- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

A traveler’s guide to the Chase Travel portal

Tamara Aydinyan

Julie Sherrier

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Updated 5:23 p.m. UTC Nov. 28, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

hocus-focus, Getty Images

For qualifying Chase cardholders, the easy-to-use Chase Travel℠ portal offers a flexible and convenient way to book hotels, flights, rental cars, cruises and more using points or a combination of points and cash.

What is the Chase travel portal?

A favorite among frequent travelers for its versatility and redemption options, Chase Ultimate Rewards® (UR) is one of the major transferable credit card rewards points programs and UR points are Chase’s flexible rewards currency.

The Chase travel portal works much like an online travel agency (OTA) similar to Orbitz or Priceline where you can book hotels, flights, cars, activities and cruises. But unlike a traditional OTA, with the Chase travel portal you can book travel with your Chase card’s rewards points, cash or a combination of the two.

Who can use the portal?

A handful of exclusively Chase-issued credit cards grant cardholders access to the Chase travel portal, but how you can utilize the portal and the value you can receive is card-specific.

The following credit cards are the only cards that earn Chase Ultimate Rewards points outright:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Ink Business Preferred® Credit Card * The information for the Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

But if you or a household member own at least one of the cards above, the rewards on the following cash-back credit cards can be combined with any of the cards listed above and used as Chase Ultimate Rewards points:

- Chase Freedom Flex℠ * The information for the Chase Freedom Flex℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Chase Freedom Unlimited®

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

And while the points earned cannot be combined with any of the UR-earning cards, the following pay-in-full card does have access to the Chase travel portal:

- Ink Business Premier℠ Credit Card * The information for the Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Is the portal worth using?

It’s often said that having the right travel credit card is important, but knowing how to redeem your miles and points can be as paramount as which card you use to earn them. However, not everybody has the patience or interest to learn the intricacies of different rewards programs to maximize the value of every mile and point.

So while transferring UR points to individual loyalty programs is still one of the best ways to get the most cents per point at a 1:1 basis, for those who value simplicity, the Chase travel portal offers a straightforward way to book travel, earn and redeem points and still receive a great deal. Best of all, you won’t be limited by any loyalty program or award space availability.

When transferring points, the minimum you can transfer is 1,000 points to the following UR travel partners with either the Chase Sapphire Reserve, Chase Sapphire Preferred or the Ink Business Preferred cards:

Regardless of how you’re using the Chase travel portal, it’s worth considering the pros and cons.

- The standard rate for Ultimate Rewards points when redeemed for travel through the Chase travel portal is 1 UR point = 1 cent, but can be worth significantly more with the UR-earning cards. The Chase Sapphire Reserve gets a redemption value of 1.5 cents per point through the Chase Travel℠ portal while the Chase Sapphire Preferred and Chase Ink Business Preferred cards each get 1.25 cents per point.

- Since you’re not limited to any loyalty programs, you can use your UR points to book boutique hotels that you’d otherwise only be able to book with cash.

- Flights booked through the Chase travel portal can earn frequent flyer miles and can be used toward advancing your elite status.

- You can earn a substantial amount of bonus points when booking through the Chase portal depending on the card you’re using.

- You can use a combination of points plus cash to purchase your reservation.

- Hotels booked through the Chase travel portal do not earn hotel points or credits toward elite status. Any elite status perks you’d receive if booking directly with the hotel will likely be forgone.

- If you experience any issues while traveling, you’d have to go through Chase to resolve the issue. For example, if there is a problem with your hotel reservation, you’ll have to contact a Chase representative for help resolving it since you didn’t book directly with the hotel. Dealing with a middleman during travel emergencies is less than ideal and something to be wary of when considering booking through the portal.

- Southwest Airlines flights do not show up in the UR travel portal, but can be reserved by calling the Chase Travel Center at 855-233-9462.

How to book travel through the Chase travel portal

You can access the Chase travel portal by logging into your Chase account and clicking on the Rewards balance on the right or by going to the Chase Ultimate Rewards website .

Once you’re logged in, if you have more than one UR-earning Chase card, you’ll be asked to select one to proceed with — a crucial step as each card has different earning and redemption rates.

After clicking on your selection, you will be taken to the Ultimate Rewards dashboard. If you click on the Earn / Use dropdown button, all of your Ultimate Rewards options will be presented. Click on Travel to proceed to the portal.

Once in the travel portal, you’ll have the option of selecting the type of booking you’d like to make.

From there, your user experience will be similar to any other OTA where you can search your travel options.

Because the Chase travel portal doesn’t limit you to transfer partners or loyalty programs, you’ll be able to search almost all major airlines. One notable exception is Southwest Airlines, which is still bookable using UR points but will require a phone call to the Chase Travel Center to reserve your flight.

One difference compared to a traditional OTA is the option to buy in cash, points or a combination of both.

If you’re short on points or if you’d like to offset the cash price with some points, you’re given the option to choose how to pay.

After that, you’ll be prompted to enter your traveler information and you’re all booked. However, you will have to log into the specific airline with your reservation code in order to reserve seats.

Booking hotels through the Chase travel portal is a similar process. And with the portal’s easy-to-use search function, you can find boutique hotels that would otherwise be unbookable with loyalty-program-based points.

However, if you have elite status with a hotel chain, you’ll want to book directly rather than going through the Chase portal in order to access status benefits and have that hotel stay count toward achieving a higher status. Or, you can transfer UR points to one of three UR hotel loyalty program transfer partners, including Marriott Bonvoy, World of Hyatt or IHG One Rewards.

Rental cars can also be booked through the portal in a similar fashion. And as in many cases, being aware of which card you’re booking your car rental with can make a big difference in case of an accident as both the Chase Sapphire Reserve and Chase Sapphire Preferred offer primary car insurance , an uncommon, money-saving benefit, which saves you from having to file a claim with your private car insurance carrier first.

A quick guide to the Chase Ultimate Rewards program

As some of the most sought-after flexible points, Chase Ultimate Rewards can be accrued through several avenues. The most lucrative way is by applying for Chase credit cards and earning their respective welcome bonuses — but be wary of Chase’s 5/24 rule , which blocks applicants from opening a Chase credit card if they’ve opened five or more cards from any issuer in the past 24 months.

If you have two Chase cards that earn UR points, you can then transfer the rewards earned to the card that carries the most redemption value. For example, you can open the Chase Sapphire Preferred card and then the Chase Freedom Flex and move any points earned on the Flex card to the Preferred card, which has a boosted value of 25% more when redeemed through the portal.

Looking to add more than one new credit card to your wallet? Here’s why you shouldn’t apply for multiple cards at the same time.

Outside of regular credit card spending, you can also grow your Ultimate Rewards pile by using the Chase shopping portal. By adding just one extra step to your online shopping, you can earn bonus points for your future travels.

While transferring points to partners is one option to maximize the value of your Chase Ultimate Rewards points, there are numerous other ways to use the Chase Ultimate Rewards program to your benefit. Whether it’s redeeming your points as a statement credit for eligible, rotating categories throughout the year through the “Pay Yourself Back” feature, booking special dining experiences with your points or using the portal to book your next vacation, the Chase Ultimate Rewards program’s flexibility makes it a great option regardless of your lifestyle.

Frequently asked questions (FAQs)

Chase Ultimate Rewards (UR) are Chase Bank’s flexible rewards currency that can be earned on several of its credit cards.

The Chase travel portal can be accessed through the Chase app or the Chase website. After logging in, you can select the option to book travel.

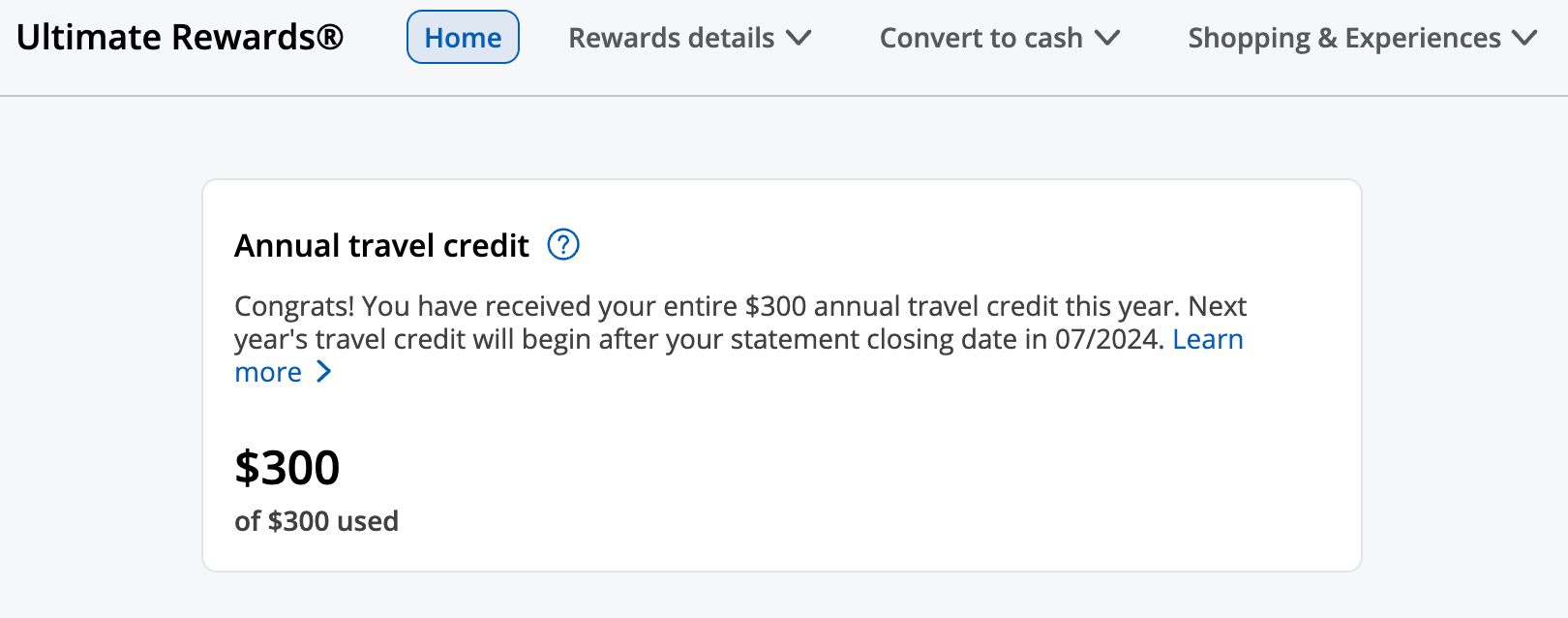

You can use your Chase travel credit, like the up to $50 annual hotel statement credit offered by the Chase Sapphire Preferred, by booking your travel through the Chase travel portal. The statement credit will automatically be applied to your account within one to two billing cycles after your purchase posts to your account — up to an annual maximum accumulation of $50.

You can redeem your Chase Ultimate Rewards directly through the travel portal with almost all major airlines with the exception of Southwest Airlines, which can be booked over the phone. With Southwest, select the flight you want at Southwest.com and then call Chase Travel Center at 855-233-9462 with the flight details.

The value you receive from the Chase travel portal will depend on the credit card you’re using. For example, if you have either the Chase Sapphire Reserve or the Chase Sapphire Preferred, your points are worth either 50% or 25% more, respectively, when redeemed for travel.

*The information for the Chase Freedom Flex℠, Ink Business Preferred® Credit Card and Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Tamara Aydinyan has been traveling the world with the help of miles and points for over a decade and enjoys teaching others to do the same. When she's not on the move, you can find her in Los Angeles or New York City, or on Instagram @deadlytravel.

Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com. She also served as an adjunct journalism instructor at the University of Texas at Austin.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

Credit Cards Lee Huffman

How to do a balance transfer with Discover

Credit Cards Louis DeNicola

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

How to use the Citi trifecta to maximize your rewards

Credit Cards Ryan Smith

- Featured Cards Opens Featured cards page in the same window.

- Card Finder Opens card finder page in the same window.

Travel Credit Cards

Start your journey today by finding the best travel credit card for your future exploration needs. Compare travel rewards benefits and offers including dining perks and new cardmember bonuses for extra points or miles.

Chase Sapphire Preferred ® credit card . Links to product page.

Chase Sapphire Preferred ® credit card card reviews (7,829 cardmember reviews) Opens overlay

New cardmember offer.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when redeemed through Chase Travel SM .

AT A GLANCE

Premium dining & travel rewards Earn 5x total points on travel purchased through Chase Travel SM , excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel Credit. Earn 3x points on dining at restaurants including eligible delivery services, takeout and dining out. Earn 2x on other travel purchases.

21.49 Min. of (8.50+12.99) and 29.99 %– 28.49 Min. of (8.50+19.99) and 29.99 % variable APR. † Opens pricing and terms in new window

$95 † Opens pricing and terms in new window

Chase Sapphire Reserve ® Credit Card . Links to product page.

Chase Sapphire Reserve ® Credit Card card reviews (4,642 cardmember reviews) Opens overlay

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel SM .

Earn 5x total points on flights and 10x total points on hotels (excluding The Edit℠) and car rentals when you purchase travel through Chase Travel℠ after the first $300 is spent on travel purchases annually.

22.49 Min. of (8.50+13.99) and 29.99 %– 29.49 Min. of (8.50+20.99) and 29.99 % variable APR. † Opens pricing and terms in new window

$550 annual fee † Opens pricing and terms in new window ; $75 for each authorized user † Opens pricing and terms in new window

Southwest Rapid Rewards ® Plus Credit Card . Links to product page.

Southwest Rapid Rewards ® Plus Credit Card card reviews (2,559 cardmember reviews) Opens overlay

Earn 50,000 points after qualifying purchases.

3,000 anniversary points each year. Plus, earn 2X points on Southwest ® purchases and 1X points on all other purchases.

$69 applied to first billing statement. † Opens pricing and terms in new window

Southwest Rapid Rewards ® Priority Credit Card . Links to product page.

Southwest Rapid Rewards ® Priority Credit Card card reviews Opens overlay

Receive a $75 annual Southwest ® travel credit and 7,500 anniversary points each year. Plus, earn 3X points on Southwest purchases.

$149 applied to first billing statement. † Opens pricing and terms in new window

Southwest Rapid Rewards ® Premier Credit Card . Links to product page.

Southwest Rapid Rewards ® Premier Credit Card card reviews (3,823 cardmember reviews) Opens overlay

6,000 anniversary points each year. Plus, earn 3X points on Southwest ® purchases and 1X points on all other purchases.

$99 applied to first billing statement. † Opens pricing and terms in new window

United SM Explorer Card . Links to product page.

United SM Explorer Card card reviews Opens overlay

Earn 50,000 bonus miles after qualifying purchases.

Join Us with 2x miles on United purchases, dining, and hotel stays. Plus, enjoy a free first checked bag, priority boarding and other great United travel benefits. Terms apply.

21.99 Min. of (8.50+13.49) and 29.99 %– 28.99 Min. of (8.50+20.49) and 29.99 % variable APR. † Opens pricing and terms in new window

$0 intro annual fee for the first year, then $95. † Opens pricing and terms in new window

United Quest SM Card . Links to product page.

United Quest SM Card card reviews Opens overlay

Earn 60,000 bonus miles + 500 Premier qualifying points (PQP) after qualifying purchases.

Pursue your quest SM . Enjoy a $125 annual United purchase credit, two free checked bags, priority boarding and other premium travel benefits. Plus, earn 3x miles on United purchases and 2x miles on all other travel. Terms apply.

$250 † Opens pricing and terms in new window

United Gateway SM Credit Card . Links to product page.

United Gateway SM Credit Card card reviews Opens overlay

Earn 20,000 bonus miles after qualifying purchases.

Start your adventure with 2x miles on United purchases, at gas stations and on local transit and commuting. Plus, 25% back on United inflight and Club premium drink purchases, and no foreign transaction fees. † Opens pricing and terms in new window

0% intro APR for 12 months from account opening on purchases. † Opens pricing and terms in new window After the intro period, a variable APR of 21.99 Min. of (8.50+13.49) and 29.99 %– 28.99 Min. of (8.50+20.49) and 29.99 %, † Opens pricing and terms in new window see pricing and terms for more details. † Opens pricing and terms in new window

$0 † Opens pricing and terms in new window

United Club SM Infinite Card . Links to product page.

United Club SM Infinite Card card reviews Opens overlay

Earn 80,000 bonus miles after qualifying purchases.

Travel in luxury. Enjoy United Club SM membership and 2 free checked bags. Plus, earn rewards faster with 4x miles on United purchases, and 2x miles on dining and all other travel. Terms apply.

$525 † Opens pricing and terms in new window

Aeroplan ® Card . Links to product page.

Aeroplan ® Card card reviews Opens overlay

Earn 60,000 bonus points. Earn 60,000 bonus points after you spend $3,000 on purchases in the first 3 months your account is open. That's enough to fly to another continent.

Earn points fast with Aeroplan. 3X points at grocery stores, on dining including take out and eligible delivery services and on purchases made directly with Air Canada. Plus, enjoy free first checked bag and other Aeroplan travel benefits.

21.74 Min. of (8.50+13.24) and 29.99 %– 28.74 Min. of (8.50+20.24) and 29.99 % variable APR. † Opens pricing and terms in new window

Marriott Bonvoy Boundless ® credit card . Links to product page.

Marriott Bonvoy Boundless ® credit card card reviews Opens overlay

3 Free Night Awards Earn 3 Free Night Awards (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening. Certain hotels have resort fees.

Earn Unlimited Marriott Bonvoy ® points and get free stays faster. Earn points on every purchase and up to 17X total points per $1 spent at hotels participating in Marriott Bonvoy ® .

$95. † Opens pricing and terms in new window

Marriott Bonvoy Bountiful ™ credit card . Links to product page.

Marriott Bonvoy Bountiful ™ credit card card reviews Opens overlay

85,000 Bonus Points Earn 85,000 Bonus Points after you spend $4,000 in purchases in your first 3 months from your account opening.

Earn Unlimited Marriott Bonvoy ® points and get free stays faster. Earn points on every purchase and up to 18.5X total points per $1 spent at hotels participating in Marriott Bonvoy ® .

Marriott Bonvoy Bold ® credit card . Links to product page.

Marriott Bonvoy Bold ® credit card card reviews Opens overlay

Earn 1 Free Night Award (valued up to 50,000 points) after you spend $1,000 on purchases in your first 3 months from account opening. Certain hotels have resort fees.

Earn Unlimited Marriott Bonvoy ® points and get free stays faster. Earn points on every purchase and up to 14X total points per $1 spent at hotels participating in Marriott Bonvoy ® .

$0. † Opens pricing and terms in new window

IHG One Rewards Premier Credit Card . Links to product page.

IHG One Rewards Premier Credit Card card reviews Opens overlay

Earn 140,000 Bonus Points After you spend $3,000 on purchases in the first 3 months from account opening.

Earn IHG One Rewards points on every purchase. Up to 26X points total per $1 spent when you stay at IHG ® hotels and resorts.

$99 † Opens pricing and terms in new window

IHG One Rewards Traveler Credit Card . Links to product page.

IHG One Rewards Traveler Credit Card card reviews Opens overlay

Earn 80,000 Bonus Points After you spend $2,000 on purchases in the first 3 months from account opening.

Earn IHG One Rewards points on every purchase. Up to 17X points total per $1 spent when you stay at IHG ® hotels and resorts.

Disney ® Premier Visa ® Card . Links to product page.

Disney ® Premier Visa ® Card card reviews Opens overlay

Disney Card Designs

$300 $400 not $300 $400 Statement Credit after you spend $1000 on purchases in the first 3 months from account opening.

Dream bigger with the Disney Premier Visa Card from Chase. Earn 5% in Disney Rewards Dollars on card purchases made directly at DisneyPlus.com, Hulu.com or ESPNPlus.com. Earn 2% on select card purchases and 1% on all other card purchases. Redeem toward most anything Disney at most Disney U.S. locations and for a statement credit toward airline purchases. Enjoy special Disney vacation financing and Disney shopping savings. Terms apply.

19.24 Min. of (8.50+10.74) and 29.99 %‐ 28.24 Min. of (8.50+19.74) and 29.99 % variable APR. † Opens pricing and terms in new window 0% promotional APR for 6 months on select Disney vacation packages from the date of purchase, after that a variable APR of 19.24 Min. of (8.50+10.74) and 29.99 %‐ 28.24 Min. of (8.50+19.74) and 29.99 %. † Opens pricing and terms in new window

$49 † Opens pricing and terms in new window

Disney ® Visa ® Card . Links to product page.

Disney ® Visa ® Card card reviews Opens overlay

$150 $250 not $150 $250 Statement Credit after you spend $500 on purchases in the first 3 months from account opening.

Reward yourself with the Disney Visa Card from Chase. Earn 1% in Disney Rewards Dollars on all card purchases. Redeem toward most anything Disney at most Disney locations in the U.S. Enjoy special Disney vacation financing and Disney shopping savings. Terms apply.

19.24 Min. of (8.50+10.74) and 29.99 %– 28.24 Min. of (8.50+19.74) and 29.99 % variable APR. † Opens pricing and terms in new window 0% promotional APR for 6 months on select Disney vacation packages from the date of purchase, after that a variable APR of 19.24 Min. of (8.50+10.74) and 29.99 %– 28.24 Min. of (8.50+19.74) and 29.99 %. † Opens pricing and terms in new window

World of Hyatt Credit Card . Links to product page.

World of Hyatt Credit Card card reviews Opens overlay

Earn up to 60,000 Bonus Points after qualifying purchases.

Turn your purchases into more free nights at Hyatt with 9X total points per $1 spent at Hyatt hotels & resorts. Plus, get 1 free night and 5 tier qualifying night credits toward status each year.

British Airways Visa Signature ® card . Links to product page.

British Airways Visa Signature ® card card reviews Opens overlay

Earn 75,000 Bonus Avios Earn 75,000 Avios after you spend $5,000 on purchases within the first 3 months of account opening.

Earn 5 Avios for every $1 spent on gas, grocery stores and dining for the first 12 months of account opening or up to $10k. These category purchases normally earn 1 Avios. Earn 3 Avios for every $1 spent on British Airways, Aer Lingus and Iberia purchases, and earn 2 Avios for every $1 spent on hotel accommodations booked directly with the hotel.

Aer Lingus Visa Signature ® card . Links to product page.

Aer Lingus Visa Signature ® card card reviews Opens overlay

Earn 5 Avios for every $1 spent on gas, grocery stores and dining for the first 12 months of account opening or up to $10k. Normally, these category purchases earn 1 Avios. Earn 3 Avios for every $1 spent on Aer Lingus, British Airways, and Iberia purchases, and 2 Avios for every $1 spent on hotel accommodations.

Iberia Visa Signature ® card . Links to product page.

Iberia Visa Signature ® card card reviews Opens overlay

Earn 5 Avios for every $1 spent on gas, grocery stores and dining for the first 12 months of account opening or up to $10k. These category purchases normally earn 1 Avios. Earn 3 Avios for every $1 spent on Iberia, Aer Lingus, and British Airways purchases, and 2 Avios for every $1 spent on hotel accommodations.

Ink Business Preferred ® Credit Card . Links to product page.

Ink Business Preferred ® Credit Card card reviews Opens overlay

100,000 bonus points after you spend $8,000 on purchases in the first 3 months after account opening. That's $1,000 cash back or $1,250 toward travel rewards when you redeem through Chase Travel SM .

Reward your business with flexible and rich rewards. Earn 3X points on shipping and other select business categories.

21.24 Min. of (8.50+12.74) and 29.99 %– 26.24 Min. of (8.50+17.74) and 29.99 % variable APR. † Opens pricing and terms in new window

IHG One Rewards Premier Business Credit Card . Links to product page.

IHG One Rewards Premier Business Credit Card card reviews Opens overlay

Earn up to 175,000 bonus points Earn 140,000 Bonus Points after spending $4,000 in the first 3 months from account opening. Plus, earn 35,000 Bonus Points after spending a total of $7,000 in the first 6 months from account opening.

United SM Business Card . Links to product page.

United SM Business Card card reviews Opens overlay

Earn 75,000 bonus miles after qualifying purchases.

Earn 2x miles on United purchases, dining, at gas stations, office supply stores and on local transit and commuting. Plus, enjoy a free first checked bag, priority boarding and other great United travel benefits. Terms apply.

$0 intro annual fee for the first year, then $99. † Opens pricing and terms in new window

United Club SM Business Card . Links to product page.

United Club SM Business Card card reviews Opens overlay

Earn 50,000 bonus miles + 1,000 Premier qualifying points (PQP) after qualifying purchases.

Travel in luxury. Enjoy United Club SM membership and 2 free checked bags. Plus, earn rewards faster with 2x miles on United purchases and 1.5x miles on all other purchases. Terms apply.

$450 † Opens pricing and terms in new window

Southwest Rapid Rewards ® Performance Business Credit Card . Links to product page.

Southwest Rapid Rewards ® Performance Business Credit Card card reviews Opens overlay

Earn 80,000 points after you spend $5,000 on purchases in the first 3 months your account is open.

Earn 4X points on Southwest ® purchases and 2X points on purchases for your business in select categories. Plus, 9,000 anniversary bonus points each year.

$199 applied to first billing statement. † Opens pricing and terms in new window

Southwest Rapid Rewards ® Premier Business Credit Card . Links to product page.

Southwest Rapid Rewards ® Premier Business Credit Card card reviews Opens overlay

Earn 60,000 bonus points after you spend $3,000 on purchases in the first 3 months your account is open.

Earn 3X points on Southwest ® purchases, 2X points on local transit and commuting, and 1X points on all other purchases. Plus, 6,000 anniversary points each year.

World of Hyatt Business Credit Card . Links to product page.

World of Hyatt Business Credit Card card reviews Opens overlay

Earn 60,000 Bonus Points after qualifying purchases.

Make the most of your small business spending with accelerated earning wherever you spend the most. Earn 2 Bonus Points total per $1 spent in your top three spend categories each quarter through 12/31/24, then your top two categories each quarter.

$199 † Opens pricing and terms in new window

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to Chase Sapphire Preferred Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

When does the Chase Sapphire Preferred® Card provide coverage?

Travel insurance benefits and limits on the chase sapphire preferred® card, the travel insurance benefits, explained, how do i file a claim, what if the card benefits are insufficient, the bottom line.

When travelers go abroad, many don’t think about travel insurance until something bad happens. But those who purchase their trip with the Chase Sapphire Preferred® Card are already covered for the most common travel woes.

Who qualifies for coverage under the Chase Sapphire Preferred® Card ? More important, how can you use your coverage in the worst-case scenario?

Empower yourself with the right information before you leave the country — then you'll be ready to lean on your travel insurance through Chase Sapphire Preferred® Card . Here’s what you need to know.

» Learn more: The best travel credit cards

To qualify, a portion of the trip must be purchased with the Chase Sapphire Preferred® Card or with Chase Ultimate Rewards® points earned from the card. Flight purchases made with Chase Ultimate Rewards® transferred to another program will not qualify for travel insurance benefits.

In many situations, travel insurance through the Chase Sapphire Preferred® Card extends beyond the primary cardholder. Trip cancellation, trip interruption, lost luggage and baggage delay coverage includes immediate family members, even if they aren’t traveling with the primary cardholder. However, there are limits to how many people can be covered per trip.

Rental car benefits are only given to the primary cardholder, who Chase defines as the “person to whom a U.S. credit card has been issued and their name is embossed on the card.” But if you meet the qualification requirements, any authorized drivers are also included in the rental car coverage.

» Learn more: Which Chase credit card is right for you?

We’ve included a table of all the travel insurance benefits provided by the Chase Sapphire Preferred® Card with further details about each benefit in the following sections.

Trip cancellation protection

If an event out of your control prevents you from departing for your vacation, trip cancellation benefits may help you recover some of your nonrefundable costs. When you pay for your trip using your Chase Sapphire Preferred® Card or using Chase Ultimate Rewards® points, the primary cardholder gets trip cancellation benefits up to $5,000 per trip or $10,000 per 12-month period. If multiple people are covered on the trip, the limit is $10,000 per trip or $20,000 per 12-month period.

» Learn more: Trip cancellation insurance: What you need to know

The trip cancellation benefit applies if a situation arises which prevents you from traveling on or before the departure date. Covered reasons include the accidental illness or injury to the traveler or a companion, severe weather that prevents a trip, or a change in military orders for the cardholder or their spouse or domestic partner.

Despite the name, trip cancellation doesn't mean cardholders can cancel their trip for any reason, or that all cancellations are covered. Travel arrangements canceled by a common carrier (like an airline or cruise line), tour operator or tour agency may not be covered, unless the cancellation is due to an organized strike or weather.

Trip cancellation also doesn't apply if you are in jail, have a reoccurrence of a pre-existing condition, or are “traveling or flying on any aircraft engaged in flight on a rocket-propelled or rocket launched aircraft.” Note, if the travel supplier cancels your trip but offers a credit or voucher for future travel, you will not be reimbursed by the Chase Sapphire Preferred® Card . If this scenario applies to you, you’ll need to decline the future travel credit to qualify for reimbursement under the Chase Sapphire Preferred® Card .

If you’re concerned with traveling and your reason for cancellation doesn't fall into one of the covered reasons, consider Cancel For Any Reason (CFAR) travel insurance, which is an optional add-on that you can purchase with a comprehensive stand-alone travel insurance policy.

» Learn more: The majority of Americans plan to travel in 2022

Trip interruption coverage

Trip interruption insurance kicks in after departure and protects your nonrefundable prepaid trip plans if an event during your trip results in an interruption. For example, if you’re injured a few days into your trip and need to return home, trip interruption benefits can help you get your money back on the unused portion of your hotel stay. Coverage provided by the Chase Sapphire Preferred® Card provides up to $5,000 per trip or $10,000 per 12-month period. If multiple people are covered, the limit is $10,000 per trip or $20,000 per 12-month period.

The benefit applies to any prepaid tour, trip or vacation charged to your Chase Sapphire Preferred® Card at a destination greater than one mile from your primary residence and for a trip that doesn’t exceed 60 days. Covered situations include accidental injury or illness experienced by the traveler, their companion or an immediate family member, severe weather preventing a trip, finding a primary dwelling to be uninhabitable or a quarantine imposed by a physician for health reasons.

» Learn more: Trip interruption insurance explained

Like the trip cancellation benefit, travelers can’t file a claim for common carrier-caused delays. In addition, traveling against a physician’s advice, to receive medical treatment, while on a waitlist for specific medical treatment or traveling with a pre-existing condition do not count as a trip interruption.

Trip delay protections

A delay can happen for any reason, from irregular operations to missing flight crews for aircraft. Depending on how long your flight is delayed, you could get reimbursed for your incidental costs, ranging from meals to a hotel room.

The Chase Sapphire Preferred® Card offers a trip delay benefit of up to $500 for each purchased ticket if you are delayed by 12 hours or require an overnight stay. The reimbursement can cover reasonable expenses, such as food, hotel rooms, toiletries and any medications you may need.

» Learn more: What you need to know about Chase's trip delay insurance

However, if the delay was made public before departing, you may not be covered by this benefit. Prepaid expenses are not covered under trip delay but could be covered under the trip interruption benefit.

Baggage delay reimbursement

The last thing any traveler wants is the baggage carousel to stop without their bags on it. Those who pay for their trip with the Chase Sapphire Preferred® Card automatically qualify for baggage delay benefits in the event they arrive at their final destination, but their bags do not.

If luggage is delayed by more than six hours while traveling on a common carrier (such as an airline or train line), the Chase Sapphire Preferred® Card baggage delay benefit can reimburse you for up to $100 in essential items per day the luggage is lost. The benefit maximum is five days of delayed luggage, for a total maximum benefit of $500.

Not all emergency items are covered under the benefit. Excluded essential items include contact lenses or glasses, hearing aids, business samples, jewelry, watches, electronic equipment and cell phones. In addition, travelers are only allowed to purchase one cell phone charger under the duration of the benefit.

Lost luggage coverage

The term “lost luggage” doesn’t just apply to bags that are never recovered. A luggage loss can also apply to bags damaged by an airline or certain items that are damaged inside the bag.

If your bags are damaged in transit, you could receive the actual cash value (replacement cost less depreciation) for the items lost, damaged or destroyed during handling up to $3,000. There are jewelry and electronics limits of $500 each, respectively. The benefit may also extend to repair costs for checked or carry-on luggage.

» Learn more: 4 easy ways to make sure your lost luggage is found

To qualify for the lost luggage benefit, all losses must be immediately reported to the carrier. A carrier damage report must be submitted with the claim, otherwise, it could be denied.

Auto rental collision damage waiver

The most unsung benefit of the Chase Sapphire Preferred® Card is the primary auto rental collision damage waiver. If you rent a car and pay for it with the Chase Sapphire Preferred® Card , you could receive reimbursement for damage due to collision or theft up to the actual cash value of the vehicle.

Because the insurance is primary coverage, you would not be forced to file a claim with other insurance sources before filing with the Chase. In order to use this benefit, however, renters must decline the rental company collision damage waiver or loss damage waiver. If the company forces you to purchase their collision damage waiver, you can call Chase for assistance.

Travel accident insurance

Travel accident insurance consists of two types of protections: Common carrier travel accident insurance and 24-hour travel accident insurance, both of which cover accidental death or dismemberment, loss of speech, sight or hearing that occur on a trip.

Common carrier travel accident insurance applies when a covered loss occurs when entering, exiting or riding as a passenger on an airline, bus, train, cruise ship or any other common carrier. The benefit limit is $500,000.

The 24-hour travel accident insurance covers any losses experienced beginning on the departure date and ending on the return date as printed on the airline ticket. The benefit limit is $100,000.

Any losses sustained while committing an illegal act, parachute jumping, or involving flights on aircraft that are not certified by the government, will void coverage.

Other assistance benefits on the Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card provides access to two helpful pay-per use services: Roadside dispatch and travel and emergency assistance services.

For a set price, roadside dispatch offers standard towing, tire changing, jump starting, lockout service, fuel delivery and standard winching assistance 24 hours a day, 7 days per week.

Travel and emergency assistance provides help and referral services and connects you with appropriate local emergency and assistance resources while you’re traveling, 24 hours a day, 7 days per week. Example of services include medical referrals, legal referrals, emergency transportation assistance and more. The cost of using the services are the responsibility of the cardholder.

To file a claim for any of these benefits, your claim time frame begins the day the loss happens.

It’s important to file a claim as soon as possible, as claims can take time to process and provide reimbursement.

Claim information can be found in the benefits guide provided with the Chase Sapphire Preferred® Card . In addition to filing a claim form, you must provide supporting documentation to prove your loss. This includes reports from your airline or other transportation carrier, receipts for purchases related to the loss, or other proof of items lost, damaged or stolen that may be covered.

Once a claim is approved, it can be reimbursed in as few as five days. If you have any questions, call 888-320-9961 from within the U.S. or 804-673-1691 from outside the U.S. Claims can also be filed online at Eclaimsline.com .

If you consider the benefits offered by the Chase Sapphire Preferred® Card to be inadequate or you don’t have a premium travel credit card that provides travel insurance, consider getting a comprehensive travel insurance policy to protect your trip.

To find a policy in your state, you can either check with an insurance provider that you’re already familiar with or check out an insurance comparison site, like SquareMouth.

Insurance comparison sites provide numerous policies to choose from, including travel medical insurance, long-term travel insurance, Cancel For Any Reason coverage and more. Choosing the right plan for you depends on your trip goals and the benefits you’d like to have on your vacation.

» Learn more: How to find the best travel insurance

Despite being an entry level travel rewards card, the Chase Sapphire Preferred® Card offers a solid package of free travel insurance benefits. The card includes trip cancellation, trip interruption, trip delay, baggage delay, lost luggage, auto rental collision coverage and travel accident insurance.

Yes, the Chase Sapphire Preferred® Card offers trip cancellation coverage of $5,000 per trip and $10,000 per each 12-month period. The cardholder and immediate family members are covered by the benefit even if they aren’t traveling with him/her. If more than one individual is insured under the same card and sustains a loss on the trip, the benefit limit is $10,000 per trip and $20,000 per each 12-month period.

Examples of covered reasons include an accidental injury, illness or death of you or your traveling companion, natural disasters, military orders and jury duty. Generally, the reasons must be unforeseen and extraordinary. Trip cancellation coverage is included with the Chase Sapphire Preferred® Card and applies to the primary cardholder and his/her immediate family.

It depends on which card you have. The Chase Sapphire Preferred® Card , the Chase Sapphire Reserve® and the Ink Business Cash® Credit Card are three popular travel rewards credit cards offer travel insurance benefits.

If you have a credit card that offers travel insurance, check to see if the limits are sufficient to cover you for your trip. Although many premium travel credit cards provide complimentary travel insurance, the benefits are usually below those of a standalone travel insurance policy.

Despite being an entry level travel rewards card, the

Chase Sapphire Preferred® Card

offers a solid package of free travel insurance benefits. The card includes trip cancellation, trip interruption, trip delay, baggage delay, lost luggage, auto rental collision coverage and travel accident insurance.

offers trip cancellation coverage of $5,000 per trip and $10,000 per each 12-month period. The cardholder and immediate family members are covered by the benefit even if they aren’t traveling with him/her. If more than one individual is insured under the same card and sustains a loss on the trip, the benefit limit is $10,000 per trip and $20,000 per each 12-month period.

Examples of covered reasons include an accidental injury, illness or death of you or your traveling companion, natural disasters, military orders and jury duty. Generally, the reasons must be unforeseen and extraordinary. Trip cancellation coverage is included with the

and applies to the primary cardholder and his/her immediate family.

It depends on which card you have. The

Chase Sapphire Reserve®

Ink Business Cash® Credit Card

are three popular travel rewards credit cards offer travel insurance benefits.

Travel insurance through the Chase Sapphire Preferred® Card is free. Although the limits aren’t as high as you could get on a comprehensive travel insurance plan, they may be sufficient for your trip needs. These benefits and others , not to mention its mid-tier $95 annual fee, make it a solid entry-level travel rewards credit card.

» Learn more: How to get the most from the Chase Sapphire Preferred® Card

When planning a trip, consider your trip costs and the type of coverage you’re looking for before purchasing an independent policy, as the benefits provided by the Chase Sapphire Preferred® Card may be adequate.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

IMPORTANT: Saudi Visa Issues in Less Than 12 Hours Now! Interesting Isn't it? Read More .

Travel & Explore the World!

Chase World Travel Brings Amazing Discounts & Affordable Travel For You. Like Never Before!

Packaged Tours

Book your umrah packages, saudi arabia, book your hajj packages, umrah starts at, book now & enjoy, a few words.

Chase World Travel has wholesale prices of all major international airlines and we proudly offer consolidated fares to Africa, Europe, South Pacific, Central/South America and the Indian Subcontinent. We have been in business for over 25 years and continue to provide expert service with professional agents for all our clients needs.

our customers love us

Latest reviews.

“My College friend recommended me to use Chase World Travel and now I only thank him for the amazing suggestion. Same is for you.”

Lauren Munoze

Reign supreme at king billy casino: a royal experience in canada’s igaming realm.

King Billy Casino stands as a regal beacon in Canada’s iGaming landscape, offering a majestic experience fit for royalty. Nestled within the digital realm, this esteemed online casino captivates players with its lavish offerings and unparalleled service. From its opulent design to its extensive array of games, King Billy Casino exudes an air of grandeur, attracting players seeking an elite gaming experience.

As one delves into the realm of King Billy Casino, they are greeted by a virtual palace adorned with gold accents and regal insignias, evoking a sense of grandiosity akin to stepping into a royal court. The casino’s user-friendly interface ensures seamless navigation, allowing players to easily explore its vast selection of games and features. Whether one is drawn to the allure of classic table games like blackjack and roulette or seeks the thrill of cutting-edge slots and progressive jackpots, King Billy Casino offers a diverse repertoire to satisfy every noble inclination.

Beyond its impressive repertoire of games, King Billy Casino distinguishes itself through its commitment to excellence in customer service and security. With a team of dedicated support staff available around the clock, players can rest assured that their inquiries and concerns will be addressed promptly and courteously. Moreover, the casino employs state-of-the-art encryption technology to safeguard players’ sensitive information, ensuring a secure and trustworthy gaming environment. In the realm of Canadian iGaming, King Billy Casino Canada reigns supreme, offering a majestic retreat where players can indulge in the finest entertainment fit for royalty.

Hajra Mazari

Jessica khan.

“I travelled over 8 times to Makkah and Medina but never got so much relaxed tour this time and it was all smooth.”

Ali Aftab Khan

Business deals, new york to bombay, get amazing discounts now, los angeles to hyderabad, new york to delhi, san francisco to amritsar, trending news, read latest updates, what are the 10 most visited countries in the world, how much does an australian trip cost, which is the cheapest country to visit, where is the most inexpensive place to vacation, we work with.

Should You Use a Credit Card Travel Portal?

Unlock the details of credit card travel portals and learn how to maximize your benefits.

Using a Credit Card Travel Portal

Getty Images

Using a credit card portal to book travel could help you save money and help you earn more points or redeem travel credits.

Key Takeaways

- Credit card travel portals search across multiple travel options, giving you the power to compare prices.

- You can use your credit card or rewards to book travel with your credit card issuer's travel portal.

- Some cards may offer travel credits and benefits when you book using the associated travel portal.

You have many options for booking travel, whether you want to book directly with airlines and hotels, use an online travel agency or book with your credit card's travel portal. Using a credit card travel portal may allow you to take advantage of cardholder benefits and credits and give you additional choices for your booking.

Understand how to use credit card travel portals to save money on your next trip and maybe get some elevated perks along the way – but also recognize when it doesn't make sense.

What Are Credit Card Travel Portals?

Similar to online travel agencies, such as Expedia or Booking.com, credit card travel portals are online travel booking platforms. Cardholders can use credit card travel portals to browse and book travel options, including flights, hotels, rental cars and experiences using your credit card or rewards.

Credit card travel portals include:

- American Express Travel.

- Capital One Travel.

- Chase Travel.

- Citi Travel.

Some credit cards offer cardholder savings or perks when you book travel using the issuer's credit card portal, such as travel credits or cardholder privileges, including free breakfast or late checkout.

How Credit Card Travel Portals Stack Up

When you use a credit card travel portal, the amount and method of payment may be the deciding factors in how you book. Using a credit card travel portal to book travel can save you money, but not always.

We compared a midweek economy flight from Los Angeles to New York and a weeklong stay at a three-star hotel in Manhattan. In some cases, credit card travel portals were competitive, but Expedia had the lowest overall price for flight and hotel costs on this test trip.

Still, this is just one example, and travel prices can fluctuate depending on how you book. It's always a good idea to compare all of your options.

Benefits of Credit Card Travel Portals

Booking your travel with a credit card travel portal can help you earn more points or redeem travel credits. Some examples:

- Cardholders of the Capital One Venture X Rewards Credit Card get a $300 annual travel credit for bookings through the Capital One Travel site. When booking on the Capital One Travel site, cardholders earn unlimited 10 miles per dollar on hotels and rental cars and 5 miles per dollar on flights. ( See Rates and Fees )

- With The Platinum Card ® from American Express , cardholders get a $200 annual hotel credit for prepaid Fine Hotels + Resorts or The Hotel Collection bookings with American Express Travel and earn five points per dollar on flights and prepaid hotels booked with American Express Travel. ( See Rates and Fees )

- Chase Sapphire Preferred ® Card holders get a $50 annual Chase Travel hotel credit and earn five points per dollar on Chase Travel purchases.

"Using the travel credits is huge," says JT Genter, editor in chief of rewards and travel tracking tool AwardWallet. "Card issuers are leaning more towards those only being accessible through the portal."

Credit card travel portal bookings may help your points go further, too. "Because I have a Chase Sapphire Preferred Card, when I use the (Chase) portal to book travel, my points get an extra 25% bump," says Chip Chinery, personal finance blogger at Chip's Money Tips. For example, you'd only pay 100,000 points for a flight or hotel that would require 125,000 Chase Ultimate Rewards points to book without the points boost.

Helpful features can add up to savings on credit card travel portals. For example, Capital One Travel offers a price match guarantee. Genter used the Capital One Travel price match feature on a flight from Cairo to Marrakech, Morocco. Although he booked with Capital One Travel, an online travel agency had a better price. He was able to price match with Capital One Travel to get a travel credit.

Genter points out that cardholders of The Platinum Card from American Express can take advantage of the International Airline Program for potential savings on international flights in first, business or premium economy.

You may also get benefits for booking with credit card travel portals, particularly when booking hotels. For example:

- Cardholders of The Platinum Card from American Express get elite benefits at participating hotels, including early check-in, room upgrades, breakfast for two, a $100 experience credit, complimentary Wi-Fi and guaranteed 4 p.m. check-out.

- If you have a Chase Sapphire Reserve ® , you can book The Edit properties through Chase Travel and receive benefits, including daily breakfast for two, a $100 on-property credit, room upgrades, early check-in and late check-out and complimentary Wi-Fi.

Drawbacks of Credit Card Travel Portals

Travel credits and on-property perks are compelling reasons to use a credit card travel portal. However, it pays to compare pricing among your card's portal, direct booking or an online travel agency, because the lowest-priced option depends on the trip you're taking. Also, you may forfeit some benefits, as credit card travel portals are third-party bookings.

With a third-party booking, you'll have less flexibility in customer service and cancellation than you would if you booked directly. For example, if you're dealing with a delayed flight and need service from the airline, you may be directed to the travel portal customer service. You may have limited options for cancellation and how you get your money or rewards back.

Another major point to consider with third-party bookings: You generally won't be able to earn points or miles with the airline or hotel, though you can earn points with your card. Additionally, you may not be able to use elite benefits for any status you hold. For example, if you have Hilton Honors status that entitles you to a daily food and beverage credit, you're not likely to get it when you book a stay with your credit card travel portal.

When to Use a Credit Card Travel Portal

Booking travel with a credit card travel portal can make sense in some scenarios. For instance:

- You want to compare your travel options across multiple airlines or hotels in the portal.

- You have a travel credit available that can only be redeemed through the issuer's travel portal.

- You have rewards you want to redeem on the portal, and booking this way offers a good redemption value.

- You want to take advantage of benefits, such as elite hotel perks that you can get when using a credit card travel portal.

- Your booking options on the portal are priced lower compared with other options.

- Booking on the portal earns elevated rewards, and the prices and benefits are comparable to those of other booking options.

"It makes sense if you want to take advantage of the credits but also to earn bonus points," says Genter. "And sometimes, they have promotions such as hyper-targeted offers."

Tags: credit cards

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Radiators fail once more: Moscow suburbs residents appeal to Putin

R esidents across the Moscow suburbs are besieged by a heating problem, for which they plead direct intervention from President Vladimir Putin. These individuals have yet to experience any semblance of home heating since winter started due to a dwindling supply of heating oil. The issue, one largely avoided by local authority communication, has left residents desperate to the point of directly appealing to the president.

While plots have been uncovered to disrupt Ukraine's infrastructure for a second consecutive winter, thus depriving civilians of heating, it seems Russians are now mired in their crisis. Irony drips from the fact that those under Putin's leadership are looking to cause turmoil in Ukraine, yet at home, they face a similar predicament.

Many dwellings within the Moscow agglomeration are presently without heat. The capital's residents are desperate, directly appealing to President Putin due to a perceived lack of alternate avenues for assistance. The absence of suitable heating functionality since winter commenced pushes them towards desperation with no relief in sight.

This seems improbable, but in Russia, it appears that anything can happen.

It remains uncertain if Vladimir Putin is actively addressing the heating crisis. Some experts suggest that Russia's heating oil reserves are depleting, which negatively affects residents' quality of life. Plagued by cold radiators and plummeting winter temperatures, these citizens have directly addressed their pleas to their head of state.

This heating crisis is happening in Elektrostal, a town approximately 71 miles from Moscow.

Ironically, Russia has constantly aimed to destroy the Ukrainian infrastructure since war broke out, deliberately trying to leave Ukrainians without heating during the harsh winters, aiming to break their strong will. It's an irony they now struggle with a domestic heating crisis, particularly near Moscow, their largest and most pivotal city.

Desperate individuals are reaching out to Vladimir Putin. They question his knowledge of the heating infrastructure conditions in the Moscow suburbs and the dire situations residents face there. Sundown brings no relief from the harsh Russian winter and without heating, their houses turn cold. With elections nearing, more and more residents find themselves reaching out directly to their president.

"Since winter's start, we've been without heating. This has been a yearly occurrence for the past three years. Despite paying for heating, we don't have enough. We implore you, help us!" - these are the desperate pleas from the heavily dressed populace dealing with the Russian winter conditions.

Experts attribute the heating oil shortage to international sanctions and surging demands for diesel fuel, pivotal to military operations. Russia now grapples with a dearth of raw materials essential for boiler and heating plant operation. As supplies dwindle, houses grow cold with little hope of any immediate corrective intervention.

It would be adequate if the war ceased, residents were prioritized, and attention accorded to their welfare.

Russians report Ukrainian drone shot down near Moscow

Putin faces strategic dilemma in prolonged Ukrainian war

Former Ukrainian deputy Kywa assassinated in Moscow amidst war tensions

Small Business Trends

10 best business travel management companies.

A good travel management company can provide you with a travel program that is tailored to your needs, as well as travel arrangers to help you with all of your travel arrangements. They can also provide you with helpful tips and advice for business travelers. If you’re looking for the best travel management services for your business, then look no further than the following 10 companies.

What are Business Travel Management Companies and What do They Offer Business Travelers?

BTMCs, provide services to their corporate clients to help manage their business travel. This can include providing software that tracks the expenses and itineraries of traveling employees, booking flights and hotels, arranging car rentals and other transportation, and providing customer service support during the travelers’ trip.

This can be invaluable for companies that have many employees traveling for work regularly, as it helps keep track of all the costs and logistics associated with business travel. Additionally, BTMCs can often negotiate lower rates for their clients on various travel services.

- READ MORE: Travel Risk Management Tips

Benefits of Using a Corporate Travel Management Company

There are many benefits to using a corporate management company for travel, including these four:

- Expense management. BTMCs can help businesses keep track of their spending on business travel and provide software to help manage and automate the expense reporting process.

- Business traveler support. Corporate travel management companies can provide customer support to travelers 24 hours a day, 7 days a week. This can be helpful in the event of an emergency or last-minute changes to travel plans.

- Travel management solution. BTMCs can provide businesses with a complete travel management solution that includes booking flights and hotels, arranging transportation, and providing customer support.

- Lower travel costs. BTMCs often have access to discounts on flights, hotels, and other travel services that they can pass on to their clients.

How to Grow Your Corporate Travel Program

A company can grow its business travel program in a few ways, including using a business management company for travel. Business travel arrangers can help to make travel easier and more efficient for employees, which can save the company time and money.

You can also educate employees on the benefits of using a travel management company in the travel program. And you can encourage employees to book their travel early.

General Criteria for Choosing the Best Business Travel Management Company- Our Methodology

Selecting the right business travel management company is crucial for streamlining your corporate travel needs. To assist you in this important decision, here are some general criteria to consider, along with a scale indicating their relative importance:

1. Expertise and Industry Experience (9/10):

- Extensive experience in corporate travel management.

- In-depth knowledge of the travel industry and its trends.

- Proven track record of successfully handling business travel for clients.

2. Cost Efficiency (9/10):

- Competitive pricing and cost-effective solutions.

- Ability to negotiate discounts with airlines, hotels, and other service providers.

- Transparent pricing structures with no hidden fees.

3. Traveler Support and Assistance (9/10):

- 24/7 availability for traveler support.

- Access to a dedicated travel advisor or consultant.

- Quick response time to resolve travel-related issues.

4. Technology and Booking Tools (7/10):

- User-friendly online booking platforms.

- Integration with expense management systems.

- Mobile apps for easy on-the-go bookings and itinerary access.

5. Customization and Flexibility (7/10):

- Tailored travel solutions to meet your specific business needs.

- Ability to accommodate last-minute changes or adjustments.

- Flexible policies that align with your company’s travel policy.

6. Traveler Well-being and Safety (9/10):

- Implementation of traveler safety measures and risk management.

- Access to real-time updates and alerts during travel.

- Compliance with health and safety regulations, especially during emergencies.

7. Reporting and Analytics (7/10):

- Access to detailed reporting on travel expenses and patterns.

- Analytics tools to help identify cost-saving opportunities.

- Insights into traveler behavior and preferences for future improvements.

8. Global Reach and Network (7/10):

- A wide network of partners and suppliers worldwide.

- Capabilities to manage international travel seamlessly.

- Knowledge of regional travel nuances and requirements.

9. Client References and Testimonials (7/10):

- Positive feedback and references from current clients.

- Case studies showcasing successful travel management experiences.

- Reputation and credibility within the industry.

10. Sustainability and Environmental Responsibility (5/10):

- Commitment to sustainable and eco-friendly travel practices.

- Options for carbon offset programs or eco-conscious travel choices.

- Alignment with your company’s sustainability goals.

The 10 Best Travel Management Companies for Business Travel

As businesses increasingly shift to a global marketplace, the need for efficient and cost-effective travel management has become more important than ever.

In this new era of globalization, organizations are looking for travel managers who can help them navigate the higher prices and complex logistics of doing business internationally. Here are ten of the best travel management companies for businesses of all sizes:

1. TravelBank

TravelBank offers a comprehensive corporate travel management solution with extensive industry experience that includes expense reports, money management, and booking. With TravelBank, businesses can save time and money while ensuring that their employees have a safe and seamless travel experience.

2. AMEX GBT

If you’re looking for an efficient and reliable way to handle your business travel, AMEX GBT is a great option with a fantastic reputation. Their risk alerts and direct communication during disruptions make them a dependable choice, while their pre-negotiated rates can save you money.

Plus, their customer care operates at a rapid 15-second response time, so you can always get help when you need it. And if you need to cancel your trip last minute, FlexiPerk can get you up to 80% of your money back.

3. SAP Concur

SAP Concur is a comprehensive solution for businesses looking to manage their travel spending. It offers a wide range of features, including booking tools, expense reporting, and invoicing. This makes it an ideal solution for companies that want to streamline their travel process and reduce their expenses.

- READ MORE: David Alexander of SAP Concur: Automating Expense and Travel Management Sheds Light on Company Spending Issues

CWT is a 150-year-old company that has a global presence in 150 countries. So it has a fantastic reputation and a wealth of industry experience. It offers a business-to-business-for-employees platform that’s reliable and easy to use. Their myCWT app is accessible on PC and mobile devices, and it allows travelers to book flights and make reservations at 800,000+ properties at special rates.

Egencia is a travel management software that can help businesses keep track of their travelers and their travel data. This can help ensure traveler safety and a smooth travel program. Egencia also offers reports and analytics so that businesses can see how their travelers are performing and where they can make improvements.

6. BCD Travel

BCD Travel offers comprehensive travel management solutions for businesses of all sizes. With offices in 109 countries, BCD Travel is well-positioned to help businesses manage their travel needs worldwide.

Their software suite includes three separate platforms that can be customized to meet the unique needs of your business. Additionally, BCD Travel offers access to APIs to integrate with their platforms, making it easy to get the exact solution you need.

If you’re looking for a comprehensive travel solution for your business, look no further than CTM. They provide online booking tools for corporate travel, making it easy to find a hotel and car rental. With CTM, you can get your business trip organized quickly and easily.

8. TravelPerk

With the world’s largest inventory of travel options and partners with the biggest names in the business, TravelPerk can cater to your every need. Forget about hours wasted researching flights, hotels, and car rentals – let TravelPerk do all the hard work for you.

9. FCM Travel Solution

If you’re looking for great deals on business travel, FCM Travel Solution is the perfect option. With over 650,000 hotel properties and major airline partnerships, FCM can offer you specially negotiated airfares and hotel rates.

Plus, their FCM Connect suite of tools includes a powerful online booking tool and an expense management platform, making trip planning and tracking expenses a breeze.

10. TripActions

TripActions has trusted partner connections and an easy booking process that’ll have you on your way quickly and easily. Plus, if you need any help along the way, TripActions’ customer support is always happy to help.

- READ MORE: business travel tips

Factors to consider when choosing a corporate travel management company

When choosing the best corporate travel management solutions for a small business, there are a few key factors to consider.