U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Europe: 4 Best Options for 2024

Allianz Travel Insurance »

Travelex Insurance Services »

Generali Global Assistance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Europe.

Table of Contents

- Allianz Travel Insurance

- Travelex Insurance Services

You almost certainly will want travel insurance for Europe, mostly because the high cost for international trips is worth protecting against travel delays and trip cancellations. Since your U.S. medical coverage will not apply overseas, you also need international health insurance that covers surprise medical expenses and medical evacuation.

If you're searching for the best Europe travel insurance that money can buy, consider the following plans and all they have to offer.

Frequently Asked Questions

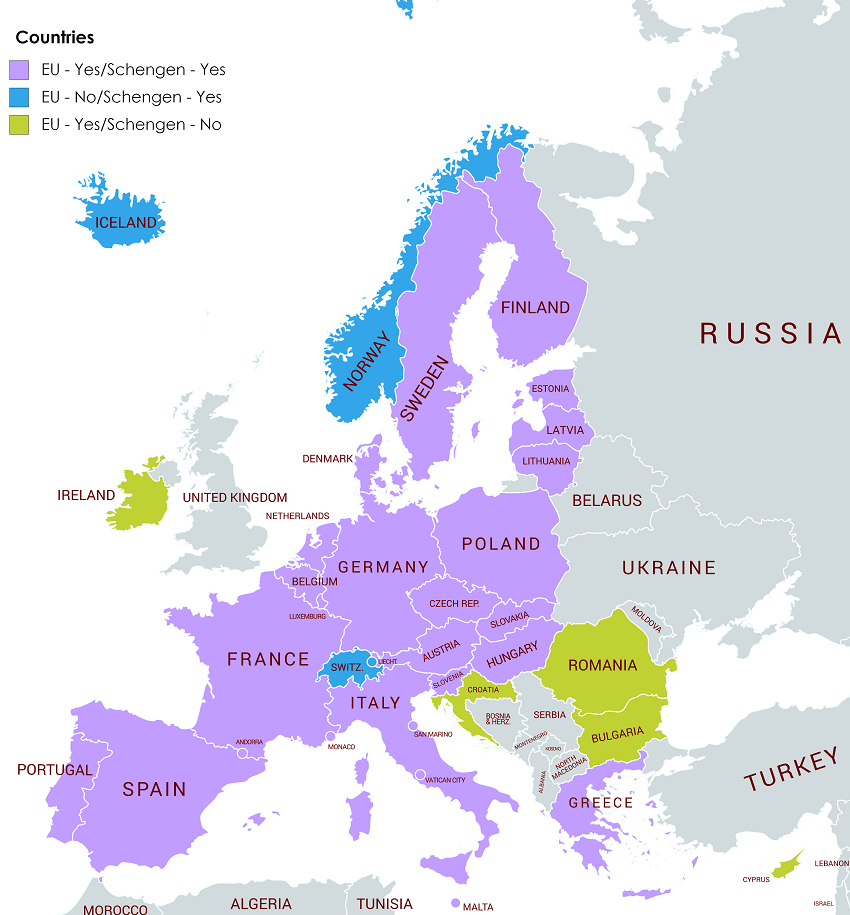

Most people need travel health insurance at a bare minimum when traveling to European destinations like France, Italy or Switzerland, as well as additional countries inside and outside of the Schengen area. After all, U.S. health insurance plans do not provide coverage for medical emergencies overseas, and the same is true for government health plans like Medicare. Check out our article on whether your health insurance covers international travel .

Other benefits built into Europe travel insurance plans can also protect the money that's been spent on airfare, hotel stays, Europe cruises and tours. For example, travelers can benefit from having coverage for trip cancellation, trip delays, lost or delayed baggage, and more.

Every travel insurance policy is unique, so you'll want to read over individual travel insurance plans to see what they protect against. That said, the bulk of travel insurance plans for trips to Europe provide the following coverages:

- Trip cancellation

- Trip interruption

- Travel delays

- Lost luggage reimbursement

- Baggage delay coverage

- Medical expenses

- Emergency medical evacuation

- Rental car damage

Some travel insurance plans also offer additional or optional coverage for sports equipment or sports equipment delays, missed connections, accidental death and dismemberment (AD&D), adventure sports and more.

Some visitors to countries in the Schengen area are required to have a visa for short stays that can last for up to 90 days within a timeline of up to 180 days. However, this is not the case for American citizens, who can stay in Europe for up to 90 days at a time without meeting specific visa requirements.

The U.S. Department of State also notes that American citizens who want to stay in Europe for more than 90 days should reach out to the country they plan on visiting to inquire about their visa process.

If you live in a country that requires a Schengen visa, you are required to purchase Schengen visa insurance that pays for overseas medical expenses. This coverage must provide at least 30,000 euros in protection against medical expenses that result from hospitalization, emergency treatment and repatriation of remains in the case of accident or death.

- Allianz Travel Insurance: Best Overall

- Travelex Insurance Services: Best Cost

- Generali Global Assistance: Best for Medical Emergencies

- WorldTrips: Best for Groups

Optional cancel for any reason (CFAR) and preexisting medical conditions coverage available

Kids 17 and younger covered for free

Lower coverage amount for medical expenses than some providers

- $100,000 per traveler in coverage for trip cancellation

- $150,000 per traveler in coverage for trip interruptions

- $500 in coverage for eligible trip changes

- $50,000 in emergency medical coverage

- $500,000 for emergency medical transportation

- $1,000 toward baggage loss or damage

- $300 in coverage for baggage delays of 12 hours or more

- $800 in protection for travel delays (daily limit of $200 applies)

- $100 per insured person per day in SmartBenefits coverage for eligible delays

- 24-hour hotline assistance

- Concierge services

Optional CFAR and preexisting medical conditions coverages available

Kids 17 and younger are covered for free

Many coverages cost extra

- 100% of trip cost for trip cancellation (up to $50,000)

- 150% of trip cost for trip interruption (up to $75,000)

- $2,000 in coverage for trip delays of five hours or longer

- $750 in coverage for missed connections

- $50,000 in coverage for emergency medical expenses ($500 dental sublimit included)

- $500,000 in coverage for emergency medical evacuation and repatriation

- $1,000 in coverage for baggage and personal effects

- $200 for baggage delays of 12 hours or longer

- $200 for sporting equipment delays of 24 hours or longer

- $25,000 for accidental death and dismemberment coverage

- 24/7 travel assistance

- 100% of the insured trip cost for financial default of a travel provider (maximum of $50,000)

- Trip cancellation and interruption coverage for preexisting medical conditions (maximum of $50,000)

- Cancel for work reasons coverage

- CFAR insurance

- Car rental coverage worth up to $35,000

- $50,000 in additional emergency medical coverage

- $500,000 in additional coverage for emergency medical evacuation and repatriation

- Adventure sports exclusions waiver

- $200,000 in coverage for flight accidental death and dismemberment

CFAR and preexisting medical conditions coverages available

High coverage limits for medical expenses and evacuation

CFAR coverage only reimburses at 60%

- $1,000,000 coverage limit for emergency medical evacuation and transportation

- $250,000 coverage limit for medical expenses ($500 limit for dental emergencies)

- 100% of trip cost for trip cancellation

- 175% of trip cost for trip interruption

- $1,000 per person for travel delays ($300 per person daily limit applies)

- $2,000 per person in coverage for baggage and $500 for baggage delays

- $2,000 per person in coverage for sporting equipment and $500 for sporting equipment delays

- $1,000 per person in coverage for missed connections

- Air flight accident AD&D coverage worth $100,000 per person and $200,000 per plan

- Travel accident AD&D coverage worth $50,000 per person and $100,000 per plan

- $25,000 in coverage for rental cars

- 24-hour travel support

Discounts for groups of five or more

Potential for high coverage limits for medical expenses

No coverage for trip cancellation

Available coverage limits vary by age

- $5,000 for local burial or cremation

- Up to $25,000 in AD&D coverage

- $100,000 in coverage for emergency reunions

- $10,000 in coverage for trip interruption

- $1,000 for lost checked luggage

- $100 in coverage for lost or stolen passports or visas

- $100 in coverage per day for travel delays of at least 12 hours (two days of coverage maximum)

- Up to $25,000 in personal liability coverage

Why Trust U.S. News Travel

Holly Johnson is a travel writer who has created content about travel insurance, family travel, cruises, all-inclusive resorts and more for over a decade. She has visited more than 50 countries around the world and has an annual travel insurance plan of her own. Johnson also has experience navigating the claims process for travel insurance plans and has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson works with her husband, Greg, who is licensed to sell travel insurance and owns the travel agency Travel Blue Book .

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The Best Travel Medical Insurance of 2024

Explore protection options for unexpected health issues abroad.

Expat Travel Insurance: The 5 Best Options for Globetrotters

Find the coverage and benefits you need for your adventures abroad.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Travel insurance for Europe: Coverage and policies for 2024

Erica Lamberg

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:30 a.m. UTC Nov. 27, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Getty Images

- A trip to Europe often requires hefty prepaid and nonrefundable deposits to secure flights, hotels and tours. Travel insurance protects these outlays if you cancel your trip for a covered reason.

- Many U.S. health insurance plans don’t provide coverage in foreign countries, making a travel insurance plan with medical expense benefits important for trips to Europe.

- The best travel insurance for Europe will package together different types of coverage, including trip cancellation, trip delay, trip interruption, travel medical, emergency medical evacuation and baggage insurance.

Planning a trip to Europe is exciting, but can also be expensive. Your itinerary may include visits to several European countries, and you can quickly rack up prepaid and nonrefundable expenses for flights, hotels, excursions, tours and experiences.

Travel insurance can give you peace of mind that you’ll be financially protected if things go wrong before or during your trip. But plans differ, so it’s important to pay attention to included coverages, limits and exclusions when choosing your insurance for travel to Europe.

Do I need travel insurance for Europe?

Travel insurance is not required for entering Europe. “But it is a very important consideration for a number of reasons,” said Scott Adamski, spokesperson for AIG Travel.

In addition to protecting your trip deposits if you need to cancel, Adamski said an important reason to secure a travel insurance policy relates to health care coverage for U.S.-based travelers headed to Europe.

“In a surprise to many, their U.S.-based health insurance policy may not provide coverage, or may provide limited coverage, when they’re traveling out of the country,” said Adamski.

“Medicare also may not provide coverage outside the U.S. (for older Americans) and there may be restrictions/limitations on medical benefits when traveling abroad,” he said. “In short, it’s vital to review your existing health care coverage before traveling.”

To make sure you’re covered financially if things go awry before or during your European vacation, look for a travel insurance plan that includes travel medical benefits as well as coverage for trip cancellation, trip delay, trip interruption, emergency medical evacuation and baggage delay or loss.

Featured Travel Insurance Offers

Travel insured.

Via Squaremouth’s website

Top-scoring plan

Worldwide Trip Protector

Covers COVID?

Medical & evacuation limits per person

$100,000/$1 million

Atlas Journey Preferred

Seven Corners

Via Squaremouth’s Website

RoundTrip Basic

Average cost for plan with CFAR

CFAR coverage

75% of trip cost

Trip cancellation insurance for travel to Europe

If you’ve booked a trip to Europe, you’re probably thinking, why would I cancel my dream vacation?

“No one plans to cancel a trip, but sometimes there are circumstances beyond our control — you suffer an injury before your trip, circumstances at your job change or your flight is canceled due to severe weather at your destination,” said Shannon Lofdahl, spokesperson for Travelex Insurance Services. “Trip cancellation and interruption coverage reimburses you if your trip is canceled or interrupted for a covered reason,” she said.

In general, covered reasons for trip cancellation insurance benefits include:

- Death of an immediate family member or a travel companion.

- A serious illness or injury to you, a close relative or a travel companion.

- A sudden and serious family emergency.

- An unexpected job loss or layoff.

- Unplanned jury duty.

- Severe weather.

- Your travel supplier is going out of business.

- A national transportation strike.

So, if three days before your trip to Vienna, Austria, your husband has a heart attack, you can cancel your trip and receive 100% of any prepaid and nonrefundable trip outlays.

It’s important to note that not all reasons to cancel will be covered by your travel insurance policy. For example, if you see a rainy weather forecast in Barcelona or get nervous to travel to Paris because you learn about a rise in petty crimes there, these are not covered reasons.

If you want the highest level of flexibility to change your travel plans, consider adding “ cancel for any reason ” (CFAR) coverage.

CFAR is an upgrade to a basic travel insurance plan that may boost the price of your policy by about 50%, but will give you the latitude to cancel your trip for any reason as long as you cancel at least 48 hours before your scheduled departure. If you meet all the requirements of your plan, you can expect to be reimbursed for 75% — or 50%, depending on the plan — of your prepaid, nonrefundable trip costs.

Trip delay insurance

Delays are an expected part of traveling these days, especially while traveling abroad, and that fact has emphasized the importance of trip delay coverage, said Lofdahl. “A short delay probably won’t cause you too much stress, but longer delays can mean missing connecting flights.”

Trip delay coverage can reimburse you for costs you incur as a result of a travel delay, as long as the delay was caused by a reason in your policy documents. Severe weather, airline maintenance issues or a security breach at an airport, for instance, are typical reasons covered by trip delay insurance.

Most policies have a waiting period before your trip delay benefits begin, such as six or 12 hours. If you meet the criteria outlined in your travel insurance policy, you can expect to be reimbursed for a meal, hotel room, taxi fare and a few personal care items to tide you over for the delay, up to the limits in your plan.

Be sure to hold onto your receipts as you will be asked to submit this documentation when you file a trip delay claim.

DOT rules : What you’re owed when your flight is canceled or delayed may be less than you think

Trip interruption in Europe

No one wants to end their trip early, especially when it’s a long-awaited European vacation, but unexpected issues can arise, said James Clark, spokesperson for Squaremouth, a travel insurance comparison site.

If there is an emergency back home that is covered by your travel insurance plan, such as a critically ill parent, or if you suffer an injury while traveling in Europe and need to cut your trip short, your policy’s trip interruption insurance can provide financial assistance.

You can file a trip interruption claim to recover any prepaid, unused and nonrefundable trip costs you lose because of your unexpected early departure. Your benefits will also typically cover a last-minute one-way economy flight home, and transportation to the airport.

Keep in mind, however, not all reasons to end a trip early will be covered. For example, if you miss your new kitten or have a fight with your partner while in Budapest, and want to go home, these are not covered reasons. You will have to pay your own way home and can’t file a claim for losses.

Americans will have to get travel authorization to enter Europe

Currently, Americans don’t have to worry about getting a visa to travel around Europe. However, that will change in mid-2025. That’s when the European Travel Information and Authorisation System (ETIAS) goes into effect, requiring people traveling from visa-exempt countries like the United States to get authorization for travel to 30 European countries.

Once applications open up, you will be able to apply on the official ETIAS website or mobile app. You’ll need your passport information to apply, and it will cost 7 euros to process the application. For those who don’t get immediate approval, the decision process could take up to 30 days.

Once approved, your ETIAS travel authorization will be attached to your passport. It will be valid for three years or until your passport expires, whichever happens first.

A standard travel insurance policy won’t cover you if you don’t get your ETIAS travel authorization in time for your trip, or your ETIAS application is rejected. It will be important to apply for ETIAS early, in case there’s a delay or you need to appeal if you’re denied a visa.

If you have “cancel for any reason” (CFAR) coverage you could cancel your trip if your visa doesn’t get approved in time, but you’d need to cancel at least 48 hours before your trip to file a CFAR claim for reimbursement.

Travel medical insurance for Europe

Don’t assume your health insurance applies outside the United States. “Many [domestic health insurance] plans won’t cover you if you become ill or injured traveling in Europe or any other country outside the U.S., and, without travel protection, you would be responsible for all the medical expenses,” said Lofdahl with Travelex.

For instance, if you twist your ankle while touring in Rome, your travel insurance can cover the cost of seeing a doctor, getting X-rays, buying prescription medication and staying in the hospital if deemed necessary. Without this coverage, you are responsible for any medical expenses.

The average cost of travel insurance is between 5% and 10% of the total price of your trip. This can be worth it for the medical benefits alone when traveling in Europe.

Travel insurance plans also typically include travel assistance, which can help if you get sick or injured in Europe. “This benefit offers a range of 24/7 services while you’re traveling — from assistance finding a covered health care provider to helping with replacing lost or stolen passports,” said Lofdahl. These services can also assist with translation services.

Emergency medical evacuation

Depending on where in Europe you’ll be visiting, you might be far from a medical facility adequately equipped to treat severe illnesses and injuries.

“For this reason, travelers with underlying medical conditions might wish to consider additional medical evacuation coverage for certain costs associated with transportation, to either the nearest recommended medical facility or back home,” said Adamski with AIG Travel.

Also, he explains, many countries in Europe — particularly in the mountainous regions — offer adventure sports for visitors. “In the warmer months, the outdoorsy types who aren’t biking might pursue mountain climbing, available through a wide range of treks and climbs for beginners and advanced climbers alike. In the winter, of course, ski enthusiasts from around the world visit a number of European countries for their access to great snow, luxurious accommodations and challenging runs,” Adamski said.

Unfortunately, accidents can happen when mountaineering, regardless of the time of year. Having a travel insurance plan can provide financial protection in the event of medical or evacuation losses, he said.

As an example, said Adamski, a policyholder might need to return to the U.S. after a skiing injury and may need accommodations such as a lay-flat seat or a row of seats to stretch out a broken leg.

“A travel insurance provider, with on-staff doctors and medical coordinators, are invaluable in assisting with medical needs in foreign countries and coordinating with airlines to get injured travelers back home. Such arrangements are remarkably expensive, ranging from $20,000 easily into the six figures,” he explained.

Medical evacuation coverage could help cover these costs, and, in AIG Travel’s travel protection plans, said Adamski, this is complemented by access to an entire medical team dedicated to consulting with the local medical providers, working with you or your family to confirm what’s in your best interests as a patient and making the necessary arrangements to get you where you need to be.

When budgeting for a trip, even the most thorough planners rarely consider a contingency that includes a five- or six-figure emergency medical evacuation, said Adamski. “To be suddenly faced with a bill like that could be devastating. Also, the expertise of the medical staff that would be helping to coordinate such an evacuation could (literally) be a lifesaver,” he said.

Clark with Squaremouth notes that travelers heading to Europe should look for policies with at least $100,000 in medical evacuation coverage. However, if a traveler is doing more remote activities, such as backpacking through the Swiss Alps or exploring the Scandinavian wilderness, “We recommend at least $250,000 in medical evacuation coverage,” he said.

Travel insurance coverage for baggage and belongings

Lofdahl with Travelex said that the return to travel has been wonderful, but the labor shortage has brought some challenges to the industry. “Delayed and lost baggage is one that most people heard about last year and into this year,” she said. “Every airline experienced increases in lost and delayed baggage, and some even had triple the number of lost and delayed bags as they did in the same period in 2021. I can tell you from experience that this can impact your trip.”

European travel generally can include connecting flights which can increase the likelihood that your luggage can be misdirected or lost.

If your luggage decides to vacation in Madrid instead of Athens, you can file a claim with your travel insurance company. Just be sure to get a report from your airline carrier first.

You may also be able to file a claim for delayed luggage. Depending on your plan, you can purchase a few items to tide you over until your bags arrive at your destination, like a swimsuit, some toiletries and a change of clothes. Just be sure to keep any applicable receipts.

Your travel insurance plan may also reimburse you for other personal effect losses while on your vacation. For example, if your camera gets stolen while touring Copenhagen, or if your leather jacket is swiped while in Milan, you can file a claim. But first, you’ll need to file an incident report with your tour leader, hotel manager or local law enforcement. You will be asked for this documentation during the claim process.

It’s very important to read your travel insurance documents carefully so you understand the scope of your benefits. There are often per-item limits and caps for coverage, rules about how depreciation will affect your reimbursement levels and exclusions which won’t be covered. For instance, lost or stolen cash isn’t reimbursable, and many high-ticket items like heirloom jewelry and designer watches are often excluded from coverage.

Baggage loss insurance is also typically secondary coverage, meaning it comes into play only after you’ve filed for reimbursement from your airline or homeowners insurance (in the event of theft).

Frequently asked questions (FAQs)

Buying a travel insurance policy for Europe isn’t required, but it is a smart way to financially protect your trip investment and to ensure you have medical coverage while traveling abroad.

“Just because it’s not required doesn’t mean it’s not a good idea. Unexpected medical bills can be costly, and an unforeseen emergency evacuation or repatriation back home to the U.S. or Canada can climb to tens of thousands of dollars,” said Terra Baykal, spokesperson with World Nomads.

Travel insurance also provides trip cancellation benefits, which can help you recoup the cost of trip deposits. “Travel insurance may reimburse you for your missed nonrefundable, prepaid travel arrangements like hotels, flights and tours, if you need to cancel for a covered reason, like the death of an immediate family member, or your last-minute illness or injury,” said Baykal.

It’s also important to find an insurer who will cover you for all the activities you plan to pursue in Europe. So if skydiving in Switzerland, paragliding in Greece or ziplining in Croatia is in the cards, make sure your insurer covers your more adventurous pursuits, said Baykal.

World Nomads automatically covers more than 150 adventure activities and sports for U.S. residents without the need for an additional adventure activities rider.

While not required to enter Europe, a travel insurance policy with emergency medical coverage is a good idea when traveling to Europe, said Baykal of World Nomads.

Many U.S.-based health insurance providers offer no coverage abroad, or very limited global benefits. If your domestic health insurance doesn’t provide adequate coverage outside of the U.S., buying travel medical insurance for Europe is recommended.

Whether your health coverage travels with you outside the U.S. depends on your Blue Cross Blue Shield plan. Check with your carrier to determine the scope of your travel medical insurance .

According to Blue Cross Blue Shield, travelers should refer to their Certificate of Coverage and riders and also call customer service to find out about limitations to travel coverage.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Erica Lamberg is a regular contributor to Fox News, Fox Business, Real Simple, Forbes Advisor, AAA and USA TODAY. She writes about business, travel, personal finance, health, travel insurance and work/life balance. She is based in suburban Philadelphia.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of April 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

The Best Travel Health Insurance Companies for Europe

If you’re traveling to Europe this summer, you will definitely want travel insurance to supplement your trip in case anything goes wrong. These are six of the best travel insurance companies for coverage in Europe.

Photo: Pexels.com

When you’re planning a trip to Europe, half of the fun is working out the details of your itinerary, creating a bucket list of attractions to visit, and mapping out the route you want to take.

It’s easy to forget about the finer details, like travel insurance.

That’s just human nature. Who wants to think about the bad stuff when there’s so much to look forward to?

Travel insurance gives you peace of mind while you’re exploring. It doesn’t matter if you’re planning a relaxing wine tour through Italy or a more adventurous jaunt through Switzerland – being insured means you’ll come home with only awesome memories and not outrageous medical bills.

But there are different types of travel insurance for Europe and the Schengen zone. Here’s how to pick the best one for your needs.

Why You Need Travel Insurance for Europe

So why do you even need travel insurance for Europe, anyway?

It all comes down to a very blunt truth: literally anything could happen while you’re on the road, and you need to protect yourself. It’s truly no different than having health insurance in your home country.

Travelers don’t like thinking about worst-case scenarios, but it’s the responsible thing to do. And a good travel insurance policy covers everything from the smallest stuff – like lost and stolen luggage – to all the big picture items, like natural disasters or broken bones. Yes, even death.

In countries where you’re not a resident, the cost of things like medical bills and emergency evacuation are drastically higher than in your home country (even compared to the US, where those bills are crazy high already). So while you might not like the idea of dishing out money for insurance, you definitely don’t want to return from your trip with hundreds of thousands of dollars in medical expenses.

Note: Depending on your home country, you might need to apply for a Schengen visa. Furthermore, countries outside the Europe Schengen zone may have different visa and travel insurance requirements than member states inside the Schengen zone, including the UK. When in doubt, talk to an agent!

BEST TRAVEL INSURANCE COMPANIES FOR EUROPE

If you take away just one important thing from this article, let it be this: Europe travel insurance is necessary. Just because these countries are developed and modern doesn’t mean you’re immune to accidents or illness on your travels.

Have a look at the different Europe travel insurance companies and their travel insurance plans.

1. Seven Corners: Best Travel Insurance Policy for Students

So you’ve got your visa application sent off and you’re planning on studying for a semester in Europe. Welcome to one of the best experiences of your life!

It’s likely that you’ll be required to have Europe travel insurance as part of your visa requirements to study abroad (and you may even need to present proof of insurance with your visa application and your visa letter). Regardless, travel health insurance is a must—and Seven Corners is the best.

Seven Corners has three different travel insurance plans specifically designed for international students. Each one is customizable so that you can even change the amount of medical coverage (up to $250,000) as well as the deductible. When you visit the student health center at your school, it’ll only cost you a $5 copay. Trip cancellation and interruption are also covered.

There are tons of options to add as well. For example, if you want to visit family back home while on your holidays, you can add coverage for when you return to the US (or wherever home may be). That means if you get into an accident while you’re at home, you’ll have health insurance coverage.

Get a quote

2. SafetyWing: Best Travel Insurance Policy for Expats & Long-Term Travelers

SafetyWing has incredibly unique travel insurance offerings for long-term travelers/expats.

SafetyWing is a rare gem of a travel insurance company because their plans allow you to have coverage for as long as you want. It works like a subscription, and your plan renews every four weeks automatically (until you cancel).

You’ll get coverage up to $100,000 for travel medical insurance and emergency medical evacuation coverage in 180+ countries. Trip interruption and trip delay coverage is also included (up to $100/day), but trip cancellations are not.

There’s one downside: SafetyWing’s insurance policies will not cover your gear. For digital nomads traveling with laptops, cameras, and other items of high value, this may be a dealbreaker. The good news is that you can add supplemental insurance like InsureMyEquipment to make sure you’ve got complete coverage.

More information

3. World Nomads: Best Travel Insurance Policy for Adventure Travelers

World Nomads is an all-around awesome insurance provider, but especially if you’re an adventurous type. They cover over 300 sports and activities, and their Explorer Plan is catered specifically to those interested in higher-risk activities.

Snowboarding in Switzerland? Diving in the Mediterranean? Competing in an air guitar competition (seriously) in Finland? This is the policy for you.

World Nomads’ plans include up to $100,000 in emergency medical coverage, medical evacuation and repatriation, and coverage for stolen or lost luggage. Bonus: their policies have always provided coverage for pandemics/epidemics, so you’re well covered up to $100,000 in emergency medical for COVID-19 too.

The user experience and customer service with World Nomads is also top-notch. If you’re not completely sure if your activity is covered, definitely speak with an insurance agent about your case.

4. Tin Leg: Best Travel Insurance Policy for Seniors

If you’re a senior ready to leave behind the US and make your dream of Europe travels come true, Tin Leg is the travel health insurance company for you.

Travel insurance requirements can be stringent for seniors, especially if you have pre-existing conditions (or if you’re over a certain age). Tin Leg is unique in that it offers travel insurance for people up to age 90!

Tin Leg has a few different plans, including the Tin Leg Economy policy with basic trip cancellations and medical coverage up to $20,000. That’s a bit low compared to other plans, but the Tin Leg Luxury policy covers people up to $100,000 for emergency medical and $250,000 for emergency medical evacuation and repatriation.

Pre-Existing Condition coverage is also included if your policy is purchased within 15 days of booking your Europe trip.

5. Travelex: Best Travel Insurance Policy for Families

Taking the whole fam on a country-hopping tour of Europe? Travel insurance coverage is a must for the whole gang.

One of the best things about Travelex is that they provide free coverage for all children age 17 and under, as long as they’re traveling with you under a single policy. It doesn’t matter if you have one kid or five…they’re all covered for travel health insurance!

Travelex is a heavy-duty insurer, and although they only have two main plans they also tons of add-on options. The Basic plan covers $15,000 in emergency medical expenses, $100,000 for emergency medical evacuation, and $500 for lost and damaged baggage.

But with their Travel Select plan, your coverage skyrockets: you’ll get $50,000 in emergency medical, $1,000 for lost or damaged luggage, and $500,000 in medical evacuation coverage. You’ll also get 150 percent of your insured trip cost reimbursed if your trip is interrupted.

6. AXA: Best Travel Insurance Policy for Multiple Trips

If you’re addicted to Europe travel, getting covered by Ama’s Multi-Trip Schengen visa travel insurance is a must.

Multi-Trip is an AXA Schengen visa insurance for frequent travelers who plan on making several trips to Europe over one year. That means if, for example, you’re traveling between the US and France all year on business, you don’t have to purchase travel insurance more than once.

AXA offers medical insurance for expenses up to €100,000 ($111,000) for both the Schengen zone as well as other countries outside of Schengen. If your Europe travel takes you to places like Monaco and Liechtenstein, the AXA Multi-Trip Schengen travel insurance is a great option for you.

But before you plan multiple trips all over Europe, make sure you’re aware of the Schengen visa requirements. Citizens of certain countries may need to apply for a visa depending on the country (if you’re a traveler from the US, you likely won’t have to). Visa refusal is never a fun experience, so make sure to include your AXA Schengen visa insurance certificate with your visa application.

If you’re unsure about anything, AXA has some great customer service. When in doubt, give them a call.

EUROPE TRAVEL INSURANCE FAQs

Now that you’re aware of the different Europe travel insurance options and their different travel insurance policies, let’s make sure you’re clear on everything else travel insurance related.

Is travel insurance necessary in Europe?

Yes, as soon as you leave the US (or your home country) to visit Europe and the Schengen area, travel insurance is necessary. Travel medical insurance is by far the most important asset for any traveler because those medical expenses will skyrocket if you get sick or injured abroad.

Plus your Schengen travel insurance should also cover things like trip cancellations and interruption. No matter what country you’re visiting, you need to be prepared.

Does travel insurance for Europe also cover the United Kingdom?

It’s important to understand that not all countries are part of the European Schengen area, including the United Kingdom. Your Schengen visa will not apply here, and your European travel insurance may not apply.

Some insurances, like World Nomads, will take into account that you’re traveling all over the European region and that you don’t just need Schengen travel insurance. When you’re requesting a quote online, you can select each destination you’ll be visiting.

You need to check with your travel insurance plan to make sure you’re covered for all your medical expenses and emergency evacuation (as well as anything else you want).

Talk to some travel insurance agents for greater clarity on your options. Europe travel awaits!

How much travel insurance do I need for Europe?

The amount of travel insurance coverage you need for Europe/the Schengen area really depends on what you’re planning to do. In any case, your insurance plan should at least cover you for up to $100,000 in medical expenses and emergency evacuation.

You’ll also want to consider what kind of expenses you’ll incur if you’re not covered for things like trip interruption, cancellations, and lost/damaged luggage. You can’t often make corrections to your travel health insurance plan after you’ve begun traveling, so make sure you get it right!

Do US citizens need travel insurance for Europe?

Yes, US citizens absolutely need travel medical insurance for Europe, including the Schengen area.

If you’re a US citizen and you get sick or if you’re seriously hurt while in Europe or the Schengen area, you could face crazy high medical expenses. That could mean hundreds of thousands of dollars in medical debt.

Europe travel insurance is a must for any traveler, and that means US citizens too.

What countries are included in Europe travel insurance?

Generally, Europe/Schengen travel insurance will cover all European countries. As mentioned above, insurers know that you’re likely to visit more than one country on your trip.

But do your homework. Some popular European countries aren’t part of the Schengen area, including the likes of Bulgaria, Croatia, and even the United Kingdom. When it comes to insurance coverage, make sure you read the fine print and make any corrections to your policy as needed.

Residents from certain countries other than the US may require a visa as well, and applicants will want to apply well in advance. Bottom line: your travel medical insurance (just like your Schengen visa requirements) may differ depending on where you’re going.

Does my health insurance cover me in Europe?

Depending on the health insurance coverage you have at home, you may have travel coverage for Europe travel too. Keep in mind this is still travel insurance though—you won’t be able to claim expenses for things like cosmetic surgery abroad.

But in general, residents of the US (and residents of other places, for that matter) shouldn’t assume they’re covered.

Pro-tip: review your policy in great detail before you leave, in case you need to make any corrections.

Do I need Schengen visa insurance for Europe?

Many citizens do not need a Schengen visa before traveling to Europe. You’ll need to figure out what the Schengen visa requirements are for your country first. If you’re a US citizen, for example, you do not need to apply for a Schengen visa.

Applying for a visa can be a daunting experience for some citizens, but the online process for applicants is pretty straightforward. Absolutely make sure you have proof of your Schengen visa travel insurance secured beforehand (like the AXA Schengen visa insurance certificate mentioned earlier), and include it with your visa letter and visa application.

Once you’ve received your Schengen visa, you’re good to go.

Now it’s time—are you ready to see Europe?

Latest Articles

- 5 of the Best Corfu Walking Tours April 22, 2024

- The 5 Most Charming Beaches in New Hampshire April 22, 2024

- Mediterranean Yacht Charter: The Best Companies April 22, 2024

- A Comparison of Luxury & Boutique Hotels in Antibes April 21, 2024

- Editor Picks: The Best London Bus Tours April 21, 2024

4 Best Travel Insurance for Europe in 2024

Home | Travel | Europe | 4 Best Travel Insurance for Europe in 2024

When traveling abroad, get a policy from one of the best travel insurance companies . Y ou can get a 5% discount on Heymondo , the only insurance that pays medical bills upfront for you, HERE!

Getting European travel insurance is one of the main requirements for obtaining a Schengen visa, whether for traveling, studying, or working overseas.

However, if you don’t need a Schengen Visa , you may ask yourself, Do I need travel insurance for Europe ? Well, it’s always a good idea. As I mentioned in my guide to the best international travel insurance companies , you should buy coverage if you want the peace of mind that comes with knowing you’re protected in any unforeseen circumstances.

4 Best travel insurance for Europe in 2024

Of course, not everyone needs the same kind of coverage, so in this article, I’m sharing the best travel insurance for Europe and Schengen travel insurance that meets all the visa requirements:

- Schengen visa travel insurance requirements

- Europe travel insurance cost & comparison

- Best travel insurance for Europe

What should European travel insurance cover?

Not to spoil the surprise, but Heymondo is the best option for Europe trip insurance and Schengen Area travel insurance . Heymondo offers comprehensive coverage at an affordable price, and it’s the only company that pays your medical expenses upfront , so you don’t have to worry about filing a reimbursement claim.

5% OFF your travel insurance

Another great option, if you’re traveling on a budget and don’t mind having a deductible, is SafetyWing . Just be aware that there is a $250 deductible per claim, and they don’t cover medical expenses upfront. You will need to pay out of your pocket and ask for reimbursement later, but it is the cheapest option by far.

I’ll give you a full review of other top travel insurance for Europe below .

Is travel insurance for Europe mandatory?

If you’re required to have a visa to enter the Schengen Area, you must have travel medical insurance for a Europe trip . Be aware that not all travelers need a Schengen visa, so check the requirements for different countries below.

If you’re a citizen of a country in the Schengen Area, you don’t need travel insurance for Europe , but it’s wise to have coverage for your trip .

What countries need a Schengen Visa to visit Europe?

Travelers from the following countries must purchase European travel insurance to obtain a Schengen visa and visit the Schengen Area:

Schengen visa insurance requirements

To obtain a Schengen visa, you must have Schengen Area travel insurance . That is, insurance that covers the Schengen Area and meets these requirements:

- At least $30,000 in coverage for medical emergencies and accidents : Healthcare and medical expenses in Europe aren’t cheap, so emergency medical coverage is a requirement. No matter where you travel in the Schengen Area, your insurance will cover the medical fees if you get sick or injured.

- Repatriation coverage in case of medical incidents or death : If you fall gravely ill in a remote area or require further medical attention for a serious injury, you may need to be transported back to your home country. This is an expensive service, so your insurance should include repatriation coverage. This way, you won’t have to pay big bucks for transportation fees.

- Coverage in all 26 Schengen Area countries for the entire duration of your trip : Even if you’re not planning to visit all 26 countries (which would be incredibly ambitious!), your insurance policy must cover all of them. The best Schengen travel insurance policies allow you to select “Europe” as your coverage area, so you don’t have to worry. I always recommend reading the fine print to ensure you don’t encounter any problems when applying for your Schengen visa.

What countries are in the Schengen Area?

The 26 countries that make up the Schengen Area are:

- Czech Republic

- Liechtenstein

- Netherlands

- Switzerland

Of those countries, Iceland, Liechtenstein, Norway, and Switzerland are the only countries that don’t also belong to the European Union.

How much does European travel insurance cost?

Choosing the best travel health insurance for Europe is one of the most frequent doubts among tourists. We currently have a policy with Heymondo , and we’re very happy with it. The company has been super responsive and helpful whenever we’ve needed assistance. I love that they take care of medical payments for us upfront, so we don’t need to pay out of pocket and file a claim.

If you’re still unsure which European tourist insurance best suits you and your needs , look at the table below. I’ve compared the cost of European travel insurance from 4 different companies. To be as impartial as possible, I’ve simulated the prices for a 30-year-old American traveling to Spain for two weeks with a trip cost of $2,500.

*Price used for example

For this European travel insurance comparison , I chose the cheapest policies that cover the Schengen Area and meet all the requirements. While Heymondo isn’t the cheapest, it offers better coverage than the others, and it’s the only one that pays for medical expenses upfront.

Also, remember that these prices are just an example and can vary depending on your trip’s duration, your country of origin, destination, and other factors. However, no matter the cost, you want travel insurance, even for the cheapest places to visit in Europe .

Best Europe travel insurance

Again, each European travel insurance company has its advantages, so I’m sharing an overview of each option below to help you make the best choice.

1. Heymondo , the best travel insurance for Europe

Heymondo is the best holiday insurance for Europe , offering $200,000 in emergency medical coverage and no deductible. One of the main advantages of Heymondo insurance is the 24/7 customer support and medical chat . This way, you can quickly consult a doctor or get directions to the nearest hospital.

Another thing I like about Heymondo is that it takes care of everything, so you won’t have to pay a single bill out of pocket . No more filing claims and waiting for reimbursement! Just remember that for Heymondo to cover expenses upfront, you must contact them before going to the doctor. If you forget or don’t have time, don’t worry. Heymondo will refund your money after you send them the medical invoice.

Besides, it covers electronic equipment , something that most travel insurance doesn’t include. For us, that coverage is crucial since we always travel with two laptops and professional camera gear.

We’ve been using Heymondo’s annual travel insurance and have been delighted with the experience. We have had to use the customer support more than once, and the team has always been professional, efficient, and kind. If you choose this company for your European travel health insurance , you can save 5% with our Heymondo discount .

2. SafetyWing , a cheap European travel insurance

If you’re looking for a low-cost Schengen travel insurance policy, look into SafetyWing . It’s one of the cheapest travel insurance companies on the market, offering excellent coverage without a hefty price.

SafetyWing’s European travel health insurance includes extensive emergency medical coverage, evacuation and repatriation protection, and up to $5,000 in trip interruption benefits for added peace of mind.

However, while SafetyWing has some of the lowest prices on the market, remember that it’s more of a medical travel insurance , so its trip-related coverage is minimal.

Also, there is a $250 deductible, so you’ll have to pay $250 before the company covers your medical costs. If you don’t want to deal with a deductible and want the added benefit of having your expenses paid upfront, I recommend Heymondo .

3. Trawick International , the best Europe travel insurance for seniors

Trawick International is another option to consider, especially if you’re looking for a good travel insurance plan for seniors . Trawick is affordable and features great medical benefits, including coverage for pre-existing conditions. The company also offers decent protection for natural disasters and repatriation.

This company also has travel insurance with Cancel For Any Reason (CFAR) . So, if you add CFAR to your policy, you’ll get reimbursed for your flight and accommodation expenses if you call the trip off, regardless of the reason for your cancellation. However, there are specific terms and conditions, so I recommend reading the policy thoroughly.

It’s important to review the different Trawick policies since some pertain to European travel insurance while others are tailored to students or tourists coming to the USA. In our comparison, we looked at the Safe Travels Explorer plan, which includes decent trip cancellation and interruption coverage, but only a small amount of baggage loss protection.

Overall, you can get much more coverage for the same price or a bit more. For example, Heymondo offers $200,000 in emergency medical expenses compared to Trawick’s $50,000. Plus, Heymondo pays your medical expenses upfront.

4. Travelex , another good travel health insurance for Europe

Lastly, Travelex is dependable tourist insurance for Europe that meets all Schengen visa insurance requirements. Its Select plan is the more expensive option, but it includes extensive repatriation and evacuation coverage, as well as natural disaster protection.

You’ll also be covered for travel-related expenses like baggage loss/theft, trip cancellation/interruption, and trip delay. Travelex is also a travel insurance that covers pre-existing conditions , making it a good choice if you want your policy to cover treatments and medication abroad for chronic diseases like diabetes.

On the other hand, the Select plan is the most expensive option of the policies we looked at, and the emergency medical expense coverage is very low. In comparison, Heymondo offers much better coverage for a lower price.

What should travel insurance for Europe cover?

When shopping around for travel medical insurance for Europe , make sure you’re looking for the best coverage. Below, you can see what the best European travel insurance should include:

Emergency medical expenses

Emergency medical coverage is the most basic and essential requirement for any European holiday insurance . Even the cheapest policies include this type of coverage. With emergency medical expenses protection, you’ll be covered for any visits, tests, treatments, and hospitalizations during the trip due to illness or injury.

However, chronic illnesses or sicknesses that existed before the start of the trip are excluded from this coverage. For example, the insurance won’t cover treatment for cancer, as that’s a chronic disease that must be treated in your country of origin. On the other hand, an emergency operation for appendicitis would be covered.

Emergency medical expenses, something that’s covered with European travel insurance

As for injuries and accidents, most policies don’t cover incidents that occur while practicing extreme sports or risky activities. In the case of Heymondo , some adventure sports are included in the Premium plan. For other insurers, there is the option to add this type of coverage to your policy for an extra fee. So, if you’re a daredevil and plan on participating in some extreme sports during your trip, I recommend getting a policy with Heymondo.

Evacuation & repatriation

Evacuation and repatriation coverage are other must-haves when buying insurance for a European trip . If you have to return to your home country due to a medical emergency or death abroad, this coverage will take care of the associated expenses. Moreover, if a family member back home gets seriously sick or dies, or there is an accident at your home, the costs will fall under this category.

Unexpected delays can happen while traveling, be it a flight delay, weather problems, or an issue with the airline. This is why many European travel insurance companies include trip delay coverage. This covers expenses like meals and accommodation if your trip is delayed several hours or more.

Trip cancellation & interruption

As for trip cancellation , it’s often not included in European travel insurance . You usually must take out a trip cancellation policy or add this coverage to your plan.

With trip cancellation protection, you’ll be covered if you have to cancel your trip for health, legal, or work reasons. The amount varies depending on your policy, but you could recover up to 100% of the money you invested in the trip. Of course, you must provide documentation justifying the cancellation.

If you want the option of canceling your trip for any reason and getting reimbursed, look into Cancel For Any Reason (CFAR) insurance . Many companies offer this coverage as an add-on.

Moreover, trip cancellation coverage is especially useful if you’re visiting multiple countries in Europe. An unexpected incident may come up in the middle of your trip, such as a family member getting sick or a natural disaster back home. Instead of losing all the money you paid for the rest of your journey, you can get reimbursed with European travel insurance with trip cancellation/interruption benefits.

Baggage loss, theft, or damage

It’s not uncommon for luggage to get lost, stolen, or damaged during travel. For this reason, I consider this type of coverage essential for any European travel insurance plan .

Be sure to check the monetary amount for this benefit since some insurers don’t offer as much protection as others. I also suggest keeping your most valuable and expensive items with you in a backpack or carry-on so you don’t risk losing them in your checked baggage.

If you can’t store your things in a hotel, consider using a luggage storage service once you’ve arrived at your destination. This way, you’re not a walking target for pickpockets!

Electronic equipment

If you’re bringing electronic equipment like a camera or laptop, be aware that these items aren’t typically covered under the baggage loss benefit. An exception is Heymondo , which includes electronic equipment protection in its policies.

For most other European travel insurance plans , you’ll have to get this coverage as an add-on for an extra fee.

Adventure sports

This is another benefit that’s often available as an add-on. If you know you’ll be participating in some extreme activities, adding this type of coverage to your policy is a good idea. Adventure sports include things like bungee jumping, skydiving, scuba diving, and white-water rafting.

Heymondo is one of the few European travel insurance companies that include adventure sports protection in its policies.

Search and rescue

Another insurance benefit is search and rescue coverage. This covers the cost of an organized search and rescue effort should you get lost or reported missing during your trip.

Natural disaster evacuation

Finally, natural disaster coverage will pay for the transportation costs if you need to return to your home country due to a natural disaster at your destination. Examples of natural disasters include earthquakes, floods, landslides, tornadoes, tsunamis, volcanic eruptions, and wildfires.

Europe travel insurance with a discount

If you decide to get travel insurance for a Europe trip , remember that you can take advantage of our discount to save money on your policy.

In the case of Heymondo , you can get a cheaper European travel insurance policy for being a Capture the Atlas reader. Just click our link below to get a 5% discount on Heymondo insurance .

Also, be sure to read our guide on the best discounts for travel so you can save money on flights, hotels, rental cars, and more.

Is Europe travel insurance worth it?

Even if you aren’t required to get a Schengen visa (and thus European travel insurance ), getting coverage is still a good idea. We never travel without insurance, and I advise everyone to do the same. After all, you never know what could happen abroad, whether you get in an accident or fall ill.

Throughout the years, my friends and I have had many experiences that highlight the importance of having insurance.

For example, I was studying English in Ireland with my cousin when he had to have emergency surgery for appendicitis. Luckily, he had EU travel insurance, so the cost of his operation was covered. He would have been stuck paying thousands if he hadn’t had travel medical insurance for Europe .

Another time, I was taking a trip to Germany, and my luggage never arrived. I was stressed out about not having any clothes or toiletries, but fortunately, I had travel insurance, so the company covered the cost of all the clothes and necessities I had to repurchase.

While those two scenarios ended nicely, my family and I have had less-than-ideal situations that resulted from not having insurance coverage.

One of those was when I planned a trip to Ukraine years ago. I had to cancel it because of a family emergency, and since I didn’t have travel insurance for Europe , I lost all the money I had invested in flights and hotels.

Similarly, my mom didn’t bother to get insurance before traveling to London. Someone stole her bag in a pub, so she lost her cell phone, camera, and wallet (with her ID and credit cards). She could’ve been covered for these losses if she had purchased European holiday insurance . Unfortunately, she had to pay to replace everything herself.

As you can see from the examples above, all kinds of unexpected circumstances crop up while traveling. It’s always better to have the added security of trip insurance. Take it from me, and don’t learn your lesson the hard way!

Other things to plan for your trip to Europe

Once you get the best travel medical insurance for Europe , finish organizing your trip with these helpful tips:

- Get one of the best SIM cards for Europe to avoid paying for roaming while using internet in Europe . We always use the Holafly eSIM , and you can even purchase it if you’re already abroad.

- Get a travel credit card to avoid hefty fees when using foreign ATMs. There are even some great credit cards with no foreign transaction fees that you can take advantage of.

- Check the iVisa website to see if you need a Schengen visa for your trip. If you do, make sure you request it in advance so you have it in time for your trip.

Lastly, enjoy your trip to the fullest!

FAQs – Travel insurance for Europe

If you still have concerns about European trip insurance , these answers to commonly asked questions may help:

Do I need travel insurance for Europe?

Travel insurance for Europe is mandatory for citizens who are required to apply for a Schengen visa.

Do I need European travel insurance if I have a European Health Insurance Card (EHIC)?

No, you don’t need European travel insurance if you have an EHIC.

Do I need Europe travel insurance for a Schengen Visa?

Yes, those applying for a Schengen visa must have European travel health insurance .

Which countries are required to have travel insurance to Europe?

Travelers who are residents and hold passports from the following countries must have travel insurance for Europe : Afghanistan, Algeria, Angola, Armenia, Azerbaijan, Bahrain, Bangladesh, Belarus, Belize, Benin, Bhutan, Bolivia, Botswana, Burkina Faso, Burma/Myanmar, Burundi, Cambodia, Cameroon, Cape Verde, Central African Republic, Chad, China, Comoros, Congo, Cuba, Democratic Republic of the Congo, Djibouti, Dominican Republic, East Timor, Ecuador, Egypt, Equatorial Guinea, Eritrea, Eswatini, Ethiopia, Fiji, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Guyana, Haiti, India, Indonesia, Iran, Iraq, Ivory Coast, Jamaica, Jordan, Kazakhstan, Kenya, Kosovo, Kuwait, Kyrgyzstan, Laos, Lebanon, Lesotho, Liberia, Libya, Madagascar, Malawi, Maldives, Mali, Mauritania, Mongolia, Morocco, Mozambique, Namibia, Nepal, Niger, Nigeria, North Korea, Northern Mariana Islands, Oman, Pakistan, Palestinian National Authority, Papua New Guinea, Philippines, Qatar, Russia, Rwanda, Sao Tome and Principe, Saudi Arabia, Senegal, Sierra Leone, Somalia, South Africa, South Sudan, Sri Lanka, Sudan, Suriname, Syria, Tajikistan, Tanzania, Thailand, Togo, Tonga, Tunisia, Turkey, Turkmenistan, Uganda, Uzbekistan, Vietnam, Yemen, Zambia, and Zimbabwe.

What is the minimum medical coverage to get a tourist visa to Europe?

Individuals must have European travel insurance with a minimum of $30,000 in emergency medical coverage to get a tourist visa to Europe.

The best travel insurance for Europe should include emergency medical coverage, repatriation and evacuation, baggage protection, and trip delay protection. It’s also a good idea to include trip cancellation coverage in the policy.

What’s not covered by travel insurance for Europe?

Some European travel insurance plans don’t include trip cancellation benefits, but this may be available as an add-on. Other things that aren’t typically included are adventure sports, electronic equipment, and natural disasters.

What is the best travel insurance for Europe?

The best travel health insurance for Europe is Heymondo since it has an excellent price-to-coverage ratio and no deductible. Plus, it is the only company that pays your medical bills upfront, so you don’t have to pay out of pocket and file a claim for reimbursement.

How much is travel insurance to Europe?

The cost of Europe travel insurance can range from $2/day to $7/day or more.

Is travel insurance for Europe worth it?

Yes, European travel insurance is absolutely worth it , whether it’s mandatory for you or not. In addition to emergency medical coverage, you’ll have baggage, trip delay, and repatriation benefits that can save you thousands of dollars.

What happens if I get sick or have an accident in Europe and I don’t have travel insurance?

If you need medical assistance during your trip, you’ll have to pay out of pocket for any care you receive at the hospital or a doctor’s office. If you have a European Health Insurance Card, you can go to a public medical center. You’ll have to pay out of pocket, but you can file a claim for reimbursement once you return to your home country.

What should I do if I have travel insurance and get sick or have an accident in Europe?

If you get sick or injured while abroad, contact your insurer to find out which medical center or hospital to go to. You can go to the nearest public hospital or clinic if you have a European Health Insurance Card.

What is the age limit for getting travel insurance for Europe?

Some insurers have age limits on their policies, such as Heymondo and SafetyWing, which cover individuals up to 69 years old. Other companies have higher age limits or no limits at all.

Can I extend my travel insurance to Europe if I’m already traveling?

The ability to extend your coverage depends on the insurer. For example, SafetyWing policies automatically renew every 28 days until you select an end date. Heymondo allows you to take out a policy if you’re already traveling, but you’ll have to wait 72 hours after purchasing it for it to go into effect.

Does my travel insurance for Europe cover a flight canceled by the airline?

Generally, European travel insurance doesn’t cover flights that are canceled by the airline. If you want this type of coverage, look into Cancel For Any Reason insurance.

I hope this guide helps you find the best travel health insurance for Europe and that you feel better prepared for your trip. Remember, if you need a Schengen visa to enter the Schengen Area, you’ll need proof of insurance to get the visa.

However, even if you don’t need a Schengen visa, it’s still worth getting European travel insurance . It’s always safer to travel with insurance coverage. This way, you can enjoy your trip and have peace of mind knowing you won’t have to pay any medical bills and cancellation fees out of your own pocket.

Again, Heymondo is the best European holiday insurance , offering excellent coverage for a reasonable price and direct, upfront payments for medical expenses. If you decide to buy a policy, take advantage of our 5% Heymondo discount code below.

Stay safe, and have a wonderful time in Europe!

Don't miss a 5% discount on your HeyMondo travel insurance

and the only one that pays all your medical bills upfront for you!

Ascen Aynat

14 replies on “ 4 Best Travel Insurance for Europe in 2024 ”

Is there a Schengen insurance that covers the UK on the same trip?

Hi Supinda, Yes, with the companies above, you can find European travel insurance plans that cover Schengen countries and the UK.

I wish to travel multiple trips to Europe 4-5 days duration

4-5 trips per year Mostly with my kids

Then I recommend you annual multi-trip travel insurance instead.

Let me know if you have any questions, Ascen

We are a family of four and applying for long term resident visa for Spain. We need health insurance for the visa. What do you recommend?

How long are you planning to stay in Spain. I usually recommend Heymondo, but if you’re staying for long, maybe it’s better to get a health insurance instead of a Travel Insurance,

Thanks, Ascen

Great information. Thank you so much for the information. Amazing services are there. i am very glad to see this blog. in the Schengen visa Itinerary also, providing good services like Flight Itinerary, Hotel Reservation and Travel Insurance are there.

hi Nigeria passport holder want to attend 15 days course in amsterdam Netherland base in Dubai UAE which travel insurance do you recommend for me thanks

I would try this one.

Let me know what you think.

We are a family of five traveling to Italy from the US. We are planning to do some hikes there. Which insurance do you recommend?

If you are going to have any kind of hiking or adventure sport I would go with insuremytrip standard for sure. It is the best insurance for Europe if you plan up to 2000m.

Thanks for this great post! I found all the info I need to decide which is the best travel insurance for my trip to Europe. I hope don’t have to use it though

I am glad to read you! Let me know if you have any question and safe travels!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

For your holidays in Europe and abroad

Travel insurance for europe .

Europe may be known to world leaders and businesses for its central position in trade and commerce or its unique geographical location between the two ‘Old World’ continents – Asia and Africa. But for travelers and explorers worldwide, it is a destination that offers the best of everything. From a vibrant history and cultural heritage to arts, architecture, nature, and food, Europe is diverse in every sense of the word. It offers everything that one may wish for on vacation. It also caters to all types of travelers. Whether you’re a backpacker or one who goes all out on their trips, you can explore Europe in your style. No wonder everyone has Europe on their list of must-visit places. Considering how popular a travel destination in Europe is, you may already know a thing or two about the region. However, travelers often overlook a few things that are worth knowing. Let’s take a look…

Discover our Travel Insurance for Europe

Travel insurance germany | travel insurance italy, is travel insurance for europe a requirement , europe travel faqs, what documents do i need to travel to europe.

- Passport with a minimum of six months validity and at least one blank page for every European country you intend to visit.

Does Europe require International Medical Coverage?

What vaccinations are required to visit europe.

- Hepatitis A and B

- Tick-borne Encephalitis

- Routine Vaccines – Flu, Polio, MMR, Shingles, Chickenpox, and Diphtheria-Tetanus-Pertussis

What is the best time of year to visit Europe?

What is the local currency of europe and its exchange rate for usd, are credit cards widely accepted in europe if yes, which ones, what local customs and cultural norms tourists visiting europe should be aware of.

- Tipping isn’t as common in Europe as in the US.

- Don’t expect everyone to know English in countries other than the UK.

- Beware of pick-pocketing; it’s common in many parts of Europe.

- In Italy, denying food is considered impolite, so it is best to accept it when offered.

- Americans are often referred to as irritating in Europe due to their loud nature. Be polite and talk at a lower volume as much as you can.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Do I Need Travel Insurance for Europe?

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.