- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the amex travel portal: booking flights, hotels and more, you can use amex points to book flights, hotels, car rentals and more through its travel portal..

Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more. Information about the American Express® Green Card has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Using American Express Membership Rewards (MR) points to book prepaid flights, hotels, cruises, rental cars and vacation packages through the Amex Travel portal can be a great way to save money on your next vacation. But are you really getting the best value by redeeming your hard-earned points this way?

Whether you use the portal or transfer points to an American Express travel partner is up to you, as are other factors — from travel date flexibility, award availability and the type of credit card you're using to personal preferences for brands, seat class and comfort level. These will all come into play during the booking process.

Below, CNBC Select breaks down the best ways to book prepaid flights, hotels, cruises, rental cars and vacation packages with Amex points through the Amex Travel portal.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here .

Earning and redeeming Amex Membership Rewards points

You can access the Amex Travel portal and pay for flights, hotels and other travel needs with cash as long as you have an American Express branded credit card, but you will need one that earns Membership Rewards (MR) points to view the number of MR points required for a booking.

Luckily, American Express has several travel rewards cards that you can earn lucrative welcome offers to help you get started:

- The Platinum Card® from American Express : Earn 80,000 Membership Rewards® points after spending $8,000 within the first six months of card membership.

- American Express® Gold Card : Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new card within the first 6 months of card membership.

- American Express® Green Card : Earn 60,000 Membership Rewards® Points after you spend $3,000 on purchases on your new Card in your first 6 months of Card Membership. Plus, earn 20% back on eligible travel and transit purchases made during your first 6 months of Card Membership, up to $200 back in the form of a statement credit.

- Blue Business® Plus Credit Card from American Express : Earn 15,000 Membership Rewards® points after you spend $3,000 in eligible purchases on the card within your first 3 months of card membership.

- The Business Platinum Card from American Express : Earn 120,000 Membership Rewards® points after you spend $15,000 in eligible purchases on the card within your first 3 months of card membership.

- American Express® Business Gold Card : Earn 70,000 Membership Rewards® points after you spend $10,000 in eligible purchases on the card within your first 3 months of card membership.

Depending on which credit card you have, there may be opportunities to earn bonus points or receive partial rebates when redeeming MR points for flights. The Platinum Card , for instance, lets cardholders earn 5X points on flights booked through the Amex Travel portal or directly with the airline on up to $500,000 worth of flights per calendar year.

The Business Platinum Card also gives cardholders redeeming MR points for economy flights with their preferred airline or booking premium-class flights through the portal a 35% points rebate (up to 500,000 points per calendar year). Those booking with the American Express Business Gold Credit Card receive a similar rebate of 25% back on up to 250,000 points each year.

Another valuable perk of having The Platinum Card or The Business Platinum Card is the up to $200 annual airline credit you can use to cover checked bag fees, change fees, charges for pet's flights, choosing your seat and inflight amenities with your preferred airline, all of which can quickly add up.

The Platinum Card® from American Express

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year, 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel, 1X points on all other eligible purchases

Welcome bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

Regular APR

See Pay Over Time APR

Balance transfer fee

Foreign transaction fee, credit needed.

Excellent/Good

See rates and fees , terms apply.

Read our The Platinum Card® from American Express review .

Getting started with the American Express Travel portal

Start by logging in to your American Express account. If you're coming from your account's dashboard page, click "Menu" in the top left corner, then select "Travel" to access more options (pictured below) and select "Book a Trip" to head to the main travel portal.

The Amex Travel portal's front page resembles your average travel booking interface, with options to search for flights, hotels, vacation packages, rental cars and cruises.

Below the main search engine, you'll find current information about cancellation policies and other important pandemic travel details. There's also an interactive map showing Covid-19 testing and vaccination requirements around the world.

Hovering over the "Book" button at the top of the page opens a separate menu with shortcuts to various portal perks, like the International Airline Program (IAP), Amex Fine Hotels + Resorts and The Hotel Collection.

Hovering over the "Explore" button in the main menu leads to many of the same shortcuts, plus options for finding a Travel Insider, Special Offers through Fine Hotels + Resorts and information about destinations and premium hotel packages.

Whether you're booking flights, hotels or other travel through the portal, you'll be given an option to "Use Only Points" or "Use Points + Card" so it's up to you if you want to redeem all your points or just some. Either way, your credit card will be charged the full amount and you'll see a credit for the value of the points used posted separately to your account within 48 hours. Be aware that you will have to use an Amex credit card that's enrolled in the Membership Rewards program and redeem at least 5,000 MR points in order to activate the Pay with Points feature.

Should you need to cancel a booking made with MR points, call 1-800-297-3276 to get them returned. You'll receive a statement credit for any bookings made with your American Express Membership Rewards card through the portal.

How to book flights through the American Express Travel portal

While you're more likely to get the best redemption value by transferring MR points to one Amex's airline partners and taking advantage of airline alliances (Oneworld, SkyTeam, Star Alliance) to book flights, there are still some considerations to keep in mind when it comes to booking through the portal.

Note that with most Amex Travel Portal bookings your MR points will only be worth 1 cent each towards flights. So if you were booking a $100 flight, you'd need to redeem 10,000 points to cover the cost.

For starters, you'll have more flexibility as far as travel dates and brands, which comes in handy when award availability is limited on certain dates through certain airlines. Flights booked with MR points through the portal are treated as paid bookings, so you won't miss out on earning elite miles or status credits. You'll also be able to see which type of seat you're booking right away, as it's listed on the right side of each search result.

It's always a good idea to shop around before settling on a redemption method, so price out how many points each flight costs through the Amex Travel portal vs. on the airline's website. Taxes and fees may also be tacked on. Unless you have the Platinum Card or Business Platinum Card , be aware that airline ticket fees of $6.99 for domestic flights and $10.99 for international flights apply when you're booking through the Amex Travel portal.

Note that low-cost carriers like Allegiant Air, Frontier Airlines and Spirit Airlines aren't part of the Amex Travel portal, though you will be able to find flights with other major American carriers like Delta and United, among other international airline partners.

During the booking process, you'll have a chance to use MR points to upgrade from economy to nonrefundable or refundable seats in premium classes, though it may not provide the best redemption value. If, however, you do have plenty of MR points lying around and crave a fancier flight experience, this is a good option. Again, it all comes down to personal preference and comfort level.

Deals on international flights can also be found by booking through the International Airline Program (IAP), which offers discounts on non-economy tickets when you book flights through one of 26 participating airlines through the Amex Travel portal with a Platinum Card or Business Platinum Card . Flights must begin in the U.S. or select cities in Canada in order to qualify for this perk and you'll have to pay a $39 service fee per ticket.

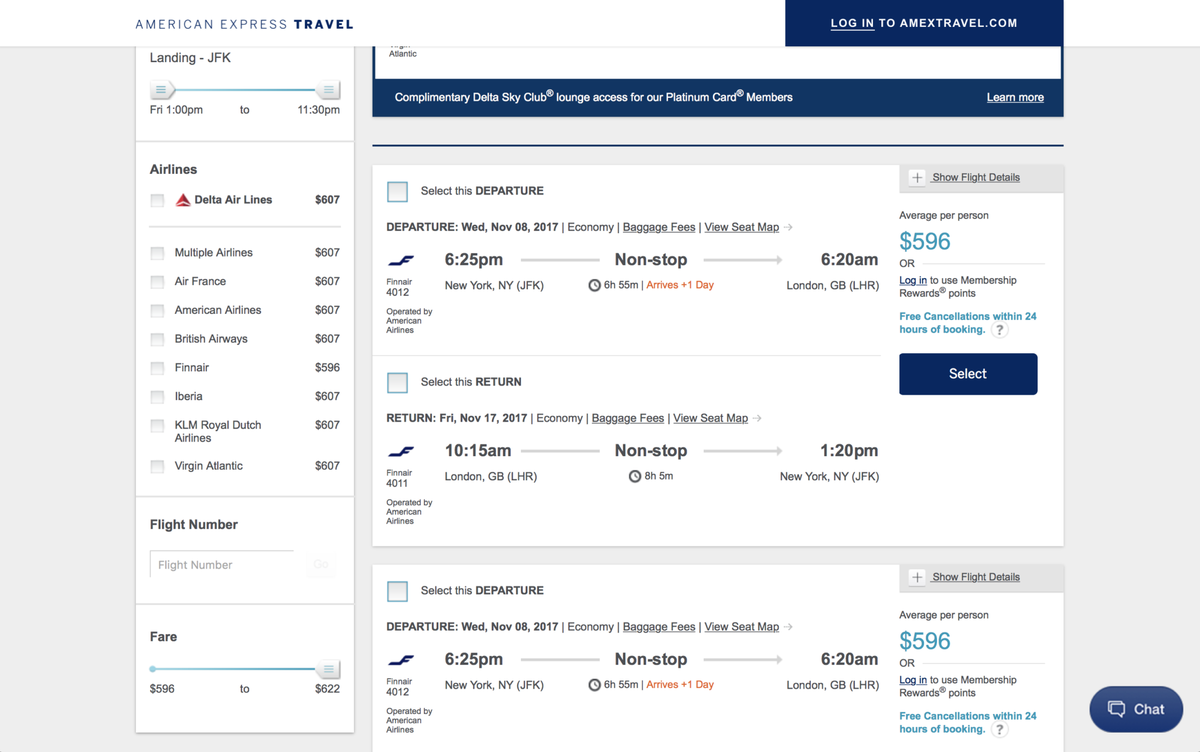

Filter search results by the number of stops, departure and landing time, airline or flight number, or sort them according to lowest price, flight duration, departure time or Amex recommendation (which usually means Delta flights will appear first, even if they're not necessarily your cheapest option).

Consider the example below, a search for a round-trip nonstop flight from Washington, D.C. to Paris from November 5-12, 2021, booked with the Amex Platinum Card. The results included a Delta flight from $674 or 67,425 MR points.

Alternatively, if you wanted to transfer your Amex MR points directly to Delta (since it's one of American Express' travel partners and you can switch them over at a 1:1 ratio) and redeem them through Delta's website, a round-trip flight would set you back 58,000 Delta SkyMiles plus another $96 in taxes and fees.

In this case, for 9,425 miles less, you'd end up with a better redemption by transferring MR points to Delta instead of going through the Amex Travel portal. But that's not necessarily the case for every flight, so always test it out first to see if using the portal makes the most sense for your travel needs.

To finish booking your flight through the portal, chose your desired route(s), review the details, select your upgrade option and pick how many MR points you'd like to put toward your purchase.

How to book hotels through the American Express Travel portal

As with flights, it's important to make sure you're getting the best deal on your MR points redemption. Consider transferring them to one of Amex's three hotel partners — Hilton Honors at a 1:2 ratio, Marriott Bonvoy at a 1:1 ratio, or Choice Privileges (Choice Hotels) at a 1:1 ratio, though there's a special promotion now through October 31, 2021, that bumps up Hilton and Marriott transfers by 30 percent.

Note that with most Amex Travel Portal bookings your MR points will only be worth .7 cent each towards hotel stays. So if you were booking a $100 hotel you'd need to redeem about 14,300 points to cover the cost. However, if you book a stay through Amex's Fine Hotels & Resorts program your points will be worth a little more, at 1 cent apiece.

Unlike MR points redemptions for flights, hotels booked through the portal are viewed as third-party reservations, so you won't be able to earn hotel points or enjoy status-related perks you'd have by booking directly through the hotel.

Begin your search by plugging in your travel dates and destination. Then, filter results by hotel or brand, star rating, price per night, neighborhood, amenities or accessibility, and sort by name, price, star rating or Amex recommendation.

For the following example, we searched for a seven-night stay booked November 5–12, 2021, with the Amex Platinum Card . The Renaissance Paris Arc De Triomphe Hotel, a Marriott Bonvoy property, was one of the best options, with rates from $306 or 43,723 MR points per night.

When booking the same stay through the Marriott website, you'd need 340,000 Marriott Bonvoy points for seven nights (which breaks down to 48,571 points per night), with nightly cash rates starting at 367 euros or $433. In this case, it would make more sense to book it through the portal. You could also earn 5X points for the stay by paying with the Amex Platinum Card or Business Platinum Card.

Make it a habit to compare the number of points required by the portal with the number of points needed to redeem through each hotel's website, as pricing may be affected by location and time of year, among other factors. To complete your booking through the Amex Travel portal, choose your room type, review the details and select how many points you'd like to use.

Premium cardholders also have access to the Fine Hotels & Resorts program, which adds extra benefits per stay at more than 1,200 properties around the world, based on availability:

- 12 p.m. check-in and guaranteed 4 p.m. late check-out

- Complimentary room upgrades and Wi-Fi

- Daily breakfast for two

- A $100 credit to use toward on-property activities, dining or other perks like airport transfers, depending on your hotel

Additionally, those with the Amex Gold Card, Business Gold Card, Platinum Card, Business Platinum Card , and in some cases, the Centurion Card, can book trips through The Hotel Collection. Note that Amex Gold Card members earn 2X points, while Platinum Card members earn 5X points on such bookings, but all receive the following benefits per stay of two or more nights:

- A credit of up to $100 to use toward on-property dining, spa, or activities

- Room upgrades (based on availability)

- Discounted rates, depending on the hotel

The Amex Travel portal also lets you search for and book vacation packages, which, depending on what kinds of sales are happening at the time, can save you a bundle or end up costing about the same as it would be to book your flight and hotel separately. If you do book a package, note that the same airline ticket fees apply as when you book separately (not for Platinum and Business Platinum cardholders, who have them waived). Cards earning MR points will score 2X points on packages, while those with Amex Platinum and Business Platinum cards will earn 5X points.

How to book cruises and car rentals

While cashing in a ton of MR points for a cruise or car rental may not yield the best redemption (your points will be worth just .7 cents each), it may still be a good option depending on your travel needs.

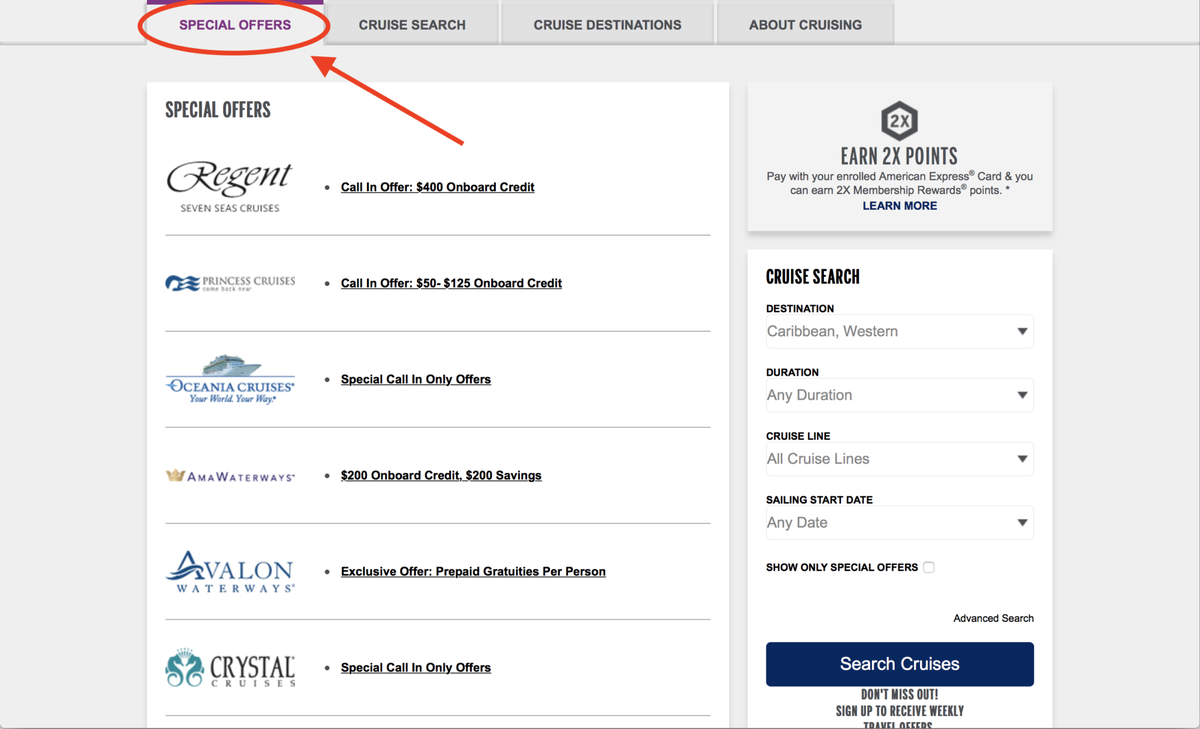

Click on the "Cruises" tab of the Amex Travel portal homepage to search by cruise line, destination, travel dates and sailing duration. Below, for example, are some results for Mediterranean cruises in November 2021.

The prices shown reflect the cost per person, based on double occupancy cabins. Depending on which card you're using and the cruise options available, you should be able to redeem Amex MR points for a portion of or all of your sailing.

Those booking with Membership Rewards credit cards can earn 2X points per dollar spent on cruises booked through the portal, while folks with Platinum Cards or Business Platinum Cards can score stateroom credits of $100–$300 and other onboard perks through the Cruise Privileges program.

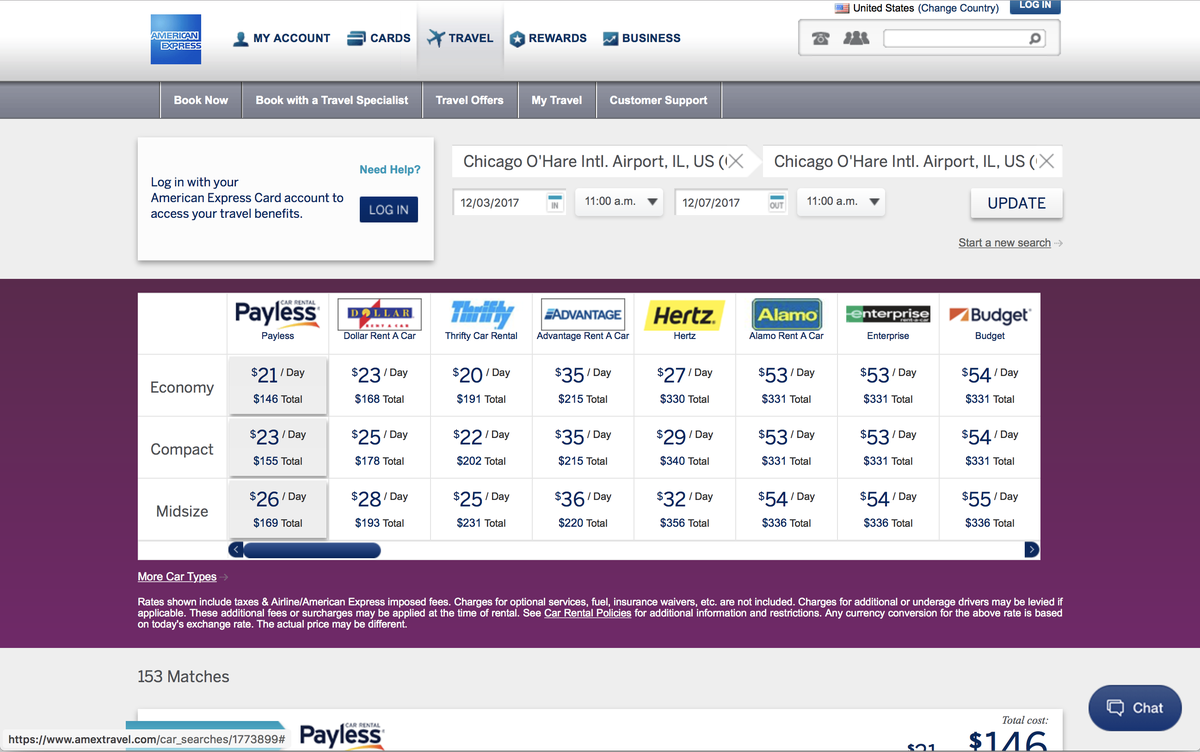

As far as car rentals, it's a pretty similar search process — just plug in your destination, whether you want to drop the car off in the same place or in a different location, your dates and the time you want to begin and end your rental.

Once the results appear, you can filter by the type of car (standard, compact, premium, etc), the option to pay now or later, price per day, pick-up location, rental car company and features like unlimited mileage, automatic vs. manual transmission, Hybrid/Electric cars or 4WD. Sort results by distance or total price.

After choosing your car, you'll be asked if you want to pay now, which means you'll be able to use MR points to book part of or all of your prepaid rental, or pay later, which means you'll have to pay cash at rental car counter — doing so can earn you 2X points per dollar, so it's an easy way to rack up some more MR points.

Next, enter information about the driver, pick how you want to pay (how many points or with cash), and review the rental car policies. As always, it doesn't hurt to comparison shop, so run the numbers through the actual rental car companies before you book to make sure you're getting the biggest bang for your buck.

Bottom line

Booking through the Amex Travel portal is a simple way to redeem your MR points, however you'll usually get much more value from Amex points if you transfer them to an airline or hotel partner's loyalty program. If you do book through Amex's Travel Portal remember that your points are worth 1 cent per point towards flights and .7 cents apiece towards other travel (except when booking a Fine Hotels + Resort property).

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

For rates and fees of The Platinum Card® from American Express, click here .

- What are A.M. Best ratings for insurance? Liz Knueven

- Robinhood Gold Card announced — Earn 3% cash back everywhere Jason Stauffer

- Overhauled Amex Hilton Business card — Up to $240 in statement credits and more Jason Stauffer

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

American Express Travel: Your Guide to Booking Flights, Hotels, Car Rentals, & Cruises

Jarrod West

Senior Content Contributor

439 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3059 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1166 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

What Is AmexTravel.com?

Fees for using the portal, searching for flights, insider fares, the hotel collection, american express fine hotels and resorts, standard hotel booking, searching for packages, compare flights+hotel to booking separately, searching for cruises, special offers, cruise privileges program, amextravel.com insiders, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

American Express is best known as a credit card issuer, but the company also offers other products and services, including travel booking and planning using AmexTravel.com.

While AmexTravel.com is available for anyone (not just cardmembers), holding an Amex card can definitely help you get extra value when using the program.

Here’s a look at what AmexTravel.com is, what services it provides, what the cost to use, the best ways to use it, and when it’s worth using!

At its most basic, AmexTravel.com is an online travel booking portal (or “online travel agency”) just like Expedia , Kayak , and Orbitz .

You can use it to book a whole trip or just a flight, hotel (or flight + hotel packages), rental cars, or even cruises. If you’d like extra assistance from a customer service agent, you can book by phone as well.

Flights booked through the portal can be subject to small fees. However, sometimes the benefits can make these fees worth it, and they’re waived for holders of the Platinum Card ® from American Express .

There are also a few “sub-categories” that fall under the AmexTravel.com umbrella, including the Hotel Collection and Fine Hotels and Resorts .

Why Should You Use AmexTravel.com?

The main reason to book with AmexTravel.com is the incredible customer service . If you run into any problems during your trip (like delays, cancellations, over-bookings, etc.), you can connect with a live travel agent by phone 24/7 who will work with you to find a solution.

Additionally, if you hold an Amex credit card that earns Membership Rewards points, you can often earn 2x points or more by using it to pay for travel services booked through AmexTravel.com.

Hot Tip: If you use your Amex Platinum card , you can earn 5x Membership Rewards points on flights booked directly with airlines or with AmexTravel.com.

Anytime you book a flight through AmexTravel.com (either on its own or as part of a package), you’ll pay a fee of $6.99 for domestic flights and $10.99 for international flights .

These fees are waived if you have the Amex Platinum card and are logged into your account.

If you choose to book a flight by phone rather than online, there’s an added $39 phone service fee .

If you make changes to your flight, there’s a $39 reissue fee in addition to whatever fee the airline charges. This only applies to advance changes, not changes due to problems like canceled flights .

Below, we’ll take a look at how to use AmexTravel.com to book flights, hotels, vacation packages, rental cars, and cruises.

Booking Flights With AmexTravel.com

Searching for flights with AmexTravel.com is similar to other online travel agencies. You can search by city or by specific airport, select your departure and return dates, and click whether you want to search for lower fares within 3 days of your chosen dates.

On the results page, American Express lists the most relevant Delta result at the top highlighted as a “featured airline.” The featured airline is followed by the lowest available fares.

When you scroll down, you can use the controls on the left sidebar to filter the results by the number of stops, departure/arrival times, airline, or even specific flight number.

By default, flights are displayed in price order starting with the lowest, except for a featured Delta flight at the top (when available). At the top of the search window above the results, all available airlines are shown, as well as the lowest available price with each airline.

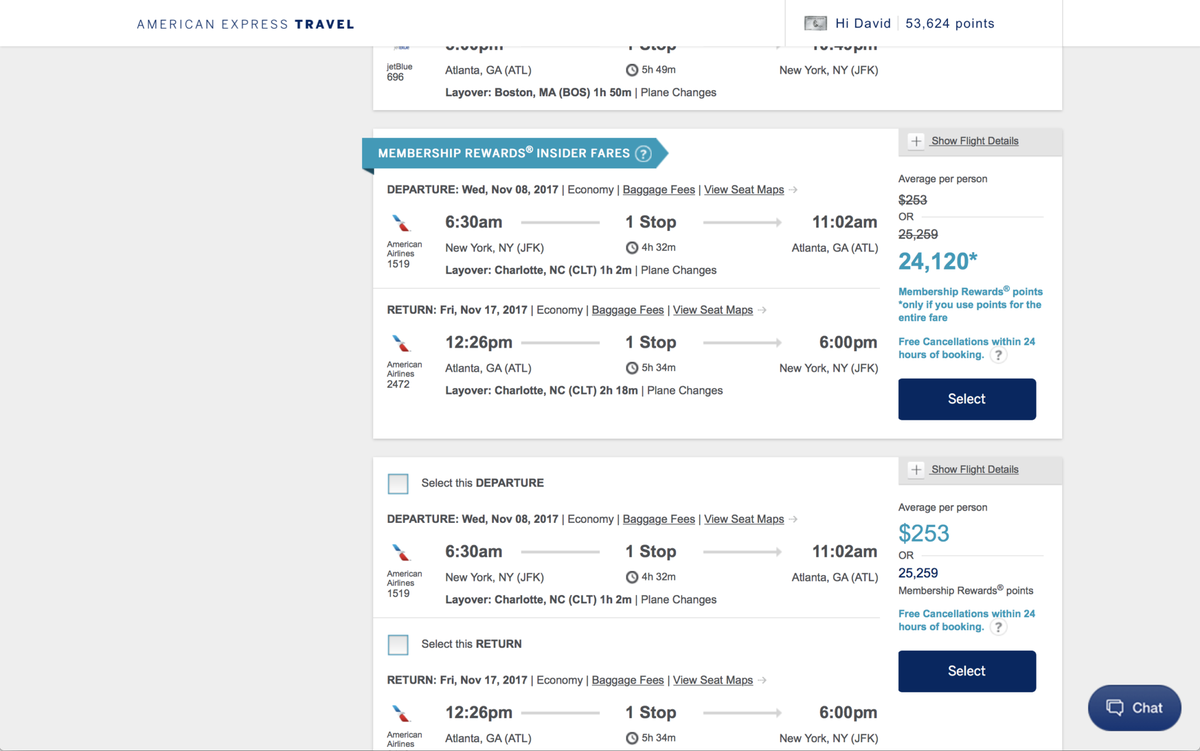

Depending on your search, you may see a blue tab labeled “Insider Fares Available” above some of the airlines listed at the top of the search window.

These are discounted fares, and they only apply if you pay for the entire flight with Membership Rewards rather than cash. Note that cash prices are rounded to the nearest dollar.

If you’re logged in and have enough Membership Rewards points to cover the entire flight, you will be able to see these discounted fares.

For example, in the below search, you’ll see an example of an Insider Fare available for purchase. The Insider Fare offered a slight discount rather than just matching the cash price in points with each point worth 1 cent (more on that below).

The difference can be fairly minimal. In the JFK-ATL example above, the discount was from 25,259 Membership Rewards points to 24,120 — changing the value from 1 cent per point to about 1.05 cents per point .

Amextravel.com charges a fee to book, but they bundle this into the displayed price. The fee is $6.99 per domestic ticket or $10.99 per international ticket. These fees are waived as a benefit of the Amex Platinum card , just make sure you’re logged into your Amex account when booking.

Hot Tip: AmexTravel.com now offers Trip Cancel Guard coverage that you can add when purchasing flights via AmexTravel.com whether paying with an American Express card, with Membership Rewards points using the Pay With Points option, or a combination of both. It provides for reimbursement of up to 75% of the cost of the non-refundable prepaid flight expense, penalty and change fees caused by the cancellation, or the amount of any expired vouchers/flight credits received for the canceled flight. Coverage is applicable when your flight is canceled for any reason and is valid until 2 full calendar days prior to your trip’s originally scheduled departure date.

When searching several different flights across different online travel agents, we found similar results to the below example each time.

To compare prices, we searched multiple online travel agents and portals using the same search parameters: departing John F. Kennedy-New York (JFK), arriving at London-Heathrow International (LHR), round-trip, 1 traveler, economy, and nonstop on specific dates.

We selected the lowest-priced nonstop flight available through AmexTravel.com: a Finnair flight operated by Oneworld partner , American Airlines.

When searching on AmexTravel.com, the flight was $595.86. This breaks down to $133 in base fare and $462.86 of government, airline, and American Express-imposed fees.

We received the same search results when we replicated this search on Finnair’s U.S. website, Kayak, and Orbitz.

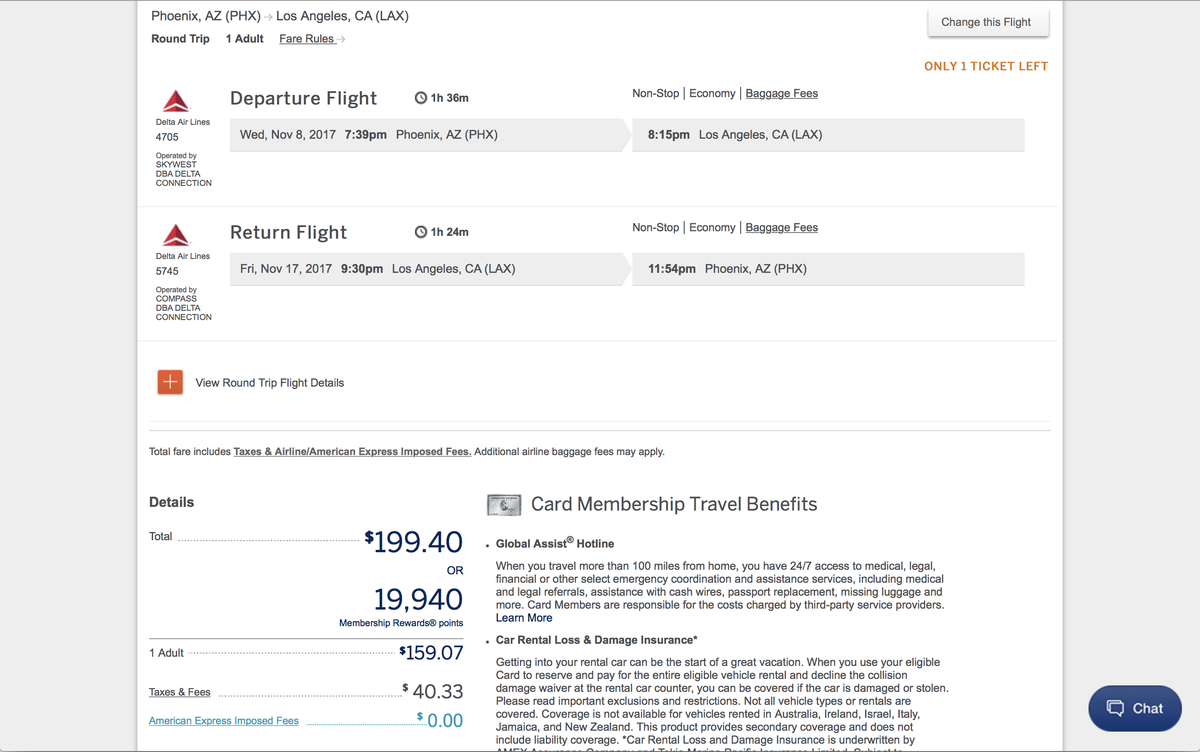

In a second search, we looked for a domestic round-trip from Phoenix Sky Harbor (PHX) to Los Angeles International (LAX) on the same dates. This flight was priced at $199.40. Keep in mind, you would usually see this rate plus the $6.99 Amex booking fee, but again, this is waived for Amex Platinum cardholders.

When cross-referencing this itinerary on Delta’s website, we found the same price listed for a regular economy fare of $199.40. However, there was a basic economy option that was a bit cheaper, which was not available through AmexTravel.com.

Other online travel portals, including Orbitz and Kayak , listed the same price.

This means, if you’re already set on the specific itinerary you want to fly, booking through AmexTravel.com can often cost the same as booking directly with the airline, or through a third party . This assumes you receive waived booking fees for being an Amex Platinum cardholder.

However, what if you’re just looking for the cheapest flight on a particular day? If you do a general search for a route on set dates, will AmexTravel.com find the same rates as other portals? In our experience, the answer is no.

In our example search, here are the lowest available regular economy non-stop flights we could find between New York (any airport) and London (any airport) when searching the same set of dates on a few different websites (sorted by price ascending):

*Including a $10.99 AmexTravel.com booking fee.

The reason for these results is likely due to the fact that the Amex portal doesn’t include some low-cost carriers like Norwegian, so travel portals that do will often win on price.

Even excluding the low-cost carriers, though, other portals like Expedia and Orbitz were able to offer lower fares by about $15.

That said, AmexTravel.com was able to find about the same fares you would find when booking directly with an airline.

Hot Tip: If you hold The Business Platinum Card ® from American Express you can get a 35% rebate on select flights when you pay with points through AmexTravel.com.

AmexTravel.com Hotel Programs

There are actually 3 programs offered for booking hotels:

- Fine Hotels and Resorts

- AmexTravel.com booking (standard)

What Is The Hotel Collection?

The Hotel Collection is a program through AmexTravel.com only available to holders of certain cards:

- The American Express ® Gold Card and the American Express ® Business Gold Card

The Amex Platinum card and the Business Platinum Card ® from American Express

The Centurion card

Perks of The Hotel Collection

When you book a hotel through The Hotel Collection, you get certain perks including:

- Room upgrade at check-in (if available)

- Up to a $100 hotel credit for on-site amenities like the restaurant, bar, room service, or spa

- Ability to use Pay With Points on prepaid reservations

- 3x Membership Rewards points for Amex Gold cardholders on prepaid bookings

- 5x Membership Rewards points for Amex Platinum cardholders on prepaid reservations

- Up to $200 credit each year towards prepaid hotel reservations with either The Hotel Collection (2-night stay) or Fine Hotels and Resorts with select credit cards

Usually, American Express guarantees that any hotel booked through AmexTravel.com will have the lowest publicly-available rates (prepaid rates only), but this rule does not apply to bookings through The Hotel Collection per the terms & conditions . Be certain to check multiple booking options to ensure you’re getting the best deal.

Rooms have to be booked through AmexTravel.com. That means that if you book directly through the hotel or another service, you won’t get the perks, even if the hotel is a part of The Hotel Collection and you pay for the stay with your American Express card.

Further, you must stay a minimum of 2 nights , and you cannot book consecutive stays within 24 hours of each other.

The good news is that these benefits are available for up to 3 rooms per stay . So if you book 3 rooms for family members, you’ll get a total hotel service credit of up to $300.

Hotel Points and Elite Benefits

Typically, you won’t earn points through a hotel loyalty program if you book through a third party, and this includes the AmexTravel.com portal.

Further, you won’t get any elite benefits that you might otherwise be entitled to if you have status with that hotel chain.

Bottom Line: The Hotel Collection is potentially useful if you’re planning to pay with your eligible Membership Rewards-earning card. This comes at the expense of hotel-specific elite benefits, including points and elite credits in any hotel loyalty program.

What Is the Fine Hotels and Resorts Program?

AmexTravel.com runs a second hotel program called Fine Hotels and Resorts (FHR). It can be a little bit confusing since it sounds like it would overlap with the Hotel Collection, but that’s not the case.

The Fine Hotels and Resorts program is exclusive to Amex Platinum cardholders (personal or business) , as well as those with the invitation-only Centurion Card .

FHR includes different hotels and resorts than The Hotel Collection, with minimal overlap. The FHR collection tends to be more geared toward leisure travelers who wish to book stays at higher-end properties.

Perks of Fine Hotels and Resorts

Booking hotels through the Fine Hotels and Resorts collection entitles you to a handful of potentially valuable perks, including:

- Early noon check-in (when available)

- Room upgrade on arrival (when available)

- Daily breakfast for 2 people

- Guaranteed 4 p.m. late checkout

- Complimentary Wi-Fi

- A unique amenity valued at $100 or more; examples include a property credit, dining credit, spa credit, or similar amenity

Unlike The Hotel Collection, rooms booked through Fine Hotels and Resorts are not all prepaid. In fact, most are standard rates that you’ll pay for at the end of your stay when you check out. In comparing several properties, including the Park Hyatt in Chicago, we found rates identical to the non-prepaid rates when booking directly through the hotel.

However, keep in mind that the hotel may directly offer prepaid and early-purchase options which may be much cheaper, though you won’t benefit from the Fine Hotels and Resorts perks.

There are fewer terms with Fine Hotels and Resorts than with The Hotel Collection. You must book through AmexTravel.com/FHR to receive the benefits .

As with The Hotel Collection, if you book directly with the hotel or through a different travel agency or portal, you won’t be able to claim FHR benefits even if it’s a participating hotel. Other terms vary by property.

Good news here! Unlike stays booked through The Hotel Collection, stays through American Express Fine Hotels and Resorts count as “qualifying rates” for hotel loyalty programs. That means if you’re staying at a hotel that’s part of a loyalty program, you’ll be able to earn points and receive the relevant benefits if you hold elite status.

Hot Tip: Want to know about the differences between these programs? Dig into our dedicated guide on the differences between the Hotel Collection and Fine Hotels & Resorts .

Searching Hotels

Searching for hotels at AmexTravel.com works more or less the same as with flights. You enter your city, dates, number of rooms, and guests. You can check a box to have properties from The Hotel Collection and Fine Hotels and Resorts displayed at the top.

Of course, if you’re interested in booking through either of those programs, you could also just book on their dedicated pages.

By default, search results are ranked by “recommended,” which seems to be decided by an algorithm factoring in price, location, and reviews.

Terms vary by the specific hotel and rate you book, so make sure to read the fine print.

The site can be a bit confusing when trying to compare prices since American Express doesn’t include all taxes and fees in the price displayed (while some hotel websites do).

For example, we searched for a 4-night stay at the Hyatt Regency London – The Churchill. American Express quoted an average of $337/night, which should make the total stay around $1,348. When you go to book, though, the total with fees is $1,625.

While it initially looks more expensive to book directly with Hyatt (where the cost is quoted at $404/night), that price includes all taxes and fees , so you’ll actually pay $1,611, or $14 less.

Our search for the Marriott Regent Park yielded similar results. It’s listed at $233/night in the search function, which implies the total to be $932.

In reality, once you click through, the total is $1,120. Booking directly with Marriott, rates are listed at $261/night, but that includes taxes and fees — for a total prepaid rate of $1,080.

For the 2 hotels in question, here’s how total prices compared through different portals (sorted by price ascending):

In both tickets, AmexTravel.com was within a few dollars of the other online travel agencies, which were all more expensive than booking directly through the hotel’s website.

Similar to The Hotel Collection, rates booked through AmexTravel.com aren’t eligible for elite benefits or hotel loyalty points.

Bottom Line: Like most other online travel portals and agencies, prices can vary between AmexTravel.com and the hotel’s direct booking channel. You won’t get elite benefits or hotel points, so it might be worth booking directly if those are valuable to you.

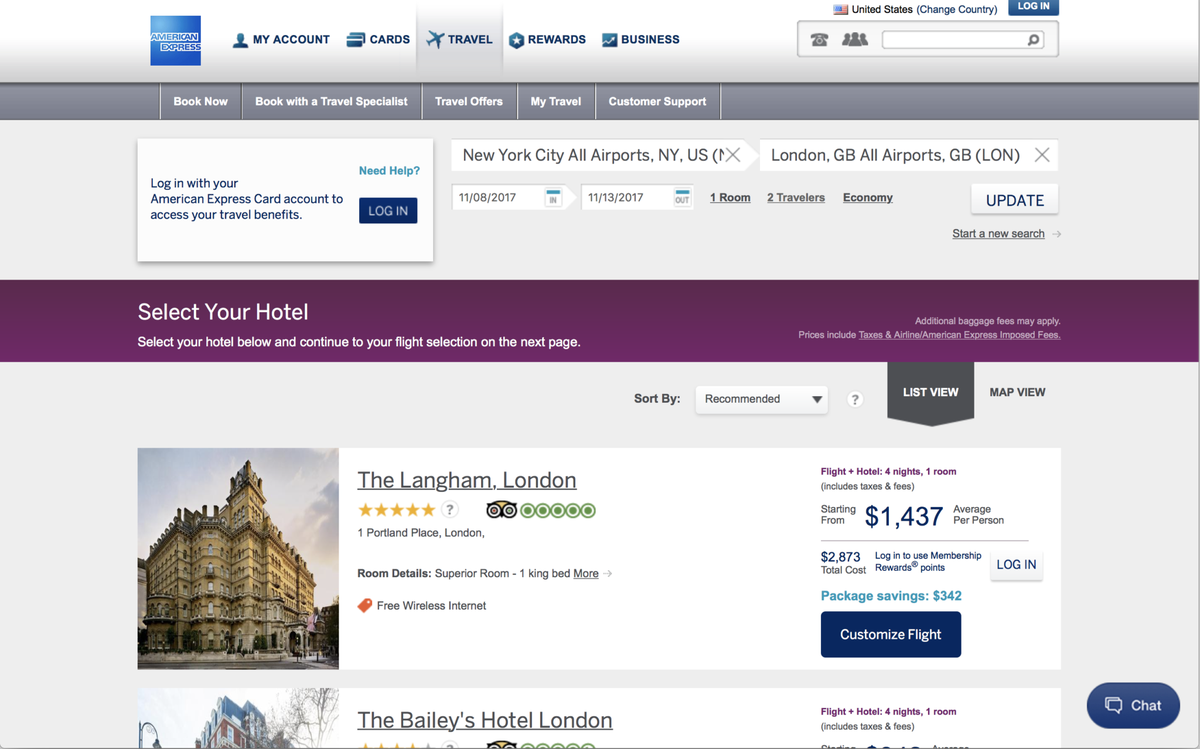

Flights+Hotel Packages

Like with many online travel portals and even airline websites, you can book packages that include flights and hotels through AmexTravel.com. Usually, the point of booking these packages is to get a discount, special perks, or promotions.

The search window for Flights+Hotels is simple: input airports (or cities), dates, number of travelers, and rooms. Results are listed in a recommended order by default just like when searching for a standard hotel.

Terms vary by the specific package you book, so make sure to read the fine print !

As with standalone flight reservations, AmexTravel.com charges a fee to book Flights+Hotel packages: $6.99 per domestic ticket or $10.99 per international ticket .

Again, these fees are waived for holders of the Amex Platinum card or the Centurion card.

In the results field, a total starting price per person is listed, including all taxes and fees with the cheapest flight option. American Express also lists how much you’re saving with the package, although this is missing for some hotels.

Once you select the hotel, you can customize your flight. The total price changes based on which flight you select.

In a sample search, we chose the Hyatt Regency London – The Churchill, and picked the cheapest nonstop flight: British Airways flight, which was Newark Liberty International (EWR) to LHR and London-Gatwick (LGW) to JFK. The package came to $1,446 per person, or $2,892 total.

Annoyingly, AmexTravel.com doesn’t show a breakdown of hotel and airfare costs and fees; instead, it just displays a total per person.

For comparison, you can search the flight and hotels separately. We tried searching for the flight first on the same day.

We found Finnair flights operated by American Airlines for $660 per person — an option that wasn’t offered as part of the package (although with the booking fee, the flights should have been $671). When we filtered the search to British Airways only, it showed a ton of options for $671.

Searching hotels next, we again chose the Hyatt Regency London – The Churchill’s lowest prepaid rate. It was listed as $337 per night for 1 room (plus taxes and fees), for a total of $2,031. For the 2 flights and the hotel, that comes to a total of $3,351, or $1,675.50 per person.

In this case, booking the trip as a package saves almost $460, even though the search results page didn’t highlight any savings specifically.

The main downside to booking a package is that you have less flexibility. Say you want to change hotels for part of the trip or maybe stay with a friend for the last few days. This isn’t an option because you must book a single hotel for the entire time between your flights. It can also make solutions harder to find if there are any problems — although the AmexTravel.com customer support should make up for that.

Bottom Line: If you’re using AmexTravel.com and your plans allow for the lack of flexibility, you might be able to save a lot of money with a package. Just make sure to compare the listed price to booking everything separately. Note that you can’t book a package retroactively: you have to book the flights and hotel at the same time.

Rental Cars

AmexTravel.com also offers a rental car booking service. You can make reservations from rental stations at airports and elsewhere.

To search for rental cars, simply enter an airport or city . You can also click a button to search near a specific address.

Results are shown in a handy grid format, with each column showing a different rental company, and each row displaying the pricing for a different category of car (economy, compact, midsize, and so on).

Bookings of up to 4 days are charged a daily rate, while bookings 5-7 days are charged on a weekly basis. There are specific rates for weekends and weekdays, as well as monthly options, with specific details varying by the rental agency.

In several sample searches, prices were generally consistent with other online travel agencies — though sometimes lower by $1-$2/day. Prices were identical to booking with the rental company directly.

Bottom Line: Renting a car through AmexTravel.com doesn’t get you any benefits above what you’d receive for paying with your credit card, such as the collision damage waiver for paying with your Amex Platinum card. However, the convenient search page makes it a great option for comparing multiple prices at once.

AmexTravel.com also offers tools to book cruises . In addition to letting you search for cruises all over the world, AmexTravel.com periodically highlights special offers on cruises, usually in the form of credits to use onboard.

To search for cruises, you need to enter the region you want to travel in, the cruise line(s) you want to travel with (or search all available lines), the month you’re planning the trip for, and the approximate length of the cruise you want.

Results are shown in order, from the lowest-priced option to the highest . Note that this is based on the lowest available rate; hovering over any result will show all available cabin types and the corresponding prices.

Under each result, the information shown includes the port of departure/return, date of departure, and ports visited.

Hot Tip: Wondering what to pack for your time at sea? Check out our ultimate cruise-based packing list — it’s printable and complete with tons of tips and advice!

Cruise rates booked through AmexTravel.com were within $1-2 of rates found on other online travel agents and websites . We found identical prices on the various cruise company websites — though each online travel portal and cruise line offers different promotions, so it might be worth comparing them.

For example, during a sample search for a weeklong Caribbean cruise in December, we found that Royal Caribbean was offering a $50 onboard credit if you booked directly.

On the search results page, you might notice a tab labeled “Special Offers.” Those offers are generally onboard credits, but can also include discounts or other special features. If you aren’t committed to a specific cruise line, these are often worth exploring.

Those with the Amex Platinum card have special access to the Cruise Privileges Program . Like the Fine Hotels and Resorts program, this is only available on specific cruises, although it’s more limited than FHR.

It includes onboard credit (often higher than otherwise offered) and a special onboard amenity, like complimentary dinner for 2 or a bottle of premium champagne.

Bottom Line: It can be worth booking a cruise through AmexTravel.com, especially if there are special offers. Make sure to compare different booking sites , though, as some may have better or exclusive promotions.

AmexTravel.com offers a feature called Travel Insiders. When you use the program, American Express connects you with a travel expert who can help you plan an itinerary based around your desired destination. Fees vary based on location, length of the trip, and details of the itinerary.

AmexTravel.com can be a very useful tool when booking flights, hotels, vacation packages, cruises, or rental cars. In many cases, it may not offer the best rate options , but it’s worth comparing to other booking sites and airlines or hotels directly.

If you have an American Express card that offers access to the Hotel Collection or Fine Hotels and Resorts, the perks can be very worthwhile.

Additionally, the extra Membership Rewards points you earn by booking through AmexTravel.com can be valuable, as long as the price is right.

Aside from the Hotel Collection and Fine Hotels and Resorts, the real value of AmexTravel.com is in the customer service provided. Booking a trip on your own is easy — dealing with problems when they arise can be less so!

If you book through AmexTravel.com, you’ll have easy access to someone who can help you get on a new flight, find a new hotel, or manage whatever other issues come up day or night. So if you’re looking to have that extra support, then AmexTravel.com might be a great choice for you!

The information regarding the Centurion ® Card from American Express was independently collected by Upgraded Points and was not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of the American Express ® Gold Card, click here . For rates and fees of the American Express ® Business Gold Card, click here .

Frequently Asked Questions

What is american express travel.

AmexTravel.com is an O nline T ravel A gency (OTA), just like Orbitz , Kayak , or Expedia . You can book flights, hotels, rental cars, or cruises through AmexTravel.com.

Do I need an American Express card to use Amex Travel services?

Whether or not you have an American Express card, you can book flights, hotels, rental cars, or cruises through AmexTravel.com. If you do have an Amex card, you might be eligible for certain perks or rewards.

Does American Express Travel cost anything?

If you book a flight through AmexTravel.com, there’s a small fee ($6.99 for domestic flights, $10.99 for international) that fee is waived for Amex Platinum, Amex Business Platinum, and Centurion cardmembers. Other services, like hotels and cruises, do not have fees.

Why should I book with American Express Travel?

AmexTravel.com has very helpful customer service resources. If you have any problems with your trip (like a canceled flight), you can call an agent who can help solve the issue.

Was this page helpful?

About Jarrod West

Boasting a portfolio of over 20 cards, Jarrod has been an expert in the points and miles space for over 6 years. He earns and redeems over 1 million points per year and his work has been featured in outlets like The New York Times.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex travel flight change American Express Cash Magnet Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2018/07/American-Express-Cash-Magnet-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

American Express Will Now Allow Card Holders to Cancel a Flight for Any Reason — What to Know

The new benefit extends to all American Express card holders, regardless of which card they have.

:max_bytes(150000):strip_icc():format(webp)/alison-fox-author-pic-15f25761041b477aaf424ceca6618580.jpg)

American Express will now allow customers to cancel a flight for any reason, allowing card holders to book their next trip with a little more peace of mind.

Going forward, travelers who book a flight through the Amex Travel will be able to cancel that flight for any reason and receive up to a 75% reimbursement of the nonrefundable flight costs, according to the credit card company . To take advantage of the new benefit, called "Trip Cancel Guard," travelers must cancel at least two calendar days before their departure date.

However, it's worth noting that the "Trip Cancel Guard" option must be purchased at the time of booking.

The new benefit extends to all American Express card holders, regardless of which card they have, a company spokeswoman told Travel + Leisure .

"People are eager to travel, and as demand increases there is a greater need to plan ahead. At the same time, a level of uncertainty still exists in this [ever changing] travel environment," Audrey Hendley, the president of American Express Travel, said in a statement. "With 'Trip Cancel Guard,' we're continuing to back our customers by giving them the value we know they want, along with the confidence to book flights with the flexibility to cancel for any reason if their plans change."

Even before offering this new benefit, American Express has always allowed Platinum card holders to cancel a trip due to things like illness or injury. The card also covers trips that are canceled due to COVID-19 quarantines.

Gold card holders are also covered for a trip delay for things like inclement weather and if their passport is lost or stolen.

Recently, American Express increased the annual fee for the Platinum Card to $695, from $550, and included a slew of new travel-related benefits like a $200 hotel credit, a $179 credit to cover a year-long membership in Clear , and free access to more than 1,300 airport lounges around the world, including more than 40 Centurion Lounges .

For travelers who don't have a credit card that offers trip cancellation, purchasing trip insurance is still a good idea with several policies also offering the chance to cancel for any reason .

Alison Fox is a contributing writer for Travel + Leisure. When she's not in New York City, she likes to spend her time at the beach or exploring new destinations and hopes to visit every country in the world. Follow her adventures on Instagram .

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

The complete guide to the Amex Travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 7:39 a.m. UTC Feb. 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

onurdongel, Getty Images

The American Express Travel portal offers valuable benefits to American Express cardholders, including special prices. Depending on which card you hold, you may also be able to pay for travel with Membership Rewards® points and get access to perks such as discounted airfare and specialty benefits at luxury hotels. Let’s take a look at how the Amex Travel portal works, whether the benefits are worthwhile and who can access Amex Travel’s website.

- American Express Travel offers hotels, vacation rentals, flights, rental cars and cruises.

- Luxury hotel benefits and discounted airfare are two benefits of booking through Amex’s travel portal.

- American Express cardholders can access Amex Travel.

How to book travel through the Amex Travel portal

Booking travel through the Amex Travel portal requires you to have an online account associated with an Amex card. While you can complete a search on the Amex Travel website without logging in, you will need to do so in order to make a booking.

After you choose whether to book a flight, hotel, vacation rental, vacation package, rental car or cruise, you’ll need to enter your travel details.

For example, if you want to book a flight through Amex Travel, you’ll need to put in your departure airport and destination as well as your dates of travel. The site will then bring up a list of matching results.

You can filter based on when the flights take off as well as how many stops you’re willing to tolerate, among other options.

The Amex Travel site offers a wide variety of hotel stays and flights, but you’ll always want to double check elsewhere before booking since it doesn’t always feature every option.

Once you’ve selected a booking, you’ll be taken through the checkout process. This includes providing your personal information and can also include seat requests and adding in loyalty program numbers.

To pay for your booking, you can use your American Express Membership Rewards, if you have a card that earns them, or your American Express card or a combination of both.

After you’ve booked, you’ll receive a confirmation email containing your reservation information. You can also find your bookings under the My Trips section of Amex Travel.

Who can use the portal?

Any American Express cardholder can use the Amex Travel portal to book travel. But those whose cards don’t earn Amex Membership Rewards points will need to pay with their Amex card.

However, many American Express cards earn Membership Rewards points that can be redeemed for travel through the Amex Travel portal. These cards include (terms apply):

The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

All information about American Express® Green Card, Amex EveryDay® Credit Card, The Business Platinum Card® from American Express and American Express® Business Gold Card has been collected independently by Blueprint.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Welcome Bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card Details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Is the portal worth using?

The Amex Travel portal can be worth using in certain cases, though it won’t always make sense. For example, some flights aren’t bookable via Amex Travel, so if what you need isn’t available you’ll want to look elsewhere.

That being said, those with certain cards are entitled to exclusive benefits that can lower prices or allow them to redeem points for travel. There are also perks for booking luxury hotels within the portal. In these cases, Amex Travel is definitely worth investigating.

How to maximize your Amex Travel benefits through the portal

International airline program.

Available to those who hold a high-end American Express card, including The Platinum Card from American Express, The Business Platinum Card from American Express and the American Express Centurion Black Card * The information for the American Express Centurion Black Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , the International Airline Program (IAP) can save you money on certain international flights booked via the Amex Travel portal.

All information about American Express Centurion Black Card has been collected independently by Blueprint.

This benefit is only available on tickets booked in premium economy, business or first class, but the savings can be significant.

For example, we looked at a round-trip flight in premium economy from San Francisco (SFO) to Tokyo (NRT). Booking with Japan Airlines (JAL) directly resulted in a cost of $4,431.40, while the Amex Travel portal and the IAP charged just $3,797.40 for a savings of over $600.

Fine Hotels + Resorts ® and The Hotel Collection

American Express also offers the Fine Hotels and Resorts and The Hotel Collection to eligible cardholders.

Fine Hotels and Resorts allows guests to book luxury hotels with special benefits. These include room upgrades, complimentary breakfast, an experience credit, late check-out, early check-in and more.

The Hotel Collection offers similar but less exorbitant benefits. It’s directed toward more midscale properties and includes an experience credit as well as a room upgrade.

35% rebate on redeemed points

Those who hold The Business Platinum Card from American Express are able to get a 35% rebate on points redeemed for eligible flights booked through the Amex Travel portal (up to 1,000,000 points per calendar year).

Eligible flights include all fare classes on an airline that you select each year. It also includes first and business class tickets on any airline.

Quick guide to Amex Membership Rewards

American Express Membership Rewards are the points you earn with eligible Amex cards. These highly flexible and valuable points can be redeemed in a number of ways, though they tend to be most valuable when transferred to Amex airline partners.

Other ways of redeeming Amex points include:

- Gift cards.

- Travel booked via Amex Travel.

- Online shopping.

- Statement credits.

While these are nice options to have, you’ll generally get much less value from your Membership Rewards points by redeeming them in these ways. Finally, although you can redeem your points in the Amex Travel portal, this isn’t necessarily a good idea if you aim to reap maximum value. Even if you’re taking advantage of the 35% rebate on redeemed points for flights, you’ll only ever receive a value of 1.54 cents per point. This is lower than you’d expect when transferring your Amex points to many airline and hotel partners.

Frequently asked questions (FAQs)

No, travel insurance is not automatically included when booking through the Amex portal. But many of the best credit cards feature complimentary travel insurance when using your card to pay, including those from American Express. Otherwise, you may be able to opt in to travel insurance during the booking process or via a third party provider.

Those with the The Platinum Card from American Express can earn 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per calendar year, 5 points per $1 on prepaid hotels booked with American Express Travel and 1 point per $1 on other purchases. The card has an annual fee of $695 ( rates & fees ).

Those with the The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , meanwhile, earn 5 Membership Rewards points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases. The card has a $695 annual fee.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

The phone number for American Express Travel is: 1-800-297-2977.

The number of Amex points that you’ll need to redeem for a flight will depend on the cash cost of your flight and whether you’re booking through Amex Travel or transferring your Membership Rewards points to an Amex airline partner. Amex Points are worth about one cent when booking flights through the portal, so a flight that costs $500 in cash would require about 50,000 Amex points. You’ll typically get a better deal with transfer partners than booking through the portal.

For rates and fees for The Platinum Card® from American Express please visit this page .

*The information for the American Express Centurion Black Card, American Express® Business Gold Card, American Express® Green Card, Amex EveryDay® Credit Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Hilton Honors American Express business card unveils new profile, plumps up annual fee

Credit Cards Carissa Rawson

Why my Citi Double Cash Card keeps getting better

Credit Cards Lee Huffman

Is the Citi Premier worth the annual fee?

Credit Cards Juan Ruiz

6 little known perks of the Citi Custom Cash Card

Credit Cards Harrison Pierce

Is the Chase Sapphire Preferred Worth it?

Credit Cards Tamara Aydinyan

Why I got the Citi Custom Cash Card this year instead of another travel rewards card

Credit Cards Kevin Payne

Breeze Airways releases new Breeze Easy credit card with lofty rewards, up to 10 points per $1

Credit Cards Stella Shon

6 little-known perks of the Citi Diamond Preferred Card

Guide to Wells Fargo Rewards: How to earn and redeem points for travel and other uses

Credit Cards Jason Steele

Best ways to use Citi ThankYou points

Credit Cards Michael Dempster

Why the Citi/AAdvantage Platinum Select is the best card for earning elite status

Top credit card combinations to maximize your rewards

Chase improves Ink Business Cash card’s welcome offer, adds first-year relationship bonus

How I used Citi ThankYou Points for an affordable Hawaiian vacation

My Citi Premier Card is underused — here’s why I’m pulling it out more in 2024

Maximize your rewards: Your points and miles checklist for 2024

I t's time to start the new year off right, and that may mean finally redeeming your Chase Ultimate Rewards points for maximum value . Or, perhaps you'll earn American Airlines Advantage status from your living room couch using American Airlines Loyalty Points .

From opting for the best Marriott Choice Benefit to selecting the right airline for your American Express airline fee credit , here's an overview of some points and miles topics to consider as you settle into 2024.

Choose your Marriott Choice benefits

If you accrued 50 or more elite nights with Marriott Bonvoy in 2023, you'll want to select your Marriott Choice Benefits by the Jan. 7 deadline.

Once you reach 50 elite nights in a calendar year, you can choose one of the following:

- Five elite night credits (toward your 2023 elite nights)

- Five Suite Night Awards

- A $1,000 discount on your favorite Marriott hotel mattress

- A $100 charity donation