- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Nationwide Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Nationwide travel insurance cover?

What does nationwide travel insurance cost, what isn’t covered by nationwide travel insurance, can you buy a nationwide plan online, is nationwide travel insurance worth it.

Are you considering purchasing travel insurance for your next vacation? It could be a good idea, especially in an era of overbooked flights, travel delays and lost luggage. Insurance company Nationwide can sell you travel insurance, which will cover you in the event that things stray from the plan.

Let’s take a look at Nationwide travel insurance, the policies available and the benefits that they provide.

Nationwide offers two different travel insurance plans for its customers: an Essential option and a Prime version. As the name implies, Prime provides more coverage and is more expensive.

With the essential plan, you'll have benefits like trip cancellation or interruption, coverage for medical emergencies and a fixed fee for delayed/lost luggage. The prime plan includes missed connection reimbursement, and generally, a higher reimbursement amount per benefit.

» Learn more: Common myths about travel insurance and what it covers

To do a proper Nationwide travel insurance review, we input a search for a 28-year-old from Michigan traveling to France for three weeks on a $7,000 trip.

A quick Nationwide travel insurance review shows that you’ll see quite a few more benefits associated with the Prime plan, though neither option is especially cheap. Coverage areas that are missing from the Essential plan include missed connection reimbursement, itinerary change reimbursement and 24-hour AD&D insurance, though this last one can be added on.

The Essential plan also sees significant drops in the monetary reimbursement you can expect when things go awry. Despite being only 38% cheaper than the Prime plan, coverage is significantly stripped down. You can especially see this with baggage delay ($100 versus $600), lost baggage ($600 versus $2,000) and trip delay ($600 versus $2,000). Trip cancellation is basically the only coverage area that remains the same — 100% no matter which plan you choose.

» Learn more: How to find the best travel insurance

Additional options and add-ons

No review of Nationwide travel insurance would be complete without mentioning add-ons. Your available options will differ based on the plan you choose.

As you can see, the available options and their costs can range quite a bit. If you’re looking for maximum coverage, it’s easy to more than double the cost of your original quote.

The most expensive add-on is only available to Prime policyholders. Cancel For Any Reason insurance allows the ultimate in flexibility as it’ll refund you up to 75% in trip costs in the event you want to cancel your trip.

Those opting for an Essential plan can also choose to purchase 24-hour AD&D coverage, which comes included with the Prime policy. Doing so includes flight-only coverage for Essential plans, though strangely that’s considered an add-on for Prime.

Finally, rental car insurance is available regardless of which plan you pick, though you can receive more coverage with the higher-tier Prime policy.

Many different travel credit cards provide complimentary trip insurance when you use your card to pay. Check these before purchasing travel insurance.

» Learn more: The best travel credit cards right now

As nice as it would be to purchase fully comprehensive travel insurance, the truth is that nearly all policies have exclusions of some kind. This may mean that your policy won’t cover instances of COVID-19 or the decision to jump out of a plane.

Here are some general exclusions you can expect:

Accidental injury or sickness when traveling against the advice of a physician.

Participation in canyoning or canyoneering, extreme sports or bodily contact sports.

War or any act of war whether declared or not.

Exclusions vary based on the policy and where you live, so you’ll want to read your guide to benefits carefully to see what coverages apply to your policy.

» Learn more: Is there travel insurance that covers COVID quarantine?

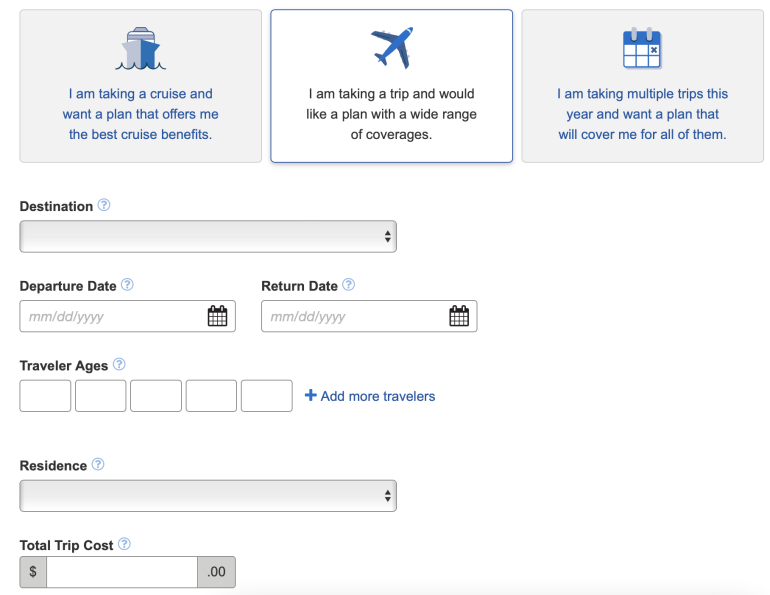

If this Nationwide essential travel insurance review has spurred you to make a decision, it’s simple to find a quote for yourself. You’ll need to navigate to Nationwide’s travel insurance page , where you’ll find a form asking for your personal information.

In addition to single-trip coverage, Nationwide also provides multi-trip plans and plans focused on cruises.

» Learn more: How much is travel insurance?

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for cruises , single trips or multi-trips.

Nationwide travel insurance plans have various benefits including trip cancellation, interruption or delay, financial default, missed connection, itinerary change, Cancel For Any Reason (CFAR), medical emergencies, 24-hour accidental death and dismemberment (AD&D), pre-existing conditions exclusion and waiver, and baggage delay. Each policy is different, so you'll want to ensure you read the fine print to know your coverage.

Nationwide's essential plan does not cover Cancel For Any Reason. However, for an additional cost, you can add CFAR to Nationwide's Prime plan. With that coverage, you will be eligible for reimbursement of up to 75% of nonrefundable trip costs. Note that this must be added on within 21 days of your first trip payment.

If you need to submit a claim, you'll first call the CBP Claims Department at 888-490-7606. A representative will provide a claim form and a list of documents to submit. Claims can then be submitted via U.S. mail, fax or through email. Assuming your claim is reimbursable, you'll receive payment via direct deposit or a check.

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for

, single trips or multi-trips.

Are you looking for strong coverage over a wide range of incidents? Nationwide could be a good travel insurance option for you, but only if you’re willing to shell out for its more expensive policy.

That being said, if you hold a travel credit card, odds are that you already have some form of complimentary travel insurance. You’ll want to check this first to see if those benefits are enough for your trip — if not, a Nationwide insurance policy could offer the coverage that you need.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Nationwide Travel Insurance: The Complete Guide

:max_bytes(150000):strip_icc():format(webp)/joecortez_headshot-56a97f185f9b58b7d0fbf9ac.jpg)

Digital Vision / Getty Images

About Nationwide Travel Insurance

Already one of the biggest names in insurance, Nationwide Travel Insurance is one part of Nationwide Mutual Insurance Company. As a whole, the Columbus, Ohio-based insurance giant started in 1925 , when the Ohio Farm Bureau Federation incorporated the Farm Bureau Mutual Automobile Insurance Company. The insurer officially changed its name to Nationwide in 1955, after expanding service to 32 states and the District of Columbia. Today, Nationwide offers more than just insurance – their divisions include a bank, a financial services company, a farmland insurance company and even a pet insurance brand.

Compared to other companies, Nationwide is a relatively new travel insurance provider. The company began offering their travel insurance products on InsureMyTrip.com in 2015, and expanded to Squaremouth.com in 2018. Currently, the insurance company focuses on three types of products: cruise travel insurance , single trip travel insurance, and annual travel insurance .

How is Nationwide Travel Insurance rated?

As one of America’s oldest insurance companies, Nationwide has a solid reputation for their financial stability and commitment to policy holders. All travel insurance policies are underwritten by Nationwide Mutual Insurance Company, which has an A+ Superior rating from A.M. Best in the financial size category of $2 billion or greater. The company also holds an A+ rating with the Better Business Bureau , with a composite customer review score of one star (out of five).

In the travel insurance marketplaces, InsureMyTrip.com gives Nationwide an average score of 4.5 stars (out of five) for their cruise travel insurance and single trip travel insurance products. At Squaremouth.com , Nationwide has earned a rating of 4.04 out of five stars, and has sold over 5,783 policies since January 2018.

What travel insurance products are available from Nationwide?

Nationwide Travel Insurance primarily focuses on three travel insurance products: cruise trip insurance , single trip insurance , and annual trip insurance . The company also offers two student education plans, which are available through InsureMyTrip.com : Academic Explorer All Inclusive Domestic and Academic Explorer All Inclusive International.

Please note: all schedules of benefits are subject to change. For the most up-to-date coverage information, contact Nationwide Travel Insurance.

Nationwide Cruise Travel Insurance

Universal Cruise Plan: Nationwide is among the few travel insurance companies to provide an independent cruise-only travel insurance plan. At the lowest end, the Universal Cruise Plan covers many of the basic situations that can go wrong while embarked at sea.

- Like traditional travel insurance plans, the Universal Cruise Plan covers a maximum trip cancellation benefit of 100 percent of non-refundable trip costs and a trip interruption maximum benefit of 125 percent of non-refundable trip costs. Covered reasons for trip cancellation or trip interruption include weather, extension of a school operating session, work-related issues, or an act of terrorism in the itinerary city.

- This plan differs from a traditional travel insurance plan by offering an Interruption for Any Reason benefit, which reimburses transportation change costs up to $250. Missed connections that cause a delay of over three hours or trip delays of over six hours are also covered, with a maximum benefit of $500 for each type of incident.

- Should you get ill or injured on the ship, this plan offers up to $75,000 of both emergency accident and sickness medical expense coverage. It is important to note that this is secondary coverage, not primary coverage. This means that all other insurance, including policies from a credit card must be depleted before the Nationwide insurance plan will cover claims. The plan also offers up to $750 of emergency dental expense coverage and up to $250,000 of emergency medical evacuation coverage.

- If your bags are delayed or lost , Nationwide’s Universal Cruise Plan can help. If your bags are delayed by more than eight hours, the baggage delay benefit will cover up to $250 in qualifying expenses. If your luggage is outright lost or stolen, the insurance plan offers a maximum of $1,500 in payouts, including a maximum of $600 for special items and a $300 per article limit.

- Finally, unplanned itinerary changes are also covered under this plan. If a port of call is changed prior to departure, this plan offers a maximum of $500 in coverage. If a covered issue impacts your cruise experience, like a fire or mechanical issue, you could qualify for up to $100 in coverage. These two specific benefits are not available to residents of Florida, Minnesota, Missouri, New Hampshire, Oregon, Pennsylvania, Virginia, or Washington state.

- As a third-party travel insurance plan covering a cruise, Nationwide’s Universal Cruise Plan is a frugal purchase with lots of benefits. For a 34-year-old male traveling on a $1,500 four-day cruise from North Carolina sailing to the Bahamas, we were quoted a price of $51.45, but your insurance quote and benefits may vary based on age, location, trip price, trip length, cruise line and destination.

- See the sample certificate of coverage

Choice Cruise Plan: While the Choice Cruise Plan introduces new benefits, including the pre-existing condition waiver, non-medical evacuation and accidental death and dismemberment coverage, the primary advantage over the basic Universal Cruise Plan is the higher maximum benefits.

- For those concerned about a pre-existing condition , this plan offers a waiver if it is purchased prior to the final trip payment and all eligibility requirements are met. The additional accidental death and dismemberment benefit offers up to $25,000 of coverage in the event of an emergency causing the loss of life or limb. If a non-medical evacuation from the ship is required, this plan offers a maximum of $25,000 of coverage.

- Like the Universal Cruise Plan, the Choice Cruise Plan offers a maximum of 100 percent trip cancellation coverage of non-refundable trip costs. The plan also offers a 150 percent maximum of non-refundable trip costs for trip interruption, an increase of 25 percent. The plan may pay up to $500 towards transportation change cost reimbursement under the interruption for any reason benefit, if eligibility requirements are met.

- If you miss a connection which causes a delay of more than three hours, the plan offers up to $1,500 in coverage for lost events or costs incurred. If your trip is delayed by over six hours, the trip delay benefits can reimburse up to $750 of incidental costs.

- Emergency accident and sickness medical expense benefits are increased to a maximum of $100,000 of secondary coverage, meaning other insurance plans must be exhausted before this plan will pay for coverage. Emergency medical evacuation coverage is increased to a maximum of $500,000, and emergency dental expense is a maximum of $750.

- For those concerned about their luggage getting lost or stolen, this plan offers increased maximums from the Universal Cruise Plan. If baggage is delayed by eight hours or more, this plan offers a maximum baggage delay reimbursement of $500 towards incidental costs. Baggage that is lost or stolen is covered to a maximum of $2,500, with a special item maximum of $600 and a limit of $300 per article. The plan also offers itinerary change coverage: a maximum of $750 for ports of call change prior to departure, $200 maximum for fire, mechanical, or other covered issue affecting your cruise experience after departure and $500 maximum for an itinerary change after departure that causes you to miss a pre-paid shore excursion . Again, changes to the ports of call and cruise experience impact coverage are not available to residents of Florida, Minnesota, Missouri, New Hampshire, Oregon, Pennsylvania, Virginia, or Washington state.

- The Choice Cruise Plan is also the first to offer the Cancel for Any Reason benefit , which allows travelers to recover up to 70 percent of non-refundable trip costs if you decide not to take your cruise after all. The Cancel For Any Reason option is an additional purchase, priced based on your quoted rate.

- Compared to the Universal Cruise Plan, the Choice Cruise plan is equally as economic as the lower plan but with more benefits. When we quoted the same trip above for the Choice Cruise Plan, we saw only an 8 percent price increase for more maximum allowances. At the price point, it could make more sense to purchase the Choice Cruise Plan to ensure you get a higher level of coverage for almost the same price.

Luxury Cruise Plan: If you are planning an expensive, once-in-a-lifetime cruise, then you may definitely want to consider the Luxury Cruise Plan.

- Offering the highest level of coverage, the Luxury Cruise Plan increases all of the maximum coverage levels, helping you retain the most peace of mind on your trip.

- Like the Choice Cruise Plan, the Luxury Cruise Plan offers a maximum 100 percent trip cancellation benefit for non-refundable trip costs, as well as a maximum 150 percent trip interruption benefit for non-refundable trip costs. The interruption for any reason benefit is increased to $1,000 to cover transportation costs if eligibility requirements are met.

- If your trip is delayed by three hours or more from a missed connection, this insurance plan can cover up to $2,500 of costs. If your trip is otherwise delayed, the Luxury Cruise Plan can reimburse up to $1,000 in costs if you are delayed for more than six hours.

- Emergency accident and emergency sickness medical expenses are still secondary coverage, but provide a large safety net for cruise travelers. Should you fall ill or have an accident, this plan offers a maximum coverage limit of $150,000. If emergency medical evacuation is required, this plan can cover up to $1 million in costs. The emergency dental expense is also increased to a maximum of $750, but accidental death and dismemberment coverage still maxes out at $25,000.

- As with the Choice Cruise Plan, this travel insurance plan offers a $25,000 non-medical evacuation benefit, along with coverage for lost and stolen luggage or delayed baggage. The plan also includes a pre-existing condition waiver if your plan is purchased prior to final trip payment and all eligibility requirements are met.

- Using the same itinerary for the Universal Cruise Plan, this high-end plan is priced significantly higher than both lower plans. Compared to the Universal Cruise Plan, prepare to pay nearly 50 percent more for the best benefits offered on a cruise ship by Nationwide.

Nationwide Single-Trip Insurance

Essential Plan : Travelers who are not going to be on a cruise ship but still want a high level of protection may want to consider purchasing a Nationwide Single-Trip insurance plan instead. The Single-Trip Essential plan balances benefits with additional buy-ups in order to build the best protection for your trip.

- At the base level, this plans offers a maximum $10,000 benefit for trip cancellation, which will cover pre-paid, non-refundable trip costs if you are forced to cancel for a qualified reason. If your trip is interrupted early, this plan offers a reimbursement benefit of up to 125 percent of insured trip costs, with a maximum of $12,500. Should your trip be delayed for a covered reason by at least six hours, this plan offers a $150 per day trip delay benefit, with a maximum benefit of $600. Luggage delay benefits offer up to $100 of coverage for incidental costs if your luggage gets lost for more than 12 hours.

- If your bags are lost or stolen during your trip, the Single-Trip Essential Plan offers up to $600 of travel insurance benefits. Individual articles are limited to $250 maximum, while valuable items are capped at a combined total of $500.

- As a basic plan, Nationwide’s Single-Trip Essential Plan also offers coverage for emergency accidents and illness while abroad. The accident and sickness medical expense benefit offers up to $75,000 of secondary coverage, meaning all other collectible insurance must be paid up to its limits before this plan will pay benefits. Emergency dental coverage is capped to $500 and is included in the medical expense coverage, while emergency medical evacuation or repatriation of remains benefits are limited up to $250,000.

- Nationwide’s plan is unique in that it extends trip cancellation or trip interruption coverage due to an act of terrorism in an itinerary city. Should you decide to cancel your trip due to an act of terrorism, you may be able to receive benefit payments. If you buy your plan within 10 days of your initial trip deposit, you will also be covered for trip cancellation and interruption due to common carrier financial default and receive the pre-existing condition waiver benefit. Additional coverages you can purchase in this plan includes accidental death and dismemberment, accidental death during a flight, and rental car collision or loss coverage.

- When we requested a quote for a 34-year-old traveler going to Germany on a $1,500 trip, Nationwide priced our plan at $45.27, which is a competitive price for travel insurance. Your price will vary based on your age, destination, trip price, travel dates and any additional options you may choose.

Prime Plan : As the premier plan offered by Nationwide for a single trip, the Single-Trip Prime Plan offers the highest coverage levels and the most add-on options.

- Prime is the only single trip travel insurance plan to feature a Cancel for Any Reason benefit, along with add-ons for accidental death and dismemberment, flight-only accidental death and dismemberment and rental car collision/loss coverage.

- The trip cancellation benefit is increased to $30,000 and is limited to prepaid, non-refundable trip costs. If you decide to purchase additional Cancel for Any Reason coverage within 21 days of your initial trip payment, you can recover up to 75 percent of your non-refundable trip costs. Cancel for Any Reason benefits are not available to those in New Hampshire, New York, or Washington state.

- The trip interruption benefit is also increased to up to 200 percent of your non-refundable tour costs, with a maximum of $60,000. If your trip is delayed by at least six hours, you could also qualify for trip delay benefits of up to $250 per day. Trip delay is limited to a maximum benefit of $1,500. This plan also offers a missed connection or itinerary change benefit of up to $500.

- If your bags are delayed or lost, the Prime Plan may cover you. The baggage delay benefit can reimburse up to $600 of incidental expenses if you are delayed by 12 hours or more. If your bags are lost or stolen, the baggage and personal effects benefits offers maximum coverage of $2,000, including a $250 per article limit and $500 maximum for valuable items.

- As with the Essential Plan, the Nationwide Single-Trip Prime Plan offers emergency accidental and sickness medical expense coverage. In an emergency, this plan offers a maximum secondary benefit of $150,000 if all expenses are covered during your trip. Included in the medical expense coverage is a maximum emergency dental benefit of $750. If you need emergency medical evacuation or your remains must be repatriated, the maximum benefit is $1 million.

- By purchasing your plan within 21 days of your initial trip payment, you also qualify for two additional benefits: trip cancellation and trip delay due to financial default and the pre-existing condition waiver benefit. These two benefits can only be accessed through early purchase. If you might add additional costs to your trip later, still purchase your insurance early because you can always add more coverage later.

- Because this travel insurance plan offers a lot more coverage, it also comes with a higher price tag. When we priced out our trip, the cost was almost double that of the Essential Plan.

What is excluded from Nationwide Travel Insurance?

All travel insurance plans have key exclusions. Before you file a claim, it’s important to know what situations are excluded from Nationwide plans. Exclusions on these plans include:

- War, Invasion, acts of foreign enemies, or civil war: If a war breaks out while in your destination country , don’t count on Nationwide Travel Insurance to pay out benefits. Any acts of war are specifically excluded from your travel insurance plan.

- Participation in underwater activities: Although deep sea diving and spelunking may sound tempting, injuries or death resulting from underwater activities are not covered under this plan. But recreational swimming is covered, so don’t be afraid to get in the water.

- Piloting an aircraft: Regardless of your status or experience as a pilot, operating an aircraft is not covered by Nationwide Travel Insurance plans. This includes actual piloting, learning to pilot, or acting as an aircraft crew member.

- Participation in hazardous activities or bodily contact sports: Much like other travel insurance plans , participating in activities such as rock climbing, hang gliding, rugby, or rodeo are not covered by Nationwide Travel Insurance. Nationwide Travel Insurance does not offer a hazardous activity add-on benefit, so you shouldn’t participate in hazardous activities while covered by these plans.

- Accidental injury or sickness when traveling against a doctor’s advice: If a doctor says you shouldn’t travel, it may be in your best interests to follow their advice. Should you get injured or ill, Nationwide Travel Insurance will not cover your treatment costs as a result.

- Confinement or treatment in a government hospital: Voluntary or not, receiving care in a government hospital is not covered under your travel insurance plan. But in some situations, the United States Government could seek claim payment for treatment.

- Pregnancy and childbirth: As with most travel insurance plans, pregnancy and childbirth is not covered. However, should you experience complications from either, those may be covered by your trip insurance.

- Services not shown as covered: Simply put: if it’s not on your travel insurance certificate of coverage, it isn’t covered.

Please note that this is not a comprehensive list of all exclusions. Before filing a claim, be sure to refer to your certificate of coverage to see all exclusions.

How do I file a claim with Nationwide Travel Insurance?

Nationwide Travel Insurance does not allow you to file a claim online, nor do they allow you to access the required claim forms online. Instead, if you need to file a claim, you must first contact Co-ordinated Benefit Plans, LLC, who processes the claims on behalf of Nationwide. The number you will call will depend on which plan you purchased and can be found on the Nationwide website .

When you call, a customer service agent will help determine if your situation may be covered under your plan and will forward claim forms you will need to return. When completing your claim, be sure to submit supporting documentation, including receipts, doctor’s reports, or time-stamped lost luggage claims with your common carrier. A claims adjuster will then determine if your situation qualifies for payment under the policy.

Some situations, like doctor or facility referrals, may be handled through Nationwide’s 24/7 travel assistance partner, On Call international. Contact phone numbers, both toll-free and collect, are available on Nationwide’s website.

Who are Nationwide Travel Insurance products best for?

Hands down, Nationwide offers the best travel insurance products for those embarking on a cruise. Because of their specialized attention to the needs of cruise travelers, their three cruise insurance plans provide an increased level of care that many others can’t provide. If you are planning a cruise and are concerned about the worst that could happen, you should definitely consider Nationwide’s cruise insurance plans ahead of plans offered by the cruise lines.

The single trip plans are comparable to many other plans, but the costs do not necessarily equate to the level of coverage you are receiving. In addition, the medical coverage offered by the plans are secondary, which could be okay if you don’t have any other medical insurance available. Before you decide to purchase a single-trip plan, be sure to weigh all your options: filing an emergency medical claim may require you to exhaust any options available through credit cards or other sources first.

Travelex Insurance: The Complete Guide

What Is Trip Cancellation Insurance?

AIG Travel Insurance: The Complete Guide

Are My Pets Covered by Travel Insurance?

The Best Credit Cards for Travel Insurance

Flight Insurance That Protects Against Delays and Cancellations

Does Travel Insurance Cover Earthquakes?

8 Air Travel Rights You Didn’t Know You Have

Dealing With Lost, Damaged, or Stolen Luggage While Flying

Baggage Wrapping Service Offers Peace of Mind for Air Travelers

How to Get Your Miles Back After Canceling an Award Flight

Disney Vacation Club: Is It Worth It?

Loss of Use Car Rental Insurance

Budget Airline Baggage Fees

What Is Trip Interruption Insurance?

Planning a Road Trip: The Complete Guide

JavaScript is required to use this site.

- International edition

- Australia edition

- Europe edition

Nationwide reduces Flex travel insurance cover for Covid cancellations

Changes by building society will apply to trips booked from 1 January 2021

- Coronavirus – latest updates

- See all our coronavirus coverage

Nationwide building society has announced a significant downgrade to the travel insurance it provides to Flex account customers that means trips booked from 1 January 2021 will not be covered if the account holder is forced to make one of a number of Covid-related cancellations.

The popular insurance , which is supplied for worldwide travel as part of the £13-a-month FlexPlus current account and European trips on standard Flex accounts, currently offers cancellation cover if lockdown or other rules change after a holiday has been booked.

However, for trips booked from 1 January, it will no longer pay out if the Foreign Office changes its advice post-booking and warns against all but essential travel.

Equally, if the insured or a travelling companion are forced to abandon the trip because they have been told to self-isolate – even though they do not actually have coronavirus – they will again be unable to reclaim their losses. It is the same story if your pre-booked accommodation goes into local lockdown.

The building society says it will still pay cancellation claims if the policyholder, a travelling companion or a close relative are diagnosed with the coronavirus after they booked the trip. It will also pay emergency medical expenses abroad if they are diagnosed with Covid-19 while abroad.

Cutting a trip short because of a change in Foreign Office advice, as long as you were not aware of this advice when you travelled, will also be covered.

Until this week’s announcement, Nationwide’s FlexPlus policy was one of the few offering cancellation cover to those caught up in a change of advice by the Foreign Office.

A few specialist insurers still offer this cover at a price.

Currently, UK travellers can only travel to a handful of destinations without having to quarantine, while the government is still advising against holidaying in many popular destinations.

- Travel insurance

- Coronavirus

Most viewed

- Nationwide travel insurance plans

- Nationwide travel insurance cost cost

Compare Nationwide Travel Insurance

- Why You Should Trust Us

Nationwide Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Nationwide has been around close to 100 years after being founded in 1926. The Ohio-based company has many different products in the insurance and finance space, including coverage for trips. Nationwide Travel Insurance policies are available for single or multiple trips and can cover cruise trips too.

- Trip cancellation coverage of up to 100% of trip costs (for cruises) or up to $30,000 (for single-trip plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three cruise-specific plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel insurance plans available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong trip cancellation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancel for any reason coverage available

- con icon Two crossed lines that form an 'X'. CFAR insurance not available with every single plan

- con icon Two crossed lines that form an 'X'. Medical coverage is lower than what some competitors offer

Nationwide Travel Insurance offers many of the standard benefits you might see with a travel insurance policy. This can include things like trip cancellation coverage, so you can recover pre-paid costs or trip interruption in the event your vacation is interrupted by an unexpected event. There's also baggage delay coverage and medical coverage.

- Cancel for any reason coverage available

Nationwide Travel Insurance Review: Types of Policies Offered

Nationwide Travel Insurance offers many of the standard benefits you might see with a travel insurance policy . This can include things like trip cancellation coverage, so you can recover pre-paid costs or trip interruption in the event your vacation is interrupted by an unexpected event. There's also baggage delay coverage and medical coverage.

The travel insurance policies offered by Nationwide are available to consumers and are divided up by the type of trip: single trip, multiple trips, or cruise coverage.

Single-trip travel insurance policies

Nationwide offers two single-trip travel insurance policies: the Essential plan and the Prime plan.

As the name suggests, Nationwide Essential plan covers the basics. It offers some protection should anything happen ahead of your trip or while you're on your trip.

The Prime plan takes your coverage to the next level, with higher coverage limits and the option to add on the coveted cancel for any reason (CFAR) coverage at an extra cost.

Both plans include trip cancellation or interruption coverage in the event of terrorism in your destination city, travel assistance from Nationwide at no additional charge, and refunds with a 10-day review period (except in WA and NY). Note that for baggage and personal effects coverage, there is a $500 combined maximum limit for valuable items (see your policy's terms and conditions for details on what's considered valuable).

Here's how the two plans stack up in terms of coverage limits. For trip delay coverage, you'll be eligible for reimbursement for delays of six hours or more.

Annual and multi-trip travel insurance policies

If you're looking for travel insurance coverage for more than one trip and want to cover your partner and children, the Travel Pro Plan may be an affordable option. It's important to note that this policy only covers events after departure, not pre-departure events. This policy could be as low as $59 as of the time of writing.

The Travel Plus Plan is another multi-trip policy from Nationwide that has flexible term limits for trip interruption and cancellation coverage, up to $10,000. This covers the gaps from the Travel Pro Plan, which only covers post-departure events. So if you needed to cancel the trip due to a covered illness or other reason, this is the plan for you.

If you want to increase the level of benefits for your after departure coverage, the Travel Pro Deluxe Plan does just that. It builds on the Travel Pro Plan, hence the name, and includes higher coverage limits for just $20 more.

All plans include the same travel assistance from Nationwide that's included with the single-trip policies. Here's how the multiple-trip plans compare:

Cruise coverage

Nationwide offers three cruise travel insurance plans.

If you're going on a short cruise or going for the first time, the Universal Cruise Plan may be a good starting point if you want added protection and to recoup nonrefundable costs. Just make sure that you qualify based on your state, as cruise coverage isn't available in all states.

If you're going on a longer cruise and want added coverage to protect your trip, the Choice Cruise plan is an option to consider. And if you're looking for the most benefits and go on many cruises, the Luxury Cruise plan offers the most coverage options.

All three policies can be refunded with a 10-day review period, except in WA and NY states.

Here's a comparison of the coverage you'll get with Nationwide's three different cruise travel insurance policies:

Additional coverage options from Nationwide

Nationwide Travel Insurance has a number of additional coverage options that can add more protection to your policy but also add to the cost as well. These include:

- Financial default coverage , in the event your travel supplier ends up in default or bankruptcy. This is available with the Essential and Prime single-trip policies.

- Pre-existing condition waiver, which may offer coverage for pre-existing illnesses or diseases if certain conditions are met. This is available with the Essential and Prime single-trip policies.

- Accidental death and dismemberment, which can have limits of $5,000, $10,000, $25,000 or $50,000 depending on the plan. This is available with the Essential and Prime single-trip policies.

- Accidental death for flights only, which can have limits of $100,000, $250,000, or $500,000. This is available with the Essential and Prime single-trip policies.

- Rental car collision or loss coverage, in the event something happens to your rental car, you can add on this coverage for up to $25,000 or $35,000 depending on the plan.This is available with the Essential and Prime single-trip policies (except in TX or NY).

- Cancel for any reason (CFAR) , which must be added to a policy and is available through the single-trip Prime Plan, the Choice Cruise Plan, and the Luxury Cruise Plan.

Nationwide Travel Insurance Cost

The cost to get a travel insurance policy through Nationwide will depend on several factors, including what type of coverage you get, whether you purchase any add-ons, as well as your destination, length of trip, and more.

On Nationwide's website, you can get a quote for a travel insurance policy by providing the following:

- Destination

- Departure date

- Return date

- Total trip cost

- Initial trip payment date

Let's review some potential costs. If you're a 35-year-old from Florida heading to Brazil for the last two weeks of the year in December and your total trip cost is $5,000 with an initial payment on September 1, your policy would be:

- $196.89 for the Essential Plan

- $273.20 for the Prime Plan

If you're a 55-year-old from Oregon heading to Mexico in the first 10 days of January via Carnival Cruise lines and spending $4,000 on the trip with an initial payment on September 1 and last payment on November 30, your policy would be:

- $172 for Universal Cruise Plan

- $206 for Choice Cruise Plan

- $244 for Luxury Cruise Plan

How to File a Claim with Nationwide

If you purchased travel insurance through Nationwide and need to file a claim, you can contact a Nationwide representative.

Claims through Nationwide are handled by Co-ordinated Benefit Plans, LLC. You can use its claims portal or call a representative, based on your type of policy.

Single trip policy phone number: 888-490-7606

Annual plan policy phone number: 866-281-1017

Cruise policy phone number : 866-281-0334

Rather reach out via email? You can contact Nationwide via [email protected] .

If you need to send documents via mail, the mailing address is:

Co-ordinated Benefit Plans, LLC

On Behalf of Nationwide Mutual Insurance

Company and Affiliated Companies

P.O. Box 26222 Tampa, FL 33623

Learn more about how Nationwide Travel Insurance compares against the competition.

Nationwide Travel Insurance vs. Allianz Travel Insurance

Much like Nationwide , Allianz insurance offers many different types of insurance coverage. While the company may be most well known for auto insurance, it offers travel insurance as well and has eight options. Allianz, a major player in the travel insurance space, has 10 options listed.

Allianz may offer higher coverage limits for the policies offered and have a streamlined process for filing a claim online. Where Nationwide wins out is the fact that you can add cancel for any reason (CFAR) for an added cost, whereas CFAR coverage isn't available when purchasing an online policy via Allianz.

Alliance Travel Insurance Review

Nationwide Travel Insurance vs. John Hancock Travel Insurance

John Hancock is similar to Nationwide in that it provides a wide range of insurance offerings and financial services. One of those offerings is travel insurance. John Hancock offers travel insurance through Bronze, Silver, and Gold policies.

When comparing policies, the budget option may be slightly more affordable with Nationwide. However, mid-tier and higher coverage options may be more affordable with John Hancock. It depends on your policy, trip details, and age. One good thing is that you can add cancel for any reason (CFAR) coverage under all John Hancock plan options.

John Hancock Travel Insurance Review

Nationwide vs. credit card travel coverage

Rewards credit cards come chock full of benefits for cardholders, some of which they might be unaware of. One such perk can be travel interruption or cancellation coverage as well as rental car coverage. Credit cards may have sufficient coverage for quick trips. However, if you want the peace of mind of having solid medical coverage or higher limits, going the traditional travel insurance route may be a better fit.

For frequent travelers, credit cards may be appealing as the coverage is constant. If you're looking for a comparable travel insurance plan with more comprehensive coverage, some companies offer annual travel insurance.

Best Credit Cards with Travel Insurance

Why You Should Trust Us: How We Reviewed Nationwide Travel Insurance

For our review of Nationwide Travel Insurance , we looked at the leading travel insurance providers and compared the amount of options provided, coverage limits, cost, customer service options, and flexibility.

Nationwide is a top contender for cruise-related travel insurance policies and stands out for having cancel for any reason (CFAR) coverage, though it's not available with every policy and comes with an extra cost. To find the best travel insurance policy for you, review various providers and compare quotes before buying a policy.

Nationwide travel insurance — frequently asked questions (FAQ)

Nationwide offers many different types of insurance policies, including travel insurance, and it could be a good fit depending on your needs. The company offers options for single trips, multiple trips, and offers robust coverage for cruise travel. Some of the policies may allow consumers to add cancel for any reason (CFAR) coverage.

Nationwide offers cancel for any reason coverage as an addition to several policies including the Prime Plan, Choice Cruise Plan, and Luxury Cruise Plan. To qualify, you must meet eligibility requirements and pay an extra cost on a plan that offers this coverage.

According to the company website , Nationwide uses credit score to determine rates for insurance products in general. Studies indicate credit score may predict a higher rate of claims for insured parties with lower credit scores. While the exact number may vary, insurers offer the best rates for scores of 700 or higher . The use of credit score in determining premiums is most common for auto insurance .

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

IMAGES

COMMENTS

FlexPlus travel insurance. U K Insurance Limited. Travel with cover for winter sports, business, weddings and more. We're changing our travel insurance provider to Aviva on 1 May 2024. From that date, what and who is covered, including cover limits, will change. Before you apply for a FlexPlus current account, read about how the insurance will ...

Call 1-877-970-9059. Nationwide provides travel insurance coverage. Do not let weather, cancelled flights, lost luggage, or certain medical emergencies ruin your trip.

Breakdown cover Insurance Product Information Document (IPID) PDF, 76KB (opens in a new window) With FlexPlus, you'll be charged £13 a month for maintaining the account. Charges can also apply for: Making large payments by CHAPS. Making an international payment. There are no Nationwide charges for using your card abroad.

60 day look back, 21 day waiver (certain conditions apply). Policy cost. $260.48. $418.22. % of trip cost. 3.72%. 5.97%. A quick Nationwide travel insurance review shows that you'll see quite a ...

In order to maintain your travel insurance cover you will need to maintain the account eligability criteria as specified in the Flex Account terms and conditions. To keep your cover you ll need to: Pay in at least £750 into your account per month (excluding transfers from any Nationwide account held by you or anyone else), and Remain a UK ...

0800 051 0154 We are open 8am to 8pm Monday to Friday, 9am to 5pm Saturday and 9am to 4pm Sunday. insurance works. If you are injured or ill while on your trip or you need to cut short. your trip call our emergency assistance service.

nationwide.co.uk/travel. or call U K Insurance Limited on . 0800 051 0154. to get a quote. Make sure your policy covers your personal circumstances . Do you need to extend your policy to cover medical conditions? You need to know that you may not be able to make a claim on your UK and European Travel Insurance if you answer yes to any of the ...

Alternatively, customers have the option to upgrade to Nationwide's FlexPlus account, which offers worldwide travel insurance for the whole family - plus other benefits - but costs £13 a ...

This policy wording confirms who is eligible for Nationwide FlexAccount Travel Cover: 1) Eligible Nationwide FlexAccount holders. If you have taken the family upgrade option, cover applies to you and. 2) The Nationwide FlexAccount holder's partner. 3) The Nationwide FlexAccount holder's dependant children.

What does Nationwide offer? Nationwide's travel insurance comes with its FlexPlus packaged current account along with UK and European breakdown assistance, and worldwide family mobile phone insurance. You will need to pay a £13 monthly fee for maintaining the account. If you have a medical condition and want to ensure it's covered, you will have to contact Nationwide at the time you book a trip.

How to buy travel insurance. Start your quote. Or call 1-877-970-9059. Comparing and choosing travel insurance coverage can be confusing. There are conditions, restrictions and exclusions, as well as various benefits with limits that may or may not apply to your situation. The following tips about the travel insurance buying process can help ...

Nationwide's Prime Plan earned 3.7 stars in our scoring of the best travel insurance companies. The Prime plan has superior medical evacuation coverage limits of $1 million, and $150,000 in ...

Annual travel insurance plans: Protect all your trips with one policy. Start your quote. Or call 1-877-970-9059. If you're a frequent traveler for work or fun, there's no reason to purchase travel insurance each time you take a trip. Instead, an annual travel insurance plan covers an entire year of trips. These plans can save you money even ...

3 September 2021. Nationwide has decided to axe its free European travel insurance offer for all existing FlexAccount customers who still have it from 31 December. This follows its earlier decision to stop offering the perk to new FlexAccount customers back in December 2016. FlexAccount holders who've held an account since before December 2016 ...

Frequently Asked Questions. Our customer services and claims handling teams have listened to your feedback and used their knowledge to put together a list of answers to your most frequently asked questions. The frequently asked questions do not replace the terms and conditions of the policy. If you're still unsure, can't find what you're ...

About Nationwide Travel Insurance . Already one of the biggest names in insurance, Nationwide Travel Insurance is one part of Nationwide Mutual Insurance Company. As a whole, the Columbus, Ohio-based insurance giant started in 1925, when the Ohio Farm Bureau Federation incorporated the Farm Bureau Mutual Automobile Insurance Company.The insurer officially changed its name to Nationwide in 1955 ...

This Travel Insurance is underwritten by U K Insurance Limited. Registered office: The Wharf, Neville Street, Leeds LS1 4AZ Registered in England and Wales No. 1179980. U K Insurance Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Nationwide building society has announced a significant downgrade to the travel insurance it provides to Flex account customers that means trips booked from 1 January 2021 will not be covered if ...

We urge any customer who has a medical issue while traveling or who has any other question regarding their travel protection plan to call us at 1-877-970-9059. Our website is also available at travel.nationwide.com. We review every claim based on its unique facts and circumstances and are happy to answer any questions you may have.

The Nationwide FlexPlus current account is a packaged account. This means it offers a range of benefits, including travel insurance, mobile phone insurance and European breakdown cover, in return for a £13 monthly fee. The account can be managed online, via the app, over the phone or in branch and can be opened on a single or joint basis.

Farm and ranch member Pay a bill, manage a claim or review a policy. For assistance, call 1-800-562-4342.; Farm and ranch agent Manage your farm and ranch customer accounts.

Compare policies and rates from participating partners with SquareMouth Travel Insurance. Insider's Rating 4.5/5. Perks. Trip cancellation coverage of up to 100% of trip costs (for cruises) or ...

Notably.. no over 70's restriction- FlexPlus Travel Insurance provider change | nationwide. ... Nationwide Flex-Plus... changing travel insurance provider. Middle_of_the_Road Posts: 623 Forumite. ... If you have a Chase current account, you may be able to get a table-topping 5.1% easy-access savings rate to go with it, as the bank has launched ...