- Travel Insurance

Bupa Travel Insurance Review

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Updated: Aug 8, 2023, 1:29pm

Bupa is a well-known name in the Australian insurance scene, and its travel insurance option is no different. With no age limit on policies and unlimited medical cover (including dental), Bupa comprehensive travel insurance is a responsible choice for all types of trips and travellers. Bupa offers three kinds of coverage: comprehensive, essentials and domestic. This review focuses on the comprehensive policy.

- Unlimited medical, hospital and dental cover

- No maximum age limit

- All pre-existing conditions need to be assessed to determine if they will be covered

- Reviews state lengthy waits for claim payments

Table of Contents

About bupa travel insurance, what is covered, who should take out this insurance.

Featured Partners

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

On Cover-more’s secure website

Unlimited, with a $2000 limit to dental

Yes, amount chosen by customer

Bupa Travel Insurance is underwritten by Allianz Australia Insurance Ltd, and the policy is very similar to the Allianz Comprehensive Travel Insurance offering. The travel insurance policy offered to Australians by Bupa is via Bupa Asia Pacific, a part of the global Bupa Group.

Along with travel insurance, Bupa also offers Australians health insurance, car insurance, home insurance, pet insurance, landlord insurance, valuables insurance, among others.

In relation to its Bupa travel insurance policy, which is analysed in detail below, customers have rated the policy 3.9 stars out of 5 from 138 reviews via Australia’s independent consumer opinion site, ProductReview.

Bupa offers its comprehensive travel insurance policy to all Australians, with no age limits in place for travellers wishing to take out their comprehensive option, although pre-existing medical conditions require assessment before being covered. The lack of an age limit is particularly helpful to senior travellers as well as families, especially considering that dependent children are included in the policy up to the age of 25–provided they are not in full time employment and will be travelling with you 100% of the time.

In terms of financial cover, Bupa covers credit card fraud up to $5,000, while personal liability is covered up to $5 million.

Delays and missed connections are an inevitable risk of travel, which is why Bupa’s travel delay cover includes coverage for missed connections: for delays of more than six hours there is $250 per person allocation and a further $250 for each additional 24-hour period after the initial six hours. The delay cover, however, is limited at $2,000 total for all travellers on the policy, and maximum per person of $500 after the initial six-hour delay.

When taking out your Bupa Travel Insurance policy, travellers can also opt for cancellation cover, with the amount chosen by the customer.

Lost luggage

Bupa’s comprehensive travel insurance policy includes lost luggage cover up to $10,000, however, sub limits apply for certain items. Policyholders do have the option to increase item limits for high value items if required. Check the pds for further details.

The last thing you want to think about on a trip is having to access medical services, but it’s important for Australians heading overseas to ensure this is included on a travel insurance policy for peace of mind.

Bupa covers overseas medical and hospital expenses, so you will not be out of pocket if you need to access medical care while abroad. If you have a pre-existing condition, however, you will need to be assessed by Bupa prior to your trip to determine if they can be covered with the policy.

Is dental cover included in medical?

Yes, Bupa does include dental within its unlimited medical and hospital expenses cover. A lot of insurance providers don’t choose to include dental within medical cover, so it is a benefit of Bupa’s policy.

Does it Cover Me for Covid?

Yes, Bupa’s travel insurance includes covid cover under its medical expenses. In terms of cancellations, these are only covered due to Covid-19 if the trip cancellation is due to a government-enforced border closure or if the policyholder has to complete quarantine due to Covid.

What about Pregnancy?

If you’re pregnant while travelling, you’re going to want to ensure your travel insurance policy covers pregnancy. With Bupa, you are covered until week 24 of your pregnancy, provided that you do not have complications with the pregnancy or a history of complications.

This cover is included under the unlimited medical expenses, however, childbirth is not covered.

What about Sports and Activities?

When taking out Bupa’s travel insurance, there are 38 activities automatically included in your plan. These include golfing, river cruising, gymnastics and more. Certain conditions apply to these automatic inclusions, such as safety provisions and terrain restrictions (or claims made would be void).

In addition to the 38 included activities, policyholders can also add on activity packs to suit their trip type for an additional cost.

These are packs that cover activities designated for ‘adventure’, such as for cave tubing and rock climbing, ‘cruise’ for those going on a multi-day cruising holiday, and a ‘snow’ pack to cover certain winter sports.

Similar to the automatically included activities, certain restrictions apply to the purchase of the additional packs. Failing to meet these requirements could result in your claims being void, which is why it is essential to read your policy’s product disclosure statement.

Customer service

Bupa offers its customers 24/7 emergency assistance with Australian based doctors and nurses, so you can receive trusted medical guidance at any time while on your holiday.

For non-medical enquiries, Bupa has a separate contact telephone number and a call back option for those calling out of hours. Further, Bupa also has a WhatsApp channel which customers can use to get in touch with the Bupa customer service team while travelling.

Bupa has made the process of making claims easier for its customers, by allowing claims to be made online via the myBupa app (available on both iOS and Android, and via web browser).

Thanks to the well-known name and the non-existent age limit when taking out a policy, Bupa’s travel insurance is well suited to a wide variety of Australian families going on holidays together. This is especially true as children up to 25 years of age are included on the policy at no extra charge, pending the meeting of certain conditions. In any case, before you take out this insurance, Forbes Advisor recommends you read the product disclosure statement carefully so you can understand the various sub-limits and exclusions.

Frequently Asked Questions (FAQs)

Is there a discount for bupa travel insurance.

While there is no automatic discount for Bupa travel insurance, pre-existing customers of Bupa (such as those with an active health insurance policy) can get 15% off their premiums.

Does Bupa Travel Insurance cover COVID?

Yes, Bupa Travel Insurance covers COVID-19 as a medical condition under its unlimited medical and hospital cover. It also covers trip cancellations caused by Covid, on the basis that there are government enforced border closures or the traveller is required to quarantine.

How do I make a claim with Bupa Travel Insurance?

Claims can be made via the myBupa app on your mobile or webpage. You can also call the 24/7 Australian-based customer service team to submit a claim over the phone on 1300 992 694.

Sophie Venz is an experienced editor and features reporter, and has previously worked in the small business and start-up reporting space. Previously the Associate Editor of SmartCompany, Sophie has worked closely with finance experts and columnists around Australia and internationally.

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Cruise Travel Insurance

- Best Domestic Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

More from

Do frequent flyer points expire, travel insurance for canada: what you need to know before you go, travel insurance for south africa: everything you need to know, travel insurance for vietnam: everything you need to know, tick travel insurance top cover review: features, pros and cons, was discovery travel insurance review: features, pros and cons.

Why Travel Insurance?

Got Questions? Ask us!

Quick buttons, insurance plans, free quotation, email [email protected].

WhatsApp +65 9175 6942

Phone Number +65 6551 2861

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

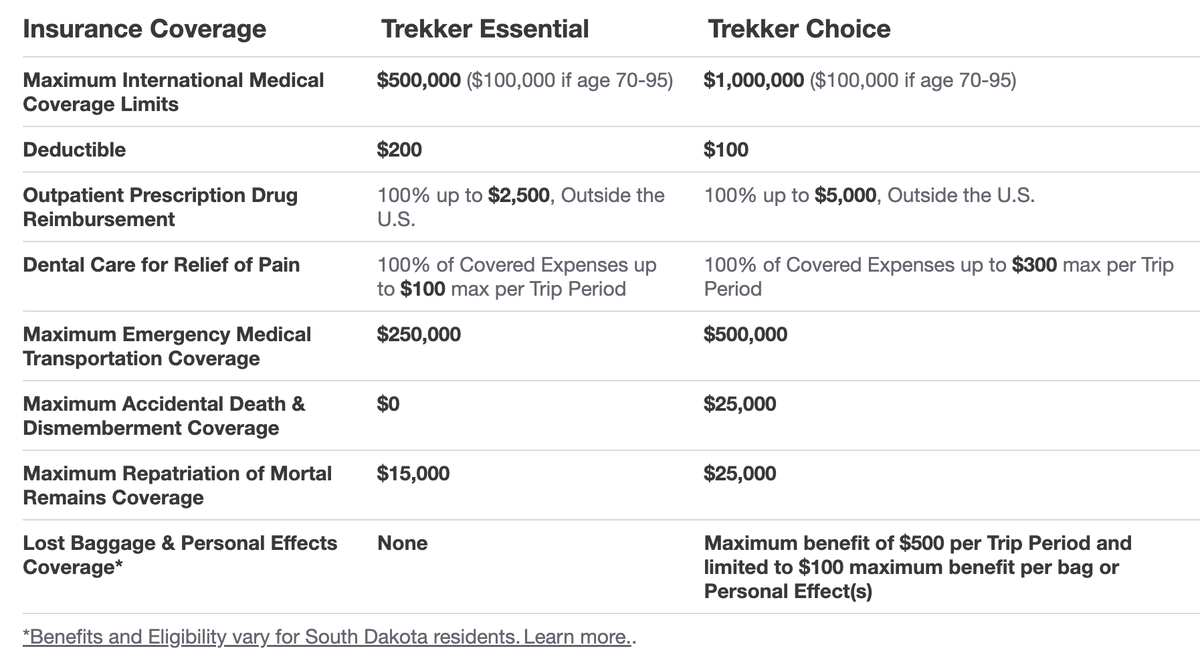

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

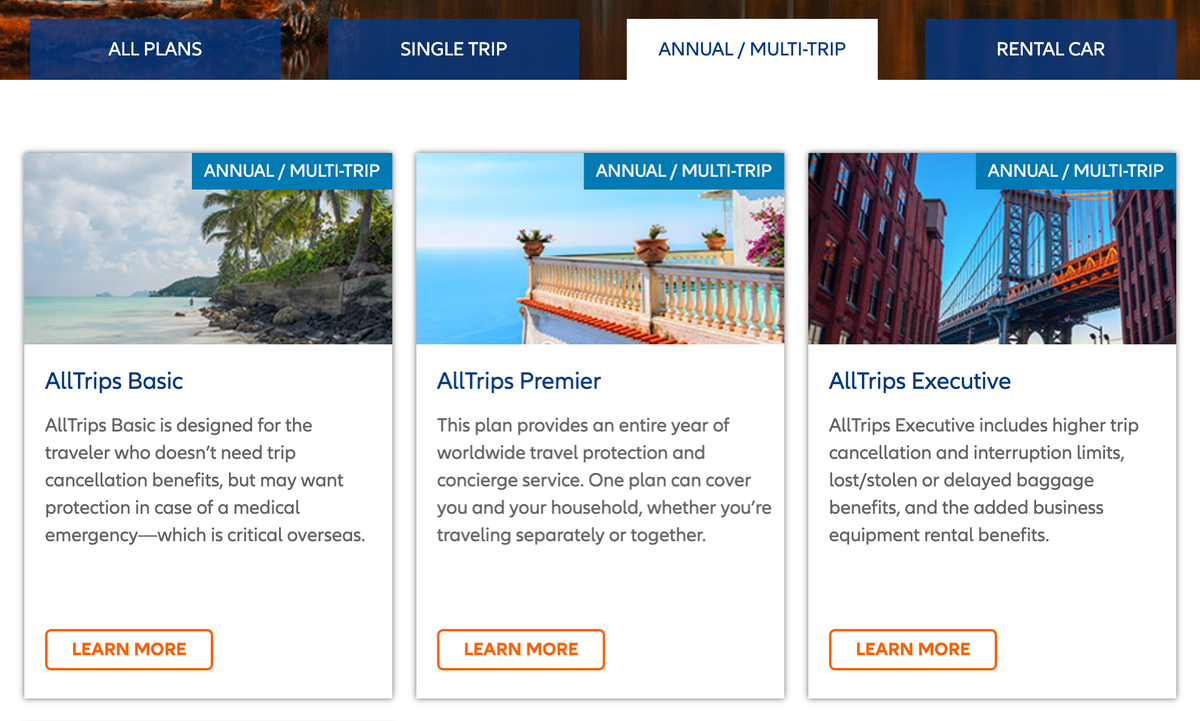

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

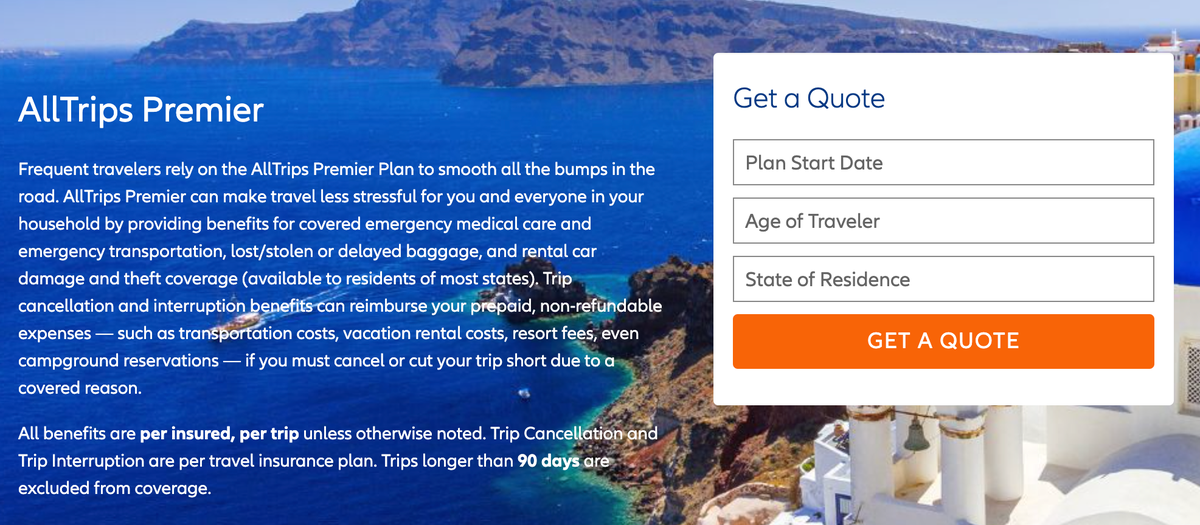

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

For the Frequent Traveler: The 11 Best Annual Travel Insurance Policies

Content Contributor

66 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

85 Published Articles 484 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3147 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

GeoBlue Trekker Choice

Geoblue trekker essential, trawick international safe travels annual basic, trawick international safe travels annual deluxe, allianz travel alltrips basic plan, allianz travel alltrips prime plan, allianz travel alltrips executive plan, allianz travel alltrips premier plan, aig travel guard annual travel insurance plan, usi affinity voyager annual travel insurance, seven corners travel medical annual multi-trip, a plan that didn’t make our list, how annual travel insurance works, when to buy an annual travel insurance policy, what annual travel insurance policies do and don’t cover, understanding trip length rules, is annual travel insurance worth it, how much do annual travel insurance policies cost, does credit card travel insurance apply annually, choosing an annual travel insurance policy, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you take multiple trips every year, insuring each one can be a hassle. There are forms to fill out, comparison shopping over and over again, and then remembering the policy documents for each specific trip. And then there’s the risk you might forget to take out travel insurance for one of your trips.

Plus, those costs add up. There must be a better way.

Enter annual travel insurance. Also known as multi-trip travel insurance, taking out an annual policy covers you for a whole year of travel. Not only is it simpler, it may be cheaper than taking out multiple single-trip policies. But is it right for you?

Annual travel insurance policies aren’t exactly the same as the trip insurance you’d buy for a weeklong holiday with your family. Here are the best annual travel insurance policies, what they do and don’t cover, and how to decide whether taking out a yearly policy might be right for you.

The 11 Best Annual Travel Insurance Policies

GeoBlue offers 2 Trekker plans for annual coverage, which are unique in several ways. These plans cover preexisting conditions, COVID-19, and all travel outside the U.S.

However, they don’t cover any trips inside the U.S. or provide any coverage for canceled, delayed, or interrupted trips. Instead, these are travel medical insurance plans . With the GeoBlue Trekker Choice plan , you’ll get higher maximum payouts in all categories and pay a lower deductible ($100). However, note that this is still secondary coverage .

You’ll get unlimited access to telemedicine and coverage for trips up to 70 days in length . Additionally, coverage is available up to age 95, which isn’t offered on most other policies.

The GeoBlue Trekker Essential plan offers the same pros and cons as the Choice plan. The main differences are the lower maximum payout values and the higher deductible ($200 instead of $100). You also won’t get the Choice plan’s lost baggage and personal effects coverage, which can provide up to $500 per trip. Again, this secondary medical insurance policy is only valid on trips outside the U.S.

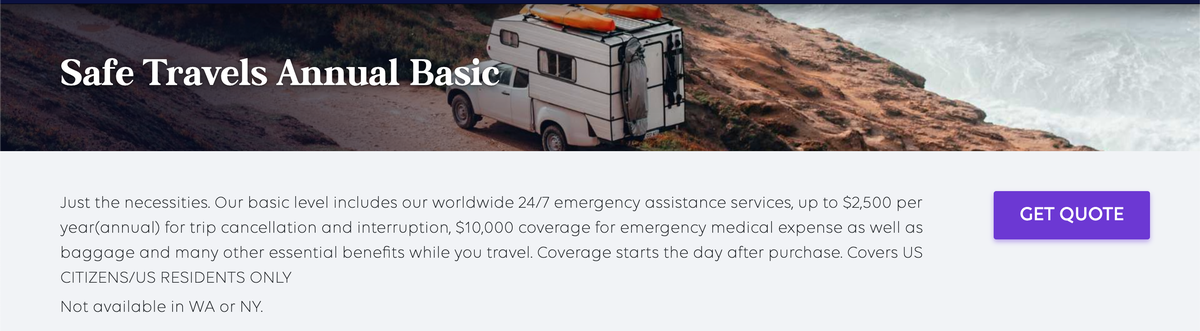

Trawick International offers 2 annual plans, and the Safe Travels Annual Basic plan is more economical. You’ll have coverage for everything you expect in a trip insurance policy , such as 100% coverage for trip cancellation or interruption (up to a $2,500 annual maximum) and coverage for delays, lost luggage, delayed luggage, and even medical expenses. To make up for the lower cost of the plan, coverage limits are lower than what you’ll find elsewhere . However, if you want peace of mind while traveling, you can get it for a year and cover trips up to 30 days in length.

While Trawick International’s Safe Travels Annual Deluxe plan offers higher maximum coverage limits than the Basic plan, its maximum payouts for medical and evacuation benefits are lower than what you’ll find with competitors . Where this plan shines is in the coverage for change fees, lost deposits on tours, and coverage for lost items if an airline misplaces your luggage.

You’ll be covered for up to $300 per trip for prepaid excursions, up to 100% of your trip cost (with an annual maximum of $5,000) for trip cancellations or interruptions, and up to $150 per item and $750 per trip for personal effects. After signing up for a plan, you’ll also get a 10-day free look period.

If you want an annual plan with a low price tag , this could be what you’re looking for. The Allianz Travel AllTrips Basic plan covers you for unlimited trips up to 45 days each over the course of a year. Coverage includes emergency medical, emergency medical evacuation, baggage loss and delays, travel delays, rental car theft and damage, and travel accident coverage.

However, there’s a fair list of exclusions from this plan . That includes trip cancellation, trip interruption, missed connections, and change fees. As the name implies, you’ll get basic coverage at a basic price.

The Allianz Travel AllTrips Prime option covers 365 days of trips, though the maximum trip length is just 45 days. While you’ll get coverage for all the standard travel insurance benefits, including trip cancellation, trip interruption, emergency medical, delays, and baggage mishaps, there are limits you should know about with this plan.

The travel accident coverage, which applies to death or the loss of a limb, maxes out at $25,000 per trip, baggage delay maxes out at $200, and baggage loss or damage maxes out at $1,000. The maximum coverage for emergency medical is $20,000, and costs can exceed that quickly in a true emergency.

However, this is a decent option if you want a fair amount of coverage across numerous categories without a high price tag.

For those worried about expensive business equipment or losing points and miles, this plan has you covered. On top of higher maximum payouts in categories such as trip cancellation, emergency medical transportation, or travel delays, you’ll also get rental car damage and theft coverage, change fee coverage, and reimbursement for renting business equipment if yours is lost, stolen, damaged, or delayed during a trip.

Moreover, you can be reimbursed up to $500 to cover fees for reinstating your points and miles if a covered trip is canceled or interrupted. The Allianz Travel AllTrips Executive plan also provides coverage for preexisting medical conditions if you meet certain criteria and buy at least 14 days before the first trip.

Allianz also has a customizable AllTrips Premier plan , allowing you to choose between several payout tiers for trip cancellation and interruption. You’ll pay more when choosing higher maximums, but this allows you to choose exactly what you want in coverage and not pay for more than you need. Another positive is coverage for preexisting medical conditions if you meet certain criteria and buy your policy at least 14 days before your first trip.

You’ll also get rental car damage and theft coverage , $500,000 of emergency medical transportation coverage, $50,000 of emergency medical, and coverage for travel delay expenses after a delay of 6 hours or more. The baggage delay coverage is up to $2,000, but it requires a delay of 12 or more hours. The maximum trip length allowed is 90 days.

The AIG Travel Guard Annual Travel Insurance plan isn’t available to Washington state residents. Still, it provides coverage for trip interruption, trip delay, lost baggage, delayed baggage, and missed connections, as well as both medical and security evacuation, accidental death and dismemberment, and travel medical expenses. However, the coverage limit for dental is just $500, and the maximum coverage for travel medical expenses is just $50,000. Those are lower limits than other plans. Additionally, trip cancellation isn’t included.

However, Travel Guard has some strengths. Trip delay coverage applies for up to 10 days and requires a delay of just 5 hours, and the missed connection benefit applies after just 3 hours. You get a “free look” period of up to 15 days to cancel for a refund, so long as you haven’t started your trip or filed a claim. Maximum coverage for any particular trip is 90 days.

USI Affinity’s Voyager plan has a Silver and Gold option , and pricing is easy to determine from the chart. Simply find your age bracket and the associated cost. The key differences between the plans are in the higher maximum payouts for nearly every coverage type with the Gold plan, other than emergency dental and accidental death and dismemberment. However, the Gold plan also includes coverage types the Silver plan doesn’t: political and natural disaster evacuation, airline ticket change fees, and trip interruption. However, trip cancellation isn’t included with either plan .

The maximum trip length is 90 days, and coverage for Silver and Gold plans lasts for 364 days. An unlimited number of international and domestic trips are covered, and you’re covered for trips as little as 100 miles from home. That’s a lower requirement than most other plans (which tend to require 150 miles).

This plan is ideal for those who don’t live in the U.S., as other plans on this list are only available to U.S. residents and citizens. While the plan technically lasts for 364 days, Seven Corners’ Travel Medical Annual Multi-Trip plan is customizable. It lets you choose a maximum trip length of 30, 45, or 60 days and include or exclude coverage for the U.S. Note U.S. citizens and residents cannot add coverage for inside the U.S.

Seven Corners also provides coverage for travelers aged 14 to 75 years, though maximum payouts decrease in some categories for those aged 65 and older. If you receive medical care in the U.S., Seven Corners will pay 90% of the first $5,000 of covered expenses and 100% of the cost afterward. You’re covered 100% outside the U.S. Note that coverage doesn’t apply to your home country (which includes the U.S. if you’re a citizen, even if you live in another country) and isn’t available in Antarctica, Cuba, Iran, Israel, North Korea, Russia, Syria, or Ukraine.

We considered another plan. Here’s why this annual travel insurance policy didn’t make our “best of” list.

IMG Patriot Multi-Trip International : For trips inside the U.S., you may be on the hook for 20% of your medical expenses if you visit a provider outside IMG’s PPO network. Additionally, the maximum trip length is 30 days, and coverage limits are quite low in multiple categories. These include $50,000 for emergency medical evacuation and $10,000 for political evacuation, a maximum of $50 per item and $250 overall for lost luggage, a $100 maximum for dental treatment, and $25,000 for accidental death and dismemberment 24/7 coverage.

Annual travel policy plans vary considerably. Most provide secondary medical insurance, so you may need to submit to your other coverage (home healthcare plan, credit card insurance provider, etc.) first and then submit to your travel insurance provider for any remaining expenses or deductibles. If you won’t have other coverage, you may want to look for a plan that provides primary health coverage instead. Also, understand that most plans provide reimbursement, so you would pay out of pocket for overseas hospital visits and then submit to your insurance provider for reimbursement after the fact.

What Is Annual Travel Insurance?

Annual travel insurance covers you for many trips over the course of a year (or sometimes 364 days). Rather than needing to buy a travel insurance policy for each trip separately — which can add up — you can buy a single policy that covers all your trips for the next year. It’s important to understand the terms of these policies, though. Some may require buying coverage in advance, such as 14 days before your first trip, while that requirement normally doesn’t exist on single-trip travel insurance.

It’s also important to note which types of trips and destinations are covered by your policy — and which aren’t. Look for how far from home you must travel to be covered and whether domestic trips are included. Moreover, consider what benefits you’re looking for. These can vary from medical-only to all the bells and whistles, such as baggage delay and medical evacuation. Once you know the type of coverage you want, you can find a policy or policies that align with your needs, helping you narrow down your options to conduct a more effective comparison.

Annual travel insurance works as an umbrella policy, covering all your trips during the policy period. You don’t need to inform the policy provider about each trip’s start and stop dates or destinations. You simply buy a policy, and then you’re protected for every trip that meets the conditions while your policy is in effect. Some regions may be excluded from coverage, and you may be subject to a maximum trip length.

Trip length is an important element to pay attention to. Annual travel insurance doesn’t cover you for a year-long trip. It covers you for a year for many small trips within that time, typically up to 30 or 45 days per trip. If you’re looking for a plan to cover you during a year-long trip to another country, you should look for specialized plans for study abroad, mission work, or other situations that apply to you. Traveling full-time? You may need a policy geared toward digital nomads and backpackers.

You should buy your annual travel insurance policy as soon as you know you’ll have multiple trips in the next year and determine that the cost of insuring each alone would be higher than that of a single multi-trip plan. What’s the break-even point on that cost? It depends on the coverage you want.

Considering that single-trip plans can sometimes be found for $10, yet an annual trip is likely to cost $150 or more per adult, you’d need 15 trips to justify the annual policy. However, that’s not really an apples-to-apples comparison, as a $10 basic travel insurance policy won’t provide as much coverage as you’re likely to find on even the most basic of annual policies.

It’s also not just about the number of trips you take but the types of trips, the complexity of the trips, and money at risk in nonrefundable costs. The more of these you foresee in your next year of travels, the more likely an annual plan would be good for you.

We already highlighted that annual policies don’t cover traveling nonstop for a year due to their restrictions on the maximum trip length. Annual travel insurance policies also restrict how far you must travel for coverage to kick in. Driving to the next town over may be a trip in your kids’ eyes, but it’s probably not far enough for your travel insurance to kick in.

While coverage varies by policy, you’ll typically have coverage for sickness, accidental death and dismemberment, lost or delayed luggage, trip cancellation, and possibly injuries during skiing or snowboarding. However, it’s important to read the terms of each policy because coverage maximums and inclusions vary widely. Some policies only provide medical coverage, while others offer robust coverage across the board.

Each policy specifies a maximum trip length. How trips longer than that are treated can vary. Most policies won’t cover any expenses related to a trip longer than the maximum trip length. Suppose you take a trip of 41 days on a policy with a maximum of 40 days. In that case, claims for delayed luggage or medical expenses may be rejected when the claim evaluator asks for your trip confirmation details.

However, GeoBlue covers the first 70 days of any particular trip. If something goes wrong during that time, you’re covered. You’re on your own for anything that happens on days 71 or beyond. Still, you’re covered on those first 70 days, despite taking a longer trip.

If you foresee long trips in the future, make sure you understand these rules.

For some travelers, yes, annual travel insurance is worth it. For others, it’s not.

Annual travel insurance is worth it when it costs less than what you’d pay to insure each trip individually. It’s also worth it if you think you might forget to purchase some of those individual policies throughout the year and would prefer to be done with them for another 365 days.

However, annual travel insurance isn’t worth it if you only take a few trips a year, they’re mostly domestic, and you don’t have major nonrefundable expenses. If you’re traveling within the U.S. with your standard health insurance policy in effect and you have credit cards that provide trip insurance for delays or cancellations, that coverage may be sufficient.

Costs will vary by your home state, age, and number of people included in the policy. Here are the “starting at” costs for our best annual travel insurance policies, sorted from lowest to highest:

Yes and no. Using a credit card to pay for your trip can provide some built-in protections. However, you should be mindful of annual maximums on any policy. You may run into limitations such as a maximum of 2 claims per 12-month period or similar exclusions. If you take many trips, that could be an issue.

To better understand what is and isn’t covered, check out our complete guide to credit card insurance .

To choose the right policy, look beyond the cost alone. Rather than immediately choosing the cheapest policy, find the policy or policies that provide the coverage types you want with payout maximums that cover your travel plans for the next year — both confirmed bookings and likely plans.

Consider your coverage needs. Will you be carrying expensive items such as scuba equipment for a trip to the Galapagos or top-notch camera lenses for a bird-watching tour in Papua New Guinea? How many extreme sports will you participate in?

Conversely, how many “never heard of this airline before” flights will you take to get off the beaten path? These are flights where you may be worried about cancelations that lead to extra costs or a misplaced suitcase.

Consider the types of trips you’ll take and the up-front money at risk if something goes wrong or you get delayed, then look at which plans align with your travels. From there, choose the best plan that aligns best with your needs, which may or may not be the cheapest one.

As an annual travel policy holder myself, I promise you that having the right plan is important when you wind up in a remote hospital in Tanzania with malaria.

Annual travel insurance isn’t right for everyone. However, it makes sense for those who travel often and could save money by taking out a single policy instead of many separate policies. It also makes sense if you’d prefer to avoid filling out paperwork numerous times throughout the year for each trip.

Annual travel insurance policies aren’t great for those who tend to travel closer to home, don’t have major nonrefundable travel expenses, or need to customize coverage for each trip because their travels tend to vary. For example, you might need different coverage for a backcountry ski trip with friends versus a 2-hour drive with your family.

Look at what annual policies do and don’t cover and see if these align with your travel goals and needs. Then, consider the prices for the plans that align well with your situation. After taking an informed look, you should have a good idea of whether an annual policy is right for your situation.

Frequently Asked Questions

Is yearly travel insurance worth it.

For some, yes. For others, no. Annual travel insurance is worth it when the cost is less than what you’d pay to insure each trip separately or you would prefer to just sign up once then be done for a year. However, annual travel insurance isn’t worth it if you only take a few, mostly domestic, trips a year where your healthcare coverage works, and you don’t have major nonrefundable expenses.

How much does annual trip insurance cost?

Costs vary greatly depending on the type of coverage you want. Annual travel insurance plan costs range from $140 to $500 for a single person. If you take a lot of trips, the cost can be worth it over the course of a year, but each person’s situation is different.

When should I take out annual travel insurance?

You should buy your annual travel insurance policy as soon as you know you’ll have multiple trips in the next year and that the cost of insuring each alone would be higher than the cost of a single multi-trip plan. What’s the break-even point on that cost? It depends on the coverage you want. Look at the different types of coverage and your expected costs for insuring each trip separately, then see if it makes sense for you.

Does annual travel insurance automatically renew?

It varies by policy provider, but some companies have an auto-renew feature to ensure you don’t have gaps in coverage.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Annual Travel Insurance in 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you’re a frequent traveler, annual travel insurance may be something you’ve been considering. Unlike single-trip insurance, annual travel insurance plans can cover you for an entire year, no matter how often you’re on the road.

Let’s look at the best yearly travel insurance companies, why we choose them and the coverage you can expect.

Factors we considered when picking travel insurance companies

We used the following criteria when choosing which companies we thought were best:

Cost . Annual plans can be expensive — depending on the type of coverage you choose — so we wanted ensure that they stayed affordable.

Types of coverage . Travel insurance for annual travelers can be limited in its coverage. We picked the ones with the broadest range of coverage for possible travel disruptions.

Coverage amounts . Annual trip insurance isn’t worth much if your limits are too low. Instead, we wanted plans with reasonable coverage amounts.

Customizability . If your travels take you to different places, you’ll want the ability to customize your plan. The best annual travel insurance plans can provide this.

» Learn more: What does travel insurance cover?

An overview of the best annual travel insurance

We gathered quotes from various travel insurance companies to determine the best annual travel insurance policies. In these examples, we used a year-long trip by a 22-year-old from Alabama. We indicated the main countries of travel as France and Malaysia, and when asked, put the total trip costs at $6,000.

The average cost for an annual travel insurance plan came out to $220. The plans ranged from $138-$386.

Let’s take a closer look at our top recommendations for annual travel insurance.

1. Allianz Travel

What makes Allianz travel insurance great:

Lower than average cost.

Provides health care and travel insurance benefits.

Includes rental car insurance up to $45,000.

Here’s a snippet from our Allianz Travel insurance review :

“AllTrips Basic (annual plan) is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.”

2. Seven Corners

What makes Seven Corners great:

Offers up to $20,000 for acute coverage of pre-existing conditions.

Includes up to $1 million for emergency medical evacuation.

Optional add-on for adventure sport activities.

$0 deductible available.

Here’s a snippet from our Seven Corners review :

“Seven Corners offers one annual policy called Travel Medical Annual Multi-Trip. The policy can be customized depending on how long you plan to be away from home for any one trip. You can travel as much as you like during the 364 days, so long as any one trip doesn’t exceed the option selected — 30, 45 or 60 days.”

What makes IMG great:

Good customizability with medical evacuations and sports coverage.

Low $250 deductible.

Includes coverage for semi-private hospital rooms.

Here’s a snippet from our IMG review:

“Some policies provide emergency medical evacuation coverage, while others skip this benefit entirely. This benefit may be more important to you if you travel to a remote location or engage in physical activity such as trekking.

More comprehensive plans may include other benefits such as assistance with acquiring a new passport, reimbursing reward mile redeposit fees or coverage for pre-existing conditions. If these are something you’re interested in, be sure to check that your policy includes these options.”

4. Trawick International

What makes Trawick International great:

100% coverage for trip cancellation and trip interruption.

Emergency medical evacuation included.

Trip delay reimbursement coverage.

Here’s a snippet from our Trawick International review :

“Trawick International is a comprehensive travel insurance provider that offers trip delay and cancellation insurance, baggage delay coverage, medical coverage and medical evacuation, rental car damage protection, and even COVID-19 coverage among its various policies.

Trawick covers trips for worldwide destinations, including for foreign nationals coming to the U.S.”

What does travel insurance cover?

You’ll find a wide variety of coverage types offered by travel insurance policies. This is true whether you're purchasing a single-trip or annual travel insurance plan. Here are some common types you can expect to find:

Accidental death insurance .

Baggage delay and lost luggage insurance .

Cancel for Any Reason insurance .

Emergency evacuation insurance .

Medical insurance .

Rental car insurance .

Trip cancellation insurance .

Trip interruption insurance .

How to choose the best annual travel insurance policy

While we’ve highlighted some of the best annual travel insurance companies, the truth is that the best plan for you isn’t going to be the best plan for someone else. If you’re interested in buying annual travel insurance, you’ll want to collect a variety of quotes to see which policy best fits your needs.

This may mean opting for a plan that covers pre-existing conditions or one that specifically includes high-risk activities. Or, if you’re in a country where health care is notoriously expensive, you may want to choose a policy with higher maximums.

Many credit cards come with complimentary travel insurance .

Whatever the case, do your research first and review all the plan details before making your purchase.

» Learn more: How to find the best travel insurance

If you want to buy annual travel insurance

Annual travel insurance can be a great option if you’re often out of town. With such a wide range of policies available, selecting a plan that fits your needs is easy. We’ve done some of the work for you by choosing the best annual travel insurance companies, all of which made the top of the list for their cost, customizability, types of coverage and plan maximums.

Like any travel insurance policy, the cost of your plan is going to vary. Factors that may affect the cost of your annual travel insurance include your age, where you’re going, how long you’ll be traveling, your policy maximums and whether preexisting conditions are included.

Although not all travel insurance providers offer annual travel insurance, many of them do. We’ve gathered together the five best, including Allianz Travel, World Nomads, Seven Corners, IMG and Trawick International.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- United States

- United Kingdom

Bupa travel insurance review

There are 5 policies to choose from with bupa travel insurance, along with a heap of add-ons including adventure activities, snow sports and wide-ranging cruise cover..

In this guide

Compare your travel insurance quotes

What does bupa travel insurance include, bupa travel insurance features – an overview, comprehensive policy features, optional add-ons, more reasons to consider bupa, frequently asked questions.

Destinations

Our Verdict

- Enjoy the flexibility to pick between a wide range of policies and set your own trip cancellation limit

- If you're involved in an emergency while you're overseas, you can enjoy peace of mind you can contact Allianz Global Assistance for help at any time – 7 days a week.

- Bupa health insurance members can score a 15% discount on their travel insurance.

- Bupa's COVID-19 coverage is limited in comparison with brands such as Fast Cover and Southern Cross Travel Insurance.

- Its cover limit of $10,000 for theft or damage to luggage and personal belongings is decent, but some competitors offer $15,000.

Review by our insurance editor James Martin

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Bupa travel insurance is underwritten by Allianz. Bupa offers quality travel insurance that can bring peace of mind that you can make the most of your trip, while knowing you'll receive financial support if things do go wrong.

All policies come with a basic excess . In most cases, you'll pay this when making a claim. You have the option to vary this excess – by committing to a higher sum, you could reduce the cost of your insurance. Keep in mind that an additional $500 excess applies to Bupa's Adventure Pack and Snow Pack.

With Bupa, you can choose between a single, couple and family policy. This provider offers a cooling-off period of 14 days – you can cancel your policy within 2 weeks for a full refund.

- Overseas emergency assistance – unlimited

- Overseas medical expenses – unlimited

- Accidental death – up to $25,000 (or $50,000 with a family plan)

- Permanent disability – up to $25,000 (or $50,000 with a family plan)

- Trip cancellation costs – chosen by you

- Additional expenses – up to $50,000 (or $100,000 with a family plan)

- Travel delay expenses – up to $2,000 (or $4,000 with a family plan)

- Personal liability – up to $5 million

- Luggage, personal effects and valuables – up to $10,000 (or $20,000 with a family plan)

- Alternative transport costs – up to $5,000 (or $10,000 with a family plan)

- Travel documents, bank cards and traveller's cheques – up to $5,000 (or $10,000 with a family plan)

- Rental Vehicle Excess – up to $6,000

- Luggage & personal effects delay expenses – up to $500 (or $1,000 with a family plan)

- Theft of cash – up to $250 (or $500 with a family plan)

Additionally, Bupa offers multi-trip cover, a domestic policy and an entry-level Essentials plan. Finally, you can opt for a non-medical plan – a basic policy that's good if you want some insurance but without cover for a pre-existing condition .

- Adventure Pack . Available to those under the age of 75, this optional cover includes insurance for activities including abseiling, deep sea fishing, caving, quad bike riding, outdoor rock climbing and motorcycles/mopeds.

- Cruise Pack . Get cover while you cruise overseas and in Australian waters. In addition to features such as unlimited medical cover and unlimited evacuation cover, you can claim up to $1,000 if you need to cancel (for an unforeseen reason) any pre-booked tours.

- Snow pack . Available to those under 75, the Snow Pack comes with a range of snow sports activities including skiing and snowboarding. Overseas emergency assistance is capped at $100,000.

- Travelling when you know you are unfit or against medical advice

- Going to a country where a 'Do not travel' alert has been issued by the Australian government

- Breaking the law

- Being under the influence of alcohol or ilicit drugs

- Death, illness or injury from an existing condition (unless it's specifically covered by your policy)

- Any consequential loss or loss of enjoyment

- A loss caused by or in connection with a criminal or dishonest act

- Failure to take precautions after a public warning of strike, riot, civil commotion or natural disaster

- Driving a rental vehicle in an illegal or dangerous manner.

Be sure to read Bupa's PDS for a full list of exclusions. Learn more about travel exclusions here .

- Range of options. Bupa offers high-quality cover with a wide range of options to meet your travel needs. But you may also opt for lower-priced cover that will come with fewer and/or lower benefit limits.

- 24/7 assistance. If the unexpected happens while you’re travelling overseas, emergency help is available 24 hours a day. If you have any difficulties while you are travelling, you can contact the Emergency Assistance Hotline and you will be able to speak with one of Bupa's trained staff. You can call Bupa on +61 7 3305 7497 (overseas) or 1800 119 412 (within Australia).

- Discounts for existing members. Bupa health insurance members can receive up to a 15% discount on their travel insurance premiums.

Am I covered for pre-existing conditions?

You can get cover for some pre-existing illnesses. However, according to Bupa's policy wording, you'd need to have "disclosed the condition to Allianz Global Assistance and they have agreed in writing to include cover under your policy for the condition".

Be aware, you won't be able to get cover for pre-existing conditions under Bupa's Essentials or Non-Medical Plans.

Is there a cooling-off period?

Yes. If you change your mind about a policy, Bupa offers a 14-day cooling off period, in which time you can cancel your insurance and get a full refund, so long as you haven’t begun your travels or made a claim. If you wish to cancel or change your policy outside of this period, you can apply to Bupa online or over the phone.

How long do I have to make a claim?

If you wish to make a claim, you typically must phone Bupa within 30 days of completing or cancelling your journey.

James Martin

James Martin was the insurance editor at Finder. He has written on a range of insurance and finance topics for over 7 years. James often shares his insurance expertise as a media spokesperson and has appeared on Prime 7 News, WIN News, Insurance News, 7NEWS and The Guardian. He holds a Tier 1 General Insurance (General Advice) certification and a Tier 1 Generic Knowledge certification, both of which meet the requirements of ASIC Regulatory Guide 146 (RG146).

More guides on Finder

Bupa is an international healthcare services provider that also offers insurance to cover car, home, life and travel.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

4 Responses

I have benign irregular heart beat. cardiologist letter says fit for travel. Which cover can I buy that covers this? John

Thanks for your inquiry.

There are brands that offer travel insurance to people with heart conditions . You can compare the costs and get more details about the cover by clicking on the “Get Quote” button. It is also best to contact your chosen insurer if you want to discuss more the level of cover.

Before applying, please ensure that you read through the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Hope this helps.

Cheers, May

Do you cover missed flights due to illness? and providing you a medical certificate for proof?

Hi Michelle,

Thanks for your question. finder.com.au is a comparison service and not an insurer. Bupa Travel Insurance do provide cover for cancellation and yes you will need to be able to provide them with substantiating evidence that a claimable event did happen.

I hope this was helpful, Richard

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Travel Insurance for Pre-Existing Conditions

- What Does Travel Insurance Cover?

Why Do I Need Travel Insurance?

- Travel Insurance COVID-19

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

Home > Travel Insurance > Bupa Travel Insurance Review

Bupa Travel Insurance Review

Learn more about Bupa’s travel insurance policies to find out about their coverage and fees and compare them with other insurers today.

Fact checked

One of the world’s leading providers of insurance, Bupa offers its almost 40 million global customers protection for their health, home, and travel arrangements. In Australia, the company has about 4.7 million customers and is underwritten by CGU Insurance.

Savvy can help you compare Bupa's plans with those of other insurers in the market so you can find the best travel insurance for your next trip. You'll be able to compare everything from benefit caps to deductibles to coverage details.

Find out more about their services here before getting a quote with us today.

*Please note that Savvy does not represent Bupa for its travel insurance products.

More about Bupa travel insurance

What travel insurance policies does bupa offer.

Bupa offers four travel insurance policies, which include:

- Overseas Comprehensive: this comprehensive travel insurance policy covers you for overseas medical expenses, urgent dental work, loss of luggage and personal liability. You’re also insured against unexpectedly needing to cancel your global holiday, as long as your reason for doing so is among those covered.

- Overseas Essentials: this streamlined policy provides you with coverage for the basics including overseas dental and hospital treatment, personal liability, cancellation, and personal liability. The key difference with this policy compared to the comprehensive option is the claim limits are considerably lower.

- Domestic: Bupa offers a domestic travel insurance policy which provides you with cover for your luggage and personal items, trip delays or unexpected delays and personal liability. You may also be covered for the excess on a rental car. This domestic travel insurance is also open to seniors.

- Annual Multi-Trip Insurance: this multi-trip policy is tailored to those taking several holidays across the year. Bupa allows you to take an unlimited number of journeys over 12 months, but they individually can’t exceed 45 days. The benefits are the same as the comprehensive or domestic travel insurance policies.

However, no matter if you’re taking a holiday to the UK or just touring Australia, it’s a good idea to compare with Savvy so you can find the best travel insurance for your holiday.

What optional extras are available through Bupa?

Bupa, like many other travel insurance companies, provides optional extras for both international and domestic getaways. These include:

- Skiing and snowboarding: taking a European holiday to carve up the slopes? Bupa requires you to take out extra coverage for an additional premium so you’re covered for a range of winter sports , including skiing, snowboarding, tobogganing or tubing. This add-on covers you for emergency assistance, damage to your equipment and costs of hiring equipment.

- Adventure: deep sea fishing, caving, quad bike riding, outdoor rock climbing and motorcycles/mopeds are all covered under this extra coverage, which is available to anyone under the age of 75.

- Cruises: if you’re booked to take an international or domestic cruise, you’ll need to purchase additional coverage if you’re going with Bupa. This cover protects you from medical costs onboard the ship, ship-to-shore evacuation, cabin confinement and cancellations.

- Valuables: this optional extra allows you to increase the cover limit or expensive items you’re going to take on holiday with you. These can include cameras, camera equipment, jewellery, camping equipment or sunglasses.

What exclusions should I be aware of when buying travel insurance through Bupa?

It’s important to remember that even the most comprehensive policy draws a line at coverage in some unforeseen circumstances. As such, Bupa has a range of exclusions, including:

- Flying on a privately-chartered plane

- Taking part in a competitive sport

- Treatment for an unapproved pre-existing medical condition

- Elective surgeries

- Accidents caused by intentionally putting yourself at risk

- Knowingly travelling to a dangerous location

- Any incident that occurs while you’re driving solo

- Travelling against medical advice

If you’ve found a policy that catches your eye, make sure you review the Product Disclosure Statement (PDS) before you set your decision in stone.

What we think of Bupa travel insurance

What we like, flexible cancellation limits.

As is the case with some big-name insurers, you’re able to set your own cancellation limit on your travel insurance policy.

Discounts for health insurance members

By entering your Bupa membership number when you purchase a travel insurance policy, you can receive a 15% discount.

24/7 support

You can rest easy knowing that Bupa is available around the clock, seven days a week, should you ever find yourself in a bind when travelling abroad.

What we don't like

Pay extra for cruise cover.

Whether you’re cruising in Australian waters or setting sail around the UK, you will need to pay extra for cruise cover. Many big-name insurers offer this coverage automatically.

Modest travel delay coverage

Bupa offers a coverage limit of about $2,000 if your mode of transport is delayed. However, these limits are lower than some of their competitors.

Tough pre-existing condition requirements

Bupa's travel insurance plans automatically cover specific forms of diabetes and asthma. Still, if you have a more serious illness, like a heart problem, you need to see a doctor and get a medical assessment to be covered.

Types of travel insurance

International.

International travel insurance can offer cover for a range of events, including medical expenses, lost luggage or items, cancellation fees and more when you're overseas and a long way from home.

If you're journeying within Australia, domestic policies are designed to offer many of the same protections as international travel insurance (with the exception of medical expenses).

Single trip

The most standard and common type of travel insurance, this policy can cover you for one trip starting and ending in Australia (and is available for both international and domestic travel).

Annual multi-trip

As the name suggests, this type of travel insurance covers multiple trips over a 12-month period. Depending on your insurer, you may be able to take an unlimited number of trips up to 90 days each.

You don't have to have a return ticket booked to take out cover while you're overseas. One-way travel insurance enables you to access cover without a set end date, such as if you're moving temporarily.

You may need to take out specialist coverage if you're setting sail on a cruise. Fortunately, cruise insurance can cover emergency evacuation, cabin confinement and more.

Just because you're older doesn't mean travel insurance isn't still important. If you qualify for cover, seniors' travel insurance can offer greater peace of mind for included events while you're travelling.

Adding winter sports or ski cover to your policy can add protection against damage to your equipment, piste closure due to bad weather and activities such as back-country skiing, heliskiing and more.

Adventure sports

Looking to enjoy some adventure sports on holiday? An adventure sports pack can grant you cover for a range of activities, such as hiking, scuba diving and motorcycle or scooter riding.

Jetsetting with the whole clan in tow? Some insurers offer family travel insurance, which enables you to include yourself, your partner and your dependent children under one policy to help you save.

If you're travelling interstate or overseas with your partner (or simply another friend or family member), you may be able to access a discount by taking out a joint or duo travel insurance policy.

Why compare travel insurance with Savvy?

Reputable insurance partners, fast and convenient online process.

You can complete the quote, comparison and purchase process online through Savvy quickly and easily.

Competitive quote costs

Regardless of the type of insurance you’re looking for, we can help you compare between competitive quotes.

Frequently asked questions about Bupa travel insurance

Yes – depending on the policy you choose, Bupa may allow you to get a full or partial refund if your travel plans are derailed because of a positive COVID-19 diagnosis , resulting in having to quarantine or accruing overseas medical expenses. In some cases, you may be covered if your travel plans are impacted by government-enforced border closures.