- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

5 Tips for Buying Schengen Visa Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. Decide which type of insurance you’d like

2. get multiple quotes, 3. use this as an opportunity to maximize credit card bonus points, 4. double-check the policy before purchasing, 5. consider using a credit card that provides trip insurance instead of buying a new policy, if you’re looking to buy travel insurance for a schengen visa.

Travel insurance can be a very important accompaniment to your trip, especially when you’re traveling throughout multiple countries. Europe is a prime example of this, where the border-free Schengen zone allows you to traverse multiple countries without passing passport control. Finding Schengen visa travel insurance isn’t always simple, however, and you’ll want to ensure that you have coverage regardless of your location.

There are plenty of things to think about before buying travel insurance when traveling throughout Europe, including: the coverage you’re looking for, how you’ll be paying and whether your credit card already offers insurance.

Let’s take a look at Schengen travel insurance and five easy tips for making sure you’re good to go — no matter where you travel within the region.

Although there aren’t generally any Schengen visa travel insurance requirements, there are multiple types of travel insurance coverage available depending on your needs. Consider carefully the type of coverage you’re looking for. Common types includes:

Travel medical insurance .

Trip interruption insurance .

Cancel for any reason insurance .

Trip cancellation insurance .

Lost luggage insurance .

Rental car insurance .

Accidental death insurance .

Emergency evacuation insurance.

Note that the U.K. left the Schengen zone a few years ago, so you’ll want to double-check whether coverage in the U.K. is valid for your travel insurance policy.

» Learn more: Is travel insurance worth it?

It’s always in your best interest to get multiple quotes before purchasing insurance. The amount you’ll pay will be heavily dependent on the type of coverage you receive, its length and any deductibles that you may have.

Cancel For Any Reason insurance, or CFAR, allows you to recoup most or all of your nonrefundable costs — no matter why you’ve chosen not to travel.

There are plenty of different websites that’ll allow you to compare different insurance plans such as TravelInsurance.com or SquareMouth.com (a NerdWallet partner), which will gather together multiple quotes in one easy search.

There are several details you’ll need to have on hand when looking for quotes. These include:

The total cost of your trip.

Your destination.

Your dates of travel.

The number of travelers.

The age of travelers.

Where you live.

When you booked your trip.

Once you’ve got all your information gathered together, it’s simple to find a policy that fits your need for travel insurance in the Schengen zone on one of the comparison websites.

» Learn more: What is travel insurance?

If you’re planning a vacation to Europe, hopefully you’ve already acquired a travel credit card or two. However, cards that focus on travel rewards won’t necessarily optimize insurance purchases.

» Learn more: How to choose a credit card for Europe travel

In this case, you’ll want to double down on rewards with a card that’ll maximize everyday spend. These cards will give you bonus points on all purchases, no matter their category. Great options for this include:

Capital One Venture Rewards Credit Card : Earn 2x Capital One Miles per dollar spent on all purchases.

Citi Double Cash® Card : Earn 2% cash back in the form of Citi ThankYou points on all purchases: 1% when you make your purchase and another 1% when you pay your bill. Plus, through the end of 2024, cardholders can get 5% cash back on hotel, car rentals and attractions booked through the Citi Travel portal .

Chase Freedom Unlimited® : Typically earn 1.5% cash back on all non-bonus category purchases.

The Blue Business® Plus Credit Card from American Express : Earn 2 American Express Membership Rewards on the first $50,000 in purchases each year. Terms apply.

Pair your Chase Freedom Unlimited® card with a Chase Sapphire Preferred® Card card or Chase Sapphire Reserve® card to unlock the full suite of Chase Ultimate Rewards® transfer partners. This strategy is sometimes referred to as the Chase Trifecta .

While you likely won’t be earning a ton of points for your travel insurance purchase (unless your costs are exorbitantly high), maximizing your earnings is always a good idea. Don’t leave money on the table.

» Learn more: The best travel insurance companies

Not all travel insurance policies are created equal. This is probably no great revelation, but it’s definitely something of which you’ll want to be aware.

This is especially pertinent when it comes to the current travel climate in the COVID-19 era. While you may purchase a health insurance plan that covers most medical costs, it may specifically exclude those incurred by COVID-19. And even if it does reimburse you for any hospital costs, it may not pay for a forced quarantine in the event of illness.

These are things you’ll want to check for when buying travel insurance for any trip. Be sure to read the terms and conditions of your policy carefully, and if there’s very specific coverage you’re looking for (such as that offering protection in the event you catch COVID-19), you can often use search filters to narrow down your options.

» Learn more: Is there travel insurance that covers COVID quarantine?

One great feature of travel credit cards is the complimentary trip insurance they often provide. In order for your trip to be eligible for coverage, you’ll need to use the card to pay for your trip. In exchange, however, you can receive some pretty powerful benefits without needing to pay out of pocket.

The Chase Sapphire Preferred® Card card, for example, provides primary rental car insurance. This means that when you decline the insurance offered at the counter, your entire rental will be covered against collision up to the actual value of the rental car.

What’s most powerful about this feature is that, as primary, it comes before your own personal insurance — possibly saving you expensive premium jumps and claims on your policy.

Other cards that include powerful travel insurance protection such as interruption, cancellation or baggage coverage include The Platinum Card® from American Express and the Chase Sapphire Reserve® card. Terms apply.

» Learn more: The cheapest flights to Europe on points

It makes sense to purchase travel insurance in many circumstances, especially with the uncertainty in today’s travel world. Take advantage of these five tips to make sure you’re properly prepared for your trip — whether you’re heading to France, Finland or any of the over two dozen Schengen countries.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Schengen Travel Insurance

Traveling to a schengen area.

- Double-check the expiration date on your passport, paying particular attention to the validity of childrens passports, whic are only valid for five years.

- Make sure your passport is valid for at least six months beyond your intended return date

- Always carry your passport with you when traveling to other countries within the Schengen Area. While there may not be any border checks at the time of your travel, officials have the authority to reinstate border controls at any time, without prior notice.

Schengen Travel Insurance of which AXA is a leading provider, covers you in all 27 Countries within the Schengen Territory that have abolished internal border controls for their citizens. The countries are:

Do I need travel insurance while traveling to Schengen Countries?

What do I receive with my Schengen travel insurance?

What countries are covered under my axa travel plan, how can axa help with your trip to europe, how to get a travel protection quote.

Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time

Does AXA Travel Insurance provide coverage for Schengen Visa?

AXA Gold and Platinum plans offer the necessary medical and assistance coverage in all 27 countries in the Schengen Territory. However, the Gold and Platinum plans only provide coverage up to 60 – 90days.

What should I do if I have a medical issue while in the Schengen Area?

Please contact the local authority as soon as possible. Then contact us on the phone number given with the special conditions you receive after taking out your policy. Our helpful staff will then do all we can to resolve your issue and get you treatment or travel home, in line with the conditions of your policy. If you require assistance while traveling, call us at +1312-935-1719

The embassy states that I must get an insurance certificate with Covid protection. Is this possible?

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Visa Traveler

Exploring the world one country at a time

Travel Insurance for Schengen Visa: A Comprehensive Guide

Updated: September 8, 2023

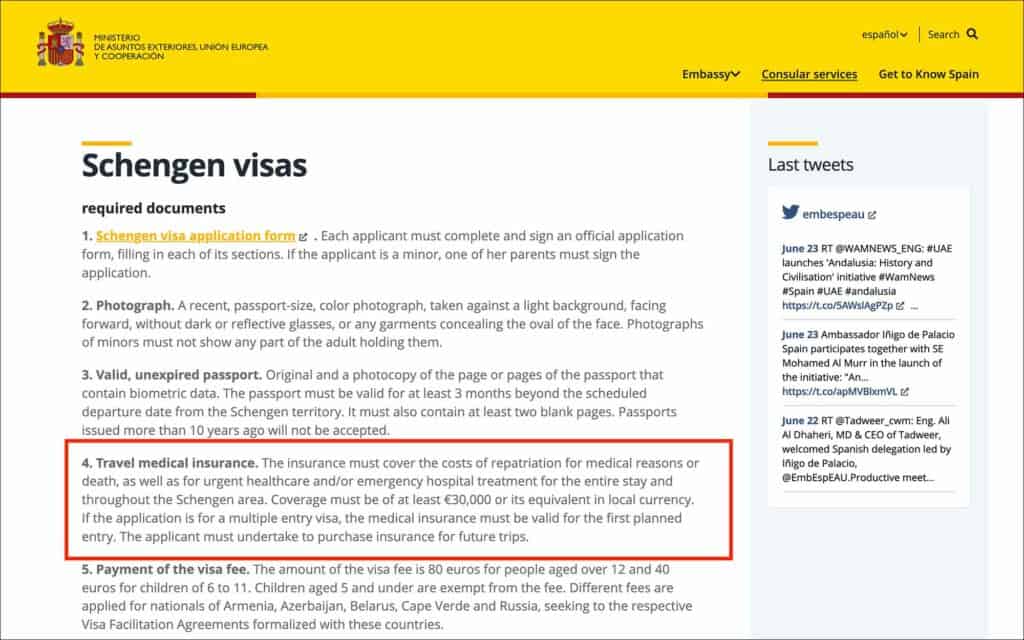

One of the key requirements of Schengen visa is the travel medical insurance. The travel insurance for Schengen visa must meet certain coverage and must be valid throughout the Schengen region for the entire duration of your stay.

With a myriad of travel insurance options in the market, picking out the right policy for your Schengen visa is difficult. In this article, you will everything about Schengen visa travel insurance and how to choose a policy for your visa.

Table of Contents

BONUS: FREE eBOOK

Enter your name and email to download the FREE eBOOK: The Secret to VISA-FREE Travel

Opt in to receive my monthly visa updates

You can unsubscribe anytime. For more details, review our Privacy Policy.

Your FREE eBook is on it’s way to your inbox! Check your email.

What is Schengen Travel Medical Insurance?

Schengen travel insurance is a type of insurance policy for travelers visiting the Schengen area. This type of travel insurance plan is designed specifically to comply with Schengen visa criteria of minimum coverage and validity requirements. Schengen travel insurance is also a mandatory requirement for obtaining a Schengen visa.

Who Requires Schengen Travel Health Insurance?

Visitors from visa-required countries planning to visit any Schengen country must require Schengen travel insurance.

If you are a traveler from a country that requires a visa to enter the Schengen zone, you must have a valid travel insurance policy. You must buy travel insurance not only for your Schengen visa application but also for any or all trips that you take to the Schengen area.

Is Travel Insurance Mandatory for Schengen Visa?

Yes, obtaining travel insurance is mandatory for Schengen visa . The European Commission’s 810/2009 Regulation mandates submitting valid travel medical insurance for Schengen visa applications.

Proof of travel medical insurance is not only mandatory for the first trip, but also for all subsequent trips for multiple-entry Schengen visas.

At the time of application, you would only need to provide proof of insurance for the first entry.

What are the Schengen Visa Insurance Requirements?

As per the Article 15 of REGULATION (EC) No 810/2009 , your Schengen visa travel insurance must meet the following three criteria:

- Must cover medical expenses up to a minimum of €30,000

- Must be valid for the entire duration of your stay

- Must be valid in all 27 Schengen countries

The policy must cover all medical expenses arising from emergency medical attention, treatment, hospitalization, emergency medical evacuation, repatriation due to medical reasons and death.

Let’s look at each of those requirements in detail.

1. Minimum Coverage

Your Schengen visa travel insurance must meet the minimum coverage requirement of €30,000. When purchasing Schengen visa travel insurance in USD, make sure the policy covers at least $50,000.

This minimum coverage is applicable for any medical expenses, emergency evacuation, and repatriation of remains.

This coverage is necessary to financially protect you in case of accidents, unforeseen illnesses, or other emergency situations that may arise during your travels in the Schengen area.

2. Validity Duration

Your travel insurance for the Schengen visa must remain valid for the entire duration of your stay in the Schengen area.

This travel insurance policy should cover you from the day you arrive in the Schengen area until the day you leave.

In terms of a multiple-entry visa, the Schengen visa insurance must be valid for the entire duration of your first entry only.

Here is an example:

You are applying for a multiple-entry visa and your trip is from Jan 01 to Jan 14. Your Schengen visa insurance must be valid from Jan 01 to Jan 14.

If you take another trip on the same visa, say from May 01 to May 14, then you must purchase another Schengen travel insurance at the time of your second trip.

For your visa application, you would only need to provide insurance for Jan 01 to Jan 14.

3. Validity in the Schengen Zone

Lastly, your Schengen visa travel insurance must be valid in all 27 Schengen countries. This is to make sure that you have coverage regardless of which Schengen country you visit during your trip.

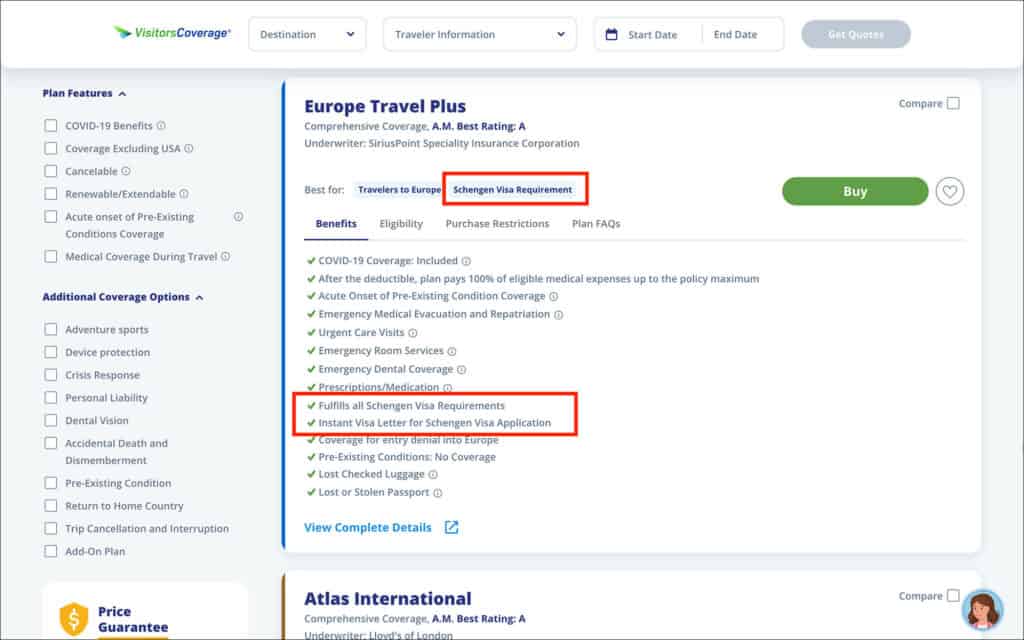

Most Schengen travel insurance aggregators such as VisitorsCoverage provide insurances that are valid in the entire Schengen zone.

In fact, any insurance valid globally is acceptable for the Schengen visa. Provided, the the insurance covers at least €30,000 in all medical costs and emergencies.

What Does Schengen Visa Insurance Plan Cover?

In general, any Schengen visa insurance plan covers medical expenses, COVID-19 protection, and trip coverage.

These coverage options are designed not only to provide comprehensive protection but also to meet the Schengen visa insurance requirements.

1. Medical Coverage

Medical coverage is the most important aspect of Schengen travel insurance. It provides coverage for emergency medical expenses, accidents, and unexpected illnesses.

The coverage also includes hospitalization, emergency hospital treatment, doctor visits, prescription drugs, and other necessary medical treatments that are considered emergency and necessary.

The policy must cover at least €30,000 for the visa. But depending on your needs and activities in the Schengen area, you can opt for policies with higher coverage.

2. COVID-19 Protection

COVID protection is not mandatory for Schengen visa. But most Schengen visa travel insurance policies offer coverage for medical treatment and quarantine expenses related to COVID. COVID tests and quarantine must be prescribed by a doctor to be eligible for the coverage.

That being said, you must review the policy details to make sure that COVID protection is included. Even though it’s not mandatory, it can provide peace of mind during your trip.

3. Trip Coverage

Trip coverage is also not mandatory for Schengen visa. But most travel insurance plans provide protection against flight cancellations, delays, and lost luggage during your travels. Trip coverage will help lessen any expenses arising from trip interruptions and baggage delays.

Review the policy details to make sure comprehensive trip coverage is included. This way, you can ensure that your trip goes smoothly, even when faced with unexpected setbacks.

What Does Schengen Visa Insurance Plan Not Cover?

Though Schengen travel insurance plans provide coverage for a wide range of scenarios, there will usually be some exclusions. One common exclusion is the coverage for pre-existing medical conditions.

It’s crucial to understand the limitations and exclusions of your Schengen visa insurance policy. Let’s look into the exclusion of pre-existing medical conditions in detail.

Pre-existing Medical Conditions

Pre-existing medical conditions are generally not covered by Schengen visa insurance plans. If you have a medical condition that was present prior to the purchase of your Schengen insurance policy, any medical expenses related to that condition during the trip will not be covered.

Review the terms and conditions of your travel insurance policy to determine if any exclusions apply to pre-existing medical conditions.

Is COVID-19 Coverage Mandatory for Schengen Visa Travel Insurance?

No, COVID-19 coverage is not mandatory for Schengen visa travel insurance. But most Schengen travel insurance companies include COVID coverage in their policy.

Even though it’s not required, having COVID protection in your travel insurance can provide financial security during your Schengen trip.

It is always better to be prepared and have coverage than face challenges during the trip.

How Much Does Schengen Visa Medical Insurance Cost?

The cost of Schengen visa medical insurance varies depending on several factors, such as age, duration of your trip, total coverage amount, and the insurance company.

Schengen travel insurance from IMG Global, through VisitorsCoverage for up to 39 years of age will cost about a dollar a day. For a one-week trip, it would be about $7 USD. The cost goes up with age.

IMG Global is a US-based insurance company offering Schengen visa insurance. If you opt for a Europe-based insurance company such as Europ Assistance, the prices are even higher. A one-week insurance policy can cost about €18.

To find the most affordable insurance policy for the Schengen visa, compare different insurance providers and policies using an insurance aggregator such as VisitorsCoverage .

How to Choose the Right Travel Insurance for Schengen Visa?

With a myriad of options available in the market, choosing travel insurance for your Schengen visa can be a daunting task. To make this process easier, consider factors such as the reputation of the insurance company, coverage limits, and customer reviews.

Let’s look at each of these factors in detail.

1. Reputation of the Company

When selecting a travel insurance provider, it’s important to evaluate their reputation in the market. A reputable insurance company will have a track record of providing reliable and quality coverage, as well as excellent customer service.

You can assess the reputation of an insurance company by looking at its reviews and ratings on sites such as Trustpilot. VisitorsCoverage , for example, has a 4.7 rating on Trustpilot.

If you choose an insurance company with a strong reputation, you will have confidence in the coverage and support they provide throughout your trip.

2. Coverage Limits and Exclusions

Another important aspect to consider is the coverage limit. The policy must be Schengen visa compliant, meaning the policy must meet the minimum coverage requirement of €30,000.

Additionally, it’s important to review if there are any exclusions such as pre-existing medical conditions or other limitations.

By reviewing the coverage limits and exclusions, you can pick out a policy that is Schengen visa compliant and provide enough protection during your trip.

3. Customer Reviews and Ratings

Reviews and ratings can be invaluable resources when evaluating any product or service in the market. Travel insurance is no different. The reviews and ratings provide insight into the insurance provider’s customer service, claims process, and embassy acceptability.

By considering the experiences of other travelers you can assess the quality and reliability of the travel insurance.

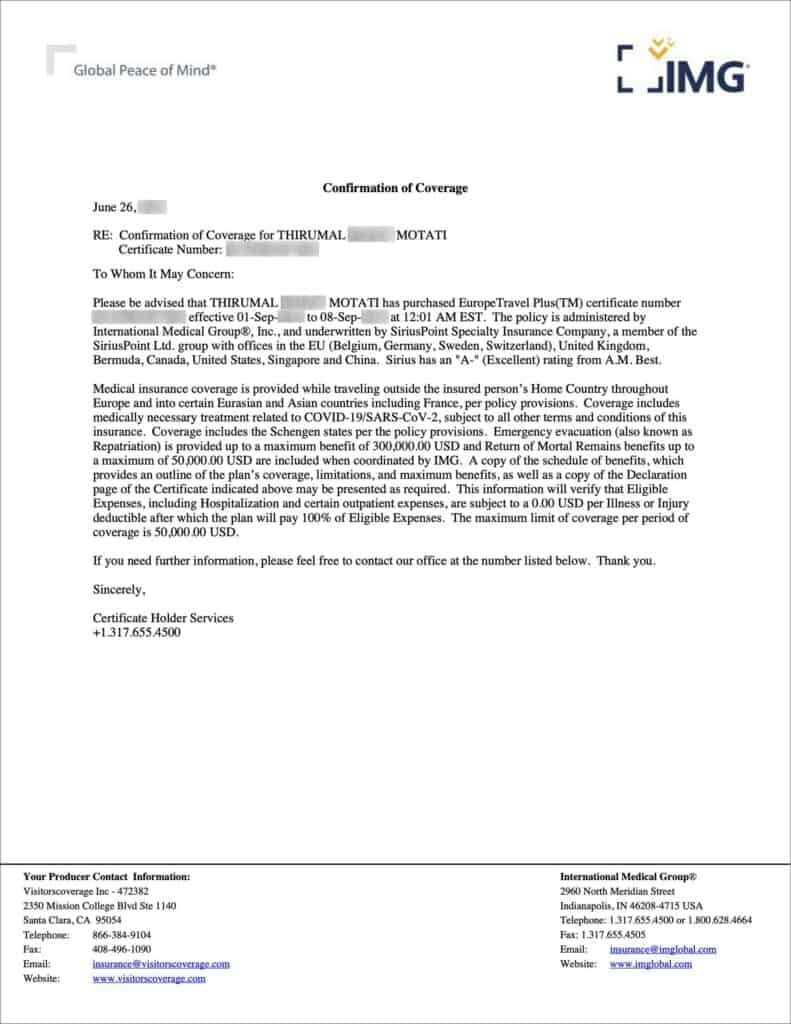

4. Schengen Insurance Certificate

Lastly, the insurance company must be able to issue a Schengen insurance certificate, also called a visa letter. Submitting a visa letter along with the policy is a mandatory requirement for the Schengen visa.

This certificate confirms that your insurance policy meets the Schengen visa criteria. The certificate should include:

- Your name (as the policyholder)

- Policy number

- Total coverage amount, which should be no less than €30,000 (or $50,000)

- Dates of validity (must cover the entire duration of your stay in the Schengen area)

- Contact details for the insurance company, in case of emergencies

Where to Purchase Travel Insurance for Schengen Visa?

Travel insurance for Schengen visas can be purchased from online insurance providers, local insurance companies and travel agencies.

Local insurance companies and travel agencies can offer personalized advice. With online platforms, you can compare prices and coverage options from multiple insurers.

Regardless of where you purchase your insurance, it’s important to make sure the insurance policy meets Schengen visa insurance requirements and provides the necessary coverage for your trip.

My recommendation is to buy Schengen visa insurance from VisitorsCoverage. Their Europe Travel Plus policy is specifically designed for the Schengen visa, meeting the minimum coverage requirements and downloadable visa letter. Here is a comparison for a 33-year-old, 7 days trip to the Schengen area.

How to Purchase Travel Insurance for Schengen Visa

To purchase your travel insurance for Schengen visa, go to the VisitorsCoverage’s Europe Travel Plus plan. Enter the following details.

- Destination Country

- Citizenship

- Residence/Home country

- Coverage Start Date

- Coverage End Date

- Arrival Date

- Date of Birth

- Email Address

Click on Continue. In the deductible and policy maximum, select $0 for the deductible and $50K for the policy maximum. Then click on Continue.

In the next steps, enter your details as per your passport. Complete the payment and purchase the policy. Once your purchase is complete, you can download your visa letter.

How To Find Cheap Schengen Travel Insurance?

Finding cheap Schengen travel insurance requires research and comparison of policies and companies. I have done this already for you. VisitorsCoverage was the cheapest in my research. If you are older than 50, then you might want to check other insurance companies to see if you can find a cheaper option.

Frequently Asked Questions (FAQS)

Do us citizens need schengen insurance.

No. US citizens do not require Schengen insurance when traveling to the Schengen area. This is because Schengen insurance is mandatory for those that require a visa for the Schengen area. And, US citizens do not require a visa for the Schengen area.

Is Schengen travel insurance refundable?

Yes. Most Schengen visa insurance companies offer reimbursement or free cancellation in the event of visa refusal. That being said, review the terms and conditions of the insurance policy before purchasing to make sure the policy is cancellable in case of visa refusal.

Can I purchase travel insurance after obtaining a Schengen visa?

No. You must purchase travel insurance before obtaining the visa. This is because travel insurance is one of the mandatory requirements for obtaining the Schengen visa. Without purchasing travel insurance, you won’t even be able to apply for the Schengen visa.

Are pre-existing medical conditions covered by travel insurance?

Pre-existing medical conditions are usually not covered by Schengen visa insurance plans. This means that any medical expenses arising due to pre-existing conditions will not be covered during your trip. Before purchasing, review the terms and conditions of the policy to determine the exclusions.

Can I extend my travel insurance coverage if my stay in the Schengen area is prolonged?

It may be possible to extend travel insurance coverage if your stay in the Schengen area is prolonged. But it depends on the insurance company and the policy type. Review the terms and conditions and also contact the insurance provider to inquire about extensions.

Obtaining the right travel insurance is a crucial step in your Schengen visa application process. The travel insurance for Schengen visa must provide at least €30,000 coverage and must be valid throughout the Schengen region for the entire duration of your trip.

While purchasing your Schengen visa insurance, consider factors such as the provider’s reputation, coverage limits and customer reviews. Compare different travel insurance providers and policies to pick out the right insurance for your Schengen visa.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Schengen Visa Travel Insurance (2024 Guide)

Josh Lew is a travel journalist and writer based in the midwestern U.S. He has been active for the past decade, covering airlines, international destinations and ecotourism for sites like TravelPulse and TreeHugger. He currently contributes to content writing agency World Words.

Sabrina Lopez is an editor with over six years of experience writing and editing digital content with a particular focus on home services, home products and personal finance. When she is not working on articles to help consumers make informed decisions, Sabrina enjoys creative writing and spending time with her family and their two parrots.

The Schengen area is an alliance of 27 European countries that allows border-free travel. It covers most of mainland Europe, including 23 European Union countries and four members of the European Free Trade Alliance.

Travel insurance is a requirement for the Schengen visa application process. You need at least €30,000 (US$32,800) in coverage in case you need medical attention during your stay in Europe, and you have to purchase coverage and obtain a certificate showing insurance to include with your visa application. Read on to learn more about the unique requirements of a Schengen visa and the role travel insurance plays in the application process.

Which Insurance Provider is Best for Schengen Visa?

Use the table below to compare the top recommended choice for travel insurance for a Schengen visa.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Is Insurance Required for a Schengen Visa?

With a few exceptions, travelers from the U.S. do not need a visa for the Schengen area if staying for 90 days or less. Americans visiting for over three months, permanent residents without citizenship and foreign nationals traveling from the U.S. will need a Schengen visa if they are citizens of a country without a visa-free arrangement with Schengen countries.

The countries in the Schengen area are: Austria , Belgium, Croatia, Czech Republic, Denmark , Estonia, Finland, France , Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovenia, Slovakia, Spain, Sweden and Switzerland. Bulgaria, Cyprus, Ireland and Romania are currently not Schengen countries.

Travelers from the U.S., Canada , and other visa-exempt countries only have to go through immigration and customs in the first country they visit in the Schengen zone. After that, they can travel to any other nation in the alliance without taking out their passport. For instance, you can fly, drive or take a train from Sweden all the way to Spain on the same visa.

Citizens from visa-exempt countries like the U.S. don’t need a visa or travel insurance to visit Europe. However, because of the high price of healthcare in Europe, travel insurance is still a good idea for visa-free travelers. But note that if you have to visit with a Schengen visa, you need to meet specific health insurance mandates.

Schengen visa holders must have comprehensive health insurance coverage. It should last for the length of their stay in the area (but does not need to cover the duration of the visa).

When you apply for a Schengen visa at the consulate or embassy of the country you plan to visit first or spend most of your time in, they will explain the specifics of the travel insurance requirements. You will need proof of a travel insurance plan for visa approval.

Schengen Visa Insurance Requirements

Schengen visa applicants need travel medical insurance . However, the policy must have specific features and minimum limits for medical coverage and medical evacuation.

Here is a closer look at the requirements for Schengen visa eligibility.

- Medical emergency insurance

- Repatriation coverage for death

- Medical evacuation insurance if you need long-term care in your home country

- Coverage limits of at least €30,000 (US$32,000)

- Coverage lasting for the entire length of your stay in the Schengen area

The purpose of these requirements is to ensure you can pay for medical treatment without requiring assistance from your host country’s healthcare system.

You need a document from your travel insurance company as proof that you have a visa-compliant policy. This insurance certificate shows that you have met the minimum requirements. It is a vital part of your visa application, and you won’t gain approval without it.

Types of Travel Insurance Policies

Schengen visa insurance plans focus on medical expenses, but travel policies can also offer other protections. Comprehensive travel insurance covers additional risks, including those related to cancellations and delays.

Here is a look at the different travel insurance coverages.

- Medical, evacuation and repatriation coverage is required for visa approval.

- Trip cancellation insurance provides reimbursement if your trip gets canceled due to covered reasons, such as an unexpected illness or injury or a crisis or disaster in your European destination.

- Trip delay and interruption coverages pay for expenses related to delays or incidents that cancel your journey earlier than planned.

- Baggage delay or loss reimburses you for missing items so that you can replace necessities and continue your travels.

- Add-ons to standard policies may include rental car insurance, pre-existing condition coverage and insurance for exclusions from standard insurance like scuba diving or climbing.

Schengen visa applicants can purchase travel insurance with comprehensive coverage to protect the non-medical aspects of their trip. International travel can be expensive, so cancellation insurance and other protections available through a complete travel policy can save you from frustration and financial loss.

Choosing the Right Schengen Visa Insurance

There are several factors to consider when selecting travel insurance.

- Coverage limits are the maximums that the insurer will pay for each claim type. Schengen visas require €30,000 (about $32,800) in medical emergency, evacuation, and repatriation insurance, but you can get a policy with higher limits if you wish.

- Pre-existing conditions are another important factor. Insurers may or may not cover them on a standard policy, but those that do not provide coverage directly may sell waivers that add coverage for your conditions.

- Deductibles are another factor to consider. This amount is an out-of-pocket payment you have to make before the insurer takes over payment. Some low-cost policies have high deductibles.

Finally, you should always get insurance with a reputable company that can provide the necessary documentation for your visa application.

Here are six reputable insurers to consider.

- Travelex offers budget and mid-range plans for international travelers. You can opt for both medical and trip cancellation coverage.

- Trawick International travel insurance offers stand-alone medical and cancellation policies, so you can opt for minimum requirements for your Schengen visa if you wish.

- AIG Travel Guard offers several tiers of travel insurance, all of which offer comprehensive coverage and provide optional add-ons.

- Seven Corners has customizable travel plans that include medical emergency, evacuation, and repatriation coverage necessary for a Schengen visa

- IMG offers stand-alone medical insurance policies and separate plans providing cancellation, lost baggage and delay benefits.

Use our insurance comparison tool to find the prices and coverage details for each of these insurance providers.

Applying for Schengen Visa with Travel Insurance

You apply for a Schengen visa at the consulate or embassy of the country you intend to travel to first or spend most of your time during your stay.

You must purchase a policy that covers the entire duration of your stay and is valid throughout the Schengen area, not just in the countries you plan to visit.

You need proof of insurance to include with the rest of application documents when applying for the visa. This means you need to purchase the insurance before submitting your application. You should only choose insurance companies able to provide the necessary documentation to include with your application.

Additional Expert Tips

There are some other considerations for Schengen visa insurance.

First, you should make copies of your insurance card, policy documents and other information and bring them with you on your trip.

Second, regulations require that you have coverage for the entire duration of your stay. If you have a multi-trip visa, you will need insurance that provides benefits for the entire stay. The best option in these cases is to get an annual or multi-trip policy that meets visa requirements for coverage types and limits.

Before leaving, you should perform a thorough policy review to ensure you have the appropriate coverage. You can consider the potential costs of medical care in your host countries and decide if the coverage you have is sufficient.

Frequently Asked Questions About Schengen Visa Insurance

Do you need travel insurance to visit schengen countries.

Travelers from visa-exempt countries can visit Europe without insurance, though they would not be protected from medical expenses or cancellations. However, those requiring a Schengen visa need €30,000 worth of medical coverage for approval.

Is Schengen travel insurance refundable?

You would be able to cancel your insurance if your visa application is not approved. Most companies will allow you to cancel the policy and get a full refund if you show evidence that your visa application was not approved.

Does travel insurance cover all of Europe?

Travel insurance for a Schengen visa must cover all 27 countries. However, some travel insurers may require that you specify all the countries you plan to visit to get comprehensive coverage.

What are the benefits of Schengen visa insurance?

In addition to being a requirement for the visa application process, Schengen insurance will cover medical costs if you get sick or suffer an injury during your Europe travel experiences. While travel health insurance is the only necessary policy component for the visa application, you can get additional benefits by purchasing a comprehensive policy.

If you have questions about this page, please reach out to our editors at [email protected] .

Homepage EN

Get Your Schengen Insurance

- Hospitalisation expenses up to 30,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area

Extend Your Coverage

- Hospitalisation expenses up to 60,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area + European Union

- Return/relocation and lodging expenses of a companion

Before traveling, please check the guidelines provided by the World Health Organization, the European Union and your local government. Important restrictions are applied to the Schengen Area and visas are likely to be limited to specific travels only. Our travel insurance policies are made to protect you against unforeseeable events, such as sudden illnesses or accidental bodily injuries. We remind you that epidemics and/or infectious diseases such as CoVid 19 are excluded from our policies.

Schengen travel insurance

Europ Assistance makes it easy for you to select and purchase your travel insurance online. Your insurance will be ready in a matter of minutes and our insurance certificates are recognized by embassies, consulates and visa centers around the world , which helps you acquire a Schengen visa for your next trip to Europe. You will immediately receive the certificate and you will be able to download it at any time in any of our six languages : English, French, Spanish, German, Russian or Chinese.

Which countries are in the Schengen area?

The Schengen area is made up of 26 countries (and 3 microstates) where travelers and residents can move freely from state to state without a passport, as there is no longer common border control between Schengen states. Travel insurance is highly suggested for all travelers, and for most countries is mandatory , as it is needed to obtain the visa to enter the Schengen area. You can obtain your visa application form from the country you plan to enter through first or the one you plan to spend the most time in.

The leading Schengen travel insurance provider

When you choose Europ Assistance as your Schengen visa travel insurance provider, you also get the support and expertise of 750,000 partners . If something goes wrong, not only will your medical expenses be properly reimbursed, but you will also get help from competent medical professionals at qualified medical centers, no matter where you are. During stressful situations or emergencies abroad, communicating in your native language can be a source of comfort. When such a situation occurs, you can trust that Europ Assistance will be there to help you 24/7 .

If you wish to subscribe for more than 20 people, please contact us

Travel dates

- Country of residence All travellers are from the same country of residence : Yes No

A Schengen visa is not required for your trip, however, you should still consider purchasing travel insurance. You can travel with peace of mind and are covered throughout the European Union with our Schengen Plus cover.

- Hospitalisation expenses up to 60,000€

- Coverage in the Schengen area + European Union

Visa Refusal

Refund of paid Schengen health insurance premium.

- Frequent Questions

- Schengen Visa rejected

Refund of Schengen Health Insurance in case of visa refusal

You have to proof a health insurance covering at least 30,000 €, valid for the period of stay in Europe when applying for a Schengen visa.

Often it is necessary to book a Schengen Health Insurance in advance and for a certain period of time to get the visa application process started. At that point, it is not for sure that a Schengen visa will be issued or that a Schengen visa will be issued for the same period of time.

We make sure that you don´t take a financial risk when booking a Schengen Insurance in advance. In case your Schengen visa will be refused, we will take back your insurance policy and fully refund the premium paid. In case your Schengen visa will be issued for a different period of time, we will adapt your Schengen insurance to the new travel period.

If so, please submit that information to us needed for cancellation of your Schengen health insurance:

- your insurance policy number

- written rejection of the visa application you have submitted for yourself or for persons you have invited to Europe, issued by the consulate or embassy or

- new period of time your Schengen visa has been issued for

- your bank account details

You can provide that information by using our contact form. We will handle your request, cancel your insurance booking and arrange refund of insurance premiums or will issue an new insurance confirmation for the new travel period.

ASK FOR REFUND OR CHANGE OF SCHENGEN INSURANCE

Most Important

Non-EU residents preparing to enter the Schengen Area have to apply for a Schengen visa.

Applications for Schengen visa are made at consulates of the first Schengen member state you will travel to for entry to the Schengen Area. Please check all information and documents you will have to submit for visa application process - like proof of sufficient financial means, flight bookings, accommodation and Schengen health insurance.

You are not entitled to claim a Schengen visa. Consulates of the Schengen member country to which you have submitted your visa application decide whether to issue a Schengen visa for you or to refuse it.

- Schengen Member Countries

- Visa Period changes

- Extend Schengen Health Insurance

- Stop Schengen Health Insurance

- Schengen Health Insurance after entry to Europe

- Claims Procedure

About Cookies

This website uses cookies. Those have two functions: On the one hand they are providing basic functionality for this website. On the other hand they allow us to improve our content for you by saving and analyzing anonymized user data. You can redraw your consent to using these cookies at any time. Find more information regarding cookies on our Data Protection Declaration and regarding us on the Imprint .

These cookies are needed for a smooth operation of our website.

Google Analytics

With the help of these cookies, we endeavor to improve our offer for you. By means of pseudonymized data from website users, the user flow can be analyzed and evaluated. This gives us the opportunity to optimize advertising and website content

You can use the live chat like a contact form to chat with our employees in near real time. Personal data is collected when the chat is started: Date and time of the call, browser type/version, IP address, operating system used, URL of the previously visited website, amount of data sent. First name, surname, e-mail address.

- Legal Notice

- Privacy Policy

Schengen Travel Insurance Plans

Trawick offers a variety of Schengen travel insurance plans to meet your Schengen Visa coverage needs. The Safe Travels International Plan is available to non-US Citizens traveling from outside the USA and Safe Travels Outbound is available to US Residents traveling from the USA to any of the 26 Schengen countries and offers benefits required by most consulates to get your visa approved. These plans include a signed visa letter. The additional Thailand required form is available upon request.

Both plans listed below have coverage for COVID-19 EXPENSES and treat it the same as any other sickness.

Safe Travels International

- COVID-19 EXPENSES are covered and treated as any other sickness

- Accident and Sickness Medical Policy Maximum Choices $50,000, $100,000, $250,000, $500,000, $1,000,000

- Deductible Choices $0, $50, $100, $250, $500, $1,000, $2,500 or $5,000

- Trip Delay $2,000

- Emergency Medical Evacuation/Medically Necessary Repatriation/Repatriation of Remains

- Political and Natural Disasters Evacuation

- UNEXPECTED RECURRENCE OF A PRE-EXISTING CONDITION - See Plan Summary of Coverage for details

- Optional Sports Coverage.

- New claims administrator and online claims filing/tracking - Effective 7/11/2023

- For non-U.S. citizens/residents traveling anywhere outside their home country excluding USA

- For ages 14 days to 89 years

- This plan is not available to any individual who has been residing outside their home country for more than 365 days prior to their Effective Date.

- Coverage for minimum 5 days to maximum up to 364 days

- Extendable for up to 364 days

- Rates are based on age, policy maximum and deductible choices

Safe Travels Outbound

- Accident and Sickness Medical Policy Maximum Choices $50,000, $100,000, $250,000, $500,000

- Emergency Medical Evacuation and Repatriation of Remains

- Non-Medical Emergency Evacuation

- Valid for US Residents traveling internationally

- For Age 14 days to 99 years of age

- Coverage for a maximum of 180 days

0 /3 selected

Privacy Policy

Trawick International’s Privacy Policy

Welcome to our website. We appreciate your interest in us. We take the privacy of our customers very seriously and are committed to protecting your privacy. This policy explains how we collect, use, and transfer your personal data, and your rights in relation to the personal data stored by us when you use our website or otherwise engage with our services.

Effective October 3, 2023

This policy sets out the following:

- What personal data we collect about you and how;

- How the data is used;

- Our legal basis for collecting your information;

- Who we share your data with;

- Where we transfer your information;

- How long we retain your information for;

- Your rights and choices in relation to the data held by us;

- How to make a complaint in relation to the data held by us;

- How to contact us with any queries in relation to this notice, or the personal data held by us.

Who is Trawick International?

Trawick International (“we,” “us,” or “our”) provides worldwide travel medical insurance, travel insurance, trip insurance for trip cancellation or trip interruption, international student insurance, group travel insurance, and many other products designed specifically for those traveling. Our travel insurance programs are designed for those traveling to the USA, individuals traveling abroad, US Citizens who are traveling in the USA and non US citizens traveling from their home country but not visiting the USA. We offer an extensive worldwide network of quality physicians, hospitals, and pharmacies. We cover employees, corporations, schools, frequent world travelers, international students, study abroad programs, missionary trips, and just the casual vacation traveler. Our individually customized plans can cover hospital stays, doctor visits, x-rays, prescriptions, ambulance, emergency evacuation, repatriation, flight insurance, trip interruption, trip cancellation, trip delay, and lost baggage.

For the purposes of European data protection laws, if you are visiting our website www.trawickinternational.com (or otherwise engaging with our services from the European Economic Area (or "EEA"), the data controller of your information is Trawick International.

What is personal data?

In this privacy policy, references to "personal information" or "personal data" are references to information that relates to an identified or identifiable individual. Some examples of personal data are your name, address, email, and telephone number, but it may also include information such as your IP address and location in certain jurisdictions.

What personal data do we collect?

We collect personal data that you provide to us when you sign up for our services, such as your contact information and financial information. We may also collect commercial information based on how you interact with our services, such as the products or services you’ve purchased or other Internet or network activity, such as your website browsing history or mobile device information.

Below are some more details on the type of personal data we collect.

Information that is provided by you:

In order to provide services to you we may ask you to provide personal information. This may include, amongst other things, your name, email address, postal address, telephone number, gender, date of birth, passport number, bank account details, credit history and claims history, citizenship status, marital status depending on the service you are seeking. The personal information that you are asked to provide, and the reasons why you are asked to provide it, will be made clear to you at the point at which we ask you for it or upon request.

Some of the information that you provide may be “special category” (or “sensitive”) personal data. Sensitive personal data relates to your racial or ethnic origin, political opinions, religious or philosophical beliefs, or trade union membership, genetic data, biometric data for the purpose of uniquely identifying a natural person, data concerning health or data concerning a natural person’s sex life or sexual orientation, and can sometimes be inferred from other, non-sensitive, information that you have provided.

Information that we collect on our website:

When you visit our website, we will seek your consent to collect certain information from your device. In some countries, including countries in the EEA, this information may be considered personal information under applicable data protection laws.

Specifically, the information we are seeking to collect includes information like your IP address, device type, unique device identification numbers, browser type, broad geographic location ( e.g., country or city-level location) and other technical information. We may also collect information about how your device has interacted with our website, including the pages accessed and links clicked.

Collecting this information enables us to better understand visitors to our website, where they come from, and what content on our website is of interest to them. We use this information for our internal analytics purposes and to improve the quality and relevance of our website to our visitors.

Some of this information may be collected using cookies and similar tracking technology, as explained further under the heading “Cookies" below.

Information that we obtain from third party sources:

From time to time, we may receive personal information about you from third party sources but only where we have checked that these third parties either have your consent or are otherwise legally permitted or required to disclose your personal information to us.

For information about a third party’s usage and/or sharing of your personal data, please refer to the third party’s own privacy statement.

We may, where we are legally permitted to, also collect personal data from the following sources in order to provide services to you:

- Credit reference agencies;

- Anti-fraud and other databases;

- Government agencies;

- Electoral register;

- Court judgments;

- Sanctions lists;

- Family members; and

- In the event of an insurance claim: the other party to the claim, witnesses, experts, loss adjusters, solicitors, and claims handlers.

How is personal data used?

We may need to use your personal data in order to carry out the following activities:

- To set you up as a new client (including carrying out “know your customer” checks);

- To provide you with an insurance quote;

- To provide our products and services to you;

- To respond to your inquiries;

- To accept payments from you;

- To communicate with you about your policy;

- To renew your policy;

- To obtain reinsurance for your policy;

- To process insurance and reinsurance claims;

- For general insurance administration purposes;

- To comply with our legal and regulatory obligations;

- To model our risks;

- To defend or prosecute legal claims;

- To investigate or prosecute fraud;

- To respond to your enquiries; or

- To secure our network and our website, debug the website and repair errors;

- To conduct audits related to our interactions with you;

- To make our products and services better and to develop new products and services;

- To send you notices and information regarding our products or services, including notifying you about special promotions or offers, where we are legally permitted to do so; and

- Enforce our Terms and other usage policies and comply with legal requirements.

Our legal basis for collecting your information:

Our legal basis for collecting and using your personal data will depend on the personal data concerned and the specific context in which we collect it.

We will normally collect personal data where we need the information to provide you with our services / perform a contract with you, where the processing is in our legitimate interests and not overridden by your data protection interests or fundamental rights and freedoms, or with your consent.

In some cases, we may use your personal data for a legal obligation, e.g., in order to complete “know your customer” and money laundering checks before taking you on as a new client.

If we ask you to provide personal information to comply with a legal requirement or to perform a contract with you, we will make this clear at the relevant time and advise you whether the provision of your personal information is mandatory (as well as of the possible consequences if you do not provide your personal information). You are under no obligation to provide personal data to us. However, if you should choose to withhold requested data, we may not be able to provide you with certain services.

Similarly, if we collect and use your personal information in reliance on our legitimate interests (or those of any third party), we will make clear to you at the relevant time what those legitimate interests are.

If you are a UK resident, we may collect and use your personal information, including sensitive personal information, on the basis of the insurance derogation in the UK Data Protection Act 2018.

If you are an EU resident, we may collect and use your personal information, including sensitive personal information, on the basis of the substantial public interest of insurance purposes, as regulated in the General Data Protection Regulation (GDPR).

If you have questions about or need further information concerning the legal basis on which we collect and use your personal information, please contact us using the contact details provided under the “Contact Us" section below.

Who is your personal data shared with?

We may disclose your personal information with the following categories of recipients.

- To our group companies, third party service providers and partners who provide data processing services (for example data hosting and storage companies, email marketing affiliates, and payment and claims processing companies) or who otherwise process personal information for purposes that are described in this Privacy Policy (see “How is personal data used?”).

- To any competent law enforcement body, regulatory, government agency, court or other third party where we believe disclosure is necessary (i) as a matter of applicable law or regulation, (ii) to exercise, establish or defend our legal rights, or (iii) to protect your vital interests or those of any other person;

- To a potential buyer (and its agents and advisers) in connection with any proposed purchase, merger or acquisition of any part of our business, provided that we inform the buyer it must use your personal information only for the purposes disclosed in this privacy policy;

- To any other person with your consent to the disclosure.

We do not sell (or exchange) your personal information for monetary compensation.

If you are a US resident, from time to time we may share your personal information with third parties for a third party’s own direct benefit and this type of sharing may be considered a sale under certain applicable laws. For more information on the type of information we may share in this manner, please contact us.

International Transfers

Your personal data may be transferred to, and processed in, countries other than the country in which you are resident. These countries may have data protection laws that are different to the laws of your country.

Specifically, the servers of Trawick International are located in the United States. Trawick International partners with many other international companies. This means that when we collect your information, we may process it in other countries.

We have taken appropriate safeguards to require that your personal data will remain protected in accordance with this privacy policy. We have also taken appropriate safeguards with our third party service providers and partners.

How long is personal information retained?

We will keep your personal data on our records for as long as we have an ongoing legitimate business need to do so. This includes providing you with a service you have requested from us or to comply with applicable legal, tax or accounting requirements. It also includes keeping your data for so long as there is any possibility that you or we may wish to bring a legal claim concerning our services, or where we are required to keep your data for legal or regulatory reasons. Please contact us using the contact details provided under the “Contact Us" section below should you require further information on our record retention procedures.

We may also retain your personal data where such retention is necessary in order to protect your vital interests or the vital interests of another natural person.

Your Rights as a Data Subject

You have the right to opt out of marketing communications we send you at any time. You can exercise this right by clicking on the “unsubscribe” or “opt-out” link in the marketing e-mails we send you or contacting us.

If you are an EU resident, you will need to opt-in to receive marketing from us. If you then wish to unsubscribe at any point, you can do so by clicking on the “unsubscribe” or “opt-out” link in the marketing e-mails we send you or contacting us.

Similarly, if we have collected and processed your personal information with your consent, then you can withdraw your consent at any time. Withdrawing your consent will not affect the lawfulness of any processing we conducted prior to your withdrawal, nor will it affect processing of your personal information that was lawfully collected on grounds other than consent.

You have the right to complain to a data protection authority about our collection and use of your personal information. For more information, please contact your local data protection authority.

We respond to all requests we receive from individuals wishing to exercise their data protection rights in accordance with applicable data protection laws.

You may exercise any of your rights in relation to your personal data by contacting us using the details set out in the “Contact us” section at the bottom of this page.

If you are resident in the UK or EU, your principal rights under data protection law are as follows:

- the right to access;

- the right to rectification;

- the right to erasure;

- the right to restrict processing;

- the right to object to processing;

- the right to data portability;

- the right to complain to a supervisory authority; and

- the right to withdraw consent.

If you wish to access, correct, update or request deletion of your personal information, we will ask you to provide us with a copy of any two of the following documents: Driver’s license; Passport; Birth certificate; Bank statement (from the last 3 months); or Utility bill (from the last 3 months). With regards to your right of access, the first access request will be complied with free of charge, but additional copies may be subject to a reasonable fee.

In addition, you can object to processing of your personal information, ask us to restrict processing of your personal information or request portability of your personal information.

If we have collected and processed your personal information with your consent, then you can withdraw your consent at any time. Withdrawing your consent will not affect the lawfulness of any processing we conducted prior to your withdrawal, nor will it affect processing of your personal information conducted in reliance on lawful processing grounds other than consent. You have the right to complain to a data protection authority about our collection and use of your personal information. For more information, please contact your local data protection authority.

Contact details for other data protection authorities in the European Economic Area, Switzerland and certain non-European countries (including the US and Canada) are available here .

If you are based in the UK or EU, you may exercise any of your rights in relation to your personal data by contacting us using email or you can use the details set out in the “Contact Us” section at the bottom of this page.

If you are resident in the US, applicable law may entitle you, upon verifiable request, to receive disclosures relating to:

- The categories and specific pieces of information we have collected;

- The categories of sources from which the personal information is collected;

- The business or commercial purpose for collecting personal information; and

- The categories of third parties with whom we share personal information.

If you wish to exercise any of the rights described above, we will ask you to verify your identity. We generally will not charge to reply to your request, but we may charge a reasonable fee or refuse your request if the request is unjustified or excessive.

Automated decision making

In some instances, our use of your personal information may result in automated decisions being taken (including profiling) that legally affect you or similarly significantly affect you.

Automated decisions mean that a decision concerning you is made automatically on the basis of a computer determination (using software algorithms), without our human review. For example, in certain instances we may use automated decisions to establish whether we will propose insurance coverage to a prospective insured. We have implemented measures to safeguard the rights and interests of individuals whose personal information is subject to automated decision-making.

When we make an automated decision about you, you have the right to contest the decision, to express your point of view, and to require a human review of the decision.

As mentioned above, we may use your personal data to send you marketing materials.

If you are a UK or EU resident, you will need to opt-in to receive marketing from us. If you then wish to unsubscribe at any point, you can do so by clicking on the “unsubscribe” or “opt-out” link in the marketing e-mails we send you or contacting us.

If you are resident in the US, you do not need to opt-in to receive marketing materials from us, and you have the right to opt-out of receiving such communications. If you would like to stop receiving marketing information from us, please unsubscribe by clicking the “unsubscribe” link in the relevant marketing email or contacting us.

Trawick International is committed to keeping our customers’ data safe. We have security measures in place designed to protect against the loss, misuse, and/or alteration of personal data under our control. Although we cannot ensure or guarantee that loss, misuse, or alteration of data will not occur, we use our best efforts to prevent this. If you have any concerns that your Trawick International account or personal data has been put at risk, please contact us.

Our sites use cookies (a small piece of information that is placed on your computer when you visit certain websites) to distinguish you from other users, to track your browsing pattern and to build a profile of how you and other users use our sites. This helps us to provide you with a good experience when you browse any of our sites and also allows us to improve our sites. If you have an online account with us, we also use cookies to recognize you to pre-fill forms to save you time. Trawick International does not mandate cookies for you to access our sites and you may freely set your browser to reject all cookies or prompt you to accept or reject them. Some of the cookies we use are session cookies and only last until you close your browser, others are persistent cookies which are stored on your computer for longer. We may collect information through web beacons about your web browsing activities such as the address of the page you are visiting, the address of the referrer page you had previously visited, the time you are viewing the page, your browsing environment, and your display settings. We do this in order to optimize your browsing experience, the use of web-based services and provide you with relevant information on Trawick International products and services when you have opted-in to receiving such correspondence.

We will not respond to Web browser “do not track” signals. If you would like additional information about online tracking and various opt-out mechanisms, please see https://youradchoices.com/

Because we may link to social media sites, and from time to time may include third-party advertisements, other parties may collect your personally identifiable information about your online activities over time and across different web sites when you visit this Site.

Please note that not all tracking will stop even if you delete cookies.

Children's Data

Our websites and applications are not directed to children under 16 and we do not knowingly collect any personal information directly from children under 16. If you believe that we are processing personal information pertaining to a child inappropriately, we ask you to contact us using the information provided under the “Contact Us” section.

Changes to this Privacy Policy

We may update this Privacy Policy from time to time in response to changing legal, technical, or business developments. When we update our Privacy Policy, we will take appropriate measures to inform you, consistent with the significance of the changes we make. We will obtain your consent to any material Privacy Policy changes if and where this is required by applicable data protection laws.

You can see when this Privacy Policy was last updated by checking the “effective date” displayed at the top of this Privacy Policy.

Any changes will be effective only after the effective date of the change and will not affect any dispute arising prior to the effective date of the change.

If you have any questions about this Privacy Policy, please contact us using the following contact details:

Post Office Box 2284

Fairhope, Alabama USA 36533

Toll Free Telephone Number: +1 (888) 301-9289

Terms and Conditions of Use

Important information.

The information contained in this website is not intended to be an offer to sell or a solicitation in connection with any product or service by Trawick International Inc., in any jurisdiction where such an offer or solicitation would be unlawful or in which Trawick International, Inc., is not qualified to do so. Products and services described in this website may not be available in all jurisdictions. Not all insurance products described in this website are available to all persons in all States, Countries, or other jurisdictions at all times.

All products contain certain conditions, restrictions, limitations and eligibility requirements. The information contained in this website is not intended to be a complete description of all terms, exclusions and conditions applicable to the products and services. For complete terms, exclusions and conditions applicable to the products offered please contact Trawick International .

By using this website, you agree to the terms of its use. If you do not agree to these terms, PLEASE DO NOT USE THIS WEBSITE. For additional information or questions, please contact Trawick International or your independent insurance broker or agent.

TERMS & CONDITIONS OF USE

Effective Date: October 6, 2023

INTRODUCTION

THESE TERMS & CONDITIONS OF USE (“T&C”) GOVERN YOUR USE OF TRAWICK INTERNATIONAL, INC.’S (“COMPANY”, “WE”, “OUR”, OR “US”) WEBSITE LOCATED AT WWW.TRAWICKINTERNATIONAL.COM OR OTHER WEBSITES CONTROLLED BY COMPANY AND ITS AFFILIATES AS WELL AS ANY DOCUMENTS EXPRESSLY INCORPORATED BY REFERENCE AND ANY RULES AND POLICIES PUBLISHED ON THIS WEBSITE (THE “WEBSITE”).

BY ACCESSING THIS WEBSITE, YOU AGREE TO THE T&C, REVISIONS, AND MODIFICATIONS. ALL CHANGES ARE EFFECTIVE IMMEDIATELY UPON POSTING, AND APPLY TO ALL ACCESS TO AND USE OF THE WEBSITE THEREAFTER. ANY CHANGES WILL NOT EFFECT ANY DISPUTES ARISING PRIOR TO THE EFFECTIVE DATE OF THE CHANGE. WE MAY SEND YOU NOTICES WITH RESPECT TO THE WEBSITE IN VARIOUS MEDIUMS, INCLUDING BY EMAIL ADDRESS, POSTAL MAIL, AND/OR BY POSTING ON THE WEBSITE.