coverage. US Citizens and residents are not eligible for coverage within the US, except as provided under incidental home country coverage or an eligible benefit period.

Should you make a change to the location of your home country during the certificate period, you are no longer eligible for coverage in the new home country except as provided under home country coverage as of the date you establish in the new home country. Individuals age 65 to 79, as of the certificate effective date, are subject to a $100,000 overall maximum limit or less. Individuals age 80 and over as of the certificate effective date are subject to a $10,000 overall maximum limit.

Benefits of Choosing Atlas America Insurance

Here are some of the notable benefits of Atlas America Insurance.

- Overall Maximum Limit for ages 80 or older – $10,000, ages 65 to 79 – $50,000 or $100,000, All others – $50,000, $100,000, $250,000, $500,000, $1,000,000 or $2,000,000

- Hospital Room and Board, including nursing services

- Local Ambulance, Emergency Room Co-payment, Urgent Care, Intensive Care Unit

- Outpatient Physical Therapy and Chiropractic Care up to $50 maximum per day

- Emergency Dental (Acute Onset of Pain) – up to $300 – not subject to deductible

- Emergency Eye Exam

- Acute Onset of Pre-existing Condition – Up to the overall maximum limit

- Emergency Medical Evacuation

- Repatriation of Remains

- Local Burial or Cremation

- Crisis Response

- Pet Return up to $1,000 – not subject to deductible

- Accidental Death & Dismemberment

- Flexibility in Renewal/ Extension

For a detailed view of the benefits, click here.

FAQs on Atlas America Insurance

When should i buy atlas america insurance.

We recommend you buy your insurance at least five days prior to departure. This gives you sufficient time to print out the insurance documents to avoid the last-minute rush.

Is Atlas America good?

Yes! It is one of the top-selling comprehensive coverage plans, highly known for its access to the best medical care and customer service.

How Atlas America Insurance Works?

The plan will pay 100% of eligible expenses, after the deductible, to the overall maximum limit as per the terms and conditions of the policy.

Who is eligible to purchase the Atlas America Policy?

Non-US citizens visiting the USA or traveling outside their home country, including business travelers and students aged at least 14 days to 99 years traveling outside their home country for a coverage length of a minimum of 5 days up to a maximum of 364 days, are eligible for this policy.

Is Atlas America Insurance suitable for all types of travelers?

Yes, Atlas America Insurance caters to travelers of all kinds. From getting specialized care for your health situation to filing a claim, Atlas America makes it easy.

Does Atlas America Insurance cover pre-existing medical conditions?

No, it does not cover pre-existing conditions, but it covers the acute onset of pre-existing conditions. Make sure to review your policy before purchase.

Can I extend my Atlas America Insurance Policy if my travel duration changes?

Yes. One of the reasons why Atlas America Insurance is a preferred policy by travelers to the United States is its flexibility in extending coverage owing to a sudden change in plans.

Can I purchase Atlas America Insurance after starting my journey?

Yes, this plan allows you to purchase after starting your journey. However, we advise purchasing insurance before you start your journey to access coverage during travel.

Can I cancel my Atlas America Insurance policy and get a refund?

Yes, you can apply for a refund based on the terms outlined in your policy.

Reasons to choose Atlas America Travel Health Insurance?

Atlas America Insurance offers several coverage options to suit every kind of traveler, providing you peace of mind during your trip to the United States, including flexibility in extending your coverage, should you need it.

Atlas America Insurance is a highly reliable insurance provider that is suitable for travel to the United States. With multiple benefits and the ability to customize your plan as you travel, it is one of the top preferred plans for comprehensive travel health insurance. Whether you’re a first-time visitor or simply visiting family, Atlas America Insurance is the plan for you! To learn more or for queries, contact VisitorPLANS.

Quick Inquiry

Recent Posts

- How to Apply for a Schengen Visa Insurance January 17, 2024

- Celebrate Christmas With Visitor Health Insurance December 27, 2023

- How To Choose The Best Tourist Health Insurance December 18, 2023

- Patriot America Plus Insurance: Benefits, Coverage, & Eligibility November 27, 2023

- Navigating Travel Medical Insurance for Your India-Canada Journey – Choose the Right Plan October 30, 2023

- Expatriate Insurance

- Medical Insurance

- Students Insurance

- Trip Insurance

- Uncategorized

- Visitor Insurance

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- September 2018

- January 2018

- December 2017

- September 2017

- January 2017

- August 2016

Sign up for free travel guide and special offers

We promise to keep it to ourselves, we are happy to help you, get in touch at 1-510-353-1180, connect with us.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

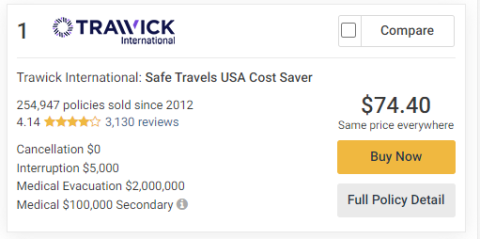

The search came up with nine results ranging in price from $74.40 to $179.18.

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

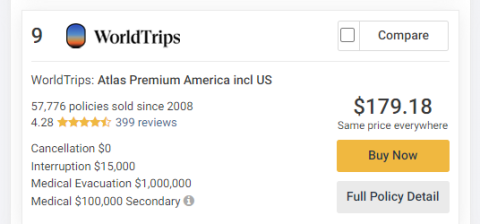

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

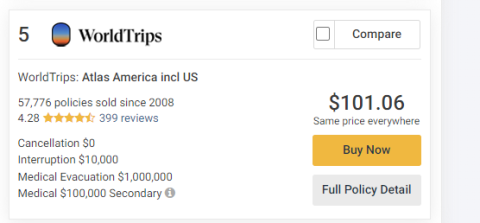

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

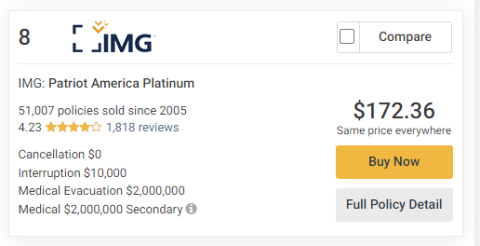

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Cheapest travel insurance of April 2024

Mandy Sleight

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:52 a.m. UTC April 11, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best cheap travel insurance company of 2024 based on our in-depth analysis of the cheapest travel insurance plans. Its Atlas Journey Preferred and Atlas Journey Premier plans offer affordable travel insurance with high limits for emergency medical and evacuation benefits bundled with good coverage for trip delays, travel inconvenience and missed connections.

Cheapest travel insurance of 2024

Why trust our travel insurance experts

Our team of travel insurance experts analyzes hundreds of insurance products and thousands of data points to help you find the best travel insurance for your next trip. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Best cheap travel insurance

Top-scoring plans

Average cost, medical limit per person, medical evacuation limit per person, why it’s the best.

WorldTrips tops our rating of the cheapest travel insurance with two plans:

- Atlas Journey Preferred is the cheaper travel insurance plan of the two, with $100,000 per person in emergency medical benefits as secondary coverage and an optional upgrade to primary coverage. It’s also our pick for the best travel insurance for cruises .

- Atlas Journey Premier costs a little more but gives you $150,000 in travel medical insurance with primary coverage . This is a good option if health insurance for international travel is a priority.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier offers $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan offers travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Cheap travel insurance for cruises

Travel insured.

Top-scoring plan

Travel Insured offers cheap travel insurance for cruises and its Worldwide Trip Protector plan gets 4 stars in our rating of the best cruise travel insurance .

- Worldwide Trip Protector offers $1 million in emergency evacuation coverage per person and a rare $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits, which means you won’t have to file medical claims with your health insurance first.

- Cheap trip insurance for cruises.

- Offers a rare $150,000 for non-medical evacuation.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person only available for cruises and tours.

Best cheap travel insurance for families

Travelex has the best cheap travel insurance for families because kids age 17 are covered by your policy for free when they’re traveling with you.

- Free coverage for children 17 and under on the same policy.

- $2,000 travel delay coverage per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Only $50,000 per person emergency medical coverage.

- Baggage delay coverage is only $200 and requires a 12-hour delay.

Best cheap travel insurance for seniors

Evacuation limit per person

Nationwide has the best cheap travel insurance for seniors — its Prime plan gets 4 stars in our best senior travel insurance rating. However, Nationwide’s Cruise Choice plan ranks higher in our best cheap travel insurance rating.

- Cruise Choice has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion. It also has a missed connections benefit of $1,500 per person after only a 3-hour delay, for cruises or tours. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Coverage for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” (CFAR) upgrade available.

- Missed connection coverage of $1,500 per person is only for tours and cruises, after a 3-hour delay.

Best cheap travel insurance for add-on options

AIG offers the best cheap travel insurance for add-on options because the Travel Guard Preferred plan allows you to customize your policy with a host of optional upgrades.

- Travel Guard Preferred upgrades include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings. There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million.

- Bundle upgrades allow you to customize your affordable travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best cheap travel insurance for missed connections

TravelSafe has the best cheap travel insurance for missed connections because coverage is not limited to cruises and tours, as it is with many policies.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of the best cheap travel insurance plans.

- No “interruption for any reason” coverage available.

- Weak baggage delay coverage of $250 per person after 12 hours.

Cheapest travel insurance comparison

How much does the cheapest travel insurance cost?

The cheapest travel insurance in our rating is $334. This is for a WorldTrips Atlas Journey Preferred travel insurance plan, based on the average of seven quotes for travelers of various ages to international destinations with a range of trip values.

Factors that determine travel insurance cost

There are several factors that determine the cost of travel insurance, including:

- Age and number of travelers being insured.

- Trip length.

- Total trip cost.

- The travel insurance plan you choose.

- The travel insurance company.

- Any add-ons, features or upgraded benefits you include in the travel insurance plan.

Expert tip: “In general, travelers can expect to pay anywhere from 4% to 10% of their total prepaid, non-refundable trip costs,” said Suzanne Morrow, CEO of InsureMyTrip.

Is buying the cheapest travel insurance a good idea?

Choosing cheaper travel insurance without paying attention to what a plan covers and excludes could leave you underinsured for your trip. Comparing travel insurance plans side-by-side can help ensure you get enough coverage to protect yourself financially in an emergency for the best price.

For example, compare these two Travelex travel insurance plans:

- Travel Basic is cheaper but it only provides up to $15,000 for emergency medical expense coverage. You’ll also have to pay extra for coverage for children.

- Travel Select will cost you a bit more but it covers up to $50,000 in medical expenses and includes coverage for kids aged 17 and younger traveling with you. It also offers upgrades such additional medical coverage, “cancel for any reason” (CFAR) coverage and an adventure sports rider that may be a good fit for your trip.

Reasons to consider paying more for travel insurance

Make sure you understand what you’re giving up if you buy the cheapest travel insurance. Here are a few reasons you may consider paying a little extra for better coverage.

- Emergency medical. The best travel medical insurance offers primary coverage for emergency medical benefits. Travel insurance with primary coverage can cost more than secondary coverage but will save you from having to file a claim with your health insurance company before filing a travel insurance claim.

- Emergency evacuation. If you’re traveling to a remote location or planning a boat excursion on your trip, look at travel insurance with a high medical evacuation insurance limit. If you are injured while traveling, transportation to the nearest adequate medical facility could cost in the tens to hundreds of thousands. It may make sense to pay more for travel insurance with robust emergency evacuation coverage.

- Flexibility. To maximize your trip flexibility, you might consider upgrading your travel insurance to “ cancel for any reason” (CFAR) coverage . This will increase the cost of your travel insurance but allow you to cancel your trip for any reason — not just those listed in your policy. The catch is that you’ll need to cancel at least 48 hours before your trip and will only be reimbursed 50% or 75% of your trip expenses, depending on the plan.

- Upgrades. Many travel insurance plans have optional extras like car rental collision and adventure sports (which may otherwise be excluded from coverage). These will cost you extra but may give you the coverage you need.

How to find the cheapest travel insurance

The best way to find the cheapest travel insurance is to determine what you’re looking for in a travel insurance policy and compare plans that meet your needs.

“Travel insurance isn’t one-size-fits-all. Every trip is different, and every traveler has different needs, wants and concerns. This is why comparison is key,” said Morrow.

Consider the following factors when comparing cheap travel insurance plans.

- How often you’re traveling. A single-trip policy may be the most cost-effective if you’re only going on a single trip this year. But a multi-trip travel insurance plan may be cheaper if you’re going on multiple international trips throughout the year. Annual travel insurance policies cover you for a whole year as long as each trip doesn’t exceed a certain number of days, usually 30 to 90 days.

- Credit card has travel insurance benefits. The best credit cards offer perks and benefits, and many offer travel insurance-specific benefits. The coverage types and benefit limits can vary, and you must put the entire trip cost on the credit card to use the coverage. If your trip costs more than the coverage limit on your card, you can supplement the rest with a cheaper travel insurance plan.

- The coverage you need. When looking for the best travel insurance option at the most affordable price, only buy extras and upgrades you really need. A basic plan may only provide up to $500 in baggage insurance, but if you only plan to take $300 worth of clothes and accessories, you don’t need to pay more for higher coverage limits.

Is cheap travel insurance worth it?

Cheap travel insurance can be worth it, as long as you understand the plan limitations and exclusions. Taking the time to read your policy, especially the fine print, well before your trip can ensure there won’t be any surprises about what’s covered once your journey begins.

“If a traveler is looking for coverage for travel delays, cancellations, interruptions, medical and baggage — a comprehensive travel insurance policy will provide the most bang for their buck,” said Morrow. But if you’re on a tight budget and are only worried about emergency medical care and evacuation coverage while traveling abroad, stand-alone options are cheaper.

Before buying travel insurance, you should also consider what your health insurance will cover.

“Most domestic health insurance plans, including Medicare, will not cover medical bills abroad,” said Morrow. Even if you’re staying stateside, you may find value in an affordable travel insurance plan with medical coverage if you have a high-deductible health plan (HDHP).

A cheap travel insurance plan is better than none at all if you end up in a situation that would have covered some or all of your prepaid, nonrefundable trip expenses.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance . From those top-scoring travel insurance plans, we chose the most affordable for our rating of the cheapest travel insurance.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Cheapest travel insurance FAQs

When buying travel insurance, cheapest is not always the best. The most affordable travel insurance plans typically offer fewer coverages with lower policy limits and few or no optional upgrades. Add up your total nonrefundable trip costs and compare travel insurance plans and available features that cover your travel expenses. This strategy can help you find the cheapest travel insurance policy that best protects you from financial loss if an unforeseen circumstance arises.

Get the coverage you need: Best travel insurance of 2024

According to our analysis, WorldTrips , Travel Insured International and Travelex offer the best cheap travel insurance. Policy coverage types and limits can vary by each travel insurance provider, so the best way to get the cheapest travel insurance plan is to compare several policies and companies to find the right fit for your budget.

A good rate for travel insurance depends on your budget and coverage needs. The most comprehensive travel insurance plan is usually not the cheapest. But cheap trip insurance may not have enough coverage or the types of coverage you want. Comparing different levels of coverage and how much they cost can help you find the best cheap insurance for travel.

The average cost of travel insurance is between 5% to 6% of your total travel expenses for one trip, according to our analysis of rates. However, you may find cheaper travel insurance if you opt for a plan with fewer benefits or lower coverage limits. How much you pay for travel insurance will also depend on the number of travelers covered, their ages, the length of the trip and any upgrades you add to your plan.

Travel insurance covers nonrefundable, prepaid trip costs — up to the policy coverage limits — when your trip is interrupted or canceled for a covered reason outlined in your plan documents. Even the cheapest travel insurance policies usually provide coverage for:

- Medical emergencies.

- Trip delays.

- Trip interruption.

- Trip cancellation.

- Lost, stolen or damaged luggage.

However, if you’re looking to save on travel insurance, you can shop for a policy that only has travel medical insurance and does not include benefits for trip cancellation .

Even when you buy cheap travel insurance, you can often use upgrade options to customize your policy to meet your specific needs.

Some common travel insurance add-ons you may want to consider include:

- Rental car damage coverage.

- Medical bundle.

- Security bundle.

- Accidental death and dismemberment coverage.

- Adventure sports bundle.

- Pet bundle.

- Wedding bundle.

- “Cancel for work reasons” coverage.

- “Interruption for any reason” (IFAR) coverage.

- “Cancel for any reason” (CFAR) coverage .

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

Travel Insurance Jennifer Simonson

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travel Insurance Mandy Sleight

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

Survey: Nearly 85% of Americans avoid family over the holidays

Travel Insurance Kara McGinley

Tips For Getting The Best Health Insurance When You Are Travelling

By: Author Ruben Arribas

Posted on April 7, 2024

Categories United States

Travelling is an exciting and enriching experience, but it also comes with potential risks, especially when it comes to health emergencies. Securing the best health insurance for your travels is crucial in ensuring that you can fully enjoy your adventure without worrying about the financial burden of unexpected medical expenses.

In this article, we’ll provide you with valuable tips for selecting the best travel health insurance plan and discuss how Medigap can help cover some or all emergency medical costs during international travel.

Read here Best VPN for Digital Nomads , Best eSim for International Travel and Best Travel Insurance Comparison

Table of Contents

BOOK YOUR TRAVEL INSURANCE

Two of our favorite travel insurance: Heymondo Vs Safetwing cheapest travel Insurance . You can get for $135 USD your Heymondo Travel Insurance with Heymondo discount code valid for 90 days. Read our full comparison of Genki vs Safetywing Travel Insurance Review and the comparison Heymondo vs Genki

Assess Your Health And Travel Needs

Before you start looking for the best health insurance plan, it’s essential to evaluate your health and travel needs. Consider any pre-existing medical conditions and the kind of activities you’ll be participating in during your trip. This will help you determine the level of coverage you need and identify any specific benefits you should look for in a policy.

Compare Different Health Insurance Plans

Not all health insurance plans are created equal. Some offer comprehensive coverage, while others may provide only basic protection. To find the best plan for your needs, compare various policies and their benefits, including the extent of medical coverage, the types of treatments and services covered, and any limitations or exclusions.

Consider Purchasing A Travel-Specific Health Insurance Plan

Some health insurance providers offer travel-specific plans, which are designed to provide coverage for health emergencies during international trips. These plans often include benefits such as emergency medical evacuation, repatriation of remains, and 24/7 assistance services, which can be invaluable during a medical crisis abroad.

Look For A Plan With A Broad Network Of Healthcare Providers

When choosing a health insurance plan, make sure it includes a wide network of healthcare providers, particularly in the regions you plan to visit. This ensures that you’ll have access to quality medical care wherever you are and can help minimize out-of-pocket expenses.

CLICK HERE TO BOOK YOUR ACCOMMODATION

Check For Coverage Of Pre-Existing Conditions

If you have a pre-existing medical condition, it’s crucial to find a plan that provides coverage for it. Not all health insurance policies cover pre-existing conditions, and some may only offer limited coverage. Make sure to read the fine print and confirm that your chosen plan offers the coverage you need.

Understand The Importance Of Medigap For International Travel

Medigap is a supplemental insurance policy designed to help cover any Medicare-approved expenses, including emergency medical costs during international travel. If you’re a Medicare beneficiary, it’s essential to consider purchasing a Medigap plan before embarking on your journey. Medigap plans can help fill the gaps in your Medicare coverage, providing additional protection and peace of mind while you’re abroad.

Medigap policies often cover 80% of emergency medical costs during the first 60 days of international travel, with a lifetime limit of $50,000. This coverage can be crucial in case of an unexpected health emergency, as Medicare generally doesn’t provide coverage outside the United States.

Review The Policy’s Cancellation And Refund Terms

Unexpected events can sometimes force you to cancel or change your travel plans. Make sure to understand the cancellation and refund terms of your health insurance policy to avoid any financial losses in such situations.

Ensuring that you have the best health insurance coverage while travelling is essential for a worry-free trip. By following these tips and considering a Medigap plan, you can confidently explore new destinations and create unforgettable memories without the stress of unexpected medical expenses. Invest the time in researching and selecting the right policy for your needs, and enjoy your travels with peace of mind.

About the Author : Ruben , co-founder of Gamintraveler.com since 2014, is a seasoned traveler from Spain who has explored over 100 countries since 2009. Known for his extensive travel adventures across South America, Europe, the US, Australia, New Zealand, Asia, and Africa, Ruben combines his passion for adventurous yet sustainable living with his love for cycling, highlighted by his remarkable 5-month bicycle journey from Spain to Norway. He currently resides in Spain, where he continues to share his travel experiences alongside his partner, Rachel, and their son, Han.

Traveling to US? Here’s why travel medical insurance should be your top priority in 2024

Travel medical insurance can safeguard your health, finances, and overall travel experience.

As you embark on your journey to explore the United States, the importance of travel medical insuranc e cannot be overstated. Whether you are exploring the bustling streets of New York City, taking in the breathtaking vistas of the Grand Canyon, or indulging in the vibrant culture of New Orleans, unforeseen medical emergencies can happen anywhere, at any time. As you plan your journey to the United States in 2024, making travel medical insurance your top priority is not just a precautionary measure; it is a necessity. Here is why:

Healthcare costs in the US

The United States boasts world-class medical facilities and top-notch healthcare professionals. However, this quality comes at a cost, and healthcare expenses in the USA can be exorbitant. Even a normal doctor’s visit or a minor medical procedure can leave you with a hefty bill. Without adequate insurance coverage, you could find yourself facing financial strain due to medical expenses.

Protection against unexpected medical emergencies

No one plans to fall ill or get injured while traveling, but accidents and illnesses can occur unexpectedly. Whether it is a sudden illness, a slip and fall, or a more serious medical emergency, having travel medical insurance provides you with financial protection and peace of mind. From hospitalization and emergency room visits to surgeries and prescription medications, your insurance policy can cover the expenses, sparing you from the burden of hefty medical bills.

Access to quality healthcare services

With travel medical insurance, you gain access to a network of healthcare providers and facilities that meet international standards, including Preferred Provider Organization (PPO) networks.

Read more columns by Chiranth Nataraj

These networks offer discounted rates to policyholders, ensuring prompt and adequate care at renowned hospitals and clinics in a medical emergency. Accessing care within the PPO network minimizes out-of-pocket expenses and facilitates swift recovery, allowing you to resume enjoying your travels with peace of mind.

Coverage for acute onset of pre-existing conditions

Pre-existing medical conditions can be challenging, especially when you are traveling abroad. Though visitor insurance plans do not cover pre-existing conditions, many offer coverage for the acute onset of non-chronic pre-existing conditions, which means the insured individual receives immediate treatment within 24 hours after the first symptom. Each plan has a distinct definition for pre-existing conditions and the acute onset of the pre-existing conditions, hence, reviewing the brochure is suggested.

Protection against travel disruptions

Traveling involves a certain degree of uncertainty, and unexpected disruptions like trip interruptions, trip delays, and loss or theft of luggage and personal belongings are not so uncommon. Some travel medical insurance plans offer coverage for these unforeseen events that can minimize the impact of travel hiccups on your overall experience. Check the brochure to understand what trip-benefits the plan covers.

Peace of mind for you and your loved ones

Traveling should be a joyful and enriching experience, free from worries and uncertainties. By investing in travel medical insurance, you not only protect yourself from financial risks but also provide peace of mind for your loved ones back home. Knowing that you are covered in the event of a medical emergency allows you to fully immerse yourself in the wonders of your journey, creating cherished memories that will last a lifetime.

Conclusion As you embark on your adventure to the United States in 2024, prioritizing travel medical insurance is a decision that can safeguard your health, finances, and overall travel experience. From mitigating the burden of healthcare costs to ensuring access to quality medical care, the benefits of travel medical insurance are undeniable. Whether you are a solo traveler, a family on vacation, or a business professional attending meetings abroad, investing in comprehensive travel medical insurance is a prudent choice that offers invaluable protection and peace of mind throughout your journey.

(Chiranth Nataraj, a contributing writer to the American Bazaar, is the founder of Visitor Guard .)

Demystifying US visitor insurance: Common myths debunked

Bringing parents to the US from India for a visit? Here are the 5 things you should consider

Why is visitor health insurance recommended for travel to USA?

Traveling to the US? Here’s why you shouldn’t skimp on travel insurance!

What does visitor insurance cover?

Indian travelers to US must get Visitor Insurance with Covid-19 cover

Chiranth Nataraj, a contributing writer to the American Bazaar, is the founder of Visitor Guard. He has more than two decades worth of experience in developing insurance and technology solutions.

Keep Reading

1.2 million indian professionals stuck in green card backlog: report, kannada koota new york is reshaping diaspora experience: badari ambatti, radha plumb becomes dod’s chief digital and ai officer, 13 indian americans in inc. 2024 female founders list, kellogg india business conference to celebrate indian diaspora, chandrayaan-3 team wins us space exploration award, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Please enter an answer in digits: five × four =

This site uses Akismet to reduce spam. Learn how your comment data is processed .

The American Bazaar is a publication of American Bazaar, Inc., based in Germantown, MD.

Quick Links

- Immigration

- Entertainment

QUICK LINKS

- Company Info

- 202-709-7010

- 202-379-3332

- [email protected]

- Privacy Policy

Type above and press Enter to search. Press Esc to cancel.

HTH Travel Insurance | Money

Best for long-term international travel insurance.

P lanning a trip? The last thing you want is to get stuck with a hefty bill if something goes wrong. The best travel insurance companies provide coverage for emergency medical costs, trip cancellation, evacuations and other potentially costly issues.

HTH Travel Insurance (also called HTH Worldwide Travel Insurance) is a reliable travel insurance provider offering three main plans and a range of benefits. This might be the right travel insurer for you if you’re heading out on a long-term journey or want the highest coverage limits.

HTH Travel Insurance stands out for its long-term plans. The Xplorer and Navigator plans are designed for expats, international students, missionaries and other travelers who plan on spending three or more months abroad. This HTH Travel Insurance review will guide you through the policies, pros and cons of HTH insurance to help you decide if it’s right for your trip.

HTH Travel Insurance Pros and Cons

So, what is insurance ? Do you need to buy it before you travel?

Some countries, but not all, require that you have travel insurance before you arrive. That said, it’s the only way to protect yourself from unexpected costs on your trip. The best travel insurance plans cover medical costs and other emergencies. Like having the best travel credit cards , traveling with insurance will help you to save money and provide peace of mind in case anything goes wrong.

HTH Travel Insurance is a good option for long trips, but it might not be the best insurer for everyone. Here’s a quick look at what you should expect from your plan.

Impressive coverage limits for medical expenses

Physician community that expands over 180 countries, access to health services worldwide via the mpassport app, offers insurance coverage for expatriates, some plans require travelers to have an existing primary health plan, 12-hour delay required for baggage delay coverage, pros explained.

Even the most affordable HTH Travel Insurance plan offers extensive coverage for medical emergencies. With TripProtector Economy, you get up to $75,000 in emergency medical coverage. TripProtector Classic offers up to $250,000, and TripProtector Preferred has up to $500,000.

That coverage is nearly triple the amount offered by other travel insurance providers. It provides security that you won’t have to pay out of pocket for an unexpected sickness or injury.

HTH Worldwide Insurance has a physician network that extends to almost every popular tourist destination. You can find a network physician in over 180 countries.

HTH Worldwide has an intuitive app that policyholders can use to find a network doctor, file a claim or learn more about their plan. The app is specially designed for long-term travelers who need to access health services in the country they’re staying in.

One unique feature of the mPassport app is its drug comparison and translation tool. You can look up any medication on the app and see an English translation, plus comparable drugs offered in the U.S. The app also has tools to search for nearby doctors and hospitals and store your electronic ID card.

HTH Worldwide is one of the few travel insurance providers that offer specialized insurance for expatriates. The Xplorer and Navigator plans are long-term health coverage options for business travelers, students, military members and anyone who travels for months at a time.

With these plans, you pay a monthly premium while you’re abroad. Coverage includes medical evacuations, physician costs, accidental death and repatriation coverage for your beneficiaries.

Cons explained

HTH Worldwide Travel Insurance offers affordable single-trip plans. To get the best rates for those policies, you must have your own health insurance plan at home. HTH offers a single-trip plan for travelers without primary health insurance, but it has limitations for preexisting conditions.

Baggage delay coverage is a common benefit of most travel insurance plans. It covers the costs of a baggage delay, like forwarding your bags or replacing the items you need.

All three HTH Travel Insurance plans include baggage delay coverage. But your baggage has to be delayed for a minimum amount of time before you can access that coverage — with TravelProtector Economy, only a 24-hour delay is covered. The other two plans cover delays of at least 12 hours. That’s a longer wait period than what other insurance plans offer.

HTH Travel Insurance Plans

HTH Worldwide Travel Insurance offers three base plans: Economy, Classic and Preferred. In addition, it provides a range of policies tailored to individual travelers’ needs.

Finding the right plan for your trip is crucial. A great travel insurance policy will help you save money and avoid stress while traveling, but the wrong plan could be an unnecessary cost. Look into HTH Worldwide’s insurance options to decide which is best for your trip.

Single Trip

Although HTH Worldwide is most popular with long-term travelers, it also offers two quick-trip plans. However, these plans don’t come with the baggage delay coverage, trip interruption and other benefits of the TripProtector plans. These are strictly travel medical insurance.

The single-trip option for travelers with primary health insurance is an affordable policy that provides medical coverage for the length of your trip. You’ll choose your maximum coverage amount (between $50,000 and $1 million) and your deductible (between $0 and $500).

The single-trip option for travelers without primary health insurance offers those same choices but has some limitations, like a 180-day exclusion for pre-existing conditions.

You can adapt HTH Worldwide TripProtector Preferred, Classic and Economy for multiple trips within the same year. Consult an HTH Insurance agent about your upcoming trips to find the right plan. HTH Worldwide’s expatriate insurance might be a better option if you take multiple long-term trips within the year.

HTH Worldwide offers two expatriate health insurance plans:

- Xplorer plan. This is the best option for families or individuals who’ll be overseas for at least three months within a single year. Xplorer is a health insurance plan, but you can add more benefits, such as baggage coverage.

- Navigator plan. The Navigator plan is an expatriate health insurance option designed for military professionals, business travelers, students and other expatriates who spend more than four months out of the year abroad.

You can modify any of HTH’s three primary plans for families and groups. These plans allow you to choose your deductible and come with some decent benefits, including baggage loss coverage of up to $2,000 per person.

HTH Worldwide is not the cheapest option for large groups of travelers. Depending on your trip’s length and cost, a family insurance plan’s total cost may be $1,000 or more. Talk with an HTH insurance agent for a more detailed cost estimate.

Trip Protection

HTH Worldwide TripProtector plans offer comprehensive trip insurance. These plans aren’t the most budget-friendly on the market, but they offer extensive coverage for medical costs, baggage delays or loss, cancellation and more. An HTH TripProtector plan might be the right insurance option if you want full-service trip protection.

HTH Travel Insurance Pricing

The exact cost of your HTH Travel Insurance premium depends on several factors, including:

- Number of travelers and their ages

- Destination country/countries

- Length of trip

- Total cost of the trip

- Pre-existing health conditions

Note that TripProtector Economy, HTH’s most affordable plan option, is only available for trips under $5,000. The other two plans are available for single or multiple trips of any length.