Fraud warning

Please be cautious of any special offers you see on social media or via messages, and avoid opening links or downloading any apps you receive from these sources inviting you to register to benefit from special offers. These links or apps may contain malware that can take over your phone. Please also refrain from inputting your account information, passwords or any other personal information into such apps or websites. Learn more .

We use cookies to give you the best possible experience on our website. For more details please read our cookie policy . By continuing to browse this site, you give consent for cookies to be used.

Our website doesn't support your browser so please upgrade.

- HSBC Malaysia online banking

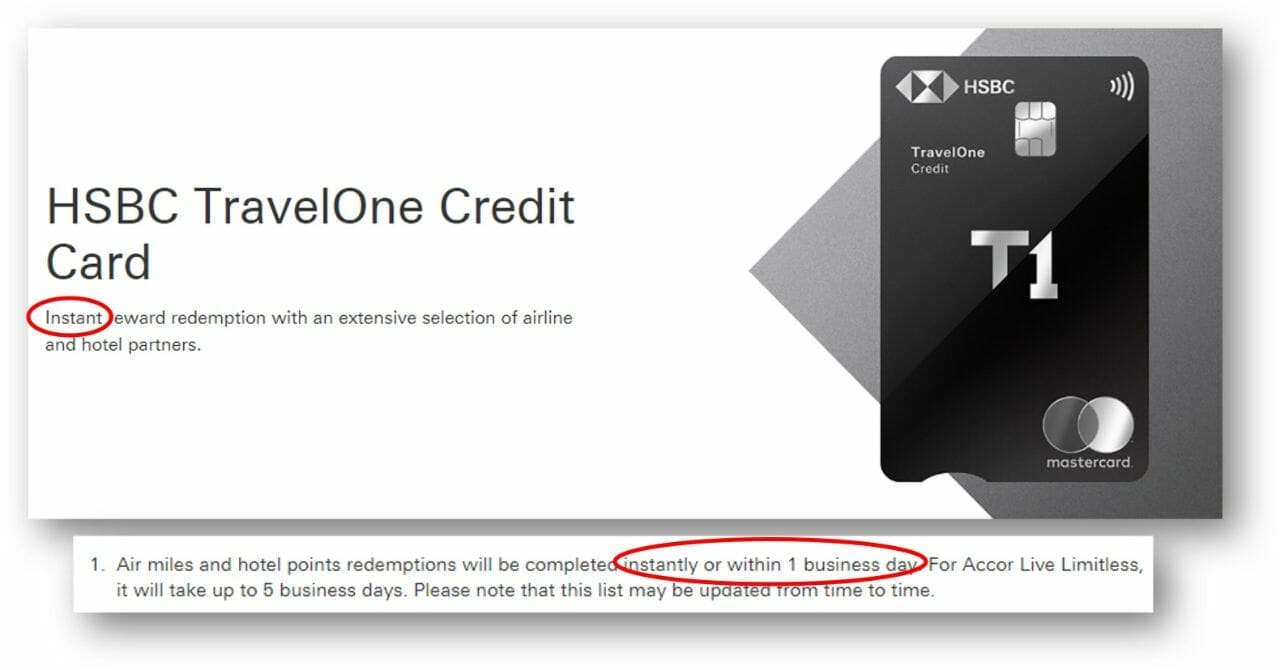

HSBC TravelOne Credit Card

Instant reward redemption with an extensive selection of airline and hotel partners.

Find out more via your eWelcome pack

Unlock a world of travel freedom

Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.

Apply online today and enjoy our exclusive sign-up offer

Open up a world of elevated travel.

Instant redemption

Earn accelerated points

Travel privileges

Split flexibly

Spend, earn, and go further, earn points and redeem them instantly.

Be spoilt for choice when you redeem instant miles and hotel points with an extensive range of airline and hotel partners such as Malaysia Airlines, airasia, Singapore Airlines, Marriott Bonvoy and more[@credit-cards-travelone-reward-programme-tncs].

- 8× Reward points on all foreign currency spend

- 5× Reward points on local travel spend (hotels, airlines and travel agencies)

- 5× Reward points on local dining spend

- 1× Reward points on all other eligible spend

- Find out how to redeem

Travel in style

- Airport lounge access[@credit-cards-plaza-premium-lounge-tncs]: You and your supplementary cardholder can enjoy a combined 6 complimentary visits per year at selected Plaza Premium airport lounge for international flights – terms and conditions apply

- Travel offers: Enjoy exclusive travel discounts on Agoda – learn more on the Agoda website

- Priceless™ Specials: discover top-tier benefits and a world of privileged access with curated offers and benefits from Mastercard – explore all offers

- Travel rewards: shop at key destinations around the world and enjoy cashback offers and discounts from both in-store and online merchants across over 25 countries – Find out more

Put your mind at ease

- Travel insurance: Register to enjoy complimentary travel insurance coverage (including COVID-19)[@credit-cards-travelone-travel-insurance-tncs] of up to USD250,000 for you and your family when you charge the full cost of your air ticket to your HSBC TravelOne Credit Card – Mastercard T&Cs apply

- ID Theft Protection™: Enjoy peace of mind when surfing and shopping online. Proactive monitoring and alerts help to ensure the security of your personal data from identity theft or fraud. Online enrolment is required – find out more on the Mastercard website

- Complimentary E-Commerce Purchase Protection: Rest easier when you shop online with up to USD1,000 coverage – find out more on the Mastercard website

More card benefits

- 1% contribution on charity spending For every charitable donation you make with your HSBC TravelOne Credit Card, we'll contribute 1% of your charity spending – up to RM500,000 per year – to our supported charities[@credit-cards-travelone-charity-donations].

- Blind notch Designed to increase accessibility and demonstrate our commitment to inclusivity. The notch signals the correct end of the card to insert into card readers and ATMs

- We're finding ways to reduce plastic waste. Your HSBC TravelOne Credit Card is made from 100% recycled plastic.

Enjoy 50% off green fees at 42 golf clubs and golf lessons at 1 participating golf academy in Singapore – Book now . Terms & Conditions apply.

Valid until: 15 January 2025

Who can apply?

- A minimum annual income of RM60,000 p.a. is required

- Primary cardholder must be at least 21 years of age; supplementary cardholder must be at least 18 years old

What you'll need

Salaried employee .

If you're working for a multinational, public-listed, government or semi-government company or office, you'll need:

Photocopy of MyKad (both sides) AND any 1 from below:

- EPF statement - latest original PDF copy of non-password protected statement downloaded from KWSP website/App OR

- Bank statement - original PDF copy of non-password protected statement downloaded from online banking website/App showing latest 3 months salary credit OR

- Letter of confirmation from employer or latest month salary slip if employed less than 3 months OR

- Latest Income Tax Return Form (Form BE with tax receipt) OR

For all other companies, you'll need:

Photocopy of MyKad (both sides) AND any 2 from below:

- EPF statement - latest original PDF copy of non-password protected statement (latest 2 years EPF statement if contribution less than 6 months) downloaded from KWSP website/App AND/OR

- Bank statement - original PDF copy of non-password protected statement downloaded from online banking website/App showing latest 3 months salary credit AND/OR

- Latest 3 months salary slip AND/OR

- Latest Income Tax Return Form (Form BE with tax receipt) AND/OR

Self-employed

If you're self-employed , you'll need:

Photocopy of MyKad (both sides) AND Photocopy of Business Registration Form (established minimum 3 years) AND any 1 from below:

- Bank statement - latest 6 months original PDF copy of non-password protected statement downloaded from online banking website/App AND/OR

- Latest Income Tax Return Form (EPF Statement or Form B with payment receipts or CP02 attached)

Foreign passport holders

If you hold a foreign passport , you must be working for a multinational, public-listed, government or semi-government company or office, or HSBC corporate lending employer. You'll also need:

Copy of passport showing personal details and work permit (must be valid for at least one year) AND

Letter of confirmation from employer stating position, remuneration and duration of employment AND any 1 from below:

- Latest month salary slip

(Minimum RM10k income per month AND working for multinational/public listed companies/government/semi-government/HSBC corporate lending employers only)

Important documents

- Product disclosure sheet (PDF) (EN)

- Product disclosure sheet (PDF) (BM)

Apply online in 10 minutes or less.

You might also be interested in

Cash instalment plan , balance transfer instalment , cash advance , more about credit cards , important notes, connect with us.

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 27 March 2024, new safety measure in the Android version of the HSBC Singapore app will be launched to protect you from malware. Read more on malware scams .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

HSBC TravelOne Credit Card

We're implementing the following changes to the travel insurance with effect from 11 May 2024:

- Change of underwriter from HSBC Life (Singapore) Pte Ltd to MSIG Insurance (Singapore) Pte. Ltd

- Change the currency of sum insured from USD to SGD

- Removal of COVID-19 coverage

The new policy will be updated on 11 May 2024.

The waiver on redemption fee for redeeming air miles and hotel points has been extended to 31 January 2025.

Unlock a world of travel freedom

Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.

Welcome gift

Apply now and enjoy instant approval[@cards-instant-approval-tnc]. What's more, receive 20,000 miles – in the form of 50,000 Reward points – when you meet these criteria:

- pay the annual fee of SGD196.20 (inclusive of GST)

- spend at least SGD500 in qualifying transactions within the qualifying spend period

- provide marketing consent when you apply

That's equivalent to a round trip air ticket to Bali!

Alternatively, apply for the card with no welcome gift rewarded and get your first-year annual fee waived.

Open up a world of elevated travel

Instant redemption

The first HSBC credit card to offer instant redemptions with an extensive selection of airline and hotel partners, all within the convenience of your mobile app.

Earn accelerated points

Get up to 2.4 miles (6X Reward points) for your spending.

Travel privileges

Complimentary travel insurance coverage (including COVID-19), airport lounge visits and more.

Split flexibly

Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans – find out more .

dpws-tools-calculator-creator

The calculated amount shown is indicative only, based on qualifying transactions. Terms and conditions apply .

How many miles you'll need to redeem a flight?

Note: The miles shown in the table are indicative only, based on the 'Miles Calculator – Redeem Miles' by Singapore Airlines as of 4 September 2023. The miles indicated are for an entire journey for 1 passenger from Singapore and they do not include taxes, fees or any promotional discounts that may apply.

Spend, earn, and go further

Automatic payments will be declined and merchants may charge a late fee.

Earn points and redeem them instantly[@cards-instantly]

- 2.4 miles (6× Reward points)[@cards-travelonetnc] per SGD1 charged on foreign currency spend.

- 1.2 miles (3× Reward points)[@cards-travelonetnc] per SGD1 charged on local spend.

- Share the perks with a supplementary card[@cards-supplementarycard].

- No redemption fee when you redeem for air miles or hotel points. This offer ends on 31 January 2025.

Be spoilt for choice with instant miles and hotel points redemption with a wide range of airline and hotel partners such as Cathay Pacific, Singapore Airlines, Marriott Bonvoy and more.

- Find out how to redeem instantly

Travel in style

- Airport lounge: enjoy 4 complimentary lounge visits per year to over 1,300 global airport lounges for primary cardholders – register now .

- Travel rewards: shop at key destinations around the world and enjoy cashback offers and discounts from both in-store and online merchants across over 25 countries – find out more .

- Priceless™ Specials: discover top-tier benefits and a world of privileged access with curated offers and benefits from Mastercard – explore all offers .

- Travel offers: enjoy a variety of travel privileges when you plan your trip – find out more .

Put your mind at ease

- Travel insurance[@cards-travelinsurancecoverage]: enjoy complimentary travel insurance coverage (including COVID-19) of up to USD100,000 for you and your family when you charge the full cost of your air ticket to your HSBC TravelOne Credit Card - read the full policy .

- ID Theft Protection™: enjoy peace of mind when surfing and purchasing online. Proactive monitoring and alerts help to ensure the security of your personal data from identity theft or fraud. Enrol online for complimentary access – find out more .

- Travel companion: before you travel, check out the latest travel and health restrictions for your trip – find out more .

Who can apply?

To apply for an HSBC TravelOne card, you must be aged 21 or above and have a minimum annual income of:

- SGD30,000, if you're a Singaporean or Permanent Resident

- SGD40,000, if you're a self-employed or commission-based Singaporean or Permanent Resident

- SGD40,000, if you're a foreigner residing in Singapore

If you do not meet these income requirements, a minimum fixed deposit collateral of SGD10,000 will apply.

What you need to apply

Apply using MyInfo via Singpass and save the hassle of providing supporting documents.

Alternatively, prepare the following supporting documents with your application.

- ID documents of the primary and any supplementary applicants

- income documents of the primary applicant

What documents are acceptable?

Important documents

- ABS consumer guide for credit cards (PDF) ABS consumer guide for credit cards (PDF) Download

- Consumer guide for credit cards Consumer guide for credit cards Modal

- Credit card FAQs Credit card FAQs Modal

- Credit card security Credit card security Modal

- Credit card terms (PDF) Credit card terms (PDF) Download

- TravelOne credit card reward points programme terms and conditions (PDF) TravelOne credit card reward points programme terms and conditions (PDF) Download

- TravelOne sign-up gift offer terms and conditions (PDF) TravelOne sign-up gift offer terms and conditions (PDF) Download

What you need to know

Your credit limit

Your credit limit is subject to our review and approval. Where you've stated a preferred credit limit, the amount we grant may be lower than what you requested.

Finance charges

A finance charge will be imposed based on the amount withdrawn, from the date the transaction is posted to your account to the date the payment is made in full or the next statement date, whichever is earlier.

Effective rate: 27.8% p.a. (minimum)

Minimum charge: SGD2.50

The annual fee is at SGD196.20 including GST, starting from the issue date for your credit card. From the second year onwards, we'll waive the annual fee for your card if you spend more than SGD25,000 per year.

Receive 10,000 miles (in the form of 25,000 Reward points) when you pay for your annual fee from the second year onwards. The Reward points will be credited to your account within the next 2 months after the annual fee is charged to your card. Valid till 31 December 2024.

No Reward points will be awarded if your annual fee is waived when you spend more than SGD25,000 per year.

Don't have an HSBC TravelOne Credit Card yet?

Apply online in just a few easy steps. It'll only take minutes, and you'll soon be on your way to receiving your welcome gift.

Want both HSBC Premier Mastercard and TravelOne?

If you're an HSBC Premier customer and would like both the Premier Mastercard Credit Card and the TravelOne Credit Card, speak to your Premier Relationship Manager or leave us your contact details or SMS PMCC <space> Name to 74722. We'll be in touch in 3 working days to assist with your application.

Share the perks with a supplementary card

Our HSBC credit cards open up a world of banking convenience, benefits and privileges. And now, you can share it with your family too.

- Earn reward points each time your loved ones spend on their cards

- Get up to 5 supplementary cards, free to you and your family for life

- Any loved one can hold a supplementary credit card as long as they're aged 18 or above

Other ways to apply

Leave us your contact details online or by SMS, and we'll give you a call within 3 working days to help you apply for this card.

Text HSAPP <space> Name <space> to 74722, or request a callback online .

Why bank with us

AsiaMoney Best Bank For Digital Solutions – Singapore

HSBC is the recent recipient of the ‘AsiaMoney Best Bank For Digital Solutions – Singapore’ Award 2023

Customer Satisfaction Index

HSBC ranked #1 in Credit Card sector for 3 consecutive years (2020 to 2022) in the Customer Satisfaction Index of Singapore.

Additional information

How can i enjoy the complimentary airport lounge .

Start enjoying your benefit

- Step 1: download Mastercard Travel Pass app (available on the Apple App Store and Google Play)

- Step 2: select 'Sign up' to register for the programme, or log on to your account if you're already a member

- Step 3: enter your HSBC TravelOne Credit Card details for a one-time verification

- Step 4: complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: set your account password

Simply use the membership number stored under 'my visits' when visiting airport lounges.

With the app, you can also view the airport lounges and restaurants available, keep track of your usage history and access many more services.

Terms and conditions apply .

Check out Mastercard Travel Pass

You might also be interested in

Entertainer with hsbc entertainer with hsbc this link will open in a new window, credit card features , hsbc singapore app , connect with us.

Is the HSBC TravelOne Card the One and Only Travel Card You Need?—MoneySmart Review 2023

Let’s talk about the HSBC TravelOne card’s name—“Travel One”. It aims to be the 1 travel card you need. HSBC says so as well: “Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.”

But does the HSBC TravelOne card (literally) live up to its name? If I only have 1 travel card, I want good miles earn rates, low (or no!) annual fees, and a slew of travel benefits and privileges.

Let’s take a look at how the HSBC TravelOne Card fares. We review the card’s earn rates, travel rewards, privileges, and more.

See our credit card ranking rubric to find out how we rank credit cards.

- HSBC TravelOne Card: Summary

- HSBC TravelOne Card: Eligibility

- HSBC TravelOne Card: Annual fees

- HSBC TravelOne Card: Earn rates

- HSBC TravelOne Card: Bonus earn categories

- HSBC TravelOne Card: Rewards points redemption

- HSBC TravelOne Card: Benefits and privileges

- HSBC TravelOne Card: Sign-up promotion

- Should I get the HSBC TravelOne Card?

- Alternatives to the HSBC TravelOne Card

1. HSBC TravelOne Card: Summary

HSBC TravelOne Card

Get a Hinomi Q1 Ergonomic Chair (worth S$499) or a Samsung 27-inch Smart Monitor M5 (worth S$432) or an Apple AirPods 3rd Gen + S$50 Cash (worth S$313.80) or S$150 Cash via PayNow when you apply and spend a min. of S$500 from Card Account Opening Date to the end of the following calendar month. T&Cs apply .

Key Features

Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app

Accelerated earn rate: up to 2.4 miles for your spending

Travel privileges: Complimentary travel insurance coverage (including COVID-19), 4 x complimentary airport lounge visits for primary cardholders and more

Split flexibly: Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

The HSBS TravelOne card is an entry-level air miles card that’s good for general spending. It doesn’t come with any bonus earn categories, but does come with a good mix of travel benefits and privileges. These include travel perks (such as cashback and discounts when you shop overseas) and travel protection in the form of complimentary travel insurance.

Back to top

2. HSBC TravelOne Card: Eligibility

Let’s first talk about who’s eligible for the HSBC TravelOne Card.

An entry-level miles card, the HSBC TravelOne Card has pretty typical age and minimum income requirements:

- Age requirement: 21 years old

- For Singaporean and PR salaried workers: $30,000

- For Singaporeans and PRs who are self-employed or commission-based: $40,000

- For foreigners: $40,000

3. HSBC TravelOne Card: Annual fees

The HSBC TravelOne Card comes with a pretty standard annual fee of S$194.40 . Generally, this is the standard annual fee for most entry-level credit cards, barring credit cards with $0 annual fee .

Of course, the annual fee doesn’t matter if a fee waiver is available. HSBC doesn’t say anything about the first year’s annual fee (you can always try your luck requesting a fee waiver !). However, they will waive the annual fee for the second year onwards if you spend over S$25,000 per year. That’s about $2083 per month.

4. HSBC TravelOne Card: Earn rates

Here’s a quick look at how the HSBC Travel One Card’s earn rates compare to other entry-level miles cards:

The HSBC TravelOne Card local spend earn rates are average at best —there are miles cards with lower local earn rates, such as the BOC Elite Miles World Mastercard , which clocks in at just 1 mile per dollar (mpd).

However, the HSBC TravelOne Card’s foreign spend earn rates are above average . The only other miles credit card out there with a comparable rate is the UOB PRVI MASTERCARD Miles Card, which comes with a $5 minimum spend caveat—you need to spend S$5 to earn UNI$6/2.4 miles.

5. HSBC TravelOne Card: Bonus earn categories

At its heart, the HSBC TravelOne Card is meant for everyday, general spending. That comes with 1 downside: it doesn’t have any bonus earn categories . These refer to specific spend categories with which you can earn a greater number of miles per dollar.

Bonus earn rates are miles credit cards are usually between 3 mpd to 10 mpd. Here are some examples:

- Standard Chartered Journey Credit Card : 3 mpd on online transactions in Transportation, Grocery and Food Delivery Merchants categories

- UOB PRVI MASTERCARD Miles Card : 6 mpd (UNI$15 per S$5 spend) on major airlines and hotels booked through Expedia, UOB Travel, and Agoda

- Citi PremierMiles Card : Up to 10 mpd on online travel bookings via Kaligo and Agoda

- DBS Altitude Visa Signature Card : Up to 10 mpd on hotel transactions at Kaligo (capped at S$5,000/month); up to 6 miles per S$1 on flight, hotel and travel packages at Expedia (capped at S$5,000/month)

Is it a big disadvantage that the HSBC TravelOne card doesn’t have bonus earn categories? We would say not necessarily. It really depends on if you’d spend more on those bonus earn categories in the first place. For example, if you don’t want to book via Kaligo, Expedia or Agoda, the Citi PremierMiles Card and DBS Altitude Visa Signature Card bonus earn rates are basically made defunct.

6. HSBC TravelOne Card: Rewards points redemption

HSBC rewards you with Rewards points for each dollar of your spending—they don’t just give you miles directly. Here’s a breakdown of the points earn rates:

- 2.4 miles (6 Reward points) per S$1 foreign spending

- 1.2 miles (3 Reward points) per S$1 local spending

The good news is that from now till 31 Dec 2023, HSBC won’t charge you any conversion fee for redeeming your points for air miles or hotel points. Usually, you have to pay an annual HSBC Mileage Programme fee of S$40, subject to GST.

On top of that, HSBC rewards redemptions are fast . According to HSBC’s TraveIOne Card page, they’ll complete redemptions for air miles and hotel points instantly or in 1 business day.

Do note that HSBC Reward points expire after 37 months . 3+ years sounds like a lot of time, but you know how these expiry dates can creep up on us without us realising—fellow points hoarders, you know what I mean.

Prefer a rewards system with points/miles that never expire? Consider the Standard Chartered Journey Credit Card for 360 Rewards Points that never expire, or the Citi PremierMiles Card for Citi Miles that never expire.

7. HSBC TravelOne Card: Benefits and privileges

Although the HSBC TravelOne Card doesn’t have any bonus point categories, it does come with a generous slew of travel benefits and privileges. Broadly, these fall into 2 categories: travel perks, and travel protection.

HSBC TravelOne Card travel perks

- Airport lounge access : As the primary cardholder, you get 4 complimentary lounge visits per year to over 1,300 airport lounges around the world.

- Travel rewards : With the HSBC TravelOne Card, you get to enjoy cashback and discounts when you travel and do your shopping overseas under the Mastercard Travel Rewards catalogue . These apply to both in-store and online merchants across over 25 countries, including Daimaru Matsuzakaya Department Stores in Japan and Bloomingdale’s in the United States.

- Mastercard Priceless™ Specials : This is another MasterCard rewards programme that you get with the HSBC TravelOne card, but this one is a bit more upmarket. It offers privileged access to benefits across travel, culinary, shopping, sports, entertainment, and arts and culture.

HSBC TravelOne Card travel protection

- Travel insurance : If you charge your air ticket (in full) to your HSBC TravelOne Card, you’ll get complimentary travel insurance coverage (including COVID-19) of up to USD100,000.

- ID Theft Protection™ : The HSBC TravelOne Card doesn’t just want to give you peace of mind while on holiday—it also aims to do so while you’re browsing and making purchases online. You can register for Mastercard ID Theft Protection™ to ensure your personal data is safe and secure, protecting you from identity theft and fraud.

- Checking travel and health restrictions : It is such a chore to check for travel and health restriction/documentation. The HSBC TravelOne gives you access to Sherpa, a travel advisory tool that tells you what Visa requirements, travel documents, and even if COVID-19 tests are needed prior to your trip.

Hungry for more benefits? Even if you aren’t travelling, the HSBC TravelOne Card comes with a dining perk you can use right here in Singapore. You’ll get complimentary access to ENTERTAINER with HSBC , which comes with tons of 1-1 deals on dining, lifestyle and travel. These deals are available worldwide, but there are plenty to choose from locally too.

ALSO READ : Best Food Discount and Rewards Apps in Singapore—Chope, Burpple, Entertainer & More

8. HSBC TravelOne Card: Sign-up promotion

From now till 31 Aug 2023, you can get up to 20,000 Miles (in the form of 50,000 Rewards Points) when you apply for the HSBC TravelOne Card.

The downside is that you need to pay the card’s annual fee of S$194.40 (GST already included), as well as spend at least S$800 in qualifying transactions within 1 month. Depending on your lifestyle, this minimum spend could be easily doable, or a tall order.

9. Should I get the HSBC TravelOne Card?

If you’re looking for a general spending travel card (that means no bonus earn categories!), the HSBC TravelOne Card is a decent choice. Its earn rates are average or slightly above average (especially when it comes to foreign spending), and we like that you earn Rewards points per dollar spent. For some other cards with similar earn rates, you need to spend say $5 before you chalk up any points. This means that the HSBC TravelOne Card can help you earn points on even the smallest purchases.

Don’t forget that the HSBC Reward points expire after a 37-month period. This could be a pro or a con, depending on how much of a points hoarder you are.

The HSBC TravelOne Card does live up to its name as the 1 and only travel card you’ll need…if you’re looking for a general spending miles card. We suggest you get the HSBC TravelOne Card if you want a general spend card, if you value travel benefits, and if you’re looking for a higher than average earn rate for foreign spending. This card isn’t for you if you want a high bonus earn rate on selected categories, or if you want miles that never expire.

10. Alternatives to the HSBC TravelOne Card

Here are some other entry-level miles cards for you to consider. These rewards points/miles never expire:

Standard Chartered Journey Credit Card : This card rewards you with a bonus earn rate of 3 miles for online transactions on transport, food delivery, and groceries. The best part is that the 360 Rewards Points you earn never expire.

Standard Chartered Journey Credit Card (No Annual Fee)

Up to 3 miles for every $1 spent

2 complimentary visits to Priority Pass lounges around the world each year

S$0 foreign transaction fee for overseas spend made and posted in June-July, November-December 2023

Complimentary travel insurance coverage of up to S$500,000.

360 Rewards Points do not expire

S$10 off Grab rides to or from Changi Airport

Citi PremierMiles Card : Citi Miles never expire! Plus, earn up to 10 miles per $1 spent on selected hotel bookings.

Citi PremierMiles Card

[FASTER GIFT REDEMPTION | GIVEAWAY] Get a Sony HT-AX7 Portable Theatre System (worth S$769) or an Apple iPad (9th Gen), 64GB (worth S$508.30) or a Nintendo Switch OLED (worth S$549) or S$300 Cash via PayNow, in as fast as 6 weeks from meeting the S$500 spend criteria! PLUS stand a chance to get a Rolex Submariner 124060 (worth S$15,521) or an Apple iPhone 15 Pro, 128GB (worth S$1,664.25) or a Sony PlayStation®5 (SLIM) Digital Edition (worth S$669) when you apply through MoneySmart! T&Cs apply .

S$1 = 1.2 Citi Miles on Local spend (no min. spend)

S$1 = 2 Citi Miles on Foreign currency spend

Earn 10,000 Citi Miles upon renewal of annual membership and payment of annual fee

Citi Miles never expire

Principal Cardholder gets to enjoy 2 complimentary visits every year to over 1,300 airport lounges worldwide.

OCBC 90 N Card : Travel$ never expire. You’ll also get up to 7 miles per $1 spent on Agoda accommodations worldwide.

OCBC 90°N Card

Designed with an LED light feature, the 90°N MasterCard Card lights up whenever you make a contactless payment.

Travel$ that do not expire - Convert Travel$ to loyalty points at 9 airline and hotel partner programmes.

Get cash rebates at up to 2.1% from your earned Travel$. No minimum spend and no caps

All online purchases on your OCBC 90°N Card come with e-Commerce Protection, which safeguards you against non-delivery or defective goods or if the seller fails to reimburse you.

Check out and easily compare the other air miles credit cards in Singapore .

P.S. Here’s our MoneySmart credit card ranking rubric

In case you’re wondering, here’s how we decide on our credit card rankings.

Don’t miss our ultimate list of credit card reviews for the low-down on credit cards in Singapore.

Found this article useful? Share it with a fellow traveller considering a miles card!

Related Articles

Air Miles vs Cashback vs Rewards – Which is the Best Credit Card Type to Use?

9 Best Air Miles Credit Cards in Singapore (Apr 2024)

7 Best Rewards Credit Cards in Singapore (2023): Citibank, OCBC, DBS & More

Best Credit Card Promotions in Singapore (Apr – May 2024): Citibank, DBS, HSBC, UOB, and More

HSBC TravelOne Card

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.sg’s Terms of Use and Privacy Policy

Already have an account? Login

Get a Hinomi Q1 Ergonomic Chair (worth S$499) or a Samsung 27-inch Smart Monitor M5 (worth S$432) or an Apple AirPods 3rd Gen + S$50 Cash (worth S$313.80) or S$150 Cash via PayNow when you apply and spend a min. of S$500 from Card Account Opening Date to the end of the following calendar month. T&Cs apply .

Are you eligible?

Promotion is valid from 15-April-2024 to 21-April-2024

Applicable for New-to HSBC cardholders only.

Customers need to apply through MoneySmart to be eligible

Applicants need to p rovide HSBC their consent to receive marketing and promotional materials from HSBC at the time of submitting their application.

What you need to know

Log into your MoneySmart account and submit your claim by 21st May 2024

Gift Options: Hinomi Q1 Ergonomic Chair (worth S$499) or a Samsung 27-inch Smart Monitor M5 (worth S$432) an Apple AirPods 3rd Gen + S$50 Cash (worth S$313.80) or S$150 Cash via PayNow

Please note that gifts will typically be fulfilled approximately 5 months after the end of the campaign month (30 April 2024).

MoneySmart exclusive rewards do not stack with external or third party promotions unless otherwise stated. See T&Cs for details.

*Instantly Activate Your Virtual Card for Google Pay and Apple Pay Shopping! T&Cs apply.

Quick Facts

Instant Rewards Redemption

Categories to maximise this card

What people use it for.

Frequent travellers who are looking for more flexibility & choices in redeeming miles and good earn rate

You are looking for a miles credit card with high earn rate and fast redemption

All Details

Key features.

- Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app

Accelerated earn rate: up to 2.4 miles for your spending

Travel privileges: Complimentary travel insurance coverage (including COVID-19), 4 x complimentary airport lounge visits for primary cardholders and more

Split flexibly: Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Overseas Spending

Annual interest rate and fees, minimum income requirements, documents required, card association, wireless payment, moneysmart promotions.

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

HSBC TravelOne Credit Card Review 2024

Introduced in early 2023, the HSBC TravelOne credit card represents HSBC's newest addition to its credit card lineup, specifically designed for those passionate about travel. It offers enhanced flexibility, ease, and appealing rewards.

Notable highlights include fee-free miles transfers with 9 frequent flyer partners and the integration with the HSBC mobile app, allowing users to effortlessly redeem travel rewards and handle their payments with utmost convenience. If you're considering whether to get the HSBC TravelOne Credit Card, let's find out if this card is suitable for you as we consider the requirements, pros and cons and more.

Pros and Cons of HSBC TravelOne Card

- 20,000 welcome bonus miles (50,000 reward points) upon payment of annual fee

- Up to 2.4 miles for every S$1 spent overseas

- No cap on miles/points earned

- Up to 1.2 miles for every S$1 spent locally

- No redemption fee when you redeem for air miles or hotel points

- Annual fee waiver available (from 2nd year onwards)

- Exclusive access to HSBC ENTERTAINER with HSBC Singapore mobile app, enjoy over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel

- Flexibility to split your purchases across a range of flexible tenors that suits your needs with HSBC credit card Instalment Plans at 0% interest fee

- Complimentary travel insurance

- Complimentary airport lounge visits per year for primary cardholders

- Interest rate of 26.90%, which is lower than some cashback credit cards (as per MoneySmart's Credit Cards comparison tool)

- Min. spend of S$1,000 to qualify for the 20,000 welcome bonus miles

- Min. spend of S$25,000 per year to qualify for the annual fee waiver

Compare HSBC TravelOne vs. Citi PremierMiles Card vs. SCB Journey Credit Card

Currently, the HSBC TravelOne Card offers the lowest minimum interest rate chargeable as compared to the Citi PremierMiles Card and Standard Chartered Journey Card.

In terms of annual fee, you'll definitely save more with the Standard Chartered Journey Card as compared to the HSBC TravelOne Card and Citi PremierMiles Card, as you wouldn't have to pay any annual fees for it.

When it comes to air miles benefits, the Citi PremierMiles Card comes up on top with the most attractive perks as compared to the HSBC TravelOne Card and Standard Chartered Journey Card, offering the highest air miles per S$1 spent on online travel bookings via Kaligo and Agoda.

However, the Citi PremierMiles Card requires a minimum spend of $800 per month for the first-year fee waiver, unlike the Standard Chartered Journey Card which does not have minimum spend requirements. HSBC TravelOne Card requires an even higher minimum spending of S$25,000 annually to be eligible for the second-year annual fee waiver.

In a nutshell, the HSBC TravelOne Card is worth getting if you're after its fee-free miles transfers with 9 frequent flyer partners, no cap on miles/points earned, plus the instant reward redemption with its extensive selection of airline and hotel partners via the HSBC Singapore mobile app.

Find Out More In Our HSBC TravelOne Blog Review

Hsbc travelone card application.

Here are 3 simple steps to apply for the HSBC TravelOne Credit Card:

Apply via MoneySmart’s credit cards page

You may begin your application by clicking on our HSBC TravelOne Card application link.

When you choose to apply online or through the HSBC mobile app and via SingPass MyInfo, HSBC will pull your identity and income data from SingPass (which is already verified), thus cutting short the processing time. The approval-in-principle page will appear within minutes of submitting your MyInfo.

Provide all documentation required

You'll need to provide all the necessary documentation in order for HSBC to approve your credit card application. This list of documents include:

- NRIC or other identification details

- Latest computerised payslip

- Latest 12 months' CPF Contribution History Statement

- Latest Income Tax Notice of Assessment (NOA)

Receive your HSBC TravelOne Credit Card

You’ll be able to activate your HSBC TravelOne Card instantly through the HSBC mobile app, and enter a One-Time Password (OTP) after keying in your 6-digit Online Banking PIN to secure all your credit card transactions. Thereafter, it’s ready for you to use on any of your purchases and you can track your air miles and other rewards with your HSBC mobile app!

Frequently Asked Questions

Are there any fees if i apply for the hsbc travelone credit card, am i eligible for the hsbc travelone credit card, if i’m late for my monthly hsbc travelone credit card bill payment, how much do i have to pay.

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

My thoughts on the HSBC TravelOne Card

The HSBC TravelOne Card is a great general spending card- and maybe that's the problem.

This week saw the launch of the TravelOne Card, HSBC’s first mass market miles card in Singapore. HSBC certainly took its time entering this segment — almost every other bank already has one — but hey, there’s no harm in being fashionably late.

I’ve spent the past couple of days poring over the details of this card and analysing its use cases. Like every new launch, the TravelOne has generated a ton of online discussion, which has been very helpful in spotting things I missed the first time round!

And as I was drafting this post, I suddenly had an epiphany.

The biggest strength of the HBSC TravelOne? It’s a great general spending card. The biggest weakness of the HSBC TravelOne? It’s a great general spending card.

If that sounds confusing, don’t worry- it’ll get clearer as we go along.

The earn rates are great (for a general spending card)

HSBC TravelOne Cardholders earn:

- 3X HSBC points per S$1 (1.2 mpd) on local spend

- 6X HSBC points per S$1 (2.4 mpd) on foreign currency spend

There is no minimum spend required, nor cap on the points that can be earned.

It speaks volumes about where the market is right now that more than a few comments have basically said “Not 4 mpd? Pfffft”. But that’s understandable in a way. Cards like the UOB Preferred Platinum Visa and UOB Visa Signature have made us so accustomed to earning 4 mpd almost everywhere that it’s become the de facto expectation for some.

And yet, it’s important to remember that the TravelOne is intended to be a general spending card , and we need to benchmark it to the appropriate segment.

In fact, given its earn rates and rounding policies, I’d say it more than holds its own against the competition; all the more so for HSBC Everyday Global Account customers who can earn a bonus 1% cashback on all transactions (capped at $300 per month).

Furthermore, I’m quite amazed that the HSBC TravelOne outearns the top-of-the-line HSBC Visa Infinite (1/2 mpd on local/overseas spend, upgraded to 1.25/2.25 mpd on local/overseas spend with a hefty minimum spend of S$50,000 in a membership year). That must have been a fascinating internal discussion, since product managers are loath to have their baby upstaged- especially by a card for the unwashed masses!

It’s not just raw earn rates, mind you. Quality of points matters as much as quantity .

If HSBC had launched a card with 1.6/2.4 mpd earn rates, yet kept Asia Miles and KrisFlyer as its only transfer partners, I’d be much more indifferent. Yes, those would be excellent earn rates for a general spending card, but at the end of the day what’s changed? It’s not breaking any new ground.

The TravelOne’s claim to fame is not its earn rates, solid though they may be. It’s the new transfer partners it’s added and will continue to add throughout 2023 (more on that later). That, to me, is more important than incrementally higher earn rates.

I’ve often believed that banks are getting the market for general spending cards wrong. It seems as if the thought process goes something like, “What’s better than 1.2 mpd? 1.3 mpd. What’s better than 1.3 mpd? 1.4 mpd…”

While this might be good for consumers in the short run, it’s ultimately not sustainable (just look at the BOC Elite Miles Card as an example). Margins get squeezed, banks have to come up with shenanigans to advertise higher rates while awarding less in practice (e.g. OCBC/UOB and their S$5 earning blocks), and it limits the scope to add other benefits that customers might value more, such as lounge visits or airport limo rides.

A much more sustainable approach would be to compete not on headline earn rates, but card features . In other words: “I can make my 1.2 mpd better than your 1.3 mpd if I offer more partners, if I offer free conversions, if I offer instant transfers.” That’s exactly what HSBC is attempting with the TravelOne.

Still, not everything is hunky dory.

- HSBC TravelOne Card does not have a bonus earn category

- HSBC excludes CardUp/ipaymy transactions from earning rewards

- HSBC no longer offers a tax payment facility

- HSBC points don’t pool (though it’s on the roadmap…more on that later)

This means there’s currently no way of turbocharging your accumulation, and at a pace of 1.2/2.4 mpd, it’d take a lot of spending to reach the critical mass needed for a redemption (especially if you’re redeeming for a family).

It’s what I call the “AMEX Platinum Problem”. While Membership Rewards points are extremely valuable, it’s hard to earn them at a decent rate (0.69 mpd for AMEX Platinum Credit Card , 0.78 mpd for AMEX Platinum Charge ). But even then, at least AMEX has 10Xcelerator partners (3.47 mpd for AMEX Platinum Credit Card , 7.8 mpd for AMEX Platinum Charge )- something HSBC lacks!

A solid sign-up bonus, with a quirk

From now till 31 August 2023 , customers who apply for a HSBC TravelOne Card will enjoy 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$194.40

- Spend at least S$800 by the end of the month following approval

- Opt-in for marketing communications during the sign-up process

Since the annual fee must be paid, you’re basically buying miles at a cost of 0.97 cents each (S$194.40/20,000 miles), or 1.09 cents if you want to adjust for the opportunity cost of spending on a 4 mpd card (S$194.40/(20,000-800*2.8) miles).

That’s a very good price indeed, and before someone says “but Citi PayAll”, remember the S$8,000 minimum spend for the current offer.

What’s noteworthy about this offer is that it’s available to both new and existing HSBC cardholders . Most of the time, the latter get left out in the cold.

But offering the same sign-up bonus to new and existing customers also creates a strange quirk. If you count as a new HSBC cardholder, you might want to apply for a HSBC Revolution Card first (seriously, why don’t you have one yet?).

New cardholders will receive:

- S$30 cash from SingSaver, no min. spend (T&Cs)

- S$150 cashback from HSBC with a min. spend of S$1,000 (T&Cs)

After the Revolution is approved, you can then apply for the TravelOne as an existing customer, since you enjoy the same 20,000 bonus miles as a new cardholder anyway.

Don’t sweat the annual fee

And since we’re talking annual fees: the HSBC TravelOne Card is not offering a first year fee waiver option at the moment. In other words, if you want the card, you have to pay the S$194.40 annual fee, though with 20,000 miles + eight lounge visits in the first membership year (not four- see below), I’d argue you’re still coming out on top.

What happens in the second year, though?

At this point, we don’t know. The official stance is that cardholders who spend at least S$25,000 in a membership year will receive a fee waiver for the second year. However, many other banks say similar things, yet offer waivers nonetheless to those who fall short of the minimum spend (either automatically or on request).

I’m not that concerned at the moment, quite frankly. The card is virtually brand new; we’ll cross that bridge when we come to it. I certainly wouldn’t pay S$194.40 just for a few lounge visits, and I suspect that HSBC knows that unless there’s a very compelling reason to pay the second year’s annual fee, the lack of waiver could spark a significant exodus.

The market has already demonstrated it’s not willing to pay annual fees in the S$30,000 card segment. OCBC tried it for a while with their 90°N Card by adding a non-waivable S$53.50 annual fee (with a further S$139 top-up to buy 10,000 miles). That experiment didn’t last very long.

So the way I see it, why not just take it one year at a time? It’s hardly something to get worked up about at this point. If the value proposition doesn’t make sense in the second year, you still have the freedom to walk away.

Expiring points aren’t a deal-breaker

Points earned on the HSBC TravelOne Card expire after 37 months , the same as other HSBC cards.

Some don’t like expiring points, but it’s not that big a deal for me. As I’ve explained in this article, non-expiring points don’t really influence my decision whether or not to get a card. Granted, nothing beats evergreen, but 37 months is a long time, and you still have additional validity once points are transferred to the airline side.

However, an argument could be made that because of the 1.2/2.4 mpd earn rates, you’d need to keep the points on the bank side for a longer time before transferring. Fair enough, though at most it means paying an additional conversion fee at the end of 37 months; not really something to lose sleep over.

Moreover, with the pace of frequent flyer devaluations, holding on to your points too long is a bad idea. The golden rule is still to earn and burn!

First year sweet spot for lounge visits

HSBC TravelOne Cardholders enjoy four lounge visits per year, a relatively generous allowance for the segment in which the card competes.

What’s more, the allowances are granted on a calendar year basis instead of membership year. This means that a cardholder can enjoy eight visits in their first membership year, regardless of whether they choose to renew.

For example, when you’re approved in 2023 you get four visits to use till 31 December 2023, and on 1 January 2024 you get another four visits to use till 31 December 2024. Whether or not you renew the card in 2024 is irrelevant.

There’s also a qualitative aspect to this: TravelOne lounge visits are provided by DragonPass, which is the only major lounge network to retain access to Plaza Premium Lounges after the operator terminated its agreements with Priority Pass and Lounge Key. In some airports (e.g. Penang, Phnom Penh) Plaza Premium lounges are the only contract lounge option (or even the only lounge option).

If there’s one fly in the ointment, it’s that lounge visits cannot be shared with a guest. Whether that’s a HSBC or DragonPass restriction I do not know, but it feels odd: if I have four visits in total, who cares whether I use all four on myself or split them with my companion for two visits together?

Fast, free points conversions

There’s three things I look for in a card:

Conversion speed

Conversion fees, conversion blocks.

The HSBC TravelOne gets two out of three right, with the last one coming agonisingly close.

The HSBC TravelOne Card has a bit of a semantics issue when it comes to conversions.

In some places, it advertises “ instant” rewards redemptions. In others, it says “instantly or within 1 business day”. The two, obviously, are not the same, and in the miles game where award space can disappear as fast as it pops up, can make all the difference.

Having spoken to both the product team as well as Ascenda (the loyalty company that’s behind the new partners), the overall sense I got was that this is a CYA thing, just in case something goes wrong.

Given the API integration Ascenda has with its partners, there’s really no reason not to expect instant conversions for all programmes except Accor Live Limitless (where transfers take up to five business days).

In any case, I’ll be testing this soon and posting the results, and I’m sure the Telegram Group will be full of data points as well.

HSBC normally requires cardholders to join its Mileage Programme to convert points, which costs S$43.20 a year for unlimited conversions to Asia Miles or KrisFlyer. You only pay one fee, regardless of how many HSBC cards you have.

With the TravelOne Card, all conversion fees are waived till 31 December 2023 . That reduces the friction in making ad-hoc top-ups to your frequent flyer account.

It’s not been confirmed whether HSBC will switch to a “per conversion” model come 1 January 2024, but if you ask me, it looks more likely than not. I’d expect to pay the usual S$25 + GST.

Unfortunately, it’s the last leg of the triangle that’s missing. While the TravelOne offers fast, free top-ups, the minimum conversion block is 10,000 miles.

While that’s on par with the market, I feel they’ve missed a great opportunity here. 10,000 miles, after all, is a significant chunk of change to move at one go. If they broke it down into smaller blocks, the utility of the card would be even greater.

If it’s any consolation, after the first 10,000 miles the subsequent conversion block is just 2 miles. This is confirmed in the FAQs:

In other words, you could convert 25,005 points to 10,002 air miles. This is great news for anyone intending to spend S$800 for the sign-up bonus in local currency then cash out. You’d have:

- 50,000 bonus points (for meeting min. spend)

- 2,400 base points (S$800 @ 3 points per S$1)

52,400 points can be cashed out exactly for 20,960 miles, avoiding orphan points.

I just wish they’d gone one step further and made the minimum conversion block 2 miles, though that may be wishful thinking on my part.

By the way, this also means that if you want an insurance policy against orphan miles, one thing you can do is keep a minimum of 25,000 points in your account at all times.

Transfer partner bonanza

HSBC TravelOne Cardholders can transfer points to a total of 12 different partners : nine airlines and three hotels.

This takes the crown of “most transfer partners” from Citi (10 airlines, 1 hotel), and HSBC isn’t done. The plan is to have more than 20 airline and hotel partners by the end of 2023.

That’s the real game-changer here. For too long, we’ve seen new partners added at a glacial pace ( Standard Chartered and OCBC (eventually) being the notable exceptions; no surprise it was Ascenda behind those too). Now HSBC has kicked things into overdrive, and while not every new partner will be “useful” from a miles chaser perspective, more options can only be a good thing.

At the same time, there’s one thing I want to make abundantly clear: there’s little point in using the HSBC TravelOne Card if all you want is Asia Miles and KrisFlyer. If that’s your goal, you’d do much better by sticking with other cards on the market. Why earn KrisFlyer miles at 1.2/2.4 mpd when you can earn them at 4/6 mpd elsewhere?

Getting the most out of TravelOne means exploring other programmes, and I can’t help but wonder if there’s an inherent paradox. Are the people most likely to give a general spending card heavy usage also the same people who would default to familiar programmes like Asia Miles and KrisFlyer?

How you feel about the HSBC TravelOne Card really boils down to what standards you’re measuring it by.

Compared to general spending cards, it excels: 1.2/2.4 mpd earn rates, 1% extra cashback for EGA customers, a favourable rounding policy, four lounge visits per calendar year, fast and free conversions, and a 20,000 miles sign-up bonus even for existing customers. I’m not about to say it’s the absolute best — the Citi PremierMiles Card may have lower earn rates and fewer lounge visits, but Citi PayAll is a fearsome beast — though it certainly ticks all the right boxes.

Compared to specialised spending cards , it pales in comparison, obviously. No general spending card, no matter how good, is going to beat 4/6 mpd!

Here’s the thing though: even if the HSBC TravelOne isn’t directly competing with a specialised spending card, it’s indirectly competing for share of wallet, because in most cases, every S$1 I put on the TravelOne is S$1 I could have put on a 4/6 mpd card.

That’s a problem that all general spending cards face, not just the HSBC TravelOne. It begs a more existential question: do you even need a general spending card?

To be sure, there are situations where it can come in useful:

- Maybe you’ve busted the 4/6 mpd caps on your specialised spending card

- Maybe the bank affiliated with your general spending card has some sort of tie-up with the merchant that grants an additional discount that would more than offset the lost miles

- Maybe this particular category of spend doesn’t qualify for any bonuses (though it’s hard to think of an example, given the wide coverage of specialised spending cards)

- Maybe you don’t know the MCC of a given merchant, and just want to be safe (but you could always find out for free )

I don’t know how common those scenarios are for you, but keep in mind this won’t even be a dilemma for the vast majority of cardholders out there. If you read this blog, chances are you’re in the minority- not just in terms of looks, charisma and sheer muscle mass, but also in terms of card usage. For every one of us who obsessively optimises each and every transaction, there’s five, maybe ten people who just put everything on their DBS Altitude, Citi PremierMiles or UOB PRVI Miles Card and call it a day.

All the same, it’d be horribly premature to write it off. My understanding is that HSBC is working on adding points pooling , and if they pull that off, a lot of things would fall into place.

Imagine what you could do with Revolution earn rates, 20+ partners and instant transfers. Imagine being able to avoid fuel surcharges and tap new sweet spots by choosing the right frequent flyer programme. Imagine a spillover effect on the rest of the market, where other banks look at the HSBC, StanChart and OCBC case studies and decide there’s value in partnering with a platform like Ascenda and bringing dozens of partners onboard at once instead of negotiating individual contracts.

As John Lennon once said “That’s very nice Yoko but I’m trying to perform with Chuck Berry” “You can say that I’m a dreamer, but I’m not the only one”.

The HSBC TravelOne poses a crucial question: is there space for a general spending card in the wallet of a miles optimiser? Or perhaps more accurately: is there space for another general spending card in the wallet of a miles optimiser?

That’s something well worth thinking about this weekend, but I personally pulled the trigger yesterday and sent in my application. I’m not about to say no to that kind of sign-up bonus, and if things work out the way I hope they will, having an extra 50,000 HSBC points in the bag would be very welcome come end-2023. HSBC has ambitious plans that go beyond just the TravelOne, and if they can deliver on that, it’d be a huge shake-up to the miles game in Singapore.

Scoffers gonna scoff, but I like what I see so far.

- credit cards

Similar Articles

Stanchart visa infinite offering s$300 cashback on tax payment facility, review: american express platinum credit card, 24 comments.

Should this be added into the article on how to calculate general spending posted on 10 Jan?

I believe the plaza premium lounge in kuching is no longer around.

You’re right. No more at Kuching airport. Penang Plaza Premium still around.

removed that!

Me again. Interesting follow up. – My biggest gripe about the AF waivability uncertainty was that if you can’t get a waiver, you’d have to cash out and cancel and with usual 10k blocks you’d be hard pressed to meet the next 10k block (most people won’t put $8k+ on a gen spend card in a year given the plethora of 4mpd options). I had missed that it was an effective 10k minimum instead of blocks – thanks for pointing this out. More agreeable that it would be easier to try on this basis. Although by that time, you’ll have … Read more »

For a mass market general spending card that is not even a week old, I think we are being too critical. As far as the annual fee is concerned, if one wants to be safe, they can wait until a year later when data points about waivability become available, but of course, there’s the tantalizing FOMO that the welcome offer might be pulled soon, cause what are the odds that existing-to-bank customers are eligible for such a thing? All in all, I think it’s only fair that we have to “pay” for the 20k miles with a bit of uncertainty … Read more »

If Aeroplan is part of the 20 in the future, I’m in.

Likely. The Malaysian version of the card launched with Aeroplan

Ya, the $800 spending is an issue to hit for a general spending card…

Maybe I’m missing something, but aren’t we buying miles at: [(194.4+800)/20,960] = 4.7 cents per mile?

Can’t count the $800 – you’re not throwing the $800 away, it is expected you are spending $800 on things you would have otherwise spent anyway. But there is an opportunity cost for that $800 if you ordinarily would have earnt 4mpd on it instead.

Fairer to say your are forgoing 800×2.8 miles since $800 spend on a 4 miles/$ card would have yielded 3200 miles so 194.40/ 17760?

Another general spending card split means you have to deal with low usage or manage too many orphan miles and low miles redemption. Unless if HSBC has a killer feature like Citi Payall (where you can almost guarantee miles volume) – I will stick with Citi for the general spending card. How much more do you spend on “general” card if you maximize your 4MPD specialized card?

Orphan miles not really an issue here though, because of how the conversions work

Yes but it is free only until end of the year – afterward it is gonna be pain to transfer if they start imposing fee per transfer. Well technically the jury is still up in the air

yup, got it- but when we use the term “orphan miles”, we’re generally referring to miles that cannot be transferred out because of min. block size, not miles that can be transferred out, but there’s a fee involved. if it were the latter, then virtually every card on the market would suffer from “orphan miles”- even the OCBC VOYAGE with its 1 mile transfer blocks (since there’s still a $25 xfer fee). and just because a card doesn’t have xfer fees doesn’t mean the orphan mile problem doesn’t exist! UOB Reserve cardholders have no xfer fees, but their transfer block … Read more »

I’ll wait till they add points pooling

If I’m HSBC customer, is still a must for me to sign up this via Singsaver or can sign-up with HSBC directly? thanks.

If you are an existing customer, can apply directly with HSBC cuz you are not NTB, hence no incentive to go through SingSaver.

So… is this better than the DBS Vantage, which currently seems like the best general all-around spending card, though with limited partners…?

it would be very difficult to compare this with a $120k card, since the two of them have such different annual fees and benefits

If we were to do that comparison, what would the outcome be?

What I struggle to find is the best overall general spending card if you’ve got a monthly spend in the $20k+ range. Conversion partners become important, and the fee can be justified if it makes sense… Most of the benefits beyond those associated with travel are not really used (e.g. sometimes dining benefits that are hard to use, etc.)

This card seems interesting due to the increased number of conversion partners, as award space with SQ seems quite limited lately.

“If it’s any consolation, after the first 10,000 miles the subsequent conversion block is just 2 miles. This is confirmed in the FAQs” — How does this compare to other cards/banks/points systems? Would be very interested to add this to the table alongside the minimum size and the fee.

Hello, how does one pay the annual fee after just getting the card? Is it similar to how we pay our credit card bills, by transferring the sum to the card account?

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

HSBC TravelOne Credit Card

Unlock a world of travel freedom

Instant reward redemption with an extensive selection of airline and hotel partners.

Welcome offer

Get a Welcome Offer of VND3,000,000 for new Primary Cardholders.

Open up a world of elevated travel

Instant redemption

Earn accelerated points

Travel privileges

Flexible card features

Spend, earn, and go further, earn points and redeem them instantly[@cards-instantly].

Be spoilt for choice with instant miles and hotel points redemption with a wide range of airline and hotel partners such as Cathay Pacific, Singapore Airlines, Vietnam Airlines, AirAsia, Marriott Bonvoy and more.

- 3× Reward points for overseas spends[@reward-points-spend-limit]

- 2× Reward points for domestic travel spends[@reward-points-spend-limit]

- Unlimited 1× Reward points[@reward-unlimited-points-exclusions] for all other spends

- Find out how to redeem instantly

Travel in style

Redeem your Reward points at a wide variety of airline and hotel partners, quickly and easily through the HSBC mobile banking app.

- Enjoy 4 complimentary airport lounge visits a year to over 1,300 global airport lounges (for primary cardholders only) - register now

- 12% discount for AGODA travel service booking service

- Complimentary airport rides 4 times a year from BE, capped at VND150,000 per trip

- Overseas administration fee only at 1.99%

- Exclusive travel and lifestyle services for Mastercard® cardholders

- Secure your personal data from identity theft or fraud with Mastercard ID Theft Protection ™

- Peace of mind with complimentary travel insurance up to VND11.5 billion

Access card offers and rewards

- Convert your card purchases into flexible monthly instalments at 0% interest with no fees for up to 24 months at HSBC’s partner merchants. Or spend VND2million at non-partner merchants and enjoy preferential conversion fee from 1.99% - find out more

- With home&Away offers, get up to a 50% discount year round at hundreds of HSBC worldwide partners

- Up to 50% off dining, entertainment, shopping, travel, spa and beauty services - see daily offers

- Refer your friends to become primary HSBC credit cardholders and enjoy rewards of up to VND5 million - see referral offer

Who can apply?

To apply, you must:

- be at least 18 years of age.

- VND15 million for salaried earners who are Vietnamese and VND36 million for foreigners

- VND40 million for Vietnamese people who are self-employed or business owners

- live in one of the following cities and provinces: Hanoi, Ho Chi Minh City, Dong Nai, Binh Duong, Long An, Da Nang, Hue, Hoi An, Ba Ria - Vung Tau, Tay Ninh, Bac Ninh, Vinh Phuc, Hung Yen, Hai Duong, Hai Phong

- have residence permission in Vietnam for at least 12 CONSECUTIVE months at the time of application, if you're a foreigner staying in Vietnam

See what you need to apply

You must submit these supporting documents :

- completed credit card application form

- identification documents for primary and supplementary applicant(s)

- current proof of residential address

- documentary proof of employment and income for primary applicant

Important documents

- Cardholder Agreement (PDF, 559KB) Cardholder Agreement (PDF, 559KB) to read about HSBC Credit Card Cardholder Agreement Download link

- Fees and charges (PDF, 747KB) Fees and charges (PDF, 747KB) to read about HSBC Credit Card fees and charges Download link

- How to protect your Credit Card (PDF, 179KB) How to protect your Credit Card (PDF, 179KB) to read about How to protect your credit card Download link

- Finance charge calculation Finance charge calculation to read about HSBC Credit Card finance charge calculation Modal link

- Credit cards users guide Credit cards users guide to read about HSBC Credit Cards User Guide Modal link

- Credit card tips Credit card tips to read about HSBC Credit Card tips Modal link

Fees and charges

For more details, please refer to Personal Banking Tariff (PDF, 747KB)

Apply online in just a few easy steps. It'll only take minutes, and you'll soon be on your way to receiving your welcome gift.

Before applying, please make sure you read the information under the ' Who can apply ?' section.

Frequently asked questions

How do i get airport lounge access .

Step 1: Download the Mastercard Travel Pass app on the App Store or Google Play and sign up as a member or log on to your Mastercard Travel Pass account if you're already a member.

Step 2: Enter your TravelOne Credit Card details (that is, your card number, CVC, expiry date and country of issuance)

Step 3: Enter your name as shown in your passport

Step 4: Create a password

Step 5: Your account will be created

Then simply use the membership number stored under 'Membership' when visiting airport lounges.

With the app, you can also view the airport lounges available, keep track of your usage history and access many more services.

How do I redeem HSBC TravelOne Credit Card reward points?

Step 1: Log on to the HSBC Vietnam app & select your HSBC TravelOne Card.

Step 2: Select 'Redeem your points', then 'Airline Miles' or 'Hotel Points'.

Step 3: Enter your details, including your airline/hotel program membership ID and the number of points you want to redeem.

Step 4: Review your order, read the terms and conditions and select 'Submit'.

How do I get hotel discounts?

Step 1: Visit https://www.agoda.com/vnmastercard.

Step 2: Select the destination, dates and number of travellers.

Step 3: Select the eligible pre-paid hotels and room types (hotels with “Promotion Eligible” label).

Step 4: Pay with your HSBC TravelOne Credit Card to enjoy your discount.

All hotel offers are governed by Agoda's terms and conditions.

- Other frequently asked questions

You might also be interested in

How to activate your hsbc credit card , supplementary card , hsbc current account , hsbc visa platinum online credit card , disclaimer .

- HSBC TravelOne Credit Card Reward Points Programme terms and conditions apply.

Find Accommodations in Moscow

Find a great place to stay in Moscow using the categories below, or search our website for Moscow Hotels .

Agoda can also help you find things to do in Moscow . Explore the city, discover important landmarks, points of interest and more!

Top trending hotels in Moscow:

- Sunflower River Hotel Moscow

- Area: Southern Suburbs

- 7.445 Very good

- AZIMUT Hotel Smolenskaya Moscow

- Area: Arbat

- 9.082 Exceptional

- Izmailovo Beta Hotel

- Area: Eastern Surburbs

- 8.160 Excellent

- Metropol Hotel Moscow

- Area: Tverskoy

- 9.030 Exceptional

- Novotel Moscow City Hotel

- Area: Presnensky

- 8.869 Excellent

- Hilton Moscow Leningradskaya

- Area: Krasnoselsky

- 8.426 Excellent

- Imperia City Hotel

- 8.064 Excellent

- Area: North-Eastern Suburbs

- 8.487 Excellent

Moscow hotels by neighborhood:

- Other Hotels

- Domodedovo Hotels

- Presnensky Hotels

- Sheremetyevo Int'l Airport Hotels

- Tverskoy Hotels

- Tagansky Hotels

- Domodedovo International Airport Hotels

- Vnukovo International Airport Hotels

- Khimki Hotels

- Arbat Hotels

- Zamoskvorechye Hotels

- Meshchansky Hotels

- Khamovniki Hotels

- Basmanny Hotels

- Krasnoselsky Hotels

- Yakimanka Hotels

- Lobnya Hotels

- North-Western Suburbs Hotels

- Southern Suburbs Hotels

- South-Eastern Suburbs Hotels

- South-Western Suburbs Hotels

- Western Surburbs Hotels

- Eastern Surburbs Hotels

- North-Eastern Suburbs Hotels

- North Suburbs Hotels

- Kotelniki Hotels

- Nekrasovka Hotels

- Odintsovo Hotels

Moscow 5-star hotels:

- Sheraton Palace Hotel, Moscow

- Hotel Baltschug Kempinski Moscow

- Golden Ring Hotel

- Swissotel Krasnye Holmy Moscow

- Golden Apple Boutique Hotel

- Hotel Savoy Moscow

- Peter 1 Hotel

- Moscow Marriott Royal Aurora Hotel

- Hotel National Moscow

- Mamaison All-Suites Spa Hotel Pokrovka

- Carlton, Moscow

- Moscow World Trade Centre

- Lotte Hotel Moscow

- Radisson Collection Hotel Moscow

- Moscow Tverskaya

- Mistral Hotel and Spa

- Petroff Palace Boutique Hotel

- Russo-Balt Hotel

- Moscow Nikolskaya

- Park-Hotel Orlovsky

- Nabat Palace Hotel

- Sheremetyevo Airport Hotel

- Imperial Park Hotel & Spa

- Barvikha Hotel & Spa

- The Rooms Boutique Hotel

- Radisson Blu Hotel Moscow Sheremetyevo Airport

- Moscow Grand Hotel

- Four Seasons Hotel Moscow

- Hotel Novy Arbat

- Ararat Park Hyatt Moscow

- Hyatt Regency Moscow Petrovsky Park

- Seasons Boutique Hotel

- Crowne Plaza Moscow - Park Huaming

- Moss Boutique Hotel

- Hotel at the Rhythmic Gymnastics Center Irina Viner- Usmanova

- StandArt Hotel Moscow. A Member of Design Hotels

- Diamond Apartments Hotel

- Radisson Blu Olympiyskiy Hotel, Moscow

- Golden Rooms Hotel

- Mövenpick Moscow Taganskaya

IMAGES

COMMENTS

Terms and conditions for the HSBC TravelOne Credit Card Programme apply. The additional Reward points are capped at a maximum of 20,000 additional Reward points for foreign currency spend; 10,000 additional Reward points for local travel spend (hotel, airlines and travel agencies); and 10,000 additional Reward points for local dining spend as ...

As a HSBC Premier customer, you can enjoy exclusive discounts on selected hotels worldwide when you book with Agoda. Whether you are looking for a relaxing getaway, a cultural adventure or a business trip, you can find the perfect hotel for your needs and budget. Visit the designated URL or the Agoda app to see the promo eligible hotels and the terms and conditions of the offer.

Details of the Promotion are as follows: 7% discount on all destinations, applicable to booking for all HSBC credit/debit cards during the below period. Hotel bookings made directly through the Agoda website will not be eligible for the offer and refund will not be arranged. Offer is only valid for HSBC credit card/i issued in Malaysia only.

Enjoy exclusive discounts on worldwide hotel bookings with HSBCHK - Agoda. Whether you are looking for a romantic getaway, a family vacation or a business trip, you can find the best deals and offers on Agoda. Book now and save more with your HSBC credit card.

Getting an HSBC TravelOne credit card 1 can make it easy to earn rewards you can redeem as air miles with your favourite airlines, as well as unlocking extras like discounts on Agoda and curated Mastercard travel perks.. Not sure if this is the card for you? Join us as we explore, looking at the HSBC TravelOne card annual fee, interest and charges, as well as the benefits you can expect in return.

To apply for an HSBC TravelOne card, you must be aged 21 or above and have a minimum annual income of: SGD30,000, if you're a Singaporean or Permanent Resident. SGD40,000, if you're a self-employed or commission-based Singaporean or Permanent Resident. SGD40,000, if you're a foreigner residing in Singapore.

10.The qualifying and participating cardholders are bound by the terms and conditions of Agoda and HSBC Singapore. In case of dispute, the decision of HSBC & Agoda shall be final. ... Agoda is part of Booking Holdings Inc., the world leader in online travel & related services. as-pc-3f-agoda-front-end-cron-bot-68f58b8cb5-bxxsw ...

16th May 2023 - 4 min read. HSBC Malaysia has launched a brand new travel credit card called the HSBC TravelOne. As a key differentiator, the card offers possibly the widest range of partner redemptions in Malaysia, covering a whopping 17 airlines and four hotel chains. The HSBC TravelOne credit card offers two major features that aims to ...

The HSBC TravelOne Card local spend earn rates are average at best —there are miles cards with lower local earn rates, such as the BOC Elite Miles World Mastercard, which clocks in at just 1 mile per dollar (mpd).. However, the HSBC TravelOne Card's foreign spend earn rates are above average.The only other miles credit card out there with a comparable rate is the UOB PRVI MASTERCARD Miles ...

Key Features. Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app. Accelerated earn rate: up to 2.4 miles for your spending. Travel privileges: Complimentary travel insurance coverage (including COVID-19), 4 x complimentary airport lounge visits for primary cardholders and more.

Travel in style. Redeem your Reward points at a wide variety of airline and hotel partners, quickly and easily through the HSBC mobile banking app. Enjoy 4 complimentary airport lounge visits a year to over 1,300 global airport lounges (for primary cardholders only) - register now. 12% discount for AGODA travel service booking service.

b. are one of the travellers and the name used to book the hotel(s) is the same as shown on your Eligible Credit Card; and ... Terms and conditions for Exclusive Agoda 15% off discount for HSBC EveryMile Credit Card. ... Agoda is part of Booking Holdings Inc., the world leader in online travel & related services.

This travel insurance includes travel medical expenses and travel inconveniences like flight and baggage delays, baggage loss, COVID-19, etc. Terms apply. Exclusive year-long deals on Agoda; Valid for the booking period until 31 March 2024, enjoy a 10% Agoda discount on worldwide hotel booking with your HSBC TravelOne credit card.

HSBC normally requires cardholders to join its Mileage Programme to convert points, which costs S$43.20 a year for unlimited conversions to Asia Miles or KrisFlyer. You only pay one fee, regardless of how many HSBC cards you have. With the TravelOne Card, all conversion fees are waived till 31 December 2023.

15% off worldwide hotel bookings. Terms and conditions: The Promotion is available to the qualifying and eligible cardholders of HSBC credit cards issued in Singapore. Discount will be reflected at the payment page after keying in valid card details and payment must be made with a HSBC credit card in order to enjoy the Promotion.