- Featured Cards Opens Featured cards page in the same window.

- Card Finder Opens card finder page in the same window.

Travel Credit Cards

Start your journey today by finding the best travel credit card for your future exploration needs. Compare travel rewards benefits and offers including dining perks and new cardmember bonuses for extra points or miles.

Chase Sapphire Preferred ® credit card . Links to product page.

Chase Sapphire Preferred ® credit card card reviews (7,829 cardmember reviews) Opens overlay

New cardmember offer.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when redeemed through Chase Travel SM .

AT A GLANCE

Premium dining & travel rewards Earn 5x total points on travel purchased through Chase Travel SM , excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel Credit. Earn 3x points on dining at restaurants including eligible delivery services, takeout and dining out. Earn 2x on other travel purchases.

21.49 Min. of (8.50+12.99) and 29.99 %– 28.49 Min. of (8.50+19.99) and 29.99 % variable APR. † Opens pricing and terms in new window

$95 † Opens pricing and terms in new window

Chase Sapphire Reserve ® Credit Card . Links to product page.

Chase Sapphire Reserve ® Credit Card card reviews (4,642 cardmember reviews) Opens overlay

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel SM .

Earn 5x total points on flights and 10x total points on hotels (excluding The Edit℠) and car rentals when you purchase travel through Chase Travel℠ after the first $300 is spent on travel purchases annually.

22.49 Min. of (8.50+13.99) and 29.99 %– 29.49 Min. of (8.50+20.99) and 29.99 % variable APR. † Opens pricing and terms in new window

$550 annual fee † Opens pricing and terms in new window ; $75 for each authorized user † Opens pricing and terms in new window

Southwest Rapid Rewards ® Plus Credit Card . Links to product page.

Southwest Rapid Rewards ® Plus Credit Card card reviews (2,559 cardmember reviews) Opens overlay

Earn 50,000 points after qualifying purchases.

3,000 anniversary points each year. Plus, earn 2X points on Southwest ® purchases and 1X points on all other purchases.

$69 applied to first billing statement. † Opens pricing and terms in new window

Southwest Rapid Rewards ® Priority Credit Card . Links to product page.

Southwest Rapid Rewards ® Priority Credit Card card reviews Opens overlay

Receive a $75 annual Southwest ® travel credit and 7,500 anniversary points each year. Plus, earn 3X points on Southwest purchases.

$149 applied to first billing statement. † Opens pricing and terms in new window

Southwest Rapid Rewards ® Premier Credit Card . Links to product page.

Southwest Rapid Rewards ® Premier Credit Card card reviews (3,823 cardmember reviews) Opens overlay

6,000 anniversary points each year. Plus, earn 3X points on Southwest ® purchases and 1X points on all other purchases.

$99 applied to first billing statement. † Opens pricing and terms in new window

United SM Explorer Card . Links to product page.

United SM Explorer Card card reviews Opens overlay

Earn 50,000 bonus miles after qualifying purchases.

Join Us with 2x miles on United purchases, dining, and hotel stays. Plus, enjoy a free first checked bag, priority boarding and other great United travel benefits. Terms apply.

21.99 Min. of (8.50+13.49) and 29.99 %– 28.99 Min. of (8.50+20.49) and 29.99 % variable APR. † Opens pricing and terms in new window

$0 intro annual fee for the first year, then $95. † Opens pricing and terms in new window

United Quest SM Card . Links to product page.

United Quest SM Card card reviews Opens overlay

Earn 60,000 bonus miles + 500 Premier qualifying points (PQP) after qualifying purchases.

Pursue your quest SM . Enjoy a $125 annual United purchase credit, two free checked bags, priority boarding and other premium travel benefits. Plus, earn 3x miles on United purchases and 2x miles on all other travel. Terms apply.

$250 † Opens pricing and terms in new window

United Gateway SM Credit Card . Links to product page.

United Gateway SM Credit Card card reviews Opens overlay

Earn 20,000 bonus miles after qualifying purchases.

Start your adventure with 2x miles on United purchases, at gas stations and on local transit and commuting. Plus, 25% back on United inflight and Club premium drink purchases, and no foreign transaction fees. † Opens pricing and terms in new window

0% intro APR for 12 months from account opening on purchases. † Opens pricing and terms in new window After the intro period, a variable APR of 21.99 Min. of (8.50+13.49) and 29.99 %– 28.99 Min. of (8.50+20.49) and 29.99 %, † Opens pricing and terms in new window see pricing and terms for more details. † Opens pricing and terms in new window

$0 † Opens pricing and terms in new window

United Club SM Infinite Card . Links to product page.

United Club SM Infinite Card card reviews Opens overlay

Earn 80,000 bonus miles after qualifying purchases.

Travel in luxury. Enjoy United Club SM membership and 2 free checked bags. Plus, earn rewards faster with 4x miles on United purchases, and 2x miles on dining and all other travel. Terms apply.

$525 † Opens pricing and terms in new window

Aeroplan ® Card . Links to product page.

Aeroplan ® Card card reviews Opens overlay

Earn 60,000 bonus points. Earn 60,000 bonus points after you spend $3,000 on purchases in the first 3 months your account is open. That's enough to fly to another continent.

Earn points fast with Aeroplan. 3X points at grocery stores, on dining including take out and eligible delivery services and on purchases made directly with Air Canada. Plus, enjoy free first checked bag and other Aeroplan travel benefits.

21.74 Min. of (8.50+13.24) and 29.99 %– 28.74 Min. of (8.50+20.24) and 29.99 % variable APR. † Opens pricing and terms in new window

Marriott Bonvoy Boundless ® credit card . Links to product page.

Marriott Bonvoy Boundless ® credit card card reviews Opens overlay

3 Free Night Awards Earn 3 Free Night Awards (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening. Certain hotels have resort fees.

Earn Unlimited Marriott Bonvoy ® points and get free stays faster. Earn points on every purchase and up to 17X total points per $1 spent at hotels participating in Marriott Bonvoy ® .

$95. † Opens pricing and terms in new window

Marriott Bonvoy Bountiful ™ credit card . Links to product page.

Marriott Bonvoy Bountiful ™ credit card card reviews Opens overlay

85,000 Bonus Points Earn 85,000 Bonus Points after you spend $4,000 in purchases in your first 3 months from your account opening.

Earn Unlimited Marriott Bonvoy ® points and get free stays faster. Earn points on every purchase and up to 18.5X total points per $1 spent at hotels participating in Marriott Bonvoy ® .

Marriott Bonvoy Bold ® credit card . Links to product page.

Marriott Bonvoy Bold ® credit card card reviews Opens overlay

Earn 1 Free Night Award (valued up to 50,000 points) after you spend $1,000 on purchases in your first 3 months from account opening. Certain hotels have resort fees.

Earn Unlimited Marriott Bonvoy ® points and get free stays faster. Earn points on every purchase and up to 14X total points per $1 spent at hotels participating in Marriott Bonvoy ® .

$0. † Opens pricing and terms in new window

IHG One Rewards Premier Credit Card . Links to product page.

IHG One Rewards Premier Credit Card card reviews Opens overlay

Earn 140,000 Bonus Points After you spend $3,000 on purchases in the first 3 months from account opening.

Earn IHG One Rewards points on every purchase. Up to 26X points total per $1 spent when you stay at IHG ® hotels and resorts.

$99 † Opens pricing and terms in new window

IHG One Rewards Traveler Credit Card . Links to product page.

IHG One Rewards Traveler Credit Card card reviews Opens overlay

Earn 80,000 Bonus Points After you spend $2,000 on purchases in the first 3 months from account opening.

Earn IHG One Rewards points on every purchase. Up to 17X points total per $1 spent when you stay at IHG ® hotels and resorts.

Disney ® Premier Visa ® Card . Links to product page.

Disney ® Premier Visa ® Card card reviews Opens overlay

Disney Card Designs

$300 $400 not $300 $400 Statement Credit after you spend $1000 on purchases in the first 3 months from account opening.

Dream bigger with the Disney Premier Visa Card from Chase. Earn 5% in Disney Rewards Dollars on card purchases made directly at DisneyPlus.com, Hulu.com or ESPNPlus.com. Earn 2% on select card purchases and 1% on all other card purchases. Redeem toward most anything Disney at most Disney U.S. locations and for a statement credit toward airline purchases. Enjoy special Disney vacation financing and Disney shopping savings. Terms apply.

19.24 Min. of (8.50+10.74) and 29.99 %‐ 28.24 Min. of (8.50+19.74) and 29.99 % variable APR. † Opens pricing and terms in new window 0% promotional APR for 6 months on select Disney vacation packages from the date of purchase, after that a variable APR of 19.24 Min. of (8.50+10.74) and 29.99 %‐ 28.24 Min. of (8.50+19.74) and 29.99 %. † Opens pricing and terms in new window

$49 † Opens pricing and terms in new window

Disney ® Visa ® Card . Links to product page.

Disney ® Visa ® Card card reviews Opens overlay

$150 $250 not $150 $250 Statement Credit after you spend $500 on purchases in the first 3 months from account opening.

Reward yourself with the Disney Visa Card from Chase. Earn 1% in Disney Rewards Dollars on all card purchases. Redeem toward most anything Disney at most Disney locations in the U.S. Enjoy special Disney vacation financing and Disney shopping savings. Terms apply.

19.24 Min. of (8.50+10.74) and 29.99 %– 28.24 Min. of (8.50+19.74) and 29.99 % variable APR. † Opens pricing and terms in new window 0% promotional APR for 6 months on select Disney vacation packages from the date of purchase, after that a variable APR of 19.24 Min. of (8.50+10.74) and 29.99 %– 28.24 Min. of (8.50+19.74) and 29.99 %. † Opens pricing and terms in new window

World of Hyatt Credit Card . Links to product page.

World of Hyatt Credit Card card reviews Opens overlay

Earn up to 60,000 Bonus Points after qualifying purchases.

Turn your purchases into more free nights at Hyatt with 9X total points per $1 spent at Hyatt hotels & resorts. Plus, get 1 free night and 5 tier qualifying night credits toward status each year.

British Airways Visa Signature ® card . Links to product page.

British Airways Visa Signature ® card card reviews Opens overlay

Earn 75,000 Bonus Avios Earn 75,000 Avios after you spend $5,000 on purchases within the first 3 months of account opening.

Earn 5 Avios for every $1 spent on gas, grocery stores and dining for the first 12 months of account opening or up to $10k. These category purchases normally earn 1 Avios. Earn 3 Avios for every $1 spent on British Airways, Aer Lingus and Iberia purchases, and earn 2 Avios for every $1 spent on hotel accommodations booked directly with the hotel.

Aer Lingus Visa Signature ® card . Links to product page.

Aer Lingus Visa Signature ® card card reviews Opens overlay

Earn 5 Avios for every $1 spent on gas, grocery stores and dining for the first 12 months of account opening or up to $10k. Normally, these category purchases earn 1 Avios. Earn 3 Avios for every $1 spent on Aer Lingus, British Airways, and Iberia purchases, and 2 Avios for every $1 spent on hotel accommodations.

Iberia Visa Signature ® card . Links to product page.

Iberia Visa Signature ® card card reviews Opens overlay

Earn 5 Avios for every $1 spent on gas, grocery stores and dining for the first 12 months of account opening or up to $10k. These category purchases normally earn 1 Avios. Earn 3 Avios for every $1 spent on Iberia, Aer Lingus, and British Airways purchases, and 2 Avios for every $1 spent on hotel accommodations.

Ink Business Preferred ® Credit Card . Links to product page.

Ink Business Preferred ® Credit Card card reviews Opens overlay

100,000 bonus points after you spend $8,000 on purchases in the first 3 months after account opening. That's $1,000 cash back or $1,250 toward travel rewards when you redeem through Chase Travel SM .

Reward your business with flexible and rich rewards. Earn 3X points on shipping and other select business categories.

21.24 Min. of (8.50+12.74) and 29.99 %– 26.24 Min. of (8.50+17.74) and 29.99 % variable APR. † Opens pricing and terms in new window

IHG One Rewards Premier Business Credit Card . Links to product page.

IHG One Rewards Premier Business Credit Card card reviews Opens overlay

Earn up to 175,000 bonus points Earn 140,000 Bonus Points after spending $4,000 in the first 3 months from account opening. Plus, earn 35,000 Bonus Points after spending a total of $7,000 in the first 6 months from account opening.

United SM Business Card . Links to product page.

United SM Business Card card reviews Opens overlay

Earn 75,000 bonus miles after qualifying purchases.

Earn 2x miles on United purchases, dining, at gas stations, office supply stores and on local transit and commuting. Plus, enjoy a free first checked bag, priority boarding and other great United travel benefits. Terms apply.

$0 intro annual fee for the first year, then $99. † Opens pricing and terms in new window

United Club SM Business Card . Links to product page.

United Club SM Business Card card reviews Opens overlay

Earn 50,000 bonus miles + 1,000 Premier qualifying points (PQP) after qualifying purchases.

Travel in luxury. Enjoy United Club SM membership and 2 free checked bags. Plus, earn rewards faster with 2x miles on United purchases and 1.5x miles on all other purchases. Terms apply.

$450 † Opens pricing and terms in new window

Southwest Rapid Rewards ® Performance Business Credit Card . Links to product page.

Southwest Rapid Rewards ® Performance Business Credit Card card reviews Opens overlay

Earn 80,000 points after you spend $5,000 on purchases in the first 3 months your account is open.

Earn 4X points on Southwest ® purchases and 2X points on purchases for your business in select categories. Plus, 9,000 anniversary bonus points each year.

$199 applied to first billing statement. † Opens pricing and terms in new window

Southwest Rapid Rewards ® Premier Business Credit Card . Links to product page.

Southwest Rapid Rewards ® Premier Business Credit Card card reviews Opens overlay

Earn 60,000 bonus points after you spend $3,000 on purchases in the first 3 months your account is open.

Earn 3X points on Southwest ® purchases, 2X points on local transit and commuting, and 1X points on all other purchases. Plus, 6,000 anniversary points each year.

World of Hyatt Business Credit Card . Links to product page.

World of Hyatt Business Credit Card card reviews Opens overlay

Earn 60,000 Bonus Points after qualifying purchases.

Make the most of your small business spending with accelerated earning wherever you spend the most. Earn 2 Bonus Points total per $1 spent in your top three spend categories each quarter through 12/31/24, then your top two categories each quarter.

$199 † Opens pricing and terms in new window

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

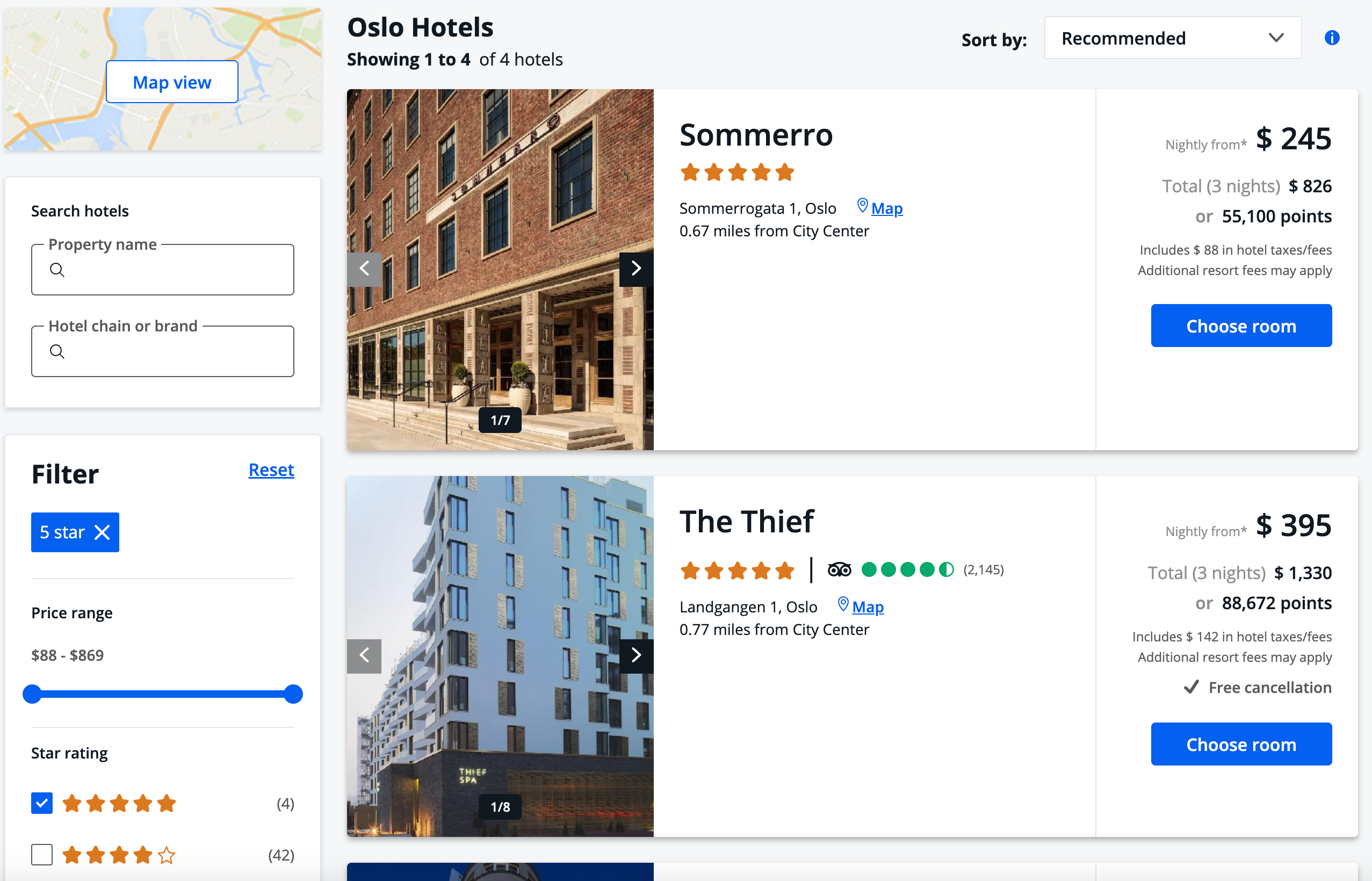

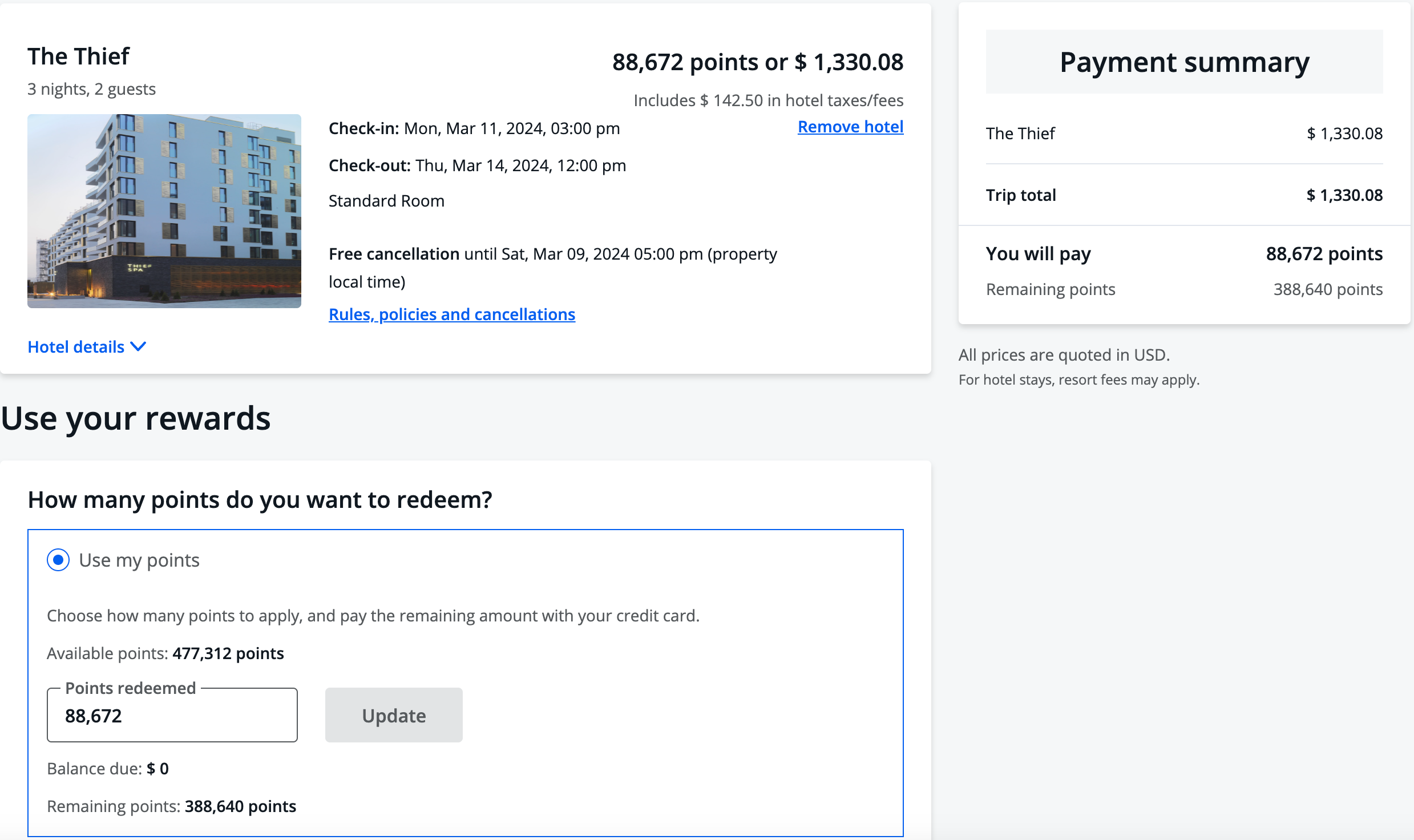

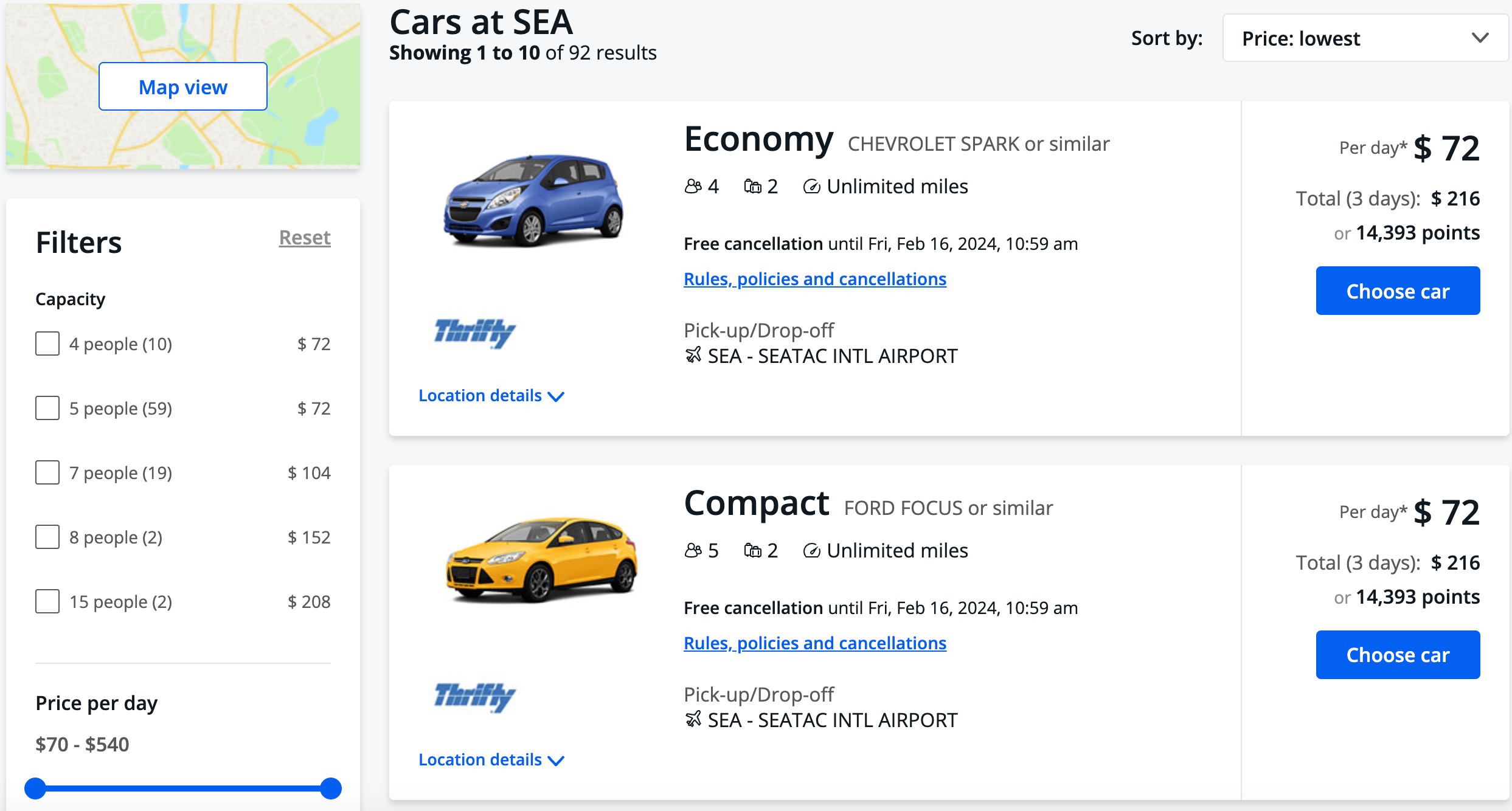

Dream, discover, book with Chase Travel

Go further when you book with Chase Travel

Competitive rates.

Take advantage of competitive rates at thousands of hotels and resorts, with no booking fees.

Seamless booking

Smoothly plan and book your whole trip, from coveted hotels and convenient flights to cars and must-do local experiences.

Premium benefits

Make the most of your card rewards. Access exclusive benefits and earn and redeem like never before.

Find inspiration

Don’t just dream it. Discover your next adventure with help from fresh trip recommendations and curated picks for unforgettable stays.

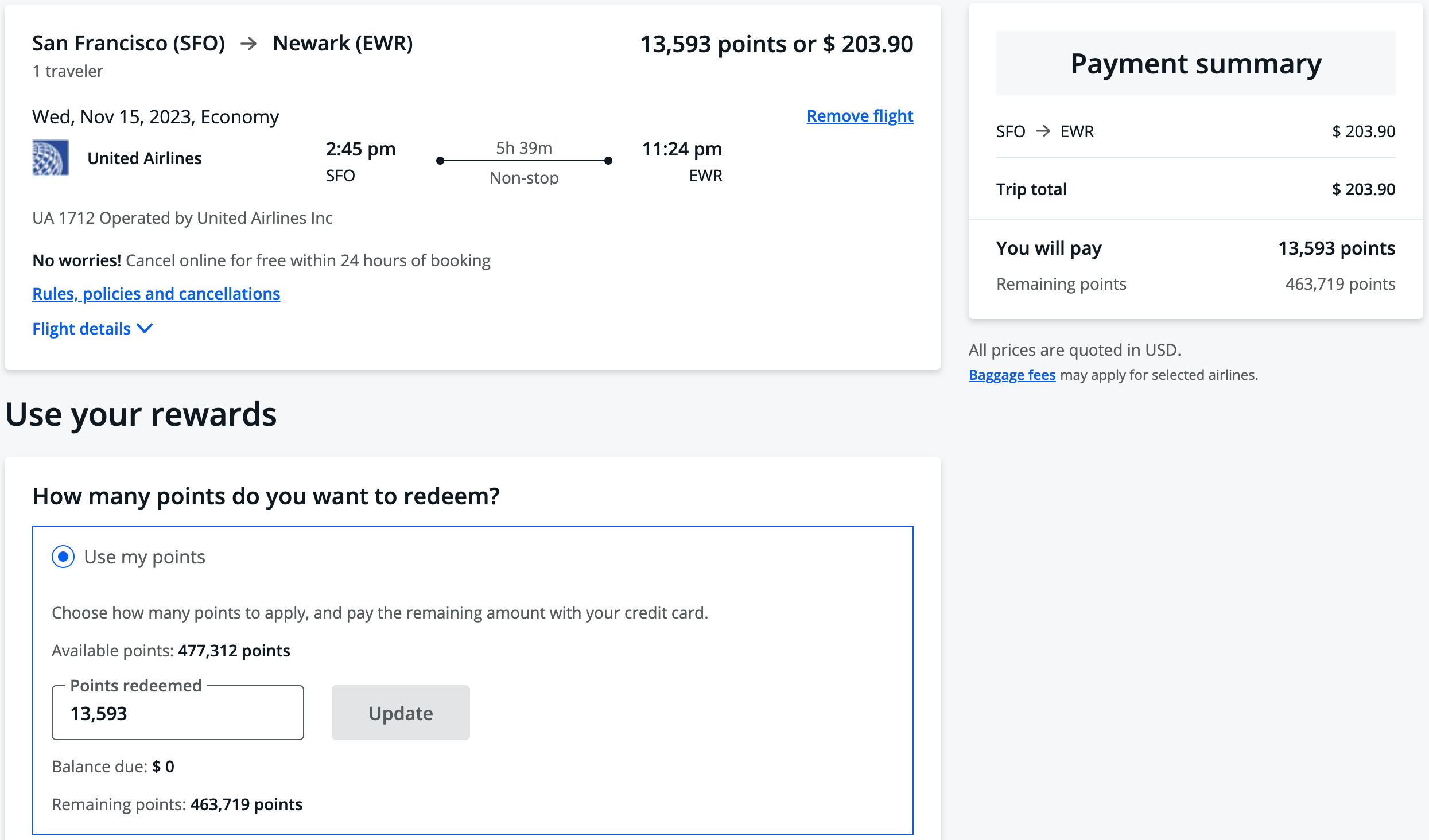

Get rewarded

Earn and redeem Ultimate Rewards points with your eligible Chase card, including Chase Sapphire, Freedom, Ink Business credit cards and more.

Earn up to 8,000 bonus points or more

Eligible cardmembers can purchase a trip through Chase Travel with their eligible Chase credit card and get rewarded with 5,000 bonus Ultimate Rewards points when purchasing 2 qualifying travel components, or 8,000 when purchasing 3. Choose from hotels, flights, cars and cruises.

Haven’t traveled with us in a while? You may be eligible for an extra 2,000 bonus points.

Activate and book March 1 to May 31, 2024 for stays through the end of the year.

- Disclosures

The BEST Travel Credit Card for 2023: Chase Sapphire Preferred

The Chase Sapphire Preferred Card is the first card I recommend to all travelers, and the best travel credit card for 2023. It comes with a sweet sign-up bonus, ongoing opportunities to earn and redeem rewards, and extra benefits that almost all travelers can take advantage of. In fact, it’s one of the few travel reward cards I’ve held onto and use regularly ever since I first got it in 2013.

Highlights of the Chase Sapphire Preferred

The Chase Sapphire Preferred Card stands out as one of the best travel credit cards for 2023 by offering generous benefits for a low annual fee:

Chase Sapphire Preferred® Card

- 60,000 reward points (worth $750 ) after meeting the minimum spend of $4,000 in the first 3 months

- $50 annual Ultimate Rewards Hotel Credit, 5x points for purchases on Chase Ultimate Rewards, 3x points on dining, select streaming services and online groceries, and 2x points on all other travel purchases.

- Points are worth 25% more on airfare, hotels, car rentals, and cruises when booking through Chase Ultimate Rewards (e.g. 60,000 points worth $750 toward travel)

- Includes trip cancellation/interruption insurance, auto rental collision damage waiver, lost luggage insurance and more.

- Can transfer your reward points to leading airline and hotel loyalty programs

- No foreign transaction fees

- Annual fee: $95

Unlike other Chase Sapphire Preferred reviews, I’ll also share a few of the card’s intangible perks: things don’t necessarily hold a dollar value but still offer additional value.

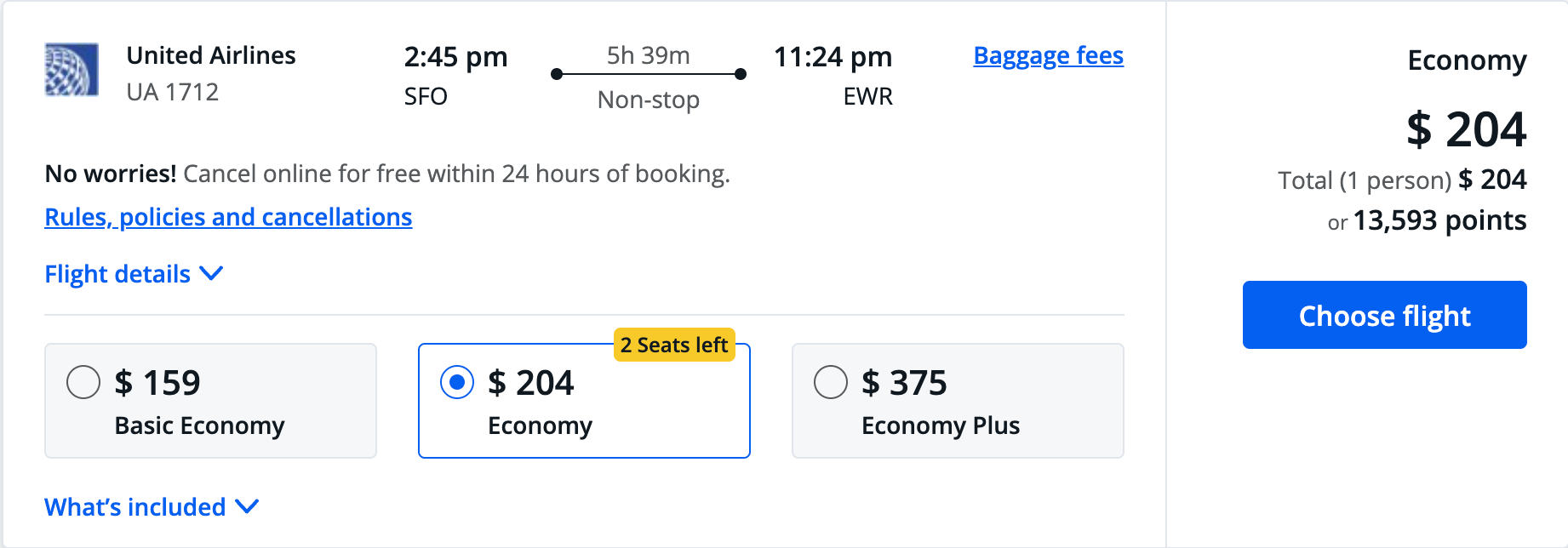

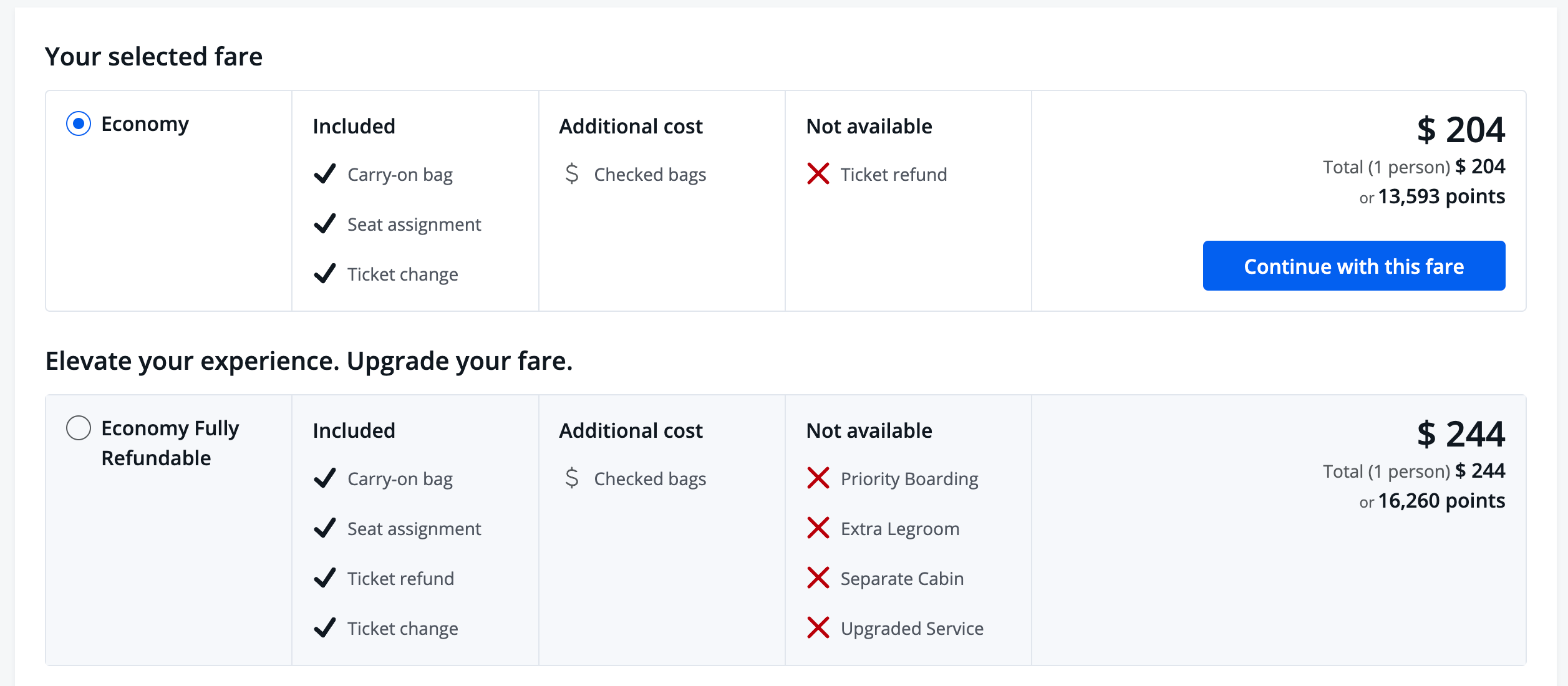

Top Ways I’ve Used the Chase Sapphire Preferred

A few years ago, I transferred my welcome bonus to United MileagePlus to book a round-trip flight to Slovenia during peak summer travel, an ordinarily expensive route. I even used the Chase Sapphire Preferred to cover my rental car CDW insurance for a roadtrip through Slovenia and Croatia!

Over the years, I’ve earned thousands of Ultimate Rewards (UR) points which helped me take some amazing trips:

- Round-trip flight Richmond, VA to Slovenia with one-way in business class valued at $3,000 — I only paid $140 in taxes

- One-way first class flight Atlanta to Vietnam valued at $8,000 — I paid $65 in taxes

- One-way economy flight from Nuremberg, Germany to Richmond for next day travel valued at $1000 — I paid $125 in taxes

- One-way economy flight from Cairo, Egypt to Paris, France valued at $400 — paid $65 in taxes

- One-way economy flight from London to Detroit valued at $700 — just $200 in taxes

- One-way economy flight Lima to Cusco, Peru on New Year’s valued at $175 — only $10 in taxes

- The only hotel I’ve ever used Ultimate Rewards for: the Hyatt Regency Kathmandu , where I used 5,000 points to save on a $140 room

And coming soon: I’m flying Iberia Airlines in a few months, after converting 34,000 Ultimate Rewards into Iberia Avios for a one-way business class flight from San Sebastian to Boston. That ticket is normally $2,000 but I only paid $125 in taxes.

Redeeming points earned with the Chase Sapphire Preferred helps me travel when I otherwise couldn’t afford it!

Where The Chase Sapphire Preferred Welcome Bonus Can Take You

The best part about the Chase Sapphire Preferred 60,000 point welcome bonus is that it’s flexible and can be used for any type of travel.

If you’re looking for some inspiration, here are a few of my favorite ideas:

1) Book a Flying Blue Business Class Promo Award to Europe

Every month, Flying Blue releases a list of cities that are eligible for awards at 20-50% off their normal mileage rate when flying on Air France or KLM. For example, we’ve recently seen tickets from Chicago to Budapest for 40,000 miles. Pair this with an economy award in the other direction on airlines like Virgin Atlantic and you’ll end up with a round-trip ticket for just the cost of taxes and fees.

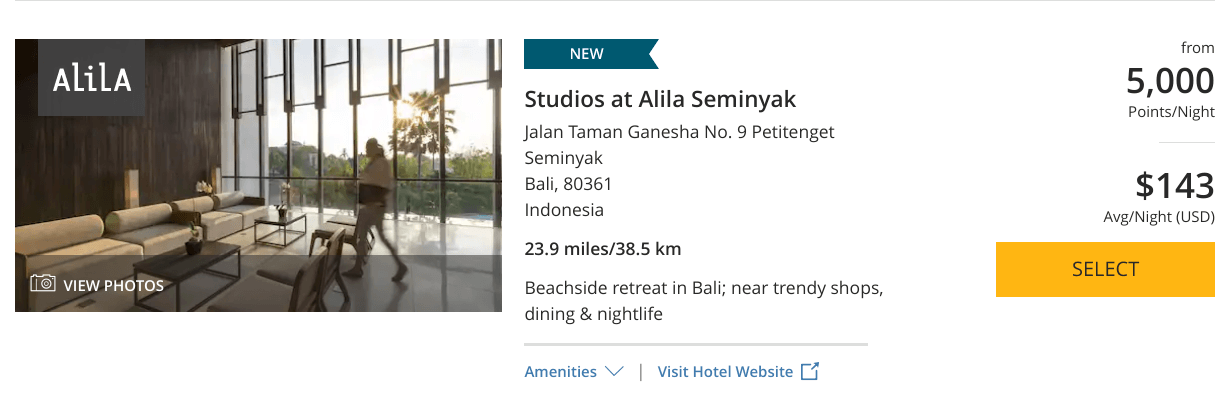

2) Book a Week in Bali

There are currently five properties on Bali that cost 12,000 Hyatt points per night or less and you can easily transfer Ultimate Rewards to World of Hyatt to make a reward booking. Choose your hotels strategically and you could hop from one part of the island to another for up to 12 nights at high-end hotels just from using your welcome bonus!

3) Book 4 Round-Trip Economy Tickets Within the USA

Finding award tickets for a family can be challenging since airlines limit the number of awards available, but you can redeem your points without limitations when you book on the Chase travel portal. If you can find a ticket from your home to anywhere else for $187 or less, your welcome bonus covers the cost of four tickets. Going somewhere more expensive? Just pay the difference in cash.

4) Book Two Round-Trip Tickets from New York to Costa Rica

By transferring your Ultimate Rewards to British Airways Avios, you’ll have enough points for two round-trip tickets from New York to San Jose, Costa Rica; the tickets add up to 26,000 miles per person and about $50 in taxes. If you’re traveling on off-peak dates, you might even find flights for cheaper when using Southwest or JetBlue points (both programs have varying award costs based on cash prices) or by booking directly from the Chase portal.

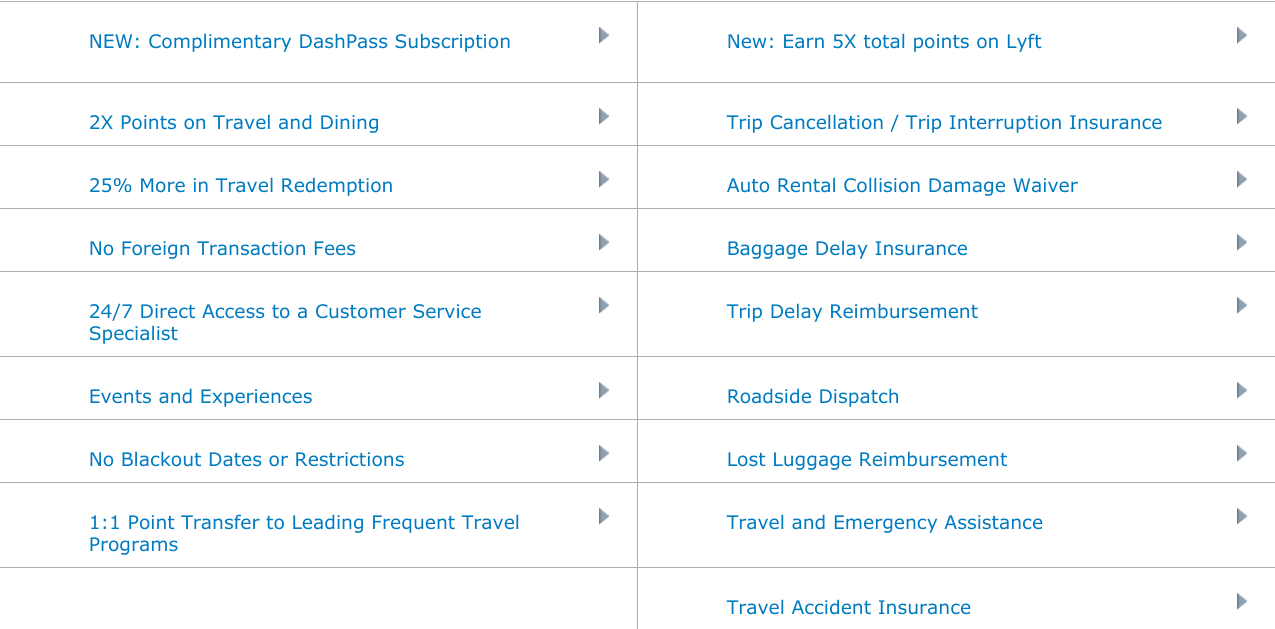

Other Card Benefits Included With Your Annual Fee

For frequent travelers, the $95 annual fee on the Chase Sapphire Preferred pays for itself with the inclusion of extra benefits.

No Foreign Transaction Fees

Let’s start with a simple but valuable benefit: there are no foreign transaction fees when you use your Chase Sapphire Preferred while traveling internationally.

Many cards, especially cards with no annual fee, add on a ~3% surcharge to all purchases made with a foreign currency. That adds up quickly if you’re traveling abroad and charging hotels, restaurants, tours, and transportation. Spend $3200 or more and you’re already money ahead.

Travel Insurance and Protection

The Chase Sapphire Preferred offers a generous travel insurance package compared to other cards with annual fees of $100 or less. To qualify, you’ll need to book and pay for your transportation ticket (flight, cruise, etc.) with the Sapphire Preferred.

Some of the protections include:

- Baggage Delay Reimbursement (up to $100 per day toward purchases of essential items when your checked bag is not delivered on time)

- Lost Luggage Reimbursement (up to $3,000 toward lost or damaged items)

- Trip Cancellation/Interruption Insurance (up to $10,000 when you need to cancel or end a trip early due to death, injury, or documented illness of you or immediate family member)

- Trip Delay Reimbursement (up to $500 toward unanticipated expenses when your trip is delayed by 12+ hours)

- Travel Accident Insurance (up to $500,000 when you die during a travel accident — yikes!)

These are great perks for low-risk trips when you wouldn’t otherwise buy travel insurance, like visiting grandma or a weekend getaway to a city in your own country. I made a claim when a cancelled flight required me to spend the night in Charlotte; I was reimbursed for my hotel, Uber rides, and meals.

Notably, medical costs are not covered, so you might want to shop around for a medical and evacuation policy on international trips. For medical insurance, we recommend World Nomads . They're the “all inclusive” option known for honoring claims made through their simple online process. They cover almost all adventure and sports activities, and you can buy and extend coverage even while on your trip.

Primary Car Rental Insurance

The Chase Sapphire Preferred is one of the few cars that offers primary collision damage waiver coverage on rental cars. This benefit is available in most countries and covers damage to all standard passenger vehicles (some “exotic” rentals, like Ferraris and Maseratis are explicitly excluded).

Remember, this is CDW coverage, so it will pay for damage to the rental vehicle, but you’ll still need liability coverage through your auto insurer at home for injuries or medical expenses.

Three Intangible Benefits

I mentioned earlier that there are a few non-dollar reasons I love the Chase Sapphire Preferred as well:

First, the card always works. The card is a Visa, which means it’s widely accepted worldwide and it’s been reliable for me even when cards from other banks were incorrectly flagged for fraud while traveling.

Next, they have awesome customer service. When I call in, I talk to a human being instead of a phone tree. Better yet, the associates I’ve spoken to are well-trained and able to assist in an appropriate manner so problems are solved quickly.

Lastly, the card is simple . The Sapphire Preferred is designed for customers who want to set it and forget it. The rewards are easy, so you don’t have to spend dozens of hours learning how to redeem them, and the website is intuitive for general banking and reward redemptions. It’s a no-brainer to apply and hold onto the card long-term so you can spend your mental energy on other things.

How to Earn Chase Ultimate Rewards

Chase offers a generous welcome bonus for new cardholders: 60,000 Ultimate Rewards points when you spend $4,000 in the first 3 months of card approval. That’s a fast way to jumpstart your earning!

Thereafter, you’ll earn Ultimate Rewards through normal everyday spending. You’ll get 2 Ultimate Rewards points per dollar spent on travel and dining and 1 point per dollar on everything else.

Chase defines travel as the things you'd expect (e.g. hotels, airfare, cruises, car rentals) but also includes less-obvious purchases like taxis, toll roads, paid parking, campgrounds, and more. Dining is also broadly-defined, including restaurants, fast food, bars, coffeeshops, and even some food delivery services (like Grubhub).

Want to earn even faster? Add an authorized user for no extra fee and their spending will earn Ultimate Rewards for the same account.

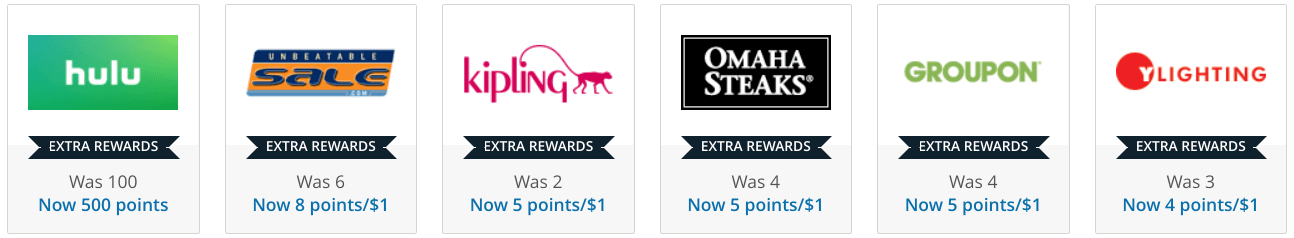

For additional earnings, you can start your online shopping purchase through the “Shop through Chase” portal. A few extra clicks will help you earn an additional points for every dollar spent at participating online retailers like Best Buy or Macy’s.com.

How to Redeem Chase Ultimate Rewards

There are two different ways to redeem Ultimate Rewards for travel. That flexibility means you should get great value regardless of your goals and preferences.

Ultimate Rewards points can be transferred at a 1:1 ratio to partner airlines and hotels where you then redeem your points directly through those frequent flyer programs. This is a great way to book high-value redemptions at a reduced rate, like first class flights and luxury hotels. I’m flying business class this spring on Iberia Airlines from Spain for just 34,000 UR — a fabulous redemption compared to the cash price of $2,000.

The downside to booking through partner programs is that rewards often come with blackout dates or capacity controls, which can be frustrating for travelers. You can work around these restrictions by using your rewards to redeem points through the Chase portal instead of transferring directly to programs.

When you book through the Chase portal, Ultimate Rewards points are worth 1.25 cents per point (e.g. the welcome bonus of 60,000 points = $750 ). You can book any flight or hotel that is normally available through an online travel agency like Expedia, so you can choose any airline or hotel of your preference with no blackout dates.

Since your points are worth a fixed value when redeeming this way, it is often a good option when flying in economy or staying at mid-range hotels. For thrifty travelers that find airfare deals or hotel sales, you might actually use fewer points than transferring to an official frequent flyer program.

The Thrifty Gist

- The Chase Sapphire Preferred is the best travel credit card, offering a welcome bonus of 60,000 Ultimate Rewards points (worth $750!)

- You can transfer Chase Ultimate Rewards points you earn with the card to flight and hotel partner programs, or redeem them for any bookable travel with no blackout dates online for maximum flexibility

- The card’s annual fee pays for itself with the welcome bonus, no foreign transaction fees, and benefits like travel protections and CDW insurance

- Looking for other options? Check out our list of the BEST travel credit cards of the year , and learn more about how to get free flights with travel credit cards & points .

Thrifty Nomads has partnered with CardRatings for our coverage of credit card products. Thrifty Nomads and CardRatings may receive a commission from card issuers. Opinions expressed here are author's alone. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Disclosures Many of the listings that appear on this website are from companies which we receive compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). The site does not review or include all companies or all available products. Thrifty Nomads has partnered with CardRatings for our coverage of credit card products. Thrifty Nomads and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Chase Sapphire Preferred Card

My Top 5 Travel Redemptions With the Chase Sapphire Preferred [2023]

Stella Shon

News Managing Editor

87 Published Articles 620 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Senior Editor & Content Contributor

88 Published Articles 654 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![chase best card for travel My Top 5 Travel Redemptions With the Chase Sapphire Preferred [2023]](https://upgradedpoints.com/wp-content/uploads/2023/04/Kailua-Hawaii.jpeg?auto=webp&disable=upscale&width=1200)

Earning Points

Redeeming points, ana business class from new york (jfk) to tokyo (hnd), ana first class from tokyo (hnd) to san francisco (sfo), 2 nights at hyatt’s hana-maui resort, virgin atlantic economy class from new york (jfk) to london (lhr), iberia business class from madrid (mad) to new york (jfk), final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Recently, the Chase Sapphire Preferred ® Card was offering an elevated 80,000-point welcome offer . While the offer is no longer available, if you were one of the lucky ones to snag this card with the elevated offer, you may be wondering how to best redeem your new stash of Ultimate Rewards points.

In fact, opening the Chase Sapphire Preferred card many years ago is what got me started on this never-ending cycle of earning travel rewards. Combined with the card’s welcome bonus offer and the excellent everyday bonus categories, I’ve stockpiled hundreds of thousands of points over the years.

But how useful are these points, anyway? While award travel is certainly not “free” by any means, redeeming points for flights and hotels has significantly helped to reduce my out-of-pocket costs on trips. In the past, my points have helped me score unbelievable experiences like ziplining through the jungles of Costa Rica and hiking towering waterfalls in Iceland.

Today, I’ll go through the top 5 travel redemptions I’ve made with my Chase Sapphire Preferred Card this year.

How To Earn and Redeem Points From the Chase Sapphire Preferred Card

Before we dive into the nitty gritty, let’s first go over how you earn and redeem points on the Chase Sapphire Preferred card. For starters, let’s take a look at what the current welcome offer is:

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Beyond earning the welcome offer, the Chase Sapphire Preferred card is a rewards powerhouse for many heavy-hitting bonus categories:

- Earns 5x points per $1 on all travel booked via the Chase Travel portal

- Earns 5x points on select Peloton purchases over $250 (through March 31, 2025)

- Earns 5x points on Lyft purchases (through March 31, 2025)

- Earns 3x points per $1 on dining purchases, online grocery purchases, and select streaming services

- Earns 2x points per $1 on all other travel worldwide

- Earns 1x points per $1 on all other eligible purchases

Whether it’s going out to eat, taking Lyft rides around the city, or even paying for my $2.75 subway rides, I’ve been able to earn bonus points on all of my routine purchases.

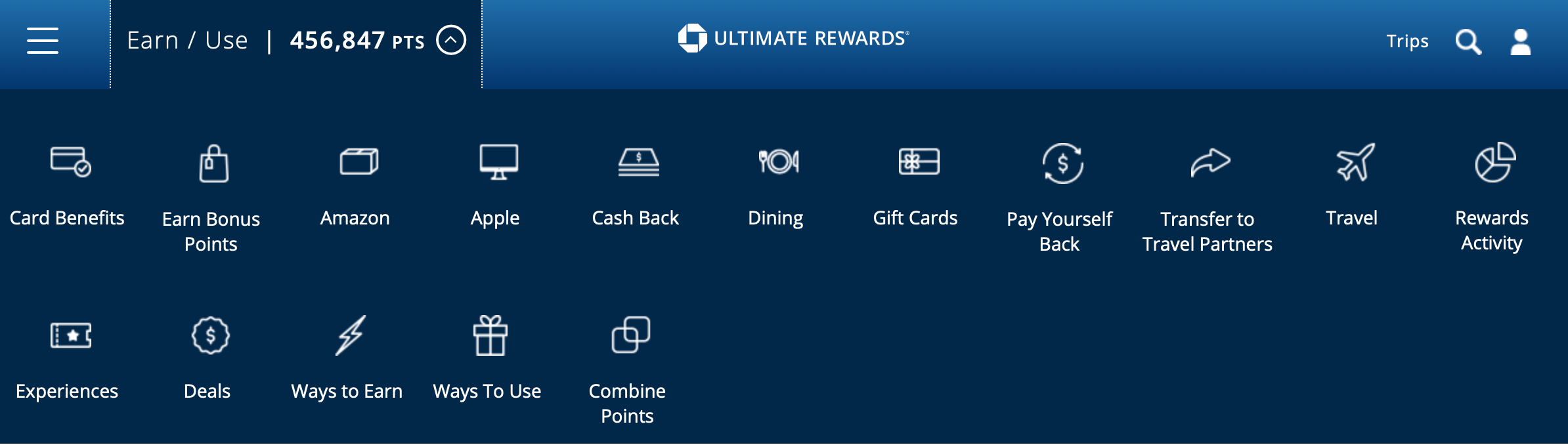

Now when it comes time to redeem points, there are many options to consider on the Chase Travel portal. At first glance, it may seem convenient to cash out your Ultimate Rewards points for gift cards or shopping on Amazon. However, your points aren’t worth very much for either option — just 1 cent or 0.8 cents each, respectively.

The best way to redeem your Ultimate Rewards points is for travel, and there are 2 main ways to do so. The first option is to make new travel bookings (flights, hotels, rental cars, or even cruises) through Chase Travel. If you redeem your points in this fashion, they’re worth 1.25 cents apiece — which is certainly a better value than gift cards or Amazon purchases — but even that method isn’t necessarily the best option.

Instead, we highly recommend that you look toward Chase’s 11 airline and 3 hotel transfer partners . Your points transfer at a 1:1 ratio to these participating loyalty programs, including more familiar faces like Marriott Bonvoy , Southwest Rapid Rewards , or United MileagePlus .

Check out our transfer partner tool calculator to know exactly what your Chase Ultimate Rewards points can get you!

But some of these international airlines that you may have never flown such as Air Canada, Singapore Airlines, and Iberia, offer outstanding value that can’t be ignored. In fact, that’s how we arrived at the value of 2 cents per Ultimate Rewards point when leveraging Chase’s transfer partners. It takes a bit more research and elbow grease, yes, but we’re here to provide these resources at Upgraded Points.

My Top 5 Chase Sapphire Preferred Travel Redemptions This Year

Next week, I’ll embark on an exciting 3-week trip to Japan and South Korea. It’s been 5 years since I’ve visited my relatives in South Korea, but this time, I’ll be flying to Asia in style.

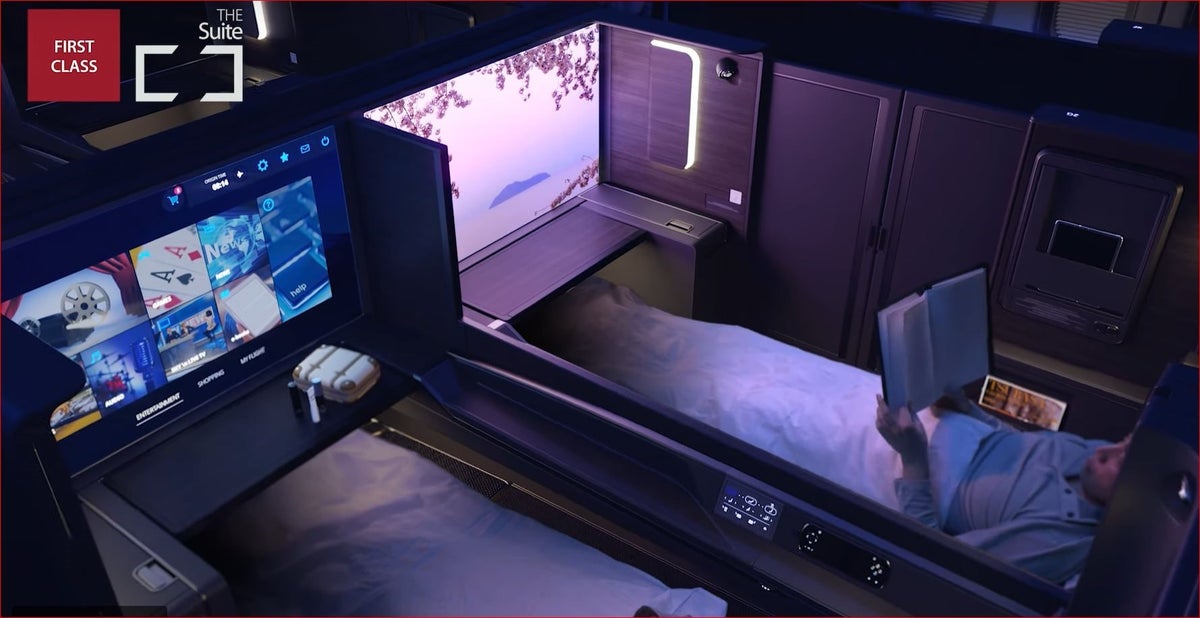

Virgin Atlantic has an incredible partnership with Japanese 5-star carrier ANA. If you can find the award space, you can book a one-way, business class flight on the carrier from New York to Tokyo for just 47,500 Virgin Atlantic Flying points. Taxes and fees will run you about $350, but you can’t argue with the value here.

A paid one-way fare would normally cost at least $5,000, so I got almost 10 cents per point by transferring Ultimate Rewards points from my Chase Sapphire Preferred card to Virgin Atlantic Flying Club . (That’s 10x more value than if I had redeemed my Chase points for gift cards!).

Now the challenging part here is finding award availability (which we’ve detailed fully in this guide) . However, there are usually 2 ways to go about it. The first method is to look way out, 330 days to be exact, when ANA first releases seat availability. The other method is the complete opposite — to look very close to the date you’re looking to fly.

I did a combination of the 2, as I originally found and booked the award space about a year ago. But just 3 weeks before flying, I decided that I wanted to change my travel date and also found plenty of award space booked in closely.

All said and done, I’ve seriously upgraded my 14-hour journey to Asia by using just 47,500 Chase Ultimate Rewards points.

Flying business class to Asia is a bucket-list redemption for many. But did you know you can also use those points to fly first class?

Largely using the same redemption method as above, I’ll be coming home via an ANA flight from Tokyo (HND) to San Francisco (SFO) — in first class. For this ticket, I did book ~330 days out.

Now this ultra-posh ticket would cost closer to $10,000, but I only ended up using 55,000 Virgin Atlantic Flying Club points and paid around $450 in taxes and fees. That’s like getting 17 cents per point in value, which is pretty amazing for Chase Ultimate Rewards points.

Now, redemptions like this seem almost too good to be true, and airlines are always on the hunt to devalue this kind of reward. This did actually happen last month, as Virgin Atlantic raised the award rates for future ANA first class bookings . As such, the same first ticket I booked now requires 72,500 points one-way.

Despite this devaluation, the ability to book first class for less than a six-figure balance of points is still incredible.

Last month, I flew to Oahu to see my college best friend living on the island. Sure, we could have just stayed at her house for the ~10 days I was visiting, but you can’t visit Hawaii without seeing (at least) another island.

Fortunately, my Chase points made this happen. I was able to make a 2-night trip to Maui come to life by booking the Hana-Maui Resort on points. This luxury hotel would have cost $800+ per night , but since it’s part of the World of Hyatt program , I could book it using 30,000 points per night instead.

Plus, Chase’s partnership with World of Hyatt is quite valuable as it’s the absolute best loyalty program for booking hotel nights. In sum, I redeemed 60,000 Chase points to achieve 2.67 cents per point in value. While this may seem like more modest of a value compared to my luxurious lie-flat seats to and from Asia, I still love to redeem my points for hotels — especially with these inflated rates recently.

Coupled with $49 island-hopping flights, I couldn’t have been happier with this redemption — stay tuned for a review coming very soon.

As glamorous as my redemptions have seemed so far, I don’t have an unlimited points stash to use just for business- or first-class flights. I love a good flight deal and am more than happy to fly economy, especially if the flight is under 8 hours or if it’s not a red-eye.

This summer, I’m going on a cruise with a friend out of Barcelona. Because it seems like everyone and their mother is trying to go to Europe this summer, award tickets are scarce.

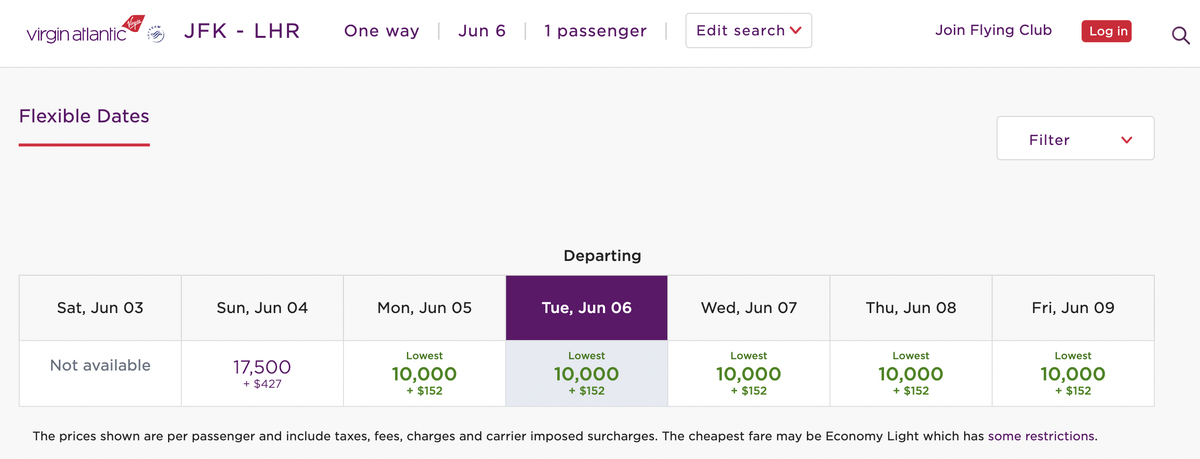

However, Virgin Atlantic saves the day yet again. The U.K.-based carrier hosts sales several times per year, and back in February, the carrier offered a 30% discount on select award flights . Therefore, I managed to book a flight from New York (JFK) to London (LHR) for just 7,500 Virgin Atlantic Flying Club points and about $150 in taxes and fees.

My same one-way ticket would have cost me at least $700, so I got a terrific 7 cents per point value. Even without the 30% award sale, the same flight would only cost 10,000 Virgin Flying Club points — and there’s lots of award availability at the time of writing.

On the way back, I decided to splurge for an Iberia business class flight from Madrid (MAD). The Spanish flag carrier offers one of the most reasonable award rates for a lie-flat seat to and from Europe: 34,000 Avios (off-peak) or 50,000 Avios (peak).

As I’m flying during the peak summer season, I transferred 50,000 Ultimate Rewards points to Iberia Avios and paid $150 in taxes and fees. The same ticket would have cost me at least $5,000 one-way, which is way too steep for an 8-hour flight. Still, that’s a sizeable value of almost 10 cents per point.

However, you could also stretch your points vastly by redeeming them for economy flights. Iberia is only charging 17,000 Avios one-way in economy for flights to Spain to/from the East Coast, which is another solid redemption to consider.

The total tally clocks in at 220,000 redeemed Ultimate Rewards points this year. That may seem like an eye-popping amount of rewards — but once you factor a stash of 80,000 points and everyday earning opportunities — I guarantee it won’t take you long to creep up with a similar balance of points.

The Chase Sapphire Preferred card is the absolute best place to start if you’ve been longing to book travel using points.

Frequently Asked Questions

Is a 80,000-point welcome offer the best on chase sapphire preferred card.

A few years ago, the Chase Sapphire Preferred card offered a historic 100,000-point welcome offer. However, it hasn’t come back since then. Therefore, 80,000 points would be a great welcome offer (when available) if you’re debating adding this card to your wallet.

How do I find award availability for Chase's transfer partners?

Read through our ultimate guide to searching for award availability, which details virtually every airline you can think of! This is a great starting point to understanding how leveraging airline alliances and partnerships can prove to be immensely beneficial when booking award flights.

Why is World of Hyatt the best hotel transfer program?

Unlike other major hotel chains, World of Hyatt publishes a clear award chart that maps out the exact number of points you’ll need for a given stay. Plus, Hyatt offers the most reasonable award rates, as you can book a hotel night for as little as 3,500 points! Be sure to read through our guide on the best ways to redeem your Hyatt points .

What are 80,000 Chase Ultimate Rewards points worth?

We value Chase Ultimate Rewards points at 2 cents each when you transfer to the bank’s loyalty partners. Therefore, 80,000 points can be worth $1,600 — or potentially even more as seen in this article!

Was this page helpful?

About Stella Shon

With a degree in media and journalism, Stella has been in the points and miles game for more than 6 years. She most recently worked as a Corporate Communications Analyst for JetBlue. Find her work in The New York Times, USA Today, and more.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![chase best card for travel Chase Sapphire Preferred Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2020/09/sapphire-preferred.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Expensivity

Exploring the world of money and finance

Best Chase Credit Card for Travel

Looking for the best Chase credit card for travel? As a travel and finance expert, I’ll cut through the clutter to pinpoint the top options. Discover the ideal Chase card for your travel needs – ensuring your next journey is both enjoyable and rewarding.

Our Top Chase Credit Card for Travel

When choosing the best Chase credit card for travel, consider each card’s benefits and drawbacks in relation to your travel style and financial objectives. Chase’s range includes cards with luxury perks, high rewards, no annual fees, and simple cash back, catering to various traveler needs.

Best Overall Chase Credit Card for Travel: Chase Sapphire Preferred Card

The Chase Sapphire Preferred® Card, with a $95 annual fee, offers a compelling mix of high rewards on travel and dining, a substantial introductory offer, and flexible point redemption options. It’s particularly appealing for its $50 annual Ultimate Rewards Hotel Credit, travel protections, and the ability to earn 5x points on travel via Chase Ultimate Rewards® and 3x on dining.

The card’s flexibility in point redemption (1.25 cents each for travel or transfer to partners) and a range of travel protection benefits make it a top choice for both frequent and occasional travelers. It’s also a great card choice for families.

Compared to the higher-end Chase Sapphire Reserve®, the Preferred Card’s lower annual fee and similar benefits make it more accessible and valuable, especially for those who don’t need luxury perks like lounge access. It also surpasses the no-fee Chase Freedom Flex℠ in points earning and travel protections, appealing more to frequent travelers, which makes it one of the ideal credit cards for airline miles.

Annual Fee: $95

Intro Offer: 60,000 bonus points

APR: 21.49% – 28.49% Variable

Recommended Credit: 670-850 (Excellent/Good)

- High Reward Rates: Earn five points per dollar on travel purchased through Chase Travel and three points per dollar on dining.

- Annual Hotel Credit: Benefit from an annual $50 hotel statement credit when booked through Ultimate Rewards.

- Travel Protection: Enjoy premium travel protection benefits including trip cancellation insurance, primary car rental insurance, and lost luggage insurance.

- Flexible Redemption Options: Points can be redeemed for 1.25 cents each for travel through Chase Ultimate Rewards® or transferred to various travel partners.

- Additional Perks: Complimentary access to DashPass, offering $0 delivery fees and reduced service fees.

- Annual Fee: The card carries a $95 annual fee, which might be a consideration for budget-conscious travelers.

- No Airline-Specific Perks: Lacks airline-specific benefits like free checked bags or lounge access.

- No Introductory APR: Absence of an introductory APR period on purchases or balance transfers.

Best Rewards Chase Credit Card for Travel: Chase Sapphire Reserve

The Chase Sapphire Reserve® is a premium travel rewards card with a $550 annual fee, offering high rewards on travel and dining, a $300 annual travel credit, and luxury travel perks like Priority Pass™ Select lounge access.

It stands out with its 10x points on hotels and car rentals, 5x on flights booked through Chase Ultimate Rewards®, and a 50% bonus on point redemptions for travel. The card’s extensive travel protections and luxury benefits make it ideal for frequent travelers who value both practical and high-end travel features.

The Sapphire Reserve® outperforms the Preferred® with higher rewards and luxury perks like lounge access, targeting frequent, high-spending travelers at a higher fee. In contrast to the no-fee Chase Freedom Flex℠, it focuses on premium travel experiences over everyday savings.

Annual Fee: $550

APR: 22.49% – 29.49% Variable

Recommended Credit: 740-850 (Excellent)

- Generous Travel Credit: $300 annual travel credit for travel purchases, effectively reducing the annual fee.

- High Reward Rates: Earn up to 10 points per dollar on hotels and car rentals, and five points on flights through Chase Ultimate Rewards®.

- Luxury Travel Perks: Access to Priority Pass™ Select lounges and up to $100 credit for Global Entry, NEXUS, or TSA PreCheck®.

- Enhanced Redemption Value: 50% more value when redeeming points for travel through Chase Ultimate Rewards®.

- Broad Travel Protection: Includes trip cancellation/interruption insurance, auto rental collision damage waiver, and lost luggage insurance.

- High Annual Fee: A steep $550 annual fee, which may not be justifiable for infrequent travelers.

- Travel-Centric Benefits: The card’s value is maximized only with frequent travel.

- High Credit Requirement: Requires excellent credit, potentially limiting accessibility.

Best No-Fee Chase Credit Card for Travel: Chase Freedom Flex

The Chase Freedom Flex℠ , a no-annual-fee card, is an excellent choice for budget-conscious travelers and those who travel less frequently. It offers 5% cash back on travel booked through Chase Ultimate Rewards® and in rotating categories, plus 3% on dining and drugstores.

The card’s $200 sign-up bonus, cell phone protection, and 0% introductory APR on purchases and balance transfers make it a versatile option for both travel and everyday spending.

The Freedom Flex℠ differs from the Sapphire cards with no annual fee and rewards suited for budget-conscious or less frequent travelers. It offers valuable cash back, especially in rotating categories, but lacks the higher rewards and travel protections of the Sapphire series. It’s more tailored for personal use compared to the business-centric Ink cards.

Annual Fee: $0

Intro Offer: $200 bonus

APR: 20.49% – 29.24% Variable

Recommended Credit: 670-850 (Excellent, Good)

- No Annual Fee: Offers significant rewards and benefits without an annual fee.

- Diverse Cash Back Rewards: Earns 5% back on travel through Chase Ultimate Rewards® and in rotating categories, plus 3% on dining and drugstores.

- Sign-Up Bonus: An attractive $200 bonus after spending $500 in the first three months.

- Additional Perks: Includes cell phone protection and an introductory 0% APR period.

- Quarterly Activation Required: Needs manual activation of bonus categories each quarter.

- Foreign Transaction Fees: Charges fees on international transactions, limiting its use abroad.

- Limited Travel Perks: Lacks the extensive travel benefits and higher reward rates of premium Chase cards like Sapphire Reserve and Preferred.

Best Business Chase Credit Card for Travel: Ink Business Preferred Credit Card

The Ink Business Preferred® Credit Card, with a $95 annual fee, is tailored for business owners who travel frequently. It offers three points per $1 on travel and select business categories, up to $150,000 annually, and a notable 100,000-point sign-up bonus.

The card’s focus on business expenses, travel protections, and primary car rental insurance make it a valuable tool for managing business travel expenses.

The Ink Business Preferred® stands out with its focus on business spending, offering higher points in specific business categories unlike the consumer-focused Sapphire cards. It’s more cost-effective for business travel than the luxury-oriented Sapphire Reserve® and offers more targeted rewards compared to the broader appeal of the Ink Business Unlimited®.

Intro Offer: 100,000 bonus points

APR: 21.24% – 26.24% Variable

Recommended Credit: 670-850 (Good, Excellent)

- High Sign-Up Bonus: 100,000 points after spending $8,000 in the first three months.

- Business-Focused Rewards: Three points per $1 on travel and select business categories.

- Travel and Purchase Protections: Includes primary car rental insurance, cell phone protection, and more.

- Bonus Redemption Value: Points worth 25% more when redeemed for travel via Chase Ultimate Rewards®.

- High Spending for Bonus: Requires $8,000 spent for the sign-up bonus.

- Focused on Business: Lacks some luxury travel perks of consumer cards.

- Chase’s 5/24 Rule: Limitations on applications if too many cards opened recently.

Best Freelancer Chase Credit Card For Travel: Ink Business Unlimited® Credit Card

The Ink Business Unlimited® Credit Card is ideal for freelancers, featuring no annual fee and a straightforward rewards system of unlimited 1.5% cash back on all purchases. Its key highlights include a $900 cash-back bonus after a $6,000 spend in the first three months and primary rental car insurance, making it a simple yet effective card for varied freelance expenses.

The Ink Business Unlimited® is ideal for freelancers due to its simple, flat-rate rewards and no annual fee, contrasting with the category-specific bonuses of the Ink Business Preferred® and the luxury perks of the Sapphire Reserve®.

It’s more business-oriented than consumer cards like the Sapphire Preferred® and Freedom Flex℠, offering practical benefits like primary rental insurance and an introductory APR period for small business and freelance needs.

Intro Offer: $900 bonus cash back

APR: 18.49% – 24.49% Variable

- No Annual Fee: Offers a simple and cost-effective structure with no yearly charge.

- Generous Sign-Up Bonus: $900 cash back after spending $6,000 within the first three months.

- Versatile Cash Back: Earn a flat 1.5% back on all business purchases.

- Introductory APR: 0% rate for the first 12 months, aiding in cash flow management.

- Primary Rental Insurance: Provides coverage for business car rentals.

- Sign-Up Bonus Spending Threshold: A high initial spend of $6,000 required to earn the bonus.

- Rewards Flexibility: Cash back doesn’t convert to Chase points unless combined with certain Chase cards.

- Limited Travel Benefits : Absence of travel protections, less appealing for frequent traveler freelancers.

Key Features to Consider in Chase Credit Cards for Travel

Chase travel cards offer diverse rewards programs, with points accumulation on travel and dining expenses and options for redeeming points for travel , cash back, or transferring to partners.

Rewards Program

The rewards program is a pivotal aspect of any travel credit card, and Chase cards excel in this area. They typically offer accelerated points accumulation on travel and dining expenses. For instance, the Chase Sapphire Reserve® provides up to 10x points on hotels and car rentals, and 5x on flights booked through Chase Ultimate Rewards®.

These points can be redeemed in various ways, including for travel bookings through Chase Ultimate Rewards®, where they may have increased value, or transferred to a range of airline and hotel partners , providing flexibility and potentially higher reward value.

Sign-up Bonuses

Sign-up bonuses are a major attraction for new users looking for starter credit cards, often influencing the choice. These bonuses, like the Chase Sapphire Reserve’s 60,000 points or the Ink Business Preferred’s 100,000 points, reward early spending and can be significant, equating to hundreds of dollars in travel or other rewards.

To earn these bonuses, cardholders must typically meet a spending threshold within the first few months. This requirement varies by card and is designed to encourage early and regular card use. It’s essential for applicants to consider their spending habits to determine if the bonus is realistically achievable.

Annual Fees

Annual fees are an important consideration when selecting a travel credit card. Cards like the Chase Sapphire Reserve® have a higher annual fee ($550), the fee is often justified by the extensive benefits offered, including annual travel credits, access to airport lounges, and increased points redemption value.

For budget-conscious travelers, cards like the Chase Freedom Flex℠ come with no annual fee but offer lower rates, striking a balance between cost and benefits.

Travel Insurance and Protections

Travel insurance and protections add significant value to travel credit cards. Chase cards, particularly in the Sapphire and Ink Business series, offer a range of protections. These include trip cancellation and interruption insurance, which can reimburse non-refundable travel expenses if your trip is canceled or cut short due to covered situations.

Auto rental collision damage waivers provide coverage against theft and collision damage for rental cars, and lost luggage insurance offers compensation for baggage delays or loss. These benefits provide a safety net, reducing the financial risks associated with travel.

International Acceptance and Fees

International acceptance and fees are crucial for travelers venturing outside their home country. Most Chase travel credit cards, especially those in the Sapphire series, are accepted worldwide and do not charge foreign transaction fees on purchases made abroad.

This feature can lead to significant savings and convenience for international travelers, eliminating the need to worry about additional costs when using their card overseas. However, it’s important to note that some cards, like the Chase Freedom Flex℠, do charge foreign transaction fees, making them less ideal for international use.

Reward Flexibility and Redemption Options

Reward flexibility and the variety of redemption options are key features to consider in Chase travel credit cards. Chase cards stand out for their versatility in how points can be used. Beyond the traditional redemption for travel or cash back, points can often be used for experiences, merchandise, or even as statement credits.

For example, with cards like the Chase Sapphire Reserve®, points can be redeemed for a 50% bonus when booking travel through Chase Ultimate Rewards®, significantly enhancing their value. Additionally, the ability to transfer points to numerous airline and hotel loyalty programs, often at a 1:1 ratio, allows cardholders to maximize the potential value of their rewards.

This flexibility is particularly beneficial for those who want to tailor their rewards usage to specific travel plans or goals, providing a level of customization that can greatly enhance the overall value of the card.

Credit Score Requirements and Accessibility

The credit score requirement is a critical feature to consider when applying for Chase travel credit cards. Cards like the Chase Sapphire Reserve® and Ink Business Preferred® typically require a high credit score, often in the excellent range (740-850). This requirement reflects the premium nature of these cards, targeting users who have established a strong credit history.

On the other hand, cards like the Chase Freedom Flex℠ are more accessible, with recommended credit scores starting from the good range (670-850). This makes them more attainable for a wider range of customers, including those who might be building their credit history or boosting their credit score.

Understanding the credit score requirements is essential for prospective cardholders to gauge their eligibility and to choose a card that aligns with their credit profile. It also helps in managing expectations regarding approval and in selecting a card that not only meets travel needs is also within reach based on one’s creditworthiness.

Frequently Asked Questions

Which chase card should i use for travel.

The Chase Sapphire Preferred® Card is an excellent choice for travel. Its strong return on travel and dining, along with benefits like travel insurance and an annual fee of just $95, provide great value, making it a popular option among travel rewards cards.

Is Chase a Good Card for Travel?

Yes, Chase cards are generally good for travel. They offer competitive exchange rates through Mastercard without adding transaction fees or mark-ups, making them cost-effective and convenient for both domestic and international use.

How Do I Avoid International Fees With Chase?

To avoid international fees with Chase, you can opt to pay for purchases in cash while traveling abroad. This method circumvents any transaction fees that might be associated with card usage.

When searching for the best Chase credit card for travel, Chase’s diverse offerings, from the value-laden Chase Sapphire Preferred® Card to the economical Chase Freedom Flex℠, provide options for every type of traveler. Selecting the right card by evaluating its rewards, benefits, and costs is crucial to enhancing your travel experience and ensuring it meets your financial and travel plans.

Best Travel Credit Cards of April 2024

14 best travel credit cards of 2024, best overall: chase sapphire preferred® card.

Why we chose it: The Chase Sapphire Preferred Card is an affordable option fit for beginners and experienced travelers. For a reasonable $95 annual fee, you get generous perks, including high bonus rewards, intro bonus, annual hotel credit and bonus anniversary points. Plus points can be redeemed for 25% more value toward travel through Chase Travel. Read our Chase Sapphire Preferred review .

- Earns flexible rewards that transfer to airline and hotel partners

- Get 25% more value when redeeming for travel booked through Chase Travel

- Generous welcome offer and bonus categories

- No intro APR

- No luxury travel perks like airport lounge access

Best for Travel Rewards: Chase Sapphire Reserve®

Why we chose it: The Chase Sapphire Reserve is one of the best premium travel cards thanks in large part to the generous rewards and outsized redemption value. On top of travel credits, lounge access and other airport perks, the card rakes in flexible Chase Ultimate Rewards points in a range of bonus categories. Plus cardholders get 50% more value when redeeming points for travel through Chase. Read our Chase Sapphire Reserve review .

- Comes with luxury travel benefits

- Generous welcome bonus and earning rates

- Get 50% more value for travel when redeeming points for travel through Chase Travel

- No intro APR offer

- $550 annual fee and $75 annual fee per authorized user

- Earns just 1X points on regular purchases

Best Premium Value: Capital One Venture X Rewards Credit Card

Capital one venture x rewards credit card.

Why we chose it: The Capital One Venture X Rewards Credit Card offers enhanced travel perks for a lower annual fee than other premium cards. For $395 per year, users get a $300 annual travel credit, a credit of up to $100 for Global Entry or TSA PreCheck membership, Priority Pass Select membership, access to Capital One airport lounges and more. Read our Capital One Venture X review .

- Comes with robust travel benefits

- Generous minimum earning rate of 2X miles on all other purchases

- Earns flexible miles that transfer to partners

- Transfer partners aren’t as good as some competing programs

- $300 annual travel credit must be used through Capital One Travel

- Fewer rewards bonus categories than some other premium cards

Best for Luxury Perks: The Platinum Card® from American Express

Why we chose it: The Platinum Card from American Express is best for luxury perks since, in our view, it comes with the most extensive list of credits and features. This includes the broadest airport lounge membership possible, airline fee credit for incidental fees and automatic Gold status with Hilton Honors and Marriott Bonvoy. Cardholders also earn a very generous welcome bonus and heightened rewards on eligible travel purchases. Read our Amex Platinum Card review .

- Comes with the best airport lounge membership available

- More than $1,500 in annual statement and merchant credits available

- Earns flexible Amex Membership Rewards points

- $695 annual fee and $195 annual fee for each additional Platinum Card ( see rates and fees )

- Earns just 1X points on other eligible non-category purchases

- Statement credits may be difficult to use

Best for Flat-Rate Rewards: Capital One Venture Rewards Credit Card

Capital one venture rewards credit card.

After spending $4,000 in first 3 months from account opening

Why we chose it: The Capital One Venture Rewards Credit Card comes with a promising flat rewards rate of unlimited 2X miles on all purchases and unlimited 5X miles on hotels and rental cars booked through Capital One Travel. This card also earns flexible miles that can be used for multiple purposes like travel statement credits, gift cards , travel bookings through Capital One or miles transfers to Capital One airline and hotel partners. Read our Capital One Venture Rewards card review .

- Earns impressive flat-rate rewards

- Miles come with flexible redemption options

Best With No Annual Fee: Wells Fargo Autograph℠ Card

Wells fargo autograph℠ card.

After spending $1,000 in purchases in the first 3 months

Why we chose it: For no annual fee, the Wells Fargo Autograph Card comes with a solid sign-up bonus and earns an unlimited 3X points on travel, gas, transit, restaurants, popular streaming services and phone plans, and 1X points on other eligible purchases. Read our Wells Fargo Autograph review .

- No annual fee required

- Earns 3X points in six popular categories

- Intro APR on purchases

- No transfer partners

- Few travel-specific benefits

Best Overall Hotel Card: World of Hyatt Credit Card

World of hyatt credit card.

Earn 30,000 bonus points after you spend $3,000 on purchases in your first 3 months from account opening. Plus, up to 30,000 more by earning 2 bonus points total per $1 spent in the first six months from account opening on purchases that normally earn 1 bonus point, on up to $15,000 spent.

Why we chose it: The World of Hyatt Credit Card is packed full of features. It offers an annual free night certificate each year after your cardmember anniversary, five elite qualifying nights per year just for having the card and a way to spend toward additional elite nights and an additional free night certificate each year.

- Category 1-4 free night certificate annually after your cardmember anniversary

- Earns two nights toward elite status for every $5,000 spent on the card

- Trip cancellation/interruption insurance, baggage delay insurance and lost luggage reimbursement

- Full welcome bonus requires costly spending

- Lackluster earnings outside of Hyatt stays

- Lower overall point value on hotel stays than some competing cards

Best for Budget-Friendly Delta Loyalists: Delta SkyMiles® Gold American Express Card

Why we chose it: The Delta SkyMiles® Gold American Express Card offers excellent value for its $150 ongoing annual fee. The card’s first free checked bag benefit applies to you and up to eight other people in your same reservation. When redeeming miles for Delta flights, you’ll receive a 15% off discount when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. You’ll also get a $200 Delta flight credit when you spend $10,000 on the card in a calendar year. Finally, you can receive an annual statement credit of up to $100 when you use your card book hotel nights through Delta Stays bookings on delta.com. Read our Delta SkyMiles Gold review .

- Free first checked bag for you and up to eight other people on your reservation

- 15% off Award Travel when using miles on Delta flights (through delta.com and the Fly Delta app)

- $0 introductory annual fee for the first year (then $150)

- Earns only 2X miles on Delta purchases

- No ability to earn Medallion Qualifying Dollars (MQDs) using the card

- $200 Delta flight credit requires $10,000 in spending on the card in a calendar year

Best for Business Travel Rewards: Ink Business Preferred® Credit Card

Why we chose it: The Ink Business Preferred® Credit Card earns generous rewards on travel and in a range of popular business categories. Plus cardholders can earn 100,000 bonus points after spending $8,000 on purchases within three months of account opening. Read our Ink Business Preferred review .

- Earns flexible Chase Ultimate rewards points

- Get 25% more value when booking travel with points through Chase Travel

- Earns 3X points in popular eligible business categories (on the first $150,000 spent in combined purchases each account anniversary year, then 1X points)

- Bonus category spending caps limit rewards potential

- Earns just 1X points on all other regular purchases

Best for Business With No Annual Fee: The Blue Business® Plus Credit Card from American Express

Why we chose it: For no annual fee, the Blue Business Plus Credit Card offers 2X points on up to $50,000 spent in purchases each year, then 1X points on other purchases. Plus rewards earned fall within the flexible American Express Membership Rewards program. Read our Blue Business Plus card review .

- Earns Amex Membership Rewards points

- Get 2X points on the first $50,000 spent in purchases each year (then 1X points)

- Earns just 1X points after $50,000 in spending each year

- Small welcome bonus

- Limited travel-specific benefits

Best for Everyday Spending: Citi Premier® Card

Citi premier® card.

After spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com

Why we chose it: The Citi Premier Card offers a robust selection of bonus rewards categories. Not only do cardholders earn a generous sign-up bonus, but they also earn 3X points on restaurants, supermarkets, gas stations, air travel and hotels. All other purchases earn 1X points. Cardholders can also earn 10X points on hotels and car rentals booked through the Citi Travel portal (through June 30, 2024). Read our Citi Premier review .

- Earns flexible rewards for travel

- Generous 3X earning rate in five popular categories

- Elevated rate on eligible travel purchases via Citi Travel through June 2024

Best for Travel Rewards on Dining: American Express® Gold Card

Why We Chose It: The American Express Gold Card might be the ultimate dining card for travelers. It offers 4X Membership Rewards points at restaurants worldwide—that’s the most points you’re likely to earn without jumping through hoops like making dining purchases through a portal. Read our Amex Gold card review .

- 4X Membership Rewards points at restaurants worldwide (plus on takeout and delivery in the U.S.)

- 4X points at U.S. supermarkets on up to $25,000 per year in purchases (then 1X points)

- Up to $120 in Uber Cash annually

- Steep $250 annual fee

- Poor redemption value beyond airfare

- U.S. supermarket bonus rewards are capped at $25,000 in spending each year

Best for Travel and Transit: American Express® Green Card

American express® green card.

After spending $3,000 on purchases on your new Card in your first 6 months of Card Membership

Why We Chose It: The American Express Green Card offers 3X Membership Rewards points on almost every type of eligible travel and transit expense. If you prefer to earn travel rewards and want a single card to consolidate your expenses on, the Amex Green Card is likely your best choice.

- Earns 3X points on a wide variety of eligible travel and transit, plus at restaurants worldwide

- Earns transferable Membership Rewards points

- Offers trip delay insurance*, baggage insurance plan* and car rental loss and damage insurance*

- $150 annual fee

- Limited cash redemption options

- No introductory APR

Related Articles

- Best Rewards Credit Cards

- How To Choose a Credit Card

- How Many Credit Cards Should I Have?

A Closer Look at the Best Travel Cards

Best overall: chase sapphire preferred card.

Why we love this card: The Chase Sapphire Preferred earns Chase Ultimate Rewards points that transfer to airline and hotel partners like British Airways, Southwest Rapid Rewards and World of Hyatt, yet cardholders can also get 25% more value when redeeming points for travel through Chase.

Other reasons to love this card include its exceptional welcome offer (earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening, worth $750 redeemed through Chase Travel) and earning rates: 5X points on travel purchased through Chase Travel; 5X points on Lyft rides (through March 31, 2025); 3X points on dining, online groceries (excluding Target, Walmart and wholesale clubs) and select streaming services; 2X points on general travel; and 1X points on all other purchases.

Who should have this in their wallet: The Chase Sapphire Preferred Card is ideal for consumers who want to earn flexible travel rewards they can redeem in more than one way without having to pay hundreds of dollars toward an annual fee each year. That said, the fact you can redeem points for cash back, statement credits, gift cards and merchandise means the Sapphire Preferred can also work as a cash back credit card.

Other cards to consider: If you want a travel credit card with perks like airport lounge access or annual travel credits, you’ll have to be willing to pay a higher annual fee. In that case, you can consider cards like the Chase Sapphire Reserve and the Capital One Venture X Rewards Credit Card.

Read our review of the Chase Sapphire Preferred

Best for Travel Rewards: Chase Sapphire Reserve