The Man Who Turned Credit-Card Points Into an Empire

Brian Kelly, The Points Guy, has created an empire dedicated to maximizing credit-card rewards and airline miles. What are they worth in a global pandemic — and why are they worth anything at all?

Brian Kelly, the Points Guy, at J.F.K. Terminal 4 before departing on a trip to Croatia. Credit... Jonno Rattman for The New York Times

Supported by

- Share full article

By Jamie Lauren Keiles

- Published Jan. 5, 2021 Updated June 15, 2023

Listen to This Article

They came to Dubrovnik by cruise ship or Ryanair — members of a new hypermobile class of tourist, who traveled for cheap and didn’t stay long. They’d seen its walled Old Town on “Game of Thrones,” and they wanted to be there themselves, so they went. Venice, Barcelona, certain beaches in Thailand — these places had all faced their own “overtouristing” problems, but even by this standard, Dubrovnik was extreme. On busy days, tourists could outnumber permanent Old Town residents about 6 to 1. With a main thoroughfare less than a thousand feet long, this pressure on the city’s charm was overwhelming. By 2017, tourism had so overburdened the Old Town that UNESCO was threatening to revoke its World Heritage status. Mayor Mato Frankovic set out to save his city by sabotage, capping passage through the gates at 4,000 daily visitors and functionally banning new restaurants. Nevertheless, the tourists kept coming.

But then, around March 2020, they stopped. After the Diamond Princess debacle, no more cruise ships appeared in the port. Airplanes were grounded, then took flight again — ending an age of quick and easy travel and ushering in a new, slower one. Pandemic travel was arduous and impeded by knotty, sometimes contradictory governmental guidelines. To travel under these conditions required an unhinged urge to take flight and a bureaucrat’s eye for parsing fine print. Brian Kelly, the founder of a website called The Points Guy, had both — plus a few million unused frequent-flier miles. This was how, on Saturday, Aug. 7, he found himself heading from New York to Dubrovnik, to see the walled city with nobody there.

His trip began at 2 p.m. the day before, with an express nasal swab at NYU Langone Medical Center. Travelers arriving in Croatia were at that time required to present a negative coronavirus test no more than 48 hours old. Between test-processing time and travel time, the tight window posed a logistical challenge. But Kelly, as the face of the world’s most popular credit-card rewards blog, had plenty of experience interpreting strict guidelines. For 10 years, readers had come to his site for help turning terms of service into free trips. In this way, the pandemic was another day at work. That afternoon, he posted footage of his nasal swab to Instagram. Nine hours later, he shared his results: negative.

The following evening, he arrived at J.F.K. ready to board a Virgin Atlantic flight to London. The business-class ticket cost him 57,500 miles, plus $724 cash. He eased his way through the TSA PreCheck line and signed into the Delta Sky Club lounge. (The airline, he knew, had a partnership with Virgin.) A bartender announced the evening special: 10,000 points for a bottle of Dom Pérignon. On that day, The Points Guy — which publishes monthly cash valuations of the top 45 rewards currencies — had Delta miles trading at 1.1 cent each. Kelly did a quick calculation in his head: The deal was worth about $110. The same bottle of Dom at a restaurant might go for $250, or more. He ordered the Champagne.

The flight boarded at 10 p.m. Kelly counted just 12 passengers in the 44-seat business-class cabin. Everyone was wearing a mask, and some fell asleep wearing two (face and eye). “Flying during Covid is kind of like flying private,” Kelly told me later. “I had my own A350 plane.” The transfer at Heathrow went smoothly. The flight touched down in Croatia just in time. Kelly presented his negative test results.

Dubrovnik that day was near-empty and majestic, saved by disease from the lure of its own beauty. Kelly met up with his friend Mauricio, a furloughed fashion merchandiser from Miami, and they made plans to meet up with more friends and all rent a boat to hop around the nearby islands. The idea was that by the time they docked again, they’d all have been in Europe for two weeks, freeing them up to travel on to other places. This was a sort of loophole in the strict E.U. travel restrictions. Kelly knew that international travel was not, at the moment, feasible for the average Points Guy reader, but he had the points, the Covid status and the time to allow his readers to travel vicariously through him. He had no idea when the world might reopen. For now, he was content to enjoy the solitude.

“No cruise ships, no mass tourists,” he says.

Just the reigning king of cheap travel, enjoying a momentary upside to its downfall.

The seeds of cheap travel were planted in the 1970s, as U.S. airline deregulation drove down the cost (and luxuriousness) of flying. The boom would not begin for another two decades, when self-book travel websites curtailed travel agents’ power, removing considerable friction from the market and allowing the consumer to take flight more casually. In 2018, according to the United Nations, global tourist arrivals reached a record annual high of 1.4 billion — a 56-fold increase since the end of World War II. This boom, like all booms, had its clear-cut losers (locals, the environment) and winners (home-sharing platforms, crowdsourced review sites, wanderlusting influencers).

Somewhere in this mix is The Points Guy, and its domain is the set of novel currencies issued by airlines and credit cards. Points are ersatz money that you earn by spending real money, a form of currency hidden inside of another. And “loyalty programs,” as the broader sector is known, are businesses inside businesses. On an ordinary, nonpandemic weekday, an American might encounter half a dozen opportunities to accrue loyalty points, from morning coffee (Starbucks Rewards) to daily commute (Exxon Mobil Rewards+) to lunch break (Chipotle Rewards) to after-work errands (CVS ExtraCare points) to date night (Regal cinema’s Crown Club). The degree to which loyalty programs actually increase customer loyalty varies widely from program to program. Good programs dangle a deliberate carrot, forging customer loyalty and heightening what behavioral economists call “switching costs.” They exploit perceived thrift and a fantasy of status to make users want to earn, and thereby spend.

Within the loyalty-program space, travel and credit-card rewards are by far the most successful and well known. As one oft-cited, almost-certainly imaginary airline executive once put it, “People are willing to pay anything for a free ticket.” Travel rewards pose a compelling incentive — a shortcut to the playgrounds of the globalized elite. (Or, if not that, at least a chance to sit in the part of the airplane where cocktails are free.) And yet, as rewards programs have multiplied, the earned point has grown increasingly complex and fungible: A Chase Ultimate Rewards point, worth about 2 cents as I write, can also be converted to a British Airways mile, which in turn can be transferred to Iberia Plus, or cashed out for a ticket on Cathay Pacific, or used to book a rental car with Hertz. The Points Guy helps readers navigate this web.

Since 2010, The Points Guy has published over 30,000 blog posts: hotel, airline and cruise-ship reviews, next to wonkish analyses of rewards-program fine print. (Some typical headlines: “Why the Amex Gold Is the Perfect ‘In Between’ Credit Card”; “How to Get to Puerto Rico on Miles and Points”; “Why I Canceled Bora Bora Again.”) Kelly is only the face of the site; the “guy” is now voiced by a 30-person team of credit-card experts, aviation reporters and expats from legacy travel media. Older travel publications sell a daydream: crisp ocean vistas, street side cafes, European hamlets with more steeples than people. The Points Guy sells that daydream as a promise, upholding a sworn oath to help you “maximize your travel.”

This is not a false promise, at least not on an individual basis. Almost anyone with a decent credit score can get a free vacation by following the protocol outlined in the “T.P.G. Beginner’s Guide.” First, forget your debit card. Your debit card has “no point — pun intended.” It takes without giving and spends without earning. “Wouldn’t you rather know that all the money you spend is like an investment toward your next trip?”

If the answer is yes, your next step is credit. Since the chuh-CHUNK days of the Diners Club card, the credit-card industry has evolved from a substitute for checks into a passport to total convenience. The latest credit cards, known on the market as “premium cards,” charge an annual fee for access to deluxe amenities: airline lounges, free TSA PreCheck, travel reimbursements and, most crucial, points. Convertible, transferable — practically alchemical — points turn diapers and caramel macchiatos into premium status, and first-class upgrades, and over-water villas at the Conrad Maldives. Points accrue passively, without apparent work, taunting the labor theory of value by simply appearing on your monthly credit-card statement.

On The Points Guy Instagram feed, there is proof of all the ways that household-budget straw might be spun into travel gold: Honeymooners hold hands in lie-flat seats. Retirees see the Taj Mahal at last. A cancer survivor with a new lease on life strikes a pose at the world’s tallest indoor waterfall. Two dads with two kids take a family selfie, en route to a free getaway in Cancún. Three shades dominate the color palate: vitreous ocean blue, white sand and cleanable-seat-back-headrest navy. Here, the legroom goes on forever. All the rooms are suites, all the pools are infinite and anyone can live like a billionaire, so long as you play your credit cards right.

Don’t have a premium credit card yet? The Points Guy is happy to sign you up for one. This is, in fact, the site’s main source of revenue. Wander the labyrinth of guides and reviews, and soon you’ll encounter your first sign-up bonus: 60,000 for Chase Sapphire Preferred; 100,000 points for a Capital One Venture. Why should running money through this essentially arbitrary chain of transactions produce value? Does it? The Points Guy is barely concerned with such questions. With one new card, a free trip can be yours. Just enter your address and your mother’s maiden name.

The Points Guy is headquartered in New York City, in a midrise office building just north of Union Square. I went there to visit on Feb. 10, a month or so before the pandemic would devastate the U.S. travel industry. Stepping off the elevator, I felt no sense of impending collapse. The office floor whirred with bullish momentum. Inside a glass-walled conference room, a blogger pecked out posts from a converted airline seat, salvaged from a defunct Concorde turbojet.

Kelly’s office was spacious and clean, appearing mostly ceremonial. In 2012, The Points Guy was purchased by Bankrate, a consumer-finance company, which in turn was acquired by Red Ventures — a portfolio of service-y sites, including Lonely Planet, CreditCards.com, Safety.com, Reviews.com and HigherEducation.com. Kelly stayed on through both acquisitions, retaining the title of chief executive and remaining the figurehead of the brand. In a typical year, he spends about four months traveling, splitting the rest of his time between two homes in the West Village and Bucks County, Pa., where he grew up. Still, when you go on vacation for a living, the line between personal and professional life can be hard to draw. (A March 2020 Business Insider article highlighted this lack of boundaries, reporting that Kelly had made passes at freelancers and snorted cocaine in front of colleagues on a business trip to the Nobu Hotel Las Vegas. Kelly and Red Ventures denied any wrongdoing.)

A bank of shelves, behind a large and empty desk, showcased evidence of Kelly’s airport-lounge lifestyle: an unopened box of Veuve Clicquot; a scale model of a Singapore Airlines jet; two copies of “Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together ... Finally.” (The author was a guest on his podcast.) In the corner of the room, on a gray sectional sofa, Kelly, in dark-wash jeans and Gucci boots, reclined into a stockpile of novelty throw pillows. One was inspired by air-traffic-control lingo (Alpha, Bravo, Charlie, etc.). Another showed a dozen smiling Celine Dions. A third, in brassy, boldface type, asked, “DO I LOOK LIKE I FLY ECONOMY?” At 6 feet 7 inches tall, he did not. He spoke with a frank insiderishness that made me feel as if I shouldn’t, either.

On TSA PreCheck: “I haven’t waited more than five minutes in years.”

On the Concorde: “I’d rather be in a lie-flat bed for six hours than a cramped seat for three. Whose time is that valuable?”

On the diminishing thrills of success: “The joy of a 50,000-point sign-up bonus is lost when now our corporate cards earn up to two million points a month.”

Kelly found points and miles as a child. One morning in 1996, his father, a health care consultant, came to him and said: “Hey, I have all these frequent-flier miles. If you can figure out how to use them, we’ll go somewhere.” Kelly, age 13 — “closeted, gay, fabulous,” by his own description — called the US Airways customer-service line, asked a few questions in his best adult voice, then hung up and told his parents, “OK, we’re going to the Cayman Islands!” (He’d first heard about the Caribbean hideaway in John Grisham’s best-selling thriller “The Firm.”) A few months later, the family of six was wheels-up on a zero-dollar flight to paradise. Thus, a devotion to miles was born.

In college, at the University of Pittsburgh, Kelly earned US Airways Gold status flying to and from student-government conferences on the university’s dime. After graduation, he moved to New York and eventually wound up in human resources at Morgan Stanley, recruiting at college job fairs (and racking up airline miles in the process). The year after he started, the economy collapsed — a failure of too-imaginative financial widgets. Morgan Stanley downsized. Kelly found himself on the firing squad, waiting outside conference-room doors to escort the casualties down to the lobby. This was thankless, demoralizing work. The lifers sometimes cried. Kelly went home feeling drained. Miles and points became an escape — rewarding on some higher plane of human need. He learned the fine print of his corporate Amex card and earned a water-cooler reputation as “the points guy.” In spring 2010, he unveiled a simple website, where visitors could pay him for help booking vacations.

This first version of The Points Guy went online just as several economic trends converged. As the economy began to improve, credit-card companies were looking for ways to regain the customers they lost during the downturn. Chase had just poached a top executive from American Express — the reigning rewards charge card at the time — and had just introduced Chase Ultimate Rewards, a new, flexible points currency designed to draw millennials into the premium-card market. Kelly added a blog to his site in June 2010, just as many other miles hobbyists were launching credit-card blogs of their own. But only Kelly was lucky enough to come across a way to turn this passion into money. In February 2011, a distant friend who had come across the site reached out and asked Kelly to meet him for dinner.

“I thought he was asking me out on a date,” Kelly says. “He was like, ‘Let’s meet up, I can help you with your blog,’ and I was like, ‘OK, that’s like the lamest excuse.’”

The two sat down for a pinot grigio near the Morgan Stanley office in Times Square. The friend, it turned out, was an account manager at LinkShare (now Rakuten), which specialized in affiliate marketing — an online sales tactic in which a company pays a commission to bloggers for selling its product. If you wrote a blog post that got the top Google ranking for, say, “best nonstick skillet,” and put in an affiliate link to the product, you could earn money for every customer you brought in. This was a relatively novel concept in 2011. To Kelly, it seemed spammy, but what did he have to lose besides time? The friend signed him up as a Chase affiliate, and Kelly put up a blog post about the Chase United card. That first month, Kelly says, he earned $5,000 in affiliate payouts. The following month, he earned $20,000. The month after that, he earned $130,000. “I don’t like talking about numbers,” Kelly says. “But basically, it just picked up from there.”

At the time we sat down in his office, The Points Guy had reached a peak of about 12 million monthly unique readers. Up on the wall, a flat-screen TV reeled off a feed of metrics from the site. The blog, by then, had published 16 posts about what we then called the novel coronavirus, covering rerouted cruise ships and suspended flights from China weeks before most mainstream publications. Still, the outbreak remained a curiosity; none of the posts were cracking the Top 10.

The main thing on Kelly’s horizon that day was a new Points Guy app, which he hoped would be released by June, after months of delays. The app, he explained, was designed to synthesize the terms of different loyalty programs, helping people choose which transactions to put on which credit card. Beyond sign-up bonuses and regular spending, a major way to rack up points is by playing the so-called category bonuses — e.g. “5x points on dining” — which vary among cards and change all the time. Hardcore earners keep track of these rules in Excel spreadsheets, or by sticking Post-it Notes to their cards. The Points Guy app would make the chaos systematic, opening the hobby up to more casual earners.

“Mastercard now has Lyft credits. Amex has off Uber. Chase now has Lyft, too” Kelly said, trailing off. “It is dizzying — the amount of constantly changing promotions and targets.”

More dizzying than racking up points is figuring out how to spend efficiently. Most casual credit-card users think of rewards as a freebie. The Points Guy thinks in terms of cold, hard cash, and wants you to get the most freebies for your money. Beyond publishing points-to-cents valuations, the site also posts step-by-step instructions for transferring points among the currencies themselves. Most airlines and credit cards have transfer partners, and those transfer partners have their own partners. By converting points among the different programs, a traveler can arbitrage his way to better deals. This convoluted system formed incidentally, over many years, as airlines and credit cards formed ad hoc agreements. Kelly, who told me he has 25 credit cards and employs a full-time staff member to manage his and his company’s rewards, admitted he still messes up the calculus. “I’ll post on Instagram, ‘I’m using Alaska Airlines to fly American Airlines to fly to London first class,’ and people will be like: ‘Dumdum! Didn’t you realize if you transfer Amex to Etihad it’s less miles?’”

Kelly is a middleman’s middleman — an intermediary in an industry that exists to turn intermediation into profit. There are three major players in the travel-rewards game: credit cards (banks), airlines and consumers. Points, the set of novel currencies minted by airlines, transform their vague-but-strong mutual interests into something fungible. This web of partnerships can become tangled, but generally speaking, the system works like this:

Airlines issue their own frequent-flier miles, but they don’t always go directly to consumers. Just as often, the currency is sold in blocks to banks. With points in hand, a bank can then issue a “co-branded” credit card, like the Chase Southwest Rapid Rewards card, and use the incentives to attract high-value customers. In another version of this arrangement, a bank issues its own currency, like Chase Ultimate Rewards. These points can be redeemed for just about anything. The bank converts its own points into real dollars when buying the desired reward from a third-party vendor.

Points function, in most ways, as real currencies do. When airlines devalue their points — as United did recently during the pandemic to counter the glut of unspent miles — it can cause a minor shock wave, nerfing one card or supercharging another. But because travel remains such a high-value prize, what industry wonks call an “aspirational reward,” the minor fluctuations have not yet destabilized the market. With points in the mix, all three players generally win: Airlines make money selling rewards; consumers enjoy the indulgence of free travel; banks recruit new customers, who more than justify the upfront cost of acquisition.

It’s a common misconception that premium credit cards earn money mainly through interest payments and annual fees. Their meat and potatoes are interchange fees, the surcharges levied on merchants per transaction. When you pay with your credit card in a store, the owner pays the bank a percentage of your total. For certain credit cards, this fee is low — maybe 1 to 2 percent. For premium cards, like Chase Sapphire or American Express, the fees can be higher, depending on the merchant, to cover the cost of a card’s amenities. (This is partly why restaurants, which operate on thin margins, sometimes exclude American Express from the list of cards they accept.) In places outside the United States, interchange fees are generally capped, which can make rewards far less rewarding. In this way, points and miles are an all-American pastime. Only here was the margin wide enough for the coupon scheme to flourish into the kind of game The Points Guy’s readers play.

You might rightly begin the history of points with Diners Club, the first credit card, which came into use in 1950 and, through issuing monthly statements, inadvertently established a way to track and analyze consumer spending. Credit cards would eventually become an indispensable tool for administering travel-rewards programs, but it was deregulation in the 1970s that did more to establish points currencies themselves. From the Nixon administration on, think-tank types on both sides of the aisle began to advocate for regulatory reforms that decreased federal involvement in America’s largest industries. Energy was partially deregulated in 1973. Railroads began in 1976. In 1978, Jimmy Carter signed the Airline Deregulation Act, which undid federal aeronautics controls in place since 1938.

Before airline deregulation, flight maps and ticket prices were set centrally by the Civil Aeronautics Board. Because this prevented airlines from competing on price, they were forced to offer fliers deluxe amenities: full meals in coach, conversation-pit seating, attractive stewardesses in Oleg Cassini suits. Under the Airline Deregulation Act, carriers were free to determine their own prices, which could theoretically increase profits, but also introduced a new quandary: What would prevent the airline market from simply becoming a race to the bottom? Frequent-flier programs emerged as a way to reward customers for staying loyal. Certainly, the business traveler would spend a little more of his boss’s money if it meant getting something extra for himself.

“Using incentives was hardly new,” says Bob Crandall, American Airlines’ C.E.O. at the time. Supermarkets gave out S&H Green Stamps, luring customers with prizes like free toasters. In the airline industry, experiments like United’s “100,000 Mile Club” had already demonstrated some success, but the big impediment to administering such programs was keeping track of customers. (Who could say whether the John Smith who flew New York to London was the same John Smith who flew Houston to Detroit?) On this front, American had a technological advantage — a new computerized reservation system. “So we started doing some research about what kind of rewards people would like,” Crandall says. The answer, somewhat obvious in hindsight, was travel.

“The only thing people want more than cash, as an incentive, is travel,” says Hal Brierley, a consultant who helped design American’s first program. AAdvantage, as it came to be called, debuted in May of 1981 with a wave of pre-enrollment mailers directed at the airline’s top customers. From the beginning, the program was tiered, with the top prize being a free round-trip ticket. “If you flew 50,000 miles in one year,” Brierley says, “you got a first-class trip to wherever we flew, which at the time meant ‘Go to Hawaii.’ Even a business guy wants a beach in Hawaii!”

With haste, other airlines unveiled their own mileage programs. (“I credit United for having responded to the program literally over the weekend,” Brierley says.) These early miles, unlike modern points, were measures of actual distance: miles flown from A to B. Program enrollees received monthly statements, tracking their progress toward the reward. At this early stage, a free trip cost an airline almost nothing to give away. Airline seats were perishable; planes take off, full or not. By turning this so-called distressed inventory into an asset, airlines retained their most loyal customers, who more than paid them back in repeat business.

Within a few years, an estimated 75 percent of all business travelers had joined at least one frequent-flier program. The programs were free; there was no risk in joining. Consumer expectations were low, and most still saw the miles as a kind of funny money. Business sections, throughout the early ’80s, devoted column space to explaining terms of service — and complaining about blackout dates and mileage thresholds. One reporter deemed frequent-flier programs “as confusing and as complicated as Rubik’s Cube.” Another critic, the former senator Eugene J. McCarthy, took to The New York Times to complain:

I was rarely able to take advantage of the special reduced fares, given if one scheduled three months in advance, or agreed to go on Tuesday and return on Sunday, before noon; or to complete one’s round trip within the Octave of the Feast of All Saints, or of the birth of Clare Booth Luce; or buy a ticket before the spring equinox and use it before the summer solstice or, failing in that, only after the September equinox and before the winter solstice, flying west before noon and east after sundown.

The gimmick reputation of early mileage programs proved to be a hindrance, but soon a set of early adopters came to see the programs for what they were worth — or rather, what they could be worth.

In 1981, when AAdvantage was introduced, Randy Petersen was 30 and working in the corporate offices of Chess King, a groovy young-men’s mall retailer founded on the market-research proposition that teen males loved auto-racing and chess. Flying from grand opening to grand opening to reposition racks of nylon parachute pants, Petersen accrued a free trip to Hawaii, booked a room at the Sheraton Waikiki and ate dinner at the luau every single night. When he returned to the Chess King offices in New York, his co-workers gathered around his desk with questions about taking free trips of their own. Seeing latent demand in their barrage of inquiries, Petersen put in his two weeks’ notice. By 1986, he had struck out on his own as the publisher, editor and only employee of the world’s first frequent-flier magazine.

The first issue of InsideFlyer looked, in Petersen’s words, like a “bad ransom note.” Typewritten commentary on airline programs mixed with photocopied offers clipped from monthly statement mailers. Its first readers were road-warrior types — guys in wrinkled suits with Hartmann luggage — who traveled enough to earn a free trip now and then, but didn’t go out of their way to earn further. This all changed in 1988, with the debut of Delta Triple Mileage, one of the first industry experiments in driving consumers to actually fly more than they might otherwise. The promotion, which delivered on the promise of its name, shortened the free-ticket accrual time from a period of years to a period of months. A free trip to Hawaii, which cost about 30,000 miles, used to be an ambitious goal. Now, it could be earned in one-third of the distance — just two round trips from LAX to J.F.K.

For the average business traveler, Delta Triple Mileage increased the immediate value of belonging to a loyalty program. For mileage obsessives like Petersen, taking miles off the gold standard of concrete distance transformed program membership from a static, passive interest to a game that could be played. Triple Mileage gave rise to a frequent-flying frenzy, one that could be amped up even further by learning and exploiting airline-route particulars. Back then, routes were more limited, and travelers often completed the last leg of a trip with a short flight from a hub airport to a smaller regional one. To make accounting for these brief jaunts less annoying, Delta decided to compensate all flights with a minimum of 1,000 rewards miles, even when the actual distance was shorter. Under Triple Mileage, the minimum, well, tripled. And quickly, InsideFlyer readers realized that by stacking these short flights they could mint their own free trips. Flying back and forth between two short-leg cities, a rewards ticket to Hawaii could be earned in just eight continuous hours of flying. “One of the most popular ones was Dallas to Austin,” Petersen says. “People would do that eight, nine, 10 times in a day.”

In time, other airlines introduced their own “multiples” promotions, and around them, a mileage community was born. InsideFlyer eventually spawned its own online replacement — a message board called FlyerTalk — where mileage prodigies, including Brian Kelly, would come to hear the lore of their mileage ancestors. Most stories from this Wild West time have proved impossible to fact-check in hindsight. Back in the ’80s, before the T.S.A. and security theater, “the number of people that used to fly under other people’s names strictly to earn frequent-flier miles was extraordinary,” Petersen says. According to his memory, one high school basketball coach enlisted a whole team to fly under his name. “Back and forth all weekend,” he says. “Between Dallas and Austin, just so he could earn bonus miles. That’s how you push the envelope. You get greedy.”

One of the greatest points-and-miles hustles of the pre-broadband age was something called the LatinPass Run. In the lead-up to the new millennium, a small handful of Latin American airlines formed a consortium called LatinPass. For a while, it was doing OK, but then the big global airlines came in and started eating up all of the business travelers. LatinPass needed a competitive edge, so it turned to Bobby Booth, an airline marketer out of Miami.

Booth’s idea was to incentivize travel with the smaller carriers by creating a million-mile prize for flying at least one international segment on each of the LatinPass member airlines in one year. There were a bunch of exceptions and fine print, stuff involving rental cars, hotels and partner airlines, all of which amounted to a brain teaser for Petersen. In 2000, he worked out a plan for how you could do it and published an article in InsideFlyer saying, “I’m going to do it all in one weekend. Any volunteers?” Three people joined the first LatinPass Run. One was a Silicon Valley investor. One was a loan officer down in Dallas. The third was an off-duty I.R.S. agent. The foursome met up in Miami on a Friday and flew 24 hours a day — up, down, connect; up, down, connect. They got into Lima, slept on the concrete floor of the airport for two hours and then caught the first flight out to Nicaragua. There was unrest in the country at the time, Petersen recalls. “You’d look at all the soldiers all around with the machine guns, and think: We’ve been here. This qualifies. I’m not getting off. No, no, I’ll sit here for two hours while you refuel.”

In the end, the whole run cost about $1,100 per person. The million miles, via transfer partners, were worth at least three first-class international round trips. Petersen published the details of the run, and after that, LatinPass really took off. “You’d pull into Lima last flight of the day,” he says, “and you’d look over and see a couple of other Americans in the back, because we were all in coach, and you’d kind of nod your head a little bit, like ‘I know what you’re doing.’”

In the end, about 250 people earned the million-mile bonus — more than the few dozen the program had forecast. (One was the famous “Pudding Guy,” immortalized by Adam Sandler in “Punch Drunk Love.”)

“They ended up folding that venture just a few years later,” Petersen says. “Just because they couldn’t handle all the redemptions.”

LatinPass was an inflection point in loyalty-program history, marking a moment when airlines began to give more thought to the delicate math required to maintain a strong points currency. By 2005, the global pool of frequent-flier miles was accruing 10 times as fast as the open seats that made the whole system possible. That year, The Economist estimated the value of these unredeemed miles as more than the value of all the $1 bills in circulation. Consumers had embraced the frequent-flier program, but now airlines found themselves facing pressures to give away seats that would otherwise be sold. In time, more and more programs would begin selling points to banks. By turning their loyalty programs into income streams, the airlines could afford to give away more free seats. In fact, according to Evert de Boer, managing partner of an airline loyalty consulting firm, seats purchased with airline points can generate more revenue than seats purchased with cash.

Today the business of selling points is more stable and more reliably profitable than the business of actually flying people places. “Over time, airline performance is very volatile,” de Boer says. “Something happens — say, the price of oil goes up, or a competitor comes in, dumping capacity — and it constantly goes up and down, up and down, up and down ... ” Points, by contrast, are relatively calm. Recently, in the midst of the pandemic, American Airlines used the program as collateral to secure a $7.5 billion CARES Act loan. Delta did the same with SkyMiles to get $9 billon from private lenders. As in other parts of the American economy, airlines are finding ways to become financial-service providers. “There have been transactions in the past where the loyalty program was acquired or sold at a total value exceeding that of the airline,” de Boer says. “It’s the tail wagging the dog.”

Earlier this year, on March 8, I traveled to Washington, D.C., to attend Frequent Traveler University, a travel-hacker seminar series held several times a year around the world, most often in airport-hotel conference rooms. This iteration took place at the Walter E. Washington Convention Center as part of a Travel and Adventure Show that, unfortunately, coincided with the first wave of Covid travel panic. In the main hall of the convention center, two scuba instructors floated idly in an unattended demonstration pool.

I arrived at the F.T.U. conference room just in time for introductory remarks by Stefan Krasowski, a blogger who had leveraged the Delta and United mileage programs to visit every U.N. member country before his 40th birthday. Krasowski, like much of the room, was male, white, not overtly subcultural-looking. He warmed up the crowd with some lighthearted cracks about how “travel hacking” had affected his marriage. His wife, he said, had recently instituted a “one-free-hotel-lounge-meal-per-day rule.” The room laughed along in recognition.

In the mileage community, almost every relationship has one obsessive and one tolerant enabler, generally known as “Player 2.” Marriage unlocks a higher level of the game by uniting two incomes, two credit scores and two Social Security numbers. Several obsessives I spoke with joked that getting access to a spouse’s credit card was one of the best days of his or her life. Krasowski told the room that one of the most common questions he gets was, “What can I do about spouses that are interested in the spending, but not the earning?” He and his wife had begun taking an annual “spousal harmony trip.” She lays out the parameters, and he has to deliver: “Fourth of July weekend, Australia. Business class, single connection preferred, Korean Air.”

My first seminar of the day was called “Awards Worth MS-ing for.” MS, or manufactured spending, was popularized through FlyerTalk. The technique has since established itself as the foremost earnings tactic of hard-core milers. The seminar was hosted by Nick Reyes, a self-declared “rabid” points and miles collector, with an open-collar shirt and a neatly trimmed goatee. He approached the lectern, took off his fedora and rubbed some sanitizer on his hands. As someone struggled to set up the projector, he stalled for time by telling the crowd that he’d named his first son Conrad, after the Hilton luxury hotel chain. (He had already collected several complimentary Conrad-branded stuffed animals from his previous stays.)

“If you were to name your child after a hotel brand, which would you pick?” he asked.

The crowd tossed off suggestions: Regis (in homage to the St. Regis hotel chain), and Bonvoy (after the recently-merged Starwood-Marriott-Ritz-Carlton rewards program).

Soon the PowerPoint presentation was up and running. Manufactured spending, Reyes explained, is a tactic in which you buy a cash equivalent using a credit card, earn credit-card rewards points for the purchase and use the cash value to pay off the bill. A simple example might entail using your Visa credit card to buy a Mastercard prepaid gift card and then repaying the bill through an online bill-pay app (perhaps even using the gift card itself). This is a tidy way to print points, but rarely are MS schemes so obvious. Bill-pay apps, gift cards and other cash abstractions tend to come along with all kinds of piddly fees. In order for an MS scheme to turn a profit, the earning must exceed the cost of manufacture.

One of the earliest MS schemes, at this point a foundational legend of the points-and-miles community, was the dollar-coin bonanza. In 2005, in an attempt to overcome the struggling Sacagawea dollar — and to piggyback off the recent state-quarter craze — Congress passed the Presidential $1 Coin Act, introducing a new series of coins. The first, featuring George Washington’s face, went into circulation around Presidents’ Day 2007. For the next few years, by congressional mandate, a new president was minted every season — Adams, Jefferson, Madison and so on.

Nearly every venue of American consumer life is set up to dissuade the use of coins, and so the new series was a failure. In order to get the currency into circulation, the U.S. Mint started a new direct-ship program, allowing consumers to buy the coins online and have them mailed out free of charge. Before long the Mint started to notice strange buying patterns, as travel hackers discovered the program, used their credit cards to buy millions of coins, and delivered the packages straight from their mailboxes to the bank. This hustle generated an untold number of mileage millionaires, and even more big-fish tales for the points-and-miles community. Here’s one: At the first Frequent Traveler University in 2010, held at a Sheraton near La Guardia Airport, attendees broke for lunch together at a nearby Chinese restaurant, only to discover that the business was cash only. When the bill finally arrived, the waitress was surprised to discover a table piled high with golden coins. (Eventually, the Mint halted the bonanza by disallowing credit-card orders altogether.)

In my second talk of the day, called simply “Manufactured Spending,” a software engineer named Mike Graziano ran through a list of other bygone MS tactics, like paying yourself through the Amazon Pay portal or prepaying a Visa Buxx debit card. In the course of my reporting, I heard of others too: paying yourself through a Square credit-card reader; overpaying your taxes with a credit card and waiting for the I.R.S. to refund you; issuing short-term microloans to the developing world using a website called Kiva. One travel hacker I spoke with divided MS schemes into two categories: pajama spend, which you could do from your computer, and real-world spend, which took in-person work. Manufactured spending was getting harder, as credit-card algorithms became smarter at catching hackers. Increasingly, the profitable schemes involved arduous real-world effort, like driving between Walmart locations to buy money orders at a discount. Some hackers I read about online build these pit stops into their real-job commutes, as a kind of second shift. Others, a small percentage, make travel-hacking (and other arcane arbitrage schemes) a full-time occupation — reselling their points in secret online markets, against the credit-card terms of service.

Staying ahead as a manufactured spender means staying alert, and attuning yourself to particular ways that abstract financial innovations can be layered. “There are new financial products popping up every day,” Graziano assured the crowd. “Bill-pay apps are Silicon Valley-backed companies. Generally they are moving very quickly, and we are not on their radar when they put these products out. When you see that, do not hesitate.”

Legally speaking, travel hacking is not a crime, though it does lead to conflict with vendors and credit-card companies, many of which have instituted rules against MS schemes. A bank or airline has a lot of leeway to decide what abides by its program’s rules and what does not. Even if a travel-hacking scheme does not outright violate the terms of service, a company can simply decide the technique transgresses the spirit of its program. In cases like these, your rewards balances might be seized. Card issuers even institute long-term bans.

Every travel hacker I spoke with had a different relation to the morality of the hobby. Credit cards and airlines are not sympathetic victims, and this fact could be used to justify almost any ethical position. Some drew the line at exploiting credit unions. Others stopped at misrepresenting their own identities, or reselling points online for cash. Pretty much every player at this level disliked Brian Kelly and The Points Guy for one reason or another, including, but not limited to: being a sellout, beating them to the punch, getting in bed with the credit-card companies, advocating for suboptimal deals, masquerading as a consumer advocate, taking credit for a community he did not create and giving a face to a subculture that would rather remain anonymous.

Kelly admits these travel hackers are not his target audience. “I don’t want to have to go around to 10 different Targets to buy different gift cards to get points,” he says. “People called me a sellout in the beginning, like, ‘Oh, you’re just doing this for the masses.’ And yeah — I am. That’s the point.” He didn’t start The Points Guy to keep his deals a secret. “That was a business decision early on, and that’s why I think we’ve been able to grow it. We are very open about the fact that we have to make money. I have 100 employees. I can’t pay their salaries in Amex points.”

I left Washington on March 8 and arrived back home in New York City just in time to watch it shut down. That Thursday, Broadway went dark, and a prohibition on gatherings of more than 500 people was announced. In the following weeks, the schools were closed; the city’s daily Covid deaths reached a peak of more than 800, by some counts. The Points Guy, with its fluency in bureaucratic jargon, pivoted almost exclusively to parsing the daily-changing crisis plans. (Some sample headlines: “Everything You Need to Know About the U.S. European Travel Ban”; “Here’s How to Figure Out if You Qualify for a Flight Refund”; “How to Cancel an Airbnb if Your Reservation Is Affected by Coronavirus.”)

Over the months that followed, I checked in with Kelly periodically as he bounced around the world, from Palm Springs, Calif., to Antigua to Mexico City — getting massages, dining out at restaurants, updating his Instagram story throughout. When we last spoke, in November, he had just returned from two weeks in French Polynesia, where he stayed at the Conrad Bora Bora Nui and swam with humpback whales. Now back home in Pennsylvania, he was once again looking forward to the release of the Points Guy app, which had been kicked down the road to mid-2021. “I’m still confident it will change the way people think about points,” he said.

While writing this article, my own perspective on miles and points certainly changed. Through day-to-day spending — and expenses, which were later reimbursed by The New York Times — my rewards balances began to grow. At press time, I have: 3,815 in AAdvantage, 4,735 in Delta SkyMiles, 5,600 in Marriott Bonvoy, 44,485 in Southwest Rapid Rewards and 65,482 in Chase Ultimate Rewards. I hoped to end this story in a faraway place, relaxing on my own plot-concluding free vacation, but who knows when this might be possible? The more I sit home daydreaming about travel, the more skeptical I feel about the sorts of trips that points and miles tend to produce.

As corporate partnerships have grown increasingly enmeshed, rewards have come to form a worldwide hamster tube, connecting Sky Club lounges to Ritz-Carlton lobbies to Wolfgang Puck Expresses to Uber Black cars. This elite global habitat — part of our world, but also apart from it — is suggestive of our stratified economy at large, one that stays aloft through financial novelties and unfettered access to cheap money. A major reason points-and-miles trips exist is because airlines turn a more stable profit by minting their own currencies than by selling actual airline seats. The flight seems almost ancillary to the financial transaction it enables — a trend across the whole economy, where the selling of goods or services serves to enable the collection of data, the absorption of venture capital funds or the levying of hidden transaction fees. In this scheme, posting to social media, or collecting points and miles, or ordering a taxi or a gyro on your phone, is merely a gesture to keep the whole process in motion. The real moneymaking happens behind the scenes, driven by a series of exchanges where value seems conjured from nothing at all.

But of course, value always comes from somewhere. If you trace the thread back on any one of these businesses, it’s always the same deal: The poor underwrite the fantasies of the middle class, who in turn underwrite the realities of the rich. When credit cards charge high interchange fees, they pass the cost of loyalty programs on to merchants, who in turn pass it back to customers by building the fees into their sticker prices. Those who pay with credit can earn it back in points. Those who pay with debit or cash wind up subsidizing someone else’s free vacation. According to a 2010 policy paper by economists at the Federal Reserve Bank of Boston, the average cash-using household paid $149 over the course of a year to card-using households, while each card-using household received $1,133 from cash users, partially in the form of rewards. It remains a regressive transfer to this day.

Almost a year into the pandemic, we’ve seen travel plummet to practically premodern lows. According to the United Nations’ World Tourism Barometer, international tourist arrivals dropped 93 percent year-over-year last June, the beginning of the summer tourism season. The ripple effect was quick and vast, manifesting itself in idiosyncratic ways: Carbon emissions dipped; the Mona Lisa sat alone for four full months, probably her longest solitude since she was painted. In famously overtouristed Venice, reduced canal traffic and the disappearance of tourist “wastewater” output contributed to what one study called “unprecedented water transparency.” The decline in export revenue from international tourism has been, according to one estimate, eight times more severe than the loss the sector experienced following the global financial crisis. Hundreds of millions of people are out of work. The United Nations predicts travel will begin to rebound as early as the third quarter of 2021. McKinsey says we might return to pre-Covid levels by 2023. “Rebound,” to me, is a strange way of describing whatever the next tourist wave might look like. In any case, I’ll keep holding on to my points.

Jamie Lauren Keiles is a contributing writer for the magazine.

Advertisement

The Platinum Card from American Express review: premium travel with plenty of perks

Mar 14, 2024 • 17 min read

Use your Platinum Card to access the elite properties of The Hotel Collection; one of the many perks of the card © Mystockimages / Getty

This series of articles about credit cards, points and miles, and budgeting for travel is brought to you in partnership with The Points Guy .

Advertiser Disclosure: This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

Popular among jetsetters who prefer luxury travel, The Platinum Card® from American Express * is best known for its premium travel perks, lucrative welcome bonus and for offering a variety of points-earning and redemption options, including 21 airline and hotel transfer partners.

Despite having a high annual fee of $695 (see rates and fees ), you’ll find that the benefits and statement credits provided to reimburse you for certain memberships and enrollment fees offset it completely, offering a value of up to $1,584 if you take advantage of every available offer. And there are no foreign transaction fees (see rates and fees ).

In this review, we’ll explore the card’s most valuable features, how it compares to competing cards and whether or not it’s worth signing up for.

Here’s everything you need to know about the Amex Platinum Card, starting with some highlights:

- Airport lounge access: The Amex Platinum Card provides members with complimentary entry to The American Express Global Lounge Collection, including the Centurion Network and Delta Sky Club lounges (which will be limited to 10 days per year as of Feb. 1, 2025), Priority Pass lounges and Plaza Premium Lounge partner sites worldwide.

- Generous welcome bonus: New cardholders can earn 80,000 bonus points after spending $8,000 within the first six months of account opening, a terrific starting point for their rewards-earning journey .

- Statement credits provided as benefits: Cardmembers receive credits to cover Clear Plus, Equinox and Walmart+ memberships; Global Entry or TSA PreCheck enrollment; select streaming services; Uber rides and food delivery; and Saks Fifth Avenue purchases.

- Flexible redemption options: Redeem Membership Rewards (MR) points for flights, hotels, rental cars and cruises via AmexTravel.com, transfer them to one of 21 travel partners, use them to pay for gift cards or use the nifty Pay With Points feature when shopping online.

How to get started with travel points and airline miles

Overview of The Platinum Card® from American Express

Between the robust portfolio of perks, statement credits and travel insurance benefits* and the wide range of redemption options you’ll have when it’s time to exchange your Membership Rewards points, it’s no wonder The Platinum Card is one of the most sought-after travel cards on the market.

Designed with luxury-loving travelers in mind, the card provides access to over 1,400 airport lounges worldwide and an array of credits toward everything from CLEAR Plus membership to a Walmart+ subscription and a generous welcome bonus to get your points-earning journey started right.

While points-earning opportunities are most lucrative when booking flights and hotels via AmexTravel.com (5X points), you’ll still earn 5X points when purchasing flights through the airline for up to $500,000 of these purchases per calendar year and 1X points for all other spending.

As for redeeming points, you can transfer them to any of Amex’s 21 airline and hotel partners, book travel elements through AmexTravel.com, exchange them for gift cards or use them to pay for recent charges or merchandise.

The best travel credit cards

The pros and cons of the Amex Platinum Card®

- Lucrative welcome bonus: The 80,000 bonus points you’ll earn after spending $8,000 within the first six months of account opening are worth $1,600 in travel when redeemed through Membership Rewards.

- 21 travel transfer partners: There are 18 airlines and three hotel brands to choose from if you want to maximize your redemption by transferring your points to a travel partner.

- Lounge access: Cardholders receive access to over 1,400 lounges worldwide through The American Express Global Lounge Collection and its Priority Pass and Plaza Premium Lounge partners.

How to make a travel budget using points and miles

- High annual fee: It’s $695 (see rates and fees ), but that annual fee will pay for itself quickly if you maximize all the included credits, which are worth up to $1,584 in value.

- Limited earning categories: With this card, you’ll earn 5X points by booking flights directly with the airline or by reserving flights and hotels via AmexTravel.com, but just 1X points for all other purchases.

- Lots of travel-related perks: If you aren’t traveling for a while, this card might not be worth it since so many of its benefits are related to flights, hotels, lounges and credits for CLEAR Plus membership.

Best travel credit cards for hotels

The Platinum Card® from American Express benefits

The Amex Platinum is a premium rewards-earning credit card designed for those who prefer to relax in the lounge and enjoy the finer things while traveling. Here’s what makes it one of the best.

Best credit cards for international travel

Welcome bonus

New applicants can pick up 80,000 bonus points once they spend $8,000 within the first six months of account opening. While that’s worth $1,600 in travel when they’re redeemed through Amex Membership Rewards, you’ll get a better value by transferring points to one of Amex’s 21 travel partners.

Should you book travel with cash or points?

Earning rewards

Cardholders can earn 5X points by booking flights directly with the airline or through AmexTravel.com (up to $500,000 per year) or by reserving prepaid hotels — including The Hotel Collection properties, which have their own perks, like up to a $100 hotel credit, room upgrades and complimentary breakfast — through AmexTravel.com. Otherwise, you’ll pick up just 1X points for all other purchases.

In other words, if you’re a fan of AmexTravel.com, you’ll make out like a bandit. But unlike other travel credit cards , you won’t have the opportunity to earn bonus points for everyday purchases like groceries and dining or travel bookings made outside the Amex Membership Rewards portal.

How to use points and miles to save money on travel

Travel perks

This card provides no shortage of premium travel benefits, including a $200 credit for Fine Hotels + Resorts and The Hotel Collection stays reserved via AmexTravel.com and a $200 airline fee credit toward incidentals on a designated airline.

Cardmembers also receive up to a $189 credit toward CLEAR Plus membership, statement credits to cover your Global Entry or TSA PreCheck enrollment, automatic Hilton Honors Gold and Marriott Bonvoy Gold Elite status and complimentary access to over 1,400 lounges worldwide through The American Express Global Lounge Collection and its Priority Pass and Plaza Premium Lounge partners.

The card comes with baggage insurance, trip interruption and cancellation insurance, trip delay reimbursement, secondary coverage for standard car rentals, evacuation and medical transportation in an emergency and access to a global emergency assistance hotline, just in case.*

You’ll also have access to a network of travel counselors to help you plan out your trip and take care of any issues that may arise. And you’ll never have to worry about paying foreign transaction fees for using the card abroad .

Best travel credit cards for foodies

Other benefits

Besides all the trip-related benefits listed above, the Amex Platinum throws in some great perks to use even if you’re not traveling.

For starters, you’ll receive an annual credit of up to $155 ($12.95 plus tax per month) for a Walmart+ membership, up to $300 in statement credits annually for an Equinox gym membership and $100 worth of credits ($50 per six-month period) for Saks Fifth Avenue purchases.

Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

$240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

Additionally, the card offers extended warranty protection (up to one year) as well as purchase protection and return protection (each up to 90 days) and cell phone protection up to $800 per claim (two claims allowed every 12 months, with a $50 deductible)*. You’ll also get exclusive access to dining, cultural, musical and sporting events through American Express.

The best credit cards with no international fees

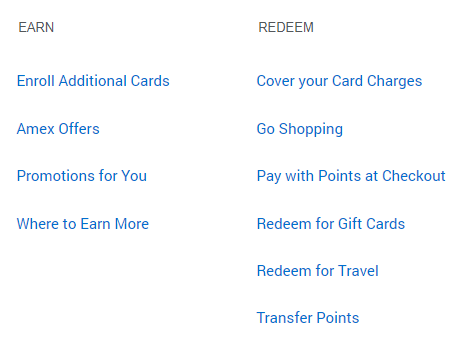

Redeeming points

Cardholders have a ton of options when it’s time to redeem Membership Rewards points, though their value ranges between 0.6 cents per point and 1 cent per point, depending on how you do it.

If you won’t be traveling anytime soon, redeem points for gift cards or use them to cover eligible charges or to pay for purchases when shopping online through MembershipRewards.com, Amazon, PayPal, Best Buy, GrubHub, Seamless or Staples, among others.

Get into the habit of checking your account (via the website or app) to see if there are Amex Offers, which you can activate for your card and use to earn even more points with every purchase.

Here’s a look at the most lucrative ways to redeem your Amex MR points:

Best credit cards for road trips

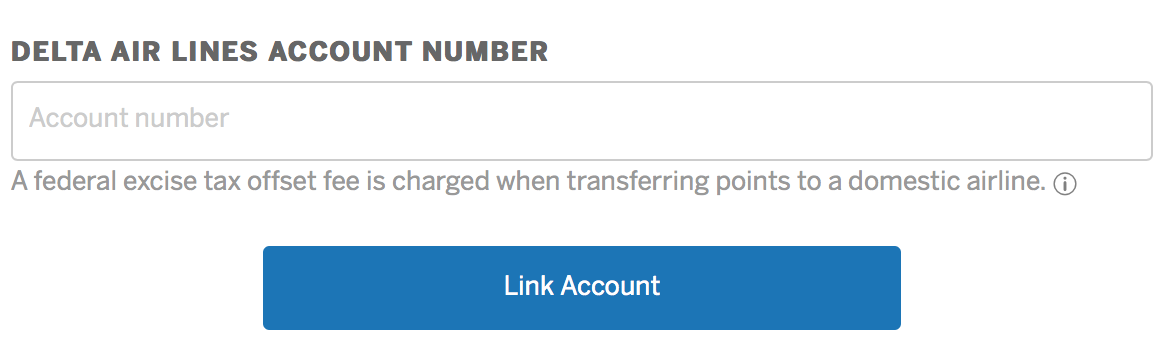

Transferring to American Express travel partners

You’ll have 21 travel transfer partners to choose from — 18 airline and three hotel loyalty programs — to get the biggest bang for your buck when redeeming your points. Check the website regularly to see if there are transfer bonuses, which would provide even more value.

Here’s a full list of American Express Membership Rewards travel partners, which each offer redemptions at a transfer ratio of 1:1 except where noted:

- Aer Lingus AerClub

- AeroMexico Rewards (1:1.6)

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- ANA Mileage Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Delta Air Lines SkyMiles

- Emirates Skywards

- Etihad Guest

- Hawaiian Airlines HawaiianMiles

- Iberia Plus

- JetBlue TrueBlue (1:0.8)

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

- Choice Privileges

- Hilton Honors (1:2)

- Marriott Bonvoy

Keep in mind that those loyalty programs are also a gateway to each airline’s alliance partners via Star Alliance, Oneworld or SkyTeam, so you could end up scoring an even better deal by taking advantage of those partnerships.

For example, you could transfer Amex MR points to Avianca LifeMiles and then use those miles to save on flights to New Zealand via United Airlines or Air New Zealand. Or, you could transfer Amex MR points to ANA Mileage Club and then use those miles to fly to Australia via United Airlines or Air Canada.

10 amazing hotels around the world you can book with points

American Express Membership Rewards travel portal

You’ll generally find that redemptions within the American Express Membership Rewards travel portal yield a value of about 1 cent per point, making them slightly less valuable than an outright transfer to a partner but still worth more than if you redeemed them for gift cards or merchandise.

That said, if you’re just starting out with points and miles and aren’t yet ready to deal with transferring points to partner loyalty programs, making a no-nonsense redemption directly through the portal is an easy option.

The best credit cards for airline miles

How The Amex Platinum compares to other cards

While the Amex Platinum is a fantastic travel rewards credit card, others offer similar premium perks — and for a lower annual fee.

Deciding which card works best for you depends on a number of factors, including your personal travel preferences, the amount of perks, points-earning opportunities and redemption options offered, and whether or not you’d rather transfer your points to loyalty program partners or book flights and hotels directly through the credit card’s travel portal.

Here’s how the Amex Platinum holds up against similar travel credit cards:

Traveling to Japan using points and miles

Amex Platinum vs. American Express® Gold Card

While you’ll have some of the same features as the Amex Platinum Card — redemption options, transfer partners and access to The Hotel Collection and exclusive event seating — the American Express® Gold Card * gives you more chances to earn points on everyday purchases, has a lower annual fee of $250 (see rates and fees ) and includes dining credits to use whether or not you’re traveling.

Its welcome bonus is lower (60,000 bonus points after spending $6,000 within the first six months of account opening), but with the Amex Gold Card, you’ll earn 4X points at restaurants worldwide and supermarkets in the US (up to $25,000, then 1X points), 3X points on flights booked directly with the airline or via AmexTravel.com and 1X points for all other purchases.

As far as statement credits, The Amex Gold Card provides up to a $120 dining credit ($10 per month) for GrubHub, Goldbelly, Wine.com, Milk Bar, The Cheesecake Factory and Shake Shack purchases, plus up to $120 in Uber cash ($10 per month) to use for rides or food delivery via Uber Eats.

It really comes down to your travel preferences, as the Amex Gold Card offers no lounge access. But if you’re not traveling for a while, it’s a great option for racking up MR points for future trips.

How to get major perks at global events and concerts with your credit card

Amex Platinum vs. Chase Sapphire Reserve®

With a $550 annual fee, similar lounge perks and a hefty welcome bonus (Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠), the Chase Sapphire Reserve is a worthy contender.

It’s greatest assets: a $300 annual travel credit, a $100 credit toward Global Entry or TSA PreCheck enrollment, more points-earning opportunities than the Amex Platinum Card and primary rental car insurance (whereas Amex only offers secondary coverage). Plus, your rewards are worth 1.5 cents per point when redeemed through Chase Travel℠.

The Chase Sapphire Reserve also offers limited-time benefits like two free years of Lyft Pink membership, one complimentary year of DoorDash/Caviar, $5 monthly DoorDash credits, a free year of Instacart and $15 monthly Instacart credits.

Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

If you prefer to redeem points with one of Chase’s 14 transfer partners, need a lower annual fee and plan to use all the Instacart and Lyft credits, the Chase Sapphire Reserve could be a better pick over the Amex Platinum.

10 amazing US hotels you can book with points

Amex Platinum vs. Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card is another worthy opponent, with a lower annual fee of $395 (see rates and fee ), a generous welcome bonus (75,000 bonus miles after spending $4,000 within the first three months of account opening) and similar premium perks.

Like the other cards, you’ll get a $100 statement credit for Global Entry or TSA PreCheck enrollment and access to exclusive cardholder dining and entertainment events. You can also book luxury accommodations via Capital One’s Premier and Lifestyle Collections, each offering its own perks.

Unlike the others, the Capital One Venture X card rewards members with 10,000 bonus miles to celebrate their anniversary. You’ll also get automatic Hertz President’s Circle elite status, primary car insurance for rentals and access to over 1,300 lounges worldwide, including Capital One Lounges and their Priority Pass and Plaza Premium Lounge partner sites.

There aren’t many downsides to this card besides its limitations. While the Chase Sapphire Reserve’s $300 annual travel credit covers all travel purchases, the $300 annual travel credit offered by Capital One Venture X can only be used toward bookings made via Capital One Travel.

While the highest-earning opportunities are limited to Capital One’s ecosystem — 10X miles for hotel and rental cars and 5X for flights booked via Capital One Travel — you’ll earn 2X miles for all other purchases. The card also has cell phone protection and lets you transfer Capital One miles to any of its 18 airline and hotel partners.

So, if you prefer Capital One Travel and its partners over Amex Membership Rewards and its partners but want to enjoy similar perks for a lower annual fee, Venture X could be a better pick.

The best credit cards for Global Entry

Is the Amex Platinum Card worth getting?

For those who prefer luxury travel, The Amex Platinum makes a great choice thanks to the premium level of perks it provides. From lounge access to extra perks and instant elite status at Hilton and Marriott hotels, there’s a reason this card is constantly topping travel rewards card lists.

Besides the generous welcome bonus, new applicants won’t have to worry about foreign transaction fees or dealing with Chase’s pesky 5/24 rule (which means your application won’t be accepted as long as you’ve already applied for five credit cards within 24 months).

If, however, your credit card strategy involves adding more Chase cards (like the Chase Sapphire Preferred® Card or Chase Sapphire Reserve ), you may want to hold off on this one until you’ve gotten those since adding the Amex Platinum Card would contribute to your list of five new cards in Chase’s eyes.

In general, the Amex Platinum Card is worth signing up for if you plan to maximize all the statement credits, if you prefer to book flights and hotels through AmexTravel.com (or flights directly with the airline) or if you prefer to transfer your points to one of its 21 travel partners.

Best credit cards for adventure travel

Is The Amex Platinum still a good credit card?

If you love airport lounges and swanky hotels, The Amex Platinum is an excellent choice. It all comes down to your travel style and whether or not you can use all the card’s benefits. If you don’t plan on traveling or maximizing the included statement credits, a different travel credit card might be a better option.

American Express Gold Card® review

What lounges can you get into with the Amex Platinum?

You’ll have access to over 1,400 lounges worldwide, including American Express Centurion® Lounges and Escape Lounges (The Centurion® Studio Partner), Plaza Premium Lounges, Delta Sky Club lounges (limited to 10 days per year as of Feb. 1, 2025), Priority Pass Select lounges, Lufthansa lounges and other Global Lounge Collection partners.

American Express Membership Rewards vs. Chase Ultimate Rewards

How much are American Express Membership Rewards points worth?

Cardholders will get the most value by transferring points to an airline or hotel partner. Membership Rewards points are worth up to 1 cent per point when redeemed for gift cards or 0.6 cents per point when exchanged for statement credits. They’re also worth anywhere from 0.7 to 1 cent per point when used to pay for online purchases or up to 1 cent per point when you use the Pay with Points feature through American Express Travel.

Best credit cards for traveling with kids

Is it hard to qualify for The Platinum Card® from American Express?

You’ll need a good to excellent credit score (670 to 850) to be accepted. Additional factors like your debt-to-income ratio, credit history and current income also come into consideration to determine your creditworthiness. Check your credit report for free on AnnualCreditReport.com to see where you stand with the main credit bureaus (Experian, TransUnion and Equifax).

Traveling to Europe using points and miles

* Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/ benefitsguide for more details. Underwritten by Amex Assurance Company.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Editorial disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

This article was first published December 2023 and updated March 2024

Explore related stories

Destination Practicalities

Apr 26, 2024 • 6 min read

Plan your visit to Saskatoon, the largest city in the Canadian province of Saskatchewan, with our first-timer's guide.

Apr 26, 2024 • 7 min read

Apr 25, 2024 • 9 min read

Apr 25, 2024 • 7 min read

Apr 25, 2024 • 6 min read

Apr 25, 2024 • 5 min read

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What’s the Value of AmEx Membership Rewards Points?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

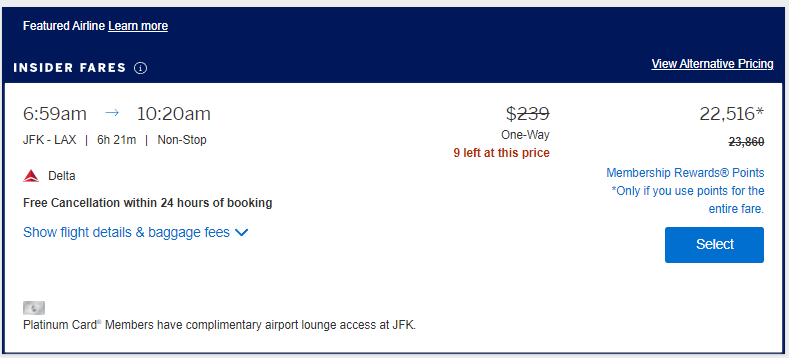

When booking travel through the portal

When transferring to partners, amex points calculator: convert points to dollars, cards that earn amex points, how did we determine our amex points value, amex points value recapped.

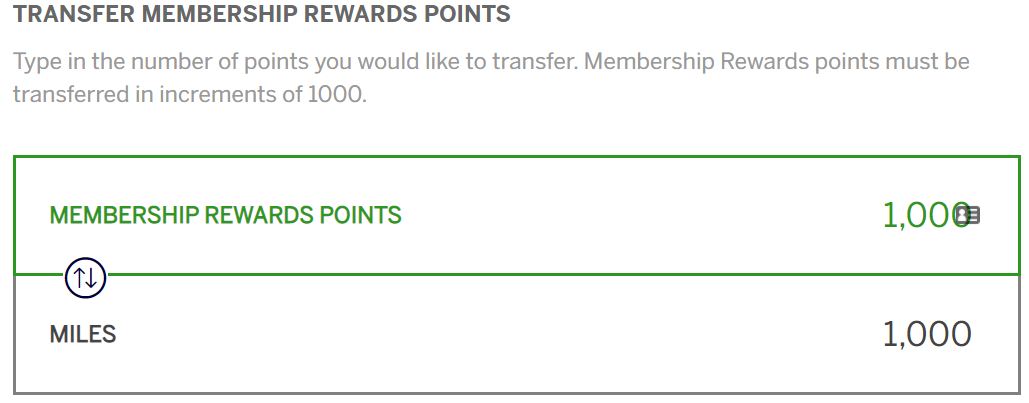

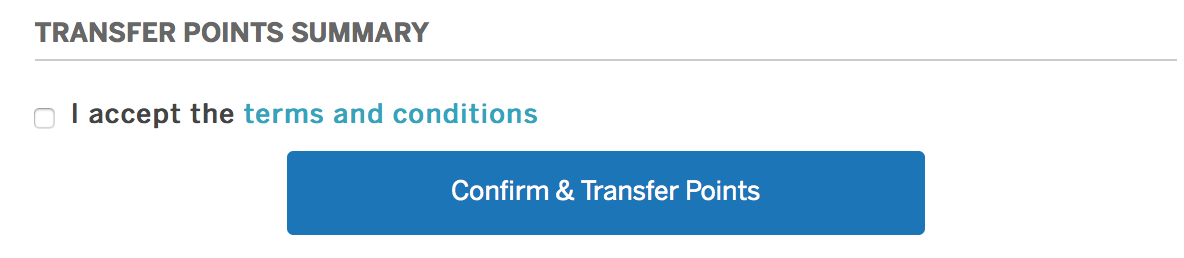

American Express Membership Points are worth 1 cent each on FHR & flights booked in the portal. Other in-portal direct redemptions are worth 0.7 cents.

The current AmEx points value is 2.8 cents when transferred to partners.

AmEx has 20 airline and hotel partners.

Flexible travel rewards like American Express Membership Rewards points are, effectively, a currency. So understanding the relative value of these points is an important consideration when earning or spending them.

So how much are AmEx points worth? Based on NerdWallet's most recent analysis , the current AmEx points value is between 1 cent when used to book travel directly and 2.8 cents when transferred to partners.

This is a big gap, and you might wonder why anyone would use these points to book travel directly if they’re so much more valuable when transferred. The short explanation is based on convenience — booking through the AmEx travel portal is a snap, whereas transferring and redeeming points can be significantly more labor intensive.

» Learn more: Best American Express credit cards

This is simple: American Express Membership Points are worth exactly 1 cent apiece when booking flights or 0.7 cent if booking hotels through the issuer's portal. This math is made explicit when booking a flight or hotel while logged in.

For example, a $210 flight will cost 21,000 points. There’s no way to “maximize” AmEx points when used in this way. You’re effectively using the points as pennies, and can book any airline or hotel room available with cash.

» Learn more: Comparing AmEx points vs. Chase Ultimate Rewards®

The big benefit here is convenience and simplicity. You don’t have to spend hours researching how to use your points or find the right transfer partner, or search for scarce award availability. You just search and book.

The big drawback is cost-effectiveness. You’re accepting a lowball value for your points as a trade-off for this convenience.

Here’s where things get more interesting — and complicated. The AmEx Membership Rewards program has some excellent transfer partners, meaning you can transfer your points to a partner and then book travel there.

AmEx has 20 airline and hotel partners, compared to Chase's 14 transfer partners . That means more access to airline sweet spots for AmEx points collectors.

With great maximization potential comes great responsibility. Understanding which AmEx transfer partners offer the best value, and which even offer flights or hotels that match your travel plans, is a major undertaking.

Here are some key programs to highlight, along with their estimated NerdWallet value.

Notice that some of the better-known programs, such as Marriott and British Airways, offer some of the lowest-value points and miles, while lesser-known programs, like Air Canada and ANA, offer some of the best.

It definitely pays to do your homework when considering AmEx transfer partnerships.

Remember to factor your travel plans into consideration, and not just transfer your points to the program with the highest-value miles. Some programs offer excellent value but limited routes and award availability.

Always search for availability on your preferred travel dates and destinations before transferring points.

» Learn more: The best first class award flights you can actually book

Use our AmEx points calculator below to convert AmEx points to dollars and determine the value of your stash of points, based on both the baseline and NerdWallet estimated values.

Another resource to help you get the best value for AmEx points is our Airline Point Transfers and Partner Award Bookings tool .

» Learn more: The best online travel booking portal might surprise you

More than a dozen American Express cards earn Membership Rewards; here are some of the most popular, including some with no annual fee :

American Express® Gold Card

Earn 4 Membership Rewards points per dollar spent at restaurants.

Earn 4 points per dollar spent at U.S. supermarkets (on up to $25,000 in spending each year, then 1 point back).

Earn 3 points per dollar spent on flights booked directly with airlines and American Express Travel.

Earn 1 point per dollar spent on all other eligible purchases.

The current welcome offer is: Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership. Terms Apply.

The Platinum Card® from American Express

Earn 5 Membership Rewards points on flights booked directly with airlines or with American Express Travel.

Earn 5 points on prepaid hotels booked on American Express Travel.

Earn 1 point on all other eligible purchases.

New members are enticed with this welcome offer: Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Terms Apply.

American Express® Business Gold Card

Earn 4x Membership Rewards points per dollar spent in two categories (from the following six) where you spend the most each billing cycle (up to the first $150,000 in combined purchases per year; then 1 point back):

Airfare purchased directly from airlines.

U.S. purchases at restaurants.

U.S. purchases at gas stations.

U.S. purchases for shipping.

U.S. purchases for advertising in select media (online, TV, radio).

U.S. purchases made directly from select technology providers of computer hardware, software and cloud solutions.

Other spending earns 1x point per dollar spent. Terms apply.

The Business Platinum Card® from American Express

Earn 5 Membership Rewards points per dollar spent on eligible flights and prepaid hotels booked through American Express — and earn 1 point for each dollar you spend on eligible purchases.

Earn 1.5 points per dollar on eligible purchases at U.S. construction material and hardware suppliers, electronic goods retailers, software and cloud system providers and shipping providers — as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

Terms apply.

Other AmEx cards that earn Membership Rewards points include:

The Blue Business® Plus Credit Card from American Express .

Business Green Rewards Card from American Express .

The Amex EveryDay® Preferred Credit Card from American Express .

Amex EveryDay® Credit Card .

American Express® Green Card .

» Learn more: The best travel credit cards