Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

How does travel insurance work on a credit card.

Credit card travel insurance protects you from some unforeseen circumstances that may disrupt your travel plans. If your credit card includes travel insurance, you may be reimbursed if your travel is affected by weather, health issues or certain kinds of emergencies outside your control.

Typically, credit card travel insurance only covers the expenses that you charge to that specific card. And because different cards have different travel insurance policies, it's important to read the fine print in your card's terms and conditions to understand your coverage levels.

What is travel insurance?

Travel insurance provides protection for expenses associated with travel, both domestic and international. Travel insurance may reimburse you if your trip gets cancelled, delayed or interrupted--or if you have to pay medical costs that your primary health insurance can't cover.

Travel insurance benefits can be broken down into a few different categories:

- Trip cancellation insurance may reimburse you if your pre-booked, non-refundable flight (that was booked with the same credit card) is cancelled under unforeseen circumstances, such as injury or if your flight is cancelled due to weather conditions or other.

- Your credit card's trip cancellation insurance may reimburse you for prepaid flights and hotel stays booked with your credit card.

- Trip interruption insurance (for trips that end earlier than planned) may cover expenses like the cost of a last-minute flight home. In most cases, only the part of your trip that was interrupted will be eligible for reimbursement.

- Travel delay insurance may reimburse expenses, such as a hotel stay, that arise from severe delays.

- Medical insurance works like a supplement to your existing health insurance, which may not cover medical costs that you incur abroad. Evacuation insurance covers the costs associated with an evacuation following a weather event or other disruption.

- Baggage insurance is supplemental to coverage provided by your airline or via your homeowners or renters insurance policy. Baggage coverage may reimburse you for the actual or replacement cost of your possessions, should they go missing as you travel.

What are the benefits of credit card travel insurance?

Many airlines and tour operators offer travel insurance as an add-on at point of purchase. Credit card travel insurance, on the other hand, is a feature offered on certain credit cards.

Credit card travel insurance provides the following benefits:

- Financial protection : Comprehensive credit card travel insurance can provide full coverage should a covered event--such as severe weather, a medical emergency affecting you or a loved one, or loss of employment--occur. In many cases, travel insurance may require you to pay any expenses out of pocket, then file a claim later for reimbursement.

- Evacuation assistance : If your credit card travel insurance includes evacuation coverage, you can get help securing transport when a covered event (like weather or a political incident) disrupts your travels. Depending on the coverage provided by your credit card travel insurance plan, even emergency medical evacuations such as those on a private jet-may be covered.

- Supplemental medical coverage : Many health insurance plans don't cover medical costs incurred outside the country. Even those that do are likely to charge a deductible. Credit card travel insurance that includes medical coverage may pay for some medical costs, including your primary plan's deductible.

- Peace of mind : Having credit card travel insurance can give you the confidence to make bold travel plans--or jet somewhere sunny in the dead of winter. A major storm might snarl your vacation plans, but with travel insurance you may get fully reimbursed.

What questions should I ask about credit card travel insurance?

Credit card travel insurance provides many benefits, but be sure to understand what coverage your card provides before you book a trip. Do your research and ask questions to maximize the value of your credit card's travel insurance program:

- What coverage levels does my card offer? Get a copy of your card's full terms and conditions to learn exactly what kinds of travel coverage are included.

- Are my family members covered by my credit card travel insurance? Travel insurance typically covers events that affect your immediate family: for example, if your child gets sick before you embark on a flight. Your more distant relatives--and pets--may not be covered, however.

- What specific events are covered? Understanding the events that can trigger a claim is crucial to getting the most out of travel insurance. For instance, involuntary unemployment may qualify you for cancellation protection--but leaving your job voluntarily may not.

Relying on credit card travel insurance

Credit card travel insurance can offer financial protection and peace of mind when you travel. Take the time to understand how your card's travel insurance works-and be aware that only expenses charged to your card are likely to be covered.

Chase Sapphire is an official partner of the PGA Championship .

- card travel tips

- credit card benefits

What to read next

Credit card basics how to find your frequent flyer number.

How do you find your frequent flyer number? Learn several ways you may be able to track down your number so you can use it when booking that flight.

credit card basics Guide to Chase Sapphire® travel insurance

Learn all about the travel insurance benefit that comes with Chase Sapphire Preferred and Reserve cards.

credit card basics The Chase Sapphire Lounge at the Sundance Film Festival

Discover the perks and benefits of being a Sapphire Reserve cardmember at Sundance Film Festival.

credit card basics Priority Pass San Diego: What to know

There is one lounge in the San Diego airport that is in the Priority Pass network, plus two spa locations and a restaurant.

What Is Schengen Travel Insurance?

Quick answer.

S chengen travel insurance is a specific type of travel insurance policy tailored to meet the travel medical coverage requirements set by the 27 (soon to be 29) European destinations within the Schengen Area. Travelers must present proof of sufficient coverage as part of the Schengen visa application process.

Schengen member countries have abolished their internal borders, allowing more accessible travel within the area. While this is incredibly convenient, some travelers may need a visa to visit Schengen countries. And one of the requirements to obtain that visa is to purchase sufficient travel medical insurance coverage.

Read on to learn more about Schengen visa travel insurance requirements and find the best travel insurance policy for your upcoming trip.

Table of contents

What is schengen travel insurance, schengen countries, visa and travel insurance requirements for the schengen area, key coverages in schengen travel insurance, how to get schengen travel insurance, schengen travel insurance faqs, summary of money’s guide to schengen travel insurance.

Schengen travel insurance is designed for travelers entering the Schengen zone, which comprises 27 (soon to be 29) European nations that have abolished internal borders.

Many visitors, including citizens from non-EU countries like India and China, must obtain a travel visa to enter the Schengen Area. And a requirement for a Schengen Visa is to have insurance covering at least €30,000 (around $32,720) in medical costs.

However, there are exemptions. For example, U.S. citizens and residents of countries such as Canada, Brazil and Mexico don’t need a Schengen visa or travel insurance for stays of up to 90 days within a 180-day period.

The Schengen Area consists of a diverse tapestry of countries. Among the member nations are some of the best places to visit in Europe , including France, Italy, Germany, Spain, Greece and the Netherlands.

Here’s the complete list:

Ireland and Cyprus are the only E.U. member states not currently part of the Schengen Agreement.

Having a valid U.S. passport allows you to spend up to 90 days within a 180-day period in the Schengen Area, whether for tourism or business purposes.

Once officially admitted, you can travel freely within the member countries without passing through customs each time. Stays under 90 days don’t require a visa for U.S. nationals, but your passport should be valid for at least six months past your travel dates.

Short stays don’t require travel medical insurance either, though travel insurance may still be worth it . That could be especially true if you plan to participate in adventure sports or other high-risk activities.

Travel insurance generally also covers cancellations and delays. Purchasing a policy could pay off if you’ve booked expensive, non-refundable flights or accommodations and didn’t purchase them with one of the best travel credit cards that offer insurance.

European Travel Information and Authorisation System (ETIAS)

Travel requirements for European Union countries are projected to change by mid-2025. Visa-exempt travelers to all 27 (soon to be 29) Schengen countries and Cyprus will need an ETIAS authorization.

Here’s what you need to know:

- You must complete an online application and pay a small fee for an ETIAS authorization.

- The authorization is tied to your passport and is valid for three years or until your passport expires.

- With a valid travel authorization, you can enter 30 European countries for short stays of up to 90 days within a 180-day period.

- ETIAS authorization does not guarantee entry into any of these countries. You still have to present your passport and documents at the border.

- The above applies to people from the U.S., Canada and dozens of other countries, so check the E.U.’s official travel website or your country’s embassy for more information. An ETIAS is not a visa and doesn’t mandate travel medical insurance.

Schengen visa requirements

You’ll need a visa if you’re from a visa-exempt country, like the U.S., and planning to stay in the Schengen Area beyond the 90-day threshold. Regardless of the length of the stay, nationals traveling from certain countries always require a visa.

Determine which Schengen country you’ll spend most of your time in and check with their official tourism or embassy website for instructions on applying for a visa. The embassy will inform you about the required documentation and instructions to meet their regulations.

Schengen visa processing time can vary depending on your country of origin and your destination country, so be sure to start the process as early as possible.

Besides the application form, the following are required to obtain a Schengen visa:

- Valid passport: Your passport must be valid for at least three months after departure.

- Passport photo: You must submit a picture of yourself that complies with the International Civil Aviation Organisation (ICAO) standards.

- Travel medical insurance: You must carry at least €30,000 (approximately $32,720) in coverage for medical emergencies, hospitalization and repatriation that’s valid in the entire Schengen Area for the duration of your stay.

- Documentation: You must provide evidence of the purpose of your visit through supporting documentation, demonstrate you have the financial means to cover expenses and accommodations and show intent to return to your home country after the stay.

- Fingerprints: Most, but not all, applicants will be required to submit their fingerprints along with their application.

Consulates of particular countries may require additional documentation.

Understanding what travel insurance covers can help you plan a worry-free journey. While plans and coverage options vary by company, here’s a breakdown of what Schengen travel insurance generally covers.

- Medical expenses: Travel medical insurance covers the cost of treating unexpected illnesses or injuries you suffer during your trip, up to your policy limits. These include the cost of medications, hospitalization and other essential medical treatments.

- Medical repatriation: Some travel medical policies also include emergency medical evacuation or repatriation, which covers some of the costs of transporting you back home or to a different medical facility to receive necessary medical treatment.

- Repatriation of remains: As the name suggests, this coverage will pay (up to your policy limits) for expenses related to transporting your body or cremated remains to your home country or point of origin.

- 24/7 Travel Assistance: Travel insurance companies generally offer round-the-clock assistance services, including language support, help recovering lost passports or prescriptions and even booking accommodations and medical transportation.

Note that some companies may require you to meet a deductible for the travel medical plan to start paying out.

Other travel-related coverage options

Most travel insurers sell policies covering medical emergencies and travel-related inconveniences such as delays, cancellations, lost luggage, and more. While you don’t need these coverage options to obtain a Schengen visa, you may still find them worthwhile.

- Trip cancellation and trip interruption: Covers non-refundable expenses if you need to cancel or cut your trip short due to unforeseen events like illness or accidents.

- Baggage loss or delay: Helps cover the cost of replacing essential items if your baggage is lost or delayed by a specified number of hours.

- Delayed flights and missed connections: Provides compensation for additional expenses caused by inconveniences such as delays or missed connections.

It’s easy to buy travel insurance for your Schengen Area trip. Many providers offer policies that fulfill the visa requirement and include additional coverage that can be tailored to your needs.

Here are some steps to help you get the right coverage.

1. Research reputable travel insurance providers

Most travel insurers bundle travel medical insurance coverage with trip cancellation, interruption, and other coverage options. If you only want to satisfy Schengen visa requirements, look for a provider that explicitly markets Schengen travel insurance or offers stand-alone travel medical coverage.

2. Select a plan that meets your needs and get a quote

Remember that you may not need trip insurance beyond the €30,000 in travel medical coverage required for a Schengen visa, so read plan details carefully to avoid buying unnecessary coverage.

It also pays to shop around and get quotes from several insurers, as travel insurance costs between 3% and 14% of the total cost of your trip, depending on the company and policy you choose.

3. Read your policy details

When shopping for travel insurance online, you’ll typically find that most companies include a policy summary or schedule. This document outlines critical details such as the policy’s coverage limits and exclusions. Carefully reading it can help you avoid surprises and frustration if you ever need to file a claim.

If you still have questions after reading the policy summary, contact the insurer before finalizing your purchase.

4. Get to know the claims process

Similarly, reading about your insurance provider’s claims process can save you time and energy in an emergency. Your policy summary should include a list of documents you’ll be required to provide as part of the claims process, which may include receipts and medical bills.

After a covered incident, contact your insurer through the company’s website or mobile app as soon as possible. Most insurers also offer travel assistance services around the clock.

5. Purchase and safeguard your policy

You will need proof of your travel medical insurance plan to apply for a Schengen visa. Keep your insurance certificate in a secure yet accessible location, whether a digital version on your smartphone or a physical printout in your travel folder.

It may also be a good idea to share a copy of your policy with a trusted friend or family member back home so they can contact your insurance provider if you cannot request medical assistance due to an emergency.

Should I get travel insurance for Europe?

Travel insurance, especially within the Schengen Area, is not just recommended but often mandatory. To obtain a visa to visit the Schengen zone, you must show proof of having sufficient travel medical insurance.

How much travel insurance do I need for Europe?

What countries does europe travel insurance cover.

- The first step before you travel to any Schengen country is to determine whether you need a visa and, therefore, mandatory travel medical insurance for a Schengen visa.

- Check with your country’s embassy, Department of Foreign Affairs or the tourism website of the country you plan to visit for specifics about medical travel insurance for Schengen visa requirements.

- You don’t need a visa or international travel insurance if you have a valid U.S. passport and are visiting the Schengen zone for less than 90 days in a 180-day period.

- If you’re a U.S. national planning to visit the Schengen Area for more than 90 days, you must apply for a visa and secure adequate travel health insurance (at least €30,000 in travel medical and repatriation coverage).

© Copyright 2024 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

RBC ® Travel Insurance

Taking a trip see if your rbc ® credit card covers you..

In just a few minutes, you can see what travel insurance you have on your RBC credit card, whether you have enough coverage for your trip, or if you need to buy additional coverage. It’s that simple!

See what travel insurance coverage your card has:

Required Information

Which RBC credit card did you use to pay for the full cost of your trip?

Good news! Your card has some travel insurance coverage.

Your card provides some valuable travel insurance coverage for you and other covered persons (opens modal window) .

Covered Persons

Covered Persons refer to you (the cardholder), your spouse and your dependent child/children who travel with you or join you and/or your spouse on the same trip. Plus, if your card includes Trip Cancellation and Interruption insurance your dependent children who are age 16-24 can travel on their own (without you or your spouse) and be covered for Trip Cancellation and Interruption. (Note: children under 16 travelling on their own are not covered). Other travellers on the same trip are not covered under your credit card travel insurance coverage.

Covered Persons refer to you (the card applicant), your spouse and your dependent child/children who travel with you or join you and/or your spouse on the same trip. Plus, if your card includes Trip Cancellation and Interruption insurance your dependent children who are age 16-24 can travel on their own (without you or your spouse) and be covered for Trip Cancellation and Interruption. (Note: children under 16 travelling on their own are not covered). Co-applicants and authorized users are also covered but their spouse and dependent children are not covered. Other travellers on the same trip are not covered under your credit card travel insurance coverage.

Refer to the credit card Certificate of Insurance for complete coverage details, limitations and exclusions.

Summary of Your Card’s Coverage

- Under age 65: Unlimited coverage Disclaimer 1 for first fifteen (15) consecutive days of your trip

- Age 65+: Unlimited coverage Disclaimer 1 for first three (3) consecutive days of your trip

Out of Province/Country Emergency Medical Insurance

This insurance covers reasonable and customary expenses, in excess of any medical expenses payable by your government health insurance plan or any other insurance plan, for emergency treatment medically required during your trip as a result of a medical emergency.

This is a summary only. All travel insurance is subject to limitations and exclusions. Refer to the credit card Certificate of Insurance for complete coverage details, limitations and exclusions.

Trip Cancellation Insurance

This insurance protects eligible cardholders against the cost of non-refundable prepaid travel arrangements if the trip is cancelled prior to your departure, due to a covered reason. For this coverage to be effective, you must have purchased your prepaid travel arrangements with your RBC ® credit card and/or Avion ® points.

Trip Interruption Insurance

Flight delay insurance.

If you miss your connecting flight, are denied boarding or your flight is delayed, this insurance reimburses you, up to a certain maximum, for reasonable and necessary expenses you may have (for example, a hotel room or restaurant meals) as long as you have checked in with the air carrier and you paid for your airline ticket with your RBC ® credit card and/or Avion ® points.

Delayed Baggage Insurance

If your checked baggage is lost or delayed, this insurance reimburses you, up to a certain maximum, for reasonable and necessary emergency purchases that you need, as long as you paid for your airline ticket with your RBC ® credit card and/or Avion ® points.

Hotel/Motel Burglary Insurance

If you need to repair or replace personal property that has been damaged or lost due to a burglary of your hotel/motel room or cruise cabin and you are a registered guest, this insurance reimburses you, up to a certain maximum, as long as you paid for your hotel/motel room or cruise cabin with your RBC ® credit card and/or Avion ® points.

Travel Accident Insurance

This insurance covers you for accidental bodily injury or death if you are injured during an accident that occurs while you are travelling on a common carrier (such as a passenger plane) as long as you paid for these transportation arrangements with your RBC ® credit card and/or Avion ® points before departing on your trip.

Auto Rental Collision/Loss Damage Waiver Insurance

When you pay for the entire cost of the rental vehicle using your RBC ® credit card and/or Avion ® points, this Insurance covers you and/or a rental agency for loss/damages to eligible rental vehicles up to the actual cash value of the damaged or stolen rental vehicle. The length of time you rent the same vehicle must not exceed forty-eight (48) consecutive days.

All insurance is subject to limitations and exclusions. Download the RBC Avion Visa Infinite Certificate of Insurance (opens PDF in new window) for complete details.

Legal Disclaimer 1) Unless otherwise noted in the Certificate of Insurance, the maximum benefit for emergency medical insurance is unlimited.

All insurance is subject to limitations and exclusions. Download the RBC Avion Visa Platinum Certificate of Insurance (opens PDF in new window) for complete details.

Lost/Stolen Baggage

We will pay the covered person for loss or damage to owned baggage and personal effects used for the personal use of the covered person while in transit as checked-in baggage or carried on board the air carrier when the full cost of the airline ticket is paid with your RBC ® credit card and/or Avion ® points.

All insurance is subject to limitations and exclusions. Download the RBC ® Avion ® Visa Infinite Business ‡ Certificate of Insurance (opens PDF in new window) for complete details.

All insurance is subject to limitations and exclusions. Download the RBC Avion Visa Business Certificate of Insurance (opens PDF in new window) for complete details.

- Under age 65: Unlimited coverage Disclaimer 1 for first thirty one (31) consecutive days of your trip

- Age 65+: Unlimited coverage Disclaimer 1 for first seven (7) consecutive days of your trip

All insurance is subject to limitations and exclusions. Download the RBC Avion Visa Infinite Privilege Certificate of Insurance (opens PDF in new window) for complete details.

All insurance is subject to limitations and exclusions. Download the RBC Avion Visa Infinite Privilege for Private Banking Certificate of Insurance (opens PDF in new window) for complete details.

All insurance is subject to limitations and exclusions. Download the RBC Rewards ® Visa ‡ Preferred Certificate of Insurance (opens PDF in new window) for complete details.

All insurance is subject to limitations and exclusions. Download the RBC ® U.S. Dollar Visa ‡ Gold Certificate of Insurance (opens PDF in new window) for complete details.

All insurance is subject to limitations and exclusions. Download the RBC ® British Airways Visa Infinite ‡ Certificate of Insurance (opens PDF in new window) for complete details.

Next Step: Tell us who is travelling so we can give you an accurate quote.

Who do you want to get a quote for?

Why we ask: Since your credit card’s travel insurance covers you, your spouse and/or your dependent children, your quote will calculate the coverage you already have on your card—saving you money!

Why we ask: Since your credit card’s travel insurance does not cover travellers other than you (the cardholder), your spouse and/or your dependent children, your quote for these travellers will not factor in your credit card coverage.

Tip: You will need to get a quote and buy travel insurance for other eligible travellers separately so that we can give you an accurate quote for everyone.

Eligibility

To be eligible for this insurance coverage, a traveller must be:

- A client of the RBC companies or a spouse or child of a client

- A Canadian resident (applicable for Emergency Medical Insurance coverage)

Travel Insurance coverage is not included on your card, but we can cover you!

Although the card you used to purchase your trip does not include coverage, you can get a quote and buy affordable travel insurance now.

We are unable to determine the travel insurance coverage on your card

We can help make sure you’re protected financially every time you travel with affordable trip cancellation and interruption insurance, emergency medical insurance and more. Get a quote and buy affordable travel insurance now.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Citi Credit Card Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Do Citi cards have travel insurance?

Car rental insurance, costco anywhere visa® card by citi travel insurance benefits, citi® / aadvantage® executive world elite mastercard® travel insurance coverage, does citibank offer travel insurance.

Citi credit cards provide a host of benefits, including some generous points and miles earning opportunities (depending on the card you have).

But, when it comes to travel insurance, let’s just say it’s not necessarily Citi cards' strong suit.

Still, there are Citibank travel insurance benefits you should know about to ensure you use the right card when paying for your next trip. Here are the primary benefits associated with Citi card travel insurance.

Only two Citi cards have travel insurance, and each one has a different set of benefits: The Costco Anywhere Visa® Card by Citi and the Citi® / AAdvantage® Executive World Elite Mastercard® .

on Citibank's application

Both cards provide rental car insurance.

The Costco Anywhere Visa® Card by Citi also offers roadside assistance, worldwide travel accident insurance and a 24/7 concierge for travel and emergency assistance. The Citi® / AAdvantage® Executive World Elite Mastercard® , on the other hand, offers baggage protection, trip cancellation/interruption insurance and trip delay protections.

» Learn more: Best Citi credit cards right now

If you use either of the two Citi credit cards listed above to pay for a car rental, Citi travel insurance will protect any damages to a rental car up to $50,000.

This amount will cover the cost of repairs or the cash value of the car, whichever is lower. It applies anywhere you rent a car — there are no geographic limitations — as long as the rental period is no longer than 31 days. Citibank travel insurance covers accidental damage, theft, vandalism or a natural disaster, and any necessary towing costs.

Citi's rental car insurance is secondary when renting a car within the U.S., but if you're renting outside of the country, it switches to primary coverage.

With secondary insurance, you need to rely on any other insurance coverage you have before Citi’s car rental insurance kicks in. Primary insurance, alternatively, will be the first line of coverage you have.

Coverage wouldn't apply if you rent the car to someone else or operate a rental car as a rideshare vehicle. It also only covers the car, not any personal injuries that might result from an accident.

There are several types of vehicles that are excluded from coverage. These include:

Trucks, pickup trucks, trailers, full-size vans on a truck chassis or recreational vehicles like campers and off-road vehicles.

Motorcycles or motorized bikes.

Commercial vehicles or cargo vans.

Any vehicle with fewer than four wheels.

Antique vehicles older than 20 years or that have not been made in the past decade.

Limousines.

Sport-utility trucks or open, flat-bed trucks.

Any vehicle that retails for over $50,000.

» Learn more: Rental car insurance explained

Roadside assistance

When driving in the U.S., roadside assistance is available for Costco Anywhere Visa® Card by Citi cardholders by calling 866-918-4670.

Roadside assistance is valuable in the event of an accident, loss of fuel or other vehicle malfunction. Keep in mind that you would still have to pay for the assistance (like a tow truck, for example), but this benefit makes it easy to reach someone with one phone call.

Citi card provides access to similar assistance as a membership program like AAA . The difference is that AAA’s annual fee covers roadside assistance fees while Citi's coverage doesn't; it solely provides access to someone who can help you for a reduced rate.

Several credit cards provide some type of roadside assistance and are worth considering before paying the annual fee for AAA.

Worldwide travel accident insurance

The Costco Anywhere Visa® Card by Citi includes accident insurance, which covers the cardholder or family members if they are injured or killed when traveling on a common carrier (any vehicle that is licensed to carry passengers like a bus, plane, cruise ship or train).

You will need to have used the Citi card to cover the entire cost of the travel on that common carrier for the benefit to apply. The maximum coverage is $250,000.

» Learn more: How does travel insurance work?

Travel and emergency assistance

The Costco Anywhere Visa® Card by Citi card provides access to a 24/7 concierge to help you with a disruption to your trip. This can include medical assistance, referrals to a doctor or legal help. It can also help if you need to adjust travel plans.

Just remember, you’ll be responsible for paying for any services used, but the call is toll-free.

Baggage protection

Only available for the Citi® / AAdvantage® Executive World Elite Mastercard® , this luggage protection provides coverage if your checked bag is stolen, lost or damaged.

The insurance covers as much as $3,000 per person ($2,000 for New York residents), but only kicks in if you use the card or American AAdvantage miles to pay for the trip.

» Learn more: The guide to baggage insurance

Trip cancellation and interruption insurance

If a covered traveler has a medical emergency or dies, the Citi® / AAdvantage® Executive World Elite Mastercard® coverage can provide reimbursement for up to $5,000 in eligible nonrefundable expenses.

You would need to use the card or American AAdvantage miles to pay for the trip.

Trip delay protection

Another benefit that’s reserved only for the Citi® / AAdvantage® Executive World Elite Mastercard® is trip delay protection . This coverage kicks in if your trip is delayed by at least six hours, and offers reimbursement for expenses incurred during the delay, up to $500 per trip.

This would include reasonable purchases like hotel stays, rental cars and meals.

» Learn more: The best travel credit cards right now

Citibank travel insurance is available, but limited. It is only offered on two cards and isn't as comprehensive as other credit cards with travel insurance .

Both cards include rental car coverage, but beyond this, each has its own set of benefits. Depending on which one you hold, it may include coverage like trip delay protection or roadside assistance.

People hold Citi cards for many reasons, including the ability to earn transferable Citi ThankYou Points . But, the travel insurance benefits are somewhat limited. If you have a Citi card, review the travel insurance perks before you take off to understand your coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Visa Traveler

Exploring the world one country at a time

How to Buy Schengen Travel Insurance from VisitorsCoverage: A Step-by-Step Guide

Updated: September 8, 2023

VisitorsCoverage is a travel medical insurance broker headquartered in the US. They sell insurance for all international travel including US trips and Schengen Visa.

VisitorsCoverage’s Europe Travel Plus meets all the requirements of Schengen visa insurance such as the minimum policy cover, copay and visa letter.

VisitorsCoverage is also the cheapest Schengen travel insurance, costing about $1 per day.

In this article, you will learn how to buy Schengen travel insurance from VisitorsCoverage and how to cancel and get a refund in case of visa refusal.

Table of Contents

Documents needed before starting the purchase.

Keep the following documents handy before you start the purchase.

- Your passport

- Your travel dates

- A credit or debit card

Steps to Buy Schengen Travel Insurance

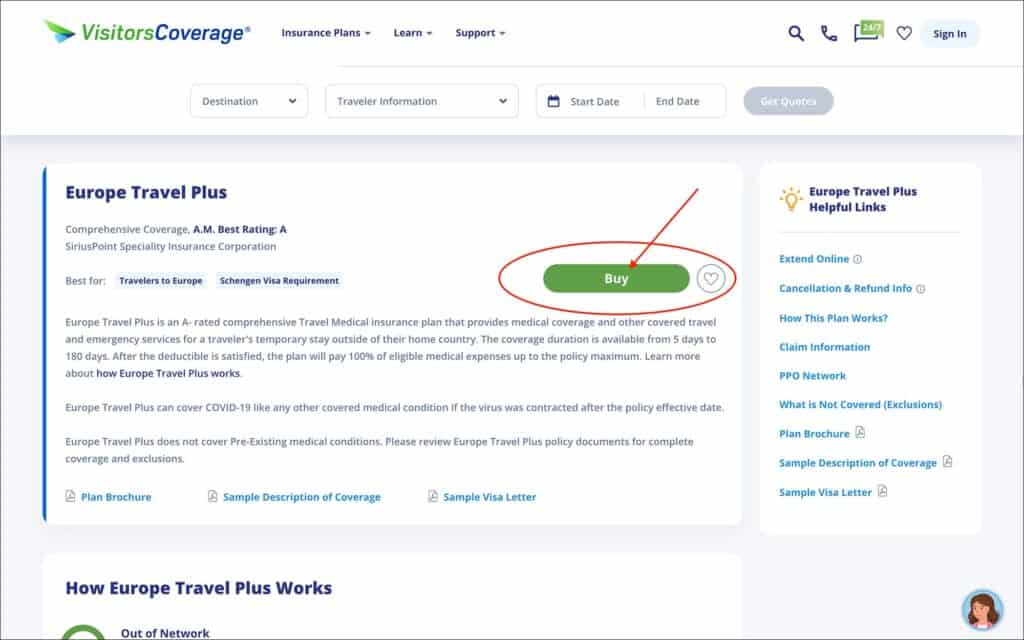

- Go to the VisitorsCoverage Europe Travel Plus page

- Click on the green “Buy” button.

You will be taken to the “Purchase Your Policy” page.

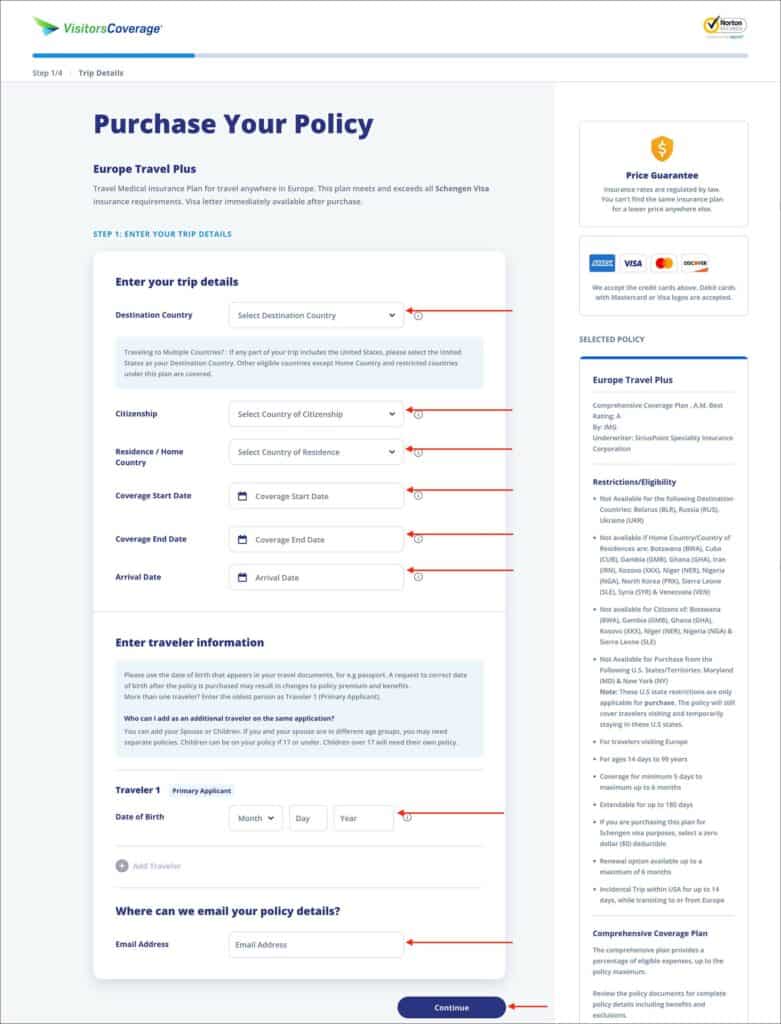

Step 1: Enter Your Trip Details

Enter the following information on the “Purchase Your Policy” page.

Section: Enter your trip details

- Destination Country [ Comment: Select your main Schengen country of application ]

- Citizenship [ Comment: Select your country of citizenship as per your passport ]

- Residence / Home Country [ Comment: Select your country of residence ]

- Coverage Start Date [ Comment: Select the policy start date ]

- Coverage End Date [ Comment: Select the policy end date ]

- Arrival Date [ Comment: Select your trip start date, which can be the same as the coverage start date ]

Destination Country Select the main Schengen country where you will be applying for your visa. For example, if you are applying for a Schengen visa at the France embassy or consulate, select “France” as your destination country.

Section: Enter travel information

- Traveler 1: Date of Birth [ Comment: Enter your date of birth as per your passport ]

Add more travelers and their date of birth by clicking on the + button.

Section: Where can we email your policy details?

- Email Address [ Comment: Enter the email address where you would like to receive your policy documents ]

Click on the blue “Continue” button.

You will be taken to the “Coverage Details” page.

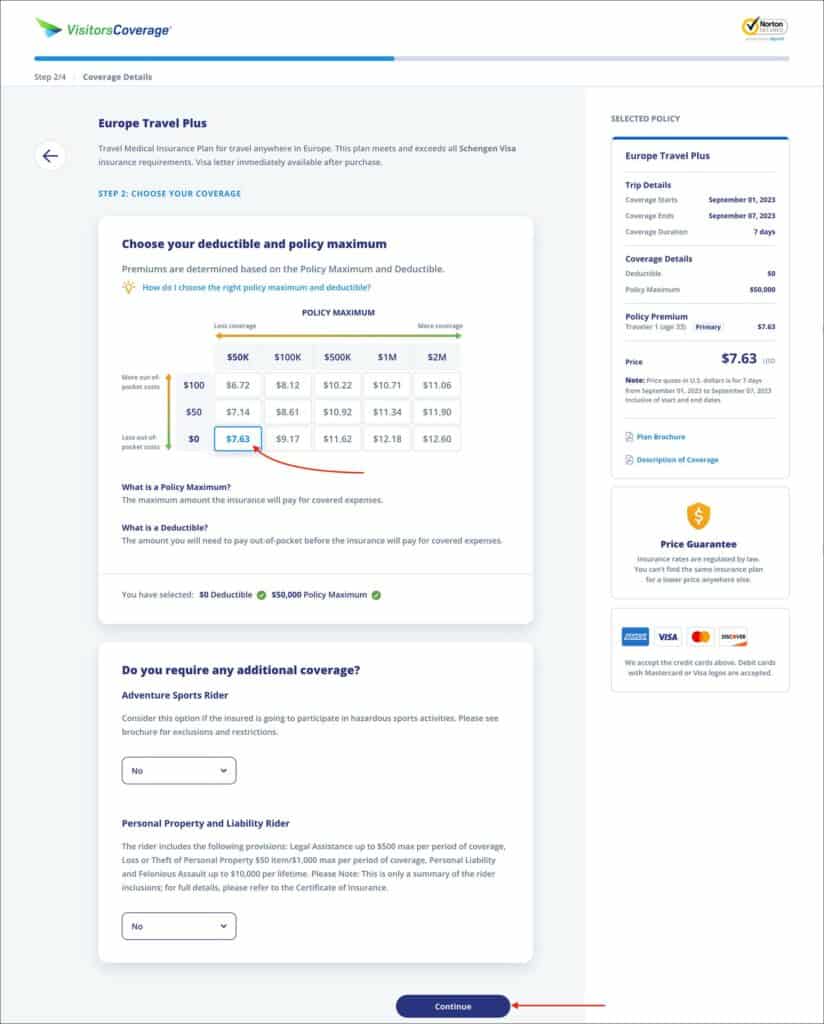

Step 2: Choose Your Coverage

Section: Choose your deductible and policy maximum.

- Deductible [ Comment: Select $0 ]

- Policy Maximum [ Comment: Select at least $50K ]

Deductible A deductible of $0 will be selected by default. Even then, make sure $0 is selected. $0 deductible is the Schengen visa insurance requirement. If you choose a different amount, the insurance will not be accepted for your Schengen visa.

Policy Maximum A policy maximum of $50,000 will be selected by default. You can increase your coverage if you prefer. But $50,000 is the minimum requirement for a Schengen visa.

Section: Do you require any additional coverage?

You can select the below additional coverage if necessary. But these are not required for a Schengen visa.

- Aventure Sports Rider [ Comment: This additional coverage may be beneficial if you plan to engage in adventure sports during your Europe trip ]

- Personal Property and Liability Rider [ Comment: This additional coverage may be beneficial if you prefer to insure your electronics, etc. ]

You will be taken to the “Applicant Details” page.

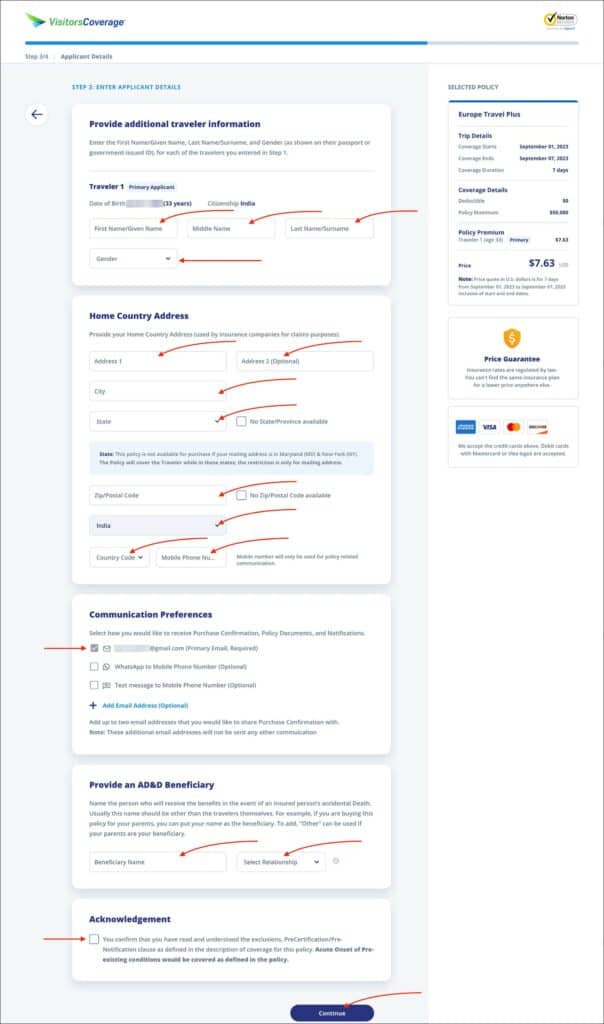

Step 3: Enter Applicant Details

Section: Provide additional travel information

Traveler 1: Primary Applicant

- First Name/Given Name [ Comment: If your passport has a Given Name, enter the given name here. If your passport has a First name, enter your first name here ]

- Middle Name [ Comment: If your passport has a Middle name, then enter the middle name here. Else leave it blank ]

- Last Name/Surname [ Comment: Enter your last name or surname as per your passport ]

- Gender [ Comment: Enter your gender ]

Traveler 2:

If you have more than one traveler in your policy, enter their details.

Section: Home Country Address

Enter your current residential address in the following fields.

- Address 1 [ Comment: Enter address line 1 of your current residential address ]

- Address 2 (optional) [ Comment: Enter Address line 2 of your current residential address ]

- City [ Comment: Enter your city ]

- State [ Comment: Enter your state ]

- Zip/Postal Code [ Comment: Enter your postal code ]

- Country [ Comment: Enter your country ]

Enter your current mobile phone number in the following fields.

- Country Code [ Comment: Enter the country code of your phone number ]

- Mobile Phone Number [ Comment: Enter your mobile phone number ]

Section: Communication Preferences

In this section, select how you would like to receive your purchase confirmation, policy documents and visa letter.

Email is mandatory, but you can also opt for phone or WhatsApp.

Section: Provide an AD&D Beneficiary

Enter the information of the beneficiary who will receive the benefits in case of accidental death of the insured.

- Beneficiary Name [ Comment: Enter the beneficiary’s full name as per their passport or ID card ]

- Relationship [ Comment: Select the relationship of your beneficiary ]

Section: Acknowledgement

Check the box to confirm that you have read and understood the coverage information.

You will be taken to the “Review and Pay” page.

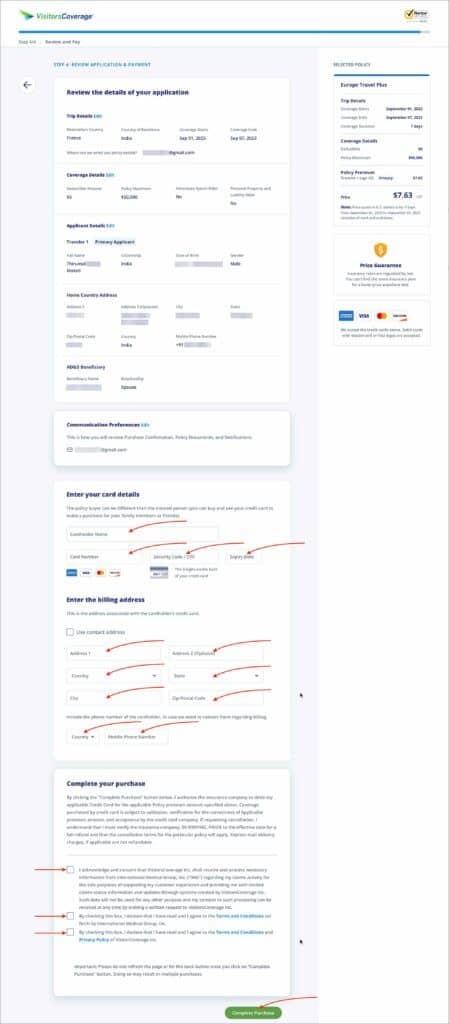

Step 4: Review Application and Payment

Section: Review the details of your application

Review all the information you have entered so far. Make sure the information is as per your passport.

Section : Enter your card details

In this section, enter your card details for payment.

Section : Enter the billing address

In this section, enter the billing address associated with your credit/debit card entered above.

Section : Complete your purchase

In this section, check all three boxes.

Click on the green “Complete your purchase” button.

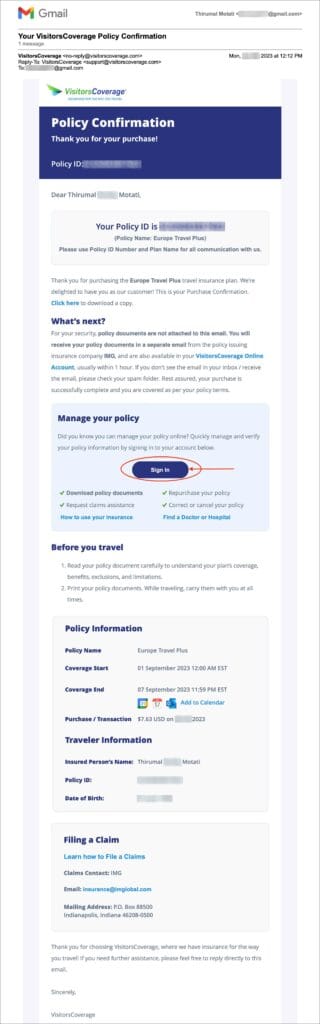

Once your purchase is complete, you will receive an email confirming your purchase.

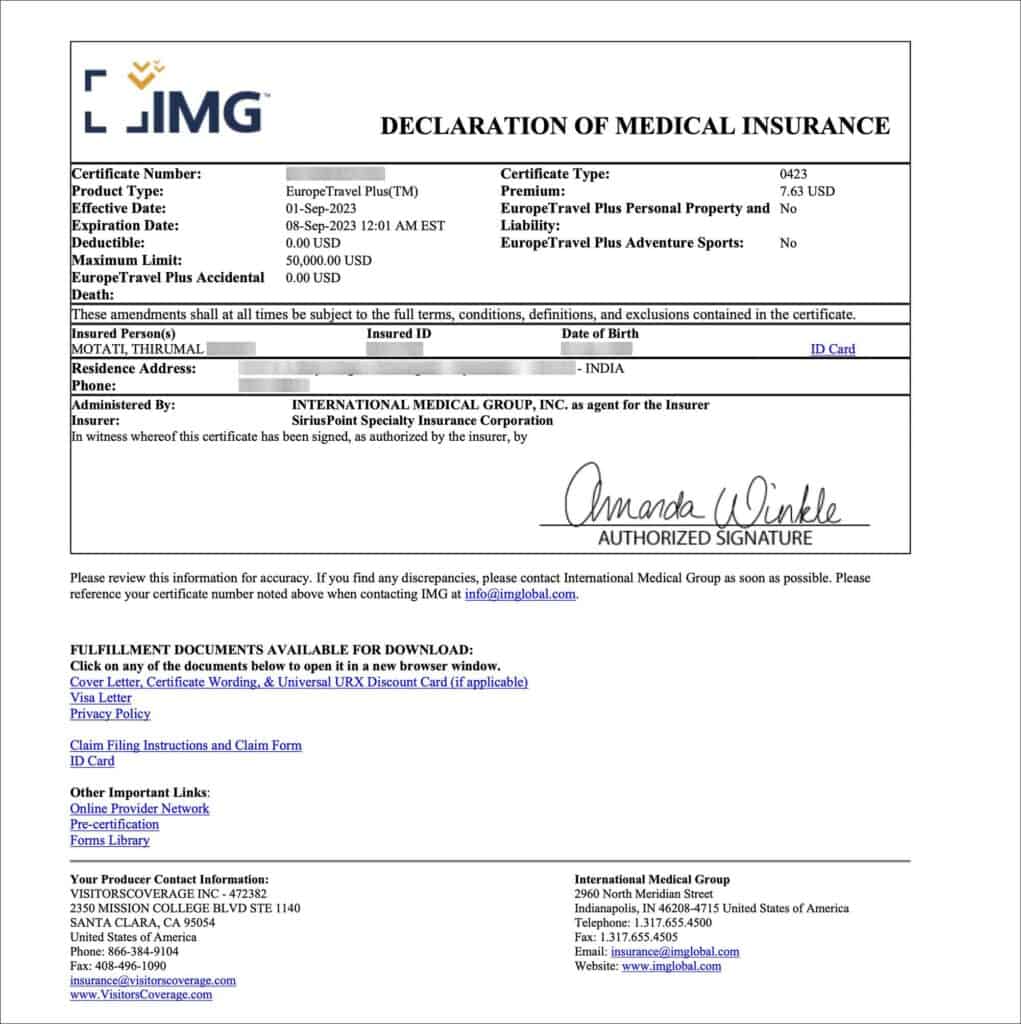

Steps to Download Visa Letter and Coverage Letter

You can download your visa letter and coverage document from the customer portal dashboard. You only need these two documents as proof of travel insurance for Schengen visa .

To go to the customer portal, you can click on the “Sign In” button in the email. Or you can follow the below steps.

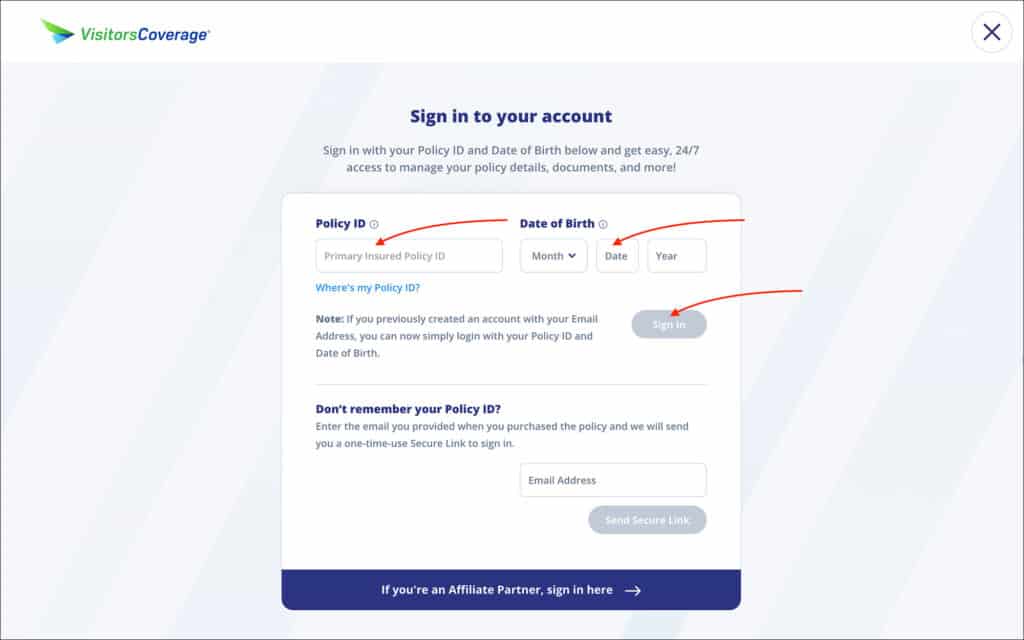

Log into Customer Portal

- Go to the VisitorsCoverage Customer Portal page

- Log in using your Policy ID and Date of Birth or using your Email.

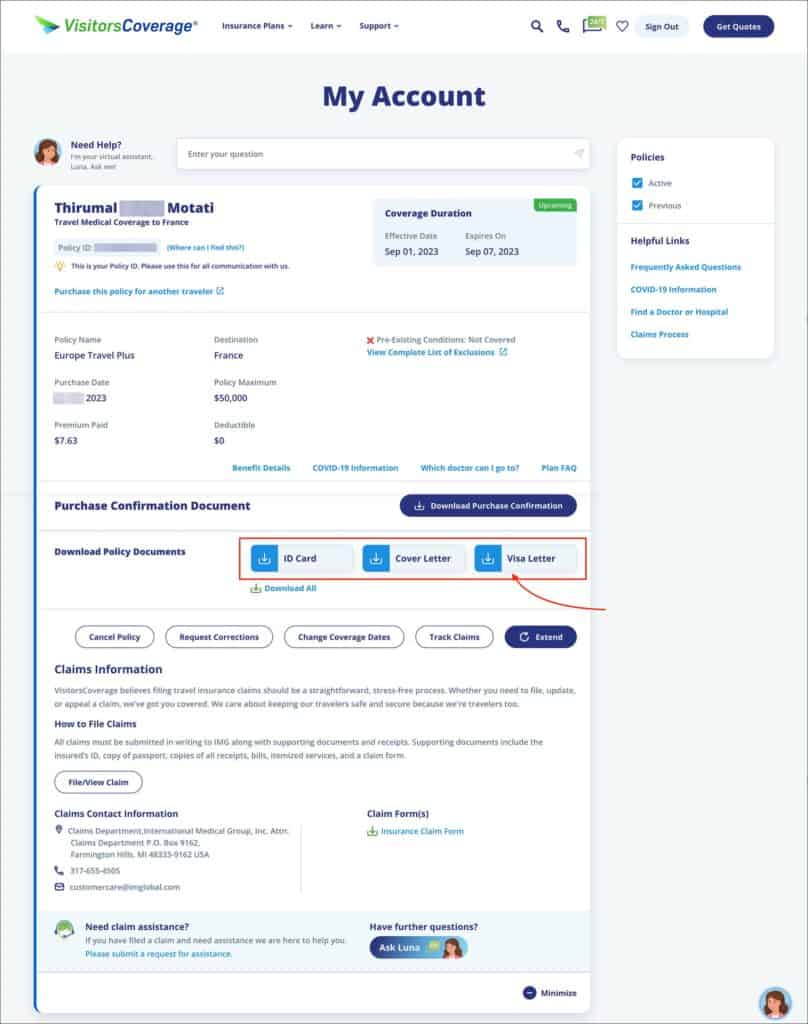

Once you log in, you will see your policy details such as the names, policy types, coverage duration, etc.

Download your Visa Letter

In the “Download Policy Documents” section, click on “Visa Letter” to download the visa letter for your Schengen visa.

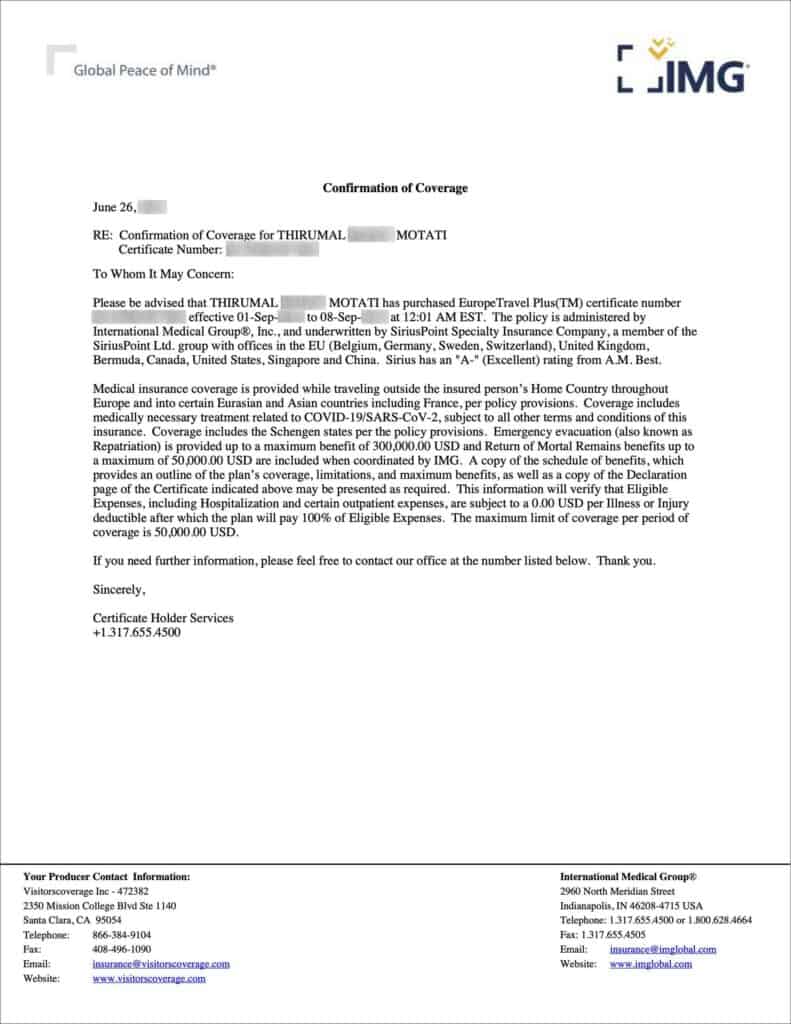

You can also download the coverage letter from IMG International by clicking the “Cover Letter” button.

Sample Visa Letter from VisitorsCoverage

Sample Coverage Letter from IMG International

Steps to Cancel Your Policy in Case of Visa Refusal

In order to get a full refund, you must cancel your policy before the insurance start date. If your visa is refused, cancel your policy right away to avoid any issues with your refund.

Follow the below steps to cancel and receive a full refund of your policy.

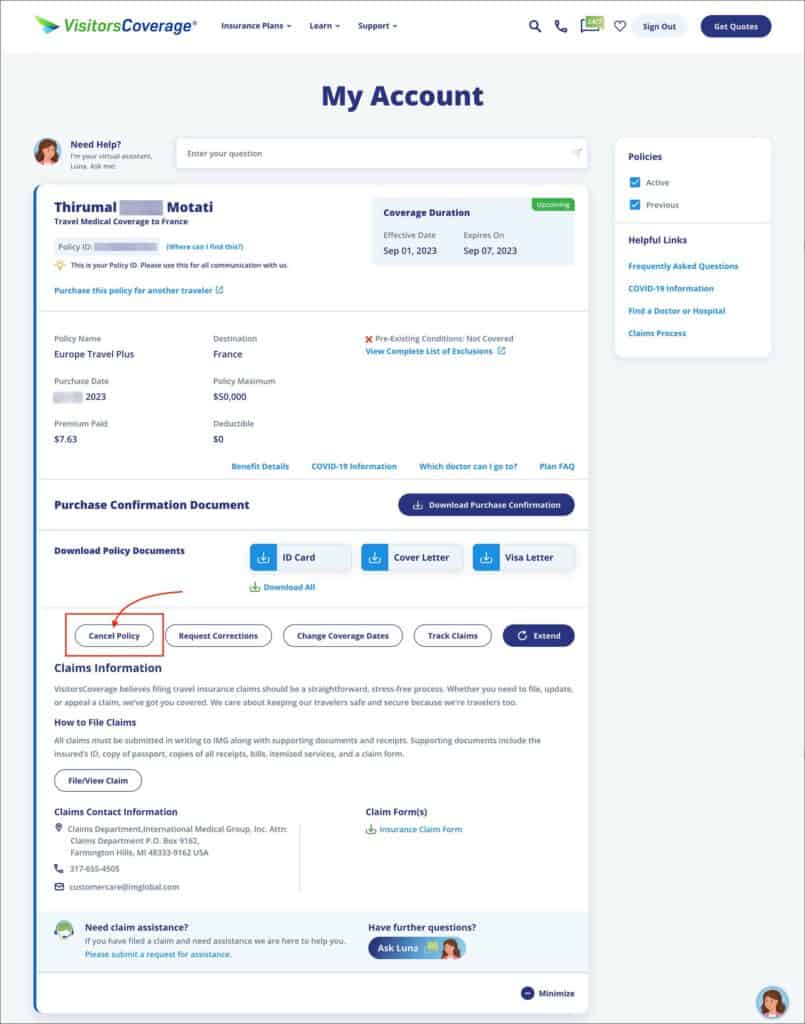

- Go to VisitorsCoverage Customer Portal

Initiate Policy Cancellation

Within the “My Account” dashboard, click on the “Cancel Policy” button.

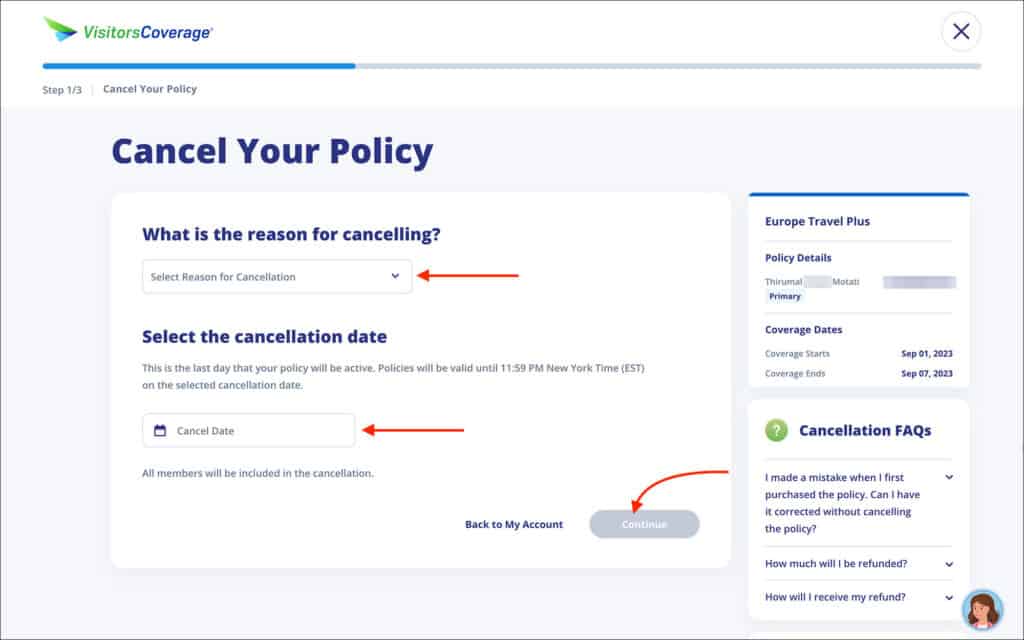

Step 1: Cancel Your Policy

- Travel plans changed

- Found a cheaper plan

- Purchased a wrong policy

- Accidentally submitted incorrect information

- Concerned with Coronavirus

- Select the cancellation date [ Comment: Select the most recent date so you can get your refund as soon as possible ]

You will be taken to the “Verify and Submit” page.

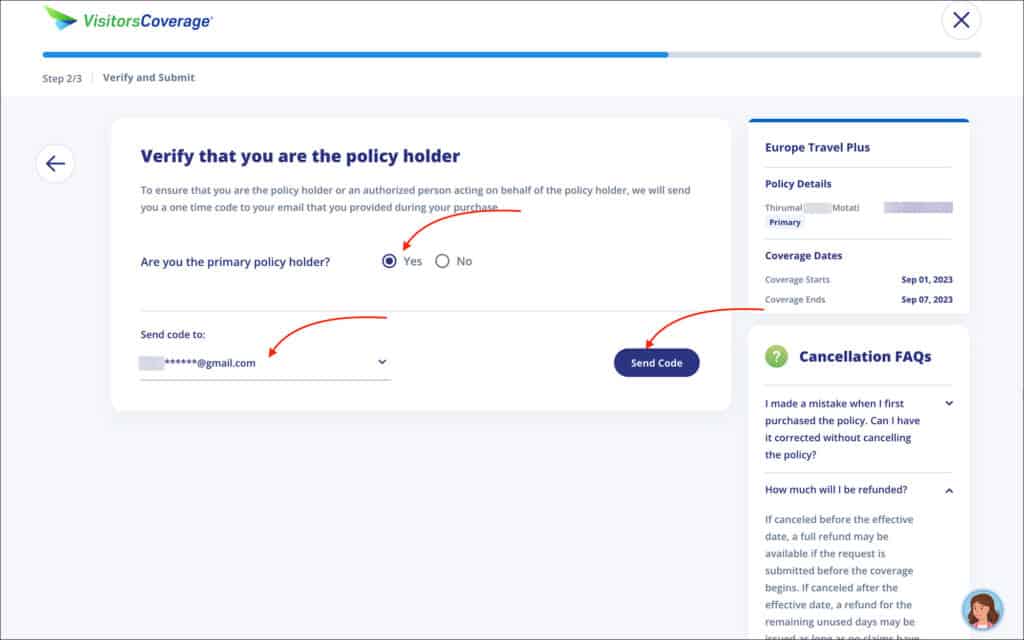

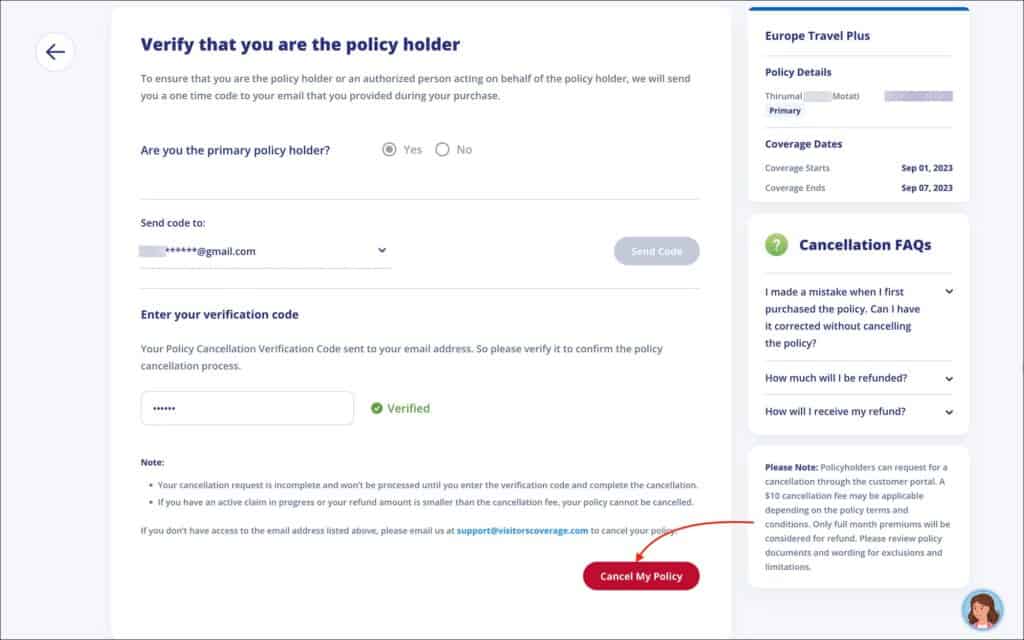

Step 2: Verify and Submit

- Are you the primary policy holder? [ Comment: Select “Yes” ]

- Send code to: [ Comment: Select your email from the dropdown ]

Click on the blue “Send Code” button.

Check your email for the verification code.

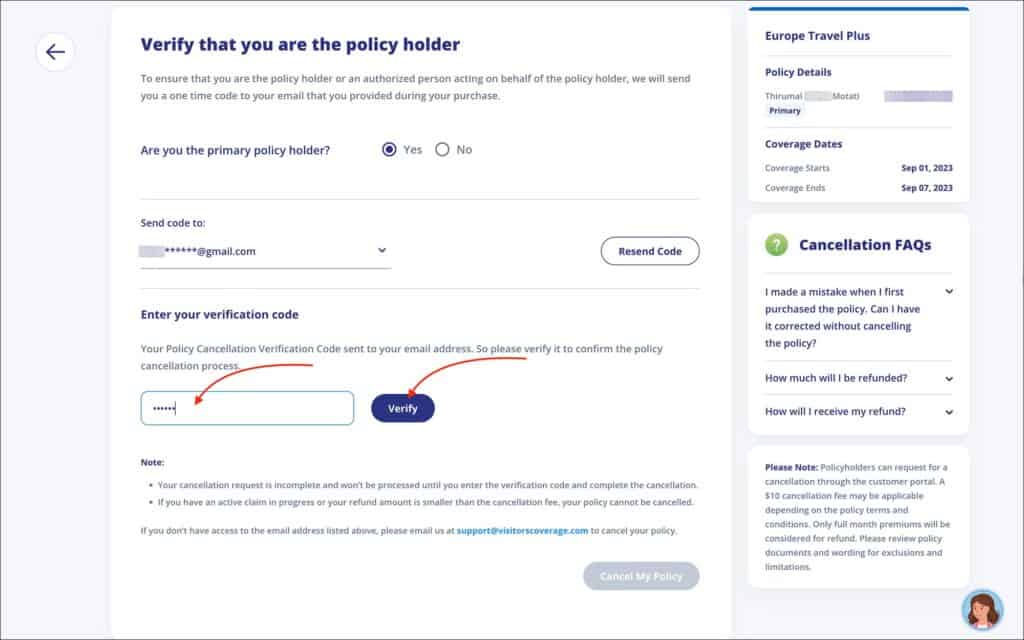

- Enter your verification code [ Comment: Enter the verification code that you received to your email ]

Click on the blue “Verify” button

Then click on the red “Cancel My Policy” button.

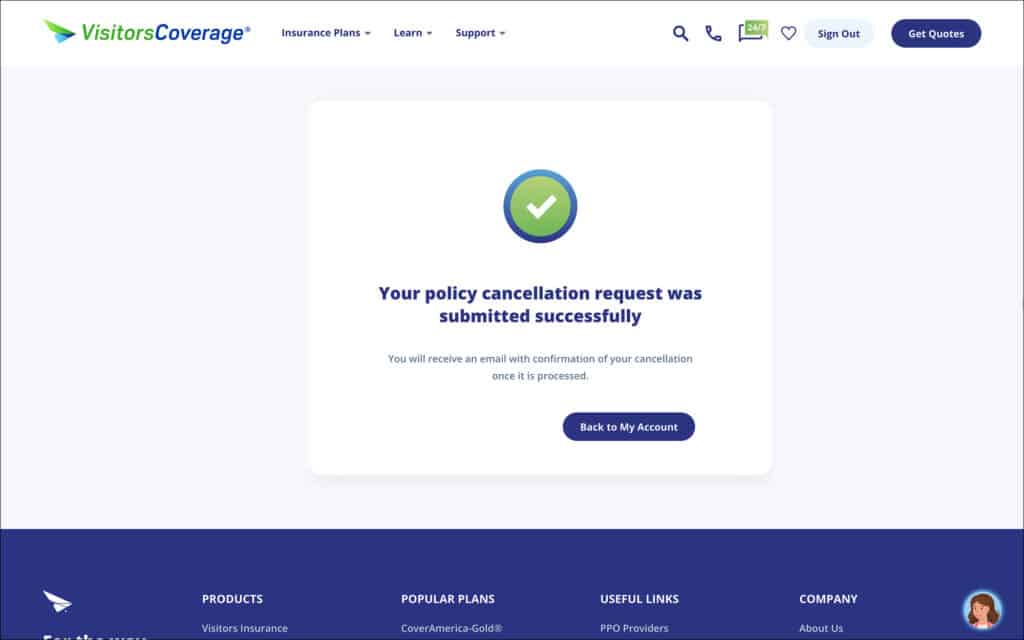

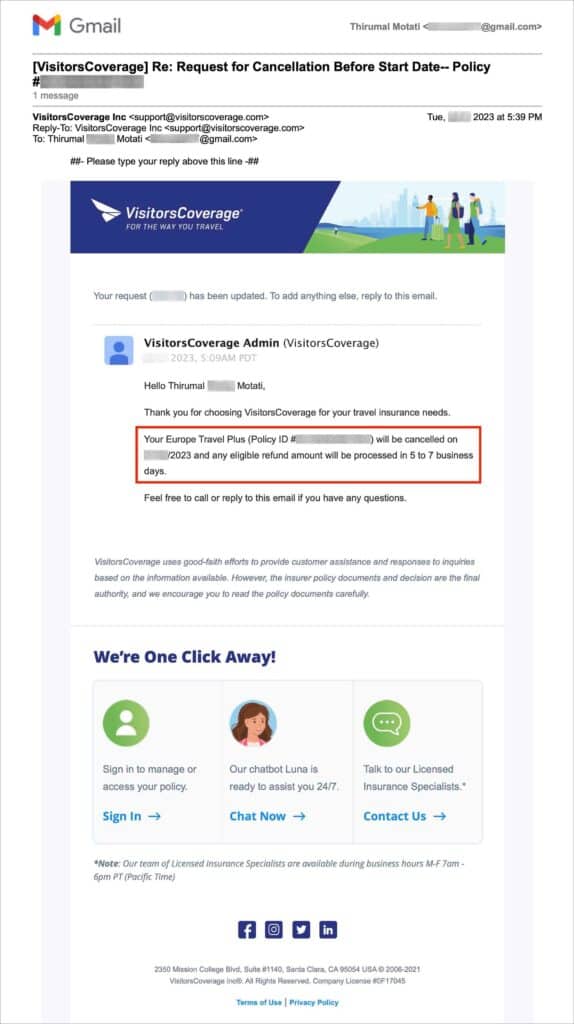

Step 3: Cancellation Success

You will be shown that your policy cancellation request was successfully submitted.

You will also receive emails from VisitorsCoverage and IMG International confirming your cancellation and refund. Save those emails as a reference if you need to contact VisitorsCoverage for any issues with refunds.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

- ATM / Branch

- Open an Account

- View All Credit Cards

- 0% Intro APR Credit Cards

- Balance Transfer Credit Cards

- Cash Back Credit Cards

- Rewards Credit Cards

- See If You're Pre-Selected

- Small Business Credit Cards

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- Small Business Banking

- Personal Loans & Lines of Credit

- Home Equity

- Small Business Lending

- Investing with Citi

- Self Directed Trading

- Credit Cards

- Credit Knowledge Center

- Understanding Credit Cards

- What are the Costco Visa travel benefits

What are the Travel Benefits of the Costco Anywhere Visa® Card by Citi?

Exclusively for Costco members, the Costco Anywhere Visa Card by Citi offers cash back on all purchases and additional cash back on categories such as eligible gas and EV charging, restaurants and eligible travel and purchases from Costco and Costco.com. Cardholders also enjoy access to Citi Entertainment ® .

These benefits and more can make the Costco Anywhere Visa a great card for travel. Let’s look at how it works.

Cash back rewards on travel

Cardholders earn unlimited 3% cash back at restaurants and eligible travel purchases. This can include airfare, hotel stays, car rentals, travel agencies, cruises and Costco travel.

Cardholders can also make the most of road trips and vacation car rentals with 4% cash back on eligible gas and EV charging transactions for the first $7,000 every year. After the first $7,000, cardholders continue to earn 1% cash back in these categories.

Other travel benefits

Cardholders can also get access to services and benefits like:

- Travel and emergency assistance

- Worldwide car rental insurance

- Travel accident insurance

- Roadside assistance dispatch service

- Zero foreign transaction fees 1

Terms, conditions and exclusions apply, please see here for more information.

These services and benefits help take the stress out of travel so you can enjoy a worry-free, relaxing vacation.

Access to Citi Entertainment

Citi Entertainment opens the door to popular experiences, such as concerts, sporting events and dining.

With the Costco Anywhere Visa Card by Citi, cardmembers can get special access to purchase tickets to thousands of events, including presale tickets and exclusive experiences for some of the most anticipated concerts, sporting events and dining experiences.

Whether you want to attend a local event while on vacation or plan a trip around a concert, your Costco Anywhere Visa® Card by Citi can enhance your travel with special entertainment experiences.

1 Important Pricing & Information

Disclosure : This article is for educational purposes. It is not intended to provide legal, investment, or financial advice and is not a substitute for professional advice. It does not indicate the availability of any Citi product or service. For advice about your specific circumstances, you should consult a qualified professional.

Additional Resources

Insights and Tools

Utilize these resources to help you assess your current finances & plan for the future.

FICO® Score

Learn how FICO® Scores are determined, why they matter and more.

Review financial terms & definitions to help you better understand credit & finances.

- Consumer: 1-800-347-4934

- Consumer TTY: 711

- Business: 1-866-422-3091

- Business TTY: 711

- Lost/Stolen: 1-800-950-5114

- Lost/Stolen TTY: 711

Terms & Conditions

- Card Member Agreement

- Notice At Collection

- Do Not Sell or Share My Personal Information

Copyright © 2023 Citigroup Inc

Important Information

You are using an outdated browser. Please upgrade your browser to improve your experience.

- For Individuals

- For Governments

- #TravelAgain

- #DoNotFallForFraud

Secure your overseas trip with Travel Medical Insurance

Get your Travel Medical Insurance with COVID-19 coverage from reputed global insurers for travel in the new normal.

Travelling from*

- South Korea

- Afghanistan

- Aland Islands

- Antigua Barbuda

- Ascension and Tristan da Cunha

- Bosnia & Herzegovina

- Burkina Faso

- Cape Verde Islands

- Cayman Islands

- Central African Republic

- Christmas Islands

- Cocos Islands

- The Democratic Republic of the Congo

- Czech Republic

- Dominican Republic

- El Salvador

- Equatorial Guinea

- French Polynesia

- Guinea Bissau

- British Indian Ocean Territory

- British Virgin Islands

- Caribbran Netherlands

- Ivory Coast

- Faroe Islands

- French Guiana

- Liechtenstein

- Marshall Islands

- Saint Barthelemy

- Saint Kitts Nevis

- Saint Martin

- Saint Pierre and Miquelon

- Hong Kong SAR

- Isle of Man

- Korea, Republic of

- Myanmar (Burma)

- The Netherlands

- New Caledonia

- New Zealand

- Norfolk Islands

- Northern Mariana Islands

- North Macedonia

- Palestinian Territories

- Papua New Guinea

- Philippines

- Puerto Rico

- Saint Helena

- Saint Lucia

- Saint Vincent Grenadines

- Sao Tome & Principe

- Saudi Arabia

- Sierra Leone

- Sint Marteen

- Solomon Island

- South Africa

- South Sudan

- Sudan, Republic of

- Svalbard and Jan Mayen

- Switzerland

- Taiwan, China

- The Holy See

- Timor Leste

- Trinidad & Tobago

- Turkmenistan

- Turks Caicos Islands

- United Arab Emirates

- United Kingdom

- United States of America

- Vatican City

- Virgin Islands of the United States

- Western Sahara

- Vietnam (Online eVisa)

- Lesotho Permits

- Korea, Democratic People's Republic of

- Ghana Permits

- Lithuania Temporary Residence Permit

- Lithuania (E-Resident card)

- Lithuania TRP and National Visa

- Falkland Islands

- Finland Residence Permit

- Faroe Iceland

- Thailand (Online eVisa)

- American Samoa

- Pitcairn Island

- Wallis and Futuna Islands

- Bouvet Island

- Akrotiri and Dhekelia

- Baker Island

- Clipperton Island

- South Georgia and the South Sandwich Islands

Travelling to*

- Schengen countries

By clicking 'Get Now,' I agree to the terms and conditions & understand that my personal data may be shared with VFS Global insurance partners.

Going on a trip abroad is exciting, but emergencies can happen, and if they do, it can be expensive and challenging affair. You can take some of your stress away by booking a travel medical insurance policy with Covid-19 coverage at competitive pricing from global insurers. Don't forget that for Schengen visa applications, travel insurance is mandatory.

Travel Medical Insurance

Emergency medical coverage, including COVID-19 treatment costs.

Competitive pricing from global insurers.

Global medical insurance coverage for evacuation and accidents.

Cancellation and trip delay coverage.

Protection for loss of passport and travel documents.

Frequently asked questions

View all FAQ's

1 . What is Travel Medical Insurance?

Travel Medical Insurance is designed to cover your emergency medical expenses while traveling abroad. In the event of an unexpected illness, injury, or medical condition during your trip, your travel medical insurance plan will reimburse you for the treatment costs, up to the limits specified in the plan.

2. Why do I need Travel Medical Insurance?

Travel Medical Insurance provides coverage for various risks that may arise during your overseas travel, including medical emergencies, COVID-19, and loss of passport. The coverage offered ensures an additional layer of protection against potential financial losses. For more detailed information on the coverage, please refer to the Travel Medical Insurance policy documents.

3. Why should you buy Travel Medical Insurance online?

Purchasing overseas travel insurance online is a convenient way to access a wide range of best plans at competitive prices from global insurers. This allows you to choose a suitable plan without incurring any extra commissions.

4. How much will overseas Travel Insurance cost?

The cost will depend on the kind of overseas Travel Medical Insurance policy you opt for, and it will vary from country to country. Multiple underlying health conditions will determine the final insurance premium you will have to pay.

5. How far in advance should I purchase Travel Medical Insurance?

It's best to purchase travel insurance within the first 14 days of your initial trip.

With Travel Medical Insurance assistance provided by VFS Global, you can book your insurance and submit your visa application together.

Even if you missed purchasing the insurance plan before or during the visa application process, you can still buy Travel Medical Insurance by visiting our website.

Our Valued Partners

Modal title

Terms and Conditions:

The VFS Global website may contain links to third-party sites promoting various products and/or services that VFS Global does not own or operate. These links to websites are in the nature of paid advertising and are not verified by VFS Global.

These links are provided for convenient access. Access to these links is voluntary and does not indicate that VFS Global endorses or is associated with any of these third-party websites. Users are requested to use these links at their own discretion, risk, and cost when dealing with these websites, and neither VFS Global nor its officers, employees, or agents shall have any responsibility or liability of any nature whatsoever for these other third-party websites/links or any other information contained in them.

Use of Your Personal Information:

In the event that you wish to avail of any of our collaboration partners' products or services, you agree and understand that by proceeding to avail of these products and services, you consent to share your personal information with them. By clicking on the box below, you confirm that you have provided your consent to us sharing your personal information with our collaboration partners for the purpose of providing products and services and receiving quotes from them.

For more information about how we use your personal information, please review our Privacy Policy. You can also review our partners' Privacy Policies - you'll be able to find these on their websites when you click through to the next page.

- Tata Steel share price

- 167.65 1.09%

- State Bank Of India share price

- 810.60 1.15%

- ICICI Bank share price

- 1,143.10 3.25%

- ITC share price

- 436.50 -0.78%

- HCL Technologies share price

- 1,390.20 -5.58%

New Schengen Visa rules: Know changes in travel, insurance trends; senior citizens visiting Europe shoots up by 100%

New schengen visa rules ushered in significant changes in travel and insurance trends, with those aged 70 and above visiting schengen destinations doubling. in the upcoming season, 82% of travellers to europe will visit france, switzerland, italy, germany, netherlands, and spain..

New Schengen Visa rules have resulted in a doubling of Europe-bound senior citizens, a survey by insurance broker Policybazaar.com revealed. The new Schengen Visa rules, announced on April 18, have also spurred significant changes in travel insurance trends over the past few days, including a 3-4 per cent surge in users who booked travel insurance policies, as per the Policybazaar survey.

Travellers to Schengen destinations aged 70 and above have doubled compared with last year's figures. A significant rise in travellers declaring pre-existing diseases was also noted.

The most sought-after add-ons for travel insurance included coverage for baggage or loss of belongings, trip cancellation, adventure sports coverage, and pre-existing disease (PED) coverage, as per the report.

Also read: New Schengen visa rules for Indians: This is how you can get multi-entry two-year visa for 29 European countries

Manas Kapoor, business head of Travel Insurance at Policybazaar.com, pointed out a surge among Europe-bound travellers who booked long-term travel insurance, after the new visa rules came into effect.

The survey noted a 3-4 per cent surge in users who booked travel insurance policies for travels that exceeded 45 days in April 2024. “This trend is expected to rise further due to the relaxed visa norms," Manas Kapoor pointed out.

In the upcoming summer season, 82 per cent of Indian travellers to European countries will be visiting popular destinations like France, Switzerland, Italy, Germany, Netherlands, and Spain, according to the survey.

The survey found a 15 per cent rise in travellers to Europe who declared pre-existing conditions including Diabetes and Hypertension, compared with last year's figures.

Also read: Indians can now apply for multiple entry Schengen visa with longer validity. Check details

But a 40% plunge was recorded in number of travellers buying travel insurance products in Euros.

The new Schengen visa regime entails a stark departure from previous rules. Previously, Indians who wished to travel to one or more European countries were granted Schengen visas for a maximum of three months.

Also read: Schengen visa fee hike: Here’s how costly your trip to Europe can get

Under the new regime, Indians will be granted Schengen visas for two years, thus facilitating their entry to any of the 29 European countries multiple times. This two-year validity is further extendable by 5 years under the ‘cascade regime’. This means Indian tourists can travel and stay in any of these European countries as visa-free nationals for a longer period.

Milestone Alert! Livemint tops charts as the fastest growing news website in the world 🌏 Click here to know more.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!

Wait for it…

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

Congratulations!

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

Subscribe to continue

This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp

IMAGES

VIDEO

COMMENTS

Collect your receipts and have your travel information handy (e.g., airline, flight number, scheduled departure date and time, actual departure date and time). Go to www.eclaimsline.com or call 1-800-546-9806 (outside the U.S. call collect 1-804-673-7481) to file a claim or get your questions answered.

Please note that the travel insurance service for people temporarily living abroad is valid until May 31, 2024. When you travel within your country of permanent residence*, your insurance will start automatically if you: Pre-booked accommodation for at least 2 nights at a distance of at least 100 km from home with your premium Visa card. Please ...

Schengen visa insurance must provide medical expenses coverage, including hospitalization, medical treatment and repatriation for medical reasons. It must also be valid in all Schengen countries ...

Visa Infinite and Visa Signature cardholders can refer to the travel insurance policy document for detailed coverage of fees as per the policy. +44 (0) 208 762 8373. English. +27 (11) 541 1068.

Hotel/Motel/Burglary Insurance Certificate. Travel Medical Insurance Certificate. Trip Cancellation/Trip Interruption Insurance Certificate. Common Carrier Travel Accident Insurance Certificate. Delayed and Lost Baggage Insurance Certificate. Flight/Trip Delay Insurance Certificate. Auto Rental Collision/Loss Damage Insurance Certificate

Credit card travel insurance provides the following benefits: Financial protection: Comprehensive credit card travel insurance can provide full coverage should a covered event--such as severe weather, a medical emergency affecting you or a loved one, or loss of employment--occur. In many cases, travel insurance may require you to pay any ...

Get multiple quotes. 3. Use this as an opportunity to maximize credit card bonus points. 4. Double-check the policy before purchasing. 5. Consider using a credit card that provides trip insurance ...

Visa Infinite Luxury Hotel Collection. The Visa Luxury Hotel Collection offers an unparalleled experience with an extraordinary collection of benefits like VIP status, complimentary breakfast daily, an upgrade when available, and a special amenity unique to each property. Get more details and choose a hotel. Hotel Collection terms and conditions.

Travel accident insurance: Up to $250,000. Rental car insurance: Covers damage or theft with restrictions. Eligible rental periods are limited to 15 consecutive days in the cardholders home ...

Cost: Your TD First Class Travel Visa Infinite Card has an annual fee charged by your credit card provider. No additional fee will be charged for the insurance coverages provided with the TD First Class Travel Visa Infinite Card. Claims: You must report Your claim to Our Administrator by calling 1-866-374-1129 no

Flight/Trip Delay Insurance Common Carrier Travel Accident Insurance Certificate. Delayed and Lost Baggage Insurance Certificate Emergency Travel Assistance Services. Auto Rental Collision/Loss Damage Insurance Certificate Purchase Security and Extended Warranty Protection. Travel Medical Insurance. Trip Cancellation/Trip Interruption Insurance ...

Schengen Visa Insurance Requirements. According to Regulation (EC) No 810/2009 of the European Parliament, medical insurance for a Schengen visa must fulfil the following requirements: A minimum coverage of medical costs: at least 30,000 EUR (equivalent to 33,000 USD as of April 2024). It should cover all member states of the Schengen Area.

Important Information about your Travel & Purchase Protection Benefits For questions, call 1-888-320-9961 if you're in the US . Auto Rental Collision Damage Waiver 03. Baggage Delay Insurance 06. Extended Warranty Protection 10. Lost Luggage Reimbursement 13. Purchase Protection 17. Roadside Dispatch\256 20. Travel Accident Insurance 22. Travel ...

Visa and travel insurance requirements for the Schengen Area. Having a valid U.S. passport allows you to spend up to 90 days within a 180-day period in the Schengen Area, whether for tourism or ...

Download the RBC Avion Visa Infinite Certificate of Insurance (opens PDF in new window) for complete details. Legal Disclaimer 1) Unless otherwise noted in the Certificate of Insurance, the maximum benefit for emergency medical insurance is unlimited.

Travel Insurance benefits cover premium Visa cardholders in case of personal accidents, medical emergencies, evacuation, repatriation expenses, trip cancellations, baggage delays, loss of personal belongings, and much more! Visit our online portal to learn more. Settling insurance and warranty claims is made easier with Visa through the below ...

cardholders by calling 866-918-4670. Roadside assistance is valuable in the event of an accident, loss of fuel or other vehicle malfunction. Keep in mind that you would still have to pay for the ...

They sell insurance for all international travel including US trips and Schengen Visa. VisitorsCoverage's Europe Travel Plus meets all the requirements of Schengen visa insurance such as the minimum policy cover, copay and visa letter. VisitorsCoverage is also the cheapest Schengen travel insurance, costing about $1 per day.

Depending on the TD credit card, travel benefits could include: Travel Medical Insurance 1. Trip Cancellation / Trip Interruption Insurance 2. Delayed and Lost Baggage Insurance 3. Flight/Trip Delay Insurance 3. Common Carrier Travel Accident Insurance 4. Auto Rental Collision / Lost Damage Insurance 5. Emergency Travel Assistance Services 6.

1-312-356-7830. Monday - Sunday, 8 a.m. - 12 a.m. ET. Read this Guide carefully. Each benefit description provides You with the details on what coverage You have and any exclusions and restrictions. This Guide to Protection Benefits ("Guide") includes important details about the benefits that come with Your card at no additional cost.

For your free pre-travel advice, travel or insurance assistance is required please contact International SOS. This service is available 24/7 and provides services in selection of languages. ... Your Visa card may have a Travel Insurance benefit when you purchase travel tickets or make hotel reservations with your card. This benefit may extend ...

Cardholders earn unlimited 3% cash back at restaurants and eligible travel purchases. This can include airfare, hotel stays, car rentals, travel agencies, cruises and Costco travel. Cardholders can also make the most of road trips and vacation car rentals with 4% cash back on eligible gas and EV charging transactions for the first $7,000 every ...

Travel Medical Insurance is designed to cover your emergency medical expenses while traveling abroad. In the event of an unexpected illness, injury, or medical condition during your trip, your travel medical insurance plan will reimburse you for the treatment costs, up to the limits specified in the plan. 2.

New Schengen Visa rules ushered in significant changes in travel and insurance trends, with those aged 70 and above visiting Schengen destinations doubling. In the upcoming season, 82% of ...

13 Bedside Companion Benefit. up to $150 per day, to a maximum of $1,500, for food and accommodation for a person if: Our Administrator has approved transportation for the person under either a Transportation to Bedside benefit or a Travelling Companion Benefit; and. Our Administrator has approved the Bedside Companion Benefit in advance .

Travel insurance companies are also hush-hush about how they are analyzing data to set rates and identify patterns in fraudulent claims data. This story is a long time coming. Travel insurance ...