Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Full List of American Express Card Customer Service Numbers [2024]

Christy Rodriguez

Travel & Finance Content Contributor

87 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

30 Published Articles 3095 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1170 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![amex travel customer service usa Full List of American Express Card Customer Service Numbers [2024]](https://upgradedpoints.com/wp-content/uploads/2021/01/customer-care-representative.jpeg?auto=webp&disable=upscale&width=1200)

American Express Personal Card Customer Service Numbers

American express business card customer service numbers, american express corporate cards customer service numbers, american express travel and membership rewards customer service numbers, american express customer service alternate methods of contact, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you want to contact American Express Customer Service regarding your personal, business, or corporate card, you’ve come to the right place. Whether you want to make a payment, apply for a new card, dispute a fraudulent charge, or simply have questions about your account, you can use the following customer service phone numbers.

The best number to call may vary depending on the purpose of your call, so we’ve broken out some common areas of concern. We’ve also included some alternate contact methods so you can choose the best way to get in touch with American Express. That said, the general customer service line is always a good place to get started.

If you need to talk to someone regarding one of the Amex credit cards , you’ll want to use the phone numbers in this section.

Customer Service for Personal Cards: 800-528-4800 or contact the number on the back of your card for the following American Express personal cards:

- American Express Cash Magnet ® Card *

- American Express ® Gold Card

- American Express ® Green Card *

- The Amex EveryDay ® Credit Card *

- The Amex EveryDay ® Preferred Credit Card *

- Blue Cash Everyday ® Card from American Express

- Blue Cash Preferred ® Card from American Express

- Delta SkyMiles ® Blue American Express Card

- Delta SkyMiles ® Gold American Express Card

- Delta SkyMiles ® Platinum American Express Card

- Delta SkyMiles ® Reserve American Express Card

- Hilton Honors American Express Aspire Card *

- Hilton Honors American Express Card

- Hilton Honors American Express Surpass ® Card

- Marriott Bonvoy Brilliant ® American Express ® Card

- The Platinum Card ® from American Express

* All information about these cards has been collected independently by Upgraded Points.

Hot Tip: This list includes all cards that American Express currently issues. If you hold a card that is not listed, you are still able to call the phone numbers listed or call the number listed on the back of your card for assistance.

To Report Lost or Stolen Card, Fraud, or Dispute a Charge: 800-528-4800

Make Payments by Phone: 800-472-9297

Apply for a Card: 888-297-1244

Check Application Status: 877-239-3491

Verify Card: Call the number listed on the activation sticker or verify receipt online

If you have an American Express business card , this is the section you’ll want to use.

Customer Service for Business Cards: 800-492-3344

- Amazon Business American Express Card*

- Amazon Business Prime American Express Card *

- The American Express Blue Business Cash™ Card

- American Express ® Business Gold Card

- The Blue Business ® Plus Credit Card from American Express

- Business Green Rewards Card from American Express *

- The Business Platinum Card ® from American Express

- Delta SkyMiles ® Gold Business American Express Card

- Delta SkyMiles ® Platinum Business American Express Card

- Delta SkyMiles ® Reserve Business American Express Card

- The Hilton Honors American Express Business Card

- Lowe’s Business Rewards Card from American Express *

- Marriott Bonvoy Business ® American Express ® Card

- The Plum Card ® from American Express

Hot Tip: If you have a card that is not listed, you can still call the phone numbers listed or refer to the number listed on the back of your card for assistance — this just means that your card may no longer be open to new applicants.

To Report a Lost or Stolen Card, Fraud, or Dispute a Charge: 800-528-4800

Apply for a Card: 800-519-6736

Verify Card: Call the number listed on the activation sticker or verify receipt online

If you hold a corporate card that your employer manages, these are the customer service numbers you’ll want to reference.

General Customer Service for American Express Corporate Cards: 800-528-2122

- American Express ® / Business Extra ® Corporate Card*

- American Express ® Corporate Gold Card*

- American Express ® Corporate Green Card*

- Corporate Platinum Card ® by American Express*

Platinum Customer Service: 800-492-3932

Bottom Line: We’ve included the numbers for cardholders only. If you’re a Program Administrator, you’ll need to call 888-800-8564 for customer service support.

If you’re looking to book or change travel through American Express or have questions about your Membership Rewards account , here are some good numbers to use.

Reservations for Air, Hotel, and Car Rentals:

- Inside the U.S.: 800-297-2977

- Outside the U.S.: 312-980-7807

Reservations for Cruises: 800-297-5627

Membership Rewards Customer Service Number: 800-297-3276

Company Website: americanexpress.com

General Inquiries Mailing Address: American Express P.O. Box 981535 El Paso, TX 79998-1535

Payment Mailing Address: American Express P.O. Box 650448 Dallas, TX 75265-0448

Customer Login: global.americanexpress.com/login

Secure Chat: Log into your American Express account and click the blue Chat box in the bottom right corner. This secure chat function will allow you to speak with an American Express representative.

Twitter: Tweet questions to @AskAmex

Facebook: Send messages via Facebook

In the event you need to contact American Express, you can use this post as a resource. It includes the various ways you can contact American Express, including by phone, chat, and social media. And could come in handy if you need to do things like make a payment, dispute a charge, or even apply for a new card.

The information regarding the Amazon Business American Express Card, American Express ® / Business Extra ® Corporate Card, American Express ® Corporate Gold Card, and American Express ® Corporate Green Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

The information regarding the American Express Cash Magnet ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the American Express ® Green Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information for The Amex EveryDay ® Credit Card has been independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the The Amex EveryDay ® Preferred Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Hilton Honors American Express Aspire Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Business Green Rewards Card from American Express was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here . For rates and fees of the Blue Cash Everyday ® from American Express, click here . For rates and fees of the Blue Cash Preferred ® Card from American Express, click here . For rates and fees of the Delta SkyMiles ® Blue American Express Card, click here . For rates and fees of the Delta SkyMiles ® Gold American Express Card, click here . For rates and fees of the Delta SkyMiles ® Platinum American Express Card, click here . For rates and fees of Delta SkyMiles ® Reserve American Express Card, click here . For rates and fees of the Hilton Honors American Express Card, click here . For rates and fees for The Hilton Honors American Express Surpass ® Card, click here . For rates and fees of the Marriott Bonvoy Brilliant ® American Express ® card, click here . For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of the Amazon Business Prime American Express Card, click here . For rates and fees of The American Express Blue Business Cash™ Card, click here . For rates and fees of the American Express ® Business Gold Card, click here . For rates and fees of The Blue Business ® Plus Credit Card from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of the Delta SkyMiles ® Gold Business American Express Card, click here . For rates and fees of the Delta SkyMiles ® Platinum Business American Express Card, click here . For rates and fees for the Delta SkyMiles ® Reserve Business American Express Card, click here . For rates and fees of The Hilton Honors American Express Business Card, click here . For the rates and fees of the Lowe’s Business Rewards Card from American Express, click here . For rates and fees of the Marriott Bonvoy Business ® American Express ® Card, click here . For rates and fees of The Plum Card ® from American Express, click here .

Frequently Asked Questions

Does amex have live chat.

American Express has a live chat feature that allows you to speak directly with an American Express representative 24/7.

To access this chat, log on to your American Express account and click the blue Chat box in the bottom right corner. American Express suggests doing this from a desktop for the best results.

What is the number for American Express customer service?

American Express has a few customer service lines depending on your card type:

- Personal cards — 800-528-4800

- Business cards — 800-492-3344

- Corporate cards — 800-528-2122

You can also contact the number on the back of your card as well.

How do I dispute a charge on my American Express card?

Once you see a charge on your card that you don’t recognize or see charges for services you believe are incorrect, you’ll want to contact American Express customer service immediately. Whether you have a personal, business, or corporate card, the best number to call is 800-528-4800 .

You can also log on to your account and do the following:

- Visit Account Services

- Select Inquiry and Dispute Center from the side menu

- Click on Open a Billing or Payment Dispute

How do I verify my American Express card?

Once you receive your new American Express card in the mail, you’ll have to confirm that you’ve received it for it to be activated. You can confirm receipt online or by calling the phone number listed on the sticker on the front of your new card.

With either method, you’ll need to provide the card number and 4-digit security code.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex travel customer service usa American Express Green Card — Full Review [2023]](https://upgradedpoints.com/wp-content/uploads/2018/03/American-Express-Green-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

The complete guide to the Amex Travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 7:39 a.m. UTC Feb. 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

onurdongel, Getty Images

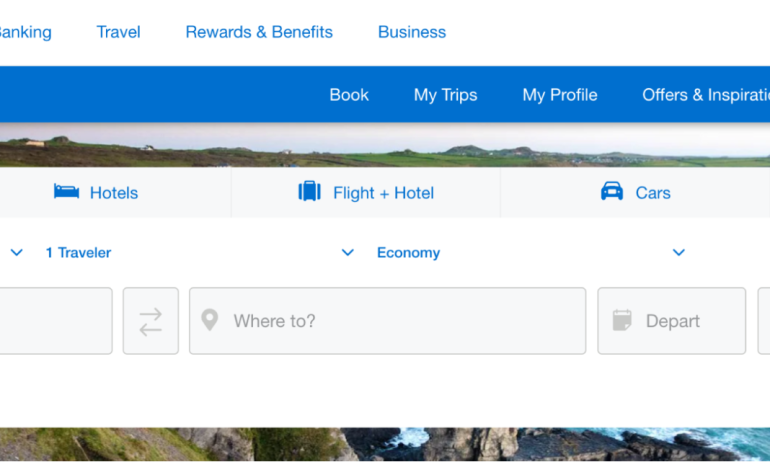

The American Express Travel portal offers valuable benefits to American Express cardholders, including special prices. Depending on which card you hold, you may also be able to pay for travel with Membership Rewards® points and get access to perks such as discounted airfare and specialty benefits at luxury hotels. Let’s take a look at how the Amex Travel portal works, whether the benefits are worthwhile and who can access Amex Travel’s website.

- American Express Travel offers hotels, vacation rentals, flights, rental cars and cruises.

- Luxury hotel benefits and discounted airfare are two benefits of booking through Amex’s travel portal.

- American Express cardholders can access Amex Travel.

How to book travel through the Amex Travel portal

Booking travel through the Amex Travel portal requires you to have an online account associated with an Amex card. While you can complete a search on the Amex Travel website without logging in, you will need to do so in order to make a booking.

After you choose whether to book a flight, hotel, vacation rental, vacation package, rental car or cruise, you’ll need to enter your travel details.

For example, if you want to book a flight through Amex Travel, you’ll need to put in your departure airport and destination as well as your dates of travel. The site will then bring up a list of matching results.

You can filter based on when the flights take off as well as how many stops you’re willing to tolerate, among other options.

The Amex Travel site offers a wide variety of hotel stays and flights, but you’ll always want to double check elsewhere before booking since it doesn’t always feature every option.

Once you’ve selected a booking, you’ll be taken through the checkout process. This includes providing your personal information and can also include seat requests and adding in loyalty program numbers.

To pay for your booking, you can use your American Express Membership Rewards, if you have a card that earns them, or your American Express card or a combination of both.

After you’ve booked, you’ll receive a confirmation email containing your reservation information. You can also find your bookings under the My Trips section of Amex Travel.

Who can use the portal?

Any American Express cardholder can use the Amex Travel portal to book travel. But those whose cards don’t earn Amex Membership Rewards points will need to pay with their Amex card.

However, many American Express cards earn Membership Rewards points that can be redeemed for travel through the Amex Travel portal. These cards include (terms apply):

The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

All information about American Express® Green Card, Amex EveryDay® Credit Card, The Business Platinum Card® from American Express and American Express® Business Gold Card has been collected independently by Blueprint.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Welcome Bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card Details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Is the portal worth using?

The Amex Travel portal can be worth using in certain cases, though it won’t always make sense. For example, some flights aren’t bookable via Amex Travel, so if what you need isn’t available you’ll want to look elsewhere.

That being said, those with certain cards are entitled to exclusive benefits that can lower prices or allow them to redeem points for travel. There are also perks for booking luxury hotels within the portal. In these cases, Amex Travel is definitely worth investigating.

How to maximize your Amex Travel benefits through the portal

International airline program.

Available to those who hold a high-end American Express card, including The Platinum Card from American Express, The Business Platinum Card from American Express and the American Express Centurion Black Card * The information for the American Express Centurion Black Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , the International Airline Program (IAP) can save you money on certain international flights booked via the Amex Travel portal.

All information about American Express Centurion Black Card has been collected independently by Blueprint.

This benefit is only available on tickets booked in premium economy, business or first class, but the savings can be significant.

For example, we looked at a round-trip flight in premium economy from San Francisco (SFO) to Tokyo (NRT). Booking with Japan Airlines (JAL) directly resulted in a cost of $4,431.40, while the Amex Travel portal and the IAP charged just $3,797.40 for a savings of over $600.

Fine Hotels + Resorts ® and The Hotel Collection

American Express also offers the Fine Hotels and Resorts and The Hotel Collection to eligible cardholders.

Fine Hotels and Resorts allows guests to book luxury hotels with special benefits. These include room upgrades, complimentary breakfast, an experience credit, late check-out, early check-in and more.

The Hotel Collection offers similar but less exorbitant benefits. It’s directed toward more midscale properties and includes an experience credit as well as a room upgrade.

35% rebate on redeemed points

Those who hold The Business Platinum Card from American Express are able to get a 35% rebate on points redeemed for eligible flights booked through the Amex Travel portal (up to 1,000,000 points per calendar year).

Eligible flights include all fare classes on an airline that you select each year. It also includes first and business class tickets on any airline.

Quick guide to Amex Membership Rewards

American Express Membership Rewards are the points you earn with eligible Amex cards. These highly flexible and valuable points can be redeemed in a number of ways, though they tend to be most valuable when transferred to Amex airline partners.

Other ways of redeeming Amex points include:

- Gift cards.

- Travel booked via Amex Travel.

- Online shopping.

- Statement credits.

While these are nice options to have, you’ll generally get much less value from your Membership Rewards points by redeeming them in these ways. Finally, although you can redeem your points in the Amex Travel portal, this isn’t necessarily a good idea if you aim to reap maximum value. Even if you’re taking advantage of the 35% rebate on redeemed points for flights, you’ll only ever receive a value of 1.54 cents per point. This is lower than you’d expect when transferring your Amex points to many airline and hotel partners.

Frequently asked questions (FAQs)

No, travel insurance is not automatically included when booking through the Amex portal. But many of the best credit cards feature complimentary travel insurance when using your card to pay, including those from American Express. Otherwise, you may be able to opt in to travel insurance during the booking process or via a third party provider.

Those with the The Platinum Card from American Express can earn 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per calendar year, 5 points per $1 on prepaid hotels booked with American Express Travel and 1 point per $1 on other purchases. The card has an annual fee of $695 ( rates & fees ).

Those with the The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , meanwhile, earn 5 Membership Rewards points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases. The card has a $695 annual fee.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

The phone number for American Express Travel is: 1-800-297-2977.

The number of Amex points that you’ll need to redeem for a flight will depend on the cash cost of your flight and whether you’re booking through Amex Travel or transferring your Membership Rewards points to an Amex airline partner. Amex Points are worth about one cent when booking flights through the portal, so a flight that costs $500 in cash would require about 50,000 Amex points. You’ll typically get a better deal with transfer partners than booking through the portal.

For rates and fees for The Platinum Card® from American Express please visit this page .

*The information for the American Express Centurion Black Card, American Express® Business Gold Card, American Express® Green Card, Amex EveryDay® Credit Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

How to do a balance transfer with Discover

Credit Cards Louis DeNicola

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

Credit Cards Lee Huffman

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

How to use the Citi trifecta to maximize your rewards

Credit Cards Ryan Smith

Hilton Honors American Express business card unveils new profile, plumps up annual fee

Why my Citi Double Cash Card keeps getting better

Is the Citi Premier worth the annual fee?

Credit Cards Juan Ruiz

6 little known perks of the Citi Custom Cash Card

Credit Cards Harrison Pierce

How to Use American Express Travel

Julie Tremaine

October 4, 2023

Going has partnered with CardRatings for our coverage of credit card products. Going and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses, and recommendations are the author's alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of all of the card offers that appear on this page are from advertisers; compensation may affect how and where the cards appear on the site; and Going does not include all card companies are all available card offers.

Since American Express introduced the traveler’s cheque in 1891, the company has been an invaluable resource to travelers domestically and abroad. One of the best of those resources: AmexTravel.com, a travel booking site for hotels, airline tickets and rental cars. Though the company offers points perks and member pricing to American Express cardholders, anyone can book on the site, not just members.

Many AmEx cards have travel perks, with different levels of points awarded for cards like the entry-level American Express Green and mid-tier Gold. The American Express Platinum, a premium card with a high annual fee of $695, offers the highest level of rewards. For all levels of card, the company offers baggage insurance, rental car insurance, trip delay insurance and a 24-hour global traveler’s assistance line (terms and conditions apply). (In addition to standard AmEx cards, the company also offers partnership cards with Delta, Hilton and Marriott.)

It’s simple to use: navigate to AmexTravel.com and enter search terms like you would on any other airline site or travel aggregator like Orbitz or Expedia. Once there, you’ll find special member pricing, incentives to use points, and easily accessible, customer-first customer service.

Earning Amex Travel points

American Express cardholders earn points through purchases, which can be redeemed for anything from gift cards to premium retailers like Saks Fifth Avenue and Nordstrom to cash off your current balance due. (I don’t recommend that—you’ll get much better value for your points redeeming for travel.)

Each level of AmEx earns points on purchases, and the higher tier cards offer progressively more points, especially on travel. In addition, there are rotating deals you can add to your card periodically at specific retailers, managed through the website.

Among other ways to earn points, Green cardholders earn 3x points on transactions involving restaurants, travel and transit. In addition to the traveler insurance offered to all cardholders, Green cardholders receive a $100 credit towards CLEAR Plus, and a $100 credit towards LoungeBuddy purchases. This card is $150 annually. Terms and conditions apply.

Travel-specific points earning for American Express Gold cardholders includes 4x points on restaurants and 3x points on flights booked through AmEx Travel.

In addition, card_name holders of the get access to member pricing of the Hotel Collection, a select group of hotels on the travel site. This card is $250 annually. Terms and conditions apply.

card_name earn 5x points on flights up to $500,000 per calendar year and prepaid hotels through AmEx Travel, among other points earning.

Amex Platinum cardholders have a significant increase in travel perks, including a $200 annual airline fee credit, a $200 annual hotel credit, and a dedicated Platinum customer service line.

When Platinum cardholders book select hotels from the Fine Hotels Collection, guests have access to room upgrades, early 12pm check in and 4pm late check out when available, in addition to on-site perks like free breakfast for two and a $100 property credit. Terms and conditions apply.

All travel purchases can be made with cash or points on AmEx Travel. Some prices are offered as daily deals to members for even lower cost when purchased with points.

The American Express Travel portal

The user-friendly travel portal works like any other airline or travel aggregator website: choose the thing you want to search for (hotel, airline tickets, flight + hotel packages, rental cars and cruises) then select from options.

There are some downsides, though. When booking airline tickets through AmEx Travel, seat assignments are considered “requests” and not always honored. I’ve recently had American Airlines not honor that request and leave me with an unassigned seat at 24-hour check in, meaning I had to pay $35 to guarantee an assigned seat.

Another downside is the hotel search function. There are usually plenty of options in a given hotel search—but sometimes, when there is a limited selection of participating hotels in a given area, the site will offer hotels 50+ miles away and not make it immediately clear that the options are far away from the desired area. American Express only gets a designated number of rooms, too, so sometimes a hotel site will have options that AmEx doesn’t have.

And of course the biggest downside is that, should something go wrong, you may end up not being able to work with the hotel or airline directly since your flight or hotel was booked with a third party.

Benefits of using Amex Travel to book your trip

Often, prices for plane tickets and for basic hotel accommodations are within a few dollars of each other through AmEx Travel or on the direct booking site—but if you pay with an American Express card and book on Amex Travel, you’ll earn a significantly higher point reward.

One of the major upsides to the Platinum card is that cardholders get status with Marriott Bonvoy and Hilton Honors, which means they can book lower-tier rooms and generally be upgraded at least one room level at check in. (This is not guaranteed, but in more than 50 hotel bookings over the past few years, I’ve never not been offered an upgrade.) (Terms and conditions apply.)

Additionally, you can stack points programs: pay in full with your card to get 3x or 5x points, and earn points through Bonvoy and Hilton Honors. The same goes with rental cars. With Hertz, Platinum cardholders are given status that guarantees an upgraded level of car, allowing you to book a less expensive option and receive a better rental. You can also skip the line at the counter and go directly to your car. (Terms and conditions apply.)

All cardholders get significant traveler perks. Airline baggage insurance will reimburse up to $500 for lost checked luggage and $1250 for lost carry-ons. Rental cars paid in full with American Express cards are entitled to damage and loss insurance—but not liability insurance—that allows you to waive the add-on damage insurance through the car rental service. (Terms and conditions apply.)

The Amex Travel International Airline Program

Platinum and Platinum Business cardholders have access to the International Airline Program. This benefit includes access to lower prices on premium airline tickets such as business and first class seats. According to American Express, cardholders save an average of $600 per first class ticket, $300 per business class ticket and $150 on premium economy fares. While the prices aren't quite as low as what we frequently see on Going (our alerts save members an average of $2,000 per roundtrip in business class , they can be a great deal when deals are scarce).

Twenty-five partner airlines include Delta, KLM, Lufthansa, British Airways, Air France, Emirates and Virgin Atlantic. Platinum cardholders earn 5x points on these purchases. When Platinum Business cardholders purchase airfare with points, they can earn a 35% points rebate.

If you see a great deal from Going, it’s worth checking the price on Amex to see if there’s an additional discount.

Booking hotels and resorts on Amex Travel

American Express Travel offers a lowest rate guarantee: if you book on AmEx Travel and see a lower price elsewhere, you can file a claim for a refund of the difference.

Though the Fine Hotels Collection offers higher room rates at nicer hotels, those rooms can sometimes be a better deal than lower-tier hotels, given the extra time at the resort, room upgrade, free breakfast and property credit. This is especially true for last-minute deals.

I recently snagged a Fine Hotels room at the NoMad Las Vegas, normally around $500 per night, for $160. At check-in I was given a suite on one of the highest floors instead of the standard room I booked, and there was a bottle of wine waiting for me in the room. I also got early check in and late check out, free breakfast for two every morning and a $100 property credit good at the entire complex (NoMad is part of Park MGM). When all was said and done, the perks were more valuable than the room, which paid for itself in added value.

Trip cancellation and insurance

Some levels of American Express card come with trip delay insurance and trip cancellation and interruption insurance, which vary by card, including the Centurion Card, Platinum, and Delta, Hilton, and Marriott cards. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Frequently asked questions about American Express Travel

Going has partnered with CardRatings for our coverage of credit card products. Going and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses, and recommendations are the author's alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of all of the card offers that appear on this page are from advertisers; compensation may affect how and where the cards appear on the site; and Going does not include all card companies are all available card offers.

Freelance Writer

Published October 4, 2023

Last updated January 22, 2024

Articles you might like

Amex Transfer Partners: Guide to American Express Membership Rewards

Mar 11, 2024

Best Travel Credit Cards of 2024

Mar 19, 2024

Credit Card Transfer Bonuses in April 2024

Apr 4, 2024

Treat your travel to cheap flights

Most deals are 40-90% off normal prices with great itineraries from the best airlines. If it's not an amazing deal, we won't send it. Sign up for free to start getting flight alerts.

Expensivity

Exploring the world of money and finance

How can I contact American Express Customer Service?

It’s easy to connect with an American Express Representative by phone. Personal credit card users can access 24/7 support by calling 1-800-528-4800. You can also correspond online with American Express Customer Service representatives 24/7 by logging into your existing account dashboard or through your mobile app and clicking on the “Chat” icon in the bottom corner of your home screen.

American Express’s customer service is noted for its general excellence. Account holders typically report high levels of satisfaction with their customer service experiences. One reason is because American Express offers its customers a variety of ways to get in touch. Customers may connect with representatives by:

- Online Chat

- Social Media

In order to access many of these channels, you must be an American Express account holder. Not yet an American Express account holder? Find out how likely you are to qualify .

Otherwise, read on to learn more about connecting with American Express Customer Service.

How can I get the fastest customer service?

The fastest way to get customer service is to call the phone number connected to your specific account type. American Express customer service makes it easy to connect with live human help by channeling accounting holders to specific customer services departments. So for the most efficient help, your best bet is to check out the American Express directory of numbers.

You’ll find contact numbers for every type of credit card that American Express offers along with hours of availability, options for hearing impaired customers, and alternative automated calling systems if you just wish to make payments over the phone.

American Express offers unique phone numbers for Personal Cards, Corporate Business Accounts (1-800-528-2122), Traveler Rewards Cards (1-800-297-2977) and Membership Rewards Cards (1-800-297-3276). But really, that’s just the tip of the iceberg.

The phone numbers listed in the American Express customer services directory include specific departments for small businesses, merchants, and those who use AmEx for their accounts payable solutions. You can also find specific phone numbers for booking cruises, managing personal loans, and much more.

Still shopping around for the right American Express Card? Check out this list of 30 questions you should ask before settling on the right credit card offer for you.

How can I contact American Express customer service online?

You may contact American Express Customer Service online using the “Chat” feature on your American Express website account dashboard. In order to use the Chat feature, you must be an account holder with access to your online account portal. If you already have an American Express card, but you have not yet created an online account, you can register here .

Once you have created an account, you will not only be able to manage payments, request higher credit limits, redeem rewards and and replace lost or stolen cards through your online dashboard, but you will also be able to use the online “Chat” feature to contact 24/7 customer service. Simply locate the “Chat” icon on the bottom of your homepage to initiate a conversation.

How can I connect with American Express Customer Service using my mobile app?

Once you have an American Express account, you’ll want to grab the AmEx mobile app for your smartphone or tablet. The mobile app gives you the power to manage your account, make payments, request credit limit increases, and replace lost or stolen cards all while on the go. And the mobile app also offers direct access to a 24/7 Chat feature. Find the “Chat” icon on the top right corner of your mobile app, click it, and connect with American Express customer service.

How can I connect with American Express on Social Media?

American Express also invites its customers to reach out directly through a number of leading social media channels in order to engage on a variety of topics. Customers may use these channels to engage directly with public facing company representatives.

For instance, American Express has a publicly accessible Facebook page on which customers are free to share their views–both positive and negative–on the company, their experiences as customers, and their views on the company’s policies writ large. A quick scan of comments on the page shows that American Express representatives are highly responsive to customer feedback of all shapes and sizes.

At one time, American Express also operated a Twitter page called Ask AmEx. This page is no longer active, instead directing visitors, “For Amex service, please contact us directly by phone, app or at http://amex.co/contactus .”

And in general, American Express strongly advises its customers to reach on through more private channels to address personal customer service matters. According to its own community service guidelines, “For customer care inquiries specific to your account, please call the number on the back of your Card, chat with us on americanexpress.com or within our mobile app . If you have a Card issue from an American Express Network Partner, please contact your issuer by calling the number on the back of your Card.”

How can I contact American Express Customer Service by mail?

You may contact American Express Customer Service by mail. If this is your preferred form of correspondence, you may send communications, forms, and documents to the following address:

American Express P.O. Box 981535 El Paso, TX 79998-1535

Protect Your Privacy

Before corresponding and transmitting personal information through any of these channels, be sure that you’ve taken all the appropriate steps to protect your privacy, your identity, and your account information. American Express stresses the importance of protecting your privacy, especially when corresponding through its social media channels.

In its Community Guidelines statement , American Express advises account holders to “protect your privacy and don’t share personal information about you, your family, or others on the American Express Facebook page. For example, you should never post your Card number, Social Security Number, phone number, or other non-public personal information about yourself or anyone else.”

While it may seem obvious that you shouldn’t share your Social Security Number on Facebook, there are plenty of far less obvious ways that identity thieves, hackers, and credit card scammers can steal your information. To learn more, and keep yourself safe, check out our list of ten ways you can protect yourself against credit card fraud.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience the American Express website and to log in to your account.

Welcome to the Help Center

How can i contact american express when traveling overseas/internationally.

If you're a US Card Member traveling internationally, you can chat with us anytime through your online account .

You can also call us collect by asking the operator to use the access code for the country you're in + 336-393-1111. If you're using a cell phone, your service provider may charge you for using minutes or for roaming charges.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to the AmEx Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use the American Express Travel portal?

Benefits of booking travel on amex travel, how to book travel in the portal, is travel insurance included when booking through amex travel, downsides of booking via amex travel, final thoughts on the amex travel portal.

The American Express Travel portal is similar to many other online booking sites in that it allows you to purchase flights, hotels and other travel reservations. The main difference is that only those who hold an American Express card can use it.

Certain cards come with additional perks for booking in the portal. For instance, some AmEx cards allow travelers to earn extra points for bookings, receive a 35% points rebate, pay for a portion of the reservation with points, get room upgrades and more. Terms apply.

Here's a look at what the AmEx Travel portal offers and how to use it to maximize your benefits.

American Express Travel flights, hotels and other reservations are available for American Express cardholders. Depending on which American Express card you have, you may earn additional points on your reservation or unlock additional features. Terms apply.

For example, The Platinum Card® from American Express cardholders earn 5x points on flights booked directly with an airline or through AmEx Travel and 5x points on prepaid hotels booked through AmEx Travel. They also have access to the Fine Hotels & Resorts collection through the travel portal. Additionally, American Express® Gold Card and The Platinum Card® from American Express cardholders can book room reservations with The Hotel Collection . Terms apply.

Here are eight reasons why booking with AmEx travel could be a good idea.

1. Earn up to 5x points

When you book flight through the AmEx Travel portal, your credit card may earn additional points for the purchase. In addition, prepaid hotel reservations through the AmEx travel portal also earn extra points. These are a few of the cards that offer a bonus when making reservations through AmEx travel:

on American Express' website

• 5 points per $1 on flights booked directly with airlines or with American Express Travel, on up to $500,000 spent per year.

• 5 points per $1 on prepaid hotels booked with American Express Travel.

• 1 point per $1 on other eligible purchases.

Terms apply.

• 4 points per $1 at restaurant plus takeout and delivery in the U.S.

• 4 points per $1 at U.S. supermarkets (on up to $25,000 in purchases per year).

• 3 points per $1 on flights booked directly with airlines or with American Express Travel.

• 3 points per $1 on eligible travel purchases.

• 3 points per $1 on restaurants worldwide.

• 1 point per $1 on other purchases.

• 2 points per $1 on the first $50,000 in purchases each calendar year.

• 1 point per $1 on purchases above $50,000 in a calendar year.

» Learn more: AmEx Membership Rewards: How to earn and use them

2. Pay for reservations using Pay with Points

With American Express Travel, flights, hotels and more can be paid for with points instead of cash. Members can even choose to pay a portion of the trip with points and the rest with cash. Once your reservations have been booked, the full amount of your trip will be charged to your American Express credit card, and then a credit will be posted for the points redeemed within 48 hours.

You must redeem at least 5,000 points in order to use Pay with Points. Points are redeemed at a value of 1 cent per point when booking flights or making Fine Hotels & Resorts reservations. Other eligible travel receives only 0.7 cents per point. NerdWallet values Membership Rewards points at 2.8 cents per point if you take advantage of transferring to and booking through travel partners, so the redemption rates in the travel portal are significantly below our ideal value.

If you need to cancel your reservation, you'll receive a statement credit on your card for the cash equivalent. Members who would rather have the unused Membership Rewards points returned to their accounts must contact American Express customer service at 800-297-3276. Terms apply.

3. Upgrade flights with points

Eligible flights booked with cash can be upgraded using your American Express Membership Rewards points. You'll receive 1 cent per point credit towards the cost when upgrading a flight with points (which is again below our AmEx point valuation ).

To upgrade your flight with points, select your airline and provide your reservation details in the AmEx travel portal. You will be notified if your flight is eligible or not. If your flight is eligible, you can submit an offer to the airline for the upgrade. The airline will accept or reject your bid between one and five days of your flight's departure and you'll receive a decision via email.

If your upgrade offer is accepted, the points will be deducted from your account. Your statement will show a charge and a credit for the corresponding points.

» Learn more: You can now use AmEx points to bid on flight upgrades

4. Discounted international flights through AmEx IAP

Platinum cardholders have access to discounted flights through International Airline Program (IAP) , which allows members to book first, business and premium economy at a discount on select airlines and routes. Plus, you'll receive 5x Membership Rewards points on the booking when using your The Platinum Card® from American Express or The Business Platinum Card® from American Express to pay for the flight. Terms apply.

There are 25 airlines that participate in this program. You can book refundable and nonrefundable tickets for up to eight passengers through the IAP. Tickets can be paid with your card, points or a combination of the two. You will have to pay a $39 nonrefundable ticketing fee, however the discount received on these tickets should outweigh the fee.

5. Cancel For Any Reason insurance

CFAR is shorthand for an insurance policy that allows you to cancel your trip for any reason whatsoever and receive a refund. In May 2022, AmEx launched its own version of CFAR coverage for airfare booked through the travel portal using an AmEx card.

This feature, called Trip Cancel Guard, will get you up to a 75% reimbursement on nonrefundable airfare costs, provided you cancel at least two calendar days out from your departure. You'll need to purchase Trip Cancel Guard coverage at the point of booking and if you cancel, whether through the airline directly or through AmEx Travel, you can request reimbursement online or over the phone.

» Learn more: The guide to Cancel For Any Reason (CFAR) travel insurance

6. 35% points rebate with The Business Platinum Card® from American Express

When The Business Platinum Card® from American Express cardholder book flights using points through the AmEx travel portal, they can receive up to 35% of their points back . The benefit is available on first or business class flights on any airline and all economy flights with their chosen airline. This benefit provides up to 500,000 points back per calendar year.

However, as with all AmEx credits , it's not as straightforward as you may hope. You will have to designate the airline for the 35% rebate and the airline must be the same as the one chosen for the $200 airline incidental credit .

» Learn more: The best travel credit cards right now

7. Fine Hotels & Resorts

The Loews Portofino Bay Hotel at Universal Orlando. (Photo by Sally French)

Fine Hotels & Resorts (FHR) is a collection of resorts and benefits available only to Platinum Card members. There are over 2,000 properties worldwide that participate in this program. When making reservations with Fine Hotels & Resorts for one night or more, you'll receive the following benefits:

$200 statement credit provided once per year.

Noon check-in (when available).

Room upgrade upon arrival (when available).

Daily breakfast for two.

Guaranteed 4 pm late checkout.

Complimentary in-room WiFi.

Unique property benefit valued at least $100.

These benefits rival those that many travelers receive when booking directly with hotels to obtain elite status perks. Some locations also offer a last-night free benefit, depending upon when you make your reservation. And some of the best hotels to book using FHR credits offer especially-unique amenities.

For example, many theme park fans consider Loews Portofino Bay Hotel as the best FHR hotel in Orlando . That's because — on top of all the above benefits — guests receive complimentary Universal Express Unlimited ride access, which allows you to skip the lines inside the Universal theme parks .

8. The Hotel Collection

The Loews Sapphire Falls at Universal Orlando falls under The Hotel Collection. (Photo by Sally French)

AmEx Gold and Platinum cardholders receive elite status-level perks at more than 600 hotels worldwide. When you stay for two nights or more, you'll receive a $100 resort credit and an upgrade upon arrival (when available). In addition, you can use your AmEx Membership Rewards credit card to book and pay for your reservation entirely or partially with your points.

While you can book travel over the phone with an agent, it is often quicker and more convenient to make your reservations through the AmEx Travel portal.

Here's how to book travel in the American Express travel portal:

Go to americanexpress.com/en-us/travel/ .

Log in with your username and password.

Select flights, hotels, flight + hotel, cars, or cruises.

Enter your travel dates, cities and other relevant information.

Choose options based on your trip.

Pay with your American Express credit card, points, or a combination.

Since you need an American Express card to make reservations through AmEx travel, you may already hold a card that offers complimentary travel insurance . If you don’t get travel insurance perks through your AmEx card, you can purchase Trip Cancel Guard through when making your booking.

Trip Cancel Guard works similarly to CFAR in that it allows you to cancel your trip for any reason whatsoever and get up to a 75% reimbursement of your travel costs as long as the cancellation is made two full days before your trip.

What is the AmEx Travel cancellation policy?

When you book travel through the American Express travel portal, you may be eligible to cancel your reservation within 24 hours and get a full refund. However, the cancellation policy is determined by the airline.

As such, AmEx instructs travelers to refer to the cancellation policy on the itinerary or reach out to customer service with any questions. Terms apply.

There are many appealing reasons why travelers want to book reservations with the AmEx travel portal. However, there are some downsides as well. These are some of the most common reasons why you shouldn't:

Low value for your points. Redeeming points through the AmEx travel portal yields a value of 1 cent per point or less. That's at least a 50% reduction compared to our value of Membership Rewards points.

Complicated customer service. Resolving flight or hotel reservation issues becomes more complicated when you book through a third party such as AmEx travel. The airline or hotel blames the booking agency and may not immediately resolve the problem in some instances. However, providers have no scapegoat when you book direct.

No hotel elite status benefits or loyalty credits. Most hotels require you to book directly to receive elite status benefits, stay credits or earn points. For travelers looking to take advantage of their elite status or earn status for the next year, booking AmEx travel hotel reservations is not a good idea.

Despite the above policy, hotels booked through Fine Hotels & Resorts allow you to earn elite night credit and earn loyalty perks associated with your elite status level on any hotel reservations — regardless if you book in the portal or not.

The AmEx travel portal offers numerous benefits for all American Express cardholders. If you have a Membership Rewards credit card, you can pay for all or part of eligible travel reservations using your points.

And any portion that you pay with your Membership Rewards card can earn up to 5x points. AmEx Travel also offers two hotel collections that provide additional perks similar to elite status benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

How can we help you?

For personalized service, please tell us about your request:

Did you know?

Still need help.

You can call us at +1 (312) 279-7761 .

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Book a Flight

Where are you going, when are you going.

IMAGES

COMMENTS

If you have an eTicket Flight Credit from a flight originally purchased through AmexTravel.com, learn how to redeem it online. For further guidance on our travel FAQs, contact information, as well as travel advice, visit our American Express online travel help centre.

Print. < Back. American Express Customer Service is available for assistance with logging in, registration, User IDs and Password. Please call 1-800-AXP-1234, available 24 hours a day, 7 days a week.

Chat with a member of our support team. The current time is outside the available chat hours. Please call Customer Support at 1-888-656-4546, or 001-312-416-0018 from outside of the US.

Once you see a charge on your card that you don't recognize or see charges for services you believe are incorrect, you'll want to contact American Express customer service immediately. Whether you have a personal, business, or corporate card, the best number to call is 800-528-4800.

Those with the The Platinum Card from American Express can earn 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per ...

Booking Tools. Pre-negotiated rates and over 2 million options in accommodations. Those are just some of the many reasons why it's better booking through us. Explore business travel services from American Express Global Business Travel. Our 24/7 Proactive Traveler Care services can swiftly take care of everything.

Amex Platinum cardholders have a significant increase in travel perks, including a $200 annual airline fee credit, a $200 annual hotel credit, and a dedicated Platinum customer service line.. When Platinum cardholders book select hotels from the Fine Hotels Collection, guests have access to room upgrades, early 12pm check in and 4pm late check out when available, in addition to on-site perks ...

To cancel your reservation with American Express Travel in the US, you can do it online or by phone: Online: Go to the American Express Travel website. Log in. Find your reservation details. Look for the cancellation option and follow the instructions. Phone: Call American Express Travel at (800) 297-3276. Provide your reservation details.

It's easy to connect with an American Express Representative by phone. Personal credit card users can access 24/7 support by calling 1-800-528-4800. You can also correspond online with American Express Customer Service representatives 24/7 by logging into your existing account dashboard or through your mobile app and clicking on the "Chat ...

If you're a US Card Member traveling internationally, you can chat with us anytime through your online account.You can also call us collect by asking the operator to use the access code for the country you're in + 336-393-1111. If you're using a cell phone, your service provider may charge you for using minutes or for roaming charges.

Members who would rather have the unused Membership Rewards points returned to their accounts must contact American Express customer service at 800-297-3276. Terms apply. 3.

I'm an Amex GBT traveler/client and need help. Get support here. Contact American Express GBT today to connect with our team of business travel experts. Get information on business travel management, events & more.

Best-in-class traveler care. We're here to help, whether it's an unexpected flight delay or a ride home from the airport. American Express Global Business Travel (GBT) is a joint venture that is not wholly owned by American Express Company or any of its subsidiaries (American Express).

For personalized service, please tell us about your request: Choose a topic. Topic Flightsz Hotels Vacation Packages Cars Cruises Membership Rewards® Pay with Points Other Travel Alerts COVID-19 Information

Create an Online Account. Replace a Card. Confirm My Card. See All Personal Cards. Open a Dispute. Free Credit Score. Traveling Soon.

To modify a reservation, you can cancel and rebook your reservation on amextravel.com or by calling a representative of amextravel.com at 1-800-297-2977. To be eligible for the 3X Membership Rewards® points, any changes to an existing reservation must be made through the same method as your original booking.