Travel Medical Insurance: What to Know

Travel medical insurance provides financial protection while traveling, since many u.s. health insurance policies, including medicare and medicaid, don’t typically cover your medical expenses outside of the country..

)

Jessica is a freelance writer, professional researcher, and mother of two rambunctious little boys. She specializes in personal finance, women and money, and financial literacy. Jessica is fascinated by the psychology of money and what drives people to make important financial decisions. She holds a Masters of Science degree in Cognitive Research Psychology.

Read Editorial Guidelines

)

Licensed auto and home insurance agent

3+ years experience in insurance and personal finance editing

Katie uses her knowledge and expertise as a licensed property and casualty agent in Massachusetts to help readers understand the complexities of insurance shopping.

Featured in

Updated October 12, 2023

Reading time: 4 minutes

)

Table of contents

- Travel medical insurance

- What’s covered

Primary coverage

Secondary coverage.

- Medical evacuation

- Comprehensive coverage

Trip cancellation

- Insurance limitations

Though you never plan to have an accident or get sick during a trip, unexpected emergencies happen. Your U.S. health insurance likely won’t cover any visits to the hospital or emergency care in a foreign country. [1] To ensure you have coverage while traveling, you can purchase a stand-alone policy for travel medical insurance.

What is travel medical insurance?

Travel medical insurance can help fill in coverage gaps if you require emergency or routine medical services while traveling overseas. Even if you have international health insurance that includes care when traveling abroad, it won’t always cover the cost of medical treatments such as X-rays, lab tests, or ambulance services in a foreign country.

Travel medical coverage primarily protects you in the event of an emergency, so long-term travelers should look into purchasing a more comprehensive plan. To prevent extensive financial losses while abroad, it’s a good idea to check with your insurance company to see if you and your family members have adequate coverage before you travel.

Before selecting medical insurance coverage, you should compare travel health plans among multiple companies. Some of the best insurers to consider include Blue Shield, Allianz Travel Insurance, American International Group (AIG), HTH Worldwide Travel Insurance, GeoBlue, Generali Global Assistance (GGA), and more.

Does your health insurance plan cover you internationally?

Many health insurance plans, including Medicare and Medicaid, are only valid within the U.S. or your home state. While some employer U.S. health plans or private plans provide international travel insurance, it’s important you read the fine print so you know exactly what your policy covers in case of a medical emergency.

Many health insurance plans with international coverage only pay for emergencies that require immediate medical attention while overseas. For example, your insurance may cover a broken bone or a hospital visit if you’re experiencing chest pains. It likely wouldn’t cover any routine medical care.

What travel medical insurance covers

Travel medical insurance covers the cost of unexpected medical expenses while abroad. If you encounter an unexpected injury or illness, your travel medical insurance will reimburse you up to your plan limit.

You can choose from different types of medical travel insurance plans and add-ons when buying coverage. The best travel insurance for you will depend on factors such as where you intend to travel, for how long, and what you plan to do.

Here are five different types of coverage you may encounter while shopping for travel medical insurance.

The difference between primary and secondary coverage has to do with payment priority. With primary medical travel insurance, the insurance plan will pay your medical costs directly, even if you have another health insurance policy. You’ll file any medical claims directly with the company you bought travel medical insurance from, which can help speed up the payment process. [2]

With secondary medical travel insurance, you’ll need to file a claim with your primary healthcare insurance provider first — even if you don’t think the insurer will provide coverage. If the insurer denies your claim or doesn’t fully cover it, you can then file it with the medical travel insurance company.

Emergency medical evacuation insurance

An emergency evacuation can be very expensive — especially if it’s in a remote area. Medical evacuation insurance can help cover the costs associated with emergency transportation to an adequate treatment facility. It can also cover the costs associated with transporting you back to the U.S.

Comprehensive travel insurance plan

Some comprehensive policies include medical travel insurance and trip-cancellation coverage if you have to cancel your trip due to something such as severe weather or a natural disaster. Many comprehensive plans also cover trip interruption, medical evacuation, travel delay benefits, and baggage delay.

With medical travel insurance, you can often include trip cancellation insurance as an add-on for an additional cost. Trip cancellation insurance covers trip costs, including your flight, cruise, or train tickets, if you can’t go on your trip. It doesn’t cover any medical care you need while traveling. [3]

Limitations of travel medical insurance

Before confirming your travel plans, check with your insurance company to see if the plan has any limitations or exclusions. Travel medical insurance policies often don’t cover medical bills related to the following three situations.

Pre-existing conditions

A pre-existing condition is a medical condition or illness you’ve had for a certain period before purchasing insurance. It’s possible to purchase insurance with pre-existing conditions coverage. The policies are often time-sensitive and only provide coverage if purchased within a certain number of days of the trip deposit — often 14 days.

High-risk activities

If you’re planning to engage in risky activities or extreme sports, such as skydiving or bungee jumping, check if your travel insurance policy excludes the activities. Many insurance plans won’t cover these risky activities. However, you may be able to purchase extreme sports insurance for additional benefits coverage.

Geographic exclusions

Some insurers won’t provide coverage if you travel to a country that the U.S. Department of State has assigned a Level 4 “do not travel” advisory to. [4] Before traveling to a country with a travel advisory, check with your insurance company to see if your coverage applies.

Travel medical insurance FAQs

Before you take off on your next overseas adventure, you should look into buying a travel medical insurance plan, as well as how you can use it if you need it and how it differs from health insurance coverage.

Who should buy travel medical insurance?

Anyone traveling to a country where their health insurance provider doesn’t provide coverage should consider purchasing travel medical insurance. Certain destinations may require you to purchase it when applying for a visa or staying for a certain amount of time, too.

For example, Schengen Area countries in the European Union require people to have travel medical insurance if they apply for a travel visa, which you’ll need if you’re staying for more than 90 days. [5]

How do you use your travel health insurance?

If you have a medical emergency when traveling and need to use your travel health insurance plan, contact your insurance company immediately. Most travel insurance companies have 24/7 customer service hotlines you can contact for help and information. Your insurer can give you step-by-step instructions on what to do depending on your specific situation.

What is travel insurance vs. medical insurance?

The main difference between travel insurance and regular medical plans is travel insurance only covers you during travel. It’s only valid during your trip to protect you against medical emergencies while you’re away from your home country.

What does medical travel insurance cover?

Travel medical insurance can provide coverage if you have an unexpected illness, injury, or other medical emergency during a trip abroad. U.S. health insurance policies don’t usually cover overseas incidents.

Related articles

- Airbnb Travel Insurance: What Guests Should Know

- Does Travel Insurance Cover Pre-Existing Conditions?

Visitor Insurance for Parents: What to Know

- Do You Need Group Travel Insurance?

- Cheapest Travel Insurance

What Does Cruise Insurance Cover?

- What Is Cancel For Any Reason (CFAR) Travel Insurance?

- U.S. Department of State Bureau of Consular Affairs . " Insurance Providers for Overseas Coverage ."

- Allianz Travel . " Primary Insurance Coverage ."

- Insurance Information Institute . " Should you buy travel insurance? ."

- U.S. Department of State Bureau of Consular Affairs . " Travel Advisories ."

- U.S. Department of State Bureau of Consular Affairs . " U.S. Travelers in Europe ."

)

Latest Articles

)

Cheapest Travel Insurance (April 2024)

Travel insurance can be beneficial, especially for people traveling to risky areas and people with health concerns.

)

How to Find the Best Travel Insurance for Seniors

Travel insurance can be beneficial for senior travelers, especially those with health concerns. Find out how you can secure your next trip.

)

Cruise insurance is a type of travel insurance that can include international medical insurance, trip delays, and complete cancellation of your trip.

)

Learn how to find visitor insurance for parents, why you need it, and the best companies offering medical coverage for visitors from abroad.

)

Is Flight Insurance Worth It?

Is flight insurance worth it? Weigh the pros, cons, typical costs, and coverage options to decide whether it’s worth purchasing.

)

Travel medical insurance can provide financial protection in case of unforeseen circumstances while traveling, such as illness or medical emergencies.

Key benefits of travel medical insurance

- Travel medical insurance coverage

- Who needs medical travel insurance?

Choosing the right travel medical insurance

How to use travel medical insurance, is travel medical insurance right for your next trip, travel medical insurance: essential coverage for health and safety abroad.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Travel medical insurance covers unexpected emergency medical expenses while traveling.

- Travelers off to foreign countries or remote areas should strongly consider travel medical insurance.

- If you have to use your travel medical insurance, keep all documents related to your treatment.

Of all the delights associated with travel to far-flung locales, getting sick or injured while away from home is low on the savvy traveler's list. Beyond gut-wrenching anxiety, seeking medical treatment in a foreign country can be exceedingly inconvenient and expensive.

The peace of mind that comes with travel insurance for the many things that could ail you while abroad is priceless. As options for travel-related insurance abound, it's essential to research, read the fine print, and act according to the specifics of your itinerary, pocketbook, and other needs.

Travel insurance reimburses you for any unexpected medical expenses incurred while traveling. On domestic trips, travel medical insurance usually take a backseat to your health insurance. However, when traveling to a foreign country, where your primary health insurance can't cover you, travel medical insurance takes the wheel. This can be especially helpful in countries with high medical care costs, such as Scandinavian countries.

Emergency medical evacuation insurance

Another benefit that often comes with travel medical insurance, emergency medical evacuation insurance covers you for any costs to transport you to an adequately equipped medical center. Emergency medical evacuation insurance is often paired with repatriation insurance, which covers costs associated with returning your remains to your home country if the worst happens.

These benefits are for worst-case scenarios, but they might be more necessary depending on the type of trips you take. Emergency medical evacuation insurance is helpful if you're planning on traveling to a remote location or if you're traveling on a cruise as sea to land evacuations can be costly. Some of the best travel insurance companies also offer non-medical evacuations as part of an adventure sports insurance package.

It's also worth mentioning that emergency medical evacuation insurance is required for international students studying in the US on a J Visa.

Types of coverage offered by travel medical insurance

The exact terms of your coverage will vary depending on your insurer, but you can expect most travel medical insurance policies to offer the following coverages.

- Hospital room and board

- Inpatient/outpatient hospital services

- Prescription Drugs

- COVID-19 treatment

- Emergency room services

- Urgent care visits

- Local ambulance

- Acute onset of pre-existing conditions

- Dental coverage (accident/sudden relief of pain)

- Medical care due to terrorist attack

- Emergency medical evacuation

- Repatriation of mortal remains

- Accidental death and dismemberment

Travel medical insurance and pre-existing conditions

Many travel insurance providers will cover pre-existing conditions as long as certain conditions are met. For one, travelers need to purchase their travel insurance within a certain time frame from when they placed a deposit on their trip, usually two to three weeks.

Additionally, travel insurance companies usually only cover stable medical conditions, which are conditions that don't need additional medical treatment, diagnosis, or medications.

Who needs travel medical insurance?

Even the best-laid travel plans can go awry. As such, it pays to consider your potential healthcare needs before taking off, even if you are generally healthy. Even if well-managed, preexisting conditions like diabetes or asthma can make a medical backup plan even more vital.

Having what you need to refill prescriptions or get other care if you get stuck somewhere other than home could be essential to your health and well-being. That's without counting all the accidents and illnesses that can hit us when away from home.

Individuals traveling for extended periods (more than six months) or engaging in high-risk activities (think scuba diving or parasailing) should also consider a solid medical travel plan. Both scenarios increase the likelihood that medical attention, whether routine or emergency, could be needed.

In the case of travel via the friendly seas, it's also worth considering cruise trip medical travel insurance . Routine care will be available onboard. But anything beyond that will require transportation to the nearest land mass (and could quickly become extremely expensive, especially if you're in another country).

Like other types of insurance, medical travel insurance rates are calculated based on various factors. Failing to disclose a preexisting health condition could result in a lapse of coverage right when you need it, as insurers can cancel your policy if you withhold material information. So honesty is always the best policy.

Even the best-laid travel plans can go awry. As such, it pays to consider your potential healthcare needs before taking off, even if you are generally healthy. Making the right choice when shopping for travel medical insurance can mean the difference between a minor hiccup in your travels and a financial nightmare.

When a travel insurance company comes up with a quote for your policy, they take a few factors into consideration, such as your age, your destination, and the duration of your trip. You should do the same when assessing a travel insurance company.

For example, older travelers who are more susceptible to injury may benefit from travel medical insurance (though your premiums will be higher). If you're traveling for extended periods throughout one calendar year, you should look into an annual travel medical insurance plan . If you're engaging in high-risk activities (think scuba diving or parasailing), you should seek a plan that includes coverage for injuries sustained in adventure sports.

Travel medical insurance isn't just for peace of mind. If you travel often enough, there's a good chance you'll eventually experience an incident where medical treatment is necessary.

Before you submit your claim, you should take some time to understand your policy. Your travel medical insurance is either primary (you can submit claims directly to your travel medical insurance provider) or secondary (you must first submit claims to your primary insurance provider). In the case of secondary travel medical insurance, a refusal notice from your primary insurance provider, even if it does not cover medical claims outside the US, is often required as evidence of protocol.

On that note, you should be sure to document every step of your medical treatment. You should keep any receipts for filled prescriptions, hospital bills, and anything else documenting your medical emergency.

As many people have found out the hard way, reading the fine print is vital. Most travel insurance policies will reimburse your prepaid, nonrefundable expenses if you fall ill with a severe condition, including illnesses like COVID-19.

Still on the fence about whether or not medical travel insurance is worth it ? It's worth noting that many travel insurance plans also include medical protections, so you can also protect against trip cancellations and other unexpected developments while obtaining travel medical insurance.

While short, domestic trips may not warrant travel medical insurance, it may be a good idea to insure longer, international trips. You should also consider travel medical insurance for trips to remote areas, where a medical evacuation may be expensive, and more physically tasking trips.

While shopping for travel medical insurance may not be fun, a little advance leg work can let you relax on your trip and give you peace of mind. After all, that is the point of a vacation.

Medical travel insurance frequently asked questions

Trip insurance covers any unexpected financial losses while traveling, such as the cost of replacing lost luggage, trip interruptions, and unexpected medical expenses. Travel medical insurance just covers those medical expenses without the trip interruption or cancellation insurance.

Travel insurance companies usually offer adventure sports as add-on coverage or a separate plan entirely. You'll likely pay more for a policy with adventure sports coverage.

Many travel medical insurance policies now include coverage for COVID-19 related medical expenses and treat it like any other illness. However, you should double-check your policy to ensure that is the case.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Agent Information

← Return to Blog

How Do Travel Medical Insurance Claims Work?

Angela Borden | Apr 5, 2024

Share Twitter share

Once you've bought Seven Corners Travel Medical Insurance , it helps to know a little about the steps in the claims process if you have an illness or injury while traveling. Understanding how we pay claims can play a part in improving your claims experience.

What Is Travel Medical Insurance?

Travel medical insurance provides high limits of medical coverage to help with medical expenses if you get sick or hurt while traveling internationally. For U.S. residents traveling internationally, two key elements — medical maximums and deductibles — work together to determine coverage for your travel medical claim.

If you aren’t sure about some of the terms you see in this article or your plan document, you can find explanations of coinsurance, copayments, medical maximums, and more in our guide to travel medical insurance terms .

How Do I Make a Travel Medical Insurance Claim?

The information below applies to travel medical insurance for U.S. residents traveling abroad. If you have or are thinking about purchasing a trip protection plan, visit our blog about the travel insurance claims process .

To file a travel medical insurance claim, you or your medical provider must submit the required information to Seven Corners. This can be done through your Seven Corners account.What documents do I need to claim travel insurance?

What documents do I need to claim travel insurance?

You may need to file more than one type of claim form for us to efficiently and carefully review your claim. This most often includes a proof of loss form and a payment authorization form. You’ll find these forms in your Seven Corners account.

You will also need to supply original itemized medical bills and receipts, and proof of payment. Depending on your situation, different or additional documents may be necessary. For example, if your injury is a result of an accident, you might also need to submit accident details and a police report.

Submitting the required documents at the time you first file your claim can help the process move more quickly as there will be less back-and-forth collecting information.

Is there a time limit on travel insurance claims?

Most plans have a timely filing limit of 90 days, meaning that if you file after that 90-day deadline, your claim may be denied. For this reason, it is always recommended that you file your claim as soon as possible after the incident.

Travel Medical Insurance Claims Procedure

The steps in the travel medical insurance claims process are outlined here and in the infographic below. In this hypothetical scenario, let’s say you’re a U.S. resident traveling to Spain. You get appendicitis on your trip, and you have Seven Corners Travel Medical Insurance. Here’s what happens next.

1. You file a claim.

After you submit your claim, you’ll receive a notification that we’ve received your submission. Once we receive all the necessary information, we will review your claim and a licensed claims advisor will contact you if something is missing.

2. You pay the deductible.

Let’s assume you’ve been billed $20,000 for treatment. You have a $100 deductible, which you selected when you purchased your Seven Corners Travel Medical Insurance plan. You pay the deductible, so the remaining balance on your medical bill is now $19,900.

If you’re wondering about coinsurance, Seven Corners Travel Medical Insurance plans for U.S. residents traveling internationally have 100% coinsurance. That means the plan begins paying after the deductible is paid.

It’s important to note that some other plans do have coinsurance that would apply and may require you to pay a percentage of your medical expenses.

3. Insurance payment is made.

If your claim is approved, and the remaining balance falls below the medical maximum you selected when the plan was purchased, Seven Corners will pay the rest of the medical expenses.

In our example, if you chose a $500,000 medical maximum, the remaining expenses ($19,900) would fall below that limit. In the end, you will pay $100, and Seven Corners will pay the remaining bill in full.

What happens if an insurance claim is denied?

Travel medical insurance claims can be denied for different reasons, including claims made for treatment before your plan’s effective date, which is the date your coverage begins, or for care that was routine or preventive. Learn more about these commonly denied travel insurance claims .

What’s the Next Step?

If you’re ready to submit a claim now, get started by logging into your Seven Corners account. You may want to collect receipts and other documents related to your situation before you start.

Contact us with questions about how to access your Seven Corners account or how to submit a claim.

- Infographics

- Study Abroad

- Testimonials

- Travel Destinations

- Travel Insurance Advice

- Travel Tips

Search Posts

Newsletter alert

Receive our monthly inspiration and travel tips from the travel insurance experts.

303 Congressional Blvd.

Carmel, Indiana 46032

Our Markets

- Consumer Insurance

- Government Solutions

- Trip Protection

- Trip Protection Annual Multi-Trip

- Trip Protection USA

- Travel Medical

- Travel Medical Annual Multi-Trip

- Travel Medical USA Visitor

- Mission & NGO

- Medical Evacuation and Repatriation

- Partnerships

- 24 Hour Urgent Travel Assistance

- Frequently Asked Questions

- Developer Portal

- System Status

Copyright © 2024 Seven Corners Inc. All rights reserved.

Privacy | Cookies | Terms of Use | Security

The Policy Pal

How to File a Travel Insurance Claim: Step-by-Step Guide

Travel insurance can provide peace of mind when you’re exploring the world, but unfortunately, accidents and unexpected events can still occur. When something goes wrong, it’s important to know how to file a travel insurance claim. This guide will walk you through the steps you need to take to file a successful claim and get reimbursed for your expenses.

Introduction

Travel insurance is designed to protect you in case something goes wrong on your trip, such as a medical emergency, trip cancellation, or lost luggage. However, many people are unsure of how to file a claim when they need to use their insurance. In this article, we’ll provide you with a step-by-step guide to help you navigate the process of filing a travel insurance claim.

Understanding Your Travel Insurance Policy

Before you even begin to file a claim, it’s important to understand your travel insurance policy. This will help you determine what’s covered and what’s not, as well as any deductibles or limits on your coverage.

Coverage Types

Most travel insurance policies offer a variety of coverage types, including:

- Medical expenses: Covers costs related to medical emergencies and injuries while traveling.

- Trip cancellation/interruption: Provides reimbursement if you need to cancel or cut short your trip due to a covered reason, such as illness or a natural disaster.

- Baggage/personal effects: Covers lost, stolen, or damaged luggage or personal items.

- Evacuation/repatriation: Covers the costs of emergency medical evacuation or repatriation in the event of a medical emergency or death.

Policy Limits and Deductibles

In addition to understanding what’s covered, you should also be aware of any policy limits and deductibles. Policy limits refer to the maximum amount your insurer will pay out for a particular type of coverage. Deductibles refer to the amount you’ll need to pay out of pocket before your coverage kicks in.

What to Do When Something Goes Wrong

If something goes wrong on your trip, such as a medical emergency or lost luggage, it’s important to take immediate action.

Document Everything

The first step is to document everything that happens. This includes taking pictures of any damage or injuries, as well as keeping all receipts and other relevant documentation.

Contact Your Insurance Company

Next, you should contact your travel insurance company as soon as possible. Most insurers have a 24/7 emergency hotline that you can call in the event of an emergency.

Follow Your Insurer’s Instructions

Your insurer will give you instructions on what to do next, such as seeking medical attention or filing a police report. It’s important to follow these instructions carefully to ensure that your claim is processed smoothly.

Filing Your Claim

Once you’re back home and ready to file your claim, there are a few steps you’ll need to follow.

Gather Your Documentation

The first step is to gather all of the documentation you’ll need to support your claim. This may include medical bills, police reports, and receipts for lost or damaged items. Make sure to review your policy to ensure that you have all of the necessary documentation.

Submit Your Claim

Once you have all of your documentation, you can submit your claim to your insurance company. Many insurers allow you to submit your claim online or by mail. Be sure to fill out all of the required forms and provide all of the necessary documentation.

Wait for Your Insurer’s Response

After you submit your claim, your insurer will review it and determine whether it’s covered under your policy. This process can take anywhere from a few days to several weeks. If your claim is approved, your insurer will typically reimburse you for your expenses minus any deductibles or policy limits.

Dealing with a Denied Claim

If your claim is denied, it can be frustrating and confusing. However, there are steps you can take to try to get your claim approved.

Review Your Policy

The first step is to review your policy to make sure that your claim was denied for a legitimate reason. If you believe that your claim was denied unfairly, you can file an appeal with your insurer.

File an Appeal

To file an appeal, you’ll need to provide additional documentation or evidence to support your claim. Make sure to follow your insurer’s appeals process carefully to ensure that your claim is considered.

Seek Legal Advice

If your appeal is denied, you may want to seek legal advice. A lawyer can help you understand your options and advise you on how to proceed.

Filing a travel insurance claim can be a daunting process, but it’s important to know how to do it in case something goes wrong on your trip. By understanding your policy, documenting everything that happens, and following your insurer’s instructions, you can increase your chances of having your claim approved. And if your claim is denied, don’t give up – there are steps you can take to try to get it approved.

What documentation do I need to file a travel insurance claim?

The documentation you need may vary depending on your insurance policy and the nature of your claim. However, common documents include receipts, police reports, medical records, and proof of travel. Be sure to review your policy carefully to ensure that you have all of the necessary documentation.

How long does it typically take for a travel insurance claim to be processed?

The processing time for travel insurance claims can vary depending on the insurer and the nature of the claim. Some claims may be processed within a few days, while others may take several weeks or even months.

What should I do if my claim is denied?

If your claim is denied, you may want to review your policy to ensure that your claim was denied for a legitimate reason. If you believe that your claim was denied unfairly, you can file an appeal with your insurer. If your appeal is denied, you may want to seek legal advice.

Can I purchase travel insurance after I’ve already left on my trip?

It depends on the insurer and the policy. Some insurers may allow you to purchase travel insurance after you’ve left on your trip, but the coverage may be limited. Be sure to review your policy carefully to understand the terms and conditions.

What happens if I need to file a claim for a covered event that happens during my trip, but I don’t have internet access to submit it online?

If you don’t have internet access to submit your claim online, you may be able to submit it by mail or fax. Be sure to review your policy to understand the options available to you. You may also want to consider purchasing travel insurance that includes 24/7 emergency assistance, which can help you in case of a covered event.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

Similar Posts

5 reasons why you need insurance coverage.

Discover the top 5 reasons why insurance coverage benefits are essential for your life. Protect your future today with our expert advice.

Dental Implants Covered by Medical Insurance: A Comprehensive Guide

Discover how to get dental implants covered by medical insurance and ensure affordable dental care. Learn about eligibility and claim process.

Claims Adjuster – Expert Tips for Efficient Claim Processing

Learn expert tips for efficient claim processing as a claims adjuster. Enhance your skills and improve claim settlement with the insights provided by claims adjuster professionals.

Renter Insurance for House Flippers: What You Need to Know

Learn what you need to know about Renter Insurance for House Flippers. Our SEO Friendly guide covers all the essentials.

Is it Worth Getting Domestic Travel Insurance?

Discover the value of domestic travel insurance – Is it worth getting domestic travel insurance? Uncover essential insights in this comprehensive guide.

Car Insurance Proof of Marriage: Do Companies Ask?

Discover if car insurance companies require proof of marriage. Get insights on how companies handle marital status for insurance coverage.

Discover more from The Policy Pal

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

How to File a Travel Insurance Claim

W hen it comes to travel, there are generally two types of people: people who cannot travel as it is too expensive and those who budget $4,000 per year for vacations, according to Forbes. Travel is costly, so people often purchase travel insurance to safeguard their financial investment from unforeseen events like illnesses, luggage delays, personal emergencies, and more.

When policyholders pay honest money for an insurance policy to offer protection, they want to be able to reap the benefits of the travel insurance claim. If your travel insurance company has denied payment, our tips on how to properly file a travel insurance claim may be helpful.

Why Buy Travelers Insurance?

Travel is generally less stressful with vacation insurance — it is packaged as a wise investment that can protect you against financial losses due to unexpected events. For instance, the U.S. State Department highly recommends international travel trip insurance as Medicare and Medicaid often do not cover overseas medical costs.

The travel insurance premium is relatively small compared to the non-refundable trip costs you could lose in a bad situation. It is particularly worth it if your trip involves non-refundable costs, international travel, or travel to a remote area with limited healthcare facilities or regions prone to natural disasters.

Some of the primary reasons people buy trip insurance are to help offset:

- Emergency medical services and treatment

- Cancellations due to a sudden illness or serious health condition

- Emergency evacuation

- Loss of a friend or family member

- Compromised destinations

- Delayed or lost luggage

- Trip interruption or cancellation

What Is Not Covered By Travel Insurance?

The best insurance policies cover basic and common travel risks and bundle different coverage types related to trip cancellation, medical issues, luggage or trip delays, and more. Travel insurance is not meant to cover all foreseeable events, and every policy will address exclusions differently. Examples of potential limitations are:

- Tropical storms, hurricanes, and other dangerous weather conditions

- Certain medical issues

- Acts of war

- High-risk behavior involving drugs, unlawful acts, or riots

- Government-imposed restrictions

Travel insurance claims submitted without proper documentation or cancellation for reasons not covered by your travel policy are surefire ways to prevent coverage and reimbursement. This is why it is helpful to understand travel insurance coverage properly and take appropriate actions before assuming foul play.

Can You Cancel Travel Insurance and Get a Refund?

Most travel insurance carriers allow refunds, depending on when a policy is canceled and if there is a money-back guarantee. Most insurers ask that the policy be revoked during the review period outlined in the contract terms to qualify for a complete travel insurance refund. If the review period has passed, then policyholders might be eligible for a partial refund or not qualify for one at all.

What To Do if a Travel Insurance Claim Is Denied

If your travel insurance claim submitted for medical reasons, delays, cancellations, or any other reason was denied by your insurer, then remember that you have options. Both denials and rejections may happen for valid as well as unethical reasons. An insurance claim denial is not the end of the road; you can dig deeper to figure out whether you can still be reimbursed under your insurance.

Travel insurance claims are routinely denied when policyholders make common mistakes in their claim forms, or they mistakenly assume their policy covers their specific situation. Good faith denials happen when policyholders do not fill out their travel insurance claim form correctly, do not submit the right documents, or do not include info like contact details for follow-up questions.

In some cases, travel insurance companies may wrongly deny claims and stall the claims process. For instance, they might fail to investigate the claim or conduct proper due diligence. In such scenarios, it is advisable that policyholders adjust and resubmit their insurance claim, appeal the denial, or pursue legal action if insurers continue to illegally hold their payout.

How To Appeal a Travel Insurance Claim: 4 Steps

The travel insurance claim appeal process allows policyholders to ask the insurer to reconsider its decision. When appealing their travel insurance claim, policyholders must:

- Carefully Review the Denial Letter: Review the specific reasons for the denial to determine your next steps. Cross-check the reasons stated with your policy documents, additional emails, and other papers.

- Review Your Policy: Review the terms of your travel insurance policy and pay attention to disclaimers, damage limits, filing time limits, and submission requirements.

- Reach Out for Assistance: After carefully reviewing your policy, if you find the denial letter and policy terms do not line up, contact an insurance legal expert with experience in handling travel insurance claims for help.

- Gather Documentation and Keep Careful Records: Maintain communication records with your insurer, copies of denial letters, and other documentation regarding your claim.

How To Write a Travel Insurance Claim Letter

Sometimes, travelers have to file a trip insurance claim when their vacation does not go according to the plan. A travel insurance claim letter is a formal piece of communication between you and your insurance agency. Its purpose is to ask for reimbursement for covered damages or losses under the travel insurance policy. Therefore, it is important to craft a professional and detailed claim letter to increase your chances of a favorable resolution.

A claim letter should include the following information:

- Introduce Yourself. Include all relevant information of the person appealing (such as the policy number and contact information).

- Address the Denial. Summarize the date you received the letter and why the denial was made. Do not leave out any important details.

- Point Out the Error. Explain why you do not agree with the claims denial, based on your policy and pertinent information.

- Attach Extra Documents. Include all other documents supporting your trip insurance claim, such as photos, additional correspondence, transcripts of phone calls, etc.

How Long Does It Take To Get Reimbursed From Insurance?

Travel insurance companies generally process most claims within a few weeks. Sometimes, the insurance claims process office might have follow-up questions, thereby increasing the time you can expect to hear back. However, if you feel that your insurance claim is taking months to resolve without a proper reason, you should speak to an experienced insurance dispute lawyer. While every situation is different, policyholders should always keep careful and consistent notes as it will help them take informed legal action if necessary.

Travel Insurance Claims Advice on Documentation

You must be thorough with your documentation to enhance your chance of successful recovery. When you file a trip claim, your insurer will more likely refund travel insurance when you include the following information in your claim submission:

- Lost Luggage: Make a list of what was lost, along with the details and cost of each lost item.

- Job Loss: Request that your previous employer send you a notarized letter on company letterhead in the case of a trip cancellation due to job loss.

- Medical Emergency: Include detailed medical records in your claim if a health emergency kept you from traveling.

- Canceled/Delayed Flight: If you could not attend your trip because the flight was canceled or delayed, provide proof such as an email that relays the reasons (mechanical issues, weather, etc.).

- Receipts for Delayed Flights: You might want to keep receipts for necessary expenses incurred due to delays, like hotel stays, transportation costs, meals, and personal necessities.

- Police Reports: These reports can help substantiate claims made for stolen items or car troubles.

- Other Reports: You may include tickets for unused flights or excursions in your insurance claim.

Has a Formal Complaint Been Filed Against the Travel Supplier?

Formal complaints against travel suppliers are helpful in legal cases dealing with similar situations. The Van Rossem v. Penney Travel Service (April 15, 1985) case exemplifies travel insurance gone wrong.

In this case, a newlywed couple arranged a honeymoon trip with travel agent Penney Travel. The agent used a wholesaler, Lotus Tours, to book the reservation without the couple's knowledge. Lotus Tours abruptly went bankrupt before booking the client's reservation with SANDLES, which remained unpaid. When the case came before the court, the judge noted that "an agent who makes the contract in his own name for an undisclosed principal is liable as a principal." Here, the defendant had failed to disclose the identity of Lotus Tours, and so, it was responsible as the principal. The couple had paid $2,059 in advance. The judge awarded them reimbursement of $1,312, plus costs and disbursements.

In another lawsuit, Touhey v. Trans National Travel , a travel agent did not check to see if the hotel a client had booked was duly constructed. The plaintiff-client was awarded $25,000 in special damages because of the mistake.

What Are Bad Faith Insurance Practices?

Bad faith insurance refers to unethical insurance practices used by an insurer to delay, deny, or lowball policyholders. Examples of bad faith insurance practices include:

- Misrepresenting contract language to prevent a payout

- Failing to disclose policy limitations and exclusions to policyholders

- Making unreasonable demands, like excessive paperwork requests to prove a covered loss

Sometimes, only a seasoned insurance dispute lawyer who regularly deals with contract breaches and bad faith claims can identify honest errors from serious red flags and help a policyholder get paid their due.

How to File a Travel Insurance Claim: A Summary

Travelers usually plan their vacations down to the last detail. Travel insurance is a buffer for unplanned curveballs that can derail even the most meticulous plans, such as medical emergencies or misplaced luggage.

Insurance companies are explicit about what travel mishaps or unexpected events they will or will not cover, which is why it is crucial to understand policy limitations and how to properly file a travel insurance claim.

As a final snapshot, the key steps to filing a travel insurance claim include:

- Reviewing policy terms and exclusions.

- Gathering necessary documentation based on submission requirements.

- Submitting your claim according to the insurer's timing and filing guidelines.

- Filing an appeal if an insurance claim is wrongly denied.

- Consulting an experienced insurance dispute lawyer to assist with an intentionally stalled, denied, or undervalued claim.

Travel insurance claims can become challenging, depending on the situation and response from your insurer. When small bumps in the road become permanent roadblocks, it is helpful to know that qualified travel insurance claims attorneys are available to help frustrated policyholders recover their losses.

WhatsApp us

+1-855-652-5565

- Pre-existing Plans

- Trip Insurance

- Cookie Policy (EU)

Get Magik Insurance Services Inc. – OnshoreKare.com License# 0M14328

Contact info

- 35463 Dumbarton Ct, Newark, CA 94560, United States

- +1-855-OK-ALL-OK / +1-855-652-5565

Instive Blog

Travel Medical Insurance – Cost, Coverage, And Benefits

Travel medical insurance is extremely important for international travel, it provides you with medical coverage ensuring your health and financial security.

International travel medical insurance is available to anyone visiting a foreign country be it leisure travelers or business travelers, whether you are visiting family members or holidaying solo.

Unforeseen medical emergencies can arise when you travel, potentially leaving you vulnerable to high costs and logistical nightmares. This is where travel insurance steps in as a crucial safeguard.

In some countries like the USA, healthcare is very expensive, while you get the best medical coverage it can be a huge financial burden without travel medical coverage.

In this comprehensive guide, we’ll explore the intricacies of travel insurance, including its cost, coverage options, benefits, and key considerations, catering to international travelers’ needs and seeking peace of mind on their journeys.

Understanding Travel Medical Insurance

Also referred to as travel health insurance, is a specialized insurance product designed to provide coverage for unexpected medical expenses incurred during international travel.

Travel medical coverage offers financial protection against a wide range of medical emergencies, ensuring that travelers have access to necessary medical care without facing overwhelming costs or logistical challenges.

Also known as travel health insurance plans these also provide coverage against travel-related risks like trip cancellation, trip interruption, travel delays, lost or stolen passport, baggage delay, etc.

Do you live in the USA and have parents visiting you from your home country? Best travel insurance for parents visiting USA can be a helpful guide.

Importance Of Travel Medical Insurance

Traveling abroad exposes individuals to various risks, including accidents, illnesses, injuries, and unforeseen medical emergencies.

Your primary health insurance coverage from your home country will most likely not provide medical coverage when you are traveling abroad.

In such scenarios, having travel insurance can become your primary insurance and make all the difference, offering peace of mind and financial security.

Here’s Why Travel Insurance Is Indispensable:

- Coverage Options: A Comprehensive travel medical insurance plan is available for coverage for medical expenses, including hospitalization, doctor visits, prescription medications, emergency medical treatment, and medical evacuation services. Comprehensive plans offer great coverage. For the budget-conscious traveler with low risks, the fixed benefits or limited coverage plans can be a perfect fit. See the differences between comprehensive plans and limited coverage plans .

- Financial Security: Medical expenses incurred abroad can be substantially higher than those in your home country. Travel insurance provides financial protection, preventing travelers from facing crippling medical bills and potential financial ruin.

- Access to Quality Healthcare: In the event of a medical emergency, travel health insurance ensures that travelers have access to quality healthcare services, regardless of their location. This includes access to reputable medical facilities and healthcare providers worldwide. A travel insurance company based in the USA will most likely offer PPO Network plans that give you access to quality healthcare at competitive prices.

Travel Medical Insurance Cost

The cost of travel insurance depends on several factors, like the traveler’s age, destination country, duration of coverage, policy maximum limits, Deductibles emergency medical coverage, pre-existing medical conditions coverage…

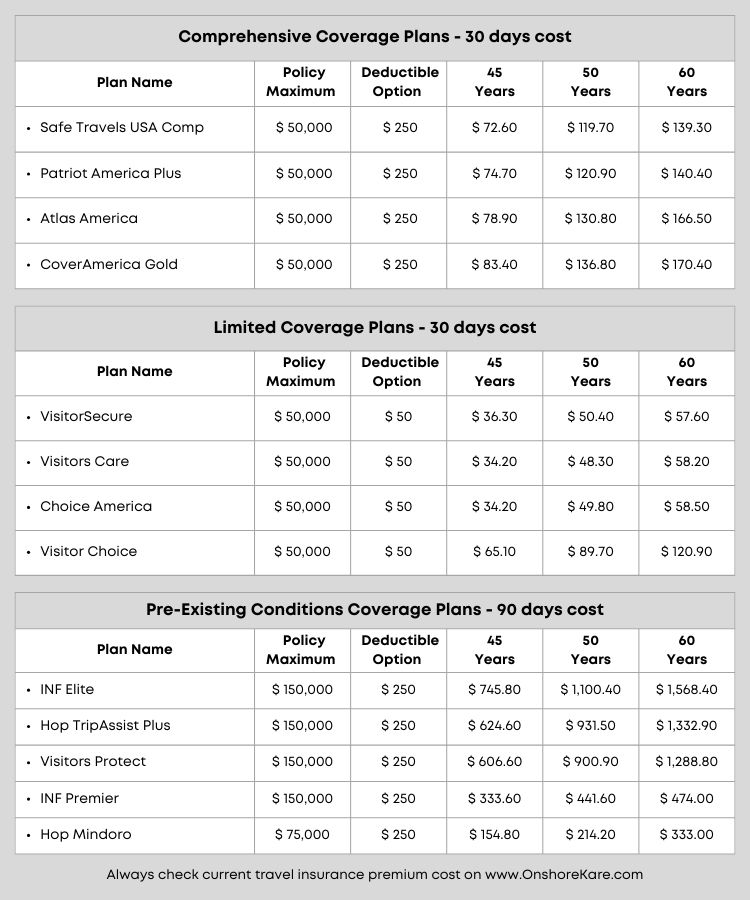

Popular Travel Medical Insurance Plans To Provide Robust Coverage:

Comprehensive plans.

Patriot America Plus

Atlas America

Safe Travels USA Comprehensive

Limited Coverage Plans

Visitors Care

VisitorSecure

Visitor Choice

While some travelers may perceive travel medical insurance as an additional expense, the benefits far outweigh the costs.

Travel medical insurance plan cost varies by age and other factors, here is a sample premium cost for ease of understanding:

Here’s What Influences The Cost:

Destination:.

The cost of travel insurance may vary based on the destination’s healthcare costs, medical infrastructure, and risk factors associated with the region.

Duration Of Travel:

Longer trips typically incur higher insurance premiums due to an increased exposure to potential medical emergencies over an extended period.

Age Of Traveler:

Older travelers may face higher insurance premiums due to the increased likelihood of medical issues and the associated risks.

Coverage Limits:

Travelers can choose from a range of coverage limits based on their preferences and budget. Higher coverage limits generally result in higher premiums.

Pre-Existing Medical Conditions:

Travelers with pre-existing medical conditions may face higher insurance premiums or limited coverage options.

Most medical travel insurance plans exclude coverage of pre-existing conditions and provide only the acute onset of a pre-existing condition benefit.

For travel insurance plans that cover pre-existing conditions the cost is much higher. At OnshoreKare we provide options for coverage of a pre-existing condition. Call +1 855 652 5565 for assistance from our licensed associates.

Popular Travel Health Insurance Plans That Provide Medical Coverage For Pre-Existing Conditions:

Visitors Protect

INF Premier

INF Elite Plus

INF Premier Plus

Popular Travel Protection Plans With Pre-Existing Conditions Coverage:

Hop Mindoro

Hop TripAssist Plus

Note: Hop plans are travel protection plans and not travel insurance plans.

Travel Medical Insurance Coverage

Travel medical insurance plans offer comprehensive coverage for a wide range of medical expenses and emergencies. Here’s what travel medical insurance typically covers:

- Emergency Medical Treatment: Coverage for emergency medical treatment, including hospitalization, doctor visits, diagnostic tests, and prescription medications.

- Medical Evacuations: Coverage for emergency medical evacuation to the nearest adequate medical facility or repatriation to the traveler’s home country in the event of a medical emergency.

- Trip Interruption/Cancellation: Some travel insurance plans offer coverage for trip interruption or cancellation due to covered medical reasons, such as illness, injury, or death of the traveler or a family member.

- Repatriation of Remains: Coverage for the repatriation of remains in the unfortunate event of a traveler’s death while abroad, including funeral expenses and transportation costs.

- 24/7 Assistance Services: Many travel medical insurance providers offer 24/7 assistance services, including access to medical professionals, medical referrals, coordination of emergency medical transportation, and assistance with lost prescriptions or medical supplies.

Key Considerations Before You Purchase Travel Medical Insurance

When purchasing travel medical insurance, several key considerations can help travelers make informed decisions and choose the right coverage for their needs:

- Coverage Limits and Exclusions: It’s essential to review the coverage limits, exclusions, and terms and conditions of a travel insurance policy to ensure it provides adequate protection for the intended travel destination and activities.

- Pre-existing Conditions: Travelers with pre-existing medical conditions should disclose their medical history accurately and inquire about coverage options available to them, as some policies may exclude coverage for pre-existing conditions or impose restrictions and waiting periods.

- Duration of Coverage: Choose a travel medical insurance policy that aligns with the duration of your trip and offers flexibility in case of unexpected changes or extensions.

- Claim Process and Documentation: Familiarize yourself with the claim process and documentation requirements of your travel medical insurance provider to ensure a smooth claims experience in the event of a medical emergency. Keep copies of your policy documents, medical records, and receipts for medical expenses incurred during the trip.

Note: Always read the policy document which lists the travel insurance benefits, emergency medical benefits, eligible expenses, exclusions, limits, and other terms like prior approval needed from the insurance company or the insurance provider before any major medical expenses are all explained.

Frequently Asked Questions About Travel Medical Insurance:

- What is travel medical insurance, and do I need it? Travel medical insurance provides coverage for unexpected medical expenses incurred while traveling abroad. It is essential for anyone traveling internationally as it offers financial protection against medical emergencies, which can be costly and unpredictable.

- Does my regular health insurance cover me while I’m traveling abroad? While some health insurance policies may offer limited coverage for overseas travel, they often come with restrictions and exclusions. Travel medical insurance fills these gaps by providing specialized coverage tailored to the needs of travelers, including emergency medical treatment and evacuation services.

- What does travel medical insurance typically cover? Travel medical insurance typically covers expenses related to hospitalization, doctor visits, prescription medications, emergency medical treatment, emergency medical evacuation, repatriation of remains, and in some cases, trip interruption or cancellation due to medical reasons.

- Are pre-existing medical conditions covered under travel medical insurance? Pre-existing medical conditions may be excluded from coverage or subject to restrictions and waiting periods depending on the policy. It’s essential to disclose your medical history accurately and inquire about coverage options available for pre-existing conditions.

- How much does travel medical insurance cost? The cost depends on factors such as the traveler’s age, destination, duration of travel, coverage limits, and pre-existing medical conditions. It’s advisable to obtain quotes from multiple insurance providers to compare coverage and prices.

- When should I purchase travel medical insurance? Travel medical insurance cover should ideally be purchased at the time of booking your trip to ensure coverage for unforeseen events that may arise before or during your travels. However, some policies may offer options for purchasing coverage after booking your trip but before departure.

- Do I need travel medical insurance if I’m traveling domestically? While travel medical insurance is primarily designed for international travel, it may still be beneficial for domestic travelers, especially if their regular health insurance does not provide coverage outside their home state or if they are traveling to remote areas with limited medical facilities.

- Can I purchase travel medical insurance for specific activities such as adventure sports? Some travel medical insurance policies offer optional coverage for specific activities such as adventure sports, hazardous activities, or high-risk destinations. It’s essential to review the policy’s coverage exclusions and limitations to ensure adequate protection for your planned activities.

- What should I do if I need medical assistance while traveling abroad? In the event of a medical emergency abroad, contact your travel medical insurance provider’s 24/7 assistance services immediately for guidance and assistance. They can help coordinate emergency medical treatment, arrange for medical evacuation if necessary, and assist with claims processing.

- How do I file a claim for medical expenses incurred during my trip? To file a claim for medical expenses incurred during your trip, you will typically need to submit a claim form along with supporting documentation such as medical bills, receipts, and medical records. Follow the instructions provided by your travel medical insurance provider to ensure a smooth claims process.

Travel medical insurance is a crucial component of responsible travel planning, offering essential protection and peace of mind for travelers venturing abroad.

By understanding its cost, coverage options, benefits, and key considerations, travelers can make informed decisions and ensure they have adequate protection against unforeseen medical emergencies.

Remember, investing in travel medical insurance is not just about protecting your health—it’s about protecting your financial well-being and ensuring a worry-free travel experience wherever your adventures may take you.

Safe travels!

Not sure what you need ? We’d love to help you plan better.

- +1 - 855-652-5565

Our Company

- Privacy Policy

- Terms of Service

- Visitors Insurance

- Insurance for parents

- Green Card Insurance

- Travel Insurance

- Student Insurance

- Health Insurance

Get in touch

We’re here to listen:

- +1-855-OK-ALL-OK +1-855-652-5565

- icon_f Whatsapp +1 (417) 932-3109

- Licence No:0M14328

© 2024, All Rights Reserved by OnshoreKare

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Cheapest travel insurance of April 2024

Mandy Sleight

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:52 a.m. UTC April 11, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best cheap travel insurance company of 2024 based on our in-depth analysis of the cheapest travel insurance plans. Its Atlas Journey Preferred and Atlas Journey Premier plans offer affordable travel insurance with high limits for emergency medical and evacuation benefits bundled with good coverage for trip delays, travel inconvenience and missed connections.

Cheapest travel insurance of 2024

Why trust our travel insurance experts

Our team of travel insurance experts analyzes hundreds of insurance products and thousands of data points to help you find the best travel insurance for your next trip. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Best cheap travel insurance

Top-scoring plans

Average cost, medical limit per person, medical evacuation limit per person, why it’s the best.

WorldTrips tops our rating of the cheapest travel insurance with two plans:

- Atlas Journey Preferred is the cheaper travel insurance plan of the two, with $100,000 per person in emergency medical benefits as secondary coverage and an optional upgrade to primary coverage. It’s also our pick for the best travel insurance for cruises .

- Atlas Journey Premier costs a little more but gives you $150,000 in travel medical insurance with primary coverage . This is a good option if health insurance for international travel is a priority.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier offers $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan offers travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Cheap travel insurance for cruises

Travel insured.

Top-scoring plan

Travel Insured offers cheap travel insurance for cruises and its Worldwide Trip Protector plan gets 4 stars in our rating of the best cruise travel insurance .

- Worldwide Trip Protector offers $1 million in emergency evacuation coverage per person and a rare $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits, which means you won’t have to file medical claims with your health insurance first.

- Cheap trip insurance for cruises.

- Offers a rare $150,000 for non-medical evacuation.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person only available for cruises and tours.

Best cheap travel insurance for families

Travelex has the best cheap travel insurance for families because kids age 17 are covered by your policy for free when they’re traveling with you.

- Free coverage for children 17 and under on the same policy.

- $2,000 travel delay coverage per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Only $50,000 per person emergency medical coverage.

- Baggage delay coverage is only $200 and requires a 12-hour delay.

Best cheap travel insurance for seniors

Evacuation limit per person

Nationwide has the best cheap travel insurance for seniors — its Prime plan gets 4 stars in our best senior travel insurance rating. However, Nationwide’s Cruise Choice plan ranks higher in our best cheap travel insurance rating.

- Cruise Choice has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion. It also has a missed connections benefit of $1,500 per person after only a 3-hour delay, for cruises or tours. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Coverage for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” (CFAR) upgrade available.

- Missed connection coverage of $1,500 per person is only for tours and cruises, after a 3-hour delay.

Best cheap travel insurance for add-on options

AIG offers the best cheap travel insurance for add-on options because the Travel Guard Preferred plan allows you to customize your policy with a host of optional upgrades.

- Travel Guard Preferred upgrades include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings. There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million.

- Bundle upgrades allow you to customize your affordable travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best cheap travel insurance for missed connections

TravelSafe has the best cheap travel insurance for missed connections because coverage is not limited to cruises and tours, as it is with many policies.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of the best cheap travel insurance plans.

- No “interruption for any reason” coverage available.

- Weak baggage delay coverage of $250 per person after 12 hours.

Cheapest travel insurance comparison

How much does the cheapest travel insurance cost?

The cheapest travel insurance in our rating is $334. This is for a WorldTrips Atlas Journey Preferred travel insurance plan, based on the average of seven quotes for travelers of various ages to international destinations with a range of trip values.

Factors that determine travel insurance cost

There are several factors that determine the cost of travel insurance, including:

- Age and number of travelers being insured.

- Trip length.

- Total trip cost.

- The travel insurance plan you choose.

- The travel insurance company.

- Any add-ons, features or upgraded benefits you include in the travel insurance plan.

Expert tip: “In general, travelers can expect to pay anywhere from 4% to 10% of their total prepaid, non-refundable trip costs,” said Suzanne Morrow, CEO of InsureMyTrip.

Is buying the cheapest travel insurance a good idea?

Choosing cheaper travel insurance without paying attention to what a plan covers and excludes could leave you underinsured for your trip. Comparing travel insurance plans side-by-side can help ensure you get enough coverage to protect yourself financially in an emergency for the best price.

For example, compare these two Travelex travel insurance plans:

- Travel Basic is cheaper but it only provides up to $15,000 for emergency medical expense coverage. You’ll also have to pay extra for coverage for children.

- Travel Select will cost you a bit more but it covers up to $50,000 in medical expenses and includes coverage for kids aged 17 and younger traveling with you. It also offers upgrades such additional medical coverage, “cancel for any reason” (CFAR) coverage and an adventure sports rider that may be a good fit for your trip.

Reasons to consider paying more for travel insurance

Make sure you understand what you’re giving up if you buy the cheapest travel insurance. Here are a few reasons you may consider paying a little extra for better coverage.

- Emergency medical. The best travel medical insurance offers primary coverage for emergency medical benefits. Travel insurance with primary coverage can cost more than secondary coverage but will save you from having to file a claim with your health insurance company before filing a travel insurance claim.

- Emergency evacuation. If you’re traveling to a remote location or planning a boat excursion on your trip, look at travel insurance with a high medical evacuation insurance limit. If you are injured while traveling, transportation to the nearest adequate medical facility could cost in the tens to hundreds of thousands. It may make sense to pay more for travel insurance with robust emergency evacuation coverage.

- Flexibility. To maximize your trip flexibility, you might consider upgrading your travel insurance to “ cancel for any reason” (CFAR) coverage . This will increase the cost of your travel insurance but allow you to cancel your trip for any reason — not just those listed in your policy. The catch is that you’ll need to cancel at least 48 hours before your trip and will only be reimbursed 50% or 75% of your trip expenses, depending on the plan.

- Upgrades. Many travel insurance plans have optional extras like car rental collision and adventure sports (which may otherwise be excluded from coverage). These will cost you extra but may give you the coverage you need.

How to find the cheapest travel insurance

The best way to find the cheapest travel insurance is to determine what you’re looking for in a travel insurance policy and compare plans that meet your needs.

“Travel insurance isn’t one-size-fits-all. Every trip is different, and every traveler has different needs, wants and concerns. This is why comparison is key,” said Morrow.

Consider the following factors when comparing cheap travel insurance plans.

- How often you’re traveling. A single-trip policy may be the most cost-effective if you’re only going on a single trip this year. But a multi-trip travel insurance plan may be cheaper if you’re going on multiple international trips throughout the year. Annual travel insurance policies cover you for a whole year as long as each trip doesn’t exceed a certain number of days, usually 30 to 90 days.

- Credit card has travel insurance benefits. The best credit cards offer perks and benefits, and many offer travel insurance-specific benefits. The coverage types and benefit limits can vary, and you must put the entire trip cost on the credit card to use the coverage. If your trip costs more than the coverage limit on your card, you can supplement the rest with a cheaper travel insurance plan.

- The coverage you need. When looking for the best travel insurance option at the most affordable price, only buy extras and upgrades you really need. A basic plan may only provide up to $500 in baggage insurance, but if you only plan to take $300 worth of clothes and accessories, you don’t need to pay more for higher coverage limits.

Is cheap travel insurance worth it?

Cheap travel insurance can be worth it, as long as you understand the plan limitations and exclusions. Taking the time to read your policy, especially the fine print, well before your trip can ensure there won’t be any surprises about what’s covered once your journey begins.

“If a traveler is looking for coverage for travel delays, cancellations, interruptions, medical and baggage — a comprehensive travel insurance policy will provide the most bang for their buck,” said Morrow. But if you’re on a tight budget and are only worried about emergency medical care and evacuation coverage while traveling abroad, stand-alone options are cheaper.

Before buying travel insurance, you should also consider what your health insurance will cover.